PORTFOLIO

JULY 2025

IS SELF-STRORAGE THE FORGOTTEN INDUSTRIAL ASSET CLASS?

MELBOURNE PARKING PLUMMENTS AND BRISBANE SETS RECORD RATES

A SELECTION OF STOCK FRESH TO MARKET

JULY 2025

IS SELF-STRORAGE THE FORGOTTEN INDUSTRIAL ASSET CLASS?

MELBOURNE PARKING PLUMMENTS AND BRISBANE SETS RECORD RATES

A SELECTION OF STOCK FRESH TO MARKET

James Linacre Head of Commercial RWC Australia and New Zealand

Welcome to the latest edition of Portfolio Magazine.

As we wrap up the 2024 financial year, it’s been another strong chapter in the RWC story, capped off by the success of our June Auction Showcase, which saw a clearance rate of 70.8 pre cent across 53 properties nationally.

This is a clear signal that the market remains active and resilient, particularly in the $1 million to $5 million range, where buyer demand has been especially strong.

This momentum sets the stage for what promises to be our biggest Auction Showcase yet, running 15 November to 15 December, with expectations to exceed 100 auctions. If you’re considering bringing an asset to market, now is the time to start preparing for that powerful end-ofyear window.

Inside this edition of Portfolio, you’ll find a range of timely insights from across the country:

Managing vacancy risk - Best practices to ensure your income stream stays secure in shifting markets.

Self-storage - We revisit this oftenoverlooked industrial asset class and examine where opportunities lie.

CBD parking trends - Melbourne sees a sharp downturn, while Brisbane surges to record rates.

And a national overview of the commercial property market, where green shoots of recovery are beginning to emerge.

I encourage you to explore our latest listings and connect with our teams across the country. We’re here to help you navigate whatever the next financial year holds.

Wishing you a successful and fulfilling FY25/26.

VANESSA RADER

Ray White Head of Research

The Australian commercial property market is showing encouraging signs of stabilisation in Q1 2025, with several sectors demonstrating improvement despite ongoing challenges. The latest MSCI data reveals a market in transition, where income returns are providing crucial support while capital values continue their adjustment phase across most asset classes.

Total commercial property returns head up

Rolling annual returns (%)

Chart: MSCI

Retail has emerged as the standout performer, delivering a robust 5.73 per cent total return for the quarter, ranking first among all major asset classes. This performance is driven by strong income returns of 5.98 per cent and minimal capital decline of just -0.24 per cent. More impressively, sub-regional retail centres are leading the charge with an exceptional 8. 4 per cent total return, followed by regional centres at 6.74 per cent. This retail revival reflects the sector’s successful adaptation to changing consumer behaviours, limited new supply, and strong population growth driving improved occupancy rates.

The retail sector’s three-year annualised performance of 4.12 per cent demonstrates sustained strength, validating our prediction that retail would transition from the previous era dominated by “beds and sheds” to become the new “bricks and clicks” leader. Metropolitan assets continue to outperform regional locations, while the integration of experiential retail and essential services has proven particularly successful in driving foot tra c and rental performance.

Industrial property continues to demonstrate its defensive characteristics with a solid 4.83 per cent total return, making it the second-best performing major asset class. Importantly, industrial is the only sector showing positive capital growth at 0.40 per cent, suggesting underlying asset value stability. The sector’s impressive three-year annualised return of 5.27 per cent reflects its sustained appeal to investors despite moderating from pandemic-era highs.

However, the data suggests a more complex picture within industrial. While headline performance remains strong, growing incentives and stabilising rents signal some cooling in traditional warehousing, even as specialised assets like data centres and cold storage continue to attract premium investment. Results can vary depending on location also, with the ongoing difficulty in land availability and cost of construction likely to set new benchmarks in value going forward.

The office sector remains the clear underperformer, with both CBD and non-CBD assets recording -4.11 per cent total returns. Despite maintaining reasonable income returns of 5.16 per cent for CBD and 5.64 per cent for non-CBD properties, severe capital value declines of -8.86 per cent and -9.27 per cent respectively highlight the structural challenges facing this asset class.

The persistent negative three-year total return performance (-2.95 per cent for CBD, -3.02 per cent for non-CBD) underscores the prolonged nature of the office market adjustment. This reflects ongoing high vacancy rates, ranging as high as 18 per cent in Melbourne CBD, and the continued impact of hybrid working arrangements on space requirements.

VANESSA RADER Ray White Head of Research

The Australian self-storage sector has become a boutique industrial investment opportunity that has largely flown under the institutional radar. While it may lack the scale of distribution centres or data centres, global sector trends suggest this asset class deserves greater attention from sophisticated investors seeking income inflation hedging and defensive yields in an uncertain environment.

The market’s tightly held nature is evident in transaction patterns spanning the past decade. Annual volumes typically range between $200 and $400 million, with notable exceptions including the extraordinary $1.3 billion transacted in 2021 during the pandemic-driven investment surge, and the sharp contractions to $193 million in 2022 and $150 million in 2023. The 2024 recovery to $420 million suggests renewed confidence, though combined with the first five months of 2025 ($77 million), the past 18 months total just $493 million, demonstrating how illiquid this market can become.

This scale limitation explains why major institutional players remain largely absent, as most funds look at size and returns well beyond what individual self-storage facilities can deliver. However, it creates opportunities for private investors and smaller funds willing to accumulate portfolios. With national occupancy rates hovering near 90 per cent, mirroring global sector trends and representing the optimal balance between revenue maximisation and growth potential, rental growth has accelerated due to housing pressures. These assets are delivering yields between 5 and 6.5 per cent, comparing favourably to traditional industrial assets in the current environment, particularly as operators increasingly adopt sophisticated dynamic pricing strategies and Revenue Per Available Metre (RevPAM) analysis to optimise performance.

