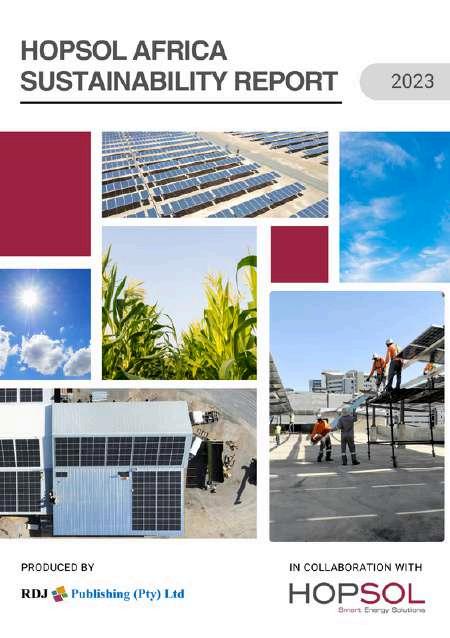

InFocus NAMIBIA

AN ENERGY AND SUSTAINABILITY OVERVIEW

Namibia’s

Namibia’s

DearReader,

Welcome to another anticipated edition of InFocus Namibia! If you’re joiningusforthefirsttime,welcomeonboard

In this month’s edition, we took an exploratory dive into several topical issues of relevance, particularly focusing on the mining industry We dig beneath the surface of the news headlines to bring you in-depth, compelling,yetinformativeinsightsandperspectives

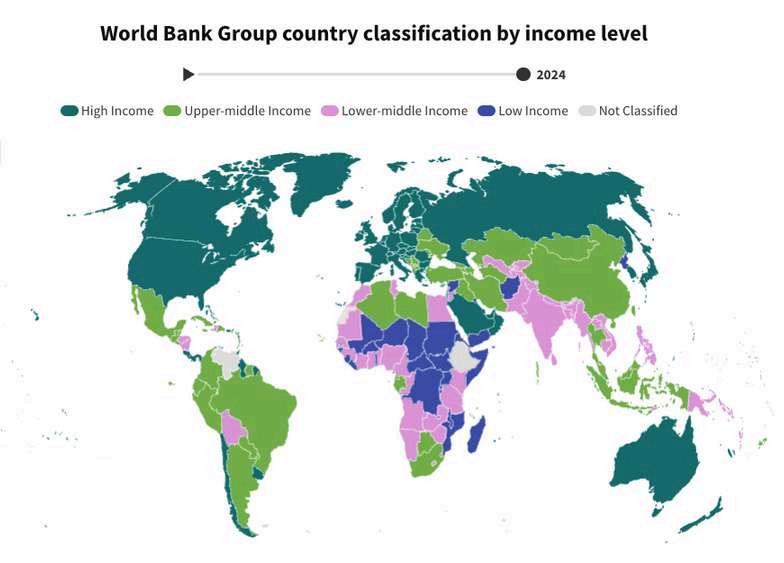

Globally,theenergytransitionisinfullswing Morethanjustrocksandrigs, the mining industry lies at the heart of the global energy transition. With mineralslikecopperandlithiumformingthebackboneofrenewableenergy infrastructure for electric vehicles to solar and wind farms, the impact is obvious The world’s demand for these resources is surging and Namibia, withitsmineral-richterrainandstrongregulatoryframework,itistherefore graduallysteppingintothatglobalspotlight

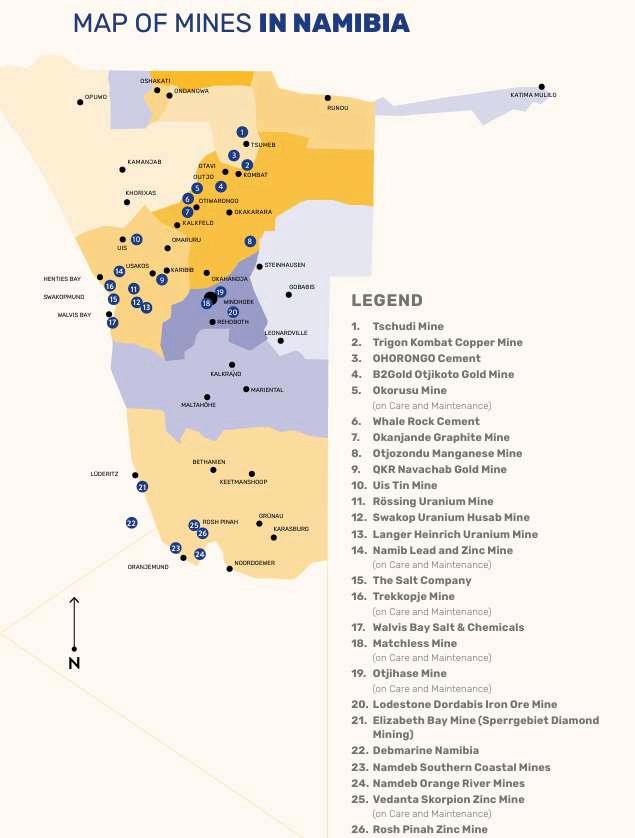

Bythecloseof2024,despitecontractingby1.2percentcomparedto2023, Namibia’s mining sector remained a pillar of the country’s economy, contributing 13.3 percent to the nation’s GDP. With 26 operational mines extracting over 100 different mineral resources, the sector also provided direct employment to more than 20,000 people and by extension affects approximately100,000individuals Thisimpactisespeciallysignificantgiven thecountry’spersistentlyhighunemploymentrate,whichwasreportedby theStatisticalAgencyat369percentin2023

This report is a FREE Publication written and authored through collaboration with RDJ Consulting Services CC based in Windhoek, Namibia.

