IMPACT RE PORT 2024

Letter from Our President

We are pleased to present the 2024 Jonathan Rose Companies Impact Report. This year's report highlights the development of our impact management systems to advance our delivery of positive outcomes for our residents, employees, communities, and the environment. This report showcases case studies and management practices that reflect our ongoing efforts to enhance the well-being of those we serve and reduce the negative impacts of real estate development and operation on the environment. The stories in this report are just a few examples of the exceptional work carried out by our mission-driven team across the nation. The performance data in this report is from the fiscal year ending December 31, 2023. We also highlight key impactful activities and progress throughout 2024.

In 2023, we fully committed the Rose Affordable Housing Preservation Fund V, preserving a total of 4,475 affordable housing units, of which 81 percent are restricted to households earning less than 80 percent of area median income. This brought our companywide total to 19,000 owned units. These affordable housing preservation funds have shown how private, mission-focused equity can help address the affordable housing crisis: preserving safe, affordable homes for some of those who need them most.

To determine where best to invest, we conducted a comprehensive analysis of every major market and MSA in the country. This deep dive allowed us to evaluate the nation for economic, demographic, social, and climate trends, opportunities, and risks. As a result, we identified a set of 19 markets that we believe offer strong opportunities for long-term economic, social, and environmental resilience and have the resources and characteristics that align with our mission to build and preserve affordable housing.

In collaboration with Tideline, respected impact investing consultants, we refined our impact management system. This engagement led to updates in our impact framework and the strengthening of our tools and processes. Additionally, we completed our first public response to the UN PRI and, in early 2024, became signatories to the Operating Principles for Impact Management. Along with our long-standing participation in GRESB, these commitments demonstrate our dedication to transparency and accountability in our impact practices.

2024 has been a year of continued strengthening for Jonathan Rose Companies. One of the most significant changes is the transition of our in-house property management function to trusted third-party managers. This strategic decision has allowed us to focus on our role as a real estate owner and leverage our investment and impact leadership more consistently across our entire platform, regardless of the operator. This approach enables us to remain laser-focused on driving innovation, sustainability, and quality across our portfolio.

Furthermore, the growth of our general contracting business, Rose Community Builders, has brought increased cost savings, efficiency, and expertise to our value-add retrofit projects. This expansion enables us to enhance the environmental sustainability and resilience of our properties, ensuring they meet our goals for quality and performance while delivering on our commitment to enhance the sustainability of our portfolio.

Each year plants the seeds for the next year's work, but it is also essential to step back and reflect on the year's harvest. I hope you find the following report on the fruits of our labor as fulfilling and inspiring as we do. Thank you for your continued support and engagement with Jonathan Rose Companies.

With best wishes,

Jonathan F. P. Rose

Company Overview

Jonathan Rose Companies is one of the country’s leading owners, developers, and operators of green, affordable, and mixed-income communities. Founded in 1989, with a mission to create a more environmentally thriving, socially just world through the development, preservation, renovation and ownership of green, affordable and mixed-income communities, Rose has created projects with more than $5 billion of value with a current portfolio of over 19,000 apartment homes in 14 states and Washington, D.C. The Firm is a fully integrated investment management, development, and asset management company with construction management, solar energy, mortgage finance, and title company affiliates.

Since our founding, we have focused on creating duplicatable model projects that integrate environmental and social responsibility with economic performance.

In this time of increasing income inequality and environmental degradation, we recognize that these issues have been created, in part, by an economic system that has not taken into account its full impacts. In response, we have been leaders in creating impact-oriented real estate investment vehicles, and developing our own impact management system to drive our work toward whole systems benefits.

We strive to achieve positive environmental impact by investing in energy efficiency, decarbonization, and water conservation to reduce our use of natural resources and toxins.

Our social impact is achieved by preserving and expanding housing affordability, and connecting our residents to health, education, financial, cultural, and social services. And we aim to achieve these impacts in a co-creative process with governments, our residents, and staff.

We have also been thoughtful about where we work—we start by selecting communities that we believe have characteristics of environmental, social, and economic resilience, and seek transit accessible and resource rich locations within them. We also aim to work in communities that have a strong demand for housing, and have made significant commitments to support affordable and environmental solutions.

There is now quite strong evidence that the zip code one grows up in significantly shapes one’s life outcome. Much affordable housing has been in lower opportunity neighborhoods. Our Community of Opportunity initiative seeks to overcome this, by enriching our communities with lower energy costs, healthier environments, and by co-creating social, educational, cultural, and financial programs with our residents.

We call this combination of affordability, housing quality, social services, and environmental impact a Rose Community. We invite you to join us in this work.

Our mission is

to create a more environmentally thriving, socially just world through the development, preservation, renovation, and management of green, affordable, and mixed-income housing.

17,000+ Affordable Units Our Portfolio 1

$5 billion Invested in Acquisitions and Development 2

19,000+ Residential Units Across 14 States and D.C.

100+ Properties

100+ Employees 5 Offices Across the U.S.A.

Impact Strategy

We envision a world where every community is a thriving landscape of opportunity, in balance with nature, contributing to the common good, and enabling its residents and staff to lead healthy, fulfilling lives.

Impact Strategy

Our business strategy is designed to deliver social and environmental impact as well as competitive, risk-adjusted market returns in our asset class.

We buy and build affordable and mixed-income housing and connect each property with health, education, cultural, and social services so that residents can become empowered partners in their communities, improving economic and social outcomes. We also invest in the energy efficiency, decarbonization, water conservation, and resilience of our buildings to lessen our demand for natural resources, in turn mitigating climate change, reducing our operating costs, and improving the health and safety of our residents. These strategies provide economic resilience and add value to our properties, strengthening our financial returns and allowing us to ultimately deploy more capital to achieve even deeper impact.

To optimize our impact, we use a model of co-creation that is rooted in data and draws upon the input and expertise of an interdisciplinary team of internal stakeholders across business practices, as well as external stakeholders including residents, financing partners, regulatory agencies, nonprofits, and consultants. Each member is responsible for viewing our projects through an impact lens and coming together to deliver a collective, cohesive, and impactful vision.

We actively focus our investments in economically resilient markets and, when possible, aim to acquire properties and locate new development projects in areas with limited exposure to current and future climate hazards. Our investment strategy applies basic real estate principles to increase value, while taking advantage of our competitive position in the market and our sophisticated partnership and debt structures to add value. We invest for impact not only because it’s the right thing to do, but because it is an essential tool in our investment strategy: helping to increase available capital, enhance revenue stability, lower operating costs, and reduce long-term exposure to risk.

As the impact investing landscape rapidly transforms, we will continue to adapt our strategy and lead the way in making greener, healthier, and more resilient communities. We carefully consider the sources of the materials with which we build, our methods of construction and the ways that we heat, cool, and operate our buildings. We also aim to partner more closely with the healthcare sector on housing, and to implement innovative ways to care for humans and nature, enhancing all of life.

Affordability Strategy

THE CHALLENGE

Across the United States, rents are escalating at an unsustainable pace. In 2021, 20.1 million renter-occupied households were cost burdened, which the Department of Housing and Urban Development (HUD) defines as households that spend more than 30% of gross income on rent.1 This represents an increase of 1 million households since 2019, leaving renters with less income to spend on other necessities such as food, transportation, and healthcare and more vulnerable to eviction.1

The affordability challenge is compounded by the lack of supply. For extremely low-income renters, those whose incomes are at or below 30% of Area Medan Income, there is an estimated shortage of 7.3 million affordable housing units.2 Moreover, low-cost rental units are being lost to market-rate conversions and demolition for new construction.

The affordable housing crisis disproportionally impacts BIPOC communities. Black, Latino, and Native and Alaska Native households are more than twice as likely as white households to be extremely low-income renters.2 These disparities have only become more prominent in the wake of climate change where the effects of extreme weather events have been exacerbated across low-income communities.