Australia’s housing affordability crisis is inadvertently becoming self-storage’s greatest growth driver. As rental costs force downsizing and push residents to outer metropolitan areas, demand for storage solutions grows. This demographic shift is particularly pronounced among Gen-Z renters and baby boomers downsizing their family homes. The generational convergence sees younger demographics storing possessions while navigating volatile rental markets, and older Australians transitioning to smaller homes while maintaining emotional attachments to furniture and heirlooms. This dual demand base provides unusual stability compared to single-demographic asset classes.

For investors, self-storage offers minimal tenant improvements, low maintenance requirements, and multiple revenue streams through insurance, access fees, and ancillary services. The month-to-month lease structure provides inflation protection and operational flexibility unavailable in traditional industrial leases. However, individual facilities rarely exceed $50 million in value, making portfolio assembly time-consuming and expensive. Management intensity however, exceeds that of distribution centres and requires increasingly sophisticated operational capabilities. Successful operators must understand their demographic catchment, implement dynamic pricing systems, and maintain detailed performance metrics that institutional buyers expect. Competition from established operators like Kennards and National Storage can pressure smaller players, while increasing reliance on technology adds to both initial and ongoing costs.

Overall, long run demand drivers remain robust, as urbanisation increases storage needs and changing work patterns drive space consolidation. Investors should focus on growth corridors where demographic trends align with supply constraints, particularly outer metropolitan areas experiencing population growth. With limited new construction in the pipeline, occupancy will continue to improve and rental rates face upward pressure.

For institutional investors, self-storage likely remains a satellite allocation rather than a core holding due to scale limitations and management requirements. However, for private equity groups and smaller institutions willing to aggregate portfolios, the fundamentals suggest attractive risk-adjusted returns over the medium term. The sector’s scarcity is compounded by industrial zoned land commanding premium pricing across the country, making new development increasingly challenging even as demand grows. Assets rarely come to market, and when they do, they often trade within established networks of operators and specialised investors. For prospective buyers, this environment demands sophisticated analysis of catchment demographics and operational metrics. Those who can demonstrate superior market intelligence are likely to command premium valuations, while the ongoing scarcity of quality assets suggests patient capital may be rewarded as the structural demand story continues to unfold.

LETEICHA WILSON RWC Property Management Specialist

One of the greatest vulnerabilities for commercial property investors is vacancy. An empty space means not just a break in rental income, but additional holding costs, incentives to entice a new tenant, and a potential ripple effect on your portfolio’s financial performance.

Managing this risk isn’t a matter of luck - it’s a matter of preparation, relationships, and forward thinking. Here are some best practices to help keep your income stream strong, even when market conditions fluctuate.

Proactive communication with your tenants

Maintaining strong relationships with your tenants can aid retention and enable you to address potential issues before they become a major concern. Providing a high standard of service, staying on top of repairs, and understanding your tenants’ growing or shrinking space requirements can aid renewal negotiations - reducing periods of vacancy.

Stay market-savvy

It’s crucial to keep your finger on the pulse of your local market. That means understanding current rental rates, incentives, competing properties, and prospective tenant demand. This knowledge lets you price your space appropriately and respond quickly when a tenant signals their intent to move on.

Consider flexible spaces and shorter leases

Some prospective tenants may be looking for flexible or less restrictive terms - especially in a changing market. Providing tailored spaces or negotiating shorter-term or break clauses can enable you to fill vacancies faster and avoid income gaps.

Improve appeal and reduce time-on-market

Small but purposeful improvements can make a big difference in securing a new tenant quickly. A fresh paint job, updated lighting, well-maintained landscaping, or adding desirable facilities can aid your marketing efforts and enable prospective tenants to picture their future in your space.

Collaborate with experienced agents - and a proactive property manager

Leasing a commercial space is a complex process - and navigating incentives, pricing, and marketing can be challenging. An experienced commercial agent can connect with prospective tenants and negotiate a strong deal - but it’s a proactive, experienced property manager who truly safeguards your income stream. A strong property manager is your first line of defense against vacancies, staying ahead of issues, retaining tenants, and preserving financial stability for your portfolio.

VANESSA RADER

Ray White Head of Research

Brisbane CBD retains its position as Australia’s most expensive parking market for the second consecutive year, with daily casual rates now averaging $80.84, surpassing Sydney’s $77.00. This marks a significant shift in the Australian parking landscape, where Sydney had historically dominated as the premium market. The change reflects broader shifts in office attendance patterns and CBD vibrancy across Australian capital cities as workers continue adjusting their commuting habits post-pandemic.

Brisbane’s pricing strength stems from limited parking supply coupled with stronger office attendance, demonstrated by its relatively contained vacancy rate of 10.2 per cent and positive occupied stock change. What makes this even more remarkable is that Brisbane continues to command premium parking rates despite the Crisafulli Government making 50 cent public transport fares permanent across all Translink networks in Queensland. However, beneath headline rates, Brisbane operators still offer substantial discounts of 55.5 per cent for online bookings and 57.9 per cent for early bird parkers, revealing continued competition for regular commuters despite the market’s apparent strength.

Melbourne presents perhaps the most concerning trajectory among major markets. Current daily rates of $64.43 have fallen below 2013 levels ($65.00), producing a negative growth rate over the 12-year period. This decline mirrors Melbourne’s struggling office market, which maintains the highest vacancy rate among Australian CBDs at 18.0 per cent and continues to experience negative occupied stock change. Melbourne operators have responded with the country’s deepest early bird discounts at 62.9 per cent, though online discounting remains surprisingly modest at just 15.1 per cent, suggesting a focus on capturing the dwindling population of regular commuters.

Source: Ray White

rate (max. daily)

Sydney’s market shows signs of recovery but remains below its 2023 peak of $85.05. With a 12.8 per cent office vacancy rate and positive, albeit modest, absorption figures, Sydney’s parking ecosystem appears relatively balanced but lacks the growth momentum seen before the pandemic. Sydney maintains significant discounts for both online bookings (-43.5 per cent) and early bird parking (-54.9 per cent), indicating ongoing competition despite the market’s gradual improvement.

