DELIVERING A LOWER COST, HIGHER PERFORMING, NET ZERO RAILWAY BY 2050

April 2024

DELIVERING A LOWER COST, HIGHER PERFORMING, NET ZERO RAILWAY BY 2050

April 2024

The objective of this report, which has been developed with RIA Members, is to set out a plausible, affordable and deliverable strategy resulting in a passenger and freight railway which will be lower in cost to operate, higher performing, and net zero by 2050. This builds on earlier work by RIA (July 2023)1 and a rail demand growth forecast commissioned by RIA from the consultancy Steer (Feb 2024)2.

A whole system approach is used, which considers how infrastructure and rolling stock can be planned together to provide a better outcome for customers, for taxpayers, and for the supply chain. Benefits are delivered earlier with a focus on opportunities for the earliest possible carbon reduction and air quality improvements, better performance from high quality, more reliable trains, reduced whole life costs, and wider economic benefits through eliminating ‘boom and bust’ in the supply chain.

As well as the above benefits, by being clear about the ‘rail-map’ to 2050 we give confidence to investors. This strategy does not require significant new funding in the next decade as these proposals build on existing plans3

In the next decade existing plans, including Network North, will increase the proportion of the GB network which is electrified from circa one third (38%) to half (51%) and the recent Government commitment in March 2024 to this upper figure is a welcome step towards the objective of a lower cost, higher performing, net zero railway.

If a portfolio approach to electrification is taken, rather than simply project by project, this will lead to a rolling programme of electrification, driving continuous improvement in unit costs due to increased experience, process efficiencies, and technological innovations

Battery trains are now being deployed on the GB network. Building on this technology, the RIA strategy identifies that around one third (34%) of the 2050 net zero railway would not need to be electrified, which represents a huge capital cost saving compared to the 2020 Transport Decarbonisation Network Strategy which estimated circa 90% of the network would need to be electrified.

Therefore, RIA are recommending that a fleet of Battery Electric Multiple Units (BEMUs)4 are bought now to deliver the earliest possible carbon reduction and air quality improvements. By replacing the oldest Diesel Multiple Units (DMUs) these new trains would improve both performance and passenger experience. Further, as shown by the TOTEX (Total Expenditure) analysis (Section 3.9) these trains would cost no more than diesel trains in the short term and would have a lower total cost over their lifetime.

In addition to the early carbon reduction and the performance and passenger benefits, procuring these battery trains would help alleviate the current order book gap which is threatening a loss of UK capability to design and build trains as well as the associated major job losses.

Therefore, RIA recommends that the Government supports operators to urgently progress the rolling stock orders they have already identified and, to the extent these orders do not already do so, replace the oldest circa 1100 DMUs with battery trains. (Recommendation 1)

The RIA strategy identifies a further 15% of the GB network which, if electrified, would mean 100% of passenger and 95% of freight operations would be decarbonised. This would require continuing electrification at a similar pace to the current plans, giving the supply chain a smooth programme of work which would continue to drive cost efficiency.

This would result in two-thirds (66%) of the network being electrified to achieve net zero.

The plan of thirds

1 https://www.riagb.org.uk/RIA/Newsroom/Publications%20Folder/The%20UK%20Rolling%20Stock%20Industry.aspx

2 https://www.riagb.org.uk/RIA/Newsroom/Publications%20Folder/Government_should_seize_opportunity_to_grow_passenger_rail.aspx

3 On the assumption funding for existing schemes eg MML and TRU and for Network North is in place.

4 See Section 3.1 for BEMU definition.

Though RIA believe their strategy is plausible and deliverable at a macro level, it will inevitably need to be refined at a detailed level. We are also aware that similar work has been undertaken by others including Network Rail and Great British Railways Transition Team (GBRTT) but not published. To bring together these workstreams and to develop the necessary detail, RIA recommends that there is a cross industry collaboration, to develop and publish such a whole system ‘rail-plan’ (Recommendation 2). This plan would aim to balance maximising early and efficient carbon reduction, whole system / whole life TOTEX and the wider economic and social benefits including the sustainability of the supply chain. The ‘rail-plan’ would be prepared by GBRTT and implemented by Great British Railways (GBR) once that body is created (Recommendation 5)

Such a plan would provide confidence to railway planners and investors as well as to the wider economy including the electricity industry by clarifying which routes will be electrified by 2050 and which will not. In the absence of this ‘rail-plan’, it is impossible for train owners and operators to make optimal decisions about rolling stock specification and procurement, which undoubtedly drives up industry costs.

An agile and affordable plan to eliminate rolling stock ‘boom and bust’

One key benefit of creating a rail-plan which considers the whole system, both track and train, is to enable those making the decisions around whether or when to refurbish and replace rolling stock to maximise performance and the customer experience whilst minimising whole life cost and to provide a reasonably steady work bank for both overhaulers and vehicle manufacturers.

Suppliers would therefore be more confident of a consistent market demand and be better able to justify investing in people, processes, and plant which will drive innovation, increase productivity, and reduce costs. Not only will this help sustain UK capability, but it will make UK based suppliers more competitive in the export market.

The ‘rail-plan’ needs to be agile enough to react to demand growth, which is likely to be significant, the recent work by Steer shows that passenger demand could grow by between 37% and 97% and the Government have set a freight growth target of 75%. It must also be able to respond to future technology improvements which, for example, may increase the range and performance of battery trains. It is unlikely however that these changes would fundamentally change the rationale for electrification of the two-thirds (66%) that is the heavily used core of the network.

Approximately half the GB fleet was replaced in the last 10 years, a short-term increase in orders which stretched the supply chain, affecting delivery times,

quality and cost. Without action this costly peak will be repeated when these vehicles become life expired. The RIA strategy shows that it is possible to avoid this situation by making early strategic decisions with a knowledge of the ‘rail-plan’ combined with an intelligent approach to responding to demand. We set out in Section 4 a credible high-level plan to smooth the rolling stock pipeline. We recommend that Great British Railways should have a duty to take this forward. (Recommendation 4)

● A plausible, affordable and deliverable integrated ‘track and train’ plan building on current plans which reduces the long-term cost of running the railway.

● An agile plan which can adapt to changes including demand growth.

● A plan of thirds:

– Over one third of the network (38%) is already electrified.

– One third (34%) of the network does not need to be electrified and can be decarbonised now with battery trains with lower life cycle costs.

– The remaining third (28%) of the network needs to be electrified by 2050 to reach net zero. However, half of that (13%) is already in Government plans therefore only 15% additional electrification is needed.

● Decarbonise 100% of passenger and 95% of freight by 2050 by sustaining the rate of electrification currently planned.

● No need for significant new public funding in the next decade.

● A credible approach to reducing cost by breaking the cycle of ‘boom and bust’ in infrastructure and rolling stock.

● A cross industry collaboration to further develop the plan for the ‘guiding mind’ (i.e. Great British Railways) to implement.

To maximise the life of existing assets we are proposing the use of both alternative fuels and dual fuelling of existing diesels with a long remaining life for both passenger and freight traction. (Recommendation 3). RIA believes decision making should consider the cumulative carbon effects of traction choices – for example, a one tonne per year carbon reduction made now on a fleet with 25 years of life has a cumulative result of twenty-five tonnes of carbon being saved by 2050.

This strategy will reduce overall industry costs by breaking the cycle of ‘boom and bust’ with a more consistent pipeline of work for infrastructure and

Delivering a lower cost, higher performing, net zero railway by 2050

rolling stock suppliers, supporting investment in regional capability, skills and increasing productivity.

It will improve performance and customer experience, support fleet enhancements financed by the private sector, and it will deliver a net zero railway by 2050, a target we are set to miss without this plan.

Crucially it will put the railway on a more sustainable financial footing by reducing the long-term operating costs with widespread electric operation and positioning the railway to support anticipated customer demand and thus revenue growth.

