Elected Officials and Districts ..................................................................................................................................................... 3 Special Recognition .................................................................................................................................................................... 4 Mayor’s Letter............................................................................................................................................................................. 5 Budget Process............................................................................................................................................................................ 7 Summary of Annual Budget ...................................................................................................................................................... 11 General Fund (Fund 100)........................................................................................................................................................... 12 Class “C” Roads (Fund 110) ....................................................................................................................................................... 35 Riverton Police Department (Fund 120).................................................................................................................................... 40 Redevelopment Agency (Fund 260).......................................................................................................................................... 44 Riverton Law Enforcement Service Area (Fund 270)................................................................................................................. 47 Riverton Fire Service Area (Fund 280)....................................................................................................................................... 50 Riverton Economic Development Infrastructure and Investment Fund (Fund 400)................................................................. 54 Community Impact - Parks (Fund 410)...................................................................................................................................... 58 Community Impact - Fire (Fund 420) ........................................................................................................................................ 61 Community Impact - Stormwater (Fund 430) ........................................................................................................................... 64 Community Impact - Roads (Fund 440)..................................................................................................................................... 67 Capital Improvement Fund (Fund 450) ..................................................................................................................................... 70 Capital Improvement Fund – SW Projects (Fund 460) .............................................................................................................. 76 Capital Improvement Fund – First Class Roads (Fund 470)....................................................................................................... 79 Grants Fund (Fund 480)............................................................................................................................................................. 82 Culinary Water (Fund 510)........................................................................................................................................................ 85 Community Impact - Culinary Water (Fund 520) ...................................................................................................................... 99 Secondary Water (Pressurized Irrigation) (Fund 530)............................................................................................................. 102 Community Impact - Secondary Water (Fund 540)................................................................................................................. 116 Sanitation (Fund 550).............................................................................................................................................................. 119 Employee Census and Pay Scale.............................................................................................................................................. 123 Debt Service Schedule............................................................................................................................................................. 129 Fee Schedule ........................................................................................................................................................................... 131 Table of Contents 2

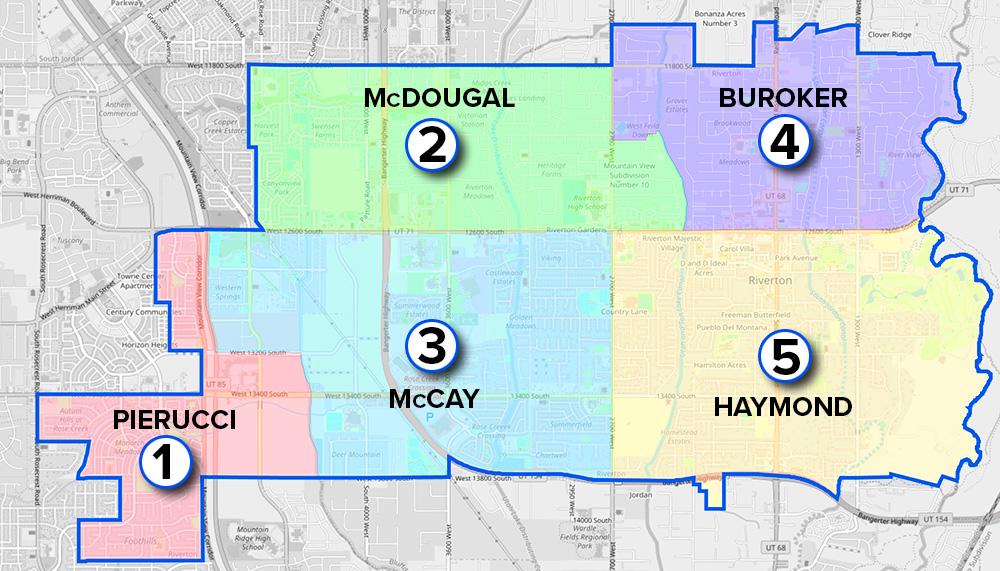

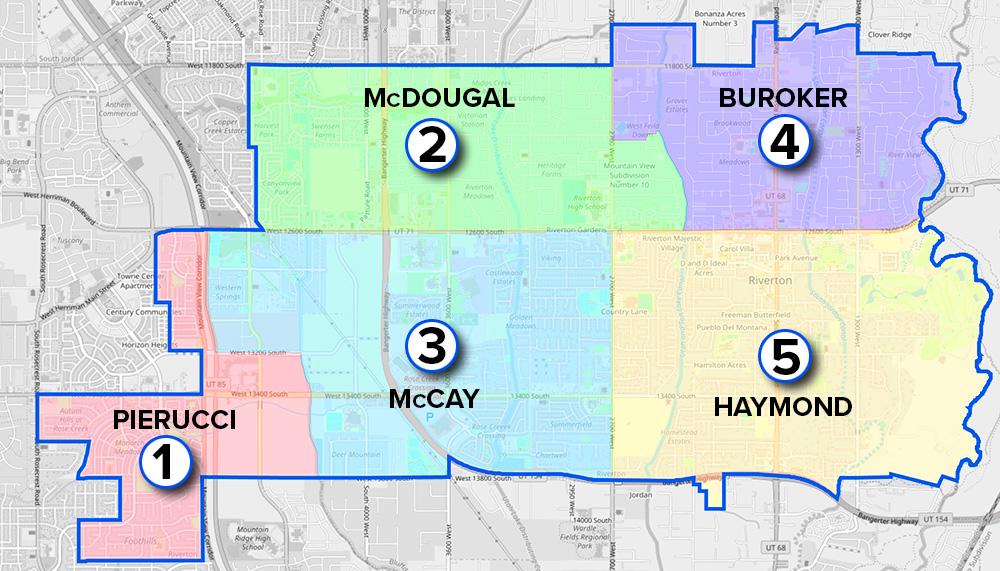

Andy Pierucci

City of Riverton

Elected Officials

Spencer Haymond

3

City of Riverton FY 2023-2024 Budget

Special Recognition

Administration / Department Heads

Ryan Carter – City Attorney

Cary Necaise – Public Works Director

Jason Lethbridge – Development Services Director

Sheril Garn – Events & Operations Director

Josh Lee - Communications Director

Shane Taylor – Chief of Police

Kevin Hicks – Interim City Manager/Administrative Services Director

Division Managers and Contributors

Mark Smith – Chief Building Official

Christopher G. Bown – Justice Court Judge

Jiny Proctor – City Treasurer

Stacie Olson – Assistant Public Works Director

Craig Calvert - Purchasing Manager / Contract Administrator

Brook Bowen - Graphic Design & Marketing Specialist

Meghin Costa – Senior Accountant

Contact Information

Riverton City Administrative Services Department

12830 S Redwood Rd

Riverton, UT 84065

Phone: 801‐208‐3122

finance@rivertonutah.gov

4

Honorable members of the City Council and residents,

Following comprehensive consultation with the interim city manager and executive sta , I am pleased to submit to you the Mayor’s Budget for fiscal year 2025 for your review and consideration. Our residents’feedback during the most recent citizen survey provided critical guidance in identifying priorities the city will address in this FY budget. Know that we hear you and we are working to implement the vision articulated for our community.

This budget addresses the challenges confronting our city as well as fully taking advantage of the opportunities before us. Due to proper planning and fiscal discipline, the city is in an enviable position. I credit the apt foresight of our elected o icials, the immense talent of city sta , and the partnership of our engaged citizenry for the thriving state of our city.

Thorough details of the financial standing of the city will be found in the enclosed budget proposal. The following are features I’d like to emphasize for all to take note of in your own consideration:

There are NO proposed fee or tax increases. This is significant since over 75 government entities held truth in taxation hearings last year. The city has produced over $16 million in taxpayer savings since creating its own fire and police service areas.

The city maintains an AAA bond rating and the debt per capita has dropped to $714 per resident, an over 20 year low.

Expenditures across all funds are $75.5 million, down from $83.8 million in FY 2024. The main reason for this decrease is due to large construction projects included in the FY 2024 budget but not in FY 2025.

When reviewing the budget, the general fund is thought to be the best barometer of financial prudence because it is less subject to change year over year. This FY 2025 general fund is increasing only 11% from last year even while bearing the burden of five additional full-time employees and still navigating the inflationary pressures of our current economy.

Despite the addition of the following positions, the city will maintain one of the lowest numbers of full-time employees per 1,000 in population among cities in Salt Lake County.

o Police o icer

o Code enforcement/animal control o icer

o Two additional stormwater maintenance workers

o Facility maintenance / plumber

o Fleet mechanic

Over the past 10 years, Riverton City’s sales tax revenue has increased over 230%. Although a slowdown is predicted, the city still anticipates a sales tax revenue of $13 million in FY 2025 – a slight increase from the previous year.

This budget proposes to eventually stop curbside recycling and replace those e orts with various o site recycling throughout the city. Riverton City elected o icials and sta are committed to helping residents be good stewards of the environment. Recycling, when done properly, can be a great way to take care of our resources. There are concerns however, that much of the material placed in curbside bins is not recycled and instead sent to the landfill. It is paramount that we ensure recycling in Riverton is e ective and not a misnomer.

OFFICE OFTHE MAYOR

5

The projects envisaged to best accomplish our strategic priorities in the next year are listed as follows:

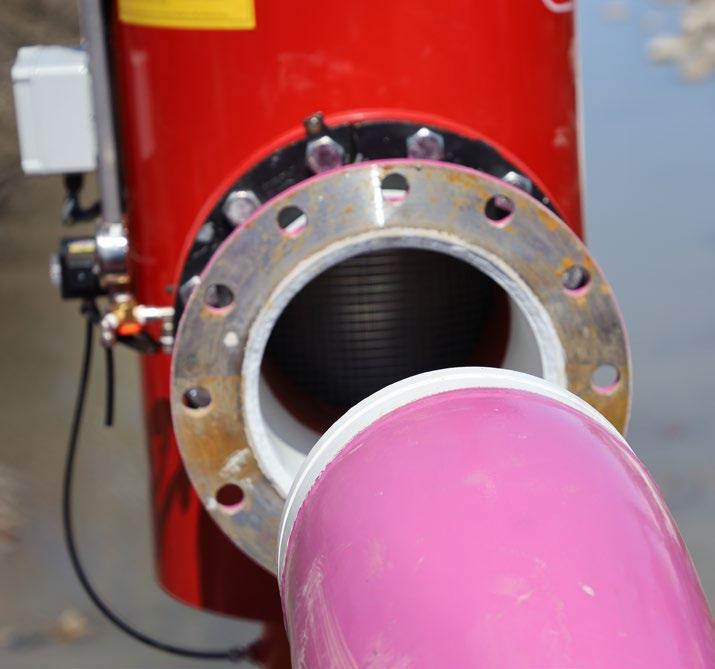

Culinary Water

The Green Well is positioned to save city taxpayers roughly $1 million in water purchases each year. This reverse osmosis plant will provide half the city with water equal to or greater than the quality of water from Jordan Valley Water Conservancy District. This fantastic investment will allow the city to keep culinary water rates low for the foreseeable future.