When early bird discounts are factored in, the effective hierarchy of parking costs shifts significantly. Sydney emerges as the most expensive early bird option at $34.75, slightly ahead of Brisbane at $34.00, despite Brisbane’s higher headline rate. Melbourne’s aggressive 62.9 per cent early bird discount strategy results in an effective daily rate of just $23.90, making it nearly as affordable as Perth ($20.50) for regular commuters despite Melbourne’s substantially higher casual rate. This inversion of pricing positions reveals how operators in different markets are strategically responding to occupancy challenges, with Melbourne prioritising volume over margin to maintain cash flow in a struggling market environment.

Source: Ray White

Hobart’s parking market has experienced a concerning downward trend, with current rates at $18.83 sitting below 2013 levels ($21.00) and showing a negative 12-year annual growth rate of -0.86 per cent. The market offers modest online discounts of 20.4 per cent but notably provides no early bird options, reflecting its unique position as a smaller capital with limited commuter patterns despite having the lowest office vacancy rate among all Australian CBDs at just 3.6 per cent.

Canberra presents an interesting case with modest but steady growth in parking rates to $21.64, despite ongoing decentralisation of government departments away from the traditional Civic centre. The reducing pool of facilities in the capital offer minimal discounting compared to other markets, with online rates discounted just 9.9 per cent and early bird options at 13.8 per cent, suggesting less pressure to fill capacity despite the 9.2 per cent office vacancy rate.

Adelaide has recorded the highest 12-month growth rate in parking at 11.3 per cent, echoing strong office absorption levels despite a high office vacancy of 16.4 per cent. Its discounting strategy remains moderate, with 15.5 per cent for online bookings and 37.4 per cent for early bird, indicating a market finding equilibrium. Perth continues its steady improvement with 3.8 per cent annual daily rate growth and relatively substantial discounting for both online (-30.5 per cent) and early bird (-44.8 per cent) options.

The direct correlation between office market health and parking rates provides a valuable economic indicator of CBD vibrancy, with discounting strategies offering additional insights into competitive pressures facing operators across Australian cities. These pressures have mounted into decision making surrounding the sale of many of these assets. Typically purpose-built parking facilities in CBD locations are tightly held and are not often subdivided from the

basement of larger office buildings. Over the last year we have seen a number of Melbourne CBD assets transact, fueling speculation surrounding their viability and long-term confidence in the asset class. Transactions have been to both offshore and domestic buyers looking to reposition and redevelop sites away from pure parking plays. Currently there are a number of parking facilities on the market across Australia, suggesting owners may be capitalising on countercyclical investment appetite or reconsidering the long-term prospects of these traditionally stable assets.

Western Sydney residential complexes surge ahead

Western Sydney’s residential investment market is gaining momentum, with RWC Western Sydney recording over $14 million in unit block sales within a single week, highlighting renewed confidence among investors as early signs of interest rate cuts begin to emerge.

The week’s standout sales included:

• 28 Station Street, Harris Park - Sold under the hammer for $3,712,500

• 32–34 Station Street, Harris Park - Sold prior to auction for $3,550,000

• 37 Patricia Street, Blacktown

- Sold under the hammer for $6,805,000

Each campaign drew competitive bidding, underpinned by tightening yields, limited stock, and a compelling value proposition in Sydney’s fastest-growing corridor.

The buyers were all private investors looking to value add through refurbishments and increase rents and increase return on investment.

“There’s no question - investor activity in Western Sydney is accelerating,” said Joseph Assaf of RWC Western Sydney.

“We’re seeing record enquiry levels and competitive bidding, particularly for entire complexes with strata subdivision potential (STCA), value-add or long term redevelopment potential. Investors know they’re getting in at below replacement cost, with rising rents and future upside.”

Buyer feedback suggests a mix of strategies across the sold assets, including long-term hold with rental uplift, refurbishments, and potential future strata subdivision, all capitalising on low vacancy rates and rising rents.

These transactions come amid a broader market resurgence. According to recent data, NSW unit block sales reached $300.6 million in 2024, marking a 25.7 per cent year-on-year increase. Already in 2025, Western Sydney is leading the charge, outpacing traditional blue-chip suburbs on both sales volumes and growth potential.

“The west has all the right fundamentals: a housing shortfall, tight vacancy around 1.5 per cent, and surging rental demand, especially in twobedroom formats,” said Peter Vines, managing director of RWC Western Sydney.

“Investors see the long-term value, and the prospect of rate cuts is giving them the confidence to act now.”

Andrew Sacco from RWC Western Sydney said that they are seeing a new generation of private investors, landbankers, strata selldown groups and syndicates target this asset class.

“The eastern suburbs had their moment – now it’s Western Sydney’s time. There’s more room for capital growth, strong returns, and flexibility around future development potential,” Mr Sacco said.

A substantial Melbourne industrial asset at 29 Garden Street, Kilsyth has been successfully sold by Brett Diston of RWC Diston Asset Services, generating strong market interest with 46 enquiries throughout the campaign.

The impressive 7,533sqm office warehouse, set on a generous 2.1 hectare site, attracted a range of buyer profiles before ultimately being secured by a Lindum Property Partners who identified the property’s untapped value.

“This site represented a rare opportunity in a tightly held industrial pocket,” said selling agent Brett Diston. “With only 35 per cent site coverage, the buyer saw enormous potential to unlock further value through lease repositioning and capital improvements.”

The purchaser, a specialist in the industrial investment sector, plans to revitalise the current improvements and enhance the hardstand offering to appeal to future tenants.

“This is a value-add play with solid fundamentals,” Mr Diston said. “They’re excited by the scope to improve rental returns by securing new leases across the vacant portions of the site, while also refreshing the overall facilities to attract higher-quality occupiers.”

The property is partially leased to a range of tenants, including international occupier Cummins Filtration International Corp, and offers excellent truck access and substantial hardstand areas.

