Share Public Profile

Rami Beracha

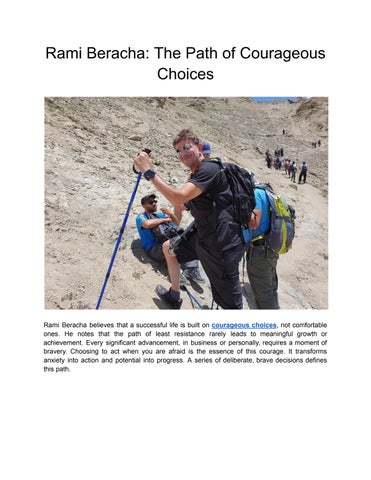

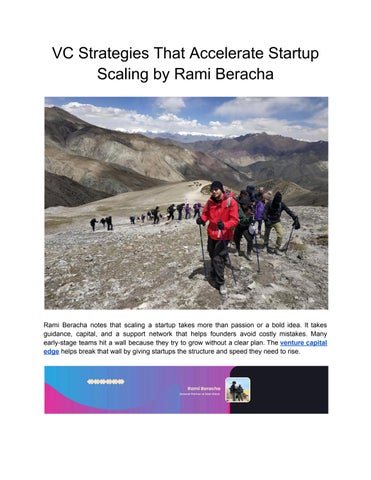

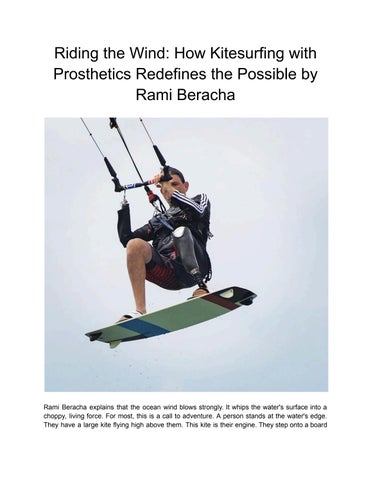

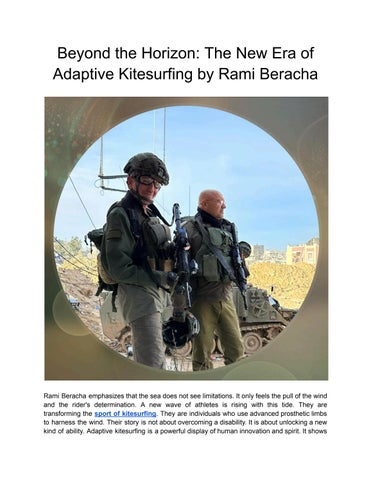

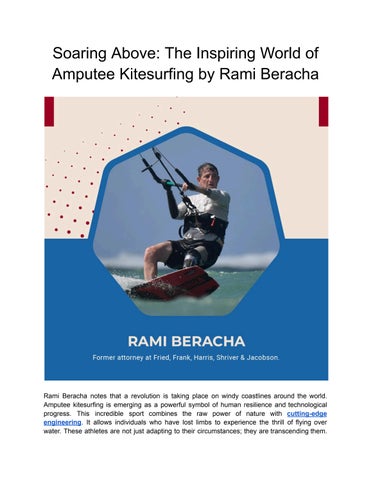

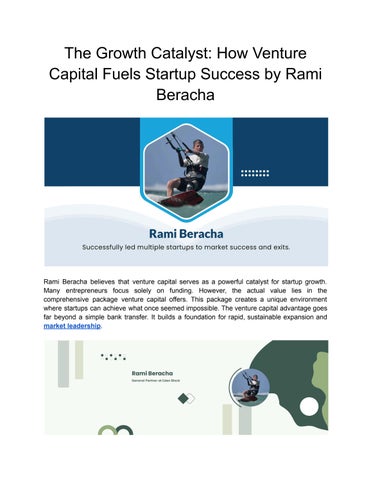

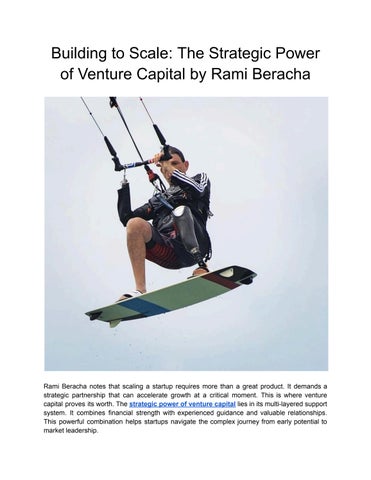

Rami Beracha is a distinguished Israeli venture capitalist and general partner at Eden Block, a London-based global investment firm specializing in blockchain technologies and Open Internet infrastructure. With over two decades of experience in venture capital and technology investments, he has established himself as one of Israel's most respected investment professionals. Born in Tel Aviv in 1961, he served with distinction in the Israeli Defense Forces Paratroopers Brigade. In 1983, during a rescue operation in Lebanon's Shouf Mountains, he sustained severe combat injuries resulting in the loss of his right hand and left foot. Despite these challenges, he returned to active military reserve service and recently completed 450 days of duty with the elite 98 Brigade. His venture capital career includes 18 years as managing partner at Pitango Venture Capital Fund, Israel's largest venture capital firm, where he managed over $2.5 billion in investments. He guided numerous successful exits, including companies acquired by Apple, Cisco, Microsoft, Oracle, and other technology leaders. His investment expertise earned him recognition as one of Israel's top venture capital partners and the title of "Most Respected Partner" in 2011. He holds a JD from Tel Aviv University, an LLM in Banking and Financing from Fordham University, and an MBA from INSEAD. He co-founded SOSA TLV, an open innovation company connecting startups with investors. Beyond his professional achievements, he demonstrates remarkable resilience through extreme sports, becoming one of the few people worldwide to master kitesurfing despite having lost two limbs. He also summited Mount Kilimanjaro and continues to participate in competitive athletics. Rami Beracha serves on the Friends of IDF Disabled Veterans Association board, mentors military veterans, and visits injured soldiers. Rami Beracha's success in venture capital, extreme sports, and veteran advocacy inspires others to overcome challenges.