INTELLIGENT RISK knowledge for the PRMIA community ©2024 - All Rights Reserved Professional Risk Managers’ International Association February 2024

PROFESSIONAL RISK MANAGERS’ INTERNATIONAL ASSOCIATION

CONTENT EDITORS

Carl Densem

Risk Manager, Financial Markets, Rabobank

Steve Lindo

Principal, SRL Advisory Services and Lecturer at Columbia University

SPECIAL THANKS

Thanks to our sponsors, the exclusive content of Intelligent Risk is freely distributed worldwide. If you would like more information about sponsorship opportunities contact sponsorship@prmia.org

INSIDE THIS ISSUE

03 Editor introduction

04 Creating and sustaining a healthy risk culture by Nino Gordeladze-O’Brien

11 Guiding principles for enhancing operational risk stress testing by Peter Ding

15 Hedging technological (crypto) commodities by Malcolm Gloyer

21 Measuring carbon exposure in investment portfolios by Daniel Arnold

27 Banking on heightened regulatory scrutiny by Scott Freidenrich

32 Navigating the unpredictable: Insights from high reliability organizations - by Famien Konan

37 ESG and world change: the competing perspectives by Ina Dimitrieva & Elisabeth A. Wilson

43 Using portfolio diversification to hedge against high inflation by Andrei Ordine

49 What they don’t teach you at risk school by Rick Nason

52 The risk mitigation power of data for our most foundational infrastructure: The power grid by John Smithers

56 Basel III compliance with securities financing transactions by Edward Bace

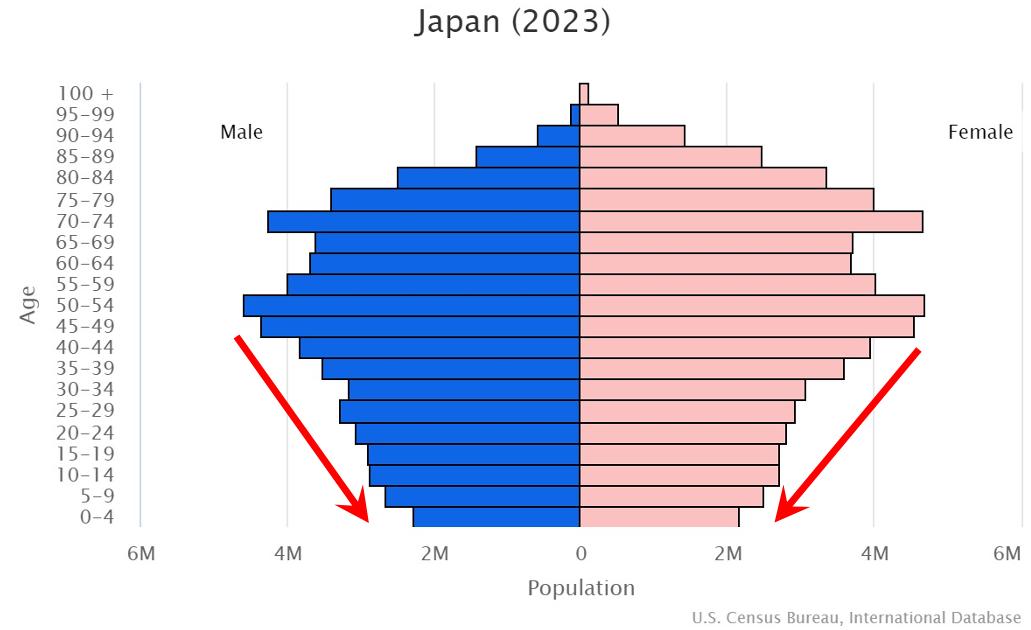

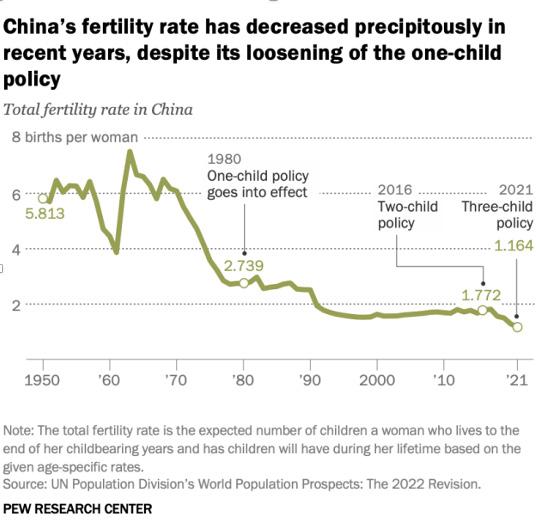

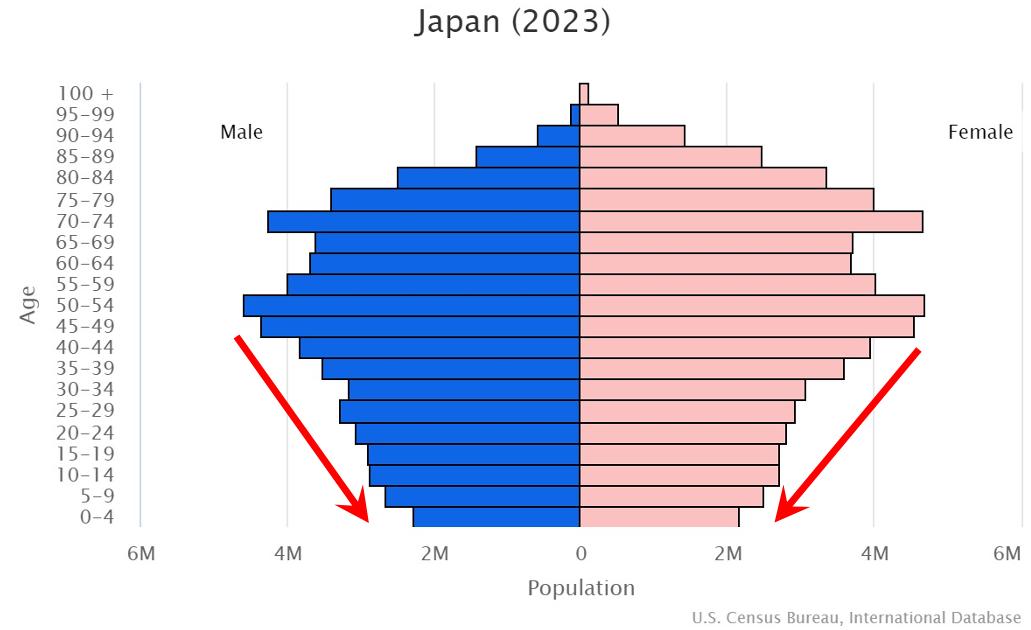

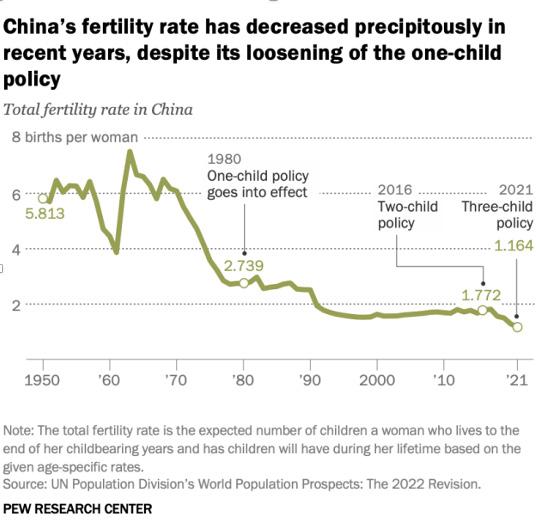

61 Why a low birth rate may be the biggest risk of all by Carl Densem

66 Tokenization: A risk and accounting paradigm change by Peter Hughes

FIND US ON prmia.org/irisk @prmia

Intelligent Risk - February 2024 02

editor introduction

Carl Densem Editor, PRMIA

Carl Densem Editor, PRMIA

Our first issue of 2024 demonstrates the diversity of areas of expertise which comprise the Intelligent Risk community. Our Capstone article focuses on risk culture, that hardto-define and increasingly important foundation for any organization’s thriving. It is also a primary focus of banking regulators, who are wary of 2023’s bank failures repeating. In Creating and Sustaining a Healthy Risk Culture, Nino Gordeladze-O’Brien explores the traits of healthy risk cultures and how to spot one in the wild. She points out that critical to practitioners this year will be supervisory assessments that look at behavior because it is the “tangible manifestation of invisible culture.” Nino also looks at the roadmap to an effective risk culture, plus how to know when you’ve arrived.

Steve Lindo Editor, PRMIA

Steve Lindo Editor, PRMIA

Staying on risk culture, you won’t want to miss Rick Nason discussing What They Don’t Teach You At Risk School. He points out the importance of sociology (how people act in groups) and psychology (how people act individually) in practising risk management. Another returning author, Famien Konan, encourages risk managers to learn from examples of resilience in other industries in Navigating the Unpredictable: Insights from High Reliability Organizations.

ESG is quite clearly being tugged in different directions, so much so that risk managers find it hard to keep up. Ina Dimitrieva and Elisabeth Wilson return to our pages with real-life examples in ESG and World Change: The Competing Perspectives. Our final highlight is of Peter Ding’s Guiding Principles for Enhancing Operational Risk Stress Testing. He outlines the regulatory background and challenges facing operational risk stress testing before setting up a common-sense, practitioner-friendly framework for going about it. You can also watch our author interview with Peter.

Top articles of 2023

In a first for Intelligent Risk we asked you, our readers, to vote on your top 3 articles of 2023 (excluding capstones). The 4 issues spanned 50 articles, so competition was stiff. The results are in! Congratulations to the following:

Top Article of 2023

Rick Nason – Does Your Risk Management Pass a Turing Test?

1st Runner-up Dr. Aakash Ramchand Dil – How A Small Oil Nation is Leading on ESG

2nd Runner-up John Thackeray – Shepherd or the Sheep: Introducing Climate Risk Frameworks

Sponsorship opportunities

Lastly, Intelligent Risk is volunteer run: our editors, authors and peer reviewers contribute our time and talents because we recognize its value. Sponsorship of the publication offers value to our sponsors and supports our ability to continue to enhance this worthwhile publication. To broaden options and offer value, two new options for potential sponsors are now available: Article Sponsorship and the Virtual Fireside Chat. These are more targeted than the existing Issue Sponsorship option. For details and to learn more about sponsorship opportunities in an upcoming issue, reach out to cheryl.buck@prmia.org

03 Intelligent Risk - February 2024

A healthy risk culture delivers many tangible benefits. Creating one starts with defining organizational culture and risk culture and developing a roadmap customized to the organization. In this article, the author explains these cultural definitions and describes the key elements of a risk culture transformation roadmap, the challenges to be expected, and the critical success factors to overcome them.

creating and sustaining a healthy risk culture

by Nino Gordeladze-O’Brien

defining organizational culture

I would like to share my insights on how organizational value can be delivered through a healthy Risk Culture at any organization, by drawing on my experiences in each of the Three Lines [of Defense] (IIA, 2020) i at systemically important/listed banks, multinational FMCG1 companies and the Big Four accounting firms in both developed and developing economies.

First, let us align on the understanding of Organizational Culture, which often is perceived to be amorphous and nebulous. For simplicity, I propose to refer to it as “the way we do things around here”, or even better “what we do, when no one is looking” (Miles, 2021) ii. According to the UK’s Financial Services Culture Board, “understanding a firm’s culture matters, because it is fundamental to the way in which a strategy agreed in the boardroom actually takes effect” (FSCB, 2018).

By now, it is commonly understood that unhealthy culture has been the root cause of corporate failures for decades internationally – from Enron’s 2001 accounting fraud to the most recent Silicon Valley Bank and Credit Suisse scandals in 2023. The multitude and the diversity of these institutional failures has resulted in the loss of public trust in the financial sector, the accounting profession and even the regulators’ ability to prevent their occurrence. Consequently, regulatory focus has been growing in this space. According to Bank of England’s (BoE) research, “robust evidence” was found, that “poor culture leads to substantially higher [banking] risk, demonstrating the importance of bank culture for prudential outcomes” (Joel Suss, 2021) iii. Other regulators, including De Nederlandsche Bank (DNB), European Central Bank (ECB), Australian Prudential Regulation Authority (APRA) and the Federal Reserve Bank of New York (NY Fed) share this view.