The building rate achieved was $2,011.15 per sqm, while the land rate came in at $720 per sqm, a strong result reflective of the asset’s location and potential.

The vendor, who originally acquired the property in 2018, opted to divest the asset as part of a broader portfolio diversification strategy.

“This campaign generated robust enquiry from both local and interstate groups, with a mix of developers, investors and owner-occupiers circling,” Mr Diston said. “It’s a strong indication of continued demand for industrial opportunities with leasing and development upside in Melbourne’s eastern corridor.”

In a rare and historic opportunity, two substantial parcels of land at 42 Denham Road and 59 Monkey Mia Road have hit the market for the first time in over four decades. Located in the pristine coastal enclave of Denham, within the iconic and internationally acclaimed Shark Bay World Heritage Area, the 26.56-hectare offering is now available with offers invited through RWC WA, represented by commercial agent Brett Wilkins.

“This is one of the most significant land opportunities we’ve seen on the Western Australian coast in years,” said Mr Wilkins. “The rarity of the offering, the sheer scale, and the world-class location make it nothing short of a generational investment opportunity.”

Set against the backdrop of Shark Bay’s protected marine landscapes, Lot 9502 offers sweeping 180-degree ocean views, while both sites boast strategic positioning within the Denham townsite.

“The buyer will wake up to Shark Bay’s crystalline waters, knowing they’ve contributed to a legacy

of environmentally conscious development in one of Australia’s most ecologically significant regions,” Mr Wilkins said.

“It’s not just land, it’s a canvas for visionary projects in harmony with nature.”

The landholding is expected to draw strong interest from a diverse range of buyers, including land developers, eco-tourism investors, high net worth individuals and family offices, and hoteliers and resort operators.

“With World Heritage protections limiting the release of developable land, and rising demand driven by infrastructure investment and

tourism, the long-term capital growth potential here is incredibly compelling.”

Denham’s market is buoyed by increasing government-backed investment in tourism, health, and education. With limited developable land due to World Heritage regulations, supply is permanently restricted, creating a powerful case for future growth.

“This is a once-in-a-generation opportunity for a buyer with vision,” said Mr Wilkins. “We expect serious interest from parties across Australia and internationally.”

One of Brisbane’s most iconic waterfront properties, the Cleveland Courthouse, has sold under the hammer for $4 million in a picture-perfect on-site auction that drew a crowd of more than 80 onlookers to Shore Street North. The property was marketed by Nathan Moore and Alex Sinclair from RWC Bayside through a robust four-week campaign.

With Moreton Bay glistening at high tide and clear blue skies overhead, eight registered bidders gathered for what was one of the most anticipated Redlands auctions of the year.

The auctioneer led the auction with energy, as three of the eight bidders actively competed, with pauses for negotiations along the way before the hammer finally came down.

The winning bidder, a businessman behind the Indian Brothers restaurant group, as well as various wedding, catering and hospitality ventures including a wedding venue in Burbank, only inspected the property for the first time yesterday.

“He fell in love with it instantly,” said Nathan Moore of RWC Bayside.

“He has big plans to restore the court house to its former glory as a restaurant and wedding venue, which is such a win for Redlands locals. The community has a deep affection for this building and to see it come back to life is genuinely exciting.”

In a remarkable twist, the underbidder was a local builder who noticed the auction crowd, stopped to watch, and registered to bid on the spot.

“There was a real energy in the air today, the sun was shining, the tide was in, and the property just looked absolutely stunning,” said Alex Sinclair. “It was one of those moments where history, location, and opportunity all aligned.”

The campaign was a success, with huge media coverage in print and on TV news in the lead up to the auction. RWC Bayside received

50 enquiries and conducted 12 inspections, which led to eight serious bidders showing up on the day.

Built originally as a courthouse, the heritage-listed property at 149 Shore Street North is perched on a 1,290sqm site with more than 20 metres of direct bay frontage. In recent decades, it operated as a beloved hospitality venue, known for its period features, including timber floors, exposed brickwork, and a working fireplace, combined with a modern commercial kitchen and outdoor dining areas.

“This sale represents more than just a transaction,” Mr Moore said. “It’s the beginning of the next chapter for one of Redlands’ most iconic buildings. To see it remain in the hands of someone passionate about hospitality and community is the best possible outcome.”

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

ALFREDTON, VIC

A gymnastics studio recently sold on a 5.4% yield with consistent rental income backed by a specialised tenant. The facility benefits from niche market demand, long-term lease potential, and minimal competition in the local area.

CAMP HILL, QLD

Shopping mall located on Tamborine Mountain with Foodworks as the anchor tenant supported by well established local businesses. Servicing the area for many years with a dentist, chemist and hairdresser.

Modern 561sqm* retail centre fully leased to 7 tenants, with a proven & complimentary tenancy mix dating back over 20 years.

RWC CAIRNS

CAIRNS, QLD

Prime Cairns Esplanade location in the “Golden Block”. 359sqm* leased to iDumplings (Australia wide) & Hecho En Mexico (Melbourne group with over 25 restaurants Australia wide).

