Digital print and finishing technologies offer countless benefits to the print landscape. However, there are complexities, such as unique, short-run jobs that have little to no room for error. Equipment manufacturers, software and workflow vendors, and integrators work together to ensure seamless and profitable production across digital application range.

Equipment manufacturers, software and workflow vendors, and integrators work together to ensure seamless and profitable production across the digital application range.

The use of digital printing and finishing tools for label production is growing. One essential part of the puzzle for making the economics work is automation and workflow. We address the availability of software and workflow tools that help streamline digital and hybrid label production environments in Streamlining Label Production

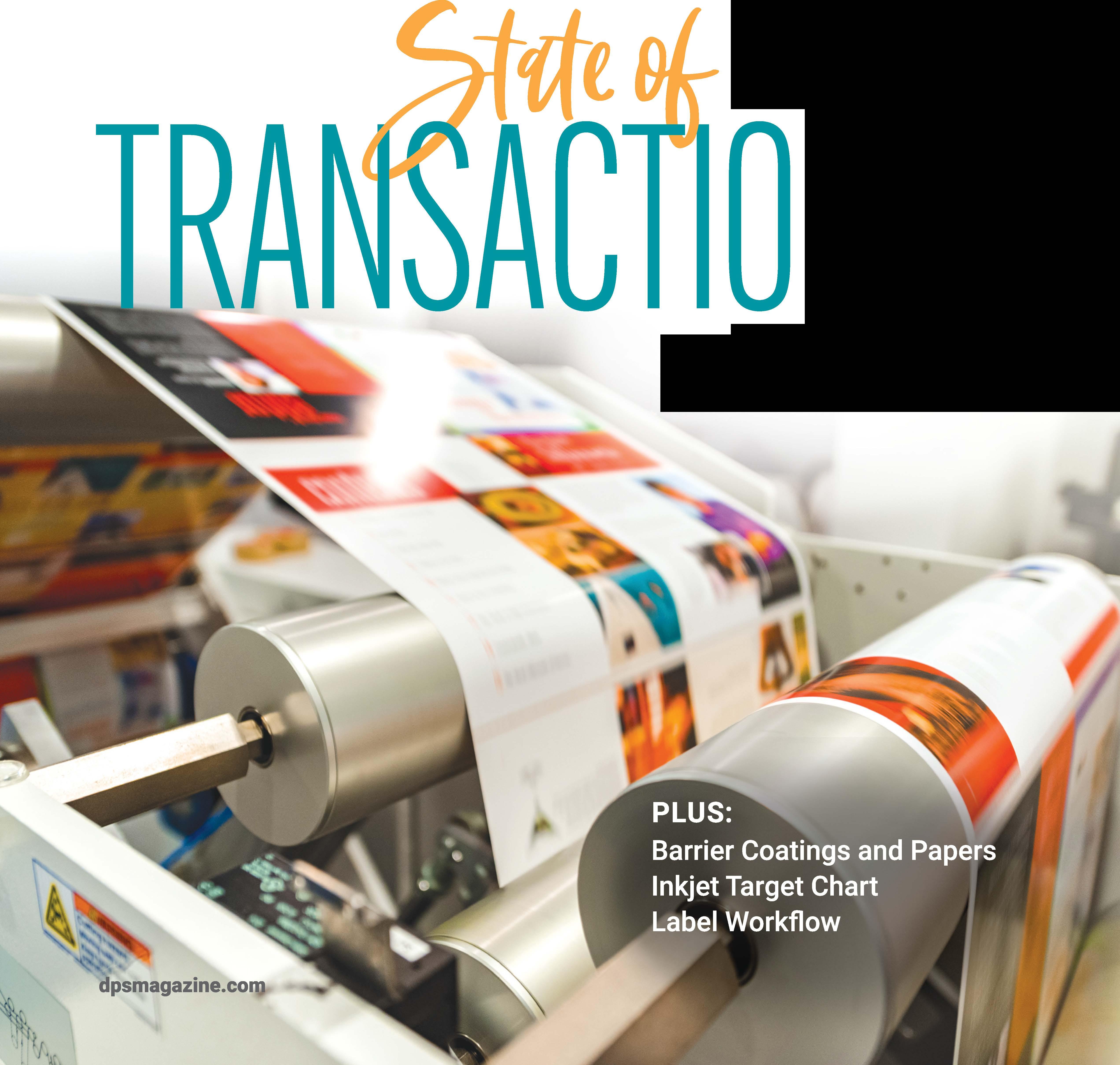

While labels and packaging are hot markets, transactional documents still make up a significant amount of overall printed pages. We discuss how electronic distribution and inkjet have revolutionized this market in Transactional Evolution

Our Best Practices column looks at barrier coatings and papers for flexible packaging. These are increasingly designed to support environmental initiatives in demand by end customers.

Our next issue will feature our semi-annual Label and Packaging Application of the Year awards. We’re teaming up with our sister publication, Industrial Print magazine on this and are looking to spotlight exceptional label and packaging pieces created by our readers. Check out dpsmagazine.com for more information!

Additionally, visit dpsmagazine.com/webinars for webinars on transactional printing and label workflow.