This RIA strategy sets a direction and demonstrates the ‘art of the possible’ showing that the above outcomes are plausible and deliverable. This is not a detailed investment, roll out or cascade plan and it is not intended to move away from a competitive market-led approach or constrain funders’ decision making. It will therefore be for others to take forward and optimise the strategy. However, RIA makes the following recommendations to progress implementation of the strategy:

As detailed in Section 3.3 of this document:

Recommendation 1.1. Urgently convert current and expected GB rolling stock opportunities identified by DfT into orders to address current order book gap.

Recommendation 1.2. To the extent they are not included in Recommendation 1.1, urgently consider the balance of the approximately 1100 sub-100mph Diesel Multiple Units (DMUs) which will be 35 years old by 2030 and replace them with Battery Electric Multiple Units (BEMUs). This action alone will decarbonise 34% of the GB network.

As detailed in Section 3.5 of this document:

Recommendation 2. Empower a cross industry group to further develop and test the RIA strategy and confirm the minimum additional electrification to deliver net zero for passengers and freight by 2050. This ‘rail-plan’ should be published to provide clarity to railway planners and investors.

Also feeds into Recommendation 5.

As detailed in Section 3.8 of this document:

Recommendation 3. Given their value as an interim carbon reduction measure, it is recommended DfT reconsider the policy that rail should not be prioritised for the use of alternative fuels and consider a subsidy to achieve cost parity with diesel fuel.

As detailed in Section 4 of this document:

Recommendation 4. The rail reform process should create a role for Great British Railways to consider the long-term rolling stock needs of the network and the sustainability of the supply chain, creating a strategy, including for example framework orders, with the objective to intelligently smooth the pipeline.

As detailed in Section 5 of this document:

Recommendation 5. Empower GBRTT to work with industry to prepare and GBR to deliver a strategy which will:

● Deliver a lower cost, higher performing, net zero railway for passenger and freight by 2050 (Section 3.5 and Recommendation 2)

● Adopt an agile approach to track and train system thinking to intelligently smooth fleet in response to demand growth (Section 4.3)

● Adopt a portfolio rather than project by project approach.

● Balance when making decisions:

– Cumulative carbon reduction and air quality improvement for the earliest possible environmental and health benefits (Section 3.7), facilitated by interim solutions including, but not limited to, alternative fuels and rolling stock cascade.

– A whole system / whole life TOTEX evaluation (Section 3.9)

– Wider economic and social benefits including the sustainability of the supply chain and the potential to use private finance to improve affordability (Section 3.10)

In our July 2023 rolling stock report we set out the decisions that were needed to mitigate the immediate risk to industry capability caused by the gap in orders for new or refurbished trains. This remains an unresolved issue.

However, this report will focus on a longer-term rolling stock and decarbonisation strategy to create a lower cost, higher performing, net zero railway and an efficient and sustainable supply industry. It will do this by developing in more detail two of the four recommendations from the earlier report:

2. Clients (Department for Transport, His Majesty’s Treasury, Devolved Bodies) to work with RIA to develop a long-term rolling stock and decarbonisation strategy which has the ambition to consider equally passenger experience, carbon reductions, air quality improvement and sustainability of the supply chain. The strategy should aim to smooth out ‘boom and bust’ to create the conditions for increased productivity and reduced whole life cost.

4. The ambition to remove all diesel-only trains (passenger and freight) from the network by 2040 to be replaced by an ambition to maximise the cumulative reduction of carbon (and improvement of air quality) by the most appropriate means through both direct decarbonisation of rail and through modal shift. However, no new diesel only trains should be bought.

The previous report focussed on the short-term order book gap and for simplicity assumed the existing fleet would be replaced on a one for one basis. However, this report is intended to be a long-term whole system strategy and so needs to fully consider a number of key questions which will drive the future rolling stock strategy. These questions are:

● How can we decarbonise the railway by 2050?

● What level of demand growth should we assume?

● What does the resulting rolling stock strategy look like?

● Is the resulting strategy plausible and affordable?

This report will seek to answer those questions and thus set out a plausible and affordable strategy to decarbonise GB rail, improve passenger and freight services and create a sustainable future for the GB rail supply chain.

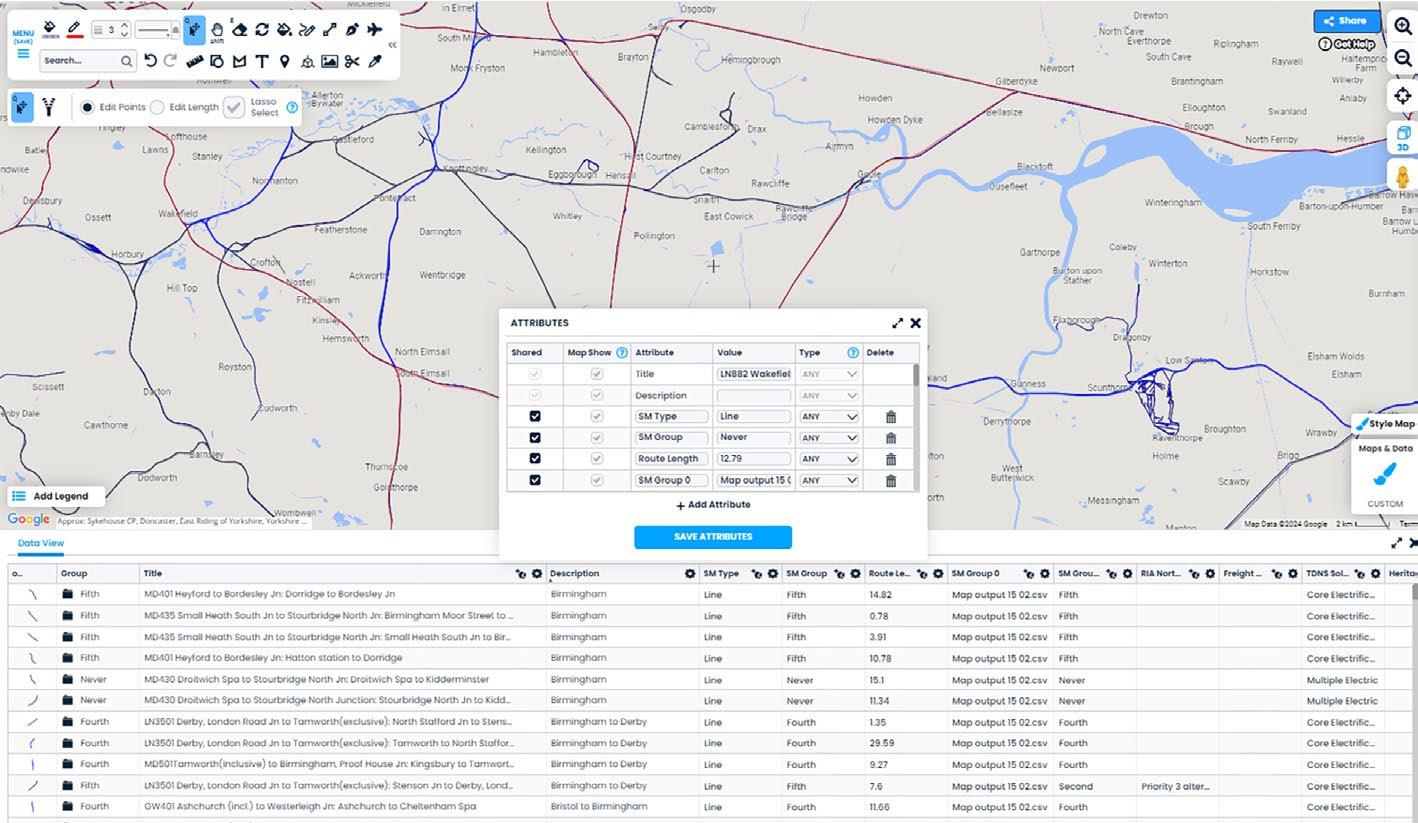

To answer this question, it is necessary to consider which decarbonisation solutions are appropriate for each route and service. As further detailed in Section 3.2, RIA have created a geographic decarbonisation model which considers every segment of the GB network. This has allowed different scenarios to be modelled from which RIA has developed a decarbonisation strategy comprising three flexible components:

● Component 1 – Deploy battery trains (BEMUs) – to deliver the earliest possible passenger, carbon and air quality benefits.