CAPSTONE ARTICLE Intelligent Risk - February 2024 04

Synopsis 1 / Fast Moving Consumer Goods

Poor culture is often better understood than “healthy culture”. Fortunately, the UK’s Financial Conduct Authority (FCA) comes to our aid by noting that “healthy cultures are purposeful and they are safe” (FCA, 2020iv , where the former criterion refers to an organizational purpose beyond the business model and profitability, and the latter highlights the significance of psychological safety at organizations, i.e. environments where employees are not worried about negative consequences when raising concerns. Another important factor, identified by regulators as being instrumental for reducing misconduct, is cognitive diversity – the term, which goes beyond the conventional diversity metrics around gender, ethnicity and social backgrounds, rather denotes different styles of thinking, information processing and perspectives, overall contributing to the improved collective problem-solving at the institution (Miles, 2021)v .

key elements of risk culture

This brings us to defining Risk Culture as a subset of overall organizational culture, which is specific to the way people think and behave about managing risk. Effective Risk Culture plays a key role in delivering overall healthy Organizational Culture. According to the results of ACCA’s global survey “Risk Culture: Building Resilience and Seizing Opportunities” (Johnson, 2023)vi, where around 2,000 risk leaders responded from across the world, “a good risk culture is an organizational culture that gives staff the capacity to spot emerging risks and act on them”. On the other hand, ECB notes that “risk culture is a set of norms, attitudes and behaviors related to awareness, management and control of risks in a bank. It shapes [staff’s] day-to-day decisions and has an impact on the risks they take.” (ECB, 2023)vii Frank Elderson (the vicechair of ECB’s Supervisory Board) highlighted the importance of culture and behavior assessments as part of ECB’s overall supervisory assessment process, in his September 2023 speech. He further noted, that “behavior is the tangible manifestation of invisible culture”, and that “it is directly observable, while culture is not” (Frank Elderson, 2023)viii. Assessing behavior as part of organizational/risk culture supervisory reviews is the approach first introduced by DNB (the Dutch regulator) in 2010ix, and since has been considered by other regulators around the world.

Bearing in mind the increased stakeholder focus on healthy Risk Culture, it would help to understand what the target Risk Culture looks like at an organization and the effort required to achieve it.

To make Risk Culture more tangible, let us break it down into four key elements (in no particular order of significance):

1. Purposeful Culture and Risk Leadership

The first element entails defining what “purposeful culture” means for an organization and the role Risk Management needs to play in helping fulfil this purpose. It covers “Tone at the Top” as well as “Tone from Above” – i.e. line manager’s behavior as one of the key influencers on employees’ behavior. Also, it includes an “Openness and Challenge” component, which encompasses psychological safety and moral courage to speak-up i.e. anti-bystanding behavior.

05 Intelligent Risk - February 2024

2. Governance & Decisions

The second element includes allocating and agreeing risk management related accountabilities and responsibilities across the Three Lines (IIA, 2020). Although it is commonly accepted that “risk management is everyone’s business”, ECB’s report (ECB, 2023)x highlights a number of improvement opportunities in this area and demonstrates the need for further effort. The second element also covers “Transparency and Reporting”, where a strategically aligned risk appetite framework is cascaded to all operations and is used as a risk-taking guide for day-to-day decision-making. Ideally, any deviations from set tolerances are timely responded to and escalated to relevant stakeholders within and outside the organization. Finally, to achieve a healthy Risk Culture, business decisions must be long-termist and supported by reward and incentives schemes to facilitate intended risk behavior (ECB, 2023).

3. The third element is “Competency”, which includes risk awareness, skills, knowledge and risk resources.

4. The fourth element “Systems and Controls” encompasses risk systems, processes and controls.

In general, the last two elements are there to support those individuals who are willing to “do the right thing”, by providing them with a common risk taxonomy and tools across the organization. They help improve communication between the key stakeholders and help them agree on mutual expectations and priorities around risk management.

roadmap to implementing a healthy risk culture

The following are seven phases of a healthy Risk Culture implementation (or enhancement) program:

1. Perform Risk Culture Diagnostic – this could be performed by utilizing a combination of various methods, including employee surveys and interviews (both focused on collecting observed behaviors rather than opinions), direct observation and analysis of staff behavior, specific tools available on the market (including Barrett’s “Cultural Values Assessment” model (BVC, n.d.)xi, Risk Type Compass (PCL, n.d.) etc., analysis of internal data and information (including customer complaints, regulatory letters, control function and assurance provider reports, incident trend analysis, employee concerns via various channels, etc.

2. Re-imagine the Target State in line with the Business Strategy for both mid- and long-term horizons.

3. Perform Gap Analysis.

4. Develop a Risk Culture strategy and a detailed Implementation Roadmap addressing the root causes of findings in the Diagnostic phase.

5. Obtain Board and management commitment for long-term support (cultural transformation could take

06 Intelligent Risk - February 2024

between 3-5 years to show any tangible results), including a budget which reflects sourcing core team members with diverse capabilities, as well as tools and systems required for an organization-wide Risk Culture strategy implementation.

6. Execute the detailed Roadmap via a phased approach by recruiting and onboarding the team, while sourcing and implementing required tools and systems. Considering the cross-functional nature of a Risk Culture transformation project, it is important to agree shared deliverables aka “key business objectives” with key stakeholders. Maintaining ongoing communication with them will provide a continuous feedback loop and opportunities to fine-tune the implementation Roadmap.

7. Periodically review, re-validate and update the Risk Culture transformation strategy and Roadmap to ensure they remain relevant in the light of changing circumstances or the business strategy.

key challenges to implementing a healthy risk culture

Below are some of the key challenges to anticipate when embarking on a Risk Culture transformation journey:

1. “One size-fits-all” approach even within the organization does not work, because often the degree of change required and employees’ readiness to change varies across the organization, while the analysis to understand this uneven terrain is frequently not undertaken, sometimes due to lack of insights and/ or tools.

2. Resistance to organization-wide change - as noted earlier, human behavior determines how healthy or unhealthy culture is formed. Human behavior itself is influenced by biases which are difficult to change. Another reason for resisting the transformation could be culture program fatigue, especially in the post-pandemic world, where many organizations have experimented with multiple modes of work and other cultural change initiatives driven by the changing operating circumstances. Also, if Risk Culture transformation is perceived to be superficial, a mere branding exercise, then it will not be supported by the critical mass of employees.

3. Difficulty in measuring culture – conventional indicators (such as training attendance rates, Net Promoter Scores, unconscious bias testing) do not actually measure culture, so it is difficult to quantify the current state of Risk Culture as well as to track progress.

4. Most organizations are likely to face conflicting stakeholder expectations and needs, consequently, the ability to manage these effectively will influence the success rate of this transformation initiative.

5. Due to competing organizational priorities, there might be difficulties in prioritizing Risk Culture initiatives.

6. According to DNB’s insights (DNB, n.d.), boards often lack expertise in behavior and culture, leaders do not sufficiently abide by the values that they endorse, and proposed measures are insufficient to achieve intended change.

07 Intelligent Risk - February 2024

critical success factors

To overcome the above challenges, the following are some of the critical success factors to aim for:

1. Strong sponsorship and advocacy both at the top and mid-level management is the driving force for any change initiative, especially the long-term cultural one. Observable leadership behavior is one of the strongest influencers to drive organizational change, this is where “walking the talk” really makes a difference. Also, it is helpful to identify and engage change champions and influencers across the organization. These may be individuals who have been with the organization for a considerable amount of time and have earned the respect and trust of their peers.

2. Tailored approach to change – gaining a comprehensive understanding of the organizational landscape in terms of the degree of culture change required and the employee readiness to change, perhaps assisted by behavioral science tools, could help identify those areas in the organization where the likelihood of transformation success is higher. Successful use cases also help with faster and more effective rollout of the change program to the rest of the organization.

3. Understanding and addressing the root causes of weaknesses identified during the Risk Culture diagnostic phase (noted earlier). Actions targeting these should be included in the detailed Implementation Roadmap (above).

4. Understanding key interdependencies across the organization and forging cross-functional commitment to support Risk Culture transformation initiatives - these could include identification of existing gaps and/or weaknesses in the processes, systems and capabilities critical for the success of the Risk Culture transformation program, and agreeing timely resolution plans with relevant stakeholders.

5. Developing new management information systems to assess culture outcomes – including meaningful forward-looking indicators (such as those developed by Bank of England (Joel Suss, 2021)xiii , inventorizing and understanding staff behaviors, with the support of various behavioral science tools. For example, Barret’s “Cultural Values Assessment” modelxiv helps identify “norms and values” at an organization as well as underlying “assumptions and beliefs” that may be driving staff behavior. Applying this tool over time could show cultural evolution and could help tailor further efforts in addressing the lagging areas.

6. Rewarding and incentivizing target [risk] behavior top-down - this could include balancing performance scorecards for both performance metrics and prudent risk-taking behaviors, aligning KPIs with the organization’s risk appetite, and applying malus and clawback clauses in case of excessive risk-taking or misconduct (ECB, 2023)xv .

08 Intelligent Risk - February 2024

conclusion

Overall, effective Risk Culture drives healthy Organizational Culture, which delivers many tangible benefits, such as shifting the mindset from reactive to proactive risk management, building organizational capability and enhancing staff resilience to change, improving social engagement, reducing reputation risk, meeting regulators’ expectations and as a result reducing fines and/or capital charges, and most importantly –improving public trust. With so many benefits on offer, there’s no reason not to embark on a Risk Culture transformation journey today.

references

i. The Institute of Internal Auditors (2020, July). THE IIA’S THREE LINES MODEL

An update of the Three Lines of Defense. https://www.theiia.org/globalassets/documents/resources/the-iias-three-linesmodel-an-update-of-the-three-lines-of-defense-july-2020/three-lines-model-updated-english.pdf

ii. Miles, R. (2021). Culture Audit in Financial Services: Reporting on Behaviour to Conduct Regulators

iii. Joel Suss, D. B. (2021, March). https://www.bankofengland.co.uk/working-paper/2021/organisational-culture-and-bankrisk - :~:text=We%20use%20this%20data%20to,bank%20culture%20for%20prudential%20outcomes

iv. Financial Conduct Authority, Discussion Paper DP20/1 (2020, March). Transforming culture in financial services, Driving purposeful cultures. https://www.fca.org.uk/publication/discussion/dp20-1.pdf

v. Miles, R. (2021). Culture Audit in Financial Services: Reporting on Behaviour to Conduct Regulators

vi. Johnson, R. (2023, April). Risk Culture: Building Resilience and Seizing Opportunities, A Global Survey and Report. https:// www.accaglobal.com/content/dam/ACCA_Global/professional-insights/riskculture/PI-RISK-CULTURE%20v8.pdf

vii. European Central Bank (2023, February). Strong risk culture — sound banks. https://www.bankingsupervision.europa. eu/press/publications/newsletter/2023/html/ssm.nl230215_3.en.html#:~:text=Risk%20culture%20is%20a%20set,on%20 the%20risks%20they%20take.

viii. Elderson, F. (2023, September). Speech: Treading softly yet boldly: how culture drives risk in banks and what supervisors can do about it. https://www.bankingsupervision.europa.eu/press/speeches/date/2023/html/ssm.sp230919~589c61455b. en.html

ix. De Nederlandsche Bank, editor Raaijmakers, M. (2015). https://www.dnb.nl/media/1gmkp1vk/supervision-of-behaviourand-culture_tcm46-380398-1.pdf

x. European Central Bank (2023, February). Strong risk culture — sound banks.

xi. Barrett Values Centre. https://www.valuescentre.com/

xii. PCL Psychological Consultancy. https://www.psychological-consultancy.com

xiii. Joel Suss, D. B. (2021, March). https://www.bankofengland.co.uk/working-paper/2021/organisational-culture-and-bankrisk - :~:text=We%20use%20this%20data%20to,bank%20culture%20for%20prudential%20outcomes

xiv. Barrett Values Centre. https://www.valuescentre.com/

xv. European Central Bank (2023, February). Strong risk culture — sound banks. https://www.bankingsupervision.europa. eu/press/publications/newsletter/2023/html/ssm.nl230215_3.en.html#:~:text=Risk%20culture%20is%20a%20set,on%20 the%20risks%20they%20take

09 Intelligent Risk - February 2024

peer-reviewed by

Steve Lindo

author

Nino Gordeladze-O’Brien

Nino’s 19 years career in risk management spans across systemically important listed banks both: in emerging and developed markets, the Big Four Consulting (EY, KPMG) and listed multinational companies in Australia. Nino accumulated unique experience in each of the Three Lines [of Defense] as well as external assurance providers granting her a broad perspective on important risk management and internal control matters.

Most recently, Nino founded GRC Consulting, focusing on Governance, Risk, Compliance, Internal Audit and ESG themes.

As Head of Enterprise Risk Management (ERM), Nino led the creation of the first ERM function at Bank of Georgia, the London Stock Exchange listed systemically important bank in Georgia. This entailed strengthening the Risk Culture and the effectiveness of the Three Lines [of Defense] Model across the organization.

