Steve Lindo Editor, PRMIA

Steve Lindo Editor, PRMIA

In this edition of Intelligent Risk we feature a provocative capstone article by one of our regular contributors, Dan DiBartolomeo, on “Why Banks Fail and What to do about it.” This article sheds light on the fall of Silicon Valley Bank and other cases by demonstrating that blindly adhering to regulation can be a recipe for disaster when market conditions change. He proposes metrics and an integrated approach for considering these dual (and dueling) pressures and what the results mean for bank management. This stimulating read is not to be missed.

Closely related on the topic of bank resiliency are three more articles. The first is “Banking System Interconnectedness” by Veni Arakelian and Andrea Calef, in which the authors explore systemic risk and offer policy recommendations. In “Balance Sheet Risk Management in Stressful Times” Dr. K. Srinivasa Rao examines the ALM missteps of SVB. And, for when all else fails, in “Beyond Recovery: How Regulators Handle Bank Resolution and the Case of Silicon Valley Bank,” Kaila Mayers looks at tools for resolving failed banks.

Aside from this flurry of thoughts on banks, our contributors wrote on a variety of other current topics this quarter: from ESG to data privacy and cyber insurance. We hope you enjoy the breadth and thoughtfulness of their ideas as much as we, the editors and reviewers, did.

Thank you to Seneca Polytechnic’s Centre for Executive & Professional Learning for sponsoring this issue.

If you’re interested in sharing your thoughts in a future Intelligent Risk or providing feedback on something you read in this issue, we welcome your emails to iriskeditors@prmia.org or posts on PRMIA’s Intelligent Risk Community webpage

Seneca Polytechnic’s Centre for Executive & Professional Learning (CEPL) specializes in courses to prepare learners for the next stage of their leadership journey. Programming offered through CEPL includes executive certificates, microcredentials and professional development courses. Whether you’re looking for increased responsibility, moving into a more senior leadership position or career progression, our goal is to support you in reaching that goal. To respond to industry demand and sectoral changes, we have recently launched new offerings in AML governance, ESG, and operational resilience

In 2023, banks which managed their risks by simply adhering to regulatory requirements ignored warning signs of market stress and changing risks, resulting in failure. This article presents a quantitative metric, founded on established economic theory, that steers banks dynamically between the poles of market conditions and regulations.

by Dan diBartolomeo

by Dan diBartolomeo

The recent set of bank failures as well those experienced in the Global Financial Crisis of 2008-2009 share a simple common root. Banks managements see risk management as a binding constraint which is always costly. They therefore prefer to ignore risk, which they are not required by regulators to address. Since the collapse of the crypto exchange FTX last November, the banking sector both in the US and Europe has come under increased stress. The entire financial system has recently been shaken by the failure of several major banks (SVB, Credit Suisse, Signature, First Republic).

While the reasons vary as to why particular banks have come under fire, the predominant risk to the banking system, including depositors, insurance funds, and the shareholders of banks is the potential for “bank runs” where uninsured depositors all want concurrent withdrawals beyond the available liquidity of a specific bank. What is needed is a framework that aligns the interests of bank managements, shareholders, and regulators to reduce the chance of similar events in the future. Healthy banks that are profitable for shareholders don’t need rescues from regulators.

Just after the closure of SVB, I had an unrelated phone conversation with a friend who is one of the most famous equity portfolio managers in history. His comment on the collapse of Silicon Valley Bank was brief, “greed and stupidity ”.

If you accept that view, the key to bank risk management is to put policies in place that compel bank senior managers to avoid such behavior. It should be noted that alarms have been raised for many years. A good example is the book Iceberg Risk by financial researcher Kent Osband. The book is a novel about people working in the risk management departments of large banks. Each chapter has a technical appendix explaining the analytical topics which arise in conversation among the characters. The novel illustrates how failures of judgement by senior managements are likely to have contributed to the Global Financial Crisis. This degree of accurate representation is remarkable given that the book was published in 2004, several years before the GFC unfolded.

To encourage sound and broadly beneficial decisions by management, our proposal is a dynamic risk management policy that contributes positively to the success of banks. This framework aligns the interests of banks shareholders and bank regulators in a new way and is demonstrably optimal for the long-term profitability of commercial banks. The proposed process relies on economic theory from Litzenberger and Rubinstein (1976), Wilcox (2000), Acerbi and Scandolo (2008) and diBartolomeo (2021).

Before we consider how to reduce the likelihood of bank failures, we should consider whether such incidents are sufficiently rare that no action need be taken. Just a few days after the collapse of SVB (March 10th, 2023) a working paper by Jiang, Matvos, Piskorski, and Seru (2023) was posted online. The study considers two key aspects of the current situation to describe the fragility of a particular bank: (1) uninsured deposits as a fraction of total assets of a bank and (2) the estimated unreported decline in capital reserves arising from the loss of market value of bank assets as a result of recent increases in interest rates. The study data came from quarterly FDIC “call reports” which are publicly available online.

SVB was in the 99th percentile (highest ratio) of uninsured deposits and in the 90th percentile in terms of capital status (i.e., 10% of banks were worse off). To the extent that more frequent evaluation might be useful, my firm’s internal models ranked SVB in the 96th percentile for most risk over the twelve months in a universe of two hundred twenty-nine large banks with US traded shares. SVB had also borrowed USD $20 Billion from the Federal Home Loan Bank months before the crisis, indicating that management was aware of possible liquidity problems.

The academic study concluded that across the US, up to 190 banks with USD $600 Billion in total uninsured deposits could be at risk of failure. The uninsured deposits estimated in the study would represent about USD $360 Billion adjusted for inflation in 2008 dollars. That figure compares to USD $750 Billion for the US allocated for “bailouts” in the GFC period. However, USD $182 Billion of the USD $750 Billion was allocated to AIG alone who not only repaid the Treasury in full, but the US Government made USD $26 Billion in eventual profits on the deal.

While USD $360 Billion is almost half of the USD $750 Billion allocated in 2008, there is a fundamental difference. A bank run is a liquidity event not a solvency event. The withdrawn cash isn’t gone from the system, most of it just moves to other banks or money market funds. Any loss of solvency arises from the impacted bank doing “fire sales” (high transaction costs) of assets to raise cash to meet withdrawals. This effect was illustrated by the deposit of USD $30 Billion into First Republic Bank by a consortium of larger banks led by JPMorgan (who later acquired FRC out of receivership). Among other nations, Japan has a long tradition of “convoy” rescues within banking.

The raw proportion of uninsured deposits among troubled banks is worth noting. The deposit base of SVB was 94% uninsured. Silvergate was at 95%, while Signature was at 90% and First Republic at 67%. Public data available from the FDIC suggests that the US average has been around 45% in recent years, so at least three of the troubled banks were double the average.

An important facet of the failures of SVB and FRC was the lack of reporting of unrealized losses in their previous financial statements. US banks with less than USD $250 Billion in assets can generally choose not to “mark to market” certain assets in their financial statements, as most bank assets are loans with no secondary market. Among the asset types often treated under “statutory accounting” treatment are high quality bonds that a bank intends to hold to maturity

Since the value of a bond is fixed at maturity (in the absence of default), the market value fluctuations through time become irrelevant to an investor who is almost certain to hold the bond to maturity (e.g., a life insurance company). Statutory accounting allows financial institutions to report much steadier earnings because the “income” of fixed income securities is always positive. If you can ignore price fluctuations total returns are always positive. With rising interest rates, the market value of many fixed income assets (bonds, MBS, loans, fixed rate mortgages) declines so unreported losses arise and become relevant if and only if a current sale of these assets is required to meet withdrawals.

US regulation requires full “mark to market” for many financial institutions including large banks, investment banks, self-clearing brokerage firms, securities exchanges, and futures brokers. Some countries (e.g., Canada) require full mark to market even for some longtime horizon entities such as life insurance companies. There have also been cases of financial institutions that intentionally abused statutory accounting such as the situation of First Executive Life Insurance (1991) and the Massachusetts Bay Transit Authority Retirement System (2015). Proponents of statutory accounting argue that requiring “mark to market” for all financial assets would add operating costs and make earnings much more volatile for small institutions. It should also be considered that valuation of non-traded assets (e.g., most loans) is subjective at best as illustrated by the relatively vague wording of FASB 157.

We should also think of a bank run in the context of endogenous time. In essence, we argue that investors and depositors make decisions on the basis of relevant information (i.e., financial news) flowing to them. The faster the rate of information arrival, the greater the volatility the concerned financial contracts are likely to experience, as described in Mitra, Mitra, and diBartolomeo (2009). A bank run is a special case of this problem, as uninsured depositors can only lose in response to financial news coverage. No news is good news. Online banking has made uninsured depositor response to negative news effectively instantaneous.

The voluntary shut down of Silvergate Bank and the collapse of Signature Bank were closely tied to turmoil in digital assets after the failure of FTX. Both concentrated in transaction processing for crypto-related clients. Annual crypto-related investments ranged from 1% to 4% of all global venture capital deals in recent years. While not a huge percentage, it was still tens of billions of dollars and sufficient to focus the attention of venture capital organizations on financial stability of their banks. Silicon Valley Bank was extremely concentrated in activities related to venture capital, in addition to being among the top in the nation in uninsured deposits. The SVB failure prompted uninsured depositors and investors to look generally at the issue of banks with high degrees of vulnerability to a bank run. Several US west coast regional banks were perceived as vulnerable along with CS and FRC, although only Credit Suisse was likely to be of global importance. Further complicating the situation were personal connections between First Republic and SVB senior managements.

Updating risk assessments daily utilizing information from both equity option markets and the analysis of financial news illustrates an interesting feature of the data. Our internal assessment of SVB firm-specific risk (i.e., not risks associated with the banking industry in general) doubled from between March 1 and March 9, the night before the collapse. The daily assessments of both CS and FRC doubled after the collapse of SVB.

There was another way for depositors to realize that certain banks were unstable. During the hurried takeover of CS by UBS, USD $17 Billion in “alternative Tier 1 capital” bonds became worthless. This kind of “hybrid” bond is structurally similar to preferred equity shares. Calling this security a bond makes it easier to sell to investors, and the “interest” is a tax-deductible expense to the issuing bank. Most AT1 bonds are structured like a convertible bond in reverse, where the issuer decides when the bond should be converted to equity. The CS AT1 bonds were unusual. They were perpetual with no maturity date like preferred equity. The legal covenants were like “catastrophe bonds” issued by insurance companies where specified conditions trigger a “wipe out” of the bondholders. As of late February, the 5.5% CS AT1 bonds were yielding 9.75%, as compared to about 1.4% for long term Swiss government bonds, so the bond market clearly recognized the high likelihood of default.

