SESSION x

GREEN UK STUDENT SESSION x GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM FOLLOW US ON SOCIAL!

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM TABLE OF CONTENTS GREEN UK STUDENT INTRODUCTION OUR MISSION & VISION ...................................................................................................... I OUR GOALS ..................................................................................................................... II ARTICLE: Why are UK students the most stressed over studying maths?........................... III PROBLEM & SOLUTION ...................................................................................................... VI WORKSHOP SESSION OVERVIEW ..................................................................................... VII SESSION ONE 1 BINGO....................................................................................................................... 2 Pre-Assessment ....................................................................................................... 4 Agenda 5 Key Terms 6 Deeper Look at Investing ......................................................................................... 9 Stock Review ........................................................................................................... 11 Glows & Grows 12 Reminders 13 Yahoo! Finance ......................................................................................................... 14 Bonus Material ......................................................................................................... 16 SESSION TWO 18 Agenda ..................................................................................................................... 19 Key Terms ................................................................................................................. 21 ARTICLE: How to Read a Payslip the Easy Way 23 Stock Review 29 New Investment Key Terms ...................................................................................... 31 PROJECT: Financial Planning for Janella ................................................................. 34 Janella’s Payslip 36 Whole Group Refection 38 Reminders ................................................................................................................ 39 Janella’s Monthly Budget .......................................................................................... 40 Bonus 41

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM TABLE OF CONTENTS SESSION THREE .................................................................................................................. 44 Agenda ...................................................................................................................... 45 Key Terms 46 Stock Market Review & Yahoo! Finance ................................................................... 48 PROJECT: Financial Planning for Janella .................................................................. 52 Glows & Grows ......................................................................................................... 54 Reminders 55 Bonus 56 SESSION FOUR 60 Agenda 61 Key Terms .................................................................................................................. 62 Simple Interest Practice Problem .............................................................................. 64 Stock Market Review & Yahoo! Finance 66 New Investment Key Terms 69 PROJECT: Financial Planning for Janella .................................................................. 70 Financial Planning Presentation Chart 71 Whole Group Refection 72 Reminders 72 Bonus ........................................................................................................................ 74 KEY TERMS GLOSSARY 78 SESSION FIVE 82 Agenda 83 Individual Stock Review ............................................................................................ 84 Financial Literacy Key Terms ..................................................................................... 86 Post-Assessment 88 Group Presentation Prep Time 89 Whole Group Refection ............................. 91 Reminders ................................................................................................................. 91 Bonus ........................................................................................................................ 92 RESOURCES 94

Rock The Street, Wall Street hopes to break the cycle of multi-generational fnancial naivete so that girls have a better chance at improving their lives, their households and their communities. Women continue to confront barriers to full equality at all levels; most critically of which is in their fnancial lives. This is even more egregious for women of color, where they earn, save and invest at lower rates. In university fnance and economics classrooms, girls are few in number. As a result, their opportunities in pay, promotion and life are unequal. Equipping girls with fnancial skills is a vital part of ensuring equal opportunity. Financial literacy is The Great Equalizer

Rock The Street, Wall Street believes to close the gender gap in the wages, wealth and in the fnancial services sector, we have to inspire girls to pursue the M in STEM and fnance, by exposing them to real life role models. The number one reason why girls are not choosing STEM professions - they don’t see women in those professions The number two reason - they don’t see their friends choosing those majors in university We engage female fnancial pros who walk the talk on all matters fnancial. They teach and motivate the next generation. Our students see girls in their RTSWS cohort choosing fnance, economics or a related computational feld as their majors/minors. Whether they choose the profession, or head into another feld, our students are far better prepared for critical decision making on all types of fnancial and career prep matters.

I GREEN UK STUDENT INTRODUCTION GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

OUR VISION

ABOUT ROCK THE STREET, WALL STREET

OUR MISSION

Rock The Street, Wall Street is reaching young women at their local high schools. We ofer young women a fight path to a fnancial education through hands-on fnancial projects, workshops, role modeling, mentoring and real-life Wall Street experiences. Girls are introduced to fnancial concepts such as savings, investments, post-secondary and university fnancial preparedness, budgets, stocks, bonds, fnancial analysis, venture capital and private equity.

Rock The Street, Wall Street is a fnancial and investment literacy program designed to bring both gender and racial equity to the fnancial markets and spark the interest of secondary school girls into careers of fnance. Girls learn about saving, investments, budgeting, stock and capital markets and their role in maintaining the welfare of their families, communities and the economy, while simultaneously helping them see the real world application of the math content they learn in the classroom.

IIGREEN UK STUDENT INTRODUCTION GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

•

fnancial

Open girls’ minds to math-focused felds of study as compatible with a career that has a positive impact on the world.

•

•

•

Spark girls’ enthusiasm for fnance at a critical age and make them aware of the societal benefts personal fnancial knowledge and math-oriented careers can ofer. Create the social capital between students and female fnancial professionals that will enable students to get a jumpstart on their personal money management behavior and on their university and work lives. Increase the number of women studying fnance, economics or related computational business felds. Create an early pipeline of female talent so as to increase the number of women who enter into the fnancial services industry. Provide a pathway to better lifetime money management, academic performance and university preparation. Coach students on resume building. Provide career discovery by ofering job shadowing and/or industry summer internships. Foster students’ continued growth in fnance through their university years and into the workforce. Create a longitudinal cohort of girls who can network with each other across cities, countries, socio-economic lines and industries. Become the go to internship and job portal for emerging, diverse talent in the services industry and beyond.

•

•

OUR GOALS • Close the gender and racial gap in wages, investments and wealth accumulation for all women. •

Increase fnancial and investment literacy of girls at a young age so that they are aware of the fnancial responsibilities AND opportunities of post-secondary life, at university, at work, at home and in their communities.

Teach girls on how being fnancially independent is key to living a self-determined life.

•

•

•

•

•

•

The UK education system: outdated methods?

The results reveal that it’s common for students to stress over maths studies and to not believe in their own abilities. In recent years, the child mental health crisis in the UK has become an increasing concern, with fve students in every classroom of 30 now thought to have a mental health problem. While exact fgures of UK students experiencing conditions such as anxiety and depression are unknown, this latest study suggests that stress and low self-esteem are commonplace, increasing the risk of mental health problems. Manan Khurma, founder and chairman of Cuemath, highlights an additional concern: “Maths anxiety - and how to reduce it - should be of great concern to any country wanting to educate a generation capable of dealing with 21st century challenges and succeeding in the modern job market.”

In December 2021, a global survey led by global maths EdTech company Cuemath found that UK students experience the most math anxiety out of 20 participating countries. The survey analysed how students aged 10-17 felt about mathematics studies, including their attitude, confdence and self-belief in their maths skills.

Perceptions of maths global survey

Poor mental health in UK schools linked to the perceived pressure to do well is also a factor that cannot be overlooked. In a 2018 National Education Union (NEU) survey of 730 education staff, 68% believed they were dealing with more mental health issues than fve years previously.

Authored by Amberley Davis ·

Khurma believes that the “uncommonly high prevalence of maths anxiety in the UK” may be caused by “an outdated approach to maths teaching generally, a culture less focused on excellence in these subjects, and a shortage of role models.”

Reviewed by Dr Sarah Jarvis MBE 02-Jan-22 www.patient.info/news-and-features/why-are-uk-students-the-most-stressed-over-studying-maths

“The UK education system is one of the most respected in the world, yet it is also very traditional,” says

A recent global survey revealed that UK students are more anxious about mathematics than anywhere else in the world. Maths anxiety is a psychological barrier that’s affecting many children from their early school years. Why are children forming negative perceptions of maths in the UK, and what concerns and challenges does this raise?