Secondary Water

Completion of the secondary (pressurized irrigation) water meters on all residential properties within city boundaries is anticipated in FY 2025. The remaining project area comprises roughly one-third of the city. State funds and American Rescue Plan Act funds will fulfill this final phase of the multi-year, state mandated project.

Enhancements to the city’s existing secondary water system and improvements to filtration and pressurization are planned. We heard from residents that this is one area they’d like the city to prioritize. Therefore, I’ve budgeted over $870,000 for secondary water system improvements, including $648,000 for filtration and pressurization. Our secondary system provides enormous financial savings to our residents, and these improvements ensure the asset will be available for generations to enjoy.

Welby Canal Trail & Bridge

Design work has commenced on the Welby Canal Trail and Pedestrian Bridge. The bridge will cross 13400 South at approximately 4200 West Street. This first phase of a multi-year project will ensure pedestrian safety and walkable routes throughout our city. This was a priority identified by residents in the citizen survey. The city has also received additional grant funds to aid in the completion of the project.

These projects will enhance the residents’way of life and establish assets for future generations. In addition, over $2.4 million has been allocated in my proposed budget for roadway projects and $3.2 million to replace a water line on 11800 South Street. The latter is a jointly timed project with the sewer district to avoid disturbing the road more than is necessary as they also address planned projects.

This proposed city budget fulfills Riverton residents’expectations in self-government. As their elected representatives, it is incumbent on us to exercise all prudence and excellence in detailing plans to accomplish our shared objectives. I welcome your ideas and feedback on how to improve this budget. I look forward to discussing this proposal with each of you and, as always, please reach out if there are any questions or concerns.

OFFICE OFTHE MAYOR

6

Organizational Change

FY 2025 Budget

The fiscal year 2025 budget includes a change to the chart of accounts that was primarily prompted by the transition to our new software. Another reason for the change was to make sure the Riverton City Chart of Accounts more closely aligns with the State of Utah’s Uniform Chart of Accounts. This will improve transparency and ease of reporting to the Transparent Utah website. The following are the funds that are included in the budget for FY 2024.

Governmental Operations Funds

100 ‐ General Fund

110 – Class C Roads

120 – Riverton Police Operations

Capital Projects Funds

400 – REDIIF

410 – Community Impact – Parks

420 – Community Impact – Fire

430 – Community Impact – Stormwater

440 – Community Impact – Roads

450 – Capital Improvements Fund

460 – Capital Improvements – SW Projects

470 – First Class Road Funds

480 – Grants

Special Revenue Funds

260 – Redevelopment Agency

270 – RLESA

280 – RFSA

Business Type funds

510 – Culinary Water

520 – Community Impact – Culinary

530 – Pressurized Irrigation (Secondary Water)

540 – Community Impact – Secondary

550 – Sanitation

Revenue Budgets

When projecting revenues for the budget, accounts are analyzed to establish historical trends. Staff will then utilize these trends along with outside resources such as the Utah State Governor’s Office of Economic Development and the Salt Lake County Mayor’s Office. Staff will also review the analytics against planned projects or programs, as well as any inside knowledge of additional items that may not be included in a simple historical analysis or from outside entities, such as a current analysis of the development activity and what projects might be coming.

The main source of revenue for the general fund is sales tax which has historically been averaging just over 10% in annual increases. However, during fiscal year 2024 we have witnessed a slight downturn in

12830 S Redwood Rd • Riverton, Utah 84065 • (801) 254‐0704 • rivertonutah.gov

7

sales tax revenue. Due to this downturn, staff has recommended a very conservative increase of 2% over the anticipated finish for FY 2024.

Expenditure Budgets

The following are the budgetary departments for the FY 2025 budget.

City Council

Mayor’s Office

Committees & Boards

City Manager’s Office

City Attorney’s Office

Risk Management

Finance / Human Resources

Information Technology

Utilities

Justice Court Animal Control / Code Enforcement

Public Works Administration

Fleet Maintenance

Communications

Development Services

Facilities Maintenance

Street Lighting

Stormwater

Recreation & Events

Cemetery Operations

Parks

Streets Maintenance

Water Maintenance

Transfers & Fund Balance

Riverton City provides many different services to its residents. The City maintains multiple fund classifications, namely the general fund, capital projects funds, and enterprise funds. Most City employees perform tasks that benefit more than one fund. In order to properly account for both the employee costs and associated supplies, or other expenditures, costs are allocated between various funds. Cost allocation is determined based on quantifiable measures as follows.

General Administrative Split

The City has a general administrative split, which is based on the number of employees, number of accounts payable checks issued, and number of purchase orders awarded. A rounded average is calculated and applied across all departments that provide general services to multiple areas of City operations. The split for FY 2024‐2025 is 70% to the general fund, 15% to culinary water and 15% to pressurized irrigation (secondary water).

Expenditures for the following departments are budgeted using this 70/15/15 general administrative split.

City Council

Mayor’s Office

City Manager’s Office

City Attorney’s Office

Risk Management

Finance / Human Resources

Information Technology

Fleet Maintenance

Communications

Development Services (Engineering portion)

Facilities Maintenance

Public Works Administration

12830 S Redwood Rd • Riverton, Utah 84065 • (801) 254‐0704 • rivertonutah.gov

8

Public Works Administration

In addition to the general administrative split, some accounts within the Public Works department are cost allocated to other funds according to construction and maintenance projects. In these instances, employees’ wages and benefits are individually allocated according to their projected workloads and could be allocated to other funds such as the class ‘C’ roads fund for street maintenance.

Water

Expenses for the water division of the Public Works Department are generally allocated 50% culinary and 50% pressurized irrigation (secondary). Exceptions to this 50/50 split are items that are specifically attributed to either the culinary or secondary water systems. In those instances, 100% of the expense is budgeted by the appropriate fund.

12830 S Redwood Rd • Riverton, Utah 84065 • (801) 254‐0704 • rivertonutah.gov

9

Mayor’s Budget

10

Worksheets

Summary

of Annual Budget by Fund

Beginning Fund/Cash Balance Revenues Interfund Transfers In Use of Fund Balance Total Budgeted Revenues Expenditures / Expenses Interfund Transfers Out Addition to Fund Balance Total Budgeted Expenditures / Expenses Ending Fund /Cash Balance 100 - General Fund 8,010,450 18,277,100 369,500 1,938,956 20,585,556 14,928,056 5,657,500 - 20,585,556 6,071,494 110 - Class "C" Roads 3,165,884 3,007,500 280,000 950,885 4,238,385 4,238,385 - - 4,238,385 2,214,999 120 - Riverton Police Operations 4,159 360,000 8,253,750 - 8,613,750 8,383,750 230,000 - 8,613,750 4,159 260 - Redevelopment Agency - 3,137,659 3,000 - 3,140,659 3,140,659 - - 3,140,659270 - RLESA 2,422,058 7,225,000 - 589,250 7,814,250 500 7,813,750 - 7,814,250 1,832,808 280 - RFSA 64,752 7,510,500 187,500 2,950 7,700,950 7,000,950 700,000 - 7,700,950 61,802 400 - REDIIF 5,058,970 4,028,000 1,250,000 1,253,000 6,531,000 2,778,000 3,753,000 - 6,531,000 3,805,970 410 - Community Impact - Parks 4,022,067 1,840,000 - - 1,840,000 10,000 - 1,830,000 1,840,000 5,852,067 420 - Community Impact - Fire - 190,000 - - 190,000 2,500 187,500 - 190,000430 - Community Impact - Stormwater Impact 1,234,502 215,000 - 180,000 395,000 395,000 - - 395,000 1,054,502 440 - Community Impact - Roads 4,399,120 600,000 - 2,715,000 3,315,000 3,315,000 - - 3,315,000 1,684,120 450 - Capital Improvements Fund 77,111 2,195,000 3,580,000 32,000 5,807,000 5,807,000 - - 5,807,000 45,111 460 - Capital Improvements Fund - SW Projects 2,369,364 - 300,000 880,000 1,180,000 1,180,000 - - 1,180,000 1,489,364 470 - First Class Roads 834,924 700,000 - 50,000 750,000 750,000 - - 750,000 784,924 480 - Grants 2,939,738 3,850,000 - 2,650,000 6,500,000 5,500,000 1,000,000 - 6,500,000 289,738 Total Governmental Funds 53,135,759 14,223,750 11,242,041 78,601,550 57,429,800 19,341,750 1,830,000 78,601,550 510 - Culinary Water 4,110,876 5,946,000 3,205,000 - 9,151,000 9,002,950 100,000 48,050 9,151,000 4,158,926 520 - Community Impact - Culinary 786,181 690,000 - - 690,000 310,000 - 380,000 690,000 1,166,181 530 - Pressurized Irrigation (Secondary Water) 3,933,844 3,794,000 2,455,000 227,100 6,476,100 6,456,100 20,000 - 6,476,100 3,706,744 540 - Community Impact - Secondary 1,143,059 896,000 - - 896,000 310,000 500,000 86,000 896,000 1,229,059 550 - Sanitation 9,401 2,207,000 140,000 - 2,347,000 2,284,750 62,000 250 2,347,000 9,651 Total Enterprise Funds 13,533,000 5,800,000 227,100 19,560,100 18,363,800 682,000 514,300 19,560,100 Grand Total Citywide 66,668,759 20,023,750 11,469,141 98,161,650 75,793,600 20,023,750 2,344,300 98,161,650 -

Beginning Fund/Cash Balance Figures are Estimates - REDIIF beginning balance also includes land held for resaleSummary of Transfers Description Amount General Fund to C Roads 280,000 General Fund to Police Operations 440,000 General Fund to REDIIF 550,000 Costco sales tax sharing agreement General Fund to Capital Improvements Fund 3,350,000 General Fund to Capital Improvements Fund - SW 300,000 Capital projects - HSU Fee General Fund to Culinary Water 305,000 Capital outlays General Fund to Secondary Water 105,000 Capital outlays General Fund to Sanitation 140,000 Sanitation subsidy General fund to RFSA 187,500 Impact fee buy-in RPD Operations to Capital Impovements Fund 230,000 RPD Vehicle "Lease" RLESA to Police Operations 7,813,750 Police Operations RFSA to REDIIF 700,000 Payment on note for cash flow REDIIF to RDA 3,000 REDIIF to Culinary Water 2,900,000 Capital outlays REDIIF to Secondary Water 850,000 Capital outlays Grants to Secondary Water 1,000,000 Land and water shares Fire Impact to General Fund 187,500 Impact fee buy-in Secondary Impact to Secondary Water 500,000 Debt service and buy-in Nonreciprocal transfers 182,000 Non-cash use of City utilities 20,023,750

Note:

Year 2024-2025 RDA and CDA operating costs Purpose Capital outlays Sources Uses Fund Police Operations CMAQ Grant for bike lanes 11

Fiscal

FUND 100 General Fund

The General Fund is Riverton City’s principal operating fund. It accounts for all financial resources not accounted for and reported in another fund.

