Executive Summary

1.This report has been commissioned by the RMT, who have asked us to critically analyse the Project Neptune report which was commissioned by Transport Scotland in 2020. The history and background to the finance and provision of life-line ferry services and the issue of competitive tendering in the pre-Brexit context is outlined here. The separation of Cal Mac and CMAL into its current structure is explained in that context.

2.The Project Neptune remit is set out including its focus on governance, project control, value for money and international benchmarking.

3.We analyse the methodology used which is, for the most part, valid with some gaps and a lack of clarity in relation to the assessment of project control and value for money.

4.The main weakness in the report is the failure to engage with the appropriate stakeholders including the island communities and the workforce. This is despite repeated acknowledgements that better communication and transparency is key to meeting the needs of those who rely on ferries for commercial and public transport and employment.

5.Moreover, there was a failure to properly consider and assess, in terms of value for money, the wider role of CalMac in providing good quality employment and supporting the cultural life of the island communities.

6.Prior to the current procurement failure, the reliability and punctuality data show that CalMac was providing a high-quality and reliable service. Moreover, CalMac can be shown to be providing public value beyond the provision of transport services.

7.We note that the Project Neptune report identifies and confirms weaknesses in relation to Project Control which were identified by Audit Scotland in 2017

8.We note that the Project Neptune report and Audit Scotland both identify lack of transparency and accountability as being central to explaining both the weak assessment of Project Control and Value for Money.

9.The identified lack of transparency and accountability is highlighted in the governance section and can be ascribed to the relationship between the three members of the tripartite governance structure - Transport Scotland, CalMac and CMAL

10.The International Benchmarking section gives rise to no recommendations from Project Neptune and we attribute that, at least in the case of Norway, to significant differences in the nature of the waterways served and the nature of the market (eg number of market participants) which differ greatly from Scotland.

2

11. In summary the report recommends ‘greater regulation and integration’ but ‘noted substantial challenges in relation to privatisation’.

12. We find much to agree with in this assessment. The arguments around increasing competition via tendering – including unbundling of routes – have been rehearsed repeatedly and they remain flawed and without serious evidence of any benefit.

13. However, we agree that steps must be taken to involve all stakeholders (the travelling public, the workforce and island businesses) and that such consultation is vital to any wellrun, transparent, open and accountable public service.

14. A Ferries Regulator is one mechanism which could provide a cost-effective mechanism to improve transparency and communication between all parties and should be considered. This could be a ‘light-touch’ regulator with limited powers and with a remit to provide transparency and accountability and an independent point of contact for stakeholders and providers. There are already regulatory mechanisms in place to cover quality of service and pricing.

20. The re-integration of CalMac and CMAL should also be strongly considered. This would reduce both coordination and communication costs as well as providing savings by removing the need for two separate tiers of management.

21. In any future consideration of the financing and provision of life-line ferry services it is imperative that the wider social and economic value of a publicly-owned ferry operator is at its heart. This goes hand-in-hand with the pressing need to devise better ways to involve all stakeholders (workers, travellers and businesses) in the design and delivery of ferry services which are the economic and social lifeblood of island communities and of Scotland’s economy.

3

Introduction

1. This report has been commissioned from the University of Glasgow by the National Union of Rail, Maritime and Transport Workers (RMT). The remit for the research is to

‘…provide a critical analysis of the Ernst & Young Project Neptune report, specifically a written report and a dissemination programme…’.

2. Members of the research team, have been involved in research on the financing and delivery of life-line ferry services from 2005 ie from the period immediately preceding the first tender of the Clyde and Hebrides service.

History and Background

3. Ferry transport in Scotland has provided a vital link to the islands for over 170 years and has been provided, in large part, by the state, for over 70 of those years. In more recent times, public debate around the financing and provision of lifeline ferry services has become highly politically contentious. The introduction of competitive tendering in 2006, which the Scottish Executive (now Scottish Government) believed was necessary to comply with EU competition law, has led to regular and repeated periods of instability for all stakeholders including the ferry users, the broader island communities, the workforce and the various local authorities both on the Scottish mainland and the islands.

4. Competitive tendering also led to a structural reform, in 2006, of the wholly-owned Caledonian MacBrayne Ltd (at a cost of £13.28 million) which separated the operation of the service into a company to be named CalMac and the ownership and maintenance of the vessels and harbours into a separate company to be named CMAL – both companies remained publicly-owned.1 In addition, the costs of the tendering process have been large – a conservative estimate of £4 million since 1999 which did not include costs ‘such as the cost of senior officials, specialist officials and Ministers, nor a proportion of the overheads which the Scottish Government accrues generally’ was given by Transport Scotland in 20182. These costs are broadly in line with those predicted by Findlay (2005). While there is some evidence of service improvement arising from conditions imposed during the tendering process, there appears to be no good reason why those conditions could not have been imposed directly. This is particularly so given that the

1 For a discussion of the issues surrounding the tender and the structural change which led to the creation of CalMac and CMAL see Findlay, J (2005)

2 Transport Scotland, (2018) Ferry Services Procurement Policy Review – Emerging Findings – to be found at https://www.transport.gov.scot/media/41273/ferry-services-procurement-interimreport_2nd-go.pdf

4

public service operator, CalMac, has retained the contract for the Clyde and Hebrides routes (the largest bundle of routes in the network, the contract for which runs till 2024). This is, in fact, the position taken by the Scottish Government and by its transport agency, Transport Scotland, as outlined in the 2018 Ferry Services Procurement Policy Review:

It is also important to recognise that a direct award to an in-house operator is also capable of delivering similar levels of operational efficiency, innovation and service improvement to those which might otherwise be obtained from tendering.3

They go on to confirm that (in order to meet the State Aid rules then in force):

In meeting the Altmark criteria, any in-house company would, by definition, have to demonstrate operational efficiency levels equivalent to those which would be provided under ideal market conditions (ibid)

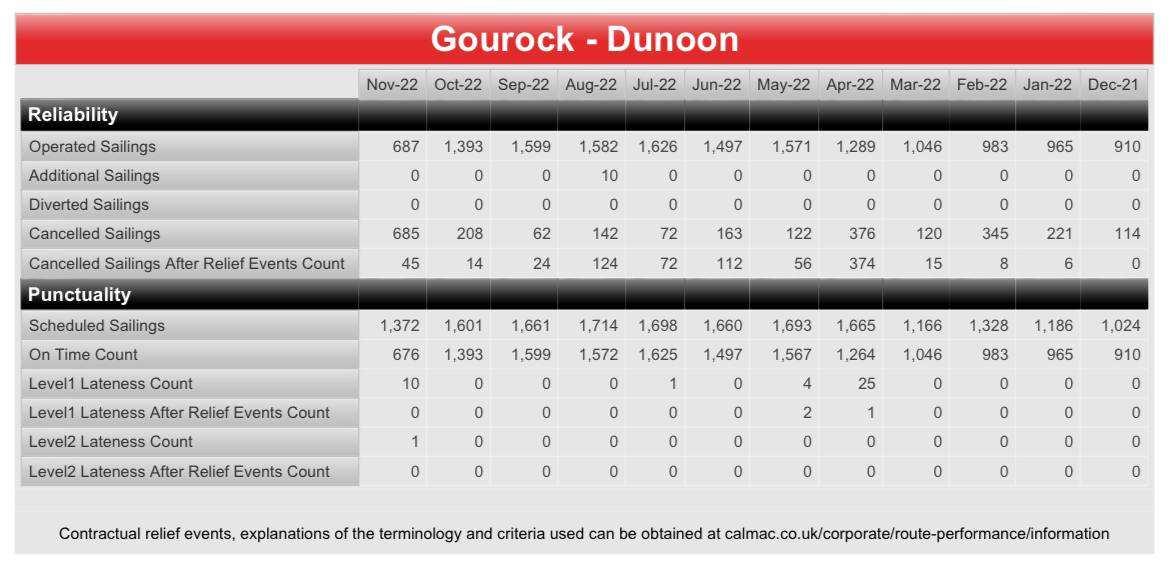

5. On this basis the Scottish Government in the pre-pandemic and post-Brexit-vote era took the view that tendering would no longer be necessary for the Clyde and Hebrides routes. Notwithstanding this, the Scottish Government did tender the Northern Isles routes and, in 2019, awarded a six-year contract to the incumbent private sector firm, Northlink which is due to end in 2026 (with the option of a two-year extension). The third, and much smaller contract, Gourock to Dunoon, previously served by the public sector Argyll Ferries, was subsumed into the Clyde and Hebrides Ferry Service CHFS) contract in January 2019.

