OCTOBER 2025

PORTFOLIO

LUXURY RETAIL’S SOCIAL MEDIA REVOLUTION

HOW SKILLED PROPERTY MANAGERS HELP INVESTORS BUY SMARTER

CLIMATE RISK ASSESSMENT VALIDATES ESG FRAMEWORK FOR COMMERCIAL PROPERTY OWNERS

AUCTION SHOWCASE

This month in Portfolio

James Linacre Head of Commercial RWC Australia and New Zealand

Hello and welcome to the October edition of RWC’s Portfolio Magazine.

September has been another phenomenal month for our group, with a wave of new talent joining RWC offices right across the country. It’s fantastic to see our network continuing to grow and thrive.

We’re also thrilled to be launching our highly anticipated RWC Auction Showcase in the coming weeks, an event that takes place only twice a year and consistently sets new benchmarks across the industry.

As Australasia’s largest real estate group, with hundreds of commercial specialists and a reach that extends to thousands of active buyers, this showcase is a standout opportunity for vendors to put their property in front of the market like never before.

Every auction taking place between 15 November and 20 December will benefit from thousands of dollars’ worth of additional exposure, all part of the national marketing push that surrounds this campaign.

And the results speak for themselves: in our June showcase, sellers who stayed the course to auction day achieved an average of 12.98 per cent higher than their best pre-auction offer.

If you’d like to be involved, or want to know more, please don’t hesitate to reach out to your local RWC agent. If you’re unsure who that is, feel free to contact me directly at jlinacre@raywhite.com or on 0405 554 825.

Warm regards,

James Linacre

Quick jump to a region

“Little Italy” retail centre sells under hammer for $10.57 million

In what is one of the largest auction sales of 2025 in South Australia, a prized large-format retail centre located at 617621 Lower North East Road, Campbelltown has sold under the hammer for $10.57 million, smashing its reserve price by over 15 per cent.

The property, offered to market for the first time in over 25 years, was fiercely contested at auction, attracting eight active bidding groups and more than 60 individual bids, with the final winning bid landing on just $1,000 above the previous.

The transaction represents a 4.69 per cent yield based on a net annual income of $483,348, setting a new benchmark for metropolitan retail investments over $5 million.

The campaign was jointly led by Oliver Totani and Jack Dyson of RWC Adelaide, in collaboration with Matthew Lane of Dulwich Lane, with the auction conducted by Sam Grover from Ray White SA/NT corporate.

“RWC had the absolute privilege to market and auction this prize asset on behalf of the dual highnet-worth family ownership,” said Oliver Totani.

“The owners needed to believe in our recommendation to take this property to auction, especially with others pushing for a more conservative EOI process. The result speaks volumes.”

“Other agents were scared off by the likely end value of the asset, but we remained confident that the rare nature of this opportunity and the depth of capital in the market would generate intense competition. We were proved right.”

Iconic Subiaco corner building

secures $5 million price tag

In another strong indicator of Subiaco’s growing investment appeal, the landmark Tighe’s Building at 131-135 Rokeby Road has changed hands for $5 million in an off-market transaction brokered exclusively by Michael Milne. The two-storey, heritage-listed property occupies a prominent 642sqm corner site in the heart of Subiaco’s retail precinct, and comes with a total building net lettable area (NLA) of 612.3sqm across retail and office tenancies. The asset currently generates a net income of approximately $260,000 per annum anchored by leading fashion retailer Decjuba.

Originally constructed in 1905 for grocer and wine merchant Michael Tighe, the property remains a visual anchor of the historic Rokeby Road & Hay Street Conservation Area.

The purchaser, DMG Property, has been actively pursuing and acquiring strategic assets in tightly held locations, particularly where rental and development upside is identified.

“DMG Property had identified the Subiaco retail strip as an area of significant long-term growth,” said Michael Milne. “131-135 Rokeby Road, being a fully leased

investment on a prime corner, was an ideal fit for their criteria. I’ve known both the buyer and seller groups for over 25 years, and was pleased to structure a deal that worked for both parties.”

The property was sold by Rockingham Park Pty Ltd, a wellregarded private property group with interests spanning investment, development, and finance.

The sale reflects a 5.2 per cent yield on net income, $7,788/sqm on land content, and a blended rate of $9,760/sqm on NLA, marking a sharp result for the strip.

Neighbours join forces to secure circa $15m sale in Rose Bay

In a landmark off-market transaction, two neighbouring owner-occupiers at 574 and 576 Old South Head Road, Rose Bay have banded together to sell their properties in a combined deal worth circa $15 million. The sale, facilitated jointly by Zorick Toltsan of RWC Eastern Suburbs and Graham Berman of Ray White Double Bay, reflects the growing appetite among developers spurred by the NSW Government’s Low and Mid-Rise Housing Reforms.

Situated within an 800m radius of the Rose Bay Town Centre, the combined landholding spans approximately 1,100sqm and is zoned R3, with a permissible gross floor area (GFA) of 1,650sqm.

