n 2020, the people of New Jersey voted to legalize recreational cannabis. In 2021, it became legal in NJ for adults aged 21 and over to possess cannabis and related products for personal use. In 2022, it became legal for New Jersey’s medical dispensaries to sell cannabis and related products to non-patient buyers.

As you can see, in New Jersey, the legal cannabis market is quickly developing. As we close out 2022 and look ahead to 2023, the legal cannabis market will take another step as non-ATCs (Alternative Treatment Centers) are expected to begin operations.

With any emerging market, there are going to be a few growing pains. Legal cannabis in New Jersey is no different. And fortunately, New Jersey isn’t the first state to experience these specific growing pains…which means we can learn valuable lessons from how other states have handled them.

Before we dive into the changes that will likely change the NJ cannabis market in 2023, let’s clarify a key vocabulary term.

An alternative treatment center, often shortened to ATC, is a retailer licensed by the New Jersey Cannabis Regulatory Commission (CRC) to sell cannabis and cannabis-derived products to patients who are part of the New Jersey Medicinal Cannabis Program. In other words, ATCs are medical dispensaries. On April 21, 2022, New Jersey ATCs that had acquired the local and state licensing to do so began selling cannabis to non-patients as well.

As of December 2022, ATCs are the only retailers permitted to sell cannabis in New Jersey. This is slated to change in 2023. Non-ATC retailers aren’t bound to the same requirements as ATCs. There also isn’t a limit on retailer licenses in New Jersey.

Currently, there are only 37 Class 1 Cultivator licenses available in New Jersey. That means that by law, the number of cultivators that can supply the NJ market is capped at 37.

That statute expires in February 2023 which is well before any non-ATC operator will begin operations. With the opportunity for a potentially unlimited number of new cultivators to enter the market, many worry this will mean there will be too much supply to meet the current demand. Too much supply can cause prices to crash—we’ve seen this happen in other states.

Every state has handled cannabis legalization and market development a bit differently. Three states in particular, Massachusetts, Michigan, and Illinois, can give us a preview of how New Jersey’s market will look in 2023.

Before any cannabis-derived product (including raw flower) can be offered to Massachusetts consumers, it needs to be tested in a statelicensed facility to ensure it meets safety and potency regulations. This is true in most states with a legal cannabis market. New Jersey is one of those states.

In Massachusetts, one of the issues that occurred when non-medical retailers entered the scene was a bottleneck at the testing stage. There were only a few licensed testing facilities, and with more product entering the market to meet the new retailers’ demand, the state’s testing labs became backed up. This bottleneck led to supply chain backups, limiting the products patients and recreational consumers could purchase in dispensaries.

As the bottleneck kept supply levels low, new retailers continued to open. This only exacerbated the issue of an oversaturated market with too little supply to meet demand. So where did consumers go?

Many went to the underground cannabis market.

Massachusetts’ underground cannabis market thrived as regulatory testing slowed the legal market, pushing dispensaries to keep prices low to compete. This led to cash flow challenges for dispensaries.

Beyond supply issues and competition with the underground market, the Massachusetts cannabis industry faced another challenge we’re also seeing in New Jersey: low municipality opt-in. Few towns chose to allow cannabis retailers to set up shop, so in the towns that did opt for legal cannabis sales, retailers are in fierce competition for market share. In New Jersey, more than 60 percent of municipalities have opted out of allowing retail cannabis stores to operate, with many of these municipalities banning all types of cannabis businesses. As non-ATC retailers in New Jersey map their 2023 launches, they’re limited to a minority of New Jersey towns— and there might not be enough room for everyone to be profitable.

Next, let’s look at the challenges Michigan’s cannabis industry faced when it transitioned from medical retailers only to permitting nonmedical dispensaries to operate. Similar to Massachusetts and New Jersey, Michigan saw low municipal opt-in, corralling cannabis retailers into a small number of cities.

When it came to supply, Michigan had the opposite problem to Massachusetts: too much supply. With far more cannabis available than consumers are buying, prices have dropped dramatically. That means low profit margins for growers and retailers, which is only magnified by pressure from the underground market.

Last, let’s take a look at Illinois, another state that can provide valuable lessons for New Jersey’s cannabis industry.

In Illinois, only a small number of cultivator licenses were issued. By limiting the number of cultivator licenses, Illinois attempted to prevent the oversaturation issue that occurred in Michigan.

We’d say so. Although the move was controversial among industry professionals, it protected Illinois’ cannabis industry from the supply and demand challenges that plague other states.

But that doesn’t mean New Jersey should copy Illinois’ cannabis playbook word-for-word. Currently, Illinois’ cannabis industry is dominated by multi-state operators—another polarizing subject among industry professionals.

New Jersey can learn a lot from other states’ cannabis industries. With our cultivator license cap expiring, New Jersey could see the same issue that plagued the Michigan market: plummeting prices because there’s simply too much cannabis available.

And that’s just cannabis that was grown by licensed cultivators and tested at state-regulated facilities—something that can be cause for concern in New Jersey if there are not sufficient testing labs for the market. New Jersey’s underground cannabis market is going strong, offering lower prices to consumers and pressuring dispensaries to keep their prices low.

Then there’s the issue of inflation. New businesses entering the market are entering during a period of high inflation, which makes launching more complicated no matter what industry you’re in.