6. The current public and political debate over the failed vessel procurement process4 is not the subject of this report. However, given the five-year delay, the more than tripling of the original contract price and, crucially, the impact on the quality of the ferry services being delivered on the C&HFS routes, it is not possible to set it to one side. The considerable impact on the island communities, in terms of the service reliability, of the failure to deliver the two new hybrid ferries (801 and 802) has coloured public attitudes to the service and its providers and has focussed minds closely on the wider question of appropriate ferry provision and governance. A recent consultation exercise by the Net Zero, Energy and Transport Committee5 is a good example of this effect. It is clear from the analysis of the responses by SPICe (Scottish

3 https://www.transport.gov.scot/media/41273/ferry-services-procurement-interim-report_2ndgo.pdf Para 5.5

4 https://archive2021.parliament.scot/parliamentarybusiness/currentcommittees/113986.aspx https://www.audit-scotland.gov.uk/news/multiple-failings-have-led-to-delays-and-cost-overrunswhich-continue-to-obstruct-delivery-of

5 https://www.parliament.scot/-/media/files/committees/net-zero-energy-and-transportcommittee/correspondence/2022/spice_summary_written_evidence.pdf

5

Parliament Information Centre) that the significant disruptions, over a lengthy period, caused by the failure to deliver the new ferries on time is what appears to underpin a majority of the responses to all questions and we discuss this further below.

7. As we write there are also concerns being raised about the late implementation of the new ticketing system which is also the result of failures in procurement policy and practice and is also outwith the remit of this report. The system is due to be introduced on 25 April 2023.6

Project Neptune Remit

8. The Scottish Government, via its executive agency, Transport Scotland, commissioned a report, referenced earlier, in December 2020, with the following remit:

The Supplier will prepare a report for Scottish Ministers on whether the governance arrangements between the tripartite bodies remain fit for purpose having regard to the overarching objective of effective, efficient and economic delivery of lifeline ferry services. The report will contain reflections on the positive aspects of the current arrangements, areas for improvement, and balanced recommendations for the optimal corporate structures and governance arrangements going forward. The project should identify any specific, practical recommendations to improve transparency of decision making for interested parties.

9 The contract was won by Ernst & Young in 2021 , a professional services company, headquartered in London. The report was delivered on 17 February 2022 and made public on 8 September 2022.

10 Given the time taken between the delivery and publication of the report there was extensive public discussion and speculation about its content and the key recommendations. It is therefore important to state clearly the remit of the report and, almost as important, what matters lay outside its remit.

11 In addition to the general specification quoted above, the tender document elaborated as follows (our commentary in bold):

• Transparency and Effectiveness - Reflections on the 2006 decision to separate infrastructure and operation of Scottish ferries, in particular whether this continues to be the preferred approach in a post EU Exit context with respect to both procurement and state aid legislation.

6 https://www.calmac.co.uk/article/8477/Information-on-our-new-booking-and-ticketing-system

6

In other words, would it make sense now to reintegrate CalMac and CMAL

• Accountability and decision-making - Review the legal, financial and operational controls of TS, CMAL and CFL/DML ensuring efficiency and value for money. Review the efficacy of current corporate structures and governance arrangement in delivering the implementation of Ministers’ policy priorities as shareholder

This appears to be an extension of Specification 1 to further consider the best organisational framework for ferry delivery given the set of actors currently involved

• Collaboration - Recommendation of a potential route/structure for direct award of ferry services contracts, that Scottish Ministers could consider as part of a future strategy

In other words, a consideration of whether the current bundle of routes should be split up for any future contract even in the absence of tendering

• Value for Money - Analyse the impact of structure and governance arrangements on Scottish Government financing and inter organisation money flows.Responsiveness to ChangeIdentify any “quick wins” in terms of efficiency, incentives and collaboration for effective decision making and delivery of ferry services.

• Examine and identify governance and restructure options for long term consideration to include an assessment of global best practice This should include an analysis of the challenges and opportunities associated with options for decentralisation (unbundling of routes into smaller packages).

In other words, to look at how ferry routes are organised in other comparable countries alongside a consideration of Specification 3

12 In addition to the matters discussed in Paragraphs 8-11 above, the matters explicitly excluded from consideration include timetabling, fares structures, communications strategies, individual vessel or infrastructure project procurement strategies, design strategies or outcomes, the merits or otherwise of direct award of contracts or the scope or duration of CHFS and NIFS contracts.

Summary of Project Neptune

13. Part 1 of the Project Neptune report deals with issues of governance, a review of internal controls for two projects (Ardrossan Harbour and the new Islay Vessel) and an assessment of whether the current arrangements provide value of money. The report provides a very detailed

7

and useful description of a number of aspects of lifeline ferry provision in Scotland. The organisational framework within which decisions are made about all aspects of the ferry service is set out in a clear and helpful way; details of the organisations involved in delivering on all the routes and the relationships between them; a map of the routes and who provides the service on those routes is also provided together with details of ownership of vessels, harbours and all related infrastructure. This explains the complications involved in the current structure and provides the backdrop against which any discussion of possible changes must be discussed. The authors acknowledge that feasibility – or deliverability as they term it - is a key aspect of any sensible proposal.

Governance

14. The report gives details of the underpinning research conducted on governance issues – which consisted of a review of relevant documents and interviews with key personnel from what the authors refer to as the Tripartite. The Tripartite consists of CMAL, CFL, and Transport Scotland. The interviews also included representatives of David MacBrayne Ltd (the holding company that owns CFL and is, in turn, wholly owned by the Scottish Government)7. It concludes that the separation of CalMac (referred to throughout by the initials CFL – CalMac Ferries Ltd) and CMAL has not been entirely successful. Given that the motivation of the original separation (Findlay, 2005; https://www.calmac.co.uk/article/2518/Company-History) was unrelated to organisational efficiency and transparency, this is not entirely surprising. Most of the issues they point to eg lack of clear roles and responsibilities causing ‘conflict between senior personnel’ from the two successor organisations, leading to, or suggestive of, a ‘lack of a joint approach and an aligned position’ were entirely predictable at the time of the division of the two parts of Caledonian MacBrayne and should have been addressed from the outset. Importantly, these conflicts have led to ‘delays in decision making/progressing projects’. This is a matter of strong relevance given the long-running procurement problems.

Project Control

15. In the Project Control section, the report’s authors look at two projects. First, the upgrading of Ardrossan Harbour, the mainland harbour for the ferries to Arran and, when completed, to Kintyre which is a joint project between North Ayrshire Council, Peel Ports Group (the owners),

7 The names, but not roles, of all those interviewed from Transport Scotland and at least one member of CMAL are redacted in the published document. This seems at odds with the emphasis the report’s authors place on transparency and no explanation is offered why this would be necessary for employees of publicly-owned (or public) bodies. In addition, most, though not all, of the names can be found easily with an online search using their job title.

8

Transport Scotland, CMAL and CFL. Second, the commissioning of the new Islay Vessel to replace the MV Hebridean (now thirty-seven years old) on the Kennacraig (Kintyre) to Port Ellen and Port Askaig (Islay) routes.

16. These projects were selected by Transport Scotland but there is no indication in the report as to why these two projects in particular were chosen, both of which were at the pre-approval stage. Apart from interviews with senior personnel, this was largely a desk-based review of documents against the framework of the Scottish Public Finance Manual8 and guidance based on methodologies formerly owned by the Office of Government Commerce which ceased to exist in 2011.

17. The review identified gaps in the project control process. Specifically, there was

• a lack of a ‘clear audit trail’ in relation to any changes in the budget for the project. This is surprising given the highly publicised problems with another project which was (and is) still in progress at that time. This gap was evident in both projects.

• a failure to define and detail the roles and responsibilities of the various organisations involved.

• no clear mechanism to escalate to an appropriate level of seniority when decisions which affect timelines and budgets were taken

• no formal mechanism for Transport Scotland to ensure that, in relation to CMAL’s procurement, that this is done in line with public sector obligations.

13. In summary, this part of the report confirmed elements of weakness identified in the Audit Scotland report of 2017 referenced here.

Value for Money

14. This part of the report contains an assessment of whether, based on the review of Governance and Project Control, the Tripartite is facilitating ‘value for money delivery of the ferry services to island communities’.

15. The methodology to assess whether value for money is being delivered was designed in conjunction with Transport Scotland. On any view, this raises a question of whether it is appropriate to assess the performance of an organisation based on a methodology designed in conjunction with that same organisation.

16. Notwithstanding this, the approach taken has merit to the extent that it is based on National Audit Office definitions and considerations and themes derived from the SPFM (Scottish Public Finance Manual) guidance. Moreover, these themes/considerations are measured against a

9

8 https://www.gov.scot/publications/scottish-public-finance-manual/ Accessed at 30/12/22.

five-point classification, developed by the authors and set out clearly: absent, basic, developing, embedded and leading. However, this analysis explicitly excludes three themes in the SPFM guidance which, in our view, are essential to addressing not only the current dissatisfaction among island communities with their ferry service but also to understanding the role of the ferry service as an important policy lever of the Scottish Government which it operates on behalf of the island communities and the Scottish population as a whole. These are: working with communities, sustainability and fairness and equality. We refer to related matters at Para 29 and we will return to them later in our overall assessment.