The content is collected from publicly available information and so its accuracycannotbeguaranteed

As global copper output powers towards 232 million tonnes in 2025, Namibiaiseyeingitssliceofthecopperpie.Newexplorationandfeasibility studiesareunderway,aimingtobringeconomicallyviablecopperprojects online in an environmental and responsible way. Meanwhile, Namibia’s uraniumstoryisgettinganewchapter WiththesigningofanMoUbetween Namibia and U.S. based NANO Nuclear Energy in June 2025, the stage is being set for local uranium processing, moving Namibia from position of rawmaterialexportertoa“value-adder”

Butminingisn’tNamibia’sonlyfrontier Offshoreoilexploration,drivenby oil giants like Shell, TotalEnergies, BW Energy and RECON Africa onshore, has created excitement and scepticism alike While discoveries hold promise, timelines for production remain uncertain. In this edition, we examine some of what’s driving those delays, is it technical barriers, commercialcaution,orperhapsstrategicgeopolitics?

Beyond our borders, we also turn our gaze to Nigeria’s sale of its stateownedoilrefineries,aparticularlytimelyanalysisasNamibiaconsidersits own refining potential. At home, we are still celebrating NamPower’s for breaking ground on its largest-ever solar PV powerplant, a cornerstone in our national energy transition We also cover progress in the Green Hydrogenprogramandprogressmaderegardinglegalmatters,ashiftthat mayredefineoursustainablefuture

Whether you're a policymaker, investor, student, or simply curious about energy, this issue offers a rich blend of insights, context, and thoughtprovokingdiscussions

Wethushopeyoufindthiseditioninformativeasusualandencourageyou to follow and engage with us on all our social media accounts as we continuetoexploreanddiscussthesevitalissues

Asalways,theconversationcontinuesat infocus@rdjpublishing.africa

Yours, editor@rdjpublishing africa

(DavidA Jarrett) EditorinChief

(GraceKangotue) Editor

RDJ Publishing (Pty) Ltd is the publishing home of the InFocus Namibia, written and authored through the collaboration with RDJ Consulting Services CC (www rdjconsulting co za)

POBox23738 Windhoek, NAMIBIA

Telephone +264817503010

Email info@rdjpublishing.africa

WEBSITE wwwrdjpublishingafrica

3,856,000

AUTHOR: DavidJarrettandTeam

Editor@RDJPublishingandRDJGroupChiefExecutiveOfficer

amibia, has significant mineral wealth Among its many mineral resources, copper has played a vital role in shaping the country’s economy, history, and Courtesy:www.iea.org

Ndevelopment. Copper mining in Namibia has roots in largescale copper mining since the late 19th century, particularly with the advent of European colonization

The earliest records of organized copper mining date back to the early 1900s, with the formation of several mining companies and the discovery of significant copper deposits. Over the decades, copper mining has seen periods of boom and decline, influenced by global copper prices, technological advances, and political shifts in the region

Copper mining is a cornerstone of Namibia’s economy The sector provides direct employment to thousands of Namibians and supports a wide array of ancillary industries, such as transportation, engineering, and equipment manufacturing. In addition, copper exports contribute significantly to Namibia’s foreign exchange earnings

On the flip side, the demand for copper continues to rise globally, driven by the growth of renewable energy technologies, electric vehicles, and digital infrastructure, all of which rely heavily on copper. Namibia, with its established mining infrastructure and ongoing exploration projects, is well-positioned to meet some of this growing demand

the clean energy transition causes a spike in global demand for the resource that has been dubbed the “metal of electrification”, used in everything from wiring to electronics and electric vehicles

……...aspointedoutbyScarlettEvansinNRIDigital

Namibia can make strides with this boost as it is home to several major copper mines, both historical and operating, which have contributed significantly to the country’s mining sector As calculated and published by others (see the link references), Global copper mine output is projected

to reach 23 2 million tonnes in 2025, representing just a 3 percent increase from 2024 levels. Meanwhile, refined copper demand reached 21.2 million tonnes in the first nine months of 2024 alone, a 4.3 percent increase compared to the same period in 2023

The same source notes that, renewable energy infrastructure remains copper-intensive:

US clean energy installations expected to grow by over 25 percent in 2024 [this may now be revised downwards]

Solar systems require approximately 5.5 tonnes of copper per megawatt

Wind turbines need up to 4 7 tonnes of copper per megawatt

China reached its 2030 renewable energy target of 1,200

GW wind and solar capacity by end of 2024

Noting further that according to S&P Global, the clean energy transition represents one of the most significant drivers of copper demand growth through 2030 The electrification of energy systems inherently requires substantial copper inputs for generation, transmission, and distribution.