Best regards, Cassandra Balentine, editor

cbalentine@rockportpubs.com

cbalentine@rockportpubs.com

dpsmagazine.com

Volume 25, Number 3 • ISSN: 1529-2320

EDITOR IN CHIEF

Thomas Tetreault 978-921-7850

EDITOR

Cassandra Balentine cbalentine@rockportpubs.com

ASSOCIATE EDITOR

Melissa Donovan mdonovan@rockportpubs.com

ART DIRECTOR

Sarah M. White swhite@rockportpubs.com

WEB EDITOR

Melissa Mueller

CONTRIBUTORS

Kemal Carr, Olivia Cahoon, Gina Ferrara, Mark Hanley

ADVERTISING SALES

PUBLISHER

Thomas Tetreault 100 Cummings Center, STE 321E Beverly, Massachusetts 01915

Ph 978-921-7850 x110 • Fx 978-921-7870 edit@rockportpubs.com

SALES

Amanda Doyon

Ph 978-921-7850 x170 • Fx 978-921-7870 adoyon@rockportpubs.com

Nicole Pizzi-Cerundolo

Ph 978-921-7850 x160 • Fx 978-921-7870 npcerundolo@rockportpubs.com

Subscribe online at dpsmagazine.com

CORPORATE & PUBLISHING OFFICE 100 Cummings Center, STE 321E Beverly, Massachusetts 01915

ROCKPORT CUSTOM PUBLISHING, LLC

CHAIRMAN

Jeffrey Jensen

PRESIDENT & CEO

Thomas Tetreault

CONTROLLER

Missy Tyler

Digital Publishing Solutions is published by Rockport Custom Publishing, LLC. Please send change of address forms to: 100 Cummings Center, STE 321E, Beverly, MA 01915. © Rockport Custom Publishing, LLC 2023. Reproduction by any means of the whole or part of Digital Publishing Solutions without written permission from the publisher is prohibited. Views expressed in the editorial pages do not imply our endorsement.

Subscription Rates: U.S. $41.65 per year, seven issues; single copies: $5.95, Canada and Mexico: $52.22 (U.S.D.), Other international subscriptions: $71.05 (U.S.D.)

Vendors: We welcome your product news. Include prices, slides, photos, and digital files with your press release. Please forward product samples and media kits to Reviews Editor, DPS Magazine, 100 Cummings Center, STE. 321E Beverly, MA 01915. We cannot be responsible for unsolicited product samples.

By Cassandra Balentine

By Cassandra Balentine

Specially formulated coatings and papers present a physical barrier between a product and packaging to protect against moisture and grease. These are increasingly developed to be more sustainable without compromising safety.

There are a few differences between barrier coatings and barrier papers for flexible packaging.

“The main difference is that barrier paper typically refers to papers formulated with barrier properties against moisture and grease. This is usually done at the paper mill level during the paper manufacturing stage,” explains Mark Hill, SVP, R&D, INX International Ink Co.

On the other hand, “barrier coatings are typically applied to a substrate after it is manufactured and provides properties like moisture, oxygen, or grease resistance to the substrate,” he adds.

Perla Johnson, marketing and product manager, S-One Holdings Corporation, points out that a barrier paper already has inherent barrier properties,

while barrier coatings can be applied to paper, film, board, or other substrates.

A coating is one way to create a barrier paper, says Dr. Lars Hancke, manager, business development, flexible packaging, hubergroup. He explains that another option is to create a barrier with the help of a film. “Barrier coatings can, for example, also be used to create monomaterial plastic packaging that can be recycled more easily.”

Barrier paper is specifically designed to provide barrier performance as part of

its structure. “Barriers to grease and oil, oxygen, and liquid water can be built into the paper manufacturing process. Barrier coatings can be used in conjunction with barrier papers to further increase performance and enable additional barriers to moisture,” comments Zack Leimkuehler, VP, business development, Ahlstrom.

Food packaging is the primary market for barrier coatings and papers.

Barrier coatings can be used in conjunction with barrier papers to further increase performance and enable additional barriers to moisture.

— Zack Leimkuehler, VP, business development, Ahlstrom

This is because food and other industrial packaging materials are sensitive to oxygen and moisture.

“The main reason is to prolong

Cristal Transparent packaging providers natural barrier properties while also creating a view to the product it protects. 2. Michelman, in conjunction with Bobst and UPM, developed new coating technologies designed to match the high barrier performance of today’s multi-material laminations.

shelf life and withstand certain storage conditions,” says Hill.

“Barrier papers with a heat seal layer target flexible packaging converters. Most foods need a barrier to keep the contents fresh within the package. The barrier offers extended shelf life,” notes Johnson.

Barrier papers are gaining importance in packaging due to a trend from film to more sustainable paper packaging, shares Hancke.

Leimkuehler points out that there are many different industries where a barrier technology is desired. “These can be barriers to regulated materials like formaldehyde or mineral oil, where the paper is key in protecting the material from transferring into or out of the structure. One of the primary targets is in the flexible packaging space where paper can offer better sustainability than historically used fossil-based films

or where compostability or recyclability is desired.”

Barrier papers and/or coatings are prevalent in many printed applications as they serve as the primary brand communication in packaging materials, including digital print spaces.

Leimkuehler adds that barrier papers can be used in a variety of printed applications, and the entire supply chain is important in the development of these applications. “Packaging converters play a critical role in converting the final packaging material from barrier papers.”

Barrier papers are a core component in many flexible packaging applications today, and are growing in market share due to the preference for a more sustainable solution as opposed to fossil-based films and plastics.

“Some common examples of how barrier papers are used in flexible packaging include non-perishable food packaging, perishable food packaging including refrigerated/frozen foods, and packaging that requires longer shelf life such as microwave packaging,” shares Leimkuehler.

The primary component of all barrier papers is cellulose. Leimkuehler explains that cellulose is a natural polymer, which is an ideal raw material from a sustainable standpoint. It is readily recyclable and compostable, and there are already high recycling rates for cellulose-based papers.

Other raw materials include a variety of additives that contribute to the technical performance of the material, and help papermakers tailor solutions specifically for their end use and end of life.