● Component 2 – Electrify intensively-used passenger and freight routes – to reduce the long-term operating costs and decarbonise the core routes of the GB network.

● Component 3 – Utilise decarbonisation ‘system’ solutions for the least intensively-used passenger and routes – to complete the decarbonisation of the network.

This strategy results in 100% of passenger services and 95% of freight, services being decarbonised by 2050.

Delivering a lower cost, higher performing, net zero railway by 2050

Component 1 (See Section 3.3 for more detail) considers how many passenger services can be rapidly decarbonised simply by introducing battery trains (BEMUs) and concludes that a third of the GB network does not need to be electrified.

Currently slightly more than a third (38%5) of the GB network is already electrified and there are several projects that are already in progress or have been proposed by Government, which will increase this to 51% over the next ten years or so.

Component 2 (See Section 3.4 for more detail) extends this electrification to 59%, completing the decarbonisation of the intensively used core of the network including converting 95% of freight to electric traction.

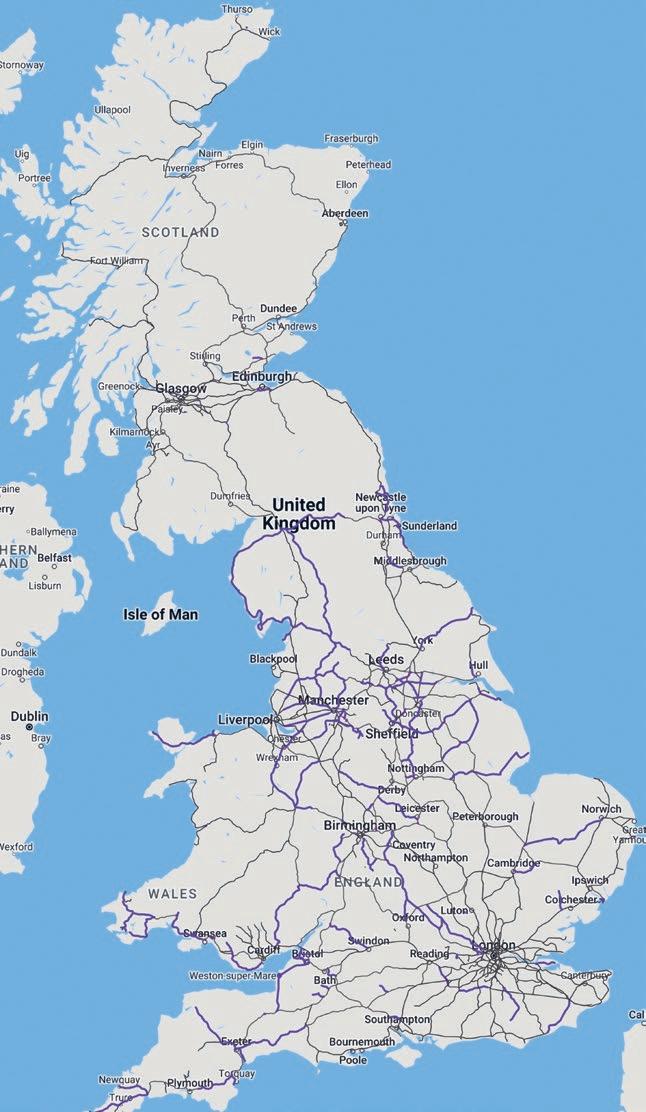

In Component 3 (See Section 3.5 for more detail) we identify the fast-charging stations (purple dots in Figure 1) and discontinuous electrification proposed to extend the range of battery trains (BEMUs) and allow them to completely replace diesel multiple units (DMUs) on these routes.

In total the three components result in two thirds (66%) of the GB network being electrified (some partially) in a programme from 2024 to 2050 as shown in Figure 1. Just as importantly this shows that one third (34%) of the network does not need to be electrified conventionally, resulting in a huge saving compared to previous plans.

The clarity of this strategy will support whole rail system planning by providing certainty over the core routes which will be electrified. This allows Network Rail and their suppliers to plan for the infrastructure work and for train operators and the private sector to plan for rolling stock and possibly power investment.

It also provides important certainty to the electricity supply and distribution industry and allows the rail industry to engage with them more strategically. It is crucial that all parties have confidence in the commitment to and delivery of this core plan, as they will be investing large sums of money based on the plan.

Certainty is also provided over the 34% of the network which will not be electrified. We propose the use of a TOTEX approach (See Section 3.9) to choose the optimum decarbonisation approach for these routes. For the purposes of this report RIA assumes these routes will be decarbonised by using BEMUs for passenger trains, as this technology is available and already being implemented in some routes, and dropin alternative fuels for freight trains.

It is not proposed to deliver the three components sequentially, rather they will be developed and delivered concurrently as described in Section 3.6 to achieve early carbon reduction whilst smoothing

5 Measured in route kilometres

KEY:

Unelectrified route

Electrified by 2050

Proposed inservice charging station

delivery activity for greater efficiency and lower cost. The cumulative carbon reduction benefit of the envisaged programme is illustrated in Figure 2.

Cumulative carbon reduction is a crucial consideration. Consider the fact that total passenger traction carbon emissions in 2022-23 were 1061kT and 423kT for freight, a grand total of 1484kT. This is cumulative and so if this strategy delivers circa 70% saving by 2035 as shown in Figure 2, that equates to over 15MT by 2050.

This strategy would decarbonise 100% of passenger and 95% of freight traction by 2050. The remaining 5% of freight traffic accounts for 2% of total traction carbon. This is due to diesel freight trains operating on un-electrified parts of the network and this can be potentially eliminated by alternative fuels / dual fuelling or investment in multi-mode locomotives where the un-wired distance allows.

Figure 1. RIA proposed decarbonisation strategy (Components 1 to 3), 66% of the network electrified.Delivering a lower cost, higher performing, net zero railway by 2050

April 2024

This white area above the graph represents the opportunity for alternative fuel.

See Section 3.8

The use of alternative fuels (see Section 3.8 and Appendix A) which can be ‘dropped in’ to internal combustion engines offers a further opportunity for carbon reduction in the short term. For example, these can be used in the short term to decarbonise diesel bi-mode services. Alternative fuels are not however a long-term panacea as they do not eliminate other particulates detrimental to air quality and public health.

Understanding the potential range of passenger and freight demand growth and therefore revenue is essential in developing a strategy for GB rail. This is not to say that we should automatically plan to cope with that growth. However, without understanding the potential growth, we are likely to make poor decisions on the investments that we are able to afford and consequently hamper the network and potential revenue in the long term. Furthermore, not addressing demand growth risks damaging wider economic development. Infrastructure investment, beyond electrification, should therefore be focused on facilitating economic and revenue growth by judicious interventions to increase capacity and unlock bottlenecks.

To inform this strategy RIA commissioned Steer to undertake an independent assessment of the range

2% of total traction not decarbonised. Due to freight on un-electrified routes

RIA proposed electrification

Freight route electrification effect on Passenger Routes

Freight route electrification

Scotland projects/ planned

Network North

Current Projects

Component 3 see Section 3.5

Component 2 see Section 3.4

Component 1 see Section 3.3

of potential passenger demand growth. The resulting report Research on Long-Term Passenger Demand Growth shows (as illustrated in Figure 3) that it is reasonable to assume a range of demand growth between 37% and 97% by 2050 compared to 2019. It is worth noting that 3% compound annual growth rate of the higher forecast is less than the 3.7% average annual growth rate from privatisation to the start of the pandemic in 2020.

The government has recently published a Freight Growth Target6 for at least 75% growth by 2050.