12

GeneralFund Expenditures

General Fund

General Fund Summary

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 Audited Adopted Projected Staff Mayor's Department Actual Budget Finish Estimate Budget

Sales & Use Tax 12,256,926 13,500,000 12,750,000 13,000,000 13,000,000 Licenses & Permits 1,209,230 1,262,000 1,418,774 1,210,000 1,210,000 Intergovernmental Revenue 74,246 400,000 98,828 600,000 600,000 Charge for Serv - Development 492,345 742,800 566,849 710,750 710,750 Stormwater HSU Fee 836,311 950,000 875,000 900,000 900,000 Rents 175,159 227,500 213,510 245,000 245,000 Charge for Serv - AC & Shelter 7,490 10,350 7,486 11,850 11,850 Charge for Serv - Celebration 166,016 179,500 184,373 211,500 211,500 Charge for Serv - Recreation 260,072 257,500 201,052 271,000 271,000 Charge for Serv - Cemetery 208,100 200,000 207,015 225,000 225,000 Fine & Forfeitures 249,831 236,000 319,437 320,000 320,000 Miscellaneous Revenue 303,077 457,250 1,890,996 567,000 567,000 Sale of Capital Assets & Taxable Surplus Goods 62,115 1,500 11,425 5,000 5,000 Total Revenues 16,300,917 18,424,400 18,744,744 18,277,100 18,277,100 Transfers In and Use of Fund Balance Transfers 201,303 127,700 225,000 187,500 187,500 Nonreciprocal Transfers 182,000 182,000 182,000 182,000 182,000 Use of Fund Balance - 588,675 - 1,972,956 1,938,956 Total Transfers In and Use of Fund Balance 383,303 898,375 407,000 2,342,456 2,308,456 Total Rev, Trans In and Use of Fund Balance 16,684,220 19,322,775 19,151,744 20,619,556 20,585,556

General Fund Revenues

Mayor's Office 62,774 67,150 61,029 72,450 72,450 City Council 157,867 209,350 153,420 218,850 218,850 Committees & Boards 22,559 106,000 73,005 76,000 36,000 City Manager's Office 706,944 304,650 206,050 339,200 315,200 City Attorney's Office 507,374 658,900 563,772 726,900 726,900 Risk Management 218,650 247,500 232,883 284,000 264,000 Finance/Human Resources 1,146,386 1,206,250 1,313,971 1,403,400 1,403,400 Information Technology 811,436 924,350 857,448 985,350 965,350

13

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 Audited Adopted Projected Staff Mayor's Department Actual Budget Finish Estimate Budget Utilities 508,978 578,950 554,804 596,000 596,000 Fleet 299,694 309,125 242,821 399,625 399,625 Communications 460,972 527,500 396,409 505,200 505,200 Development Services 1,450,044 2,023,650 2,016,348 2,219,150 2,219,150 Facilities Maintenance 540,621 599,200 595,853 724,200 724,200 Justice Court 214,364 345,750 270,003 331,150 331,150 Animal Control/Code Enforcement 274,445 302,500 304,654 418,000 418,000 Public Works Administration 1,195,292 1,000,500 983,673 1,078,456 1,078,456 Street Lighting 359,645 366,000 349,355 443,600 373,600 Stormwater 343,745 310,500 318,547 593,025 593,025 Recreation & Events 1,181,201 1,370,750 1,265,325 1,399,800 1,399,800 Cemetery Operations 65,968 68,000 46,697 55,500 55,500 Parks 1,764,907 2,075,500 2,144,917 2,432,200 2,232,200 Total Expenditures 12,293,868 13,602,075 12,950,983 15,302,056 14,928,056 Transfers Out and Addition to Fund Balance Transfers 4,192,763 5,720,700 4,995,000 5,317,500 5,657,500 Addition to Fund Balance - - - -Total Trans Out and Add'n to Fund Balance 4,192,763 5,720,700 4,995,000 5,317,500 5,657,500 Total Exp, Trans Out and Add'n to Fund Bal 16,486,631 19,322,775 17,945,983 20,619,556 20,585,556 197,589 - 1,205,761 -Beginning Fund Balance 6,607,099 6,804,688 6,804,688 8,010,450 8,010,450 Change in Fund Balance 197,589 (588,675) 1,205,761 (1,972,956) (1,938,956) Ending Fund Balance 6,804,688 6,216,013 8,010,450 6,037,494 6,071,494 % of Revenues 32.94% 26.49% 35.45% 27.20% 27.36% Riverton City Strategic Goal for Fund Balance = maintain a minimum of 20% 14

General Fund

Operating vs. Capital Expenditures

One-time (Capital & Transfers)

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 Audited Adopted Projected Staff Mayor's Department Actual Budget Finish Estimate Budget Operating Revenues 16,300,917 18,424,400 18,744,744 18,277,100 18,277,100 Operating Expenditures 12,237,509 13,557,075 12,909,593 15,075,056 14,901,056 One-time Revenues (Transfers & FB) 383,303 898,375 407,000 2,342,456 2,308,456 One-time Expenditures (Capital) 56,359 45,000 41,390 227,000 27,000 One-time Expenditures (Transfers & FB) 4,192,763 5,720,700 4,995,000 5,317,500 5,657,500

Operating

15

General Fund

General Fund Revenues

General Fund

The economy seems to be slowing down a little bit, estimate is to conservatively react to this projected slowdown.

• CMAQ Grant for bike lanes project (rollover from FY 2023) - see 11303052480300

• WFRC Grant for updating the AT and Transportation Master Plan

Estimated

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments

100 310310 General Sales & Use Tax 12,256,926 13,500,000 12,750,000 13,000,000 13,000,000

100 320140 Business Licenses 16,250 15,000 10,800 15,000 15,000 100 320210 Building Permits - Residential 986,708 860,000 1,253,371 850,000 850,000 Estimated 130 SFD, 308 MFD and various ADU and solar permits 100 320220 Building Permits - Commercial 128,665 312,000 57,338 265,000 265,000 Estimated 135,000 square feet 100 320230 Sign Permit 16,453 20,000 12,788 20,000 20,000 100 320250 Animal Licences 15,176 20,000 14,510 15,000 15,000 100 320260 Road Cut Permits 45,977 35,000 69,967 45,000 45,000 100 330210 State Operating Grants 1,500 280,000 - 500,000 500,000

100 330270 State Liquor Fund Allotment 47,746 50,000 53,828 55,000 55,000 100 330300 Local Intergovernmental 25,000 70,000 45,000 45,000 45,000

Center contributions

other cities

$35,000 from Herriman

$10,000

Bluffdale 100 340203 Inspection Fees 31,625 25,500 30,038 35,000 35,000 100 340205 Street Light Connection Fee 4,680 5,000 1,350 5, 000 5, 000 100 340207 Plan Check Fee - Residential 280,670 387,000 409,639 382,500 382,500

Senior

from

•

•

from

130 SFD, 308 MFD and various ADU and solar permits 100 340208 Plan Check Fee - Commercial 84,159 202,800 37,451 172,250 172,250 Estimated 135,000 square feet 100 340209 Site Plan Application Fee 49,205 60,000 52,805 60,000 60,000 100 340210 Accessory Dwelling Unit Fee 3,675 2,000 2,100 3, 000 3, 000 100 340211 Board of Adjust Fee 1,375 3,000 1,238 3, 000 3, 000 100 340212 GIS Fee 15,850 5,000 2,641 5, 000 5, 000 100 340213 Noticing Fee 3,694 7,500 2,312 5, 000 5, 000 100 340214 Subdivision Fee 5,927 25,000 19,964 25,000 25,000 100 340215 Conditional Use Fee 7,150 10,000 7,238 10,000 10,000 100 340216 Zoning Amendment Fee 4,335 10,000 75 5,000 5,000 100 340220 Stormwater HSU Fee 836,311 950,000 875,000 900,000 900,000

16

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 100 340250 Volunteer Sports Participation 21,237 20,000 15,719 20,000 20,000 100 340252 Sports Field Maint/Prep Fees 37,905 40,000 27,743 40,000 40,000 100 340253 Healthy Riverton Fees 3,637 3,000 11,550 5, 000 5, 000 100 340254 Recreation Program Fees 66,235 70,000 37,149 70,000 70,000 100 340255 Civic Center Program Fees 9,670 10,000 435 10,000 10,000 100 340256 Rodeo Arena Fee 550 1,500 600 1,500 1,500 100 340265 Burial Fee 97,150 75,000 91,500 100,000 100,000 100 340267 Abatement Fee - 5,000 - 5,000 5,000 100 340269 Returned Check Fee 3,920 3,000 1,560 3, 000 3, 000 100 340270 City Portion of Bldg Surcharge 1,673 1,000 1,563 1, 500 1, 500 100 340300 Adoption Fee 2,560 1,500 2,400 3, 000 3, 000 100 340310 Animal Impound Fee 3,160 5,000 3,308 5, 000 5, 000 100 340320 Euthanization Fee - 250 - 250 250 100 340330 Boarding Fee 1,500 3,000 1,178 3, 000 3, 000 100 340340 Animal Control Misc. Fee 270 600 601 600 600 100 340406 Cemetery Plots 110,950 125,000 115,515 125,000 125,000 As of February 2024, we have a total of 202 available plots; including baby and cremation plots 100 340407 Rodeo Revenue - Ticket Sales 43,912 47,500 44,500 67,500 67,500 Increase includes an additional night 100 340409 Community Events Revenue 3,805 3,000 18,198 7, 000 7, 000 100 340410 Rodeo Sponsors 20,150 22,500 9,540 27,500 27,500 Increase $5,000

new sponsor for the sorting event 100 340411 Town Days - Sponsorships 75,149 75,000 47,715 75,000 75,000 100 340412 Town Days Revenue 22,000 22,000 57,295 25,000 25,000 100 340413 Misc Event Donations/Sponsors 1,000 9,500 7,125 9,500 9,500 Includes a $2,500 donation from Waste Management for the Youth Council 100 340415 Sale of Books, T-shirts, etc. 2,766 250 1,145 1,000 1,000 100 340416 Miss Riverton Tickets 1,180 2,500 - 1,500 1,500 100 340610 Rental Civic Center 7,563 12,500 - 25,000 25,000 100 340620 Tower Rent 167,597 215,000 213,510 220, 000 220,000 100 340630 Parks and Public Properties 16,514 15,000 9,435 15, 000 15,000 100 340635 Tangible Property Reservations 19 - - -100 340640 CR Hamilton Pavilion 41,330 40,000 46,890 50, 000 50,000 100 340650 Old Dome Meeting Hall 40,200 37,500 40,950 40, 000 40,000 100 340660 Main Park Reservations 16,900 15,000 7,703 15, 000 15,000 100 340670 Sports Field Reservations 4,695 3,000 2,880 3, 000 3, 000 100 340900 Nonreciprocal Interfund Rev 182,000 182,000 182,000 182, 000 182,000 17