In her previous role as the Chief Audit Executive/Head of Internal Audit at the company, Nino modernized the Internal Audit function and influenced the introduction of many innovative, advanced risk management frameworks throughout the Group. These experiences gave Nino in depth understanding of business processes, covering key risks and controls across a broad spectrum throughout the Group.

Prior to relocating from Australia, Nino held senior risk management roles in both 1LOD and 2LOD at Westpac Banking Corporation (the second largest bank in Australia) based in Sydney.

Nino is recognized as a thought leader and a keynote speaker at various international risk management professional events, platforms and publications.

10 Intelligent Risk - February 2024

This article highlights challenges facing operational risk stress testing and emphasizes the importance of universal guiding principles. The article outlines typical stress test phases and introduces overarching principles. It emphasizes the need to transform narrative stories into quantifiable stress scenarios and address low-frequency, high-impact risks. Applying these principles can enhance stress testing programs, help organizations identify hidden risks and improve risk management.

guiding principles for enhancing operational risk stress testing

by Peter Ding

introduction

The demand for rigorous stress testing within operational risk has witnessed a significant surge, primarily driven by intensified regulatory scrutiny and heightened interest from bank boards and senior management. The shift from the AMA (Advanced Measurement Approach) to the Basel III - SA (Standardized Approach) for operational risk capital calculation has also underscored the critical role of quantitative stress tests in evaluating and confirming the adequacy of capital calculated under the SA framework.

AMA and SA background

The AMA approach, while technically risk-based, encountered significant challenges due to the absence of standardized methodologies, the arbitrary nature of scenario selections, and the subjectivity in determining the severity of chosen scenarios. These limitations led to capital calculations that lacked consistency and comparability across different institutions, creating avenues for regulatory arbitrage. In contrast, the newly introduced SA approach prioritizes enhanced standardization by implementing uniform methodologies and parameters. Nevertheless, it departs from a purely risk-based approach, placing greater emphasis on a bank’s operating size in its calculation.

Consequently, how can banks ascertain and substantiate the adequacy of the SA calculation to cover their operational risks? Stress testing emerges as a valuable tool, perhaps one of the few available, to tackle this question. It can effectively address whether the capital amount determined via the SA approach is sufficient. Moreover, stress testing can serve the critical purpose of identifying potential capital shortfalls and assessing the need for additional Pillar II capital add-ons.

Intelligent Risk - February 2024 11

Synopsis

challenges facing operational risk stress testing

Stress testing methodologies frequently encounter hurdles and even resistance in terms of their outcomes. The challenges that operational risk managers continually confront can be attributed, in part, to the pervasive nature of operational risks, data constraints, the lack of standardized modeling approaches and result benchmarks, and communication gaps among stakeholders. Although there’s no one-size-fits-all solution that can completely resolve these challenges, the establishment and adoption of universally applicable guiding principles could substantially enhance the quality of stress testing analysis, and in turn elevate stakeholder acceptance and overall effectiveness of stress testing programs.

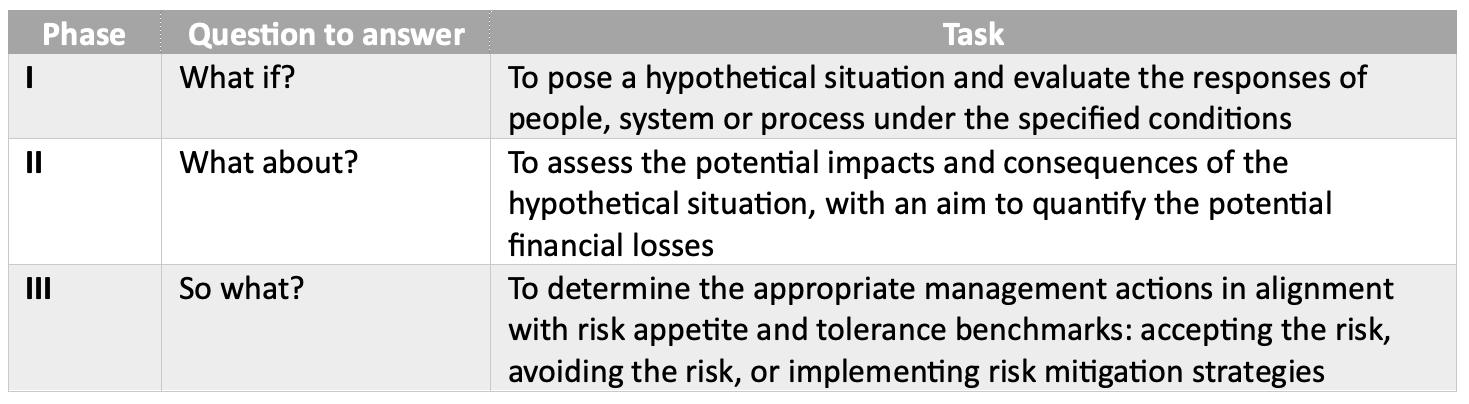

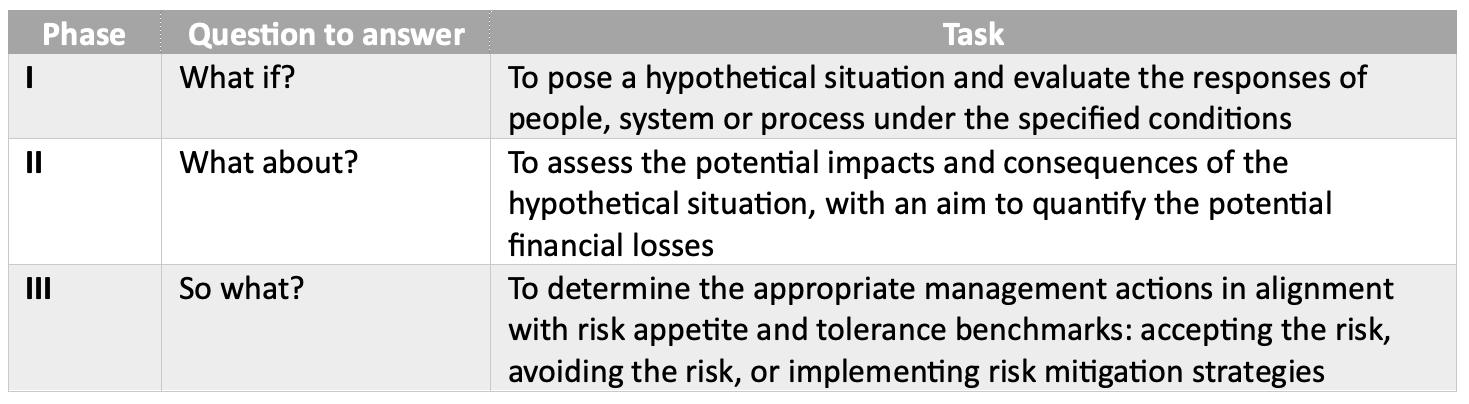

A typical stress testing exercise involves three phases and addresses three key questions.

The principles that will help guide us through these phases are discussed in the next section.

overarching principles

Principle 1: Adversity, not BAU. The primary objective of stress testing is to assess the bank’s resilience in the face of unexpected or extreme scenarios. In contrast to business-as-usual forecasts or budgets, which focus on predicting likely outcomes within the regular operating environment, stress testing is designed to evaluate potential losses stemming from improbable yet plausible situations.

Principle 2: Types of Hypothetical Stress. Stress testing can be based on either a hypothetical operating environment or the occurrence of hypothetical risk events. For instance, stress assumptions may involve heightened intensity or frequency of cyber threats or the assumption of a successful attack on specific systems. If the stress test pertains to the operating environment, a robust mechanism should be established for translating the stressed environment into probabilities of risk events.

Principle 3: Translate the Narrative. A narrative storyline or high-level topic may serve as an initial concept or starting point, however a narrative description alone is insufficient to enable effective stress testing analysis. To conduct a comprehensive assessment and allow for precise quantification, it is imperative to translate such a narrative into a well-defined stress scenario than can be presented with quantifiable and measurable factors.

12 Intelligent Risk - February 2024

Principle 4: Importance of Data. The prevalence of unavailable data and incomplete, inconsistent data poses a frequent challenge in operational risk assessment. To surmount these data-related obstacles and enhance the accuracy and reliability of the stress testing analysis, it is crucial to leverage a comprehensive data management approach, including making the most of the data at hand, supplementing it with external sources and references, consulting subject matter experts (SMEs) for their insights, building assumptions that can withstand scrutiny and maintaining the adaptability and resilience of parameters.

Principle 5: Correlations Change. In a hypothetical stressed situation, the dynamics between various variables can undergo substantial changes, and the typical cause-and-effect, input-output, or revenue-cost relationships may become disrupted. Placing excessive reliance on historical facts and relationships that have been observed within a business-as-usual (BAU) context can be ineffective or misleading. Therefore, it is necessary to approach stress testing with a fresh perspective, recognizing the likely broken relationships and applying robust overlays to account for these changes.

Principle 6: Reputational Impact. Assessing the implications for customer loyalty and reputation can be a complex task due to their intangible nature. However, it’s crucial to recognize that these aspects can carry substantial financial consequences over the long term. Negative impacts on customer loyalty and reputation may lead to reduced customer retention and decreased market share. Therefore, there is a need to explore innovative approaches to devise reasonable methods for translating the impact of these intangibles into financial loss estimation.

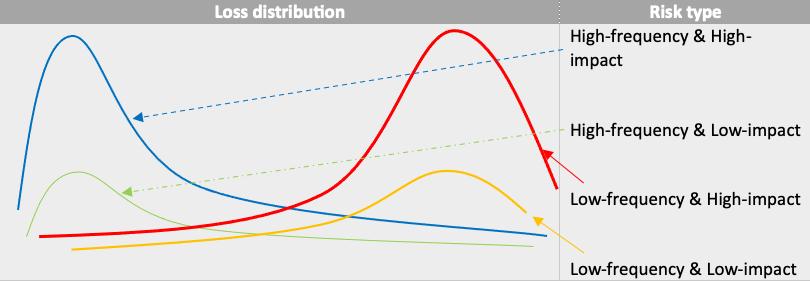

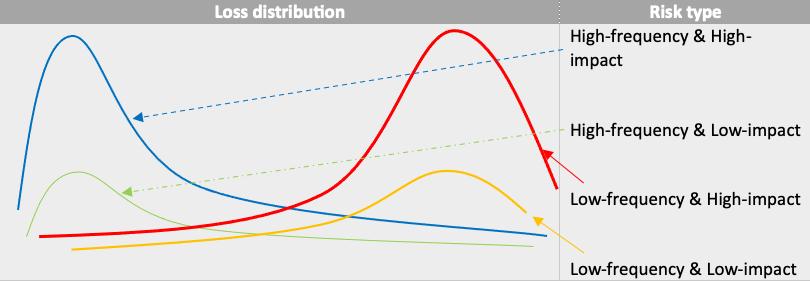

Principle 7: Lesser-Known Operational Risks. Operational risks can be categorized into four distinct groups based on their frequency and impact, as illustrated in the following chart. High-frequency risks are typically well-identified and closely scrutinized during routine risk assessments, receiving the attention they deserve. In contrast, low-frequency risks present a challenge in terms of detection within standard monitoring practices. Moreover, historical loss data often lacks sufficient information about low-frequency risk events, which can lead to their underestimation or neglect. However, significant surprises often arise from low-frequency, high-impact risks. Therefore, low frequency risks, especially those with a potential for high impact, should not be overlooked or given insufficient consideration.

13 Intelligent Risk - February 2024

Figure 1: Type of Operational Risk Loss Distribution

conclusion

Through the application of these fundamental principles in the design and implementation of stress tests, organizations can significantly enhance the quality and effectiveness of their stress testing programs. Effective stress tests play a pivotal role in uncovering overlooked risks that might go unnoticed in routine operations and risk monitoring, thereby reducing the potential for unexpected surprises and enhancing the organization’s readiness for adverse situations. Furthermore, a well-structured stress testing program can contribute to the refinement of an organization’s risk appetite and risk tolerance framework, making them adaptable and relevant in both normal and challenging circumstances.

peer-reviewed by

Jammi Rao

author

Peter Ding

Has over 20 years’ experience in banking industry, including extensive involvement in commercial lending, corporate financial service, Basel implementation and risk management. For the recent 10 years, having been focused on risk analysis and modelling and developed various models for risk rating, credit decisioning, capital calculation, liquidity assessment, stress testing and quantification of financial and non-financial risks. Holder of MBA degree in Finance and the PRM designation.

