The bitter harvest of

The bitter harvest of

• Farm Rock Produce Inc., operating out of Calexico, CA, for failing to pay a $171,938 award in favor of an Idaho seller. As of the issuance of the date of the reparation order, Fernando Prince and Eduardo Arturo Leal Anaya were listed as the officers, directors and/or major stockholder of the business.

• United Fruit Veg Corporation, Inc., operating out of Doral, FL., for failing to pay a $51,483 award in favor of a Florida seller. As of the issuance of the date of the reparation order, Richard Vega was listed as the officer, director and major stockholder of the business.

Frutas de Paraguay projects a record growth of up to 600 tons in persimmon exports to Europe, boosting the local economy in Misiones.

As part of sustained growth, Frutas de Paraguay, located in Cerro Costa, district of Santa María, reported an increase in persimmon exports to Europe between 2023 and 2025. With the support of the National Plant and Seed Health and Quality Service (Senave), the company expects to reach between 400 and 600 tons exported this year. The process began in 2023 with 130 tons, grew to 200 tons in 2024 (+53.8% year-over-year), and as of April 2025, 340 tons have already been shipped, mainly to Spain.

Phytosanitary inspections ensure compliance, but causes of growth remain unspecified The export growth has been accompanied by phytosanitary inspections carried out by Senave to ensure compliance

with the sanitary requirements demanded by the destination countries.

According to available information, the 2025 shipments began with five consignments of between 5 and 10 tons each, representing an initial volume of 25 to 50 tons. Subsequently, the company reached a total of 340 tons exported in the first few months of the year. The strategy of weekly shipments with controlled volumes has been key to meeting the required quality standards.

Strong presence in Spain, but no data on market diversification Although data shows that the main destination for Paraguayan shipments has been Spain, there is no public information on diversification to other Euro -

pean countries. This concentration could represent either an opportunity or a risk, depending on how demand evolves in that specific market.

Production boosts local economy, but lacks economic impact figures

The growth in exports has directly benefited the local economy in the Misiones department, where the production is based. According to available data, the export volume would nearly triple between 2023 (130 tons) and 2025 (up to 600 tons projected).

Senave’s role has been crucial in the export process, conducting inspections to certify the phytosanitary quality of the products.

The Civil Court of Valparaíso halted the limited compensation fund proposed by Maersk after the failure of the bulk carrier Saltoro. Exporters are claiming damages of US $58 million.

The Civil Court of Valparaíso has suspended Maersk’s attempt to establish a limited compensation fund of US$16.3 million. The measure took place in April 2025 after exporters demanded US$58 million in damages following the failure of the Saltoro vessel. The incident occurred on January 13, 2025, in international waters. Exporters argue that the Chilean court lacks jurisdiction, citing existing contracts with clauses assigning jurisdiction to London or Hong Kong.

Jurisdiction Challenged and Contractual Limits Disputed

Exporters challenge the competence of

the Chilean court, as the incident occurred in international waters, not national territory. Experts point out that contractual clauses set liability limits higher than those invoked by Maersk in Chile. The original contracts stipulate compensation close to US$58 million, more than triple the amount proposed by the shipping company in Valparaíso. This has led to tension over which jurisdiction should settle the case: Chile, London, or Hong Kong, as outlined in the agreements between the parties.

The damaged cargo consisted of fresh cherries, which have a shelf

life of 30 to 40 days. Lawyers representing the affected parties stated that the shipping company failed to disclose this information and did not analyze or communicate potential actions to prevent damage to the exporters. This omission has been a central issue in the claim, with affected parties demanding that the carrier’s assumed responsibility match the contractually agreed amounts. However, Maersk has yet to publicly disclose the criteria used to set the initial US$16.3 million limit.

The Valparaíso court granted Maersk three business days from

the suspension to present its arguments, with the deadline set for April 21, 2025. Based on Maersk’s response, the court could decide on jurisdiction, request additional evidence, or postpone a ruling on the claimed amounts. The official statement did not include details about the specific defense strategy the company plans to use.

