NOVEMBER

2025

2025

Part of the group with a family factor.

CITY REALTY GROUP CREATE RECOGNISE GROW

04.

Market CommentGood news is gaining credibility...

08.

Mount Roskill Sales Statistics

October 2025

14.

Article – Tony Alexander: What the OCR drop to 2.25% means for mortgages and house prices in 2026

18.

Article – Tony Alexander: Three forces shaping the housing market’s next move

06.

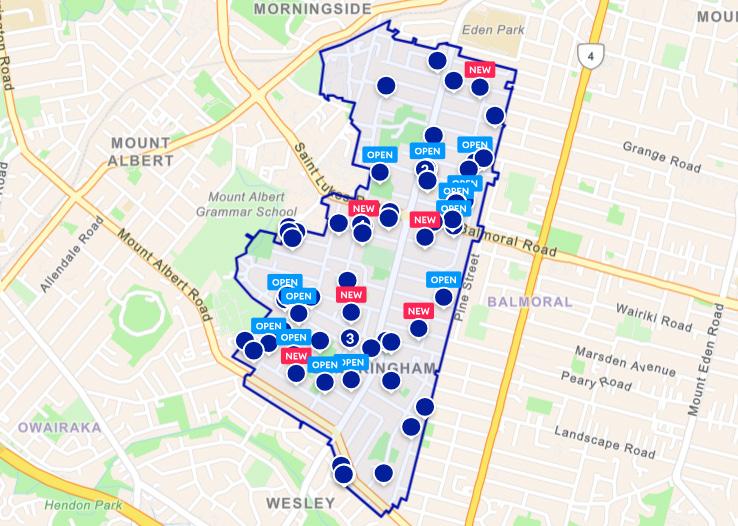

Sandringham Sales Statistics October 2025

12. Auction Update with Cameron Brain

16. Our month in Review Top Stories & Events from the City Realty Group

22. Ray White SuperCity Property Management

The New Pet Rules for Residential Tenancy Bonds

20.

LoanMarket Update: Falling OCR Reshapes Mortgage Choices.

28. Why choose us?

Ray White Sandringham & Mount Roskill team

“There is a growing confidence that the property market (and the wider economy) is beginning to improve,” says Daniel Horrobin, Director of City Realty Group. “We’re seeing encouraging signals from multiple independent sources.”

The latest REINZ October Report reinforces this sentiment:

Market confidence and positivity are evident… The market appears to have stabilised; this may be due to median prices remaining relatively level year on year across the country. Sales have increased nationwide, and salespeople across the country have all commented on the growing positivity and activity they are observing at a regional level.”

Economist Tony Alexander also noted in the NZ Herald (OneRoof, 22 October) that “the chances of good economic outcomes next year look a lot stronger… not least the lagged effect of lower interest rates.”

Daniel adds, “We now look toward the final OCR announcement for the year, with predictions signalling the possibility of a further cut.”

In a surprise move this month, the Reserve Bank confirmed plans to loosen LVR restrictions from 1 December, further supporting buyer momentum heading into summer.

City Realty Group’s internal data shows a sharp lift in buyer engagement.

“Early November saw a dramatic surge in openhome activity across our Group,” says Daniel. “Although the number of open homes held dipped slightly week-on-week, the number of buyers met increased by 103%. This reflects renewed confidence and a clear uplift in urgency among active purchasers.”

First-home buyers are a major force in this trend. As reported by the NZ Herald (12 November), 27% of all home purchases are now being made by first home buyers (a record) helped by lower interest rates, increased choice and favourable loan-to-value lending conditions.

The Central City office also hosted a highly successful Buyers Information Evening on 11 November, featuring expert insights from lawyers, mortgage advisers, property managers and Ray White City Apartments agents.

“Attendance exceeded expectations, and the feedback was excellent. We will absolutely be running more of these events,” says Daniel.

“We head into the end of November with a big Auction Day on the 27th — with 13 auctions already confirmed — and expect to finish 2025 with strong momentum,” Daniel concludes.

Total Sales

October 2025

15

October 2024

21

There was a -28% decrease in the total number of sales year on year.

Total Sales Value Median Sales Price Median Days On Market

October 2025

$23,780,500

October 2024

October 2025

$1,380,000

October 2024

$32,126,000 $1,490,000 40.5

There was a -25% decrease in the total sales value year on year.

Source: REINZ

There was a -7% decrease in the total median sale price year on year.

October 2025

42

October 2024

There was a 3% increase in the total median DOM year on year.

Total Sales

October 2025

59

October 2024

40

There was a 47.5% increase in the total number of sales year on year.

Median Sales Price

October 2025

$1,200,000

October 2024

$913,150

There was a 31% increase in the total median sale price year on year.

