AUGUST 2025

PORTFOLIO

HOW TIKTOK’S DEMOGRAPHIC SHIFT COULD RESHAPE AUSTRALIAN COMMERCIAL PROPERTY

SENIOR HOUSING: CAPITALISING ON AUSTRALIA’S DEMOGRAPHIC SHIFT

COMMERCIAL CLARITY: EXPERTS DISSECT A SURPRISING YEAR IN PROPERTY MARKETS

This month in Portfolio

James Linacre Head of Commercial RWC Australia and New Zealand

Welcome to the August edition of Portfolio Magazine.

This month, we take a closer look at the demographic and market shifts that are subtly - and sometimes dramatically - reshaping Australia’s commercial property landscape.

In this issue, Vanessa Rader explores how TikTok’s changing user base could influence the future of commercial real estate. With 8.5 million Australians now spending more time on TikTok than any other social platform, we’re watching closely as the platform matures from a teen-dominated space into a multigenerational channelwith potential implications for retail, advertising, and location strategy.

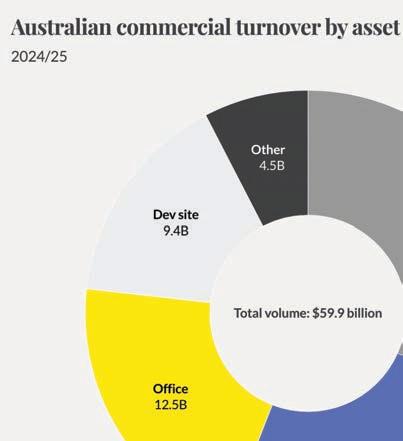

We also examine a major reshuffle in asset class performance. In FY24/25, retail was the surprise outperformer with a 19.2 per cent jump, while medical and childcare assets suffered a 28.9 per cent decline. With fewer but larger deals driving total transaction

volumes to $59.9 billion, we unpack the forces behind this capital rotation.

Another feature delves into senior housing - a sector primed for growth as Australia ages - and how policy and planning decisions may be creating more friction than momentum.

You’ll also hear from Leteicha Wilson on the hidden cost of poor tenant selection, and get the highlights from our recent Between the Lines Live event, where Vanessa Rader and Ian Hetherington brought a combined wealth of insight to the financial year ahead.

Finally, off the back of our incredibly successful June Auction Showcase, we’re now preparing for our end-ofyear program. If you’re considering selling, now’s the time to speak with your local RWC agent.

Enjoy the read.

Quick jump to a region

How TikTok’s demographic shift could reshape Australian commercial property

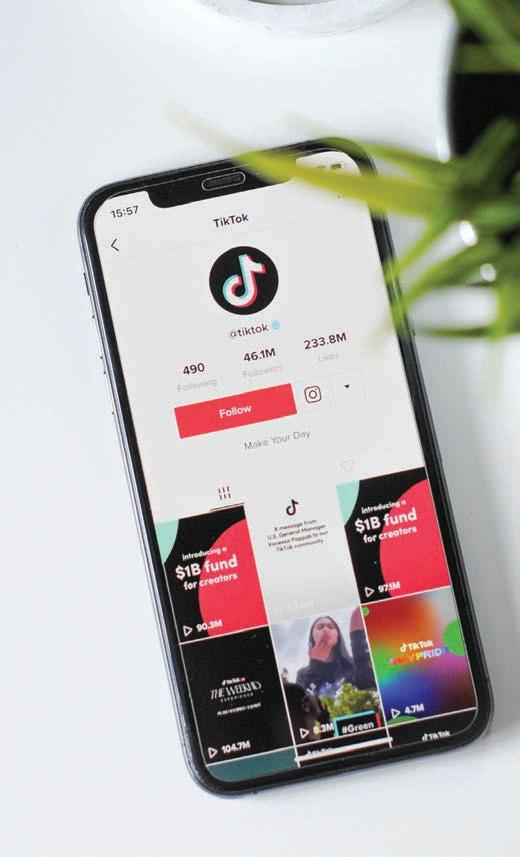

Australia’s TikTok landscape is undergoing a demographic transformation with implications extending far beyond social media into commercial property markets. With 8.5 million active users spending 1.5 hours daily on the platform (more time than any other social media app), the Australian market is positioned to follow the demographic maturation patterns already evident in the United States, where TikTok’s user base has fundamentally shifted from teen-dominated to multi-generational.

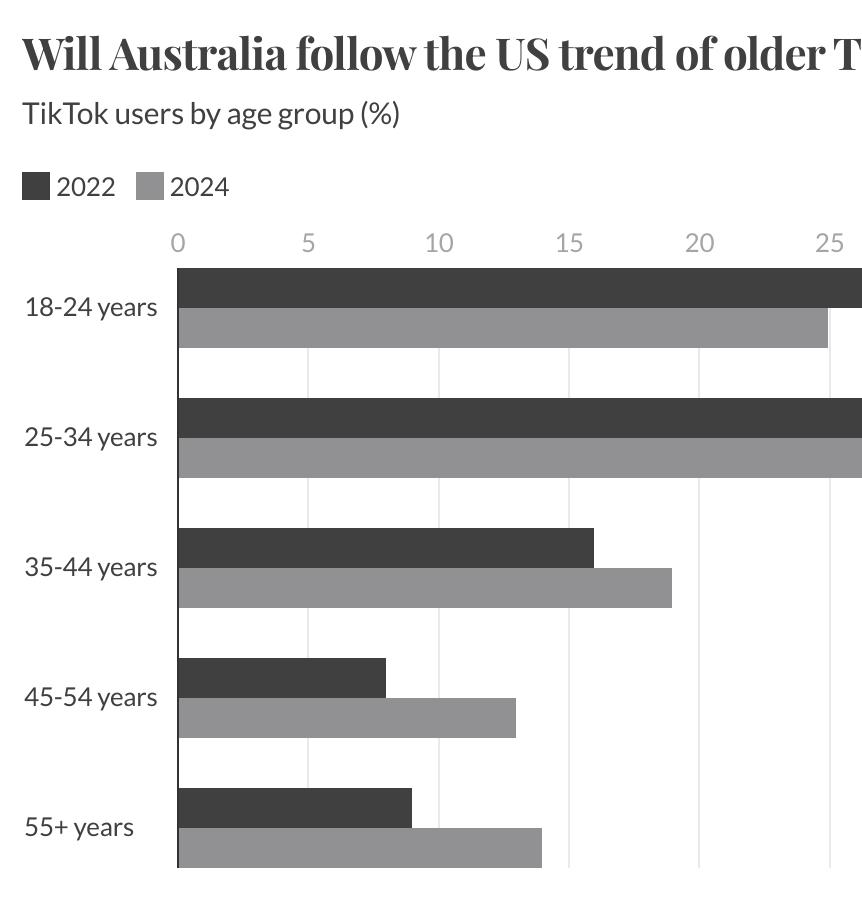

The demographic evolution is striking when compared to US trends. While Australia’s TikTok user base remains dominated by 18-24 year-olds,

American data reveals a dramatic shift with users aged 45-54 surged from 8 per cent to 13 per cent between 2022 and 2024, while those 55+ jumped from 9 per cent to 14 per cent. Most significantly, the traditionally dominant 18-24 cohort actually declined from 35 per cent to 25 per cent, with 25-34 year-olds now representing the largest segment at 35 per cent. This demographic inversion suggests Australia is approximately 1-2 years behind a similar transformation that will fundamentally alter how businesses approach their physical spaces and customer engagement strategies.