If the limited fund proposed by Maersk prevails, the company could benefit significantly, while Chilean exporters—particularly Exportadora El Silo— could face major losses, given the real value of the perishable cargo affected.

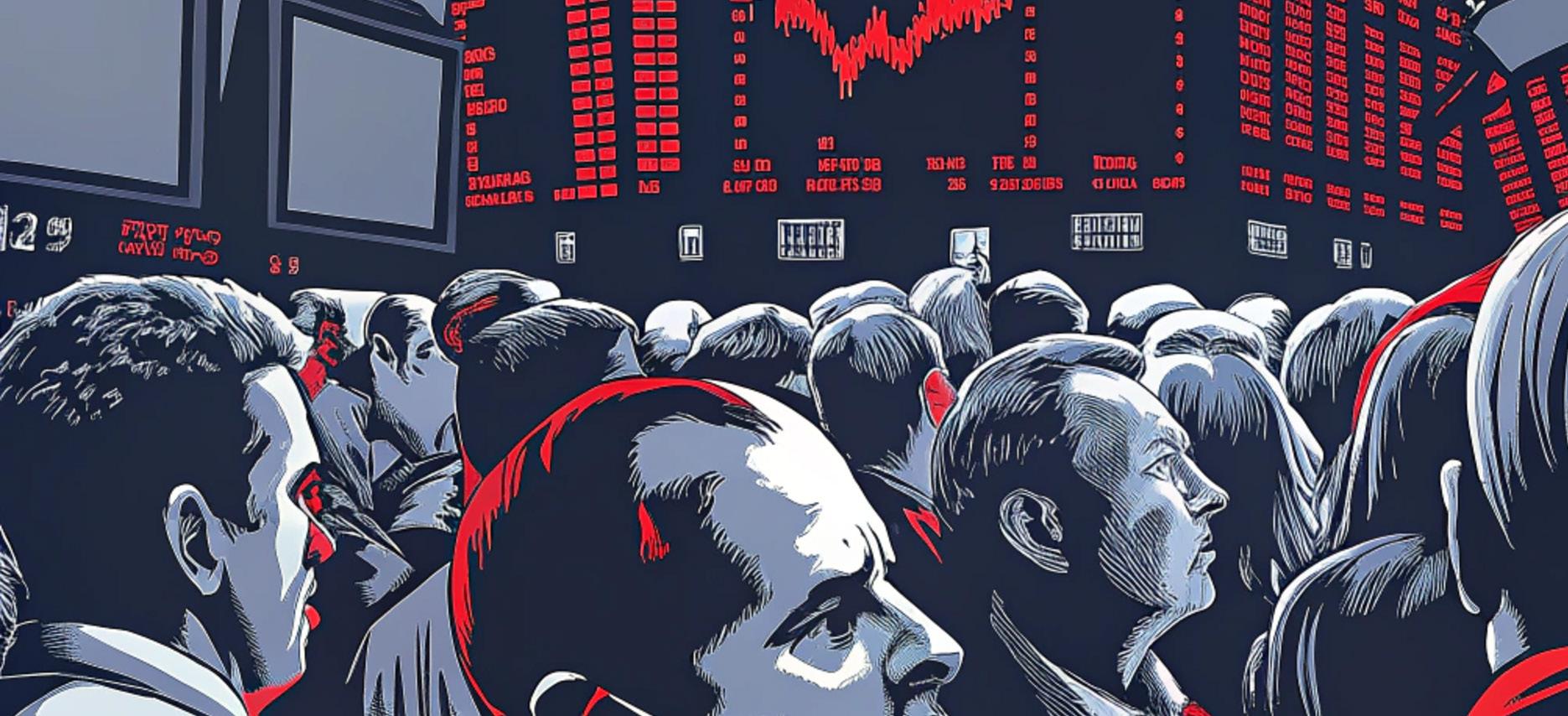

“If I send a bushel of soybeans worth $10 here, it will cost $21.50 by the time it gets to China,” calculated Caleb Ragland, a Kentucky farmer and president of the American Soybean Association. For U.S. producers like Ragland, the math is grim: the colossal tariffs imposed by Donald Trump in April 2025 have more than doubled the cost of their crops in the world’s largest market, burying competitiveness under a mountain of customs duties. His testimony is just one of many warning signs flashing across the global agribusiness sector in the wake of the latest trade war unleashed from Washington. In an unprecedented move in modern trade history, Trump imposed a blanket minimum tariff of 10% on all imports—a blow affecting everything from European machinery to Latin American fruit—and slapped a 145% tariff specifically on Chinese goods. The repercussions were immediate and severe: from the crop fields of the American Midwest to ports in Asia and Latin America, the economic tremors of a policy shaking the foundations of international trade are being felt worldwide.

A Trade War Like No Other Trump’s surprise announcement in early April marked a sharp rupture with the post-WWII trade system. At dawn on April 5, U.S. customs agents began collecting the new 10% general tariff at ports, airports, and borders—effectively enacting a “full rejection” of the mutually agreed tariff regime that had governed global commerce since the Second World War. “This is the biggest trade action of our lifetimes,” said trade lawyer Kelly

Ann Shaw, former White House adviser, calling it a “seismic” shift in how the U.S. conducts trade with the rest of the world. The White House declared a national emergency to justify the measure. According to Trump, chronic trade deficits pose a threat to both the economy and national security, and the lack of “reciprocity” from other countries must be corrected with a firm hand. “When they hit us, America will strike back harder,” said spokeswoman Karoline Leavitt, summarizing the administration’s aggressive stance.