So what can NJ operators do to combat this?

The same thing business owners in every industry do when they’re facing inflation and volatile pricing: maintain healthy cash reserves. If you’re a business owner in the cannabis industry, over-plan and have contingencies in mind. Your overplanning can—and should—include having larger capital reserves than you think you reasonably need.

As an entrepreneur in New Jersey’s developing cannabis industry, keeping up with industry developments and changing laws as you build your own business can be a headache. It can also be difficult to know the most profitable way to move forward as the industry adapts to changing trends and regulations.

Protect your business by working with a tax and business advisor who understands the unique challenges you face in the cannabis industry.

Steve Tellian is a Senior Manager at Sax LLP who works within the tax and A&A departments for both the firm’s Cannabis and Construction Practices and assists in 401k audits. Within the cannabis practice, he specializes in cannabis tax and Section 208E. Lastly, Steve plays a vital role in training younger staff to mitigate any concerns or challenges they may have. He can be reached at stellian@saxllp.com

n the wake of the COVID pandemic lockdowns, getting back to normal—whatever that means anymore—has proven to be a different kind of challenge for every industry. But while some industries grapple with sky-high energy costs and others face labor shortages and shifting consumer habits, just about every industry that relies on predictable, consistent supply shipments is finding itself at the mercy of the supply chain.

Put simply, we’re still dealing with shipping delays that are not expected to resolve anytime soon. These stem from a variety of factors: extreme weather, shifting consumer demand, labor shortages, energy costs, and geopolitical challenges. We’re not going to rehash what you already know—instead, we’re going to focus on what the current supply chain situation means for the construction industry moving forward.

It sounds obvious, but it’s more crucial than ever that you plan ahead for upcoming projects as you order supplies and secure subcontracts. Your suppliers are your collaborators—when they know what’s on your docket and what you’re going to need to complete each of those projects, they’re better equipped to get the supplies you need to you in a timeframe that fits your project. This enables them to get ahead of any shipping challenges they might face and potentially avoid those delays altogether, keeping you on track and your clients satisfied.

Planning ahead may now involve fronting costs earlier than historically needed for your business. Instead of purchasing job materials and supplies 2-3 months prior to a job start, you could now be looking at 4-6 months of holding time. To further the impact, not only would you be floating those costs for longer periods, but most likely at higher prices given the increased rates and limited availability. Cash has always been key in the construction industry, but now more than ever it will involve more planning and strategy to maintain your company’s cash flow.

In 2022’s economic climate, metal markets have been particularly unpredictable. There are a few reasons for this, including:

• China’s zero-COVID policy

• Weaker demand from Chinese manufacturers

• Fears of a global recession

Unpredictable metal prices have a ripple effect on other industries, including the construction industry. Copper prices in particular have spiked in recent years, putting electrical contractors at a disadvantage. They, as well as contractors in other fields, have seen this impact their cash flow and have been forced to increase their prices. Many contractors have found themselves struggling to increase or escalate the costs listed in their contracts to match market pricing.

Certain supply chain issues, like a reduced workforce due to pandemic restrictions, are resolving as people head back to work. But record numbers of workers chose to retire early because of the COVID pandemic, and now the logistics industry is seeing a gap between the number of people who’ve left the field and the number of people seeking to enter it.

You might have encountered this same challenge in your company. Simply put, there are fewer skilled workers entering the construction industry than there are exiting it. As you adapt your processes to work with this labor trend, know that adjacent businesses, like suppliers and importers, are grappling with the same challenge.

On November 15, 2021, President Biden signed the Infrastructure Investment and Jobs Act into law. This legislation, meant to update the country’s outdated and rundown roads, bridges, railroads, public transit, energy and water infrastructure with $550 billion in federal funding, largely had an adverse effect on contractors who pick up federally funded projects.

Here’s why: the Act requires that all materials used in these construction projects contain at least 55 percent domestic content and that all materials used be produced in the United States.

Additionally, contracts are “strongly encouraged” to have project labor agreements in place for projects costing more than $35 million.

Materials sourcing requirements can make projects more expensive and take longer to complete. Recognizing this, legislators included the option for construction firms to waive this requirement in the Act’s language. Issues like a lack of materials’ domestic availability, poor domestic quality, and high domestic cost can make it inevitable that firms will need to source materials from outside the US, and this could be complicated by foreign trade practices and friction regarding the public’s perception and interest in these projects.

The bottom line is the construction industry is facing more than just supply shortages; many contractors are also facing logistical and compliance-related difficulties. Companies who pick up federally funded projects are urged to carefully read, understand and consider the requirements included in the Infrastructure Investment and Jobs Act because failure to do so can mean big profit losses.

At Sax LLP, our role is to empower you to make the best financial decisions for your construction business. The best course of action for one business isn’t the same as another—your goals are unique, your business model is unique, your assets are unique, and your needs are unique. We look at all of that when we assess your business’s needs and develop effective strategies for you.

Tyler Goodspeed, CPA is a Tax Manager in Sax’s Construction Practice who specializes in multi-state tax engagements within construction, real estate, and manufacturing companies. He assists in tax planning for corporations, S-Corps, and partnerships, as well as individual planning. Tyler also plays a role in training and development for staff. He can be reached at tgoodspeed@saxllp.com

t’s no secret that energy prices have skyrocketed. You saw it at the gas pump all summer, you feel it in your utility bill.

