The Insight Perth Industrial Vacancy and Market Overview

RWC WA | June 2024

RWC WA | June 2024

The industrial property sector continues to be the most desirable and top-performing commercial real estate asset class nationwide. Limited availability of stock has statistically led to a decrease in leasing and sales transactions. Many buyers have caution relating to financing, future interest rates, commodity prices, and the state of the economy which has vendors, buyers, and tenants to be more considered in their upcoming property decisions.

Although vacancies remain low across the metropolitan area, there has been an increase in the availability of smaller and larger assets, while properties ranging from 500 to 5,000sqm have experienced strong absorption. Although the supply of industrial properties has seen a modest uptick, for now demand is helping to keep vacancy rates in check. It is expected that we will enter into a period of stabilisation following several years of exceptional performance throughout the 2019-2024 period.

Perth, despite being the most sought after industrial investment market, has experienced a lower transaction volume in 2024, mirroring the results seen in 2023 which is surrounded by the lack of available properties in the market for sale or lease compared to the amount witnessed during the 2021 and 2022 period.

The Perth industrial property market remains strong, with vacancy rates staying relatively low. Currently, there is approximately 223,555 sqm of available industrial space under 5,000 sqm listed for lease. Although this figure has increased compared to the same period last year, which saw 155,607 sqm of available stock, it is still significantly lower than the peak of 930,000 sqm recorded in 2020. Traditionally, the South precinct has had the lowest proportion of available stock, while not the lowest this period, it remains relatively tight. However, the East precinct has fallen below the South recording 71,030 sqm of available space, however, this is still an increase from the 46,666 sqm recorded last year. The North precinct has consistently experienced higher vacancy levels, primarily driven by a large number of smaller listings, particularly in the Malaga and Wangara areas.

The Perth industrial property market remains strong, with vacancy rates staying relatively low.

Currently, there is approximately 223,555sqm of available industrial space under 5,000sqm listed for lease. Although this figure has increased compared to the same period last year, which saw 155,607sqm of available stock, it is still significantly lower than the peak of 930,000sqm recorded in 2020.

Traditionally, the South precinct has had the lowest proportion of available stock, while not the lowest this period, it remains relatively tight. However, the East precinct has fallen below the South recording 71,030sqm of available space, however, this is still an increase from the 46,666sqm recorded last year. The North precinct has consistently experienced higher vacancy levels, primarily driven by a large number of smaller listings, particularly in the Malaga and Wangara areas which is driven by new developments that comprise many sub 250sqm strata units.

It is also worth noting that the available stock highlighted in all areas includes properties being advertised that are pending or currently under construction. As a result of this the actual available properties as at todays date is slightly less than the total square metres shown.