We should consider the implications of bank failures on the stability of sovereign creditworthiness. Banks are strongly encouraged by regulation with minimal requirements for capital reserves to hold government debt as their major reserve asset. The government needs banks to function smoothly to keep their national economy out of chaos, so acts as a de facto guarantor. The new combination of UBS/CS will have assets twice the annual GDP of Switzerland. Total Swiss banks assets are around five times GDP. All US bank assets combined are about one times annual GDP. Analytical models of the relationship between national banking systems and sovereign credit are provided in Bodie, Gray and Merton (2007) and Belev and diBartolomeo (2019).

Let us now turn to our recipe for keeping banks prosperous and out of trouble. We will first consider a bank simply as a pool of assets to be managed to maximize risk-adjusted return for a set of investors. A good example are the private credit funds that have pension funds and insurance companies as participants. We will next consider how having highly leveraged balance sheets impacts an investment entity. Ignoring liquidity concerns and local community considerations, a bank would look very much like a highly levered fixed income hedge fund.

Our goal is to derive an intuitive dynamic risk management policy that is mathematically optimal to ensure that banks stay solvent and yet maximize long term returns to their shareholders, thereby aligning the interests of all stakeholders. Finally, we will illustrate risk calculations that allow both bank management and regulators to observe whether optimal risk policies are being followed from data already at hand.

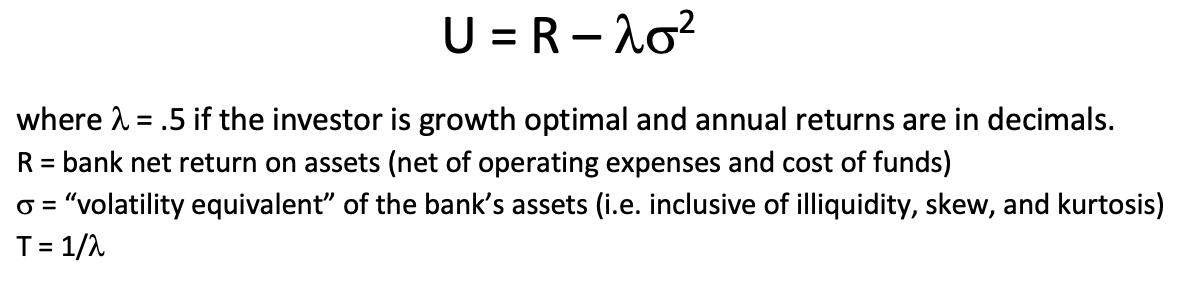

If an investment entity has no liabilities and an infinite time horizon, their objective is “growth optimal” where the intent is to maximize the expected geometric mean return. If returns are measured in decimal form, then the objective can be stated as a simple expression, as described in Markowitz and Levy (1979).

It is often more convenient to express this equation using the reciprocal of lambda which I will call “risk tolerance” (T), and if returns are measured in annual percentages (more common in banking), the growth optimal value of T is 200. If the investor has liabilities or cares about maintaining solvency (i.e., a bank) during the path to the long-term horizon, T will be smaller making the penalty for taking risk larger. If the financial entity has liabilities (i.e., a bank), the relevant extension was first presented in Litzenberger and Rubinstein (1976) and two papers by Wilcox (2000, 2003).

The optimal value of T at each moment in time is just the capital ratio of the bank times 200 (e.g., If a bank has 6% capital ratio at a moment in time, the optimal value of T is 12). The intuition is that a bank should have zero risk tolerance with respect to fulfilling liabilities. The available surplus can be invested to maximize long-term growth to benefit shareholders. This does not imply holding two portfolios but rather maintaining the optimal level of T over time to maximize U, given the set of available return/risk tradeoffs of the assets the bank can choose to hold on its balance sheet.

Banks have a lot of multiple ways to maintain optimal risk tolerance levels. They can increase or decrease capital (sell or buyback equity shares) as was hastily attempted in the SVB case. They can also Increase or decrease their issuance of Additional Tier 1 capital bonds (issue or call). Most easily done is to increase or decrease asset risk (annual volatility equivalent) through derivatives (CDS, interest rate swaps) used to extend or hedge asset portfolio risks.

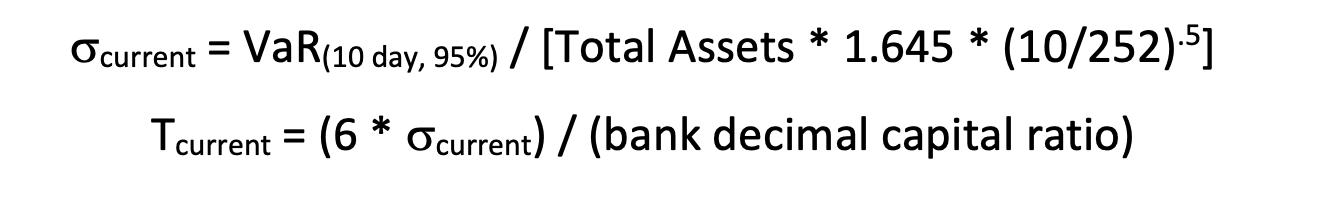

To know how to change their risk tolerance (T) to the optimal level given current circumstances, the bank needs to know what T is implied by the current operations. Banks routinely report a short term “Dollar Value at Risk” metric to regulators. A typical report would be “10 trading day horizon at a 95%, confidence interval”.

The derivation of the value of 6 for the coefficient in the second formula is given in diBartolomeo (2021). These formulae assume that banks are calculating their “Value at Risk” in a realistic manner. Such valid VaR estimation requires consideration of several issues including skew and kurtosis of the expected distribution of asset returns (e.g., credit risk creates negative skew), illiquidity of bank assets, and the aforementioned issue of unrealized losses in asset value that have not yet been recognized on financial statements.

The issue of higher moments in the distribution of expected asset returns is addressed in diBartolomeo (2023). These effects are routinely captured in VaR estimation. The issue of banks holding illiquid assets while having “at call” liabilities is well modeled in Acerbi and Scandolo (2008). Their process is for the bank to maintain an explicit liquidity policy that says, “we will be prepared to liquidate P percent of our total assets in N trading days”. The expected loss of asset value associated with a “fire sale” of bank assets can then be added into the estimated “Value at Risk”. With respect to the potential of bank runs, the value of P should clearly be tied to uninsured deposits.

Since VaR represents potential dollar losses on a portfolio of financial assets, we should also add in unrealized losses as these losses will be realized if immediate liquidity is required to meet withdrawals. Increased VaR values may require banks to add to liquidity and capital.

Given the probabilistic nature of the unrealized losses being realized in the future, this issue belongs in the realm of risk management, not financial accounting.

We assert that most bank failures are the result of business policy decisions wherein risk management practices required by regulators are always seen as a cost to shareholders. By framing the policy decisions of a bank in a fashion similar to a hedge fund, we can take advantage of a great deal of economic theory that would guide bank managements to optimal behavior, aligning the interests of shareholders and regulators to greatly minimize the likelihood of bank failures.

The general principle is that bank risk management policy should be dynamic through time and reset frequently to the level which is optimal for both regulators and shareholders given market conditions and the degree of leverage on the bank’s balance sheet. Successful implementation of such a process is dependent on accurate estimation of Value at Risk, inclusive of the effects of asset illiquidity, higher moments in asset returns, unrealized losses, and potential transaction costs of greatly accelerated asset sales during a “run on the bank”.

1. Litzenberger, Robert and Mark Rubinstein, “The Strong Case for the Generalized Logarithmic Utility Model as the Premier Model of Financial Markets”, Journal of Finance, 1976, Volume 31(2), pp. 551-571.

2. Wilcox, Jarrod. “Better Risk Management”, Journal of Portfolio Management, 2000, Volume 26(4), pp. 53-64.

3. Acerbi, Carlo and Giacomo Scandolo, “Liquidity Risk Theory and Coherent Measures of Risk”, Quantitative Finance, 2008, Volume 8(7), pp. 681-692.

4. diBartolomeo, Dan. “Simplified Investment Performance Evaluation”, Journal of Performance Measurement, 2021, Volume 25(3).

5. Jiang, Erica Xuewei and Matvos, Gregor and Piskorski, Tomasz and Seru, Amit, Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs? (March 13, 2023). Available at SSRN: https://ssrn. com/abstract=4387676 or http://dx.doi.org/10.2139/ssrn.4387676

6. Mitra, Leela, Gautam Mitra and Dan diBartolomeo. “Equity Portfolio Risk Estimation Using Market Information and Sentiment”, Quantitative Finance, 2009, Volume 9(8), pp. 887-895.

7. Gray, Dale F. and Bodie, Zvi and Merton, Robert C., Contingent Claims Approach to Measuring and Managing Sovereign Risk. Journal of Investment Management, Vol. 5, No. 4, Fourth Quarter 2007, Available at SSRN: https://ssrn.com/ abstract=1084683

8. Belev, Emilian and Dan diBartolomeo, “Finance Meets Macroeconomics: A Structural Model of Sovereign Credit Risk” in Contingency Approaches in Corporate Finance, Editors M. Crouhy, D. Galai and Z. Weiner, 2019. World Scientific.

9. Markowitz, Harry and Haim Levy, “Approximating Expected Utility by a Function of Mean and Variance”, American Economic Review, Volume 69(3), pp. 308-317.

10. Wilcox, Jarrod. “Harry Markowitz and the Discretionary Wealth Hypothesis”, Journal of Portfolio Management, 2003, Volume 29(3), pp. 58-65.

11. diBartolomeo, Dan. “Investment Performance Evaluation when Returns are Not Normally Distributed”, Journal of Performance Measurement, 2023, Volume 27(2), pp. 10-16.

peer-reviewed by

Steve Lindo & Carl Densem authorDan diBartolomeo is founder and president of Northfield Information Services, Inc. He serves as PRMIA Regional Director for Boston, as well as on boards for several financial industry associations including IAQF, QWAFAFEW, BEC and CQA. Dan spent eight years as a Visiting Professor in the risk research center at Brunel University in London. In 2010, he was awarded the Tech 40 award by Institutional Investor magazine for his analysis that contributed to the discovery of the Madoff hedge fund fraud. He is currently the co-editor of the Journal of Asset Management and has authored nearly fifty research studies in peer review publications.