17. None of the SPFM themes assessed in this exercise are graded as embedded or leading which presents a fairly negative picture of the current arrangements. Interestingly, in each case the reason given for the assessment is largely based on organisational matters: ie the current tripartite structure and the communication and transparency deficiencies highlighted in the Governance section of Project Neptune. In the case of one of the SPFM themes – Collaborative Working and Partnership – the report makes clear that all three organisations recognise the importance of delivering a good service to island communities but because of the

‘lack of shared objectives and strategic planning, within the Tripartite, the link between these engagements [with communities] and decisions taken/outcomes delivered is not always clear.’

18. In summary, the value for money assessment, based on a reasonable methodology, albeit not applied to all elements in the SPFM, indicates clear room for improvement. Helpfully, the mechanism for achieving that improvement appears to be obvious and, moreover, in line with previous assessments by Audit Scotland.

International Benchmarking

19. In Part 2 of the report, the authors of the report carry out an international benchmarking process which covers various models of ferry provision from Canada (British Columbia), Norway, New Zealand (Auckland), Australia (NSW). This exercise, helpful as far as it goes, looked at key points of difference across the various models including the identity of the commissioning body, whether or not there is a regulator, who holds the contract, public/private ownership of operator, vessels and infrastructure, the number of passengers annually, the amount taken in fares (Farebox); the extent of subsidy; pre-tax profit made, number and average age of vessels, number of terminals and routes, and contract length and type. There is no mention of the nature of the waters, and the type of vessel required, on routes served in each of these

10

jurisdictions and any difference which might arise as a result of them. This would have been useful to give some context to the extent to which a fair comparison can be made.

20. In order to try to understand the comparisons, the research team interviewed two officers of the Norwegian maritime union9. They confirmed that the majority of their ferry routes do not cross open waters and, for that reason, do not require the same type of vessel – this is one fact which would require to be considered carefully when making comparisons or making any inference about the extent to which any lessons can be learned from the Norwegian experience. Moreover, although there was, at one point, a large number of small companies serving the various Norwegian routes, the position now is that there are now only two larger companies who are funded by the government to provide most of the ferry services in Norway. The existence of a degree of monopoly power held by the private sector ferry companies does represent a risk to the government in terms of the outcome of future tender negotiations.

21. A domestic comparison of ferry services with rail, roads, water and air travel (Highlands and Islands Airport Ltd), was also conducted alongside an analysis which identified four key themes: regulation, integration, privatisation and decentralisation.

22. Part 2 of Project Neptune concludes with an elucidation of ‘Future Options’ following by an evaluation of each option and a series of recommendations which we shall discuss in the next section of this report.

23. While this section of the report is interesting, the authors themselves draw no firm conclusions about what, if any, lessons can be learned from the experience of ferry provision in the countries they examined. Our view, certainly in relation to Norway, is that there is little to be learned which could easily or usefully be applied in the Scottish context.

Project Neptune Recommendations

24. In summary the report recommends ‘greater regulation and integration’ but ‘noted substantial challenges in relation to privatisation’.

25. The key recommendations are divided into short term matters eg to engage in consultations with local communities on their preferences for reform of the sector and to identify the optimal commercial arrangements for delivery of the next CHFS contract (2024).

9 The interview took place by Zoom on Friday 3 February 2023 with Ronny Oksnes and Jan-Erik Lundby from the Norsk Sjømannsforbund/Norweginan Seafarers Union and was conducted by Findlay.

11

26. In the medium term, the Ernst & Young authors recommend the introduction of a ferries regulator and to give further consideration to the re-integration of CMAL and CFL.

Analysis of Project Neptune Report

27. Here we will consider those recommendations, the evidence they are based on and identify gaps in the coverage of the report and any implications that might have in assessing its merit.

28. There is much in Project Neptune to agree with in terms of recommendations but first we will identify areas which could have been better elucidated or evidenced.

29. We also note that the report itself aligns in the following respects with the Audit Scotland review of Transport Scotland’s Ferry Services10 which concluded/recommended, among other things that:

• Ferry operations are complicated and responsibilities and accountabilities are not well understood by users.

• There is a need to improve the transparency of decision-making for ferry users. This may include streamlining and formalising how it consults with and involves ferry users, by giving specific user groups a formal remit to comment on operational and policy matters

• There is a need to better communicate their roles, responsibilities and accountabilities to improve customers’ and stakeholders’ understanding.

30. These points chime closely with the recommendations outlined by Project Neptune in relation to governance (Para 14) and greater liaison with communities (Para 25) which suggests that not enough progress has been made in relation to engagement and transparency since 2017.

31. In our view, the Project Neptune report, while setting out and assessing the options for the future in a helpful and clear way, is lacking in a number of respects.

32. While recommending that there should be ‘regular engagement and consultation with local communities’, specifically in relation to preferences for reform, there is no evidence that within the project there was any attempt to engage with local communities or to understand the need for regular consultation and involvement of communities as integral not just to any reform but as a matter of ongoing practice.

33. The report fails to identify any stakeholders beyond the users of the ferry system despite the ‘engagement and views of key stakeholders’ being part of the requirements of the commissioned report11. This ignores the importance of ferries in terms of employment and, 10 Audit Scotland

11 https://www.gov.scot/binaries/content/documents/govscot/publications/foi-eirrelease/2021/09/foi-202100228098/documents/foi202100228098---information-

12

(op cit)

indeed, the fact that many of those employed in the sector are also local residents. We agree that consultation with stakeholders is vital to any well-run, transparent, open and accountable public service, but the definition of stakeholders is too narrow and should be expanded to include the workforce and their trades union representatives.

34. This leads to a further gap in the analysis contained in the Project Neptune report – the failure to recognise and outline the role of ferries beyond the provision of transport. We have outlined here, and at various times in the past, the importance of the Scottish ferry service to other important areas of Scottish Government policy eg Fair Work. This aspect is clear even in the remit given to the Project Neptune team by the Scottish Government which emphasises growth and equality of opportunity for all. The Project Neptune team argue in Section 6 of Part 1 of their report, that they have ‘considered holistically’ three themes proposed in the Scottish Public Finance Manual: working with communities, sustainability, fairness and equality. However, there is little or no discussion on these issues. A narrow focus on ferry provision in terms of transport precludes a wider value for money assessment.

35. In line with our previous work (Findlay, 2005, 2010 and 2016) and, for the same reasons, we are in agreement with Project Neptune in relation to the advisability (or lack thereof) of unbundling (a process which will allow for profits to be made on some routes whilst leaving the Scottish taxpayer with the bill for routes which can never be profitable)

36. The value of the international benchmarking section is limited and we note that no recommendations are made to adopt any practices uncovered in this exercise.

37. We agree with authors’ conclusion that privatisation is not a policy which is deliverable in any rational and efficient sense. In addition to the matters raised by Ernst & Young in relation to deliverability there is still, and always will be, the issue of Operator of Last Resort in the context of a lifeline ferry service12. This is highlighted at various points in the report, and it remains the case that should a private operator withdraw from delivering ferry services, the Scottish Ministers, as Operator of Last Resort, are obliged to provide a replacement. The Project Neptune team identify areas such as rail, where Government has, in fact, been called upon to do so. It is simply not feasible that they could do this for the Scottish Ferry routes without a publicly-owned, functioning operator in place ie CalMac.

38. In relation to the re-integration of CalMac and CMAL we agree that this should be seriously considered. Our analysis of the original decision to separate both parts of the company

released/foi202100228098---information-

13

released/govscot%3Adocument/FOI202100228098%2B-%2BInformation%2Breleased.pdf

Findlay, 2016, pp9-10

12

concluded that it was unfounded in law, would lead to high costs with no value to the public, and a lack of transparency and additional costs associated with a requirement to have two companies delivering a vital service. Specifically, we concluded that it risked ‘co-ordination and communication problems which do not currently exist within a single company structure’.13 On any view, that conclusion has been found to be justified. However, this does not mean that the fixed costs associated with separation can be recouped but it does provide a basis for believing that such coordination and communication costs can be reduced in future. In addition, the need for two separate tiers of management can also be removed.

39. A Ferries Regulator, as recommended by Project Neptune, appears to be one of a number of ways in which the desired transparency and accountability can be delivered for the travelling public. A single point of contact for the communities could be provided by a regulatory body which would be tasked with improving communications between the operator/Transport Scotland and ferry users. This does, of course, mean an additional expense, but, in addition to the reintegration of CalMac and CMAL, this would not have to be a large or expensive commitment. Indeed, a small complement of staff should be considered, given that its role could be limited to improving transparency and communications in circumstances where the service delivered is already monitored in other ways.

Quality and Reliability of CalMac Ferry Services

48. An aspect of the operation of CalMac which, surprisingly, is not covered in the Project Neptune report (the remit of which is discussed at Paras 8-15) is an assessment of the quality and reliability of CalMac and its role as a policy lever in relation to other Scottish Government priorities.

49. Inevitably, the former is more difficult to assess in the light of the procurement failures which have impacted so severely on this aspect of CalMac operations. Nevertheless, in any consideration of ‘the effective, efficient and economic delivery of lifeline ferry services’14 a review of these matters is an essential element of determining what the future could and should look like as well as being essential to understanding the views of the community.