Johnson says they can be made from high-quality Kraft paper on the exterior with a heat-sealable layer on the inside.

Recyclability is increasingly in demand.While paper has a high rate of recycling,Johnson admits that it depends on how much and what type of barrier was applied to the paper. From there it is determinedif it can be recycled in the paper-only bin or as mixed recycling.

S-One Labels & Packaging offers a solutioninEMEAandis working onone for the U.S. "In February, S-One Labels & Packaging released FlexPaper Barrier Paper. This solution is the first paperbased coated structure in the S-OneLP EMEA line specifically designed for HP Indigo Digital Presses. FlexPaper Barrier Paper meets the demand from converters who want a paper-based pouch web that will help them to save money, increase profits, print faster, and have the ability to place low minimum order quantities," sharesJohnson.

SheaddsthatFlexPaperBarrierPaper is manufactured as a multilayer of paper and plastic. The line achieves best results withHP Indigobutalsoworkswellwitha rangeofflexographicpresssolutions.

3. S-One Labels & Packaging offers a barrier paper solution for flexible packaging in EMEA and is working on onefor the U.S.

Additional benefits of FlexPaper include a FSCcertified paper component, puncture resistance and heat sealability, highopacity, a polyethylene (PE)/EVOH COEX sealant layer designed to prevent leaking and keep contents fresh, oxygen barrier property to extend shelf life of packaged goods, and a white paper layer that eliminates the need for white ink to help lower ink costs and provide fasterprintspeeds.

Barrier coatings are also designed to create more sustainable flexible packaging solutions.

Johnson explains that barrier coatings are typically applied on top of the paper to add the barrier. They are applied by using typical paper machine coaters, offmachine coaters, andprinting presses.

In terms of recyclability, they are generally compatible with recycling processes. "They use water as a carrier so they can be made to be recyclable, making them idealfor use in sustainable packaging solutions;' notesJohnson.

hubergroup Print Solutions offers an oxygen barrier coating-the HYDROLAC GA Oxygen Barrier Coating, which enables mono-polyethylene or monopolypropylene packaging for oxygen-sensitivefoodssuchasnutsorfreshpastaas itprotectsthe contents from oxygen.

Moreover, hubergroup's HYDRO-X Water Barrier Coating and ACRYLAC MGA 9003 coatings make the paper water and grease resistant. Thereby eliminating the need for a PE film lamination as water or grease barrier.

Paper packaging with the barrier coating can be recycled in the already wellestablished paper recycling system and is, thus, an environmentally friendly packaging solution. "These barrier coatings were developed for the packaging of moisture-sensitive food such as sugar or dry petfood andfor applications from the non-food sector such as cement packaging. Moreover, they are applicable for packaging greasy foods," notes Haneke.

Hubergroup'scoatingsarewater-based andcontainsynthetic, organicbinders.

As sustainability initiatives roll out acrosstheglobe, brands and converters seek out paradigm-shifting technologies that facilitate improved end-of-life solutions for flexible packaging structures-including both fiber- and filmbased substrates.

Michelman, in conjunction with partners BOBST and UPM, developed new coating technologies in total packaging solutions designed to match the high barrier performance of today's multimaterial laminations.

The next generation of multifunctional oxygen primers that Michelman createdaredesignedtoprovideenhancedbarrier properties at low coat weight while simultaneously enabling metallization of coresubstrates.Thisinnovation,whichis developed in collaboration with BOBST andotherpartners,resultsintwosustainable packaging solutions, oneBARRIER PrimeCycle, afullPEmono-materialbarrier alternative to non-recyclable metallized film; and oneBARRIER FibreCycle, is a paper-based packaging solution designed to replace high barrier film packaging, according to a recent Michelman pressrelease.

Ahlstrom

Hubergroup

INX International Ink Co.

Michelman

S-One Holdings Corporation

Both barrier coatings and papers are essential to flexible packaging applications today. With growing demand for sustainable solutions, these options continue to evolve. dps

One of the most important functions that label management software can provide is automation. “What you want to do is add speed to your workflow—from the time you receive the customer request for quote all the way through production. This can be done through automation. The higher the automation, the more speed you can achieve across the production and business landscape,” shares Jack J.Lafler, VP, sales and technical services, HiFlow Solutions.

Typically, the faster a file can be delivered to the press—to match increasing press speeds—the better, agrees Mike Agness, EVP, Americas, HYBRID Software. This is particularly important as labels have become personalized and “an efficient tool is needed to send these oneoff labels to the digital printer so that the press is not waiting for files from the prepress system.”

A series of workflow tools help assure speed and accuracy. These include features that take job details from a management information system (MIS), accept files from a customer, preflight them, and prepare them as printable PDF files for the digital printer’s RIP, which Agness says usually means

delivery to the front end of a digital press system.

A second series of tools deal with customer reviews—the ability to prepare and quickly send proofs for review, and ultimately approvals.

In addition to automation, workflow tools in the label space provide another important benefit—access to real-time data. “Plants produce a constant stream of data points, from machine performance to changeover times and inventory levels. A MIS not only collects the data, it routes the information to dashboards where the job KPIs are seen visually and immediately. Workflows then become lean, as any bottlenecks are quickly dealt with,” says Lafler.

Several areas of label production workflow are more easily, and more often, automated.

Lafler sees many aspects of production like quote to job, job to scheduling, scheduling, shop floor data, inventory, shipping, and complete costing of each job are tasks popular for automation.

“Most mundane prepress tasks—like color correction and step and repeat for digital presses—have been automated for years,” states Agness. He says these tasks are probably the most likely automated. “Others, like job reviews and approvals with updates made to a database, have been introduced by many vendors over the past five to eight years and are getting more traction.”