Trump’s tariff assault targeted countries with the largest trade surpluses with the U.S. Following the 10% global base, Washington announced even higher “reciprocal” tariffs starting April 9: Europe faced 20%, Japan 24%, Vietnam 46%, and even close allies like Israel 17%. China, America’s main economic rival, became the main target, receiving an additional 34% tariff—bringing the total to around 54% on Chinese goods. Beijing immediately retaliated: “The market has spoken,” a Chinese official declared after global stock markets tumbled following Trump’s announcement. China imposed 34% tariffs on all U.S. products and restrictions on exports of strategic minerals.

The escalation continued at breakneck speed. On April 10, Trump doubled down, imposing a total 145% tariff on Chinese imports, fulfilling his vow to “level the playing field at any cost.” China responded in kind, raising its own tariffs to 125% on U.S. goods—hitting agricultural, energy, and manufacturing exports hard. From Washington, Trump

proclaimed on social media: “This is an economic revolution, and we will win. Stay strong—it won’t be easy, but the result will be historic.” In Beijing, the Finance Ministry condemned the “excessively high” U.S. tariffs, calling them “a violation of basic economic rules and a unilateral act of bullying that defies common sense.” Analysts agreed: once tariffs surpass 35%, trade becomes virtually impossible. At these levels, Chinese companies lose all profit margins, and American goods become prohibitively expensive in China. The trade war has entered uncharted territory, with the world’s two largest economies seemingly willing to sacrifice bilateral trade to prove their strength.

French President Emmanuel Macron warned: “A trade war benefits no one. We must remain united and determined to protect our citizens and businesses.” The global impact was instant: stock markets from New York to Tokyo plunged, losing over $5 trillion in market value in just two days. Oil and other commodities fell sharply on recession fears, while investors fled to U.S. Treasury bonds

for safety. Many affected nations called for dialogue to prevent disaster. British Prime Minister Keir Starmer urged negotiations with Washington to “shield British businesses from the storm” and hinted at possible subsidies. Others took diplomatic steps: Israel sent its Prime Minister to Washington over the 17% tariff, and Japan sought direct talks with Trump after being hit with a 24% duty. The European Union announced multi-billion-dollar retaliatory measures but temporarily paused them in hopes of negotiating. Trump made a tactical retreat on April 11: he granted a 90-day reprieve on the highest tariffs for countries that did not retaliate—an attempt to isolate China. Still, global uncertainty was already set in motion, and no temporary moratorium could calm the storm.

