The largest and most successful companies globally place human insight at the center of their business strategies.

When one thinks of the core drivers of business performance, the classics come to mind: sales and marketing strengths, cost advantages, product quality, pricing power, market and competitive advantages, and so forth. However, over the past two decades many of the most successful leaders across the world’s biggest corporations have come to believe that the most critical lever for value creation is something altogether different: people.

Whereas historically leaders viewed their businesses through the lens of the P&L, and then more recently of KPIs, the most innovative companies are now pushing their organizations to build a deeper, more qualitative understanding of their customers, employees, investors and other stakeholders. Companies like Google, Meta, Microsoft and many others have hired not just the world’s best scientists and engineers, but also (and perhaps less publicly) thousands of PhD anthropologists, sociologists, political scientists and more to help them unlock growth and focus through a deeper understanding of what matters to people - and what doesn’t. 11 At ReD Associates, we have seen similar focus firsthand at a broad range of industry leaders, including Lego, Adidas, Samsung, Ford, Intel, and The Gates Foundation.

We wanted to understand if this trend is also manifest among the world's best Private Equity firms.

We surveyed and talked to more than 40 leading Private Equity investors and operators to understand how PE firms build and execute their business cases for deals. Our survey covered leaders representing more than $360bn in assets under management, with average deal sizes across the spectrum from single digit millions to more than $1bn, and including some of the largest and most respected funds in Europe and North America.

Overwhelmingly we found that PE leaders also believe human insight into customers, executives teams and company culture is critical and difficult.

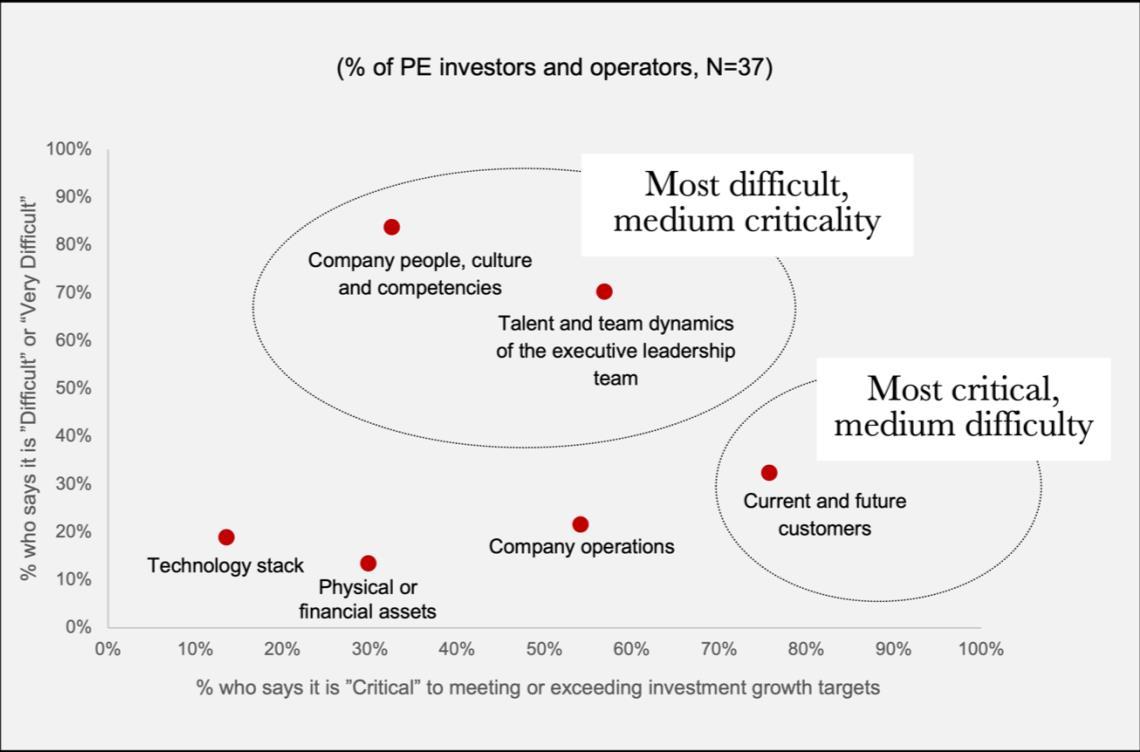

Private Equity leaders clearly share the perspective of business leaders in other sectors. The below chart summarizes how respondents rated six different aspects of a target or portfolio business in terms of both their importance to returns (X axis) and their difficulty in getting right (Y axis):

1 According to a non-exhaustive analysis of Linkedin data, both Google and Meta have more than 1000 ‘UX researchers’ on staff, while Microsoft, Amazon and others have 500+. UX researchers predominantly have advanced degrees in the social and human sciences and are tasked with understanding people and society from a social science perspective. Meanwhile, according to data from Indeed, the number of UX research job openings in the US grew 566% from 2020-2022, vastly outpacing other high growth tech disciplines such as software engineering or product management.

Difficultyvs.Importanceofbuildingastrongdata-drivenperspectiveon…

As you can see, investors believe that developing a strong understanding of a company’s customers is by far the most important driver of returns, and that doing so is difficult compared to understanding other elements of a business, such as their technology, operations, or finances. Regarding a company’s leadership team and culture, investors clearly indicated that understanding these components well is also important, but that these are by far the most difficult business elements to get right.

In other words, the aspects of a business that relate to people - whether they be customers or staff - are core to PE returns and yet all substantially harder to understand and manage than the non-human elements of a business. Intuitively, this is not surprising - it is much harder to predict and shape their behaviors than it is to manage static elements like physical products or pure financial metrics. The question is, what are PE leaders doing about this problem?