“Traditional practices such as preflighting, safe zone detection, automatic cut path addition, and bleed generation for both regular and irregular shapes still rank highly in the list of essential features for print production,” notes Peire.

Printers and converters continue to lean towards automated presses for layout and scheduling needs to aid in labor requirements and ensure the sequences in production run smooth and efficiently, offers Mike Pruitt, product manager, SurePress, Epson America, Inc. “Scheduling these jobs with the use of layouts is an essential element in today’s MIS workflow system to provide full visibility of machine capacity from long- to short-turn runs and offer detailed printing steps for customer approval throughout.”

Steve Lynn, director, labels and packaging, Durst Image Technology, sees automation in all areas, from prepress fixes on files to automatic imposition, simple color management, as well as automated variable data and data processing.

“Sharing data between systems is the most automated workflow tool because this integration eliminates the need to duplicate data entry, which significantly improves accuracy and efficiency,” comments John Cusack, business development manger, Baldwin Vision Systems.

“Having one comprehensive software system that automates these processes and one database that connects the whole of the label ecosystem allows efficiency and productivity to skyrocket,” adds Lafler.

He feels there are so many reasons to connect a label management system, including to control costs and create lean workflows. “Just automating and connecting estimating to a central database and data collection can ensure that the customer has a quote quickly, faster than the competition. In the competitive world of label converters, speed is key. And an MIS system gives you that speed,” says Lafler.

Sebastiaan Hermans, marketing manager, and Lowie-Pascal Geerinck, product manager, CERM, feel that in general, prepress workflow integrations are most common when looking for business automation in the label production process. This is closely followed by digital presses and finishing equipment,

while conventional and flexographic presses are less commonly automated.

Jan De Roeck, director of marketing, industry relations and strategy, Esko, points out that the further you go towards the printing press, the more automated the functionality is, which means RlPing the job is completely automated. In the case of conventional flexographic, the organization of separations on the flexographic plate is automatically optimized for exposure. Additionally the layout of individual jobs on the sheet or web, including options for ganging and variable data is fully automated and supposed by technologies like artificial intelligence. "The inspection of incoming artwork is highly automated and of course in general terms, all repetitive and mundane tasks can be automated and should be automated to avoid human errors as much as possible in the workflow. This drives time-to-market acceleration, cost reduction, and quality improvements."

Many other areas are prime for automation, but may not be getting the traction they should be.

"Label printers should automate web processing submission and costing ofjobs as a basic start," recommends Pruitt.

Cusack feels that printers should strive to fully automate the entire workflow. "The technology is available to share and communicate information between the process workflows, and it's imperative to adapt this capability to maintain competitiveness in the current

lieves that if label providers are still doing manual processes with software, they should look at the latest software developments to automate their business.

"Label printers should aim to automate as many repetitive tasks as possible, freeing up their printing experts to focus on more creative and subjectivity tasks," agrees Ben Richardson, senior DFE specialist, Mark Andy. He points out that while machines efficiently handle tasks such as placing graphics or writing packing labels, more complex tasks such as a production planning, quality control, and setting up hybrid labels may require the expertise of a skilled production team.

Peire says many label printers don't realize what automation capabilities exist today as they tend to evaluate tools as they have been for many years, not questioning potential process optimization.

For example, for something like proof sheets, visualizing the artwork with order and technical information is very often still created manually. "This is in combination with the approval workflow. Chasing of approvals a very labor-intensive job that can be automated. Lastly, there is a surge of interest in automating dynamic imposition to generate the most efficient and cost-effective printing method," shares Peire.

When it comes down to it, Peire feels that automation priorities truly vary from printer to printer. "Therefore we typically engage in a short discovery conversation where we explain our general capabilities and how we can help and give the customer areas to think about. From there, we arrange a consultation to explore specific needs, often leading to a collaboration where we provide some form of

automation to streamline parts of the process, which lead to the quickest or most impactful results."

De Roeck believes that label printers should take a step back to look at their entire workflow, from receiving a request for a quote over design, prepress, production, and finishing, all the way to packing and shipping of the finished product. "Using the principles of value stream mapping, many opportunities for cost and waste reduction will surface. The low hanging fruit for workflow automation are those workflow steps that benefit mostly from automation."

Without integration, workflow tools cannot meet their full potential. Further, when we hone in on label workflow, systems both specifically target this type of work and exist as part of a larger system.

"We believe it's important to support conventional, hybrid, and digital label workflows since many label printers incorporate all three methods into their production environment," shares Cusack.

A variety of tools are available with an automated connected workflow. For example, Baldwin inspection technology can integrate with prepress workflow tools such as HYBRlD and Esko, and with digital production workflows such as HP Indigo and Global Graphics, and MIS systems such as LabelTraxx and CERM.

"We believe in connecting all elements of your business and integrating your workflow;' state Hermans and Geerinck. They explain that the use of standard integrations such as third-party connections with MIS creates predictability and foreseeable trajectory and implementation process with a guaranteed result in the end. "Otherwise you might be in for more than you bargained for in terms of time, resources, and investment."

Durst's workflow solutions are a bigger system with various versions for the specialization of specific print markets. "We have Durst Workflow Label that is

specific to Label Converters, and also Workflow Large Format, and Workflow Corrugated,” offers Lynn.

Epson works with Wasatch software, which Pruitt points out is primarily used in the production of labels but can interface with larger systems such as Esko. “Partnering with the Esko software enables the support of diverse automated packaging applications allowing for a more streamlined automated production practice.”

When looking at integration, De Roeck suggests going for solutions providers with open system architectures and workflows natively based on PDF. “The important keyword here is industry standard,” he suggests. It is important to validate data exchange formats beforehand and verify if the integration is a low-code or even a no-code effort.

