NOVEMBER 2025

AUSTRALIA’S CRANE ACTIVITY: OFFICE SECTOR CONTRACTS

ENTERTAINMENT PRECINCTS EMERGE AS INNER INDUSTRIAL LAND TIGHTENS THE FRESHEST COMMERCIAL LISTINGS FROM ACROSS AUSTRALIA AND NEW ZEALAND

NOVEMBER 2025

AUSTRALIA’S CRANE ACTIVITY: OFFICE SECTOR CONTRACTS

ENTERTAINMENT PRECINCTS EMERGE AS INNER INDUSTRIAL LAND TIGHTENS THE FRESHEST COMMERCIAL LISTINGS FROM ACROSS AUSTRALIA AND NEW ZEALAND

James Linacre Head of Commercial RWC Australia and New Zealand

As we approach the final stretch of 2025, momentum across our network is building – and this month’s magazine reflects the strength and energy we’re seeing in commercial real estate right across Australia and New Zealand.

In this edition, we take a closer look at the shifting dynamics in the market. Notably, we explore how Australia’s crane activity is tapering in the office sector but growing in others, signaling further structural changes underway. Meanwhile, entertainment precincts are emerging as one of the most exciting growth stories, driven by increasing pressure on inner urban industrial land.

We’re also thrilled to showcase the freshest commercial listings from across the RWC network, as we prepare to launch our final Auction Showcase campaign for the year, running from mid-November to mid-December. This is one of only two national auction events we hold annually, and it consistently delivers benchmark results for our clients. With more

than 50 properties going under the hammer across the country, it’s shaping up to be our strongest auction season yet. Please don’t hesitate to reach out if you’d like to get involved or learn more.

Finally, we’re proud to announce the official launch of RWC Pacific Group on the Gold Coast, led by Jackson Rameau. This is a significant milestone for our network. Jackson’s leadership, professionalism, and client-first approach are exactly what RWC is all about. His new venture strengthens our presence on the east coast and aligns perfectly with our broader strategy for growth.

Enjoy the edition – and here’s to finishing the year strong.

Warm regards,

James Linacre

RWC WA’s latest market report, “The Insight: Perth Retail Strips,” reveals a significant turnaround in the city’s retail landscape, with the average vacancy rate across eight key strips falling to its lowest point since 2018.

The comprehensive report, authored by RWC director of capital markets Brett Wilkins, demonstrates a robust recovery driven by Western Australia’s strong economic fundamentals and an evolution in tenancy mix.

According to the report, the overall average vacancy rate has dropped from 6.33 per cent last year to a remarkable 5.32 per cent in 2025. This positive trend is a direct result of a favourable economic climate, characterised by low unemployment, sustained population growth, and a flourishing residential property market that has bolstered consumer confidence and discretionary spending.

“The survey of 581 tenancies across key locations reveals a dynamic shift in the retail mix, with a notable move away from traditional retail categories toward experiential and service-based offerings,” Brett Wilkins said.

While strips like Albany Highway and Leederville have solidified their reputations as dining destinations with a high concentration of cafes, restaurants, and specialised food retailers, other strips have maintained their unique character.

Bay View Terrace in Claremont and Napoleon Street in Cottesloe continue to buck national trends, remaining strongholds for highstreet fashion and lifestyle retail, a testament to their affluent local catchments.

Meanwhile, Scarborough Beach Road in Mount Hawthorn has firmly established itself as a services hub, with an impressive 36.86 per cent of its tenancies

dedicated to health, beauty, and wellness services.

Brett Wilkins, who has been analysing Perth’s retail strips for nine years, commented on the findings.

“This report highlights the resilience and adaptability of Perth’s suburban retail precincts. The improvements in vacancy rates are not just about a strong economy; they are a reflection of savvy business owners and landlords pivoting to meet consumer demand for unique, inperson experiences and essential services,” he said.

“We’re seeing a flight to quality as local private investors and owner-occupiers compete for welltenanted properties, reinforcing the long-term value of these locations. While challenges like inflation persist, the data points to a very healthy and stable market with a bright outlook.”

The newly formed RWC Pacific Group is directed and operated by third-generation agent, Jackson Rameau on the Gold Coast. RWC Pacific Group will service a highdemand stretch of the Pacific Coast, from the Northern Rivers of New South Wales through to Queensland, with a focus on both local Gold Coast dominants and interstate institutional partnerships with strategic investment opportunities.

“We’re here to redefine what it means to be a high-performance agency on the coast. We’re not just local, we are a no non-sense commercial business facilitating sales across the east coast of Australia,” said Jackson Rameau.

“There’s enormous capital looking for opportunities across the Pacific Coast, and we’re perfectly positioned to help deploy it into the right growth corridors. This market is no longer secondary, it’s centre stage with the upcoming Brisbane Olympics.”

Still under 30, Mr Rameau is a three-time RWC #1 auction agent internationally and was recently ranked the #3 international agent across the entire global RWC network.

The launch of RWC Pacific Group comes with strong backing from the top levels of the RWC network, and the team has already attracted seven elite staff members into the new venture.

With a mandate to drive growth in capital transactions and deepen ties with major agents in Sydney, Melbourne, Brisbane, and beyond, RWC Pacific Group will continue to build strategic partnerships across the commercial spectrum - from large private funds to ‘mum and dad’ investors.

“The opportunity to harness national and international capital and direct it into local high-growth markets is what excites us,” said Mr Rameau. “We remain committed to the exciting small-to-medium opportunities in quality locations while tackling larger-scale deals. Our network, combined with Ray White’s reach, allows us to play at the top level, and that’s exactly where we intend to stay.”

‘Insatiable’ campaign

strong campaign response for prominent industrial facility at Woods Close, Huntingwood has led to its sale for $14,710,000 after RWC Western Sydney made the executive decision to transition from an Expressions of Interest campaign to a live auction, citing the high level of buyerengagement.