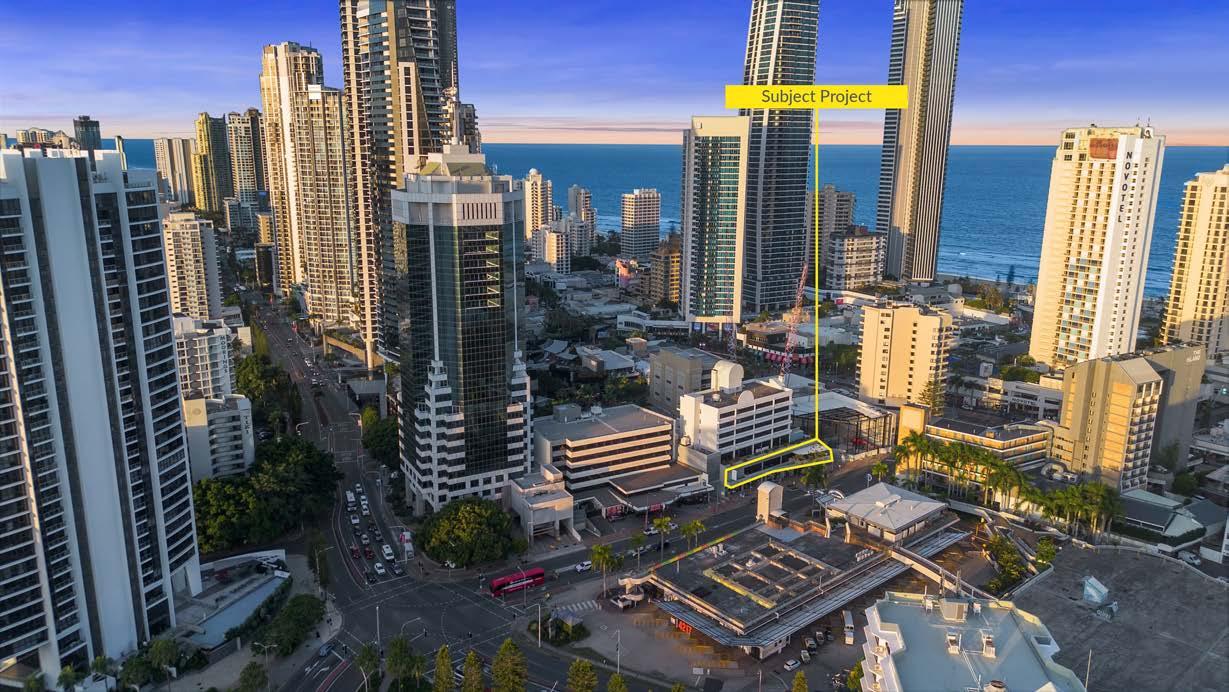

2/9 Beach Road, Surfers Paradise, 4217

Auction Thursday, 24 July at 11am Gold Coast Turf Club, Bundall

Occupied by an operator on-site for 30+ years

Premium $3 million fit-out (completed 2020)

67 Gaming machines

500m* From Paradise Centre and Circle on Cavill

Travis Brown 0433 131 604

Gregory Bell 0414 380 555

Renewed 6 year net lease, with options until 2037 RWC Gold Coast

Surrounded by major amenities

Stirling McInnes 0481 303 783 *Approx.

2,243m2* NLA licensed venue, 730 patron capacity raywhitecommercial.com

35 Panorama Drive & 54 Gull Place, Tweed Heads West, 2485

Suitable for Subdivision, Residential, Commercial

Proximity to Airport, University, Beach, Shops

Existing DA approval for medium residential scheme R3 Medium density residential Median House Price of $1,350,000 (Tweed Heads)

3/48

Super

Air

Toilet/shower/kitchen

Secure

Lease Contact

RWC

Lot 6 Murdochs Road, Moore Park Beach, 4670

Expansive 31.33ha* site

Low Density Residential zoning

Exceptional connectivity with triple road access

Infrastructure-ready with established town water

Directly opposite Moore Park Beach State School

Local amenities medical centre, childcare and tavern

Fast-growing region with significant demand for housing

Lot 932 Landsborough Drive, Rural View, 4740

15.07Ha site within a 55Ha master planned community

Located in the heart of Mackay’s thriving growth region

Development Approval for 386 dwellings

Includes Bulk Earthworks Operational Approval

Locally sourced construction team ready to build

4.6Ha Storm water detention basin already completed

$1m* Worth of council rebates in infrastructure charges

by a national duty-free

Short walk to cavill mall, beach and light rail station

Otilly & Lewis Located at 3 & 4/8 Grebe Street, Peregian Beach, 4573

Otilly & Lewis, an iconic name in lifestyle and homewares retailing, is now available for sale - with the option to purchase the 112m2* strata title freehold premises as well.

•Est. 20+ years - strong local & international reputation

•Exclusive products including European brands, boutique artisans and in-house lines

•Prime location in Peregian Square with maximum foot traffic and visibility

•Loyal customer base

•Run the business hands-on or enjoy freedom to travel while experienced, loyal staff manage daily operations

•Opportunity to purchase the two strata freeholds, or lock in a long term lease

12 Eenie Creek Road, Noosaville, 4566

3/48 City Link Drive, Carrara, 4211

809m2* fully fenced site with 450m2* under roof

230 square metre warehouse plus office

150m2* covered loading dock

Super functional design over two levels

Medium Impact Industry zoning

High clearance with electric roller

Multiple roller door access to clear span areas

Air conditioned & carpet mezz/office

Combined net rental return $70,052.50pa*

Toilet/shower/kitchen amenity

Immaculate condition

Perfect for investors and developers

Vacant possession possible from January 2026

Secure gated complex

Expressions Of Interest

Closing 25 July 2025

Lease Contact Agent

Tracey Ryan 0421 981 490 tracey.ryan@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

David Brinkley 0448 594 361 david.brinkley@raywhite.com

RWC Noosa & Sunshine Coast

Big Red Shed is on the market - Noosaville raywhitecommercial.com

RWC Robina

Lot 71/6 Quamby Place, Noosa Heads, 4567

14/6-8 Enterprise Street, Molendinar, 4214

202m2* plus 193m2* exclusive use outdoor area

Functional layout to suit a very wide range of uses

High quality bespoke medical/professional office fitout

Huge high-clearance warehouse space plus large office areas

Versatile layout - suitable for various business uses (STCA)

600m2 all inclusive Warehouse, Office and Separate Flat (*approx.)

