Hallmark® Report

About the RE/MAX Hallmark®

Report

The RE/MAX Hallmark® Report for 2024 explores these dynamics in depth, providing a nuanced perspective on the issues reshaping our industry. From evolving policy debates to demographic shifts and the enduring need for housing solutions, this edition offers an invaluable resource for those navigating the unpredictable terrain of real estate.

As a trusted source for market intelligence, the RE/MAX Hallmark® Report combines expertise, collaboration, and innovation to deliver actionable insights. We invite you to explore this edition and join us in shaping the future of real estate—together.

Steve Tabrizi Chief Operating Officer RE/MAX Hallmark® Group of Companies

The global real estate landscape stands at a critical crossroads, reflecting a period of prolonged uncertainty. For over two years, the sector has grappled with muted activity and restrained investor confidence, driven by economic headwinds, and shifting consumer dynamics. As 2025 approaches, a palpable sense of cautious optimism is emerging, fueled by declining interest rates. Yet, the question remains: will these lower borrowing costs be sufficient to spark the resurgence of a market deeply influenced by external pressures and internal complexities?

In a world increasingly defined by volatility, the path forward appears fragmented. Market performance varies dramatically, shaped by factors such as region, asset class, and the nuanced characteristics of each investment or development opportunity. The strength of a real estate balance sheet and government policies now plays a pivotal role in determining success, emphasizing the importance of strategic foresight and disciplined execution.

Navigating Uncertainty With Opportunity In Mind

For the real estate industry, uncertainty is nothing new, but the current climate demands more than traditional resilience. It requires a willingness to think differently, to identify and seize opportunities in an environment where clarity is fleeting. The RE/MAX Hallmark® Report focuses on these factors, bringing together data, research, and insights to paint a comprehensive picture of the Ontario and Canadian markets.

This is not merely a retrospective analysis—it is a forward-looking guide. Our approach combines thirdparty data, global perspectives, and independent Hallmark research to provide context and uncover actionable strategies. We recognize that not everyone agrees on the merits of a niche-focused strategy, but as the market fragments, specialization may offer a vital edge.

2024

A Double-Edged Sword for Canada’s Economic Growth Outlook: Navigating Uncertainty and Shifting Markets

The road to recovery is neither straight nor smooth. The looming impact of interest rate fluctuations, a cautious investor base, shifting immigration policies, and the political ripple effects of the 2024 U.S. presidential election create a complex backdrop for Canadian real estate. Together, these factors set the stage for both challenges and transformative opportunities.

Canada is projected to be the fastestgrowing economy among G7 nations in 2025, with a forecasted GDP growth rate of 2.4%, according to the International Monetary Fund (IMF). This optimistic outlook is attributed to several factors:

1. Economic Diversification: Canada’s economy has benefited from a mix of strong resource-based industries and technological innovation. The growth of tech hubs in cities like Toronto and Vancouver has bolstered productivity and economic resilience.

2. Immigration and Labor Market Growth: Canada’s immigration policies are expected to sustain a growing labor force, which contributes to increased consumer spending and economic activity. This is a significant advantage compared to aging populations in other G7 countries.

3. Soft Landing for Inflation: The IMF highlights that inflation in Canada has been moderated without triggering a recession, thanks to prudent monetary policies. This has created a more stable economic environment conducive to growth.

4. Strong Trade and Industrial Policies: Although global trade faces challenges, Canada’s commitment to multilateral frameworks and well-structured trade agreements supports its export-driven sectors.

GDP growth rate

These elements position Canada uniquely within the G7, which includes economies with slower projected growth rates due to more entrenched structural challenges. However, the IMF also cautions about potential risks, such as global inflationary pressures and geopolitical uncertainties, which could impact this trajectory.

Canada’s real GDP growth is projected to exceed 2.4% next year, a notable increase from this year’s 1.1%, with housing expected to account for nearly 25% of that growth. This highlights the critical role real estate continues to play in Canada’s economy, cementing its position as a key driver of economic activity.

The anticipated resurgence in the housing market, buoyed by potential interest rate cuts, reflects optimism that lower borrowing costs will entice buyers back. This could stimulate a ripple effect across related sectors, reinforcing confidence in the broader economy.

At RE/MAX Hallmark®, we view this as a pivotal juncture for the real estate industry. While the outlook is encouraging, achieving sustained growth will require more than macroeconomic adjustments. Strategic foresight, market adaptability, and proactive leadership are imperative to navigating emerging challenges and capturing opportunities in this evolving landscape.