There’s a lot of conflicting information swirling around about the energy price increases. And even though we’re currently seeing a price dip at the pumps, you’ve probably been hearing and reading about the increases that are coming this winter. It can be difficult to separate the facts from the fear-mongering, so we’ve done our best to take an objective look at what’s going on in the world and how we know it’s impacting energy prices—no speculation here; just the facts.

In response to the war in Ukraine, the European Union banned Russian oil imports. That ban went into effect on December 5th, 2022.

Currently, officials from the Group of Seven (G7) are enforcing a $60 per barrel price cap on Russian oil prices for the non-EU countries that continue to import it. Russia’s response was that should this happen, it will stop selling oil to countries that impose this cap… which, according to analysts, will cause oil prices to increase.

The US Strategic Petroleum Reserve released the last batch of its primary reserves, the reserves President Biden authorized to release in March 2022, in December. The Strategic Petroleum Reserve may release more of its resources in 2023. However, we can’t rely on these reserves forever—they’re currently at their lowest point since the mid-1980s.

Our domestic energy issue isn’t just oil. Natural gas prices are currently at a 14-year high. There are a few reasons why:

• A hot, hot summer had people cranking the AC, sucking up electricity (which is largely produced using natural gas)

• Low natural gas inventory levels in the US

Natural gas inventory is down here because production is down. Production is down for a few reasons:

• Decreased demand during the COVID lockdowns (less driving, entire buildings and complexes closed). Production still hasn’t gotten back to where it was pre-lockdowns

• Wall Street putting pressure on oil and gas companies to focus on returning cash to investors via stock buybacks and dividends

Despite gasoline prices’ volatility over the past year, you’ve undoubtedly noticed prices drop from the record highs they hit earlier in 2022. If you’re a diesel driver, you’ve probably noticed that diesel prices haven’t dropped—and that they’re still right around $5 per gallon.

The reason for this is fundamentally the same as the reason for the volatility we saw with gasoline prices: supply and demand. But with diesel, there are a few different details at play.

While most passenger vehicles use gasoline, the majority of commercial trucks take diesel fuel. Because trucks continued to deliver goods through the COVID pandemic, demand for diesel remained near its pre-pandemic levels. But diesel refining went way down as refineries slowed production to meet reduced gasoline demand. So today, the US has very low diesel reserves—nationally, at levels not seen since 2008. In some regions, such as the Northeast, reserves levels are even lower. In the Northeast, for example, diesel reserves are at their lowest point since 1990.

That’s part one of the issue.

Part two is Europe's sanctions against Russian energy imports. That means more overseas buyers will be in the market for US diesel, which means higher demand and thus, higher prices for its limited supply.

Stateside, refineries have largely ramped up production to meet the growing demand for diesel. That demand largely comes from Europe and the existing US logistics industry.

But then there’s the issue of transporting diesel within the US. In theory, producers in the South could transport diesel to the Northeast to alleviate shortages there…but, the Jones Act, aka the Merchant Marine Act of 1920, prohibits foreign vessels from transporting US goods between US ports. The 55 US-owned tankers are currently in use, which leaves the energy industry without an easy solution. It’s possible to temporarily waive the Jones Act, but that waiver would have to come from the Department of Homeland Security.

To put it bluntly, energy prices are going up. According to analysts cited by USA Today, there’s still room for them to rise

The tough truth is, there’s no easy solution to the rising energy prices. Like every other market, the energy market is driven by supply and demand. With one of Europe’s main suppliers suddenly exiting their market, Europe is scrambling to keep residents supplied—and that has a ripple effect on markets across the globe.

In the long-term, we could see a pivot to increase production or to aggressively invest in other energy sources. It’s quite possible we’ll see both. In the short-term, we’re paying more to keep our homes and businesses lit and warm.

Joshua Chananie, CPA is a Partner with Sax and Leader of the firm’s Consumer Products Practice, concentrating on advising clients on the key areas critical to their success. With more than 15 years of experience, Josh specializes in distribution and inventory management, shareholders agreements, profitability, succession planning, financial strategy, operational efficiencies, risk management, and tax challenges. He can be reached at jchananie@saxllp.com

Written by: Jerome Fusco Managing Director jfusco@saxca.com

Written by: Jerome Fusco Managing Director jfusco@saxca.com

Written by: Joy Matak, JD, LLM Partner jmatak@saxllp.com

Written by: Joy Matak, JD, LLM Partner jmatak@saxllp.com

How do partners ensure a highly successful outcome when selling their medical practice? A thoughtful and planned path provides practitioners with a high likelihood of success. A strategic approach includes assembling a trusted team of advisors who can provide partners with a clear understanding how to drive value in a sale process.

While financials are fundamental, there are other key elements which are often overlooked and have significant implications on the outcome. It is essential to have a strong understanding of what drives value through the eyes of the investor, the current competitive landscape, organizational synergies with an acquiror, and key risks and considerations related to your business as well as the overall healthcare landscape.

Preparation is key to the sale process. Prior to sending a potential buyer any sensitive information, partners should be well organized and understand the message the information is conveying. Investors – both strategic (hospital systems and other practices) and financial

(private equity) – are well-versed in sale processes and can digest a high amount of diligence materials quickly. This can lead to uncovering positive and negative trends that may not be overly apparent to practitioners.