Several copper mines are showing promise as well as lessons learnt such as:

Haib Copper Project: Located in the far south of Namibia, near the border with South Africa, the Haib Copper Project is considered one of the largest undeveloped copper deposits in southern Africa Haib is a large and advanced copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators Mineralization at Haib is typical of a porphyry copper deposit and the deposit remains intact.

Haib is one of the few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in Southern Africa (both in Namibia) Due to its age, the deposit has been subjected to multiple metamorphic and deformation events, but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment

The project is managed by Deep-South Resources Inc , a Canadian exploration company. More than 70,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014) Teck remains a strategic and supportive

shareholder In addition to extensive drilling, metallurgical testing, geophysics and geological mapping, various mine modeling and technical studies have been completed to date.

New exploration and feasibility studies are ongoing, with a focus on developing an economically viable and environmentally responsible operation that could contribute substantially to Namibia’s future copper production Further details are available under the Company’s profile on SEDAR+ at www.sedarplus.ca

Kombat Mine: Situated in the Otavi Mountainland, the Kombat Mine has a rich history dating back to 1850 when early prospectors discovered copper mineralization in the area Commercial mining operations began in the early 20th century, and Kombat became a significant source of copper, producing over 12 million tonnes of ore during its operational lifespan. Mining operations originally commenced in 1962 and continued until 2008, resulting in 45 years of production with a total of 12 46 million tonnes of ore grading at an average of 2 6 percent copper Historic data from past production, recent exploration efforts and significant pre-existing infrastructure are key factors that have equipped Trigon with extremely valuable insights to facilitate the successful restart of the mine.

Most recently, the Kombat Mine has been the focus of revitalisation efforts, with modern technology and investment aimed at restarting mining and increasing output Production from the open pit recommenced in 2023 Surpassing expectations, underground mining began ahead of schedule in 2024, accessing higher-grade ore recovery and positioning the company to enhance margins and cash flow Ore processing occurs at the refurbished Kombat plant, currently operating at a throughput of 30,000 tonnes per month (30ktpm) Plans are underway to increase the throughput to 60,000 tonnes per month (60ktpm) to

accommodate ore from both underground and surface sources.

The mine has changed hands several times, with various companiesattemptingtoresumeoperationsafterperiodsof closure.

Recent investments in exploration and technology have improved the efficiency and sustainability of copper mining operations The government's commitment to attracting international investment, streamlining regulations, and promoting responsible mining practices further enhances Namibia’sreputationasamining-friendlyjurisdiction

Like many mining-dependent economies, Namibia faces challenges such as fluctuating commodity prices, the need for skilled labor, and balancing economic growth with environmental stewardship Addressing these challenges requires ongoing collaboration between government, industry,andcommunities

At the same time, Namibia’s copper sector presents numerous opportunities The development of new projects like the Haib Copper Project, the reopening of historical mines, and advances in mining technology hold the promise of increased production, job creation, and economic diversification.

https://mine nridigital com/mine jun24/namibia-copper-miningpotential

https://discoveryalert com au/news/copper-market-outlook-2025global-demand-production

https://www iea org/reports/copper-2

https://www koryxcopper com/ https://trigonmetals com/kombat-mine/

contributed by:

Namibia signed an MoU with U.S. firm NANO Nuclear to boost uranium processing. The deal adds the U.S. to Namibia’s talks with China and Russia on nuclear cooperation. No formal nuclear agreements yet, but Namibia aims to build its first plant.

Namibia's Industrial Development Agency (NIDA) signed a memorandum of understanding with U Sbased NANO Nuclear Energy on Friday, June 20 The

agreement aims to "significantly enhance" Namibia's uranium resources This initiative positions the United States alongside Russia and China as potential partners in Namibia’s ambitions for local yellowcake processing.

Namibia, Africa’s leading uranium producer, supplies 10 percent of the global market The country is intensifying efforts to add value to this critical resource Earlier in January, former Namibian President Hage Geingob reiterated this vision to Chinese Foreign Minister Wang Yi A similar approach was adopted by the new President, Netumbo Nandi-Ndaitwah, during her meeting with Russian Deputy Prime Minister YuryTrutnev. President NandiNdaitwah specifically raised the idea of a nuclear partnership with Russia, particularly for the beneficiation of Namibia’s natural resources

The country's outreach to these three nuclear powers is strategically significant. China, the largest foreign investor in Namibia's uranium mining industry, with interests in the Rossing and Husab mines, is also actively investing in its own nuclear power development

According to the International Energy Agency (IEA), China alone hosted half of the 63 nuclear reactors under construction worldwide at the end of 2024 Russia is another major player in the nuclear industry, controlling approximately 44 percent of global uranium enrichment capacity. Rosatom, the Russian national nuclear company, is also active in Namibia, where its subsidiary Uranium One is developing the Wings project. Finally, Washington seeks to diversify its uranium supply sources and reduce its dependence on Russian enriched uranium by 2028, making this type of partnership potentially beneficial for the U S as well

