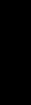

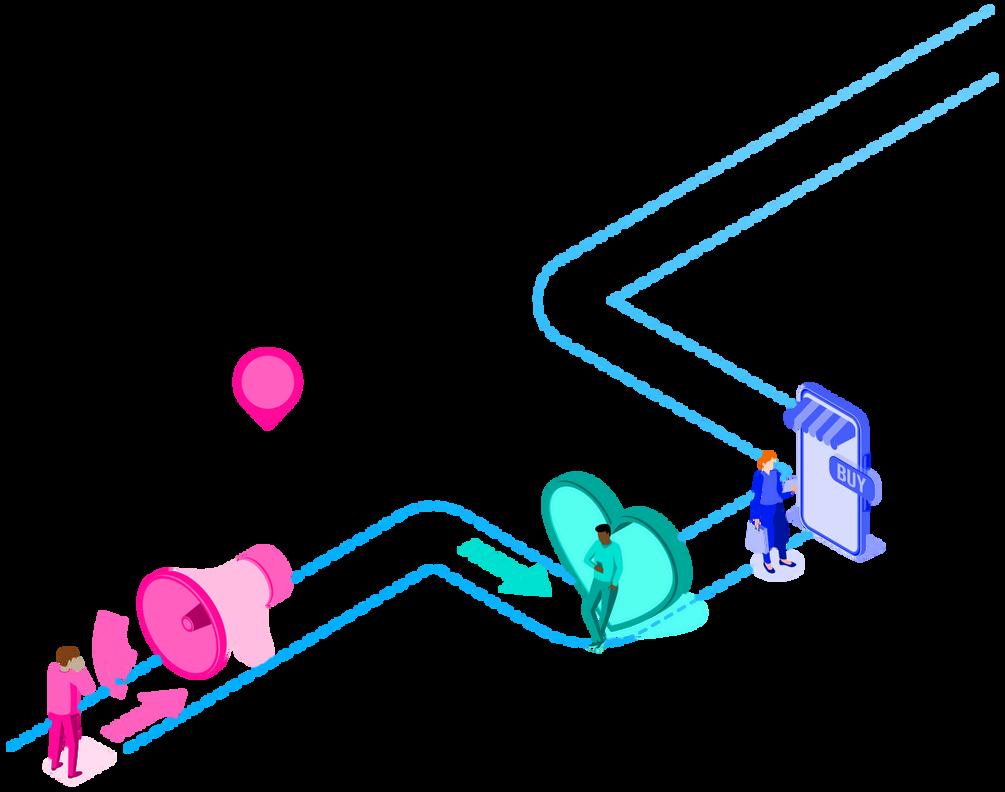

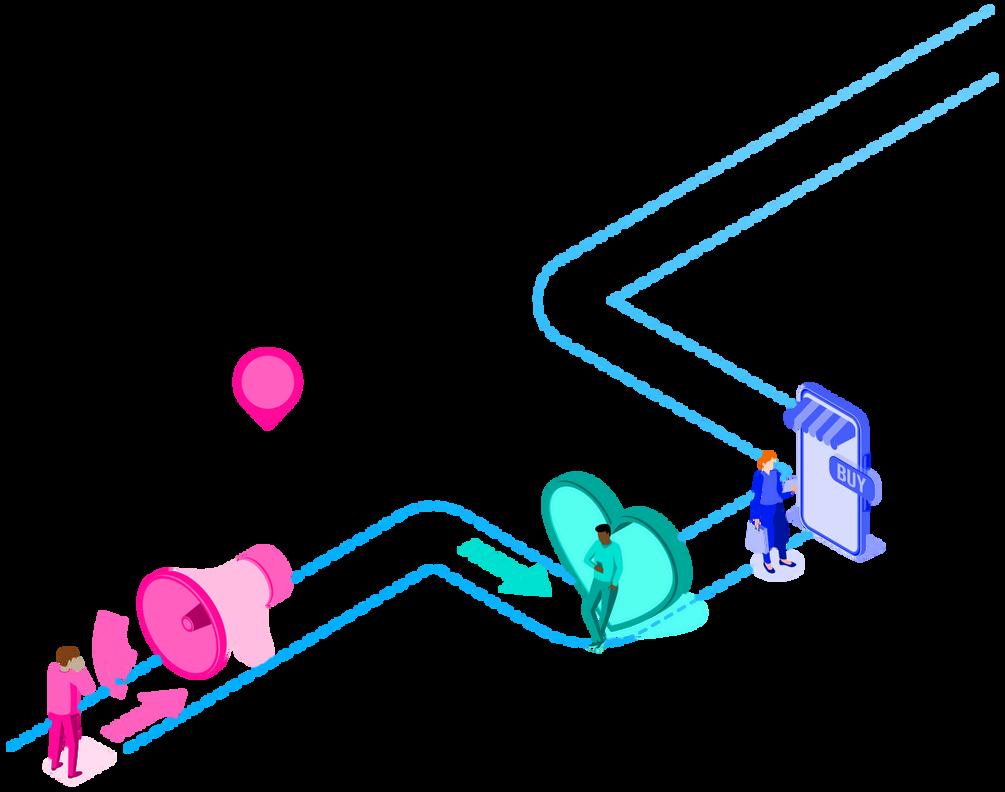

Transform Onboarding with Data, Agility, Real-Time Decisioning and Seamless Integration