What makes this demographic shift particularly significant for Australian commercial property is the engagement intensity. Australian TikTok users average 26-minute sessions and return to the app multiple times daily, with over 90 per cent being repeat users according to Data AI. When this level of sustained attention combines with the higher spending power of mature demographics it creates a powerful convergence of discovery behaviour and purchasing capacity that retail and commercial property must prepare to accommodate.

The engagement patterns reveal interesting nuances about Australian user behavior. While Australians spend 38 hours and 51 minutes monthly on TikTok (well ahead of the worldwide average of 34 hours and 56 minutes, ranking 17th globally), they open the app just 304 times per month compared to the worldwide average of 358.7 times. This suggests Australian users have longer, more intentional sessions rather than quick, frequent checkins, indicating a more mature engagement pattern that could accelerate as demographics shift toward older users who typically prefer deeper, less fragmented content consumption.

The commercial property implications are already emerging. E-commerce activity through TikTok is rising rapidly in Australia, with 38 per cent of users willing to view ads in exchange for free services. This creates a direct link between social media discovery and purchasing behaviour that physical retail spaces must accommodate. Shopping centres and retail developments that can bridge this digital-to-physical journey will capture disproportionate value as traditional retail tenant strategies require complete reconsideration.

The platform’s music-driven trends and local cultural hashtags suggest retail spaces need to become more experience-focused and socially integrated. When demographics mature to match US patterns, Australian shopping centres focused purely on younger audiences may miss their largest potential market segment, the 35-54 age group with higher disposable income and established purchasing power. This demographic evolution aligns with expectations that retail will be the standout commercial property performer, with assets delivering strong returns and representing 41.1 per cent of all commercial transactions.

The implications for tenant mix are profound. Healthcare facilities could see accelerated demand as TikTok users discover wellness content and seek corresponding physical services. The platform’s popularity for educational and informative content means neighbourhood centres anchored by health services and

lifestyle brands are gaining increased relevance. Food and beverage operators leading retail’s revival must adapt to serve both digital natives and social mediaengaged older consumers, while service-based tenants offering consultations, treatments, or experiences that complement online discovery are becoming premium prospects for landlords.

Perhaps most significantly, over 350,000 Australian businesses now use TikTok, representing a massive shift toward social media-integrated commerce. This business adoption rate suggests emerging demand for commercial spaces that can accommodate content creation, live streaming, and social media integration alongside traditional retail functions. The creator economy is maturing rapidly, with influencers commanding high rates for major campaigns, indicating demand for professional infrastructure. The 41.5 per cent penetration rate among social media users suggests this isn’t niche demand, it’s becoming mainstream business infrastructure.

For retail landlords, this creates multiple revenue opportunities. Content creation studios can command premium rents while serving multiple tenants. Pop-up spaces designed for viral marketing campaigns offer flexibility and higher turnover rates. Traditional retail spaces with built-in streaming capabilities, professional lighting, and social media optimisation become more attractive to tenants who understand omnichannel retail.

The opportunity extends beyond pure content creation facilities. With Australian users actively engaging with branded content and local trends, retail spaces need dynamic adaptability. QR code integration, in-store social media experiences, and livestream shopping events are shifting from novelty to necessity. Service stations could capitalise by creating social mediafriendly spaces that encourage longer dwell times during EV charging, while traditional anchor tenants may need to adapt their physical spaces for social media integration.

Australia’s current position of high engagement, growing business adoption, but still demographically young, represents a strategic opportunity. Commercial property investors and developers who prepare for TikTok’s demographic maturation before it fully arrives can capture first-mover advantages. As the platform evolves toward the US model of broader age engagement, Australian retail and commercial property positioned for this shift will benefit from both higher spending power demographics and established social media integration capabilities.

Senior housing: Capitalising on Australia’s demographic shift

Australia’s senior housing sector presents a strategic investment opportunity shaped by powerful demographic forces, yet recent state budget allocations reveal a policy environment that may inadvertently constrain sector growth while exacerbating broader housing market pressures.