Why are UK students the most stressed over studying maths?

Why are students afraid of mathematics in the UK?

RESULTS UK students have the most negative perceptionsGlobally many students believe they cannot do maths Female students have higher maths-related anxiety than males14-year-old25%.students fear maths the most33%25%40%26%

ARTICLE

According to the survey, this maths anxiety takes seed in a child’s early school years and grows from there, peaking at age 14-15 years. It also shows that more girls have a negative perception than boys - 25% compared with 20%.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

III GREEN UK STUDENT INTRODUCTION

MATH PERCEPTIONS

Unfortunately, there is growing evidence to suggest that mental health issues, including anxiety and depression, are dramatically increasing in UK schools. The NEU survey found that 48% of students were experiencing panic attacks - a sudden physiological response to anxiety.

Cultural value placed on STEM subjects

Although it may not be a widely recognised issue, the high number of UK students who have anxiety toward mathematics is a cause for concern. The fact that 1 in 4 students - and as many as 40% aged 14-15 - are afraid of maths and don’t believe in their own abilities raises red fags for a crisis of anxiety, low confdence and low self-esteem in our Mathschools.anxiety

While the UK government has a STEM strategy in recognition of the importance of these subjects “to grow a dynamic, innovative economy”, according to Khurma countries like India and China place a great deal more emphasis on these modules.

The same survey also suggests that 67% of students believed their a nxiety and other mental health issues were due to pressure from schools to do well, and 48% said it was due to the burden they put on themselves to succeed. In either case, the systemic need to achieve academically is having an adverse affect on mental health.

also impedes learning because preoccupation with anxiety affects attention and processing speed. Research shows that being preoccupied with fear or stress can make it harder for people to access their working memory. Having low self-esteem and low confdence has also been shown to demotivate students, resulting in poorer academic performance.

Why is math anxiety a big concern?

In the UK, the uptake of maths in further education is very low compared to other countries, which translates to a lack of role models. Whatever the reasons for this poor track record, having fewer infuential fgures in maths may do little to convince students that doing well in this area is within their reach.

A shortage of role models

Khurma goes on to highlight the knock-on effect of this widespread psychological barrier on the economy:

Mental health in UK schools

Khurma. “The way maths is taught and learned in UK schools can contribute to the subject being perceived as complicated, and one in which only smarter students should hope to succeed.”

After all, research has consistently shown the signifcant impact of female role models on female students when they either show confdence or doubt in their own maths abilities.

Poor mental health can lead to conditions such as anxiety and depression, and also result in low self-esteem, defned as the thoughts we have about ourselves, and low confdence - how we rate our own abilities. Low self-esteem and confdence levels contribute to maths anxiety, including performance anxiety and a negative perception of our maths skills.

GREEN UK STUDENT INTRODUCTION IV GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

Khurma also believes that the UK doesn’t bestow the same cultural value on succeeding in STEM (science, technology, engineering and mathematics) subjects. These studies are considered important because they teach skills that are integral to the technological and scientifc industries that sustain economic growth.

“Math anxiety reduces the number of young adults pursuing careers needing such skills. The UK economy gains £200 billion annually from its maths talent - 10% of its overall GDP. It is easy to see the impact on a country and its economy, when it is so reliant on its math skills.”

V GREEN UK STUDENT INTRODUCTION GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

Experts recommend that parents and teachers use positive reinforcement in order to build up young peo ple’s self-esteem and confdence in their maths abilities. Some also suggest reframing anxiety - for example, having them write down and think critically about their worries regarding maths in order to help them realise the fear is illogical.

Khurma believes it’s also important to make maths fun and engaging from an early age. Cuemath is a global after-school one-on-one adaptive learning programme that makes use of interactive simulations. The personalised teaching techniques are designed to increase student’s engagement by making maths learning less about abstract concepts and more of a human activity.

“Math anxiety often stems from being overwhelmed by an established body of material; a perception of orthodoxy where one must learn by heart to succeed. We advocate and teach a more nimble and versatile perspective on maths thinking, and logical problem-solving.”

The Wall Street feld trip is a capstone experience whereby students are given a rare glimpse into corporate ofce settings, the workplaces and work lives of fnanciers. The experience allows the students to shadow female treasury ofcers, wealth managers, analysts, comptrollers, entrepreneursaccountants,andmore.For many of our students, this is their frst glimpse into the world of fnance, opening their eyes to a new world of possibilities.

Overcoming maths anxiety

VI GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM 18% 6%11.3% 11.2%

To understand and be able to explain living expenses.

Session

VII UK Green Curriculum Workshop Sessions

•

GREEN UK STUDENT INTRODUCTION GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

•

To play the role of a fnancial planner for Janella Sims, a 28-year-old female. Create a budget for her, keeping in mind her short-term and long-term goals.

To understand and be able to explain where their tax dollars go.

•

•

•

Green Curriculum Learning Outcomes:

•

To follow the price movements of Apple (AAPL) and the FTSE 100.

To become familiar with various types of careers in fnance. Topics and Key Terms: Please write in the day, time and location of each session on the following page. Be sure to add these dates to your phone calendar as well to set reminders. The session schedule is also available in the RTSWS app.

To defne basic investment terms.

GREEN UK STUDENT INTRODUCTION GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM IX

www.rockthestreetwallstreet.com/internship-job-portal

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 Session 1 Welcome to RTSWS Session #1! • Be sure you have a pen, pencil or writing utensil • Grab a snack • Get ready to share your name, grade and favorite emoji Human Scavenger Hunt - BINGO Find another RTSWS student or volunteer who can answer “yes” to a BINGO question on the next page. You must have that person sign their name within the square. The object is to meet as many people as you can and fll a “BINGO!” (A complete line horizontally, vertically or diagonally). You can only use a person once to fll in a square. 1

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 12 interviewedHasbeforejobafor bankaHasaccount leftyaIsscootersorBikesorschooltoworkcatsPrefersdogsover isBirthdaymonththis greenHaseyes twinaIspineappleLikespizzaon LeftIsHanded languagecartwheelfishpetaHasCandoaIslearninganotherIsanonlychildbackwardsDletterhandedleftIsNamestartswithCansaythealphabetPlaysateamsportIsatwinmusicalaPlaysinstrument thanmoreHas countryanothersiblings4HasgreeneyesHasvisited orBikesworktoscootersschoolor atobeenHastheinconcertmonthpast monthBirthdaymonththisis withstartsNameletterfirstsamenameyouras bankaHasaccount catsPrefersdogsover howKnowswhistleto theirtouchCantheirtotonguenose theinbornWasasmonthsameyou pineappleLikespizzaon

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 RTSWS COHORT NORMS Our RTSWS cohort norms will help us decide together the expectations for our sessions and the behaviors that will allow us to reach our goals. Norms: The behavioral expectations or rules of the class. Class norms inform us how we are expected to behave towards each other and the materials we use. • Come prepared to be a part of RTSWS with your handbook, a writing utensil and a positive attitude. • Be kind and encourage one another - we are all in this together! • Ask questions, share your opinions and let the volunteers know when you do not understand something. • _________________________________________________________________________________________________________________________________________________________________________ • _____________________________________________________________________________________ As a cohort, briefy discuss what each norm means and what it looks like in action. 3

PRE-ASSESSMENT

by tilting

This is not graded. We just want to know what you already know and it helps RTSWS better understand students’ prior knowledge. If you do not know an answer, it is OK to select “I don’t know.” This will not be shown to your school or any teachers. Just do your best!