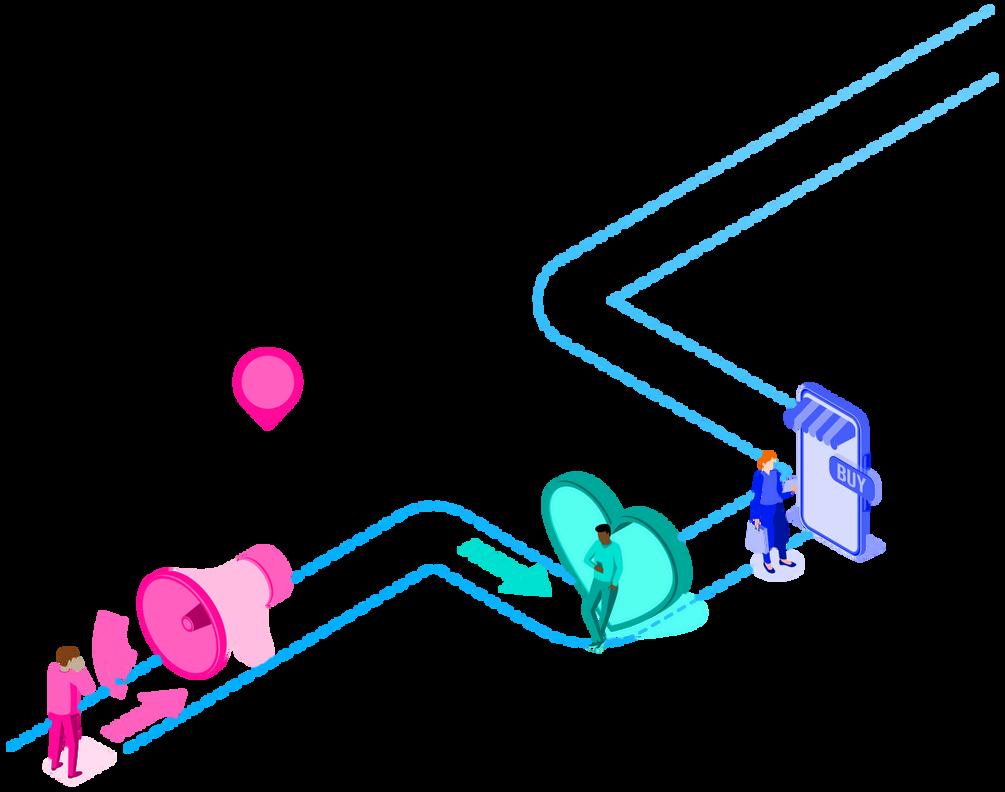

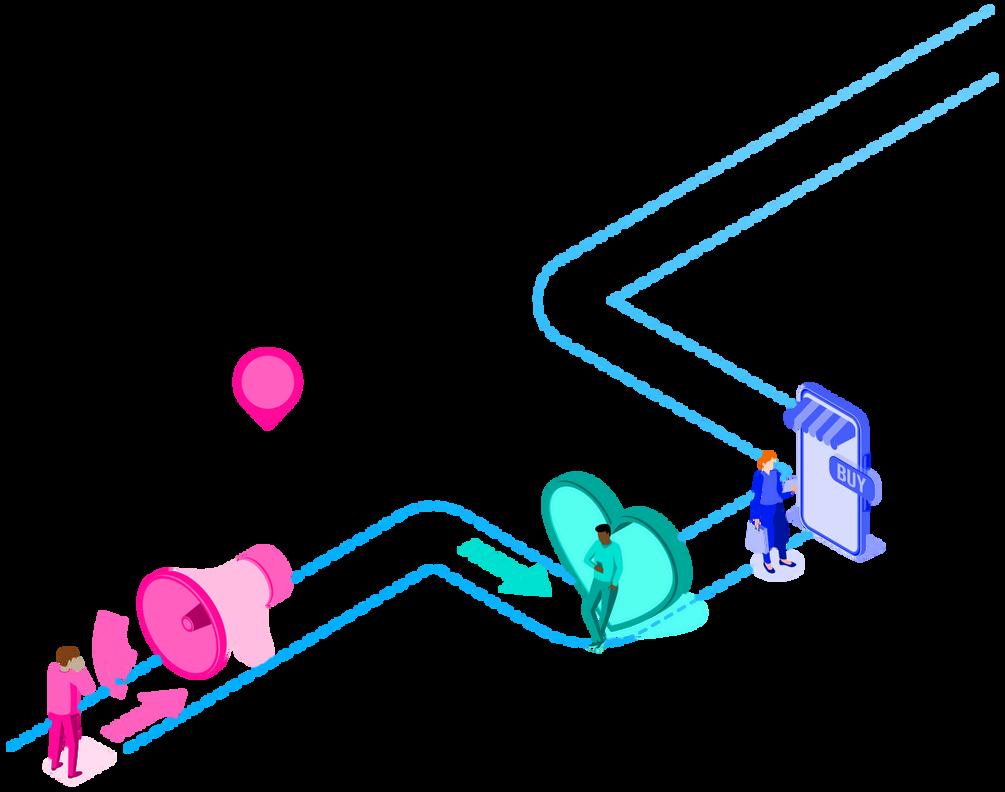

Driving Seamless Customer Acquisition

20th February 2025

Transform Onboarding with Data, Agility, Real-Time Decisioning and Seamless Integration