Software integrators, like Four Pees, also help facilitate automation. “We see certain software vendors offering bigger, monolithic systems. These systems are typically referred to as end-to-end solutions and provide a complete suite of software, hardware, and services that enable label production from design to delivery. While that approach has merit and fits the needs of certain customers, we strongly believe in more of a building block approach where you use out-ofthe-box technologies to build an adapted technology platform that fits the specific business and technical requirements of the printer. Ultimately our goal is not to see how we can differentiate ourselves, but how our customers can differentiate themselves in the market, become more competitive, and allow them to grow,” offers Peire.

Noted previously, integration—and communication—between systems is essential when it comes to optimizing workflow.

Printers should strive to work with technology vendors that provide the capability to openly connect with other vendor’s systems, says Cusack.

“Integrating a label press with the correct APIs and appropriate RIP, scheduling, and cost estimating software allows for accurate communication to the press to better streamline the automation process for long- and shortterm runs,” notes Pruitt.

James Robinson, business analyst, Significans Automation, points out that to ensure communication between different technologies in print and label production, it is helpful to utilize middleware and software, such as the Enfocus suite

of software. He says this can act as a hub to bind all of the isolated processes together, making it easier for different systems to communicate with each other.

Another suggestion is to create a hands-off approach, which can be achieved by using automation to retrieve order data from one system and pass it on to another without manual intervention, says Robinson.

Finally, don’t forget to collect and store data. As order data is retrieved, it should be collected and stored in a production server environment. The data can be organized into a job folder that contains all the relevant information.

Lafler recommends asking about integration services when shopping for a workflow management system. “If it’s an out-of-the-box system, ask about what ERPs they connect to on a regular basis. Also, when adopting a new workflow

system, it’s always important to have your shop floor workers on board, and maybe, even enthusiastic about getting rid of manual data collecting on Microsoft Excel spreadsheets.”

Lynn suggests talking to suppliers to get a demonstration of their software and ask for examples of integration with other technologies. “We have many standalone and fully integrated installations of Durst Workflow software—small companies using Durst Workflow as an all-in-one solution, through to large multi-plant locations who have Durst Workflow integrated with other software tools, MIS, and enterprise resource planning systems.”

“Probably the best advice for those who are still not 100 percent automated, is to make sure your data in the MIS is in order,” says Agness. “The old statement, garbage in, garbage out still rings true. No workflow can automate with incorrect data. The correct information in the MIS must be in the right place. Also, of course, make sure your

production workflow application can connect to these systems.”

Flexibility is also essential and production management should be open to new efficiencies, says Agness.

“Integration is not a purpose on its own. However, in all verticals in the print industry, hardware technology is often more highly regarded than software technology. When looking at how different printing devices have all evolved to deliver similar quality at a similar speed, the real benefits in productivity and process optimization are coming from other, not always visible areas,” comments Peire.

Therefore, he says giving technology and process optimization the attention it deserves by assigning a dedicated person would be his biggest recommendation, from there set goals, plan for integration, standardize data, choose the right technology, test and validate, monitor and maintain, and get expert help.

As label printers move to digital processes, the importance of workflow automation is increasingly apparent. From layout to approval, workflow tools exist to ensure efficiency and quality while improving turnaround times—all leading to more satisfied customers.

Digital printers benefit greatly from automation in the prepress process as they often deal with short runs, quick turnaround times, and personalized work. “Essentially, they require a higher throughput of jobs to press, so by eliminating errors and reducing the need for repetitive tasks, automation can help digital printers free up some time for customer relations, quality control, continuous, improvement, and new business development,” comments Richardson.

For more on workflow automation for labels, visit us online for a two-part web series as well as a webinar on the topic. dps

by Cassandra Balentine

by Cassandra Balentine

ransactional documents are essential communications between customer and provider. These are complex documents riddled with secure information that must get to the right recipient on time, often in electronic and print versions.

Traditional print has evolved to include multiple channels, making print just one of many options for assessing information. "The push has been for electronic delivery and the focus is around customer satisfaction/retention, along with a reduction

in rising postage, materials, and labor costs;' comments Kemal Carr, president, Madison Advisors.

Marc Mascara, manager, professional services, production print solutions, Canon Solutions America, Inc., adds that the transactional print market is quite complex in its nuance as it flows through each and every vertical. "The divergence of Above: Canon'sColorStream8000seriesoffersnative1,200dpiresolutionatprint speedsofupto525feetperminute.

polarization between what consumers desire and what the enterprise strives for continues to drive innovation.”

It is evident that consumers have become more critical regarding their preferred communications channels. “For instance, the younger generation prefers digital channels for paying bills and marketing, but research shows they continue to gravitate to paper mail for their statements, which in itself is a sea change in how the younger generation is viewing things,” shares Mascara.

This is in contrast to how the enterprise looks at cost reduction methods and how best to implement their paper suppression programs. The end result is poor customer experience and diminishing customer satisfaction. “Just this example has had a marked impact on how transactional print has accelerated its transition into a true multichannel or optichannel environment, that can

answer the call to provide customers with the communication channel they desire and the innovations along with smart print manufacturing answer the call for faster, better, cheaper. Advancements in artificial intelligence (AI) and innovations that help drive optichannel workflow bring digital and print communication into a more symbiotic relationship,” says Mascara.

Transactional documents constantly evolve, overshadowed by more ‘sexy’ print applications like labels, packages, signage, and even books.

The continued move to inkjet, in both cutsheet and roll-sheet configurations, is a noticeable trend. “Multiple print manufacturers are represented in almost every environment we are installed in,” notes Margaret Curry, national manager, PPS and strategic accounts, RISO.