The property attracted over 0 enquiries, 25 inspections, and 17 formal offers from a mix of investors, funds, and potential occupiers. The depth of competition prompted the agency to pivot mid-campaign to an auction format in order to ensure transparency and give all parties equal opportunity to participate.

“We don’t often move from EOI to auction, but in this case, it was clear there was significant competitive tension and a strong pool of genuine buyers,” said Peter

Vines, managing director at RWC Western Sydney. “Switching to an auction allowed us to manage that interest in a fair and open environment, which ultimately delivered a great outcome for ourclient.”

“Another really interesting characteristic was that six of the bidders were all owner occupiers to occupy in around seven years time which is incredibly unique.”

The property was sold on behalf of RA Peel Holdings Pty Ltd to a private investor. Situated in one of Western Sydney’s most established industrial precincts, the site offers 3,518sqm of building area , including 2,700sqm of highclearance warehouse and 817sqm of o ce space , along with 21 car spaces, surplus land at the rear, and a fully gated layout with excellent truck access.

The site also holds local historical significance, believed to be the resting place of ohn Wood, the original landowner of the entire suburb of Huntingwood.

“The campaign confirmed what we’re seeing more broadly in this asset class-well-located, functional industrial assets are still in high demand,” said Victor Sheu, director at RWC Western Sydney. “The volume of enquiry and the variety of interested parties, ranging from institutional buyers to owneroccupiers, reflected how tightly held this part of the market is.”

“This was a really engaged group of buyers. Many had active mandates and were ready to move quickly. It made sense to let that play out in a more transparent and competitive se ng,” said RWC Western Sydney sales executive Owen White.

In a major transaction that highlights the continued strength of Brisbane’s western industrial corridor, RWC Southwest’s Harry Egan has successfully brokered the sale of six industrial lots at 61 River Road, Redbank, for a combined value of $14,775,000.

The site, comprising six separately titled lots, has now been completely sold within just 18 months, representing a full sellout of a subdivided estate that had been owned by four separate private vendors, many of whom had held the land for over 20 years.

The campaign involved a mix of four public campaigns and two off-market transactions, leveraging strong marketing levers and database work to achieve standout enquiry and ultimate success.

“This is a really strong result for Redbank and further validation that the suburb is no longer just an ‘up-and-coming’ western corridor location,” said Harry Egan, Director at RWC Southwest.

“We’ve seen a real shift in the buyer profile; this campaign alone had four owner-occupiers and one investor. It reflects the growing confidence in Redbank’s position as a key industrial hub.”

The lots sold as follows:

• Lot 1 – $1.85 million

• Lot 2 – $1.4 million

• Lot 3 and Lot 5 (sold together) – $5.675 million

• Lot 4 – $3.45 million

• Lot 6 – $2.4 million

Situated in the evolving industrial precinct of Redbank, the estate has benefitted from the recent gentrification and expansion of major logistics and warehousing operations, most notably through Goodman’s Redbank Estate, home to high-profile tenants such as Australia Post, Coles, DB Schenker, L’Oréal, Visy, CHEP, and FedEx.

“The presence of such multinational and national occupiers has completely repositioned Redbank,” Mr Egan said.

“What was once overlooked is now one of the most active pockets in Brisbane’s industrial landscape. There’s real demand from owneroccupiers who want strategic positioning without paying premium inner-west prices.”

VANESSA RADER Ray White Head of Research

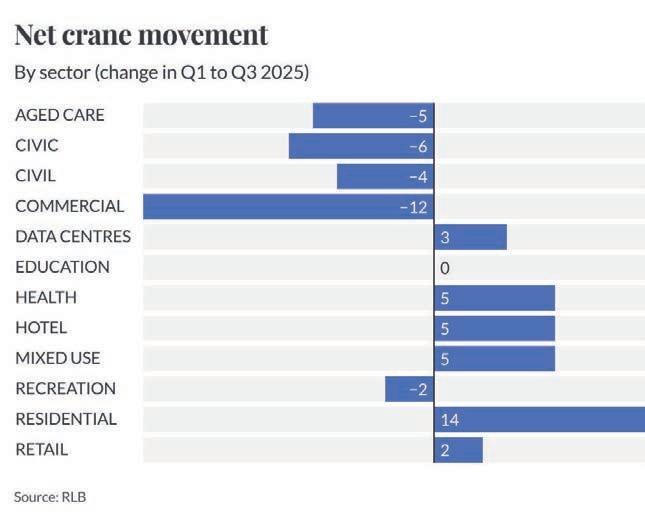

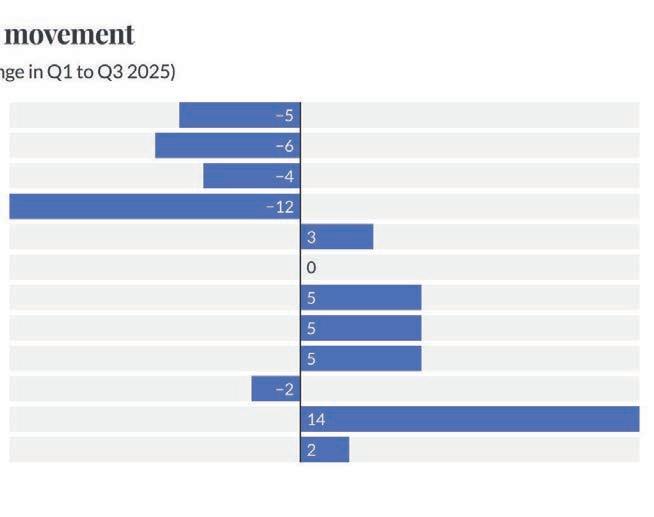

Australia’s construction sector recorded 845 cranes across major cities in Q3 2025, maintaining activity above the long-term average of 775 cranes for the eighth consecutive edition. While the national count edged up marginally from 840 in Q1 2025, the latest Rider Levett Bucknall (RLB) Crane Index reveals significant regional divergence, with three markets achieving record highs amid broader sectoral shifts.