13 Findlay, 2005 p14

14 See the Project Neptune remit outlined in Section 4.1

14

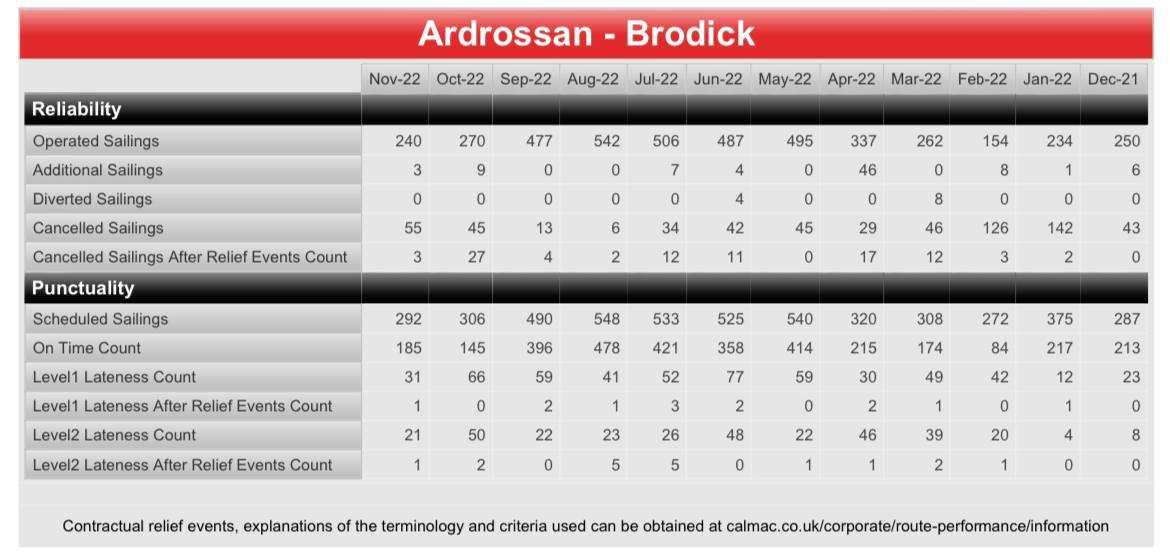

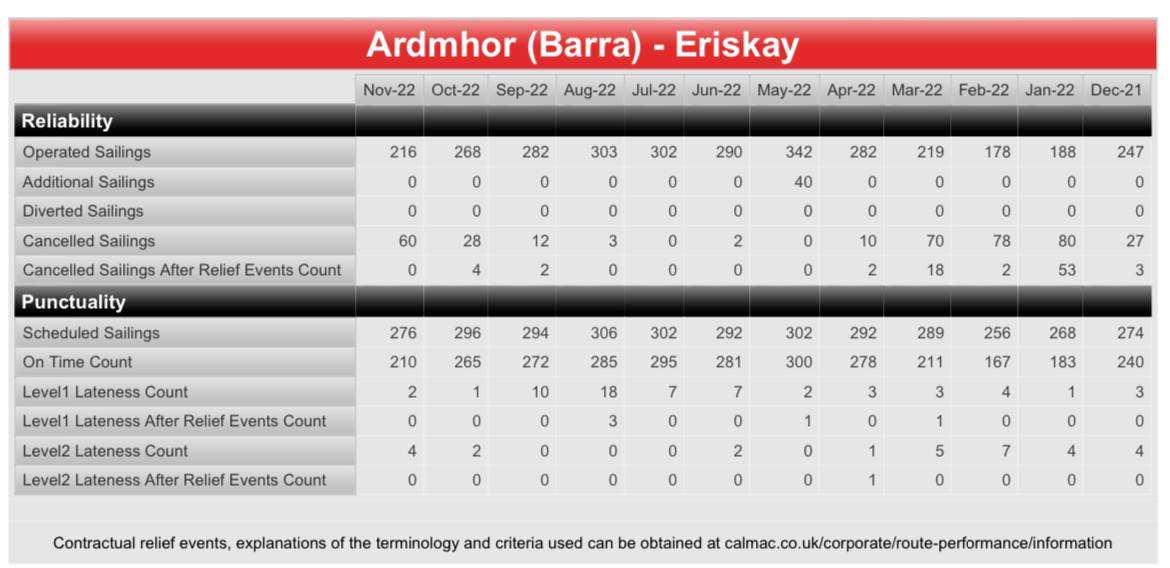

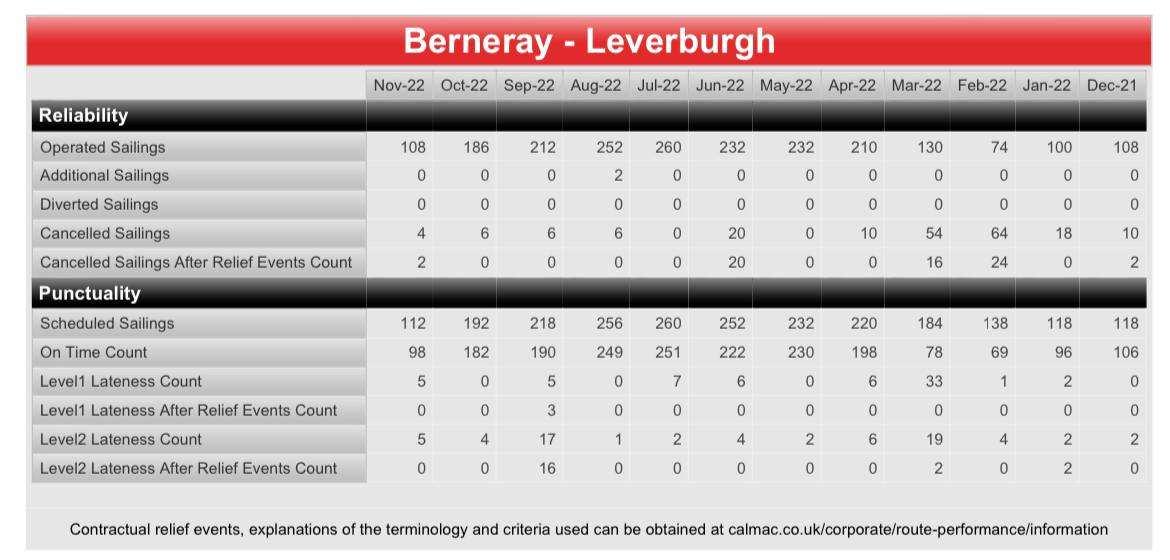

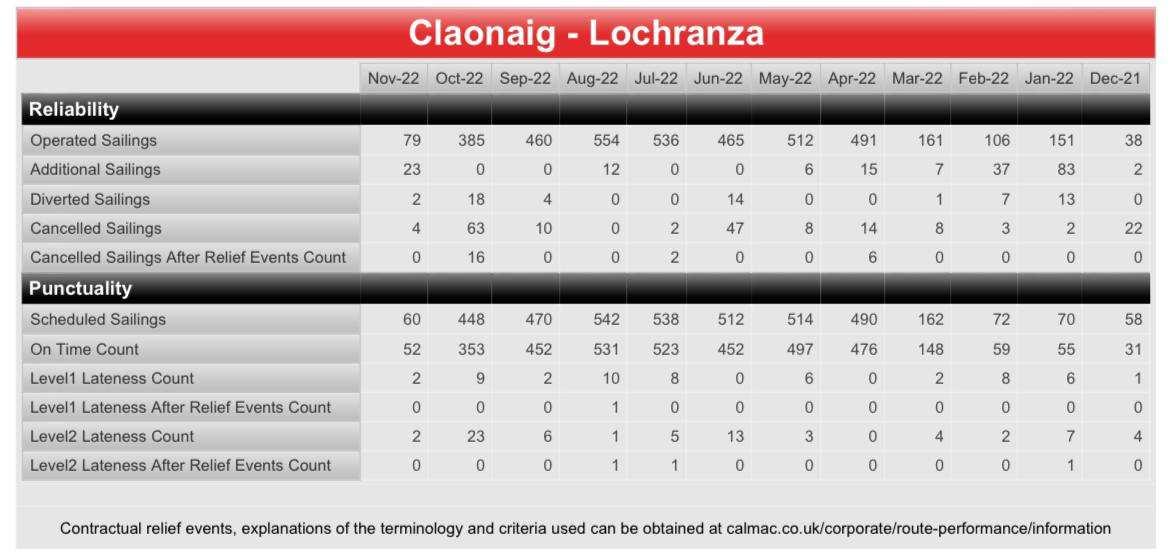

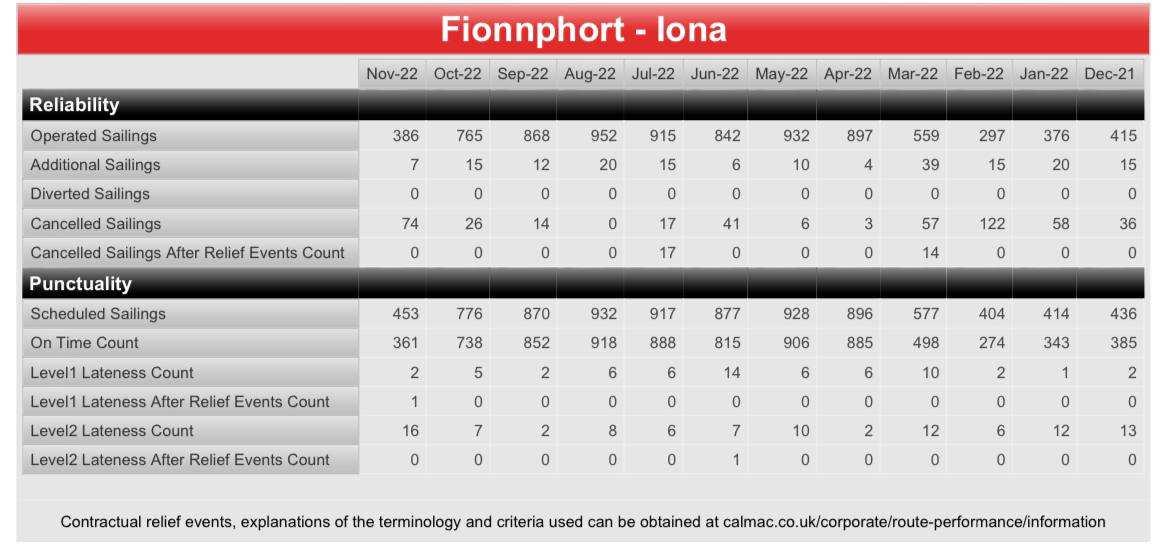

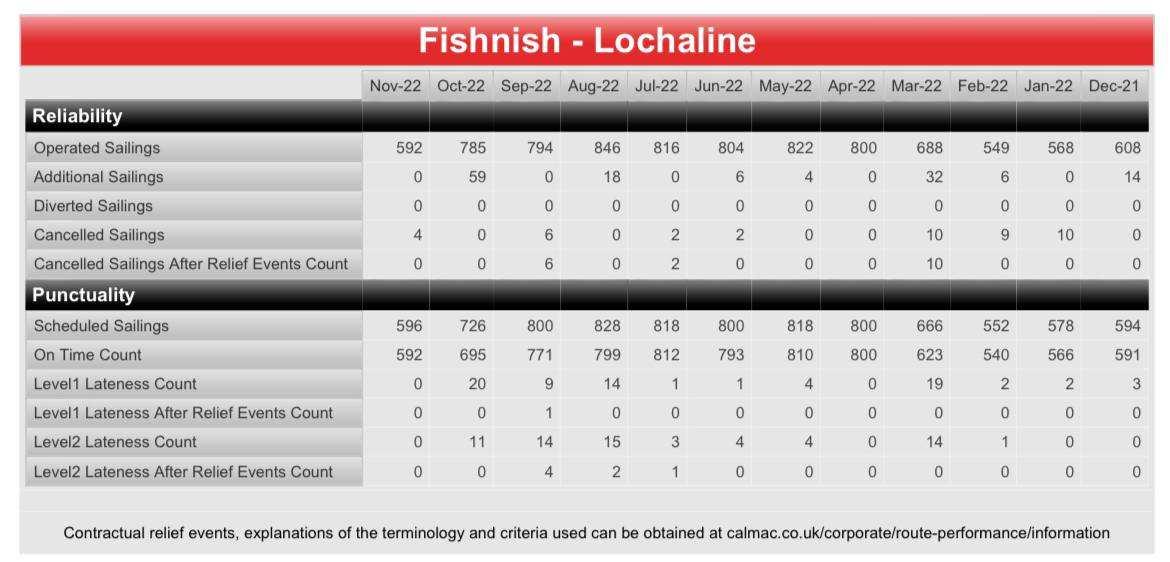

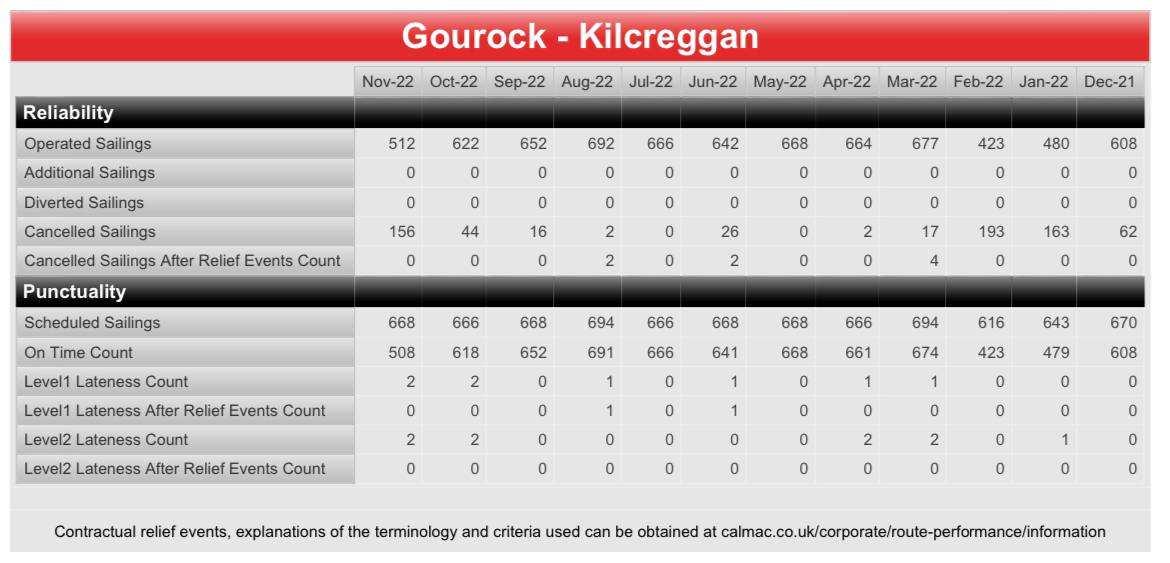

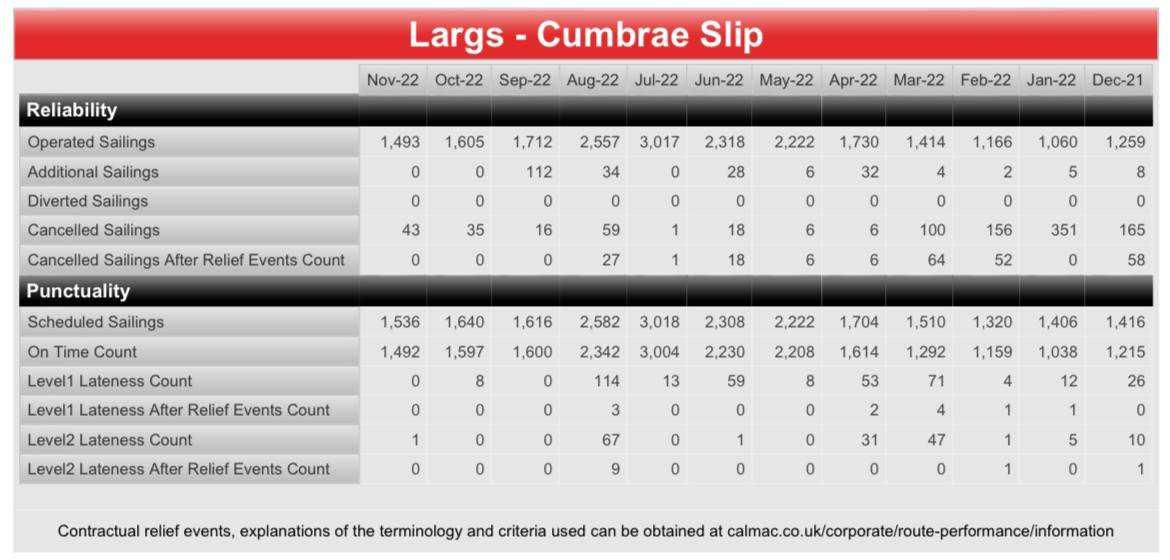

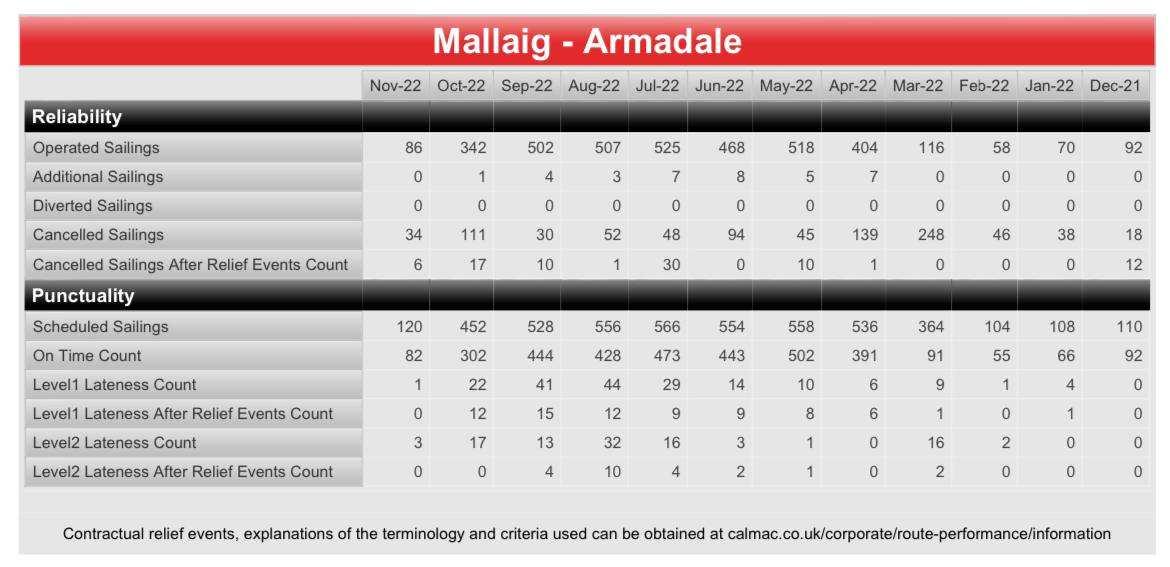

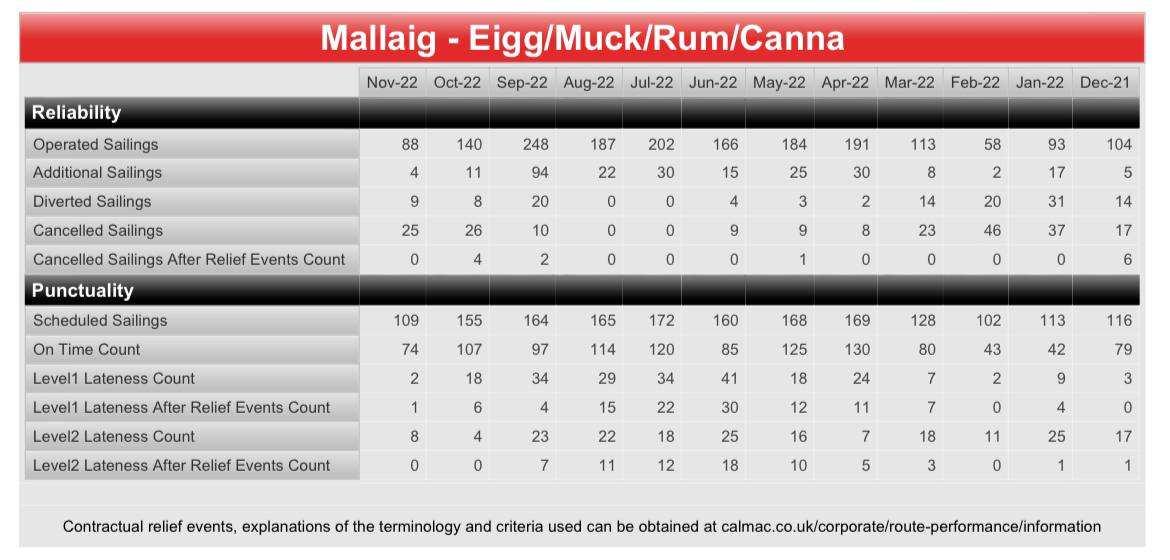

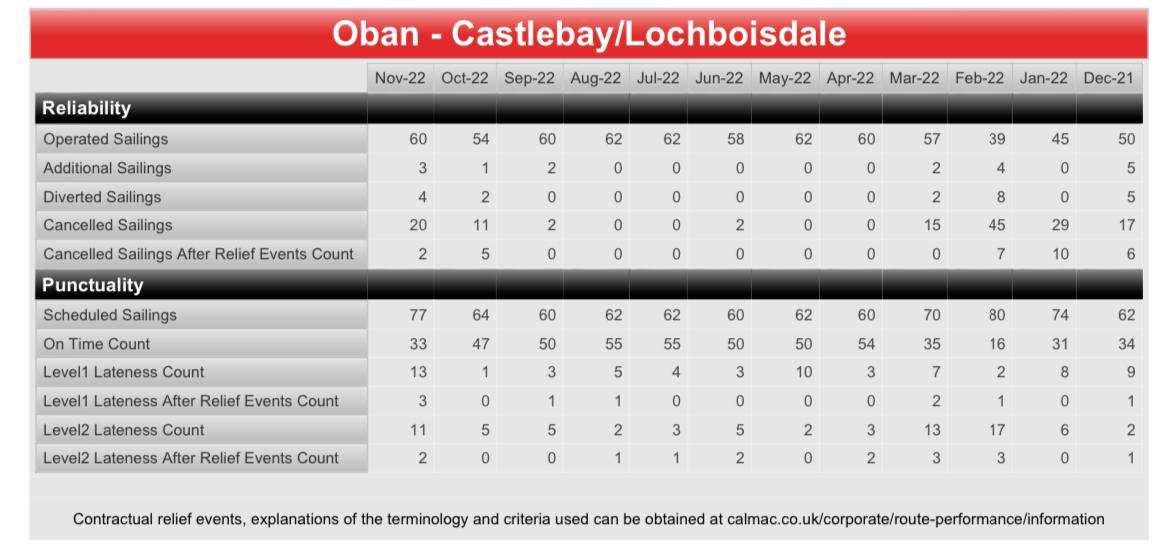

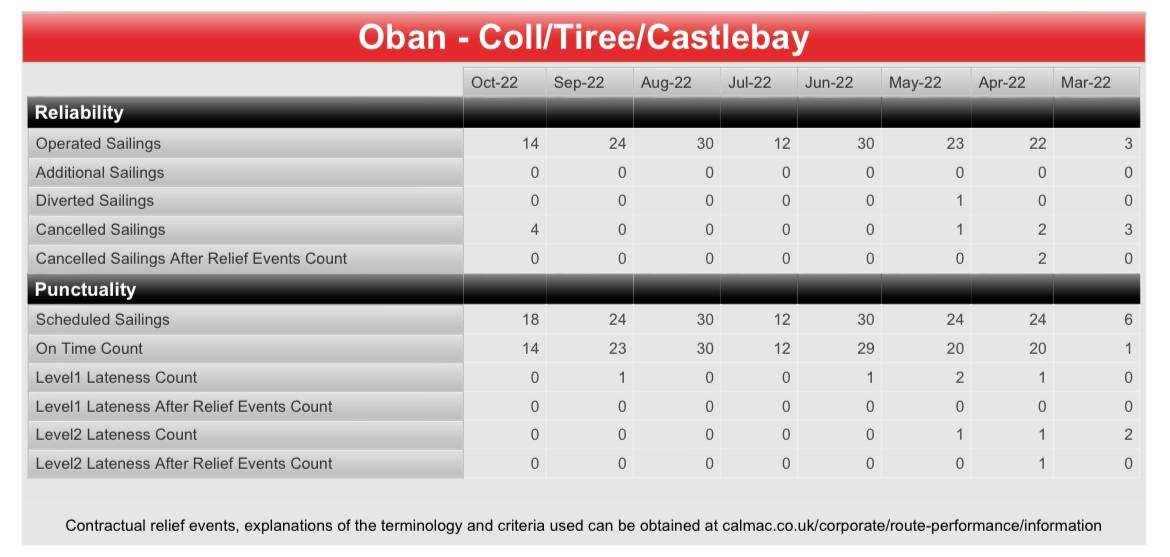

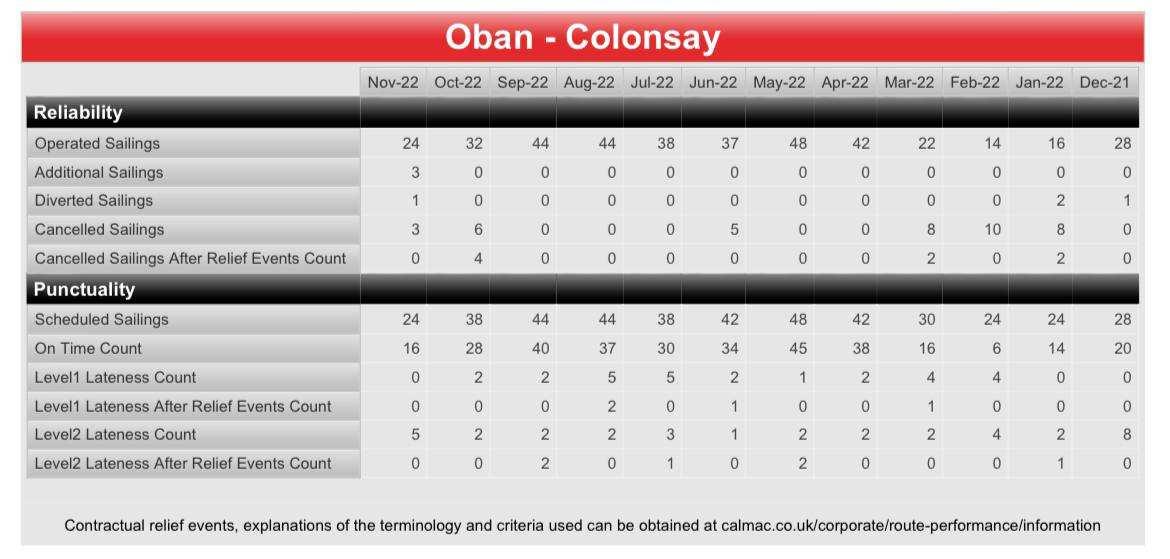

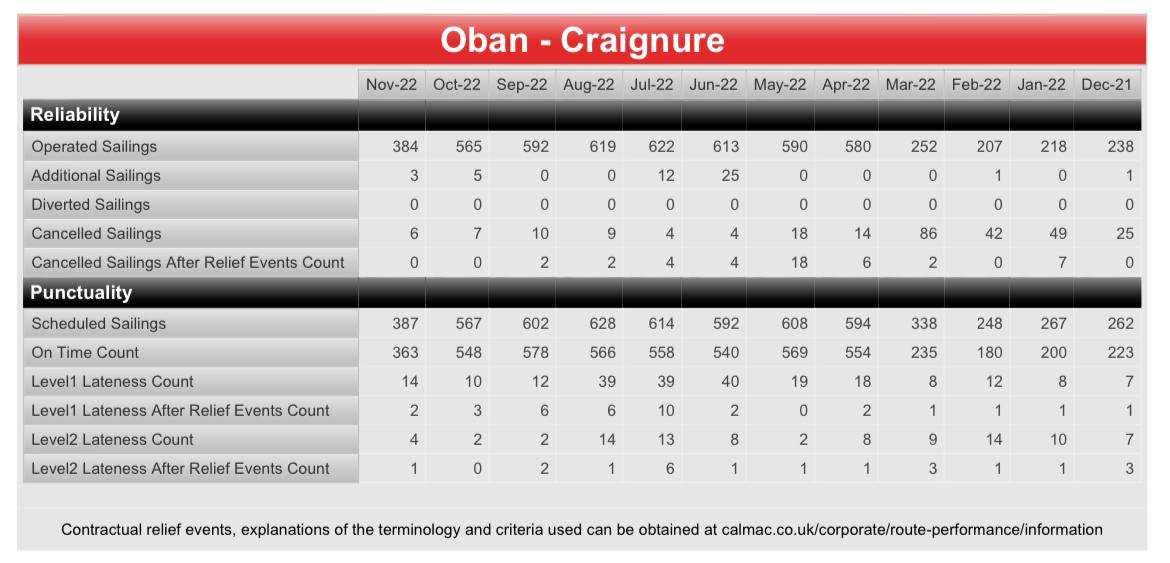

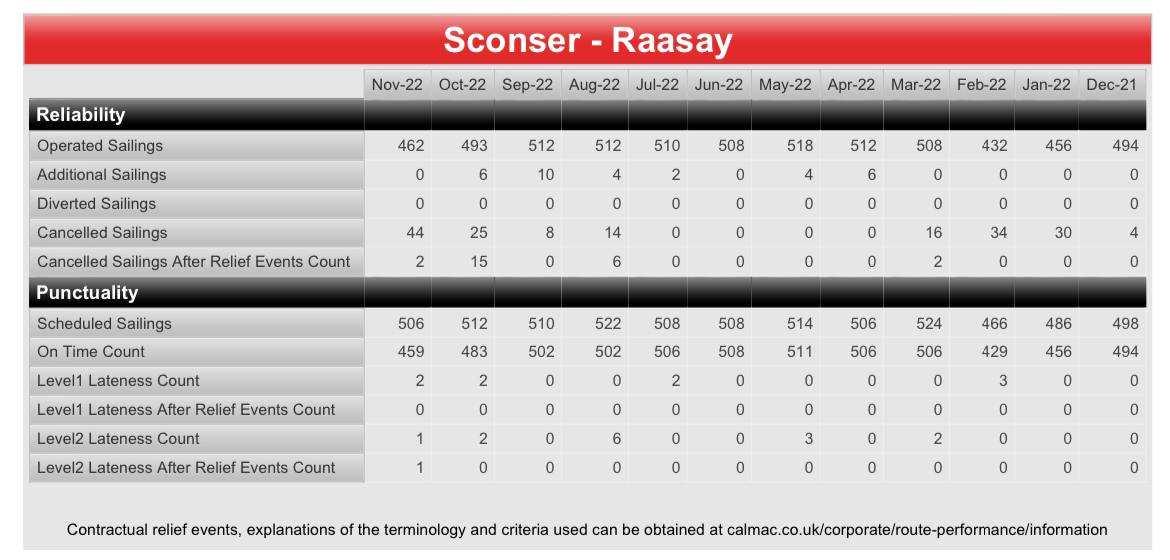

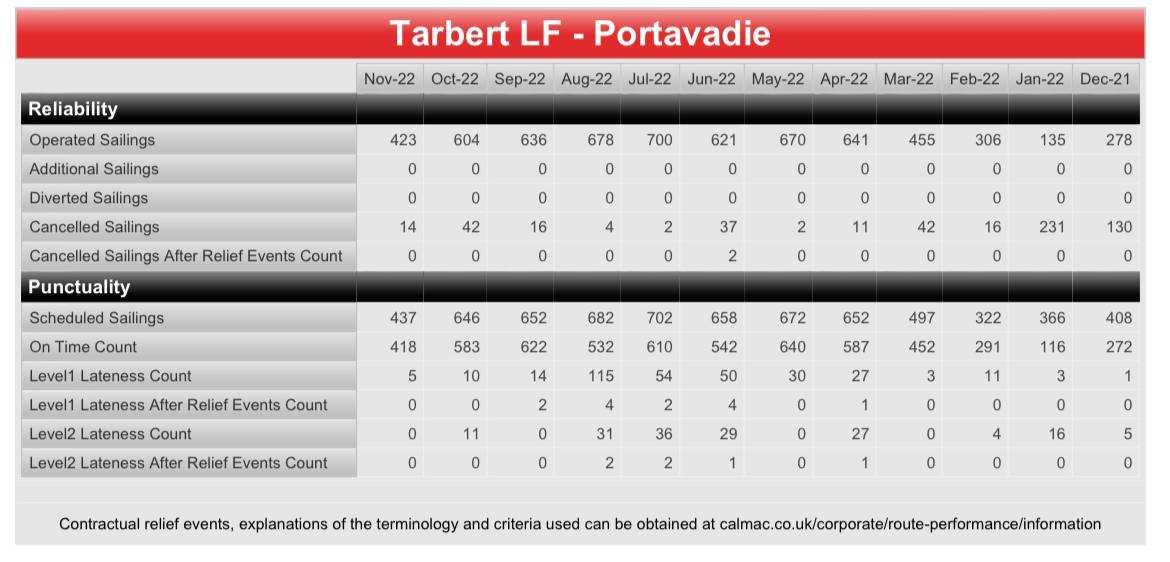

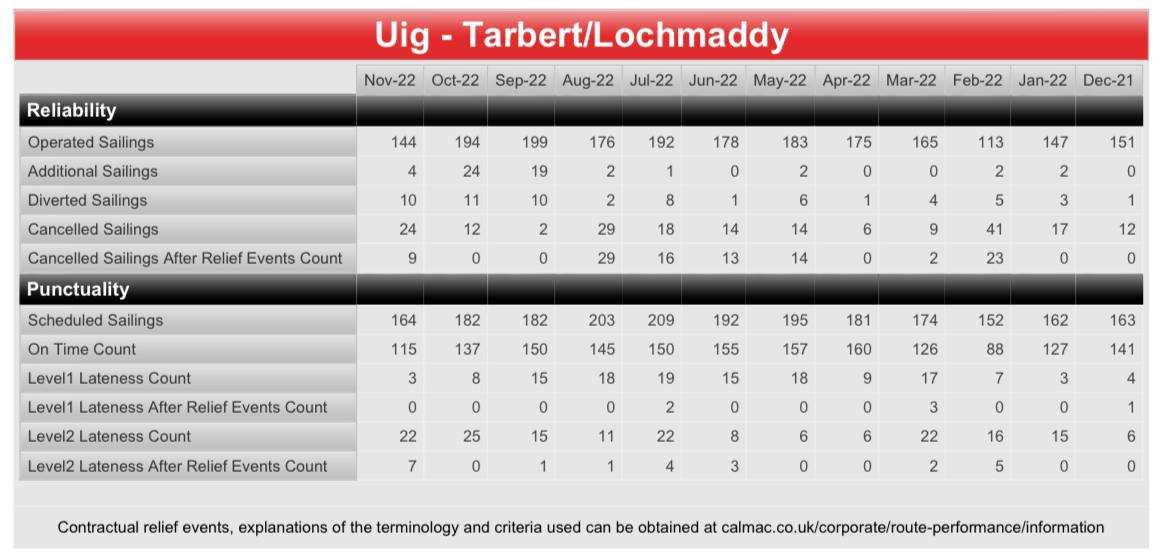

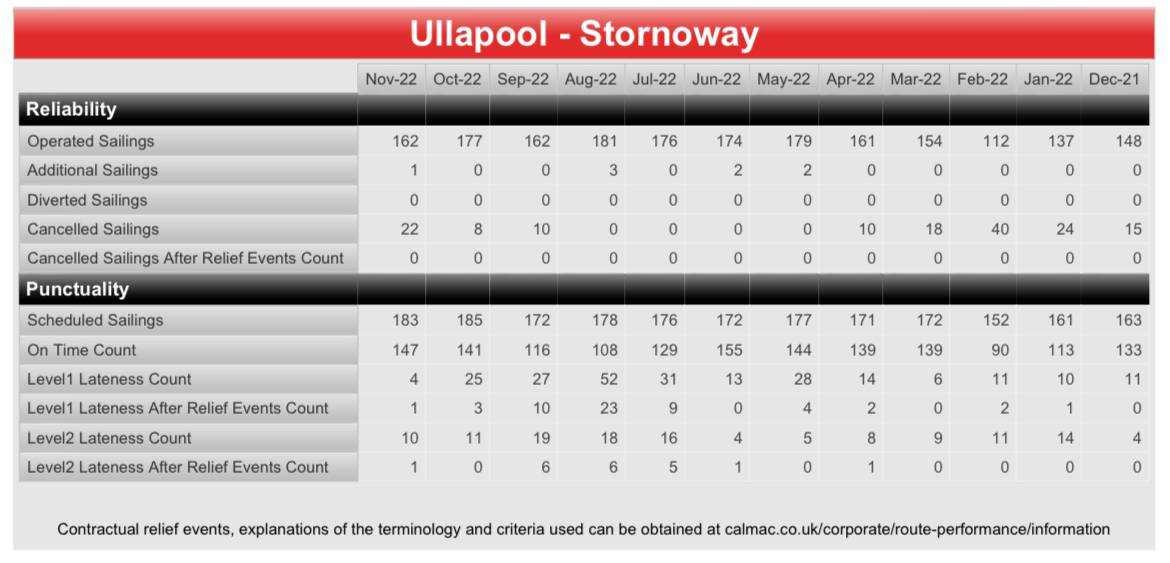

Reliability and Punctuality

50. These figures are published by Transport Scotland annually and relate to the number of sailings which took place as a proportion of the published timetable. It does not include sailings which are cancelled due to bad weather – a matter which, under International Maritime Law16 is solely at the discretion of the Master of the vessel, and which is based on his/her judgement on safety. Also excluded are cancellations due to the availability or operational restrictions of harbour facilities or lateness caused by having to wait for the arrival of other public transport connections. The latter reason is highly relevant to ferry transport in Scotland and the willingness of ferries to await the arrival of trains to mainland harbours before sailing to the islands is something much appreciated by islanders and tourists alike. In the table below, it is clear that there has been a slight deterioration in the reliability of the service since around 2015/16 ie a point