Synopsis

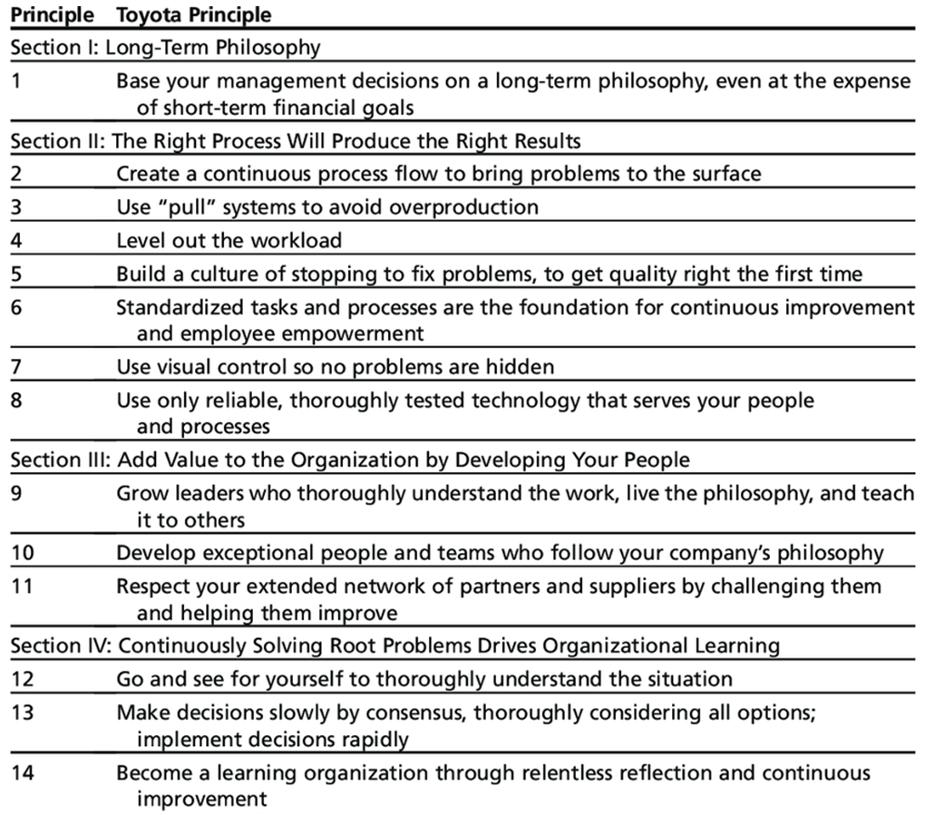

The success of an organization in an unpredictable, chaotic, and emerging AI-supported world depends on its ability to cultivate a resilient culture that adapts to changing circumstances. This resilience is crucial in mitigating both indirect and direct risks, which, if they materialize, could lead to a temporary or permanent disruption to the organization.

Regardless of size or type, the heartbeat of any organization is its operations. Understanding an organization’s functions, processes, technology, data, people, physical structures, governance, and policies will depend on the layers of defense that exist to keep the organization functioning. In the world of operational resilience, the three layers of defense of the organization work together, adapt to emerging risks through micro-change management processes, scenario analysis, and risk journey experiences. Exercising the heartbeat, and the entire organization into a condition of desired resilience readiness and maturity can be accomplished by defining what operational resilience means for your organization.

The 2023 Global Risk Report from the World Economic Forum explores the need for an investment in multi-domain, cross-sector risk preparedness to help support a collective approach in building global resilience. Due to the interconnectedness of risks through various environments, the inherent nature of abrupt or chaotic changes in global risk landscapes, emergence of a polycrisis, and the eventual costbenefit requirement that most organizations abide by to make decisions. So, how do organizations still manage chaos knowing that there are organizational impediments in doing so?

When faced with challenges, unpredictability, and in need of effective strategic alignment, developing a culture of resilience is crucial for individuals, communities, and organizations to prosper. In the world of business, this uncertainty can be likened to chaos, and an organization’s ability to navigate and utilize chaos effectively is referred to as business resilience.

Resilience is to embrace chaos and leverage its potential to facilitate necessary changes within an organization’s processes, technology, people, knowledge, work environment, community engagement, communication, and governance. If chaos is risk, then resilience means thriving as a collective, to attain strategic goals and the expectations of those that depend on the organization to continue functioning, regardless of if a risk is realized. A culture of resilience within an organization means everyone has a shared responsibility in its ability to operate. The challenge: very few organizations know where to start. The opportunity is that operations are always at the heart of each organization, and that is why resilience planning needs to start there.

Traditionally, most organizations utilize industry standards in business continuity, risk management, occupational health and safety, cybersecurity, etc. to build frameworks, processes, programs, and hire skilled labor or specialized agencies with various approaches. Due to lessons learned during the COVID pandemic, inflation, challenges with supply chains, labour, and countless other factors, rising costs are adding additional complications in the ever-complex environment of risks. Mitigating potential disruptions requires a combination of emerging risk methodologies such as operational resilience to challenge the status quo in risk management and enhance lines of defenses. Due to its reliance on having a methodology that incorporates multi-line-of-defense domains and fosters adaptability across different sectors, operational resilience is one solution to support risk identification, mitigation, change, response, and recovery.

Skilled labor, specialized knowledge processes, capacity management, effective communication and cycles help drive operational risk and resilience strategies forward for organizations. While operational resilience is an emerging discipline, it will require intensive planning for risk mitigation, technology solutions to help aid in that planning, and innovating digital or physical process changes within your organization to help it evolve in a competitive environment and to adapt to emerging risks.

In understanding the risk landscape, line of defense controls involved during “business as usual”, the stakeholders’ responsibilities to support risk mitigation actions or recovery efforts, and all the processes, functions, technologies, data, and people which contribute to the enhanced understanding of what resilience means to any organization, you begin building a vision of what resilience means for your organization.

With a strong vision of becoming a resilient organization, the primary goal of attaining operational resilience is empowering the key technical, business, and external vertical stakeholders in making actual change to the organization. Operational resilience takes it a step further by leveraging strategies and tactics to enable certain processes of creativity with the intent of reducing the burden on resources and capacity. As an example, a unique method of risk reduction using creativity through perspective analysis using agile-user stories during scenario validation exercises is to understand the perspectives of key stakeholders to ideate operational-resilient change opportunities.

While every organization is different and will define the scope of operational resilience differently, the most common factor regardless of the methodology is that the heartbeat’s most critical functions and dependencies will always need the people behind each beat. A proposed operational resilience framework and adaptability into existing lines of defense processes is published in the Journal of Business Continuity and Emergency Planning: “How to build more resilient businesses and communities – A proposal.”

People are the foundational building block of building a culture of resilience, the next block is the ideas that we bring to life to bring about resilient change within organizations. Finally, it is how we make sure that the ideas we implemented keep running the way they are intended to do so, regardless of the disruption or realized risk.

Empowering your people through upskilling can result in enhanced understanding across your organization in areas such as defense maturity and operational readiness. Providing professional learning opportunities for your teams will also prepare your people to better understand lines of defense and the highly sought after that encompasses all lines of defense. Such learning will empower your teams to identify and understand the risk journey and to assist in the development of sound resilience strategies for your organization. One example of professional learning in operational resilience is the course, Operational Resilience, offered at Seneca Polytechnic. Designed for working professionals, the courses provide learners with the foundational capabilities of building operational resilience within their respective organizations.

To bring the heart and the organization together to build a culture of resilience, remember, “Alone we can do so little; together we can do so much.” - Helen Keller. A culture of resilience is all-encompassing, with a common goal of making the organization and its people thrive in the face of adversity.

the critical role of people

Martin Gierczak takes pride in helping businesses and organizations ‘bounce back’ from shocks but also internalize growth and development strategies so the organization can evolve and adapt to dynamic and interconnected environments. His expertise ranges from business continuity, crisis management, emergency management, IT disaster recovery, health & safety, wellness, Lean Six Sigma, Agile, Information Mapping, and project management for financial, service, government, and not-for-profit organizations for the past 10 years.

Martin’s unique methodology in operational resilience encompasses several professional disciplines and synthesizes the framework to be adaptable for organizations to implement regardless of the size or industry to help build more resilient organizations. His paper on operational resilience is published by the Journal of Business Continuity & Emergency Management and titled “How to build more resilient businesses and communities”. He is a coalition member of Climate Proof Canada, a mentor with The Forum, the City of Markham’s small business digital resilience program, Disaster Recovery Journal, Business Mentors Network, and the Ontario Association of Emergency Managers (OAEM).

Currently, Martin is a professor at Seneca Polytechnic for operational resilience, Project Management Specialist of Operational Resilience with the Bank of Canada and serves as OAEM’s Director of Communications.