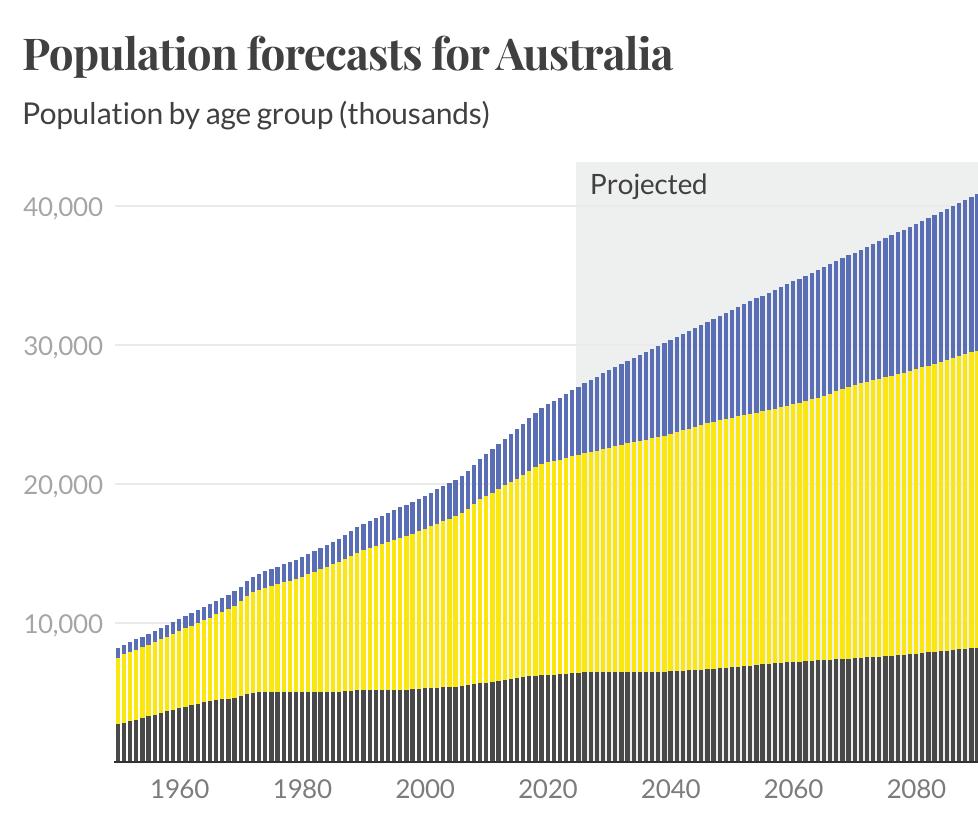

The ABS projects the over-65 population will reach 6.9 million by 2050, representing 22 per cent of the population, while the over-85 cohort will triple to 1.5 million. This demographic transformation is accelerating rapidly, with the working-age population ratio declining from 4.2 working-age people per senior

in 2019 to 3.1 by 2058. The scale of this shift becomes apparent when considering that Australia’s over-60 population has nearly doubled from 3.3 million in 2002 to approximately 6 million today, with around 130,000 people annually joining this cohort. Current senior housing remains at only 5 per cent of the eligible population, compared to international markets where utilisation reaches higher levels as demographics mature, indicating substantial market expansion potential.

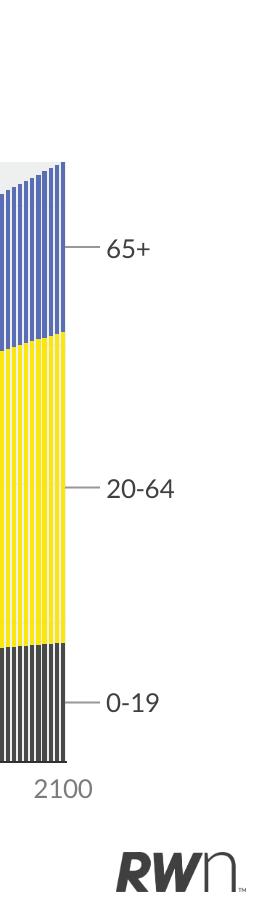

Transaction activity demonstrates sustained institutional conviction despite broader economic uncertainty. Preliminary 2024/25 financial year data shows transaction volumes reaching $1.36 billion nationally, representing a modest decline from the 2019/20 peak of $2.24 billion but maintaining historical consistency with annual volumes typically ranging between $1.8-2.0 billion over the past decade. The sector’s transaction profile differs markedly from other commercial property segments, with activity concentrated among local private buyers, institutions including not-for-profits, and

listed entities rather than offshore capital. This domestic focus provides market stability while reflecting the specialised nature of aged care operations requiring local expertise and regulatory compliance. Major institutional players continue active acquisition programs, with portfolio transactions demonstrating investor preference for scale platforms that can navigate complex regulatory environments while capturing operational efficiencies across multiple facilities.

The 2025/26 state budgets demonstrate governments’ clear preference for keeping seniors in existing homes rather than supporting purpose-built development. Queensland’s budget exemplifies this approach, allocating $26.8 million for home modification subsidies and $62.7 million in pensioner rate subsidies to help seniors remain in current properties. While senior housing assets generally benefit from land tax exemptions across most states, this provides limited new policy support for sector expansion. These aging-

in-place policies create unintended consequences for housing supply, with approximately 80 per cent of Australians aged 65-plus owning their homes outright and government incentives encouraging them to stay. This effectively removes substantial housing inventory from the market precisely when Australia faces acute housing shortages, as valuable family housing stock remains occupied by seniors who might otherwise downsize to purpose-built accommodation.

The policy framework illustrates a disconnect for the senior housing sector, where demographic projections suggest current approaches are financially unsustainable as care needs intensify. Construction activity remains constrained, with development facing regulatory complexities and extended approval processes, while government funding focuses on fragmented home-based services rather than efficient purposebuilt facilities. This supply constraint, combined with demographic pressures, creates artificial scarcity in purpose-built accommodation that supports asset values but limits accessibility for the growing senior population requiring specialised housing solutions.

The sector also faces significant workforce challenges that impact investment considerations. As the demographic transformation accelerates, the aged care workforce struggles with staffing shortages while demand intensifies. This workforce constraint creates operational risks for existing facilities but also supports the investment case for modern, efficiently designed facilities that can optimise staff productivity and attract quality employees through better working environments.

For investors, the current environment presents strategic positioning opportunities ahead of inevitable policy evolution. Current budget allocations supporting aging-in-place will prove financially unsustainable as the demographic transformation accelerates and informal caregiving capacity diminishes. The combination of constrained supply, demographic inevitability, yield variability, and consistent institutional transaction volumes creates attractive entry conditions for investors capable of long-term investment horizons. As policy settings eventually align with demographic realities, early investors in quality senior housing assets positioned in strong demographic growth areas may capture significant value creation through both operational performance and asset appreciation, particularly given the sector’s proven institutional acceptance and defensive operational characteristics.

Commercial clarity: Experts dissect a surprising year in property markets

VANESSA RADER

Ray White Head of Research

The latest instalment of Between the Lines Live brought together two of Ray White’s most seasoned commercial minds.

Head of Research Vanessa Rader and Capital Transactions Director Ian Hetherington unpacked the 2024/2025 financial year and explored where the opportunities lie in the commercial property market.

With more than three decades in the industry, Ian Hetherington didn’t shy away from the hard truths facing the sector, while

Vanessa Rader grounded the discussion in detailed transaction data and a broader economic view.

Vanessa opened the discussion with a review of the year’s preliminary transaction data, which shows approximately $56 billion in commercial sales over FY2024.

“While that sounds large, last year we were over $60 billion - and even higher the year before that,” she said. “There was a spark of optimism late last year, but it hasn’t quite carried through the way we expected.”

That sluggishness, Ian explained, can be partly attributed to investor sentiment.

“When investors are anxious, they tend to sit on their hands,” he said. “There’s a lot of uncertainty in the world right now - conflict, global leadership transitions, and general economic unease. It’s not an easy space to have a high level of conviction in.”

Still, both agreed that interest rate shifts could help unlock movement.

“If rates come down, they'll come down because there’s concern,” Ian said. “But lower rates mean cheaper debt, and historically, that drives yields down too.”

Office: Challenge or opportunity?

A large portion of the discussion focused on the much-scrutinised office market, which Vanessa noted has endured sustained pressure.