However, Canada’s over-reliance on real estate poses systemic risks:

1. Rising Household Debt: Canadian households continue to bear one of the highest debt-to-income ratios globally, exceeding 180%. This leaves limited capacity to absorb economic shocks, making households—and the broader economy—vulnerable to volatility.

2. Housing Affordability: With ownership costs reaching unsustainable levels in cities like Toronto and Vancouver, the affordability crisis has sidelined many potential buyers. This not only exacerbates inequality but also heightens the risk of a market correction with wider economic repercussions.

3. Economic Concentration: Dependence on real estate highlights a lack of diversification in Canada’s growth model. Productivity growth and innovation remain underdeveloped, leaving the economy overly reliant on a single sector prone to cyclical fluctuations.

4. Monetary Policy Risks: While rate cuts may temporarily boost market activity, they could also reignite price inflation and create a boom-bust cycle. This underscores the importance of aligning short-term measures with long-term economic stability.

In conclusion, while real estate has consistently supported economic growth, its disproportionate influence exposes Canada to significant risks. Balancing immediate gains with a focus on productivity, innovation, and affordability is crucial for fostering sustainable economic development and resilience in the years ahead.

Fewer Starts and Growing Supply Challenges

The core issue behind Ontario’s projected decline in housing starts and deepening supply shortages in 2025 isn’t solely rooted in policies or red tape, but rather in the lack of a skilled labor force. Even if regulatory barriers were removed, the construction sector still faces a critical shortage of workers. According to recent analyses, this shortage is a significant hindrance to housing development, exacerbating the housing crisis as demand continues to grow.

The Residential Construction Council of Ontario (RESCON) has pointed out that while government efforts, such as addressing zoning restrictions and implementing new funding programs, are steps in the right direction, the broader labor issue remains largely unaddressed. Ontario’s housing sector needs more skilled tradespeople and laborers to meet the growing demand. This shortage is compounded by the fact that the province is experiencing escalating immigration levels, which increase the need for housing but simultaneously strain the available workforce.

Thus, while removing red tape and implementing smart policies can ease some pressures, a fundamental shift is needed to invest in labor force development, workforce training, and attracting new talent into the construction industry to truly mitigate the housing supply shortage.

Canada’s immigration system faces significant challenges with the expected departure of over 1.2 million temporary residents next year, as many of their permits are set to expire. These individuals, primarily international students and foreign workers have built lives in Canada, but as their statuses end, the country anticipates a large-scale exodus, which could affect both the economy and society.

ToSLOW GROWTH Canada’s Government Aims

However, there’s skepticism about whether the majority will leave voluntarily. Past experiences show that temporary residents often seek to extend their stay in Canada, either through asylum claims or by going underground, especially when facing difficult returns to their home countries. In response, the government has ramped up enforcement efforts, increasing raids and removing those who breach work permits.

This situation is compounded by a broader immigration policy shift. Canada’s government aims to slow the growth of its temporary resident population due to ongoing housing and affordability issues. The country plans to reduce the total number of temporary residents, potentially causing slower economic growth as fewer workers contribute to sectors that depend heavily on immigrant labor. However, authorities will likely need to balance the enforcement of removals with the practical challenges of tracking down individuals who overstay their permits. This creates an ongoing tension between the country’s immigration policies and the realities faced by temporary residents.

The consequences of these developments are far-reaching, as the reduction in temporary residents could ease pressure on housing markets but also slow economic expansion. While some sectors may benefit from reduced demand, other challenges, such as labor shortages and an aging population, could intensify. Thus, while Canada anticipates the departure of many temporary residents, the actual impact will depend on how effectively the government can manage this complex situation.

Rate Decision

The Bank of Canada’s

rate decisions are shaped by a combination of factors that include inflation, employment trends, and the state of the global economy.

In 2025, Canada’s inflation rate is expected to return to the Bank of Canada’s target of 2%, paving the way for potential rate reductions. The central bank may lower its policy rate further, possibly placing it within the neutral range of 2.25% to 3.25%. This shift could be influenced by a combination of factors, including ongoing economic adjustments and a stabilization of inflation, allowing the BoC to balance its focus on growth and price stability.

The neutral rate is designed to neither stimulate nor restrain the economy, helping to sustain growth while keeping inflation in check. As inflation cools and economic activity stabilizes, the BoC’s decision to lower rates could help stimulate more consumer spending and borrowing, particularly benefiting the housing market and broader economy.