- Waste Management

General Fund

Various trainings and conferences including but not limited to: ULCT, ICMA, ICSC, Fall elected officials conference, disaster trainings, etc. (split with 510 and 530 funds)

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 100 350100 Court Fines 249,831 235,000 319,437 320,000 320,000 100 350110 Traffic School - 1,000 - - - Not being done anymore 100 350120 Public Defender Revenue - 1,000 - -100 350130 Prosecutor Split Revenue - 500 - -100 360000 Sundry Revenue 57,642 40,000 59,566 50,000 50,000 100 360010 Cash Over/Short (8) - (12) -100 360100 Interest Earnings 230,423 400,000 1,820,673 500,000 500,000 100 361210 ULGT Safety Grant 6,661 6,500 6,500 6, 500 6, 500 Use of Fund Balance 588,675 - 1,972,956 1,938,956 100 370142 Transfer from Fire Impact 201,303 127,700 225,000 187,500 187,500 Fire Impact Fee Buy-in 100 370300 Sale of Capital Assets 48,740 - - -100 370301 Sale of Taxable Surplus Goods 13,375 1,500 11,425 5, 000 5, 000 Total Revenues 16,684,220 19,322,775 19,151,744 20,619,556 20,585,556

Mayor's Office 10101010 410101 Regular Wage 28,806 31,000 31,110 32,000 32,000 Includes a 4% COLA and a 1% benchmark adjustment 10101010 410200 Benefits 21,022 23,000 24,056 24,000 24,000 10101010 410201 Mobile Phone Allowance 672 700 714 700 700 10101010 410202 Transportation Allowance 2,520 2,600 2,835 2, 800 2, 800 10101010 420450 Riverton Choice Awards 1,519 1,750 1,750 1, 750 1, 750 10101010 420900 Education and Conferences 3,315 5,000 - 5,250 5,250

GeneralFund Expenditures

10101010 450200 Operating Supplies - - - 2,800 2,800 State of the City Award Ceremony 10101010 450400 Books, Publications, Subscr. 382 350 105 350 350 10101010 455000 Miscellaneous Expenses 4,538 2,750 459 2,800 2,800 Total Mayor's Office 62,774 67,150 61,029 72,450 72,450 City Council 10101011 410101 Regular Wage 96,218 92,500 92,500 95,000 95,000 Includes a 4% COLA

1% benchmark adjustment 10101011 410200 Benefits 49,845 98,000 55,761 105,000 105,000 10101011 410201 Mobile Phone Allowance 2,520 2,700 2,678 2, 700 2, 700 18

and a

General Fund

Various trainings and conferences including but not limited to: ULCT, ICMA, ICSC, Fall elected officials conference, disaster trainings, etc. (split with 510 and 530 funds)

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10101011 420900 Education and Conferences 3,083 5,000 37 5,000 5,000

10101011 420950 Council Retreat 5,471 8,500 2,445 8, 500 8, 500 Council reteat and council meeting meals 10101011 450200 Operating Supplies - 150 - 150 150 10101011 450400 Books, Publications, Subscr. - 500 - 500 500 10101011 455000 Miscellaneous Expenses 730 2,000 - 2,000 2,000 Total City Council 157,867 209,350 153,420 218,850 218,850 Committees and Boards 10101013 420106 Elections - 35,000 32,069 -10101013 470300 Committees and Boards 4,959 10,000 - 10,000 10,000 10101013 470310 Historical Preservation Comm 1,661 5,000 5,000 5, 000 5, 000 10101013 470330 Jordan River Commission 2,940 3,000 - 3,000 3,000 10101013 470340 Riverton Art Commission 10,000 2,500 2,500 2, 500 2, 500 Jazz Band 10101013 470350 Senior Center 3,000 3,000 - 3,000 3,000 10101013 470360 Riverton Comm Art Organization - 7,500 7,500 12, 500 12,500 10101013 470395 JSD Bus Route Contribution - 40,000 25,936 40,000Mayor Move to REDIIF (see account 40131100470395) Total Committees and Boards 22,559 106,000 73,005 76,000 36,000 City Manager's Office 10111012 410101 Regular Wage 183,006 127,000 81,914 152,000 152,000 Includes a 4% COLA and estimated 3% merit 10111012 410200 Benefits 65,596 59,000 32,632 66,000 66,000 10111012 410201 Mobile Phone Allowance 588 700 620 700 700 10111012 410205 Employee Education 8,442 21,000 6,000 21,000 21,000 Employee tuition reimbursement program 10111012 410350 Employee Comp/Incentive Awards 6,378 5,000 4,500 6, 000 6, 000 10111012 420105 Lobbyist 28,000 30,000 31,500 30,000 30,000 10111012 420810 Memberships - Economic Dev 21,742 24,000 23,638 24,000ULCT Membership Mayor: Cut membership 10111012 420820 Business Development 19,834 29,500 21,221 29,500 29,500 10111012 420900 Education and Conferences 354 4,750 1,276 4,750 4,750 ULCT, ICMA, UCMA, and other various conferences 19

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10111012 450300 Meetings & Luncheons 595 2,000 1,500 2, 000 2, 000 10111012 450400 Books, Publications, Subscr. 353 700 500 2,250 2,250 • APWA • RWAU • ICMA • UCMA • ICC 10111012 455000 Miscellaneous Expenses 685 1,000 750 1,000 1,000 10111012 470450 Payment to Developer 371,370 - - -Total City Manager's Office 706,944 304,650 206,050 339,200 315,200 City Attorney's Office 10121030 410101 Regular Wage 315,028 352,000 309,007 400,000 400,000 Includes a 4% COLA and estimated 3% merit 10121030 410103 Overtime 193 1,500 1,455 1, 500 1, 500 10121030 410200 Benefits 149,374 190,000 143,702 210,000 210,000 10121030 410201 Mobile Phone Allowance 1,694 2,200 1,260 2, 200 2, 200 10121030 420100 Professional & Technical 12,999 31,000 42,036 31,000 31,000 10121030 420107 Minutes 70 3,000 - 3,000 3,000 10121030 420108 Codification 2,154 3,000 2,456 3, 000 3, 000 10121030 420115 Contract Labor - Prosecutor 14,583 60,000 57,188 60,000 60,000 10121030 420116 Contract Labor - Constable 211 1,000 - 1,000 1,000 10121030 420400 Advertising and Public Notices - 750 - 750 750 10121030 420500 Printing and Binding - 700 - 700 700 10121030 420900 Education and Conferences 5,259 7,000 1,902 7,000 7,000 • UMAA • UMCA (2 times per year) • Risk Conferences • BCI Trainings 10121030 450100 Office Supplies 192 1,000 750 1,000 1,000 10121030 450300 Meetings & Luncheons 212 750 750 750 750 10121030 450400 Books, Publications, Subscr. 3,810 2,500 2,614 2, 500 2, 500 10121030 455000 Miscellaneous Expenses 1,558 1,500 654 1,500 1,500 10121030 470102 Witness Fees 37 1,000 - 1,000 1,000 Total City Attorney 507,374 658,900 563,772 726,900 726,900 20

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments Risk Management 10121180 420301 Liability Insurance 93,305 100,000 104,251 120,000 120,000 10121180 420302 Property Insurance 74,476 75,000 86,134 90,000 90,000 10121180 420303 Vehicle Insurance 38,230 40,000 35,000 40,000 40,000 10121180 450200 Operating Supplies 3,569 2,500 1,224 2,500 2,500 • Recognition gift cards • CPR trainings • OSHA training 10121180 450300 Meetings & Luncheons - - - 1,500 1,500 Staff lunches for passing safety/risk requirements 10121180 470400 Claim Settlements 9,071 30,000 6,274 30,000 10,000 Mayor Reduce based on historical usage Total Risk Management 218,650 247,500 232,883 284,000 264,000 Finance/Human Resources 10131100 410101 Regular Wage 532,288 568,000 622,892 635,000 635,000 Includes a 4% COLA and estimated 3% merit 10131100 410103 Overtime 8,938 5,000 9,983 5, 000 5, 000 10131100 410200 Benefits 271,585 361,000 302,140 386,000 386,000 10131100 410201 Mobile Phone Allowance 3,182 3,000 2,187 3, 600 3, 600 10131100 410401 FSA & EAP Administration 2,163 3,500 3,974 4, 200 4, 200 10131100 410403 Wellness Committee 2,107 5,000 4,742 5, 500 5, 500 10131100 410404 Drug Testing 5,372 5,500 5,937 7, 000 7, 000 10131100 420100 Professional & Technical 26,464 30,000 30,000 30,000 30,000 • Annual external audit plus a federal single audit • Outside consulting as needed 10131100 420122 Report Processing Fees 487 750 375 1,000 1,000 Fees for GFOA processing of ACFR and PAFR 10131100 420400 Advertising and Public Notices 2,364 1,500 6,000 2,100 2,100 Deseret Digital - membership for job postings 10131100 420407 Employee Relations 5,580 5,000 5,000 5,000 5,000 Benefits fair, employee milestone awards (5, 10, 15, 20, 25, 30), etc. 10131100 420500 Printing and Binding 10,266 10,000 9,832 10,000 10,000 Printing of utility bills 10131100 420600 Postage and Shipping 19,636 27,500 23,685 27,500 27,500 Postage for mailing utility bills 10131100 420900 Education and Conferences 5,783 6,000 6,500 7,000 7,000 • Tyler Technologies (software) • UGFOA • UAPT • IPMA • SHRM • Miscellaneous tranings 21

