SaintPiusXSchoolservesGodincommunionwiththeRoman CatholicChurchbyfosteringmoral,social,andintellectualgrowth withinacollegepreparatorysettingtoteachyoungpeopletobeethical leadersinservicetoothers.

BuildingonourtraditionofCatholicteachingandacademicexcellence, SaintPiusXSchoolisthebestschoolforfamiliesinNewMexico.

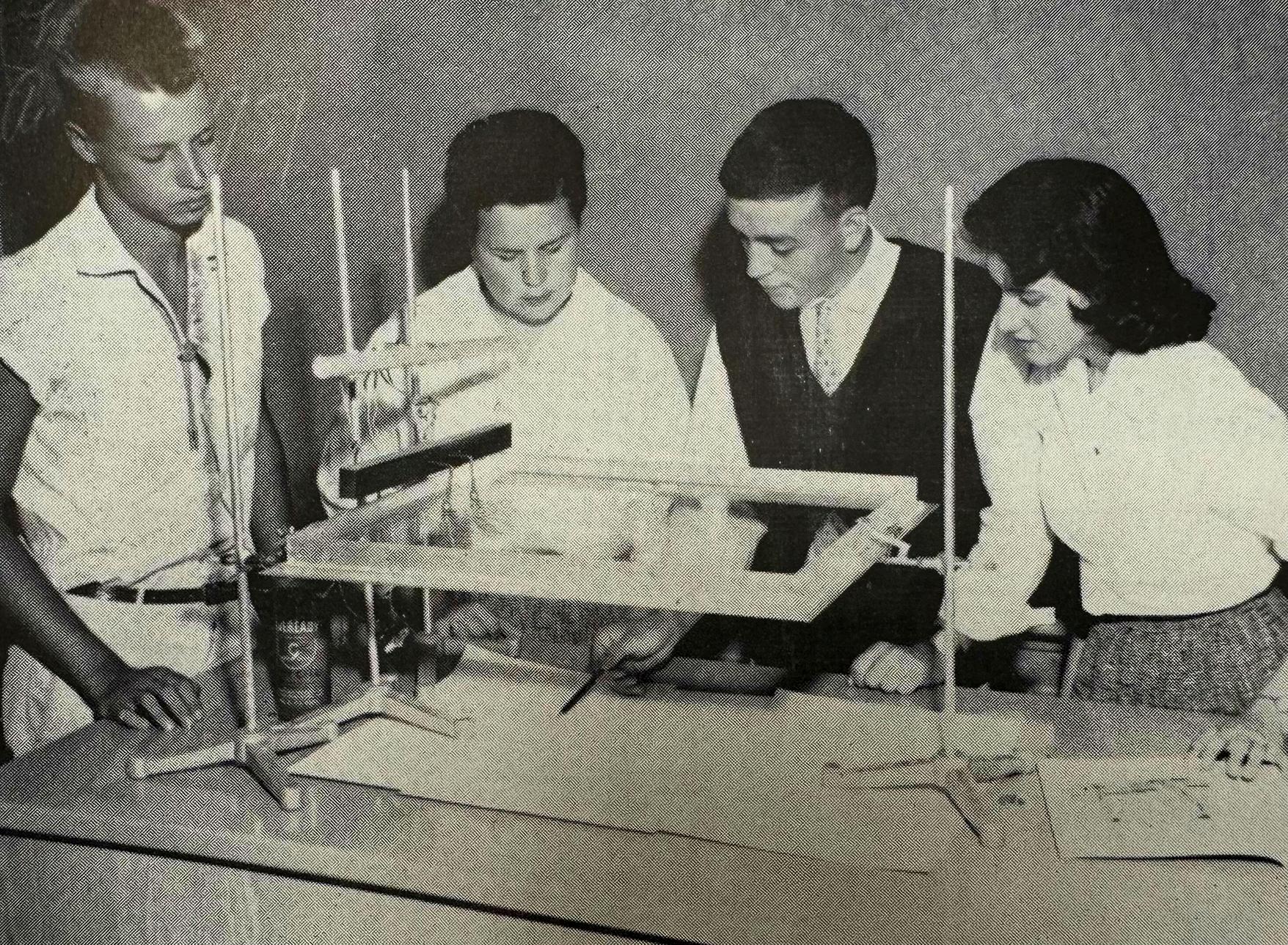

Foundedin1956inthebasementofSt.CharlesBorromeoelementaryschool,St.PiusXSchoolhasgrownintoone ofthetopacademicandvalues-driveninstitutionsinNewMexicoandtheSouthwest Nestledonascenic52-acre campuswithbreathtakingviewsoftheSandiaMountains,thecurrentSt PiusXSchoolcampuswasoncehometo theCollegeofSt.JosephontheRioGrandeandtheUniversityofAlbuquerque.