NANO Nuclear Energy, for its part, views the memorandum of understanding with NIDA as a milestone in its strategy to "power the future of nuclear energy in the United States " It is important to note, however, that none of these discussed initiatives have yet translated into formal commitments between Namibia and these potential partners NIDA and NANO Nuclear Energy intend to continue negotiations toward a definitive agreement. It remains unclear whether similar discussions are already underway with Russia and China Regardless, the stakes are high for Namibia, which aims not only to add value to its uranium but also to construct its first nuclear power plant

AUTHOR: KovimarivaSamuelMungunda EmergingEnergy&FinanceAnalyst

Date:July2025

Courtesy:GettyImages

Namibia has found itself in the spotlight of Africa’s upstream oil and gas industry following several high-profile offshore discoveries since 2022

International giants such as TotalEnergies, Shell, and BW Energy have announced promising finds in the Orange Basin, with early estimates pointing to billions of recoverable barrels beneath Namibia’s deepwater shelf (The Namibian, 2024). However, despite the buoyancy of these discoveries, the road to first oil has stretched longer than many expected, and questions are mounting over whether the delays are driven by technical, commercial, political, or strategic considerations

This analysis dissects the real factors behind Namibia’s oil timeline, benchmarks them against peer countries, and distills what Namibia must do to unlock its energy fortune.

To understand why the hype exists, Namibia’s offshore plays are exceptionally competitive by African standards:

High-quality light sweet crude (estimated at 34–38° API gravity): makes it cheaper to refine and more attractive for export markets (Africa Energy Outlook, 2023)

Massive recoverable reserves: Up to 11 billion barrels of oil equivalent (BOE) discovered to date (Wood Mackenzie, 2024).

Deepwater assets within relatively accessible shelf depths: (1,500–3,000m) compared to Angola (up to 5,000m) and Nigeria’s ultra-deep (up to 6,000m) (African Energy Chamber, 2024)

Stable political regime and zero oil production legacy issues: Unlike Nigeria’s onshore militancy or Libya’s geopolitical volatility (The Brief, 2024)

By these metrics, Namibia should arguably be faster to FID (Final Investment Decision) than other African producers Yet it remains in the waiting room.

Courtesy:Pixabay

While early discoveries were significant, Namibia’s frontier basin status means subsurface data is sparse Unlike mature regions like Angola or Egypt, Namibia lacks decades of production history to de-risk development plans (TotalEnergies, 2024)

According to the African Energy Chamber (2024), at least 20–30 appraisal wells are required post-discovery to confirm commercial viability and delineate resource extent, most of which are only underway now

Deepwater projects require billions in upfront investment before the first dollar returns. Namibia lacks midstream oil export infrastructure, pipelines, or storage depots to monetize these discoveries (UNDP Namibia, 2023) The closest export facility is Walvis Bay, which would need significant upgrades

Most oil majors delay FID until market conditions justify risking $6–12 billion per development (Wood Mackenzie, 2024) With oil prices volatile and offshore supply costs rising 17 percent in 2023 alone (Rystad Energy, 2024), timing FID is a balancing act

Although Namibia’s Petroleum Act is investor-friendly, local content frameworks, fiscal terms, and environmental clearances remain under review (The Namibian, 2024) Multinationals typically wait for clarity on taxation, profitsharing, and ESG regulations before locking capital into 30year projects

Strategically, there’s logic in delaying FID:

Leverage for better fiscal terms: As discoveries increase, Namibia’s bargaining power improves

Time to strengthen domestic capacity particularly in energy law, petroleum engineering, and financial governance

Opportunity to align oil monetization with green growth plans avoiding the “resource curse” seen elsewhere.

This is evident in Namibia’s hydrogen and renewable drive, positioning itself not just as a producer but an integrated energy player (AfDB, 2024)

Angola went from discovery to first oil in 4–5 years in Block 15, thanks to ExxonMobil’s aggressive capital commitments and pre-existing midstream infrastructure (Rystad Energy, 2023)

Ghana’s Jubilee Field achieved FID within 3 years due to state-backed guarantees and expedited regulatory approvals (Africa Energy Outlook, 2023)

Namibia lacks both yet its reserves are comparable or superior

An under-discussed factor is Namibia’s need to clean house institutionally before managing an oil economy From upgrading public finance systems to reinforcing anticorruption frameworks and refining local content rules, delays may be deliberate to buy time and avoid institutional shocks when oil money flows in (UNDP Namibia, 2023).

This aligns with SWAPO’s 2025–2030 manifesto calling for "structural energy governance reforms" before commercial production (SWAPO Manifesto, 2024)

Namibia isn’t being played Namibia is playing, but the clock is ticking The delayed FIDs reflect a high-stakes game of aligning technical viability, infrastructure readiness, fiscal leverage, and institutional capacity

Namibia is attempting to balance investor appetite with sovereign control and long-term energy security leverage. It’s a delicate, necessary, but risky game

The challenge is to avoid falling into the ‘sweet tomorrow’ trapthathasderailedmanyAfricanresourceplays.