In order to measure your growth and knowledge of fnancial and investment literacy in the course of the next 5 sessions, we are going to take a quick pre-assessment to establish your baseline.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1

At this time, we are going to begin the pre-assessment. During the pre-assessment, please remain silent so that other RTSWS students in your cohort can focus and do their best. When you are done with the pre-assessment, you will indicate you’re complete to the volunteers your laptop screen

down OR placing your phone upside down 1. Login to your RTSWS App on your phone or a school computer: (app.rockthestreetwallstreet.com/ 2. Click on the button labeled “Take the Pre-Assessment” 3. You will have 7 minutes to complete the pre-assessment A RTSWS volunteer will let you 3 minutes remaining and when there is 1 minute remaining. 4. At the end of the test, click “Submit” 4

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 LET’S GET Today’sSTARTED!GuidingQuestion: How are expenses, investments and savings considered when planning fnancial goals for myself and when advising others on their own fnancial goals? SESSION #1 AGENDA 1. Welcome 2. Attendance 3. Human Scavenger Hunt - BINGO 4. Pre-Assessment 5. Spending, Saving and Investing Key Terms & Activity 6. Stock Market Introduction 7. Refection: Grows and Glows 8. Reminders for Next Session By the end of today’s session, we will be able to compare savings, expenses and investments. We will be able to understand why saving and investing is important in achieving fnancial goals. Take a peek into the future. Where do you see yourself in 10 years? Using the magic crystal ball seen here, jot down 5 goals have for your future. (Examples: university, car, family, career…) 5 How do you tell anaccountant to be quiet? You tell them to usetheir invoice

KEY TERM: Savings

6

Which of the goals above might you need to start SAVING money for? Provide an estimate of how much money you might need to save for each.

Using the goals within your crystal ball, consider what the fnancial needs will be in order to meet these Whichgoals.ofthe goals above will require you to SPEND money?

Savings refers to the money you have left over from your income after spending needs or expenses have been met. This money is kept in the form of cash or bank deposits. Savings are exposed to no risk, but also come with minimal returns.

Setting aside money you do not spend now for emergencies or for a future purchase.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 KEY TERM: Sustainability

In order to increase the amount of money you have saved for your fnancial goals, you may choose to grow your savings through investing. Using the space below, write down everything you know about

INVESTING. 7

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 Buying assets such as stocks, bonds, mutual funds or real estate with the expectation that your investment will grow in value. Investments are usually used to achieve long-term goals. KEY TERM: Investing 8

One common form of investing is purchasing stocks

Let’s Take a Deeper Look at Investing

9

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1

Stocks are shares (pieces) of ownership in a company.

.

The stock market is the sum of all individual stocks and when an individual stock moves, the market as a whole would also move by a tiny amount. Often, the stock market will move up or down because of larger events going on in a certain country or all around the world.

The collection of physical and electronic markets where buyers and sellers can trade shares. It is like a giant, global auction. Most trading happens through stock exchanges.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 STOCK MARKET

10

Today’s Stock Price: Date: Up/Down: ( %) 6 Month Trend: x y 11

Company = A symbol by which stocks are identifed. Tickers are a few letters that distinguish a company’s shares in market.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 STOCK REVIEW Using Yahoo! Finance (https://uk.fnance.yahoo.com/) complete the following:

: Apple Ticker: Ticker

the stock

What can be improved on for the next session? What terms or ideas do we need to spend additional time on? List three “grows” below: 123

12

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 GLOWS AND GROWS GLOWS

What went well today? What did you LIKE about today’s session? List three “glows” below:

GROWS321

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 REMINDERS FOR NEXT SESSION The next RTSWS session is… Date: ___________________________________________ Time: __________________________ Before the next session… NOTES • Set up your own Yahoo! Finance portfolio and watchlist using the instructions on page 14. 13 Don’t forget to check out the bonus section for additional key terms, bonus articles and challenge activities.

Want to create your own Yahoo! Finance login to begin creating your own watchlist and portfolio of stocks to monitor?

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 YAHOO! FINANCE UK INSTRUCTIONS

INSTRUCTIONS:https://mobile.yahoo.com/fnance

2.

1. Copy this link into your browser or go to Yahoo! Finance through Google search: https://uk.fnance.yahoo.com/ Click “Sign in” 3. Click “Create an Account” 4. Fill out all the required felds, including your frst and last name, username, password, birthday and mobile number. Click “Continue” 6. Enter the 5-digit verifcation code once you have received it. Click “Verify” and then “Continue” 7. Click “Done” 8. You’re all set. When you click “Done,” you’ll navigate back to the Yahoo! Finance homepage where you can access your profle in the top-right corner www.uk.fnance.yahoo.com

14

5.

My Portfolio - The name for the Yahoo! Finance toolkit that enables you to follow the collected stocks you are interested in tracking. Once you establish stocks to follow through My Portfolio, you will have access to multiple analytics across Yahoo Finance that will aford greater insight into the stocks you’re interested in.

Watchlists - Follow Yahoo! Finance-curated watchlists of related companies, specifc markets or industry sectors. Get the Yahoo! Finance app on your smartphone and other mobile devices:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 Add to Your Portfolio or Watchlist:

1. Click on “My Portfolio,” then “My Watchlist” then “Add Symbol”

4.

Add To Your Portfolio: Apple (AAPL)

Any

FTSE 100 FTSE is short for “Financial Times Stock Exchange.” The FTSE 100 is an index made up of shares from the 100 biggest companies by market capitalization on the London Stock Exchange (LSE). other companies you are interested in tracking!

15

2. Enter the tickers of any stocks you want to track (Example: AAPL for Apple)

3. If you don’t know the symbol, type in the company name and Yahoo! Finance will fnd the ticker for you Stocks you select will appear in your watchlist

So what do people spend their money on anyway?

Average Household Budget in the UK

https://www.nimblefns.co.uk/average-uk-household-budget

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 BONUS16 SESSION 1 BONUS More on Savings and Spending

• In 2020, the average UK household budget was £2,548 a month (£30,571 a year) based on an average of 2.4 people per household.

Updated March 10, 2022

• Of those renting, the average monthly rent in the UK is now £871 for private renters and £446 for social renters. The average spent on mortgage payments is around £733 a month.

• The second largest cost for the average UK household, behind housing, is transport. An average of £4,820 is spent per year to get around.

• The typical UK household saves £180 per month—this represents the median amount saved each month. That means that 50% of households save less than £180 a month and 50% of households save more.

• Brits spend the most on transportation, housing and food. In fact, 14% of household budgets go towards transportation, up to 30-35% towards rent or mortgage interest payments and 11% on food.

• The third largest household budget category is food. The average UK household spends £3,312 a year on groceries and non-alcoholic drinks at home.

• The average UK household spends £7,000 on utilities, communications & TV services and other household operational and maintenance expenses like insurance and council tax, as well as household goods & services.

Here’s a full breakdown of the average spending by category:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 1 BONUS 17

Where Households Spend Their Money

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 Welcome to RTSWS Session #2! • Be sure you have a pen, pencil or writing utensil • Grab a snack • Get ready to share your name, grade and a hobby you enjoy outside of school RTSWS COHORT NORMS Let’s review our RTSWS cohort norms. These are the expectations for our RTSWS sessions that we set during session #1. Norms: The behavioral expectations or rules of the class. Class norms inform us how we are expected to behave towards each other and the materials we use. • Come prepared to be a part of RTSWS with your handbook, a writing utensil and a positive attitude. • Be kind and encourage one another - we are all in this together! • Ask questions, share your opinions and let the volunteers know when you do not understand something. • • _________________________________________________________________________________________________________________________________________________________________________ 18

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 LET’S GET STARTED! Today’s Guiding Question: Why is a budget important in helping plan for short-term and long-term expenses and goals? SESSION #2 AGENDA: 1. Welcome 2. Attendance 3. Norms 4. Review Agenda 5. Introduction to Budgeting 6. Stock Market Review 7. Project Work Time: Financial Planning for Janella 8. Whole Group Refection 9. Reminders for Next Session By the end of today’s session, we will be able to diferentiate fxed, variable and occasional expenses and understand the key components of budgeting. 19

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 Take a look at the image below. What do you notice? 20 Entertainment

~1

~5-10

Personal budgets are extremely useful in managing an individual’s or family’s fnances over both the short-term and long-term.