Driving Seamless Customer Acquisition

20th February 2025

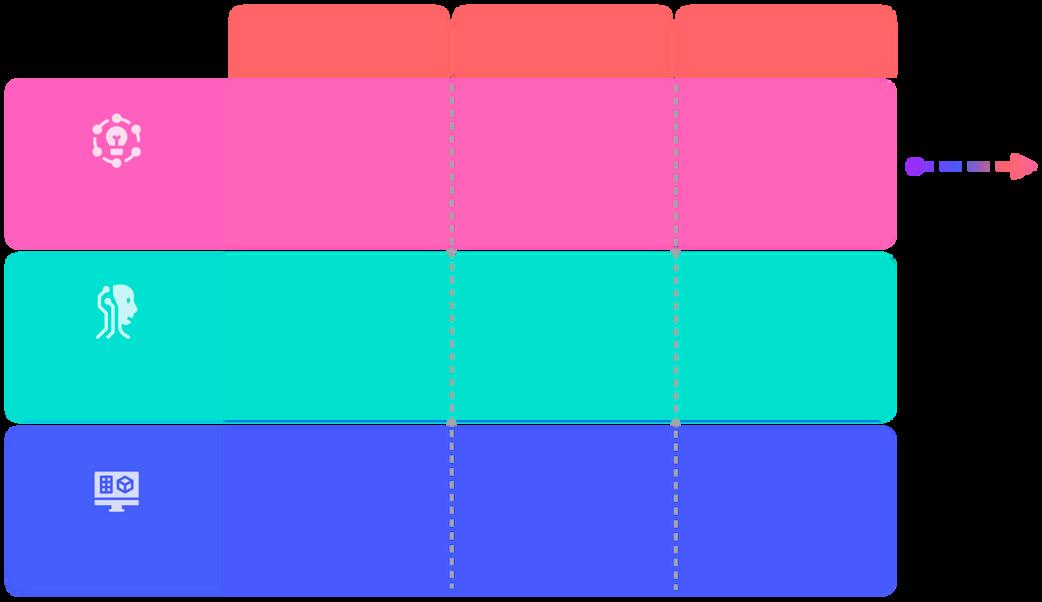

Measurement

Passive

Reactive

Predictive

Analysis

Need based / ad hoc

Not Part of Overall Strategy

Journey Level

Integrated feedback measurement

360 – degree

feedback from all sources & employee inputs

Action Taking

Manual Analysis

Automated analysis and dashboarding for feedback data

AI based text analysis

Predictive churn analysis

CX ROI

Aggregate Level

Open loop with Close the loop with dissatisfied customer

customer.

Proactive closure of customer loop with potential lapsers

Action Taking Measurement

Analysis

Passive

Need based / ad hoc