Organization is critical. It goes beyond having legal documents and financials neatly organized. There must be a keen understanding of the trends that these documents show. Strategic organization reduces the potential for findings of key risk factors that were unbeknownst to the partners and enables the partners to highlight, through diligence, the strong underlying value of the practice.

Strategic organization also includes qualitative alignment. Discussions with internal key stakeholders are essential to positioning the business. Additionally, it is important to have internal alignment on the goals of the practice. Whether the objective is maximizing financial consideration for near retirement partners or obtaining the right buyer to drive future growth for partners earlier in their career, it is vital that the messaging is uniform and consistent.

Consulting with a team of specialists can help the partners go through numerous scenarios, think critically about long-term goals and, ultimately, agree upon messaging, approach, and overall goals. Preparation takes time. It is recommended that an advisory team is assembled 6-12 months before formally launching a sale process. A strong attorney is crucial and in addition, the team needs skilled financial advisors, including:

Accountants – An accountant who specializes in healthcare helps organize the financials, ensures accuracy in financial reporting, and aligns the business with essential metrics during due diligence. In addition, they can assist sellers with an analysis of accounting records prior to sale, along with converting financial statements to accrual-based accounting, which will be required by a potential purchaser to ensure the best possible outcome.

Investment Banker – The right investment banker is critical. They are the quarterback of the process who will give partners insight on trends, help properly position the company with investors, and highlight key elements that financials demonstrate. They work with the partners on identifying potential buyers, negotiate key

deal terms, maintain data flow, and work with advisors on critical transaction elements.

Trust & Estate Specialists – A trust and estate specialist offers guidance on how to best structure the practice and eventually sell it, with an eye towards income stream protection and wealth preservation for the seller and future generations of the seller’s family. Most strategic sales involve a skilled professional early in the process to explore estate planning and income tax savings opportunities. Once sales negotiations commence, it may be too late to restructure the practice in ways that will facilitate financial flexibility with the most advantageous tax opportunities available.

It’s critical to understand that any buyer will have an investment committee who will scrutinize the transaction. A thoughtful message will demonstrate the key investment highlights, so investors understand their “next bite of the apple” and show the partners have the right processes in place to mitigate downside. This helps advisors negotiate and drive a premium price.

What makes the practice’s story most compelling? Demonstrating to potential buyers a captivating acquisition opportunity:

• Explain how the practice has evolved to meet market dynamics

• Convey current success and the path for future growth

• Practice advantages compared to others in their respective market (i.e. geographic and specialty)

• Strong recruiting and retention strategies for practitioners, which leads to recurring patients and a strong referral network

A trusted advisory team’s value is demonstrated by working with the team to craft the strongest narrative possible. The team will prepare a professional and credible presentation for investors.

Putting yourself in the buyer’s shoes is important and often overlooked. A thoughtful narrative highlights potential synergies between the practice and purchaser. A strong story emphasizes the successful strategies and how that can be potentially applied to the purchaser’s practice (on the strategics). Potential areas to pique the buyer’s interest include:

• Is the practice in the geographic area that expands the buyer’s reach?

• Does the practice complement others in the purchaser’s portfolio?

• How can the practice be integrated and collaborate with complementary practices and companies for a robust growth model?

• Are there best practices and processes that enhance the offering of the acquiror?

Conversely, risks need to be assessed and conveyed with a thoughtful strategy to alleviate possible concerns. Risks can be market driven (insurance, regulatory, et al.), as well as those associated with the practice. The latter aspect includes how key doctors who are not partners will view the sale and can be mitigated through a unified message. For that reason, those physicians should be brought into a potential sale discussion early to understand their future plans and growth objectives. Given the nature of the healthcare industry, there are numerous risks; identifying those that directly impact your practice will show a greater degree of thought and give buyers stronger confidence that the team truly understands the dynamics of the industry.

Once we have decided to move forward, thorough due diligence commences. The team is in place to work with the practice to ensure proper delivery and messaging of the information. While this process may become exhaustive for the partners, due diligence is critical and generally takes considerable time because all aspects of the medical practice are evaluated before the acquisition. A select list of broad diligence topics is below (all of which have numerous layers of information).

• Financial

• Compliance/Regulatory

• Operational

• Information Technology

• Legal

A company may have strong financial performance but if internal practices are found noncompliant, the transaction can be delayed or have a significant impact on value. All parties need to be aware of the key liabilities and risks that a buyer will undertake as a result of the sale. The purchaser will have its own consultants who will analyze all information and generally take a conservative and cautious view on potential risks and liabilities.

The best offer is not always determined solely by the highest sale price. Partners must be mindful of how the new structure will affect them and other key employed practitioners/physicians. There are numerous stories of practice sales negatively impacted by an unalignment of post-sale expectations that lead to early exits by key practitioners dissatisfied with the new owner.

To align interests, investors often structure acquisitions with an element of deferred compensation. It is imperative that the transition is smooth so partners earn the deferred piece of the consideration. To achieve this collaboration, partners must ask probing questions and understand all the dynamics about the path to earning the deferred compensation.

The best outcome is when all the information is transparent and all of the interests are properly aligned and agreed to ahead of time. Advisors should encourage the partners to speak with previously acquired partners and ask the critical questions.