Repercussions Across Global Agribusiness Agriculture became the first battleground where the tariff war drew blood. Knowing the political sensitivity of farming in the U.S., China targeted American agricultural exports: soybeans, corn, wheat, pork, and beef now face heavy punitive

tariffs. Nearly all U.S. agricultural goods now encounter additional taxes at the Chinese border. “If our interests are harmed, we will never stand idly by,” warned the Chinese government—and they delivered, imposing tariffs that have made importing U.S. food nearly impossible. The numbers are stark: the American Soybean Association estimates that total costs of getting soy to China now include about 115% in taxes. For Midwest farmers, this means losing their biggest grain market overnight. “Soybean producers lost nearly $20 billion in value during the 2018–19 trade war,” recalled Ragland, noting that much of that lost demand was permanently captured by Brazil. Now, farmers fear an even bigger and longer-lasting hit. According to Zippy Duvall, president of the American Farm Bureau, farmers are “squarely in the crosshairs of retaliation” and a resolution must be found that doesn’t make them collateral damage.

More than 20% of U.S. farm income depends on exports. There is simply no domestic market large enough to absorb, overnight, the massive volumes of soy, meat, and other food previously bought by China. “You can’t replace that level of demand in the domestic market,” says Ishan Bhanu, an analyst at Kpler. China once accounted for 60% of globally traded soybeans, building a protein system— chicken and pig farms fed with soymeal—around U.S. imports. With that outlet now closed, U.S. producers are stuck with unsold inventory and falling prices. Even before this escalation, U.S. soybean exports to China in 2024 were at multi-year lows, displaced by Brazil. Now, with Chinese tariffs exceeding 100%, it’s uncertain whether that door will ever reopen—even long term. “We hope for calm, but financially we are very worried about what will happen with the crops we’re planting this spring,” Ragland told the agricultural press, voicing the deep anxiety

across America’s farm belt.

The global agribusiness fallout extends far beyond the U.S. Trump’s decision to impose a 10% tariff on all imports also hits food exporters worldwide who supply American consumers. Latin America—North America’s off-season produce basket—feels the blow.

In Chile, industries like salmon, fresh fruit, and wine now face declining competitiveness in a key export market. “Our highly open economy is being tested for resilience,” read one Chilean headline, reacting to the news that even a friendly trade partner like Chile would not be spared Trump’s minimum 10% tariff. Products like Peruvian blueberries and Mexican avocados now enter the U.S. with added cost, threatening sales. Latin American farmers—already operating on tight margins—may see those margins vanish if they have to absorb the tariff cost to keep U.S. customers. In Mexico, ve-

getables and beer—top exports to the U.S.—were initially hit with a 25% punitive tariff over a migration dispute, before a partial truce was reached for Canada and Mexico. Still, many Mexican producers fear the tariff sword could fall again if political tensions resurface.

Ironically, a few global players see opportunity in the turmoil. Spanish pork producers, for instance, are eyeing an unexpected advantage: with China slapping a 125% tariff on U.S. pork, Spanish exporters are stepping in to fill the gap—selling more hams and shoulders to China. “We’ve seen the light at the end of the tunnel where most only see darkness,” said a Spanish pork industry leader. Brazil and Argentina, the agro-exporting giants, could also benefit: with U.S. soybeans nearly locked out of China, Chinese buyers are turning more eagerly to South American crops—potentially driving up prices for those nations.