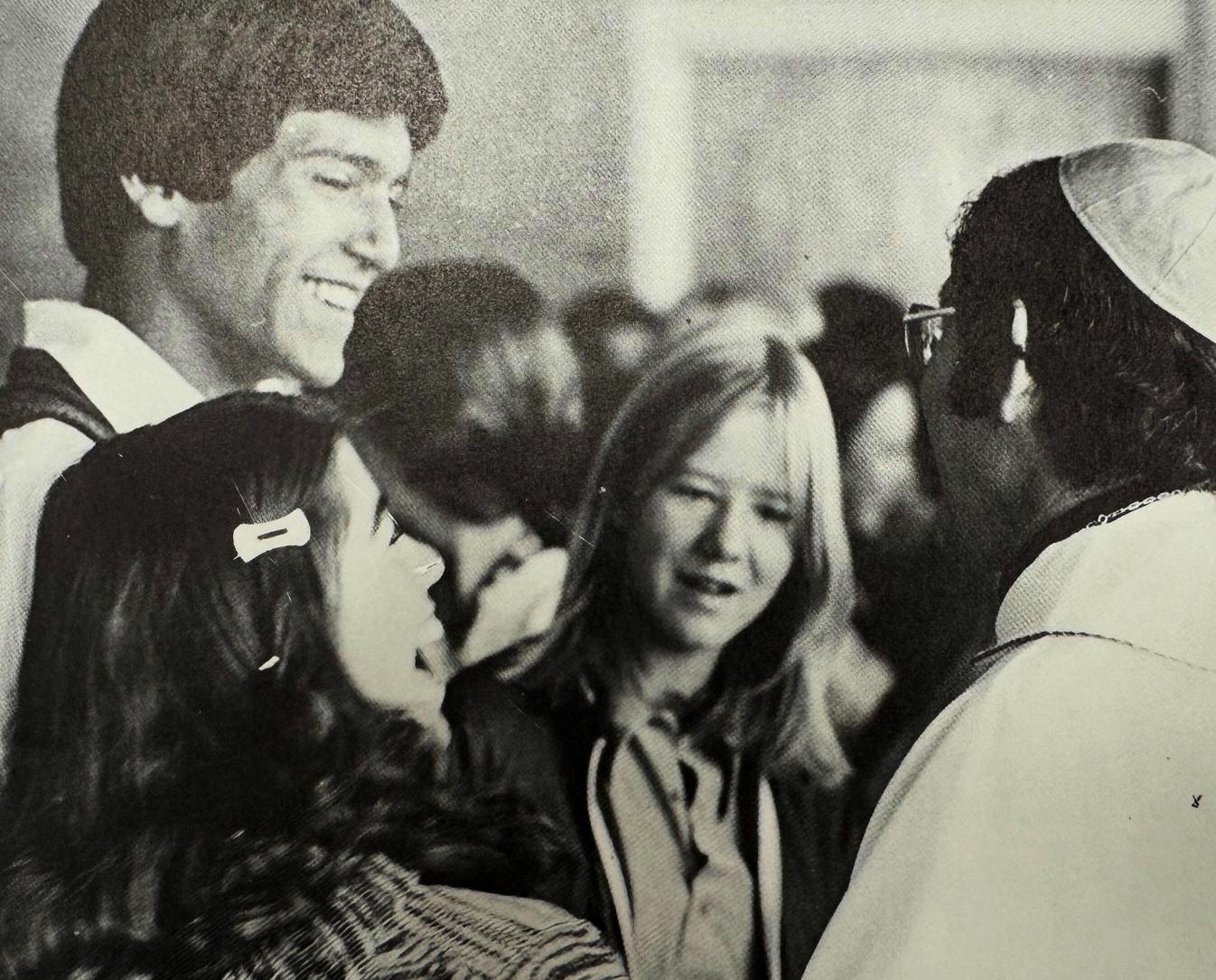

Adistinguishedinstitution,St.PiusXSchoolisrecognizedforitsacademicexcellence,athleticachievements,artistic creativity,andnurturingschoolenvironment.Nowservingstudentsingrades6–12,theschoolprovidesawellrounded,collegepreparatoryeducationtailoredtodiverselearningstyles AsaCatholicinstitution,St PiusX Schoolembracesaholisticapproachtoeducation,fosteringeachstudent’sintellectual,spiritual,andpersonal growthwhileviewingparentsasessentialpartnersinthisjourney.