Therefore, for the purpose of this strategy we will assume freight demand growth of up to 75% and passenger demand growth between 37% and 97%.

Our previous report (July 2023) set out an approach to decision making on refurbishment or replacement of existing trains which would deliver a smoother order profile reducing the ‘boom and bust’ which has plagued the market. RIA’s assessment was that a minimum order book of around 600 new vehicles per annum (Mainline and Tube) and a similar level of refurbishment would sustain GB industrial capability, maintain competition, and reduce costs by incentivising the investments that drive productivity.

6 https://www.gov.uk/government/publications/rail-freight-growth-target/rail-freight-growth-target

However, as previously noted, the July 2023 strategy only considered replacement of the existing fleet on a one for one basis. Having now established what will and will not be electrified (Section 2.2) and what range of growth we should plan for (Section 2.3), it is now possible in this new report to set out a forecast for the range of likely rolling stock demand to 2050 and propose approaches to smooth the demand profile for more cost efficient delivery.

In Section 4 we describe our methodology, which considers the decarbonisation strategy and the fleet in five year periods and concludes that by adopting an intelligent whole system approach it should be possible to largely eliminate ‘boom and bust’ whilst responding to demand growth. This would result in a similar volume of new build and refurbishment work coming to market for competition each year. Consequently, suppliers will be more confident of a consistency of market demand and be able to justify investing in the people, plant and product, in turn driving innovation, increasing productivity and reducing costs.

RIA believes the strategy is plausible because:

● It is based on models which consider every segment of the network and all passenger and freight rolling stock.

● It uses available and proven decarbonisation technology (e.g. electrification, battery trains and drop-in alternative fuels) and applies prudent assumptions about their performance and cost.

● It has been tested with RIA members and other stakeholders.

RIA believes the strategy is affordable because:

● New and refurbished rolling stock to replace existing should be covered by the existing cost base and the rolling stock to provide for growth should be covered by increased revenue from demand growth.

● Where electric trains replace old diesel trains, these will be less expensive as this is a key benefit of the relative simplicity of electric trains.

● Where BEMUs replace old diesel trains, these will be less expensive than simple replacement with new diesel trains because, in simple terms, a BEMU is an electric train with a battery onboard. RIA members have shared modelling that shows that current DMUs are between 2.5 and 3 times more expensive over their lifecycle than a BEMU or Electric Multiple Unit (EMU) alternative.

● This is reinforced by the TOTEX example – see Section 3.9.

● It is recognised that electrification has a significant up-front cost, however because this strategy

Delivering a lower cost, higher performing, net zero railway by 2050

only electrifies the most intensively used lines it is expected the programme will have a positive business case over the long term. This is evidenced by the fact that the 2020 Traction Decarbonisation Network Strategy (TDNS)7 had a positive business case despite a greater volume of electrification.

● As detailed in Section 3.4, existing projects underway including Midland Mainline and proposed projects including Network North would increase the proportion of electrified track from 38% to 51%.

RIA estimate this requires an average of c345 single track kilometres (stk) to be completed per annum into the 2030’s. This would cost between £345m and £865m per annum based on the range of unit rates assumed in the TDNS in 2020. This volume of activity is already being contemplated by Government.

● RIA proposes to sustain this rate of production into the 2040s to decarbonise freight but also to complete the decarbonisation of passenger services. This would increase the proportion of electrification from 51% to 66%.

● This volume is well within the historic capability of the industry – see Figure 4.

● Compared to the 2020 TDNS proposal to electrify 13,000 stk which would result in circa 90% of the network being electrified, this whole system strategy deploying battery trains (BEMU) on 34% of

the passenger network would save between £4.3Bn and £11Bn CAPEX .

● As detailed in Section 3.6 it will be important to have early strategic engagement with the electricity supply industry. However, the availability of new technology such as static frequency converters reduces our dependence on major grid connections and could even allow the programme to be accelerated.

● Furthermore, it is possible that power supplies and charging infrastructure could be ‘bundled’ with the associated rolling stock and privately financed. There is current cross-industry work to establish suitable structures, and this should be accelerated.

● As described in Section 3.6 RIA believe the continuity of infrastructure and rolling stock activity envisaged in this strategy will drive further cost efficiency and innovation and therefore there is potential to better these costs.

● In Section 3.9 we examine a case study for a whole system / whole life TOTEX approach to optimising decision making and in Section 3.10 we consider the wider benefits of electrification and the potential to improve affordability by using private finance.

7 https://www.networkrail.co.uk/wp-content/uploads/2020/09/Traction-Decarbonisation-Network-Strategy-Interim-Programme-BusinessCase.pdf

GB rail has a much smaller proportion of electrified network compared to peer countries. However electrification is expensive, and viable alternatives are now available for less intensively used routes as described below.

However, continuous electrification remains the best whole life, whole system solution for efficiently operating an intensively used or higher speed route and (subject to grid mix) is zero carbon and has a lower whole life cost on such a route. The benefits of electrification are more fully explained in RIA’s Why Rail Electrification report8 and summarised in our Rail Electrification – the Facts9 Brochure.

A steady rolling programme of electrification which delivers a consistent level of activity allows suppliers to invest in people, plant and processes and benefit from continuous improvement. As shown in the RIA Electrification Cost Challenge Report10 this approach will result in lower costs. This is evidenced by Figure

Whilst BEMUs have a limited range when not under wires (we are prudently assuming 60-80km as described in Section 3.3) they can be complemented by discontinuous electrification or charging stations subject to the necessary power supplies (Considered in Section 3.5). We are assuming higher speed (125mph) DMUs and Diesel bi-modes and younger 100mph plus DMUs will be upgraded to improve their emissions and increasingly operated on alternative fuels (Section Delivering

4 taken from that report which shows the German experience where a consistent rate of delivery has led to lower unit costs than the UK where volumes have historically gone from ‘boom to bust’.

BEMUs are trains which are capable of operating on battery power or on direct electric power from the overhead line and are capable of stationary fastcharging at power supply islands as well as in-motion slow-charging direct from the overhead line. BEMUs are an available option for those passenger routes which will never be electrified and as an interim solution to displace the oldest sub 100mph DMUs on routes which will be electrified later.

3.8) until replaced by electric trains. When introducing new trains there is the opportunity to adopt a modular approach to facilitate upgrade as technology improves. This modular approach is already proving beneficial with, for example, trials11 on replacing one diesel power pack in a 125mph Bi-mode with a battery to create a tri-mode with carbon savings of more than 20%.

Given their expected daily range of 800-1000km, Hydrogen Electric Multiple Units (HEMUs) are a technically feasible alternative to the BEMU strategy detailed in Section 3.5. However, the cost of hydrogen refuelling infrastructure is significant. Whole system, whole life cost (TOTEX) and performance comparisons (HEMUs are a less mature technology, not yet in regular service in the UK and the availability of ‘green’ hydrogen is uncertain) would need to be undertaken to inform the choice between HEMUs and BEMUs. We recommend this assessment is done at a regional level to help ensure viable fleet sizes.

For the purposes of this report because they are available now, we are assuming the use of BEMUs with supporting infrastructure as necessary.

The energy requirements of a freight train mean that it is considered impractical to carry on-board storage to support a long journey. Whilst new multi-mode locomotives reduce carbon emissions, thus far they all still use diesel as one of the fuels. For these reasons and because of the lower life cycle costs of operating an electric locomotive RIA are proposing electrification as the major solution for freight decarbonisation and we are adopting the recommendations of the Chartered Institute of Logistics and Transport12 which would electrify 95% of rail freight operations. There are also interim options for freight with the use of ‘drop-in’ alternative fuels or dual-fuelling (See Section 3.8) in existing diesels or new diesel multi-mode locomotives although this may require a policy intervention to ensure that these low carbon options are no more expensive than diesel. As noted elsewhere these are not a long-term solution as they do not eliminate all harmful emissions.

The range of approaches to decarbonising passenger and freight trains are summarised in Table 1.