Selling a medical practice can be an emotional and stressful period for partners. Assembling a team of experienced healthcare experts can help create a smooth process that focuses on market conditions and buyer considerations to achieve the best possible outcome for everyone – both short and long-term.

Deborah Nappi, CPA, MST is a Partner at Sax LLP, and serves as Leader of the firm’s Healthcare Practice. She specializes in consulting services, revenue cycle management and physician productivity in the rapidly changing landscape. She serves as interim CFO during M&A transactions, mitigating risk and ensuring a smooth and successful process. She conducts due diligence for private equity, analyzes Healthcare related transactions on the buy and sell side, reviews practice evaluations and manages post-close transactions. She can be reached at dnappi@saxllp.com

Jerome Fusco is Managing Director at Sax and the Leader of the firm’s Investment Banking arm, Sax Capital Advisors. In this capacity, Jerome oversees Sax’s investment banking initiatives with a concentration on mergers and acquisitions, capital raising and other advisory services for middle market clients. Jerome has over 15 years of experience across the spectrum of financial analysis, investment banking, credit analysis, corporate financial planning, debt and equity raising and business development. He enjoys working with clients across all industries and helping them achieve their short-term and long-term goals. He can be reached at jfusco@saxca.com

Joy Matak JD, LLM is a Partner at Sax and Leader of the firm’s Trusts and Estates Practice. She has more than 20 years of diversified experience as a wealth transfer strategist with an extensive background in recommending and implementing advantageous tax strategies for multi-generational wealth families, owners of closely-held businesses, and high-net-worth individuals including complex trust and estate planning. She can be reached at jmatak@saxllp.com

Written by: Adam Holzberg, CPA, MBA Partner aholzberg@saxllp.com

Written by: Adam Holzberg, CPA, MBA Partner aholzberg@saxllp.com

onprofits face multiple challenges in their day to day. While many of these challenges are like their for-profit counterparts, one area unique to the nonprofit community is overhead.

Overhead is defined as a nonprofit’s administrative and fundraising expenses and is typically viewed as a percentage of total expenses. These expenses include accounting, information technology, human resources, training, and management. While every company has overhead, only nonprofits are stigmatized by it. A nonprofit can be highly successful addressing their mission, but if donors perceive their overhead to be too large, that success could be held against them.

The perspective that a nonprofit’s large overhead is a negative was pushed by charity watchdogs and others looking for an easy way to grade nonprofits and help donors make informed decisions. Using the overhead percentage would reveal to donors how much of their contribution would go to actual program expenses versus overhead.

The idea was that the more a nonprofit spends on its programs, the more a donor’s money would directly impact the mission. Put in another way; it led to the belief that the best charitable nonprofits were the ones that spent less on these overhead costs. This standard is unique to nonprofits as for-profits are expected to spend on themselves to enhance operations and in-turn enhance their service offerings. Meanwhile, a nonprofit that demonstrates similar spending is deemed inappropriate as it diverts funds away from the causes the nonprofit is fighting for. This began what is now called the “overhead myth”, that overhead should define a nonprofit’s effectiveness.

Based on published data from charity watchdogs, donors have developed unrealistic expectations of how much money it takes to run an organization. According to surveys, donors feel organizations should have 20% or less overhead rates. Many have said that when deciding whether to give to an organization, the overhead ratio is more important to them than the success of the organization's programs. Meanwhile, fellow nonprofit foundations, who provide grants to their nonprofit counterparts, also fall under this line of thinking regarding overhead.

On average, a grant would cover at most 10-15% of an organization’s overhead, typically well below the amount needed to cover the organization's costs. In a Grantmakers survey, 80% admitted that the overhead rates they cover in their grants are too low.

Nonprofits also pushed the belief that overhead was a bad thing. Many celebrated their low overhead rates and published them in promotional materials, further cementing into people’s minds that nonprofits should only have low overhead.

Additionally, many nonprofits have turned to misrepresent their actual numbers. A study on overhead costs found that 33% of nonprofits reported no fundraising costs despite fundraising activities, and 12.5% reported no administrative costs. The average overhead ratio ranged from 13-22%, but under additional scrutiny, the actual overhead rate was likely between 17-35%. These actions reinforce the unrealistic expectations of donors.

The impact of this myth has led to the nonprofit community cutting back on necessary infrastructure improvements to their organization for fear of raising their overhead percentage. This has a significant impact on the ability of a nonprofit to function properly. A nonprofit with poor infrastructure cannot properly track its program outcomes and show what is working versus what is not, poorly trained staff cannot deliver the quality services that its beneficiaries require, and

understaffed organizations struggle to service their mission. Instead of revealing the most efficient nonprofits, this myth and mindset has created significant inefficiencies within nonprofits and unrealistic expectations for donors.