ARTICL KEY TERM: Budget 21

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

Long-term

An estimation of revenue and expenses over a specifed future period of time. It is a plan that allows individuals, businesses and governments to control their spending to save for future priorities.

Short-term = year or less = years

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 Revenue vs Expenses Revenue = Money coming in! Expenses = Money going out! Revenue = Money coming in! The most common form of revenue would be money earned through your income or pay. In order to determine revenue or income that can go onto a budget, we need to understand how to read a payslip and how much our As a group, you will read through the excerpts from the payslip article on the following pages. Review the diferent infographics and be sure to jot down and ask any questions you may have! REVENUE EXPENSES 22

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

Why is Knowing How to Read a Payslip is so Important?

ARTICLE: How To Read a Payslip- The Easy Way Payslip Matters to

When entrepreneur and Muppeteer Jim Henson made his frst dollar, he framed it and hung it on his ofce wall. For everyone, whether you’re the company owner or an employee, earning an income is a source of pride and a primary foundation for economic security.

Michelle Mire

Surprisingly, in spite of how important getting paid actually is, most people don’t understand the fundamentals of payroll, including what’s taken out or added to a payslip.

From paying the bills to retaining valued workers, payslips matter to employers and employees.

https://blog.wagepoint.com/all-content/how-to-read-a-paycheck-the-easy-way-infographic

23 Every

Every Employee

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 What are Some of the Most Basic Details in a Payslip? While there’s no specifc format set in stone, there’s some standard information that’s included no matter how a payslip is designed. Some of the most basic details include: • Personal Information – Name and home address • Payroll Number – Provided by company to identify individuals on payroll • Tax Code Tells employer how much tax-free pay you should get before deducting tax from the rest • National Insurance Number – Personal number for the social security system • Payments, wages, bonuses and commission – How much you have earned before deductions are made • Deductions Tax and National Insurance • Pensions A long term savings plan with tax relief • Student Loan – Deductions of loan repayments 24

25 £50/hr. £4,000

This is really the crux of why a payslip is provided to employees. Total pay is the amount of the payslip before any taxes or other deductions are taken out or any contributions are added. Net pay is the fnal amount that the employee takes home.

What’s

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

the Diference Between Total Pay (Gross Pay) and Net Pay (Final Pay)?

• Pensions the amount you contribute towards any employer or workplace pension will be shown.

To contribute means to add. When it comes to payroll, employees aren’t the only ones who have to pay taxes. Employers also contribute to Pension and Medical Insurance. Plus, they’re also responsible for unemployment insurance. Other contributions may also include other income, like overtime, tips, bonuses, commissions, expenses and paid time of such as sick, personal or vacation time.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

26

• The tax you have paid Your payslip should show the amount of income tax that has been deducted. The amount of tax that you pay depends on your salary and your Personal Allowance.

• The National Insurance contributions that you have paid Your National Insurance (NI) contributions are deducted from your gross pay. NI goes towards providing some benefts, for example a state pension.

• Student loan – if you are making repayments on a student loan then this will be shown.

What Are Contributions and What’s Added to a Paycheck?

The verb deduce means to subtract or take away. Income tax is the deduction that everyone is most familiar with. As part of issuing payroll, employers (businesses) have to take out (withhold) a percentage of each employee’s taxable pay. This is done every time payroll is run. (Shepherds Friendly Society)

Deductions can include taxes, pension contributions, medical insurance payments, school loans, garnishments.

Types of Deductions:

What Are Deductions and What’s Taken Out of a Paycheck?

• Court orders or child maintenance – unpaid fnes and other court orders can be deducted directly from your pay.

What’s the Diference Between Total vs Year-to-Date Amounts in a Payslip?

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

Depending on how a payslip is formatted, you may see fgures for total and year-to-date amounts. When you see these fgures, the total is the total amount of the paycheck and year-to-day is the total since the start of the fscal year for your payroll.

27

There are many diferent types of expenses. Review the chart below to learn more about fxed expenses, variable expenses and occasional expenses and brainstorm examples for each type.

Examples: • Utilities

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

Examples: • New seasonal clothing • Home maintenance • Car maintenance • • • 28

Fixed Expense Expenses that cost the same amount each month. These bills cannot be changed and are usually paid on a regular basis (monthly, weekly or yearly). Expense Expenses that vary from period to period. These bills can be more easily changed or altered depending on use and needs. (water, gas, electric) OccasionalExpense(Periodic)

Examples: • Rent • Car payment/ Transportation • Mortgage/Rent • • • Variable

Expenses = Money going out!

Like fxed expenses, these bills generally cannot be easily changed; but, they do not occur on a regular weekly or monthly basis, making them more challenging to plan for.

• Groceries • Automobile gas • • •

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 STOCK REVIEW

Review last week’s key terms:

The collection of physical and electronic markets where buyers and sellers can trade shares. It is like a giant, global auction. The stock market is the sum of all individual stocks and when an individual stock moves, the market as a whole would also move by a tiny amount.

29

Stocks: Shares (pieces) of ownership in a company. Stock Market:

Ticker: The symbol by which stocks are identifed. Tickers are a few letters that distinguish a company’s shares in the stock market.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 STOCK MARKET REVIEW & YAHOO! FINANCE Company: Apple Ticker: Ticker = A symbol by which stocks are identifed. Tickers are a few letters that distinguish a company’s shares in the stock market. Today’s Stock Price: Date: Up/Down: ( %) 6 Month Trend: x y 30

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 NEW INVESTMENT KEY TERMS Mutual Fund A professionally managed fund that pools lots of investors’ money in order to buy a basket of investments. 31

KEY TERM: ETF

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 232 ETF (Exchange Traded Fund):

A collection of stocks and bonds (or other securities) pooled into a single fund. You can buy and sell shares of ETFs on a stock exchange the same way you buy and sell stocks. Although they are very similar to mutual funds, unlike mutual funds, you can trade ETFs throughout the trading day.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM REGISTER USINGTHE RTSWS APP! 33

My Group Members:

• Be creative! (See page 40 for Monthly Budget document)

• You may not be able to meet all of Janella’s fnancial goals, so pick the ones you think are best and be ready to share why.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2

You have been hired!

34

PROJECT: Financial Planning for Janella

The next page shows the information she has provided you. You may use your phones, tablets or laptops to research and decide on the remaining expenses.

Janella Sims, a 28-year-old professional in your city has hired your group as her fnancial advisors. She recently started a new job and needs a budget to match her annual salary. During the fnal RTSWS session, your group will be presenting your proposed budget and recommendations to Janella on her living and spending choices.

TO DO: Using Janella’s payslip and notes, determine Janella’s monthly take home pay and add it to her monthly budget on page 40.

Using the expenses listed on Janella’s monthly budget, defne each as fxed, variable or occasional. With any extra time, begin to fll in Janella’s budget with her monthly expenses.

TIPS: • Be aware of the diference between Janella’s wants and her needs.