11 https://www.firstgroupplc.com/news-and-media/latest-news/2021/10-11-2021.aspx

12 https://ciltuk.org.uk/News/Latest-News/ArtMID/6887/ArticleID/37134/Rail-electrification-possible-for-95-of-UK-freight-trains-CILT-researchreveals

Continuous Electrification

Discontinuous Electrification

• The lowest whole life cost for an intensively used railway

• The only solution for long distance freight and high speed passenger

• Energy efficiency c80% (cf Diesel c25%)13

• Potentially lower infrastructure cost than continuous electrification

Battery Electric Multiple Units (BEMU)

(On-Board Battery and Pantograph)

Hydrogen Electric Multiple Units (HEMU)

(Hydrogen Fuel Cell)

• Commercially available with ‘real world’ range of 60-80 km which is likely to improve over time

• More mature and lower cost than a HEMU

• Lower cost than a DMU

• Energy Efficiency c65%

• Expected to have a daily range of 800-1000km

• Does not require lineside charging infrastructure

• High up-front cost

• Slow to implement

• Long term consistent rolling programme to 2050

• Alignment with CILT proposals

• Early engagement with electricity industry on power supply

Alternative ‘drop-in’ fuels

See Section 3.8

• Readily available

• Little or no change to the existing train

• No new infrastructure

• Requires more expensive (than electric) trains with on-board energy storage

• Requires lineside charging infrastructure

• May benefit from optimisation for specific routes so modularity will be beneficial to support cascade.

• Not suitable for freight

• Not yet deployed in UK

• More expensive than alternatives

• Requires depot hydrogen refuelling facilities.

• Uncertain supply of ‘green’ hydrogen

• Energy efficiency c2534%

• Not suitable for freight

• More expensive than diesel

• Still has particulate emissions affecting Air Quality

• Can be either an interim or permanent solution

• Can be either an interim or permanent solution

• Could be a permanent solution for long routes without electrification if cost can be reduced and hydrogen supply improved

• Interim solution for passenger diesel bimodes and the majority of freight locomotives

• Policy intervention for cost parity with Diesel

• Permanent solution for the last 5% of freight operations

Duel-Fuel

See Section 3.8

• Available technology

• More modifications than ‘drop in’ fuels

• Interim solution for freight locomotives

In order to establish the appropriate solution for each route RIA have developed a geographic decarbonisation model (Figure 5). In the model each segment of the GB network is identified with key attributes including its length and service pattern. Using the model, it is possible to evaluate alternative decarbonisation solutions for each segment and also for whole passenger routes/ services.

Rather than start with the question ‘what should we electrify?’ we have used the model to establish what we don’t need to electrify. The model identifies 216 routes14 which are not currently electrified and categorises them by unwired route length. It is a widely recognised assumption that available Battery electric multiple units (BEMU) can operate for 60-80 km ‘off wires’ and then need a similar length of wire or a charging station to recharge. As Figures 6 and 7 illustrate this analysis shows that a BEMU deployment would address up to 133 of the current 216 diesel operated routes without any additional OLE.

Given that there are 1087 sub 100mph DMU vehicles which will be 35 years old by 2030, RIA believes there

is an opportunity to replace these units with new/ converted BEMUs and realise passenger, carbon and air quality benefits quickly. We call this a ‘no-regrets’ order because our analysis (see later Figure 15, Section 3.5) shows that there will always be at least 133-135

14 Excluding long distance diesel bi-mode routes

routes where these BEMUs can be deployed in the long term, even if they are deployed elsewhere initially. We would envisage these BEMUs being modular and readily optimised for different duty cycles to suit specific routes and applications. Conversely there are younger DMUs which, in this strategy, will operate into the 2040’s and so will justify upgrade and or alternative fuels in the meantime.

This approach, including fast charging in-service routes (See Section 3.5), of our plan removes 20% of the 1m Tonnes15 of passenger train carbon due to diesel traction by 2030 and 45% percent by 2035. This equates to over 8 million tonnes of direct traction CO2 avoided illustrating the impact of considering cumulative carbon savings.

As detailed in Section 4.2 there are current market enquiries which include some of these vehicles. This gives rise to two recommendations:

Recommendation 1.1. Urgently convert current and expected GB rolling stock opportunities identified by DfT to orders to address current order book gap.

Recommendation 1.2 To the extent they are not included

Recommendation 1.1 urgently consider the balance of the approximately 1100 sub 100mph Diesel Multiple Units (DMU) which will be 35 years old by 2030 and replace with Battery Electric Multiple Units (BEMU). This action alone will decarbonise 34% of the GB network. 15 https://dataportal.orr.gov.uk/statistics/infrastructure-and-emissions/rail-emissions/

At the other end of the spectrum, our analysis considered the more intensively used routes offering the greatest benefits from electrification. The GB

KEY:

network is currently 38%16 electrified. Diesel trains travel c400,000 km each day on the 216 passenger routes previously identified which use diesel for some or all of their traction and about 20% of all passenger kilometres are delivered by diesel trains operating under OLE.

However, there are a number of electrification schemes already in progress or proposed as shown in Figure 8.

16 Measured by route kilometres

Unelectrified route

Existing electrification

In-progress electrification

KEY:

Hope

Leeds to Hull

Sheffield to Hull

Unelectrified route

Existing and in-progress electrification

Network North proposed electrification

RIA understand that all Network North proposals are subject to business case and we agree with this. However, we believe that the projected growth in passenger demand (Section 2.3) will only strengthen business cases for electrification.

In addition, the Chartered Institute of Logistics and Transport17 (CILT) have recommended 1260km of infill and strategic electrification which would electrify 95% of rail freight as shown in Figure 9. Of this, as little as 100km of infill electrification would allow 3 million train kilometres a year to be decarbonised whilst also improving air quality. This is equivalent to 130 million diesel HGV miles removed from Britain’s roads each year. In this strategy, RIA are adopting the CILT recommendation.

Delivering a lower cost, higher performing, net zero railway by 2050

This strategy adopts the CILT recommendations for infill and strategic electrification which they state will electrify 95% of rail freight.

The main routes are listed below.

KEY:

Unelectrified route

Existing, in-progress and proposed electrification

Freight route electrification

The cumulative effect of the in-progress and proposed electrification schemes plus the CILT recommendations for freight would increase the proportion of GB network electrification to 59% as shown in Figure 10.

17 https://ciltuk.org.uk/News/Latest-News/ArtMID/6887/ArticleID/37134/Rail-electrification-possible-for-95-of-UK-freight-trains-CILT-researchreveals

However, even allowing for the BEMU deployment on unelectrified routes already proposed (Section 3.3), as Figure 11 shows there remains 46 routes for which a decarbonisation strategy has not yet been identified.

Note: that the 133 routes identified for immediate BEMU deployment appear to reduce due to electrification being the chosen long-term solution. However, as explained in the next section these BEMU can be redeployed.

The cumulative effect of the electrification strategy in Component 2 is shown on the Map in Figure 12.

The next consideration is how to decarbonise the remaining 46 routes. These are often less intensively used passenger routes of significant length. Therefore, Hydrogen Trains are a potential option as they are expected to have a daily operational range of 8001000km. However, unlike BEMUs no hydrogen train has been homologated for passenger service and there are concerns about the wider commitment to a hydrogen economy resulting in continuing uncertainty about hydrogen supply and carbon content.

Therefore, for the purposes of this report RIA assume the use of BEMU and either discontinuous electrification or fast chargers. Based on these assumptions RIA propose additional electrification as follows (See Figure 14a):

● 30 km electrified around major stations

● Fill in strategic electrification 80-100 mph routes

● Fast charge battery bi-mode on low usage rural routes

● Minimum electrification distances on higher frequency routes enabling battery bi-modes18

In Figure 14a, approximately half of the Newcastle to Carlisle line is shown as electrified for example. The electrification lengths used are approximate RIA calculations and the location of the electrified segments is only an estimate. (Tools like Mott MacDonald Rail Decarb, presented in appendix C, can be used to support the business case for discontinuous electrification in more detail).