14 Intelligent Risk - February 2024

Synopsis

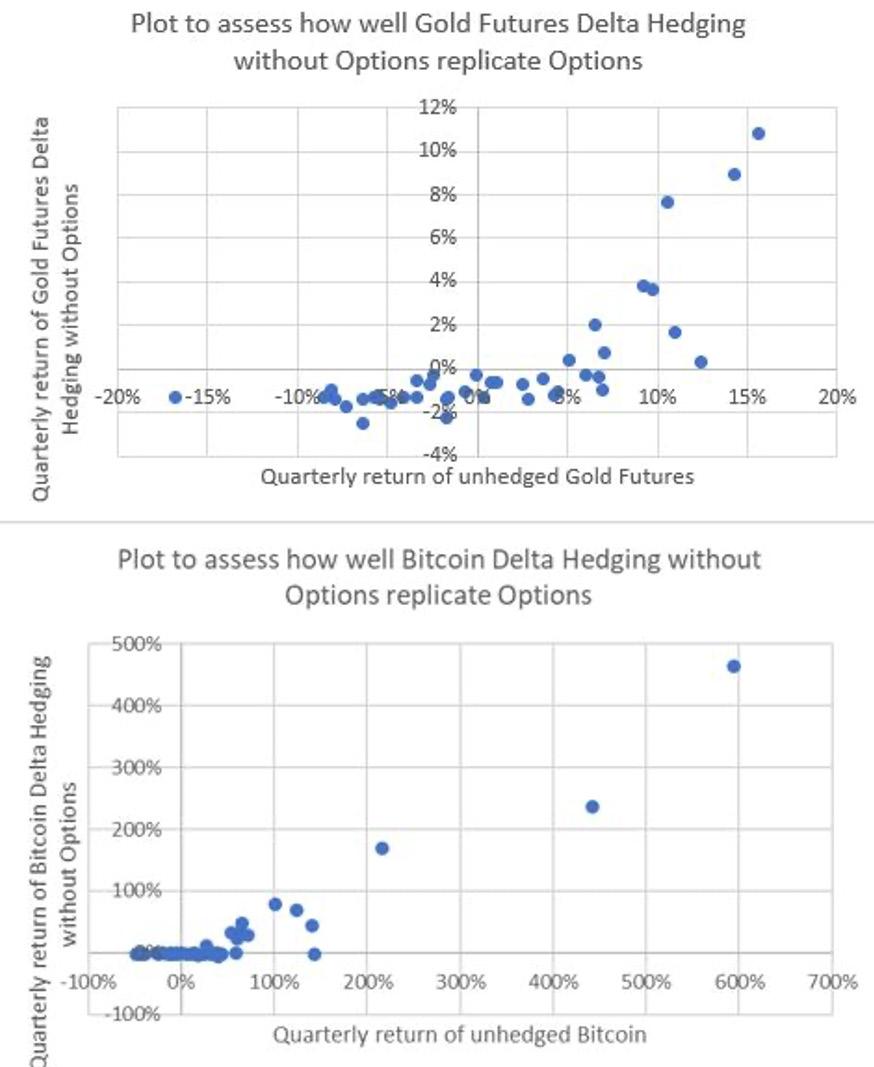

This article discusses synthetic exposure to financial assets that simulates purchasing an option on the underlying cryptocurrency asset without using derivatives as an alternative to asset allocation-based cryptocurrency research. The approach uses the basic Black-Scholes pricing model and Hull’s delta hedging algorithm, replicating the trend in financial assets with observable market inputs. This provides a valuable comparison for practitioners allowing them to draw robust inference that is likely to persist over time.

hedging technological (crypto) commodities

by Malcolm Gloyer

With an exploding literature on crypto, many papers focus on asset allocation and the third central moment or “skewness” (Ang et al., 2022)1 despite Markowitz recognising in 1952 that “the third moment of the probability distribution of returns from the portfolio may be connected with a propensity to gamble 2.” Positive portfolio contributions are unlikely to persist if these “can be attributed to rebalancing gains due to capitalizing on high excess quarterly returns on cryptocurrencies and, in opposite, due to topping-up the allocation to cryptocurrencies following their low quarterly returns relative to other asset classes”3

While volatility scaling and trend-following models have a successful history, is sufficient data really available for anyone to conclude that “the cash-crypto portfolio with equity-like volatility has fewer downside tail events and much lower volatility of volatility than the S&P 500 portfolio over our short historical sample”?4. Given the short period of availability, high volatility and non-stationarity of cryptocurrency returns, how can risk managers draw robust inference that is likely to persist over time?

comparing gold and bitcoin

Historically, gold has frequently been used as a token that creates its own financial network. Given its limited industrial use, gold’s value has come from being accepted across most national currency networks. In contrast to most other tokens, Bitcoin has a hard stop at 21 million units 5, potentially analogous to the 244,000 metric tons of gold that represent estimated total world gold discovered to date (extracted and known underground reserves) 6. However, different stochastic price patterns limit comparative analysis between gold and Bitcoin asset classes.