However, this boom carries risks. Brazil’s growing reliance on soy exports to China leaves it vulnerable: a Chinese economic slowdown or policy shift could abruptly hit its farmers. Meanwhile, as more exporters redirect trade flows, net food-importing countries in Africa or the Middle East may face price volatility if big exporters prioritize China or other lucrative markets. Meanwhile, small food and agribusiness entrepreneurs in the U.S. are also feeling the impact. Processors and distributors relying on imported ingredients are seeing their costs rise by 10% overnight. “Small businesses will have to raise prices, cut staff, or even close,” warned John Arensmeyer, analyst at Small Business Majority, assessing the impact of tariffs on local entrepreneurs. Many importers of gourmet foods, spices, or foreign beverages fear that price increases due to tariffs will drive away customers, reducing their margins to zero. Similarly, large U.S. food corporations anticipate difficulties: Coca-Cola and PepsiCo have indicated that the cost of sweeteners, juices, and other imported inputs will rise, forcing them to adjust their strategies. “We will have to activate every lever at

our disposal to mitigate the impact of tariffs on our cost structure,” stated Andre Schulten, CFO of Procter & Gamble, announcing that they will raise prices on daily consumer products to compensate for the “widespread tariff war.” In short, from the Midwestern farmer to the neighborhood shopkeeper, the agri-food chain feels it is walking a tightrope in this new era of aggressive protectionism.

Beyond sectoral disruptions, Trump’s tariff war extends its effects like a ripple over inflation and the global economy. In the United States, the average consumer will soon notice that their wallet is taking a hit. Tariffs are, in practice, consumption taxes: importing companies pay the customs levy, but in most cases, they end up passing that cost onto retail prices. “Higher prices will likely force consumers to foot the bill,” economists noted when analyzing the extent of Trump’s tariffs. Everyday products—from clothing and appliances to imported foods—are becoming more expensive. Mass consumer giants are already announcing price hikes: Procter & Gamble will raise prices on diapers and cleaning products; PepsiCo warns that its beverages and snacks could cost more to offset imported inputs. Even small businesses, with little financial cushion, are passing on the increased costs to their customers or facing the decision to reduce staff to survive.

This new inflationary wave arrives at a delicate moment. After the 2020–21 pandemic crisis, the U.S. had dealt with elevated inflation levels not seen in decades, which had just begun to moderate to the 4% range in early 2025. The imposition of a 10% universal tariff on imports acts as a strong headwind against that moderation. The government itself, however, has downplayed the problem: an official report cited studies that supposedly showed “no correlation” between tariffs from Trump’s first presidency and inflation, claiming that the effect on prices was very slight. Many independent economists openly disagree with that assessment. They point out that, even if the

direct effect on general indices might be diluted, consumers will feel the price increases of certain essential goods in a tangible way. For example, tariffs make foreign mobile phones, computers, and televisions more expensive (although Trump temporarily exempted part of mass consumer electronics, he anticipates specific tariffs on semiconductors soon). Also, goods like furniture, tires, or tools—many from Asia—will see increases. For a working-class family, the result is similar to a hidden tax: their money buys less. Core inflation could rise several percentage points if companies manage to pass most costs onto the public.

In China, in turn, the 125% tariffs on U.S. products mean that certain goods—such as some agricultural specialties, meat, or luxury American cars—will become dramatically more expensive or disappear from stores. However, the average Chinese consumer might notice it less: China had

been diversifying its suppliers and promoting local substitutes precisely to withstand such a blow. On Chinese social media, a patriotic tone resonated in the face of the crisis: “Who needs Starbucks if we have Luckin Coffee? Why buy an iPhone when we can get a Huawei?” wrote a user on Weibo, celebrating consuming domestic brands instead of imports from the U.S. This trend to replace imports with local production partly mitigates inflationary pressure in China, while reinforcing the government’s narrative of self-sufficiency. Still, the depreciation of the yuan to lows not seen since the 2008 financial crisis raises the cost of all imports for China, which could fuel some imported inflation in sectors like energy or high technology.

