On the login page, you will enter your Last Name, Date of Birth, and Last Four (4) of Social Security Number.

THEbenefitsHUB checks behind the scenes to confirm employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile.

Select either Text, Email, Call, or Ask Admin options to get a code to complete the final verification step.

Enter the code that you receive and click Verify.

You can now complete your benefits enrollment!

Please contact the benefit office for additional login support at 254-215-2074 or 254-215-2072

Provid great bene t choices to you and your family is justcial welfare of the people who make our district work so well.

or cancel coverage during the year if you have a qualifying change in the family or employment status that causes you to include:

HOW DO I ENROLL?

Visit

On the login page, you will enter your Last Name, Date of Birth, and Last Four (4) of Social Security Number then click Login

Select either Text, Email, Call, or Ask Admin options to get a code to complete the final verification step.

Enter the code, then click VERIFY

YOU ARE NOW READY TO ENROLL IN YOUR BENEFITS.

WHO IS ELIGIBLE?

•

•

insurance at full cost.

WHO IS AN ELIGIBLE DEPENDENT?

•

• • • INTRODUCTION

Dependent children of any age who are disabled Children under your legal guardianship

NEW HIRE ENROLLMENT of the following month.

Loss or gain of eligibility for other insurance (including

ti

rary ID card or give your provider the insurance company’s phone number to call and verify your coverage if you do not havean ID card at the time of service. VISION cards are NOT provided.

Department

The period once per year during which existing employees are given the opportunity to enroll in or change their current elections.

September 1 – August 31st

New

You have 31 days from your new hire date to make your benefit elections.

IRS guidelines allow you to make changes outside of Open Enrollment for the following defined reasons:

Marriage/Divorce

Birth or Adoption

Death of spouse or covered dependent

Change in your spouse’s work status that affects eligibility

Medicare eligibility

Annual Deductible

The amount you pay each plan year before the plan begins to pay covered expenses.

After any applicable deductible, your share of the cost of a covered health care service, calculated as a percentage (for example,20%)of the allowed amount for the service.

Specific dollar amount you mustpay your providerper visit.

Occurs when providers bill a patient for the difference between the amount they charge and the amount that the patient’s insurance pays. This normally happens when using services out of network. If this happens please call your medical insurance provider to reconcile the charges.

In-network doctors, hospitals, optometrists, dentists and other providers who have contracted with the plan as a network provider. Lowers chargesand reduces out pocket expenses. Out of network charges a higher payment and higherout of pocket cost. Check your plan to ensurethey provide out-of-network coverage.

Out-of-Pocket:expensesyou mustpay for health related services that are above your monthly premium. Out-ofPocket Maximum: the mostan eligible or insured person can pay in co-insuranceforcovered expenses per plan year.

Plan does not pay until deductible is met

Pay less out of each paycheck

Pay more out of pocket at doctor until deductible is met

Higher Deductible Wellness visits 100%

Same deductible for medical and prescription Enroll in HAS/Flexible Spending to help pay for out of pocket cost

In and out of network coverage – with two separate deductibles

Pay more out of paycheck

Pay less at doctor

Lower deductible

Medical and prescription have different deductibles

Co-payments for office visits

Must use a provider within the network

A facility fee is a charge that you have to pay when you see a doctor at a clinic that is not owned by that doctor. Facility fees are charged in addition to any other charges for the visit. Not all clinics or hospital charges a facility fee.

As a TRS-ActiveCare participant, your coverage includes TRS Virtual Health choices powered by Teladoc® and RediMDTM. You and your family can get convenient, quality health care from the comfort of home, on your lunch break, or while traveling without having to go to a doctor’s office.

With virtual medical visits through either Teladoc or RediMD, you and your covered family members** have access to licensed board-certified doctors, 24 hours a day, seven days a week. You can also get prescriptions sent to your pharmacy if needed.

Conditions treated include:

• allergies

• asthma

• back and shoulder strains

• blood pressure • cold • cough • contusions/bruises

diabetes

TRS-ActiveCare PrimaryTRS-ActiveCare Primary TRS-ActiveCare Primary+TRS-ActiveCare Primary+ TRS-ActiveCare 2

2

flu

headaches

infections

sinus infection

skin issues

sore throat

stomach problems

stress

*$0 copay for participants and covered family members on the TRS-ActiveCare Primary, TRS-ActiveCare Primary+, and TRS-ActiveCare 2 plans through RediMD. For participants with TRS-ActiveCare HD, medical telehealth visits through RediMD apply to the deductible. Once the deductible is met, the plan pays 70% of the Medical Consult Fee of $30. Participant would pay 30% after deductible. $12 copay for participants and covered family members on the TRS-ActiveCare Primary, TRS-ActiveCare Primary+ and TRS-ActiveCare 2 plans through Teladoc. $42 medical consult fee for TRS-ActiveCare HD participants through Teladoc. Immediate family members who don’t have a TRS-ActiveCare health plan can also use TRS Virtual Health at a fixed rate. RediMD = $35/visit; Teladoc = $55/visit

**If the patient is 17 or younger, a parent or guardian must be present during the virtual visit.

Teladoc also offers confidential mental health services from licensed therapists, psychologists, psychiatrists, or certified drug and alcohol abuse counselors for adults 18 and older

Mental health conditions treated include:

• alcoholism, addiction, and substance-related disorders

• attention disorders

• bipolar, schizophrenia and psychotic disorders

• depressive and anxiety disorders

• eating disorders

• neurocognitive disorders and dementia

• obsessive compulsive and related disorders

• personality disorders

*$70 copay for participants and covered family members on the TRS-ActiveCare Primary, TRS-ActiveCare Primary+, and TRS-ActiveCare 2 plans. 30% coinsurance (after deductible) for TRS-ActiveCare HD participants, and depending on whether a consultation is with a psychiatrist, psychologist, or social worker, additional costs may be incurred. Visit www.bcbstx.com/trsactivecare/coverage for more detailed information.

Visit www.teladoc.com/trsactivecare and follow the instructions to set up your account. You can also download the Teladoc app from the Apple App Store or Google Play Store or call 1-855-Teladoc (1-855-835-2362) for help from a customer service representative.

Visit www.redimd.com/trsactivecare and click Register. Enter code trsactivecare, click Next and follow directions to complete your profile. You can also register by calling RediMD customer service at 1-866-989-CURE (1-866-989-2873), option 3.

Virtual and telephonic visits are powered by exclusive software owned and operated by RediMD. It is important to verify and understand the terms and conditions of your benefit plan. Terms and conditions may apply based on plan design with limitations and exclusions. Virtual and telephonic services provided are not to be accepted as a health plan or act as a pharmacy distributor or prescription manager. RediMD reserves the sole right to deny care when it believes the risk of possible abuse is present. A virtual visit with RediMD does not provide assurances prescription orders will be issued. RediMD does not prescribe DEA-controlled substances, non-therapeutic drugs, or drugs that may harm or lead to abuse. RediMD operates in many different states and is subject to regulatory rules and jurisdictional limitations. Oversight and program management, including contracted providers, of the virtual medicine services provided are solely controlled by RediMD. RediMD and the RediMD logo are registered trademarks of RediMD LLC and may not be used without written permission.

Teladoc and the Teladoc logo are trademarks of Teladoc, Inc. and may not be used without written permission. Teladoc is being provided to TRS-ActiveCare members and members of plans administered by TRS-ActiveCare. Teladoc and Teladoc physicians are independent contractors and are neither agents nor employees of TRS-ActiveCare or plans administered by TRS-ActiveCare. Teladoc does not replace the primary care physician. Teladoc does not guarantee that a prescription will be written. Teladoc operates subject to state regulation and may not be available in certain states. Teladoc does not prescribe DEA controlled substances, non-therapeutic drugs, and certain other drugs which may be harmful because of their potential for abuse. Teladoc physicians reserve the right to deny care for potential misuse of services. BCBSTX makes no endorsement, representations, or warranties regarding third-party vendors and the products and services offered by them.

and

See how much better life can feel with digital mental health programs from Learn to Live.1

More than half of people will struggle with a mental health concern at some point in their lives.2 But you can learn new skills to break old patterns that may be holding you back. Digital mental health programs from Learn to Live can help you get your mental health on track so you can feel better and enjoy life more.

Learn to Live is included in your TRS-ActiveCare health plan at no added cost.

An online assessment helps pinpoint the right programs to help with your concerns, such as:

• stress, anxiety and worry

• depression

• insomnia

• social anxiety

• substance use

Explore quick and easy lessons whenever it fits your schedule. A little homework between sessions helps you keep up your progress. Activities are based on therapy techniques with a track record of helping people get better.

If you need one-on-one support to reach your goals, connect with a coach by phone, text or email. They’ll lift you up, cheer you on and help you master your new skills.

Your personal results, program progress and messages with your coach are private. We won’t share these details with your employer.