Expectations for inflation to stabilize align with global economic projections, with Canada anticipated to experience moderate growth in 2025. However, external factors, such as the performance of major trading partners like the U.S., will continue to influence Canada’s economic landscape and the Bank’s decisions.

Seizing Opportunities Amid Rising Demand and Evolving Trends.

Canadian home sales experienced a surprising increase in October 2024, showing a 7.7% month-overmonth jump. This was the highest level of sales activity since April 2022. This surge in sales is seen as a positive sign for the market, especially considering the more favorable mortgage rates that started to take effect earlier in the year. The surge in sales was mainly attributed to a combination of new listings from September and a significant 50 basis point rate cut by the Bank of Canada during the same month, which likely encouraged buyers to act.

Despite the sales increase, the number of new listings was down by 3.5% month-over-month, indicating that the supply of homes coming to market was still constrained. This led to a tightening of the sales-tonew listings ratio, which moved to 58% in October, signaling a more balanced market condition compared to previous months. As a result, while prices saw only slight month-over-month changes, they still remained 6% higher year-over-year, showing resilience in the housing market.

This increase in sales activity in October could set the stage for a more robust market in 2025, especially if new listings pick up and mortgage rates continue to decline. However, the true sustainability of this trend will depend on the supply of homes in the coming months, particularly as the spring market approaches.

Ontario’s real estate market in November 2024 has seen notable shifts, with a marked increase in home sales compared to previous months. The Greater Toronto Area (GTA) in particular experienced a jump in sales, as many buyers returned to the market. Home sales for the GTA in October 2024 surged by 44.4% year-over-year, which is a significant recovery from previous periods of lower activity. This increase in market activity can be attributed to factors such as lower borrowing costs due to the Bank of Canada’s rate cuts, which improved affordability for homebuyers.

In terms of price trends, Ontario’s real estate prices showed mixed results across different areas. In Toronto, there were significant month-over-month price gains, with the average home price rising 8.2% from the previous month, signaling more confidence in the market. However, some suburban areas like Brampton and Mississauga also saw rising prices.

Looking forward, the outlook remains cautiously optimistic. With the easing of mortgage rates, the demand for housing is expected to increase further, but the market will likely continue facing challenges from inventory levels and rising construction costs. Buyers may find better deals in the months ahead, especially in areas where inventory levels remain elevated.

Consumer Spending

In October 2024, Canadian consumer spending showed a modest recovery following a two-month decline. However, when adjusted for population growth, real retail sales remained below pre-pandemic levels, with Q3 results showing a notable dip. October’s sales only marginally returned to February 2020 levels, reflecting the ongoing impact of the Bank of Canada’s interest rate hikes starting in spring 2022.

October also saw an uptick in spending on car maintenance and health and fitness, with Canadians preparing for winter and the upcoming holidays. Clothing and furniture sales also showed growth, indicating broader consumer confidence in these areas. On the other hand, spending at hotels and restaurants improved slightly, but the data still points to a slower recovery compared to earlier in the year.

Despite this uptick in spending, the trend is far from strong enough to indicate a complete reversal of the slump. High debt servicing costs and the impact of inflation on essential goods continue to strain household budgets. Many Canadians are expected to face higher mortgage renewal rates in 2025, which could further dampen consumer activity. Thus, while October brought some relief, expectations remain cautious, with subdued consumer spending likely continuing into the second half of next year.

Are Sales Gains Signaling a Turning Point?

As the Canadian housing market enters the fall season, consumer sentiment has turned increasingly optimistic, driven by recent interest rate cuts and improving affordability. The Bank of Canada’s decision to lower the prime lending rate to 6.45% has provided relief to buyers, creating more favorable conditions for first-time homebuyers, upgraders, and investors alike. This shift follows a challenging period of higher rates and reduced affordability that kept many buyers on the sidelines

Key Trends in the Fall Housing Market:

1. Increased Market Activity: Local real estate boards have reported significant increases in home resales this fall, with October sales surpassing September levels and even outperforming figures from a year ago in some regions. Cities like Toronto, Montreal, Ottawa, and Calgary are witnessing heightened buyer interest, particularly as price stability and rising inventory provide more opportunities.