Our Approach

For over 30 years, tackling the affordable housing crisis has been core to our business. Our approach revolves around acquiring, developing, and preserving low-income housing across the country. Our affordability strategy consists of three mechanisms of change:

ACQUISITIONS

We buy existing affordable housing units to ensure that the housing stock remains affordable for residents predominately earning 30-80% of AMI. We also create new affordable housing units by voluntarily placing income restrictions on naturally occurring affordable housing.

ACQUISITION-REHAB

We leverage 4% and 9% Low Income Housing Tax Credits to rehabilitate existing affordable housing properties, improving the conditions of the asset to make the communities affordable for the long term.

DEVELOPMENT

We deliver new units of affordable housing through ground-up development. We add critical supply in major markets around the country where demand for affordable housing is the greatest.

Affordable Housing Typologies

Affordable rental housing is broadly defined by the U.S. Department of Housing and Urban Development (HUD) as housing where resident-paid rents are no more than 30% of a household’s gross income. At Rose, we most commonly see three types of affordable housing:

RENT SUBSIDIZED HOUSING

HUD provides rental subsidy through Section 8 Housing Assistance Payment (HAP) contracts. Eligible tenants pay up to 30% of their monthly income toward rents, and HUD pays the owner the difference between the tenant’s payment and the contract rent. Rental subsidies can be either tenant-based (via Housing Choice Vouchers that follow a tenant if they choose to move), or project-based (tied to the real estate and will remain at the property even if a tenant vacates).

RENT RESTRICTED HOUSING

This primarily refers to the federal Low-Income Housing Tax Credit (LIHTC) program, which is administered by state housing finance agencies that allocate a stream of tax credits to developers, who then sell the tax credits to a tax credit investor. Properties are encumbered for at least 30 years by deed restrictions that limit allowable rents to 30% of the household income of renters earning no more than 60% of Area Median Income.

NATURALLY OCCURRING AFFORDABLE HOUSING (“NOAH”)

NOAH refers to properties that are not subsidized or restricted by any government program. These properties are “naturally affordable” due to their age, location, and condition and are also referred to as Workforce Housing. Rose has worked on a case-by-case basis to devise structures with local governments, housing agencies, and mission-driven third parties to create new affordable housing deed restrictions in exchange for low-cost financing or tax relief.

Our Affordability Composition

Our portfolio predominately comprises rent subsidized, rent restricted, and NOAH units. We also own several mixed-income properties and properties subject to additional state and local programs that seek to create and preserve affordable housing.

62%, or over 11,000 units in our portfolio are rent subsidized through Section 8 HAP contracts. 1 HAP units are nominally restricted to households earning less than 80% AMI, however, in practice, serve deeply vulnerable populations – typically earning less than 30%-50% AMI.

An additional 25% are subject to rent restrictions. This number includes NOAH units on which Rose has voluntarily placed rental restrictions. Only 2,470 units, or about 13% of units in our portfolio are available to rent at market rates and require no income qualifications (Figure 1).

Portfolio Affordability Breakdown

Target Market Selection

Our organization conducted an extensive analysis to refine geographic focus areas (“target markets”) for investment over the next decade. Market resilience was central to our interdisciplinary approach to research and selection. With so many economic, environmental, and political factors influencing affordable housing investment, we were determined to develop an evidence-based, holistic framework to guide us.

We began with an analysis of financial, economic, and demographic indicators of market condition across 390 Metropolitan Statistical Areas (MSAs) in the U.S. Scoring all markets using a dataset of MSA-level Census variables and CoStar forecasts enabled us to narrow down 390 MSAs to just 28 markets with strong economic fundamentals. Population growth, rent increases, a constrained housing supply, and employment growth exemplify the type of economic indicators we looked for in the initial screen.

Subsequent research focused on the interaction of risk and opportunities posed by local housing policies, environmental policies, insurance costs, and climate hazards in each potential target market. For example, green building performance standards in cities with strong green incentive programs increase opportunity for strategic investments that both preserve and decarbonize affordable housing. Meanwhile, green building performance standards in cities with very little or no incentives available to support greening can increase operating costs and threaten our ability to preserve affordable rents.

Ultimately, company leaders gathered for a series of market discussions informed by the results of our interdisciplinary research. Through this comprehensive process, we identified and selected our new set of 19 target markets, reinforcing our commitment to impactful, evidence-driven investing.

We use a proprietary local intelligence tool called MapDash to research and inform our investment locations. This map highlights our 19 selected target markets.

Impact Management System

We have developed an Impact Management System (IMS) which organizes the commitments, plans, implementation, monitoring, and evaluation strategies into an implementation framework that guides our impact delivery process and improves outcomes for our communities, company, and investors. Our impact management begins with our deep commitment to enhancing social well-being and improving our ecological footprint, which we define through a multi-stakeholder strategic intent and goal-setting process. We set portfolio-wide targets for our company, investments, and investment funds that establish guidelines for housing affordability, social impact, environmental goals, and governance priorities. We commit to both what we will do and how we do it by underpinning our impact delivery strategies in established third-party frameworks. Our IMS is aligned with the Operating Principles for Impact Management, to which we became a signatory in early 2024, and its embedded environmental management system is aligned with the ISO 14001 protocol.

PLAN

We tailor impact plans for each investment, using a data-driven, co-creation model. Our interdisciplinary team includes members of acquisitions, construction, asset management, and impact professionals who leverage third-party technical consultants, tools, site visits, resident engagement, and deep experience to evaluate properties and development opportunities that optimize for impact and financial returns.

IMPLEMENT

We bring the impact plan to life through physical and operational changes upon acquisition and development. We renovate properties to deliver spaces to improve housing quality, facilitate social programming, and achieve the environmental goals of the project. We also train and empower site staff to deliver the social and environmental mission in day-to-day operations by hiring impact-dedicated staff like Resident Services Coordinators and establishing policies and procedures to meet our health, safety, and environmental standards.

MONITOR

Impact is continuously tracked, measured, and reported. We use a survey platform to gather data about implementation of social programming at sites and a utility monitoring platform to track environmental performance. We also use collect qualitative information from our network of service providers and property managers to monitor progress and challenges and collect best practices. The data is assessed by the impact team and communicated internally to asset managers and executives and externally through quarterly reports and our yearly Impact Report. Impact professionals identify issues and opportunities and work collectively with asset and property management to address them.

EVALUATE

To achieve continuous improvement, deepen impact and deliver results more efficiently, we assess performance against the impact plan and goals on a periodic basis. Quarterly meetings and annual business plan reviews provide forums for updates on impact delivery, sharing of lessons learned, and executive-level feedback on strategic initiatives. We aim to achieve impact at exit through responsible disposition and by sharing our learnings with the broader industry.

IMPACT MANAGEMENT SYSTEM FRAMEWORK

Review and improve impact decisions and processes based on achievements and lessons learned. Continuously improve in subsequent investments and commitments.

MONITOR

Track, measure, and report impact and financial performance. Communicate progress to all parties and make adjustments as appropriate.

EVALUATE PLAN

Evaluate opportunities using proprietary and third-party assessment tools and co-create impact plans to achieve desired goals.

IMPLEMENT

Make physical changes through construction and train staff and service coordinators to implement operational vision.

PLAN

• Impact Opportunity Score

• Site Inspections & Due Diligence

• Energy Audits

• Green Certification Feasibility

• Resident Engagement & Surveys

• Scope Development

IMPACT MANAGEMENT TOOLS + STRATEGIES

IMPLEMENT

• Renovations and Retrofits

• Communities of Opportunity Toolkit

• Resident Services Coordinators

• Green Operations

• Clean Energy Procurement

MONITOR

• Utility Tracking and Real-Time Monitoring

• Web-based Service Coordinator Software

• Internal & External Reporting

• Annual Impact Report

EVALUATE

• GRESB Survey

• Impact at Exit Memos

• Lessons Learned Meetings

• Impact Management Committee Reviews

Partnering for Impact

We have long worked to achieve a variety of material social and environmental objectives through our investment in the affordable housing sector. Though we operate only in the United States, we recognize our position as a member of the global community as well as the global nature of the climate change crisis. To understand our contribution to global goals, we have mapped our actions and investments against the United Nations’ Sustainable Development Goals (SDGs), a set of 17 goals to promote social, economic, and sustainable development worldwide. As part of Jonathan Rose Companies’ commitment to creating tangible, and scalable impact that extends beyond the communities where we operate, we have identified six that are materially relevant to our organization. Importantly, Goal 17 relates to partnership and the promotion and sharing of knowledge, lessons, and impact. We are proud of the many partnerships and strategic relationships we engage in to set public commitments, share best practices, learn from peers, and report and promote our impact achievements. Several of our key impact partnerships are listed below:

In 2024, Jonathan Rose Companies became an official signatory to the Operating Principles for Impact Management, a framework to incorporate impact considerations throughout the investment lifecycle. With support from Tideline, Rose updated our impact management system to align with the Principles.