introduction

Intelligent Risk - February 2024 15

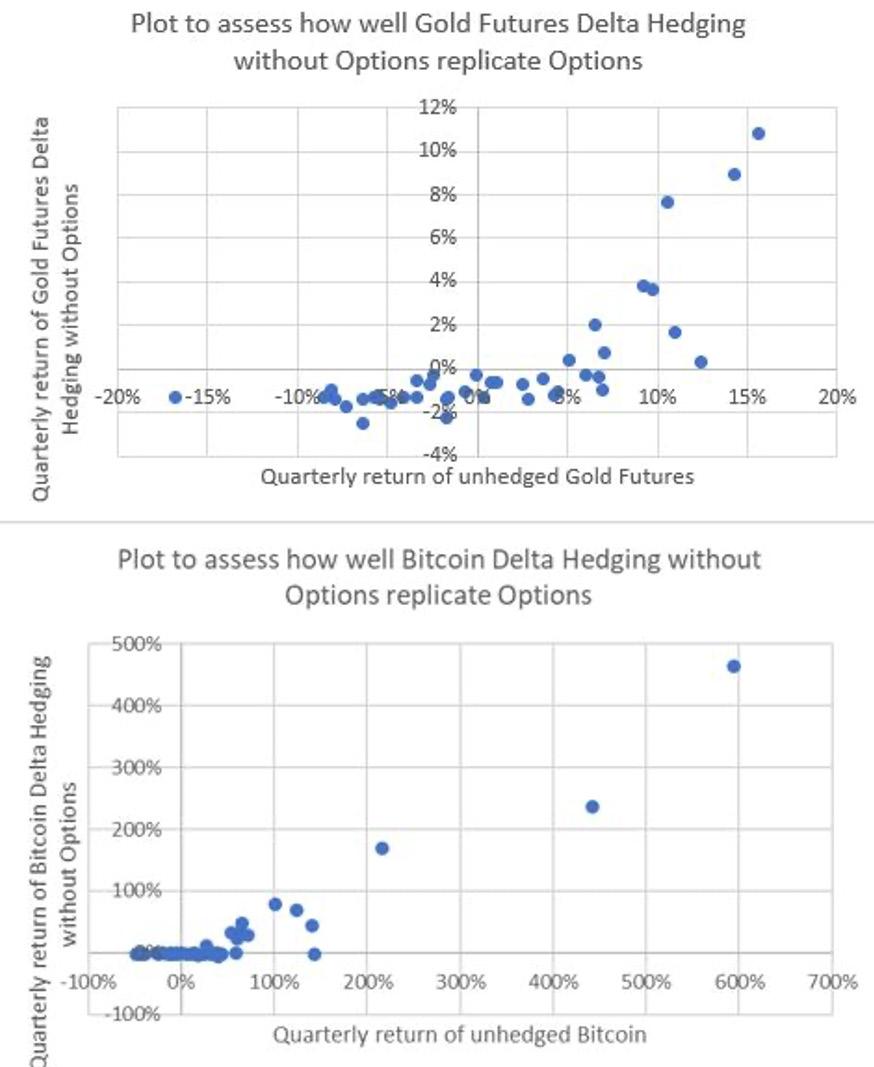

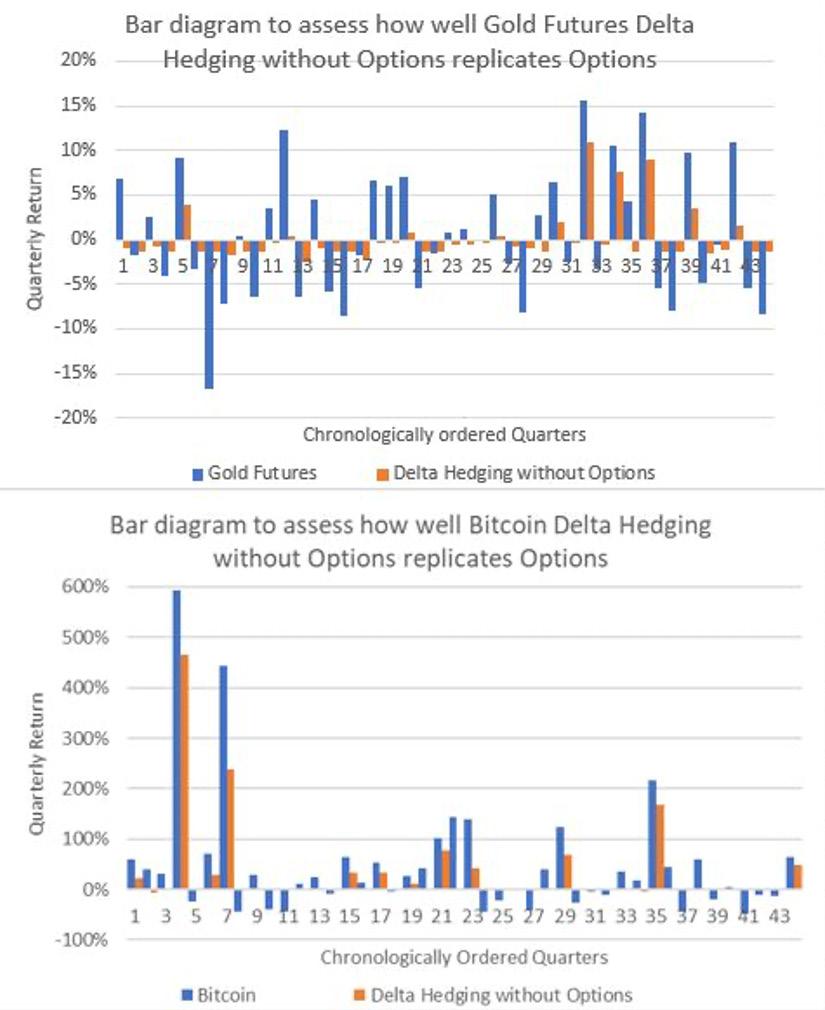

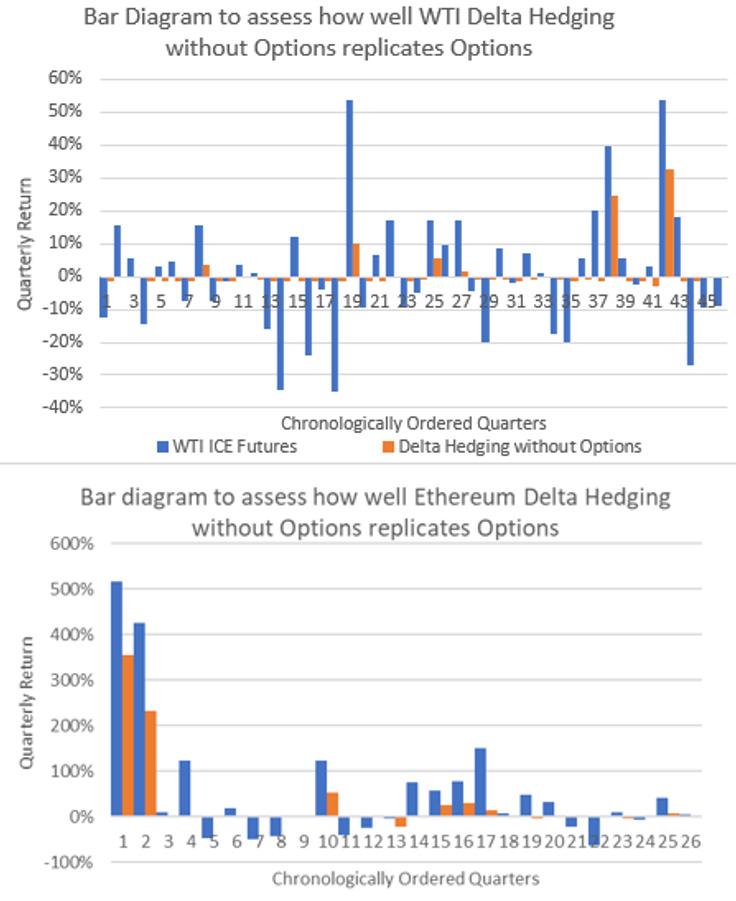

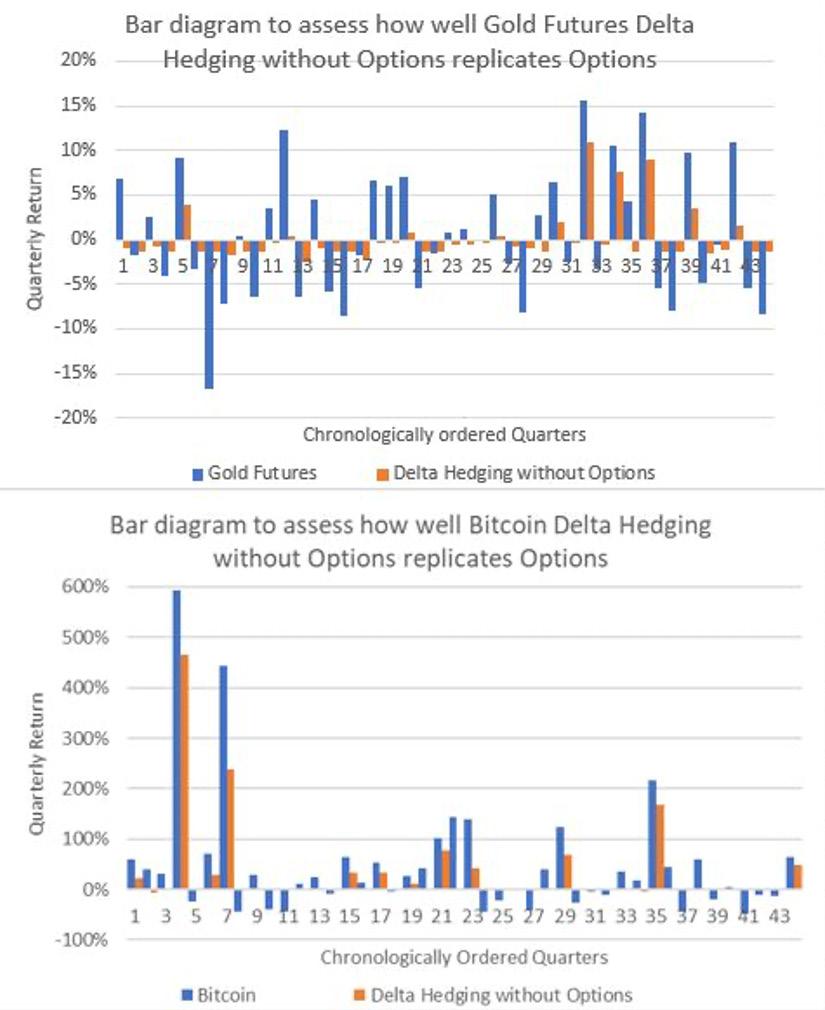

One novel approach is to model gold futures and Bitcoin using dynamic hedging without options, then compare the model’s success (using quarterly returns of each of the 44 replicated options simulated from mid-2011 to date) against unhedged gold futures and Bitcoin price returns. The idea is to replicate the option’s pay-off diagram. Similarities in the shapes of the plots demonstrate commonality in gold and Bitcoin historical prices.

16 Intelligent Risk - February 2024

Figure 1: Plots comparing gold and Bitcoin delta hedging without options to profile of option pay-off

An alternative approach to comparing gold with Bitcoin is to model gold futures and Bitcoin using dynamic hedging without options before assessing each model’s success in capturing underlying asset upside. To do this, we look at plots of the sequential quarterly returns of replicated options against unhedged gold futures and Bitcoin returns. A similar percentage of upside capture under different market conditions demonstrates commonality in the response of gold and Bitcoin historical prices when applied to a dynamic hedging without options model.

17 Intelligent Risk - February 2024

Figure 2: Upside capture plots for gold futures and Bitcoin delta hedging without options

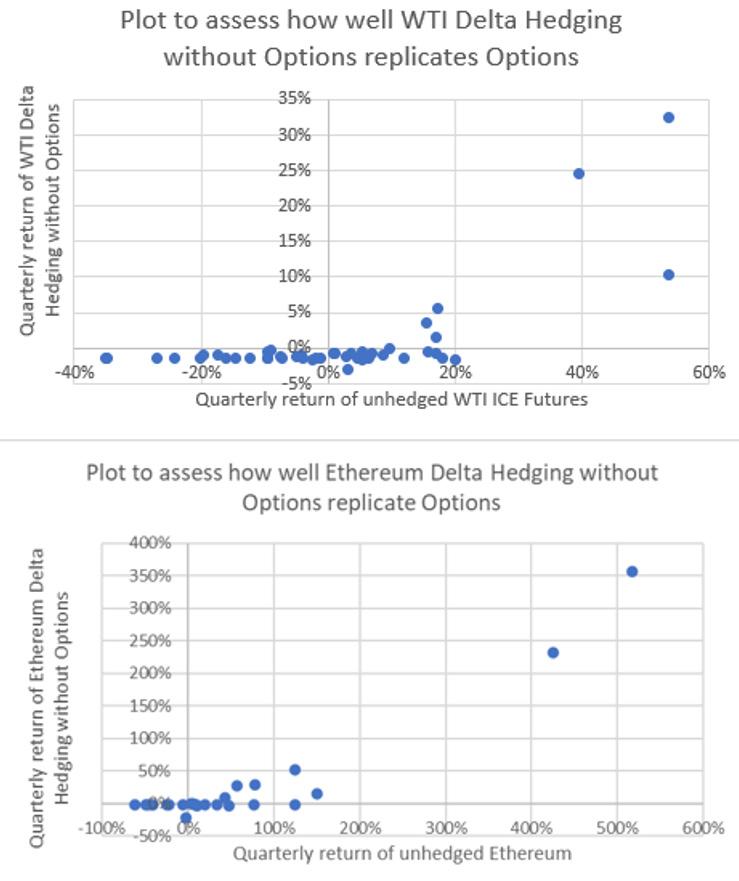

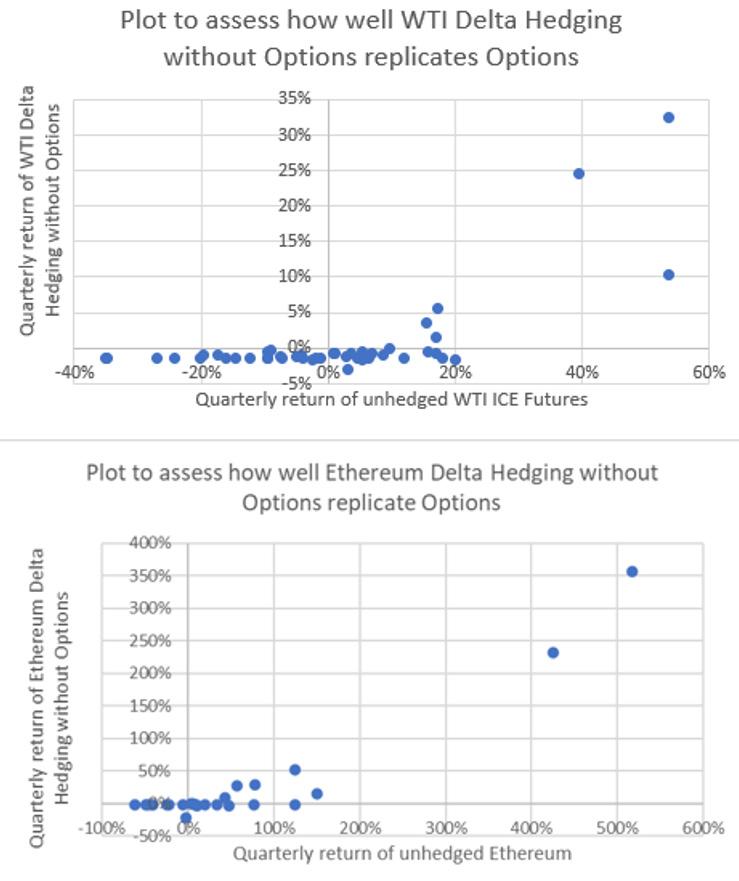

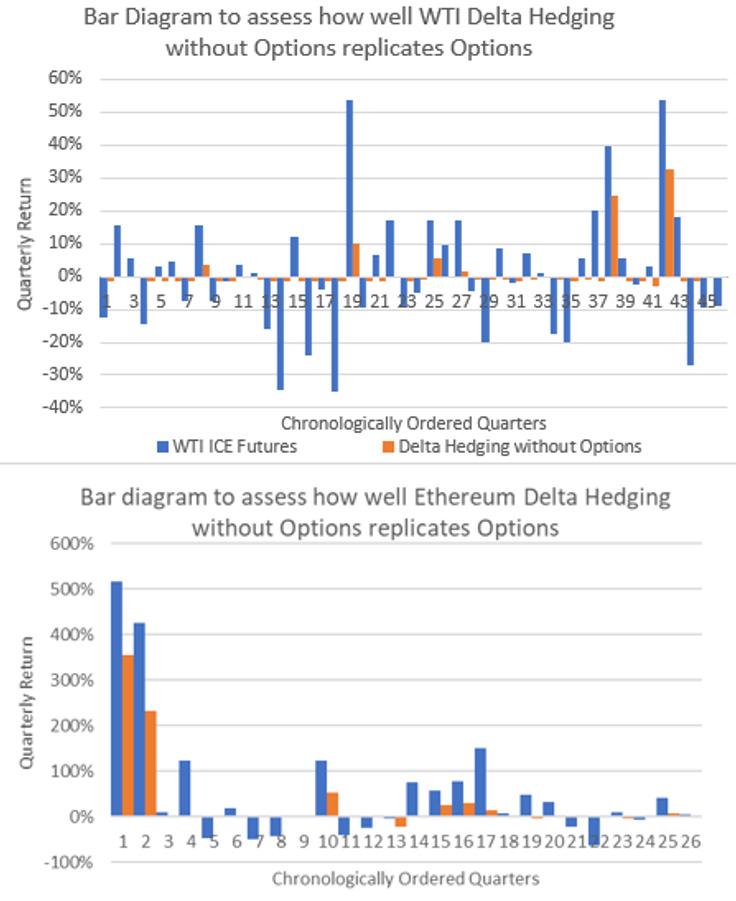

comparing oil and ethereum

Ethereum dominates a group of native coins on blockchains that facilitate smart contracting, allowing users to send crypto assets not just to other users (as they can do with Bitcoin) but also to algorithms which enable functionality like decentralised exchanges. Such cryptocurrencies are similar to oil in a way, as both are instrumental in the creation of value or wealth elsewhere in the economy. This similarity results in Ethereum and oil being a worthwhile comparison. Oil futures and Ethereum can be modelled using dynamic hedging without options and the models’ success judged by how well the return plots replicate the option pay-off diagram.

Figure 3: Plots comparing oil futures and Ethereum delta hedging without options to option pay-off profile

Figure 3: Plots comparing oil futures and Ethereum delta hedging without options to option pay-off profile

18 Intelligent Risk - February 2024

19 Intelligent Risk - February 2024

Figure 4: Upside capture plots of oil futures and Ethereum delta hedging without options

Simulated delta hedging trading strategies that take a position in cash and an underlying asset proportional to the hedge ratio of a synthetic option provide a way of comparing cryptocurrencies to more traditional asset classes. Risk managers can draw inference from similar patterns in synthetic option pay-off diagrams and underlying asset upside capture that are likely to persist over time.