Log in to Blue Access for MembersSM at www.bcbstx.com/trsactivecare.

Click Wellness

Choose Digital Mental Health. If you have questions or need help registering for Learn to Live, call a Personal Health Guide at 1-866-355-5999.

1. Learn to Live provides educational behavioral health programs; members considering further medical treatment should consult with a physician. 2. https://www.cdc.gov/mentalhealth/learn/index.htm

Learn to Live, Inc. is an independent company that provides online behavioral health programs and tools for members with coverage through Blue Cross and Blue Shield of Texas. BCBSTX makes no endorsement, representations or warranties regarding third-party vendors and the products and services offered by them.

We understand how hard it can be to maintain a healthy lifestyle. Sometimes, you may need a little motivation. That’s why your TRS-ActiveCare plan includes the Blue Points program.1 This program may help you get on track — and stay on track — to reach your wellness goals. With the Blue Points program, you can earn points for regularly participating in many different healthy activities. You can redeem your points in an online shopping mall, which offers a variety of merchandise, such as electronics and home goods.

Blue Points has many convenient and personalized features:

EARN POINTS INSTANTLY

The program gives you points immediately, so you can start using them right away.2

Don’t have enough points yet for that reward you really want? No problem! You can apply the points you have and use a credit card to pay the balance.

The Well onTarget portal at www.wellontarget.com lets you see all your points information in one place. It's easy to see how many points you can earn and how many you've earned year to date.

Redeem your points in an online shopping mall. Reward categories include apparel, books, health and personal care, jewelry, electronics, music, and sporting goods.3

Look how quickly your Blue Points can add up! Here are some sample activities you can complete to earn Blue Points:

Complete a health assessment4 2,500 points every six months

Complete a self-management program 1,000 points per quarter

Use trackers to see your progress toward goals 10 points, up to a maximum of 70 points per week

Enroll in the fitness program5 2,500 points

Add weekly fitness program center visits to your routine Up to 300 points each week

Complete progress check insUp to 250 points per month

Connect a compatible fitness device or app to the portal 2,675 points

Track activity using a synced fitness device or app 55 points per day

The Fitness Program gives you flexible options to help you live a healthy lifestyle.

As a TRS-ActiveCare participant, the Fitness Program is available to you and your covered dependents age 16 and older.* The program gives you access to a nationwide network of fitness locations.

You also have access to a virtual fitness program so that you can stay active from the comfort and convenience of your home. You’ll get full and unlimited access to live classes, digital fitness as well as wellness videos.

A choice of gyms to fit your budget and preferences.**

$19 Initiation Fee (no initiation fee for the Digital Only option)

• Studio Class Network: Boutique-style classes and specialty gyms with a pay-as-you-go option and 30% off every 10th class.

• Family Friendly: Workout with members of your family, including covered dependents.

• Convenient Payment: Monthly fees are paid via automatic credit card or bank account withdrawals.

• Mobile App: Search locations, register for classes, check-in at the gym and see your activity history.

• Real-Time Data: Track your progress to see how many classes you’ve completed or how many goals you’ve reached.

• Complementary and Alternative Medicine (CAM) Discounts through the Whole Health Living Choices Program: Save money through a network of 40,000 wellbeing providers, such as acupuncturists, massage therapists and personal trainers. Register at www.whlchoices.com

• Blue PointsSM : Get 2,500 points for joining the Fitness Program. Earn additional points for weekly visits.***

• Web Resources: Go online to find fitness locations and track your visits.

• Digital Fitness: Stay active from the comfort of your own home! Access thousands of digital fitness videos and live classes. Digital access is included with Base, Core, Power and Elite memberships. You can also exclusively join the Digital Only plan.

It’s easy to sign up:

1. Go to www.bcbstx.com/trsactivecare, and log in to Blue Access for MembersSM

2. Under the Wellness tab, choose Fitness Program

3. There, you can enroll, then search for nearby fitness locations and learn more about the program. Remember, you can visit any participating fitness location in your plan after sign up. You can also choose the Digital Only plan.

4. Verify your personal information and method of payment. Print or download your membership ID card. You may also request to receive the ID card in the mail.

5. Visit a fitness location today!

Find fitness buddies, take a digital class and try something new!

Join the Fitness Program today to help reach your health and wellness goals.

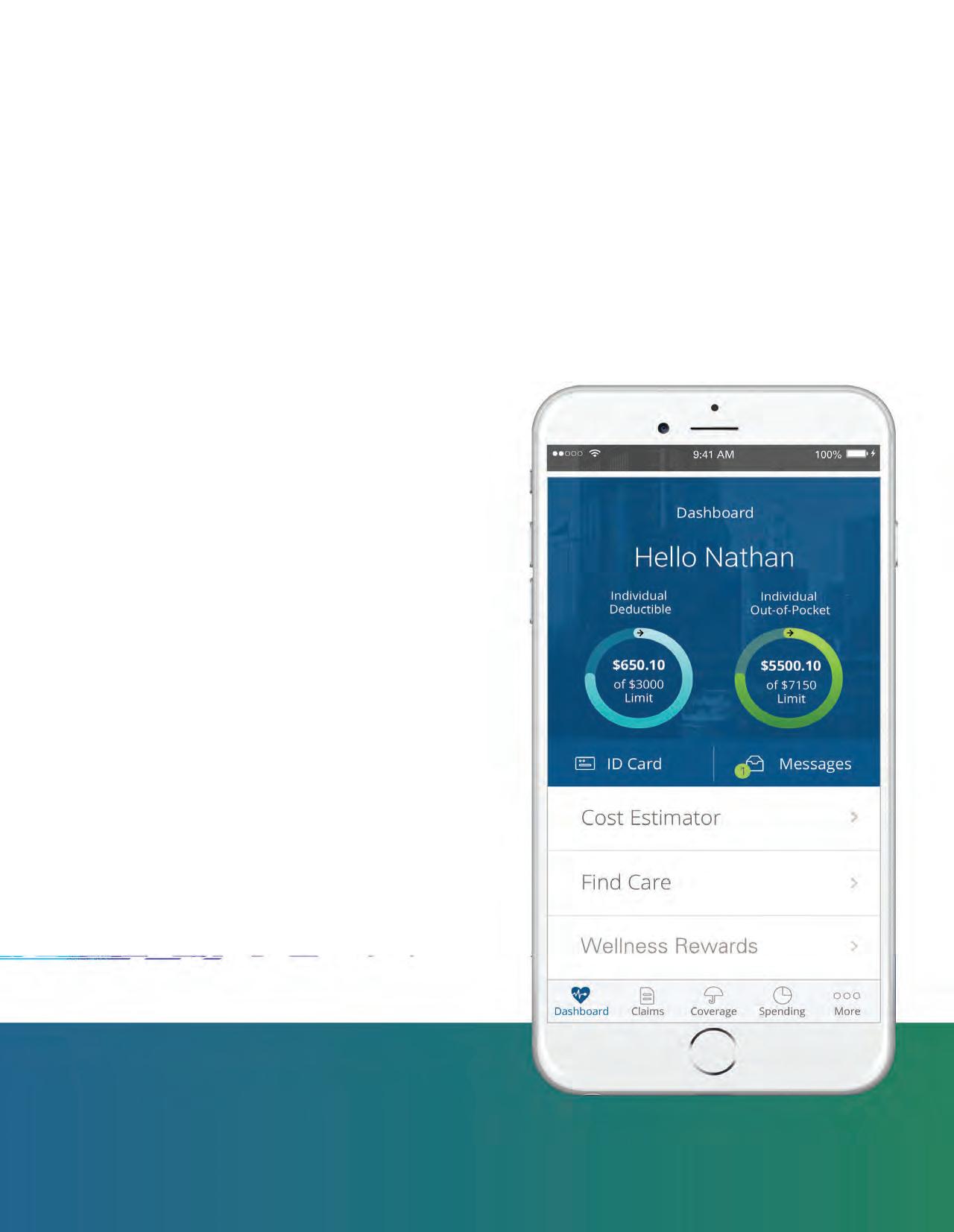

Stay connected with Blue Cross and Blue Shield of Texas (BCBSTX) so you can easily get to your TRS-ActiveCare health plan information, wherever you are.

Also available in Spanish

• View and email your member ID card.

• Find an in-network doctor, hospital or urgent care facility.

• Access your claims, coverage and deductible information.

• Download and share your Explanation of Benefits.

• Get push notifications and access to the Message Center.

Maximize your savings

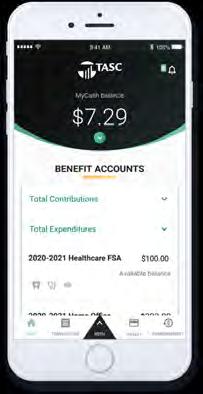

A Health Savings Account, or HSA, is a tax-advantaged savings account you can use for healthcare expenses. Along with saving you money on taxes, HSAs can help you grow your nest egg for retirement.