Notes from your meeting with Janella:

• She wants to join a tennis club. Herpreferred club costs £70/month• She wants to go out for a nice dinnertwice a month, about £40/month• She is undecided on what type offlat she wants • She is saving for holiday next summerwhich will cost £750

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 35 • She wants to purchase a house or flat in the next three years. She hopes to have a down payment of £25,000 for the purchase • Remaining student loans: £12,000. She currently pays off £250/month • She wants to regularly put aside money for emergencies • She wants to begin contributing to her retirement savings • Janella shared with you her most recent payslip (shown on following page) • She receives an annual salary of £45,000 and she is paid monthly in the amount of £3,750 (45,000 / 12 months per year = £3,750)

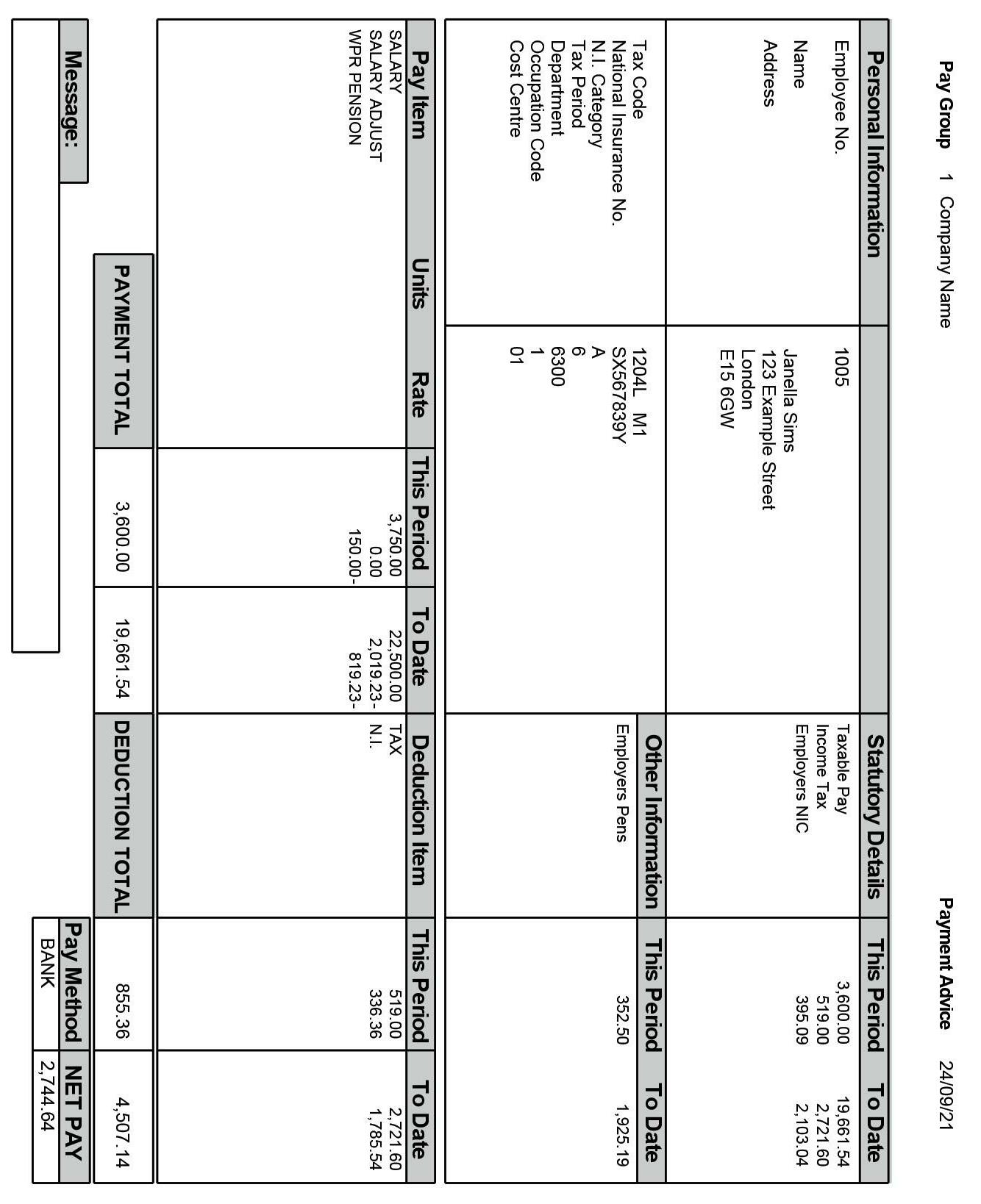

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 236 Janella’s Payslip:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 37 The Wall Street feld trip is a capstone experience whereby students are given a rare glimpse into corporate ofce settings, the workplaces and work lives of Thefnanciers.experience allows the students to shadow female treasury ofcers, wealth managers, analysts, comptrollers, entrepreneursaccountants,andmore.For many of our students, this is their frst glimpse into the world of fnance, opening their eyes to a new world of possibilities. RTSWS SPRING MENTORSHIP COMING SOON! What is the Spring Mentorship? You will be paired with a mentor that you will work with for all 5 sessions. You will work on resume writing, interview skills, self-advocacy, LinkedIn and skills for university and beyond. You can utilize your mentor to help you talk through university and career options as well! Go to the RTSWS App to Enroll! Login to your RTSWS app & click “Enroll for Spring Mentorship”.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 What surprised you most about what you learned today? Whole Group Refection: What Surprised You? 38

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 39 Don’t forget to check out the bonus section for additional key terms, bonus articles and challenge activities. REMINDERS FOR NEXT SESSION The next RTSWS session is… Date: ___________________________________________ Time: __________________________ Before the next session… NOTES

TransportationFlatRent

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 240

Step 1: Calculate your net income

The foundation of an efective budget is your net income. That’s your take-home pay— total wages or salary minus deductions for taxes and employer-provided programs such as retirement plans and health insurance. Focusing on your total salary instead of net income could lead to overspending because you’ll think you have more available money than you do. If you’re a freelancer, gig worker, contractor or are self-employed, make sure to keep detailed notes of your contracts and pay in order to help manage irregular income.

Step 3: Set realistic goals

Begin by listing your fxed expenses. These are regular monthly bills such as rent or mortgage, utilities and car payments. Next list your variable expenses—those that may change from month to month, such as groceries, gas and entertainment. This is an area where you might fnd opportunities to cut back. Credit card and bank statements are a good place to start since they often itemize or categorize your monthly expenditures.

Before you start sifting through the information you’ve tracked, make a list of your short- and long-term fnancial goals. Short-term goals should take around one to three years to achieve and might include things like setting up an emergency fund or paying down credit card debt. Long-term goals, such as saving for retirement or your child’s education, may take decades to reach. Remember, your goals don’t have to be set in stone, but identifying them can help motivate you to stick to your budget. For example, it may be easier to cut spending if you know you’re saving for a vacation.

Record your daily spending with anything that’s handy—a pen and paper, an app or your smart phone, or budgeting spreadsheets or templates found online.

Step 4: Make a plan

https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

This is where everything comes together: What you’re actually spending vs. what you want to spend. Use the variable and fxed expenses you compiled to get a sense of what you’ll spend in the coming months. Then compare that to your net income and priorities. Consider setting specifc—and realistic—spending limits for each category of expenses.

Step 2: Track your spending

Once you know how much money you have coming in, the next step is to fgure out where it’s going. Tracking and categorizing your expenses can help you determine what you are spending the most money on and where it might be easiest to save.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 BONUS 41 SESSION 2 BONUS More on Budgeting!

6 Simple Steps for Creating Your Own Budget

Once your budget is set, it’s important to review it and your spending on a regular basis to be sure you are staying on track. Few elements of your budget are set in stone: You may get a raise, your expenses may change or you may reach a goal and want to plan for a new one. Whatever the reason, get into the habit of regularly checking in with your budget following the steps above.

If the numbers still aren’t adding up, look at adjusting your fxed expenses. Could you, for instance, save more by shopping around for a better rate on auto or homeowners insurance? Such decisions come with big trade-ofs, so make sure you carefully weigh your options.