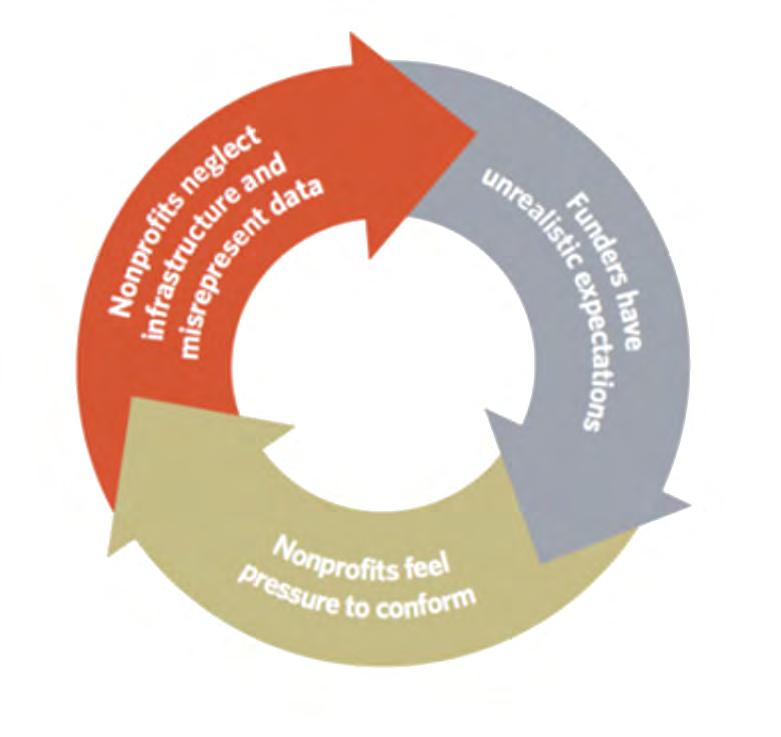

These unrealistic expectations and misrepresentation of data has led to what is now called the “nonprofit starvation cycle” pictured in Illustration A.

Illustration A

Thompson, Ken. “Social Justice and a Relevant Philanthropic Sector (Part 2).” The Aspen Institute Forum for Community Solutions, 29 Apr. 2020, https://www.aspencommunitysolutions.org/social-justice-and-a-relevantphilanthropic-sector-part-2/

Without a necessary infrastructure or even fears of spending additional money on fundraising, nonprofits cannot grow. From 1970 to 2009, 144 nonprofits crossed the $50 million revenue barrier. In that same time frame, 46,136 for-profit companies crossed that same barrier.

Nonprofits, like any organization, need to invest in their people and technology. In the current environment, executive directors are often underpaid for the work they are doing, and the staff sees stagnant wages as donors view every dollar spent on workers as less of their money going to the issues they care about. With this, nonprofits are forced to run on skeleton crews who are overworked and overextended, which hinders their ability to attract and retain top talent and perform at peak capacity.

In addition to needing to invest in their people, technology, and operations to be the best they can be, nonprofits also need to be able to take greater fundraising risks. Not every risk will indeed pay off, and a nonprofit is likely always to remain more conservative than a for-profit, but currently nonprofits are not afforded any room for risktaking. Donors need to see instant results and spending the necessary time to build a brand-new fundraising program could be disastrous in the current environment. If for-profits were treated the same, we would never have seen what we know today as Amazon, for example, which for years and years saw losses as the infrastructure was created to support the company that now dominates the global market.

As the comic in Illustration B clarifies, if you want to save the pandas, you cannot just drop a ton of money and call it a day. This mission can only be realized if the nonprofit is afforded the ability to spend on overhead to create the infrastructure to make it a reality.

Many donors still believe that high overhead means an inefficient nonprofit. A study done in 2018 sought to provide hard data on how incorrect this is, and that the current way of thinking about nonprofit donations is fundamentally flawed. The study compared the overhead ratio to two other efficiency measures not traditionally used by nonprofits: data envelopment analysis (DEA) and stochastic frontier analysis (SFA).

These two efficiency measures, while not necessarily suitable for the average donor, were chosen as they can adequately measure overhead and program expenses and the outcomes of a nonprofit compared to the overhead ratio, which only looks at overhead and program expenses. The study partnered with Habitat for Humanity and used their financial and operational data to measure the efficiencies of their hundreds of affiliates. The study found that despite DEA and SFA being two very different approaches to measuring resource spending and outcomes, they were significantly and highly correlated. Essentially, affiliates who ranked high on one of these measures were also ranked high on the other. However, the overhead ratio was typically negatively correlated with the outcomeinclusive measures.

In the study, the top-ranking affiliate under the SFA measure ranked #43 for DEA. However, as its overhead ratio was 32%, it ranked #676 according to the overhead ratio. The top-ranking affiliate under DEA was ranked #2 by SFA but was ranked #713 according

to the overhead ratio due to its rate of 36%. This study provided the hard facts to show that the overhead myth does not just destroy an organization’s infrastructure, but that using it as a measure of efficiency is inaccurate. Nonprofits that would be considered inefficient according to general donor thinking are the most efficient when considering their outcomes.

Correcting this problem will take education. Many organizations, including charity watchdogs, have begun attempting to educate donors and the general populace against this line of thinking on overhead. An alternative needs to be established and accepted by nonprofits and donors that moves away from using overhead as a measure and instead focuses more on outcomes and impact. This is no easy feat. How do you compare a soup kitchen serving meals to an issue-based organization to a social service organization providing counseling? The overhead ratio was quick and easily understood. However, the alternative may not be so straightforward. The charity watchdogs and larger foundations are making headway in providing measurable impact to donors.

1. Functional allocation time study: Employees in nonprofits are often wearing multiple hats. A time study can help nonprofits better allocate the employees’ time between the program and overhead. The organization and funders must accurately understand the actual costs between the program and overhead as we move forward from the overhead myth.