Adelaide emerged as a standout performer, reaching its highest crane count since tracking began. The RLB Crane Index for Adelaide now stands at 433 points, with 26 cranes operating across the city. Health infrastructure is driving growth with five cranes across hospital redevelopments and expansions. The commercial sector contributes another five cranes, while residential development maintains momentum with 12 cranes across inner-city and coastal precincts.

The Gold Coast continues its construction surge, recording 67 cranes and an index level of 447 points, both records for the region. Crane numbers have increased 110 per cent over the past three years, driven almost entirely by residential and mixed-use development responding to strong population growth. The scale of activity reflects both build-to-sell apartment projects and emerging build-torent developments, with institutional capital increasingly targeting the Gold Coast for largescale rental housing.

Wollongong and Shellharbour achieved their strongest result since joining the index in 2019, rising to 111 points with 20 cranes operating across the region. Health infrastructure expansion and mixed-use developments continue to reshape the Wollongong CBD, with the latter now representing 35 per cent of regional crane activity.

Data centres emerged as significant growth driver, increasing from 29 to 32 cranes nationally. Melbourne’s west leads this expansion, reflecting the strategic importance of digital infrastructure. These large-format industrial developments typically feature extended construction timeframes and substantial institutional capital investment.

Mixed-use developments recorded the strongest proportional growth, rising from 103 to 108 cranes and now accounting for 12.8 per cent of all crane activity. This trend reflects both planning requirements for higher-density precincts and developers’ risk mitigation strategies through asset class diversification. Sydney leads mixed-use activity with 80 cranes, concentrated in Parramatta, Macquarie Park and inner-city renewal precincts.

The hotel sector showed renewed confidence, growing from nine to 14 cranes nationally, 55.6 per cent increase reflecting recovery in tourism and hospitality investment. Health infrastructure maintained steady activity with 28 cranes nationally, up from 23 in Q1 2025, with major hospital expansions underway in Brisbane, Adelaide and Perth.

In contrast, the commercial office sector experienced sharp decline, falling from 60 to 48 cranes nationally, this 20 per cent reduction reflecting elevated CBD vacancy rates and subdued tenant demand. Office projects now represent just 5.7 per cent of national crane activity. Civic and institutional projects also fell from 34 to 28 cranes as government building programmes reached completion.

Sydney remains Australia’s most active construction market with 370 cranes, accounting for 43.8 per cent of national activity. Residential development accounts for 210 cranes (56.8 per cent), while mixed-use projects represent 80 cranes (21.6 per cent). Activity continues shifting toward outer suburbs, with Sydney’s north reaching record 118 cranes, 31.9 per cent of the city’s total.

Melbourne maintained stability at 199 cranes, dominated by major infrastructure including the North East Link project with 46 cranes, the largest concentration on any single infrastructure project in Australia. Residential activity increased from 90 to 106 cranes, its highest level since Q3 2020. Brisbane recorded 73 cranes, up from 65, with health infrastructure providing the growth catalyst.

Canberra experienced the sharpest decline, dropping to 12 cranes from 22, its lowest level since Q3 2015. The residential sector decreased from 15 to nine cranes, while commercial activity contracted from three to one crane.

The contrasting fortunes across markets underscore the construction industry’s transition phase. Record activity in Adelaide, Gold Coast and Wollongong reflects strong demand in more affordable markets experiencing population growth, while commercial office weakness signals rebalancing toward data centres, mixed-use precincts and infrastructure aligned with Australia’s demographic and technologicaltransformation.

VANESSA RADER

Ray White Head of Research

As the NBL season is in full swing, following the recent NBA preseason games in Australia, two major basketball focused entertainment precincts have opened in Sydney and Melbourne highlighting a new trend for inner industrial markets. A 2,000 sqm immersive destination has launched in Alexandria, while Port Melbourne’s 9,700 sqm facility combines elite basketball infrastructure with major retail presence. But their significance extends well beyond sports culture, these facilities represent an emerging response to a critical property market challenge: what happens when inner industrial land becomes too scarce and expensive for traditional users.

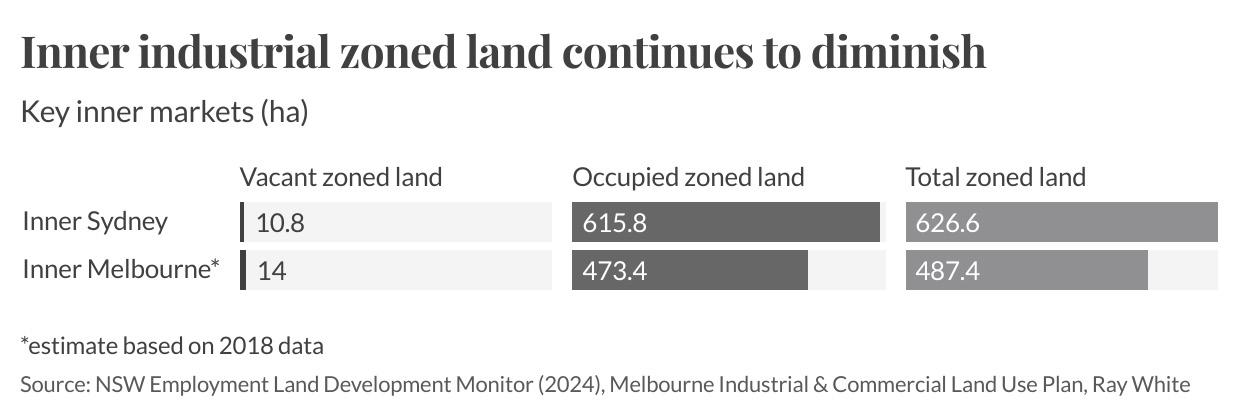

Australia’s inner industrial markets are reaching a critical inflection point. With vacant zoned land down to just 10.8 hectares in Inner Sydney and an estimated 14 hectares in Inner Melbourne, property owners are increasingly turning to entertainment focused tenants capable of justifying the premium land values that traditional industrial users can no longer afford.