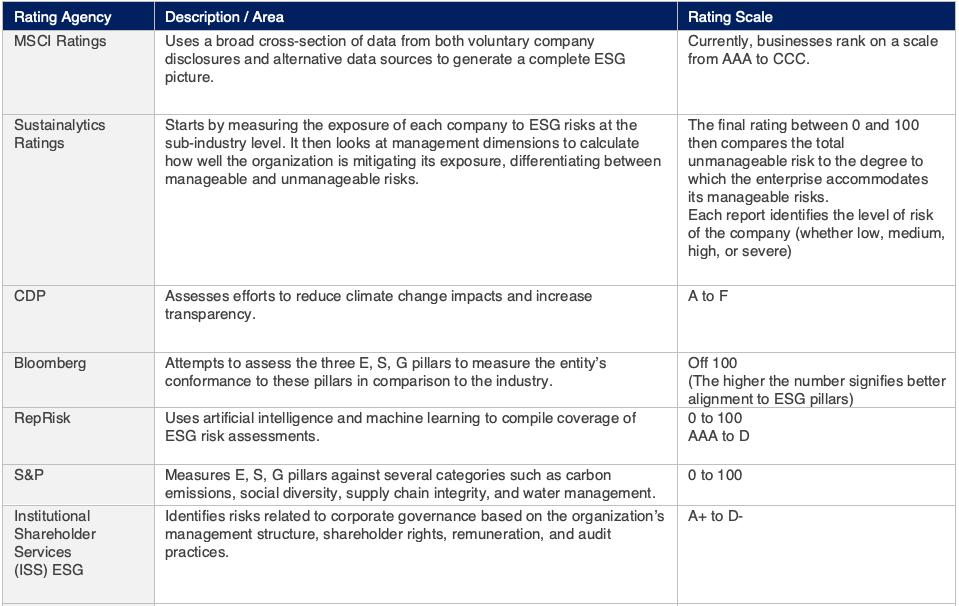

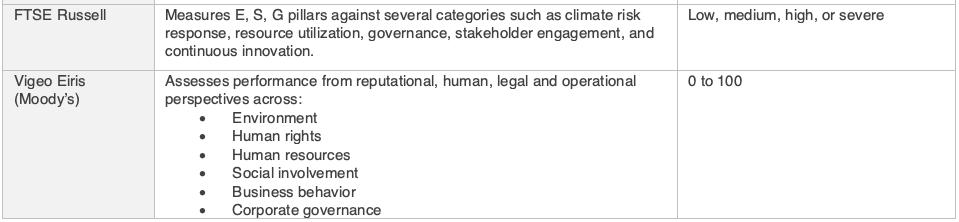

ESG rating agencies differ in their approach to judging how aligned companies are to ESG pillars. Variation arises from their methodology but also their data sources, scoring systems and other factors. This article explores this range and discusses the chorus of voices calling for standardization akin to that of credit rating agencies.

Environmental, Social, and Governance (ESG) scoring is gaining momentum and is a prominent indicator that determines if a company is “socially responsible”. Since social responsibility is in essence a subjective notion, subsequently so is socially responsible investing – and ultimately the growing requirement for ESG rating agencies. Nevertheless, every emerging initiative comes at a cost alongside numerous challenges. In the case of ESG scoring, challenges include the lack of data, ambiguity of scoring, qualitative data considerations versus quantitative, non-uniformity between ESG rating agencies, evolving regulations and many more. This article explores those challenges, the different ESG rating agencies’ calculation methodologies, and evolving ESG rating regulations.

In order to assess a company’s sustainability practices and approach to managing ESG risk, data analytics companies developed ESG risk ratings that measure a company’s ESG alignment practices resulting in a score (similar to the traditional credit scoring developed by rating agencies, which are monitored on non-ESG parameters). The score is calculated against an ESG matrix and expressed in various formats, such as a number scale, which can be 1 to 10 or 0 to 100 (the higher signifies an improved alignment to ESG pillars), simply based on a letter system, or built on five risk levels, such as negligible, low, medium, high, and severe.

ESG scoring systems are also classified into two categories: industry specific or industry agnostic. Industry-specific scoring systems evaluate topics that have been considered material to the industry at large. Industry-agnostic ESG scores attempt to combine widely-accepted factors that are vital across industries.

ESG scoring is measured against each of the three risk pillars:

• Environmental: GHG emissions, improvements in water and resource efficiency, and development of ecofriendly products

• Social: stable supply chain management, fair trade systems, securing and nurturing talent, and the company’s overall relationship with stakeholders

• Governance: legal and compliance issues in Board operations, independent professionalism, diversity of board of directors, and development of a long performance-linked remuneration system

ESG scores are provided by several third-party providers, such as researchers and analysis firms. These companies include Bloomberg, Refinitiv, RepRisk, MSCI, and many more. There are more than 140 different ESG data providers.

Table 1 below summarizes some of the different agencies that report ESG scores, detailing the rating scale adopted and the area of measurement.

Data by ESG rating agencies is collected by two means: either self-reported or from publicly available data sets. Some agencies may exclude self-reported data entirely and only depend on publicly available data. Some rating agencies also adopt artificial intelligence (AI), leveraging machine learning into their data screening process.

These agencies review publicly available data and conduct primary research with company management about the organization’s sustainability efforts. Still, based on ESG rating agencies’ varying data collection approaches, assigning a final ESG risk score can be perceived as potentially subjective and biased.

The deficiency of ESG scores lies in the fact that every agency deploys its own methodology, analysis, and algorithms in evaluating ESG metrics. This is mainly attributed to the measurement, differential weighting, and sources of the ESG data and factors, which presents what could be viewed as misaligned standards. For example, this allows Shell, an oil company, to boast a higher sustainability score than Tesla, a company that makes electric vehicles using renewables. Many industry players argue that this differential is justified since the ESG evaluation and scoring is so subjective, requiring investors ultimately to evaluate each rating score against the agency’s methodology, then to compare both to ensure a company’s portfolio objective is in line with ESG risk versus return.

On the other hand, the benefits of ESG scoring are numerous. Generally, the market view is that companies with better ESG scores are more equipped to face future climate change-related and socioeconomic risks, are more inclined to long-term strategic thinking, and are committed to long-term value creation rather than short-term gains. According to research conducted over 1,000 academic papers published between 2015 and 2020, a positive relationship between ESG and financial performance was exhibited (Whelan, Atz, Clark 2020).

Subsequent to highlighting ESG scoring benefits, the requirement for increased uniformity between ESG rating agencies is becoming apparent. Note that ESG rating agencies are not regulated in the same way as credit rating agencies, for which regulation now requires uniform calculation methodologies to increase transparency. Additionally, on November 22, 2022, the Financial Conduct Authority (FCA) announced the formation of a working group to develop a voluntary code of conduct to address growing concerns around labelling and provision of ESG benchmarks. The FCA also supported a paper published in June 2022 titled “ESG integration in UK capital” (CP21/18, from clause 2.32), which highlighted strong support for an internationally unified approach following the International Organizations of Securities Commission’s (IOSCO)1 recommendations.

ESG ratings are gaining importance among investors and financial institutions for their ability to demonstrate the alignment of a company’s ESG initiatives. The main requirement is to maintain a healthy ESG rating in comparison to competitors and peers in order to form a competitive advantage. ESG rating agencies continue to develop and improve the rating measurement process, and these agencies play a vital role in transitioning to a sustainable world. Nevertheless, investors should bear in mind the differential evaluation criteria between rating agencies and the requirement to match these criteria to a company’s portfolio and strategic profile to minimize conflict of interest and misinterpretation, which can be detrimental to investor confidence. Nonetheless, ESG scoring is predicted to continue gaining in importance as a futuristic investing mechanism - with high reliance on ESG rating agencies.

1. Polsk, Deloitte. “Comparing Rating Agencies and ESG Methodologies - Deloitte US.” Deloitte, 2022, www2.deloitte.com/ content/dam/Deloitte/ce/Documents/about-deloitte/ce_table_ratings_esg_eng.pdf.

2. “9 Best ESG Rating Agencies - Who Gets to Grade?” The Impact Investor | ESG Investing Blog, 18 Feb. 2023, theimpactinvestor.com/esg-rating-agencies/.

3. Macrì, Letizia. “ESG Rating: What’s the Future?” Corporate Disclosures, 2023, www.corporatedisclosures.org/content/ opinion/esg-rating-whats-the-future.html.

4. Clark, Whelan Atz. “ESG and Financial Performance - NYU Stern.” NYU, 2020, www.stern.nyu.edu/sites/default/files/ assets/documents/NYU-RAM_ESG-Paper_2021%20Rev_0.pdf.

Nadia AlQassab is a Senior Lecturer at the Banking and Finance Center at the BIBF. She holds the Professional Risk Manager (PRM), the Sustainability and Climate Risk (SCR) Certificate, and an MBA in Business Administration from Strathclyde University. She previously worked as the AVP Market Risk Senior Manager at Gulf International Bank (GIB) and Head of Market and Middle Office Desk at Bank of Bahrain and Kuwait (BBK). She was chosen in 2009 as an Executive Trainee, with a fast-track career in BBK and was re-selected in 2020 as part of the Ashridge leadership program (the first leadership program for senior managers developed in BBK). She also participated in the first mentorship program initiated by BBK. Additionally, Nadia has served as a parttime lecturer with Ernst and Young.

Synopsis

A recent survey on risk culture reveals the need for companies to embed a risk culture across the organization instead of it only existing in the executive functions. It also shows trends in the top risks noted by respondents from around the world, reflecting the recent upheaval and uncertainty in society and the environment.

From record heatwaves and rising macro uncertainty to further hype around generative artificial intelligence (AI) and its rapid adoption, the hazards and opportunities facing organizations today require more critical thinking than ever before, and a recent global survey and report, “Risk Culture:

Building Resilience and Seizing Opportunities”, published by the Association of Chartered Certified Accountants (ACCA) together with the Association of Insurance and Risk Managers (Airmic) and the Professional Risk Managers’ International Association (PRMIA), unravels what our respective members think about risk culture and to what extent it helps or hinders their ability to navigate this fast-changing world.

The key findings of our first-of-a-kind study are that risk conversations continue to happen in a vacuum at the top of organizations. While we see a will to improve risk culture, engagement across roles and functions requires much more engaging and careful communication than what is actually happening in practice. Overall, we found that everyone needs to be aware of risk because in today’s highly interconnected world, even a weak risk culture is better than none.

At the heart of our joint-research was an online survey, which attracted 1,823 responses – more than the World Economic Forum’s Global Risks Report 2023. Conducted during the last two weeks of October 2022, the survey was followed by an online community platform, one-on-one interviews, and other roundtable discussions, together allowing us to gather perspectives from over 2,000 risk and financial leaders around the world and across a wide range of industries.

ACCA is also including the questions in its quarterly Global Economics Conditions Survey (GECS) reports, so organizations can benchmark the data going forward and gain a better understanding of how and where risk is evolving from the accountancy professionals’ perspective.

When asked ‘what do you believe are the top three risk priorities at your organization today’, respondents of ACCA’s 2023 Q2 GECS survey showed that ‘regulatory, legal, compliance’ risks had dropped from first to fourth place since the survey in October 2022, with ‘economic inflation, recession, interest rates’ moving from third to first place and ‘talent scarcity, skills gaps, employee retention’ rising from fourth place to second.