2. Review internal policies: Ensure internal policies are up to date with current societal trends so the nonprofit can most accurately reflect its work in the current environment.

3. Educate the Board of Directors: Everyone within the organization must be on board with the change to a more impact-driven organization. As board members typically come from outside the nonprofit community, educating them on trends and myths within the sector is essential. Hence, they understand what is best for the organization.

4. Focus on mission impact: Nonprofits should strive to become better storytellers so they can best tell their organization’s message about the effects of their programs. Telling a better story can help move away from the spending details.

5. Introduce better metrics to show the impact: Nonprofits should stop highlighting their program and overhead ratios and replace them with stories on mission impact.

6. Educate funders and set realistic expectations: Nonprofits should be upfront with funders about the funds it will take to implement or run a program. Proposals should be submitted asking to cover all the expenses necessary to run a program.

Adam Holzberg, CPA, MBA is a Partner at Sax and specializes in audits, accounting and advisory services for closely held companies and non-profit organizations. He focuses on increasing the overall operational efficiencies, financial reporting best practices, and internal controls for clients. He can be reached at aholzberg@saxllp.com

s we close out 2022 and look ahead to the new year, real estate remains a hot topic. Over the past two years, we saw mass migration from cities to suburbs as lockdowns sent workers home and millennials largely reached points in their lives where home ownership became a priority. We saw housing prices skyrocket as interest rates dropped to historic lows. And now, as interest rates continue to climb again, investors and traditional home buyers alike aren’t quite sure what to do.

Our job is to give you the tools you need to make the investments and other financial decisions that best serve your goals. So, to help you make sense of the current real estate market, we’re breaking down how these recent interest rate hikes will likely play out and what that means for you as an investor.

First, let’s define basis points.

A basis point is one hundredth of a percent. One basis point is written as 0.01%.

10 basis points, often abbreviated as bps, is written 0.10%. 100 bps is written as 1.00%.

In 2022, the Federal Reserve raised its interest rate by 0.75% on four separate occasions. As of December 14, 2022, the federal interest rate is 4.25-4.50%. The federal interest rate is the rate that commercial banks can charge each other to borrow excess reserves overnight.

So, what does this mean for the market—and for you? To put it bluntly, it makes commercial loans more expensive. When an increased federal rate makes it more expensive for banks to borrow money needed for commercial loans, the banks pass that increase onto borrowers. Debt service cost, which is the cost of borrowing money, and the interest and principal payments due on a loan during a specific period of time—go up for both parties.

When things cost more, you buy less. And that’s exactly what’s happening in the market now. Commercial real estate transactions slowed down dramatically in the third quarter of 2022.

As a real estate investor, determining the best strategy for navigating this next phase of the market cycle can be tricky. Keep in mind that with a lower loan-to-value ratio on the loans you take out, you’ll get a lower leveraged internal rate of return. That doesn’t necessarily mean you should sit this cycle out, but that you might need to change up your investing strategy for your next commercial real estate purchase.

It’s always in your best interest to discuss your specific financial status, needs and goals with a professional advisor so you can receive personalized advice. However, here are a few general guidelines to follow as an investor in the current real estate climate:

• Raise more common equity capital than you did previously. It’s the amount of money all common shareholders invest in a company, and in this climate, it’s prudent to build yourself a capital “buffer”.

• Similarly, raise more preferred equity capital than you did for previous investments. This is the capital that certain investors put up in exchange for certain perks, like a higher rate of return than common shareholders.

• Raise your mezzanine debt. This is the debt that’s subordinate to pure debt, but senior to pure equity. In other words, it’s the debt that your lender can convert into equity in your company in the event you default on your loan.

• Hustle more! Deals are more difficult to find, and when you do find them, they’re often more difficult to execute than they were in the past. The only way to counter this is to spend a lot more time and effort looking for deals. This might mean trying new avenues for finding deals or simply devoting more time to researching them.

As a prospective buyer, effective due diligence is more important now than it’s ever been. This is because the market is more competitive, and deals are closing faster than they did in previous years. Compounding this, lots of sellers are keeping their prices high and aren’t willing to negotiate down very far because they saw how much their properties were worth just six months ago.

As an investor, you know what’s going on in the real estate market… but that doesn’t mean the seller always does. When a seller doesn’t understand how interest rate increases can decrease property values, it can be difficult to get on the same page and negotiate effectively. That puts the onus on you to do watertight due diligence and when possible, arrive with cash in hand. Buyers with more cash and a solid understanding of a property’s value are more competitive and tend to close their deals more quickly.

Here’s what the experts are predicting will happen over the next few years: the commercial real estate market will grow. In fact, the economists surveyed for the ULI Real Estate Economic Forecast are largely predicting better-than-average growth in a variety of sectors over the next few years. These include GDP growth, unemployment rates and CMBS issuance. They also forecasted the commercial real estate transaction volume to moderate somewhat from its 2021 level but remain higher than it was pre-pandemic.

For inflation, the economists predicted 6% in 2022, 3% in 2023 and 2.5% in 2024.