The supply constraints are stark. Inner Sydney’s 10.8 hectares of vacant industrial land represents just 1.7 per cent of the total 626.6 hectares of zoned industrial land across Bayside and Sydney LGAs. In Inner Melbourne, the situation is similarly tight, with an estimated 14 hectares remaining from 487.4 hectares of zoned land across Port Phillip, Melbourne, and Yarra, assuming minimal consumption of two hectares annually since the last comprehensive survey in 2018. No new industrial land is being zoned in either market.

This scarcity, combined with widespread industrial to residential rezoning creating new urban communities, has created opportunities for alternative uses that can generate the returns necessary to justify current land values. Entertainment precincts with diversified revenue streams are emerging as the natural evolution.

These entertainment destinations represent entirely new asset classes designed to serve the residential communities now calling these former industrial areas home. The model addresses multiple revenue streams that traditional industrial or retail tenants cannot match, retail sales, hospitality operations, venue hire to multiple user groups, corporate events, and brand activations. This diversified income approach provides property owners with stable returns while creating destinations that drive extended dwell times and repeat visits.

Alexandria exemplifies the transformation underway. Once dominated by manufacturing and logistics, the suburb has undergone extensive residential rezoning while attracting a young professional demographic drawn to its proximity to the CBD, airport, and creative industries. This new resident base creates natural demand for entertainment and lifestyle destinations within walking distance, demand that can justify premium rents driven by constrained land supply.

Traditional industrial tenants, facing escalating land costs, are increasingly relocating to outer suburban locations where larger sites and superior logistics access come at a fraction of the cost. This shift is being driven by dramatic land value appreciation that has fundamentally altered the economic equation for property owners in areas like Alexandria and Port Melbourne.

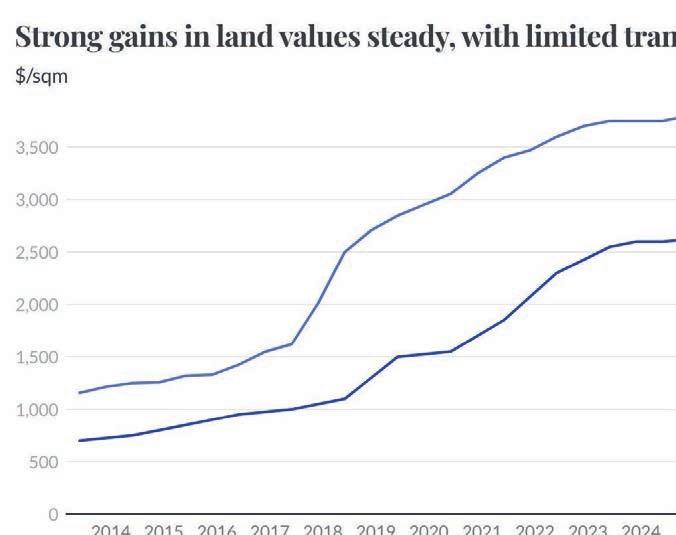

Over the past decade, Inner Sydney industrial land values have surged 223 per cent from $1,175/sqm in 2013 to $3,800/sqm in 2025. Inner Melbourne has experienced even steeper growth of 275 per cent, climbing from $700/sqm to $2,625/sqm over the same period.

With land costs exceeding $2,500/sqm, entertainment focused tenants who can justify premium rents through diversified revenue models are becoming increasingly attractive to property owners. Traditional industrial users simply cannot generate the returns necessary to compete for these sites.

The investment required for these conversions however, is substantial. Basketball facilities demand specialised flooring, high end retail fixtures, hospitality fit outs, and acoustic treatments. However, these capital intensive improvements create barriers to entry and tenant stickiness while generating rental premiums that justify the outlay in markets where land values have more than doubled in five years.

While adaptive reuse in inner markets isn’t new, industrial buildings have been transforming to reflect urbanisation for decades, the current wave is being accelerated by the intersection of severe land scarcity, unprecedented value growth, and changing consumer behaviour. Post-pandemic consumers increasingly value experiences over transactions, seeking destinations that combine shopping, dining, and social interaction in authentic environments. Industrial heritage buildings, with their high ceilings and open floor plates, provide ideal canvases for these immersiveexperiences.

The timing is particularly opportune. The NBA preseason games which welcomed the New Orleans Pelicans to Melbourne, generated significant interest in basketball culture, and the NBL season will sustain this momentum. These entertainment precincts can harness broader cultural trends and capitalise on increased consumer interest in ways that traditional industrial or retail uses simply cannot match.

For property investors, the emergence of entertainment precincts in former industrial areas represents a pragmatic response to fundamental market economics. As inner city industrial land values continue appreciating on minimal remaining supply, entertainment destinations appear positioned to serve as commercial anchors for emerging urban communities, generating returns that compete with even the strongest industrial markets while serving populations that traditional industrial tenants cannot monetise.

Alexandria and Port Melbourne represent the vanguard of this transformation, but they’re unlikely to remain unique. Across Australia’s major cities, similar gentrified former industrial precincts from Brisbane’s Fortitude Valley to Perth’s Northbridge, face comparable land scarcity, value appreciation, and demographic shifts.