With transparent policy finalization, midstream infrastructure roadmap announcements, Namibia could secureitsplaceasSub-SaharanAfrica’snextmajoroil&gas exporter

As the old adage goes: “It’s not how fast you strike oil it’s what you do when it starts flowing ”

energychamber org/report/the-state-of-the-african-energy-2024outlook-reportenergychamber.org/report/the-state-of-the-africanenergy-2024-outlook-report deloitte com/za/en/Industries/energy/perspectives/africa-energyoutlook-2023.html rystadenergy com/services/price-inflation-solution content/uploads/SWAPO-Manifesto-Implementation-Plan pdf thebrief.com.na/2025/03/namibias-offshore-oil-and-gas-boomgateway-to-prosperity-or-a-road-to-ruin-a-call-to-action-for-all-ofus https://furtherafrica.com/2025/06/26/namibia-emerges-as-africasnew-energy-frontier/ https://d4f7y6nbupj5z cloudfront net/wpcontent/uploads/2025/03/Republic-of-Namibia-2025-26-BudgetStatement 250327 145903 pdf totalenergies com/system/files/documents/202403/PR South Africa TotalEnergies expands its presence in the Or ange Basin pdf undp org/media/document/1210791

Appendix:KeyCalculations

AppraisalWellRequirement Ruleofthumb:2–3appraisalwellsperdiscovery 10majorfindstodatex2–3=20–30appraisalwellsneeded

OffshoreDevelopmentCostEstimate TypicalAfricandeepwaterdevelopment:$6–12billion

Source:WoodMackenzie(2024)

OffshoreInfrastructureDeficit Noexistingcrudeexportpipeline;estimatedpipelinecosttoWalvis Bay:$3–4billion

Source:UNDPNamibia(2023)

As

Asia Britain

Caribbean Southern Africa

USA

SwakoppoortVonBachOlushandjaOmatakoOmaruruDeltaDamOanobDreihuk

Name

Author’s analysis and representation of NamWater’s weekly dam bulletin - dated 14 July 2025