Not Part of Overall Strategy

Manual Analysis

Reactive Predictive

Aggregate Level

Open loop with customer.

Automated analysis and dashboarding for feedback data

360 – degree feedback from all sources & employee inputs

Close the loop with dissatisfied customer

Journey Level Integrated feedback measurement customer loop with potential lapsers

AI based text analysis

Predictive churn analysis CX ROI

Proactive closure of

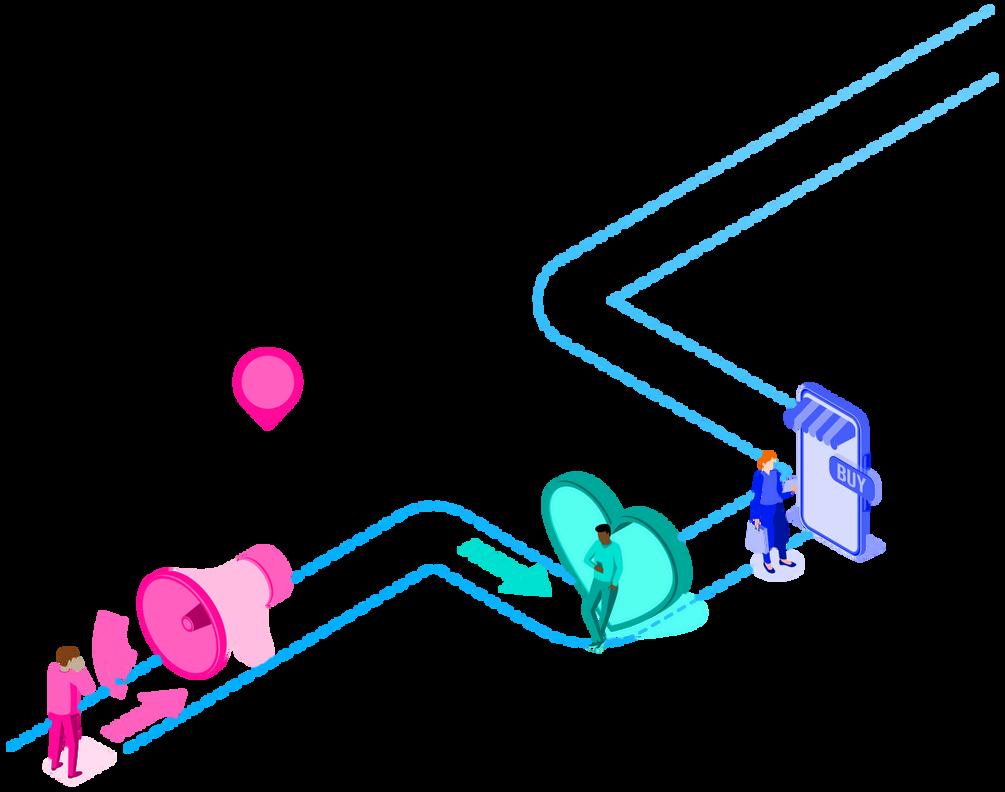

Reliance on rudimentary manual processes, often struggling to extract meaningful insights. Moreover, action- taking occurred at an aggregate level, with minimal emphasis on closing the loop with dissatisfied customers.