Respondents from the Caribbean and Central and Eastern Europe were the only two regions that didn’t have ‘economic inflation, recession, interest rates’ as their first risk priority in 2023 Q2, with ‘regulatory, legal, compliance’ and ‘talent scarcity, skills gaps, employee retention’ taking the top spots, respectively, this time around. Interestingly, North America was the only region to see ‘logistics, supply chain disruption, supply shortages’ move into the top three risk priorities since October 2022, while Central and Eastern Europe was the only one with ‘misconduct, fraud, reputational damage’ in the top three; it tied with ‘economic inflation, recession, interest rates’ as third.

Responses to other questions, including ‘what do you feel is the most underestimated risk facing your organization today’, not only show just how lagging and lacking governance is at even some of the most mature companies, but also underline the power of questioning in informing major decision makers and ensuring positive risk-taking.

Risk and accountancy leaders can together “forage for information” and think beyond their limitations of knowledge to ensure their organizations make the most of today’s disruption.

As part of the report and overarching campaign to support our professions, we created the following 10 calls to action to help organizations assess where improvements can be made:

1. Empower risk leaders to drive risk culture and influence behaviors through a common language.

Risk knowledge should be shared and discussed together across functions. Risk leaders must reach out to others and not wait to be approached to discuss mutual interests that are critical to the organization (such as the key performance indicators (KPIs)), making team members feel involved in matters that affect them.

2. Resist the danger of tunnel vision when faced with a multitude of risks.

We see an understandable tendency for people to focus on the immediate issues relevant to their job, meaning that larger risks are ignored and a lack of diversity of thought informing decision making materializes. Getting risk conversations happening up and down the organization consistently is the secret sauce of a successful risk culture.

3. Assess the behaviors driving both good and bad outcomes.

Behavioral analysis provides rich insights about stakeholders’ attitudes that don’t make it into out-ofdate risk reports. Senior management should optimize that knowledge by linking it to strategy and policy, improving corporate governance, due diligence, and decision making.

4. Don’t mistake a “tick the box” compliance approach as true, value-added risk management.

Organizations should focus on the outcomes that rules and regulations seek to engender. In many ways, a compliance culture is the antithesis of a good risk culture. An effective risk culture enables the organization’s people to understand and take on the right risks in an informed manner and rewards them for this.

5. Consider how you define the role of accountants in risk culture, particularly on reconciling ethics with profits.

The complexities of today’s evolving business models mean accountancy professionals should be reviewing any conflicts with stated values and deciding whether opportunities are in line with desired ethics.

6. Communicate risk appetite and its purpose to help guide behavior and inform better decision making.

In the absence of a clearly defined risk appetite, decision-making will ultimately be reduced to personal judgment, which can depend dangerously on inference and is subject to bias.

7. Eliminate the fear factor by creating a “hands up” culture through visibility and leading by example.

Risk and accountancy professionals, in their various roles setting up risk governance processes, can intentionally affect the environment and how safe team members feel. Speaking up about risk is a behavior that organizations can and should encourage.

8. Measure and incentivize the risk culture you want by ensuring “everyone owns it”.

Risk culture is a crucial aspect of organizational culture given today’s risk landscape, and we found a direct correlation between a better understanding of risk footprint and enhanced working relationships and job satisfaction.

9. Promote good governance through role clarity and knowing who is responsible and accountable for what.

Leaders must ensure there is a clear distinction between responsibility and accountability, and that staff know what they are individually liable for. It won’t only be regulators stepping up their scrutiny; everyone is raising their expectations in today’s digital, vox pop world.

10. Coordinate multi-stakeholder engagement for pro-society outcomes.

Industry bodies must collaborate more with regulators to ensure that risk and financial professionals are well-informed and that communications between practitioners and policy makers are more meaningful and less geared to a “box ticking, being compliant” style of management.

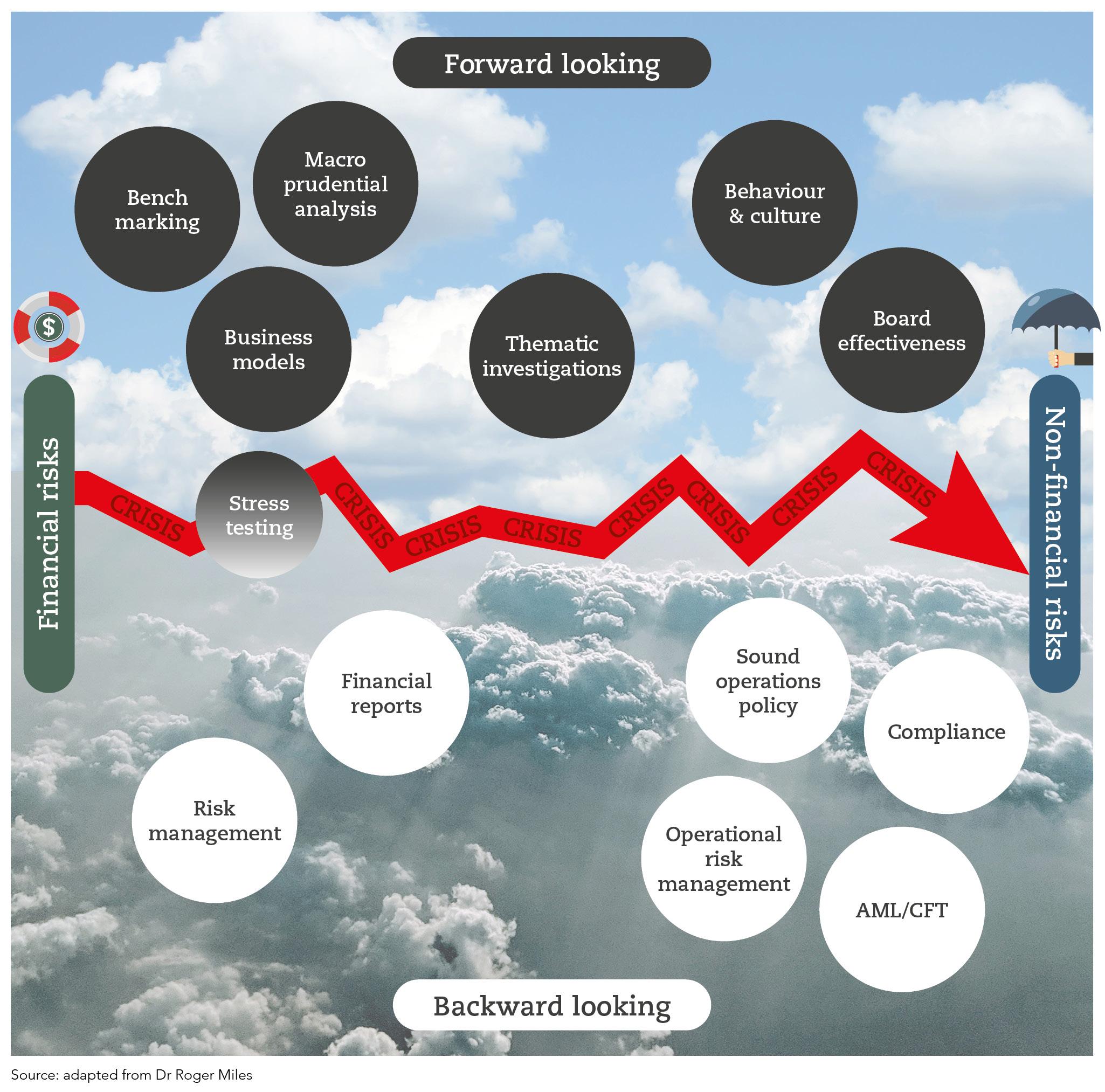

Figure 2: Risk culture supervision

Figure 2: Risk culture supervision

‘Climate change regulation and its impact on clients’, ACCA member in Ireland.

‘The financial market boom is underestimated by organizations, which may lead to inappropriate investment appraisal’, ACCA member in China.

‘A mass liquidity event in the market has been a concern. I think many businesses, organizations, and industries have failed to properly evaluate catastrophic low-probability risk events. The ability to continue as a going concern should be paramount. Sometimes a pure EV [enterprise value] look on things opens the door to potentially having to stop playing the game altogether. Staying in the game should be paramount’, ACCA member in USA.

‘Potential market disruption caused by AI to part of our customer base and our readiness for the impacts’, ACCA member in New Zealand.

‘Greenwashing, cheating risk and potential fraud’, ACCA member in Vietnam.

‘Skill and capability shortages across the sector and nation’, ACCA member in Scotland.

‘Non-adaptability of technological advancements’, ACCA member in Pakistan.

‘Customers’ changing demands’, ACCA member in Saudi Arabia.

‘Talent shortages due to migration to more stable and advanced economies’, ACCA member in Nigeria.

‘Risks in CEE [Central and Eastern Europe] due to the war in the Ukraine, including potential nuclear leak’, ACCA member in Poland.

‘Government and Bank of England having opposing economic approaches will lead to recession or a long period of stagnation’, ACCA member in the UK.

‘Succession risk’, ACCA member in Sri Lanka.

‘Fraud’, ACCA member in Hungary.

‘A prolonged period of high interest rates shall result in the need to pass this through the deposits, narrowing down the NII [net interest income] margin, and this may coincide [with] an economic cycle of recessionary times, making bank funding even more scarce and difficult to raise’, ACCA member in Greece

‘With economic hardships, staff may make fake deals with suppliers’, ACCA member in Malawi

‘Employees [not] understanding the strategy and vision of the company’, ACCA member in England.

Rachael Johnson is ACCA’s Global Head of Risk Management and Corporate Governance for Policy and Insights, and author of the recent report, Risk Culture: building resilience and seizing opportunities, published jointly by ACCA, Airmic, and Prmia.

Rachael has over two decades’ experience creating thought leadership on a range of financial topics, including risk, responsible investing, sustainable finance, regulatory change management, and risk governance. As the secretariat of ACCA’s Global Forum for Governance, Risk and Performance, she also advocates and provides comments for consultations for policy makers. In January. 2022 she set up ACCA’s Chief Risk Officer and Heads of Risk Forum and was awarded the DCRO’s prestigious Risk Exemplar’s award. Additionally, she is a member of both the Accountancy Europe’s (AcE) Corporate Governance Policy Group and the Business at OECD (Biac) Corporate Governance Committee, which is currently supporting OECD in revising the G20 Principles of Corporate Governance. She also serves on the ESG Exchange’s Technical Committee.

