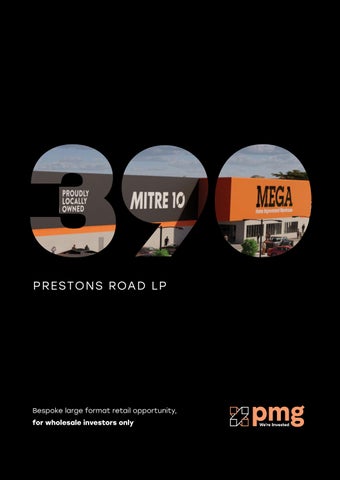

PRESTONS ROAD LP

Bespoke large format retail opportunity, for wholesale investors only

Click to watch the video

Bespoke large format retail opportunity, for wholesale investors only

Click to watch the video

To acquire a share of a prime large format retail property in Christchurch upon its completion, at a purchase price below a current as-if-complete market valuation.

Objective

Deliver investors a total pre-tax compounded annual rate of return of at least 12% per annum on capital contributions over the Limited Partnership’s (LP) life. Strategy

Prior to development, secure Mitre 10 as a tenant at the property, and commit to the acquisition of 60% of the property (Property Share) and provision of development funding;

During development, advance funding over time to generate interest income;

At development completion, acquire the Property Share with the lease to Mitre 10 commenced, at the effective cost of development; and

Dispose of the Property Share over a three year period from initial capital commitment.

20 year

initial lease term

12%+ p.a.*

target gross 3 year internal rate of return

6% p.a.*

target gross cash return, paid quarterly

Secured fully net lease with national home improvement brand Mitre 10;

Structured acquisition and funding terms to generate value while protecting capital;

Development from a renowned, expert local builder, Tuatara

Structures under a fixed-price contract; and

Attractive long-term location, set to serve a growing catchment with supportive demographics.

*Indicative targets only, are subject to change, and based on certain assumptions. There is no guarantee of future performance.

With over 80 independently owned stores, Mitre 10 is one of New Zealand’s most recognised and trusted brands. Their proven track record in the home improvement sector makes them an ideal tenant.

by a trusted developer and builder

To be developed by Tuatara Structures, this project is backed by an industry leader with a proven track record in delivering high-quality commercial developments on time and within budget.

Target size

Seeking up to $14.0 million of equity commitments, with a minimum of $100,000 per investor. Up to $6.0 million of equity has been conditionally committed to the LP.

Investment risks

Primary risks associated with development execution, market value, and saleability of the property over time. Other risks will apply.

Regular distributions

Targeted gross distributions of 6.00% per annum on capital called, paid quarterly. On disposal, a final distribution will be paid from any residual surplus after performance fees (if any).

Liquidity

A PMG fund will co-invest alongside the LP to acquire the remaining 40% of the property, and intends to own the entire property long term. Intent is to provide investor liquidity within three years of equity commitment through sale via an embedded option mechanism to the PMG fund.

dates

November 2024

Capital commitment date and first capital call.

March 2025

First quarterly distribution declared.

December 2025

Development completion and acquisition of the Property Share.

Fees and costs

Key fees to be paid to PMG (as manager) by the LP include contribution, establishment, disposal and performance fees. Other fees and third-party expenses will apply.

Further information related to this opportunity will be made available only to wholesale investors in an upcoming Information Memorandum.

021 193 4550 matt.mchardy@pmgfunds.co.nz

027 700 9970 ben.cant@pmgfunds.co.nz

027 700 6979

rory.diver@pmgfunds.co.nz