As delta hedging is based on Black-Scholes, extensions to this model may be included like the volatility smile and fat tails in the underlying asset, but the strategy in turn suffers from known Black-Scholes limitations, such as assuming no arbitrage opportunities and that asset returns follow a lognormal pattern, thus ignoring large price swings that are observed more frequently in the real world.

references

i. Ang, A., Morris, T., Savi, J. (2022). Asset Allocation with Crypto: Application of Preferences for Positive Skewness. SSRN. https://ssrn.com/abstract=4042239

ii. Markowitz, H. (1952). Portfolio Selection. Journal of Finance, 7:77-91.

iii. Sepp, A. (2023). Optimal Allocation to Cryptocurrencies in Diversified Portfolios. SSRN https://ssrn.com/abstract=4217841

iv. Harvey, C.R., Zeid, T.A., Draaisma, T., Luk, M., Neville, H., Rzym, A. and Hemert, O.V. (2022, June 2). An Investor’s Guide to Crypto. SSRN. https://ssrn.com/abstract=4124576

v. Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. ResearchGate. Bitcoin: A Peer-to-Peer Electronic Cash System (researchgate.net)

vi. U.S. Geological Survey. How much gold has been found in the world? U.S. Department of the Interior. How much gold has been found in the world? | U.S. Geological Survey (usgs.gov)

peer-reviewed by

Carl Densem

Malcolm Gloyer

As a Certified Practicing Project Manager (CPPM MAIPM), Malcolm has more than 30 years’ experience working on projects in the UK and Australia, specializing in market risk, derivatives and commodities. Malcolm has worked as a consultant at companies including Bank of America Merrill Lynch, London Metal Exchange, Nomura, ABN Amro, EDF Trading, Santander and Lloyds Bank and has been a guest lecturer at several universities. Malcolm has had articles published in professional investment magazines and has written several eBooks.

conclusion

author

20 Intelligent Risk - February 2024

Synopsis

Index providers, fund managers and investors in financial assets are increasingly feeling the need to measure their portfolios’ carbon exposure. However, existing metrics are both inconsistent and lacking in reliable data. This article explains and compares the characteristics of carbon exposure measurement methods which are currently available for financial assets.

measuring carbon exposure in investment portfolios

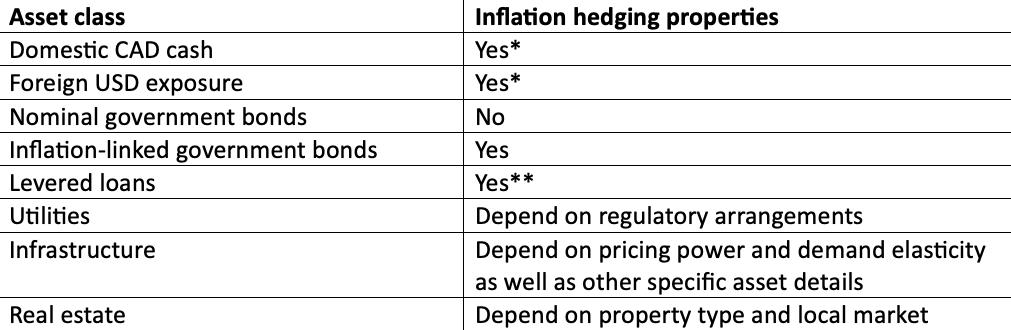

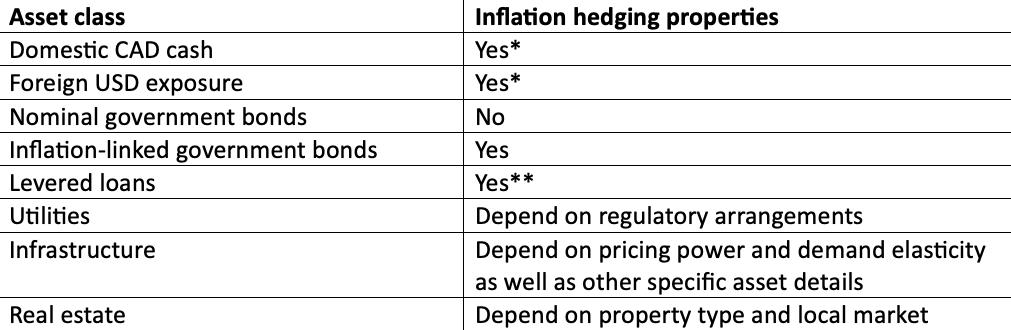

by Daniel Arnold

Measuring and accounting for carbon exposure in a portfolio is a key metric for investors seeking to manage or reduce their carbon exposure. International organisations including the Partnership for Carbon Accounting Financials i (PCAF) and Task Force on Climate-Related Financial Disclosures ii (TCFD) have developed standards that investors can leverage. Equally important to the standards is the need for them to be applied with consistency and transparency. To avoid confusion when comparing investments, clear labelling and understanding of the differing metrics is required.

There are three ways that confusion and false comparisons can occur without careful disclosure and description of the data.

• International organisations define an asset’s Carbon Intensity (CI) and a portfolio’s Weighted Average Carbon Intensity (WACI) in Carbon Emission tons CO2e/$M Revenue. We observe demand for other CI variants that use divisors including Enterprise Value Including Cash1 (EVIC), Total Sales, or Unit Production based measures. Each method has benefits and disadvantages, but they are not comparable.

• Portfolio WACI is time sensitive. When comparing different portfolios, the same date and CI method must be used.

• Distributing and accumulating fund share classes will have diverging emission levels due to the reinvestment of dividends. Carbon targets are harder to meet for accumulating share classes. We find it is preferable to use Financed Emissions to measure the change in carbon over Inflation Adjusted WACI or WACI.

Intelligent Risk - February 2024 21 1 / Also labelled Carbon Footprint by TCFD and Green House Gas (GHG) Intensity in EU Benchmark Regulation

comparing portfolios’ current carbon exposure

When assessing a fund or index’s carbon profile we believe investors have two key questions: (1) How does the carbon exposure of the portfolio compare to other potential portfolios, and (2) Have carbon reduction targets been met.

WACI is the best metric to compare a portfolio’s carbon exposure at a single point in time. For an accurate comparison, timeliness and consistency of the metric are key. The methods used to calculate Carbon Intensity can be broadly grouped into asset-based (typically EVIC) or fundamental- based (revenues/sales).

Asset-based measures offer the advantage of ensuring full allocation of carbon across the assets of the company. They are, however, subject to higher variability due to price moves. Fundamental-based measures offer more stable intensities, but over or underestimate carbon based on dollar value invested. Taking MSCI World Index an example, the EVIC WACI is circa 45 vs a Revenue WACI of 105. Unless defined otherwise, this article will focus on EVIC WACI.

As with bond yields, EVIC WACI has an inverse relationship to its divisor. Given the volatility in equity markets, EVIC WACI data from days apart will vary considerably and are not comparable. It is also important that the date for the EVIC WACI data is the same as for the holdings/weights of the portfolio.

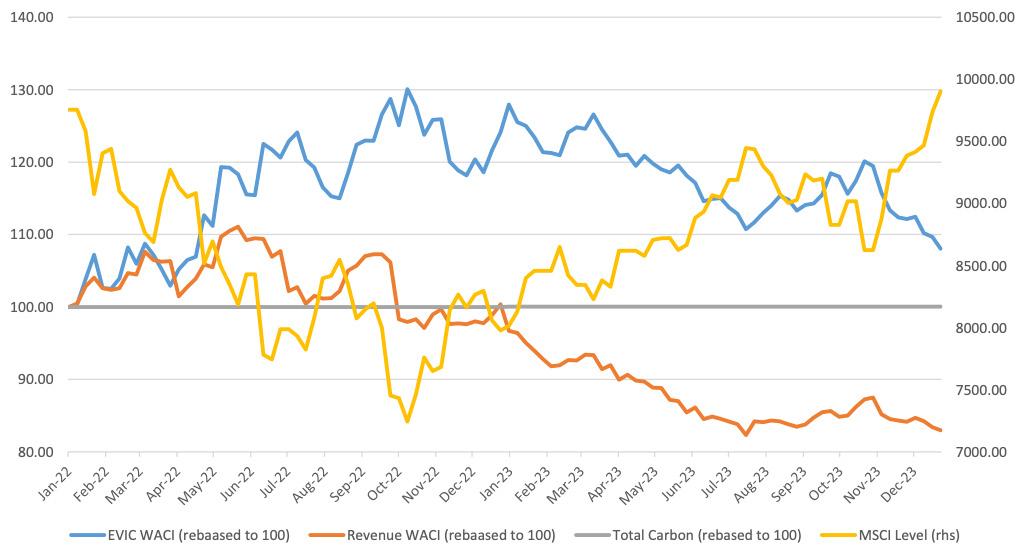

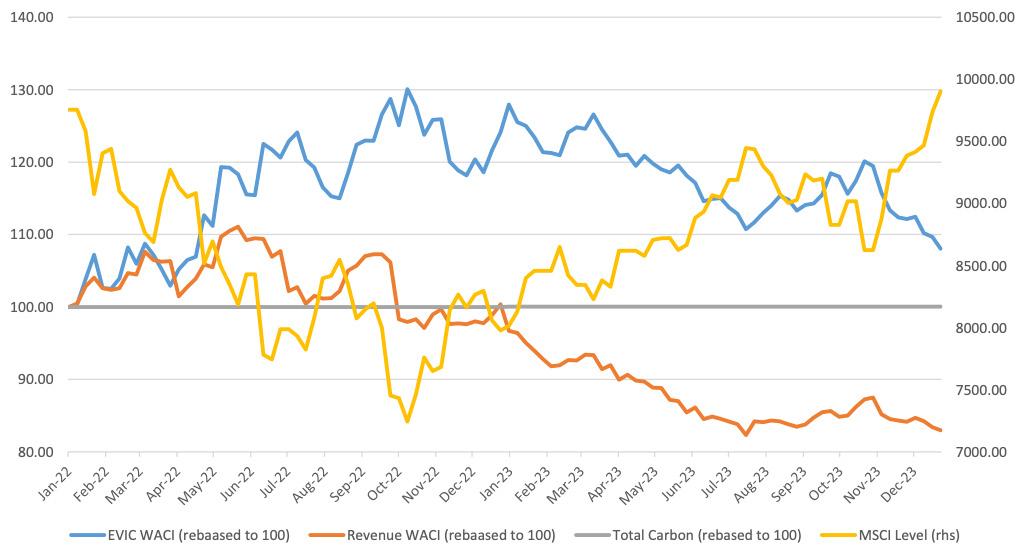

The period 2022 - 23 highlights the relative movement of Carbon Intensities. During this period the Total Carbon of MSCI World Index has remained essentially flat, but the EVIC WACI has ranged between 42 and 54, representing a 30% increase from low to high. Revenue WACI exhibited a similar range, but with the metrics moving in opposite directions over the test period.

22 Intelligent Risk - February 2024

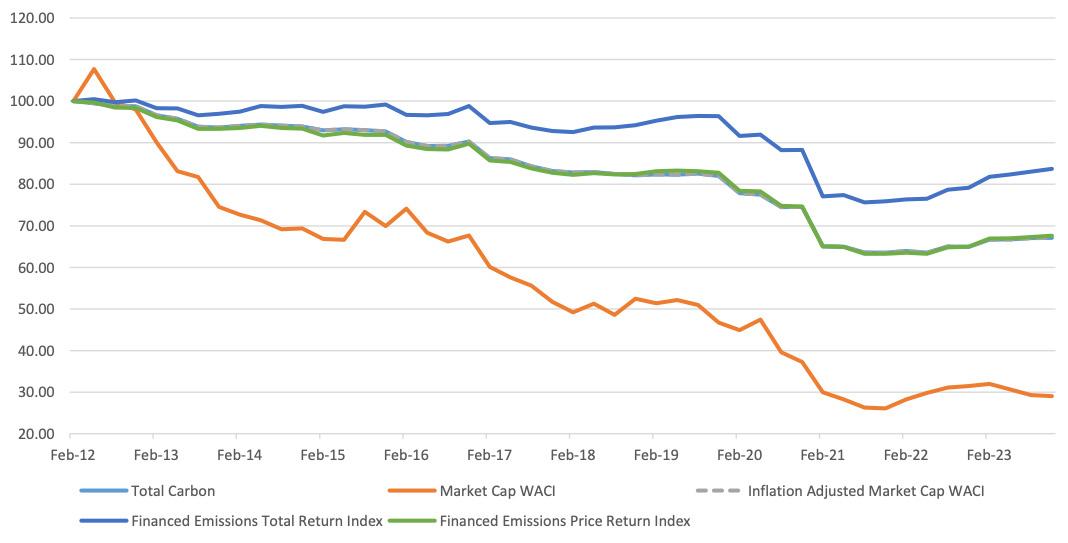

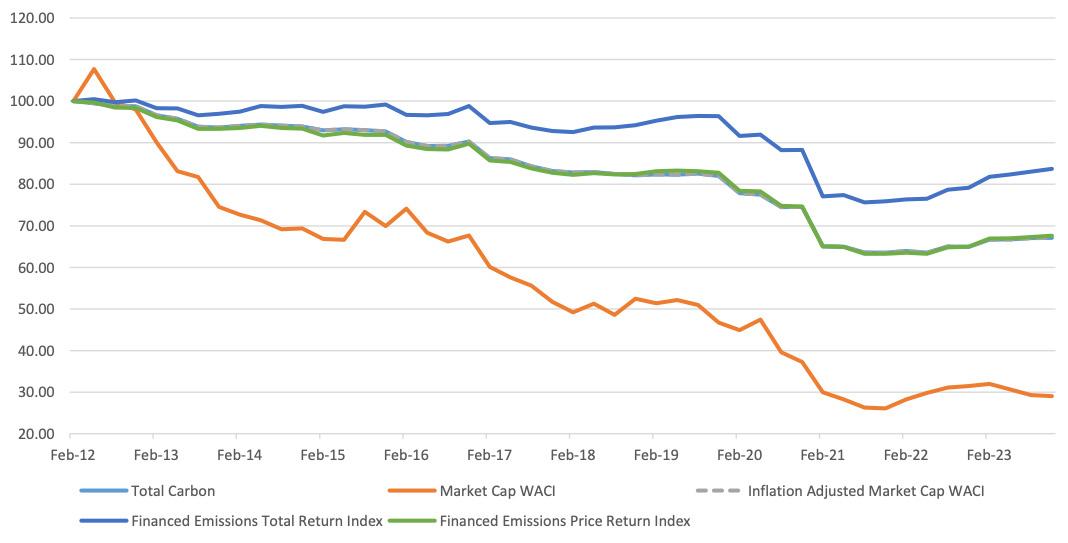

Figure 1: Variability of Rebased Carbon Intensity Over Time (Source: Deutsche Bank, Factset, MSCI)