The site has potential for development up to four to six storeys, aligning perfectly with the government’s push for increased housing density in welllocated suburbs.

“This sale showcases how strategic amalgamations can unlock enormous value in Sydney’s evolving planning landscape,” said Zorick Toltsan of RWC Eastern Suburbs. “The vendors were owner-occupiers who capitalised on the reforms, achieving far more than if they had sold their homes separately.”

The buyer, a local developer, is expected to take advantage of the site’s zoning and location to deliver a new medium-density residential project that aligns with the state’s updated planning guidelines.

Bundall strata sells for $13.4 million under the hammer

A prominent commercial property at 1-9/117 Ashmore Road, Bundall, has sold under the hammer for $13,400,000, marking a significant transaction for the Gold Coast market and the continuation of a long-standing relationship between the seller and RWC Gold Coast.

Marketed by Gregory Bell, Michael Willems, Jackson Rameau, and Stirling McInnes, the highperforming retail centre drew 107 enquiries throughout the campaign and saw eight registered bidders compete at auction.

The successful purchaser, a Gold Coast based businessman with fuel industry interests had previously acquired another asset through RWC Gold Coast earlier this year for approximately $3 million.

The fully-leased investment generates a net income of $939,535.08 per annum + GST and is anchored by a BP service station alongside a mix of established, long-term tenants.

“This is a milestone result for an exceptional asset,” said Gregory Bell. “It’s also a deeply personal one. Our office has managed this property for over 25 years, and I’ve had the privilege of working closely with Cassandra Nicholls and her late husband Brian, who originally purchased the site for $1.7 million in 1986. They’ve been loyal clients of the business for decades, and it was an honour to bring their asset to market and secure such an outstanding outcome.”

The sale carries extra historical significance for the RWC Gold Coast team. Brian Nicholls, a wellknown figure in the music industry through his ownership of a record company, had strong ties to the business and its people.

Stirling McIness, who played a key role in the current campaign, revealed that his father, Duncan McIness, originally sold the property to Brian and Cassandra nearly 40 years ago.

“Being involved in this transaction feels like things have come full circle,” said Mr McIness. “My dad handled the original sale to the Nicholls family in the 1980s, and to now help guide its transition to a new owner is really special. It shows the generational trust our business builds with clients.”

Climate risk assessment validates ESG frameworks for commercial property owners

VANESSA RADER Ray White Head of Research

Australia’s inaugural National Climate Risk Assessment, released earlier this week, provides the definitive evidence base that commercial property owners have long needed to support established Environmental, Social and Governance (ESG) frameworks. Rather than introducing new requirements, this comprehensive analysis of climate threats across the nation cements the scientific foundation for ESG practices that have been embedded in the market for years, giving property investors the quantified risk data to validate their existing sustainability strategies.

The assessment reveals that commercial properties face dramatically escalating risks, with 43 per cent of commercial structures in the Northern Territory already positioned in very high risk areas, compared to just 9 per cent nationally. Queensland’s north shows 47 per cent of commercial buildings in high risk zones. These aren’t distant projections but represent current exposure levels that will intensify as global warming progresses from today’s 1.2°C to projected scenarios of 1.5°C, 2.0°C, and 3.0°C.

For commercial property owners, these findings intersect directly with mounting ESG disclosure requirements and investor expectations around climate risk management. The assessment identifies ten priority hazards that property owners must now factor into their strategic planning: temperature extremes, drought, bushfires, storms, flooding,

coastal erosion, and ocean changes. Each hazard carries specific implications for asset valuation, insurance costs, and operational viability.

The financial implications are immediately tangible. Properties facing flood, bushfire, tropical cyclone, and heatwave exposure could see the number of high risk areas double by 2100. More pressingly, the assessment warns that climate related disruptions to business operations will trigger cascading effects through the financial system via declining cashflows and breaches of loan covenants. These relationships, while poorly understood, are increasingly scrutinised by lenders and investors applying ESG frameworks that have been evolving over the past decade.

Commercial property insurance presents a particularly acute challenge, with policies generally excluding “actions of the sea” while coastal hazards intensify. The assessment projects that over 1.5 million people will live in areas experiencing sea level rise and coastal flooding risks by 2050, directly impacting coastal commercial assets and their insurability

The industrial sector, despite its recent outperformance, isn’t immune. Warehouses and logistics centres face acute hazards including extreme heat, bushfires, and flooding that can disrupt critical supply chains. Data centres, increasingly vital infrastructure, must contend with temperature extremes and power grid vulnerabilities. These operational risks translate directly into ESG performance metrics that institutional investors monitor closely.

However, the assessment also identifies adaptation pathways that align with established ESG best practices. Risk based planning for physical infrastructure, incorporating building codes and land use regulations that reflect future climate risks, can effectively reduce community and asset level exposure. Properties demonstrating climate resilience through design, location,

and operational strategies will command premiums as ESG conscious capital flows increasingly dominate investment decisions.