at which nine out of the thirty-five vessels in the fleet had reached the end of their natural lives with another five being within their last five years17. Punctuality also dipped during this period although by 2021 had recovered to the levels of a decade previously. These figures are largely

15 CalMac Annual Carrying Statistics, available at https://www.calmac.co.uk/corporate/carryingstatistics-annual. Accessed 20/12/22

16 International Management Code for the Safe Operation of and for Pollution Prevention, para 5.5. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file /1116152/MSIS02_R10.22.pdf Accessed 28/03/2023

17 See Appendix 1 (CalMac Fleet)

15

Year15 Reliability Punctuality 2009/10 99.9 99.9 2010/11 99.8 99.9 2011/12 99.9 99.8 2012/13 99.9 99.8 2013/14 99.9 99.8 2014/15 99.9 99.8 2015/16 99.6 99.7 2016/17 99.9 99.7 2017/18 99.5 99.8 2018/19 99.5 99.6 2019/20 99.6 99.7 2020/21 99.7 99.9

reflective of the position as found by Findlay in 2005 (p15), 2010 (p4) and 2016 (p12) and reflect the fact that until that time all the evidence suggested that the standards of reliability, punctuality, customer service and overall efficiency18 were extremely high.

51. These figures are averages across the whole fleet and, undoubtedly, will mask inferior (and superior) levels of punctuality and reliability on particular routes blighted (or not) by infrastructure and aging vessel problems. Crucially then, these statistics may not adequately capture particular island experiences particularly since 2015-16. In 20-21, for example, the average age of vessels used on the ten worst-performing ferry routes was just under 30 years19 .

52. Notwithstanding this point, these statistics are robust and perfectly acceptable measures of performance and, to date, there has been no serious suggestion that any operator could have improved on this performance with the vessels and infrastructure available.

