Examining Property Values in Austin, TX

Community & Regional Planning | Fall 2020

Bianca Pizarro Vazquez | Samantha Bernacki

Joshua Goldberger | Courtney Banker

1

Key Questions

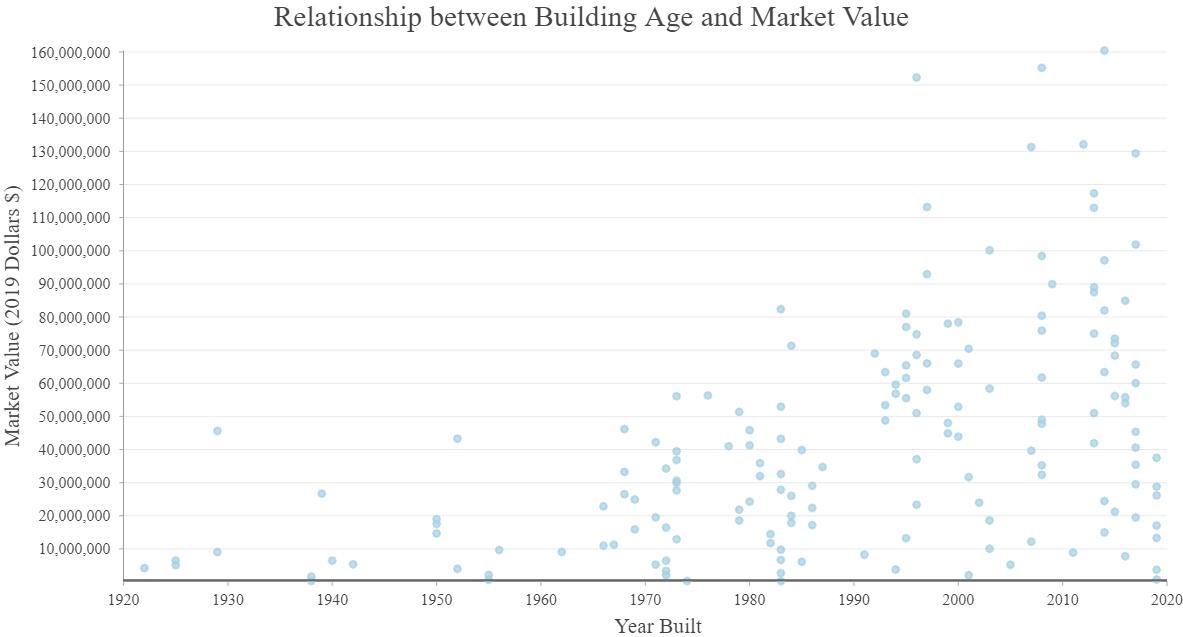

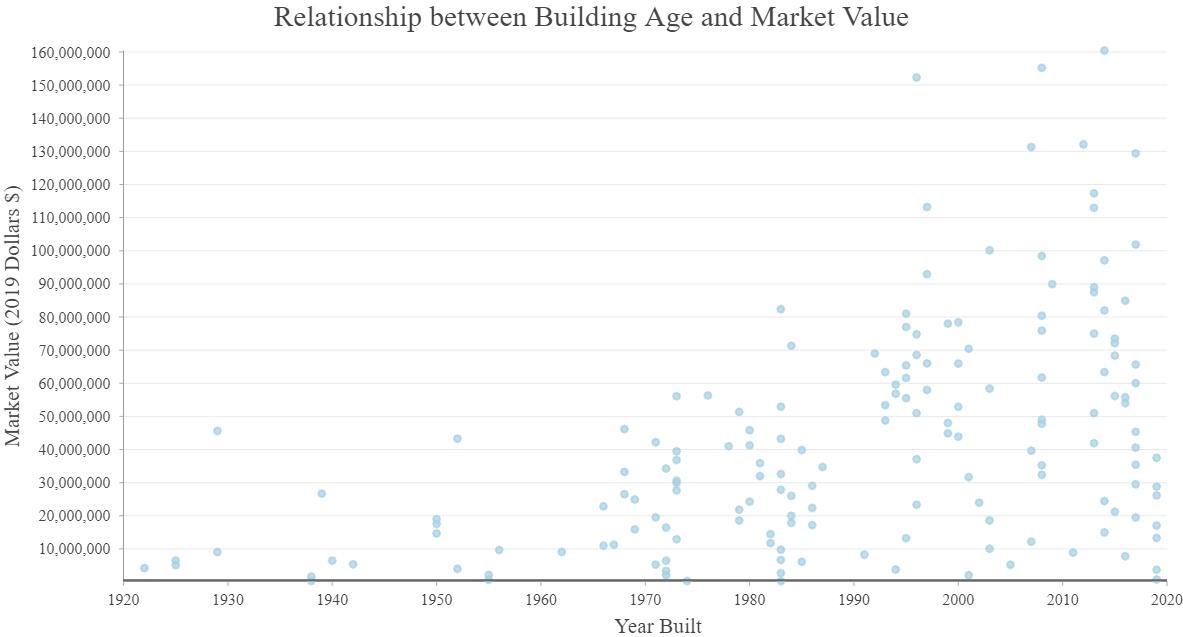

1. What is the relationship between the age of buildings in Austin and their estimated property value?

2. How does existing land use affect property value? Which types of residential developments are most valuable?

3. How have home renovations impacted property values of single family homes in Austin? Where are they occurring?

4. What residential properties in Austin are delinquent on taxes?

2

Year Built by Decade

3

Market Value in 2019

4

Year Built and Market Value

5

Existing Land Use

6

Total Market Value of Residential Type by Year Built

7

Total Market Value by Residential Type

Apartment/ Condo Duplex Group Quarters Large-lot Single Family Mixed Use Mobile Home Retirement Housing Single Family Three/ Fourplex

8

Total Market Value by General Land Use

9

Apartment/ Condo Duplex Group Quarters Large-lot Single Family Mixed Use Mobile Home Retirement Housing Single Family Three/ Fourplex

10

Average Market Value Per Acre by Residential Type

Home Renovations and Market Value

11

Home Renovations and Market Value

Tax Delinquency

13

Tax Delinquency by Zip Code

14

Tax Delinquency by Land Value

15

Takeaways

1. The newer the buildings, the more expensive they are.

2. Residential development comprises 35% of the entire city, but account for almost four times the total market value of commercial/industrial uses.

3. Single family homes comprise 23% of the city, and 73% of residential properties in the city. However, mixed use developments are much more valuable per acre.

4. Single family homes have performed well throughout, despite economic recessions. Data suggests this will remain true during the COVID recession.

5. Remodeled homes have a higher market value regardless of construction year.

6. The higher the land value of a parcel, the more taxes a delinquent parcel owes.

16

Appendix

17

Data + Assumptions

● State Aggregation of County Property Appraiser Data

● Year Built

● *Estimated* Market Value

○ Missing / incorrect estimates

● Residential Land Use

○ State codes and City of Austin land use data

● Building Permits

● Tax Delinquency from Travis County

18

Estimated Total Property Value

19

Estimated Property Value per Acre

20

Average Market Value per Acre by Year Built

Average market value: $8.1 billion per acre

Homes in historic neighborhoods around urban core.

21

Total Area by General Land Use

22

Average Market Value by General Land Use

23

Total Area by Residential Type

Apartment/ Condo Duplex Group Quarters Large-lot Single Family Mixed Use Mobile Home Retirement Housing Single Family Three/ Fourplex

24

Home Renovation Permits Issued in Past Decade

25

Home Renovations by Zip Code

26

Home Renovations by Zip Code

27