The timing couldn’t be more critical. As interest rates fall and commercial property markets show signs of recovery, the window for acquiring and developing climate-resilient assets is narrowing. Forward-thinking investors are recognising that ESG compliance isn’t just about reporting requirements, it’s about fundamental asset protection and value creation in a climate-changed world.

The assessment’s systematic approach, analysing risks across different warming scenarios and timeframes through 2090, provides the evidence base that established ESG frameworks have long required. Property owners who have been implementing climate risk strategies can now point to definitive science to support their approaches. The assessment validates existing sustainability initiatives while providing the granular data needed to refine and enhance climate adaptation strategies.

For Australian commercial property owners, this assessment represents the maturation of climate risk from an emerging consideration to a fully quantified operational reality. The document doesn’t create new ESG obligations but rather provides the scientific backbone for sustainability practices that forward thinking investors have been developing for years. Those who have already integrated climate considerations into their ESG strategies, investment decisions, and asset management practices will find validation and enhanced precision. Those who haven’t will discover that the established ESG frameworks now have irrefutable scientific support.

The message is unambiguous: the National Climate Risk Assessment confirms what the ESG community has long understood. Climate adaptation isn’t just good environmental stewardship but essential business strategy for the commercial property sector’s sustainable future.

Luxury retail’s social media revolution drives growth across Australian CBDs

VANESSA RADER

Ray White Head of Research

Australia’s luxury retail landscape is experiencing a fascinating transformation, with social media culture and experiential shopping driving growth in most capital cities despite cost-of-living pressures affecting discretionary spending. The sector’s evolution reflects how premium brands are adapting to capture both traditional luxury consumers and new demographics seeking Instagram-worthy experiences and exclusive packaging.

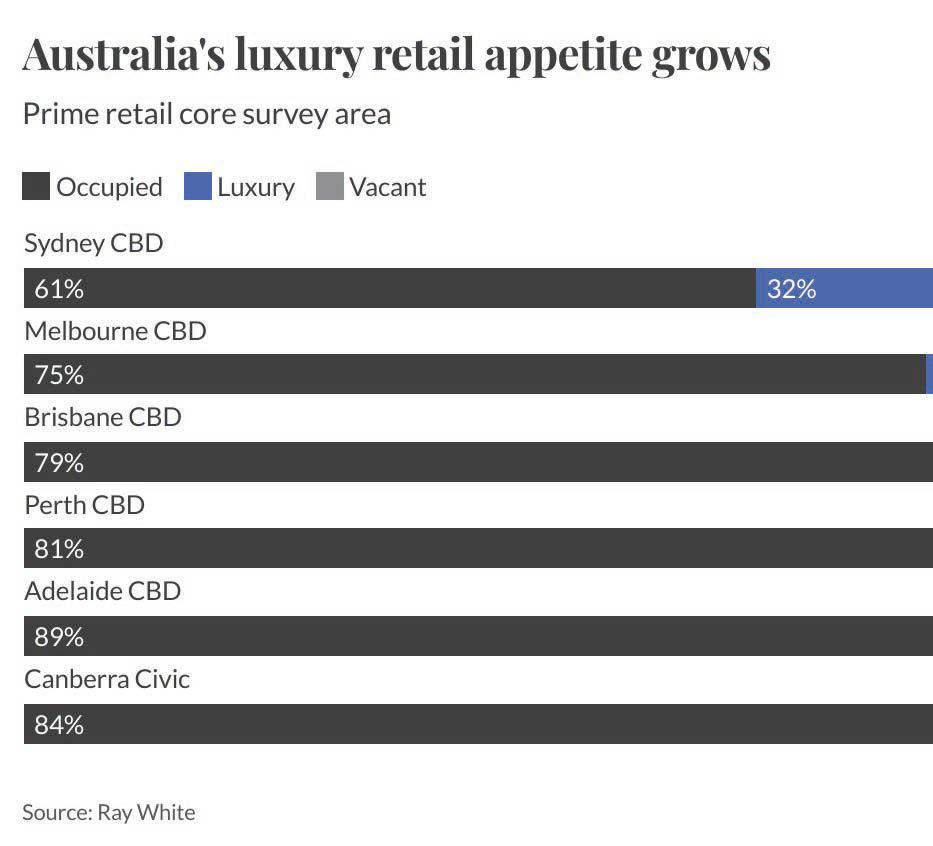

Sydney continues to dominate Australia’s luxury retail scene, with premium brands representing 32.1 per cent of surveyed CBD shops in 2025, up from 25.5 per cent in 2024. This remarkable 6.6 percentage point increase demonstrates Sydney’s growing international credentials as a luxury destination. The expansion beyond traditional Castlereagh and King Streets into Market Street precinct shows luxury brands’ confidence in Sydney’s market depth and tourist appeal.

