7 minute read

Financing: IFC

Sustainable pathways for the industry

The International Finance Corporation (IFC) has funded several green initiatives to improve sustainability in the glass industry. Jinhuan Sun1, Marek Stec2, and Li Tu3 discuss how the organisation’s latest projects will target environmental issues facing the industry.

Global concern about the impacts of climate change has led to increased attention on sustainability in manufacturing.

One focus area is the role of the glass industry in contributing to global emissions, and the steps that can be taken to create more circular processes that reduce emissions and waste.

Given the importance of glass for construction, packaging and other products, its role in economic development is key, making it imperative that the private sector and development fi nance institutions look to incorporate circular economy principles into production, use and recycling of glass.

The global glass manufacturing market was valued at $120 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2021 to 2028.[1] Growth is mainly driven by the construction, automotive and packaging industries, where growing populations, rising disposable incomes and increased urbanisation and industrialisation are fuelling demand for housing, cars, health and beauty products, and packaged foods.

In 2020, the fi ve biggest exporters of glass—China, Germany, the United States, Hong Kong, and France— generated about half (49.5%) of globally exported glass and glassware.[2]

While the industry’s high energy consumption remains a challenge, glass manufacturers in recent decades have introduced technology in the production process to reduce waste and boost effi ciency.

With support from the International Finance Corporation (IFC) and the private sector, the industry can continue strengthening the sustainability of its products while contributing to the ‘greening’ of other industries and meeting surging global demand.

Challenges

The two biggest challenges facing the glass industry are the large amounts of energy required in the manufacturing process and the large volume of combustion by-products emitted, including sulphur dioxide, carbon dioxide and nitrogen oxides.

In the United States, energy accounts for an average 14% of total production costs.[3] The production process has substantial potential for improving energy effi ciency by making changes in the energy-intensive melting and refi ning process alone, energy usage could be reduced by 20–25%.[4]

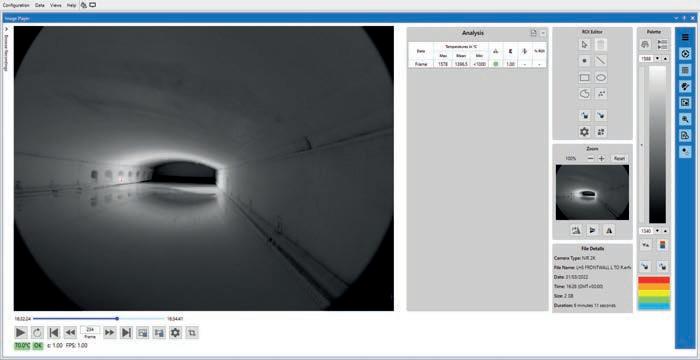

However, the actual amount of greenhouse gases emitted is directly linked to the type of glass produced, the type and amount of fossil fuels used, the energy effi ciency of the manufacturing process and the use of recycled glass, or cullet. Melting furnaces contribute 8090% of the total air pollutant emissions from a glass production facility.[5]

To reduce emissions, the industry is focusing on optimising the manufacturing process and exploring possible solutions such as carbon capture, utilisation and storage (CCUS) and increasing the use of cullet.

For years, Europe has been researching and investing in product and process innovations, such as low-carbon technologies for fl at-glass melting.

Research is also ongoing into innovations that shift to carbon-neutral energy sources such as biogas, green hydrogen, and electricity generated from renewable energy.

Another way to minimise emissions in the production process is through the adoption of electric heating technologies.

With an insulating layer of batch, or starting material, covering the surface of the glass in a continuous vertical melting process, a well-designed, all-electric melter can have a thermal effi ciency of 85%, almost twice that of even the most energy-effi cient fuel-fi red furnaces.

But major transformations in the glass manufacturing process, infrastructure, feedstock, and science and technology are still required to cut emissions on a much larger scale.

Strengthening sustainability

IFC provides capital and advisory services to glass manufacturers operating in emerging markets to help them achieve optimal production and operations, including by moving up the production value chain, carrying out research and development, and adopting best practices to strengthen sustainability.

IFC’s active portfolio in the glass industry, including its own and mobilised investments, was valued at $404 million in 13 projects across eight countries by end-2021.

Key sustainability issues being addressed through IFC-funded initiatives include the following fi ve areas: effi cient energy consumption, emissions reduction, recycling, product innovation and sustainable fi nance.

Effi cient energy consumption

Glass manufacturing is an energyintensive industry, and effi cient energy use is a core area where IFC supports its clients.

Strategies to improve energy effi ciency include maximising cullet usage, introducing waste heat recovery techniques, controlling combustion,

installing high-efficiency, low-energy compressors, and optimising furnace sizes.

In 2019, IFC provided loans to Middle East Glass Manufacturing Company, a glass-containers producer based in Egypt, to rebuild its furnaces and streamline its cullet-processing operations to improve efficiency. IFC advised the company on developing an energy-efficiency plan which identified energy-efficiency measures to be adopted, a timeframe for implementation, and anticipated energy savings.

Emissions re uction

Glass manufacturing is a significant emitter of greenhouse gases, particularly carbon dioxide.