Further, while black-only toner devices experience a drop in volume, color inkjet picks up transactional volumes, she adds.

“The biggest change in the transactional space is the shift to color print versus B&W, allowing invoices and statements to act as marketing/communication tools—not just documents,” agrees Brad Turner, VP, transformation, BelWo, Inc.

“Looking back five years ago, there was talk in the industry around the benefits of full-color inkjet and white paper factories, but at that time only a few printers actually made the move to adopt it. Fast forward to now, all of our customers use full-color inkjet in some fashion,” offers Ryan Semanchik, president, Transformations, Inc.

This evolution goes beyond the equipment required and comes with software solutions that offer optimized PDF output for size control and speed efficiency along with improved color management.

Patrick Kehoe, EVP, product management, Messagepoint, says the pandemic accelerated the push to reduce print volumes of transactional communications in favor of electronically distributed communications, in many cases out of necessity rather than just the desire to align with customer preferences.

Statement producing companies have, for years, conducted ongoing campaigns to get recipients to switch from physical mail to electronic statement delivery, admits Aron Allenson, product manager, high-speed inkjet, Screen USA. He says these campaigns are primarily instituted for statement production cost savings through the elimination of print and postage. “The result is that large percentages of people have opted out of physical mail. This has caused statement producer volumes to go down. In some cases this has driven plant closures and consolidations. At the same time, there have been mixed results with transpromo advertising within statementing. The primary reason for

mixed results is the groups responsible for statements don’t have the bandwidth or expertise to effectively utilize and in some cases acquire data to relatively market their customers.”

Automation is essential to the efficiency and effectiveness of the transactional document lifecycle. Andrew Gunn, global director, production value proposition and product lifecycle; Billy Stojanovski, global product marketing manager, global brand and strategy; and Moisha Clark, production lifecycle iGen and Baltoro HF Inkjet Presses; Xerox Corporation, say while the term digital transformation is relatively new in the transactional print market, a streamlining evolution has been in the making for the last several years and workflow is one key component.

“There are lots of inefficient manual processes and steps in prepress using legacy file formats. The notion of automation hasn’t always been a focus, but when you observe prepress processes in terms of hours to complete a task, it’s a real eye-opening experience. Using the same files, workflow automation can reduce that time down to minutes or seconds. We understand workforce constraints put a burden on printers today and workflow automation can free up resources for more important tasks,” they comment.

Adding pressure, service level agreements (SLAs) have continued to shrink in the transactional print service provider market. “Customers want providers to produce transactional print faster—sometimes within 24 or even 12 hours. The shorter the SLA, the less a transactional printer can afford for something to go wrong. This also drives them to look for faster processes

and print and finishing devices to speed up the production of the work. In short, workflow and process optimization and automation take center stage in production print planning and execution,” adds Mary Ann Rowan, chief experience officer, Solimar Systems.

“Digital printing technology has enabled transactional printers to offer more customized and personalized products, while also reducing costs. Additionally, automation processes improve efficiency and reduce turnaround time. Companies increasingly use digital data and analytics to better understand their customers and their preferences, allowing transactional printers to tailor their services to meet customer needs. Web to print has also become more popular, allowing customers to create, submit, and track their transactions online,” adds Avi Greenfield, VP, product management, CXM, Quadient.

Bryan Ten Broek, VP of business development, Nordis Technologies, feels that personalized communications are increasingly important for attracting and retaining customers. Just as companies are expected to deliver communications based on channel preferences, consumers increasingly want tailored content in communications. They expect a business

to know their existing relationships, services, and products as well as customize offers, payment and financing options, information, news, and other messaging to their circumstances.

In the past five years, Johan Laurent, director of business operations, Standard Finishing Systems, noticed increased demand by the financial sector for visually engaging, personalized statements that better appeal to customers and meet regulatory requirements. This demand fueled the transactional market’s switch to digital print, particularly in high-volume shops, to allow for easier data management from prepress through post press.

“Customer expectations have evolved significantly in the last five years, changing the temperature of the conversation. Today, customer preference is dictating what companies offer because customers want to choose their method of communication. They seek vendors that offer multiple channels of communication, whether it be print, email, take online payments, send out text messages, or all the above. It is a multi-generational demographic of buyers that want options,” says Semanchik.

Ideally, Allenson says there would be a push for better usage of available data

for transpromo marketing. “People don’t mind getting marketed to as long as the marketing is relevant. Often the companies sending out statements have the best access to that data and the question is, will they see the value of it and then devote the resources to executing it well. If they do, this could change the nature of transactional printing from a simple relaying of facts to marketing quality printing.”

“Companies leverage omni-channel, customer communications management (CCM) platforms to deliver better customer experiences. They respond to growing consumer expectations for digital and mobile options by adding email and text messaging, which provides greater choice and convenience,” offers Ten Broek.

It’s essential to give consumers with access to the information they want on

the channel they prefer, whenever they want it. “As a result, all aspects of production print and customer CCM have evolved to incorporate new channels. And while print remains important, it is just one aspect of a broader communication experience that companies must provide. This includes ensuring that all communications are not only accessible, but useable on various mobile and web platforms,” states Ernie Crawford, president/CEO, Crawford Technologies.

However, it is important to note that the expansion of channels and devices that people use to access information creates new data security challenges for communication providers. “They implement stronger security measures to ensure confidential information is protected and avoid the risk of a security breach, while ensuring they can provide relevant communication when and where it is needed,” adds Crawford.