Perth has emerged as the surprise luxury growth story, with representation jumping from 5.3 per cent to 7.5 per cent over the 12-month period. This strong increase suggests luxury brands are finally recognising Perth’s affluent consumer base and growing tourism appeal, with asset upgrades proving crucial in attracting international brands seeking quality retail environments.

Brisbane’s luxury presence has remained stable at 9.7 per cent compared to 9.8 per cent in 2024, indicating a mature market where luxury brands have established their footprint but aren’t aggressively expanding. The consistency suggests luxury retailers view Brisbane as a solid secondary market with steady demand from both local consumers and domestic tourists.

Surprisingly, Melbourne’s luxury representation has declined from 16.5 per cent to 15.8 per cent, primarily due to closures along the famous “Paris End” of Collins Street. However, this contraction likely reflects temporary asset refurbishments rather than fundamental market weakness, with several former high end stores undergoing upgrades that temporarily remove them from retail counts. Melbourne’s luxury retail is expected to rebound as these refurbished assets return to market with enhanced amenities.

Adelaide and Canberra continue to register minimal luxury presence at 1.1 per cent and 0.6 per cent respectively, highlighting how luxury brands remain concentrated in markets with significant tourist flows and affluent consumer bases.

The social media influence on luxury retail cannot be overstated, with brands increasingly embracing viral culture to capture younger demographics. Louis Vuitton’s recent launch of bag charms, directly responding to the Labubu craze that has swept luxury markets. This strategic move demonstrates how established luxury houses are adapting to social media trends while maintaining their premium positioning.

The crossover between luxury fashion and viral culture extends across multiple brands. Balenciaga has embraced gaming culture through Fortnite collaborations, while Gucci has created viral internet-inspired pieces and gaming platform partnerships. Dior has developed limited Pokemon accessories and Prada has released anime and manga-inspired collections. These partnerships represent luxury brands’ recognition that exclusivity now includes cultural relevance and social media shareability.

This trend explains the continued expansion of luxury retail in Australian CBDs despite economic pressures. Consumers increasingly seek both the quality product and the social currency that comes with luxury brand engagement. The experiential element has become crucial, from store ambiance and personal service to the coveted shopping bags and premium packaging that signal social status on social media platforms.

Tourism recovery is supporting luxury retail expansion, with international visitors providing crucial spending power. Hotel occupancy rates above 75 per cent in most capitals indicate sustained tourist flows that underpin luxury retail demand, particularly in Sydney and Perth where luxury growth has been strongest.

Interestingly, the luxury concept extends beyond traditional fashion and jewelry into food retailing. Premium chocolates, artisanal gelato, and specialty food offerings represent “affordable luxury” that appeals to cost-conscious consumers seeking small indulgences during challenging economic times. This trend explains the growth in specialised food retailing across most CBD markets.

Despite cost-of-living pressures, the luxury retail sector’s growth suggests consumers are prioritising quality experiences and selective indulgences over broad based consumption. The integration of social media culture, experiential retail, and accessible luxury concepts positions this sector for continued growth as Australian CBDs evolve into sophisticated retail destinations that compete internationally for both consumers and premium brands.

How skilled property managers help investors buy smarter

LETEICHA WILSON RWC Property Management Specialist

When investors think about property managers, they often picture someone who steps in after the deal is done, collecting rent, managing tenants, and overseeing maintenance. But the truth is, some of the most valuable work a property manager can do for an investor happens before settlement, during the due diligence process.

For commercial property investors, buying well is just as important as managing well. A property that looks attractive on paper, strong yield, well-known tenant, long lease term, can still hide risks that only surface once the ink is dry. This is where a skilled property manager becomes an investor’s secret advantage.

Spotting the story behind the lease

Every investment is underpinned by the strength of its lease. A property manager can dissect the detailnot just the headline rent or term, but the rent review mechanisms, make-good obligations, operating cost recoveries, and incentive structures. Are rent increases aligned with the market? Are the obligations fair, enforceable, and clear? A lease that’s poorly written or overly tenant-favourable can erode the value of an asset over time.

Assessing tenant quality

It’s not just about the lease, it’s about who’s paying the rent. Property managers have a trained eye for tenant behaviour and performance. They’ll look at whether the tenant has a history of arrears, whether their business model is sustainable, and if they’re complying with maintenance obligations. A long lease means very little if the tenant is unlikely to survive the term.

Identifying hidden costs

One of the biggest risks for investors lies in what’s not immediately visible. Air conditioning systems that haven’t been serviced for years, fire systems approaching compliance deadlines, or structural elements nearing end-of-life, these are costly surprises that can gut returns. Experienced property managers know what to check and can highlight these “time bombs” before they fall into a new landlord’s lap.

Understanding market context

Buying a property isn’t just about the asset itself, it’s about its position in the market. Is the rent sustainable compared to comparable assets? Is the property exposed to a tenant mix that’s too concentrated in one industry? Are lease expiries bunched together, creating risk of multiple vacancies at once? Property managers work on the ground in these markets daily, so they bring a level of context that goes far deeper than a sales brochure.