Now that you’ve documented your income and spending, you can make any necessary adjustments so that you don’t overspend and have money to put toward your goals. Look toward your “wants” as the frst area for cuts. Can you skip movie night in favor of a movie at home? If you’ve already adjusted your spending on wants, take a closer look at your spending on monthly payments. On close inspection a “need” may just be a “hard to part with.”

You might choose to break down your expenses even further, between things you need to have and things you want to have. For instance, if you drive to work every day, gasoline counts as a need. A monthly music subscription, however, may count as a want. This diference becomes important when you’re looking for ways to redirect money to your fnancial goals.

Remember, even small savings can add up to a lot of money. You might be surprised at how much extra money you accumulate by making one minor adjustment at a time.

Step 5: Adjust your spending to stay on budget

Step 6: Review your budget regularly

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 BONUS

42

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 2 BONUS Create Your Own Budget! Use the monthly budget template below to create your own personal budget. Fill in your monthly income, savings and expenses to begin to plan for your future fnancial goals! BONUS ACTIVITY 43

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 Welcome to RTSWS Session #3! • Be sure you have a pen, pencil or writing utensil • Grab a snack • Get ready to share your name, grade and leader you look up to RTSWS COHORT NORMS Let’s review our RTSWS cohort norms These are the expectations for our RTSWS sessions that we set during session #1. Norms: The behavioral expectations or rules of the class. Class norms inform us how we are expected to behave towards each other and the materials we use. • Come prepared to be a part of RTSWS with your handbook, a writing utensil and a positive attitude. • Be kind and encourage one another - we are all in this together! • Ask questions, share your opinions and let the volunteers know when you do not understand something. • _________________________________________________________________________________________________________________________________________________________________________ • ____________________________________________________________________________________ 44

Have you ever seen a movie or a cartoon where someone hides their money under their mattress?

45 Think About

Or maybe you’ve heard your grandparents say they used to do this?

asset? I feel so

Do people still hide their money under their mattress?

Hiding money under the mattress stemmed from the Great Depression-era when safes were not afordable and there was a deep distrust of fnancial institutions across the world. People trusted themselves and their homes to keep their money safe more than they trusted the bank.

While it is a good idea to keep some cash for an emergency, keeping money at home leaves a tremendous risk for theft or loss due to fre or another unexpected disaster. Need an example? In 2009, one woman replaced her mother’s old mattress, and later learned that it is where she hid her life savings of (estimated £810,875.56…). Here’s another… a man in Moline, Illinois, USA, accidentally donated a suit which had £10,544 in a pocket. Hiding cash is not secure and infation causes spare cash to lose its value over time. It! the overworked asset say to the other depreciatedunder

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 LET’S GET STARTED! Today’s Guiding Questions: How can both current accounts and savings accounts afect your fnancial planning and management of your fnancial goals? What are the similarities and diferences between a stock and a bond? SESSION #3 AGENDA: 1. Welcome 2. Attendance 3. Norms 4. Review Agenda 5. Current Accounts, Savings Accounts and Bonds 6. Stock Market Review 7. Project Work Time: Financial Planning for Janella 8. Whole Group Refection 9. Reminders for Next Session

What did

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 A general increase in prices and fall in the purchasing value of money Brainstorm 3 places you can keep money, instead of under your mattress: 1. __________________________________________________________________________________ 2. __________________________________________________________________________________ 3. __________________________________________________________________________________ Why do people have bank accounts? KEY TERM: Infation 46

Bond (Gilt):

A low-risk debt investment, similar to an I.O.U., that is issued by companies, governments or states to fund projects. When you purchase a bond, you are lending money to the borrower or “issuer.” In exchange, the issuer pays you a certain amount of interest periodically. When the bond matures (or becomes time to pay), the borrower will pay back the initial investment or the “principal” value of the bond, plus interest.

NEW INVESTMENT KEY TERMS 47

Current Account: A type of bank account most people use for day-to-day personal fnances. They’re a secure place to keep money, and allow you to receive money (e.g. a wage from an employer) and transfer money elsewhere (e.g. buying something in a shop).

While savings accounts generally ofer a small amount of interest, another option for earning interest on your money is to purchase a bond. Bonds may ofer a higher return and tend to be a safe form of investment for money you are saving long-term.

Government bonds are known as gilts in the UK and are an investment vehicle that provides a fxed rate of return until their expiry.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3

Savings Account: An account ofered by banks that is used for money you plan to save longer term. The money in a banking account is insured by the Financial Services Compensation Scheme (FSCS.)

Investing in the stock market is one of the places people may choose to keep their money!

48

Review last week’s key terms:

A collection of stocks and bonds (or other securities) pooled into a single fund. You can buy and sell shares of ETFs on a stock exchange the same way you buy and sell stocks. Although they’re very similar to mutual funds, unlike mutual funds, you can trade ETFs throughout the trading day.

A professionally managed fund that pools lots of investors’ money in order to buy a basket of investments.

Mutual Fund:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 STOCK MARKET REVIEW & YAHOO! FINANCE

ETF (Exchange Traded Fund):

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 STOCK MARKET REVIEW & YAHOO! FINANCE Company: Apple Ticker: Today’s Stock Price: Date: Up/Down: ( %) 1 Month Trend: x y 49

50

NEW INVESTMENT KEY

You can’t invest directly in the FTSE itself… but, you can invest in exchange-traded funds (ETFs) that track the FTSE. Let’s take a look at an example of an FTSE tracking ETF… TERM

The index of the UK’s largest 100 companies, by market capitalization. The FTSE 100 is a key indicator and is often referred to by fnancial experts.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 FTSE 100 (Financial Times Stock Exchange 100)

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 FTSE 100 Index Ticker: Today’s Stock Price: Date: Up/Down: ( %) YTD (Year to Date) Trend: x y ^FTSE 51

TO DO: Continue to fll out Janella’s Monthly Budget document on page 40. If you did not fnish during last week, be sure that all expenses are defned as either fxed, variable or occasional.

TIPS: • Be aware of the diference between Janella’s wants and her needs. You may not be able to meet all of Janella’s fnancial goals, so pick the ones you think are best and be ready to share why. Be creative!

52

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3

Use Janella’s Monthly Budget document to fll in monthly expenses. Use the notes Janella provided to determine the cost per month of each of her expenses. For expenses that Janella did not share the cost of, use Google or another search engine to look up aveage costs in her area.

PROJECT: Financial Planning for Janella

My Group Members: (See page 40 for Monthly Budget document)

You and your group will begin to make recommendations for Janella. How much should she budget for her fat rent? Should she purchase cable tv? How much should she budget for groceries? These are all recommendations you and your group will need to come up with and be prepared to present to Janella. During session #5, you and your group will present your budget recommendations for Janella to the cohort. Begin to think about how your group wants to present: poster board, PowerPoint, or just talking through the budget without any props. Next session, your group will be given time to put together and fnalize your presentation.

•

•

Today, you and your group will continue to work on Janella’s budget. As you continue to fll out her monthly budget, you and your group will begin to prepare your recommendations for her fnancial planning.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION PROJECT3 WORKSPACE 53

What went well today? What did you LIKE about today’s session? List three “glows” below:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 GLOWS AND GROWS GLOWS

54

GROWS321

What can be improved on for the next session? What terms or ideas do we need to spend additional time on? List three “grows” below: 123

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 REMINDERS FOR NEXT SESSION The next RTSWS session is… Date: ___________________________________________ Time: __________________________ Before the next session… 55 Don’t forget to check out the bonus section for additional key terms, bonus articles and challenge activities.