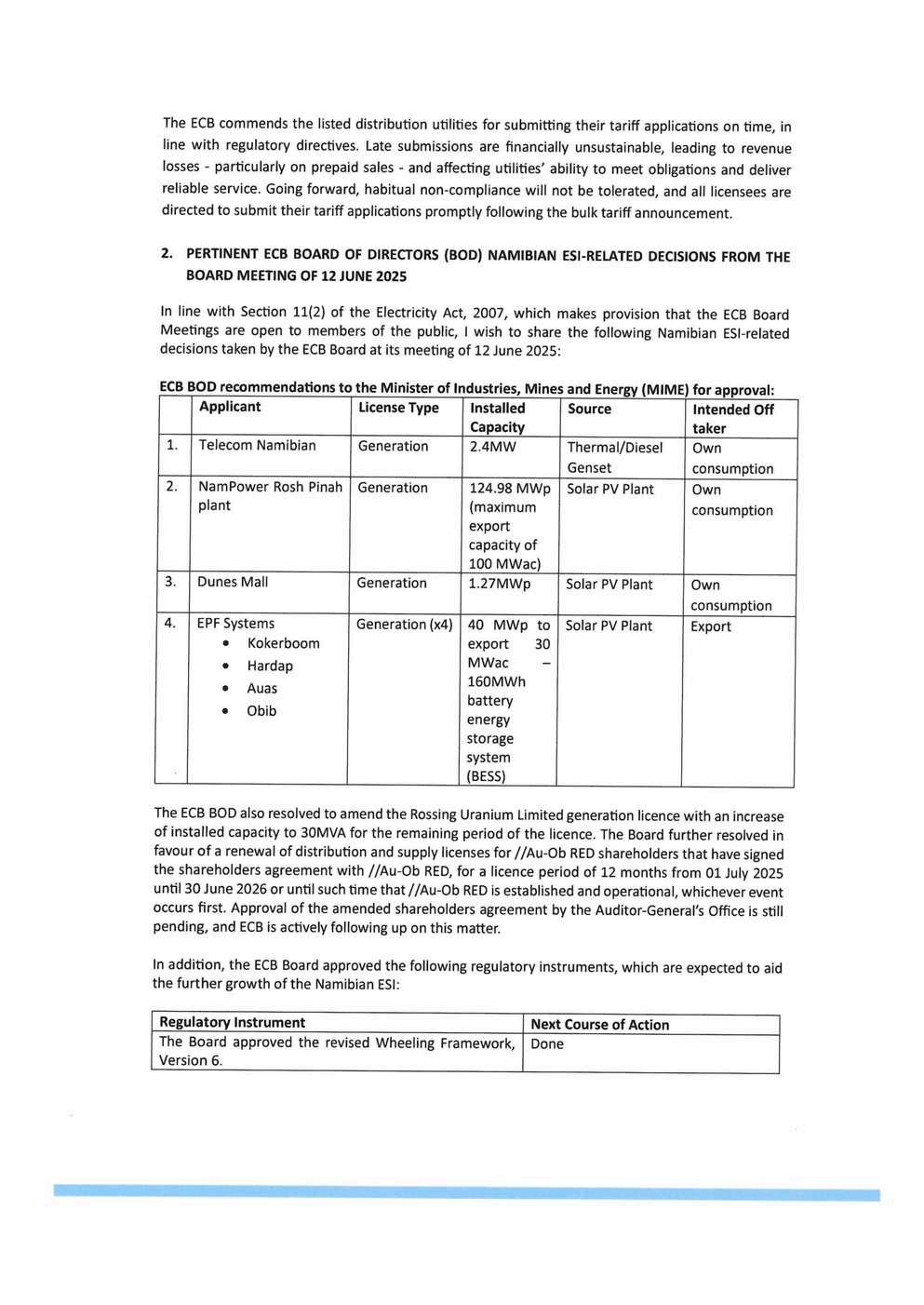

According to records by NamWater’s weekly Dam Bulletins, Namibia has a total Reservoir capacity of 1556.71 million cubic meters (Mm3), whose present volumes stand at 1333 43 Mm3 (or 85.7%). This means that the country’s water deficit is currently 223.28 Mm3 (or 14.3 %).

contributed by:

After two decades of unsuccessful efforts to revive its state-owned refineries, Nigeria may be heading toward selling them. The head of NNPC, appointed just a few months ago to get the plants back on track, now admits the overhaul is proving far more complex than initially expected.

Nigeria is now openly considering the sale of its state-owned oil refineries. Bayo Ojulari, the newly appointed head of the Nigerian National Petroleum

Company (NNPC), made this announcement in an interview with Bloomberg on the sidelines of the 9th OPEC seminar in Vienna

"Sale is not out of the question All the options are on the table, to be frank, but that decision will be based on the outcome of the reviews we're doing now," Ojulari said. He

noted that a strategic review of the company’s refining activities is underway and expected to be completed by year-end.

His comments mark a turning point For years, Nigerian authorities have repeatedly promised to revive the Port Harcourt, Warri, and Kaduna refineries Yet, according to a 2023 parliamentary report, nearly $25 billion was invested between 2003 and 2023 with no lasting results.

Despite several public announcements of progress, the outcomes have been disappointing. Port Harcourt, relaunched at the end of 2024 after a $1.5 billion overhaul, was shut down again in May 2025. Warri, which had resumed operations at 60 percent of its capacity, is also idle following a major technical failure In Kaduna, rehabilitation work is still ongoing

Ojulari admitted that the technical complexity has exceeded expectations. Some of the new technologies introduced are incompatible with outdated equipment, and he conceded the facilities have been dormant for far too long

His assessment echoed that of Aliko Dangote, who recently stated it is unrealistic to modernize these plants without starting from scratch. Investing in them, he argued, is like trying to drive a 40-year-old car using modern parts.

Appointed in April 2025 by President Bola Tinubu, Ojulari, a former Shell executive, was meant to symbolize a new era for NNPC. His mandate includes reviving oil production,

modernizing the state oil giant, and most critically, restoring the country’s public refining capacity.

Less than four months into the job, one of his core missions is already in doubt The setback speaks volumes about the sector’s entrenched dysfunctions: poor technical choices, flawed governance, and recurring corruption scandals

For Ojulari, this is a defining test. He is preparing NNPC for a potential initial public offering by 2028. However, success will depend on showing that the company can make tough decisions, move past years of waste, and refocus its efforts on high-yield projects, particularly in the gas sector

NNPC had set ambitious targets to produce 200,000 barrels of refined products per day by 2027 and 500,000 by 2030. With this latest shift, those goals now appear increasingly out of reach.

Olivier de Souza

The Green Hydrogen Program has mobilized funds to fast-track legal drafting.

contributed by:

AUTHOR: JemimaBeukes

Date:24June2025

Namibia’s green hydrogen ambitions are gaining traction with a draft energy policy already submitted for government review

presented by:

comfortable will be submitted to be Cabinet,” said Mnyupe

He also revealed that they have, “mobilized some funding for legal drafters to be procured and also put out, I think a tender for legal drafters to come forward.”

South African President Cyril Ramaphosa early this month stressed that Africa “cannot close that gap with potential alone ”

“To make use of these opportunities, we need to establish appropriate policy and regulatory environments. We now have to go beyond just talking about it,” he said.

READ MORE: Namibia’s green hydrogen: Strong winds and a legal push

The Whistle recently reported that Namibia still operates without a dedicated energy law, with the Green Hydrogen Program confirming this, explaining that Namibia currently regulates gases including ammonia and hydrogen under the Road Traffic and Transportation Act, 1999

Additionally, Mnyupe noted the Program secured N$2 5 million to complete three pre-feasibility studies aligned with Namibia’s green industrialization goals.