2. Affordability Improvements: The rate cuts have eased mortgage payment burdens, improving loan eligibility and encouraging activity. Markets such as Ottawa and Vancouver are seeing a more balanced dynamic, where increased inventory has helped alleviate some affordability challenges.

3. Shift in Buyer-Seller Balance: Despite rising demand, major markets like Vancouver, Toronto, and Victoria remain relatively balanced. Sales have outpaced new listings, tightening supply and giving sellers more bargaining power. This balance has contributed to stable prices, with the MLS Home Price Index showing modest changes.

4. Future Prospects: The Bank of Canada is expected to implement further rate cuts into next year, potentially boosting market activity further. However, there are concerns that rapid price increases could negate affordability gains, particularly in high-demand regions. Additionally, relaxed mortgage insurance rules set to take effect later this year are likely to ease the path for prospective buyers.

Challenges Ahead

While the outlook is positive, challenges such as stretched affordability and limited housing supply in some regions persist. The market’s recovery is cautious, balancing optimism with the need to address systemic affordability and accessibility issues. Nonetheless, this fall marks a potential turning point, with a favorable environment for buyers and sellers alike.

Critical Decision

Canada is facing a critical decision regarding its immigration policy, as the federal government plans to reduce the number of new permanent residents in 2025 from 500,000 to 395,000—a reduction of 21%.

This decision aims to manage population growth, ease pressures on housing markets, and address public concerns about overpopulation and resource strain. However, this shift raises significant questions about Canada’s long-term economic stability.

Immigration has long been a driving force behind Canada’s labor force expansion and economic growth, particularly in sectors like healthcare, technology, and construction, which heavily rely on skilled migrants. A reduction in immigration could slow economic growth, exacerbate labor shortages, and place more pressure on Canada’s already strained housing market.

While the government is targeting high-skilled immigrants, especially through programs like Express Entry, the broader effects of these changes may still hinder Canada’s ability to maintain its economic dynamism. Reducing the flow of immigrants risks diminishing consumer spending, which is crucial for economic recovery amidst high inflation and interest rates.

In conclusion, while the reduction may address immediate concerns like housing affordability, it could have long-term economic implications. Canada’s ability to strike a balance between managing population growth and sustaining economic vitality will be key to the success of this policy shift.

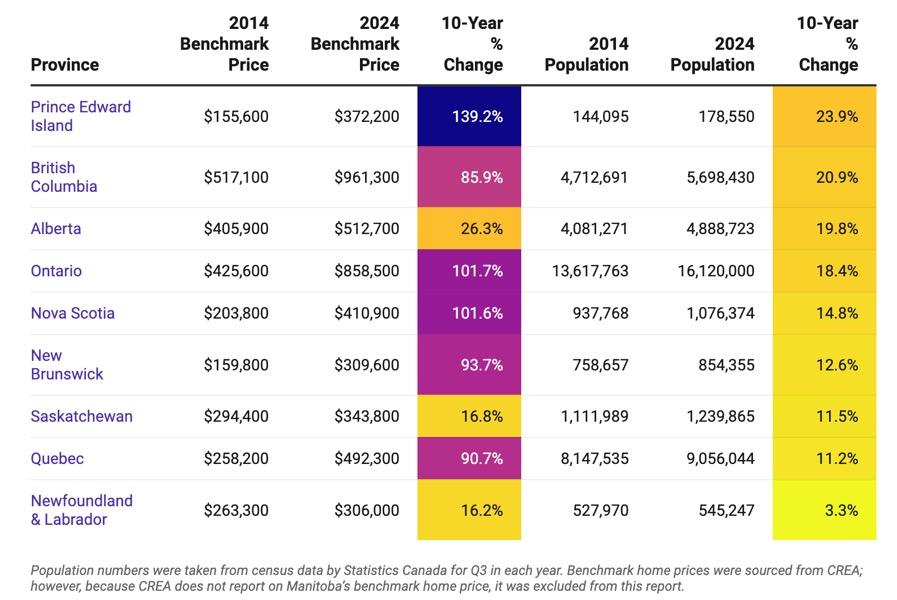

GROWTH Price Surge Outpaces Population

In recent years, Canada’s home prices have been growing faster than the country’s population, creating a growing housing affordability gap. This trend can be largely attributed to the rapid population increase fueled by rising immigration levels, particularly since 2015, as the Canadian government set ambitious immigration targets. For example, in 2022, Canada’s population grew at a significantly faster rate than housing completions, leading to an imbalance in supply and demand. The number of new homes being built each year has not kept pace with the influx of new residents, contributing to escalating home prices.