As WACI is sensitive to both asset prices and the asset measure, investors need equivalent data to compare the carbon exposure of potential investments. A comparable situation exists in fixed income, where an investor would not compare a bond’s treasury spread today with another asset swap spread from a week ago. Beyond the calculation, carbon emission data continues to be an emerging data set. Whilst many companies provide detailed reporting, the reported methodology behind data points is not always consistent. Other companies currently do not report, which requires the calculation of estimates or exclusion of these companies from the portfolio reporting.

comparing different methods for analyzing changes in carbon exposure

When measuring a portfolio’s carbon exposure over time, the metrics must accurately track the actual exposure change and not be skewed by unrelated factors. Total Carbon, defined as the simple summation of all the stocks’ emissions, offers a simple metric, but it is not representative of the portfolio’s actual investments. Where a carbon reduction target is implemented, such metrics should align with the decarbonization target to avoid greenwashing scenarios.

WACI is not an appropriate metric, given that it is a ratio that has direct variability to price movements. This means a comparison between two dates does not inform us about the actual change in carbon output.

Financed Emissions as defined by PCAF and Total Carbon Emissions as defined by TCFD are equivalent metrics which aim to measure the carbon output of the portfolio. This is achieved by proportioning the companies’ carbon emissions to each holding in the portfolio and summing this result, essentially sharing the portfolio of companies across all the investors. This is a clear metric that allows an investor to track the evolution of their investments’ carbon exposure. For funds, the Financed Emissions per fund unit allow analysis that excludes the impact of up or down-sizing of the total investments.

The EU Benchmark Regulations’ Low Carbon benchmarks reference a modified Inflation Adjusted Green House Gas (GHG) Intensity to represent the benchmarks’ carbon exposure and provide a reference for cutting carbon output. The modification adjusts the current GHG Intensities by the change in EVIC, essentially adjusting for asset price inflation or deflation.

Investors face two challenges when measuring carbon exposure over time. Changes in the capital structure or pricing of equity vs debt of companies will change the carbon exposure of these elements. These changes can have a material impact on a portfolio’s carbon exposure. We believe this is an unavoidable feature of target carbon investing and will require investors to manage and explain the exposure accordingly.

Secondly, the measure must be consistent over time and reflect changes in the portfolio. Financed Emissions and Inflation Adjusted GHG Intensity offer a measure of change in carbon exposure. Our view, however, is that Financed Emissions is the superior metric as it is consistent when applied to different portfolio allocations (market cap vs equal weighted), does not require a rebasing, and accounts for reinvestment of income.

23 Intelligent Risk - February 2024

To exemplify the benefits of Financed Emissions, we tested market capitalization-based indices using market capitalization-based intensity. This measure was specifically chosen, as the divisor for both the stocks’ weight and intensity are the same, therefore the carbon output of the index is equal to the Total Carbon of the portfolio. It is thus possible to validate the metric by comparing these to the Total Carbon. The MSCI World was selected as a test index and the resultant metrics along with the Total Carbon are rebased to 100 and compared from 2012 in Figure 2.

The Total Carbon, Financed Emissions Price Return and Inflation Adjusted WACI are almost identical. The Emissions Total Return is closely correlated to the Total Carbon but consistently diverges away from it. This can be attributed to the reinvestment of dividends in the index that increase the holding proportionally across the index membership. In effect, the reinvestment of cash flows increases the total value of investments and hence the carbon emissions of the index. The impact of reinvesting dividends on carbon output is a key factor that must be considered when making carbon targeted investments.

To further assess and compare the Financed Emissions and Inflation Adjusted WACI, similar analysis was performed for equal weight and equal sector weight indices (Figure 3 and 4). In these back-tests, the equivalence of Inflation Adjusted WACI and Financed Emissions PR no longer holds, with Inflation Adjusted WACI exceeding Financed Emissions TR in some periods.

Figure 2: Rebased Carbon Exposure for Market Cap index based on Market Cap CI (Deutsche Bank, Factset, MSCI)

24 Intelligent Risk - February 2024

The Financed Emissions metric is calculated using current carbon intensities and the dollar holding in each instrument, giving an accurate accounting of the carbon emissions of the portfolio.

Figure 3: Rebased Carbon Exposure for Equal Weight index based on Market Cap CI (Deutsche Bank, Factset, MSCI)

25 Intelligent Risk - February 2024

Figure 4: Rebased Carbon Exposure for Equal Sector Weight index based on Market Cap CI (Deutsche Bank, Factset, MSCI)

The Inflation Adjusted WACI relies on the rescaling of the current Carbon Intensity based on the overall change in asset values, effectively normalizing the adjustment based on the average change in asset measure. The impact of using normalized data on non-market capitalization portfolios is to skew the Carbon Intensity base adjustment results away from the Financed Emissions.

conclusion

We therefore view Financed Emissions as a better measure for assessing the true carbon change over time. Distributing (price) and reinvesting (total return) portfolios will also have different paths and therefore, to avoid divergence from the target, an asset manager/index provider may need to manage the portfolios differently. For reinvesting funds and Total Return indices the selection of Financed Emissions ensures they are targeting the appropriate carbon reduction. Financed Emissions changes, along with factors including current emission intensities, forward projections based on client commitments and credibility, are key factors when making carbon target investment decisions.

peer-reviewed by

Steve Lindo

author

Daniel Arnold

Daniel joined Deutsche Bank in 2000 and is the Head of Deutsche Bank Index Quant (DBIQ). Daniel pioneered the development of DB’s index platforms and systems, covering all asset classes, major instrument types, and investment styles. They have been used for as the underlying’s for Swaps, Notes, Certificates and ETF’s. Prior to becoming Head of DBIQ Daniel held various roles in the index team, both in London and New York. Whilst working in New York he led the development of indices used in Deutsche Bank’s US ETF platform. Daniel holds an MEng in Engineering Mathematics from the University of Bristol.

i / https://carbonaccountingfinancials.com/standard ii / https://www.fsb-tcfd.org/ 26 Intelligent Risk - February 2024

Synopsis

A string of bank failures in the first quarter of 2023 has led bank management teams, boards – and regulatory agencies – to take a closer look at institutions’ treasury risk management practices. While the bank failures may have accelerated rulemaking and introduced an era of stricter supervisory examinations, a host of other market trends is also adding urgency to banks’ enhancement of treasury risk management frameworks.

banking on heightened regulatory scrutiny

by Scott Freidenrich

Market factors including central bank interest rate actions, quantitative tightening, declining bond market liquidity and commercial real estate stress are affecting deposit levels, access to funding sources, and asset valuations. For many treasurers and chief financial officers at banks across the asset size spectrum, the game has changed1. Compliance with regulatory rules, accurate regulatory reporting, and fundamentals such as robust contingency funding plans are table stakes. Examiners expect bank management teams not only to meet the regulatory requirements but also to improve risk management practices with internal stress testing frameworks tailored to their balance sheet and business model, strong operational capabilities and sound control environments. In short, regulators are demanding that bank management teams continually improve their risk management practices and identify and remediate weaknesses faster.

The Office of Comptroller of the Currency (“OCC”) indicated its intent to have more thorough exams in its fiscal year 2024 operating plan 2.Now that the OCC’s FY 2024 has begun, banks can expect examiners to follow the priorities outlined by the OCC. Two priorities of particular interest in light of the bank failures are interest rate risk and liquidity risk management.

OCC advised examiners to “determine whether banks appropriately manage interest rate risk through effective asset and liability risk management practices 3.” OCC also noted, “Risk management should consider a robust suite of interest rate scenarios and assumption sensitivity analyses, when appropriate, as rising rates may negatively affect asset values, deposit stability, liquidity, and earnings 4. ”On liquidity risk management, the OCC pointed out that “banking system liquidity remains strong, but sharp rate increases could adversely affect banks’ deposit volume or mix and reduce liquidity from investment portfolio pledging or sales because of unrealized losses” and might lead to negative net tangible equity capital, limiting banks’ access to funding 5

Intelligent Risk - February 2024 27

opportunities for enhancement

Banks therefore should take advantage of opportunities to enhance their risk management frameworks and practices. Some key areas of focus include:

Proactive, company-driven risk management. This approach is expected by management teams, boards and regulators. Some of the following actions are embedded in regulatory rules, but banks should keep going even after meeting regulators’ prescribed steps:

• Stress testing of on- and off-balance sheet positions based on a range of relevant liquidity, interest rate and credit spread conditions, given multiple economic scenario backdrops

• Reverse stress testing to identify the scenarios that would most negatively impact a bank’s health

• Deposit segmentation, concentration analysis and stability analysis

• Early warning indicators and triggers

• Enhanced dashboards including risk metrics updated daily

• Transparent management and board reporting

• Operational readiness for pledging of securities and loans

• Risk data tracing, lineage and governance

These analyses, exercises and reporting capabilities help to formulate a risk management framework that enables efficient decision making, governance and accountability.

Planning with deposit impact in mind. Another opportunity to enhance risk management is considering current macroeconomic factors and central bank activities when planning. For example, banks should estimate the ongoing deposit impact from the Federal Reserve’s (“The Fed”) quantitative tightening program and resulting reduction of liquidity in the financial system. Similarly, banks should evaluate potential deposit volatility drivers such as changes in the Fed’s balance sheet including the size of the Reverse Repo Program and the Treasury General Account6.In addition, banks should determine the extent to which brokered deposits are an adequate and efficient solution to replace declining client deposits7. U.S. banks now hold about $1.2 trillion in brokered deposits and at some institutions, brokered deposits represent more than 10% of their total deposits8. The quick boost from brokered deposits may be outweighed by greater cost, potential for increased liquidity risk and negative feedback from regulators and rating agencies.

expect new rules

Prepare for the impact of new rulemaking and guidance. Even if your bank isn’t directly affected by new rules, consider that the underlying ideas, purpose and function of the rules could be directly or indirectly applied to any bank:

28 Intelligent Risk - February 2024

Basel III endgame. The Fed, FDIC and OCC have all requested public comment on proposed rules to strengthen capital rules for large banks under the final components of the Basel III framework 9. While the Basel III endgame would apply to banks with $100 billion or more in total assets, it raises important issues about Tier 1 equity capital adequacy. The Bank Policy Institute asserts that increasing capital requirements on large banks is not only unnecessary but also will reduce GDP, and it advocates for withdrawal of the proposed rule change10. The Basel III endgame proposal might evolve, but institutions should conduct a pro forma impact analysis, consider data and technology requirements, and think about communication strategies for investors.

Resolution planning. The FDIC is proposing to strengthen its resolution plan rule for Insured Depository Institutions (IDIs) in the event an IDI experiences material distress or failure. The proposal would require large IDIs to submit more robust resolution plans and, for smaller IDIs, a comprehensive strategy every two years11. This strategy requirement for IDIs with total assets between $50 billion and $100 billion would require institutions to analyze operating under a bridge bank approach, along with plans for legal entity simplification, enabling continuation of critical services and implementing data rooms to house critical documents.

Long-term debt requirements. Under current rules, large and complex banks must meet total lossabsorbing capacity requirements, which include maintaining a certain amount of long-term debt. Under a proposed rule change from the Federal Reserve Board and FDIC, all large banks with total assets of $100 billion or more would have to meet long-term debt requirements12. Items for bank treasurers and CFOs to consider include: determining shortfalls and leaving ample time to address them; evaluating optimal debt terms; estimating the impact to net interest revenue and net interest margin; and considering the impact on the leverage ratio and liquidity buffers.