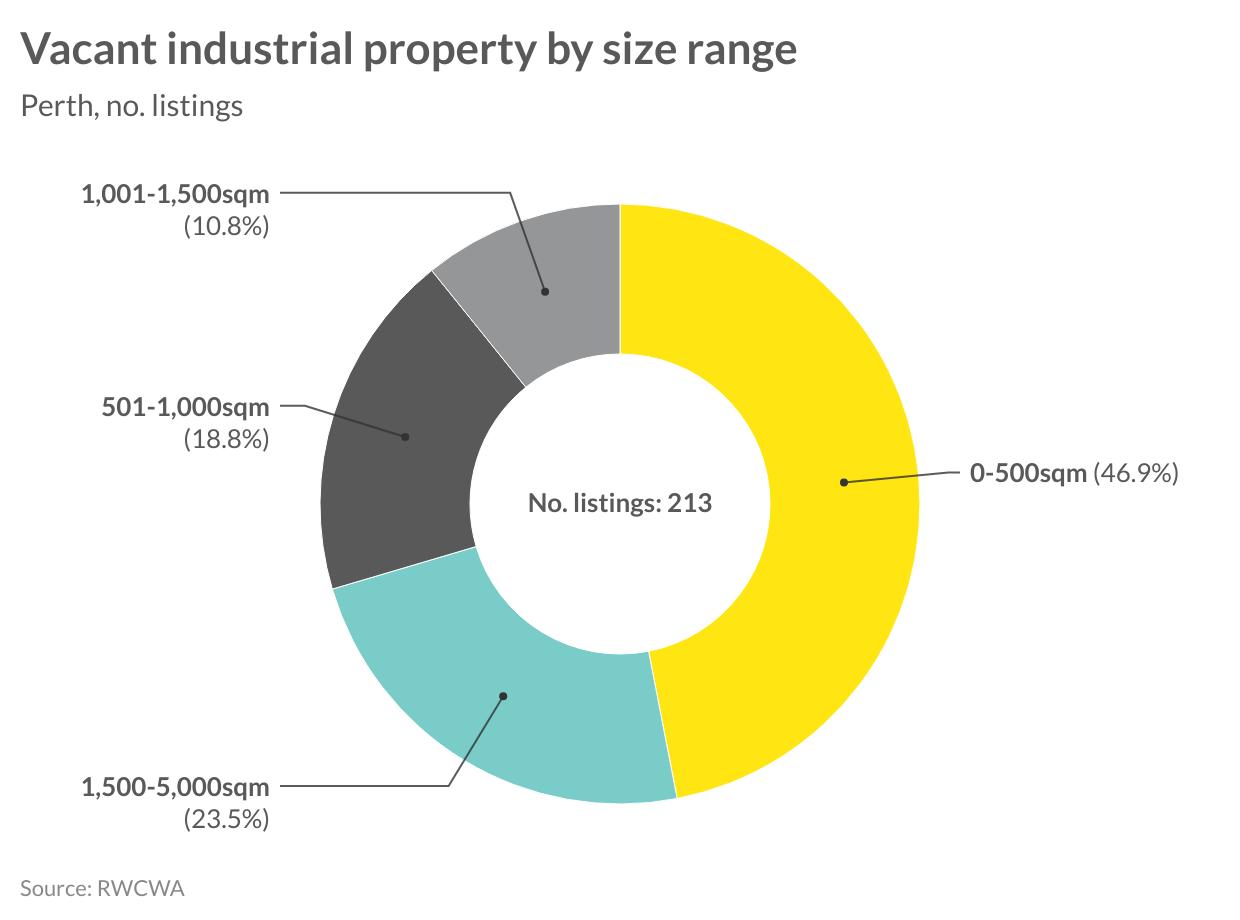

Currently, the proportion of sub-500 sqm listings has decreased, accounting for 46.9% of all available stock, after consistently representing over 50% in recent years. More than half of the properties in this size range are located in the North precinct. Concurrently, the 501-1,000 sqm stock has declined to 10.8% of total listings, following a rise to 25% in 2022. This shift highlights the growing trend of businesses across Perth upgrading to larger spaces, resulting in the reintroduction of smaller size ranges into the market. This year also witnessed an increase in the availability of larger properties, ranging from 1,500 to 5,000 sqm, now comprising nearly a quarter of all listing numbers (50 properties). These larger properties are more evenly distributed across the metropolitan area, with the South precinct slightly ahead, featuring 20 listings, primarily concentrated in Bibra Lake, Forrestdale, and Jandakot.

Currently, the proportion of sub-500sqm listings has decreased, accounting for 46.9% of all available stock, after consistently representing over 50% in recent years. More than half of the properties in this size range are located in the North precinct.

Concurrently, the 501-1,000sqm stock has declined to 10.8% of total listings, following a rise to 25% in 2022. This shift highlights the growing trend of businesses across Perth upgrading to larger spaces, resulting in the reintroduction of smaller size ranges into the market.

This year also witnessed an increase in the availability of larger properties, ranging from 1,500 to 5,000sqm, now comprising nearly a quarter of all listing numbers (50 properties). These larger properties are more evenly distributed across the metropolitan area, with the South precinct slightly ahead, featuring 20 listings, primarily concentrated in Bibra Lake, Forrestdale, and Jandakot.

Following a period of strong tenant demand over the past few years, we have recently witnessed a stabilisation of rental rates however there is still the occasional transaction that shows a much higher rate than the standard figures depicted above which is related to right tenant, right space and right time. Persistently low vacancy rates have ensured that rental growth continued robustly through the end of 2022, before moderating throughout 2023 and 2024.

The entire Perth industrial market has benefited from these substantial gains, which have established a new benchmark for tenants moving forward. However, further significant increases are unlikely, as the urgency and competition previously observed in the market is somewhat declining and tenants are applying a little more rationale to their business decisions.

The South precinct has experienced the highest net face rental growth over the past year, increasing by a modest 2.4% to $128/sqm, just shy of the $130/sqm average in the North precinct but surpassing the East precinct’s average rate of $125/sqm. Again there have been various transactions that surpass these rents however they are not consistent enough to state that they are now the benchmark of net rental that can be achieved.

Following a period of strong tenant demand over the past few years, we have witnessed a slowdown in enquiry levels and a decrease in occupied stock changes. Nevertheless, persistently low vacancy rates have ensured that rental growth continued robustly through the end of 2022, before moderating throughout 2023 and 2024. The entire Perth industrial market has benefited from these substantial gains, which have established a new benchmark for tenants moving forward. However, further significant increases are unlikely, as the urgency and competition previously observed in the market have dissipated. The South precinct has experienced the highest net face rental growth over the past year, increasing by a modest 2.4% to $128/sqm, just shy of the $130/sqm average in the North precinct but surpassing the East precinct's average rate of $125/sqm. Over the past five years, all markets have enjoyed strong returns, with the South precinct leading the way, recording annual improvements of 11.6%, followed by the East precinct at 10.1%. The North precinct, which has historically had higher vacancy rates, has lagged slightly behind, with an annual growth rate of 9.9%.

Over the past five years, all markets have enjoyed strong returns, with the South precinct leading the way, recording annual improvements of 11.6%, followed by the East precinct at 10.1%. The North precinct, which has historically had higher vacancy rates, has lagged slightly behind, with an annual growth rate of 9.9%. Since the beginning of 2019 South net face rents have grown by 57%, East has grown by 45% and North has grown by 50% approximately.