In 2023, Jonathan Rose Companies submitted its first voluntary disclosure to the Principles for Responsible Investment, a framework developed by the United Nations to help institutional investors integrate material ESG considerations. These Principles support our impact investment strategy and our broader goal of fostering thriving communities. Our 2024 disclosure will become publicly available upon completion.

Sustainable Development Goals Supporting Our Impact Strategy 1

Promote healthy living at all Jonathan Rose Companies properties.

• Provide all residents with education on safety, nutrition, and healthcare through the Communities of Opportunity program

• Provide fitness facilities and organize exercise programming such as yoga, walking, and dance

• Facilitate on-site health screenings and exam space

• Improve indoor air quality with ventilation and healthy building materials

Procure green power for all properties, when feasible, and reduce energy demand through efficiency and conservation.

• Reduce energy consumption through conservation measures

• Install solar panels and other renewable sources of energy on-site

• Purchase renewable energy credits to offset energy usage

Provide safe and affordable housing, access to safe and inclusive green spaces, and reduce the adverse environmental impacts of cities.

Minimize negative environmental impacts by reducing waste through recycling and implementing sustainable procurement practices.

Reduce energy, emissions, and water intensity at all properties and strengthen resilience against future climate impacts.

• Preserve affordable housing for the long term

• Acquire and develop properties with appropriate urban density

• Support public policy that improves environmental conditions locally

• Design green and open space to facilitate access to nature

• Reduce waste generation through responsible procurement and operations, including a shared community goods library

• Implement and optimize recycling and compost programs

• Select products with minimal use of toxic chemicals and facilitate responsible disposal of hazardous materials

• Set goals to achieve energy, water, and emissions savings and implement strategies and plans to achieve them

• Reduce site-level fossil fuel consumption by implementing electrification and on-site renewable generation

• Assess current and future climate risk at all properties and implement strategies to improve resilience

Encourage and promote public, public-private, and civil society partnerships to build strategic relationships and expand reach.

• Partner with local and national agencies to enhance the affordable housing market

• Engage local and national partners that align with our social and environmental mission

• Increase social and civic engagement of employees and staff through voter registration

Integrated Impact in Action: Sendero Verde

Jonathan Rose Companies partnered with L+M Development Partners and Acacia Network to create Sendero Verde, the world’s largest Passive House-certified affordable housing project. This 709-unit, fully affordable development in East Harlem embodies our commitment to transforming communities by combining environmental and social impact. Sendero Verde reduces energy consumption by nearly 58% compared to typical NYC multifamily buildings, aligning with New York’s climate goals while providing safe, affordable homes that also support residents’ health and well-being.

Sendero Verde is a physical embodiment of our Communities of Opportunity program, which extends beyond simply providing housing and aims to create a more environmentally thriving, socially just world. By partnering with Harlem Children’s Zone, Union Settlement, and Promesa Inc., we’ve infused over 85,000 square feet of community space with resources including a charter elementary school, arts programming, and health services. The site’s robust social services program supports formerly unhoused residents with housing specialists, mental health services, and arts and culture programming. Additional amenities, including community gardens, a public courtyard, local art, and neighborhood-serving retail, strengthen Sendero Verde as a social and cultural center that reflects East Harlem’s vibrant heritage.

Sendero Verde represents our vision for urban development that fosters equity, resilience, and sustainability. This project is a testament to the potential of affordable housing to transform communities by promoting environmental responsibility and enhancing quality of life for residents.

Sendero Verde provides housing opportunities for a broad spectrum of income levels, supporting residents formerly experiencing unhousing to those earning to those earning up to 110% of the Area Median Income (AMI).

SOCIAL FEATURES

AFFORDABLE HOUSING UNITS

709 FLOOR AREA

750,000 SF PUBLICLY ACCESSIBLE COURTYARD 20,000 SF

40 – 60 Years

COMMUNITY GARDENS

3 YEARS OF AFFORDABILITY

ENERGY SAVINGS1

58%

32.2 kBTU/SF

Social Impac t

Social Impact

Communities of Opportunity strive to connect our residents to opportunity by co-creating health, social services, education, and recreation programming alongside our residents and employees.

Our Rose Communities vision for social impact is to empower residents through the co-creation of programming and interventions, improving health and well-being and resulting in better life outcomes, with great housing communities as the platform.

We use an Asset Based Community Development model that encourages active community participation, empowering residents and achieving community-driven, sustainable solutions. Implementing Rose Communities Social Impact vision requires purposeful outreach and connection with residents and their networks. Each property will have its own culture, its own strengths, and its own wants and needs. Our approach encourages partnership and leadership from residents, collaborating to implement positive change and contributing to their neighborhoods.

Through the strategic development and implementation of our Rose Communities Social Impact program, we are working to restore social and racial equity in our communities through an integrated set of interventions, grouped into seven Social Impact focus areas:

• Housing Stability

• Economic Opportunity

• Health & Well-being

• Digital Connection

• Community Building

• Learning

• Food Security

Our CORES Certification (Certified Organization for Resident Engagement and Services) recognizes the robust and integrated approach we have adopted for the delivery of resident services. We are committed to achieving the highest standards for resident services, supporting resident health and well-being, and using data and performance metrics to measure our impact and inform the future direction of our programming.

Communities of Opportunity

Through our Communities of Opportunity program, we work to create a more socially just world by leveling the playing field of opportunity. This program engages residents across ten impact categories, driving interventions that address the Social Determinants of Health and promote well-being.

To support residents effectively, we employ an Asset-Based Community Development (ABCD) approach to design and implement our social programming and engagement strategies. ABCD is a sustainable, communitydriven model that empowers residents and fosters active participation in community development. Central to this approach is collaboration: we work closely with residents to identify their strengths and shared vision for their community. This understanding is deepened through ongoing engagement, community building, and regular surveying, ensuring that our efforts are guided by and responsive to residents’ needs and aspirations.

Community managers and resident services coordinators play a vital role by hosting events, leveraging external resources, and forming partnerships to bring services, support, and programming to our communities in alignment with our Communities of Opportunity Toolkit 2.0. These efforts are designed to improve residents’ lives, increase property stability, and provide scalable solutions across our portfolio and the affordable housing sector.

To monitor progress and drive action, we use Success Measures by NeighborWorks, a software tool that tracks social programs and engagement on a monthly basis. By the end of 2023, approximately two-thirds of our portfolio was actively tracking events in Success Measures. In 2024, our goal is to onboard the vast majority of properties to further enhance our tracking capabilities.

10,000+ Events Hosted1

1.05 million Pounds

108,000+ Event Participants

3,075 Health Events Hosted

13,580 Households Connected to Food Distribution

10 Categories of Impact

SAFETY

Ensuring that our residents feel safe and secure at home is key to improving their lives.

Practice: Vial of Life, scam prevention trainings, programming with police, disaster preparedness

COMMUNITY BUILDING AND RECREATION

Connecting residents with their neighbors creates a sense of connectedness and can contribute to overall well-being.

Practice: Back-to-school drives, Mommy and Me playgroups, music, art, and dance classes

FOOD SECURITY

Distributing free or discounted healthy food on campus helps reduce food insecurity and improve health and well-being for our residents.