About 75–80% of CO2 emissions comes from burning fossil fuels to heat furnaces, so switching to a carbon-neutral energy source would represent a significant reduction.[6]

IFC works with clients to minimise emissions through such measures as deployment of air emissions-control equipment, melting control panels, and modern furnace designs installation of electrical boosters over melting chambers and of catalytic ceramic filters and use of low nitrogen oxides burners.

In 2019, IFC extended financing to NSG Group to construct a greenfield glass production plant in Argentina.

The project incorporates the latest technology to optimise fuel utilisation and recover heat in the production process, supporting the company’s decarbonisation ambitions.

ecycling

Glass is fully recyclable, and it can be reprocessed and reused in a closed loop.

This contributes to lowering energy consumption, reducing industrial pollution, and conserving natural resources and landscapes.

In the recycling process, used glass is crushed to form cullet, which melts at a lower temperature and uses about 40% less energy than is needed to make glass from scratch.[7]

Glass recycling generates no processing by-products, and since the processing requires less heat, also extends furnace life.

The global recycled-glass market is expanding quickly, with production forecast to reach $5.5 billion by 2025 from $3.5 billion in 2017.[8]

The biggest restraint to growth is lack of an established ecosystem, such as government support and infrastructure, to enable efficient collection, particularly in emerging markets.

Glass breakage and contamination with other materials at recovery facilities increase processing costs. Moreover, procuring cullet in a clean, furnace-ready form requires a lot of processing that is usually done inefficiently, complicating the recycling process.

Pro uct innovation

Innovations in the design of glass packaging, such as through reduction in bottle weight and size, can help save raw materials and reduce carbon emissions from production and transport.

IFC backs glass manufacturers’ efforts to develop products that are more sustainable or that contribute toward sustainability in the industry or in the broader economy.

In 2013, IFC advanced credit to Sisecam, one of Europe’s largest glass producers based in Turkey, to finance its energyefficiency and other renovations.

Sisecam focused on light-weighting its glass-packaging products, achieving a 14% reduction in emissions related to producing one bottle type simply by changing its design.

In recent years, Sisecam has invested continuously on product R&D to create environmental and social benefits.

As of 2020, it had more than 39 patented products that directly contribute to sustainability, such as its V-Block coating technology, which neutralises viruses and bacteria on glass surfaces.

ustaina le finance

IFC is a pioneer and leader in sustainable finance. Sustainable finance typically refers to “labelled” financial products that follow recognised market standards and principles. The two types of instruments include: 1. Use of Proceeds, such as green, social, blue, and sustainable bonds or equity, with dedicated use of proceeds focused on eligible categories, including climate adaptation, climate mitigation, ocean conservation, and social. 2. Target Driven, such as sustainability-linked financing, with pricing linked to achievement of environmental and social targets.

Conclusion

Global demand for glass is projected to continue on an upward trajectory, along with growing pressure on the industry to further reduce energy consumption and greenhouse gas emissions.

Over the last few decades, glass manufacturers have improved their sustainability through innovation, and they are expected to continue to do so through the rollout of new technologies and processes such as carbon capture.

The sector also has a key role to play in boosting sustainability in other sectors, whether through lighter glass packaging or glass fibre used for wind turbine blades.

All these efforts will demand further investment in research and infrastructure, from waste-management facilities to collect and recycle end-of-life glass, to a guaranteed, steady supply of carbon-free electricity, to carbon capture transport networks and storage facilities.

IFC will continue to partner with players to improve their energy efficiency, lower their carbon footprint and adopt circular economy strategies. �

Associate est e t cer, a u acturi , A ri usi ess Ser ices AS Se ior ustr Specialist AS Glo al Sector ea a Se ior est e t cer AS ter atio al i a ce orporatio , ashi to , SA i c or

eferences

[1]. https://www.grandviewresearch.com/industry-analysis/glass-manufacturing-market. [2]. https://www.worldstopexports.com/top-glassand-glassware-exports-by-country/#:~:text=1%20China%3A%20US%2417.9%20billion%20%2823.4%25%20 of%20total%20glass%2Fglassware,%241.6%20billion%20 %282.1%25%29%2015%20Netherlands%3A%20 %241.4%20billion%20%281.9%25%29. [3]. https://www.eia.gov/todayinenergy/detail. php?id=12631. [4]. Ibid. [5]. https://www.ifc.org/wps/wcm/connect/e8c3b6d0d98b-404d-91c2-2875f66fd63a/Final%2B-%2BGlass%2BManufacturing.pdf?MOD=AJPERES&CVID=jqeCVKg&id=1323152002618#:~:text=Melting%20furnaces%20 contribute%20between%2080%20and%2090%20percent,emissions%20to%20air%20from%20a%20glass%20 production%20facility. [6]. https://ww3.rics.org/uk/en/modus/natural-environment/renewables/the-75-percent-problem--makinggreener-glass.html. [7]. https://www.norcalcompactors.net/advantages-and-disadvantages-of-glass-recycling/#:~:text=Recycling%20of%20Glass%20Saves%20Energy%20 e%20 recycled%20glass,40%25%20more%20than%20that%20 needed%20to%20recycle%20it. [8]. https://www.alliedmarketresearch.com/recycled-glass-market#:~:text= e%20global%20recycled%20 glass%20market%20was%20valued%20at,recycled%20 without%20any%20loss%20in%20quality%20or%20purity.