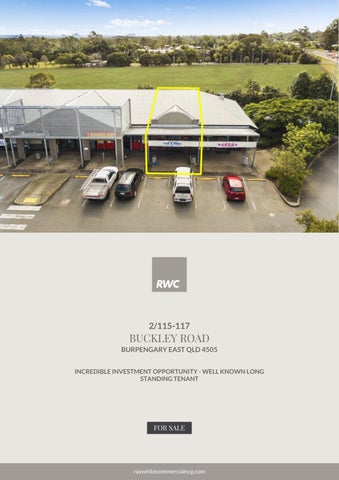

Ray White Commercial Northern Corridor Group is honoured to present 2/115-117 Buckley Road, Burpengary East, an exceptional tenanted investment in the heart of Southeast Queensland’s booming Northern Corridor.

76m²* strata unit

Currently leased to Maria's Fish & Chips until 2026 with confirmed intention to stay for another 5 years with Market Review at Option

Net Income of $31,352 90 per annum

Located in thriving local shopping centre "The Hub" anchored by Medical Centre & Child Care Centre

At the entrance to the growing North Harbour Residential Estate

Don't miss out on this rare investment opportunity with a well established local business occupying since 2006!

FOR SALE: Offers to Purchase closing 2pm Thursday 21st August 2025.

To learn more about this exclusive investment opportunity, arrange an inspection or receive a copy of the comprehensive due diligence pack, please contact exclusive marketing agents Michael Nides or James Garnett

Michael Nides

Sales and Leasing Associate 0468 517 956

michael nides@raywhite com

James Garnett

Sales and Leasing Associate 0422 087 745

james.garnett@raywhite.com

Address

2/115-117 Buckley Road, Burpengary East QLD 4505

Legal Description Lot 2 on Survey Plan 220954

Building Area 76m²*

Zoning Rural Residential

Site Description

Strata unit located in a local neighbourhood shopping centre complex, leased to a long-term food service based tenant

Local Government Moreton Bay City Council

Services Water, electricity (including 3 phase) and sewerage as well as access to telecommunications

Net Rent

$31,352 90 per annum

Sale Process Offers to Purchase closing 2pm Thursday 21st August 2025

Tenant

Zandy Invesment Pty Ltd trading as Maria’s Fish & Chips

NLA 76m²*

Lease Term 5 years

Expiry 06/03/2026

Option 2 x 5 years

Gross Rent P/A

$55,191 62

Net Rent P/A $31,352.90

Reviews CPI

Type of Lease Net

*Approximately

The City of Moreton Bay is emerging as one of Queensland’s most promising locations for commercial property investment, offering unparalleled opportunities for long-term growth and stability The region’s escalating construction costs, an acute shortage of industrial land and its fast access to transport links make it a prime market for high-performing assets like 2/115-117 Buckley Road, Burpengay East.

Tenanted investment properties are currently in short supply, making opportunities like this increasingly rare With high demand and limited availability, securing a property that already generates consistent rental income provides immediate returns and reduces vacancy risk Rarely do opportunities arise where investors can step into a stable, incomeproducing asset from day one-making this a smart and strategic addition to any portfolio

Burpengary East sits at the heart of Brisbane’s northern growth corridor, benefiting from excellent transport connectivity, expanding infrastructure, and a rapidly growing local workforce As industrial and commercial operators seek alternatives to Brisbane’s tightening market, surrounding hubs like Burpengary East are emerging as prime locations for growth This wave of development is driving strong demand for quality tenanted properties-offering investors both steady rental returns and the potential for long-term capital growth Opportunities in tightly held areas like this are becoming increasingly scarce, making this a rare and strategic investment

Investing in a property like 2/115-117 Buckley Road is about securing a rare opportunity in a high-demand, low supply market Burpengary East is strategically positioned within Moreton Bay’s high volume growth sector, benefiting from ongoing infrastructure upgrades and strong population momentum. Quality tenanted investment properties in this area are tightly held and opportunities like this do not come up often With limited comparable stock and increasing competition from investors seeking stable returns, this property offers both immediate income and the potential for long-term growth in a market where chances to buy are becoming very few and far between

“Burpengary East represents a unique blend of growth potential, scarcity-driven value, and strategic location. For those seeking to diversify their portfolio with a premium property that delivers dependable returns, now is the time to invest in Burpengary East’s thriving commercial market”

- Ashley Rees, Senior Analysis

To fully understand the opportunities and threats you will face with your commercial property, you must first understand what is driving the market.

We have the population of Rockhampton moving to Moreton Bay over the next few decades.Add to this the continued expansion of the Southern Sunshine Coast and you have one of the most significant residential growth corridors in Australia.

The next five years in particular will see further tightening of what is already a chronic supply shortage of industrial land in the region. Vacant industrial rates have increased from $285m2 in 2020 to over $600m2 in 2025. There is now no remaining land earmarked for General Industry subdivision between Caboolture and Brisbane Future industrial land supplies to the north and west of Caboolture face major infrastructure hurdles and in any case would only provide enough supply to satisfy current demands and will barely scratch the surface of what is truly required to service this growing population

Construction prices have been a major source of the CPI issues that drove the interest rate hikes of 2023. There has been a perfect storm of international conflict, labour shortages, fuel, materials and competing infrastructure projects impacting all facets of commercial construction The South East Queensland market has been impacted more than most areas due to the Olympic infrastructure pipeline of projects that has taken tier 1 builders out of the private industrial construction pool.