These early adopters are establishing a template that could reshape how Australia’s urbanising industrial areas evolve when land supply constraints make traditional uses economically unviable. The entertainment precinct model offers property owners a proven pathway to maximise returns from tenants who can justify premium rents through their ability to generate multiple income streams while serving local residential populations that are the inevitable result of inner area densification.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

Bank Arcade is a heritage shopping arcade located in the heart of Hobart’s CBD. The site contains what is believed to be some of Hobart’s oldest building remains, possibly dating back to 1804-1805. It houses around twenty small shops and businesses such as cafés, florists, boutiques, and services with many tucked upstairs behind charming façades.

A purpose built construction located in a sought after innovation precinct, “Nangu” boasts 1,448.25sqm across two stories. The tenants are committed to a ten year lease with a further two five year options, annual 5% increases and are responsible for 100% of all building outgoings. A DA has been approved for a second building on site and provisions for EV charging are already in place. Featuring a mock courtroom, forensic labs and a crime scene recreation room, it presents an exciting new management opportunity for the RWC Canberra team.

RWC BALLARAT

This property features a spacious, well-lit industrial warehouse with high ceilings, an internal mezzanine office space, and ample room for workshop or storage use.

L1 , L3 / 192 Mulgrave Rd, Westcourt, 4870

Lot 1 & 3 at 192 Mulgrave Road, Westcourt, Cairns - A remarkable opportunity to acquire a versatile office building on Mulgrave Road, one of Cairns high profile locations. This exceptional property, constructed in 2005, boasts a generous land area of 1,247 sqm and a well-designed building area, making it ideal for various professional uses.

Key Features:

This unit consists of:

•Lot 1 - 184 sqm - Ground Floor - Tenanted

•Lot 3 - 150 sqm - First Floor - Tenanted

•Strategic Location: Situated on Mulgrave Road, on the corner of Collinson Street, this property benefits from high visibility and easy access to primary transport

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

18B/22 Spence Street, Cairns City, 4870

An exceptional opportunity to secure a first floor hospitality venue in one of Cairns' most iconic buildingsthe historic Central Hotel. The ideal setting for a nightclub, cocktail bar, function venue or live entertainment space right in the heart of the city's thriving hospitality precinct.

Property highlights:

•Prime Level 1 position with elevated views overlooking Cairns City

•Generous 311sqm open plan layout - ideal for flexible bar, lounge or event configurations

•Surrounded by other leading bars, restaurants and nightlife venues driving strong foot traffic

•Prominent signage exposure available and easy access for patrons

1&2/117-121

Looking for a rock-solid commercial investment on one of Cairns' main arterials. Selling Lot 1 and Lot 2 separately or combined. Welcome to Traders Lanewhere location, exposure, and reliability come together. Two premium, tenanted offices are now available for sale - both positioned right on the corner of Anderson & McCormack Streets, ensuring unbeatable visibility and easy access for clients and staff alike. These professionally presented suites offer secure leases, steady returns, and a prime position within the well known Traders Lane Complex - a well-known commercial hub just minutes from Cairns CBD.

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

RWC Cairns

raywhitecommercial.com

163 Annerley Road, Dutton Park, Brisbane, Qld, 4102 Expressions Of Interest Closing Thurs 20 November 2025 at 1pm (AEST).

•High traffic exposure with 221,200* vehicles weekly.

•2km* from Brisbane CBD opposite one of Qld’s largest Healthcare precincts.

•707m2* office area + 181m2* external deck area.

•32 car parking bays* (secure basement).

•Vacant Possession potential in the near term.

•1,801m2* land area (86.8 metre* street frontage).

•Opposite Boggo Road Cross River Rail Priority Development Area.

•Set to benefit from over $18 billion* of new infrastructure projects.

•Opposite Brisbane South State Secondary College and 1km* from University of Queensland.

•Exceptional transport connectivity and amenity.

•Huge potential for future development^.

•Invest | Occupy | Develop

Paul Anderson 0438 661 266 p.anderson@raywhite.com

Tom Barr 0405 144 352 tom.barr@raywhite.com

raywhitecommercial.com RWC Queensland

397-429 South Street, Harristown, 4350

•Massive 6.95ha site with 50 freehold titles*

•Strategically located in Harristown's established business precinct

•300m* South St frontage and direct Gore Hwy access

•Zoned for low and medium-impact industries, allowing a broad mix of industrial uses

•Fully serviced with water, sewer, power and stormwater infrastructure in place - ready for immediate action

•Vacant possession - zero delay in taking control and executing your development vision

•Capitalise on Toowoomba's industrial land shortage

•Ideal for large-scale subdivision or industrial projects

•Exceptional road infrastructure and accessibility

•Secure one of the region's last remaining large-scale industrial infill sites

Sale/Lease

Land Area: 69,462 square metres*

Brian Doyle 0434 551 628 brian.doyle@raywhite.com

Peter Marks 0400 111 952 peter.marks@raywhite.com

RWC Toowoomba

raywhitecommercial.com

930 Tamborine Oxenford Road, Wongawallan, 4210

Formal Offers To Purchase Above $2,225,000 to be submitted by 27 November, 4pm

Business operating for over 30 years - market leaders

Long term tenure, sale on walk in walk out basis

Two homesteads included, ample bore water

Customers Aus wide, enormous potential to expand

Sale incl large stock in hand, extensive solar power

All equipment unencumbered

James Bell 0412 252 091

Stirling McInnes 0481 303 783

Gregory Bell 0414 380 555

RWC Gold Coast

raywhitecommercial.com

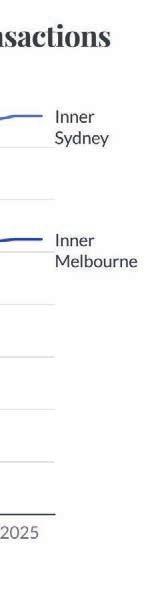

Low Density

One of the most sought after suburbs in Brisbane and cottage located on future Lot 4

Existing 5 bedroom house to be retained on future Lot 1

11.5km* from Brisbane CBD

44 Stirrat Street, Gladstone Region, 4680

An incredible site located next to the busy Dawson Highway, providing high exposure to traffic, and great rental returns.

