OFFICE OF INVESTMENTS OVERVIEW

Established in 2008, the Office of Investments was created to handle the day-to-day management of the investable assets and to act as an internal resource regarding the portfolio for Territorial Headquarters and the field. The Office of Investments manages the corporate and planned giving assets, investment manager and other portfolio relationships, outright non-cash gifts throughout the Territory, and other duties. As of September 30, 2021, the assets under management by the Office of Investments totaled in excess of $2.78 billion

The mission statement of the Office of Investments is:

The Office of Investments provides oversight and investment responsibility for an institutional portfolio that is approximately $2.67 billion (excluding Planned Giving Assets). There are thirty-nine (39) manager relationships, representing seventy-one strategies (71). The responsibility for maintaining and overseeing the assets and these relationships is placed with the Office of Investments. All of these duties are accomplished with a staff of seven individuals as shown below:

OFFICE OF INVESTMENTS

“Investing prudently to grow the entrusted assets to support the Mission of The Salvation Army, Southern Territory”Lariza Vergara Investment Assistant / Project Manager Justin Goff, CFA Senior Investment Analyst Alex Lauchlan Investment Operations Manager Bob Li Investment Management Assistant Diane Kendrick Planned Gift Operations Manager Mike Sutton Director - Office of Investments

DUTIES OF THE OFFICE OF INVESTMENTS

The duties of the Office of Investments are illustrated with the chart below which shows the three key areas of responsibility:

PORTFOLIO ADMINISTRATION OFFICE OF INVESTMENTS

PLANNED GIVING ADMINISTRATION

ASSET PROCESSING AND OUTRIGHT GIFTS OF STOCK

PORTFOLIO ADMINISTRATION

The Office of Investments handles the complex operations involved in managing the portfolio’s asset allocation in line with the Investment Policy Statement, managing portfolio construction, monitoring tactical strategy, engaging in portfolio management and rebalancing, overall portfolio maintenance, which includes facilitating inflows and outflows, preparing portfolio reporting, assisting in the Territory’s external audit, and other functions. Additionally, the Office of Investments develops and maintains relationships with investment managers and investment consultants to help allocate and monitor the Territory’s assets. The Office of Investments serves as the primary point of contact for the portfolio’s investment managers, investment consultants, and custodian.

The Office of Investments also acts as the primary internal resource to evaluate macro-economic and financial market issues, and their relevance to, or impact on, the Territorial portfolio. The Office of Investments seeks out and analyzes information from news sources, investment managers, strategists, analysts, investment forums, consultants, contacts, and third-party providers to help provide due diligence and recommendations on investments and investment strategy.

In conjunction with the consultant, The Office of Investments is responsible for The Army’s due diligence of strategies and investment managers. The Board of Trustees has delegated authority to the Office of Investments for recommendations on managers, strategies, allocations, and operations to the Investment Advisory Board. It is also a responsibility of the Office of Investments to make spending policy recommendations to the Territorial Finance Council.

INVESTMENT PROCESS

Various internal and external parties are involved in the long-term, strategic management of the portfolio, while day-to-day management of this process is provided by the Territory’s Office of Investments. The Office of Investments acts to help coordinate the moving pieces and various parties involved in the investment process. Importantly, the Office of Investments also helps ensure continuity in the investment process when personnel or other changes occur with investment managers and other external service providers.

The portfolio’s assets are invested in a multitde of different strategies managed by professional investment management firms. These firms are approved by the Territorial Finance Council (under the direction of the Board of Trustees) as recommended by the Territorial Investment Advisory Board and monitored by the Office of Investments (Trustee), Pavilion Mercer (Consultant), and Northern Trust (Custodian).

Currently, the Territory utilizes the services of 39 professional investment managers across 71 different investment strategies as illustrated below:

T R A D I T I O N A L DOMESTIC EQUITY DOMESTICFI K1 INTERNATIONAL EQUITY GLOBAL GLOBALFI REAL A S S E T S HEDGEFUNDS REAL AS S E T S PRIVATE EQUITY A L T E R N A T I V E S INFLATION PROTECTION RISK REDUCTION GROWTH LIQUIDILLIQUID LIQUID

The Salvation Army Southern Territory exercises great care in the management, monitoring, and governance of the portfolio’s funds. The Board of Trustees, Territorial Finance Council, Investment

DUE

The due diligence process is critical to ensure proper oversight of the assets under management (see below). Due diligence activities include, but are not limited to, manager meetings (on site or at THQ), conference calls, webinars, client conferences, and other methods. The overarching goal of the due diligence process is to ensure that The Army’s portfolio has the best available (“best in class”) investment managers and strategies to accomplish the investment objectives. In fiscal 2021, the Office of Investments participated in over 170 meetings with investment managers, the consultant, and other service providers as a part of the due diligence process (including meetings, conference calls, webinars, and conferences).

(Figure 2)

The Office of Investments is also responsible for the oversight of the investment and administrative functions of the planned giving life income agreements across the Territory. Currently, the Office of Investments oversees or directly administers the activity of 1,355 life income agreements, makes payments to 836 income beneficiaries, and has a market value in excess of $102.1 million. The chart below provides a breakout of the various gifts under management:

The Gift Annuity program’s back-office administration is handled completely through the Office of Investments. The Gift Annuity investments are managed by Bank of New York Mellon Wealth Management. Gift Annuity software programs Crescendo Pro and Crescendo Admin are utilized in the administration of the program.

These software programs assist the Office of Investments with all aspects of gift administration. The Gift Annuity program is comprehensive and requires specific capabilities and skills to run efficiently. Tax reporting, payment calculation, database maintenance, and much more go into the efficient operation of this program.

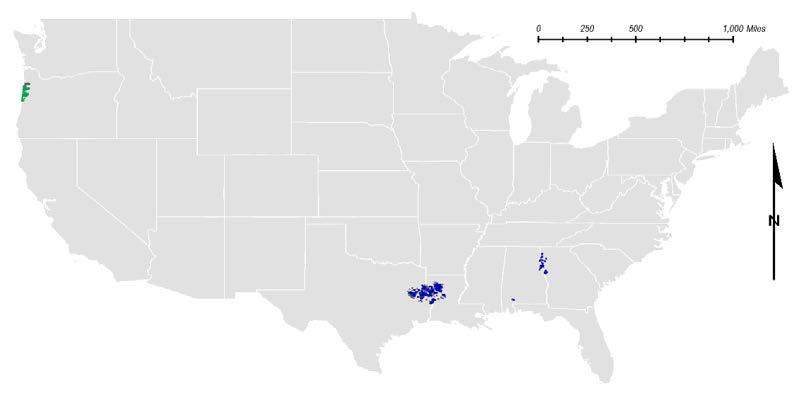

The Gift Annuity investment pool, currently $67.1 million, is a commingled pool of all Gift Annuities. In some cases, it is segregated into various accounts representing the requirements of certain states. Generally, Gift Annuities are regulated by the states in which the Southern Territory operates. Bank of New York Mellon Wealth Management, along with the Office of Investments, monitors state requirements of the fifteen southeastern states and the District of Columbia to ensure that The Army’s Gift Annuity program is in continual compliance with these various governmental agencies.

Payments to beneficiaries are made on an ongoing basis. In fiscal 2021, over $4.8 million was dispersed through over 6,217 payments to beneficiaries.

TRUSTS

Charitable Remainder Trusts are managed by both Bank of New York Mellon Wealth Management and the Office of Investments. Bank of New York Mellon Wealth Management is responsible for the investments and much of the administration. The Office of Investments ensures that all communications related to the beneficiaries are carried out in accordance with the direction of the beneficiary and the Planned Giving Department. Annual trust reporting packages are created for distribution to beneficiaries through the efforts of the Office of Investments and the Bank. In excess of 150 customized tax reporting packages are prepared each year for distribution to trust beneficiaries. These packages contain annual updates to the beneficiary on the performance of their trust, the asset make-up of the trust, payment information on the upcoming year, and the Grantor Tax Information Letter or K-1 (tax reporting from the prior year). Currently, the Office of Investments administers 85 charitable trusts covering 127 beneficiaries.

POOLED INCOME FUNDS

The Army’s four Pooled Income Funds (PIFs) are managed by BNY Mellon Wealth Management. These PIFs are The Salvation Army Pooled Income Fund, the William Booth Pooled Income Fund, the Evangeline Booth Pooled Income Fund, and the Catherine Booth Pooled Income Fund. These four PIFs combined represent 49 beneficiaries, with a market value in excess of $2.9 million.

ASSET PROCESSING & OUTRIGHT GIFTS OF STOCK

The Office of Investments is also tasked with the processing of outright gifts of securities, and asset transfers from around the Territory (generally non-cash gifts). In the processing of all outright gifts of securities, the Office of Investments is governed by, and adheres to Minute 31(c). All outright gifts of stock, fixed income instruments, mutual funds, etc. are directed to a brokerage account at BNY Mellon Capital Markets, where instructions are given for the liquidation. The Salvation Army does not attempt to time the markets, so all gifts below $250,000 in market value are liquidated immediately upon the market open of the following business day. Gifts in excess of $250,000 require sign off to ensure best pricing is obtained on these gifts. The Office of Investments oversees this operation and serves as the processing agent for the Territory for all of these types of gifts.

