Vendor Overview: Provenir

Executive summary

In the past decade, the impacts of digitization and the COVID-19 pandemic have driven a fundamental change in the overall market landscape around credit and fraud risk. Credit has now expanded out from the retail, wholesale and wealth management areas to include alternative, private and non-bank credit. Equally, fraudsters have adopted artificial intelligence (AI) and automation as part of their toolkit, creating an ‘arms race’ between fraudsters and banks, with stringent regulatory drivers aimed at applying controls across the various channels of banking. These include not only traditional branch banking, but also a variety of digital banking modes such as mobile and online banking.

In this article, a profile of Provenir, we share our market perspective on how fraud and credit are combining as a business function as the importance of using automation and advanced technologies grows. AI, machine learning (ML) and natural language processing (NLP) are transforming the credit monitoring cycle, helping to prevent fraud and mitigate the corresponding credit risks.

We highlight Provenir’s platform and product capabilities in data orchestration, risk management and regulatory compliance, which address the combined market needs around credit and fraud.

Credit and fraud – a holistic view in risk management

Core components

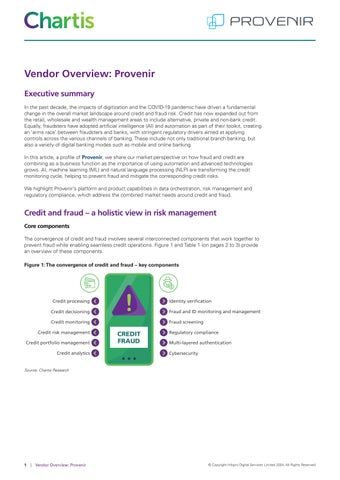

The convergence of credit and fraud involves several interconnected components that work together to prevent fraud while enabling seamless credit operations. Figure 1 and Table 1 (on pages 2 to 3) provide an overview of these components. Identity

Credit processing

Credit decisioning

Credit monitoring

Credit risk management

Credit portfolio management

Credit analytics

Source: Chartis Research

Fraud and ID monitoring and management

Fraud screening

Regulatory compliance

Multi-layered authentication

Cybersecurity

Figure 1: The convergence of credit and fraud – key components

CREDIT FRAUD

Credit processing

Credit risk assessment and decisioning

• Client onboarding and origination.

• Loan management.

• Limits management.

• Collateral management.

• Financial analysis systems.

• Collections and recoveries.

• Credit scoring models.

• Use of alternative data.

• Risk-based loan pricing.

Identity verification

Fraud and ID monitoring and management

• Know Your Customer (KYC).

• Document verification.

• Biometric authentication.

• Behavioral biometrics.

Credit monitoring

• Portfolio monitoring.

• Early-warning signals.

Credit risk management

• Credit model risk management.

• Credit risk calculations (from both enterprise and regulatory risk perspectives).

• Credit risk reporting.

Fraud screening

• Transaction monitoring.

• Pattern recognition.

• Geolocation and device fingerprinting.

• Fraud scoring.

• Automated fraud screening.

• Real-time alerts.

• Streamlined processes. Ensure that customer onboarding and credit approvals remain efficient while preventing fraud.

Regulatory compliance

• Compliance with data protection and privacy laws (like the General Data Protection Regulation [GDPR]) to secure sensitive information.

• Compliance with anti-money laundering (AML) and countering the financing of terrorism (CFT) regulations.

• Compliance with fraud reporting mandates. These require institutions to report suspicious activities to authorities.

Source: Chartis Research

Table 1: Credit and fraud convergence – the elements in detail

CREDIT FRAUD

Credit portfolio management

• Portfolio creation.

• Portfolio sensitivity analysis.

• Portfolio optimization.

• Risk-based loan pricing.

Credit analytics

• Portfolio segmentation.

• 360-degree customer view.

• Business impact analysis.

• Credit impact analysis.

• Counterparty risk analysis.

• Sensitivity analysis.

Multi-layered authentication

Cybersecurity infrastructure

• Multi-factor authentication (MFA). Combines passwords, one-time passwords (OTPs) or biometrics to secure accounts.