• Contribute to your HSA by payroll deduction, online banking transfer or personal check.

• Pay for qualified medical expenses for yourself, your spouse and your dependents. Both current and past expenses are covered if they’re from after you opened your HSA.

• Use your HSA Bank Health Benefits Debit Card to pay directly, or pay out of pocket for reimbursement or to grow your HSA funds.

• Roll over any unused funds year to year. It’s your money — for life.

• Invest your HSA funds and potentially grow your savings.¹

You can use your HSA funds to pay for any IRS-qualified medical expenses, like doctor visits, hospital fees, prescriptions, dental exams, vision appointments, over-the-counter medications and more. Visit hsabank.com/QME for a full list.

You’re most likely eligible to open an HSA if:

• You have a qualified high-deductible health plan (HDHP).

• You’re not covered by any other non-HSA-compatible health plan, like Medicare Parts A and B.

• You’re not covered by TriCare.

• No one (other than your spouse) claims you as a dependent on their tax return.

2

3

The IRS limits how much you can contribute to your HSA every year. This includes contributions from your employer, spouse, parents and anyone else.2

2023 - 2024

2024 - 2025

$8,300 $4,150 $7,750 $3,850

You may be eligible to make a $1,000 HSA catch-up contribution if you’re:

• Over 55.

• An HSA accountholder.

• Not enrolled in Medicare (if you enroll mid-year, annual contributions are prorated).

A huge way that HSAs can benefit you is they let you save on taxes in three ways.

1 You don’t pay federal taxes on contributions to your HSA.3

Visit www.hsabank.com orcallthe numberonthebackofyourdebit cardformoreinformation.

2

Earnings from interest and investments are tax-free.

3

Distributions are tax free when used for qualified medical expenses.

Coverage Highlights – Texas Belton Independent School District

Standard Insurance Company hasdeveloped this document to provide you withinformation about the optional insurance coverage youmay select throughBelton Independent School District.Writtenin non-technical language, this is notintended as a complete descriptionof the coverage.If you have additional questions, please check with yourhuman resources representative.

Eligibility

To become insured, you must be:

A regular employee of Belton Independent School District, excluding temporary or seasonal employees, full-time members of the armed forces, leased employees or independent contractors

Actively at work at least 15 hours each week

A citizen or resident of the United States or Canada

Please contact your human resources representative for more information regarding the following requirements that must be satisfied for your insurance to become effective. You must satisfy:

Eligibility requirements

An eligibility waiting period of 0 days

An evidence of insurability requirement, if applicable

An active work requirement. This means that if you are not actively at work on the day before the scheduled

effective date of insurance, your insurance will not become effective until the day after you complete one full day of active work as an eligible employee.

You may select a monthly benefit amount in $100 increments from $200 to $8,000; based on the tables and guidelines presented in the Rates section of these Coverage Highlights. The monthly benefit amount must not exceed 66 2/3 percent of your monthly earnings.

Benefits are payable for non-occupational disabilities only. Occupational disabilities are not covered.

Plan Maximum Monthly Benefit: 66 2/3 percent of predisability earnings

Plan MinimumMonthly Benefit: 10percent of your LTD benefit before reduction by deductible income

Educator Options Voluntary Long Term Disability

Coverage Highlights – Texas Belton Independent School District

Benefit Waiting Period and Maximum Benefit Period

The benefit waiting period is the period of time that you must be continuously disabled before benefits become payable. Benefits are not payable during the benefit waiting period. The maximum benefit period is the period for which benefits are payable. The benefit waiting period and maximum benefit period associated with your plan options are shown below:

Options1-6: Maximum Benefit Period of 3 years for Sickness

If you become disabledbefore age 64, LTD benefits may continue during disability for 3 years. If you become disabled at age 64or older, the benefit duration is determined by your age when disability begins:

AgeMaximum Benefit Period

642 years 6 months

652 years

661 year 9 months

671 year 6 months

681 year 3 months

Options1-6: Maximum Benefit Period To Age 65 for Accident

If you become disabled before age 62, LTD benefits may continue during disability until you reach age 65. If you become disabled at age 62 or older, the benefit duration is determined by your age when disability begins:

AgeMaximum Benefit Period

623 years 6 months

633 years

642 years 6 months

652 years

661 year 9 months

671 year 6 months

681 year 3 months

69+1 year

Preexisting Condition Exclusion

A general description of the preexisting condition exclusion is included in the Group Voluntary Long Term Disability Insurance for Educators and Administrators brochure. If you have questions, please check with your human resources representative.

Preexisting Condition Period: The 90-dayperiod just before your insurance becomes effective Exclusion Period: 12 months

Preexisting Condition Waiver

For the first 30 days of disability, The Standard will pay full benefits even if you have a preexisting condition. After 30 days, The Standard will continue benefits only if the preexisting condition exclusion does not apply.

Coverage Highlights – Texas Belton Independent School District

For the plan’s definition of disability, as described in your brochure, the own occupation period is the first 24months for which LTD benefits are paid.

The any occupation period begins at the end of the own occupation period and continues until the end of the maximum benefit period.

Employee Assistance Program (EAP) – This program offers support, guidance and resources that can help an employee resolve personal issues and meet life’s challenges.

Family Care Expense Adjustment – Disabled employees faced with the added expense of family care when returning to work may receive combined income from LTD benefits and work earnings in excess of 100 percent of indexed predisability earnings during the first 12 months immediately after a disabled employee’s return to work.

Special Dismemberment Provision – If an employee suffers a lost as a result of an accident, the employee will be considered disabled for the applicable Minimum Benefit Period and can extend beyond the end of the Maximum Benefit Period

Reasonable Accommodation Expense Benefit –Subject to The Standard’s prior approval, this benefit allows us to pay up to $25,000 of an employer’s expenses toward work-site modifications that result in a disabled employee’s return to work.

Survivor Benefit –A Survivor Benefit may also be payable. This benefit can help to address a family’s financial need in the event of the employee’s death.

Return to Work (RTW) Incentive –The Standard’s RTW Incentive is one of the most comprehensive in the employee benefits history. For the first 12 months after returning to work, the employee’s LTD benefit will not be reduced by work earnings until work earnings plus the LTD benefit exceed 100 percent of predisability earnings. After that period, only 50 percent of work earnings are deducted.

Rehabilitation Plan Provision –Subject to The Standard’s prior approval, rehabilitation incentives may include training and education expense, family (child and elder) care expenses, and job-related and job search expenses.

LTD benefits end automatically on the earliest of:

The date you are no longer disabled

The date your maximum benefit period ends

The date you die

The date benefits become payable under any other LTD plan under which you become insured through employment during a period of temporary recovery

The date you fail to provide proof of continued disability and entitlement to benefits

Employees can select a monthly LTD benefit ranging from a minimum of $200 to a maximum amount based on how much they earn. Referencing the appropriate attached charts, follow these steps to find the monthly cost for your desired level of monthly LTD benefit and benefit waiting period:

1.Find the maximum LTD benefit by locating the amount of your earnings in either the Annual Earnings or Monthly Earnings column. The LTD benefit amount shown associated with these earnings is the maximum amount you can receive. If your earnings fall between two amounts, you must select the lower amount.

2.Select the desired monthly LTD benefitbetween the minimum of $200 and the determined maximum amount, making sure not to exceed the maximum for your earnings.

3.In the same row, select the desired benefit waiting period to see the monthly cost for that selection.

If you have questions regarding how to determine your monthly LTD benefit, the benefit waiting period, or the premium payment of your desired benefit, please contact your human resources representative.

If you become insured, you will receive a group insurance certificate containing a detailed description of the insurance coverage. The information presented above is controlled by the group policy and does not modify it in any way. The controlling provisions are in the group policy issued by Standard Insurance Company.

Life insurance can be an ideal way to provide money for your family when they need it most. purelife-plus offers permanent insurance with a high death benefit and long guarantees1 that can provide financial peace of mind for you and your loved ones. purelife-plus is an ideal complement to any group term and optional term life insurance your employer might provide and has the following features:

You own it

You can cover your spouse, children and grandchildren, too2

Youcanqualifybyanswering just3questions–noexamsorneedles.

You can take it with you when you change jobs or retire

You pay for it through convenient payroll deductions

You can get a living benefit if you become terminally ill3 It’s Affordable

1.Beenactivelyatworkonafulltimebasis,performingusualduties?

2.Beenabsentfromworkduetoillnessormedicaltreatmentforaperiodof morethan5consecutiveworkingdays?

3.Beendisabledorreceivedtests,treatmentorcareofanykindinahospital ornursinghomeorreceivedchemotherapy,hormonaltherapyforcancer, radiation,dialysistreatment,ortreatmentforalcoholordrugabuse?