Ample car parking

Self-contained suite with kitchen and bathroom

Access to Noosa Harbour Resort facilites

Just minutes from Hastings Street and Gympie Terrace

Parking for 7 cars plus easy truck access

Being sold with vacant possession

Secure gated complex in well-maintained estate

Sale $2,500,000 + GST (if applicable)

Lease Contact Agent Air conditioned throughout

RWC Noosa & Sunshine Coast

Paul Butler 0418 780 333 paul.butler@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

David Brinkley 0448 594 361 david.brinkley@raywhite.com

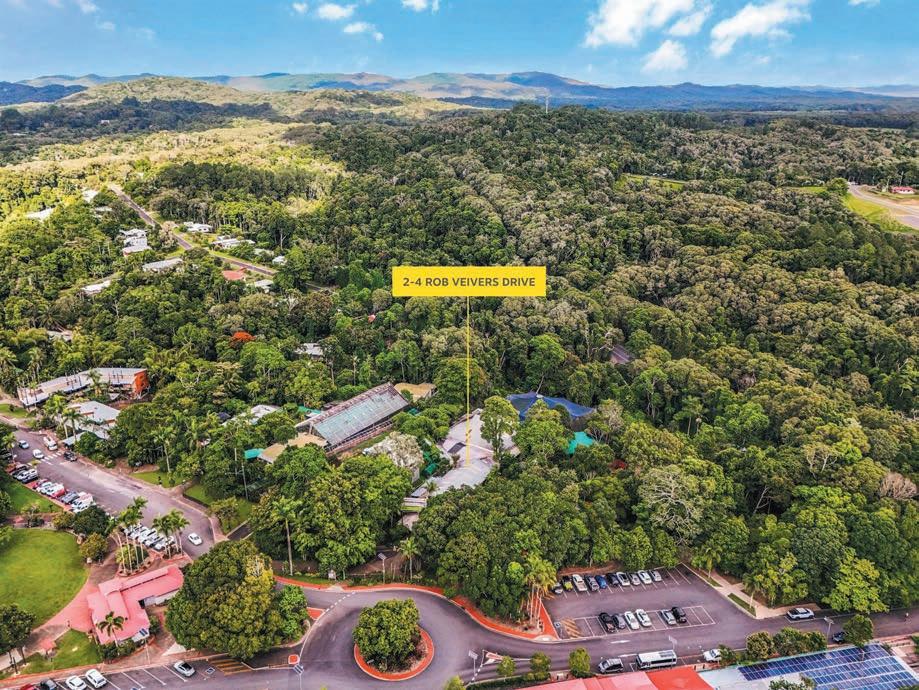

2-4 Rob Veivers Drive, Kuranda, 4881

Positioned in the heart of Kuranda making this an attractive choice for buyers seeking a prominent presence in the area known as 'The Village in the Rainforest'. The freehold site offers an income with 3 anchor tenants Bird World, Koala Park, Frogs Cafe & over 60 undercover stalls at Kuranda Heritage Markets, many have been marketeers for over 20 years and are the essence of this eclectic site.

Prepare to be impressed & imagine owning & earning an income with the opportunity to showcase your ideas, live & work in this amazing lifestyle nestled in the heart of one of Far North Queensland's most famous tourist attractions. Own and play your part in the history of this World Heritage site - this region truly holds the power of nature on a grand scale.

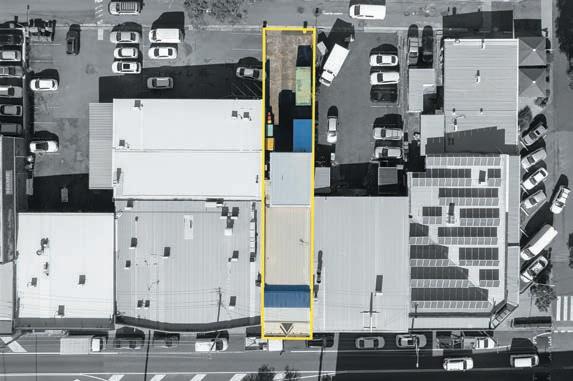

479 Underwood Road, Rochedale South, 4123

•Land area - 809m2

•Building area - 205m2

•Reception

•Boardroom

•8 Individual offices

•Air-conditioned

•Male and Female amenities

•11 On-site car parks

•Land dimensions - 20.1 x 40.2 Metres

•Ample street parking

•Zoned Centre - Intended land use includes: Childcare centre, retail, dwelling unit, function centre, retail store, health care services, offices, and much more (STCA)

•Walking distance to retail shops including cafes, convenience store, and gymnasium

•Easy access to M1 Motorway

Auction 11th July 2025 - 12 PM On-Site

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

Zane Bevacqua 0400 270 666 zane.bevacqua@rwcs.com.au

RWC Springwood

raywhitecommercial.com

9,539m2* allotment with 100m+ arterial road frontage

Two residences, multiple commercial sheds, retail shop

Close to Brisbane CBD, M1, Belmont Shooting Complex

Long-term infrastructure upgrades from 2032 Olympics

Holding income from JCDecaux billboard

Sustainable landholding in a rapidly evolving precinct

Bayside

136-140 Russell Street, Toowoomba City, 4350

Offers To Purchase

Land Area: 3166 square metres*

Floor Area: 880 square metres*

•Nestled in a bustling commercial area of Toowoomba, this commercial space benefits from high exposure

•The building boasts a thoughtful design that harmonises with the surrounding environment, featuring a welcoming facade that invites customers in

•The varying interior spaces include multiple rooms suitable for different commercial businesses, and a versatile layout that can be tailored to your needs

•Enjoy a beautifully landscaped garden, perfect for creating an inviting atmosphere for clients

•With ample parking, your clients will appreciate the convenience

•The vacant tenancies offer a blank canvas for your creative vision, with opportunities to enhance the interior and exterior design to reflect your future plans for the property