Despite their importance, more than half of PE leaders don’t believe enough time is spent addressing the human side of their deals.

Culture, talent and customers (the human areas) are the three areas where PE leaders are most likely to say they don’t spend enough time over the course of the deal cycle. A full 56% said they did not believe their firms and/or portfolio company CEOs spent enough time on building a data-driven perspective on the company’s culture and executive team over the course of the investment life-cycle. And while the majority believe they spend the right amount of time on building a perspective on customers, not a single person thought they spent too much time on that area.

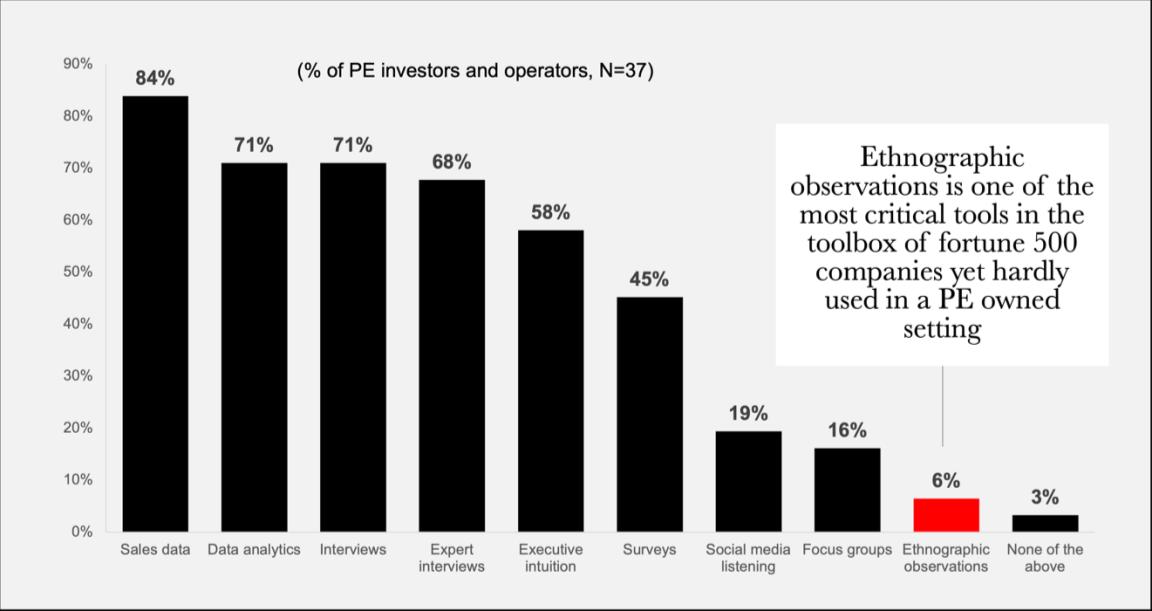

Additionally, when PE leaders do try to make sense of a target or portfolio company’s customer base, they uniformly miss one of the key tools that other industry leaders employ.

Whichofthefollowingdoesyourfirmroutinelyrelyonwhenbuildingdata-driven perspectives oncurrentandfuturecustomersandhowtoservethem?

PE leaders leverage a variety of methods for making sense of people, from analyzing traces of customer behavior through sales data or data analytics, over asking customers what they think in surveys or interview, to leveraging their own intuition or the opinions of experts. But none of these methods reveal whypeople do the things they do, or provide the deep understanding of people’s lived experience that is necessary to reliably predicting how their lives could be different. For that, you need ethnography – the systematic study of people and cultures through first hand observation by trained researchers This kind of work has a unique ability to illuminate not just how the world is today, but also how it is changing or could be changed, allowing for the kind of original perspectives that ensure investment edge. Companies like LEGO, Samsung, Coloplast and many others have leveraged this kind of ‘Thick Data’ to make sense of people and culture and drive outsized growth. For most fortune 500 leaders, it has become a standard part of the strategy toolkit.

Looking ahead - a new source of value creation in PE?

In summary, while leading private equity leaders agree with the broader business sector that developing a keen understanding of the humans and cultures behind their businesses is critical to their success, they are largely trailing other

industries in applying the necessary time, resources, and tools to this domain. We believe that in the coming years the best-performing PE firms will prioritize addressing this gap. And indeed, some already are. An example is EQT, the Swedish global investment organization with $227 billion assets under management. Several of EQT's portfolio companies (i.e. Karo and Atos Medical) have successfully taken a deeper approach to understanding their customers and in return accelerated the process of value creation.

Who will emerge as the leaders in this area? How will they integrate new approaches to developing human insights into their work? We intend to follow this trend closely and would welcome speaking with any private equity investors who would like to share their perspective or join us in following these developments.

AboutReDAssociatesandthestudy

ReD Associates is a global strategy consulting firm that specializes in applying the social and human sciences to make sense of the human side of business, and drive growth, focus and momentum. Our work has helped some of the world’s most influential businesses and organizations reshape their industries, including Lego, Adidas, Samsung, Ford, Intel, Meta, Novo Nordisk, The Gates Foundation and many others.

Following a growing number of successful projects for Private Equity firms and their portfolio companies, ReD is now conducting a research project to understand how investors and operators use insights on people and culture to drive business results today, and how they perceive the value of such information.

Our research examined how three kinds of human insight affected company performance: Namely, we looked at the effect of building a strong, data-driven perspective on how to improve 1) company’s people, culture, and competencies, 2) Talent and team dynamics of the executive team and 3) how to serve current and future customers, up against insight into how to improve other areas like operations, technology and physical and financial assets.