Helping investors buy with confidence

When you involve a property manager in the due diligence process, you’re not just buying bricks and mortar. You’re buying income. And income is only as strong as the lease, the tenant, and the asset condition behind it.

Skilled property managers bring an investor’s lens to every detail, ensuring you don’t just buy a property, you buy an investment that performs.

For investors, the best property managers aren’t just there to collect rent. They’re there to protect and grow your investment from the very beginning. Involving them before you buy means fewer surprises, stronger performance, and the confidence that you’re making the right call.

RWC bowls into Australia’s summer of cricket

RWC has proudly announced its commitment to leverage Australia’s Summer of Cricket via their national signage program, including the highly anticipated Men’s Ashes Series and a full calendar of men’s and women’s internationalfixtures.

Eighteen months after repositioning from Ray White Commercial to RWC, the campaign signals a major milestone in the brand’s evolution, providing a national platform to drive awareness and engagement beyond traditional commercial real estate channels.

“This is more than a financial commitment, it’s a statement,” said Dan White, managing director of the Ray White Group. “We are dedicated to investing in RWC’s future, and cricket gives us the perfect stage to tell the market that Ray White Commercial is now RWC.”

Todd Alexander, head of marketing at the Ray White Group, highlighted the strategic nature of theinvestment.

“This campaign allows RWC to connect with an audience that sits right within our commercial property heartland. From national LED signage through partners MKTG, to over 5,800 mentions across SEN broadcasts, we’re ensuring the message is heard loud and clear, Ray White Commercial is now RWC.”

“This campaign is a definitive move to entrench RWC’s new identity in the minds of the Australian public, across every boundary, innings and match highlight,” Mr Alexander said.

Backed by Ray White Group’s legacy, the brand is now confidently forging its own identity in the commercial property market, and Australia’s Summer of Cricket is just the beginning.

Following the success of Ray White’s residential network through its AFL campaigns, the Group identified cricket, and particularly The Ashes, as the ideal avenue to mirror that success for its commercialarm.

James Linacre, head of commercial at RWC, said the campaign is a critical move in extending the brand’s reach. “You would be hard pressed to find a television or device in Australia that isn’t streaming cricket over summer. We want to embed RWC in the national sporting consciousness, and align with a sport whose audience shares a strong synergy with our commercial client base.”

Through a multi-layered campaign running from August 2025 through to March 2026, RWC will activate a wide-reaching national presence across cricketing fixtures featuring both the Australian men’s and women’s teams.

Assets under management

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

RWC COLLECTIVE

WACOL, QLD

133sqm of brand new warehouse with premium office space and mezzanine.

RWC SOUTHWEST

YATALA, QLD

RWC BALLARAT

BALLARAT, VIC

Newly constructed early learning centre combines a sleek architectural design with durable brickwork and timber finishes, creating a modern and functional space. Conveniently located with dedicated parking and easy access, it is purpose-built to cater for families and the local community.

890sqm commercial office/warehouse on a prime 2,106sqm block in the tightly held Yatala Industrial precinct

RWC TASMANIA

HOBART, TASMANIA

Constructed in 1936, this six-level landmark offers office and retail space in the heart of the Hobart CBD. With a prime corner location, high exposure, and views over Franklin Square.

QLD

10858 Warrego Highway - Lots 7&8, Charlton, 4350

Industrial development site based in Charlton^

•22.44Ha* Total land area (Inline lot sale)

•Lot 7 - 11.996Ha* incl. residence & sheds

•Lot 8 - 10.437Ha* corner position plus dam

•433m* Warrego Highway frontage west of O'Mara & Steger Roads

•Medium Impact Industry zone - 'Transport & Warehousing' precinct

•Located within the expanding Charlton-Wellcamp Enterprise Area

•Strategic subdivision site^ featuring major arterial road frontage

•Information Memorandum available - Written offers considered prior to close of marketing

•Full site inspections strictly by appointment

Expressions Of Interest

Closes 16 October 2025

Land Area: 22.44 hectares*

Craig Bradley 0488 075 167 craig.bradley@raywhite.com

Paul Schmidt-Lee 0499 781 455 paul.schmidt-lee@raywhite.com *Approx

RWC Toowoomba

raywhitecommercial.com

'Rosalie House', 135 Lavenders Road, Lilyvale, 4352

A once in a lifetime investment opportunity

Nestled in the picturesque Lilyvale Valley (just 25 minutes north of Toowoomba), Rosalie House offers a rare opportunity to acquire one of South East Queensland's most popular vineyard estates with a thriving hospitality business. Property features include:

•20,000sqm* Lot

•Rural Zoning

•$208,000p.a Gross lease with annual increases

•10 year lease until 2035 to Rosalie House Restaurant

•The homestead accommodation is listed on AirBNB and caters for weddings

•Original Rosalie Homestead - 345sqm*

•Cellar door & Restaurant - 300sqm* GFA

•Solar power - 76 panels, 22kW

•Bore water on site

Expressions Of Interest

Land Area: 20,000 sqmuare metres*

Paul Schmidt-Lee 0499 781 455

paul.schmidt-lee@raywhite.com

Logan Sattolo 0497 497 722

logan.sattolo@raywhite.com

RWC Toowoomba

raywhitecommercial.com

Position your business for success with this high-profile 567sqm freehold property along bustling Mulgrave Road, directly opposite Earlville Shopping Centre.