“Return-to-office metrics remain weak in some states - Melbourne in particular has been the slowest and hardest to watch,” she said.0

Ian offered an optimistic overview. “There’s definitely a shift - people are beginning to accept this new normal,” he said. “Once the core CBDs fill up, we’ll see the fringe markets follow. Right now, I think the best investment opportunities lie in low A-grade or B-grade office stock in CBDs.”

Vanessa added that tenant needs have also changed post-pandemic, with many businesses shrinking their office footprint to allow for hot-desking and hybrid work.

Ian noted: “I’m still surprised the desire for your own desk hasn’t returned in force. But fear - especially around job securitycould be part of what’s bringing people back.”

Industrial still in high demand

On the industrial front, Vanessa raised concerns about a lack of available land. Ian agreed, noting the strength of institutional demand.

“Industrial is here to stay,” he said. “Yes, warehousing demand can dip if the economy slows, but the overall market remains resilient. Yields will tighten in the short to

medium term, and urban renewal is absorbing what’s left of innerring industrial land. It’s pushing development further out.”

Retail shines bright

Ian championed the retail sector as a “shining light” of the year.

“I’ve been talking up retail for the last 12 months, and it’s proving itself,” Vanessa said.

Ian concurred: “Retail yields have been retracting for a long time. People are often too binary in their thinking - retail isn’t dying; it’s evolving. Fewer new shopping centres are being built, but the ones that exist are adapting - we’re seeing elevated food, media, and experiential offerings that keep them relevant.”

Vanessa added, “Just look at Tokyo - their centres are dynamic, social, and multi-layered. It’s an exciting benchmark for what could evolve here.”

Where are the opportunities?

As the webinar wrapped, Vanessa posed the critical question: where are the biggest opportunities today?

Ian said “Office is the contrarian play, but the value is there. If I had to invest before Christmas, I’d be looking at low A or B-grade Sydney CBD assets, or something in Brisbane with 3-4 years WALE and a solid NABERS rating.”

In a market where uncertainty is abundant, the key message from the webinar was clear, while the financial year may have been muted, there are still opportunities to be found for the informed, the flexible, and the brave.

The real cost of poor tenant selection in commercial assets

LETEICHA WILSON RWC Property Management Specialist

In commercial property, occupancy alone doesn’t equal security. A tenancy may tick the “leased” box, but if the tenant isn’t the right fit, operationally, financially or reputationally, it can become a ticking time bomb for the investor.

Too often, we see the true cost of poor tenant selection unfold well after the ink has dried. Whether it’s rental arrears, property damage, vacancy churn, or a broader impact on asset performance, the wrong tenant can undermine even the best asset.

Here’s why tenant selection is one of the most important decisions an investor can make, and how your property manager plays a pivotal role in getting it right.

It’s not just about filling a vacancy

In soft markets or high vacancy environments, the temptation is to fill the space quickly. But rushing a lease deal without proper due diligence can be costly. Poor credit history, unstable business models, or mismatched space requirements can quickly turn a “leased” space into a management headache.

Good tenants do more than pay rent on time. They care for the property, uphold the lease terms, fit the property’s long-term use, and often contribute to a better tenant mix, especially in multi-tenanted assets.

The financial fallout

When a tenant defaults, the impact is immediate, lost rent/outgoings, legal costs, potential damage to the property, and lengthy re-leasing periods. But the damage doesn’t end there. Repeated tenant turnover can create uncertainty, which affects asset valuation and buyer interest down the track.

Your property’s income stream is one of the key drivers of its value. Unreliable tenants, high arrears, or poorly structured leases introduce volatility that savvy investors, and valuers, pick up on.

Reputational risk and property positioning

In retail and industrial spaces, the type of tenant you place can influence the entire site. A disruptive tenant may deter others, cause friction in shared spaces, or negatively affect customer traffic. Over time, this chips away at your asset’s desirability and limits your options when the next lease ends.

An experienced commercial property manager or leasing agent brings more than just a tenant - they bring a process. This includes:

• Robust tenant screening: Background checks, financial assessments, trading history and fit-forpurpose assessments.

• Lease structuring for protection: Ensuring clear lease terms that align risk, with appropriate security, make good clauses and exit conditions.

• Long-term alignment: Matching tenant needs with asset strategy to support longer lease terms and reduce churn.

It’s not just about securing a lease - it’s about securing the right lease.

Strong tenants don’t just pay rent, they contribute to your asset’s story. They build stability, enhance valuation, and reduce management overheads. A property with a well-selected, long-standing tenant and a solid lease will always outperform one that has been a revolving door of compromise tenancies.

The Sector Shuffle: Commercial Property Asset Performance 2024/25

Australia’s commercial property landscape experienced a dramatic reshuffling during the 2024/25 financial year, with retail emerging as the standout winner posting a remarkable 19.2 per cent surge while medical and childcare assets faced a substantial 28.9 per cent decline. Total market activity reached $59.9 billion across 7,754 transactions, with the 18.5 per cent reduction in deal numbers masking a fascinating story of sector rotation as institutional and offshore capital aggressively pursued fewer but significantly larger transactions, fundamentally altering the competitive dynamics across asset classes.

Industrial property maintained its position as the largest sector by volume, attracting $19.0 billion in transactions during 2024/25, representing 31.6 per cent of total market activity. Despite a modest 1.6 per cent decline from the previous year’s $19.3 billion, the industrial sector demonstrated continued appeal across traditional warehousing, logistics facilities, and the increasingly significant data centre segment. The sector’s appeal stems from its defensive characteristics, low vacancy rates, and continued demand from e-commerce and logistics operators. Data centres, in particular, have attracted substantial institutional and offshore investment, driving significant value appreciation within the broader industrial classification. The 16.3 per cent reduction in transaction numbers to 3,548 deals indicates consolidation toward larger assets, with institutional investors and offshore capital targeting premium logistics facilities and specialised industrial assets.

The retail sector emerged as the standout performer, with transaction volumes surging 19.2 per cent to reach $14.6 billion in 2024/25, representing 24.3 per cent of total market activity. This substantial recovery validates predictions of a retail renaissance, underpinned by limited new supply, strong population growth, and successful adaptation off retail formats inline with new trends. The sector attracted broad-based investor interest across neighbourhood centres, sub-regional assets, and strip retail locations, with private investors particularly active in the sub-$20 million segment while institutional and offshore capital targeted larger portfolio opportunities. Despite the strong volume growth, transaction numbers declined 21.3 per cent to 1,472 deals, again reflecting the trend toward larger transactions.