So what does this all mean for your investing strategy? It could mean a pivot. Or a shift. Or perhaps a slowdown or refocusing. It doesn’t mean real estate’s a poor investment—in nearly all economic climates, real estate is generally one of the most profitable investments you can make. But how you invest in real estate can change depending on a variety of factors, and a skilled financial expert in the industry can help you determine your best strategy based on these factors.

We can’t predict every little detail or exactly when things will happen in the market, but here’s what we can do: use all available data to assess the current market, forecast the changes and trends these current conditions will cause, and advise you on how to optimize your portfolio and capitalize on these trends. If you’re a real estate investor or you want to learn more about investing in real estate, speak with a member of our real estate team

s a homeowner, you know your homeowners insurance policy covers any losses you suffer in the event of a disaster or other emergency.

But do you know how much coverage you really need to carry in order to receive full compensation in the event of a disaster? And do you know what happens when you aren’t carrying enough coverage—and how to fix this?

As a holistic wealth advisory firm, part of our job is to ensure that every client is appropriately insured at all angles. Your home is one of your most valuable assets, perhaps your most valuable asset. It’s important that you carry appropriate insurance coverage for your home, and from a financial standpoint, it’s critical that you get the most out of your policy

Two of the most important homeowners insurance terms to know are:

Replacement cost . An item’s replacement cost is the amount needed to repair it with similar quality materials. Depreciation is not factored into an item’s replacement cost.

Actual cash value. This is the amount needed to repair or replace an item minus depreciation. So to give an example, let’s say you want to replace your two-year-old basement carpet after the basement is flooded in a storm.

Because the carpet has experienced wear and tear unrelated to the flood in the two years since you had it installed, you can’t expect to be reimbursed for the full amount you paid when you first bought it. Instead, you can recover the carpet’s actual cash value, which an insurance adjuster calculates by subtracting its depreciation amount from its replacement cost.

Put into a formula, this looks like: Replacement cost - depreciation = actual cash value

In most cases, “full coverage” is defined as 80% of the home’s replacement cost . When you initially purchase a homeowners insurance policy, you’re usually required to buy a policy that provides full coverage.This is known as the 80% rule

So what happens when your home’s value goes up? If you own a home, you’ve likely seen its value increase over the years as you’ve upgraded and improved it. If your home’s value has increased significantly, keep that 80% rule in mind. With a higher-value home, you need to increase your insurance coverage to 80% of its new value.

Here’s what can happen if you don’t adjust your coverage: In the event of a disaster, your insurance provider might only cover the difference between the coverage you have and 80% of the home’s replacement cost. Here’s an example to illustrate this scenario:

You bought your home for $300,000. As per the 80% rule, you needed to purchase insurance for $240,000.

In the years that follow, you renovate your home. A decade after you bought it, the cost to repair your home is $400,000. But then a tornado rips through the neighborhood, landing a 100-year-old oak tree through your roof.

The damage will cost $100,000 to fix.

You go to file a claim with your insurance provider and find that you’re still only covered up to $240,000…60% of your home’s replacement cost. So to determine how much they’ll cover toward repairing the damage, your insurance provider divides the amount of coverage you have by 80% of your home’s replacement cost.

In this scenario, that’s 240,000/320,000 = 0.75.

So instead of paying the full $100,000 (minus your deductible), your insurance provider would only pay $75,000 minus your deductible.

When Should I Adjust my Insurance Coverage?

Here’s where it can be a bit tricky to determine when to adjust your coverage. In the past two years, house prices rose dramatically. But a more expensive house doesn’t necessarily mean you need to buy more insurance coverage.

The 80% rule is that you need to cover 80% of the home’s replacement cost. Factors that impact a house’s replacement cost include:

• Construction material prices

• The house’s square footage

• The value of the home’s components and construction materials

• Construction labor costs

For example, installing new windows can increase your home’s replacement cost, because new windows are generally of higher quality than older ones and haven’t depreciated much yet. Your home’s appraised value can be a jumping-off point for determining your home’s replacement cost, but the replacement cost isn’t always going to be 80% of the home’s value.

So how can you know if you’re carrying a sufficient amount of coverage?

Check up on it.

Every year, take a moment to look over your policy in detail. Know what’s covered and how much you are covered for. Then,

take a look at local building and materials costs. Determine what it would cost to make specific “big” repairs and replacements, like your roof, if you had to make them today.

Then, take inventory of all your appliances, housing materials (siding, flooring, etc) and other objects covered by your homeowners insurance policy. Keep a record of how old they are and what they would cost to repair or replace right now. This can help you determine how much to adjust your policy and in the event you do need to file a claim, it can help you streamline the process.

After your annual “policy checkup,” you can discuss your policy with your insurance provider. A representative can discuss your policy with you in detail and help you determine if you need to adjust your coverage level.

Determining how much homeowners insurance you need to carry can be a complex, nuanced subject. It also has far-reaching repercussions that can leave you on the hook for thousands if you aren’t sufficiently covered.

Our team can help you determine the homeowners insurance policy that’s the best fit for your home. Interested in learning more? Schedule your initial consultation with a member of Sax Wealth Advisors today

Joseph Piela, CFP® is a Partner and Wealth Advisor at Sax Wealth Advisors with over 20 years of experience. Daily, Joe helps high-net-worth individuals and families, professionals and closely held businesses reach their financial goals through the creation and maintenance of holistic financial plans. He can be reached at jpiela@saxwa.com.