Several provinces have seen this issue more acutely, as urban areas continue to absorb a disproportionate share of Canada’s population growth. In cities like Toronto and Vancouver, where housing demand is already high, home prices have surged while new housing supply struggles to catch up. Experts argue that restrictive zoning laws, lengthy approval processes, and lack of sufficient construction capacity are some of the key factors holding back the necessary housing development.

This growing housing gap between supply and demand presents a complex challenge for both policymakers and Canadians. While increasing housing density and removing bureaucratic barriers could help alleviate some pressure, the reality is that the housing industry cannot rapidly scale up to meet sudden population booms. Without addressing this disconnect, Canada may continue to face higher housing costs, especially in its major cities.

In October 2024, Ontario’s housing market displayed nuanced trends shaped by economic conditions and evolving buyer behaviors:

1. Average Selling Prices: The province saw a 3% year-over-year decline in the average home price to approximately $850,900. Single-family homes decreased by 2.4%, averaging $936,000, while condos experienced a sharper decline of 6% to $589,600. In the GTA, the average price for detached homes was $1,423,056, down 1.2% from 2023.

2. Rents and Vacancy Rates: Average rents in Ontario declined by 8% year-over-year to $2,350. However, rental demand remains high due to challenges in home affordability, keeping vacancy rates at historic lows despite new completions.

3. Sales Activity: Home sales increased 7.7% month-over-month, reaching levels not seen since April 2022. This recovery reflects improved buyer interest despite higher borrowing costs. The GTA, for example, recorded notable sales increases across most property types.

4. Listings and Inventory: New listings were down by 3.5% compared to the previous month, contributing to tighter market conditions. However, inventory remains substantial, offering buyers more choices and creating a generally balanced market.

5. Future Outlook: A moderate to robust rebound in home sales and prices is anticipated between 2025 and 2026, driven by sustained population growth, easing interest rates, and increased activity in emerging cities within Ontario that are strategically close to employment hubs. These factors are expected to create favorable conditions for transactions in areas outside traditional urban centers.

However, significant challenges will persist in the rental market, as housing supply continues to lag behind demand, exacerbating affordability issues. The rental sector is likely to remain under pressure due to high demand and limited vacancies, reflecting the broader housing market’s supply constraints.

How Canada’s Federal Policies Are Choking Business Investment

Canada faces a serious business investment problem, and the consequences are evident in its economic performance. Several factors contribute to this issue:

1. Declining Productivity: Canada’s productivity has been underperforming for years. It now stands at just 71% of the U.S. level, showing a long-term decline relative to other G7 countries. The lack of significant productivity growth is partly due to limited competition in certain sectors and insufficient capital investment, which hampers technological adoption and overall efficiency.

2. Weak Capital Investment: Investment in critical business infrastructure has been stagnating since the mid-2010s. Key sectors like machinery, engineering, and intellectual property products saw significant investment declines, leading to lower capital intensity. This reduction in available capital for workers, especially in comparison to the U.S., puts Canada at a disadvantage in terms of productivity and global competitiveness .

3. Limited Business Growth: Canada’s economy features a disproportionate number of small and medium-sized businesses, which typically lack the resources to scale and become more competitive. This structure limits the potential for innovation and productivity growth. Canada’s failure to adequately invest in capital, improve productivity, and foster a more competitive business environment has serious implications for its future prosperity. Addressing these issues requires targeted efforts to increase business investment, boost workforce skills, and incentivize competition and innovation.

Growing Divide in Capital Availability Among Canadian Real Estate Investors

The widening capital access gap between large and small real estate investors in Canada is fueled by economic, regulatory, and market dynamics, significantly affecting market dynamics, ownership patterns, and investor opportunities

Key Factors Behind the Divide

1. Interest Rates: High borrowing costs and stricter mortgage stress tests disproportionately impact smaller investors reliant on leverage, while larger players with ample reserves remain less affected.

2. Institutional Dominance: REITs and private equity firms outbid smaller investors, leveraging economies of scale and access to bulk financing.

3. Tighter Lending Standards: Conservative bank policies force smaller investors to rely on expensive private lending, widening the gap.

4. Limited Equity Access: Wealth disparities and rising property prices favor established investors with significant capital and advanced fundraising options.