The office sector recorded $12.5 billion in investment activity, representing 20.9 per cent of total market activity and achieving a modest 2.1 per cent increase from 2023/24. This continues the structural adjustment within the sector, reflecting ongoing high vacancy rates and the permanent impact of hybrid working arrangements. Return-to-work patterns have varied significantly across states, creating volatility in take-up rates and further complicating market dynamics. Prime assets have performed best, attracting both institutional and offshore investors seeking quality, while secondary grade stock faces mounting pressure with potential for further value declines. Transaction numbers fell 18.8 per cent to 1,306 deals. The high cost of construction driven by labour shortages and extended project timelines has put pressure on development viability, ironically supporting effective rents as new supply remains constrained despite raw material costs moderating.

Development site transactions reached $9.4 billion, representing 15.6 per cent of total market activity, though this marked a significant 15.8 per cent decline from 2023/24 levels. The reduced activity reflects ongoing challenges in development economics, with

high construction costs and extended timelines affecting project viability. However, the continued substantial level of activity suggests underlying confidence in future development opportunities, particularly in residential and mixed-use projects. Private investors and developers have been particularly active in this segment, while listed property groups have shown selective interest in larger development opportunities.

The hotel and pub sector attracted $2.9 billion in investment, representing 4.8 per cent of total market activity and experiencing a slight 1.3 per cent decline from 2023/24. The sector continues to benefit from tourism recovery and strategic repositioning of assets, with both domestic and offshore capital showing interest in quality hospitality assets.

Medical and childcare facilities generated $1.7 billion in activity, representing 2.8 per cent of total market activity but experiencing a notable 28.9 per cent decline from 2023/24 levels. This reduction reflects increased selectivity from investors in these previously popular alternative asset classes, with buyers becoming more discerning about location, operator quality, and long-term demographic trends.

The modest interest rate reductions experienced in the latter half of 2024/25 have begun to improve market sentiment, with early indicators suggesting renewed investor appetite. The expected continuation of rate reductions into 2025/26 is anticipated to provide further stimulus to transaction activity, particularly benefiting sectors with strong fundamentals such as industrial and retail. As we transition into 2025/26, the market is positioned for selective recovery. While sellers remain in a cautious holding pattern due to global economic uncertainties, the combination of improving interest rate conditions and Australia’s relatively stable economic environment suggests increased investment activity ahead. The industrial sector’s continued strength, retail’s strong recovery, and potential office market stabilisation indicate a market adapting to structural changes while maintaining its appeal to both domestic and international investors. The data suggests 2024/25 represented a crucial transition year, with asset classes experiencing varied fortunes reflecting their adaptation to postpandemic market dynamics and evolving investor preferences.

German waste giant secures prime Jandakot site for $16.25 million

In a major transaction underscoring the strength of Perth’s southern corridor, a significant 4.7-hectare landholding in Jandakot has sold for $16.25 million to Germanbased waste management company, Remondis.

Ray White Commercial WA agents Lachlan Burrows, Michael Danagher, and Tom Jones successfully brokered the deal for 49 & 53 Cutler Road on behalf of local vendors, the West Coast Skin & Hide Co, a family business with historical ties to the land.

The site, which spans 47,298sqm, was sold following a competitive on-market campaign and represents one of the last remaining large-scale infill opportunities in the area.

“This sale represents a rare chance to secure scale, zoning flexibility and exposure in a tightly held precinct,” said Mr Burrows. “It’s not often you get a site this large, surrounded by so much infrastructure, major retailers and growing residential density.”

The land is uniquely positioned adjacent to the future Perth Surf Park, Cockburn Gateway Shopping City, Cockburn Central Station, and the Kwinana Freeway, making it a prime candidate for long-term strategic investment.

“Due to recent infrastructure upgrades, Verde Drive now runs directly through the property, significantly expanding the road frontage and allowing for a wide range of future developments,,” Mr Danagher said.

The buyer, Remondis, already occupies neighbouring sites and purchased the land to support future growth and expansion in Western Australia.

“This was a strategic acquisition for Remondis, and their purchase is a clear sign of confidence in the area’s growth trajectory,” Mr Jones said.

The land has a storied history, once used for tanning skins and hides in the 1980s and ’90s. Since then,

it has remained largely dormant as the surrounding precinct has transformed into a thriving commercial and residential hub.

“Our vendors, who have held the land across multiple generations, felt the time was right to sell given the rising interest from major players and the influx of infrastructure upgrades in the area,” Mr Burrows said.

The transaction follows a string of development activity in Jandakot and surrounds, with ongoing investment into roads, retail precincts, and residential catchments fuelling demand for well-located sites.

“This is a textbook example of the infill opportunity that doesn’t come along often,” Mr Danagher concluded. “You’ve got scale, location, and a long-term industrial occupier who knows the area and its potential.”

The South Sydney strata retail surge

RWC South Sydney has wrapped up a major retail strata investment run, selling 12+ individual shops across high-demand South Sydney suburbs in recent weeks, including tightly held Danks Street in Waterloo and prominent pockets of Alexandria and Mascot.

The properties, spread across Waterloo, Alexandria and Mascot, attracted strong interest from both local and interstate investors and owner-occupiers, with net yields ranging between 5 and 6 per cent, demonstrating continued appetite for well-leased, self-supporting retail assets.

Leading the sales campaign was experienced commercial agent Phillip Elmowy, who said the results were a clear sign that buyers remain confident in quality strata retail with strong tenancy profiles.

“We’re seeing serious demand for investment-grade retail strata, particularly where the tenants are established and well-known brands. That’s what sets these assets apart,” Mr Elmowy said.

“Every one of these deals was driven by the strength of the tenancy. That’s the core of a

good investment, you want the businesses to be thriving.”

Among the highlight sales was 1–8 / 2 Danks Street, Waterloo, a collection of eight shops in a mixed-use building developed six years ago by the vendor, who built the entire corner block. The asset was sold for circa $7 million to a private investor. The shops are home to a collection of international and renowned tenants.

“This is a premium holding on one of Sydney’s most sought-after lifestyle strips. These are rare shops that don’t come up often,” Mr Elmowy said.

“We actually sold shop 9 in the same building just two months earlier for $515,000 to a super fund, that one was only 25sqm, which shows just how in demand these retail investments are.”

Also transacted were three shops at 620 Botany Road, Alexandria, in the modern Amara Building. Shops 1 and 2 were sold together to one investor, while Shop 3 was purchased separately by another investor.

“Alexandria continues to evolve into a strong mixed-use precinct,

and assets like these with strong rental returns are particularly appealing,” Mr Elmowy said.

Meanwhile, Shop 1 / 674 Botany Road, Alexandria, was sold by RWC South Sydney Alex Santelli to an owner-occupier, demonstrating confidence from business operators in establishing a longterm foothold in the area.

