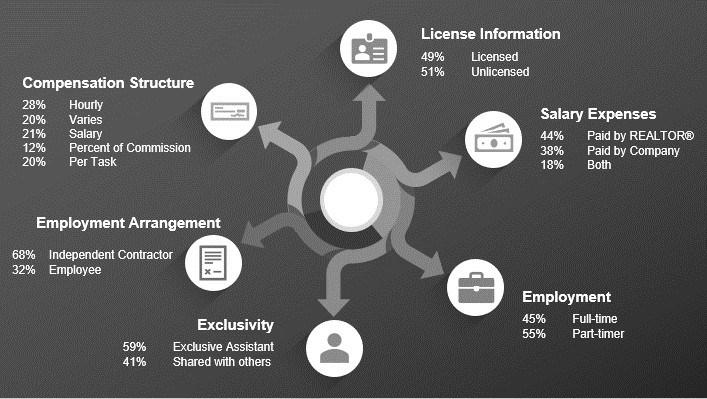

MODULE 1 – YOUR CAREER IN REAL ESTATE Characteristics of Personal Assistants It was also found in this survey that personal assistants have the following common characteristics:

Employee or Independent Contractor Professional Assistants may work as either an independent contractor or an employee of the real estate agent. Unless also licensed as a real estate agent, professional assistants are not permitted to receive a portion of any earned commission. Professional Assistants and agents should consult with the Principal Broker of a firm to ascertain what is permissible under the provincial law and the policies of the Brokerage as it pertains to what, if any, portion of a real estate commission can be paid to the professional assistant. As an employee of an agent the professional assistant is paid either a salary or an hourly wage by the agent or the firm. The agent or firm is responsible for the tax withholdings of the employee, as well as other associated costs as required for an employee by the Government of Canada. This may include healthcare benefits, sick leave, and personal paid time off. Independent contractors are those who work for one or more agents and are paid a gross amount without any withholdings. The independent contractor is obligated to pay their own taxes, provide their own equipment, and are generally not provided with any benefits or paid time off.

BrokerLogiQ | Real Estate Professional Assistant Course | 12