Empowering the Military Community

CRA Opportunities with Our Nation’s Heroes

Empowering the Military Community

The GoVA Foundation is dedicated to empowering underserved military communities through a comprehensive approach to financial education and support.

Inspired by the Community Reinvestment Act (CRA) program, we are committed to fostering financial literacy and providing accessible financial products and services to those who have served our nation. Our mission is to bridge the financial knowledge gap by offering tailored education programs, focusing on the unique needs of military families.

By preparing and organizing resources, we aim to create a supportive environment that ensures every member of our military community can access a diverse range of financial tools and courses, ultimately enhancing their financial well-being and security.

Service members do not get to choose where they are stationed, and some military benefits are not taxed, which places them in a lower median income bracket.

Seattle, WA

Monterey, CA

Las Vegas, NV

Camp Pendleton, CA

San Diego, CA

Anchorage,

Colorado Springs, CO

San Antonio, TX

Chicago, IL

Portland, ME

Fort Meade, MD

Washington, D.C.

Quantico, VA

Charleston, SC

Florida

With a team of Veterans and military spouses, GoVA Foundation understands the military community because we are part of it.

The four lowest enlisted paygrades (E-1 to E-4) make up over half of all enlisted service members. Base pay and housing stipends are tied tomilitary rank.

Dual income households are uncommon. According to the DoD, Military spouse unemployment rate is 21%, due to frequent moves and locations with limited employment opportunities. This is more than 5 times the national average of 3.7% unemployment. Only 53% of military spouses participate in the labor market (part-time or full-time).

About 7% of all children eligible for WIC benefits nationwide live with a family member who served or is serving in the U.S. military, according to the USDA.

25% of military families are considered food insecure, according to the USDA’s definition.

Military base pay is often at or below the median household income, even for enlisted members who have served up to 10 years, or for officers with several years of service.

What is the monthly income allowance for LMI households in your region?

In Cumberland County, NC—near Fort Liberty, and home of the GoVA Headquarters— the 2021 median household income was $50,746, and the Poverty Rate was 18%.

Any service member earning under $4,166 monthly in base pay is below the household median for Cumberland County. This includes:

• Enlisted, up to rank E7 with less than 6 years time in service

• Enlisted, up to rank E6 with less than 10 years time in service

• Officer rank O1 with less than 3 years time in service

The numbers are similar for Hoke County, and increase slightly for nearby Harnett and Moore Counties, where the median household income is close to $60,000.

These counties account for almost 50% of North Carolina’s total Veteran population, which totals 615,500.

Fort Liberty is one of the Army’s largest bases, with 53,700 active-duty troops stationed there. This is almost 10% of the entire Army force. 25,000 family members (spouses and children) live on Fort Liberty, with many more living in the surrounding towns.

Moore Harnett Cumberland Hoke

GoVA is also developing a program to offer down payment and closing cost assistance grants on home purchase loans for Veterans borrowers in LMI communities (Topic J-3)

EDUCATE:

DIGITAL LITERACY TRAINING TO INCREASE ACCESS TO ONLINE BANKING SERVICES FOR A LMI COMMUNITY (TOPIC AA-15)

Our scholarship program gives military families in LMI neighborhoods access to hundreds of interactive courses, articles, and videos on a variety of financial and banking topics.

This subscription to the digital membership platform, The Edge, would typically cost $4.99 monthly. The GoVA Foundation creates scholarships at a reduced rate-- $3.99 monthly, or $47.88 per year-- then offers these scholarships to the military community to provide free access to The Edge.

Our digital literacy training program helps military members like ROTC and JROTC candidates to become enrolled in online banking services, so they can continue to bank online no matter where the military sends them.

PREPARE:

CREDIT COUNSELING AND PERSONAL MONEY MANAGEMENT (TOPIC AA-9)