But unlike saving, you can’t be sure of what you’ll earn. So if you’re thinking about investing, it’s important to learn the basics and work out whether it’s right for you. This simple guide covers the main types of investments, what you can expect and some rules to remember.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 BONUS56 SESSION 3 BONUS

Investing has the potential to generate a better return than a savings account. While your money’s not locked away, you should be prepared to set it aside for at least 5 years to give it the best chance to grow. And keep in mind the value of any investment can jump around so you could get back less than you put in.

What can you invest in? Well, from the more common types of investments – such as gold, property or shares, to the more specialist – such as art, wine or cryptocurrencies, the answer is almost anything.

Investing means setting some of your money aside for the future and putting it to work for you. When you invest, you’re buying into something you believe will increase in value over time.

The great thing about funds is you’re not putting all your eggs into one basket. Instead, your money goes into a range of investments. This is known as diversifcation and it can be an efective method for spreading your risk. That’s because if some of the investments in the fund perform badly over a certain period, others may perform well.

Although savings rates are starting to go up, they don’t match infation. That’s why many people choose investing to help them plan for the future.

ARTICLE “Investing for Beginners” HSBC UK https://www.hsbc.co.uk/wealth/articles/beginners-guide-to-investing/

What is investing?

Instead of overwhelming you with the entire investment universe, let’s focus on 2 well-known ways to invest: funds and shares. What are funds? Funds are a ready-made basket of investments. When you invest in funds, you’re buying into a mix of assets, which may include shares, property, government bonds and cash. Funds save you from trying to pick individual investments that you think will perform best.

An active or multi-asset fund is run by a professional fund manager who chooses which shares, bonds or other assets to hold and monitors them on your behalf. You pay extra for the fund expertise with the aim of receiving returns which outperform the market A passive fund or index fund simply follows or tracks a given market or index. As there is no active involvement from the fund manager, passive funds generally charge less in fees

If the company performs well or is expected to perform well demand for its shares will generally increase, pushing its share price up. If the company does - or is expected to do - badly, its share price will generally drop. Interest rates and the wider economy can also have an impact on share prices.

As a shareholder, the value of your investment rises and falls with the share price. So while the money you invest has the potential to grow, it could also fall in value so you may get back less than you invest. What do you want from an investment?

•

There are 2 main ways you might make money from an investment: via growth - also known as ‘accumulation’ - or via an income. If you’re considering funds, this means choosing between an accumulation or income fund: • With an accumulation fund, the income generated is reinvested within the fund, meaning your investment would be more likely to grow in value over time • With an income fund, any income the fund generates will be paid directly to you

•

There are 2 main types of funds:

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 3 BONUS 57

manager’s

Funds vary in risk from ‘cautious’ funds at the lower-risk end of the scale to ‘adventurous’ at the higher-risk end. If you’re younger, you may have more time on your side to ride out any turbulence so you might want to consider a more adventurous fund.

As you get closer to retirement, your investments could have less time to recover from any dips so a more conservative fund may be more appropriate. What are shares? Shares are units of ownership in a company. When you buy shares, you’re efectively buying a small stake in a company. Companies sell shares to raise money, which they then use to expand their business. Investors, known as shareholders, are then free to buy and sell some or all of those shares on the stock market at any time.

Investing for growth could be good if you‘re able to invest over a longer period, as accumulation

5. Start as early as you can so your money will have more time to grow.

To fgure this out, start by asking yourself a few questions.

Takeaway investing tips for beginners

1. Investing is for the long term – ideally for 5 years or more. 2. The higher the potential rewards, the higher the risk of losses. 3. You don’t need to pick your own stocks many frst-timers start investing in funds 4. Diversifcation can lessen the impact of one investment performing badly.

Keep in mind, investing in shares can take a lot of research and you’d need to hold a balance of diferent stocks to mitigate the risk of losing money with one particular company. Is investing right for you?

Investing is for the long term

If you’re considering shares, you also need to decide whether you’re investing with the aim of achieving either growth or income.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM 58 GREEN STUDENT UK SESSION 3 BONUS

funds may provide you with greater returns in the long term.

The reward,higherthehigherrisk InvestfundsinDiversifyfunds Start early

Whereas investing for income could be a good shorter-term strategy if you’re nearing or in retirement. By choosing funds that pay dividends, you could receive regular payments to boost your existing income or pension.

TAKEAWAY INVESTING TIPS FOR BEGINNERS

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM 59GREEN UK STUDENT SESSION 3 BONUS JAN - APRIL 2023

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 Welcome to RTSWS Session #4! • Be sure you have a pen, pencil or writing utensil • Grab a snack • Get ready to share your name, grade and favorite beverage RTSWS COHORT NORMS Let’s review our RTSWS cohort norms. These are the expectations for our RTSWS sessions that we set during session #1. Norms: The behavioral expectations or rules of the class. Class norms inform us how we are expected to behave towards each other and the materials we use. • Come prepared to be a part of RTSWS with your handbook, a writing utensil and a positive attitude. • Be kind and encourage one another - we are all in this together! • Ask questions, share your opinions and let the volunteers know when you do not understand something. • _________________________________________________________________________________________________________________________________________________________________________ • _____________________________________________________________________________________ 60

61

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 LET’S GET STARTED! Today’s Guiding Questions: How does a person’s risk tolerance impact their investment decisions? How are interest rates calculated and what are the diferences between simple interest and compound interest? How does stock market volatility impact investors’ decisions and their investments? SESSION #4 AGENDA: 1. Welcome 2. Attendance 3. Norms 4. Review Agenda 5. What is Risk Tolerance and Why is it Important? 6. Stock Market Review 7. Project Work Time: Financial Planning for Janella 8. Whole Group Refection 9. Reminders for Next Session Think About It!

Janella’s younger sister, Julia, recently received some money on her birthday. She wants advice about the best way to have her money work for her. She wants to pick the best way for her to make more money. Her friend told her, “Buy a scratchcard. It may be a longshot, but you don’t have to spend much and you could become a millionaire.” Her grandmother said, “Hide it in a safe place in the house so you’ll always have it on hand for emergencies.”

Have you ever heard the phrase, “have your money work for you.”

Think About It!

(Continued)

Her cousin advised her to, “Buy stock in a technology company. Tech companies are always in the Janellanews.”told her, “Put it in a savings account. It’ll earn compound interest over time, so you’ll have more than what you started with.”

1. Who gave the best advice? Why?

Risk Tolerance:

Investment Risk:

62

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4

The amount of risk that an investor is comfortable taking or the degree of uncertainty that an investor is able to handle.

KEY TERMS

The chance of losing all or part of the value of an investment.

Let’s discuss a few new key terms and determine how they may impact Julia’s decision for having her money work for her.

2. Who gave the riskiest advice? Why?

An individuals’ risk tolerance is based on a number of factors including age, fnancial stability and amount of time before invested funds are needed for other purposes.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4

Example: If you borrow £1,000 (Principal) with 10% interest annually, the interest owed will be £100 (£1,000 x 10% or .10 = £100). If you’ve paid nothing on the loan after one year you will owe £1,100.

Interest:

Simple Interest

63 KEY TERMS

The cost of borrowing money. In other words, you are paying a certain amount for the use of borrowing money. Interest is expressed as a rate, such as 3%. When you lend or invest money, a higher interest rate is better because it means you earn more. When you borrow money, a lower interest rate is better because it means you pay less.

A set rate on the original amount lent to the borrower. The borrower will have to pay this interest.

SIMPLE INTEREST PRACTICE PROBLEM

Find the simple interest and the total amount owed after 2 years.

Principal = £ 2,100 Annual rate of interest = 11% Interest per year = ____________

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4

COMPOUND INTEREST PRACTICE PROBLEM

Find the compound interest and the total amount owed back after two years.