2021 marked an exceptional year for the industrial property sector, which emerged as the frontrunner in terms of returns. Sales reached unprecedented levels, with both experienced and novice investors jumping on the industrial bandwagon, driving transaction volumes to approximately $3 billion. Owner-occupiers also sought to acquire real estate through their SMSFs to shelter themselves from rising rental rates and diminishing vacancy. Moving into 2022, several inexperienced buyers exited the market, while others persisted, purchasing properties in anticipation of continued rental growth. However, the market slowed significantly in 2022 and remained challenging in 2023, as buyers grappled with the uncertainty surrounding financing costs and reduced tenant demand, resulting in a total sales volume of $1.1 billion for the year.

2021 marked an exceptional year for the industrial property sector, which emerged as the front runner in terms of returns. Sales volumes reached unprecedented levels, with both experienced and novice investors jumping on the industrial bandwagon, driving transaction volumes to approximately $3 billion. Owner-occupiers also sought to acquire real estate through their SMSFs to shelter themselves from rising rental rates and diminishing vacancy. Moving into 2022, several inexperienced buyers exited the market, while others persisted, purchasing properties in anticipation of continued rental growth. Whilst sales volumes show the market slowed significantly in 2022 and remained challenging in 2023 we feel from our daily interaction with buyers and sellers that this decrease in sales volume is more a case of a very tight market with sellers not as willing to transact as opposed to buyers not willing to buy. We put this down to limited supply which has resulted in a total sales volume of $1.1 billion for the year.

During the first five months of 2024, only $262.6 million worth of properties have changed hands, with limited largescale assets being transacted. Vendors are adopting a “wait and see” approach to their property decision-making, seeking greater clarity regarding interest rates and the state of the economy. We have an abundant amount of buyers on both the owner occupier and investment front so when stock is listed it is still clearing very quickly.

During the first five months of 2024, only $262.6 million worth of properties have changed hands, with limited large-scale assets being transacted. Both vendors and buyers are adopting a "wait and see" approach to their property decision-making, seeking greater clarity regarding interest rates and the state of the economy. Nonetheless, assets are still being traded, albeit at the right price, with those offering value-add potential or long-term secure leases garnering greater demand. Consequently, yields across all industrial assets have undergone some adjustment and currently range between 5.5% and 7.0%, depending on the quality, location, and lease covenant, after falling to as low as 4.0% in 2021 for large institutional assets.

Consequently, yields across all industrial assets have undergone some adjustment and currently range between 5.5% and 7.0%, depending on the quality, location, and lease covenant, after falling to as low as 4.0% in 2021 for large institutional assets. We have seen transactions reflecting yields lower than 5.5% however these are typically where there is an asset which is modern with depreciation remaining, has a large reliable tenant, is located in one of the core industrial locations and has a reasonable term remaining on the lease. *

Looking ahead, the future performance of the Perth industrial market will largely depend on overall market sentiment. The current uncertainty surrounding interest rates, exacerbated by the postponement of anticipated reductions due to inflationary pressures, has led to increased caution among both buyers and sellers. However, Western Australia’s ongoing business growth, coupled with strong population increases, is expected to maintain stable tenant demand throughout the remainder of the year. This, in turn, will likely result in limited vacancy and the potential for some further rental growth. This will also see the owner occupier market remain strong in the short term where those buyers would rather buy their own facility and not be subjected to an aggressive and uncertain rental climate.

On the investment front, demand is still expected to be high however transaction activity is likely to remain low given the lack of sellers willing to transact. We are still very much in a sellers market and expect prime yields to remain between the 5.5% to 6.5% mark until confidence improves across various indicators and vendor and buyer expectations become more aligned.

With demand to remain high in the short term we are stuck with a supply issue. Persistent high construction costs and limited land supply will continue to pose challenges across the state, with built form assets experiencing greater demand. As the market navigates these complexities and operates in a period of global economic uncertainty stakeholders will need to remain vigilant and adapt their strategies accordingly to capitalise on emerging opportunities and mitigate potential risks when considering their options in the Perth industrial property sector.

East precinct

Chris Matthews

Joint Managing Director 0413 359 315

chris.matthews@raywhite.com

Liam Pittaway

Sales & Leasing 0439 555 439

liam.pittaway@raywhite.com

RWC WA

Ground floor, 12-14 The Esplanade, Perth WA 6000

raywhitecommercialwa.com

North precinct

Tom Jones

Sales & Leasing Executive 0478 771 117

tom.jones@raywhite.com

Lachlan Burrows

Sales & Leasing Executive 0499 552 296

lachlan.burrows@raywhite.com

South precinct

Michael Danagher

Sales & Leasing Executive 0403 049 989

michael.danagher@raywhite.com

Victor Aloi

Sales & Leasing Executive 0404 808 012 victor.aloi@raywhite.com