Audit Scotland confirmed this general assessment in a review published in 2017 which stated that:

The operators of Transport Scotland’s ferry contracts are performing well and, in 2016, about 99 per cent of sailings were on time. Ferry users are generally happy with services but there is variation across routes and some frustrations exist.

They go on to say, in a point to which we will return, that Transport Scotland’s arrangements for consulting and involving ferry users could be improved.20

External benefits of a publicly-owned ferry provider

53. While the Project Neptune report (see below) makes some mention of the role of CalMac in supporting the economic, social and cultural life of the islands, it does bear emphasis here. These are elements which are not/have not been built into a tendering exercise and which arise in large part, if not solely, from CalMac’s non-profit seeking status. These are not elements which a private sector provider will provide of its own volition – we can see that in the operation

18 ‘..in 2015 CalMac returned £1.98m of subsidy to Transport Scotland (£1.92m in 2014 and £10.35m in total since 2007-8) as a result of efficiencies made during the year’. Findlay, 2016, p12 – figures derived from CalMac Annual Report and Accounts for the relevant years.

19 See Appendices 2-4 for route-based punctuality and reliability figures

20 Transport Scotland’s Ferry Services, a report prepared by Audit Scotland, October 2017 to be found at

https://www.audit-scotland.gov.uk/uploads/docs/report/2017/nr_171019_ferry_services.pdf

16

of the Northern Isles contract by the private sector employer Serco Northlink which, while not a bad employer, does not meet the standards of CalMac in a number of significant areas. We can classify some of the benefits of a publicly-owned provider as