Morethan80%ofSt.PiusXSchoolfacultyholdadvanceddegrees,offeringstudentsastrongfoundationinmath, science,English,worldlanguages,thearts,religion,andhistory.Studentsareeducatedincurrenttechnology, relevantknowledge,ethics,conceptsandissuestosucceedintherealworld Nearlyallgraduatespursuehigher education,attendingtopinstitutionsregionallyandnationwide

Beyondacademics,St.PiusXSchooloffersadynamicstudentexperiencewithmorethan25sportsteamsandover 30clubs,includingtheater,instrumentalandvocalmusic,modelUN,andacademicdecathlon.Communityservice, campusministry,andretreatsshapecompassionateleaders,withstudentsrequiredtocomplete20ormorehoursof serviceannuallytograduate Theseeffortsbringenergyandgoodwilltolocalcharitableorganizations

Rymer,a1964St.PiusXgraduate,earnedhercumlaudedegreefromtheUniversityofNewMexico, majoringinEnglishandPoliticalScience Withdecadesofexperienceinpolitics,publicrelations,and communityservice,shespent11yearsasExecutiveDirectorofTheArcofColorado,leading14chapters supportingindividualswithintellectualanddevelopmentaldisabilities.

SinceretiringtoNewMexicoin2017,shehasremainedactive,servingontheSt PiusXSchool,Inc Board ofTrustees,asPresidentofDisabilityRightsNM,andasadocentattheAlbuquerqueMuseum

Schubert,a1970St.PiusXgraduate,istheretiredAssociateGeneralCounselatBankofAmerica,San Francisco.HegraduatedcumlaudefromPrincetonUniversityin1974andearnedhislawdegreefromYale LawSchoolin1977.

Withover40yearsofexperienceincorporatefinance,heplayedakeyroleinTheSonomaLandTrust’s acquisitionofthe5,600-acreJennerHeadlandsproperty,preservingthissceniclandoverlookingthe RussianRiverandthePacificOceanforpublicuse

Givingcashisthesimplestwaytomakea differenceforSt.PiusXSchool.Formost donors,acashgiftistaxdeductible.

Givingsecurities,includingstocksandbonds,is easyandeffective.Ifyouhaveheldappreciated securitiesformorethanayear,givingthemto St PiusXSchoolcanprovideataxdeduction andhelpavoidcapitalgainstaxes.

Agiftofrealestate,suchasyourhome,ranch, vacationproperty,commercialproperty,oreven vacantland,couldbeyourmostimpactful donation.Moreover,ifyourpropertyhas appreciated,givingittoSt.PiusXSchoolcan provideataxdeductionandhelpyouavoid capitalgainstax

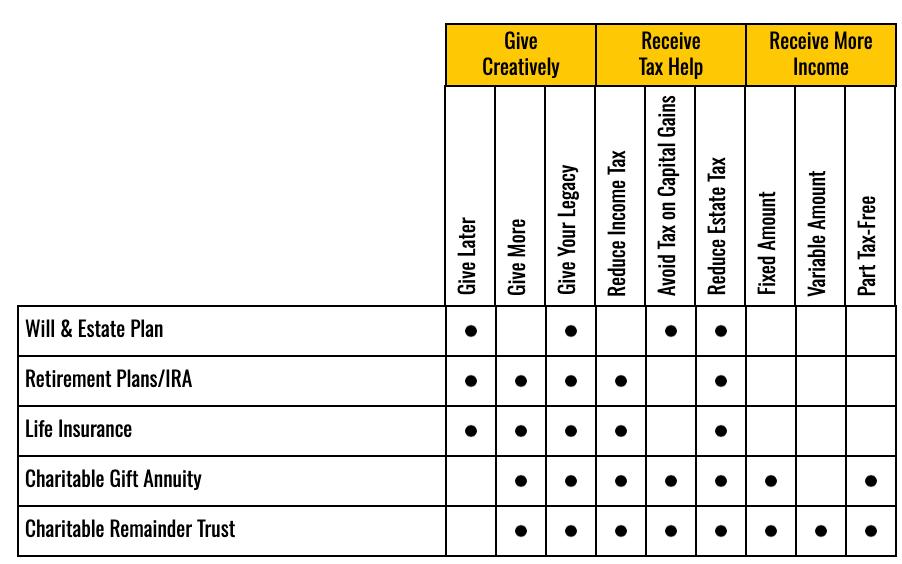

Ifyounolongerneedyourlifeinsurancepolicy, youcanlistSt.PiusXSchoolasthebeneficiary.

GivingSt PiusXSchoolpartofyourretirementassets,such asyourIRA,401(k),403(b)orothertax-deferredplan,is asimplewaytomakeagiftandavoidtaxesorreduce yourtaxrate Thisisespeciallyrelevantforindividualsaged 70½orolderwhoarerequiredtotakeaRequiredMinimum Distribution(RMD)eachyear.Moreover,retirementplans passedtoyourchildrenandheirscarryatax-related burden.Ontheotherhand,namingtheSchoolasa retirementplanbeneficiaryavoidsincometaxes,andthe Schoolreceivesthefullvalueofyourretirementplangift.