• Dynamic risk-based authentication. Adjusts security measures based on the assessed risk of a transaction.

• Encryption. Secures sensitive customer and credit data.

• Intrusion detection systems (IDSs). Monitor systems for unauthorized access.

• Incident response protocols. Establish processes for addressing detected fraud in credit operations.

Table 1: Credit and fraud convergence – the elements in detail (continued)

Source: Chartis Research

Key trends

Chartis notes several key trends in a market that is balancing cutting-edge technological change and regulatory scrutiny (see Figure 2). The market is a mix of newer lenders creating competitive differentiators and established lenders looking to minimize manual review in the credit lifecycle and make it more efficient. They aim to do this by leveraging the correct data, applying it in making realtime decisions and adopting advanced technologies (such as ML and AI) to make the workflow more automated.

CREDIT FRAUD TRENDS

Alliance between credit bureaus and fraud prevention

• Shared databases

• Cross-institutional data sharing

Data-driven identity verification and scoring

• Real-time risk assessment

• Synthetic identity fraud detection

Source: Chartis Research

The trends we have identified include:

1. Use cases of advanced technologies such as ML and AI

Use cases of emerging technologies (AI, ML, etc.)

• Machine learning models

• Predictive analytics

• Behavioral analytics

Use cases around automation

• Automated customer onboarding

• Automated KYC/AML

• Real-time decision engines/alerts

• Automated fraud screening

• Automated fraud reporting mandates

• Automated incident response protocols

• Machine learning. Models identify patterns in credit and fraud data to predict risks.

• Predictive analytics. AI tools analyze vast amounts of credit data to predict potential defaults or fraud using bid data analytics. This improves the accuracy of both credit scoring and fraud prevention by spotting subtle patterns that traditional methods may miss.

• Behavioral analytics. AI models can learn typical customer behaviors, helping to flag suspicious actions that deviate from norms. This includes monitoring transaction frequency, size and location to catch fraud at various points.

2. Use cases around automation

• Automated customer onboarding. Automation in credit checks, combined with fraud screening, allows institutions to onboard legitimate customers more quickly while deterring fraudsters.

• Automated KYC and AML. Credit applications often include automated KYC/AML checks to verify identities and detect fraudulent patterns.

• Real-time decision engines. ML and AI tools enable automated workflows for instant credit approvals and simultaneous assessing of fraud risk.

• Real-time alerts. These notify stakeholders of suspected fraud during credit evaluations. By continuously monitoring transactions and credit line changes, financial institutions can react quickly to unusual activity. They use real-time data to identify and respond to high-risk transactions immediately, reducing losses and protecting customers.

Figure 2: The credit and fraud convergence – key market trends

2. Use cases around automation (continued)

• Automated fraud screening. This can integrate fraud checks directly into credit application workflows.

• Automated fraud reporting mandates. These help institutions report suspicious activities to authorities by implementing an automated workflow.

• Incident response protocols. These establish automated processes for addressing detected fraud in credit operations.

3. Alliances between credit bureaus and fraud prevention agencies

• Shared databases. Credit bureaus and fraud prevention agencies increasingly share data, allowing for more comprehensive risk assessments. This may include using blacklists of known fraudulent identities, real-time alerts and joint analysis.

• Cross-institutional data sharing. By sharing data about known fraud cases, financial institutions can help other firms prevent fraud by spotting emerging trends and repeat offenders.

4. Data-driven identity verification and scoring

• Real-time risk assessment. By analyzing credit and transaction histories in real-time, financial institutions can identify unusual patterns that may indicate fraud. Advanced analytics look beyond basic credit scores to assess the credibility of an applicant.

• Synthetic identity fraud detection. Increasingly common in credit fraud, synthetic identities combine real and fake information to create new ‘personas’, and require a detailed understanding of variances in both credit and behavioral data.

Provenir’s software capabilities in combating fraud and addressing credit challenges

Provenir, headquartered in Parsippany, New Jersey, US, operates globally, with major regional offices in the UK, Canada, India and Singapore. It also has sales and service professionals throughout North America, Latin America, Europe, the Middle East, Africa, Asia and Australia.