Total Sales Value

October 2025

$77,648,787

October 2024

$39,393,517

There was a 97% increase in the total sales value year on year.

Source: REINZ

Median Days On Market

October 2025

36

October 2024

41

There was a -12% decrease in the total median DOM year on year.

This week has delivered another impressive display of momentum, competition, and high performance across the Ray White CRG auction rooms, with both our Auckland Central and Sandringham teams demonstrating why we continue to be leaders in the auction space.

Our Auckland Central team — who conduct approximately 250 auctions each year and regularly attract more than 400 bidders — delivered a flawless result with a 100% sale rate across all auctions. Apartment transactions require specialist knowledge, particularly around legalities and complexities unique to Auckland’s CBD and city-fringe market. Our apartment specialists continue to set the standard, providing expert guidance, proven processes, and consistently strong outcomes for both buyers and sellers.

The standout result from Auckland Central was 1012/8 Ronayne Street, a leasehold apartment marketed by Dominic Worthington and Ady Huang. With a declared reserve of $49,000, the property attracted eight registered bidders and sold under the hammer for $126,500, highlighting once again the strength of buyer demand when quality apartments are professionally marketed and auctioned.

Over at Ray White Sandringham, the team delivered an equally strong performance with 11 scheduled auctions and outstanding buyer engagement across all price points. A full auction room and 29 active bidders generated 73 bids throughout the afternoon, resulting in five properties selling under the hammer and a further three currently in negotiation. The highlight was 55 Hayr Road, Mt Roskill, marketed by Diane Goer. Beginning at $900,000, the auction drew 17 registered bidders and 31 bids, with the property selling for an exceptional $1,936,000.

Thank you to all our vendors for their trust, to the bidders who participated, and to our committed CRG teams whose professionalism and collective effort continue to drive exceptional results.

As we head into December, auction bookings continue to build strongly, and we are already taking entries for our January Auction Events on the 28th and 29th of January. It is shaping up to be a strong start to 2026.

If you are a Real Estate Salesperson exploring new opportunities — or someone considering a career in real estate — I would welcome the opportunity to introduce you to our highperforming Ray White CRG team.

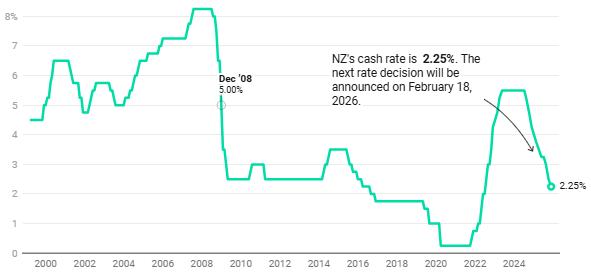

The Reserve Bank has cut the cash rate a whopping two percentage points this year.

ANALYSIS: As had been widely expected, the Reserve Bank cut the Official Cash Rate by another 0.25% to 2.25%. This is well below the peak of 5.5% the cash rate reached during the fight to bring down inflation, and the central bank notes in its accompanying Monetary Policy Statement that there are signs that the economy is beginning to recover.

However, while the bank members only debated leaving the cash rate unchanged or cutting 0.25%, most emphasis appears to have again been placed on the volume of spare capacity in the economy – meaning high unemployment. It is expected that this spare capacity will help inflation fall away from the current 3% towards the mid-point

NZ’s Official Cash Rate Drops To 2.25%

of the target band at 2% by the middle of last year.

For good measure, the Reserve Bank noted downside risks to growth in China, the risk of disruption in equity markets should optimism about AI prove unfounded, the risk that consumers remain cautious in their budgeting, and an expectation of only mild rises in house prices from here on out.

None of these things is particularly surprising, and most have been mentioned before. However, what does stand out to those of us who delve deeply into the entrails for these rate decisions was the frequency with which upside risks to inflation were mentioned.

The graph shows the OCR since its introduction in 1999.

Chart: OneRoof.co.nzSource: Reserve Bank of New Zealand

For instance, the Reserve Bank noted that the economy’s sustainable economic growth rate is now probably only 1.5% a year, courtesy of our low productivity growth. That means a risk that inflation appears with only mild growth in the economy.

It noted that household inflation expectations and business pricing intentions are running at above-average levels. It specifically noted a risk I have also been highlighting: that when growth returns, businesses will seek to quickly rebuild crunched margins by raising selling prices.

The bank also noted the increasing politicisation of central banks offshore and the risk that this will result in higher and more persistent international inflation. And for good measure, it noted upside growth risks from Fonterra’s return of capital to farmers and the possibility that people react more strongly to interest rate cuts than currently expected.

In the end, five of the Monetary Policy Committee members voted to cut the cash rate 0.25% and one voted to leave it unchanged. The best way to read this

alongside the risks already noted is that it would take something highly negative to hit the New Zealand economy for interest rates to be cut any further.