Located in Calliope, the building sits on an 606m2* site.

•606m2* total site area

•110m2* & 96m2* professional Retail/Office tenancies

•Two street access

•Exposure to high traffic

•Zoned 'Neighbourhood Centre' Enquire today to receive full details.

The Property if offered for sale by formal offers to purchase.

356 Middle Road, Greenbank, 4124

•4 Tenants with long term leases

• Current net income - $458,155.06 PA

• Projected additional income - $145,000* PA Net

• Vacant land - 1,193sqm - 10 Year HOA signed with NT

• Total expected income of $620,000* PA Net

• Current building area - 377sqm

• Land area - 4,588sqm

• Anchored by Metro Petroleum with over 300 Metro Service Stations Australia wide

• Metro Petroleum has one of the largest independent service station networks in Australia

• 13,000 Approximate daily passing traffic

• Strategically located in Greenbank high growth area

Sale Contact Agent

Aldo Bevacqua 0412 784 977 aldo.bevacqua@rwcs.com.au

Jett Bevacqua 0450 005 810 jett.bevacqua@rwcs.com.au

3/2-16 Beal Street, Meadowbrook, 4131

•Total building area - 624sqm

• Ground floor showroom / reception (air-conditioned)

• Load bearing mezzanine floor (areas A + B) -74sqm

• Mezzanine is council approved

• Container-height roller door with drop-off access

• Many 3 Phase power outlets (125 amps)

• Multiple 15 amp and 240 power points

• Equipped with 2 powered roof ventilators for Optimal Airflow

• LED high bay lights

• Ceiling height: 7.8m at roller door

• Ceiling height: 6.5m at rear of warehouse

• 6 x Allocated carparks and street parking

• Male and Female amenities plus third toilet and shower

• Easy access to Pacific Highway, Logan & Gateway Motorways

• Zoned: Medium impact

Sale $2,300,000 + GST

Annabel Salcedo 0412 152 799 annabel.salcedo@rwcs.com.au

1 Lanyana Way, Noosa Heads, 4567

Secure investment with diversified income

Long lease terms - expiries staggered to 2029-2030

Net income: $310,140*pa | gross income: $377,200*pa

NLA: 596m2* | land area: 524m2*

Recent capital upgrade - new roof August 2025

Basement car parking + public car park directly adjacent

Sale Contact Agent

RWC Noosa & Sunshine Coast

raywhitecommercial.com

Paul Butler 0418 780 333 paul.butler@raywhite.com

David Brinkley 0448 594 361 david.brinkley@raywhite.com

11/11 Bartlett Road, Noosaville, 4566

386m2* high clearance warehouse + 102m2* mezzanine

Automatic roller door - potential for additional access points

Parking for 78 vehicles shared amongst occupants

Kitchenette and accessible shower and bathroom

Vacant possession

Auction On site at 10:00am Friday 28 Nov 2025

Painted floor and air-conditioned office/showroom Large square format high clearance warehouse raywhitecommercial.com

David Brinkley 0448 594 361 david.brinkley@raywhite.com

Rachel Cadamy 0455 902 627 rachel.cadamy@raywhite.com

Blake Cooper 0406 117 538 blake.cooper@raywhite.com Kris Valcic 0415 406 614 kris.valcic@raywhite.com

31-35 Parker Street, Bega, 2550

AuctionWorks at 50 Margaret Street, Sydney Tuesday 11 November at 10:30am

Expansive 2,113 sqm* land area

Flexible MU1 Mixed Use zoning with a 13m height limit

Offered with vacant possession

150m* to Capital Pathology Bega

2.5km* to South East Regional Hospital (Bega)

Combined 900 sqm* across two buildings raywhitecommercial.com Liquidators appointed

161-163 Prince Edward Avenue, Culburra Beach, 2540

Auction Wednesday, 26 November at 10:30am (AEDT)

Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Diverse Income Stream: Leased to multiple tenants

Secure Tenancies: Mix of new & long-term fixed leases

Corner position in Culburra Beach retail hub

Value-add potential with rental upside and growth

400m* to Culburra Beach

Site area: 2,345sqm* RWC SC

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Mariia Kononets 0478 119 535 mariia.kononets@raywhite.com

raywhitecommercial.com

Lot 8/63 Foveaux Street, Surry Hills, 2010

Auction Tuesday, 25 November at 10:30am (AEDT) AuctionWorks, 50 Margaret Street, Sydney NSW 2000

Leased 11+ years to 2031 to Sub-Zero Group Australia

Further 5-year option to June 2036

Total Gross Rental Income of $259,755 per annum

Fixed 4% annual rent increases in January.

278sqm* strata + parking

Includes secure car park, goods lift & loading dock access

City-fringe, 400m to Central Station & Tech Central

*Approx.

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Mariia Kononets 0478 119 535 mariia.kononets@raywhite.com

RWC SC

raywhitecommercial.com

4 Carrington Avenue, Hurstville, 2220

Secure off street parking for 9 cars

Zoned MU1: Mixed Use, 1832sqm* permissible GFA

Land area 407.20sqm*, FSR 4.5:1, 23 metre height limit Auction Tuesday 18 November 2025

Previous DA approval for a 7 storey project

Mezzanine Level, 50 Margaret Street Sydney

John Skufris 0414 969 221 j.skufris@rwcss.com

Anthony Vella 0412 232 904 a.vella@rwcss.com

Two level freehold commercial office building RWC South Sydney

Three commanding street frontages raywhitecommercial.com

Perfectly positioned within one of Sydney's fastestgrowing lifestyle and employment hubs, this premium investment opportunity offers the flexibility to invest, reposition or redevelop in a precinct that continues to evolve into a world-class destination.

