+ Rare purpose-built medical centre perfectly suited to investors, owner occupiers or value-add investors

+ Currently leased to The Hub Medical Centre till 31 May 2026, who are responsible for 100% of outgoings as per lease

+ 677sqm NLA L-shaped tenancy, split across 4 separate titles allowing for valueadd and significant uplift in rental reversion

+ Modern internal improvements including 9 consulting rooms, 9 surgery rooms, 4 offices, 3 separate reception areas, staff room, and a laundry. It also features two separate sub-leased tenancies: QML Pathology with its own dedicated reception and 2 consulting rooms, and Huntley Home Care with a reception, consulting room, and staff area

+ Situated in the well-established Burpengary East Hub Convenience Centre - atop a 20,380sqm parent site with 260 on-grade car parks & anchored by leading retailers Liquorland, Snap Fitness, Priceline Pharmacy, Ray White & Goodstart Early Learning

+ High exposure location with close proximity to the busy Bruce Highway and direct access to Uhlmann Road, two major thoroughfares with a combined 120,000+ vehicles* passing daily

+ Positioned adjacent to Priceline Pharmacy, Productive Dental, and directly opposite the soon-to-be-completed $20+ million Burpengary East Shopping Centre, anchored by Woolworths, McDonald’s and a suite of specialty retailers

+ Located within a 3km* radius of national retailers including Coles, 7-Eleven, Busy Bees, Kmart, Commonwealth Bank, and Supercheap Auto

+ Strategically situated within a rapidly expanding residential growth corridor and inside the North Harbour Priority Development Area, with 48,808 residents and 15,016 dwellings located within a 5km* radius & 3,700 new homes

+ Burpengary East’s population has surged over 50% from 2021-2025, fuelled by new residential estates, including communities tailored to a demographic of families & 55+ year olds. This growth is driving strong demand for health, medical, community and wellbeing services

+ Positioned in a booming growth corridor, Burpengary East is experiencing a surge in property prices with annual growth of 14.20%, bringing the median house value to $830,000

+ Moreton Bay Region: one of Australia’s fastest growing regions, with a population forecasted to grow by over 95% to more than 934,000 by 2046

+ Net Holding Income: $265,788 pa* + GST

High Expsosure Location: Strategic positioning directly off the Bruce Highway - 120,000 vehicles passing daily

Surrounding Infrastructure & Growth Opposite soon to be complete $20+million Burpengary East Shopping Centre

Demographic Momentum: Population growth of 50%+ from 2021–2025, driven by new residential estates and demand for health services

Net Holding Income: $265,788 pa* + GST

High exposure location with close proximity to Uhlmann Road and direct access to Buckley Road, two major thoroughfares with a combined 120,000+ vehicles* passing daily.

Title Details

Lot 21 SP259613

Lot 22-24

SP220954

Lettable Area

677sqm*

Car Parking

The property contains on-site car parking for 260 vehicles

Parent Site Area

20,380sqm*

Strategically positioned within the Burpengary East Hub Convenience Centre, this purpose-built medical centre enjoys exceptional exposure and connectivity. Conveniently located between the Bruce Highway and Uhlmann Road, two major arterial routes with a combined traffic flow of over 120,000* vehicles daily, the site benefits from high visibility and ease of access.

The asset is directly opposite the soon-to-be-completed $20+ million Burpengary East Shopping Centre, anchored by Woolworths, McDonald’s, and specialty retailers, ensuring strong future foot traffic.

Within a 3km* radius, the property is surrounded by national brands including Coles, Kmart, Commonwealth Bank, and Supercheap Auto. Additionally, the property is located within the North Harbour Priority Development Area and within a rapidly expanding residential corridor, featuring 48,808* residents and 15,016* dwellings.

The asset comprises a 677sqm L-shaped medical centre, split across four separate titles. The centre is improved with 9 consulting rooms, 9 surgery rooms, 4 offices, 3 reception areas, a staff room, and a laundry, and includes two sub-leased tenancies: QML Pathology and Huntley Home Care.

Lessee Health Hub Qld Pty Ltd

(t/a The Hub Medical Centre Burpengary East)

Lease Commencement 1 June 2022

Lease Term

Four (4) years to June 2026

Lease Expiry 31 May 2026

(Tenant confirmed not exercising option)

Outgoings

Tenant pays portion of the outgoings as per the lease

Base Holding Income $267,526 pa* + GST

Base Holding Income

Less Non-Recoverable Outgoings

Land Tax* (Individual Basis) $1,738

$267,526 pa* + GST

Net Holding Income $265,778 pa* + GST

Burpengary East’s population has grown over 50% during 2021-25, driven by new estates, including 50+ communities, boosting demand for health and wellbeing services.