The Office of Investments processes gifts for Resource Development, Local Development (those units not part of Territorial Resource Development), and other channels. Additionally, the Office of Investments advises and assists the Territorial Legal Department with the transfer, re-titling, distribution, and liquidation of securities related to estates, trusts, and legacies. Furthermore, for those gifts that are not eligible for DTC (electronic) transfer into The Army’s account at BNY Mellon Capital Markets, the Office of Investments may initiate the opening of a brokerage account, the reconciliation and redemption of all assets, and the closure of the account.

During FY 2021 the Office of Investments processed a total of 1,067 gifts in the brokerage account, with a dollar value in excess of $17.8 million. The breakout for all gifts processed by the Office of Investments during fiscal 2021 is as follows:

Serving in a vital role of support to The Army’s Southern Territory, the Office of Investments has handled all of the functions listed in the preceding pages, and has guided the management of The Army’s portfolio since 2008. The Office of Investments has been tasked with producing investment results that have consistently met investment policy guidelines. The Office of Investments strives for efficiency, quality control, and smooth operations to ensure that the appropriate funding of the Mission of The Army is supported. The Office of Investments along with the Consultant and the exceptional manager line up will continue to strive to produce superior risk-adjusted returns in accordance with The Army’s guidelines, policies, and procedures.

Signed with permission

Signed with permission

Signed with permission

Signed with permission

Signed with permission

Signed with permission

Signed with permission

Signed with permission

Signed with permission

This page intentionally left blank

The Salvation Army Southern Territory

November 2021

This report has been prepared for the sole use by The Salvation Army Southern Territory. It is not for further distributionor communication to any other person or entity.

welcome to brighter

Relationship History

TheSalvationArmySouthernTerritoryhiredHammondAssociates,aninvestment consultingfirmbasedinSt.Louis,Missouri,toserveasitsadvisorinJune2008.In January2011,HammondAssociateswasacquiredbyMercerInvestmentConsulting, Inc.(Mercer).

Mercerhasprovidedinvestmentservicesformorethan45yearsandisoneofthe globalleadersinofferinginstitutionalinvestmentservices.MercerInvestment Consulting,Inc.wasincorporatedin1972toprovideinvestmentadvisoryservicesin theUS.InJanuary2016,MercerInvestmentConsulting,Inc.changedtheformofthe organizationfromacorporationtoalimitedliabilitycompanyand,therefore,the namewaschangedtoMercerInvestmentConsultingLLC(MIC).Recognizingthe needtoexpandandintegrateitsinvestmentservicesofferingsintheUS,in2005 MercerestablishedMercerInvestmentManagement,Inc.(MIM),aninvestment adviserspecializinginmulti-managerinvesting.AsofMarch29,2019,MICandMIM mergedintoonesingleentity,MercerInvestmentsLLC.

Mercerisaleadingglobalinvestmentconsultingfirm,whoseclienteleincludes corporateandpublicretirementbenefitplans,endowmentsandfoundations,as wellashealthcareandhighnetworthclients.Clientscontinuetoreceivepro-active advicefromMercer’sNot-ForProfitInvestmentConsultingteamalongwiththe depthandbreadthoftheworldwideMercerorganizationandresearchplatform.

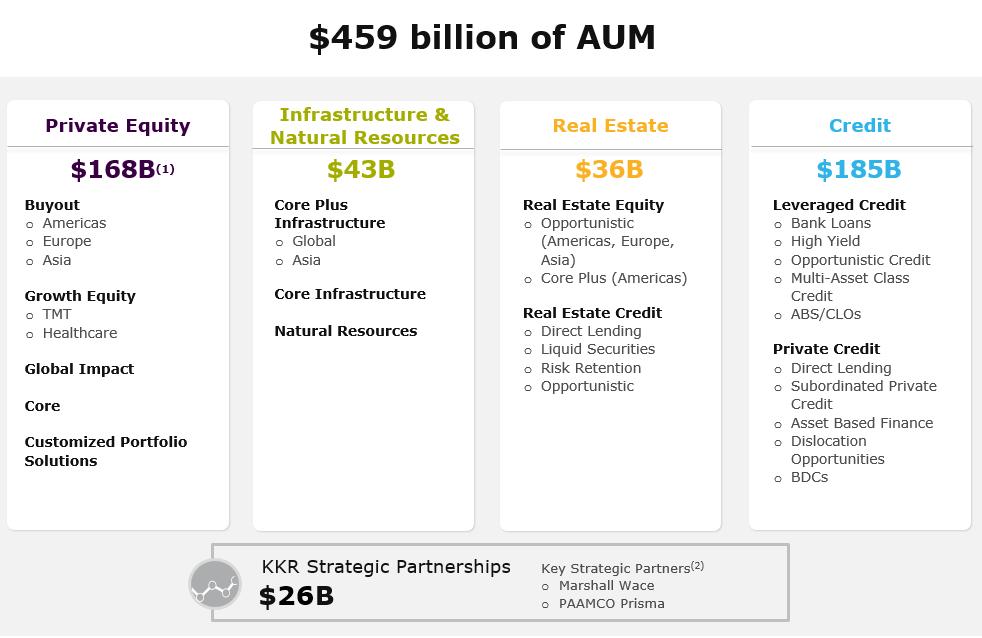

Mercer’sInvestmentsbusinessisaglobaleffortwithover4,400clientsand60offices worldwideasofJune30,2021.IntheUnitedStates,Mercer’sInvestmentsbusiness has18officesandmorethan1,300institutionalclientswithmorethan$4.6trillionin assetsasofJune30,2021.Mercerprovidesafullrangeofinvestmentconsulting advicefortheArmy,includingassetallocation,investmentstrategy,manager researchandselection,performancereportingandriskmanagement.

TimWestrich,Principal,andMichaelAncell,Partner,leadtherelationshipandare ablyassistedbyBretWatson,Associate.KyleFreelsandDianaChurchillprovide additionalvaluableassistanceintheareasofinvestmentoperationsand performancereporting.TheteamoperatesfromMercer’sSt.Louisoffice.

1 PleaseseeImportantNoticesforimportantinformationaboutAssetsunderAdvisementandAssetsunder Management.

© 2020 Mercer LLC. Allrights reserved.

Consulting Team

TimothyWestrich,CFA(FirmTenure:14years/IndustryExperience:18years)

TimisaPrincipalandSeniorConsultantspecializinginadvisingendowmentandfoundation clients.PriortojoiningMercer,TimservedasaConsultantatHammondAssociates.Timhas alsoworkedasanAnalystintheInvestmentBankingdepartmentatA.G.Edwardsandasan AnalystinthePublicFinancedepartmentatEdwardJones.

TimholdsaBSBAinFinance/BankingandRealEstatefromtheUniversityofMissouri.Hehas earnedtheCharteredFinancialAnalyst(CFA)designationandisamemberoftheCFA InstituteandcurrentlyservesasTreasureroftheCFASocietyofSaintLouis.Timalsoholdsa Series3NationalCommodityFuturesLicense.

MichaelAncell,CFA(FirmTenure:17years/IndustryExperience:34years)

MichaelisaPartnerandSeniorConsultantwithMercerInvestments.Hehasadvised institutionalclientssince2004.

HispreviouscareerincludesservingasheadoffinancialinstitutionsequityresearchforBanc ofAmericaCapitalManagement,helpingmanageBankofAmerica's$300billionofassets undermanagement.PriortothathewasseniorfinancialservicesanalystforEdwardJones helpingconstructandmonitormodelequityportfolios.Michaelbeganhisprofessional careerasafinancialinstitutionexaminerwiththeFDIC.

HeholdsanMBAinFinancefromtheKelleySchoolofBusinessatIndianaUniversityin Bloomington.HegraduatedmagnacumlaudefromtheUniversityofMissouriColumbia withaBAdegreeinFinanceandhasreceivedhisCharteredFinancialAnalyst(CFA) designation.MichaelservedasPresidentoftheCFASocietyofSaintLouisandservesonthe BoardofTri-CountyTrustCompany.

BretWatson,CFA (FirmTenure:2years/IndustryExperience:8years)

BretisaseniorassociateatMercer,wherehemanagesandprovidesguidanceon institutionalinvestmentportfoliosandplandesign.Previously,Bretworkedasaportfolio analystforNeubergerBerman.

BretgraduatedfromtheUniversityofWisconsinwithaBBAinFinance&Investment BankingandisalsoaCFAcharterholder.HeiscurrentlyenrolledattheUniversityofChicago BoothSchoolofBusinesswhereheispursuingaMastersofBusinessAdministration.

© 2020 Mercer LLC. Allrights reserved.