1 Guaranteesaresubjecttoproductterms,limitations,exclusionsandtheinsurer’sclaimspayingabilityandfinancialstrength.

2 CoveragenotavailableonchildreninWAorongrandchildreninWAorMD. InMD,childrenmustresidewiththeapplicanttobeeligibleforcoverage.

3 Conditionsapply.AcceleratedDeathBenefitDuetoTerminalIllnessRiderFormICC07-ULABR-07orFormSeriesULABR-07

PureLife-plusisaFlexiblePremiumAdjustableLifeInsurancetoAge121.Aswithmostlifeinsuranceproducts, TexasLifecontractsandriderscontaincertain exclusions,limitations,exceptions,reductionsofbenefits,waitingperiodsandtermsforkeepingtheminforce.PleasecontactaTexasLiferepresentativeorsee thePureLife-plusbrochureforcostsandcompletedetails.ContractformICC18PRFNG-NI-18orFormSeriesPRFNG-NI-18.TexasLifeislicensedtodobusinessin theDistrictofColumbiaandeverystatebutNewYork. 21M058-CGeneric2001(exp0523)

Choice of $10,000 increments up to 5 times your Basic Annual Earnings or $500,000

Choice of $10,000 increments up to 100% of your Supplemental Life election or $100,000 $10,000

*Child(ren)’s Eligibility: Dependent children ages from birth to age 26 years old

Like most insurance plans, this plan has exclusions. Supplemental and Dependent Life Insurance does not provide payment of benefits for death caused by suicide within the first two years (one year for group policies issued in Missouri, North Dakota and Colorado) of the effective date of the certificate or an increase in coverage. This exclusionary period is one year for residents of Missouri and North Dakota. If the group policy was issued in Massachusetts, the suicide exclusion does not apply to dependent life coverage. The suicide exclusion does not apply to residents of Washington, or to individuals covered under a group policy issued in Washington.

Please note that a reduction schedule may apply. Please see your employer or certificate for specific details.

How to Apply*

• Complete your enrollment today! Be sure to indicate your Beneficiary

* All applications for coverage are subject to review and approval by MetLife. If you choose to apply for increased coverage, the increase may be subject to underwriting. MetLife will review your information and evaluate your request for coverage based upon your answers to the health questions, MetLife’s underwriting rules and other information you authorize us to review. In certain cases, MetLife may request additional information to evaluate your request for coverage.

Enrollment in this Supplemental Term Life insurance plan is available without providing medical information as long as:

For Annual Enrollment

• The enrollment takes place prior to the enrollment deadline, and

• You are continuing the coverage you had in the last year, or

• You are requesting to increase existing coverage by two increments, and the total amount of coverage does not exceed 4 times your basic annual earnings or $200,000

For New Hires

• The enrollment takes place within 31 days from the date you become eligible for benefits, and

• You are enrolling for coverage equal to/less than 4 times your basic annual earnings or $200,000

If you do not meet all of the conditions stated above, you will need to provide additional medical information by completing a Statement of Health form.13

You must be covered in order to obtain coverage for your Spouse and child(ren).

Your Spouse and dependent children do not need to provide medical information as long as:

For Annual Enrollment

• The enrollment takes place prior to the enrollment deadline, and

• You are continuing the coverage you had for your Spouse and child(ren) in the last year

• You are requesting to increase existing coverage for your Spouse by one increment, and the total amount of coverage does not exceed $50,000

For New Hires

• The enrollment takes place within 31 days from the date you become eligible for benefits, and

• You are enrolling for Spouse coverage equal to/less than $50,000

If you do not meet all of the conditions stated above, you will need to provide additional medical information by completing a Statement of Health form. 13

You must be Actively at Work on the date your coverage becomes effective. Your coverage must be in effect in order for your Spouse and eligible children’s coverage to take effect. In addition, your Spouse and eligible child(ren) must not be home or hospital confined or receiving or applying to receive disability benefits from any source when their coverage becomes effective.

If Actively at Work requirements are met, coverage will become effective on the first of the month following the receipt of your completed application for all requests that do not require additional medical information. A request for your amount that requires additional medical information and is not approved by the date listed above will not be effective until the later of the date that notice is received that MetLife has approved the coverage or increase if you meet Actively at Work requirements on that date, or the date that Actively at Work requirements are met after MetLife has approved the coverage or increase. The coverage for your Spouse and eligible child(ren) will take effect on the date they are no longer confined, receiving or applying for disability benefits from any source or hospitalized.

You can select any beneficiary(ies) other than your employer for your Basic and Supplemental coverages, and you may change your beneficiary(ies) at any time. You can also designate more than one beneficiary. You are the beneficiary for your Dependent coverage.

Grief Counseling (all states except NY)1 To help you, your dependents, and your beneficiaries cope with loss

You, your dependents, and your beneficiaries have access to grief counseling1 sessions and funeral related concierge services to help cope with a loss — at no extra cost. Grief counseling services provide confidential and professional support during a difficult time to help address personal and funeral planning needs. At your time of need, you and your dependents have 24/7 access to a work/life counselor. You simply call a dedicated 24/7 toll-free number to speak with a licensed professional experienced in helping individuals who have suffered a loss. Sessions can either take place in-person or by phone. You can have up to five face-to-face grief counseling sessions per event to discuss any situation you perceive as a major loss, including but not limited to death, bankruptcy, divorce, terminal illness, or losing a pet.1 In addition, you have access to funeral assistance for locating funeral homes and cemetery options, obtaining funeral cost estimates and comparisons, and more. You can access these services by calling 1-888-319-7819 or log on to www.metlifegc.lifeworks.com (Username: metlifeassist; Password: support).

Download this helpful Funeral Planning Guide at https://www.metlife.com/funeralplanning/funeral-guide/

Funeral Discounts and Planning Services2

Ensuring your final wishes are honored

As a MetLife group life policyholder, you and your family may have access to funeral discounts, planning and support to help honor a loved one’s life — at no additional cost to you. Dignity Memorial provides you and your loved ones access to discounts of up to 10% off of funeral, cremation and cemetery services through the largest network of funeral homes and cemeteries in the United States.

When using a Dignity Memorial Network you have access to convenient planning services — either online at www.finalwishesplanning.com, by phone (1-866-853-0954), or by paper — to help make final wishes easier to manage. You also have access to assistance from compassionate funeral planning experts to help guide you.

Beneficiary Claim Assistance3 For support when beneficiaries need it most

This program is designed to help beneficiaries sort through the details and serious questions about claims and financial needs during a difficult time. MetLife has arranged for specially trained third party financial professionals to be available for assistance in-person or by telephone to help with filing life insurance claims, government benefits and help with financial questions.

Life Settlement Account5

For immediate access to death proceeds

The Total Control Account® (TCA) settlement option provides your loved ones with a safe and convenient way to manage the proceeds of a life claim payments of $5,000 or more, backed by the financial strength and claims paying ability of Metropolitan Life Insurance Company. TCA death claim payments relieve beneficiaries of the need to make immediate decisions about what to do with a lumpsum check and enable them to have the flexibility to access funds as needed while earning a guaranteed minimum interest rate on the proceeds as they assess their financial situations. Call 1-800-638-7283 for more information about options available to you.

Estate Planning Services8,11

To help ensure your decisions are carried out

When you enroll for Supplemental term life coverage, you will automatically receive access to Estate Planning Services at no extra cost to you. Estate Planning Service offers unlimited access to complete wills and other important estate planning documents quickly and easily online with access to online notary services, or work one-on-one with a MetLife Legal Plans’ attorney, in-person or on the phone, to prepare or update a will, living will, or power of attorney

Visit legalplans.com/estateplanning to get started.

Will Preparation8

To help ensure your decisions are carried out

When you enroll for Supplemental term life coverage, you will automatically receive access to Will Preparation Services at no extra cost to you. Both you and your Spouse will have unlimited in-person or telephone access to one of MetLife Legal Plans, Inc nationwide network of 18,000+ participating attorneys for preparation of or updating a will, living will or power of attorney.* When you use a participating plan attorney, there will be no charge for the services.* Like life insurance, a carefully prepared will (simple or complex), living will and power of attorney are important.

• A will lets you define your most important decisions, such as who will care for your children or inherit your property.

• A living will ensures your wishes are carried out and protects your loved ones from having to make very difficult and personal medical decisions by themselves Also called an “advanced directive,” it is a document authorized by statutes in all states that allows you to provide written instructions regarding use of extraordinary life-support measures and to appoint someone as your proxy or representative to make decisions on maintaining extraordinary life-support if you should become incapacitated and unable to communicate your wishes

• Powers of attorney allow you to plan ahead by designating someone you know and trust to act on your behalf in the event of unexpected occurrences or if you become incapacitated

Visit legalplans.com/estateplanning to get started.

*You also have the flexibility of using an attorney who is not participating in the MetLife Legal Plans, Inc. network and being reimbursed for covered services according to a set fee schedule. In that case you will be responsible for any attorney’s fees that exceed the reimbursed amount.

