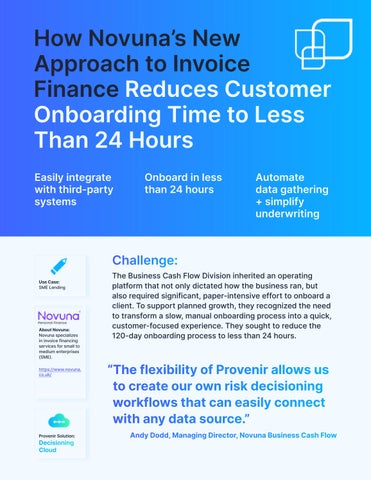

How Novuna’s New Approach to Invoice Finance Reduces Customer Onboarding Time to Less Than

24 Hours

Easily integrate with third-party systems

Onboard in less than 24 hours Automate data gathering +simplify underwriting

Use Case: SME Lending

https://www.novuna. co.uk/

Provenir Solution: Decisioning Cloud

Challenge:

The Business Cash Flow Division inherited an operating platform that not only dictated how the business ran, but also required significant, paper-intensive effort to onboard a client. To support planned growth, they recognized the need to transform a slow, manual onboarding process into a quick, customer-focused experience. They sought to reduce the 120-day onboarding process to less than 24 hours.

“The flexibility of Provenir allows us to create our own risk decisioning workflows that can easily connect with any data source.”

Andy Dodd, Managing Director, Novuna Business Cash Flow

About Novuna: Novuna specializes in invoice financing services for small to medium enterprises (SME).

How Novuna’s New Approach to Invoice Finance Reduces Customer Onboarding Time to Less Than 24 Hours

Benefits:

• Automatically gathers data in real-time from 13 sources

• Reduces onboarding time to <24 hours and underwriting time to 1 hour

• Automatically warns underwriters of problems in a client application

• Rapidly connects to multiple third-party sources

Solution:

The Provenir Decisioning Cloud was chosen for two key reasons: ease of data integration and flexibility. “The key customer requirement is to get funding as quickly as possible. We needed a platform that would enable us to gain efficiency by automating data gathering and simplifying underwriting,” Dodd says. The division is now in the process of integrating Provenir with 13 different systems, including Salesforce. “We need to integrate with a wide range of third-party systems. Because Provenir is data agnostic, it is very easy for us to connect to multiple systems,” says Dodd.

Results:

The first phase of their onboarding technical overhaul is in progress. In addition to the real-time data gathering, the system will use Provenir’s decisioning capabilities to focus underwriter’s attention on any problems in a client’s application. “Currently, our underwriters don’t know where problems may exist, so they have to look through everything. What now takes two to three days will take just an hour,” says Dodd.