Pavilion, a Mercer Practice At A Glance

Qualified,experienced,globalstaff Firm

1,300+ clients in the US1

48+ years advising institutional investors2

200+ research professionals in ten countries1

Consultants average 10+ years of investment experience2

NationalNon-ProfitCenterof Excellence

25+ years of experience

180+ retainer endowment & foundation clients2

1.Data as ofJune30, 2021. 2.Data as ofDecember31, 2020

Specialistexpertise

EndowmentandFoundation Consultingfocusing on issues such as asset allocation, spending methodology, manager selection, and alternative investments

HealthcareConsultingfocusing on issues such as integrated financial strategy with investment strategy

PrivateWealthConsultingfocusing on issues such as investment policy, asset allocation, tax implications, and complex reporting and analysis

DefinedBenefitPlans focusing on issues such as regulatory changes, risk management, plan design, funding, and investment strategy

DefinedContributionPlans focusing on issues such as benefit adequacy, member engagement, fee transparency and post-retirement spend down including significant experience with 403(b) plans

Outsourcing for clients who prefer to delegate some or all of their decisions to a third party combining customized strategic allocation advice with a robust specialist investment manager structure

Our Services

• Investment Policy Review and Development

• Investment Manager Due Diligence and Recommendations for Traditional and Alternative Asset Classes

• Asset Allocation Studies

• Spending Review

• Asset/Liability Studies

• Fee Analysis

• Performance Analytics

• Monthly/Quarterly Client Performance Reporting

• Comprehensive Reports

• Online Access to Performance Data

• Periodic Investment Review Meetings

•Capital Markets Research •Quarterly Research Report •Market Updates and Commentary •Alternatives Research •Peer Universe Rankings

•Research Articles / White Papers

Functional View of the World’s Asset Classes

GrowthAssets

Drives long-term capital appreciation

Seeks to mitigate high return volatility through diversification and tilts to areas with attractive relative valuations

Includes public and private equity, as well as growth fixed income.

RiskReductionAssets

Lower volatility asset classes

Minimize correlation to equity returns

Includes both US and global fixed income and hedge funds

InflationProtectionAssets

Attractive for institutions with inflation-sensitive liabilities

Protects against unanticipated inflation

Includes real estate and natural resources investments

Research and Thought Leadership

ResearchReportsProvidedtoClients

• Quarterly Market Environment Report –broad overview across markets and asset classes

• Capital Markets Outlook –updated quarterly

• Dynamic Asset Allocation Report –Short-term valuation-based signals

•Specialized white papers

• The Endowment Model

• Not for Profit Endowments and Foundations Top Considerations for 2021

• Prioritizing action in a market crisis -a framework for Endowments & Foundations

• Investment Beliefs –Governance Bedrock for E+F Investment Committees

• Effectively Aligning Definitions of Success with Proper Benchmark Selection

• A Trilogy on Return and Risk for Endowments and Foundations

• Viewing Spending Policies Through A Different Lens

• Beatingthe Pack -What Role ShouldPeer Relative Rankings PlayIn Endowment Planning?

• Mercer Capital Market Monitor –October 2021

• Mercer Market Environment Webcast: www.mercer.com/webcasts

ClientConferences

•Annual Non-Profit Client Conference

• St. Louis, typically held in the fall

•Global Investment Forums

• 2022 schedule and locations to be determined

© 2020 Mercer LLC. Allrights reserved.

Global Manager Research

Manager and StrategyStatistics as of30 June2021,includes sub-advisedstrategies.

InvestmentProfessionalsexcludeFinancial Servicesand are FTE (not countof employees).ResearchSpecialists exclude10 central support/adminstaff.

https://www.mercer.com/our-thinking/mercer-esg-ratings.html

https://www.mercer.com/content/dam/mercer/attachments/private/nurture-cycle/gl-2018-wealth-guide-to-mercersinvestment-strategy-research-ratings-mercer.pdf

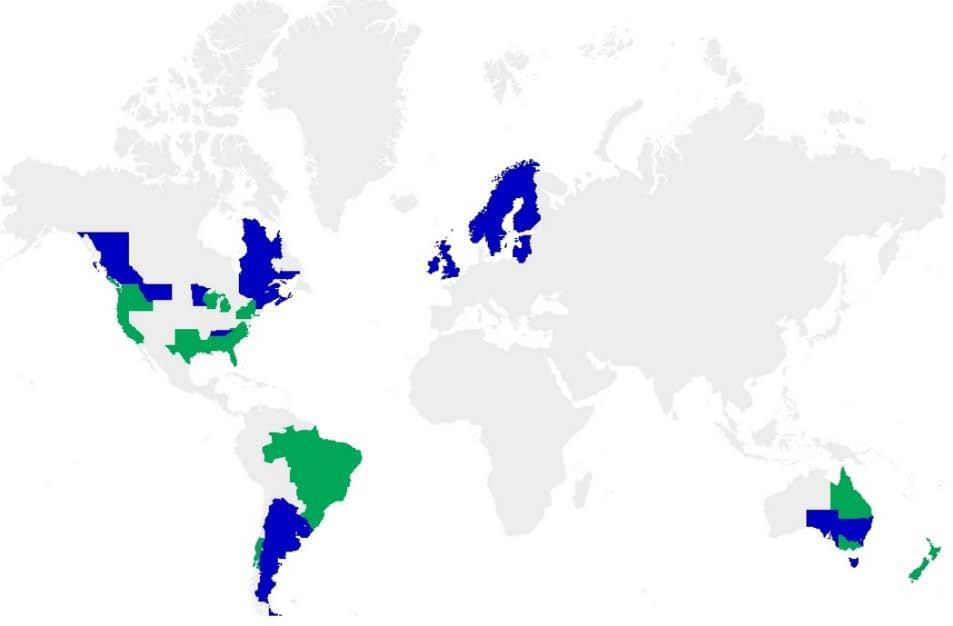

Mercer’s Manager Research team is located around the globe, allowing us to provide The Salvation Army with access to potential solutions in all major markets.

Our local presence allows us to provide frequent and in-depth updates on asset managers and new innovative ideas around the globe.

However, all members of our ManagerResearch team use the same rigorous process to assess asset managers’ capabilities to ensure that we identify the appropriate managers regardless of their geographic location.

© 2020 Mercer LLC. Allrights reserved.

Investment Manager Research Rigorous Framework and Ratings Process

Ideageneration

We appraise the manager’s ability to generate or source value-adding investment ideas

Portfolioconstruction

The quality of a manager’s portfolio construction process will determine how effectively its value-adding investment ideas are converted into consistent outperformance

Implementation

Value added at the idea generation and portfolio construction stages must outweigh the drag on performance due to transaction costs and overcome limitations relating to capacity constraints

Businessmanagement

Well-managed investment firms are more likely to maintain and enhance the competitiveness of their investment strategies over time

Aboveaverageprobability of outperformance

Averageprobability

Belowaverage probability

Not rated

Provisionalrating:Where there is uncertainty about a rating that we expect to resolve quickly

Watch: Where there is some uncertainty about a rating that we do not expect to be resolved soon but consider it unlikely that it will lead to a rating change

TrackingError:Potential for high tracking error or high volatility

Some research performed but not completed for a variety of reasons

Ratings are Mercer’sview onprospectivefuture performancerelative to benchmarks,on a risk-adjusted basis,over a full business cycle.Theymay or may notbe in keepingwith pastperformance.

The Salvation Army and Northern Trust

COMMITTED TO SERVICE, EXPERTISE AND INTEGRITY

Core principles that guide everything we do for clients, partners and the communities we serve.

Exceptional service for our clients, partners and communities

Client-focused

Service Expertise

Integrity

Act with the highest ethics, utmost honesty and unfailing reliability

Expanding our knowledge and capabilities to your advantage

•

•

•

•

•

•

•

•

•

•

•

OUTSTANDING FINANCIAL STRENGTH AND STABILITY

Well-positioned for continued investment in our business, across all market cycles

STRONG CAPITAL POSITION

Northern

Advanced Approach

Common Equity Tier 1 13.0% 4.5%

Tier 1 14.1% 6.0%

Total 15.4% 8.0%

Tier 1 Leverage 7.1% 4.0%

Supplementary Leverage 8.4% 3.0%

Standardized Approach

Common Equity Tier 1 11.9% 4.5%

Tier 1 12.9% 6.0%

Total 14.3% 8.0%

SUPERIOR CREDIT RATING

Tier 1 Leverage 7.1% 4.0% Standard

Northern Trust Corporation

Short Term/Commercial Paper

The Northern Trust Company

Short

HIGH QUALITY BALANCE SHEET

Securities 36% Money market assets 33%

Loans and leases 23% Other 8%

Balance sheet is highly liquid and low risk

Standard & Poor’s assigned the highest credit ratings of any comparable U.S. based bank to our Corporation and main bank subsidiary, The Northern Trust Company.

EXPERTISE

of top-tier public and private

AWARDS FOR INNOVATION AND CORPORATE CITIZENSHIP

We consistently rank among the premier providers of trust, custody and private banking services.

Awards/Rankings Date Publication/Source

• Custodian of the Year 2021 Global Investor Investment Excellence Awards

• Best Administrator Technology 2021 HFM US Services Awards

• Best Mental Health in the Workplace Strategy: Multinational Implementation 2021 This Can Happen Awards

• Best Custody Specialist Institutional 2021

• Best Asset Servicing Mandate, Alternatives (Modular) 2021

• Best Middle Office Outsourcing, Fund Managers (FSI) 2021

The Asset Triple A Sustainable Investing Awards for Institutional Investor, ETF, and Asset Servicing Provider 12th consecutive year

The Asset Triple A Sustainable Investing Awards for Institutional Investor, ETF, and Asset Servicing Provider

The Asset Triple A Sustainable Investing Awards for Institutional Investor, ETF, and Asset Servicing Provider

• Best Custodian 2021 Private Equity Wire European Awards

• Best Cash Management / Treasury Services 2021 HFM US Quant Awards

• Best Mutual Fund Administrator 2021 Fund Intelligence Operations and Services Awards

• Gender Equality Index Member 2021 Bloomberg Fourth consecutive year

• Top ranking of 100% on the Human Rights Campaign Foundations, “Best Place to Work for LGBTQ Equality” 2021 Corporate Equality Index 14th consecutive year

WHY NORTHERN TRUST?