Stricter banking regulations and supervision implemented after 2008 were thought to have ensured banking system stability. The collapse of several noteworthy banks in 2023 disproved that. This article examines the basics of banking system interconnectedness and provides some additional policy recommendations.

banking system interconnectedness by Veni Arakelian & Andrea CalefAfter the collapse of Lehman Brothers in 2008, both bank regulators and the banks themselves engaged in a scramble to shield the system to prevent future bank failures that could spread throughout the system through interconnections. These included stricter criteria for bank capital adequacy, short-term and structural liquidity, and market risk, as well as enhanced supervision. Despite these efforts, in 2023 we became spectators to a series of episodes that shook everyone. First with the collapse of Silicon Valley Bank (SVB), Signature Bank (SB), then the Swiss giant Credit Suisse (CS) and First Republic Bank. While the first, second and fourth banks were not large enough to be considered systemic, so were not under the strictest supervision of the authorities, the fact that the second is not only systemic but also a major player in global banking was a very big negative surprise that shook the markets and woke up the fear of a new domino of bank failures. The Swiss government rushed to close the deal between Credit Suisse and UBS, considering this move to be the best available option to restore confidence in the markets. Next, Deutsche Bank found itself under the microscope of market participants, being under significant pressure, which was reflected in the increase of its CDS (the Deutsche Bank 1-year CDS surged from 46.703 on the 7th of March 2023 − to 225.132 on the 28th of March 2023, exhibiting a huge spike within the last three days).

The threat was back, but it looked like the system was more ready this time, due to academics, regulatory authorities and market participants having worked in the same direction. Although these efforts did not succeed in avoiding these three bank collapses, they did prevent a full-scale systemic risk event.

In the next sections, we review some basic concepts and make some policy recommendations.

Although there is not a unique and widely accepted measure of contagion and systemic risk, both are closely related to banks’ synchronized behavior and correlated portfolios. Measures like conditional valueat-risk (CoVaR), which is the value at risk conditioned on the distress of institutions, and SRISK, which measures the capital shortfall of a firm conditional on a severe market decline, are used to quantify them. Nevertheless, those measures do not take into account the interactions within the banking system.

Interconnectedness can be measured by three equally weighted indicators, the intra-financial system’s assets, liabilities and bank debt, and equity securities. We distinguish the interconnectedness into two categories: direct and indirect. The first category refers to explicitly documented or otherwise directly observable links between entities through financial transactions, obligations, contracts, and other arrangements or relationships. Credit exposures between banks are among the most basic types of direct interconnectedness. The second category refers to the channels through which the distress of one entity can affect the distress of another entity, even in the absence of a direct link between the two. Ways in which distress can propagate between ostensibly unrelated entities include exposure to common assets, markto-market losses, margin calls and haircuts, shadow banking and information spillovers.

The pre-requisite to assessing systemic risk and interconnectedness is to identify the structure of a financial network. This allows the analysis to concentrate on how risk spreads from one node to the next.

To evaluate the resilience of a given network, two actions, each requiring multiple decisions, must be taken. First, the network should be subjected to a hypothetical shock, which necessitates determining what type of shock is suitable for analyzing the specific risk being evaluated. Endogenous shocks originate from within the network (e.g., the default of a bank in a banking network), while exogenous shocks originate from outside the network (e.g., a significant macroeconomic event). Moreover, to be considered is whether shocks are idiosyncratic (in which case they initially affect only one node) or common (in which case they affect numerous nodes simultaneously). Second, the propagation of the impact through the network should be analyzed. The propagation of a shock requires certain assumptions regarding the transmission of stresses between interconnected components. Stress can be transmitted sequentially, from one node to the next, or simultaneously, to multiple nodes at once. Shock propagation can be mechanical, or behavioral (e.g., trading methods based on heuristics), or both.

When it comes to macroprudential regulation, either all the potential dangers have to be identified to set buffers against sudden changes, or shock absorption may be utilized to enhance resilience. The failure of the banking supervisors to detect the risk that ultimately brought down SVB, SB, CS and First Republic Bank is the point to focus on.

This is consistent with the current school of thought in financial regulation, which emphasizes a comprehensive inventory of potential threats before formulating rules and buffers to keep the risks away. Notably, the pool of potential threats and risks should accommodate the financial system in a broader sense, including non-systemically important banks, investment banks, shadow banks, asset managers and even insurance companies.

The other option is to make the banking system more resilient by improving its capacity to absorb shocks. The banking system, contrary to widespread assumption, is very robust, able to weather virtually any storm. Authorities might leverage this innate resilience to improve shock absorption, making the system more resilient to failures like SVB, CS and First Republic. The banking system can be diversified to achieve this, by issuing more bank charters, reducing concentration risk by spreading their risks across industries and asset classes, and lowering the impact of an industry downturn on the banks’ loan portfolios. The Basel III framework ensures banks have enough capital to sustain losses. Additionally, banks may transfer risks by insuring against natural disasters or cyberattacks. However, the findings about the true impact of diversification are still mixed1. Diversification actions in the direction of eliminating risks are happening with the rise of competition with non-financial institutions and FinTech or BigTech companies. Therefore, regulation should also be rethought. Basel III was written in a period during which nominal interest rates were falling, leading to banks’ assets’ appreciation; however, the regulatory framework should entail provisions for (especially aggressive) increasing interest rate periods, which would lead to a more dynamic and counter-cyclical approach to liquidity ratios. More variety means higher shock absorption in the system. This means rules can be made less onerous and cheaper to implement. The benefits would include faster economic growth, cheaper regulatory costs, and reduced systemic risk.

Veni is a macrofinance and financial econometrics expert with more than fifteen years of experience in research, teaching, and the banking industry. She works as a Senior Economist at Piraeus Bank, and she is an Industry Associate at the UCL Center for Blockchain Technologies. Her research interests are systemic risk, macroeconomic uncertainty, and the implications of both for asset pricing and portfolio allocation. Recently, she has also worked on the effects of technological innovation on financial intermediation and systemic risk.

Veni holds a bachelor’s degree in mathematics from the National and Kapodistrian University of Athens and a PhD in financial econometrics from the Athens University of Business Administration.

Disclaimer: The views expressed are those of the author and do not necessarily reflect those of the Piraeus Bank.

Andrea Calef, PhDDr Andrea Calef is a Lecturer in Economics at the School of Economics of the University of East Anglia and a research member of the Centre for Competition Policy. Andrea conducts micro applied research in banking, international finance, and systemic risk as well as ESG Investing, FinTech and Crypto with focus on both investment and policymaking perspectives, due to his previous working experience at the European Central Bank and at a renowned asset management. He co-authored various responses to policymakers’ consultation papers. Part of Andrea’s projects are funded by grants (AERC and CERRE).

Piraeus Bank, Greece & UCL Centre for Blockchain Technologies, London, UK.

School of Economics, University of East Anglia, Norwich, UK.

Piraeus Bank, Greece & UCL Centre for Blockchain Technologies, London, UK.

School of Economics, University of East Anglia, Norwich, UK.

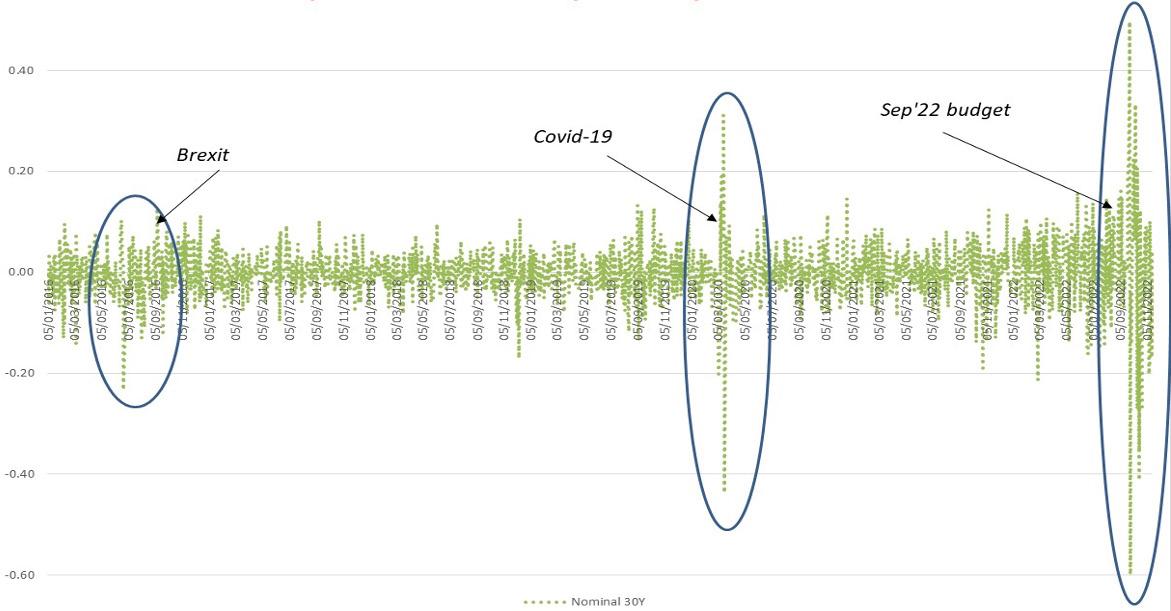

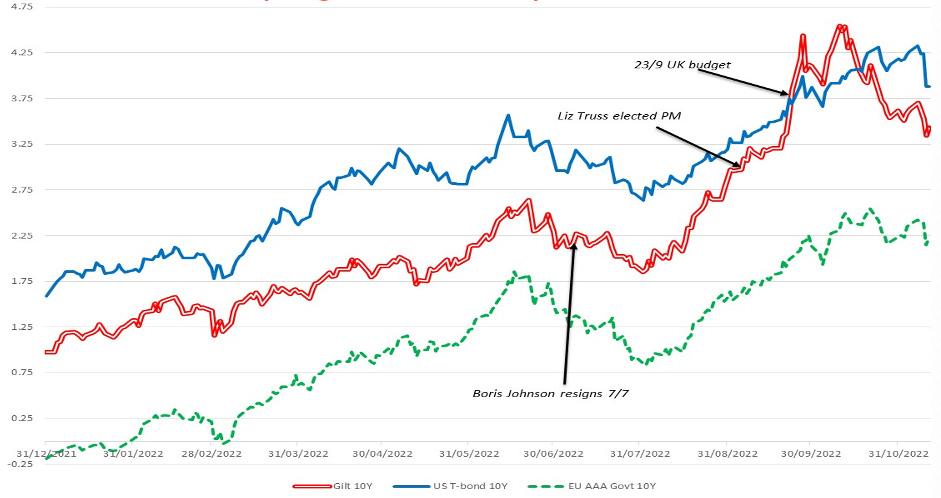

In this article the author discusses synthetic exposure to financial assets that simulates purchasing an option on the underlying asset without using derivatives. The approach uses the basic Black-Scholes pricing model and Hull’s delta hedging algorithm, which can replicate the trend in financial assets with observable market inputs (FX rates and short-term interest rates) and is tested on Apple and WTI oil futures to show its effectiveness. This provides a valuable contribution for practitioners as a simple and effective solution that can be readily implemented in a spreadsheet macro rather than through an often expensive and administratively complex options-based strategy.