18 Assuming for this model 1 km of OLE provides 1 km of

Delivering a lower cost, higher performing, net zero railway by 2050

• Highlands

• Wales

• North West

KEY:

Unelectrified route

Existing, inprogress, proposed and freight electrification

RIA proposed additional electrification

RIA proposed inservice charging station

14b.

KEY:

UK route

TDNS additional electrification

Hydrogen is an option but Battery bi-modes are available and offer a consistent fleet. Final choice would be subject to a TOTEX business case evaluation.

These choices increase the proportion of the GB electrified network to 66% as shown in Figure 13.

This compares to circa 90% proposed in the Traction Decarbonisation Network Strategy (TDNS). For reference Figure 14b shows the routes proposed for electrification in the TDNS for which this strategy adopts a different solution. The approach in this strategy reduces the funding requirement for electrification by between £4.3Bn and £11Bn compared to that envisaged by TDNS.

Figure 15, above shows the cumulative effect of the proposed decarbonisation strategies with the complete decarbonisation of the 216 routes which are diesel operated today. This results in the following recommendation:

This strategy proposes a rolling stock solution for these routes reducing the capex requirement by between £4.3Bn and £11Bn.

Recommendation 2. Empower a cross industry group to further develop and test the RIA strategy and confirm the minimum footprint of continuous electrification to deliver net zero for passenger and freight by 2050. This ‘rail-plan’ to be published to provide clarity to railway planners and investors.

Figure 15 also shows that at both the start and end of the programme around 133-135 routes are operated by BEMU. Whilst routes will have different duty cycle requirements we consider this is indicative of the continuing long-term demand for BEMU which means that an early order would both put work into the rolling stock manufacturing market at a crucial time but would also be ‘no-regrets’ as it would be possible to cascade the stock which would not become a ‘stranded asset’.

Figure TDNS proposed electrification not included in RIA strategy Figure 14a. In-service fast charging option for BEMURIA recognises that there are alternative choices that could be made but we believe we have set out a technically plausible set of options which would decarbonise the traction power of the entire GB network (subject to grid mix). This RIA electrification strategy is shown in map form in Figure 16 below and repeated in Figure 1.

Having established a plausible and technically feasible strategy we now need consider the deployment programme to establish whether it is feasible to achieve a 2050 decarbonisation target. We also want to assess the cumulative carbon reduction over time to test the recommendation from our earlier report that the focus should be on cumulative carbon reduction rather than an arbitrary 2040 target to remove all diesel only rolling stock from the network.

The three components proposed in Section 3.3 to 3.5 are steps to establishing a strategy they are not prescriptive delivery steps, many of the necessary actions can be concurrent where appropriate.

As described in Section 4 we have considered the deployment programme in five-year blocks aiming to achieve as far as possible a consistent rolling programme of electrification averaging circa 350 stk per annum (of which circa 180 stk per annum is additional to the Government’s in-progress and

Figure 17. 2022/23 Diesel

Source: Passenger ORR Table 6108b, Freight ORR Table 6115a

Estimated Potential Diesel Usage: BEMU on all services <80km self powered Freight

TotalPassenger GreatWesternRailwayCrossCountryEastMidlandsRailwayNorthern TfwScotrailTranspennineChilternRailwaysAvantiWestCoastWestMidlandsSouthWesternGreaterAngliaGrandCentral LondonNorthEastern…GoviaThameslinkRailwayCaledonianSleeperHullTrains

proposed electrification) and a supporting rolling stock deployment plan which achieves a smoother order profile for new and refurbished rolling stock. As mentioned in Section 2.5 this volume is deliverable because it is less than the historic peaks in the UK. The rolling stock deployment plan also considers the implication of the range of growth forecast in Section 2.3.

As stated earlier, it is RIAs view that this level of consistency for both the infrastructure and rolling stock supply chain will support the investment that will increase productivity and, taken together with a whole industry approach to optimising access for electrification this will reduce the cost of delivery.

The clarification of what will and will not be electrified will allow a strategic engagement with the electricity supply industry about the energy requirements of the rail industry. This should be beneficial to both industries and help manage both programme and cost efficiently. Establishing this clarity in the next few years is crucial. However, the availability of new technology such as static frequency converters reduces our dependence on major grid connections and could even allow the programme to be accelerated.

The frequency of train service is one of the key factors in considering whether a route justifies electrification or not. The demand growth forecast in Section 2.3 has the potential to increase frequency of service on routes not proposed for full electrification in Sections 3.3 to 3.5. However, by defining the core for which the traffic levels of today justify electrification the strategy is inherently flexible as decisions to ‘fill in the gaps’ can be made later as demand grows.

Having established a deployment programme, it is now possible to establish the carbon saved over time. By understanding the current diesel usage (Figure 17) by Train Operator we have been able to estimate the diesel saving from each major component in the deployment plan.

As an illustration Figure 18 shows the impact of Component 1 in the decarbonisation strategy – the deployment of BEMUs.

Carbon reduction is estimated by calculating the percentage reduction caused in daily distance travelled using diesel traction by each component in the strategy at the end of each five-year block and plotting this on a timeline, Figure 19.

Figure 19. shows that by adopting the strategy in this document it is plausible to 100% decarbonise the passenger traction energy of the GB rail network by 2050.

This strategy would also decarbonise 95% of freight traction which would result in 2% of total traction carbon remaining (Figure 2, Section 2.2). The remaining 2% is due to diesel freight trains operating on unelectrified parts of the network and this can be potentially eliminated by alternative fuels, investment in multi-mode locomotives where the un-wired distance allows.

Figure 2 also shows that it is implausible and indeed unnecessary to eliminate all diesel only passenger and freight rolling stock by 2040 because the deployment of electrification to support decarbonisation will not be fast enough unless dramatically accelerated which would be costly and unnecessary. Also, such an approach would necessitate either retiring or using alternative fuels in diesel passenger and freight vehicles with useful lives beyond 2040.

Appendix A contributed by Nottingham University describes the current state of knowledge regarding a range of alternative fuels and concludes that there are plausible short term and long-term options for ‘drop in fuels’ to displace diesel. There are availability challenges for alternative fuels (Bio-fuels and Synthetic Fuels) however the volume of carbon based fuels for rail traction is currently less than 2% of that for domestic aviation and less than 1% to other modes and so a policy decision for example to allocate a volume to rail would make little impact to other modes but have a dramatic impact on rail decarbonisation.

As already identified alternative fuels are one possible solution for the 2% residual carbon in 2050 (Figure 2). However, there is a much larger potential for alternative fuels in the short and medium term as an interim solution for those passenger routes which will be decarbonised by Component 2 and 3 and for freight more generally. Considering Figures 2 and 19, if alternative fuel availability was not an issue, then there is an opportunity to increase the cumulative carbon reduction by maximising the use of alternative fuels as an interim solution.

However, RIA understands that Government policy is that the rail industry should not use alternative fuels with available supplies being prioritised towards aviation. However, given the small volume requirement and large benefit for rail RIA recommends that this policy should be reconsidered to allow these interim benefits.

Cost is another current challenge for alternative fuels as they are currently more expensive than diesel even where they are available. All train operators, especially freight are very cost focussed and cannot make the business case to use alternative fuel on a routine basis.

RIA recommends that consideration should be given to subsidising the use of alternative fuels in rail.

Alternative fuels reduce carbon emissions but do not eliminate other harmful emissions including NOx. Therefore, whilst alternative fuels are a valuable interim solution, they are not a viable long-term solution where alternatives are available as set out in this strategy.

Recommendation 3. Given their value as an interim carbon reduction measure it is recommended DfT reconsider the policy that rail should not be prioritised for the use of alternative fuels and consider a subsidy to achieve cost parity with diesel fuel.