YoucandesignateSt.PiusXSchoolasa beneficiaryinyourwill,livingtrust,orother estateplandocument.Inquireaboutsample language.

Nothinghasgrowthpotentiallikeyourstakeina growingcompany.Therearekeytimesinthelifeofa businesswhenitmakessensetosetasidesomeofthe ownershipinterestforcharitablecontributions,suchas: Whenacompanyisbeingformed Beforeaninitialpublicoffering(IPO) Whenacompanyisbeingrecapitalized Beforethesale,merger,oracquisitionofacompany Beforeanownerorpartnerinacompanyretires

Bydonatingcloselyheldstockbeforetheseliquidity eventsoccur,youcanclaimanimmediatetaxdeduction forthefullmarketvaluewithouteverrecognizinga taxablegain.Youessentially"doubleup"onthetax benefits.

Ifyouare55orolder,youcangivecashorappreciated securitiestotheSchool Withacharitablegiftannuity (CGA),youarepaidafixedamount(withratesbased onyourage)annuallyfortherestofyourlife.This paymentstreamprovidessecurityforyouandyour lovedones,andsomeofthisincomemaybetaxfree. Afteryourlifetime,theremainderintheannuity accountbenefitstheschool

Acharitableremaindertrustallowsyoutotransfercash andappreciatedsecuritiesaswellaspropertytoSt.PiusX Schooloryourbank/trustcompany.Thedifferenceis thatinsteadofasimplecontract,yourassetfundsatrust, whichdirectsaspecificdistributiontoyouoryour family,withtheremainderbeingdistributedtothe school Thetrustwillprovideyouwithanupfront charitabletaxdeductionandprovideyouwithincome forlife(flexibleorfixedforlifeorforasettermofyears).

Youcantransfercash,appreciatedsecurities,andor propertyintoaleadtrustthatmakesgiftstoSt.PiusX Schoolforanumberofyears Youwillreceivea charitablededuction,andyouoryourfamilyreceives theremainderofthetrustatataxsavings.

Westronglyencouragealldonorstoconsultwiththeirlegal,financial,ortaxadvisorswhenmakingdecisionsregardingtheir estateplans St PiusXSchooldoesnotprovidelegal,tax,orinvestmentadvice,andanyinformationprovidedbytheschool shouldnotbeconsideredassuch

PopePiusX,bornGiuseppeSarto,wasknownforhisdeephumility,pastoralheart,andunwavering commitmenttostrengtheningthefaithoftheChurch.Hisdedicationtoservice,education,andthespiritual formationofyouthembodiesthevaluesweupholdatSt.PiusXSchool.TheSartoLegacySocietyisnamedinhis honortorecognizeindividualswho,likePopePiusX,makealastingimpactthroughtheirfaithandgenerosity. ByincludingSt.PiusXSchoolintheirestateplans,membersoftheSartoLegacySocietyhelpensurethefuture ofCatholiceducationforgenerationstocome.

Thereisnominimumgiftrequirement membershipiscomplimentaryandlastsalifetime.Membersreceive aSartoLegacygiftandaninvitationtoanannualreception.

Becomingamemberissimple.JustletusknowthatSt.PiusXSchoolispartofyourestateplans.Youmay choosetodisclosetheamountorkeepitprivate,berecognizedduringyourlifetimeorremainanonymous,and specifyexactlyhowyouwouldlikeyourgifttobedirected ensuringyourwishesarecarriedoutjustasyou envision.

Unrestricted Bequest

“Igive,devise,andbequeathtoSt.PiusXSchool,Inc.,anonprofitorganizationlocatedat5301St.JosephsDr.NW, Albuquerque,NewMexico87120,thesumof$ __(or %ofmyestate,oradescriptionofthespecific asset),foritsgeneralpurposes.”

Restricted Bequest

“Igive,devise,andbequeathtoSt PiusXSchool,Inc,anonprofitorganizationlocatedat5301St JosephsDr NW, Albuquerque,NewMexico87120,thesumof$ __(or %ofmyestate,oradescriptionofthespecific asset),tobeusedforthefollowingpurpose:[e.g.,tuitionassistance,STREAMeducation,capitalimprovements, etc.].Ifatanytime,inthejudgmentoftheschool,itisimpossibleorimpracticabletocarryoutthedesignated purpose,theschoolshallusethebequestforapurposeasnearaspossibletotheoriginalintent.”

Residual Bequest

“Igivetherest,residue,andremainderofmyestatetoSt PiusXSchool,Inc,anonprofitorganizationlocated at5301St JosephsDr NW,Albuquerque,NewMexico87120,foritsgeneralpurposes”

St.PiusXSchool

5301St.JosephsDr.NW Albuquerque,NM87120

TaxIdentificationNumber:88-1027223

Formoreinformation,contact: AdvancementOffice (505)831-8423 advancement@spxabqorg