THE INSIGHT

PERTH

03

04

05

Perth Industrial Vacancy

Perth Metropolitan vacancies by size range

Perth Industrial Net Face Rents

06 Summary 07

Perth Industrial Sales Turnover

The industrial asset class continues to reign as the most coveted and high-performing commercial asset class across the nation.

However, prevailing uncertainties regarding financing, interest rates, commodity prices, and the economy at large have induced a sense of prudence among vendors, buyers, and tenants, causing a slight dip in transaction activity for both leasing and sales.

Despite this downturn, vacancy rates in the metropolitan area remain low, with a slight upsurge in smaller and larger assets being made available to the market. The absorption of 500-5,000 sqm assets has been commendable, but an increase in supply has also been noted, which is likely to keep vacancy rates slightly higher than the record lows of the previous year. This will inevitably affect the rental market, which has experienced robust growth over the years.

Overall, the industrial market continues to hold its position as the prime investment market. Nonetheless, 2023 is forecasted to usher in a period of stability for Perth's industrial sector, in contrast to the dynamic transaction activity observed in the past two years. Notwithstanding this, the market remains healthy and active.

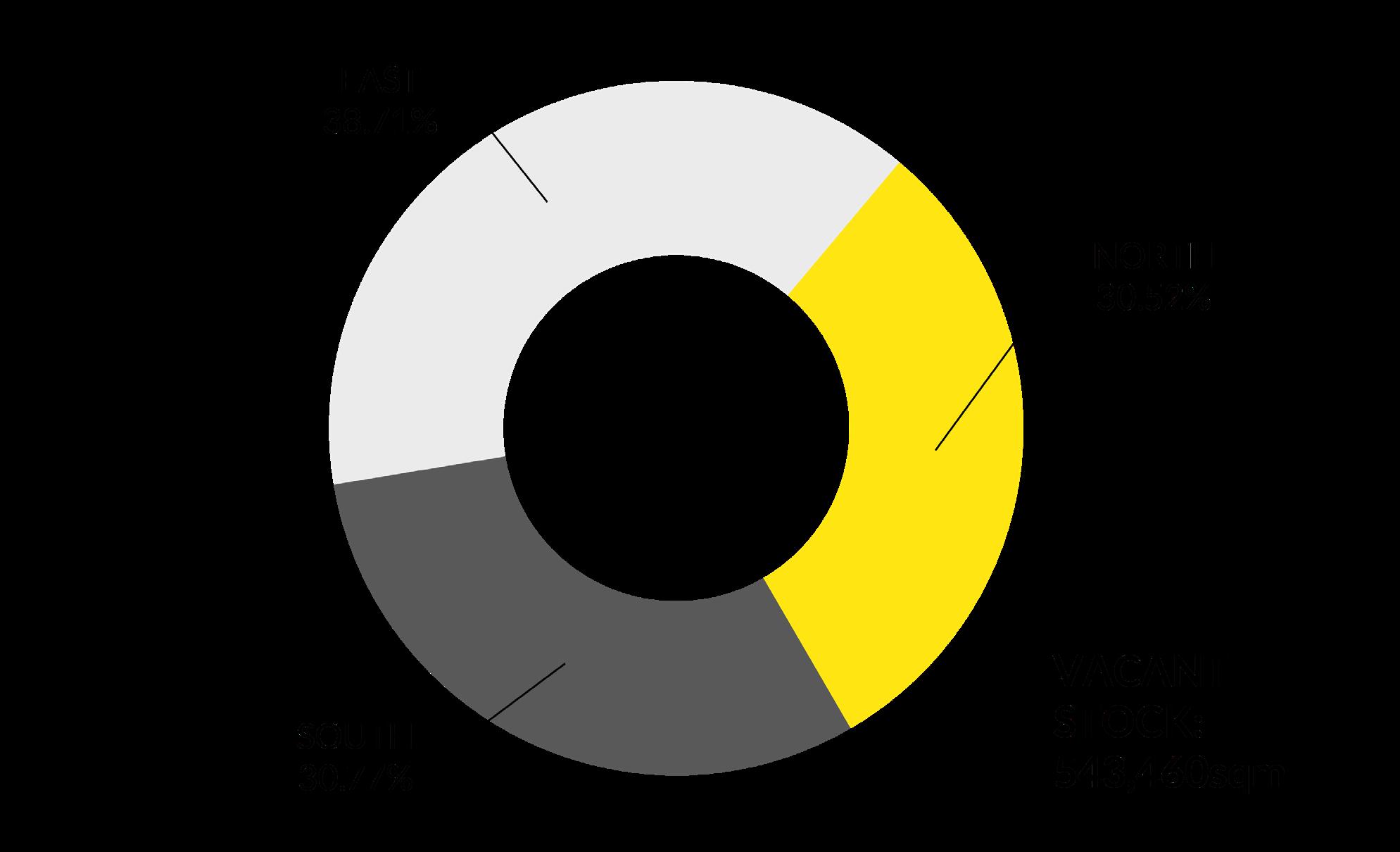

The Perth industrial market continues to benefit from limited vacancy. While there has been some movement in the stock to market, this has been due to the larger 5,000+sqm size range assets which include some new stock and backfill space. Currently there is 543,460sqm of vacant industrial supply listed for lease, this low level of available stock, whilst slightly higher than this time last year, follows the trend seen over the last few years after peaking a over 1million sqm in October 2020. Historically the South precinct has been the home to the smallest proportion of stock however, this year we have seen this move in line with the North precinct both representing just over 30% of all listings. The East precincts home to the greatest volume of vacant stock at approximately 210,000sqm with Canning Value and Welshpool home to the largest pool of stock notably in the larger size range.

BY NO. LISTINGS

BY NO. LISTINGS

This year we have seen the sub 500sqm listings again grow to represent over 50% of all available stock, over the last couple of years, this segment has fallen to be 43.72% last period. Of stock in this size range more than half is in the North precinct with Malaga and Wangara the suburbs with the greatest vacancy. In response to this increase in the smaller size, 5011,000sqm stock has fallen to now 14.16% after rising to a quarter of all listings last year, this highlights the growing nature of businesses across Perth with tenants committing to larger spaces allowing them to cater for growth as well as house more stock to combat supply chain issues. This trend continues up the larger size ranges too with listings 1,501 through to 5,000sqm all collectively representing 20% last year to now just short of 12% of all listings.