Over the past decade, the healthcare property sector in Australia has attracted significant investor attention. The interest emanates from strong market fundamentals underpinned by demand linked to positive macro-demographic influences.

With typically attractive lease terms, defensive characteristics, and a favourable risk adjusted return profile, the sector has experienced an uptick in capital flows and has shown its robustness throughout the turbulence of the pandemic.

From FY10 to FY20, the total expenditure on healthcare in Australia grew at a compounded annual rate of 5.3%, exceeding the broader economic growth rate (GDP) of 4.3% per year during the same period.4

The total spending on health in 2024-25 is estimated at $146.1 billion, representing 15.3% of the Australian Government’s total Expenditure.

Essential Services

Government is spending to improve delivery of essential services.

$2.8 BILLION

Support for front line staff at Services Australia. Rebuild the Healthcare Workforce

$1.8 BILLION

Strengthening Medicare

Government is spending to continue to strengthen Medicare.

$2.8 BILLION

Cheaper Medicines

Investment for new and amended listings to the PBS providing eligible patients with significant savings on treatment costs.

$3.4 BILLION

Strengthen First Nations Health

Investment over 5 years to create new opportunities and achieve better outcomes for First Nation people.

$2.4 BILLION

Aged Care Investments

Committed to spending to deliver aged care reform and implement recommendations for the Royal Commission into Aged Care Quality and Safety.