Founded in 2004, Provenir focused on providing software solutions to the financial services industry, specifically targeting the lending and risk management sectors. Provenir’s decisioning solutions now combine everything its clients need to create frictionless onboarding and customer engagement experiences that optimize every decision on the customer journey. Today the platform is used in 60+ countries, by 120+ customers, processing more than 4 billion transactions, with a 250+ strong team.

Chartis considers Provenir to be a global leader in software and services, providing top-tier RegTech and risk products to financial institutions across the globe. Provenir exhibits best-in-class capabilities nearly across the board, with comprehensive solutions for credit risk decisioning, credit monitoring, credit risk management, credit portfolio management, identity verification and fraud and ID monitoring and management. The company’s adoption of such advanced technologies as AI and ML has enabled it to provide an industryleading automated workflow framework that addresses the market challenges around credit and fraud risks. It also provides a robust analytical framework that allows financial institutions to analyze data and make timely decisions in real time. The fact that Provenir delivers on both these fronts is distinctive.

Due to the highly configurable nature of its platform, Provenir empowers clients across a range of industries, including payments, banking, digital banking, small and midsize enterprise (SME) lending, credit unions, FinTech, telecom, auto financing, buy now, pay later (BNPL), consumer lending, credit cards and embedded finance.

Core platform and product capabilities

The schematic in Figure 3 (on page 7) depicts Provenir’s overarching product architecture. The low-code UI for the Provenir platform is robust, supporting a visual, point-and-click, drag-and-drop design studio where credit policies, fraud rules and other definable processes are configured, tested and ultimately deployed as web services.

Business objects, including calculations, rules, integration points, decision trees, models, get-value and setvalue objects and sub-processes, are depicted as icons with connectors between them. Provenir’s platform is predominantly used by financial institutions to support a variety of credit and/or fraud risk management processes for various financial product sets in the areas of card, retail and commercial lending.

These processes are often found in the end-to-end customer credit and fraud risk lifecycle, consisting of identity verification, fraud and ID monitoring and management, credit monitoring, credit risk management and credit portfolio monitoring and management.

Figure 3: The Provenir platform and capabilities

Source: Chartis Research

Key differentiators and growth strategy

Figure 4 captures the highlights of Provenir’s strategy across the dimensions of product, go-to-market (GTM) and marketing.

When comparing Provenir with similar players operating in this space, Chartis identifies Provenir’s core differentiators as:

• Providing full and mature customer lifecycle capabilities across fraud and credit in one platform.

• Subject matter expertise across delivery and product teams, to create powerful solutions for global customers.

• Automated workflow management of data, with the adoption of use cases around ML/AI and a lowcode framework.

• Flexibility of configuration and ease of connection to internal and third-party data and applications.

• A broad and growing marketplace of third-party data vendors to empower customers to evolve their decisions dynamically.

• No-code case management, allowing manual workflows to be set up in minutes.

• Integrated decision intelligence that allows users to visually understand complex patterns within seconds.

• An aggressive product roadmap that focuses on creating the next generation of decisioning.

• Self-service model for running the software.

Source: Chartis Research

Targeted

Partnerships

Figure 4: The Provenir strategy

Conclusion

Chartis firmly believes that the credit and fraud areas will be ever more significant to financial institutions going forward. The adoption and implementation of such regulatory initiatives as early-warning signals (EWSs) and equivalent frameworks are going to be key compliance drivers encouraging firms to jointly address their credit- and fraud-related challenges.

In this journey, financial institutions are looking to upgrade their existing technology infrastructure by investing in modern-age platforms that:

• Leverage such advanced technologies as AI and ML.

• Are user-friendly.

• Have a complete workflow solution that supports the credit and fraud risk lifecycle – including analytics – to prevent regulatory fines and penalties.

• Are scalable going forward.

Within this context, Provenir offers a robust and flexible platform that can help institutions tackle their credit and fraud challenges effectively and quickly.