In the global economy, the effects are twofold: on one hand, trade slowdown can cool economic activity, reducing demand and containing certain prices (as seen in the drop in oil). But on the other

hand, bottlenecks and supply disruptions generate focused upward pressures. Europe, for example, fears that intermediate products needed for its factories will rise in price if shortages occur or if it has to buy them from the U.S., where they are now more expensive due to the 10% tariff. Emerging countries face a similar dilemma: some agricultural inputs (feed, fertilizers, machinery) may become more expensive, complicating their food security. Additionally, if the dollar strengthens (as it usually does in times of uncertainty, being a refuge for investors), developing countries’ currencies weaken, making their essential imports more expensive and adding fuel to the domestic in-

flationary fire.

Central banks watch with concern. The U.S. Federal Reserve finds itself at a crossroads, having to combat a possible inflation spike caused by tariffs just as it was preparing to cut rates to stimulate an economy weakened by the trade war. Elsewhere, from London to Seoul, monetary policymakers are weighing how to respond if prices for certain goods soar or if growth comes to an abrupt halt. “Compared to three months ago, we’re not as optimistic about the consumer,” admitted Jamie Caulfield, Chief Financial Officer of PepsiCo, reflecting the decline in business confidence. The threat of stagflation (economic stagnation with high inflation)

looms on the horizon if the situation drags on: the supply shock caused by tariffs raises costs while economic activity suffers.

Global corporations themselves have issued warning signs in their financial reports. Nearly 30 multinationals around the world have cut their 2025 revenue forecasts in the weeks following the tariff escalation. Industrial manufacturers, airlines, and shipping companies are expecting lower business volumes; retail chains fear a drop in consumption if prices continue to rise. In the U.S., giants like American Airlines have withdrawn their financial guidance for the year, citing trade uncertainty. “We have to wait for clarity before ma-

king drastic decisions like changing suppliers or product formulas,” explained the CFO of Procter & Gamble, emphasizing that regulatory volatility hampers business planning. In short, the economic climate has cooled: inflationary pressures are now compounded by a drop in investor confidence, which could drag down the post-pandemic global recovery.

A political and economic cost difficult to harvest

As weeks go by, it becomes clear that the consequences of Trump’s tariffs extend far beyond the combative rhetoric with which they were introduced. The promised revitalization of manufacturing and protection of

American workers has come with significant side effects. In the fields of Iowa and Illinois, farmers look at their crops with uncertainty, wondering if there will be buyers in the fall. John Doe, a farmer in Illinois, summarizes his anxiety as he fingers a handful of soybeans from an overflowing silo: “We’ve lost our main customer and we don’t know if they’ll come back.” The Trump administration, aware of the dissatisfaction in the rural heartland that forms part of its political base, has hinted at aid packages for agriculture similar to the subsidies given during the 2018 trade war. But many producers, proud to compete in open markets, would rather go back to selling freely than depend on government handouts.

On the domestic political front, Trump’s measures have also caused divisions. Several U.S. states that rely on imports and exports have raised their voices in opposition. California formally sued the federal government over the tariffs, accusing Trump of overstepping his powers and “causing financial harm to the state and the country.” The legal complaint argues that the International Emergency Economic Powers Act (IEEPA) does not authorize the president to “tax all goods entering the U.S. at will,” and that such power lies with

Congress. The lawsuit details the already visible impact: “President Trump’s new tariff regime has had devastating effects on the economy, creating chaos in stock and bond markets, wiping out hundreds of billions in capitalization in hours, freezing investment due to a decision of tremendous consequence made without notice or procedure, and threatening to push the country into recession.” These are unusually strong words, reflecting the anxiety in economic circles. Other states like New York and Illinois are considering joining similar legal battles, while the Chamber of Commerce and business associations are pressuring Congress to halt or temper the tariff agenda. Even members of Trump’s own Republican Party, traditionally supporters of free trade, have expressed private concerns about the impact on businesses in their districts.