5. Market Dynamics: Urban competition and shifts to riskier secondary markets limit smaller investors’ scalability.

6. Policy Pressures: Taxes and rent controls squeeze smaller landlords more than diversified institutional investors.

7. Risk Tolerance: Larger investors capitalize on market uncertainties, while smaller players retreat due to financial constraints.

Implications

Larger investors are increasingly dominating the market, limiting opportunities for smaller players, who have historically been a cornerstone of Canada’s economy for the past 50 years and with smaller investors withdrawing, competition and pricing dynamics are being impacted, leading to potential market stagnation.

As institutional investors gain more control, concerns about affordability and potentially reshaping the housing landscape.

The View From The Condo Market

The Ontario condo market is under significant stress, driven by high borrowing costs, regulatory challenges, and market imbalances. Smaller investors are particularly affected, with some forced to sell or facing financial distress. Policies aimed at reducing speculation, like foreign buyer and vacant home taxes, have impacted both domestic and international investors. While these measures are meant to cool the market and enhance affordability, they can also force investors to sell to meet tax obligations. Furthermore, as condo prices stagnate or decline due to interest rate hikes and market fluctuations, many investors and homeowners are facing negative equity, where their property’s value is below the mortgage balance, complicating efforts to sell or refinance.

As interest rates rise and the housing market remains sluggish, some lenders to distressed condo developers are stepping in to buy troubled projects and finish them. A prominent example is Gentai Capital, which, along with two partners, purchased a partially completed condo project in Kitchener out of receivership for $75 million. Gentai converted its second mortgage into equity and injected new capital, with construction managed by ELM Developments. This shift from lender to developer reflects a growing trend in Ontario since 2022, where lenders are taking on development roles to avoid losses.

U.S. Real Estate Market 2024: Trends, Challenges, and Future Oulook

Over the past two decades, the U.S. housing market has experienced dramatic shifts, marked by a speculative boom and subsequent crash followed by a complex recovery. The market peaked in 2006, driven by easy credit and speculative buying, but the subprime mortgage crisis in 2008 caused a severe collapse, leading to a dramatic fall in home values and widespread foreclosures. By 2012, home prices had plummeted by over 35% from their peak, and many builders halted construction due to excess inventory and diminished demand.

A slow recovery began, supported by low interest rates, improving economic conditions, and demographic shifts, notably the rise of millennial homebuyers. By 2014, housing starts surpassed one million units annually, signaling a return to growth. The COVID-19 pandemic in 2020 further boosted housing demand, particularly in suburban areas, as remote work became common. However, this pandemicdriven surge was quickly tempered by rising interest rates in 2022, as the Federal Reserve took action to combat inflation. Higher mortgage rates reduced affordability, limiting buyer demand and slowing new construction, especially for first-time buyers and younger households.

By 2024, existing home sales are at their lowest pace in years, with many prospective buyers deterred by the “lock-in effect,” where homeowners with low-interest rates are reluctant to sell. Despite this, new home sales remain resilient, particularly in the South and Midwest, where inventory remains tight, and builders are focusing on smaller, more affordable homes. Affordability continues to be a challenge, with many consumers opting to rent due to rising prices.

Foreign demand for U.S. housing has also seen a significant decline, mainly due to a stronger dollar and rising prices. From April 2023 to March 2024, foreign purchases of U.S. homes dropped by 36.47%, marking the lowest level since 2009. Canadian buyers, however, remain active, making up the largest share of foreign buyers at 13%, while countries like China, Mexico, and India also continue to show interest, especially in Florida.

The U.S. housing market remains severely undersupplied, particularly in the affordable housing sector. The gap between housing demand and supply is estimated at 1.8 million units, with a need for 18 million new units between 2024 and 2033 to restore balance. Housing permits and starts have declined since 2021, and as of September 2024, the number of authorized but not yet started units reached 278,300. The construction of single-family homes continues to dominate, but a slowdown in multifamily construction, particularly in the Sunbelt, could reverse the trend of moderate rent growth. decline in multifamily construction could lead to rising rents in the future.

The U.S. housing affordability crisis is becoming a prominent political issue, with proposals to increase housing supply or provide financial aid to low- and moderate-income households being actively discussed ahead of the 2024 elections. While lower mortgage rates may ease affordability pressures in the future, the cost of shelter is expected to remain high in the post-pandemic economy, which could contribute to a decline in homeownership rates and a shift toward smaller, more affordable homes.