The Green Hydrogen Program has also mobilized funds to accelerate the legal drafting process. James Mnyupe, head of the Namibia Green Hydrogen Program, confirmed this during the Global African Hydrogen Summit 2025 press conference in Windhoek on 23 June 2025

“In terms of legal frameworks that are currently in place or at least that are being developed. We have drafted a policy that we have submitted to the ministry of mines and energy, they spent a good amount of time with their officials to understand their perspective as well that policy is going through quite a few drafts, and once the ministry is

These confirmed the feasibility of an ammonia and fertilizer facility near Neckartal Dam and identified gigawatt-scale green hydrogen sites outside Tsau //Khaeb National Park, suited for industries such as green steel, lithium beneficiation, agriculture, and green electricity exports via the Southern African Power Pool (SAPP).

Namibia’s offshore wind potential near Lüderitz was confirmed at 20 to 35 GW and these studies recommended a pilot turbine project to develop local expertise and knowledge transfer in this emerging sector

Mnyupe also said the Programme, together with the Ministry of Finance, is currently developing a detailed investment plan, aligned with the priorities of the upcoming National Development Plan 6 (NDP6)

19 June 2025 – Driven by its commitment to the sustainable development of the country, NamPower held a media groundbreaking ceremony to officially mark the commencement of the construction of the 100 MW Sores |Gaib Power Station - situated 33 km northwest Rosh Pinah.

Sores |Gaib, which in Khoekhoegowab means “Power of the Sun” , will be NamPower’s largest Solar PV Power Station to date. Upon completion, the power station will contribute significantly to the national energy mix, displacing a significant amount of imported energy and reducing reliance on fossil fuels. Additionally, Sores |Gaib will play a pivotal role in fostering economic development, enhancing energy independence, and strengthening climate resilience in Namibia.

NamPower’ s total investment in this project stands at N$1,6 billion.

The project is funded through a combination of a loan from KfW (German development bank, equivalent to about N$1,3 billion) and the remainder from NamPower’s own reserves. This loan was facilitated within the framework of the intergovernmental agreement, underscoring the enduring partnership and cordial relations between the Government of Namibia and the Government of the Federal Republic of Germany.

Pictures1&2:RepresentativeoftheEPCContractor-ChinaJiangxi InternationalCorporationandChintNewEnergyDevelopment JointVenture;ManagingDirectorofNamPower,MrKahenge Haulofu;RegionalCouncilloroftheOranjemundConstituency, HonourableLazarusNangolo

Picture3:RegionalCouncilloroftheOranjemund Constituency,HonourableLazarusNangolowith EPCContractorteam

During the construction phase of this project, over 300 direct jobs are expected to be created with the aim of employing local labor and thereby promoting skills development In addition, the Engineering, Procurement and Construction (EPC) Contractor has made a commitment to allocate 25 percent of the Contract Price, equivalent to N$356 million, towards Local Content NamPower has prioritized local content participation and skills development as integral components of its implementation strategy

Also, through the project’s Environmental and Social Management Plan, the company has made firm commitments to preserve the integrity of the environment through protecting biodiversity and promoting responsible labor and community engagement practices

NamPower’s mandate has always been clear: to generate, transmit, and where required distribute electricity in a manner that is reliable, affordable, and sustainable. In recent years, however, this mandate has gained greater significance as the world responds to the challenge of climate change and the urgency of energy transition. NamPower Managing Director Kahenge Haulofu emphasized that the 100 MW Sores |Gaib Power Station Project represents progress and a long-term commitment to the sustainable development of our country. “Our country has abundant sun and we as a nation are ready to seize the opportunities that renewable energy offers. The 100 MW Sores IGaib Power Station is a critical step in fulfilling that potential” , he stated in his speech at the groundbreaking event.

The commercial operation date of the power station is set for June 2026.

contributed by:

Guinea’s government terminated its deal with Emirates Global Aluminium’s (EGA) subsidiary, triggering over 2,000 job cuts.

The dispute centers on EGA’s alleged failure to build an alumina refinery as required by Guinea’s push for local mineral processing.

Other companies, such as China’s SPIC, are advancing their own alumina refinery projects in Guinea, signaling a shift in the country’s mining sector.

Tensions between governments and mining companies have rocked West Africa’s job market in recent months In April, a dispute between Barrick

Mining and Mali’s government forced subcontractors to lay off workers Now, Guinea faces its own crisis

On July 10, Guinea Alumina Corporation (GAC), the Guinean arm of Emirates Global Aluminium (EGA), announced plans for mass layoffs. GAC said it will initially cut more than 2,000 employees and subcontractors The company blamed the move on an intensifying dispute with Guinea’s government over the construction of an alumina refinery

Guinea, the world’s second-largest bauxite producer, wants to climb the value chain. The government demands that companies build local alumina plants to process the ore into higher-value products GAC committed to building a refinery capable of producing 1 2 million tonnes per year, with a target completion date in 2026 However, disagreements over the project’s progress erupted in 2024 The government blocked GAC’s bauxite exports and then halted mining operations entirely.