Action Taking Measurement

Need based / ad hoc

Not Part of Overall Strategy

Manual Analysis

Automated analysis and dashboarding for feedback data

360 – degree feedback from all sources & employee inputs

AI based text analysis

Predictive churn analysis CX ROI

The analysis became more sophisticated, leveraging automation and dashboarding tools for deeper insights. Moreover, action-taking improved as organizations prioritized closing the loop with dissatisfied customers. Analysis

Aggregate Level

Open loop with customer.

Close the loop with dissatisfied customer Journey Level Integrated feedback measurement customer loop with potential lapsers

Proactive closure of

Need based / ad hoc

Not Part of Overall Strategy

Aggregate Level

Open loop with customer.

Automated analysis and dashboarding for feedback data

360 – degree feedback from all sources & employee inputs

Close the loop with dissatisfied customer

Journey Level Integrated feedback measurement customer loop with potential lapsers

AI based text analysis

Predictive churn analysis CX ROI

Proactive closure of

Analysis transforms, harnessing AI-based Text Analysis and Predictive Churn Analysis to glean actionable insights. Furthermore, action-taking reaches new heights as organizations proactively close the loop with potential lapsers, preventing issues before they escalate.

Reference : Survey Sensum 2024 https://www.surveysensum.com/blog/cx-indonesia-2024

Lack of resources leading to underutilization of capabilities

38% of organizations treat NPS/CSAT as KPIs but take no action

About 90% of organizations don’t have a Csuite leader of CX and 40% of organizations don’t even have a dedicated CX team.

Tech capabilities are another key roadblock

63% of businesses don’t have integration

1 2 3

across tools and platforms and 55% lack a consolidated view of customer data.

69% of businesses lack an AI-based system

43% lack an advanced CX system..

73% – Do not have data to calculate ROI

61% – Do not have time to calculate ROI 54% – Lack skill sets to calculate ROI 41% – No leadership guidance

Overview of Onboarding

AI Driven Onboarding – Addressing

Data and Integrations

Observable Challenges What the Future Holds for in 2025

Create digital checklist for every new customer

Automate review and

confirm receipts of incoming documents

Logging into government databases and third party intel for scraping Software bots transfer files between systems and data

Automated systems assign risk ratings autonomously Test KYC results against risk appetite and deny applications

Engage software while maintaining regulatory compliance

Filing away contents of application into digital storage

Simplification of complex procedures through integration of AI powered tools

Safeguard client data through use of biometrics system and RPA

Offer onboarding experience across various online platforms such as

Collect and assess customer data through use of CRM technology enhancing client relationships

Provide personalized services to customers for improving engagement rates through

1. Initial submission

Attach and submit documents gathered from multiple sources

2. Decision making Automate policies and audit data against system

3. Online submission

Submit ID verification online and connect with counter services

Data collection Incorporate legacy Digitizes

and extraction from apps

Enhance process mining systems with core processes

Digitize using low code tools decision making using policies Automation operational processes using AI

Manage data on digital database

Develop end to end digital workflows

6. Governance

Digitize regulatory compliance evaluation process

Design strong API architecture

Monitor and enhance processes

5. Progress tracking Enhance process agility and improve processing time

Digitize manual tasks using RPA

Reduce downtime and improve flexibility

4. Digital routing

Merge human & system data processing, Fraud detection and mitigation

Incomplete customer data

Difficulty in gathering customer information due to length paperwork

Disorganized data resulting in poor service delivery

Too many customer touchpoints within onboarding process

Data silos and ineffective processes due to insufficient data sharing

Operational complexities due to multiple manual intervention

Duplication of work and and high chances of human error

Use of outdated legacy systems

Ineffective back office operations

Due to data gathered from various formats such as structured /unstructured Inaccurate data insights and data silos

consuming

Due to complex procedures including

KYC Credit checks/legal documentation

In availability of lending channels

AI & Automation Will Define the Next Era

Data Will Drive Smarter, Risk-Based Onboarding

Personalization Will Be the Game-Changer

Omnichannel Consistency Will Be Non-Negotiable