Estate Resolution ServicesSM7 (ERS)

Personal service and compassion assistance to help probate your and your spouse’s estates.

MetLife Estate Resolution ServicesSM provides probate services in person or over the phone to the representative (executor or administrator) of the deceased employee's estate and the estate of the employee's Spouse Estate Resolution Services include preparation of documents and representation at court proceedings needed to transfer the probate assets from the estate to the heirs and completion of correspondence necessary to transfer non-probate assets. ERS covers participating plan attorneys’ fees for telephone and face-to-face consultations or for the administrator or executor to discuss general questions about the probate process.

WillsCenter.com9

Self-service online legal document preparation

Employees and spouses have access to WillsCenter.com, an online document service to prepare and update a will, living will, power of attorney, funeral directive, memorandum of wishes or HIPAA authorization form in a secure 24/7 environment at no additional cost. This service is available with all life coverages. Log on to www.willscenter.com to register as a new user.

So you can keep your coverage even if you leave your current employer Should you leave Belton ISD for any reason, and your Supplemental and Dependent Term Life insurance under this plan terminates, you will have an opportunity to continue group term coverage (“portability”) under a different policy, subject to plan design and state availability. Rates will be based on the experience of the ported group and MetLife will bill you directly. Rates may be higher than your current rates. To take advantage of this feature, you must have coverage of at least $10,000 up to a maximum of $500,000

Portability is also available on coverage you’ve selected for your Spouse and dependent child(ren). The maximum amount of coverage for Spouses is $100,000; the maximum amount of dependent child coverage is $1-,000. Increases, decreases and maximums are subject to state availability.

Generally, there is no minimum time for you to be covered by the plan before you can take advantage of the portability feature. Please see your employer or certificate for specific details.

Please note that if you experience an event that makes you eligible for portable coverage, please call a MetLife representative at 1888-252-3607 or contact your employer for more information.

Accelerate Benefits Option10

For access to funds during a difficult time

If you become terminally ill and are diagnosed with 24 months or less to live, you have the option to receive up to 80% of your life insurance proceeds. This can go a long way towards helping your family meet medical and other expenses at a difficult time. Amounts not accelerated will continue under your employer’s plan for as long as you remain eligible per the certificate requirements and the group policy remains in effect.

The accelerated life insurance benefits offered under your certificate are intended to qualify for favorable tax treatment under Section 101(g) of the Internal Revenue Code (26 U.S.C.Sec 101(g)) 10

Accelerated Benefits Option is not the same as long term care insurance (LTC). LTC provides nursing home care, home-health care, personal or adult day care for individuals above age 65 or with chronic or disabling conditions that require constant supervision.

The Accelerated Benefits Option is also available to spouses insured under Dependent Life insurance plans. This option is not available for dependent child coverage. Conversion

For protection after your coverage terminates

You can generally convert your group term life insurance benefits to an individual whole life insurance policy if your coverage terminates in whole or in part due to your retirement, termination of employment, or change in employee class. Conversion is available on all group life insurance coverages. Please note that conversion is not available on AD&D coverage. If you experience an event that makes you eligible to convert your coverage, please call 1-877-275-6387 to begin the conversion process. Please contact your employer for more information.

Waiver of Premiums for Total Disability (Continued Protection)

Offering continued coverage when you need it most

If you become Totally Disabled, you may qualify to continue certain insurance. You may also be eligible for waiver of your Supplemental and dependent term life insurance premium until you reach age 65, die, or recover from your disability, whichever is sooner.

Total Disability or Totally Disabled means you are unable to do your job and any other job for which you are fit by education, training or experience due to injury or sickness. The Total Disability must begin before age 60, and your waiver will begin after you have satisfied

a 9-month waiting period of continuous disability. The waiver of premium will end when you turn age 65, die, or recover. Please note that this benefit is only available after you have participated in the Supplementalterm life plan for 12 months and it is not available on dependent coverage. This 12 month requirement applies to new participants in the plan.

1-Grief Counseling services are provided through an agreement with LifeWorks US Inc. LifeWorks is not an affiliate of MetLife, and the services LifeWorks provides are separate and apart from the insurance provided by MetLife. LifeWorks has a nationwide network of over 30,000 counselors. Counselors have master’s or doctoral degrees and are licensed professionals. The Grief Counseling program does not provide support for issues such as: domestic issues, parenting issues, or marital/relationship issues (other than a finalized divorce). For such issues, members should inquire with their human resources department about available company resources. This program is available to insureds, their dependents and beneficiaries who have received a serious medical diagnosis or suffered a loss. Events that may result in a loss are not covered under this program unless and until such loss has occurred. Services are not available in all jurisdictions and are subject to regulatory approval. Not available on all policy forms.

2-Funeral Discounts Services and discounts are provided through a member of the Dignity Memorial® Network, a brand name used to identify a network of licensed funeral, cremation and cemetery providers that are affiliates of Service Corporation International (together with its affiliates, “SCI”), 1929 Allen Parkway, Houston, Texas. The online planning site is provided by SCI Shared Resources, LLC. SCI is not affiliated with MetLife, and the services provided by Dignity Memorial members are separate and apart from the insurance provided by MetLife. Not available in some states. Planning services, expert assistance, and bereavement travel services are available to anyone regardless of affiliation with MetLife. Discounts through Dignity Memorial’s network of funeral providers have been pre-negotiated. Not available where prohibited by law The discount is available for services offered in any state except KY and NY, or where there is no Dignity Memorial presence (AK, MT, ND, SD, and WY). For MI and TN, the discount is available for “At Need” services only. For coverage issued under a multiple-employer trust, services are not available for WA residents.

3-Beneficiary Claim Assistance, Transition Solutions and Retirement Planning MetLife administers the PlanSmart program, and has arranged to have specially trained third party financial professionals to offer financial education. The financial professionals providing financial education are not affiliated with MetLife but are providing the program under a service provider contract.

Any content in this workshop or any other information provided as part of the PlanSmart program is for educational purposes only. It is not intended to provide legal, tax, investment, or financial advice or make any recommendation as to whether any investment or savings option is appropriate for you. Each individual’s legal, tax, and financial situation is unique; therefore, you should consult with your own attorney, accountant, financial professional or investment advisor regarding your specific circumstances. MetLife does not provide legal, tax, or investment recommendations or advice.

Third-party financial professionals provide securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. www.SIPC.org. 6 Corporate Drive, Shelton, CT 06484, Tel: 203-513-6000. MMLIS is not affiliated with MetLife Consumer Services or any of its affiliates.

5-Life Settlement Account.Subject to state law, and/or group policyholder direction, the Total Control Account is provided for all Life and AD&D benefits of $5,000 or more. The assets backing the Total Control Account (TCA) are maintained in the general account of MetLife or the Issuing Insurance Company. These general accounts are subject to the creditors of MetLife or the respective Issuing Insurance Company. MetLife or the Issuing Insurance Company bears the investment experience of such assets and expects to earn income sufficient to pay interest to TCA Accountholders and to make a profit on the operation of the TCAs. Regardless of the investment experience of such assets, the effective annual rate on the Account will not be less than the rate guaranteed on the welcome guide. The TCA and other available settlement options are not bank products and are not insured by the FDIC or any other governmental agency. In addition, while the funds in your account are not insured by the FDIC, they are guaranteed by each state’s insurance guarantee association. The coverage limits vary by state. Please contact the National Organization of Life and Health Insurance Guaranty Associations (www.NOLHGA.com or 703-481-5206) to learn more. FOR FURTHER INFORMATION, PLEASE CONTACT YOUR STATE DEPARTMENT OF INSURANCE.

7- MetLife Estate Resolution Services are offered by MetLife Legal Plans, Inc. Cleveland, Ohio. In certain states, legal services benefits are provided through insurance coverage underwritten by Metropolitan General Insurance Company , Warwick, Rhode Island. Certain services are not covered by Estate Resolution Services, including matters in which there is a conflict of interest between the executor and any beneficiary or heir and the estate; any disputes with the group policyholder, MetLife and/or any of its affiliates; any disputes involving statutory benefits; will contests or litigation outside probate court; appeals; court costs, filing fees, recording fees, transcripts, witness fees, expenses to a third party, judgments or fines; and frivolous or unethical matters.

8. Will Preparation Services are offered by MetLife Legal Plans, Inc. Cleveland, Ohio. In certain states, legal services benefits are provided through insurance coverage underwritten by Metropolitan General Insurance Company, Warwick, Rhode Island. For New York sitused cases, the Will Preparation service is an expanded offering that includes office consultations and telephone advice for certain other legal matters beyond Will Preparation. Tax Planning and preparation of Living Trusts are not covered by the Will Preparation Service.