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10131100 421000 Bank Charges 227,195 150,000 257,796 250,000 250,000 10131100 421200 Equipment Rental 398 750 500 750 750 10131100 450100 Office Supplies 15,925 15,000 15,000 15,000 15,000 Citywide office supplies - used to be in nondepartmental 10131100 450209 Uniforms 380 750 750 750 750 10131100 450400 Books, Publications, Subscr. 2,115 3,000 3,000 3,000 3,000 • TechNet Salary Survey • GFOA - National & Local • APT - National & Local • SHRM & IPMA • ISM • NIGP • Publications & updates 10131100 455000 Miscellaneous Expenses 4,160 5,000 3,677 5, 000 5, 000 Total Finance/Human Resources 1,146,386 1,206,250 1,313,971 1,403,400 1,403,400 Information Technology 10131120 410101 Regular Wage 138,411 152,000 160,836 173,000 173,000 Includes a 4% COLA and estimated 3% merit 10131120 410103 Overtime 2,502 2,750 3,613 2, 750 2, 750 10131120 410200 Benefits 73,612 90,000 84,881 100,000 100,000 10131120 410201 Mobile Phone Allowance 8,679 10,000 4,157 2, 000 2, 000 Phone allowance for 3 employees 10131120 420201 Mobile Communications - - 1,456 8,000 8, 000 Mobile hotspots throughout the City 10131120 420100 Professional & Technical 1,934 13,000 8,353 13,000 13,000 10131120 420120 Computer Support Contracts 350,546 480,000 480,000 455,000 455,000 10131120 420430 Security System 12,888 - 2,807 21,000 21,000 Security System was previously un-budgeted but included in the maintenance for each building 10131120 420900 Education and Conferences 2,050 4,000 4,000 4,500 4,500 Tyler conference and other local IT trainings and conferences 22

General Fund

Includes the new First Digital contract, but maintains a portion of the existing contract while converting the firewalls and tunnels to the new IP addresses.

Mayor:

Eliminate the fiber building to building connection for the last 6 monts of the year

Includes the new First Digital contract, but maintains a portion of the existing contract while converting the firewalls and tunnels to the new IP addresses.

Includes the new First Digital contract, but maintains a portion of the existing contract while converting the firewalls and tunnels to the new IP addresses.

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10131120 430400 Phone/Internet - Civic Center 61,024 50,000 32,275 70,000 50,000

10131120 430410 Phone/Internet - Public Works 2,828 2,500 646 7,000 7,000

10131120 430440 Phone/Internet - Old Dome 2,294 2,500 800 4,000 4,000

10131120 450000 Materials & Supplies 10,862 10,500 6,071 10,000 10,000 10131120 450110 Software 14,035 10,500 4,295 10,500 10,500 10131120 450209 Uniforms 383 500 - 500 500 10131120 450400 Books, Publications, Subscr. - 350 - 350 350 10131120 450514 Maintenance - Mach & Equip 3,654 14,000 11,017 14, 000 14,000 10131120 455000 Miscellaneous Expenses 779 1,750 363 1,750 1,750 10131120 480505 Capital Outlay - Comp. Equip. 31,965 30,000 12,774 27, 000 27,000 10131120 480507 Capital Outlay - Technical Equipmen 92,991 50,000 39,106 61,000 61,000 Upgrade SAN servers for increased capacity due to Ransomware protection Total Information Technology 811,436 924,350 857,448 985,350 965,350 Utilities 10131145 430100 Sewer - Civic Center 476 600 585 750 750 All sewer accounts Include the base rate increase 10131145 430110 Sewer - Public Works 311 500 429 500 500 10131145 430130 Sewer - Senior Center 444 600 763 750 750 10131145 430140 Sewer - Old Dome Meeting Hall 661 750 922 1,000 1,000 10131145 430150 Sewer - Parks 2,338 4,000 4,139 4, 000 4, 000 10131145 430160 Sewer - Main Park 3,583 6,000 7,407 7, 000 7, 000 10131145 430170 Sewer - Rodeo Grounds 333 1,000 787 1,000 1,000 10131145 430200 Heat & Fuel - Civic Center 18,556 20,000 23,199 22,000 22,000 All heat & Fuel accounts include a rate increase that took effect January 2023 10131145 430210 Heat & Fuel - Public Works 21,572 22,500 20,172 22,500 22,500 10131145 430230 Heat & Fuel - Senior Center 18,398 17,500 38,363 45,000 45,000 23

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10131145 430240 Heat & Fuel - Old Dome 4,938 6,000 4,336 5, 000 5, 000 10131145 430260 Heat & Fuel - Main Park 5,201 6,000 5,281 5, 500 5, 500 10131145 430280 Heat & Fuel - Precinct 1,529 2,000 1,438 2, 000 2, 000 10131145 430290 Heat & Fuel - CR Hamilton 5,266 5,000 4,682 5, 000 5, 000 10131145 430300 Power - Civic Center 29,774 40,000 34,086 40,000 40,000 All power budgets are set based on historical analyses and estimated increases in consumption 10131145 430310 Power - Public Works 23,314 25,000 25,173 25,000 25,000 10131145 430330 Power - Senior Center 34,501 38,000 39,662 42,000 42,000 10131145 430340 Power - Old Dome 10,755 11,500 9,197 10,000 10,000 10131145 430350 Power - Street Lights 40,555 65,000 42,938 50,000 50,000 10131145 430360 Power - Parks 70,707 80,000 77,366 82,000 82,000 10131145 430365 Power - Main Park 10,549 15,000 13,786 13,000 13,000 10131145 430370 Power - Rodeo Grounds 10,708 13,000 10,265 13,000 13,000 10131145 430380 Power - Precinct 6,813 8,500 7,830 8, 500 8, 500 10131145 430395 Power - Traffic Lights 5,695 8,500 - 8,500 8,500 10131145 431000 Nonreciprical Interfund Util. 182,000 182,000 182,000 182,000 182,000 Total Utilities 508,978 578,950 554,804 596,000 596,000 Fleet 10131150 410101 Regular Wage 71,513 74,000 81,655 102,000 102,000 Includes a 4% COLA and estimated 3% merit Includes an additional Fleet Mechanic 10131150 410103 Overtime 988 1,925 1,780 1, 925 1, 925 10131150 410200 Benefits 42,338 48,000 46,015 68,000 68,000 10131150 410201 Mobile Phone Allowance 672 - 453 10131150 450209 Uniforms 736 1,150 736 1,150 1,150 Uniforms for three employees 10131150 450213 Personal Protective Equipment 322 1,050 1,000 1, 050 1, 050 Safety equpment for three employees 10131150 450514 Maintenance - Mach & Equip 11,852 15,000 8,623 24,000 24,000 10131150 450516 Maintenance - Vehicles 60,283 40,000 9,293 45,000 45,000 10131150 450585 Fuel 95,796 100,000 88,597 125,000 125,000 10131150 450603 Maintenance - Generator 13,677 24,000 2,795 24,000 24,000 Increase for Fire Station generators 10131150 450800 Small Tools and Minor Equip 1,445 2,500 1,874 2, 500 2, 500 10131150 455000 Miscellaneous Expenses 73 1,500 - 5,000 5,000 Various miscellaneous expenses includes some additional funds for outsourced minor jobs as needed 10131150 480501 Capital Outlay - Equipment - 12,000 12,000 Fire Station generators Total Fleet 299,694 309,125 242,821 399,625 399,625 24

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments Communications 10141160 410101 Regular Wage 240,790 245,000 203,195 240,000 240,000 Includes a 4% COLA and estimated 3% merit 10141160 410103 Overtime 1,095 3,500 1,475 3, 500 3, 500 10141160 410200 Benefits 115,226 135,000 106,291 140,000 140,000 10141160 410201 Mobile Phone Allowance 1,437 1,650 1,538 1, 650 1, 650 10141160 420400 Advertising and Public Notices 5,298 13,000 8,017 13,000 13,000 Email and text platforms, supplemental advertising, promotional items, etc. 10141160 420401 Community Outreach 12,316 10,500 4,615 10,500 10,500 City swag, awards, State of the City, contests, etc. 10141160 420403 Public Education 8,008 13,000 11,500 13,000 13,000 Public education campaigns, postcards, etc. 10141160 420404 Social Media & Digital Adv 4,249 7,000 5,443 7, 000 7, 000 10141160 420405 Print Newsletter 11,675 16,000 4,675 16,000 16,000 10141160 420406 Event Cal & School Newsletter 12,098 15,500 17,916 17,500 17,500 Printing of the calendar, for distribution 10141160 420900 Education and Conferences 1,417 4,750 2,875 2,500 2,500 PIO Conference, business licensing conference, graphic design software trainings 10141160 450000 Materials & Supplies 2,715 7,000 7,698 Emergency Management supplies 10141160 450209 Uniforms 700 750 - 700 700 10141160 450400 Books, Publications, Subscr. 2,318 350 183 350 350 Newspaper subscriptions, etc. 10141160 450660 Website Maintenance 4,674 7,500 3,799 7, 500 7, 500 10141160 451001 Street Light Banners 36,119 45,000 16,584 30,000 30,000 10141160 455000 Miscellaneous Expenses 837 2,000 604 2,000 2,000 Lunch meetings, team building meetings Total Communications 460,972 527,500 396,409 505,200 505,200 Development Services 10151130 410101 Regular Wage 773,274 1,045,000 1,144,064 1,125,000 1,125,000 Includes a 4% COLA and estimated 3% merit 10151130 410103 Overtime 2,896 2,500 4,074 2, 500 2, 500 10151130 410200 Benefits 386,588 658,000 590,597 685,000 685,000 10151130 410201 Mobile Phone Allowance 4,386 4,250 5,248 4, 500 4, 500 10151130 410301 Stipend - Planning Commission 12,600 18,900 9,900 18,900 18,900 Planning Commission Stipend @$100 per meeting x7 members) 10151130 420100 Professional & Technical 24,536 15,000 7,544 70,000 70,000 General Plans Update (text, Traffic), property survey/appraisals, expenses related to Property Acquisition 10151130 420101 WCD Contr. Labor - Inspections 48,110 120,000 60,443 100,000 100,000 Shums Coda/Sunrise Contract Inspections 25

General Fund

APWA Conferences

Transcription for PC, BOA variance/appeals. Corresponding revenue line for PC & BOA. Reflects cost increase to service.