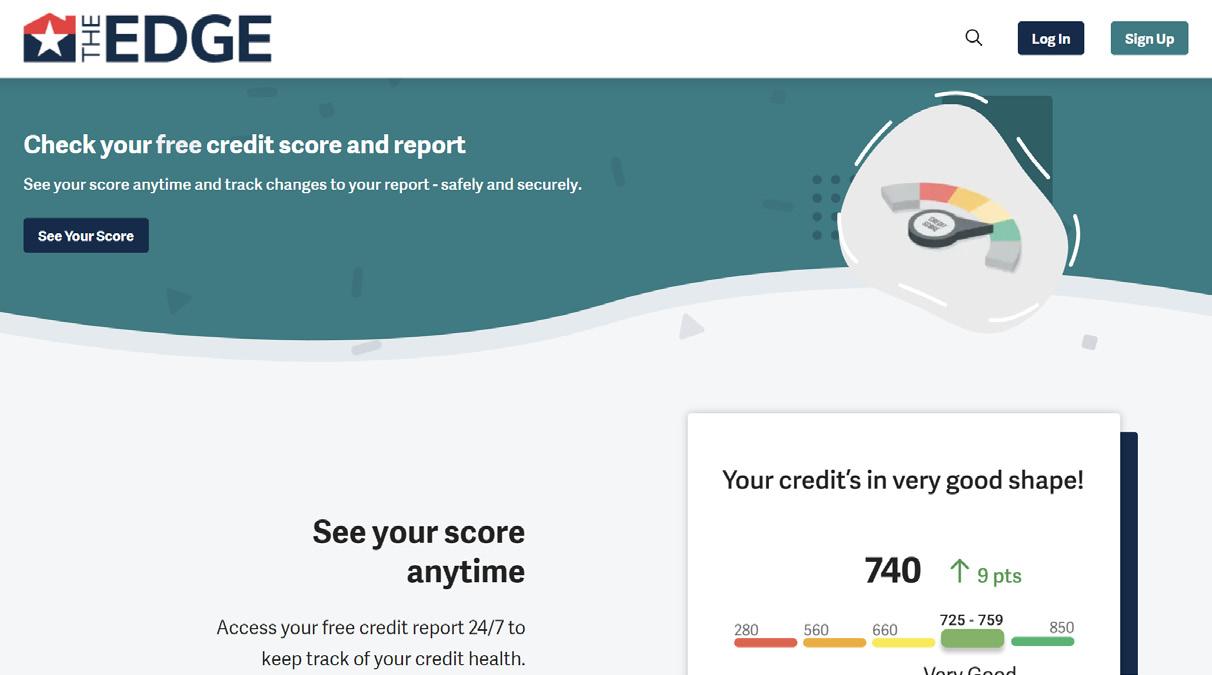

Resources on The Edge give members free credit score reports, tools to improve credit, and hundreds of resources to become informed on money management topics.

Support includes our Concierge Center to provide guidance and point toward additional credit repair resources or to assist with mortgage applications.

DELIVER:

PROVIDE VA LOANS TO LMI INDIVIDUALS (TOPIC A-7)

GoVA assists service members applying for a VA loan with resources to explain the process, a streamlined digital application, and a Concierge Center to walk individuals through the application.

Our Financial Improvement Tools (F.I.T.) meet the educational standards of these regulatory agencies:

GoVA can assist financial institutions with their Services Test based on our programs for financial wellness, outreach, and education to the military community.

• VA Home Loan Guide provided free to members of The Edge

• Buying a Home topic with 28 videos, articles, and interactive resources

• Mortgage Topic with 15+ educational articles and calculators

• Getting Started Guide for Buying a Home

• Loan Application Assistance from our Concierge Center

• Start Here Guide on “Getting Started with Banking”

• Course on Banking with Financial Institutions

• Category on “Becoming Banked” with multiple articles and informative videos

• Personal Assessment Quiz of “Your Money Personality”

• Course on “Creating a Financial Plan for Your Priorities and Goals”

• Budgeting Category with 50+ articles, videos, courses, and tools

• Interactive Budget Tool to build a personalized budget

• Free Credit Score and Report

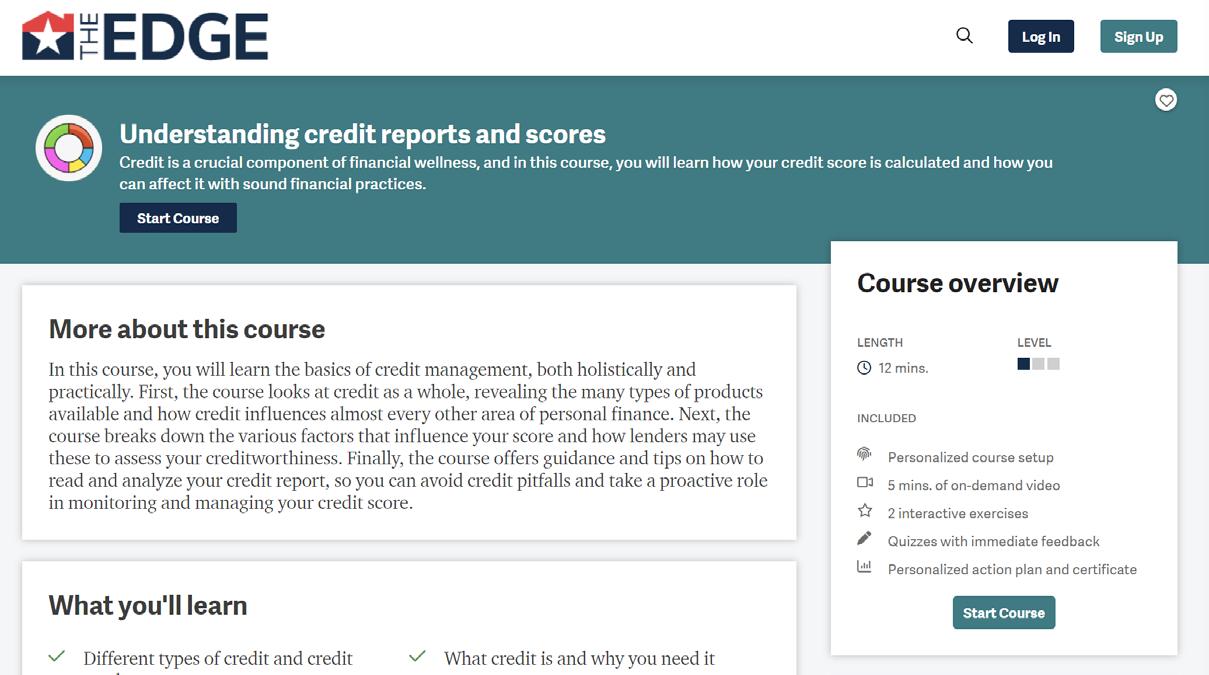

• Courses on “Understanding Credit Reports” and “Optimizing Your Credit Score”

• Getting Started Guide on “Improving a Poor Credit Score”

• Articles and Videos on Rebuilding Credit