Paul Schmidt-Lee 0499 781 455

paul.schmidt-lee@raywhite.com

RWC Toowoomba

raywhitecommercial.com

305m2*

1/35 Limestone Street, Darra, 4076

3/48 City Link Drive, Carrara, 4211

96sqm* corporate air conditioned offices over 2 levels

230 square metre warehouse plus office

246sqm* clearspan, high bay warehouse

Super functional design over two levels

Warehouse access via container height roller door

High clearance with electric roller

3-phase power

Air conditioned & carpet mezz/office

3 exclusive carparks

Toilet/shower/kitchen amenity

12 radial kilometres from the Brisbane CBD

Immaculate condition

Male & female amenities + kitchen

Secure gated complex

Lease Contact Agent

Lease Contact Agent

RWC Milton

RWC Robina

raywhitecommercial.com

Cadell Rees 0410 460 166 cadell.rees@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

3/55-65 Christensen Road, Stapylton, 4207

14/6-8 Enterprise Street, Molendinar, 4214

152sqm* office/warehouse

Functional layout to suit a very wide range of uses

Container height roller door

Huge high-clearance warehouse space plus large office areas

Kitchen and amenities

600m2 all inclusive Warehouse, Office and Separate Flat (*approx.)

3 exclusive car parks

Self-contained suite with kitchen and bathroom

Proximity to major arterial networks

Parking for 7 cars plus easy truck access

Secure gated complex in well-maintained estate

Lease Contact Agent

Lease Contact Agent

Air conditioned throughout Industrial with Approved Caretaker's residence raywhitecommercial.com

Milton

Robina

Cadell Rees 0410 460 166 cadell.rees@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

Theo Grespos 0466 565 286 theo.grespos@raywhite.com

5-7 Henderson Road, Alexandria, 2015

Auction Tuesday 29 July 2025 at 10:30am (AEST)

Auctionworks, 50 Margaret St, Sydney NSW 2000

348sqm* freehold landholding

700sqm* building over two levels

Flexible MU1 Mixed Use zoning | FSR 2.5:1

Offered on a sale and lease back

Excellent internal fitout and rear lane access

180m* to Waterloo Metro | 550m* to Redfern Station

Ideal for investors, developers or future occupiers^

Lachlan O’Keeffe 0413 464 137

Samuel Hadgelias 0480 010 341

Liam Regan 0488 542 600

RWC SC

raywhitecommercial.com

Land size: 1,018sqm*

Zoning: E1 Local Centre

DA approved for 20 apartments with ground floor retail

Future penthouses with potential water views

Existing commercial building with multiple tenancies

100m* to Mantra Hotel Ettalong Beach

300m* to Ettalong Beach

Surrounded by major occupiers

197-201 Rodd Street, Sefton, 2162

•Site Area 5,428sqm*

•53m* frontage

•R2 Low Density Residential Zoning

•DA Approval for 115 single room aged care development

•800m* from Immaculate Heart of Mary Catholic Primary School

•850m* from Sefton Train Station

•1.7km* from Chester Square Shopping Centre

Part Level 12/111 Elizabeth Street, Sydney, 2000

The St. James Centre is located in the heart of the legal precinct of Sydney’s CBD near the corner of Elizabeth and King Streets. The building is within a minute's walk of St. James and Martin Place Railway Stations. End-oftrip showers on level 1, and bike racks are in the basement.

•Bespoke premium legal or accounting fitout

•Client focused reception, 4p meeting room, 12 desks

•12p boardroom, 9 glass-fronted legal style offices

•Large kitchen and breakout area with bench seating

•Elevated grandstand views East over Hyde Park

•Bathrooms fully refurbished with DDA with shower

•New chevron timber floors throughout the lift lobby

raywhitecommercial.com

25 Station Street, Engadine, 2233

Auction Tuesday 22nd July 2025 at 6pm (AEST)

Venue: Cronulla RSL, 38 Gerrale Street, Cronulla NSW 2230

RWC Sutherland Shire is proud to present 25 Station Street, Engadine for Sale via Auction. This prime investment opportunity is fully leased and is located in the heart of Engadine with a secure net income $240,620 p.a.

•Fully leased to established tenants - Engadine Music Centre & MF Dance Studio

•Returning $240,620 net - strong cash flow

•Providing excellent upside potential for future redevelopment (STCA)

•Only 150 metres to Engadine train station, ensuring outstanding accessibility

•Generous landholding in a tightly held commercial precinct

Brad Lord 0439 594 121 blord@raywhite.com

Rodney Clarke 0452 273 384 rodney.clarke@raywhite.com

RWC Sutherland Shire

raywhitecommercial.com

141 Swan Street, Morpeth, 2321

3/48 City Link Drive, Carrara, 4211

An outstanding multi-tenancy diversified income investment opportunity for discerning investors bolstered by a strong tenancy mix & Morpeth's burgeoning boutique tourism profile.

230 square metre warehouse plus office

Super functional design over two levels

• Underpinned by a secure tenancy outlook with a Long established Pharmacy and Ice Cream parlour providing for 4 and 5 year tenure

High clearance with electric roller

• Zone E1: Local Centre

• Rear access with substantial parking

Air conditioned & carpet mezz/office

• High profile location in bustling Swan Street

Toilet/shower/kitchen amenity

Immaculate condition

Secure gated complex

Lease Contact Agent

Auction Tuesday 29th July 2025 at 10:30AM In-Rooms (Sydney) and Online

Lee Follington 0417 443 478 lee.follington@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

RWC Newcastle

RWC Robina

raywhitecommercial.com

raywhitecommercial.com

72 Station Street, Waratah, 2298

14/6-8 Enterprise Street, Molendinar, 4214

Rare suburban warehouse with parking occupying a prominent corner location providing for an exciting adaptive reuse/development opportunity (STCA^).

Functional layout to suit a very wide range of uses

Huge high-clearance warehouse space plus large office areas

• Land Area: 791m2*

• Building Area: 375m2*

600m2 all inclusive Warehouse, Office and Separate Flat (*approx.)