•

• Survey Engineering certifications

• Building inspector training

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10151130 420102 Contract Labor - Inspections 127,432 50,000 112,710 120,000 120,000 Shums Coda/Sunrise Contract Inspections

mostly residential 10151130 420103 WCD Plan Checks 12,558 40,000 23,304 30,000 30,000 Contract Plan Checks - includes some Centercal tenant improvements 10151130 420104 Contract Labor - Plan Checks 32,520 40,000 40,060 30,000 30,000 Contract Plan Checks, includes specialty plans checks eg solar 10151130 420107 Minutes - 3,000 - 3,000 3,000 City initiated, response to legal actions/appeals 10151130 420400 Advertising and Public Notices 5,966 3,000 3,180 3, 500 3, 500 Corresponding revenue line 10151130 420600 Postage - - - 2,500 2,500 Previously was budgeted in nondepartmental 10151130 420900 Education and Conferences 3,260 5,000 5,500 7,000 7,000 • Local conferences

CE credits •

• Inspector

• Tyler Conference •

10151130 450100 Office Supplies 218 1,250 - 875 875 10151130 450209 Uniforms 1,991 3,750 3,269 2, 625 2, 625 Uniforms for 11 employees 10151130 450213 Personal Protective Equipment 477 2,500 1,500 1,750 1,750 Boots, visibility vests, eye protection, safety supplies 10151130 450220 PZ Commission Expenses - - 225 6,750 6,750

10151130 450400 Books, Publications, Subscr. 1,549 2,500 432 1,750 1,750

-

&

PE Lincense CUE

CEU

Building

certifications

10151130 455000 Miscellaneous Expenses 11,683 9,000 4,298 3,500 3,500

fee, Dept/ED meeting

project costs, Total Development Services 1,450,044 2,023,650 2,016,348 2,219,150 2,219,150 Facilities Maintenance 10171140 410101 Regular Wage 253,295 261,000 289,293 348,000 348,000 Includes

10171140 410102 Temp/Seasonal Wage 17,847 35,000 - 15,000 15,000 10171140 410103 Overtime 3,919 2,100 3,016 2, 100 2, 100 26

SLC Recorder Data Fees, GOEO Database

expenses,

a 4% COLA and estimated 3% merit Includes one additional facility maintenance worker

General Fund

•

etc.

• New power washer and other equipment for the car wash

and

etc.

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10171140 410200 Benefits 143,093 172,000 156,072 220,000 220,000 10171140 410201 Mobile Phone Allowance 2,382 1,500 1,899 2, 000 2, 000 10171140 420201 Mobile Communications - 750 57 400 400 10171140 420432 Elevator Monitoring 6,751 10,000 1,831 10,000 10,000 10171140 420900 Education and Conferences - - - 1,100 1,100 HVAC and plumber licenses 10171140 450209 Uniforms 1,437 3,000 1,641 3, 000 3, 000 10171140 450213 Personal Protective Equipment 435 1,000 597 750 750 10171140 450400 Books, Publications, Subscr. - 350 - 350 350 10171140 450508 Maintenance - C.R. Hamilton - 30,000 41,788 10,000 10,000 Toiletries, cleaning supplies, boilers, HVAC filters, equipment repair and replacement, etc. 10171140 450511 Maintenance - Civic Center 14,228 14,000 40,820 21,000 21,000 Civic center repairs and back plaza upkeep 10171140 450512 Maintenance - Public Works 8,958 7,500 3,714 7,500 7,500

Toiletries, cleaning supplies, boilers, HVAC filters, equipment repair

replacement,

and

10171140 450513 Maintenance - Senior Center 18,545 15,000 2,989 15,000 15,000

supplies, boilers, HVAC

repair

replacement,

10171140 450514 Maintenance - Mach & Equip 279 2,500 - 2,500 2,500 Small tools and equipment as needed 10171140 450515 Maintenance - Old Dome 11,070 10,000 374 10,000 10,000 Restroom countertops

the restrooms, rain gutters

never had them) 10171140 450517 Maintenance - Precinct 9,112 5,000 4,047 5, 000 5, 000 10171140 450519 Maintenance - Park Bldgs 31,531 10,000 33,928 32,000 32,000 Toiletries, cleaning supplies, boilers, HVAC filters, equipment repair and replacement, etc. 10171140 450800 Small Tools and Minor Equip 2,094 2,500 1,578 2, 500 2, 500 10171140 455000 Miscellaneous Expenses 470 1,000 820 1,000 1,000 10171140 480201 Governmental Bldgs & Grounds 15,175 15,000 11,390 15,000 15,000 Rodeo grounds fencing Total Facilities Maintenance 540,621 599,200 595,853 724,200 724,200 Justice Court 10232034 410101 Regular Wage 111,615 125,000 93,348 117,000 117,000 Includes a 4% COLA and estimated 3% merit 10232034 410103 Overtime 651 - 1,197 1,000 1, 000 10232034 410200 Benefits 49,394 90,000 57,327 75,000 75,000 10232034 410201 Mobile Phone Allowance 360 1,350 383 750 750 Phone allowance for two employees 27

Toiletries, cleaning

filters, equipment

in

(building

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10232034 420110 Contract Labor - Judge 11,305 81,000 60,000 60,000 60,000 Interlocal agreement with Taylorsville 10232034 420111 Public Defender 23,050 20,000 33,488 30,000 30,000 Increase in criminal cases needing a public defender 10232034 420112 Bailiff 13,694 17,000 15,918 34,000 34,000 Increase to two bailiffs required by security plan 10232034 420113 Substitute Court Clerk - 2,000 259 - - No longer needed with two court clerks 10232034 420114 Interpreter Services 2,527 2,500 5,571 5,000 5,000 Four fold increase in number of cases requiring interpreter services 10232034 420900 Education and Conferences 1,129 4,000 150 4,000 4,000 10232034 450209 Uniforms 137 600 879 600 600 10232034 450400 Books, Publications, Subscr. - 300 - 300 300 10232034 455000 Miscellaneous Expenses 448 1,000 650 1,000 1,000 10232034 470101 Jury Fees 56 1,000 833 2,500 2,500 Total Justice Court 214,364 345,750 270,003 331,150 331,150 Animal Control / Code Enforcement 10252110 410101 Regular Wage 106,557 115,000 117,913 178,000 178,000 Includes a 4% COLA and estimated 3% merit Includes an additional Animal Control / Code Enforcement Officer 10252110 410103 Overtime 1,535 2,000 3,802 2, 000 2, 000 10252110 410200 Benefits 71,965 85,000 82,250 131,000 131,000 10252110 420201 Mobile Communications - 500 102 500 500 On-call phone 10252110 450209 Uniforms - 1,000 - 1,500 1,500 Uniforms for 3 employees 10252110 420210 Abatement Expenses - 10,000 - 5,000 5,000 10252110 420220 Animal Shelter Contract 94,389 89,000 100,586 100, 000 100,000 Total Animal Control / Code Enf 274,445 302,500 304,654 418,000 418,000 Public Works Administration 10303010 410101 Regular Wage 759,382 577,000 634,783 615,000 615,000 Includes a 4% COLA and estimated 3% merit 10303010 410102 Temp/Seasonal Wage 165 - - -10303010 410103 Overtime 7,709 5,000 224 5,000 5,000 10303010 410200 Benefits 393,439 352,000 300,126 357,000 357,000 10303010 410201 Mobile Phone Allowance 6,069 6,500 2,319 2, 750 2, 750 Phone allowance for 6 employees 10303010 420100 Professional & Technical 750 5,000 4,267 10,000 10,000 Engineering Services 10303010 420201 Mobile Communications - - 41 -28

General Fund

•

•

GIS

• APWX- Conference

• ESRI Conference

• Publications & Subscriptions

• NFPA & IES Membership for Streetlighting

• Blue Staking - Operator renewal

• Streetlighting DOPL renewal

• Biennial Electrical license

Replace streetlighting underground locator, and maintenance of other miscellaneous equipment

•General Supplies

•Deptartment Christmas luncheon

•Public Works - City-wide luncheon

•Quaterly Training

• Monthly Billing Service

•Marking Paint and Flags

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10303010 420500 Printing and Binding 92 750 25 1,050 1,050 Printing needs such as flyers & reports 10303010 420900 Education and Conferences 7,401 14,000 14,000 29,876 29,876

Streetlighting

Conference

IES

UGTC-

Training

10303010 450100 Office Supplies 475 1,000 1,570 2, 000 2, 000 10303010 450200 Operating Supplies 1,245 2,250 - 2,250 2,250 10303010 450209 Uniforms 4,896 5,250 5,826 10,600 10,600 Uniforms for Public Works, Stormwater, and Streetlighting employees 10303010 450213 Personal Protective Equipment 715 3,250 3,167 7,750 7,750 PPE for Public Works, Stormwater, and Streetlighting employees 10303010 450400 Books, Publications, Subscr. 1,188 2,500 2,253 4,380 4,380

10303010 450514 Maintenance - Mach & Equip 575 2,500 1,114 4,800 4,800

10303010 450520 Traffic Calming Mitigation 6,919 20,000 10,000 20,000 20,000 10303010 455000 Miscellaneous Expenses 4,272 3,500 3,958 6,000 6,000

Total Public Works Administration 1,195,292 1,000,500 983,673 1,078,456 1,078,456 Street Lighting 10303050 410101 Regular Wage 125,028 95,000 107,793 100,000 100,000 Includes a 4% COLA and estimated 3% merit 10303050 410103 Overtime 1,269 500 627 500 500 10303050 410200 Benefits 64,778 55,000 29,319 57,000 57,000 10303050 410201 Mobile Phone Allowance - - 638 600 600 10303050 421307 Bluestakes 12,395 12,000 16,813 12,000 12,000

29

General Fund

Charges for

• General maintenance repair & replacement

•Replacement of wire due to theft on Sentinel Ridge Blvd

Mayor

Move replacement of wire due to theft on Sentinel Ridge Blvd to capital projects (see account 45303050-480306)

Includes two new stormwater maintenance workers

• Increase general maintenance for repairs on system identified through staff camera inspections • 12600 S 1500 W UDOT detention pond

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10303050 440401 Power Connection Fees 1,430 3,500 998 3,500 3,500

10303050 450611 Maintenance - Street Lights 154,745 200,000 193,168 270,000 200,000

new Rocky Mountain Power connections

Total Street Lighting 359,645 366,000 349,355 443,600 373,600 Stormwater 10303110 410101 Regular Wage 215,838 164,000 172,408 277,000 277,000 Includes a 4% COLA and estimated 3% merit