The Gap Between Housing Demand And Supply Is Extimated

At 1.8M Units

The U.S. housing market remains in a state of flux, balancing between ongoing recovery efforts, affordability issues, and a persistent undersupply, particularly in the affordable housing sector. The outlook for homeownership is uncertain, with a not favourable interest rates and a cooling housing market making it harder for many to enter the market. These trends are likely to have ripple effects on Canadian markets as well, with shifting buyer behaviors and investment patterns expected in the coming years. Despite challenges, opportunities remain, especially for builders focusing on affordable, smaller homes in regions with tight inventory.

Conclusion

The real estate markets in both Canada and the USA are currently navigating a period of heightened uncertainty, driven by a complex interplay of factors. One of the foremost concerns is the unpredictable trajectory of interest rates. While central banks in both countries have recently initiated rate reductions, there remains significant uncertainty regarding how much further these rates may fluctuate. Such rate changes directly influence mortgage costs, exacerbating the affordability challenges faced by many buyers. The potential for prolonged high rates has instilled caution among prospective homebuyers, leading to reduced demand across various markets. Homeowners are also feeling the pressure, as rising refinancing costs further complicate financial decision-making, adding to the broader economic uncertainty.

The escalating cost of living, particularly in urban centers, is placing substantial strain on household budgets. Wage growth in numerous sectors has not kept pace with inflation, and the costs of everyday essentials—such as food, transportation, and healthcare—continue to rise. This leaves many potential homebuyers with less disposable income, creating even greater barriers to homeownership. The affordability crisis has become a central issue in public discourse, with many questioning the long-term sustainability of real estate markets that are increasingly out of reach for the average consumer.

Compounding these issues are concerns surrounding employment. While certain sectors are experiencing relative job growth, pockets of economic instability remain, and the threat of job cuts in specific industries looms large. These challenges undermine consumer confidence, and the increased uncertainty surrounding job security often leads to a more cautious approach to making major financial commitments, such as purchasing a home. Political factors—specifically, changes in tax policies, housing regulations, and government incentives—add another layer of unpredictability to the market. The lack of clarity regarding future policy directions complicates planning for buyers, sellers, and investors, further contributing to market hesitation.

Immigration also plays a pivotal role in shaping housing demand, particularly in urban markets. Both Canada and the USA rely on immigration to sustain economic growth, yet the quality and integration of newcomers into the housing market remain significant considerations. The ability of new immigrants— especially those with varying income levels and professional backgrounds—to secure affordable housing is a critical factor in market demand. The growing political polarization surrounding immigration policies has added to the uncertainty regarding the long-term impact of immigration on the housing market. While newcomers may stimulate demand for certain housing types, particularly rental properties, their ability to drive sustainable demand for homeownership remains uncertain amid shifting immigration policies.

Investors, who have historically been a cornerstone of the real estate market, are also facing new challenges. The combination of high interest rates, unpredictable tax policies, and a volatile economic environment has led many investors to seek more favorable opportunities abroad. Countries offering better tax incentives and lower barriers to entry are becoming increasingly attractive, drawing capital away from Canadian and American real estate markets. This shift in investment has intensified market volatility, as the absence of institutional investors leaves a void that local buyers, particularly those without substantial financial backing, are often unable to fill. Few segments of the market illustrate the current turbulence better than Canada’s condominium sector.

Cities such as Toronto, once emblematic of rapid growth, are now facing a more sobering reality. Developers, especially smaller, undercapitalized players, are encountering immense financial pressures. These challenges are manifesting in delays, cancellations, and financial restructurings of ongoing projects. Historically, population growth has served as a stabilizing force for the housing market, but recent shifts in federal immigration policies aimed at reducing both temporary and permanent immigration have raised questions about future demand. The condominium market, long buoyed by new arrivals and urbanization, now faces an uncertain future, as affordability concerns and shifting consumer preferences take center stage.

In conclusion, the convergence of high interest rates, rising living costs, political instability, and evolving immigration and tax policies has created a perfect storm for the real estate markets in both Canada and the USA. Investors are retreating, and buyers are adopting a wait-and-see approach as they await greater clarity on economic conditions, policy directions, and the future of the housing market. As a result, both markets are likely to experience ongoing volatility, with potential for short-term corrections and longerterm shifts in housing dynamics. The outlook remains uncertain, and the real estate landscape is poised for further disruption as both countries grapple with these multifaceted challenges.

In Canada and The United States, The Housing Markets Are In A Period of

Uncertainty