It is reasonable to embrace a view that we have reached the bottom of the interest rates cycle. But that does not mean that rises now start setting in. As the central bank heavily emphasised, our economy has a lot of spare capacity. The question is how quickly it will get used up through 2026 and 2027 as growth gets driven upward by a wide range of factors. These include higher farm incomes, the lagged effect of low interest rates, more tourists, more foreign students, increased infrastructure investment, increased house building, cyclically recovery household spending, business investment, and inventory rebuilding.

Speaking personally, if I were borrowing at the moment, I would be happy to fix my mortgage interest rate for a period of 3-5 years – probably the latter. But these are very uncertain times still – especially offshore – so I’d give serious thought to splitting across a couple of terms just to spread the risk.

What a stunning day at the Sandringham Street Festival! Our team had such a great time chatting with locals and visitors from across the community, sharing a few market insights, meeting new faces, and soaking up the sunshine!

We’re so proud to be part of such a vibrant and connected neighbourhood.

We celebrated Diwali with music, food, colors, and lots of laughter. From beautiful traditional outfits to the delicious festive spread, every moment was filled with joy and togetherness.

It’s always special when we take time to celebrate each other’s cultures and traditions — that’s what makes our team truly one of a kind.

This weekly catch-up has become a key opportunity to connect on buyer activity, upcoming listings, market insights, and any challenges you’re facing — all in a supportive, collaborative environment.

It’s also a great way to start our Saturday’s with the team before the day gets underway.

We were thrilled to host Richie Lewis & Sam Steele from Ray White Manukau to our CRG Speaker Series last month. Sam & Richie provided valuable insight for our CRG sales team.

On an amazing 15 years with Ray White! Your commitment, professionalism, and dedication have played a huge role in shaping the strength and spirit of our team. Over the years, you’ve built meaningful relationships, delivered exceptional service, and contributed to the culture we’re so proud of today.

Is the stage being set for a rebound?

ANALYSIS: When we talk about housing market drivers, we are essentially talking about three things: job security, mortgage interest rates and migration.

Let’s deal with job security first. If householders feel worried about their ability to retain their current job or easily get a new one if laid off, they will naturally feel disinclined to take the risk of buying a property and taking on a bigger mortgage.

Half of the respondents of my most recent survey of real estate agents said buyers were showing concerns about their income prospects. That’s slightly down from a peak of 56% of respondents expressing the same in June last year, and well above the 14% in January 2024, before the economic rot really set in. Job confidence is not there yet.

But from my monthly survey of businesses with MintHC we can see that employers are getting ready to raise their staff numbers, and when people see that happening, job confidence will rise and willingness to make a housing purchase will increase.

When I asked businesses this month what they planned to spend more money on, 12% said recruitment, up from last month’s reading of 9%. It’s also the strongest reading since June 2023 and firmly suggests hiring plans are gathering pace.

The second biggest influence on the housing market is mortgage interest rates. Two years ago, the popular one-year fixed mortgage rate was around 7.4%, and a year ago, it was 5.8%. Now the rate is around 4.5%.

Interest rates are now in stimulatory territory, and the Reserve Bank will probably cut the cash rate by 0.25 percentage points next week, pushing the one-year fixed rate down even more. Financing costs are now a source of stimulus for the housing market.

Rounding out our trio of factors is net migration flows. Over the past decade, the average net inflow each year has been 50,000 people. Back in October 2023, the annual net inflow was 135,000, and now it is just 12,400.

Population growth is below average, hence the restraint in the housing market. However, just as the labour market is at the start of a cyclical upturn, so too is the migration cycle. The net annual gain bottomed out at 10,300 in May. More than that, if we add up the flows over the past three months and multiply by four to get the annualised equivalent, the flow is 35,000 compared with -13,000 annualised in the three months to May and 27,000 a year ago.

What we have then are stimulatory interest rates and job confidence, plus population growth at the start of their cyclical upturns. How long will it be before the improvements in the latter two factors are strong enough to cause noticeably greater strength in the residential real estate sector?

I’d say towards the end of summer and start of autumn, with assistance from the overall economy improving and small to mediumsized business owners anticipating better profits, which is important for the middle to upper parts of the market.

First-home buyers are likely to be as actively engaged in a year as they are now and have been since early 2023. More investors are likely to make a purchase as the months advance. But worries about a capital gains tax will stay the hands of those who have yet to make the switch to yield. Plus, selling by older investors who have held investment property for a long time is likely to remain strong as the cost of living and the advancing of years bring a desire to free up cash to fund their retirement.

We are currently suggesting a mix of short term and medium-term rates, with potentially a small portion of your mortgage on a long-term rate.