10303110 410103 Overtime 2,191 500 3,875 1,000 1,000 10303110 410200 Benefits 111,827 128,000 118,544 216,000 216,000 10303110 410201 Mobile Phone Allowance - - 765 775 775 10303110 420401 Community Outreach - 6,000 10,330 6, 000 6, 000 SW Coalition Membership 10303110 440301 SW Permit & Management 1,750 2,000 2,625 2, 250 2, 250 10303110 450500 Maintenance - SW System 12,139 10,000 10,000 90,000 90,000

Total Stormwater 343,745 310,500 318,547 593,025 593,025 Recreation & Events 10505030 410101 Regular Wage 463,940 410,000 444,553 440,000 440,000 Includes a 4% COLA and estimated 3% merit 10505030 410102 Temp/Seasonal Wage 13,956 10,000 7,326 10,000 10,000 10505030 410103 Overtime - - 14,559 10,000 10,000 10505030 410105 Events - Guaranteed overtime 87,492 80,000 120,741 100,000 100,000 Increase for third night of rodeo 10505030 410200 Benefits 211,118 390,000 288,457 307,000 307,000 10505030 410201 Mobile Phone Allowance - 3,000 2,933 2, 800 2, 800 30

General Fund

Combining with Community Events (10505030-450320)

URPA conference, director retreat, miscellaneous local trainings for certifications

Monthly staff meetings, senior staff meeting, employee socials (Thanksgiving, Halloween, misc.)

All Old Dome events and activities (FFN

• Increase for third night of Rodeo • $5,000 from Waste Management for sorting payout (see revenue line 100340410)

in the park, Friday Fun Nights, Hope Walk, Public Safety Night, JYI, Halloween, etc.

(see

Tennis, monsters after dark, hunter safety, other miscellaneous classes, etc.

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10505030 420401 Community Outreach 14,320 20,000 5,703 - -

10505030 420900 Education and Conferences 2,568 4,000 4,000 4,000 4,000

10505030 450100 Office Supplies 218 1,000 457 1,000 1,000 10505030 450209 Uniforms 1,598 1,250 1,250 1, 500 1, 500 10505030 450305 Staff Meetings & Luncheons 3,875 10,000 10,000 12,000 12,000

10505030 450310 Cultural Event Programs 15,737 31,000 23,856 35,000 35,000

entertainment) 10505030 450311 Christmas - Santa's Arrival 4,194 8,000 8,151 9, 000 9, 000 10505030 450312 Christmas Celebration 18,283 22,000 19,553 20,000 20,000 10505030 450313 Easter Celebration 3,504 8,500 8,500 9, 000 9, 000 10505030 450314 Rodeo 33,950 33,500 50,000 50,000 50,000

10505030 450315 Town Days 102,181 110,000 101,337 120,000 120,000 10505030 450316 Town Days - Float 24,492 25,000 24,750 13,000 13,000 Includes repairs to elected officials float 10505030 450317 Town Days - Fireworks 46,000 40,000 40,000 42,000 42,000 Increase for cost of living increase per contract 10505030 450318 Town Days - Entertainment 7,100 18,000 18,000 22,000 22,000 10505030 450319 Miss Riverton 9,676 12,000 3,498 8, 500 8, 500 10505030 450320 Community Events 15,025 25,000 14,904 50,000 50,000

10505030 450321 Youth Council 3,603 8,000 2,291 9,000 9,000 $2,500 grant

Waste Management

revenue

100-340413) 10505030 450322 Recreation Events 49,322 60,000 15,006 68,000 68,000 Fall football,

marathon,

10505030 450323 Community Classes 15,246 6,500 14,831 13,000 13,000

10505030 450400 Books, Publications, Subscr. 3,858 3,000 365 3,000 3,000 10505030 451000 Christmas Decorations 28,821 30,000 18,787 30,000 30,000

10505030 455000 Miscellaneous Expenses 1,124 1,000 1,518 10,000 10,000 Total Recreation & Events 1,181,201 1,370,750 1,265,325 1,399,800 1,399,800 31

Movies

from

line

flag football, Start Smart, half

etc.

Add and replace Christmas street light decorations

General Fund

• Sprinkler Supply annual training

• Sprinkler World annual training • NRPA

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments Cemetery Operations 10513172 410101 Regular Wage 39,068 28,500 19,492 25,000 25,000 Includes a 4% COLA and estimated 3% merit 10513172 410103 Overtime 7,905 6,000 6,643 6, 000 6, 000 10513172 410200 Benefits 18,996 24,000 16,037 15,000 15,000 10513172 410201 Mobile Phone Allowance - 500 143 500 500 10513172 450505 Maintenance - Cemetery - 9,000 4,382 9, 000 9, 000 Requesting the same funding as FY23-24 Total Cemetery 65,968 68,000 46,697 55,500 55,500 Parks 10515031 410101 Regular Wage 433,116 523,000 590,141 545,000 545,000 Includes a 4% COLA and estimated 3% merit 10515031 410102 Temp/Seasonal Wage 29,659 128,000 46,450 168,000 168,000 10515031 410103 Overtime 32,431 20,000 16,129 10,000 10,000 10515031 410200 Benefits 237,415 264,000 343,548 395,000 395,000 10515031 410201 Mobile Phone Allowance 6,991 8,500 4,048 5, 000 5, 000 10515031 420201 Mobile Communications - 500 41 500 500 10515031 420100 Professional & Technical - - - 5,000 5,000 Engineering services for budgeted project 10515031 420900 Education and Conferences 3,545 7,000 7,000 10,000 10,000 • UNLA Greens Conference

UCPI certified playground inspector

Risk

•

• Tree

Assessment

• Irrigation Specialist • LTAP

10515031 421300 Restroom Cleaning Contract 42,000 72,000 72,000 80,000 80,000 Current contract price plus estimate for new restrooms behind City Hall 10515031 421305 Mowing Contract 609,497 600,000 600,000 612,000 612,000 Current contract price + 2% for the anticipated increase 10515031 421308 Sports Field Maint & Prep 66,845 70,000 80,000 70,000 70,000 Projected field prep cost for baseball, softball & football 10515031 450100 Office Supplies 305 500 - 500 500 10515031 450209 Uniforms 4,465 5,000 5,677 5, 700 5, 700 Uniforms for 10 employees 10515031 450213 Personal Protective Equipment 4,610 2,500 2,656 6, 300 6, 300 PPE for 10 employees 32

General Fund

UNLA Greens membership; UCPA Utah cemetary & parks membership; ISA/UCFC membership; Weather Trak Smart controller cubscription; Horticulture, tree, irrigation & pesticides updated books

Materials needed to maintain parks & grounds such as irrigation supplies, sod, chemicals, flags, etc.

New tree planting, tree pruning & maintenance

Maintenance of small equipment, purchase of small equipment such as leaf blowers, snow blowers, line trimmers, sprayers, etc.

Incentives, luncheons, awards & miscellaneous supplies

• Main Park Update to Weather Trak controler

•Park bench and table replacement

• Smart controller replacement 3-yr project

• Three stainless steel strong boxes for meter enclosure

Mayor

Move all projects to the 450 Fund (see account 45515031-480302)

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 10515031 450400 Books, Publications, Subscr. 538 2,000 7,325 11,100 11,100

10515031 450504 Maintenance - Grounds 188,536 287,000 287,000 250,000 250,000

10515031 450507 Maintenance - Trees 58,405 50,000 50,249 51,500 51,500

10515031 450514 Maintenance - Mach & Equip 3,334 3,500 1,472 4,500 4,500

10515031 455000 Miscellaneous Expenses 2,031 2,000 1,181 2,100 2,100

10515031 480501 Capital Outlay - Equipment 41,184 30,000 30,000 200,000 -

Total Parks 1,764,907 2,075,500 2,144,917 2,432,200 2,232,200 33

General Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments Transfers 10999000 490121 Transfer to C-Roads - 280,000 - 280,000 280,000 CMAQ Grant for bike lanes project (rollover from FY 2023) - see 11303052-480300 10999000 490125 Transfer to RPD Operations 400,000 420,000 420,000 440, 000 440,000 Sales tax subsidy for law enforcement 10999000 490280 Transfer to RFSA 201,303 127,700 225,000 187, 500 187,500 Fire impact fee buy-in 10999000 490400 Transfer to REDIIF 575,000 550,000 520,000 550, 000 550,000 Costco Sales Tax Sharing Agreement 10999000 490450 Transfer to CIF 2,000,000 2,500,000 2,500,000 3,150,000 3,350,000 10999000 490460 Transfer to SW Capital Project 836,460 950,000 875,000 300,000 300,000 Rest of SW HSU fee staying in the General Fund to cover SW maintenance operations 10999000 490510 Transfer to Culinary Water - 410,000 40,000 305,000 305,000 10999000 490530 Transfer to Pressurized Irrig. - 80,000 40,000 105,000 105,000 10999000 490550 Transfer to Sanitation 180,000 403,000 375,000 - 140,000 Total Transfers 4,192,763 5,720,700 4,995,000 5,317,500 5,657,500 Total Expenditures 16,486,631 19,322,775 17,945,983 20,619,556 20,585,556 197,589 - 1,205,761 -Beginning Fund Balance 6,607,099 6,804,688 6,804,688 8,010,450 8,010,450 Change in Fund Balance 197,589 (588,675) 1,205,761 (1,972,956) (1,938,956) Ending Fund Balance 6,804,688 6,216,013 8,010,450 6,037,494 6,071,494 Estimated prepaids 130,000 130,000 100,000 100,000 100,000 % of Revenues 32.94% 26.49% 35.45% 27.20% 27.36% 34

FUND 110

Class “C” Roads

The Class “C” Roads Fund accounts for repairs and maintenance of Riverton City’s streets, sidewalks, curbs and gutters financed by the city’s share of the gas tax.