We’re unique…

In our product leadership and innovation

We are a diversified, world class asset servicer offering comprehensive product capabilities.

In our strong culture and heritage

Our 130 year heritage is undiluted by mergers and strengthened by strategic acquisitions.

In our financial strength and stability

Market opinion assigns us a P/E premium up to twice that of our peers, especially reassuring during difficult economic times.

In our service model

We approach every client as a fiduciary aligned with their best interests, free of conflict.

In our client standards

Our client centric approach is committed to providing service, expertise and integrity.

In our business focus

We are highly focused, client centric and lead in the industry markets we serve.

IMPORTANT INFORMATION

Confidentiality Notice: This communication is confidential, may be privileged, and is meant only for the intended recipient. If you are not the intended recipient, please notify the sender as soon as possible. All materials contained in this presentation, including the description of Northern Trust, its systems, processes and pricing methodology, are proprietary information of Northern Trust. In consideration of acceptance of these materials, the recipient agrees that it will keep all such materials strictly confidential and that it will not, without the prior written consent of Northern Trust, distribute such materials or any part thereof to any person outside the recipient’s organization or to any individual within the recipient’s organization who is not directly involved in reviewing this presentation, unless required to do so by applicable law. If the recipient is a consultant acting on behalf of a third party client, the recipient may share such materials with its client if it includes a copy of these restrictions with such materials. In such event, the client agrees to comply with these restrictions in consideration of its accepting such materials.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability as an Illinois corporation under number 0014019. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. This material is directed to professional clients only and is not intended for retail clients. For Asia-Pacific markets, it is directed to expert, institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. For legal and regulatory information about our offices and legal entities, visit northerntrust.com/disclosures. The following information is provided to comply with local disclosure requirements: The Northern Trust Company, London Branch, Northern Trust Global Investments Limited, Northern Trust Securities LLP and Northern Trust Investor Services Limited, 50 Bank Street, London E14 5NT. Northern Trust Global Services SE, 10 rue du Château d’Eau, L 3364 Leudelange, Grand Duché de Luxembourg, incorporated with limited liability in Luxembourg at the RCS under number B232281; Northern Trust Global Services SE UK Branch, 50 Bank Street, London E14 5NT; Northern Trust Global Services SE Sweden Bankfilial, Ingmar Bergmans gata 4, 1st Floor, 114 34 Stockholm, Sweden; Northern Trust Global Services SE Netherlands Branch, Viñoly 7th floor, Claude Debussylaan 18 A, 1082 MD Amsterdam; Northern Trust Global Services SE Abu Dhabi Branch, registration Number 000000519 licenced by ADGM under FSRA # 160018; Northern Trust Global Services SE Norway Branch, 3rd Floor, Haakon VII's Gate 6, 0161 Oslo, Norway; Northern Trust Global Services SE, Leudelange, Luxembourg, Zweigniederlassung Basel is a branch of Northern Trust Global Services SE (itself authorised by the ECB and subject to the prudential supervision of the ECB and the CSSF). The Branch has its registered office at Aeschenplatz 6, 4052, Basel, Switzerland, and is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA. The Northern Trust Company Saudi Arabia, PO Box 7508, Level 20, Kingdom Tower, Al Urubah Road, Olaya District, Riyadh, Kingdom of Saudi Arabia 11214 9597, a Saudi Joint Stock Company Capital 52 million SAR. Regulated and Authorised by the Capital Market Authority License # 12163 26 CR 1010366439. Northern Trust (Guernsey) Limited (2651)/Northern Trust Fiduciary Services (Guernsey) Limited (29806)/Northern Trust International Fund Administration Services (Guernsey) Limited (15532) Registered Office: Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3DA. Northern Trust International Fund Administration Services (Ireland) Limited (160579) / Northern Trust Fiduciary Services (Ireland) Limited (161386), Registered Office: Georges Court, 54 62 Townsend Street, Dublin 2, D02 R156, Ireland.

northerntrust.com

Polsinelli Legal Services The Salvation Army

October 2021

POLSINELLI OVERVIEW FOR THE SALVATION ARMY

Firm Name

Polsinelli PC 100 S. Fourth Street, Suite 1000 St. Louis, MO 63102 314.889.8000

Firm Overview

Polsinelli is a large, national, first generation law firm with the entrepreneurial DNA of its earliest days. Built over 40 years ago on a strong foundation, we now are an Am Law 100 firm with 900 attorneys in 21 offices. Like minded legal talent from across the country who hold in high regard the same principles of superior client service, diversity of thought and collaboration has made us who we are today. The firm’s attorneys provide value through practical legal counsel infused with business insight, and focus on health care, financial services, real estate, intellectual property, middle market corporate, labor and employment and business litigation.

Principal Offices

We strive to align our services to our clients' business goals. Doing so has allowed us to attract experienced attorneys across the country seeking a platform best suited to their clients' priorities.

POLSINELLI OVERVIEW FOR THE SALVATION ARMY

With our firm’s concentration of presence in lower overhead markets, we are able to offer more comprehensive services than local or regional firms and more competitive overall cost than national firms concentrated in higher cost markets.

Firm Practice Areas and Specialties

We are a full service law firm with broad expertise in virtually every legal discipline. Below are areas of our experience we believe most applicable to The Salvation Army.

Limited Partner Representation

We represent large institutional investors, such as charitable organizations and endowments, family offices and funds of funds and high net worth individuals, in their investments in a variety of asset classes. We have extensive experience negotiating governing documents and side letters, mitigating complex tax issues such as UBTI, ECI, and other U S and foreign tax issues and working through regulatory, governance and ESG issues. We work with investors investing in private equity funds, hedge funds, real estate, separately managed accounts, operating companies and commodity pools. More specifically, we routinely handle the following types of matters for our investor clients:

▪

▪

▪

Negotiate side letters with fund managers, and when appropriate, negotiate changes to the limited partnership agreements and other organizational documents of the funds.

Assist in the final close “most favored nations” side letter election process by reviewing each of the offered provisions in light of the client’s specific circumstances.

For our tax exempt clients, evaluate the tax driven structures being employed by funds (e.g., corporate blockers).

▪

▪

▪

▪

Negotiate investor letters and render legal opinions (in the event we have been unable to remove that requirement in a side letter) with respect to credit facilities entered into by funds.

Analyze and provide advice concerning appropriate registration and exemption issues with respect to the investment structure and operations of clients under the Investment Advisers Act of 1940, the Investment Company Act of 1940 and the Commodity Exchange Act.

Assist on co investments and other direct investments made as part of an alternative investment mandate.

Negotiate investment management agreements with advisers (usually with respect to separately managed accounts and mandates) and consultants (usually with respect to general oversight of investment policies and adviser/manager selection).

Nonprofit Organizations

Polsinelli is one of the nation’s leading providers of legal services to nonprofit organizations. We’ve built our team with nationally recognized nonprofit attorneys that hold business acumen and in depth industry knowledge on state and federal tax and nonprofit issues. Our attorneys are well versed on the challenges facing tax exempt organizations, which has

POLSINELLI OVERVIEW FOR THE SALVATION ARMY

enabled us to make significant contributions to nonprofit entities through our use of innovative approaches to meeting their legal and organizational needs.

Corporate and Transactional

Polsinelli’s Corporate and Transactional practice provides a range of legal services from selecting the appropriate choice of entity through exit strategies and everything in between during the life cycle of a business. Working in collaboration with attorneys from the firm's Tax and other related practices allows us to provide our clients with comprehensive legal advice designed to minimize liability, maintain flexibility and advance our client’s objectives.

Securities & Corporate Finance

Polsinelli’s Securities & Corporate Finance attorneys combine significant transactional capabilities and regulatory knowledge with experience across a range of industries to help publicly traded and privately held companies plan and execute capital raising transactions, address complex disclosure and regulatory issues and establish appropriate governance policies and practices.

Our significant experience providing counsel in a full range of financial transactions to a variety of capital markets participants, including public and private issuers, underwriters and placement agents, allows us to deliver practical solutions to our clients quickly and efficiently

Our team focuses its counsel on the following areas and services:

Debt and equity capital markets

SEC disclosure, corporate governance and listed company compliance

REITS and real estate capital markets

M&A, going private and other strategic transactions

Polsinelli Contacts

Ruben K. Chuquimia, Shareholder Ruben’s practice includes a broad range of corporate, securities, and transactional work. He has represented a wide variety of corporate clients, including large publicly traded corporations, privately held entities, private equity funds, start up companies and entrepreneurs. Ruben has been recognized for his experience in corporate and M&A work by Chambers USA every year since 2011 and by The Best Lawyers in America every year since 2012.

Relationship with Polsinelli

Polsinelli’s engagement by The Salvation Army commenced in April of 2012. The principal focus of the engagement is to review potential alternative investments and to negotiate investment terms with fund managers.

Value Added Services

Ensuring clients receive exceptional value as part of their experience with Polsinelli is central to how

POLSINELLI OVERVIEW FOR THE SALVATION ARMY

we approach relationship building. We understand and respect that our clients’ desire for a robust partnership is evolving and driven by growing internal expectations and constraints. Below is a selection of services we offer.