Challenger retail banks, insurance companies, and fund managers use data effectively to compete directly with longer-established industry incumbents, including more effective and efficient use of fintech-like ‘open banking’ payment systems and enhanced risk simulation modelling implemented alongside flexible cloud and edge computing. Meanwhile there has been comparatively little competition to the products provided by investment banks, meaning that products like over-the counter (OTC) financial option contracts remain expensive and inflexible for purchasers such as treasurers, investors, and insurers.

However, alternative solutions that can leverage the simulation power of cloud and edge computing are now becoming available that may better suit the budgets and operational constraints of purchasers of investment banks financial products. In this article we examine a delta hedging model implemented without options that can be calibrated to suit users’ risk profiles and is cost effective in calculating a hedge ratio based on the historic volatility of the underlying asset rather than the alternative strategy of purchasing options priced using implied volatility.

Opportunities for delta hedging without options are demonstrated by a corporate client approaching a Treasurer to actively manage their Apple share exposure.

The corporate client is seeking to maintain exposure in order to participate in Apple share upside but with a lower threshold of risk – essentially the client would like to implement an option roll forward strategy on Apple shares but simulations reveal that using options renders this strategy prohibitively expensive and administratively complex as available option expiry dates do not match the required period of the hedge.

Portfolio insurance without options provides an opportunity to hold Apple shares and cash in proportion to the hedge ratio of a synthetic Apple share option contract. This strategy has the advantage of setting the risk profile of the strategy to match the client’s desired exposure to Apple shares. The Treasurer could implement this Apple share portfolio insurance strategy as follows:

Similar use cases can be constructed for an insurance Risk Manager hedging the interest rate risk of their liabilities by constructing a portfolio of assets that match any movement in the value of liabilities resulting from a change in interest rates to meet regulatory restrictions, a Private investment manager managing a client’s Tesla share exposure, an insurance company underwriting a client’s Bitcoin exposure and a trader arbitraging by selling WTI ICE options and buying delta-hedged WTI ICE futures without using options.

In late 2022 US investors turned to buying put options on individual US stocks1 after being frustrated by a controlled decline in the S&P 500 that negated the insurance provided by their short-term S&P 500 put options and VIX volatility index related protection. However, such a strategy is unlikely to be more successful during a prolonged period of market risk. What investors, treasurers, traders and insurers need are flexible hedging solutions that allows them to customise their risk profile then roll their hedge forward cost effectively for as long as they need protection from directional risk caused by market volatility.

As options based hedging strategies increase market volatility by amplifying price movements before fuelling a rebound2, a flexible, non-options based hedging solution would benefit participants who prefer less volatile markets. Delta hedging without derivatives offers long term asset price volatility insurance via a mechanism for gaining synthetic exposure to financial assets through the use of a technique that simulates purchasing an option on the underlying asset with an algorithm that leverages the concept of delta hedging, potentially disrupting the financial options market.

A delta hedge trading strategy that replicates the performance of an option by buying and selling the underlying asset in proportion to changes in the option’s hedge ratio can be used as an alternative to expensive and operationally complex derivatives.

A spreadsheet model with embedded macros replicating Hull’s3 Black-Scholes4 based delta hedging technique with a market momentum and trade reversal suppression measure was calibrated using:

1. Bank of England US$ vs £ exchange rates, 1-month US LIBOR and geometrically weighted historical US$ vs £ exchange rate volatility to simulate 91-day options.

2. S&P 500 daily returns, 1-month US LIBOR and geometrically weighted historical S&P 500 daily return volatility to simulate 91-day options.

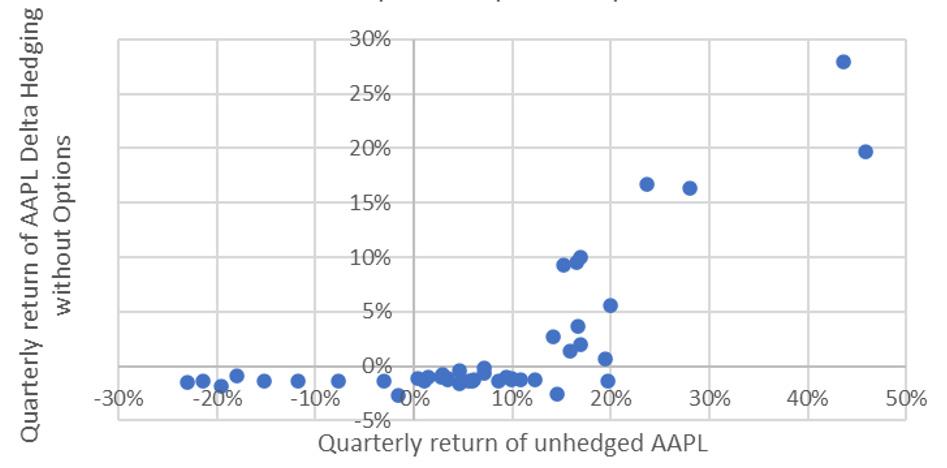

Using this model with Apple shares (AAPL)5, 91-day AAPL options were simulated from 2011 to 2023. Figure 1 shows comparative cumulative 91-day plan performance figures for log-returns of unhedged AAPL shares, delta hedging without options and 1-month US LIBOR.

In order to assess the model’s success in replicating options, Figure 2 plots the quarterly return of each of the 44 replicated options against unhedged AAPL share price return which should be similar to the option’s pay-off diagram taking account of the lower cost of the hedge (using historic rather than implied volatility).

replicate Options

3 / Hull, J. C. “Options, Futures, and Other Derivatives” 3rd edition Prentice Hall 1997 Pages 312 - 317

4 / Black, F. and M. Scholes “The Valuation of Option Contracts and a Test of Market Efficiency”, Journal of Finance, 27 (May 1972), 399-418 5 / https://uk.investing.com/equities/apple-computer-inc

Figure 1: Delta Hedging without options vs AAPL share price (2011-23) Figure 2: Plot to assess how well AAPL Delta Hedging without OptionsAnother assessment of the model’s success in replicating options, plotting the quarterly return of each of the 44 replicated options against unhedged AAPL share price return as a bar graph, is shown in Figure 3.

Using Amazon and Tesla share prices produced consistent results to Apple.

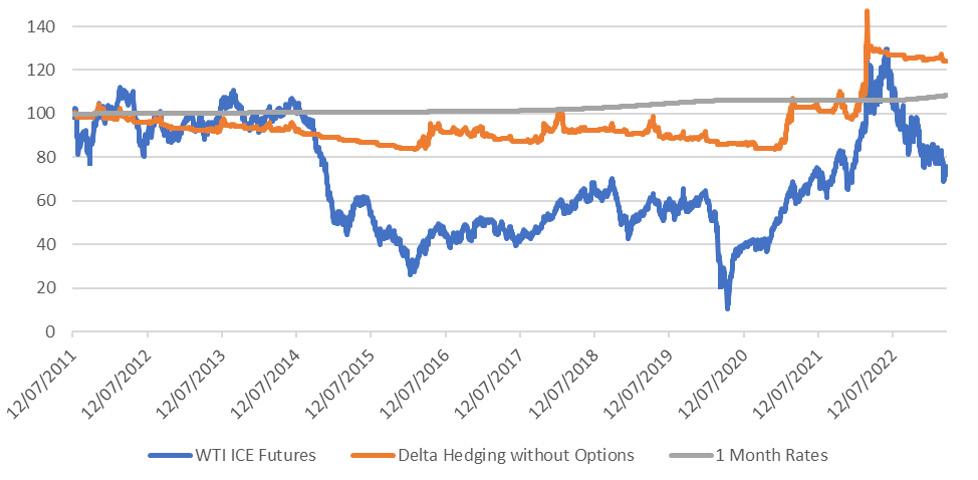

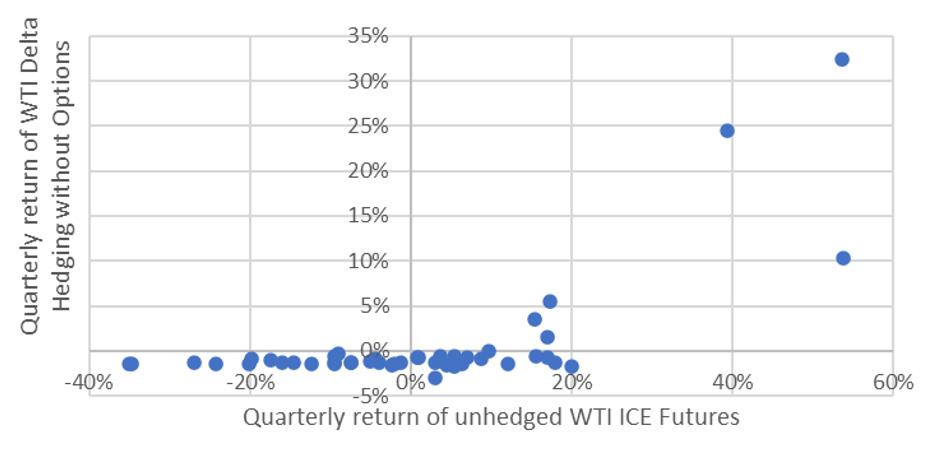

Using the same model with WTI ICE Future prices6, 91-day WTI options were simulated from 2011 to 2023.