35

TotalClass 'C'Expenditures

Class 'C' Roads Fund

2022-2023 2023-2024 2024-2025 2024-2025 Audited Projected Staff Mayor's Department Actual Finish Estimate Budget Class 'C' Revenue Class 'C' Road Funds 3,097,682 3,000,000 3,000,000 3,000,000 Other Revenues 87,613 17,000 7,500 7,500 Total Class 'C' Fund Revenues 3,185,295 3,017,000 3,007,500 3,007,500 Transfers In and Use of Fund Balance Transfers - - 280,000 280,000 Use of Fund Balance - - 950,885 950,885 Total Transfers In and Use of Fund Balance - - 1,230,885 1,230,885 Total Rev, Trans In and Use of Fund Balance 3,185,295 3,017,000 4,238,385 4,238,385

Fleet 48,115 106 98,000 98,000 Public Works Administration - 71,406 73,525 73,525 Streets Maintenance 2,139,834 2,579,280 4,066,860 4,066,860 Total Class 'C' Fund Expenditures 2,187,949 2,650,792 4,238,385 4,238,385 Transfers Out and Addition to Fund Balance Addition to Fund Balance - - -Total Trans Out and Add'n to Fund Balance - - -Total Exp, Trans Out and Add'n to Fund Bal 2,187,949 2,650,792 4,238,385 4,238,385 997,346 366,208 -Beginning Fund Balance 1,802,331 2,799,676 3,165,884 3,165,884 Change in Fund Balance 997,346 366,208 (950,885) (950,885) Ending Fund Balance 2,799,676 3,165,884 2,214,999 2,214,999 Operating Revenues 3,185,295 3,017,000 3,007,500 3,007,500 Operating Expenditures 1,846,323 2,574,293 2,988,385 2,988,385 One-time Revenues (transfers & FB) - - 1,230,885 1,230,885 One-time Expenditures (Capital) 341,626 76,499 1,250,000 1,250,000

Operating

36

Class 'C' Roads Fund Summary

Operating vs. Capital Expenditures

One-time (Capital)

Class 'C' Roads Fund

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments Class 'C' Revenue 110 330250 Class-C Roads Funds 3,097,682 3,000,000 3,000,000 3,000,000 3,000,000 Riverton City's share of the gas tax 110 360000 Sundry Revenue 8,724 - 5,000 -110 360100 Interest Earnings 78,889 5,000 - 7,500 7,500 Use of Fund Balance - 681,025 - 950,885 950,885 110 370110 Transfer from General Fund - 280,000 - 280,000 280,000 CMAQ Grant for bike lanes project (rollover from FY 2023) - see 11303052-480300 110 370300 Sale of Capital Assets - - 12,000 -Total Revenue 3,185,295 3,966,025 3,017,000 4,238,385 4,238,385 Class 'C' Expenditures Fleet 11131150 410101 Regular Wage 31,016 31,000 - 58,000 58,000 Includes a 4% COLA and estimated 3% merit Includes an additional Fleet Mechanic 11131150 410103 Overtime 530 2,000 - 2,000 2,000 11131150 410200 Benefits 16,569 22,000 106 38,000 38,000 Total Fleet 48,115 55,000 106 98,000 98,000 Public Works Administration 11303010 410101 Regular Wage - 45,000 47,973 45,000 45,000 Includes a 4% COLA and estimated 3% merit 11303010 410103 Overtime - 275 17 275 275 11303010 410200 Benefits - 28,000 23,244 28,000 28,000 11303010 410201 Mobile Phone Allowance - - 172 250 250 Total Public Works Administration - 73,275 71,406 73,525 73,525 Streets Maintenance 11303052 410101 Regular Wage 520,923 535,000 528,387 558,000 558,000 Includes a 4% COLA and estimated 3% merit 11303052 410102 Temp/Seasonal Wage 13 17,000 - 18,000 18,000 11303052 410103 Overtime 17,718 20,000 9,385 20,000 20,000 11303052 410200 Benefits 339,107 405,000 315,021 430,000 430,000 11303052 410201 Mobile Phone Allowance - - 1,245 1,600 1,600 11303052 420100 Professional & Technical 35,500 25,000 19,094 25,500 25,500 Engineering services for projects 11303052 420201 Mobile Communications - - - 500 500 Streets on-call phone

37

Class 'C' Roads Fund

Class 'C' Roads Fund

(Multi-site facilities Management

Conference (2 employees)

specialized training for all employees

City does not own, including

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 11303052 420205 Street Striping 8,371 75,000 75,683 80,000 80,000 In-house

contracted striping

11303052 420900 Education and Conferences 2,133 7,000 716 10,000 10,000 •CONEX

conference • APWA

•LTAP

11303052 421200 Equipment Rental 90 5,000 5,518 10,000 10,000 Specialty equip

grader

machine 11303052 421309 Tree Trimming 947 5,000 5,023 5,100 5,100 Contract Parkstrip Right of Way tree trimming costs 11303052 450209 Uniforms 5,553 5,000 6,691 5,700 5,700 Spring & Fall uniforms, this includes winter coats, & winter coveralls 10 employees @ $570 an employee 11303052 450213 Personal Protective Equipment 2,910 3,500 3,555 3,570 3,570 Hard hats, safety

safety glasses, safety vests, snow cleats, & steel-toed boots 10 employees 11303052 450400 Books, Publications, Subscr. 1,003 750 - 1,000 1,000 Annual membership dues for APWA, ULTAP, & UAPA 11303052 450502 Maintenance - Class C Roads 56,493 80,000 80,000 181,600 181,600 •In-house roadway maint, signage, small tools, & traffic control • Repair damaged concrete panels on 13400 S 11303052 450503 Snow Removal 40,730 30,000 56,081 30,600 30,600 Salt for roads during winter storms 11303052 450514 Maintenance - Mach & Equip 39 7,000 8,652 7,140 7,140 Power tools replacement or repair 11303052 450521 Maintenance - Salter / Plow 16,213 18,000 17,250 20,000 20,000 •Maint of plows & salters to ensure plows are in top condition to respond to winter storms quickly & efficiently 11303052 450607 Maintenance - Traffic Signal 49,271 72,500 70,000 73,950 73,950 • WCG Services • New signs and radar patrol equip 11303052 450608 Maintenance - C/G/S 36,202 130,000 100,000 132,600 132,600 Contract and in house repair, replace & maintain of City curbs, gutters, & sidewalks 11303052 450609 Maintenance - Asphalt 663,136 1,200,000 1,200,000 1,200,000 1,200,000 Asphalt repairs and overlays as determined by City's roadway maintenance program 11303052 455000 Miscellaneous Expenses 1,857 2,000 480 2,000 2,000 Incentives, awards, lunches, and other misc. items 38

&

for City roadsincludes additional amount for cost increases

Snow

& mastic

gloves,

Class 'C' Roads Fund

•13400 S 2700 W - 3200 W CMAQ bike lane CMAQ Grant of $280,000 in revenue line 110-370110)project management with UDOT - roll-over •13400 S Bridge replacement $520,000 (City's portion, UDOT is in the finishing stages of obtaining a grant for the remainder of this project) - roll-over

2022-2023 2023-2024 2023-2024 2024-2025 2024-2025 ORG OBJECT Audited Adopted Projected Staff Mayor's Code Code Account Title Actual Budget Finish Estimate Budget Comments 11303052 480300 Capital Outlay - Infr Proj 341,626 1,195,000 76,499 1,170,000 1,170,000

11303052 480501 Capital Outlay - Equipment - - - 80,000 80,000 Street sign making

street

house, saving time and money Total Streets Maintenance 2,139,834 3,837,750 2,579,280 4,066,860 4,066,860 Transfers Addition to Fund Balance Total Transfers - - - -Total Expenditures 2,187,949 3,966,025 2,650,792 4,238,385 4,238,385 997,346 - 366,208 -Beginning Fund Balance 1,802,331 2,799,676 2,799,676 3,165,884 3,165,884 Change in Fund Balance 997,346 (681,025) 366,208 (950,885) (950,885) Ending Fund Balance 2,799,676 2,118,651 3,165,884 2,214,999 2,214,999 39

machine - to make

signs in-

FUND 120 Riverton Police Department

The Riverton Police Department Fund is used to account for law enforcement activities and operations.

40

Riverton Police Operations Fund

Riverton Police Operations Fund Summary

Police Operations Expenditures

2022-2023 2023-2024 2022-2023 2024-2025 2024-2025 Audited Adopted Projected Staff Mayor's Department Actual Budget Finish Estimate Budget Riverton

Other Revenues 1,356,932 360,000 372,643 360,000 360,000 Transfers 6,875,000 7,668,450 7,629,357 8,253,750 8,253,750 Use of Fund Balance - - - -Total Riverton Police Operations Revenues 8,231,932 8,028,450 8,002,000 8,613,750 8,613,750 Riverton

Information Technology 99,909 121,750 168,975 158,750 158,750 Fleet 692,117 584,000 610,477 496,500 496,500 Police Operations 7,436,250 7,322,700 7,222,548 7,728,500 7,728,500 Transfers - - - 230,000 230,000 Total Riverton Police Operations Expenditures 8,228,276 8,028,450 8,002,000 8,613,750 8,613,750 3,657 - (0) -Beginning Fund Balance 502 4,159 4,159 4,159 4,159 Change in Fund Balance 3,657 - (0) -Ending Fund Balance 4,159 4,159 4,159 4,159 4,159 Operating Revenues (w/ RLESA & GF transfers) 8,231,932 8,028,450 8,002,000 8,613,750 8,613,750 Operating Expenditures 7,418,683 7,863,450 7,876,131 8,523,750 8,523,750 One-time Revenues - - - -One-time Expenditures (Capital) 809,593 165,000 125,869 90,000 90,000

Police Operations Revenues

Operating

41

Operating vs. Capital Expenditures

One-time (Capital & Transfers)

RivertonPoliceOperations Expenditures

Riverton Police Operations Fund

PoliceOperations Fund

2022-2023 2023-2024 2022-2023 2024-2025 2024-2025 ORG OBJECT Audited Adopted 2023-2024 Projected Staff Mayor's Code Code Account Title Actual Budget Actual YTD Finish Estimate Budget Comments RivertonPoliceOperations 120 330210 State Operating Grants 171,853 100,000 42,351 100,000 100,000 100,000 120 330300 Local Intergovernmental 196,452 195,000 107,712 195,000 195,000 195,000 120 360000 Sundry Revenue 15,814 15,000 12,780 18,043 15,000 15,000 120 360020 Premium OT - Non-government 32,708 50,000 10,238 50,000 50,000 50,000 Use of Fund Balance 120 370110 Transfer from General Fund 400,000 420,000 - 420,000 440,000 440,000 120 370127 Transfer from RLESA 6,475,000 7,248,450 - 7,209,357 7,813,750 7,813,750 120 370250 Proceeds from Financing 760,490 - - - -120 370300 Sale of Capital Assets 179,616 - 9,600 9,600 -Total Riverton Police Operations Revenues 8,231,932 8,028,450 182,681 8,002,000 8,613,750 8,613,750