Offering maximum exposure and strong passing traffic, this rare opportunity allows you to own land and premises in one of Cairns’ most in-demand commercial corridors. The flexible, open-plan layout suits a wide range of uses, including retail, office, or service-based businesses. On-street parking and easy access add convenience for both staff and customers.

With secure freehold ownership, attractive yield, longterm capital growth potential, 502 Mulgrave Road delivers the perfect balance of visibility, security, and opportunity for both owner-occupiers and investors.

Susan Doubleday 0408 038 380

susan.doubleday@raywhite.com

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

raywhitecommercial.com

1/62 Abbott Street, Cairns City, 4870

Secure a slice of Greece on Abbott

Whether you're seeking capital growth, passive rental income, or simply a savvy investment, this opportunity offers a slice of Mykonos in the heart of Cairns.

Currently leased to the popular Mykonos Grill and Yiros Bar, the property combines a secure tenancy with prime visibility, strong foot traffic, and reliable rental income.

Situated within Cairns City’s vibrant dining precinct, the venue enjoys exceptional exposure. Just metres from the iconic Night Markets and a short stroll to the Esplanade, major hotels, serviced apartments, tourist attractions, and a key route for cruise ship passengers, it’s perfectly positioned to capture both local and visitor trade.

Sale $680,000

ROI 9.3%

RWC Cairns raywhitecommercial.com

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

2/3-5 Upward Street, Cairns City, 4870

Opportunities of this calibre are rarely available. Whether you're an astute investor seeking long-term growth or a medical professional planning ahead, this is a chance to secure a quality property in a highdemand location.

Property Highlights:

• Prime location within walking distance to both Cairns Public and Private Hospitals, plus surrounding specialists

• Currently tenanted, delivering secure income from settlement

• Modern, professional suite with a excellent internal layout and natural light

• Tightly held precinct, surrounded by established medical professionals

• Located on Level 1 with stair and lift access

• Onsite parking for clients and patients

Sale $205,000

RWC Cairns raywhitecommercial.com

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

27 Scenery Street (Dawson Hwy), West Gladstone, 4680

Dawson Highway - rare offering in

Rarely will such an opportunity arise. Located on Dawson Highway, this is surely one of Gladstone's most sort after locations. Positioned on a very high traffic intersection, the building offers the opportunity to invest or occupy.

Details

•664 m2* building area

•Combination retail, office and workshop tenancies

•1,434m2* site area

•16 onsite car parks

266 Roma Street, Brisbane, 4000

Auction Friday 7 November 2025, 10:00am (AEST)

In-Room:

Level 26, 111 Eagle Street, Brisbane

Rare Freestanding CBD Freehold with Dual Frontage

438sqm* site with 700sqm* GFA across two levels

Valuable dual frontage to Roma Street & May Street

Secure basement car parking - a rarity in this precinct

Opposite Roma Street Station & Cross River Rail project

Strategic location within Brisbane's key growth corridor

Jason Hines 0418 721 744

jason.hines@raywhite.com

John Dwyer 0439 034 010

john.dwyer@raywhite.com

RWC Queensland

raywhitecommercial.com

•89m2* property positioned within the tightly held Rumba Resort retail complex

•Prime location directly across the road from the beach and overlooking Pumicestone Passage

•Suitable for retail/hospitality (STCA)

•Tourist Accommodation zoning

•Vacant possession

7.4m-8.2m* clearance, burnished warehouse floors

Full-height container roller doors with steel shutters

3-phase power and 30kW solar provisions per unit

Air-conditioned mezzanine offices

MI - Medium Impact Industry zoning

Secure gated business park with 24/7 monitored entry

1,486sqm* dual street access site

1,100sqm* building over 2 levels

22* on site parking spaces

Zietsman 0412 047 026

Jones 0499 773 788

Feltoe 0447 714 899 Lachlan O'Keeffe 0413 464 137

Elevated & cleared site with a prominent corner position

Centrally located close to major amenities

30km* East of the Brisbane CBD

468sqm*

356 Middle Road, Greenbank, 4124

•4 Tenants with long term leases

• Current net income - $454,795.58 PA

• Projected additional income - $145,000* PA Net

• Vacant land - 1,193m2 - 10 Year HOA signed with NT

• Total expected income of $620,000* PA Net

• Current building area - 377m2

• Land area - 4,588m2

• Anchored by Metro Petroleum with over 300 Metro Service Stations Australia wide