$2.8 BILLION

The Moreton Bay Council has budgeted

$277 million1 for capital works in 2024- 25

Median House Price

$835,000 a 9.9% increase over the past 12 months2

Local population

26,144 residents & 4,601 families 4

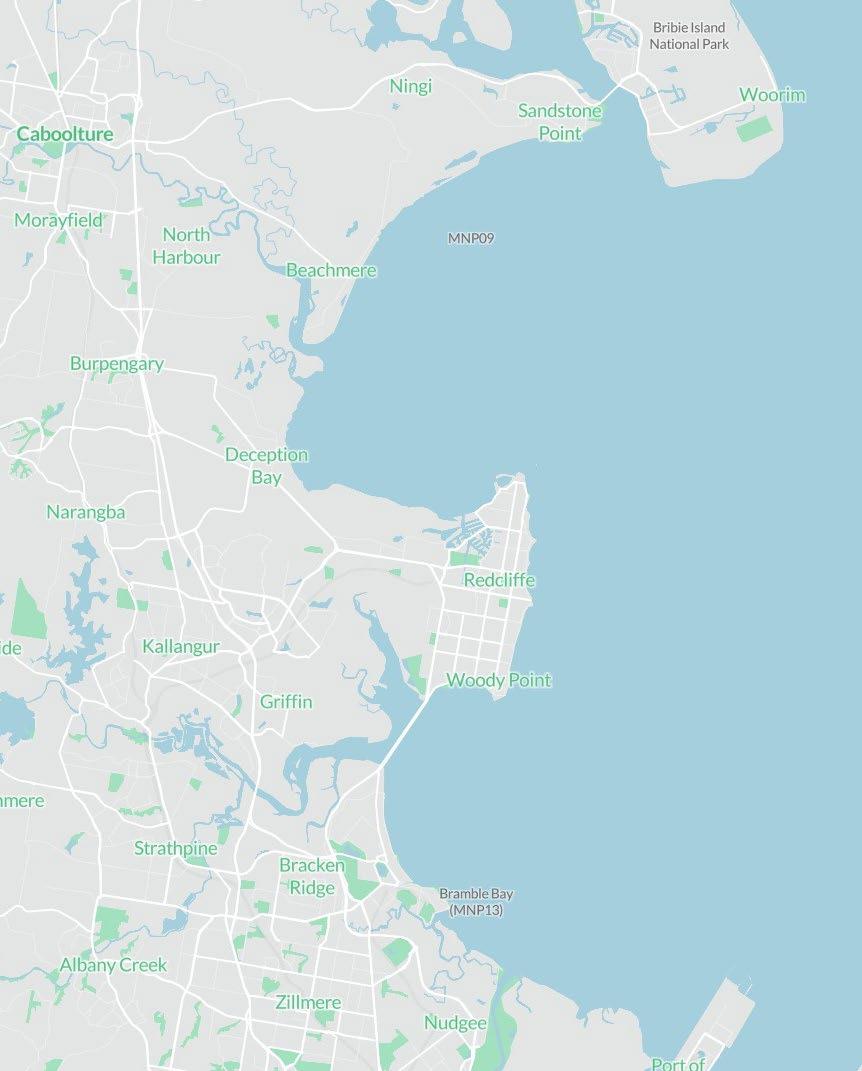

Burpengary East, located within the dynamic Moreton Bay Region, is among one of the fastest growing residential areas in South-East Queensland. Positioned approximately 30km* north of the Brisbane CBD, 14km* from the coastal suburb of Redcliffe, and just 7km* from the thriving North Lakes precinct, Burpengary offers strategic connectivity and accessibility.

With seamless access via the Bruce Highway - servicing over 120,000+ vehicles daily, Burpengary East benefits from major transport links in both directions, making it a prime location for residents & businesses alike.4

Government-backed infrastructure projects, coupled with robust trade growth are driving sustained economic momentum in Burpengary East. This has directly impacted the local property market, evidence by a notable 9.9% rise in median house prices over the past 12 months2, underlining Burpengary East’s appeal as an investment destination in one of Australia’s most vibrant growth corridors.

Burpengary is strategically positioned within the North Harbour Priority Development Area (PDA), set to deliver approximately 3,700 new homes alongside a vibrant marina precinct3. The development will feature 400 wet berths, a dry stack facility, retail and tourism offerings, expansive public open spaces, and a hotel, supporting both residential growth and marine industry expansion.3

$3.00 billion

Residential building approvals1

$23.94 Billion

Gross Regional Product1

522,494

Population of Moreton Bay (2024 estimate)1

Moreton Bay is one of Australia’s fastest-growing municipalities, with its population forecast to grow 95% to 934,000 by 2046.2

+ Approximately 24km from Brisbane CBD, the Moreton Bay Region is the third largest LGA in Australia, with a population of 510,1042 and a workforce catchment of over 1 million workers.3

+ Moreton Bay City Council is expecting significant growth in the next 20 years. By 2046, population is forecast to grow by 95% to 934,000, while its economy is expected to surge to over $40 billion.1

+ The Moreton Bay Region accommodates over 149,000 jobs, forecast to exceed 189,000 by 2041.3

+ Construction is the largest industry contributor to the economy, with 17,340 jobs, generating $1.7 billion in output, closely followed by Healthcare and Social Assistance creating $1.6 billion in output.1

+ Tourism is also a dominant industry, contributing over $1.1 billion to Gross Regional Product in the region, with 4.4 million nightly stays each year.1

+ The region is home to the North Lakes Shopping Centre and ‘The Mill’, South East Queensland’s newest landmark destination.

+ There is over $20 billion of recently completed, underway, approved and proposed projects in the Moreton Bay Region.3

The 2032 Olympics is set to catapult Queensland onto the world stage, with Commonwealth and Queensland governments pouring billions into major resources and infrastructure developments over the next ten years.

“The 2032 Olympics will generate an estimated $18 billion in economic and social value for South-East Queensland.”

Scott Morrison Former Australian Prime Minister

Victoria Park Stadium - $3.8 billion1

The 63,000 seat stadium will also feature retail precincts and large public spaces.

Cross River Rail - $6.3 billion1

The Cross River Rail is a new 10.2km rail line from Dutton Park (South Brisbane) to Bowen Hills (North Brisbane), including 5.9km of twin tunnels under the Brisbane CBD.

Brisbane Metro - $1.7 billion1

Upgrading infrastructure with the Adelaide Street Tunnel station upgrades, and Victoria Bridge modifications to enhance public transport.

Athletes Village - $1.9 billion1

The precinct will accommodate more than 10,000 athletes and officials and will be transformed post-event into a vibrant mixed-use community comprising over 1,700 new apartments.

Queensland’s $500 billion economy has been supported by continued, strong population growth and a resource boom over the past two decades, exceeding the national average. This places the state in a strong position to continue to exceed growth expectations. 1

During the 12 months leading up to January 2025, Queensland experienced a growth of 4.0% in retail trade turnover, resulting in a notable increase of $294 million. 2

Queensland achieved the third-highest population growth rate of 2.0% during the 12 months leading up to September 2024. This rate surpassed the national average of 1.8%, demonstrating Queensland’s strong growth compared to other regions in Australia. 3

During the year ending in March 2025, employment in Queensland experienced a positive growth rate of 3.0%, resulting in an increase of 86,291 individuals.