Rounding out the series of transactions, Shop 12 / 1–3 Elizabeth Avenue, Mascot, was sold by an investor to another investor, again reflecting the robust nature of South Sydney’s strata retail market.

Mr Elmowy said the selfsupporting nature of all the properties was a key drawcard.

“Returns of 5-6 per cent net in today’s market are incredibly strong,” he said.

“Each of these shops is leased, self-sustaining, and located in growing residential hubs. We expect demand for these kinds of investments to remain high well into 2025 and beyond.”

All properties were marketed and sold by the RWC South Sydney team.

Auto investment races out the door at 4.55% yield

A fully leased, high-profile corner site on the Gold Coast’s tightly-held Brisbane Road at Labrador has sold for $4,350,000 prior to auction, in a deal negotiated by RWC Gold Coast’s Jackson Rameau and Michael Willems.

Located at 46-48 Brisbane Road, Labrador, the 1,687sqm* dual-frontage site attracted an outrageous amount of attention from both local and interstate investors wanting to lock down this asset. Anchored by established national tenants The Car Place and Midas Tyre & Auto, the asset delivers a secure triple net income of $197,760 per annum.

“This campaign generated an incredible 58 qualified enquiries in just 9 days, which speaks volumes about the demand for welllocated, retail or industrial style investments with net leases,” said agent Jackson Rameau.

“Ultimately, the property received multiple offers and signed contracts in the first week online and was then snapped up before auction by an international investor who recognised the rarity and strength of this corner holding.”

Mr Rameau credited a strategic marketing campaign for creating competitive tension early in the process, which resulted in the owner wanting to sell and secure such a tight yield given the auction was still three weeks out.

“We’ve seen a clear trend towards premium prices being achieved when sellers commit to an auction process where buyers are forced to prove their interest or miss out. We believe this premium result was directly due to our auction strategy and tailored campaign rather than a traditional EOI process where buyers tend to sit back and wait,” he said.

The private local seller was reportedly thrilled with the outcome, which further cements Brisbane Road as one of the Gold Coast’s most sought-after commercial strips.

“There’s no question that highexposure assets leased to national style tenants continue to outperform. Buyers - particularly from interstate or overseas - are chasing secure income streams and long-term growth, and they’re willing to pay a premium for the right opportunity,” Mr Rameau said.

This result adds to a growing list of successful sales along Brisbane Road and highlights the ongoing strength of the automotive and service retail sector.

Historic Adelaide CBD site sold to local developer

An Adelaide CBD development site with triple street frontage and Capital City zoning has officially changed hands, with the former King’s Head Hotel at 353–357 King William Street sold by RWC Adelaide.

The high-profile 780sqm site, situated on the corner of King William and Sturt Streets, was sold by the Mortgagee in Possession to South Australian family enterprise AA Advancements, following a strong expression of interest campaign that drew attention from a wide range of prospective developers and investors.

RWC Adelaide Partners Jack Dyson, Harry Einarson and Managing Partner Oliver Totani managed the campaign, which concluded with the deal being transacted shortly after the EOI closed.

“This property offered an extremely rare chance to secure a triple-fronted development site with direct tram line access in the tightly held southern pocket of Adelaide’s CBD,” Mr Dyson said.

“With its Capital City zoning allowing for development up to 53 metres and an existing

approval for a 16-storey serviced accommodation tower, the site presents outstanding potential for a major project in a location that is quickly growing in appeal.”

Previously home to the King’s Head Hotel, a once-bustling venue known for championing South Australian produce and beverages, the property has sat dormant for some time following a series of unsuccessful redevelopment attempts.

“After several false starts in recent years, this sale marks a turning point for the site,” Mr Einarson said.

Located just a short walk from Victoria Square and Adelaide Central Market, the property sits in a thriving legal, government and hospitality precinct. It is surrounded by key institutions including the Supreme, District, Magistrates and Youth Courts of South Australia, and is steps away

from popular cafes, eateries and the Prohibition Liquor Co.

“The area is a vibrant mix of residential, commercial and lifestyle offerings,” Mr Totani said. “Combine that with immediate tram access and proximity to major city destinations, and you have one of the most well-connected and versatile development sites on the market.”

The sale reflects a broader trend of renewed interest in centrally located, developable parcels of land in Adelaide’s CBD, particularly as planning certainty and transport infrastructure continue to improve.

“There’s a noticeable shift back toward CBD development now that cost pressures are easing and interest rates have stabilised,” Mr Dyson said. “Buyers are looking at sites like this with fresh eyes and renewed confidence.”

QLD

prime corner position, shovel ready with BA

Proposed: Net rental of circa $170K* per annum

Land area 506m2*

Proposed 284m2* office / Medical suite

specialist in immediate area

Zoned: Medium Density Residential High profile TC of circa 35,000* vehicles daily

4/32 Chapple Street, Gladstone Central, 4680

Dual level, high bay warehouse with offices

•Positioned within a very neat 235m2* industrial complex

•Attractive and functional industrial unit

•Ideal for a range of business uses

•Three separate offices and open plan office space

•Large Mezzanine on Level 2

•High Bay warehouse area with high roller door

•Kitchenette and toilet

•Located in busy and sought after Chapple Street precinct

•Ideal for growing business searching for a new home

485 Ruthven Street, Toowoomba City, 4350

Unrivalled CBD command: Toowoomba's prime commercial frontline

•High-exposure location with dual frontage to Ruthven and Duggan Streets

•Refurbished roof, modern electrical systems and improved guttering

•Secure your own footprint in the CBD's most soughtafter precinct

•Ideal layout for retailers, office users or service providers looking for impact and convenience

•465sqm* on a 1:1 land-to-building ratio - every metre optimised for productivity and customer flow

•One block from Grand Central and essential services

•Double street exposure equals branding potential

•A rare, freehold commercial holding in a central area

•Lease part, use all or adapt to suit - this is your business launchpad with built-in adaptability

Brian Doyle 0434 551 628 brian.doyle@raywhite.com

RWC Toowoomba Peter Marks 0400 111 952 peter.marks@raywhite.com

raywhitecommercial.com

•Land Area - 390m2*

•Building Area - 370m2* (202m2* warehouse and 168m2* office)

•Car Parking - 4 external on-grade spaces

•Vacant possession 30 June 2026

•Net passing income $65,864* per annum

•Planning Authority - Economic Development Queensland

•Zoned Mixed Use - Bowen Hills Priority Development Area

53-57 Abbott Street, Cairns City, 4870

Cairns CBD Freehold with Development Potential

Three adjoining freehold commercial lots in one of the city's most high-profile and tightly held locations. Positioned directly opposite the Cairns Reef Hotel Casino. Ideally suited to developers, owner-occupiers seeking to make their mark in the Cairns CBD.