Practice: Mobile food pantries, Meals on Wheels, community gardens, SNAP benefits

HEALTHY LIVING

Encouraging a healthy lifestyle can greatly improve residents’ physical and mental health.

Practice: Health screenings, health education, fitness groups and events, nutritional programs, mental health services

FINANCIAL SECURITY

Economic stability is essential in ensuring the long-term success of our residents.

Practice: Benefits assistance, tax preparation and preparedness, budgeting classes, couponing

LIFELONG LEARNING

Providing education support and technology to children and adults fosters a foundation for success.

Practice: ESL classes, GED test classes, computing classes

CIVIC ENGAGEMENT

The voice of our residents is extremely important in civic life, and participation can influence policies that may affect their daily life.

Practice: Voter registration, community cleanups, intergenerational volunteerism

GREEN EDUCATION

Building environmentally friendly properties can instill sustainable habits in the lives of our residents.

Practice: Recycling education, green cleaning supplies, Go Green Week

TRANSPORTATION

Access to safe and reliable public transportation can increase opportunities for our residents.

Practice: Schedules and routes displayed in lobbies, support with access to transport

COMMUNICATION, INFORMATION, AND TECHNOLOGY

Transparent and frequent communication between building staff and residents is vital to creating impactful communities.

Practice: Digital access, bulletin boards, Opportunity Walls, monthly calendar of events

Housing Stability Strategy

Rose is dedicated to ensuring safe and stable housing. Our strategy aims to prevent evictions and support residents facing financial difficulties and life disruptions that can jeopardize stability.

EDUCATION AND EARLY INTERVENTION

We provide financial literacy education, budgeting skills, and banking resources. Our teams proactively communicate with residents to identify and address financial issues early, offering reminders and support.

ASSISTANCE OPTIONS

We recommend local resources for financial counseling, job training, and food security. Resident Service Coordinators (RSCs) conduct benefits checks to ensure that residents receive all entitled government assistance. Community management helps with emergency rental assistance applications. Community partnerships bring support services to our properties, including wellness programs and healthy food deliveries that can ease economic burden at the end of the month.

FLEXIBLE RENT PAYMENTS

We offer flexible rent payment plans for residents experiencing temporary financial hardships, without excessive fees or penalties.

ESUSU MICROLOAN SUPPORT

Using the Esusu platform, we report on-time rental payments to credit agencies to help residents establish and boost credit scores. In times of financial hardship, residents can access 0% interest microloans up to $5,000. Our teams assist with loan applications.

62% OF AFFORDABLE UNITS SERVED BY RSCs

71 PROPERTIES WITH ESUSU OFFERED

$209,096 IN ESUSU RENT RELIEF

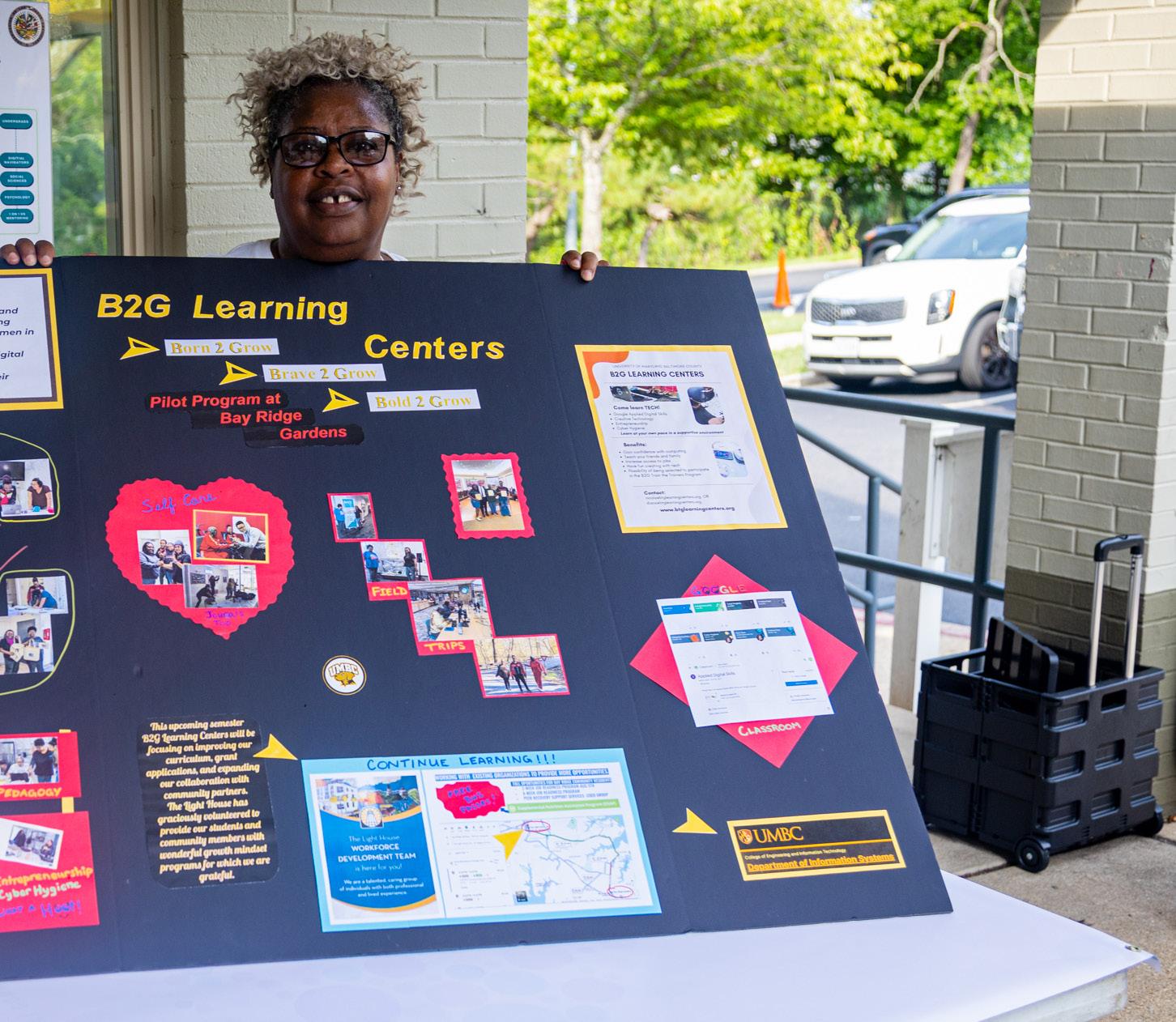

BAYRIDGE GARDENS - Annapolis, MD

Communities of Opportunity Tour

Our Communities of Opportunity program includes a combination of services, programs and physical spaces. Areas for residents to gather, socialize, access technology, and engage in physical activity all contribute to positive outcomes. A Resident Services Coordinator, Community Manager, and engaged resident population are helpful in activating the physical spaces. Below are the key physical design elements to support a full Communities of Opportunity program, which each property strives to incorporate as space, layout, and budget allow.

1

COMMUNITY ROOM

Each property should have a multipurpose community room where people can gather for social, health, and educational events, access high-speed internet, and where important information can be posted in a centralized location. This room is the hub of the community.

2

OUTSIDE/GREEN SPACE

Access to green spaces positively influences mental and physical health by connecting people with nature, but there is disparity in access along racial and socioeconomic lines in the United States. We strive to mitigate that disparity by bringing safe green outdoor space to all our developments.

FITNESS ROOM

4

LOBBY BULLETIN BOARDS/DIGITAL SCREENS

Bulletin boards and digital screens are used to share information about the larger community, advertise upcoming events, and share transportation information. 3

COMPUTER LAB

5

Physical activity improves overall well-being and reduces the risk of negative health outcomes. We provide a fitness room with equipment tailored to residents’ abilities and schedule regular health and fitness programming.

7

RESIDENT SERVICE COORDINATOR

A Resident Service Coordinator is employed to connect with community partners, connect residents with vocational and educational opportunities, and help with healthcare coordination. The coordinator also plans social programming and makes referrals.