In which example, simple interest or compound interest do you owe more?

Example: If you borrow £1,000 (principal) with 10% interest compounded annually, you’d have £100 (£1,000 x 10% or .10 = £100) in interest in the 1st year. If you’ve paid nothing after 1 year, you will owe £1,100. But, after the 2nd year you will owe £1,210 (£1,210 = £1,100 x 0.10 or 10%) because now you have to pay 10% of £1,100 instead of just the principal of £1,100.

Principal = £ 2,100 Annual rate of interest = 11% Interest in 1st year = ____________ Total amount after 1st year = Total interest in 2nd year = ________________ Total amount owed after 2 years = ______________

64

Total interest (2 years) = Total amount owed after 2 years = ______________

Compound Interest

Interest on both the principal (starting amount) and the interest paid on that loan.

Black, Latino neighborhoods,

In 25 Years, the Pay Gap Has Shrunk by Just 8 Cents. Why does the gender wage gap still exist? And what can be done to close it? We unpack the issue. Francesca Donner and Emma Goldberg. 3/25/21 www.nytimes.com/2021/03/24/us/equal-pay-day-explainer.html 9 Strategies For Narrowing The Gender Pay Gap In 2021. Margaret Wack | 3/7/21 | www.moneyunder30.com/strategies-for-narrowing-the-gender-pay-gap July 2020 www.clevergirlfinance.com/blog/racial-wealth-gap/ By Calazans April 2021 www.thenation.com/article/economy/race-debt/ Bola Sokunbi | Feb 2021 | www.clevergirlfinance.com/blog/financial-well-being-for-women-of-color in report finds. Erik Ortiz. June 29, 2020. www.nbcnews.com/news/us-news/student-debt-crisis-creates-vicious-cycle-inequality-black-latino-neighborhoods-n1232388

CornerEquity Corner

Rock The Street, Wall Street strongly believes in the importance of closing the gender and racial gap in the field of finance. Understanding and acknowledging the issue is the first step to solving the problem. Take some time to read through these articles we recommend on the gender pay gap, the racial wealth gap and the importance of financial security as a woman of color. We encourage you to educate yourself and take steps towards solving this problem!

Gender Gap

Equity

Want to Fix the Racial Wealth Gap? Start

Canceling Student Debt. Sabrina

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM

Racial Wealth Gap Articles The Racial Wealth Gap And How You Can Change It. Nicole |

General/Extra Why Your Financial Well-Being As A Woman of Color Is Critical.

Articles Equity

GREEN UK STUDENT SESSION 4 65

|

Student debt crisis creates a 'vicious cycle' of inequality

Wage

|

|

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 INDIVIDUAL STOCK REVIEW Company: Apple Ticker: Today’s Stock Price: Date: Up/Down: ( %) 12 Month Trend: x y STOCK MARKET REVIEW & YAHOO! FINANCE Review last week’s key terms: FTSE 100 An index that tracks the stock price movements of the 100 largest UK publicly traded companies. The FTSE is one of the most watched and most important stock market indexes within the UK. 66

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 FTSE Company100 : ^FTSE Today’s Stock Price: Date: Up/Down: ( %) 12 Month Trend: x y 67

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM SCAN THE QR CODE TO JOIN!

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4

The frequency and magnitude of stock price movements or whole market movements, up or down. The bigger and more frequent the price swings, the more volatile the market is said to be.

NEW INVESTMENT KEY TERMS 69

Volatility

In discussing how the stock market is performing, we might describe how volatile the market is… Stock Market

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 PROJECT: Financial Planning for Janella My Group Members: TO DO:

Extra Time? Review the article “Risk Tolerance, Risk Capacity, and Risk Alignment: How to Take On The Right Level of Risk” By Marguerita M Cheng in the session 4 bonus materials. Today, you and your group will fnalize your decisions for Janella’s budget and prepare to present your recommendations for her fnancial planning.

FINALIZE your fnancial recommendations for Janella. Use the Financial Planning Presentation Chart on the next page to start putting together your presentation for next session. During the next session, you and your group will present your budget recommendations for Janella to the cohort. PLAN and ORGANIZE how you will present to the group. You may choose to make a poster, PowerPoint, or just prepare to talk through the budget without a visual aid.

FINALIZE Janella’s Monthly Budget document on page 40. Use the notes Janella to determine the cost per month of each of her expenses. For expenses that Janella did not share the cost of, you can use Google or another search engine to look up average costs in her area.

70

provided

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 71 Group Members:

What do you believe is the most important recommendation that you will present to Janella today? Other presentation pieces?

What are Janella’s main sources of income? What were the main decisions your group made in regards to Janella’s budget? What are Janella’s largest expenses? Were there any expenses Janella has that you are recommending she cut out? What was the hardest part of completing Janella’s budget?

Financial Planning Presentation Chart:

Why is money called dough? Because we all knead it.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 WHOLE GROUP REFLECTION What is something new that you learned today? REMINDERS FOR NEXT SESSION The next RTSWS session is… Date: ___________________________________________ Time: __________________________ Before the next session… 72 COMING SOON: RTSWS FIELD TRIP

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 73 Check out the bonus section for additional key terms, bonus articles and challenge activities. REMINDER! One top score from each cohort will receive a £25 gift card prize! POST-ASSESSMENTNEXTSESSION DON’T FORGET TO STUDY THE KEY GLOSSARYTERMS ON THE UPCOMING PAGES

Bonus Key Term: Bull Market

A market in which prices continually fall. Bear markets are times when the outlook seems bleak for a company, an industry, or the overall economy. Traders and investors are less willing to buy stocks, and many are looking to sell. This causes prices to fall.

A market condition where stock prices are continually rising. Bull markets are characterized by optimism and excitement from traders and investors. Bear Market

Bull Market • Rising Market • Positive Investor Response • Strong Economy • Low Unemployment • High Stock Prices • High Consumer Spending • High Profts Bear Market • Declining Market • Negative Investor Response • Weak Economy • High Unemployment • Low Stock Price • Less Consumer Spending • Low Profts More on Risk Tolerance: Risk Tolerance Quiz Learn more about your own investment risk tolerance with The Motley Fool’s Risk Tolerance Quiz: Find the quiz (dated May 21, 2017) via Google search for “motley fool risk tolerance quiz.” https://www.fool.com/retirement/2017/05/21/whats-your-investment-style-take-this-risk-toleran.aspx

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 BONUS74 SESSION 4 BONUS

When uncertain economic situations arise, such as the COVID-19 pandemic, they send fear into investors’ hearts, especially those close to or who are in retirement. The risk of losing their money stares them in the face, and they wonder what the right step to take is.

GREEN UK STUDENT WORKBOOK | WWW.ROCKTHESTREETWALLSTREET.COM GREEN UK STUDENT SESSION 4 BONUS 75

https://www.thestreet.com/retirement-daily/your-money/risk-tolerance-risk-capacity-and-risk-alignment-how-to-take-onthe-right-level-of-risk

Risk Tolerance, Risk Capacity, and Risk Alignment: How to Take On The Right Level of Risk

In such situations, investors tend to make bad decisions, informed by the present uncertainty rather than by their fnancial plan. Benjamin Graham, the father of value investing, said, “Individuals who cannot master their emotions are ill-suited to proft from the investment process.” Charlie Munger, vice chairman of Berkshire Hathaway, puts it this way: “A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. You need to keep raw, irrational emotion under control.”

One way to avoid such situations is for investors to defne their risk profle and construct their fnancial plans according to their risk profle. To do this, they need to understand risk tolerance, risk capacity and how to achieve risk alignment.

By Marguerita M Cheng, The Street (April 2, 2021)

Diversifcation, Investment Portfolio and Risk