Depending on the size of your mortgage & your appetite for risk, it could be worth splitting your mortgage to mitigate future risk. For example, a client with a $600,000 mortgage could put $200,000 on a 6 month, $200,000 on a 1 year and $200,000 on a 3-year rate.

On the 8th of October the Reserve Bank of New Zealand (RBNZ) drastically lowered the Official Cash Rate (OCR) to 2.5%, some were expecting it to be 2.75% and the banks had pre cut their rates expecting 2.75%. Due to it being a 2.5% there should be some more cuts.

Since August 2024, the OCR has been slashed by a total of 300 basis points –from a peak of 5.50% to its current 2.5%

level. The cuts to date have provided much-needed relief to the economy, particularly for borrowers. The RBNZ has suggested if inflation stays where it is then there is room for further rate cuts. However, if inflation does move upwards, we could see a pause in rate cuts.

There are many factors that affect our interest rates. However, the RBNZ has a singular focus: maintaining inflation within its 1–3% target band. Broader economic or employment concerns are secondary to this mandate. The RBNZ noted annual consumers price index inflation is currently around the top of the Monetary Policy Committee’s 1 to 3 percent target band. However, with spare capacity in the economy and declining domestic inflation pressure, headline inflation is expected to return to around the 2 percent target midpoint by mid-2026.

Despite calls from some economists for further cuts to support the slowing economy, the central bank is staying cautious. We have potentially hit a balance point. The talk now is when to start looking at fixing for longer term. There is a feeling that you could risk going a 6 month or 1 year rate one more time, but after this should be looking at longer term rates.

When it comes to refixing, we recommend holding out until a few days before your fixed rate rollover date. This will allow you to potentially get the lowest rate on offer. Most banks release rates for you to refix 1-2 months before your date, however, do hold off as when you lock your rates there is typically a break fee if they drop before your refix date and you want to change.

As always, any questions - feel free to get in touch.

If you’ve ever tried to convince a landlord that “Yes, Baxter is very well-behaved… except that one time with the courier, ”then you’ll know that pets and rentals in New Zealand have always been a bit of a tricky mix.

But great news for the four-legged, finned, or feathered members of the family: New pet bond rules are finally here, and they bring a little more clarity—and a lot more wagging tails—into the rental world.

The Government has introduced a pet bond option as part of the changes to the Residential Tenancies Act. This allows landlords to require an additional bond specifically related to pets, on top of the standard bond.

Here’s the headline version:

• Up to two weeks’ rent can now be taken as a pet bond.

• It’s in addition to the standard bond (which is still capped at four weeks).

• It must be lodged with Tenancy Services—no private piggy banks.

• Only charged if a pet is allowed—so no bond for imaginary dogs or neighbourhood strays.

This extra bond is designed to cover pet-related repairs—think scratched floors, chewed corners, or that mysterious smell you still can’t identify.

What This Means for Tenants

More rentals may be willing to open their doors to pets—finally!

With a structured bond system, landlords get reassurance, and tenants get a better shot at keeping their furry family members with them.

For tenants, it also means:

More transparency

Fewer “No pets, sorry” listings

A fair way to manage risk without surprise fees

Plus, your cat can remain smugly confident that they are, in fact, still the centre of the universe.

What This Means for Landlords

Landlords now have a clearer way to say “yes” to pets while reducing concerns about damage. The pet bond doesn’t become a windfall—it’s simply there to cover real, pet-related costs if they occur.

We expect more landlords to reconsider their stance and open up their properties to responsible pet-owning tenants. And we all know: happy tenants = longer tenancies = fewer headaches.

Pets are part of the family. And while some of them may be a little extra… “creative” with their décor choices, the new pet bond system gives everyone better peace of mind.

Here at Ray White Supercity Property Management, we’re excited about this change. We see it creating more opportunities, happier households, and a rental market that reflects the way Kiwis really live.

If you have questions about how the new rules apply to your tenancy or property, give our team a shout—we love a good chat (and a good pet story).

Until next month, take care—and give your pets a treat from us!

City Realty Group is the group with the ‘family factor’ - we’re family owned and we treat people like family. We’re all about open doors and open minds. We encourage a unifying atmosphere where opportunities are created, individuals are recognized and everyone grows - from our team to vendors, investors and tenants.

Our experienced and established team service the market Auckland wide -from Residential, Luxury Apartments, waterfront properties and rentals. With a dedicated property management team and marine brokerage teams. City Realty Group has a strategic partnership with Loan Market to provide clients with the best mortgage advice and rates through brokers.

+64 (9) 281 4707 www.rwsandringham.co.nz

+64 (9) 308 5551 www.rwmtroskill.co.nz

OUR LOANMARKET MORTGAGE ADVISORS

WE CAN NEGOTIATE A LOWER RATE. WORK WITH A QUALIFIED AND COMPETENT MORTGAGE ADVISER