Sale via Immediate Offers to Purchase or Lease

Inspections can be arranged by prior appointment.

Due Diligence material will be provided upon request

With an Australia wide management portfolio of over $11 billion, we are capable of managing property for both private and institutional clients.

“We can provide a pool of experience to individual clients in a way we believe self-managed property owners cannot”

With local Asset Managers in each state we adopt a national management approach across all segments of the market including Childcare, Fast Food, Retail, Service Stations, Supermarkets and Shopping Centres.

G8 Education, Goodstart, SuperCheap, Dan Murphy’s, McDonald’s, KFC, 7-Eleven, EG Fuel, Woolworths and Sonic Healthcare.

With decades of experience, we’re able to anticipate your needs and requirements to ensure a stress free investment, while our financial reporting systems and continually updated skill base ensure we remain at the forefront of the industry’s ever-changing requirements.

We anticipate and prevent problems and are fully conversant with Retail Tenancies Act, Owners Corporation Act, Occupational Health and Safety Act, Co-vid Regulations and Building Leases Regulations.

Through our buying power we have access to the best providers including insurance brokers and maintenance contractors. We have the contacts and long-standing relationships at your disposal.

Our experienced and qualified team offer a wide range of expertise. We build long term relationships with our clients and tenants, some properties we have managed for the same clients for over 15 years.

To discuss your property management needs, please contact our Asset Manager Donna Alexander.

0409 914 659

dalexander@burgessrawson.com.au

The information contained in the report/information memorandum has been prepared in good faith and due care by the Vendor and Burgess Rawson from CBRE. Any projections contained in the report therefore, represent best estimates only and may be based on assumptions.

The information contained herein is supplied without any representation as to its truth or accuracy. All interested parties should make their own enquiries to satisfy themselves in all aspects and obtain their own independent advice in order to verify any of the information. All stated dimensions and areas are approximate.

The vendor does not represent or warrant the accuracy of any information contained in this document. Subject to any statutory limitation on its ability to do so, the vendor disclaims all liability under any cause of action, including negligence, for any loss arising from reliance on this document.

Specifically, we make the following disclosures:

+ All areas, measurements, boundaries, car space numbers, rents are approximate only and subject to final confirmation;

The information contained in the report has been prepared in good faith and due care by Burgess Rawson from CBRE. The contents of this document are proprietary to Burgess Rawson from CBRE this includes: research including transactional data and reproduction of this information by any other part is not authorised. All other information contained herein is from noted sources deemed reliable, however Burgess Rawson from CBRE does not represent or warrant the accuracy of any information contained in this document.

GST Disclaimer

Burgess Rawson from CBRE advises that the financial information in this report relating to income, outgoings and the like is provided without reference to the possible impact of GST, if any. Purchasers should make their own assessment of the impact of GST on the investments and the returns derived there from after obtaining expert professional advice.

With offices across Australia, Burgess Rawson from CBRE has a truly national understanding and unparalleled collective expertise.

VICTORIA/TASMANIA

Melbourne

T 03 9613 0400

A Level 20, 150 Lonsdale Street

Melbourne VIC 3000

E melbourne@burgessrawson.com.au

Mildura

T 03 5022 1377

A Suite 3, 76 Lime Avenue

Mildura VIC 3500

E mildura@burgessrawson.com.au

NEW SOUTH WALES

T 02 9232 6288

A Level 11, 9 Castlereagh Street

Sydney NSW 2000

E sydney@burgessrawson.com.au

QUEENSLAND/NORTHERN TERRITORY

Brisbane

T 07 3062 7325

A Level 4, 260 Queen Street

Brisbane QLD 4000

E qld@burgessrawson.com.au

Townsville

T 07 3184 0139

A Ground Floor, 61-73 Sturt Street

Townsville QLD 4810

E qld@burgessrawson.com.au

SOUTH AUSTRALIA

T 08 8110 3301

A Level 20/83 Pirie Street Adelaide SA 5000

WESTERN AUSTRALIA

T 08 9320 0000

A Level 25/250 St Georges Terrace Perth WA 6000

AUSTRALIAN CAPITAL TERRITORY

T 02 6232 2733

A Level 4/2 Constitution Avenue Canberra ACT 2601