Thought Leadership and Education

Firm hosted events for CLE credit

E Alerts, newsletters and other updates on new regulations and trends

Technology

Cloud based file sharing through data rooms or client extranets

client portals to support cost tracking, matter or case progression, attorney time tracking, project tools and forms and historical data

polsinelli.com | Polsinelli is very proud of the results we obtain for our clients, but you should know that past results do not guarantee future results; that every case is different and must be judged on its own merits; and that the choice of a lawyer is an important decision and should not be based solely upon advertisements. Polsinelli PC. Polsinelli LLP in California. Polsinelli PC (Inc.) in Florida.

46 Southfield Avenue, Suite 450, Stamford, CT 06902 battea.com | +1 203 987 4949 | info@battea.com

BatteaClassActionServices,LLCisagloballeaderandexpertinallstagesofassertingand processingsettlementclaimsinconnectionwithantitrustandsecuritieslitigation. Battea has beenaleaderinthespace since 2001,servingmorethan900institutionsaroundtheworld, includingmanyoftheworld’slargestbanks,hedgefunds,assetmanagersandbuy-side investors.Withdeeprootsintheclaimsfilingandfinancialtechnologysectorsanditsglobal presence,Batteaisoptimallypositionedtohelpclientsnavigatetheincreasinglycomplex processofobtainingtrustworthyinformationaboutlitigationthatimpactstheirinvestments andbusinesses.ThecombinedexperienceoftheBatteateamisunrivaledamongindustry peersandbroughttobearforourclients,guidingthemthroughtheentirecycleofthe litigationandsettlementprocess.Battea’sexpertiseissimplyunmatched.

ThelandscapeforU.S.classactions,internationalsecuritieslitigationandsecuritiescentricanti trustlitigationhasevolvedrapidlyaroundtheglobe.ThatiswhyBatteahasaugmentedits professionalstaffthroughkeyhiresthatcreateauniqueblendoftradingtransactionanddata securitytechnologists,formerclaimsadministrators,financialindustryexperts,securities litigationanalystsandeconometricexperts,andaprofessionalbusinessdevelopmentteam includingfull servicemarketingandcommunicationsservices.

• Average of 25 years of experience

• Foremost experts in financial trading technologies

• Executives include former CEO, CIOs, CTOs, CFOs

• Management holds MBAs, CPAs, and CFAs

• Series 3, 6, 7, 24, 27, 34, 55, & 63 Certified

Main Contacts:

Trent Calabretta

VP, Sales 203 987 4949 trent@battea.com

Chris Marcon VP, Account Management 203 987 4949 cmarcon@battea.com

46 Southfield Avenue, Suite 450, Stamford, CT 06902 battea.com | +1 203 987 4949 | info@battea.com

Service Commencement Date:

March 15, 2019

Services Provided:

Securities and antitrust litigation settlement research, global fund damage analysis, and securities class and collective action claims filings.

46 Southfield Avenue, Suite 450, Stamford, CT 06902 battea.com | +1 203 987 4949 | info@battea.com

This page intentionally left blank

American Century Investments

Bringing You Up-to-Date on American Century Investments

Firm

▪

▪

Assets under management were US$236.1 billion as of 9/30/2021.

Year to date as of 9/30/2021, more than US$6.6 billion in institutional assets were gained through new or additional fundings across multiple vehicles and strategies.

Ownership Structure

100%

80%

60%

16%20%

40% 10%

▪

Our Diversity, Equity and Inclusion (DEI) efforts fall under three pillars: Employee Engagement, Talent Development and Community Partnerships. Six Business Resource Groups Accelerate, Charlie Mike, Emerging Professionals, Enable, Mosaic and Pride have been formed to offer prioritization and support for DEI initiatives.

40%

20%

44%

70%

▪

The firm recently established a “Green Team” to further formalize its commitment to promoting sustainable business practices. The Green Team collaborates across the company in organizing and facilitating action around sustainable environmental opportunities that affect our employees, clients, and community.

▪

American Century Investments® won the 2021 Refinitiv Lipper’s Best Overall Large Firm and Best Equity Large Group Awards.

Investments

▪

As of September 30, 2021, more than 80% of firm assets under management are subject to the application of ESG considerations into the investment process employed by each strategy’s portfolio managers. The degree to which ESG considerations impact a portfolio’s holdings vary by portfolio.

0%

Equity Voting

Employeesand othershareholders

Nomura Holdings, Inc. StowersInstitute and family

Data as of 9/30/2021

Foundation for Success

■ Founded in 1958

▪

Enhanced our Target Date offering through the introduction of One Choice Blend+, a new series of active target date portfolios that blend fundamental active strategies with systematic low cost strategies.

▪

Expanded our fixed income capabilities with the launch of two new strategies: a blended Emerging Markets Bond offering and a Multi Sector Fixed Income strategy. Additionally, in September, the firm hired the portfolio management team responsible for Aberdeen Standard Investments’ Total Return Bond strategy. The team utilizes the same methodology they employed at Aberdeen and brings additional expertise to the fixed income platform.

▪

Launched four Avantis strategies (ETFs only) in September: U.S. Large Cap Value, International Large Cap Value, Emerging Markets Value (all cap) and the REIT ETF which invests globally

Thought Leadership

▪

Investment Opportunities in a Post COVID World ▪

2020 Emerging Markets Sustainable Impact Report ▪

ESG Outlook: 6 Key Trends We’re Tracking 2021 ▪ Navigating the Low Volatility Anomaly ▪

Our 2021 Capital Market Assumptions ▪

Integrating ESG Criteria in Multi Asset Portfolios ▪ Revisiting Earnings Acceleration ▪

Emerging Markets Review & Outlook: Sequenced Rather Than Synchronized ▪ U.S. Sustainable Large Cap Core: Sustainability Report ▪ Breakthrough Medical Treatments Brighten Outlook for Alzheimer's Patients ▪ Small Cap Biopharmaceuticals: The Epicenter of Medical Innovation

Firm data as of 9/30/2021

■ $236 billion in assets $111 billion in Institutional assets ■ ■ 197 investment professionals ■ More than 200 institutional clients ■ Globally located

Expertise spans five distinct investment disciplines

Kansas City (Headquarters) New York Mountain View (CA) Los Angeles London Hong Kong Sydney Frankfurt

Data as of 9/30/2021. Assets in USD.

Investing With a Well-Defined Bottom-Up Growth Philosophy

We believe that accelerating, sustainable growth in revenues and earnings, driven by an inflection in business fundamentals, results in stock price outperformance.

We focus on inflection points in companies’ fundamentals because we believe markets are inefficient at identifying these changes.

Our process is designed to uncover stocks that outperform as earnings growth accelerates, market expectations rise and multiples expand.

We believe the direction of earnings growth is a more powerful predictor of stock price performance than the absolute level of growth.

15%7%10% 22%

Growth Over Time

21%23%20% 20%

Growth Over Time

Identifying Market Inefficiencies

Persistent Inefficiencies

▪ Market is slow to recognize positive inflection points in the earnings cycles of individual companies.

▪ Market is inefficient in extrapolating current operating trends into future earnings around these inflection points.

Actual company fundamentals Wall Street consensus expectations

The Salvation Army Non-U.S. Growth (Gross of Fees)

The Salvation Army Non-U.S. Growth (Net of Fees)

MSCI EAFE

The Salvation Army Non-U.S. Growth (Gross of Fees) 0.24 7.03 21.37 14.74 14.21 11.04

The Salvation Army Non-U.S. Growth (Net of Fees) 0.10 6.61 20.72 14.12 13.59 10.43

MSCI EAFE 0.45 8.35 25.73 7.62 8.81 7.46

Excess Return (Gross of Fees) 0.69 1.32 4.36 7.12 5.40 3.58

Excess Return (Net of Fees) 0.55 1.74 5.01 6.50 4.78 2.97

Data as of 9/30/2021. Performance in USD Periods greater than one year have been annualized. Inception date: 11/1/2012. Past performance is no guarantee of future results.

Source: FactSet

Performance Commentary – One Year Ending 9/30/2021

▪

The Salvation Army Non U.S. Growth portfolio underperformed the MSCI EAFE benchmark for the one year ended September 30, 2021, gaining 20.7% net of fees versus the index gain of 25.7%. The portfolio faced a strong headwind of the outperformance of value vs. growth, as the MSCI Value index gained 30.7% vs. the MSCI Growth index up 20.9%.

▪

Stock prices gained early in the year fueled by strong evidence of a global recovery in earnings growth despite new virus variants complicating the re opening in some regions. Economic activity was driven by strong rebound in both consumer demand and capital investment.

▪

The first 6 months of the fiscal year were led by stocks believed to benefit the most from re opening and cyclical recovery. This manifested in a high beta, low quality bounce off the market bottom irrespective of company specific fundamentals. The MSCI EAFE Value index outperformed the Growth index by 1600bps in this time period.

▪

Earnings growth continued to come in better than expectations setting records for sequential earnings beats. Broad based earnings gains led the global earnings revision ratio to new highs. Visibility into future earnings growth improved and it became apparent earnings would exceed pre pandemic levels sooner than expected.

▪

▪

▪

While the momentum of the cyclical recovery persisted through the time period, it is no longer accelerating. Much of the deep cyclical recovery is reflected in earnings estimates and valuations.

Growth rates are expected to normalize as macro influences stabilize. Structural and secular drivers will dominate. We anticipate earnings will be the key driver of stock price performance as PE multiples have declined.

The portfolio underperformed for the time period primarily due to positioning in financials, energy and materials. In addition, stock selection within consumer discretionary detracted from returns.