•Land Area: 975sqm | Build Area: 600sqm*

•Zoning: Principal Centre

•On-Site Parking: 8 dedicated spaces

•Development Plans: Previously approved plans for dual commercial tenancies plus residential apartments (available at no cost for resubmission)

Whether you're planning a landmark development, expanding your portfolio, or seeking a strategic base for your operations, 53-57 Abbott Street delivers the exposure, versatility and upside to support your goals.

raywhitecommercial.com

- 434

Land Area: 7.34Ha*

Located 10mins* south from the Bundaberg CBD

Significantly advanced development approval

Close to Bundaberg Airport, Railway Station & Hospital

Located nearby substantial lifestyle amenity

Wed 20 Aug 2025 4pm

Creevey 0408 992 222 Nathan Huxham 0403 583 306 Philip O'Dwyer 0451 419 885

Zoned Low Density Residential raywhitecommercial.com

Special Projects Queensland

Educational facilities in close proximity

784sqm* office & showroom over two levels

176sqm* warehouse, 200amp 3 phase

Tenancy Two:

476sqm* office & showroom over two levels

1,030sqm* warehouse, 200amp 3 phase Can be leased separately or together

1/1808 Logan Road, Upper Mount Gravatt, 4122

Premium medical investment tenanted by I-Med Radiology

Lot 1, 1808 Logan Road, Upper Mount Gravatt, a bluechip medical investment anchored by I-MED Radiology, Australia’s largest diagnostic imaging provider.

Investment Highlights:

•Secure Lease: New 5-year lease with options to 2040.

•Strong Tenant: Fully leased to I-MED Radiology, with a high-cost, specialised fit-out reinforcing long-term commitment.

•Modern Space: 464sqm* of purpose-built medical tenancy with 10 exclusive and 147 shared car parks, plus ambulance access.

•Strategic Location: 11km* south of Brisbane CBD. This is a rare opportunity to acquire a defensive, incomegenerating healthcare asset in one of South Brisbane’s most prominent medical precincts.

franz.stapelberg@raywhite.com

jessica.delgaizo@raywhite.com

raywhitecommercial.com

35 Vanessa Boulevard, Springwood, 4127

•4 Units (Can be combined)

• Each unit is strata titled

• Total area - 527m2

• 17 Basement car parks + 2 Disabled car parks

• Total land area - 801m2

• Zoned - Centre

• 5 Minute walk to Springwood Bus Terminal

• 10 Minute walk to major shopping centres, cafe's and more

• Close to M1 Pacific Motorway & major arterial roads

Sale Contact Agent

Aldo Bevacqua 0412 784 977 aldo.bevacqua@rwcs.com.au

Zane Bevacqua 0400 270 666 zane.bevacqua@rwcs.com.au

Springwood

239-241 Ewing Road, Woodridge, 4114

• Total land area - 2,244m2

• Property can be sold as vacant possession or as a tenanted investment

• Currently split into 2 tenancies

• Total gross income - $218,181 PA Gross + GST

• Total net income - $189,974.72 PA Net + GST

• Car yard tenant pays $163,636 PA Gross + GST

• Rear yard tenant pays $54,545 PA Gross + GST

• Demountable air-conditioned office

• Dual street access

• Zoned - Mixed use

Sale Contact Agent

Aldo Bevacqua 0412 784 977 aldo.bevacqua@rwcs.com.au Zane Bevacqua 0400 270 666 zane.bevacqua@rwcs.com.au

• 3492m2 commercial zone corner block in best location of the Ipswich Central Business Precinct

• Street frontage 70.6m along Brisbane Rd x 38m along Braeside Rd

• Stable retail rental incomes with flexible lease term

RWC CSR

raywhitecommercial.com

Christina Li 0430 360 408 christina_li@raywhite.com

4127

• Development Approval for two single-level retail showroom buildings

• 71 on-site car parks positioned at the rear of the development

• Drive-through access with full ingress/egress

• Zoned for Retail Showroom use - other uses may be considered STCA

• Development footprint of approx. 9,787m2 on a 25,880m2 total area

• Existing approvals include Development Approval, Earthworks, and Sewerage (Operational Works)

Grant Turner 0457766812 grant.turner@raywhite.com

Julie Ryan 0447445453 julie.ryan@raywhite.com

NSW | ACT

•High-clearance warehouses with clear span interiors

•Unit 49: Total 324 sqm*

(Warehouse: 277 sqm*, Office: 47 sqm*)

•Unit 51: Total 286 sqm*

(Warehouse: 239 sqm*, Office: 47 sqm*)

•Unit 55: Total 338 sqm*

(Warehouse: 255 sqm*, Office: 83 sqm*)

•On-site parking with 3 car spaces per unit

•Zoned E3 Productivity Support

Tuesday 26th August 2025 at 10.30am. Auction Works: Level 1, 50 Margaret Street, Sydney.

Zoned E1 - Local Centre

Proposed increase in planning controls under the IWC

Ground floor shop leased until July 2027

First Floor 3 BR residence leased until Feb 2026

Rear access and parking

Close proximity to public transport

124 Kings Road,

Five Dock, 2046

Securely Tenanted Childcare Investment in an Affluent Suburb

•Licensed 47-Place Operating Childcare Centre

•Current Net Passing Income of $312,123* + GST per annum

•Tenant liable for 100% of outgoings

•Leased till January 2033 with two (2) further ten (10) year option terms till 2053

•Annual increase of 3% or CPI (whichever is greater)

•Six (6) month bank guarantee and personal guarantee

•Reputable operator - Learn & Laugh, with over 11 centres throughout NSW

•Benefitting from land tax exemption

•Vendor committed to sell

Auction In-Room, Mezzanine Level, 50 Margaret Street, Sydney Tuesday 26 August 2025 at 10:30am (Unless Sold Prior)

Peter Vines 0449 857 100

Joseph Assaf 0401 397 696

Andrew Sacco 0452 234 653

RWC Western Sydney

raywhitecommercial.com

new lease to Westpac until May 2030

3 + 3 + 3 year options to 2039

Approx. 345.8 sqm of ground floor strata retail area

Lot 11/49-51 Belmore Road, Randwick, 2031 Rear lane access to 4 secure undercover car spaces

held, high traffic retail and commercial precinct

1,165sqm* freestanding office/warehouse

4,885sqm* corner site

Zoned E4 General Industrial

High clearance, clear span warehouse

Access via dual on-grade container-height roller shutters

Well appointed office, lunchroom and staff amenities

Excellent truck access with ample hardstand and parking

Auction Tuesday 26 August 2025 at 10:30am (AEST) AuctionWorks, 50 Margaret St, Sydney NSW 2000

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Nick Ward 0433 702 903 nick.ward@raywhite.com

RWC SC

raywhitecommercial.com

Level 21, 1 Castlereagh Street, Sydney, 2000

Level 21/1 Castlereagh Street SYDNEY

1 Castlereagh Street commands a proud position on the corner of Hunter and Castlereagh Streets at the footsteps of surrounding premium office towers. The lobby has undergone a recent refurbishment providing a minimalist classy entrance. There is basement has parking, and end of trip facilities with showers, lockers and bicycle racks.