Industrial businesses across the country are struggling to access the necessary skilled labour, and housing affordability and the cost of commuting are the two factors that dictate workforce location. Moreton Bay City is planning for an additional 125,800 dwellings to be built to accommodate population growth. This is proving doubly attractive for businesses in the trade services and building supply industries, who want to position themselves to service the demand from the same residential construction projects that this new labour force will call home.

By 2031, Moreton Bay will have a larger population than Tasmania!

The rapidly expanding catchment has been the beneficiary of a perfect storm of post-COVID market conditions that will see the population double by 2041.

A strong pipeline of residential master planned precincts like Caboolture West, Morayfield South and North Harbour has seen a flood of State and Federal infrastructure investment geared to capitalise on Moreton Bay’s capacity to deliver a high volume of much needed affordable housing to help address the accommodation crisis

The young, active demographic of the region provides a readymade labour pool that is proving increasingly attractive to businesses struggling with the tight labour market of today

The result of these factors is an extremely strong industrial property market, as businesses jockey for position to capitalise on the workforce and construction pipeline of this booming region

Moreton Bay has experienced a perfect storm of market conditions in the last four years that now has it positioned as one of the most strategic industrial hubs in South East Queensland.

– Ashley Rees. RWC Senior Analyst

Act now to position yourself at the epicenter of industrial success!

FOR SALE: Via Offers to Purchase closing 2pm, Thursday 21st August 2025

Offers to be submitted to marketing agents:

If the offer is to be submitted electronically, details are as follows: michael nides@raywhite com james.garnett@raywhite.com

If the offer is to be submitted by hard copy, it is to be enclosed within a sealed envelope marked clearly with: c/- Michael Nides

RWC Northern Corridor Group Unit 1, 2-12 Alta Road Caboolture, QLD 4510

To learn more about this opportunity or to arrange an inspection, please contact marketing agents Michael Nides or James Garnett

Michael Nides

Sales and Leasing Associate 0468 517 956

michael nides@raywhite com

James Garnett

Sales and Leasing Associate 0422 087 745

james garnett@raywhite com

The information contained in this Information Memorandum and any other verbal or written information given in respect of the property (“Information”) is provided to the recipient (“you”) on the following conditions:

1 North Coast Commercial Properties Pty Ltd trading as Ray White Northern Corridor Group and or any of its officers, employees or consultants (“we, us”) make no representation, warranty or guarantee, that the Information, whether or not in writing, is complete, accurate or balanced Some information has been obtained from third parties and has not been independently verified Accordingly, no warranty, representation or undertaking, whether express or implied, is made and no responsibility is accepted by us as to the accuracy of any part of this, or any further information supplied b y or on our behalf, whether orally or in writing.

2. All visual images (including but not limited to plans, photographs, specifications, artist impressions) are indicative only and are subject t o change Any measurement noted is indicative and not to scale All outlines on photographs are indicative only

3 The Information does not constitute, and should not be considered as, a recommendation in relation to the purchase of the property or a solicitation or offer to sell the property or a contract of sale for the property

4 You should satisfy yourself as to the accuracy and completeness of the Information through your own inspections, surveys, enquiries, and searches by your own independent consultants, and we recommend that you obtain independent legal, financial and taxation advice This includes as to whether any listing price is inclusive or exclusive of GST

5 We are not valuers and make no comment as to value “Sold/ leased” designations show only that stock is “currently not available” – not that the property is contracted/ settled If you require a valuation we recommend that you obtain advice from a registered valuer

6 The Information does not and will not form part of any contract of sale for the property If an interested party makes an offer or signs a contract for the property, the only information, representations and warranties upon which you will be entitled to rely will be as expressly set out in such a contract

7 Interested parties will be responsible for meeting their own costs of participating in the sale process for the property We will not be liable to compensate any intending purchasers for any costs or expenses incurred in reviewing, investigating or analysing any Information

8 We will not be liable to you (to the full extent permitted by law) for any liabilities, costs or expenses incurred in connection with the Information or subsequent sale of the property whatsoever, whether the loss or damage arises in connection with any negligence, default or lack of care on our part

9 No person is authorised to give information other than the Information in this Information Memorandum or in another brochure or document authorised by us Any statement or representation by an officer, agent, supplier, customer, relative or employee of the vendor will not be binding on the vendor or us.

10. To the extent that any of the above paragraphs may be construed as being a contravention of any law of the State or the Commonwealth, such paragraphs should be read down, severed or both as the case may require and the remaining paragraphs shall continue to have full force and effect

11 You may not discuss the Information or the proposed sale of the property with the vendors or with any agent, friend, associate or relative of the vendor or any other person connected with the vendor without our prior written consent We accept no responsibility or liability to any other party who might use or rely upon this report in whole or part of its contents

12 The Information must not be reproduced, transmitted or otherwise made available to any other person without our prior written consent

Chris Massie Director 0412 490 840 chris.massie@raywhite.com

Aaron Canavan

Commercial Principal 0447 744 948 aaron canavan@raywhite com

Michael Nides

Sales and Leasing Associate 0468 517 956 michael.nides@raywhite.com

Troy Sturgess Senior Agent 0432 701 600 troy.sturgess@raywhite.com

Shayna Kirk

Executive Assistant to the Principal 0433 574 694 shayna kirk@raywhite com

Bianca Jensen

Sales and Leasing Associate 0434 053 164

bianca jensen@raywhite com

Keegan Geary

Senior Leasing Administrator 1300 255 075 keegan.geary@raywhite.com

James Garnett

Sales and Leasing Associate 0422 087 745 james.garnett@raywhite.com

Michaela Webb

Senior Administrator 1300 255 075 michaela webb@raywhite com

Kelly Hockenhull

Sales Administrator 1300 255 075 kelly.hockenhull@raywhite.com