9-WillsCenter.com is a document service provided by SmartLegalForms, Inc., an affiliate of Epoq Group, Ltd. SmartLegalForms, Inc. is not affiliated with MetLife and the WillsCenter.com service is separate and apart from any insurance or service provided by MetLife. The WillsCenter.com service does not provide access to an attorney, does not provide legal advice, and may not be suitable for your specific needs. Please consult with your financial, legal, and tax advisors for advice with respect to such matters.

10-ABOThe Accelerated Death Benefit due to Terminal Illness Rider pays up to [80]% of an insured's Life Insurance proceeds (with the balance payable upon final claim) in most states if the insured becomes terminally ill. Conditions and restrictions may apply. Any outstanding loans will reduce the cash value and death benefit.The Accelerated Benefits Option is subject to state availability and regulation. The accelerated life insurance benefits offered under your certificate are intended to qualify for favorable federal tax treatment. If the accelerated benefits qualify for favorable tax treatment, in which case the benefits will not be subject to federal taxation.

This information was written as a supplement to the marketing of life insurance products. Tax laws relating to accelerated benefits are complex and limitations may apply. You are advised to consult with and rely on an independent tax advisor about your own particular circumstances.

Receipt of accelerated benefits may affect your eligibility, or that of your spouse or your family, for public assistance programs such as medical assistance (Medicaid), Temporary Assistance to Needy Families (TANF), Supplementary Social Security Income (SSI) and drug assistance programs. You are advised to consult with social service agencies concerning the effect that receipt of accelerated benefits will have on public assistance eligibility for you, your spouse or your family.

11-Digital Estate Planning is not available for customers sitused in FL or located in GU, PR and VI. It is not included with dependent life coverages or certain GUL/GVUL policies. Domestic Partnerships are not currently supported however members in a domestic partnership may use a MetLife Legal Plans attorney for their planning needs. Online Notary is not available in all states. If you are unable to access the legalplans.com/estateplanning website, you can find a network attorney by calling MetLife Legal Plans at 1-800-8216400, Monday through Friday, 8am-8pm EST. You will need to provide your company name, customer number and the last 4 digits of the policyholder's social security number. Group legal plans are provided by MetLife Legal Plans, Inc., Cleveland, OH. In certain states, group legal plans are provided through insurance coverage underwritten by Metropolitan Property and Casualty Insurance Company and Affiliates, Warwick, RI.

13. All applications for coverage are subject to review and approval by MetLife. If you choose to apply for increased coverage, the increase may be subject to underwriting. MetLife will review your information and evaluate your request for coverage based upon your answers to the health questions, MetLife’s underwriting rules and other information you authorize us to review. In certain cases, MetLife may request additional information to evaluate your request for coverage.

This summary provides an overview of your plan’s benefits. These benefits are subject to the terms and conditions of the contract between MetLife and Belton ISD and are subject to each state’s laws and availability. Specific details regarding these provisions can be found in the booklet certificate.

Nothing in these materials is intended to be advice for a particular situation or individual. Please consult with your own advisors for such advice. Like most group insurance policies, insurance policies offered by MetLife contain certain exclusions, exceptions, waiting periods, reductions, limitations and terms for keeping them in force. Please contact your benefits administrator or MetLife for costs and complete details.

Life coverages are provided under a group insurance policy (Policy Form GPNP99) issued to your employer by MetLife. Life coverages under your employer’s plan terminates, when your employment ceases, when your Life and AD&D contributions cease, or upon termination of the group insurance policy. Dependent Life coverage will terminate when a dependent no longer qualifies as a dependent Should your life insurance coverage terminate for reasons other than non-payment of premium, you may convert it to a MetLife individual permanent policy without providing medical evidence of insurability.

GroupNumber: 00575448

ACancerinsuranceplanthroughGuardianprovides:

•Lump-sumcashpaymentsforcertainprocedures,screeningsandtreatmentsrelatedtoacoveredcancerdiagnosis,inaddition towhateveryourmedicalplancovers

•Paymentsaremadedirectlytoyouandcanbeusedforanypurpose

•Abilitytotakethecoveragewithyouifyouchangejobsorretire

•Affordablegrouprates

AboutYourBenefits:

BenefitispaidwhenyouarediagnosedwithInternalcancerforthefirsttimewhileinsuredunderthisPlan.

Employee$5,000

BenefitAmount(s)

BenefitWaitingPeriod- Aspecifiedperiodoftimeafteryour effectivedateduringwhichtheInitialDiagnosisbenefitswillnotbe payable.

CANCERSCREENING

BenefitAmount

RADIATIONTHERAPYORCHEMOTHERAPY

Benefit

Pre-ExistingConditionsLimitation: Apre-existingcondition includesanyconditionforwhichyou,inthespecifiedtimeperiodprior tocoverageinthisplan,consultedwithaphysician,received treatment,ortookprescribeddrugs.

Portability: AllowsyoutotakeyourCancercoveragewithyouif youterminateemployment.PortedCancerplanterminatesatage70.

Child(ren)AgeLimits

FEATURES AirAmbulance

Ambulance

Spouse$5,000

Child$5,000

$75;$75forFollow-Upscreening$125;$125forFollow-Up screening

Scheduleamountsuptoa$10,000 benefityearmaximum.

3monthsprior/6months treatmentfree/12monthsafter.

Scheduleamountsuptoa$15,000 benefityearmaximum.

3monthsprior/6months treatmentfree/12monthsafter.

IncludedIncluded

Childrenagebirthto26yearsChildrenagebirthto26years

$200/trip,limit2tripsperhospital confinement

Anesthesia 25%ofsurgerybenefit

Anti-Nausea

AttendingPhysician

Blood/Plasma/Platelets

$50/visitupto20visits

$250/trip,limit2tripsperhospital confinement

25%ofsurgerybenefit

$50/dayupto$150permonth$50/dayupto$250permonth

$25/daywhilehospitalconfined. Limit75visits.

$25/daywhilehospitalconfined. Limit75visits.

$100/dayupto$5,000peryear$200/dayupto$10,000peryear

BoneMarrow/StemCell

ExperimentalTreatment

ExtendedCareFacility/SkilledNursingcare

GovernmentorCharityHospital

HomeHealthCare

HormoneTherapy

Hospice

HospitalConfinement

ICUConfinement

Immunotherapy

InpatientSpecialNursing

$100/dayupto$1,000/month$200/dayupto$2,400/month

$ 100/dayupto90daysperyear$150/dayupto90daysperyear

$300perdayinlieuofallother benefits

$400perdayinlieuofallother benefits

$50/visitupto30visitsperyear$100/visitupto30visitsperyear

$25/treatmentupto12treatments peryear

$50/treatmentupto12treatments peryear

$50/dayupto100days/lifetime$100/dayupto100days/lifetime

$300/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement

$400/dayforfirst30days; $600/dayfor31stdaythereafter perconfinement

$500permonth,$2,500lifetime max

$400/dayforfirst30days; $800/dayfor31stdaythereafter perconfinement

$600/dayforfirst30days; $800/dayfor31stdaythereafter perconfinement

$500permonth,$2500lifetime max

$100/dayupto30daysperyear$150/dayupto30daysperyear MedicalImaging

Outpatientandfamilymemberlodging-Lodgingmustbemorethan 50milesfromyourhome.

OutpatientorAmbulatorySurgicalCenter

PhysicalorSpeechTherapy

Prosthetic

ReconstructiveSurgery

ReproductiveBenefit

SecondSurgicalOpinion

SkinCancer

$75/day,upto90daysperyear$100/day,upto90daysperyear

$25/visitupto4visitspermonth, $400lifetimemax

SurgicallyImplanted:$2,000/device, $4,000lifetimemax

Non-Surgically:$200/device,$400 lifetimemax

BreastTRAMFlap$2,000

Breastreconstruction$500

BreastSymmetry$250

Facialreconstruction$500

$50/visitupto4visitspermonth, $1,000lifetimemax

SurgicallyImplanted:$3,000/device, $6,000lifetimemax

Non-Surgically:$300/device,$600 lifetimemax

BreastTRAM$3,000

Breastreconstruction$700

BreastSymmetry$350

Facialreconstruction$700

NoBenefit$1,500eggharvesting,$500eggor spermstorage,$2,000lifetimemax

$200/surgeryprocedure

BiopsyOnly:$100

ReconstructiveSurgery:$250 Excisionofaskincancer:$375 Excisionofaskincancerwithflap orgraft:$600

$300/surgeryprocedure

BiopsyOnly:$100

ReconstructiveSurgery:$250 Excisionofaskincancer:$375 Excisionofaskincancerwithflap orgraft:$600

SurgicalBenefit

Scheduleamountupto$4,125Scheduleamountupto$5,500 Transportation/CompanionTransportation-Benefitispaidifyou havetotravelmorethan50milesonewaytoreceivetreatmentfor internalcancer.