• Zone E1: Local Centre

• Substantial 12 space car park

Self-contained suite with kitchen and bathroom

• Ground floor and mezzanine office with elevator

• Accessible amenities

• 3-phase power

Air conditioned throughout

• Split-system air conditioning units

Parking for 7 cars plus easy truck access

• High clearance access

Secure gated complex in well-maintained estate

Lease Contact Agent

Expressions Of Interest

Closing Thursday 24th July 2025 at 4PM

RWC Robina

raywhitecommercial.com

Lee Follington 0417 443 478 lee.follington@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

Barry Price 0402 140 240 barry.price@raywhite.com

42 Denham Road & 59 Monkey Mia Road, Denham, Western Australia

Two Rare Coastal Development Opportunities - Buy One or Both Sites

Lot 9500 (59 Monkey Mia Road): 17.73 Ha Lot 9502 (42 Denham Road): 8.86 Ha

The largest development opportunity within the Shark Bay region. Both lots are strategically positioned within the Denham townsite and offer a compelling mix of scale, coastal orientation, and accessibility with a mixture of residential, tourism and hospitality opportunities.

Lot 9502 enjoys sweeping 180-degree ocean views. Lot 9500 occupies the highest natural ridgeline in Denham, also offering scenic outlooks across the coastline.

12/66 High Street, Fremantle, 6160

Auction On site, 2pm Tuesday, July 22.

RWC WA is delighted to present an exceptional opportunity to acquire a prestigious ground-level commercial property situated on the prominent corner of Pakenham Street and High Street, in the heart of Fremantle's iconic West End.

Extensive street frontage to both High and Pakenham Streets, offering businesses maximum exposure in one of Fremantle's most vibrant and historically rich precincts.

Property Highlights:

•Prominent ground level commercial unit

•Area: 159m2 (SLA)

•High street exposure

•Vacant possession suitable for multiple uses

•Live streaming & on-line bidding available

*Approx.

Brett Wilkins 0478 611 168

brett.wilkins@raywhite.com

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

RWC WA

raywhitecommercial.com

5

11 Fairbrother Street, Belmont, 6104

3/48 City Link Drive, Carrara, 4211

The property provides a fantastic opportunity for owner occupiers to secure a 1,466m2* building on a prime 3,878m2* parcel of land in the core eastern corridor of Belmont.

230 square metre warehouse plus office

Super functional design over two levels

High clearance with electric roller

The property comprises an approximate 1,123m2* warehouse, 135m2* canopy, and a 188m2* office. Constructed on reinforced concrete floors, brick and metal cladding elevations and a metal deck roof.

Air conditioned & carpet mezz/office

Toilet/shower/kitchen amenity

The warehouse provides a functional approx 6 meter clear span area with excellent natural lighting and multiple access points. Attached to the rear of the warehouse is an approx 135m2* canopy suitable for covered loading/unloading, undercover vehicle parking or laydown area.

Immaculate condition

Secure gated complex

Sale Offers Invited

Lease Contact Agent

RWC WA

RWC Robina

Chris Matthews 0413 359 315 chris.matthews@raywhite.com

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

Liam Pittaway 0439 555 439 liam.pittaway@raywhite.com

raywhitecommercial.com *Approx

raywhitecommercial.com

8 King William Street, Bayswater, 6053

14/6-8 Enterprise Street, Molendinar, 4214

500m2 site with dual street access

Functional layout to suit a very wide range of uses

9-storey development potential

Huge high-clearance warehouse space plus large office areas

100 metres to train station

600m2 all inclusive Warehouse, Office and Separate Flat (*approx.)

Flexible mixed-use zoning

Self-contained suite with kitchen and bathroom

Fully leased, holding income with redevelopment clauses

Air conditioned throughout

Live streaming & on-line bidding available

Parking for 7 cars plus easy truck access

Secure gated complex in well-maintained estate

Auction Onsite July 22nd at 11am

Lease Contact Agent

RWC WA

RWC Robina

raywhitecommercial.com

raywhitecommercial.com

Tom Jones 0478 771 117

Richard McCouaig 0411 375 993 richard.mccouaig@raywhite.com

Lachlan Burrows 0499 552 296

Brett Wilkins 0478 611 168

1/14 Lionel Road, Mount Waverley, 3149

•Total building area | 285m2*

•Leased to Victorian Ballet School

•Income | $58,349.40 p/a net

•Current term | 3 + 3 + 3 years (From Jan 25)

•Ground floor with excellent exposure

•On-site parking for ten (10) cars

•Low maintenance & well-presented

•Strong tenant since 2022

•Special Use Zone (SUZ)

1 Woolacott Street, Coburg, 3058

Land area | 330m2*

Building area | 280m2*

7 car parks on Title

Zoning | General Residential

First time available since 1972

Suitable for a variety of uses STCA

1/442 Elizabeth Street, North Hobart, 7000 Sale Expressions Of Interest closing 17 July 2025 at 4pm (AEST)

RWC Tasmania have been appointed to offer for sale this prominent and quality office building situated in Elizabeth Street, located only a 2 minutes stroll to the popular North Hobart entertainment strip.

Key Investment Highlights:

+ 309 sqm* of building area across 2 levels plus a rear studio

+ Site Area: 736 sqm*

+ To be sold with vacant possession + Serviced throughout with reverse cycle air conditioners

+ Excellent exposure to busy Elizabeth Street + 8 onsite car parks + scope for 4 tandems

+ Self contained bed-sit flat located at the rear (STCA)

Trevor Fox 0419 355 917

trevor.fox@raywhite.com

Hayden Peck 0412 766 395 hayden.peck@raywhite.com

RWC Tasmania

raywhitecommercial.com

127 Williams Street, Kaiapoi, 7630

A fantastic little retail investment opportunity with a new lease in place.

Well located shop fronting the main street right in the heart of Kaiapoi. This awesome spot is advantaged by having excellent profile to both pedestrians and passing traffic.

New lease in place from November 2024 to a curtain, drapes and soft furnishings shop. Rental returning $27,000pa + GST + outgoings.

This very presentable retail/office building of 108m2* has been strengthened to a seismic rating greater than 67% NBS.

(approx*)