• Metro Petroleum has one of the largest independent service station networks in Australia

• 13,000 Approximate daily passing traffic

• Strategically located in Greenbank high growth area

Sale Contact Agent

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

Jett Bevacqua 0450 005 810 jett.bevacqua@rwcs.com.au

29 Kenway Drive, Underwood, 4119

Freestanding warehouse in prime location

• Warehouse area - 216sqm

• Secure hardstand - 130sqm (30sqm undercover)

• Land area - 597sqm

• 3 phase power

• Male and Female amenities

• Air conditioned office 10sqm

• Dual roller door access

• LED lighting in warehouse

• Security bars

• Alarm system

Auction Auction - 6th Nov 20252.30pm - Onsite

raywhitecommercial.com RWC Springwood

Aldo Bevacqua 0412 784 977 aldo.bevacqua@rwcs.com.au

Jett Bevacqua 0450 005 810 jett.bevacqua@rwcs.com.au

NSW | ACT

Block 1 Section 81 & Block 1 Section 92, Whitlam, 2611

Two Prime DA Approved Sites

Available in one line are these approved RZ4 residential developments sites, well located in an elevated position, adjacent to the proposed Whitlam Local Centre and school.

Block 1 Section 81 Whitlam: 5,353 sqm approx.

DA Approved for 48 dwellings

Block 1 Section 92 Whitlam: 4,455 sqm approx.

DA Approved for 42 dwellings

McGrath 0411 140 523 daniel.mcgrath@raywhite.com

raywhitecommercial.com

Level 1, 1 Castlereagh Street, Sydney, 2000

Level 1/1 Castlereagh Street

Sydney

1 Castlereagh Street is an B Grade building located on the corner of Hunter and Castlereagh Streets. The NE aspect gives as floors excellent solar access. The lobby has undergone a recent refurbishment providing a classy entrance. There is basement has parking, and end of trip facilities with showers, lockers and bicycle racks. Energy rating.4.5 Stars, Water 3.5 Stars

•New fitout now completed & ready for occupation.

•Generous natural sunlight from the North & East

•Reception, 10p boardroom, 1x6p meeting room

•1 office , 3 meeting rooms, 2 focus rooms, 54 desks

•Large kitchen/breakout area with cafe seating

153sqm* + 2x undercover car spots

Open plan with concrete flooring

High ceilings & curved glass frontage

Common amenities with shower and bike storage

Grease trap and exhaust provisions

Tenanted by Sleek windows 5 year lease

$80,000 nett + outgoings 4% increases

2.1m

Expected

PRIME PACIFIC HIGHWAY CORNER SITE

A rare strategic offering providing a prominent sought after northbound corner site location poised to capitalise on burgeoning local development.

• 1,377m2* site area

• Zone MU1: Mixed use

• Substantial 47.5m2* Pacific Highway frontage

• Fenced hardstand yard

• Site office

Expressions Of Interest

Closing 4PM Monday 27 October 2025

RWC Newcastle

raywhitecommercial.com

Lee Follington 0417 443 478

lee.follington@raywhite.com

A standout strategic holding situated opposite Charlestown Square Shopping Centre providing for a range of potential upside opportunities.

• 575m2* site area

• Zone: MU1 Mixed Use

• Original brick and tile residence

• Existing commercial tenancy income

All offers must be received by the Agent in writing by the deadline to be considered. Lee Follington 0417 443 478 lee.follington@raywhite.com 21 Canberra Street, Charlestown, 2290

Top

One leased, two remainingprominent first floor offices

Two separate offices available, one with open plan layout and plenty of natural light, the other offering two self-contained offices. Both suites have access to shared amenities and air conditioning. Prime exposure to the Kingsway and President Avenue, unmatched signage opportunities to elevate your brand presence. Exceptionally convenient and high profile location.

• Remaining 106m2* first-floor office space with flexible configurations

• Total property size of 262m2*

• Dedicated car spaces for staff or clients

• Recently renovated with new carpet and painting throughout

• Located in Caringbah CBD with proximity to transport, dining, and amenities

• Secure and private building entry

Lease Contact Agent

Brad Lord 0439 594 121 blord@raywhite.com

180 Taren Point Road, Taren Point, 2229

Big, bold & bulky

New building purpose built to ensure maximum retail floor area is achieved on the ground floor (360m2*), and is complimented by a first floor office or additional showroom (100m2*), also complimented with 10 on grade car parking spaces. Surrounded by major national retailers and benefiting from prime exposure, this modern building offers outstanding signage, accessibility, and flexibility for large-format retail, showroom, or trade-style users looking to position their business in a high-performing corridor.

• Near new bulky goods retail showroom 460m2*

• Freestanding with ample parking

• Premium main road signage opportunities

• Surrounded by established bulky goods and retail operators

Lease Contact Agent

Brad Lord 0439 594 121 blord@raywhite.com

1 Belmore Road, Randwick, 2031

Building area 252sqm*

Favourable E2 Local Centre zoning

High pedestrian and vehicular exposure

Sale Contact the agent if you'd like further information.