•Building Area: 1,217sqm*

•Established childcare operator in place

•Net passing income of $615,704.84 + GST per annum

•Outgoings fully payable by tenant

•3% annual rental increases

•Licensed for 90 placements

•32 secure on-site car spaces

•No strata levies payable under the stratum

369 Worrigee Road

Worrigee, NSW, 2540

Development consent secured with construction certificate ready to go

All consultant reports completed and stamped (bushfire, ecology, engineering approvals in place)

Shovel ready; construction can commence immediately upon settlement

Only residential development bordered by three established nature reserves

111 Large lots (minimum 2500sqm) with varied sizing for multiple price points

Only known large community lot subdivision on nsw south coast with full approvals and construction readiness

Auction 2 December 2025 Unless sold prior

Craig Hadfield 0401 088 137 craig.hadfield@raywhite.com

Julie Gauci 0481 142 265 julie.gauci@raywhite.com

RWC Shoalhaven Central Group raywhiteshoalhavencentralgroup.com.au

2-4 Fairport Avenue & 44-48 Ocean Parade, The Entrance, 2261

•Located in one of the Central Coast's most desirable coastal precincts

•DA Approved 47 Units (9 dual key)

•DA Approved 6 Storey Development plus rooftop area and 2-level basement.

•Generously sized units with thoughtful design to maximise view of the ocean

•Favourable mix of 1 Studio, 5 x 1 Bedrooms, 24 x 2 Bedrooms, 12 x 3 Bedrooms, & 5 x 4 Bedrooms.

•Existing holding income of a block of eight (8) units with an annual income of $187,720* per annum

•Approximately 50m* to The Entrance Beach & 550m* to the Town Centre

raywhitecommercial.com

9A Beresford Avenue, Beresfield, 2322

A rare budget price tenanted commercial investment opportunity, providing for a versatile well presented space, including a dedicated reception area, 3 consult rooms, storage kitchen/breakout area and exclusive use amenities.

•229m2* site area

•100m2* building area

•Existing tenancy

•Zone: E1 Local Centre

•Rear access courtyard / onsite parking able to accommodate up to 6 vehicles

Level 16, 1 Castlereagh Street, Sydney, 2000

1 Castlereagh Street is an B Grade building located on the corner of Hunter and Castlereagh Streets. The NE aspect gives as floors excellent solar access. The lobby has undergone a recent refurbishment providing a classy entrance. There is basement has parking, and end of trip facilities with showers, lockers and bicycle racks. Energy rating.4.5 Stars, Water 3.5 Stars

•New fit out now completed and ready for occupation.

•Stunning entry area with Chevron flooring & set ceilings

•10p boardroom, 1x5p meeting room, 1x4p meeting room, 1 office

•38 desks, plus 6p collaboration bench, 3 focus rooms

•Large kitchen and breakout area with cafe style seating

1-16/127 Church Road, Tuggerah, 2259

Unit sizes from 98sqm to 261sqm (approx)

16 full concrete panel units

High clearance automatic roller doors

Due for completion early 2026 The Aisle industrial unit development

1/463

Exclusively presenting this quality retail/office opportunity located next door to the South Caringbah institution 'Lady Hill' takeaway.

This is an open plan refurbished shop with excellent natural light and corner exposure featuring exposed brick walls and neutral floating floors throughout. This opportunity gives the next occupant a blank canvas to build their brand within the 77m2* premises which also features its own internal amenities making it the ideal boutique retail space or office.

• Ideal location next door to Lady Hill Takeaway

• High exposure 77m2* corner site

• Full of natural light plus own internal amenities

• Neutral internal finishes to build your business

• Ideally suited to boutique retail or office users

Lease Contact Agent

Brad Lord 0439 594 121 blord@raywhite.com

RWC Sutherland Shire

raywhitecommercial.com

7 Kiama Street, Miranda, 2228

A rare opportunity to secure a unique freehold property offered to the market for the first time in almost 40 years.

The building features a large clear span factory floor with good internal clearance, significant power and is serviced by an oversized lunchroom and ground floor amenities fitted with showers. The first floor features 3 generous sized air conditioned offices with great natural light and more amenities. Currently tenanted until Jan 2026, however it is offered with immediate occupation following.

• Secure freehold factory on significant land holding (1,347m 2*)

• Solid 950m2* building with ground & first floor amenities

• 10* car spaces with additional hardstand for loading/unloading

• Electric sliding gate entry with fully fenced hardstand

Lease Contact Agent

Brad Lord 0439 594 121 blord@raywhite.com

6 Windsor Ave, Mount Waverley, 3149

•Total Land Area | 185m2*

•Total Building Area | 120m2*

•Three bedrooms with built-in robes on the upper level

•Converted open fireplace on the ground floor

•Modern renovated kitchen featuring 900mm selfcleaning oven

•Free-standing property with rear yard and large garage

•Directly opposite Jordanville Train Station

•Convenient bus access to both Deakin University and Monash University, with connecting train to Holmesglen TAFE

•Within the Ashwood High and Essex Heights Primary School Zones

•Excellent access to High Street Road, Warrigal Road and the Monash Freeway (M1)

•Offered with vacant possession

2645 South Gippsland Highway, Tooradin, 3980

Green Wedge Zone | Land area 198 acres*

Two titles | Offers potential for separate ventures

Direct frontage to the South Gippsland Highway

High visibility and accessibility via Dore Road

Sheds, power, fencing, and dams throughout property

4BR home leased on 5 acres returning $40,800 pa

Opportunity for various uses in the future (STCA)