Authorities accused GAC of failing to meet its construction promises GAC countered in a press release by stating that Conakry had wrongfully declared the termination of their agreement, though the company did not provide further details. This standoff triggered the wave of layoffs. Since its launch, GAC’s mine created 3,200 jobs - 96% held by Guinean nationals

The company warned that the layoffs could be just the beginning According to GAC, the future of the remaining employees is uncertain. The company plans to fight the government’s decision in international courts but has not commented on the refinery’s fate.

Meanwhile, other players are making headway In March, Chinese giant SPIC began building a new alumina plant in Boffa

This article was initially published in French by Aurel Sèdjro Houenou

Edited

in English by Ange Jason Quenum

Meet Nicole Felix, the creative force behind the visuals at RDJ Publishing (Pty) Ltd. As Chief Designer, Nicole brings together logic and imagination to craft designs that not only captivate but communicate with purpose. Holding a Diploma in New Media Design, she excels at transforming complex ideas into clear, visually engaging narratives Since joining the team in 2022, Nicole has grown from a quiet newcomer into a confident and accomplished designer, one who thrives on turning information into impactful, meaningful design.

1. How would you describe your design style in three words?

Bold, Thoughtful and Impactful.

2. What’s your favourite part about working with the team?

My favourite part of working with the RDJ Team is that we work together seamlessly. This is only possible through clear communication. Frequently asking questions and asking for advice ensures that my design work improves I trust my team to give me feedback and I respect everyone’s ideas I know that my team members are willing to collaborate and that they will give their support any time I require it. Whenever faced with a problem, we work together to solve the problem.

3. How do you stay inspired and keep your ideas fresh?

I am always looking for inspiration on and offline. Online I follow several local and international pages on Instagram where I draw inspiration from More good sources for inspiration are Pinterest and Tik Tok I also like to go old school and look at books and magazines for ideas and inspiration In Namibia print media is still alive and kicking, so I like to look at what’s in the market. And let’s be honest nothing beats going out into the world to get inspiration. Going to the local galleries or even going for a walk-in town to look at posters or public art like graffiti keeps me inspired

4. What’s one project you’ve worked on here that you’re particularly proud of?

While it might sound like the obvious answer, working on our monthly publications, InFocus Namibia and Energy and Sustainability Africa, is something I genuinely take pride in. Seeing each issue come together reminds me why I love what I do. Each issue is a chance to craft something that sparks conversation and challenges perspectives I especially enjoy the creative freedom of designing eye-catching, thought-provoking cover images, often the first invitation to engage our audience I’m proud of how the quality of our publications has grown, and I’m excited to keep pushing the boundaries to make each edition even better.

5. What’s a fun fact most people don’t know about you?

Fun fact: as a child, I dreamed of working for a magazine. When I began my studies, I had no idea that this is where my oath would eventually end up

6. What advice would you give to anyone pursuing a career in graphic design? My piece of advice?

Just start Whether you are still studying, job hunting or interning, begin creating and putting your work out there. Take on as many projects as possible, even if they are unpaid or self-started. Do it nervous. Do it scared. Even if you’ve started something and quit, pick it up again The most important thing is to start

NamPower

Description: Procurement of Consultancy Services for Forest Stewardship Council (FSC) Certification Services from a FSC Accredited Certification Body for the Certification of the Proposed NamPower FSC Group Scheme for The Otjikoto Biomass Power Station

Bid Closing date: 01 August 2025

https://www nampower com na/Bid aspx?id=272209

Description: Supply and Delivery of Optical Fibre Ground Wire (OPGW) - Auas-Kokerboom II Transmission Line.

Bid Closing date: 15 August 2025

https://www nampower com na/Bid aspx?id=282210

Description: Supply and Delivery of Earth Wire – Auas-Kokerboom II Transmission Line

Bid Closing date: 15 August 2025

https://www.nampower.com.na/Bid.aspx?id=282211

Roads Authority

Description: Concrete and Steel Road Structures in the Rundu Region

Bid Closing date: 08 August 2025

https://www ra org na/open-bids

TransNamib

Description: Consulting Services to Perform a Benchmarking Exercise on Locomotive Suppliers and Manufacturers Suited for Namibia and The SADC Region.

Bid Closing date: 08 August 2025

https://www transnamib com na/procurement/

Debmarine Namibia

Description: EOI - Consultancy Services for Research and Technology Development.

Bid Closing date: 29 August 2025

https://debmarine.com/tenders-and-eoi

DAVID JARRETT

EDITORINCHIEFAND CHIEFEXECUTIVEOFFICER

@RDJGROUP

SILPA KANGHONO COORDINATOR:DIGITALMARKETINGAND EVENTS

@RDJPUBLISHING

LAHJA AMAAMBO CONTRIBUTINGAUTHOR @RDJGROUP

NICOLE FELIX CHIEFDESIGNER (LAYOUTANDDESIGN)

@RDJPUBLISHING

GRACE KANGOTUE CHIEFRESEARCHER/ECONOMIST EDITOR @RDJCONSULTING

CHILOMBOOLGAPRISCILA CONTRIBUTINGAUTHOR @RDJGROUP

RESEARCHBY: PUBLISHEDBY:

RENEEJARRETT EXECUTIVE-ADMINISTRATION @RDJGROUP

PRINTEDBY: