Tax Flash

Amendment of the Tax Calendar for the Filing of the Income Tax Return Decree No. 520 of April 6th,2020. Through Decree No. 520 the Ministry of Finance amended the dates for the filing and payments of the income tax return for large and ordinary taxpayers, as well as the return of foreign assets, in the following terms: 1.

Income Tax A.

Large Taxpayers

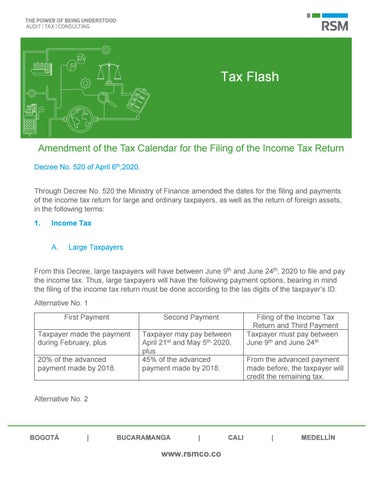

From this Decree, large taxpayers will have between June 9th and June 24th, 2020 to file and pay the income tax. Thus, large taxpayers will have the following payment options, bearing in mind the filing of the income tax return must be done according to the las digits of the taxpayer’s ID. Alternative No. 1 First Payment

Second Payment

Taxpayer made the payment during February, plus 20% of the advanced payment made by 2018.

Taxpayer may pay between April 21st and May 5th, 2020, plus 45% of the advanced payment made by 2018.

Filing of the Income Tax Return and Third Payment Taxpayer must pay between June 9th and June 24th From the advanced payment made before, the taxpayer will credit the remaining tax.

Alternative No. 2

BOGOTÁ

|

BUCARAMANGA

|

www.rsmco.co

CALI

|

MEDELLÍN