• Good quality employment

• Training and Safety

• Support for cultural events

54. These matters have been discussed in detail in Findlay (2016, pp19-26) but suffice to say here that the key elements of the Scottish Government’s flagship policy of Fair Work are delivered via companies like CalMac – indeed it would not be an exaggeration to say that CalMac is a leading provider of good quality jobs, security and career progression to island and mainland communities where such jobs are even more scarce than in urban areas. The contribution of this to the island/Scottish economy has been valued by academic researchers21 but, importantly, it is not an aspect of CalMac’s contribution which is regularly measured and published. Indeed, Audit Scotland made this point in it’s 2017 report:

Transport Scotland does not routinely measure the contribution that ferry services make to social and economic outcomes at a network level, which makes it difficult to determine whether its spending is value for money. Better information would allow Transport Scotland to demonstrate the impact of its decisions and the contribution that ferries make to the Scottish Government’s National Outcomes. 22

55. This is a key element which is missing from the Project Neptune report despite the fact that the commissioning document emphasises the ‘strategic aims of reducing inequalities, climate action and economic growth’.

56. A consistent methodology for, and regular calculation of, the impact of CalMac and Serco Northlink to the economy (highlighting any differences between them) would provide a muchimproved measure of the economic and social importance of ferry services to set against their not insubstantial cost. There has been a natural tendency for islanders