73 Railway Parade North, Glen Waverley, 3150

5-year lease with two additional 5-year options

Lease + Options through to 2039

Land - 190sqm* / C1Z

Returning a significant net income of $122,055 per annum*

Two-Level Freehold Building A versatile 182.5sqm*

Auction Wednesday, 19th Nov at 1:00pm

RWC Glen Waverley

raywhitecommercial.com

4/28 Ricketts Road, Mount Waverley, 3149

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422 883 011 will.jonas@raywhite.com

Total Building Area: 424 sqm*

High-Clearance Warehouse: 6.9 m* internal height

Zoning: Special Use Zone 6 (SUZ6)

Access: 5 m* motorised container-height roller door

Power: 3-phase supply Prime

Parking: 5 dedicated on-title car spaces

Auction 20th of November at 1 pm

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422 883 011 will.jonas@raywhite.com

raywhitecommercial.com

149A & 149B Macquarie Street, Hobart, 7000 Sale Expressions Of Interest closing Thursday, 27th November 2025 at 4pm (AEDT)

RWC Tasmania are pleased to be marketing for sale 149a and 149b Macquarie Street, Hobart.

149a Macquarie Street, Hobart: + 100% Leased to Maven Dental and TAG Art Gallery. Lease to Maven Dental until November 2031 with further options available + Net Passing Income: $205,675* + GST

149b Macquarie Street, Hobart: + 100% leased to 6 tenants, with the opportunity to owner occupy the first floor + Net Passing Income: $134,803* + GST + Two-level, dual access asset with a gross building area: 420sqm*, and site area: 276sqm* with 2 on-site car parks

Matthew Wallace 0418 136 086

matthew.wallace@raywhite.com

Claude Alcorso 0417 586 756

claude.alcorso@raywhite.com

RWC Tasmania

raywhitecommercial.com

31A & 31B Murray Street, Hobart, 7000

RWC Tasmania has been appointed to present, for the first time in over 60 years, 31A & 31B Murray Street, Hobart.

Available individually or in one line, this offering represents a rare opportunity to secure two prominent retail assets in a tightly held pocket of Hobart’s CBD.

Property Highlights:

+ High exposure, consistent foot and vehicle traffic

+ Excellent street frontage and proximity to CBD

+ Zoned: 'Central Business', suitable for various uses^

+ 31A is 45 sqm* over two levels, leased to 'Millionaires Club' to Nov '26

+ 31B is 62 sqm* across two levels, leased to 'Halfway South' to Apr '26

Tasmania

441 Macquarie Street, South Hobart, 7004

RWC Tasmania offers to the market for sale 441

Macquarie Street, South Hobart, a substantial industrial asset, with a diversified range of re-positioning options, suitable to Future Owner occupiers, Investors and Developers^.

Property Highlights:

+ Substantial 1,951 sqm* allotment & 15* on-site parks

+ Net Passing Income: $76,652* + GST

+ Gross Building Area: 950 sqm*

+ Zoned: 'Inner Residential' per Tasmanian Planning Scheme

+ Significant re-positioning or re-development capabilities^

+ SAMCO lease expiry 31 Oct 2027, providing great holding income or renewal option

Sale Expressions Of Interest

closing Thursday, 27th November 2025 at 4pm (AEDT)

Tom Balcombe 0417 979 194

tom.balcombe@raywhite.com

Claude Alcorso 0417 586 756

claude.alcorso@raywhite.com

RWC Tasmania

raywhitecommercial.com

Prime town centre location adjacent to fuel station and Hotel 1

on major motorway ‘Indian Ocean Drive’

Secure Income: WALE GLA 7.12 yrs / Income 6.93 yrs

Andrew Woodley-Page 0438 939 869 andrew.woodley-page@raywhite.com Excellent tenancy mix: IGA, BWS, CBA + 6 high quality specialty

Income (fully leased) as at 31/12/25 $630,106 p.a.

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

1/1 Tanunda Drive, Rivervale, 6103

524m2* total strata area

Two separate tenancies leased

$143,864.13 net passing income

Zoned Mixed Use

Sale Offers Invited

RWC WA

raywhitecommercial.com

Chris Matthews 0413 359 315 chris.matthews@raywhite.com

Liam Pittaway 0439 555 439 liam.pittaway@raywhite.com

22/639 Beach Road, Warwick, 6024

3,735m2 cinema complex leased to HOYTS

Anchor of the Warwick Entertainment Precinct

Adjacent to sub-regional Warwick Grove Shopping Centre

Established suburb catchment, consistent trading performance

Strong, defensive income profile

Expressions Of Interest closing Thurs 13th Nov 2025 at 2pm AWST

Andrew Woodley-Page 0438 939 869 andrew.woodley-page@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

422 King William Street, Adelaide, 5000

Expressions Of Interest Closing Thursday 20th November at 4pm (ACST).

Fully leased income at market rents - $738,933*

WALE - 1.69 years by area

Site Area - 1,780sqm* across four certificates of title

Lettable Area - 2,362sqm*

Car Parks - 38 car parks on site

Zoning - Capital City allowing up to 53m (STCC)

Totani 0412 808 743

Einarson 0421 747 442 Jack Dyson 0448 685 593

Net income - $588,111* RWC Adelaide

Units 6 & 7, 150 Cavendish Road, Christchurch, NZ, 8051

Two well-presented and interconnected commercial units which have housed the Government’s National Library of New Zealand since 2011.

The Department of Internal Affairs has just renewed the lease for a further term. Rental $210,142.32pa net + GST. The property is made up of 2 strata units of 382.4m2* and 946.5m2*. Total 1,328.9m2* and comes with 18 car parks.

Located in Christchurch’s popular northwest, this busy modern complex contains a good mix of office and warehouse tenants. Seismically rated at 73% NBS.

A fantastic investment opportunity, as you would be hard pressed to find such a strong and reliable Tenant.