▪

Within consumer discretionary, top detractors included UK online apparel retailer ASOS. The company experienced slowdown in UK sales due to supply chain issues and has been unable to turn around its flailing U.S. business. The team sold the stock. China based Alibaba declined due to concerns over regulatory issues, and the team exited the position. Brazil based Magazine Luiza was weak despite continued strong earnings results.

▪

▪

The portfolio underweight in energy detracted 107 bps from excess returns.

Within financials, the underweight in banks detracted 150 bps from excess returns. In addition, long time portfolio holding London Stock Exchange declined due to concerns over delays in realization. The portfolio is underweight banks but does have some exposure to names with company specific drivers to growth.

▪

▪

On a positive note, multiple portfolio holdings added to the strong absolute returns. The common theme of top contributors was strong earnings reports and improved visibility of durable earnings improvement.

Multiple names within information technology added to returns, including payment processor Adyen, semiconductor equipment manufacturer ASML, components supplier Murata Manufacturing, and IT services provider Capgemini.

▪

Several holdings in industrials added as well. Top performers included Japan HR technology company Recruit Holdings, which owns Indeed.com, U.K. Construction equipment leasing company Ashtead, and power tool manufacturer Techtronic Industries.

As of 9/30/2021. Opinions and estimates offered constitute our judgment and along with other portfolio data are subject to change without notice. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities.

Portfolio Outlook and Positioning

▪

▪

▪

We remain focused on our disciplined, bottom up fundamental process aimed at identifying opportunities with accelerating, sustainable growth, where we see upside to consensus estimates.

While rates of growth have peaked, visibility into a long duration, earnings recovery has improved despite shortterm transitory issues. Earnings are forecasted to reach pre pandemic levels sooner than originally anticipated.

We believe 2022 will be a year of more normalized earnings growth as macro influences stabilize. This could lead to increased dispersion of returns as the market rewards stocks on fundamental merits.

▪

▪

We anticipate earnings will be the key driver of stock price performance and could continue to see multiple contraction.

We continue to take a balanced approach in the portfolio but believe company specific and secular drivers are becoming more attractive versus reopening or cyclical factors. We have exposure to companies poised to benefit from cyclical strength but also possess outsized durable growth drivers, as well as those supported by ongoing long term secular themes.

▪

▪

Input prices such as raw materials, labor and natural gas continue to rise, some at an accelerated pace. We are closely monitoring the acceleration of price increases and potential impact on profits and end market demand.

Recovery in travel names remains volatile. We trimmed positions where visibility remains low. We maintain positions in companies that also have support of specific competitive advantages.

▪ We added to positions in European banks as we see loan growth improving with economic activity.

▪ We maintain exposure to multiple secular growth themes including:

The Shift to Online Activity – E commerce penetration remains high and is growing in some industries.

Importance of a Strong, Global Communications Infrastructure Demand for data, cloud computing and remote access are driving increased investment as companies debate the need for a large central office.

Digitization – The need for efficiency and productivity will continue to drive spending in multiple industries.

Increased Environmental Awareness and Investment in Green Energy Solutions The trend is accelerating with the support of multiple fiscal stimulus programs in all regions of the world.

Luxury and Premium Brands – Pent-up consumer demand and high savings rates are driving increased consumer spend.

Construction and Infrastructure Spending Supported by fiscal programs, corporate CAPEX and strong housing trends.

Production and Supply Chain Reorganization Companies continue to invest to bring capacity closer to home. The quest for greater efficiency leads to higher usage of automation and robotic solutions.

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

As of 9/30/2021. Opinions and estimates offered constitute our judgment and along with other portfolio data, are subject to change without notice.

Refinitiv Lipper Awards Important Disclosures:

The Refinitiv Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk adjusted performance relative to their peers.

The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Refinitiv Lipper Fund Award. For more information, see lipperfundawards.com . Although Refinitiv Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Refinitiv Lipper.

Refinitiv Lipper Fund Awards, ©2021 Refinitiv. All rights reserved. Used under license.

Composite Performance

December 31, 2020

Non-U.S. Growth Equity (USD) Benchmark: MSCIEAFE (Net) Index

Year

2011-10.88-12.00-12.1422.2622.436N/A$2,548,748$109,483,940 201222.8521.5317.3219.8819.37120.54$4,138,412$124,740,627 201324.7223.5822.7816.3016.25120.54$5,477,857$139,308,411 2014-3.91-4.71-4.9012.4113.03180.32$6,617,164$145,752,355 20151.630.87-0.8111.4012.46170.48$6,151,546$146,186,455 2016-4.93-5.621.0011.8812.46180.40$6,139,121$156,826,943 201731.9331.1125.0311.8212.00170.87$7,367,617$173,311,771 2018-14.15-14.60-13.7912.5811.40150.47$5,371,754$149,483,375 201929.7329.0722.0112.0710.96120.24$6,220,141$178,050,055 202027.3626.727.8217.7318.1490.42$6,894,543$212,549,453

Performance Disclosures

December 31, 2020

Non-U.S. Growth Equity (USD)

For purposes of compliance with the Global Investment Performance Standards (“GIPS®”), the Firm is defined as American Century Investment Management, Inc (“ACIM” or “the Firm”)

American Century Investment Management, Inc. claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards ACIM has been independently verified for the periods January 1, 1992 to December 31, 2020 A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm wide basis The Non U S Growth Equity composite has had a performance examination for the periods January 1, 1994 to December 31, 2020. The verification and performance examination reports are available upon request.

The Non U S Growth Equity strategy seeks to provide a total return that exceeds the benchmark (MSCI EAFE (Net) Index) by 2% to 3% on an annualized basis over a full market cycle using a fundamentally driven growth equity investment strategy targeting predominantly large cap companies in developed markets outside the U S with the ability to investment up to 15% of the portfolio in emerging markets

Performance shown represents total returns that include accrued interest and dividend income, realized and unrealized gains and losses. The performance for this composite is net of foreign income tax withholding and includes the effect of foreign currency where applicable

Gross of fee returns are net of all trading costs and are calculated before management fees, administrative fees, custody fees and distribution and service fees, as applicable Net of fee returns are calculated after all trading costs, actual management fees, custody fees, distribution and services fees, as applicable Beginning December 1, 2018, the composite includes one or more accounts that utilize a model fee to calculate account level net of fee performance Net of fee returns utilizing a model fee are calculated after applying the standard management fee schedule for separate accounts based on the individual account's daily asset levels Actual management fees may differ from the standard management fee schedule Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request

The management fee schedule for separate accounts is as follows: 75% on the first $25 million; 65% on the next $25 million; 60% on the next $50 million; 55% on all assets thereafter Both the highest management fee and highest total expense ratio for the American Century Non U S Growth Trust, which is included in the composite, is 0 68% on all assets.

The composite’s dispersion of annual returns is measured by the asset weighted standard deviation of individual portfolio gross of fee annual returns Only portfolios that have been managed within the composite for the full year are included in the asset weighted standard deviation calculation. Dispersion is not calculated for composites that have five or fewer portfolios for the full calendar year

The MSCI EAFE (Net) Index is designed to measure developed market equity performance, excluding the U S and Canada The performance results for the MSCI EAFE (Net) Index are net of foreign income tax withholding

The Firm established a $5 million minimum portfolio size for inclusion in the composite.

The creation date for this composite is June 16, 2000 The inception date for this composite is June 1, 1991

A list of all composite and pooled fund investment strategies offered by the firm, with a description of each strategy, is available upon request The type of portfolios in which each strategy is available is indicated

Past performance may not be indicative of future returns. The value of any investment may rise or fall over time Principal is not guaranteed, and investors may receive less than the full amount of principal invested at the time of redemption if asset values have declined

GIPS® is a registered trademark of CFA Institute CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein

American Century Proprietary Holdings, Inc All rights reserved

American Securities

American Securities Overview

ASP I $71mm

ASP II $350mm

ASP III $650mm ASP IV $1bn ASP V $2.3bn ASP VI $3.6bn ASP VII $5bn ASP VIII $7bn

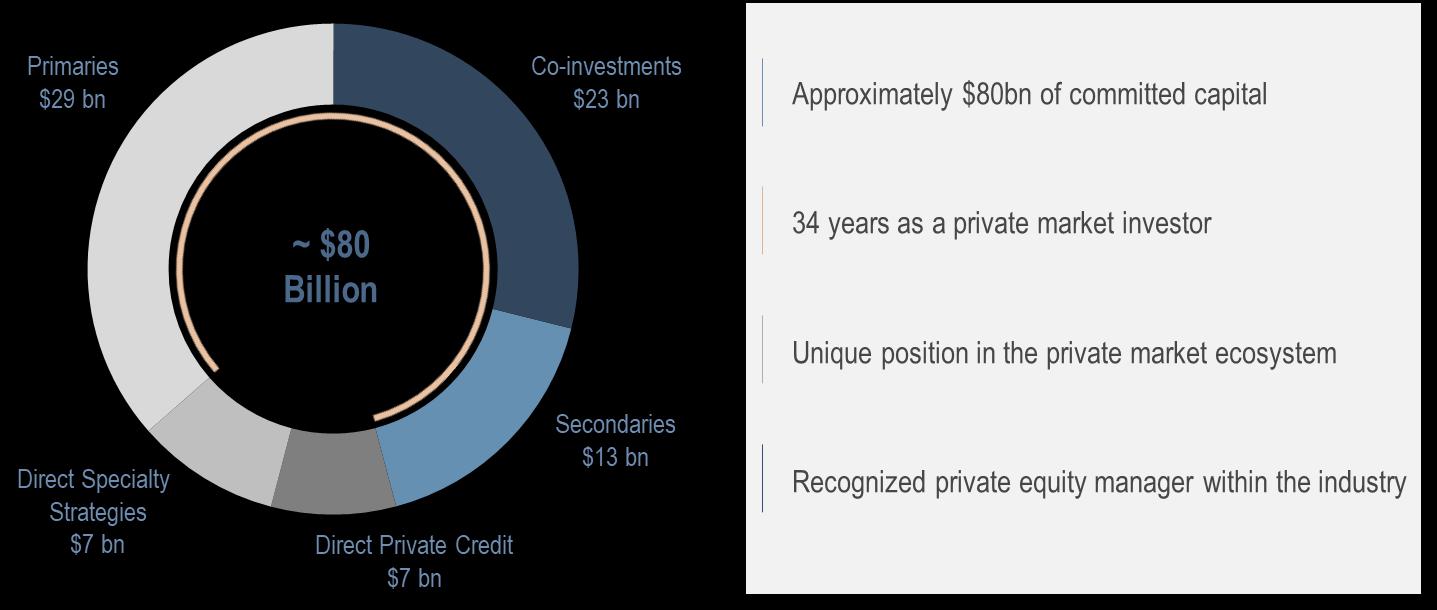

American Securities is a North American buyout firm that partners with experienced management teams and continuously invests in their long-term success

$25+ billion of committed capital firmwide, including affiliates

42-person Investment Team serving as thought partner to CEOs and their management teams on strategic direction and capital allocation

53-person in-house Resources Group to assist management teams in functional and strategic execution

Firm Developments

Notable Promotion

Mark Lovett, who originally joined American Securities in 2007 as a pre-MBA Associate and then rejoined as a Vice President in 2012 after working at a former American Securities portfolio company, was promoted to Managing Director at year-end 2020

ESG & DEI

In August 2021, engaged third-party provider to assist in ESG KPI collection across ASP VIII portfolio for reporting in 2022

In April 2021, formed DEI Committee with members from different teams and of different seniorities to continue driving progress on DEI

AS Birch Grove

In June 2021, American Securities closed the merger of its opportunistic credit business with Birch Grove Capital, a credit asset management business This transaction does not impact American Securities’ ownership or management

The combined entity, which is named AS Birch Grove, manages approximately $5 billion in credit assets

American Securities Partners VIII, L.P.

ASP VIII is a 2019 vintage fund with $7 billion in commitments

Declared effective on January 15, 2019

Investment period of six years, concluding on January 15, 2025 Fund life of up to 25 years 10-year initial term with three one-year extensions 12 additional one-year extensions, provided that a majority in interest of Limited Partners does not object in writing to any such extensions TSA Southern Territory’s commitment to ASP VIII is $30 million

To date, approximately $15.9 million has been called for investments, fees, and expenses(1)

June 30, 2021(4) 1.3x 37.0% 1.2x 22.9% (5) December 31, 2020 1.1x 7.2% 0.9x -13.5% (5) December 31, 2019 1.0x 0.0% N/A N/A

Past performance is not indicative of future results. Comparable benchmark performance results are unavailable at this timefor 2019 vintage North American buyout funds.

(1)Excludes capital related to closed transactions that was funded via American Securities Partners VIII’s credit facility and has not yet been called from investors. Including capital outstandingon the credit facility,approximately $16.8 million of TSA SouthernTerritory’s commitment has been utilized.

(2)Gross IRRs are calculated (x) with respect to realized investments, based on the actual daily capital inflows to and outflowsfrom ASP Portfolio Companies, and (y) with respect to unrealizedinvestments and the remainingunrealizedportions ofpartiallyrealized investments, based upon the timingofactual dailycapital inflows and the assumptionthat such unrealized investments are disposed of for cash at their respective unrealizedvalues as ofperiodend.

(3)Net IRR represents the cumulative internal rate of return since the fund’s inception based on the due dates of capital contributions, the actual date of distributions, and the net asset valueof limitedpartners(which has takeninto consideration managementfees, partnershipexpenses, and carried interest) asofperiodend.

(4)The Q3 reporting process is still underway at this time. Quarterly letters, inclusive of performance information as of September 30, 2021, will be distributed in early-to-mid November.

(5)Excluding the effect of the credit facility, ASP VIII’s estimated net IRR would be 17.5% as of June 30, 2021and -8.9% as of December 31, 2020.

American Securities Partners VIII Investments

As of June 30, 2021 ($ mm)(1)

Acquisition

Dec 2019 $377.0$483.7 1.3x17.7%

Dec 2019 $516.1$471.3 0.9x-5.9%

Jan 2020 $372.0$737.2 2.0x61.6%

Debt Initiative(3) Mar 2020 –Mar 2021 $51.7$61.2 1.2x37.6%

Jan 2021 $527.5$584.3 1.1x27.5%

Apr 2021 $187.0$236.8 1.3x N/M

Leading provider of non-destructive testing and related services to energy and industrial end markets in North America

Largest developer and operator of fitness clubs under the Planet Fitness brand

Leading contractor to the U.S. federal government and select allied national governments, supporting programs of critical national significance across defense, security and intelligence, energy, and environmental cleanup

Three former American Securities portfolio companies and 14 where we previously performed significant due diligence

Leading specialty building product distributor of wallboard, suspended ceiling systems, metal framing, and complementary products in North America

One of the largest independent outpatient medical imaging providers and physician radiology practices in the U.S.

(1)The Q3 reporting process is still underway at this time. Quarterly letters, inclusive of performance information as of September 30, 2021, will be distributed in early-to-mid November.

(2)Gross IRRs are calculated (x) with respect to realized investments, based on the actual daily capital inflows to and outflowsfrom ASP Portfolio Companies, and (y) with respect to unrealized investments and the remaining unrealized portions of partially realized investments, based upon the timing of actual daily capital inflows and the assumption that such unrealized investments are disposed of for cash at their respective unrealized values as of June 30, 2021.

(3)Excludes an investment in the debt of United PF, which is recorded as part of the United PF entry in the table above.

American

Partners VIII Investments (Continued)

May 2021 $400.0$567.21.4xN/M

Leading renewable energy services business focused on the engineering, procurement, and construction and development of solar and storage projects

Regional last-mile delivery company providing residential e-commerce delivery solutions, custom-routed logistics, and global critical delivery services

May 2021 $562.0$754.01.3xN/M

Global leader in premium kitchen electrics appliances, non-electric kitchenware, personal care, grooming, health, and beauty products Oct 2021 $299.5

Provider of technology hardware, software, and services to over 2,500 enterprise and mid-market customers in the U.S. Pending ~$380

Renewable energy company focused on engineering, procurement, and construction and operations & maintenance services mainly for large scale solar and storage markets

The Salvation Army Southern Territory Annual Portfolio Review Meeting

Organizational Update

As of September 30, 2021

$34.5 Billion in Assets

• Assets under management: $28.3 billion

• Assets under advisement: $6.2 billion

Ownership

•Part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley

Investment Strategies

• High Quality Small / SMID Cap/ Select Equity: $18.8 bnin assets

• High Quality Large Cap Growth: $1.3 bnin assets

• High Quality Socially Responsible : $6.7 bnin assets

• High Quality Fixed Income : $1.5 bnin assets

Fiscal 2020 Significant Events:

On October 8, 2020, Morgan Stanley (MS) announced its intention to acquire Eaton Vance (EV), the majority owner of Atlanta Capital Management. The transaction was completed in March of 2021. There has been no change to our investment team or investment process.

COVID-19 Response/Update:

In March 2020, we elected to have all employees work remotely for health reasons. In September 2020, we began a formal return to office (RTO) program where all investment professionals who have received a COVID vaccine are back in the office full time.

Small Cap Portfolio Management Bios

Charles B. Reed, CFA is a Managing Director-Equities and Principal of the firm. Mr. Reed serves as a portfolio manager for Atlanta Capital’s Small Cap, SMID Cap and Select Equity portfolios. Prior to joining the firm in 1998, Mr. Reed was a portfolio manager with the Florida State Board of Administration. He was responsible for managing their internal special situation equity fund. Mr. Reed holds a Chartered Financial Analyst designation and is a graduate of Florida State University where he earned a Bachelor of Science degree in Finance.

William O. Bell, IV, CFA is a Vice President and Principal of the firm and serves as a portfolio manager on the Small Cap, SMID Cap and Select Equity portfolios. Prior to joining the firm in the fall of 1999, Mr. Bell was a portfolio manager with the Florida State Board of Administration. He was responsible for managing their internal special situation equity fund. Mr. Bell is a graduate of Florida State University, where he earned a Bachelor of Arts in Finance. Mr. Bell holds a Chartered Financial Analyst designation.

W.Matthew Hereford, CFA is a Vice President and Principalof the firm and serves as a portfolio manager on the Small Cap, SMID Cap and Select Equity portfolios. Prior to joining Atlanta Capital in December 2002, Mr. Hereford worked for 5 years at INVESCO. He was responsible for managing their Concentrated Equity Portfolio. Mr. Hereford is a graduate from the University of Mississippi, where he earned a Bachelor of Business Administration degree in International Business. Mr. Hereford holds a Certified Financial Analyst designation and is a member of the Atlanta Society of Financial Analysts.