On the international stage, diplomatic channels are heating up behind the scenes. The World Trade Organization received a formal complaint from China, accusing the U.S. of violating multilateral trade rules with its “reciprocal” tariffs. However, the WTO is currently at its weakest, with its arbitration mechanism paralyzed in recent years. Still, the dispute has become a battleground for narra-

tives: is the U.S. a reliable partner or an unpredictable actor? Traditional allies of Washington, like the European Union, are trying to strike a difficult balance: they condemn Trump’s policy of fait accompli, yet simultaneously seek exemptions to avoid greater damage to their own economies. Many share the underlying criticism of certain Chinese practices—such as industrial subsidies and forced technology transfers—but oppose the U.S. president’s unilateral and confrontational approach. Meanwhile, Beijing is actively working to align other countries around a common stance against what it calls U.S. “economic coercion,” ironically positioning itself as a defender of the free trade system it once criticized.

True to form, Trump seems to be betting on confrontation as a path to negotiate from a position of strength. His administration has hinted that it

could reduce tariffs on China to more “reasonable” levels (perhaps 50% instead of 145%) if Beijing yields on certain demands. However, to date, neither Washington nor Beijing has shown signs of making substantial concessions. Each side is waiting for the other to blink first. “If the U.S. keeps playing the numbers game with tariffs, China will no longer respond,” declared China’s Ministry of Finance, suggesting that beyond the current 125%, any further U.S. tariff would be “a joke in the history of the world economy.” In other words, China has drawn a line: it has a tolerable limit, but also a red line it will not cross in retaliation. Meanwhile, Trump faces a looming test of results: he will need to demonstrate that his hardline strategy yields real concessions from trade partners or tangible benefits for American workers—before the political and economic costs become unsustainable.

Artificial intelligence and blockchain optimize food supply chains, drive halal certifications, and reduce costs—but deepen the technological gap between developed and emerging countries.

The adoption of artificial intelligence (AI) and blockchain is transforming processes in the global agri-food industry, according to the Tridge Vision: AI Applications in AgriFood Industry & Market Opportunities report (March 2025). Companies like Otafuku Holdings, which uses AI to develop 200 new sauce varieties annually in Japan, and Gatorade, which launched AI-driven personalized bottle customization (October 2024), are leading this trend. The report highlights how countries such as Argentina, South Korea, and the Philippines are digitizing trade procedures to optimize supply chains, improve efficiency, and reduce costs.

vs. Potential Exclusion

Technological implementations like Argentina’s digital animal import system (launched in March 2024 with support from SENASA) have reduced inspection times from one day to five minutes. Similarly, platforms such as uTradeHub in South Korea streamline export procedures. However, countries with limited technological capacity may face exclusion due to the digital divide. According to the report, in 2023 the digital transformation index in trade reached 78% in developed countries, compared to just 48% in Sub-Saharan Africa.

Halal Certification: Transparency vs. High Costs

The report also highli-

ghts the growing use of blockchain in halal certification, citing statements from Malaysia’s Deputy Prime Minister, Datuk Seri Dr. Ahmad Zahid Hamidi, who said at the 2024 Global Halal Summit: “Malaysia must strengthen its halal certification framework using blockchain, following the examples of the UAE, Saudi Arabia, and Australia.” Mobile apps like Scan Halal and Verify Halal have reduced ingredient verification times from minutes to seconds.

Economic Impact and Unspecified Projections

The report includes relevant economic projections, such as Vietnam’s rice exports dropping from 7.1 million to 4 million tons by

2030—opening opportunities for India and Thailand. It also notes the annual growth of the halal market in the UAE at 5.5% through 2029. However, the report does not provide specific figures regarding the global economic impact of these technologies, nor does it detail potential risks related to the lack of standardization in critical data, such as carbon emissions.

Corporate Statements vs. Limited Information Hyunwoo Lee, Lead Analyst at Tridge, emphasized: “At Tridge, we believe in uniting the power of data, technology, networks, and human expertise to transform, innovate, and positively impact individuals, businesses, and the world.”