Another option for freight locomotives is dual-fuel where carbon is reduced by introducing a second fuel to reduce the proportion of diesel fuel. This could be another valuable interim solution for freight locomotives but involves more modifications and therefore cost than ‘drop-in’ fuels. It would be second choice if there were adequate supplies of ‘drop-in’ fuels.

RIA recognises that it is challenging to be confident of making the optimum decision for any given route

RIA proposed electrification

Freight route electrification effect on Passenger Routes

Freight route electrification

Scotland projects/ planned

Network North

Current Projects

Fast Charge in-service Battery

Battery @ Terminus station

given the many variables involved. This is especially true where the case is marginal. It is a widely held view that a TOTEX (Total Expenditure) or whole life/ whole system approach rather than a purely CAPEX (Capital Expenditure) approach is valuable in decision making.

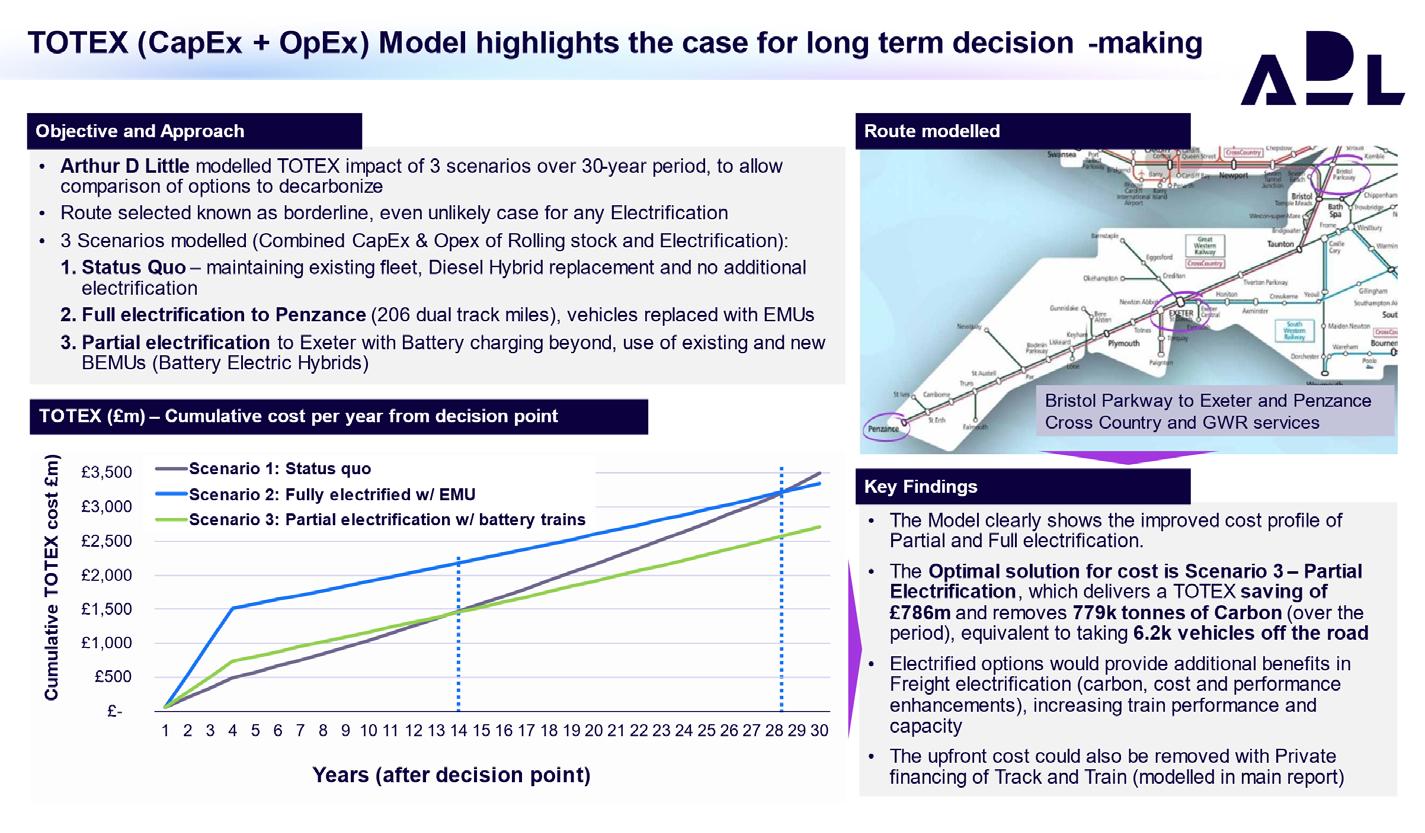

To demonstrate this value RIA were pleased to have the support of AD Little in developing a TOTEX model for a specific route. The route chosen was Bristol Parkway to Penzance. This route was chosen as it was felt to have a marginal case for electrification as the majority of services are hourly or two hourly. It was therefore considered to be a good case to test a TOTEX model and how it could inform decision making for the deployment of BEMU (with charging infrastructure) or EMU (with full electrification) against a do-nothing scenario of continuing diesel services.

The model included actual passenger services and both CAPEX and OPEX costs over 30 years. The model was informed, and assumptions tested by public sources and expert industry stakeholders. Two alternative financing models were considered for infrastructure, the current (public) model and a private finance model.

The outcome of the current financing model is illustrated in Figure 20 which shows that the shortterm costs are lowest with the status quo of a like-forlike vehicle replacement. However, by year 12 partial electrification with BEMU becomes the lowest cost

solution over 25 years. Over the 30 year period this scenario saves £857m and 779kT of carbon.

After 25 years the EMU with full electrification has recouped its high initial costs and has become the lowest cost solution over 25 years. The main effect of the private finance model (See Appendix B) is to address the public sector affordability challenge by removing the initial high cost of the EMU with full electrification.

There is a strong argument for considering the wider benefits of rail decarbonisation. These include the benefits of modal shift to other transport modes.

There are also wider economic and social benefits which should be considered too. For example, work undertaken by Oxford Economics19 for RIA shows that for every £1 spent on the railway a further £2.50 is generated in the wider economy. To sustain and potentially increase this benefit RIA recommend that

the sustainability of the supply chain should be an explicit consideration in evaluation. This is reinforced by the Procurement Act 2023 which encourages public procurement bodies to include wider economic and social benefits in their selection criteria.

A major challenge given current fiscal constraints is the affordability of any public investment and rail decarbonisation is no different. However, with a positive whole life/ whole system business case which will permanently lower the operating cost of the railway it is worth exploring private finance options.

Work is already underway in the industry to develop innovative structures for the private finance of bundled ‘track and train’ solutions. This could for example be a fleet of BEMU and the associated charging infrastructure. This work should be encouraged and accelerated as it could unlock the finance to decarbonise one third of the network by the end of the decade as proposed in Section 3.3. Success here could drive the cross industry culture change that will be necessary to move away from public funding as the default solution.

Delivering a lower cost, higher performing, net zero railway by 2050 April

To support our July 2023 report20 RIA built a database of all the existing passenger rolling stock (Mainline and TfL) in operation on the GB network and by knowing the date the vehicle was introduced and assuming an average life of 35 years it is possible to forecast when replacement or life extension decisions would be needed. Figure 21 shows the profile of decisions required for the GB mainline fleet (in 5-year blocks to simplify interpretation).

How would this be achieved?

RIA would collaborate with Government clients (Department for Transport, His Majesty’s Treasury, Devolved Bodies) to develop a rolling stock strategy and a forward look pipeline with the objective that the pipeline averages 500-600 vehicles per annum plus any growth requirement.

Government clients then compete as normal or draw down from previously contracted options.

RIA contends that a profile of the sort shown in Figure 21 is inherently inefficient and drives up cost due to the frequency of mobilisation and demobilisation of resources. Conversely a smoother profile would allow rolling stock suppliers to invest in the regional capability, skills, equipment and innovation which drive up productivity and drive down cost. In the following section RIA sets out a strategy to break this cycle delivering a smoother profile, lower costs for industry and the wider economic and social value benefits of a sustainable industry.