Technology is an increasingly important part of life and is becoming necessary to complete schoolwork, pay bills, and access resources, yet many low-income residents do not have access to computers or the internet. We provide access to internet-connected computers and devices in computer labs and education spaces.

KITCHEN

In addition, using a kitchen for nutritional demos, cooking together and sharing a meal as a community is a great way to build bonds and increase social connectedness. 8

6

MEDICAL SCREENING ROOM

A common barrier to receiving medical care for many elderly or disabled individuals is mobility and access to transportation. A private medical screening room allows nurses, podiatrists, and other health experts to provide much-needed medical care on-site.

LIBRARY

Having a designated library can help improve literacy rates and allows educational material to be easily accessible. Jonathan Rose Companies encourages properties to stock libraries with culturally appropriate books. 9

Communities of Opportunity in Action: Telehealth Intervention Program for Seniors

The Telehealth Intervention Program for Seniors (TIPS), launched at Grace West Manor in Newark in 2019, has significantly advanced resident health and wellness, with demonstrated reductions in hospitalizations and fall rates, and improvements in self-reported health. Initially funded by Fannie Mae’s Sustainable Communities Innovation Challenge, TIPS offers free, accessible, on-site health screenings and tailored wraparound social services to support underserved residents, particularly those managing chronic conditions. Volunteer Resident Health Ambassadors promote the program and help tailor wraparound services to resident needs, fostering a "high-touch" health infrastructure that strengthens health engagement and community connection. A Health Economist from Columbia's Mailman School of Public Health assesses the program’s impact on health metrics such as hospitalizations and self-reported health.

Following success at Grace West, the program expanded to Village Center in Detroit through a “Scale What’s Working” grant from the Thome Aging Well Program in September 2023, replicating the TIPS’s model and Ambassador roles to ensure that it remains residentcentered. An initial “soft launch” event saw strong turnout, and since its formal launch in early 2024, TIPS has enrolled over half of Village Center's senior residents in weekly health screenings and services, such as mental health support, nutrition education, and exercise, which reduce isolation and encourage holistic health.

Residents at Village Center report improved trust and safety, with many feeling motivated to participate regularly. The expanded model has already demonstrated impacts, including reduced hospital visits, underscoring TIPS as a replicable program that improves health and strengthens community ties. As TIPS proves its effectiveness, we are seeking sustainable funding to expand this integrated health model to additional properties in our portfolio, enhancing residents’ quality of life across our affordable housing communities.

PLYMOUTH SQUARE - Detroit, MI

REDUCTION IN HOSPITALIZATIONS IN TIPS PARTICIPANTS COMPARED TO PRIOR TO TIPS ENROLLMENT1 50%

REDUCTION IN UNDER-30-DAY REHOSPITALIZATIONS RATES COMPARED TO PRIOR TIPS TO ENROLLMENT1 85%

REDUCTION IN THE NUMBER OF TIPS PARTICIPANTS EXPERIENCING FALLS1 100%

RESIDENTS ENROLLED IN TIPS2 50%

Health Starts at Home: Our Research Study

Jonathan Rose Companies and the Community Opportunity Fund have continued their partnership with Columbia University’s Mailman School of Public Health, Dartmouth Institute for Health Policy & Clinical Practice, Harvard University’s T.H. Chan School of Public Health, Enterprise Community Partners, and Success Measures at NeighborWorks America, to study the effects of the Communities of Opportunity model, which combines social and environmental interventions on resident health and well-being.

The initial phase of the research was conducted in 2023, to gain an understanding of residents’ lived experiences across the 10 properties included in the study. The team hosted kick-off community events at each property to first distribute a survey that included questions about living at the property and participating in resident services, health and well-being questions, demographic information, and satisfaction regarding their building and unit. The first round of surveys achieved an average of 51% response rates across the surveyed sites.

Following the research survey, the properties participated in environmental air quality monitoring, in which monitors were placed throughout the property to better understand the household experience. The QuantAQ monitors tracked fine particulate matter in the air to evaluate the health effects of air quality, placing monitors in public spaces, one outdoors, and one in a community room; and 20 monitors in resident units, for one week.

The next phase of the research will focus on data analysis and deploying a second survey to assess whether there were any changes throughout the year, as well as sharing the results with residents and collectively brainstorming and selecting activities to be funded with action grants at each property.

VILLAGE CENTER - Detroit, MI

Environmental Impact

Environmental Impact

We are committed to tackling the urgent challenges of climate change, pollution, and biodiversity loss.

Rose is committed to tackling the urgent challenges of climate change and pollution. By minimizing the climate and resource impacts of our portfolio, we create properties that are not only resilient and future-proof but also promote the health and well-being of our residents. Our approach integrates third-party green building certifications to guide both design and operations, ensuring environmental benefits that reduce operating costs, enhance stability, and improve safety.

Our team of environmental impact professionals collaborates closely with project teams to set and achieve sustainability goals aligned with our six core Environmental Impact areas:

• Decarbonization

• Clean Energy

• Water Efficiency

• Green Operations

• Biodiversity

• Climate Resilience

In new developments, we employ advanced techniques such as all-electric, high-performance design, and resilient construction with renewable energy and storage options, setting new benchmarks for sustainable, affordable, and mixed-income housing. For our green retrofits, we pursue comprehensive reductions in emissions, energy, and water use through certifications like Enterprise Green Communities. These retrofits include cost-effective upgrades such as LED lighting with sensors, low-flow water fixtures, enhanced insulation, and improved air sealing. Using a data-driven approach, we monitor and analyze environmental performance across all properties, identifying further opportunities for energy and water efficiency in collaboration with property and asset management.

From pioneering projects to ongoing operations, we are committed to creating scalable, replicable models that drive impactful change. Our influence extends to city, state, and federal levels, where we advocate for policies and programs supporting greener buildings and develop solutions for sustainable buildings of the future. We will continue to lead and innovate with our peers in combating climate change and advancing the well-being of our communities.

Climate Change Mitigation Goals1

In order to reduce our impact on the environment, we have set forth a series of climate change mitigation goals for our portfolio. These mitigation goals aim to reduce the emissions, energy, water use, and landfill waste from our properties over time. We establish a baseline for each property and actively work to achieve the goals by implementing improvements and continually monitoring performance. We strive to achieve the targets at each individual property to contribute to our overall portfolio goals.

GREENHOUSE GAS REDUCTION

We design, construct, retrofit, and operate properties to minimize their emissions of greenhouse and ozone-depleting gases. We are committed to both mitigating through reducing emissions and adapting to our changing environment.

GOAL

Reduce carbon dioxide-equivalent (CO2e) emissions intensity by 20% or more from baseline.2

ENERGY REDUCTION

We design, construct, retrofit, and operate properties using strategies to reduce energy use, including integrated design, efficiency improvements, conservation measures, and optimized operations.

GOAL

Reduce energy intensity by 20% compared to baseline.2

WATER REDUCTION

We design, construct, retrofit, and operate properties to make the most efficient use of water resources, minimize consumption, and reduce adverse effects on water infrastructure systems.

GOAL

Reduce water intensity by 15% compared to baseline.2

WASTE REDUCTION

We design, construct, retrofit, and operate properties to minimize waste sent to landfills. We aim to design waste out of our processes and to divert landfill waste through recycling and composting.

GOAL

Increase the amount of waste diverted from landfills by 15% from baseline.2

MIRAMAR TOWERS - Los Angeles, CA

CITY VIEWS - Atlanta, GA

GRACE WEST MANOR - Newark, NJ

Electrifying for the Future: Our Electrification Strategy

Electrification of building systems is a core pillar of Rose’s decarbonization strategy. We pursue electrification wherever it is technically and economically feasible. Each of our ground up development projects starts with an assumption of all-electric systems. We also evaluate each acquisition for electrification potential and implement mid-cycle electrification projects for established assets in our portfolio. Our electrification process map provides a standardized framework for assessing these opportunities in existing buildings that accounts for building type and available infrastructure, incentives, impact on utility bills, grid carbon intensity, and other characteristics.

Our electrification efforts in California are proving especially fruitful. In the last two years we have deepened our ties to California-based electrification vendors and incentive program administrators in order to develop comprehensive, well-funded electrification projects for our properties in the state. The first of these is already online: In December 2023 we completed a project at The Grove in Ontario, CA, that converted central gas-fired heating systems to heat pump chillers that provide both heat in winter and air conditioning in summer. The project also fully electrified the central domestic hot water systems and converted gas dryers to electric models. No gas-based systems remain in the residential buildings. Based on this initial success, we are building a pipeline of similar projects at our properties throughout California.

We also seek to implement electrification projects in colder regions of the country – for example at a 16-unit low-rise building at Lake Grove Village in Chicago, IL. Colder climates present unique challenges since high heating demand typically means that electrification results in increased utility costs. By simultaneously pursuing other energy efficiency and renewable energy projects, we aim to reduce or eliminate the adverse financial impact.

For the next several years, the Firm’s focus will be on building internal capacity, technical knowledge, and resources to be able to scale up our electrification efforts across the portfolio. We monitor the market for technical advancements, incentive and rebate programs, and financial tools that will help accelerate our work as we strive to eliminate or dramatically reduce on-site fossil fuel use.

THE GROVE - Ontario, CA

The installation of heat pump chillers at The Grove in Ontario, CA, was part of an electrification project completed in 2024.

Environmental Retrofit Tour

We tailor each property’s renovation scope to the specific needs of the site and its residents. However, we have a standard set of commonsense retrofit measures that we typically implement to achieve utility savings, improve indoor environmental quality, and attain whole building green certifications when feasible. Some of these important measures include the following:

INSULATION & AIR SEALING

Adding and supplementing insulation to a property’s roofs and walls helps the building retain heat in the winter and slows heat from reaching the interior in the summer. Air sealing also improves the building’s fire resistance, reduces pest problems, and limits noise transfer and movement of odors between different parts of the building.

HIGH-PERFORMANCE WINDOWS

Replacing windows at the end of their useful life with higher-performance models can substantially reduce heat loss and gain within a building, reducing utility bills, and improving resident thermal and acoustic comfort. We select ENERGY STAR windows specific to each region. 1

INDIGENOUS PLANTS & EFFICIENT IRRIGATION

Our landscape design prioritizes indigenous, noninvasive, drought-tolerant plants that encourage biodiversity and restore precolonial ecology. Efficient irrigation technologies such as drip irrigation systems, irrigation timers, moisture control sensors, and rain delay controllers all help reduce water consumption while maintaining healthy plant life.

HEALTHY MATERIALS

Setting rigorous environmental standards for product procurement can help ensure that residents remain healthy and building interiors remain resilient. Product categories including hard-surface and soft-surface flooring, paints, cabinets, sealants, and adhesives have third-party certifications that test for reduced VOCs and other toxic chemicals.

BOILER TUNING & CONTROLS

Tuning boiler systems ensures that equipment is running optimally and according to original design intent. Adding or upgrading control systems helps systems respond to changes in outdoor temperatures and indoor heating and hot water demands. At the end of a boiler’s useful life, replacing equipment with high-efficiency, condensing models can greatly reduce energy use and emissions and improve indoor air quality.

ENERGY-EFFICIENT APPLIANCES

Always-on or frequently used appliances such as refrigerators, dishwashers, washing machines, and dryers should be upgraded to energy-efficient ENERGY STAR models whenever feasible. Efficient appliances help reduce annual utility costs, greenhouse gas emissions, and operational costs.

SOLAR PV & BATTERY STORAGE

Rooftop Solar PV systems allow for a portion of the building’s electricity demand to be generated by natural sunlight. Where feasible, Solar PV Systems are paired with battery storage, which allows the site to use the stored energy during emergency situations like power outages.

LIGHTING FIXTURES & CONTROLS

Upgrading existing light fixtures and bulbs with high-efficiency LED systems significantly reduces the property’s electrical demand while maintaining or improving existing light levels and reducing ongoing maintenance costs. We also install occupancy sensors, timers, and photocells that decrease energy use by providing light only when necessary.

LOW-FLOW FIXTURES & REAL-TIME WATER MONITORING

Installing real-time water monitoring sensors in a building allows for owners to be targeted in their water conservation efforts which may include fixtures such as low-flow aerators, showerheads, and toilets.

Sustaining Vital Resources: Our Water Conservation Strategy

In today’s rapidly evolving real estate market, water conservation has emerged as a critical component of sustainable development and responsible property management. For us, embracing water-saving measures is not only a commitment to environmental stewardship but also a strategic investment in long-term value and resilience. As water scarcity becomes an increasingly pressing issue, integrating water conservation and monitoring practices into our projects reduces operational costs and aligns with our portfolio-wide goals. By prioritizing water efficiency, we position ourselves as leaders in sustainable real estate, driving both ecological and economic benefits.

At the earliest stages of a property’s acquisition, our environmental impact team pinpoints water efficiency opportunities by collecting utility bills, conducting water rate analyses and comparing the property’s water use intensity against its peers. Procuring this data during due diligence allows our acquisitions team to underwrite a project more accurately and build out a retrofit plan that meets our firm’s goals and reduces ongoing operational costs.

The next phase of a successful water conservation project hinges on the strategic implementation and utilization of real-time water monitoring data. By incorporating advanced monitoring technologies, we can gain immediate insights into water consumption patterns, identify inefficiencies, and detect potential leaks before they escalate into significant issues. Access to real-time water data allows property ownership and management to make informed decisions on water conservation measures and optimize water management practices.

Over the years of integrating water conservation measures into our retrofits, we have consistently observed that a significant portion of water waste in multifamily buildings stems from leaking toilets and inefficient irrigation systems. By addressing these areas with targeted solutions—such as installing leak-proof toilet fill valves and smart irrigation systems—we have continually experienced significant water reductions at our most inefficient properties.

31% DECREASE IN WATER USAGE $47,000 REDUCTION IN WATER COSTS $

2101 S. MICHIGAN - Chicago, IL

In 2023, the team used real-time water monitoring at 2101 S. Michigan Apartments in Chicago, IL, to identify that there was significant water loss on-site from leaking toilets. The team installed leak-proof fill valves in August, and the site has since experienced a 31% decrease in water usage, resulting in a $47k reduction in water costs for the property.

Environmental Impact in Action:1 Archer Courts

Archer Courts is a 146-unit Senior and Family Section 8 property located in the Chinatown neighborhood of Chicago. In 2021, Rose acquired the property and initiated a comprehensive renovation project to enhance energy efficiency, sustainability, and the overall living experience for its residents.

Using $10 million in investment, Rose undertook significant property upgrades. The renovation included major in-unit updates such as the installation of Energy Star-rated appliances, LED lighting with advanced controls, and water-saving fixtures. Additional enhancements included a full roof replacement with upgraded insulation, an overhaul of the building’s exhaust system, and security and accessibility improvements. Rose also redesigned the community center to align with its broader social impact objectives, ensuring that the space fosters both community engagement and resident well-being.

The project earned Enterprise Green Communities Certification in March 2024. In continued pursuit of deeper decarbonization and property improvement, Archer Courts was selected for a grant of up to $11.76 million from the U.S. Department of Housing and Urban Development’s (HUD) Green and Resilient Retrofit Program (GRRP). This grant will support future investment in decarbonization and climate resilience measures, further solidifying Archer Courts as a model for sustainable, affordable housing in the community.

ARCHER COURTS - Chicago, IL

ACTUAL ENERGY REDUCTION2 35%

ACTUAL EMISSIONS REDUCTION2 33%

PROPERTY-WIDE EMISSIONS SAVINGS 2.8 MT PER UNIT PER YEAR

ACTUAL WATER REDUCTION 54%

PROPERTY-WIDE WATER SAVING 58,100 gal PER UNIT PER YEAR

AVOIDED UTILITY COSTS $211,500

Rose Companies Portfolio Characteristics1

NUMBER OF PROPERTIES 90

GREEN CERTIFIED PROPERTIES2 45

GREEN CERTIFIED AREA - COMPLETED3

7.87 million SF

GREEN CERTIFIED AREA - IN PROGRESS3

2.52 million SF

% PORTFOLIO COMPLETED OR PURSUING CERTIFICATION3 63%

GRESB SCORES OVER TIME4

Annual Site Energy Use By Type5

Annual Site Energy Use for the Rose Companies portfolio is composed of several types of source energy: natural gas, grid-purchased electricity, and electricity procured through renewable energy credits. We aim to account for and expand on-site generation capacity and increase the proportion of green power until 100% of electricity is offset or from carbon-free sources.

Environmental Performance6

The Rose Companies portfolio has reduced its collective emissions intensity by 13%, its energy use intensity by 9%, and its water use intensity by 18% against a blended baseline.

AS OF 2023

AS OF 2023

AS OF 2023

Annual Net Avoided Emissions7

Each year, the Rose Companies portfolio can account for its net avoided Greenhouse Gas Emissions at each owned property against baseline year emissions. The waterfall chart below shows the net annual avoided emissions for the portfolio cumulatively from 2008 through 2023.

TOTAL EMISSIONS AVOIDED 32,843 MTCO2e

EQUIVALENT TO CARBON SEQUESTERED BY 543,000

TREES GROWN FOR 10 YEARS

Governance Strategy

Our Integrated Management Approach

Our company is organized to co-create and deliver innovative and impactful investments by sharing lessons, best practices, and resources across all our business practices. We have an integrated investment management and development group that buys and builds properties, supported by our design and construction team and internal and external groups, to successfully deliver on our vision.

BAYRIDGE GARDENS - Annapolis, MD

SENDERO VERDE - New York, NY

GALE ECKINGTON - Washington, DC

JACKSON PARK TERRACE - Chicago, IL

1

INVESTMENT MANAGEMENT

Our investment management group consists of acquisitions, asset management, impact teams, portfolio management, fund accounting, and investor relations. We conduct interdepartmental due diligence to understand an asset’s historical financial, environmental, and social performance and identify opportunities for property improvements and value creation through creative financing, income generation, and operational savings.

2

ACQUISITION-REHAB

Our Acquisition-Rehab work leverages Low Income Housing Tax Credits to rehabilitate existing affordable housing properties across the country to transform communities and preserve affordability for the long term. Our interdisciplinary Acq-Rehab team navigates complex regulatory systems across a variety of agencies and stakeholders and brings in capital partners to execute transformational deals that address deferred maintenance, deliver deep environmental benefit, and improve resident experience.

3

DEVELOPMENT

Our development team oversees all new affordable and mixed-income construction projects in the Jonathan Rose Companies portfolio from proposal to occupancy. Using creative design and financing solutions, we work with community partners, government agencies, and our designers to deliver our vision for a greener and more equitable world through models that can be replicated by other developers.

4 DESIGN AND CONSTRUCTION

Our Design and Construction practice group collaborates on all projects across the new development and investment pipeline to coordinate and implement project scopes and achieve our environmental and social goals. Our growing inhouse construction group, Rose Community Builders (RCB), specializes in renovating our occupied communities and acts as a general contractor to help streamline schedules at many of our acquisition-rehab projects.

5

ROSE COMMUNITY CAPITAL

Rose Community Capital provides customers with affordable, workforce, and mixed income multifamily housing finance services. As a designated FHA Multifamily Accelerated Processing (MAP) and USDA 538 lender, we originate, underwrite, place, and service FHA and USDA-insured multifamily mortgage loans. RCC also provides bridge lending for affordable, workforce housing and construction loans.

Who We Are

LEADERSHIP

Firm leadership is guided by the Management Committee, which consists of partners and department heads who make decisions on behalf of all stakeholders. Additionally, the Firm benefits from the expertise of an Advisory Board, including the Company’s Founder and CEO, Jonathan F.P. Rose, and external industry advisors. Impact strategy and environmental, social, and governance (ESG) considerations are integrated into each department’s operations and are overseen by relevant committees such as the Diversity, Equity, Inclusion, and Belonging (DEIB) Committee, Benefits Committee, and Enterprise Risk Committee. These committees report directly to the Management Committee, ensuring that ESG issues are consistently addressed at the highest levels. Fund- and asset-level impact strategies are ultimately overseen by the Investment Committee.

Impact management is led by dedicated environmental and social impact teams in close collaboration with other departments, especially Investment Management and Development. The environmental impact team drives sustainability initiatives across the portfolio and at the property level, working with the investments team to set targets and achieve environmental and financial outcomes. The social impact team manages external resident service providers, establishes partnerships, and leads property-level social initiatives to fulfill our commitment to housing stability and resident well-being. Both teams participate in research studies to assess the effectiveness of our programs and share best practices within the industry. Impact performance is tracked through a data management process and reported quarterly to the Investment Department and executive leadership, ensuring that impact considerations are integrated into business decisions.

Diversity & Inclusion at Rose Companies1

DIVERSITY, EQUITY, INCLUSION, AND BELONGING

Rose has formed a Diversity, Equity, Inclusion, and Belonging (DEIB) Committee, which enveloped our Anti-Racism Committee for a more comprehensive program. The role of the DEIB Committee is to examine organizational policies and practices and recommend policy and directional changes to ensure that we achieve a diverse, equitable, and inclusive workplace and to ensure that we conduct our work through the lens of DEIB and racial equity.

Rose seeks to build a diverse and inclusive culture that reflects the neighborhoods and communities where it operates. The Firm embraces and encourages our employees’ differences in age, race, ethnicity, family, or marital status, gender identity or expression, language, national origin, physical and mental ability, political affiliation, religion, sexual orientation, socioeconomic status, veteran status, and other characteristics that make our employees unique. We are committed to recognizing and valuing intersectionality, ensuring that every individual’s unique combination of identities is acknowledged and respected, fostering an inclusive environment where diversity is celebrated, all employees are welcome to bring their whole self to work, and they are treated with dignity.

The Committee has updated our DEIB Committee Charter and DEIB Statement and has organized our efforts into three pillars — Internal, External and Community — which have established the following priorities:

INTERNAL

• Recruitment and Hiring

• Retention and Advancement

• Compensation and Benefits

• Training and Professional Development

• Culture and Belonging

EXTERNAL

• Procurement

• Partnerships

• Advisory Board

COMMUNITY

• Community Engagement Approach

• Rose Social Impact Program

SELECT ACTIVITIES

We conducted a confidential external salary review to determine whether any discrepancies existed between gender, race, etc. No discrepancies were found.

We engaged supplier.io to conduct a data enhancement on our vendor information to identify certified diverse vendors and establish a baseline of diverse spending.

We engaged with the majority of our third-party property managers to train or retrain them on Rose’s Social Impact program and approach to community engagement.

Benefits Programs at Rose

We are pleased to invest in our most important asset – our people. We believe it is important to find the right balance between a fun work environment, challenging career and passion to make a difference in the world. Rose Companies provides our team members with all of these. Our unique culture breeds a positive, respectful environment where employees can thrive and have a positive impact.

PERFORMANCE MANAGEMENT

To foster a culture of collaboration and teamwork, while allowing for individual performance to shine, Rose use an annual bonus plan that compensates employees for goal achievement across three dimensions: individual goals, departmental goals, and company goals. The dimensions are weighted according to an employee’s level within the organization: mid- and junior-level staff have a higher weighting on individual goals, while senior- and executivelevel staff have a higher weighting on achievement of departmental and company goals.

The company goals include a financial goal, a social goal, and an environmental goal. Each year, the impact team works with Management Committee to determine environmental and social goals that will advance progress toward impact targets and initiatives. Examples of previous goals include emissions reductions, water reductions, and digital connection through provision of WiFi and free or low-cost devices.

HEALTH AND WELLNESS

Health and well-being are the foundation for a successful life. We have crafted a benefits and wellness program to help employees and their families strengthen their foundation through preventive services, additional coverage options, and access to programs to help navigate life’s challenges.

• Medical insurance including two PPO plans and a Health Savings Account plan

• Dental + Vision insurance

• Additional insurance coverage options including accident, hospital indemnity, and critical illness

• Company paid short-term disability

• Company paid long-term disability (with buy-up option)

FINANCIAL SECURITY

• Access to Teledoc to connect with a quality doctor in minutes

• Employee Assistance Program

• Health Advocate

• Paid parental bonding

• PeopleOne wellness site and company wellness programs

Our competitive compensation and benefits package is supplemented by programs that help employees and their families achieve their financial goals.

• Annual bonus plan for achievement of individual, departmental, and company goals

• Profit-sharing plan for eligible employees

• 401(k) with company match

• Company paid Life Insurance (with option to purchase additional Life Insurance)

PROFESSIONAL GROWTH

• Pre-tax flexible spending accounts for medical, dependent care, and commuter benefits

• Employee referral program

• Charitable giving match through CharityVest

• Financial education and one-on-one consultation

Employees have access to training and professional development opportunities throughout the year through virtual workshops, in-person sessions, lunch and learns, and online courses. Topic included:

• Identifying microaggressions

• Unconscious bias

• Active shooter preparedness

• Cybersecurity

• Investment policy compliance

• Managing stress

• Crucial conversations

• Social Impact

• In addition, employees have opportunities for professional development, including:

• Tuition reimbursement up to $5000/year for full-time employees and $2500/year for part-time employees.

• Participation in industry conferences, events, and memberships

• Reimbursement for relevant professional accreditations and continuing education

About This Report

This is Jonathan Rose Companies 2024 annual Impact Report. Unless otherwise stated, all performance data is reported for calendar year ending December 31, 2023. Like-for-like performance metrics included in the report have been externally verified by CodeGreen Solutions.

To provide feedback or request additional information, please email:

Lauren Zullo

Managing Director Impact lzullo@rosecompanies.com

For more information, please visit: www.rosecompanies.com

551 Fifth Avenue, 23rd Floor, New York, NY 10176

917.542.3600

www.rosecompanies.com

Disclosures

This Impact Report (the “Report”) prepared by Jonathan Rose Companies (the “Company”) is provided for informational or educational purposes. A reader of the Report may not rely on this material as the basis upon which to make an investment decision. This material does not purport to be complete on any topic addressed. The Report does not constitute a solicitation in any jurisdiction. Moreover, this Report neither constitutes an offer to enter into an investment agreement with the recipient nor an invitation to respond to it by making an offer to enter into an investment agreement. Any potential investment managed by the Company, or its affiliates, will be suitable only for certain financially sophisticated and qualified investors who meet certain eligibility requirements.

The Report is not intended to provide, and should not be relied upon, for tax, legal, accounting, or investment advice. Individuals should make their own investigations and evaluations of the information contained herein and consult their own attorney, business adviser, and tax adviser as to legal, business, tax, and related matters concerning the information in this Report.

The properties appearing throughout this Report are representative properties related to certain of the Company’s activities. Information about such properties is provided for informational purposes only. There can be no assurance that the Company, or an affiliate of the Company, will invest in or manage similar properties.

This Report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of expense savings, and proposed or expected activities. Moreover, certain historical performance information has been included in this material and such performance information is presented by way of example only. No representation is made that the performance presented will be achieved by any current or future projects or investments, or that every assumption made in achieving, calculating, or presenting either the forward-looking information or the historical performance information herein has been considered or stated in preparing this material. Any changes to assumptions that may have been made in preparing this Report could have a material impact on the performance that is presented herein by way of example.

This Report is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The information and opinions contained in this Report are derived from proprietary and nonproprietary sources deemed by the Company to be reliable, and not necessarily all-inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to pass. Any properties named within this Report may not necessarily be held in any funds or accounts managed by the Company or any affiliate of the Company. Reliance upon information in this Report is at the sole discretion of the reader.

The investment strategy employed by the Company and/or its affiliates involves the purchase and development of land and real estate. Thus, any portfolio that employs this strategy may experience more volatility and be exposed to greater risk than a more diversified investment portfolio. Real estate investments are subject to the risks incidental to the development, ownership, and operation of real estate, including, among other things: (i) local real estate and financial conditions; (ii) risks due to dependence on cash flow; (iii) changes in availability of financing at attractive pricing; (iv) changes in tax, real estate, environmental, and zoning laws and regulations; (v) natural disasters; and (vi) the ability of the sponsor to manage the properties and service providers. The characteristics of any future projects or investments may vary from the characteristics of those shown herein and may not have comparable risks and returns. A project or an investment made by the Company on behalf of its clients is speculative and involves significant risks, including loss of the entire investment.

Past performance may not be indicative of future results. The reader should not rely upon the historical data referred to in any of the case studies in making any investment decision. This report has not been audited or otherwise verified by any outside party and should not be construed as representative of the investment experience or returns that may be achieved in the future by the Company.

GRI Standards Content Index

DISCLOSURE NUMBER DISCLOSURE TITLE

GRI 2: GENERAL DISCLOSURES 2021

The organization and its reporting practices

2-1 Organizational details

REFERENCE/LOCATION

Cover Page, Our Portfolio, Company Overview

2-3 Reporting period, frequency and contact point About This Report

2-5 External assurance About This Report Activities and Workers

2-6 Activities, value chain and other business relationships Company Overview, Our Portfolio, Partnering for Impact

2-7 Employees Who We Are Governance

2-9 Governance structure and composition Who We Are 2-10 Nomination and selection of the highest governance body Who We Are

2-11 Chair of the highest governance body Who We Are

2-12 Role of the highest governance body in overseeing the management of impacts Our Integrated Management Approach

2-14 Role of the highest governance body in sustainability reporting Impact Management System

2-18 Evaluation of the performance of the highest governance body Impact Management System

2-19 Remuneration policies Benefits Programs at Rose Strategy, Policies, and Practices

2-23 Policy commitments Impact Management System, Partnering for Impact

2-28 Membership associations Partnering for Impact

2-22 Statement on sustainable development strategy Letter from Our President

GRI 3: MATERIAL TOPICS 2021

3-1

Process to determine material topics

3-3 Management of material topics

TOPIC STANDARDS

Environmental

302-3

302-4

305-5

Social

401-2

Energy intensity

Reduction of energy consumption

Reduction of GHG emissions

Benefits provided to full-time employees that are not provided to temporary or part-time employees

404-2 Programs for upgrading employee skills and transition assistance programs

405-1

Diversity of governance bodies and employees

413-1 Operations with local community engagement, impact assessments, and development programs

SECTOR DISCLOSURES

GRI G4 Sector Supplement: Construction and Real Estate

G4 CRE8 Type and number of sustainability certification, rating and labeling schemes for new construction, management, occupation and redevelopment

Who We Are

Impact Strategy, Impact Management System, Our Integrated Management Approach

Environmental Performance

Environmental Performance

Environmental Performance

Who We Are

Who We Are, Benefits Programs at Rose

Who We Are

Who We Are

Rose Companies Portfolio Characteristics

TCFD Disclosures

TCFD

RECOMMENDED DISCLOSURES

REFERENCE/LOCATION

Governance: Disclose the Organization’s governance around climate-related risks and opportunities

a) Describe the board’s oversight of climaterelated risks and opportunities

b) Describe management’s role in assessing and managing climate-related risks and opportunities

Jonathan F.P. Rose, who is the President and Founding Partner of the Company, serves as the senior decision maker on climate-related risks, opportunities, and issues. Mr. Rose and Partners receive quarterly reports detailing portfolio and asset-level performance on ESG topics. In addition, Jonathan Rose Companies conducts annual meetings with the Management Committee about sustainability performance including GRESB results, identified risks and opportunities related to climate, and the ESG program in general to discuss upcoming priorities. Annual reporting covers updates on long-term strategic objectivs, updates and notification regarding regulatory changes, and updates regarding proposed actions to improve the performance of the assets.