RWC Eastern Suburbs

raywhitecommercial.com

Tanya Sassoon 90217988 tanya.sassoon@raywhite.com

Grant Whiteman 0418 244 566 gwhiteman@raywhite.com

48-52 Wilberforce Avenue, Rose Bay, 2029

Land Size: 1,100m2 approx

Wide 27m frontage

Permissible FSR of 2.2:1 with 22m height limit

Potential GFA of 2,390m2

Expressions Of Interest

Closing Thursday 30th October, 2025 at 3pm

Zorick Toltsan 0411227784 ztoltsan@raywhite.com

VIC

2645 South Gippsland Highway, Tooradin, 3980

Green Wedge Zone | Land area 198 acres*

Two titles | Offers potential for separate ventures

Direct frontage to the South Gippsland Highway

High visibility and accessibility via Dore Road

Sheds, power, fencing, and dams throughout property

4BR home leased on 5 acres returning $40,800 pa

Opportunity for various uses in the future (STCA)

Large landholding of 2,757m2*

Flexible Industrial 1 Zoning

Suited to a range of industrial, uses^

Occupy, developer or landbank/invest

Premium court position just 250m* from Sydney Road Sale

$2,700,000 Close to major arterials, incl M80 & Hume FWY

Ted Dwyer 0411 312 165 ted.dwyer@raywhite.com

•Total building area | 494m2*

• Total land area | 545m2*

• Freestanding clear span warehouse

• Excellent street frontage

• Functional layout, roller door access

• Leased to Sussan Corporation on monthly tenancy

• Under market rent of $43,723* p.a. net

• Industrial 1 Zone (IN1Z)

• Ideal for owner occupiers or value-add investors

Jonathan On 0479 003 122 jonathan.on@raywhite.com 14

RWC Oakleigh

Ryan Amler 0401 971 622 ryan.amler@raywhite.com

6 Manton Road, Oakleigh South, 3167

•Total land area | 280m2*

• Total building area | 256m2*

• Including office area | 15m 2*

• One (1) allocated car spot plus ample on street parking

• Current rental | $33,847 p/a Net*

• Three (3) year lease commenced July 2023

• Two (2) further terms of Three (3) years each

• Ample amenities including kitchenette & M/F Toilets

• Three (3) phase power

• Great location close to Huntingdale Shops & Huntingdale Railway/Bus Station

Oakleigh

George Kelepouris 0425 798 677

george.kelepouris@raywhite.com

Jonathan On 0479 003 122 jonathan.on@raywhite.com

WA

914

Whole building ready for occupation

914 Hay Street is a beautiful three storey heritage building located to the bustling west end of the Perth CBD. A premier location for premium and A grade office space and in close proximity to RAC Arena and the new ECU campus.

• The whole building comprising basement, ground floor retail and first floor offices is offered with vacant possession.

• Building Area: 1,759m2

• Land Area: 855m2

• Zoning: City Centre - City Centre Precinct 5

• Suitable for a variety of used including retail, offices, accommodation, entertainment, medical services, restaurant, Tavern and more.

• Ideal for owner occupation, repositioning or redevelopment

Sale Offers from $4,400,000 + GST

WA

21 Burler Drive, Vasse, 6280

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

Vasse Vacant Industrial Under instructions

726m2* Warehouse on 2,005m2 land

Thriving Business Park with ‘Light Industry’ zoning

Proximity to Dunsborough and Busselton

Vacant possession

Expressions Of Interest Closing 15 Oct 2025 at 16:00 AWST

Brett Wilkins 0478 611 168

Unit1/18ATaurusPlace, Bromley,Christchurch,8062

SmartandTidyWarehouse Unit

An exceptionalopportunitytoacquireanappealing, versatileandwell-maintainedindustrialwarehouseunit inawellestablishedindustrialhubofChristchurch.

Greatsizedwarehouseof195m2*,officeof21m2*, amenitiesof4m2*.Totalareaof220m2*(plusan unconsentedmezzanineof42m2*).

Thiswellpresentedunitoffersafunctionallayout perfectforowner-occupiers,tradespeople,storage,oras anadditiontoyourinvestmentportfolio.

Seismicallyratedat 78% NBS. PleasenotetheVendorisnotregisteredforGST.

SA | NT

21 Edmund Avenue,

Auction

Onsite Friday 10th of October at 11am (USP)

Fuel Your Portfolio

Leased to BP subsidiary to 2036 with options to 2056

BP (British Petroleum) - A global energy leader

Oliver Totani 0412 808 743

Harry Einarson 0421 747 442

Connor Melvill 0468 812 921

Fixed 3% rent reviews guaranteeing strong rental growth

Offers significant depreciation benefit

Rare corner site of some 652sqm*

RWC Adelaide

Est. net income $133,226 pa + GST raywhitecommercial.com

No Stamp Duty payable!