Rowan suggests that both security and shrinking SLA timelines create a need for continued evolution in the transactional print market. “Beginning with security, as ransom attacks and other security vulnerabilities have increased, the need to protect both customer and company data has become crucial. To do this, transactional customers are in technology, people, and vendor partnerships. Those investments increase the costs of producing transactional print in a very tight market.”

Transactional documents often take a lot of coordination to be not only informative, but effective communication pieces. Common challenges transactional providers face involve security, staffing, service options, disaster recovery, and supply chain issues.

Carr feels that one of the biggest challenges data center transactional printers face today is that their cost

model is in direct conflict with the organization’s cost strategies, which is a reduction in postage spend and operational expenditure that can only be met with the migration to digital. He sees significant initiatives within organizations to move customers to digital delivery, which reallocates budget away from operational advancements.

“Look at an average bill, statement, or letter, it’s an opportunity to look at the information contained in these and explore if there is an opportunity to provide more information on companion products or services that they can offer,” note Gunn, Stojanovski, and Clark. “In other cases, just the move from monochrome to color might speed up the time it takes the consumer to pay. For that to happen the folks in the data center and print facility need to work together with their marketing departments and plan future steps together.”

Matt Mahoney, EVP, sales and marketing, Racami, says challenges come when data centers/transactional providers own too much technology that doesn’t work well together, creating inefficiencies and quality problems

Further, the cost of compliance, lack of knowledge of digital communications and complex multi-channel workflows, the cost of insurance to protect against cyber attacks and errors, and dealing with aging technology—both software and hardware—that has to be replaced are other issues,notes Mahoney.

Ten Broek agrees, adding that the demand for easily accessible production and performance data from transactional printers and communications providers to improve business decision-making continues to rise.

This comes when it is increasingly important for organizations to demonstrate competence in both print and digital output. “The electronic output experts come from the digital space and use digital tools. Print experts steadily evolve print capabilities in their area. As the two come together, it is difficult to get a team

with expertise in both. Many organizations keep this separated for traditional reasons, but this strategy adds a lot of cost, introduces complexity, and creates opportunities for cross-channel inconsistencies,” shares Greenfield.

Declining volumes make it hard to justify in-house plants and operations. “As customers want more flexibility and agility in their operations overall and as they seek out efficiencies in managing both print and electronic communications, it is important for printers to adapt to offer the kinds of services that address those changing needs,” offers Kehoe.

Security considerations are constant. “Five years ago security was not the issue it is today. Now it is the first topic of conversation,” says Semanchik.

Compliance and data security are top of mind, especially now in our current environment with security concerns and regulations. “As outsourcing trends continue to rise in favor of print providers, businesses look less towards providers with the lowest cost and more towards providers that have a proven track record with advanced delivery solutions, including data security,” comments Mascara.

The stakes are high when handling sensitive documents. Industries such as insurance, financial services, and healthcare must navigate an ever-changing regulatory landscape with increasing penalties and risk; penalties that could ultimately run them out of business if not in compliance, explains Semanchik.

“Security and the tracking of documents is increasingly important to make sure data stays secure and you can tell a customer where it is at all times. Having the right certifications is also critical and requires a robust data center that can pass audits. At the very minimum, a data center needs to be certified in Systems and Organization Controls 2 (SOC 2). Compliance with SOC 2 requirements indicates that an

organization maintains a high level of information security and ensures sensitive information is handled correctly,” explains Turner.

“Stricter data regulations are a challenge as transactional print providers need data management and integrity solutions that protect sensitive customer data,” agrees Laurent.

Whether it is rising costs or security, data centers/transactional printers face a number of significant challenges. “Organizations continue to manage increasing volumes of confidential data that put them at risk for a security breach. They need to ensure they have the right processes, training, and tools in place not only to protect their customers’ data, but also their brands,” observes Crawford.

While economic conditions may seem challenging, there is no better time to invest in modern technology and tools to replace outdated systems. “This, combined with investments in staff training, will help an organization be in an optimal position to take advantage of new customer and market needs,” adds Crawford.

“Digital natives understand security concerns and identify with the trend back towards paper adoption,” suggests Mascara. “With that said, customers have digital fatigue, which is also nudging every age group of consumers to traditional mail/paper. So innovation is not static. Innovations in print will also continue. Just over the last three years we've seen innovations in inkjet technology and digital press capital expense, especially as smart print manufacturing helps drive the cost down for both manufacturers and print providers in terms of reduced labor costs. The negative for print, as everyone is aware, is the delivery cost associated with the mail stream.”

It is easy to get caught up in the complications of things, but there is a lot of opportunity in the transactional print space.

Curry says this may come in the form of better inline finishing for inkjet presses, the ability to handle smaller volume jobs and reprints, or improved monitoring capabilities.

“Printed transactional documents might be declining in volume, but they

aren’t going away any time soon. We see a huge opportunity for both in-house operations and service providers to step up and provide electronic distribution services,” says Kehoe.

Organizations look to these operations to provide the control and governance that

Electronic distribution of transactional documents are essential and should be integrated into a omni-channel strategy.

“Practically all of our production customers offer it in tandem with the printed files,” notes Margaret Curry, national manager, PPS and strategic accounts, RISO. “Software composition and post-composition companies have emphasized the importance of composing documents for multi-channel distribution. Storage and indexing of these electronic files along with data security are important features of any solution.”

“Electronic distribution is no longer optional—it is a must-have,” states Ernie Crawford, president/CEO, Crawford Technologies. “Given that nearly 60 percent of internet traffic came from mobile devices last year and the fact that most people view email on their mobile device before they open it on a PC, digital is a key component of every organization’s strategy. Organizations utilize workflow solutions that allow them to easily manage and streamline the creation, production, and delivery of both digital and physical transactional communications.”