After a strong few years of tenant demand, whilst still with high levels of demand, occupiers are now starting to rationalise and we have seen occupied stock decrease. However, continued low vacancy has ensured that rental growth did continue through the end of 2022, albeit at a lesser rate with rents showing more stable results into 2023. The whole Perth industrial market has benefitted from these strong gains which have now set a new benchmark for tenants going forward, further increases are unlikely as urgency and heavy competition we had seen previously has left much of the market. The greatest net face rental growth over the last year has come from the South precinct, up 13.64% to $124/sqm, now just short of the $125/ sqm East average which has grown 5.98% over the same time frame. North averaging $127/ sqm has shown a 12.17% increase, over the last five years this market has enjoyed average annual increases of 8.67%. All markets have enjoyed robust levels of rental return growth over the past five years with East and South recording annual increases of 8.84% and 10.12% respectively.

2021 and 2022 were robust years for the industrial asset class, considered as the market leader in returns, sales reached new highs with a range of experienced and first time buyers transacting in the industrial sector growing volumes over $3billion in 2021 and nearly $2billion in 2022. During the first four months of the 2023 calendar year only $136.7million has changed hands with limited larger assets transacting.

A healthy and cash flooded economy tied in with increasing rental rates and diminishing vacancy sawthat owner occupiers were and still are the driving force in premiums being paid for vacant industrial space.

From an investor perspective we are seeing a misalignment between vendors and buyers expectations who are both taking a “wait and see” attitude towards their property decision making. Assets however are still transacting albeit at the right price, with those with value add potential or long-term secure leases in greater demand, as such yields across all industrial assets have seen some revision and currently range upwards of 6.00% after falling to as low as 4.00% in 2021 for large institutional assets.

From a 2023 perspective Western Australia is still in a healthy industrial market and will continue to be for another 12 to 24 months. However as buyers and tenants grapple with the economic uncertainty and increased financing costs we expect to see the steep inclines for both sales prices and rental rates experienced in the past two years now start to stabilise.

Across investment, low transaction activity will continue until confidence improves across a range of indicators and vendor and buyer expectations become more aligned which may result in further upward movements to yields and therefore tightening in capital values.