WaiverofPremium-Ifyoubecomedisabledduetocancerthatis diagnosedaftertheemployee'seffectivedate,andyouremain disabledfor90days,wewillwaivethepremiumdueaftersuch90 daysforaslongasyouremaindisabled.

$0.50/mileupto$1,000perround trip/equalbenefitforcompanion

$0.50/mileupto$1,500perround trip/equalbenefitforcompanion

Included Included

• Alternative Care – Benefit is paid for palliative care (bio-feedback or hypnosis) or lifestyle benefits such as visits to an accredited practitioner for smoking cessation, yoga, meditation, relaxation techniques and nutritional counseling.

•

• Cancer –Cancermeansyouhavebeendiagnosedwithadisease manifestedbythepresenceofamalignanttumor characterizedbytheuncontrolledgrowthandspreadofmalignantcellsinanypartofthebody.Thisincludesleukemia, Hodgkin'sdisease,lymphoma,sarcoma,malignanttumorsandmelanoma.Cancerincludescarcinomasin-situ(inthenaturalor normalplace,confinedtothesiteoforigin,withouthavinginvadedneighboringtissue).Pre-malignantconditionsorconditions withmalignantpotential,suchasmyelodyplasticandmyeloproliferativedisorders,carcinoid,leukoplakia,hyperplasia,actinic keratosis,polycythemia,andnonmalignantmelanoma,molesorsimilardiseasesorlesionswillnotbeconsideredcancer. CancermustbediagnosedwhileinsuredundertheGuardiancancerplan.

• ExperimentalTreatment –Benefitswillbepaidforexperimentaltreatmentprescribedbyadoctorforthepurposeof destroyingorchangingabnormaltissue.AlltreatmentmustbeNCIlistedasviableexperimentaltreatmentforInternal Cancer.

Gotowww.GuardianAnytime.comto accesssecureinformation aboutyourGuardianbenefits.Youron-lineaccountwillbeset upwithin30daysafteryourplaneffectivedate.

ConditionalIssueunderwritingisrequiredonthoseenrollingoutsideofthe initialenrollmentperiodorannualopenenrollmentperiod.

Thisplanwillnotpaybenefitsfor:Servicesortreatmentnotincludedinthe Features.Servicesortreatmentprovidedbyafamilymember.Servicesor treatmentrenderedforhospitalconfinementoutsidetheUnitedStates.Any cancerdiagnosedsolelyoutsideoftheUnitedStates.Servicesortreatment providedprimarilyforcosmeticpurposes.Servicesortreatmentfor premalignantconditions.Servicesortreatmentforconditionswithmalignant potential.Servicesortreatmentfornon-cancersicknesses.

CalltheGuardianHelpline(888)600-1600,weekdays,8:00AM to8:30PM,EST.RefertoyourmemberID(socialsecurity number)andyourplannumber:00575448

Cancercausedby,contributedtoby,orresultingfrom:participatinginafelony, riotorinsurrection;intentionallycausingaself-inflictedinjury;committingor attemptingtocommitsuicidewhilesaneorinsane;acoveredperson’smentalor emotionaldisorder,alcoholismordrugaddiction;engaginginanyillegalactivity; orservinginthearmedforcesoranyauxiliaryunitofthearmedforcesofany country.

IfCancerinsurancepremiumispaidforonapretaxbasis,thebenefitmaybetaxable. Pleasecontactyourtaxorlegaladvisorregardingthetaxtreatmentofyourpolicy benefits.

Contract#GP-1-CAN-IC-12

Thisdocumentisasummaryofthemajorfeaturesofthereferencedinsurancecoverage. Itisintendedforillustrativepurposesonlyanddoesnotconstitute acontract.Theinsuranceplandocuments,includingthepolicyandcertificate,comprisethecontractforcoverage.Thefullplandescription,incl udingthe benefitsandallterms,limitationsandexclusionsthatapplywillbecontainedinyourinsurancecertificate.Theplandocumentsarethefinalarbiterof coverage.Coveragetermsmayvarybystateandactualsoldplan.Thepremiumamountsreflectedinthissummaryareanapproximation;ifthereisa discrepancybetweenthisamountandthepremiumactuallybilled,thelatterprevails.

Protection for the treatment of cancer and 23 specified diseases

Receiving a cancer diagnosis can be one of life’s most frightening events. Unfortunately, statistics show you probably know someone who has been in this situation.

With Cancer insurance from Allstate Benefits, you can rest a little easier. Our coverage pays you a cash benefit to help with the costs associated with treatments, to pay for daily living expenses, and more importantly, to empower you to seek the care you need.

You choose the coverage that’s right for you and your family. Our Cancer insurance pays cash benefits for cancer and 23 specified diseases to help with the cost of treatments and expenses as they happen. Benefits are paid directly to you unless otherwise assigned. With the cash benefits you can receive from this coverage, you may not need to use the funds from your Health Savings Account (HSA) for cancer or specified disease treatments and expenses.

• Includes coverage for cancer and 23 specified diseases

• Benefits are paid directly to you unless otherwise assigned

• Coverage available for you or your entire family

• Waiver of premium after 90 days of disability due to cancer for as long as your disability lasts (primary insured only)

• Premiums do not increase due to age

• Additional rider benefits may be added to enhance your coverage, if your employer has chosen to make them available to you

With Allstate Benefits, you can protect your finances if faced with an unexpected cancer or specified disease diagnosis.

Are you in Good Hands? You can be.

THIS IS NOT A POLICY OF WORKERS’ COMPENSATION INSURANCE. THE EMPLOYER DOES NOT BECOME A SUBSCRIBER TO THE WORKERS’ COMPENSATION SYSTEM BY PURCHASING THIS POLICY, AND IF THE EMPLOYER IS A NON-SUBSCRIBER, THE EMPLOYER LOSES THOSE BENEFITS WHICH WOULD OTHERWISE ACCRUE UNDER THE WORKERS’ COMPENSATION LAWS. THE EMPLOYER MUST COMPLY WITH THE WORKERS’ COMPENSATION LAW AS IT PERTAINS TO NON-SUBSCRIBERS AND THE REQUIRED NOTIFICATIONS THAT MUST BE FILED AND POSTED.

Early detection, improved treatments and access to care are factors that influence cancer survival1

19 million

The number of cancer survivors in the U.S. is increasing, and is expected to jump to nearly 19 million by 2024 2

1http://tinyurl.com/jp8tuaq

2Cancer Treatment & Survivorship Facts & Figures, 2014-2015

Jane is like anyone else who has been diagnosed with cancer. She is concerned about her family and how they will cope with her disease and its treatment. Most importantly, she worries about how she will pay for her treatment.

Here is what weighs heavily on her mind:

•Major medical only pays a portion of the expenses associated with my treatment

•I have copays I am responsible for until I meet my deductible

•If I am not working due to treatments, I must cover my bills, rent/mortgage, groceries and my child’s education

•If the right treatment is not available locally, I will have to travel to get the treatment I need

Here’s how Jane’s story of diagnosis and treatment turned into a happy ending, because she had supplemental Cancer Insurance to help with expenses.

Jane chooses benefits to help protect herself and her family members if diagnosed with cancer or a specified disease

Jane undergoes her annual wellness test and is diagnosed for the first time with cancer.

Jane’s doctor reviews the results with her and recommends pre-op testing and surgery. He provides her with the location of a hospital that specializes in her cancer. However, Jane must travel 400 miles, where she undergoes pre-op testing (medical imaging) and is admitted to the hospital for surgery.

Jane undergoes surgery, anesthesia, radiation/ chemo, and is visited by a doctor during a 3-day hospital stay. And every 2 weeks she has radiation/ chemotherapy at a local facility, is given antinausea medication, and sees her doctor during her follow-up visits.

Following each visit, Jane goes online to file her claims, where she is able to track each and have the benefit payments direct deposited to her bank account.

Jane’s Cancer claim paid her cash benefits for the following:

Variable Wellness

Cancer Initial Diagnosis

Continuous Hospital Confinement

Non-Local Transportation

Surgery

Anesthesia

Radiation and Chemotherapy

Medical Imaging

Inpatient Drugs and Medicine

Physician Attendance

Anti-Nausea

For a listing of benefits and benefit amounts, see your company’s rate insert.

Using your cash benefits

Cash benefits provide you with options, because you decide how to use them.

Finances

Can help protect HSAs, savings, retirement plans and 401(k)s from being depleted.

Travel

Can help pay for expenses while receiving treatment in another city.

Home

Can help pay the mortgage, continue rental payments, or perform needed home repairs for after care.

Expenses

Can help pay your family’s living expenses such as bills, electricity, and gas.

MyBenefits: 24/7 Access allstatebenefits.com/mybenefits

An easy-to-use website that offers 24/7 access to important information about your benefits. Plus, you can submit and check your claims (including claim history), request your cash benefit to be direct deposited, make changes to personal information, and more.

Variable Wellness Benefit

Category 1: Blood tests for triglycerides, CA15-3 (breast cancer), CA125 (ovarian cancer), CEA (colon cancer) and PSA (prostate cancer); Hemoccult stool analysis; HPV (Human Papillomavirus) Vaccination; Lipid panel (total cholesterol count); Pap Smear, including ThinPrep Pap Test; Serum Protein Electrophoresis (test for myeloma).

Category 2: Biopsy for skin cancer; Mammography, including Breast Ultrasound; Thermography; Doppler screening for carotids or peripheral vascular disease; Echocardiogram; EKG; Chest X-ray; Stress test on bike or treadmill.

Category 3: Bone Marrow Testing; Colonoscopy; Flexible sigmoidoscopy; Ultrasound screening for abdominal aorticaneurysms.

Benefits (subject to maximums as listed on the attached rate insert)

HOSPITAL CONFINEMENT AND RELATED BENEFITS

Continuous Hospital Confinement - inpatient confinement

Government or Charity Hospital - confinements in lieu of other benefits, except Waiver of Premium

Private Duty Nursing Services - nurse cannot be employed by confining hospital

Extended Care Facility - within 14 days of a hospital stay, up to the number of days of the hospital stay

At Home Nursing - private nursing care, up to the number of days of the previous hospital stay

Hospice Care Center or Team - terminal illness care in a facility or at home; one visit per day

RADIATION/CHEMOTHERAPY AND RELATED BENEFITS

Radiation/Chemotherapy for Cancer - covered treatments to destroy or modify cancerous tissue

Blood, Plasma and Platelets - transfusions, administration, processing, procurement, cross matching

Medical Imaging - initial diagnosis or follow-up evaluation based on covered imaging exam

Hematological Drugs - boosts cell lines for white/red cell counts and platelets; payable when Radiation/ Chemotherapy for Cancer benefit is paid

SURGERY AND RELATED BENEFITS

Surgery* - based on Schedule of Surgical Procedures; per operation on an inpatient/outpatient basis

Anesthesia - 25% of Surgery benefit for anesthesia received by an anesthetist

Ambulatory Surgical Center - payable only if Surgery benefit is paid

Second Opinion - second surgery or treatment opinion by a doctor not in practice with your doctor

Bone Marrow Transplant

Stem Cell Transplant

MISCELLANEOUS BENEFITS

Inpatient Drugs and Medicine - not including drugs/medicine covered under the Radiation/Chemotherapy for Cancer or Anti-Nausea benefits

Physician’s Attendance - one inpatient visit by one physician

Ambulance - transfer to or from hospital by licensed service or hospital-owned ambulance

Non-Local Transportation - obtaining treatment not available locally

Outpatient Lodging - payable only if Radiation/Chemotherapy for Cancer benefit is paid; more than 100 miles from home

Family Member Lodging and Transportation - adult family member travels with you during non-local hospital stays for specialized treatment. Transportation not paid if Non-Local Transportation benefit paid

Physical or Speech Therapy - to restore normal body function

New or Experimental Treatment - payable if physician judges to be necessary, and only for treatment not covered under other policy benefits

Prosthesis - surgical implantation of prosthetic device for each amputation

Hair Prosthesis - wig or hairpiece every two years due to hair loss

Nonsurgical External Breast Prosthesis - initial prosthesis after a covered mastectomy

Anti-Nausea Drugs - prescribed anti-nausea medication administered on outpatient basis

National Cancer Institute Evaluation/Consultation - evaluation/consultation as a result of cancer

Egg Harvesting and Storage - harvesting of oocytes and storage of oocytes/sperm at licensed facility

Waiver of Premium** - must be disabled 90 days in a row due to cancer; pays as long as disability lasts, up to 5 years

Cancer Initial Diagnosis Level Benefit - for first-time diagnosis of cancer other than skin cancer

Variable Wellness Benefit - per day, once per category per year; see left for list of wellness services and tests

OPTIONAL RIDER BENEFITS

Intensive Care (ICU) a. ICU Confinement - Illness or accident confinements up to 45 days/stay

b. Step-Down ICU Confinement - Confinements up to 45 days/stay

c. Ground/Air Ambulance - Not paid if the policy’s Ambulance benefit is paid

Cancer and Specified Disease Additional Benefit - increases the benefit paid on the following base policy benefits: Continuous Hospital Confinement; Government or Charity Hospital; Private Duty Nursing Services; Extended Care Facility; At Home Nursing; Hospice Care; Radiation/Chemotherapy for Cancer; Blood, Plasma and Platelets; Hematological Drugs; Medical Imaging; Surgery; Anesthesia; Bone Marrow Transplant; Stem Cell Transplant; Ambulatory Surgical Center and Second Opinion

*Two or more surgeries done at the same time are considered one operation. The operation with the largest benefit will be paid. Outpatient is paid at 150% of the amount listed in the Schedule of Surgical Procedures. **Premiums waived for primary insured only.

Eligibility

Coverage may include you, your spouse or domestic partner and children under age 26.

Termination of Coverage

(a)Policy coverage terminates at the end of the grace period or your death (except that your covered spouse or domestic partner becomes the new insured; coverage will continue until their death). The riders terminate at the end of the grace period, if the policy terminates, or on the next renewal date after you request termination. Rider coverage under the Cancer Initial Diagnosis Rider also terminates when a benefit is paid on all covered persons.

(b)Spouse/domestic partner coverage ends upon divorce/ termination of partnership. (c) Coverage for children ends when the child reaches age 26, unless he or she continues to meet the requirements of an eligible dependent.

The policy is guaranteed renewable for life, subject to change in premiums by class. All premiums may change on a class basis. A notice is mailed in advance of any change.

23 Specified Diseases Covered - Addison’s Disease; Amyotrophic Lateral Sclerosis (Lou Gehrig’s Disease); Brucellosis; Diphtheria; Encephalitis; Hansen’s Disease; Hepatitis (Chronic B or Chronic C with liver failure or hepatoma); Legionnaires’ Disease (confirmation by culture or sputum); Lyme Disease; Multiple Sclerosis; Muscular Dystrophy; Myasthenia Gravis; Primary Biliary Cirrhosis; Rabies; Reye’s Syndrome; Rocky Mountain Spotted Fever; Sickle Cell Anemia; Systemic Lupus Erythematosus; Tetanus; Thalassemia; Tuberculosis; Tularemia; Typhoid Fever.

LIMITATIONS AND EXCLUSIONS

Pre-Existing Condition Limitation

(a) We do not pay benefits for a pre-existing condition during the 12-month period (6 months for persons age 65 and over) beginning on the date that person’s coverage starts. (b) A pre-existing condition is a disease or condition for which: there existed symptoms which would cause a prudent person to seek diagnosis, care, or treatment within the 12-month period prior to the effective date; or medical advice or treatment was recommended or received from a medical professional within the 12-month period prior to the effective date. (c) A pre-existing condition can exist even though a diagnosis has not yet been made.

Policy Exclusions and Limitations

(a)Benefits are not paid for any loss, except for losses due to cancer or a specified disease. (b) Benefits are not paid for losses caused or aggravated by cancer or a specified disease or as a result of treatment. (c)Treatment must be received in the United States or its territories.

Hospice Care Team Limitation: Services are not covered for food or meals, well-baby care, volunteers or support for the family after covered person’s death.

Blood, Plasma and Platelets Limitation: Does not include blood replaced by donors or for immunoglobulins.

For the Radiation/Chemotherapy for Cancer; Blood, Plasma and Platelets; and New or Experimental Treatment benefits, we pay 50% of the billed amount if the actual costs are not obtainable as proof of loss.

For the Radiation/Chemotherapy for Cancer benefit, we do not pay for treatment or emergency or room charges; treatment planning, management, devices, or supplies; medications or drugs covered elsewhere in the policy; X-rays, scans, and their interpretations; or any other drug, charge or expense that does not directly modify or destroy cancerous tissues.

Intensive Care Rider Exclusions and Limitations

(a) Benefits are not paid for: (1) attempted suicide or intentional self-inflicted injury; (2) intoxication or being under the influence of drugs not prescribed by a physician; or (3) alcoholism or drug addiction. (b) Benefits are not paid for confinements to a care unit that does not qualify as intensive care unit including progressive care, subacute intensive care, intermediate care, private rooms with monitoring, step-down and other lesser care units. (c) Benefits are not paid for step-down confinements in the following units: telemetry or surgical recovery rooms; post-anesthesia care; progressive care; intermediate care; private monitored rooms; observation units in emergency rooms or outpatient surgery units; beds, wards, or private or semi-private rooms; emergency, labor or delivery rooms; or other facilities that do not meet the standards for a step-down hospital intensive care unit. (d) Benefits are not paid for confinements occurring during a hospitalization prior to the effective date. (e) Children born within 10 months of the rider date are not covered for confinement occurring or beginning during the first 30 days of the child’s life.