•Sub penthouse floor with three sides of light

•Existing fitout in place with capacity for over 50 staff

•North East aspect with corridor views to Sydney Harbour

•Offered on a new direct lease on flexible terms

8/1 Box Road, Caringbah, 2229

Fantastic Office Suite in Caringbah's Industrial Area

RWC Sutherland Shire is pleased to present to market Suite 8, 1 Box Road, Caringbah, a modern and professional office space within a well maintained commercial complex in one of the Shire's most accessible business hubs.

• 103m2* office suite with reception and glass-partitioned offices

• 2 car spaces on title

• Lift access, shared kitchen, and common bathroom amenities

• Ducted air-conditioning throughout

• Generous natural light and balcony with city outlook

• Suits those seeking an affordable entry-level investment or a wellpositioned office to occupy in future

Sale $630,000 - $660,000

Brad Lord 0439 594 121 blord@raywhite.com

Rodney Clarke 0452 273 384 rodney.clarke@raywhite.com

8/360 Kingsway, Caringbah, 2229

Fresh cut investment

RWC Sutherland Shire is pleased to exclusively present for Sale 8/360 Kingsway, Caringbah, a great opportunity to secure this neat and tidy leased strata investment right in the middle of Caringbah CBD. Positioned on a high-exposure retail strip, near the Caringbah institution Essenze Chocolates, this entry-level investment benefits from outstanding exposure to both high volumes of vehicle and foot traffic. This tenant is secured until 30/9/26 with the lease providing for two further options of 5 years on a current net income of $26,412.05*.

• Street-facing shop with prominent exposure

• Modern 44m2* shop plus, two secure car spaces and lock-up storage

• Leased to an established tenant - over 37 years experience

• Secure lease till Sep 26 plus 2 x 5 year options

• Fantastic proximity to Caringbah Train Station

Sale

$490,000 - $510,000

Brad Lord 0439 594 121 blord@raywhite.com

Rodney Clarke 0452 273 384 rodney.clarke@raywhite.com

raywhitecommercial.com

VIC

709 Centre Road, Bentleigh East, 3165

•Total building area | 180m2*

•Total land area | 150m2*

•Total income | $48,126.43 p.a.*

•Ground floor retail leased to established beauty tenant

•First floor separately metered and tenanted residence

•Suit long-term investors seeking a dual-income freehold

4/27 Winterton Road, Clayton, 3168

Thu 21 August 2025 at 12:00pm (On-site and Online)

•Total building area | 275m2*

•Street frontage with direct access

•High clearance warehouse

•Brand-new roof

•2 on-site car spaces

•M/F amenities & Kitchenette

•3 phase power

•Vacant possession

•Industrial 1 Zone (IN1Z)

Amler

971 622 ryan.amler@raywhite.com Jonathan On 0479 003 122 jonathan.on@raywhite.com

Extensive northern frontage of 80m*

Expansive land parcel of 4,240m2* Functional warehouse/office improvements of 2,500m2* Well-positioned in a high-demand industrial pocket Rental of $315,000* p.a. + GST

Rare 115.4ha* across 3 titles, flexible holding

Growth area near key communities and hubs

Easy access to SH1, SH22 & key urban centres

Dairy setup with homes and farm buildings

Rural zone with long-term upside & schools

Major landholding in growing rural corridor

3/277 Kilmore Street, Christchurch City, 8011

Investment - Fully Leased CBD Office Unit

Contemporary ground floor commercial unit of 161m2* fully leased to 2 separate tenancies.

Office '1' of 95m2* is well leased to a professional Tenant to 2027. Office '2' of 66m2* is leased to an IT company to 2026 (+ 1 ROR of a further 3 years) Total rental $41,044*pa + GST + outgoings.

Advantaged by having a seismic rating of 100% NBS, 4 onsite car parks, windows to 3 external walls providing good natural light and multiple access points.

An affordable entry level investment with 2 tenancies, providing good spread of income risk (*approx)

1/304-328 and 3/304-328 Queen Street, Auckland City, NZ

A prime development opportunity - in the economic heart of Auckland's CBD

Offered for sale are the properties at 1/304328 and 3/304328 Queen Street, encompassing two titles, the existing buildings, and a valuable resource consent granted in December 2022. This consent allows for a transformative 53,000m2 GFA mixed-use development, including apartments, retail and car parking. The site benefits from “Business City Centre” zoning, enabling a broad mix of commercial, retail, and residential activities. The development scale and central positioning make this a compelling proposition for large-scale developers and strategic investors. Opportunities of this scale and zoning on Queen Street are rare. Unlock the future of Auckland’s city centre with this premier holding.

Sale International Tender 4pm Tuesday 30 September 2025 (Unless Sold Prior)

Banson Chong +64 21 1639 939

banson.chong@raywhite.com

Ray White Remuera

rwremuera.co.nz

WA

1716 & 1720 Albany Highway, Kenwick, 6107

This property provides an opportunity for owner occupiers, investors and developers to acquire strategic land holding of 3,788m2 to 8,763m2 along Albany Highway. The properties are on two separate titles and can be sold together or individually.

1716 Albany Highway - Comprises an approximate 1,914m2 building positioned on a 4,975m2 parcel of land. Construction broadly comprises reinforced concrete floors, a mix of brick and metal clad elevations and a metal deck roof.

1720 Albany Highway - Comprises 3,788m2 parcel of land. Positioned on the site is an approximate 212m2 office building constructed of reinforced concrete floors, brick elevations and a metal deck roof. In addition to this is an approximate 165m2 open metal framed shed with metal clad elevations.

Expressions Of Interest

Closing 27 Aug 2025 at 4pm AWST

WA

Chris Matthews 0413 359 315 chris.matthews@raywhite.com

Liam Pittaway 0439 555 439 liam.pittaway@raywhite.com

161 Great Eastern Highway, Belmont, 6104

for rental reversions or repositioning 3,430m2* site with 1,908m2 NLA

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

TAS

SA | NT

leased with a 2.4 year WALE

5,908sqm* corner site with 64 car parks

Zoned for future development up to 4 levels Net income of $496,083 pa* with upside

Adelaide CBD's Most Secure Investment