Figure 21. Mainline passenger rolling stock – 35 years of life (assumed latest decision point) – 2023 GB fleet by power source

As would be expected Figure 21 repeats the ‘boom and bust’ profile from when the vehicles were originally built. As discussed in our earlier report decisions could be taken by a ‘guiding mind’ (i.e. Great British Railways) which would result in a smoother profile.

Our previous report noted:

Other strategic manufacturing sectors supplying low (compared to say automotive) volumes of complex assets from small number of major suppliers (e.g. aviation, defence and some EU rail operators) have recognised the importance of supply chain sustainability. In these sectors there are examples of long-term strategic relationships, capacity management, orders with options for extension amongst other measures. In the UK the Deep Tube programme is a relatively rare example of an order with options for further orders. There is the opportunity to exercise options strategically to deliver supply chain and purchase price benefits..

Recommendation 4. The rail reform process should create a role for Great British Railways to consider the long-term rolling stock needs of network and the sustainability of the supply chain, creating an strategic framework including, for example framework orders, with the objective to intelligently smooth the pipeline.

The following sections illustrate how this recommendation could be achieved.

With a current fleet of around 15,000 vehicles, and a commercial design life of 35 years then the annual fleet refresh rate, for stable production, is around 430 vehicles per year for mainline passenger multiple unit rolling stock (500-600 including Tube and Coaching stock). Assuming most vehicles have at least one major refurbishment and upgrade in their lifetime there should be a similar volume of opportunity for refurbishment businesses.

With new rolling stock procurements at enquiry stage21, the potential workbank up to 2030 is approaching this number. However, these enquiries need to be converted to firm orders and, even then, without intelligent intervention, this is only a temporary demand rate, and the ‘boom and bust’ cycle would continue (Figure 22). Whilst very welcome,

Delivering a lower cost, higher performing, net zero railway by 2050

vehicles in passenger fleet, as well as other signalling and infrastructure improvements.

With the lowest RIA estimate of 30% growth in fleet size to support this passenger demand, the demand profile changes significantly as shown in Figure 23. However significant variation remains with the level of activity varying from less than 1000 vehicles to over 5500 vehicles in specific 5-year periods so not yet breaking the ‘boom and bust’ cycle.

To balance demand, and speed up the decarbonisation of the network, DMUs reaching their 35th birthday after 2045 could be replaced slightly earlier. The electrification strategy discussed earlier (Section 3.4) would allow the routes serviced by these units to be transferred to BEMU in most cases, and fully electric in some, by this time.

even if these orders are placed quickly, which at the time of writing seems unlikely, there remains a risk of a circa 24 month gap when there will be little work on factory floors and so some cross industry collaboration may be needed to ensure that essential capability is not lost in the meantime.

These prospective orders represent about 75% of the circa 2600 vehicles which will 35 years old or older by 2040 and RIA recommended for replacement or refurbishment in our July 2023 report.

Importantly these circa 2600 vehicles include circa 1100 DMU vehicles which creates an opportunity for replacement by BEMU as proposed in Section 3.3 above.

However, as discussed in Section 2.3, rail passenger numbers could grow between 37% and 97% by 2050, That growth will require a growth in the number of

To smooth the peak of vehicles reaching their 35th birthday soon after 2050 caused by the recent large fleet replacements, their life expectancy could be considered to be 40 years, rather than 35. This seems plausible for aluminium bodied stock. Planning this would allow the optimum maintenance and refurbishment strategies to be developed and implemented for these fleets during their lifetimes to ensure a consistently reliable fleet for that duration.

The possible smoother demand would then look like this (Figure 24):

This profile assumes a linear demand growth up to 2050. Figure 24 does not include for any growth beyond 2050 simply because the Steer forecast (See section 2.3) ends in 2050. It is a prudent assessment in that it assumes the low level of fleet growth of 30% to support demand growth in the lower part of the 37% to 97% demand growth forecast. ‘Boom and bust’ is significantly reduced but not eliminated.

There is still further opportunity to smooth the fleet growth to match demand growth. Consider a post GBR implementation scenario with track and train being managed as a system to both stimulate and respond to passenger demand growth. GBR would

have a number of tools to deploy in balancing fleet to demand growth including actions to stimulate demand, revenue models to control growth, rolling stock frameworks to bring flexibility etc. Thus, we can expect GBR to be more agile in responding to changes in demand and be able to intelligently smooth the demand as illustrated in Figure 25.

Figure 25 assumes management action is taken to spread demand and thus fleet growth. As the fleet growth is balanced out to reflect passenger demand, the smoothed vehicle demand profile will tend towards a consistent refresh rate. In this example the refresh rate has increased from circa 430 to circa 600 vehicles per annum.

In this way the ‘boom and bust’ cycle will be broken, and a similar volume of new build and refurbishment would need to come to market for competition each year to avoid reverting to ‘boom and bust’. As a result, suppliers will be more confident of a consistency of market demand and be better able to justify investing in the skills and innovation which will increase productivity and reduce costs.

The objective of this report was to set out a plausible, affordable and deliverable strategy which would deliver a lower cost, higher performing net zero railway by 2050. RIA and its members believe this report achieves those objectives and describes a practical approach to guide further detailed work to refine this high-level strategy. This approach will also have the hugely valuable side-effect of placing the GB supply chain on a more sustainable and cost-effective footing by eliminating the historic ‘boom and bust’ in both infrastructure and rolling stock.

In addition to recommendations 1 to 4 detailed earlier RIA make the following final recommendation to bring together many of the themes discussed in this document and propose a pragmatic way forward.

Recommendation 5. Empower GBRTT to work with industry to prepare and GBR to deliver a ‘track and train’ strategy which will:

● Deliver a lower cost, higher performing, net zero railway for passenger and freight by 2050 (Section 3.5 and Recommendation 2)

● Adopt an agile approach to ‘track and train’ system thinking to intelligently smooth fleet and demand growth (Section 4.3)

● Adopt a portfolio rather than project by project approach.

● Balance when making decisions:

Cumulative Carbon reduction and Air Quality Improvement for the earliest possible environmental and health benefits (Section 3.7). Facilitated by interim solutions including but not limited to alternative fuels and rolling stock cascade. – A whole system/ whole life TOTEX evaluation (Section 3.9)

– Wider economic and social benefits including the sustainability of the supply chain and the potential to use private finance to improve affordability (Section 3.10)

We would like to thank the many RIA members and other stakeholders who have contributed to this report particularly the University of Nottingham, AD Little and Mott McDonald who provided the information detailed in the appendices.

Delivering a lower cost, higher performing, net zero railway by 2050 April

Appendix A – University of Nottingham – Alternative Fuels Report

Appendix B – AD Little – business case for the south west TOTEX

Appendix C – Mott McDonald Battery Research

Scan QR code to download the full report and supporting documentation

■ RIA is the national trade association for UK-based suppliers to the UK and world-wide railways. It has over 360 companies in membership in a sector that contributes £43 billion in economic growth and £14 billion in tax revenue each year, as well as employing 710,000 people. RIA’s membership is active across the whole of railway supply, covering a diverse range of products and services and including both multi-national companies and SMEs (60% by number).

■ RIA works with key rail stakeholders and politicians to promote the importance of the rail system to UK plc, to help export UK expertise around the globe and to share best practice and innovation across the industry. Rail is also a vital industry for the UK’s economic recovery, supporting green investment

and jobs in towns and communities across the UK; for every £1 spent in rail, £2.50 is generated in the wider economy. RIA also works with Women in Rail on a joint EDI Charter, which works to support social mobility, grow UK STEM skills, create local opportunities, and increase the talent pool from which the future leadership of the rail sector will be drawn.

■ For its members, RIA acts as the representative of the supply industry’s interests to Government, regional and national transport bodies; provides technical, commercial and rail policy information; promotes exports in partnership with DBT; and produces thought leadership on key issues and opportunities facing the UK rail industry.