Figure 4 shows comparative performance figures for WTI, delta hedging without options and 1-month US LIBOR were then generated based upon these calculations for the entire simulated period by cumulating consecutive 91-day plans. 6 / https://uk.investing.com/commodities/crude-oil

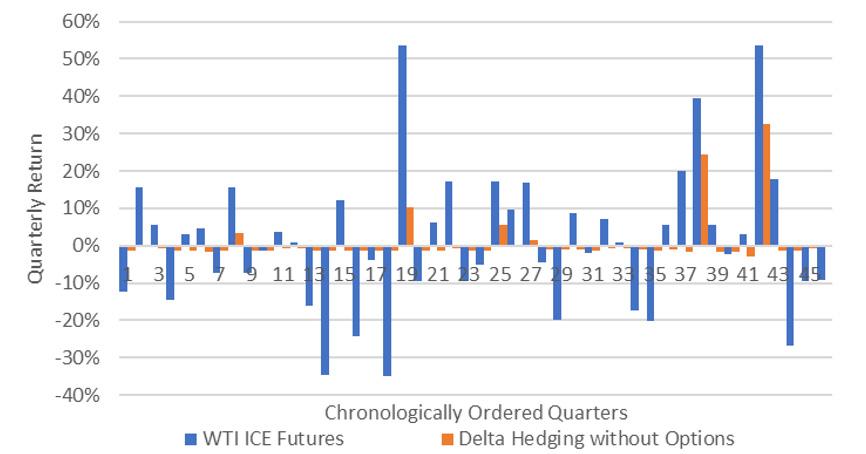

Figure 3: Bar diagram to assess how well AAPL Delta Hedging without Options replicates Options

Figure 3: Bar diagram to assess how well AAPL Delta Hedging without Options replicates Options

In order to assess the model’s success in replicating options, Figure 5 plots the quarterly return of each of the 46 replicated options against unhedged WTI ICE Futures price returns, which should be similar to the option’s pay-off diagram taking account of the lower cost of the hedge (using historic rather than implied volatility).

Plotting the quarterly return of each of the 46 replicated options against unhedged WTI ICE futures price return as a bar graph, is shown in Figure 6.

Using Brent ICE Futures and Gold Futures produced consistent results to WTI ICE Futures.

Figure 5: Plot to assess how well WTI Delta Hedging without Options replicates Options

Figure 6: Bar diagram to assess how well WTI Delta Hedging without Options replicates Options

Figure 5: Plot to assess how well WTI Delta Hedging without Options replicates Options

Figure 6: Bar diagram to assess how well WTI Delta Hedging without Options replicates Options

Simulated delta hedging trading strategies that take a position in cash and an underlying asset proportional to the hedge ratio of a synthetic option provide a cost-effective alternative to strategies that use options to delta hedge portfolios of equities and commodities. Due to its flexibility, the delta hedging without options model has also been successfully applied to small cap and cryptocurrencies where derivatives (if available) are often illiquid as well as expensive. As delta hedging is based on Black-Scholes, extensions to this model may be included like the volatility smile and fat tails in the underlying asset, but the strategy in turn suffers from known Black-Scholes limitations, such as assuming no arbitrage opportunities and that asset returns follow a lognormal pattern, thus ignoring large price swings that are observed more frequently in the real world.

Steve Lindo authors peer-reviewed by Malcolm GloyerMalcolm is a Chartered Member of the Chartered Institute for Securities and Investments. As a Certified Practicing Project Manager (CPPM MAIPM), he has more than 30 years’ experience working on projects in the UK and Australia, specializing in market risk, derivatives and commodities. Malcolm has worked as a consultant at companies including Bank of America Merrill Lynch, London Metal Exchange, Nomura, ABN Amro, EDF Trading, Santander and Lloyds Bank and has been a guest lecturer at several universities. Malcolm has had articles published in professional investment magazines and has written several eBooks.

This article explores the areas which should be of most concern to managers as data privacy laws are rolled out and start to take effect. The author describes five key corporate operational risks that management should review closely in order to implement appropriate measures to comply fully with the stringent requirements of Data Protection and Privacy regimes.

According to ISO 31000, risk is the “effect of uncertainty on objectives” and an effect is a positive or negative deviation from what is expected.

ISO 31000 recognizes that all of us operate in an uncertain world. Whenever we try to achieve an objective, there’s always the chance that things will not go according to plan. Every step has an element of risk that needs to be managed, and every outcome is uncertain. Whenever we try to achieve an objective, we don’t always get the results we may expect.

Sometimes we get positive results and sometimes we get negative results – and occasionally, we get both. The traditional definition of risk combines three elements: it starts with a potential event and then combines its probability with its potential severity. A high risk event would have a high likelihood of occurring and a severe impact if it actually occurred.

The coming of privacy regimes for private corporations and public organizations, have focused leaders’ thoughts on the personal data held within their organizations and how best to protect it against various risks these data face. Since the first step towards securing and protecting anything is understanding what you have, an Information Asset Register is crucial.

An Information Asset Register (IAR) is a database which holds details of all the information assets within your organization. This can include:

• Physical assets such as paper files

• Computer systems

• Data and how you store, process and share it

Creating an IAR helps to make information assets easy to find, share and maintain. This will also help organizations develop and maintain the processing records requirement of GDPR and LGPD for personal data.

Any organization that is required to comply with the relevant privacy regime (GDPR, LGPD, etc.) must conduct regular risk assessments and must implement ‘technical and organizational measures to ensure a level of security appropriate to the risk.’

To do that, organizations need to know what their risks are and how severe subsequent threats may be. Companies need to identify the most appropriate solutions for mitigating risk and ensure they meet the relevant privacy regime’s requirements to:

• Safeguard the confidentiality, integrity, availability and resilience of personal data, processing systems and services

• Quickly restore the availability of and access to personal data after a data breach, and

• Regularly test the effectiveness of technical and organizational measures for safeguarding the security of processing 2

Also, as privacy is a fundamental right for all people, GDPR and other privacy regulations require that organizations fully consider the risks that processing poses to the privacy and freedoms of individuals. Some examples that are more likely to result in ‘high’ risk include:

1. Systematic automated profiling

2. Large scale monitoring of sensitive data

3. Systematic monitoring of a publicly accessible area

The following are five key corporate operational risks (COR) management teams should look at more closely in relation to GDPR, LGPD, and other privacy regimes.

2 / For a full set of measures to enable and support organizations to comply fully with privacy regimes (GDPR for EU, and LGPD for Brazil) and improve their personal data processing operations are detailed in the author’s books (see ‘author’s summary data’ for link to the books).

corporate operational risks where vigilance is needed

Organizations should have in place, under all privacy regimes, the right Information Asset Risk Assessment Process to detect and investigate a personal data breach and ensure the firm has the right measures in place to notify the individuals impacted and the authorities.

A usual Information Asset Security Risk Analysis and Management Methodology contains the following steps:

• Step 1. Identify Information Assets

• Step 2. Classify and label information

• Step 3. Identify threats

• Step 4. Identify vulnerabilities

• Step 5. Assess security risks

• Step 6. Identify security measures

• Step 7. Document assessment results.

Under GDPR and LGPD, individuals (data subjects in the GDPR and LGPD lexicons) have several rights, including the right to be informed about the data a firm holds, the right of erasure, the right to data portability, and the right to not be subject to automated decision-making, including profiling. Given the sensitive nature of much of the data processing all organizations do on individuals, it’s likely that many firms will be tested for privacy-compliant personal data handling by individuals, consumer groups and other advocate groups.

GDPR and other regimes now make it a legal requirement for firms to adopt a privacy by design and by default approach in new system/product/service development. Firms must carry out a Data Protection Impact Assessment as part of new system/product/service development project in many circumstances.

Personal data exist in both computerized databases (e.g., personnel, customer) as well as in the employment records held within the Human Resources function.

HR teams should make sure that all of the GDPR requirements are implemented within the Human Resources’ handling of employee and applicant data. Compliance measures include: an Employee privacy policy, Employee Confidentiality Statement, etc.

The fines that could be imposed for failure to comply with GDPR, LGPD and other regimes can be disastrous. For GDPR they can be as high as €20 million, or 4% of a firm’s annual global turnover.

It is paramount that management should work with compliance teams to ensure that proper measures and documentation exist to comply fully with the relevant privacy regime to mitigate this risk.

Clearly it makes good business sense for firms to establish procedures and automated mechanisms (software) to monitor data protection and data privacy-related risks, requests from individuals for their personal data, breaches and other events that may impact operations, so that they can track and manage these risks more effectively, as well as report on them to senior management and the board. Understanding these risks will help organizations abide by regulation and thereby avoid costly compliance fines, plus limit other consequences such as corporate reputation and brand damage.

John Kyriazoglou, B.A (Hon), CICA, is a Business Thinker, Consultant and an Author. He is currently the Editor-in-Chief for the Internal Controls Magazine (U.S.A.) and consults on Data Privacy and Security Issues (GDPR, e-Privacy, etc.) to a large number of private and public clients. He has written numerous articles and several books on Data Privacy, Business Management Controls, IT Strategic and Operational Controls, Teleworking and Ancient Greek Wisdom.

For more details, see: Bookboon

Synopsis

Cyber insurance premiums have increased and insurers are reducing coverage, putting CFOs and risk managers under pressure to negotiate smartly for cyber insurance. Cyber risk is now a significant business risk. Quantifying cyber risk using FAIR enables accurate assessment and cost-effective mitigation. Organizations can make informed decisions by leveraging benchmark data and FAIR analysis, combining insurance with good security practices.

by Nick Sanna

by Nick Sanna

Cyber insurance premiums have seen an 11 percent increase in Q1 2023, as reported by insurance brokerage Marsh1. Insurers are not just raising premiums but reducing coverage as well. This places increasing pressure on CFOs, risk managers and their attorneys to read policy documents with an eagle eye and negotiate smartly on cyber insurance as well as other lines such as D&O, general liability/ CGL, crime insurance, property insurance, which may also provide coverage for a cyber-instigated loss event.

Cyber risk has become a significant business risk. Ransomware attacks have exploded. In 2022, approximately 66 percent of organizations reported to be victim of ransomware attacks, as indicated by a Sophos survey of 5,000 organizations. With “digital transformation” being a top priority for many organizations, the cyber “attack surface” will continue to grow, increasingly impacting corporate operations.

Insurance is just one aspect of the puzzle in “transfer, tolerate, treat or terminate.” CFOs need to understand the entire spectrum of cyber risk and response. That requires normalizing cyber risk as part of enterprise risk. Achieving this goal requires quantification of cyber risk in dollar terms so that it can be aligned with the rest of the disciplines of enterprise risk.