to focus solely on the reliability and punctuality of the ferry services which are so important to them. It is natural therefore that they may fail to understand the other ways in which ferry transport contributes to their lives as well as the economic well-being of Scotland. It is the responsibility of the Scottish Government, via its executive agency, Transport Scotland, to provide a good standard of

21https://www.calmac.co.uk/article/3313/New-study-reveals-economic-impact-of-CalMac-services 22 Audit Scotland (ibid)

17

transparency on this issue in order to reassure islanders, and Scottish taxpayers in general, that value for money is being provided. On the basis of the existing evidence referenced above, and evidence on the return of subsidy as well as the quality of service (prior to the procurement failure) it is our view that value for money is being provided.

Concluding comments

56 The decision by the Scottish Government to commission this report was not, in itself, a poor one and, indeed, the report makes a valuable contribution to providing a clear outline of the structure of the various agencies involved and their relationship to each other. Moreover, there are several useful recommendations which should be seriously considered. However, much of what has been recommended was already contained in some form in the 2017 Audit report. There remain some gaps in the Project Neptune report and this should be taken into account by policy makers in considering what to do with it. Chief among these are the failure to consider the wider social and economic value of a publicly-owned ferry operator and the pressing need to devise better ways to involve all stakeholders in the design and delivery of ferry services which are the economic and social lifeblood of island communities and of Scotland’s economy.

18