Salvation Army Small Cap

Investment Returns as of September 30, 2021

Market Value 9/30/20$58,539,450 Market Value 9/30/21$76,214,270

Inception Date 4/30/95 $6,000,200

1Year 9/20 –9/21

PriorFiscal 9/19 –9/20 Three Year* 9/18 –9/21 Five Year* 9/16 –9/21

Total Fund 30.64 -2.53 10.11 14.07

Russell 2000® Index 47.68 0.39 10.54 13.45

Significant Flows since 04/30/95

08/01/97 $9,638,673 07/28/989,000,000 08/19/981,000,000 05/27/993,000,000 02/27/011,000,000 10/29/03 -20,000,000 04/14/09 -8,750,000 09/07/10 -9,750,000 05/26/11 -10,000,000 03/28/12 -5,000,000 12/17/13 -10,000,000 05/08/14 -10,000,000 06/30/16 -5,000,000 08/01/16 -5,000,000 08/23/16 -15,000,000 06/13/17 -10,000,000 10/23/19 -3,000,000 01/13/20 -10,000,000 09/04/20 10,000,000 09/11/20 10,000,000

Salvation Army Small Cap

Calendar Year Returns

Investment Objective:

The investment objectives, in order of priority, are (1) the preservation of capital; (2) to earn, on an annualized basis, over a full market cycle (three to five years), a total return (net-of-fees) which will exceed CPI plus 5%; and, (3) to achieve asset returns which exceed the performance of the Russell 2000 Index.

YearTotal FundRussell 2000

199624.816.5 199740.622.4 19985.1-2.5 19990.421.3 200017.4-3.0 200111.12.5 2002-7.1-20.5 200327.647.3 200420.218.3 20056.14.6 200616.118.4 20076.8-1.6 2008-19.5-33.8 200927.027.2 201025.926.9 201110.4-4.2 201212.116.3 201342.638.8 20143.14.9

Salvation Army Small Cap

Calendar Year Returns (cont’d)

Investment Objective:

The investment objectives, in order of priority, are (1) the preservation of capital; (2) to earn, on an annualized basis, over a full market cycle (three to five years), a total return (net-of-fees) which will exceed CPI plus 5%; and, (3) to achieve asset returns which exceed the performance of the Russell 2000 Index.

YearTotal FundRussell 2000

2015 5.1 -4.4 201618.98 21.31 2017 14.69 14.65 2018 1.72 -11.01 201927.06 25.53 202012.15 19.96 2021 YTD8.49 12.41

Since Inception (4/30/95) 13.25 9.79

Salvation Army Small Cap One Year as of September 30, 2021

The portfolio experienced strong absolute performance but underperformed the benchmark over the past twelve months, gaining +30.6% versus the Russell 2000 Index return of +47.7%.

Low quality stocks have largely outperformed high quality stocks since the March 2020 pandemic lows due to the record amount of stimulus injected into the economy. Current low quality small cap outperformance is similar to levels experienced prior to the “Dot-Com” and Financial Crisis (see graph above). We would expect this extreme to normalize in favor of higher quality.

During the fiscal year, the portfolio experienced positive stock selection in Communication Services. Negative stock selection was most pronounced in Industrials, Consumer Discretionary, Technology, Financials, and Materials.

Our underweight to Health Care, Utilities, and Real Estate benefited overall allocation. Our underweight to Energy detracted from performance as commodity price inflation lifted energy stocks.

While low quality market dynamics are a near-term challenge to high quality strategies, we remain committed to investing in higher quality companies with positive earnings, strong balance sheets, and strong levels of profitability.

Sources:

High and low quality research portfolios compare the aggregate of all companies within the benchmark index with SPGMI Quality Rankings of B+ or Better to those with SPGMI Quality Rankings of B or Below.Thedata equalstherolling 5-year returnofthehigh qualityresearchportfoliominustherolling 5 year returnofthe lowqualityresearchportfolio fortheindex.

S&PGlobal,FTSERussell,WilshireAtlas,eVestment, AtlantaCapitalasof June 30, 2021.Salvation Army Small Cap Small Cap Investment Process

Step 1 CREATE A “FOCUS LIST” OF HIGH QUALITY COMPANIES

Evaluate U.S. companies within the $200 million to $4 billion capitalization range.

Exclude companies with:

• Volatile earnings streams

• Short operating histories

• High levels of debt

• Weak cash flow generation

• Low returns on capital

The result is a focus list of approximately 200 high quality companies.

Step 2 CONDUCT PROPRIETARY FUNDAMENTAL RESEARCH

Company specific research includes: Research must answer the following questions:

• Selectively meet company management and visit facilities

• Communicate with competitors, suppliers and buyers

• Review annual reports, 10K’s, 10Q’s, periodicals, and journals

• Is this the type of business we want to own?

• What price are we willing to pay?

“We believe that companies with a demonstrated history of consistent growth & stability in earnings provide attractive returns with moderate risk over the long-term.”

Salvation Army Small Cap

•

•

•

•

•

•

•

•

“We will sell a business if”

Information for Investment Portfolio Annual Review Meeting

The Salvation Army Southern Territory

November 2021

Baillie Gifford and the Salvation Army Southern Territory

Appointed to manage $61 million in an International Non US equity portfolio for The Southern Territory from October 2, 2000

Appointed to manage $50 million in the Emerging Markets Fund from May 3, 2010

Appointed to manage $56 million in the Long Term Global Growth Equity Fund from August 31, 2017

Baillie Gifford remains an independent partnership since its formation in 1908. It has 47 partners, 1,576 staff (319 investment professionals) and $466.8 billion under management as at September 30, 2021

Changes at Baillie Gifford in the year to September 30, 2021

3 new partners appointed, and 2 partners retired in 2021, including Joint Senior Partner, Charles Plowden

13 new investment graduate trainees joined in September 2021

Baillie Gifford The Salvation Army Southern Territory November 2021Teams

International Equities

Gerard Callahan*

30 years’ experience

30 years with Baillie Gifford

Joe Faraday

19 years’ experience 19 years with Baillie Gifford

Iain Campbell*

17 years’ experience 17 years with Baillie Gifford

Emerging Markets Team

Will Sutcliffe*

22 years’ experience

22 years with Baillie Gifford

Andrew Stobart

30 years’ experience 30 years with Baillie Gifford

Ben Durrant

9 years’ experience 4 years with Baillie Gifford

Huatai Cui

2 years’ experience 2 years with Baillie Gifford

Long Term Global Growth Team

Mark Urquhart*

25 years’ experience 25 years with Baillie Gifford

James Anderson*

38 years’ experience 38 years with Baillie Gifford

John MacDougall*

21 years’ experience 21 years with Baillie Gifford

Michael Pye

8 years’ experience 8 years with Baillie Gifford

Sophie Earnshaw 11 years’ experience 11 years with Baillie Gifford

Moritz Sitte 11 years’ experience 11 years with Baillie Gifford

Mike Gush* 18 years’ experience 18 years with Baillie Gifford

Roderick Snell 15 years’ experience 15 years with Baillie Gifford

Sophie Earnshaw 11 years’ experience 11 years with Baillie Gifford

Kitsu Egerton

Joined Baillie Gifford in September 2021

Alice Stretch 3 years’ experience 3 years with Baillie Gifford

Gemma Barkhuizen 4 years’ experience 4 years with Baillie Gifford

Robert Wilson 5 years’ experience 5 years with Baillie Gifford

Brogan Harris

Joined Baillie Gifford in September 2021

International Equities Portfolio

Investment Philosophy and Process

Philosophy

Growth: We believe superior profit growth leads to outperformance in the long run

Active: Bottom up stock selection enables exploitation of inefficiencies

Long term: Share prices reflect fundamentals over the long term

Investment Process

Performance

Fund % MSCI EAFE Index %

12 Months to September 30, 2021 21.81 26.29

12 Months to September 30, 2020 25.51 0.93

3 Years to September 30, 2021 (p.a.) 14.66 8.11

5 Years to September 30, 2021 (p.a.) 12.68 9.32

Since Inception (10/31/00) to September 30, 2021 (p.a.) 6.81 5.15

Since Inception (10/31/00) to December 31, 2000 1.42 0.28

12 Months to December 31, 2001 19.09 21.21

12 Months to December 31, 2002 18.08 15.66

12 Months to December 31, 2003 31.89 39.17

12 Months to December 31, 2004 17.09 20.70

12 Months to December 31, 2005 14.85 14.02

12 Months to December 31, 2006 23.34 26.86

12 Months to December 31, 2007 13.29 11.63

12 Months to December 31, 2008 41.99 43.06

12 Months to December 31, 2009 38.32 32.46

12 Months to December 31, 2010 16.36 8.21

12 Months to December 31, 2011 10.86 11.73

12 Months to December 31, 2012 20.18 17.90

12 Months to December 31, 2013 26.19 23.29

12 Months to December 31, 2014 4.28 4.48

12 Months to December 31, 2015 4.41 0.39

12 Months to December 31, 2016 0.31 1.51

12 Months to December 31, 2017 27.11 25.62

12 Months to December 31, 2018 15.75 13.36

12 Months to December 31, 2019 33.68 22.66

12 Months to December 31, 2020 28.12 8.28