In the past, print and electronic documents were handled separately. However, Ryan Semanchik, president, Transformations, Inc., points out that today, electronic distribution options are part of the overall workflow. “You can take a single data file and control where and how each communication is delivered. Distribution options can be modified in real-time as customers modify their delivery preferences.”

“A few years ago, you might have asked a customer to select a preference for email, SMS, or paper-based interactions. Now, the same customer might want a text message as advance warning before a payment will be deducted, a text message confirmation of a payment, a more detailed email with transactional details, and a downloadable electronic copy for tax or expenses purposes on a portal—or in the mail,” recalls Avi Greenfield, VP, product management, CXM, Quadient. “Electronic isn’t an option; it’s part of a journey that has accumulated more steps as customers sort through more digital noise in their life.”

By integrating electronic distribution into the workflow, Brad Turner, VP, transformation, BelWo, Inc., says printed and electronic documents remain consistent in both look and information, no matter what channel they are sent through.

are so important for these kinds of communications. “This doesn’t go away just because the communications are electronic, there is still a need for that kind of expertise, and many organizations are well suited to bring those capabilities together,” adds Kehoe.

Companies increasingly look to consolidate print and digital communications and vendors so they can operate from one platform, improving productivity and security while simplifying vendor management. “A single omni-channel system makes it simple to add digital channels and easier to cater to consumer preferences. Many consumers opt for a combination across channels, such as text messaging, email, and print/mail,” says Bryan Ten Broek, VP of business development, Nordis Technologies.

Ten Broek adds that a single platform can centralize USPS tracking, archiving and reporting while streamlining return mail, bounced, or unopened emails and text messages.

The challenge of electronic distribution is how to present it, says Crawford. “You can’t expect people to view a PDF on a mobile device. SMS and MMS provide amazing opportunities for marketers, however many of them fail to effectively link the digital message for the recipient, member, participant, or end user,” he explains.

Patrick Kehoe, EVP, product management, Messagepoint, says many organizations take a lowest common denominator approach to electronic communications based upon their current workflow— PDF. “The ability to convert their page-oriented printed documents to PDF and manage distribution through a portal in concert with an invited pull email has been a relatively easy concept for many organizations to wrap their arms around and adopt. While this process fits well into their current workflow and provides a cost reduction for print and mailing costs, it creates a terrible customer experience for users trying to navigate these documents on a mobile device. We’ve all experienced the pinch and zoom and scroll trying to view a PDF on a smartphone.”

Better options might be to provide responsive content that can be presented in the channel and device of choice for the user, so they can have a more natural feel for how they interact with this content. “For heavy transactional applications like brokerage accounts and communications with lots of transactional details, mobile applications or mobile websites are purpose built to provide this information. Those can still use the feeds and content from your traditional channels, but need to be optimized for the electronic channels. These require rethinking the production and content management workflow with these different channels in mind,” recommends Kehoe”

He also points to the opportunity to help customers make printed communications work a little harder for them, thereby making your role more valuable.

Semanchik sees a the potential to increase competitiveness in the transactional market space by implementing technology that allows you to build more offerings into the system beyond just print and mail. "For example, adding the ability to do online payments to your offering is a great way to build additional revenue and foster more growth from current customers. Also, added value, such as stronger compliance solutions with extensive dashboarding, reporting, tracking, auditing features, and business intelligence providing full transparency throughout the document lifecycle can really help you excel against your competition rather than playing catch up."

The goal is becoming a full-service provider and doing everything you possibly can for a customer, comments Turner. "To grow your business, find out what else you can do in addition to the transactional work for the customers you have. The more you are able to help support a customer's business, the more you foster customer stickiness, meaning they are more likely to stay with you for a long time."

Gunn, Stojanovski, and Clark believe the transition from B&W to color printing offers the biggest opportunities. "Our customers tell us they actually get paid back quicker or on time because their customers read color statements faster. In fact, color statements can increase payment response by up to 30 percent," they offer.

Print to digital conversions using techniques like quick response (QR) codes is expected to continue for the coming years, according to Greenfield.

The continued migration to securecloud workflow solutions helps

alleviate staffing requirements around application onboarding time and cost, predicts Crawford.Additionally, the regulations related to accessible communications are growing and organizations that can provide accessible, digital, and print versions are going to see great growth in the coming years.

With the right technology and channels in place, Ten Broek says companies can shift focus to optimize omni-channel communications and find the right mix by segment andindividualto deliver a superior personalized customer experience that drives engagement and loyalty. ''AI-driven data analytics plays an important role in identifying that right mix and timing."

Crawford believes the use of Al in providing data insights for the creation of personalized, relevant communications will be a significant opportunity for communication providers.

Carr sees the biggest opportunity in the next few years is the reduction in operational cost as a result of migration to digital delivery.

For printed documents, the new generation of automation is hitting the print market from both printers and print finishing suppliers, adds Laurent.

Transactional documents are necessary to communicate essential information between a business and customer. While digital delivery options continue to emerge, print is here to stay.

If we were asked to speculate on the future of transactional print a decade ago, the outlook might be bleak. But now, Mascara sees a flattening trend line. "Print is not going away, digital is not taking over. Both have been leveling off for the past few years. But keep in mind the curve that is flattening is in a different progression for each vertical. That's why it's important to keep an eye on innovation and customer communication preference. This is not a major resurgence of transactional print, but print is emerging as the enabler for digital communications. Following the pandemic, we see this acceleration of the trend of print as the first entry point to a customer, be it transpromo or QR codes on statements, enabling and driving the consumer to secure and relevant forms of communications," he concludes.

Read more on this topic online at dpsmagazine.com and check out our webinar at dpsmagazine.com/webinars. dps