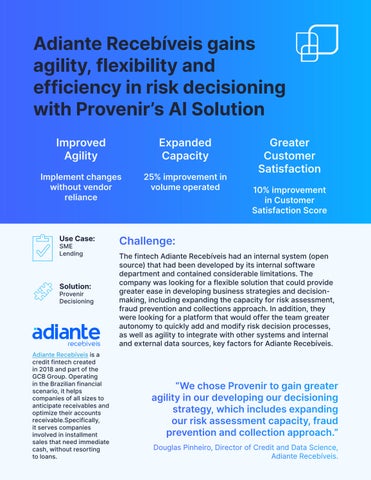

Adiante Recebíveis gains agility, flexibility and efficiency in risk decisioning with Provenir’s AI Solution

Improved Agility

Implement changes without vendor reliance

Use Case: SME

Lending Solution: Provenir Decisioning

Expanded Capacity

25% improvement in volume operated

10% improvement in Customer Satisfaction Score

Challenge:

The fintech Adiante Recebíveis had an internal system (open source) that had been developed by its internal software department and contained considerable limitations. The company was looking for a flexible solution that could provide greater ease in developing business strategies and decisionmaking, including expanding the capacity for risk assessment, fraud prevention and collections approach. In addition, they were looking for a platform that would offer the team greater autonomy to quickly add and modify risk decision processes, as well as agility to integrate with other systems and internal and external data sources, key factors for Adiante Recebíveis.

Adiante Recebíveis is a credit fintech created in 2018 and part of the GCB Group. Operating in the Brazilian financial scenario, it helps companies of all sizes to anticipate receivables and optimize their accounts receivable.Specifically, it serves companies involved in installment sales that need immediate cash, without resorting to loans.

“We chose Provenir to gain greater agility in our developing our decisioning strategy, which includes expanding our risk assessment capacity, fraud prevention and collection approach.”

Douglas Pinheiro, Director of Credit and Data Science, Adiante Recebíveis.

Adiante

Recebíveis gains agility, flexibility and efficiency in risk decisioning

with Provenir’s AI Solution

Solution:

Adiante Recebíveis adopted Provenir’s AI-driven Decisioning Platform to scale its operations across multiple markets. The decision to implement Provenir’s solution was motivated by its flexibility and the autonomy it offers for developing decisioning strategies. This includes focusing on expanding risk assessment, fraud prevention, and collection strategies. Adiante currently uses this advanced platform in its risk analysis processes for all new requests for receivables anticipation, as well as in the evaluation of new customers, using traditional and alternative data from multiple sources.

Benefits:

• Flexibility to quickly add and modify risk decision processes or analytical workflows

• Low-code decision engine allows users to implement any rule without limitations on the creativity of the teams

• Simplified integrations with external providers resulting in a more complete view of credit counterparties

• Enables access to traditional and alternative data sources, including credit bureaus

• Easy creation of personalized strategies on a single platform

• Possibility to customize and adapt credit policies with user-friendly configuration, allowing for increased self-reliance

Adiante

Recebíveis gains agility, flexibility and efficiency in risk decisioning with Provenir’s AI Solution

Results:

The adoption of the Provenir Decisioning cloud-native platform provided Adiante Recebíveis greater agility, flexibility and efficiency to the credit risk analysis processes and decisions on receivables anticipation.

• 30% reduction in short-term default (30 days) and a 25% increase in the volume operated

• Greater data intelligence and agility in decisioning with higher quality and the lowest possible friction for the customer, resulting in a 10% improvement in customer satisfaction level (CSAT - Customer Satisfaction Score)

• Gain in self-sufficiency and agility to quickly create and change rules, develop and test new strategies, implement new business models and market products

• Greater flexibility in accessing and integrating connections with internal and external sources of traditional and alternative data

• Discovery of redundancies identified after transferring rules from the previous system to the Provenir platform

• Elimination of 40% of the rules that were obsolete or redundant, allowing for a cleaner flow and simplification of the decisioning logic

• Processes were simplified, neutralizing the need for the involvement of the technology team to change decision flows

• Flexibility to manage policies and a reduction of the complexity that existed in the system, increasing the speed of launching and marketing new products

Would you like to know more details about this success story? Check out the series of videos with customer testimonials on YouTube.

Explore What’s Possible