Liquidity risks and contingency planning. U.S. banking regulatory agencies issued guidance in July 2023 on funding and liquidity risk management, recommending institutions maintain contingency funding plans that take into account a range of potential scenarios13. An important tool for banks that have liquidity stress is the Fed’s discount window. However, planning to access the window is not quite the same as being prepared to do so. Banks therefore should improve their operational readiness and test the processes they will need to perform at the window, from identifying and pledging eligible assets to pre-pledging assets. A good practice used by many large banks is to test the window by borrowing small amounts on a quarterly basis.

conclusion

Clearly, there is a cost to getting things right in a bank’s risk management practices up front and then staying compliant by investing in enhancements. But that cost is much lower than the financial and potential reputational impact to the institution if regulators identify problems and dictate the remediation requirements. Banks that aspire to achieve or maintain industry leadership positions will understand that an ounce of prevention is worth a pound of cure, especially preventative measures that improve the overall risk management framework and keep bank examiners satisfied.

29 Intelligent Risk - February 2024

Disclaimer

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates or its other professionals. FTI Consulting, Inc., including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or a law firm.

references

1. “US banks report $872B YOY drop in deposits,” Zuhaib Gull, S&P Global Market Intelligence (September 25, 2023), https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-banks-report-872b-yoy-drop-indeposits-77596674#:~:text=The%20majority%20of%20large%20US,and%20Citigroup%20Inc.

2. “Fiscal Year 2023 Bank Supervision Operating Plan,” Office of the Comptroller of the Currency Committee on Bank Supervision (2022), https://www.occ.gov/news-issuances/news-releases/2022/nr-occ-2022-124a.pdf.

3. Ibid

4. Ibid

5. Ibid

6. William J. Perlstein, “What’s Next for the Treasury General Account?”, FTI Consulting (June 02, 2023), https://www.fticonsulting.com/insights/articles/whats-next-treasury-general-account.

7. “Banks Load Up on $1.2 Trillion in Risky ‘Hot’ Deposits,” Wall Street Journal (September 12, 2023), https://www.wsj.com/finance/banking/banks-load-up-on-1-2-trillion-in-risky-hot-deposits-e9477800.

8. Ibid

9. “Agencies request comment on proposed rules to strengthen capital requirements for large banks,” Board of Governors of the Federal Reserve System (July 23, 2023), https://www.federalreserve.gov/newsevents/pressreleases/bcreg20230727a.htm.

10. “Basel Endgame: Background and Key Issues,” BPI (September 5, 2023), https://bpi.com/basel-endgame-background-and-key-issues/.

11. “Fact Sheet on Proposed Rule on Resolution Planning for Insured Depository Institutions,” Federal Deposit Insurance Corporation (August 29, 2023), https://www.fdic.gov/news/fact-sheets/idi-resolution-planning-8-29-23.html.

12. “Fact Sheet on Proposed Rule to Require Large Banks to Maintain Long-Term Debt to Improve Financial Stability and Resolution,” FDIC (August 29, 2023), https://www.fdic.gov/news/fact-sheets/ltd-resolution-8-29-23.html.

13. “Addendum to the Interagency Policy Statement on Funding and Liquidity Risk Management: Importance of Contingency Funding Plans,” FDIC (2023), https://www.fdic.gov/news/financial-institution-letters/2023/fil23039a.pdf.

30 Intelligent Risk - February 2024

peer-reviewed by

Carl Densem

authors

Scott Freidenrich

Scott Freidenrich is a Senior Advisor in FTI Consulting’s Financial Services practice, focusing on balance sheet management, treasury and CFO reporting and operations, investor relations, governance and regulation for banks, broker-dealers and other financial institutions and corporations. Mr. Freidenrich also works with financial technology companies in advisory board roles. He has more than 30 years of treasury, finance and investor relations experience in the bank and broker-dealer industry. Mr. Freidenrich served as Global Treasurer at BNY Mellon for 12 years. During that period, he also served as President of their OCC-regulated bank subsidiary, managed investor relations, developed and led Resolution and Recovery Management and was responsible for the company’s Pension and 401K investment program team. Prior to joining BNY Mellon, he held various senior roles at Citigroup.

31 Intelligent Risk - February 2024

Risk management stands to learn from the principals behind high reliability organizations, especially in today’s interconnected world beset by conflict. The author explains the keys to becoming a high reliability organization, how these directly translate into changes to an organization’s existing ERM and walks the reader through an example in the IT services industry.

navigating the unpredictable: insights from high reliability organizations

by Famien Konan

In today’s rapidly evolving world, organizations face the daunting challenge of adapting to unforeseen events. The Covid-19 pandemic and the Russia-Ukraine conflict serve as stark reminders of the vulnerability inherent in our interconnected global economy and tightly woven supply chains. These “black swan” events can lead to poor performance or even organizational failure. In this context, it’s crucial to explore how organizations can achieve exceptional performance and thrive in an environment where unexpected disruptions occur with increasing frequency.

the concept of high reliability organizations

One powerful framework for defining high performance amidst adverse conditions is the concept of High Reliability Organizations (HROs). This concept was elegantly defined by Weick and Sutcliffe in their seminal work in 2001. HROs are organizations that operate under challenging conditions yet experience fewer problems than one might expect, thanks to their exceptional ability to manage the unexpected. Examples of such organizations include aircraft carriers and nuclear power plants, which consistently deliver peak performance in dynamic environments characterized by high and evolving risks. HROs rely on five core guiding principles to navigate the complex landscape of the unexpected on a daily basis:

• Preoccupation with Failure: HROs maintain constant vigilance and concern for potential failures, recognizing that proactive identification is key to averting disasters.

• Reluctance to Simplify: They avoid oversimplifying complex situations, acknowledging the intricacies that may hide potential risks.

• Sensitivity to Operations: HROs maintain a deep awareness of their operational environment, ensuring they detect deviations from normalcy promptly.

Synopsis

Intelligent Risk - February 2024 32

• Commitment to Resilience: These organizations prioritize resilience as a strategic asset, making them capable of bouncing back swiftly from disruptions.

• Deference to Expertise: They value expertise and empower those with specialized knowledge to make critical decisions when necessary.

The amalgamation of these five principles creates a state of “mindfulness” within HROs. This state allows them to successfully manage unexpected risks, surpassing the capabilities of traditional risk management. Consequently, they maintain consistently high operational performance over time, even in the face of immense complexity and uncertainty.

a parallel to risk management

While HRO principles are particularly focused on industries where high reliability and safety are paramount, they align with some aspects of established risk management frameworks such as ISO 31000 and COSO ERM in their common goal of enhancing performance through effective risk management.

The concept of ‘Preoccupation with Failure’ underscores the critical need for proactive risk identification, an integral component of robust risk management practices.

Similarly, ‘Reluctance to Simplify’ aligns with the rigorous practice of conducting comprehensive risk assessments to comprehend the intricacies of risks and their potential ramifications. Both ‘Preoccupation with Failure’ and ‘Reluctance to Simplify’ find their ideal application in stress testing and scenario analysis.

‘Sensitivity to Operations’ serves as a foundational requirement to cultivate an organization’s preoccupation with failure and reluctance to oversimplify. Organizations attuned to their operational environments become adept at crisis prevention by continually monitoring for subtle signs of stress and impending failure. This entails the utilization of incident reporting systems to capture near-misses and safety incidents, providing invaluable operational insights.

The imperative of ‘Commitment to Resilience’ within HROs corresponds to the development of robust business continuity plans in risk management, ensuring that operations persist even in adverse conditions. Organizations are increasingly turning to reverse stress-testing as an effective method for discerning the necessary actions required to manage the cascading effects of unforeseen events.

Lastly, ‘Deference to Expertise’ underscores the importance of informed decision-making grounded in expertise and knowledge. This approach ensures inclusivity in the risk management process, ensuring that the right individuals are engaged in risk-related decision-making.

Clearly the HRO principles stress the importance of proactive risk identification, comprehensive risk assessments, operational sensitivity, resilience building, and informed decision-making based on expertise and knowledge.

33 Intelligent Risk - February 2024

transforming into a high reliability organization

By integrating HRO principles into the Enterprise Risk Management (ERM) framework, an organization can create a more proactive, resilient, and effective approach to managing unexpected events and enhancing overall organizational performance. However, there is no one-size-fits-all recipe for building the capacity of an HRO. The processes and practices that embody HRO principles are highly contingent on the unique context and industry of each organization. Achieving high reliability is an ongoing journey rather than a fixed organizational structure. For organizations aiming to transform into HROs, they can expand their ERM framework around three essential pillars:

• Senior Leadership Commitment to Risk Management: To foster high reliability, senior management and the Board of Directors must exhibit unwavering commitment to risk management functions. This commitment entails establishing a separate risk-management function dedicated to handling unexpected events, with a direct reporting line to senior leadership. This risk function should be staffed by individuals possessing the requisite skills and supported by appropriately sized technology infrastructure. The Board should also maintain awareness of inherent business risks and ensure that the organizational strategy aligns with the risk appetite.

• Cultivating a Risk-Aware Culture: Senior leadership plays a crucial role in cultivating a culture of risk awareness and mindful anticipation throughout the organization. This shift involves moving from mere risk controls to a culture in which risk events are critically examined across all organizational units in a coordinated manner. Moreover, it encourages open and candid discussions about these risks. Clear ownership of risks at all levels of the organization, including those emanating from higher hierarchical levels, is pivotal to this transformation.

• Continuous Improvement Program: Senior leadership should implement a comprehensive continuous improvement program across the organization. This program should incorporate process improvement tools and methodologies to address emerging issues and potential pitfalls that may jeopardize the organization’s resilience in the face of unexpected events. It should also encompass training, education, and a commitment to continuous learning to enhance the skills and adaptability of the workforce.

These three pillars serve as a conceptual framework for organizations striving to attain the exceptional level of reliability associated with HROs. This framework underscores the paramount significance of leadership and culture in shaping an organization’s attitude towards risk.

34 Intelligent Risk - February 2024

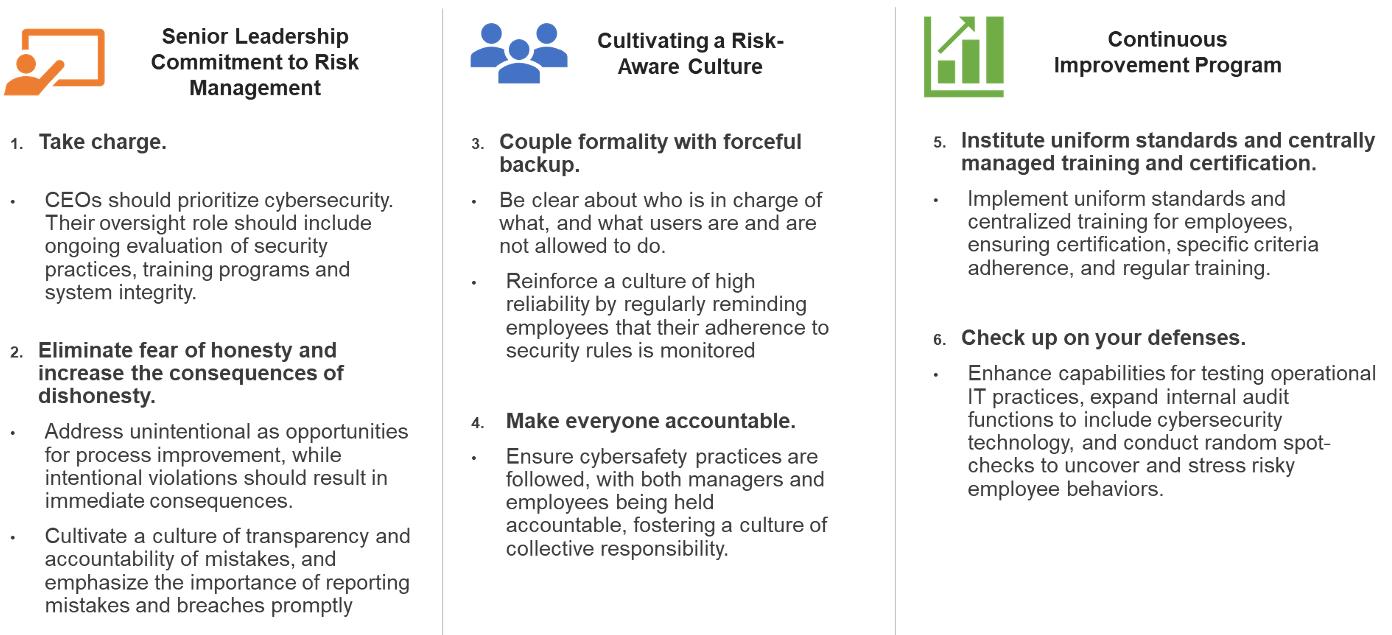

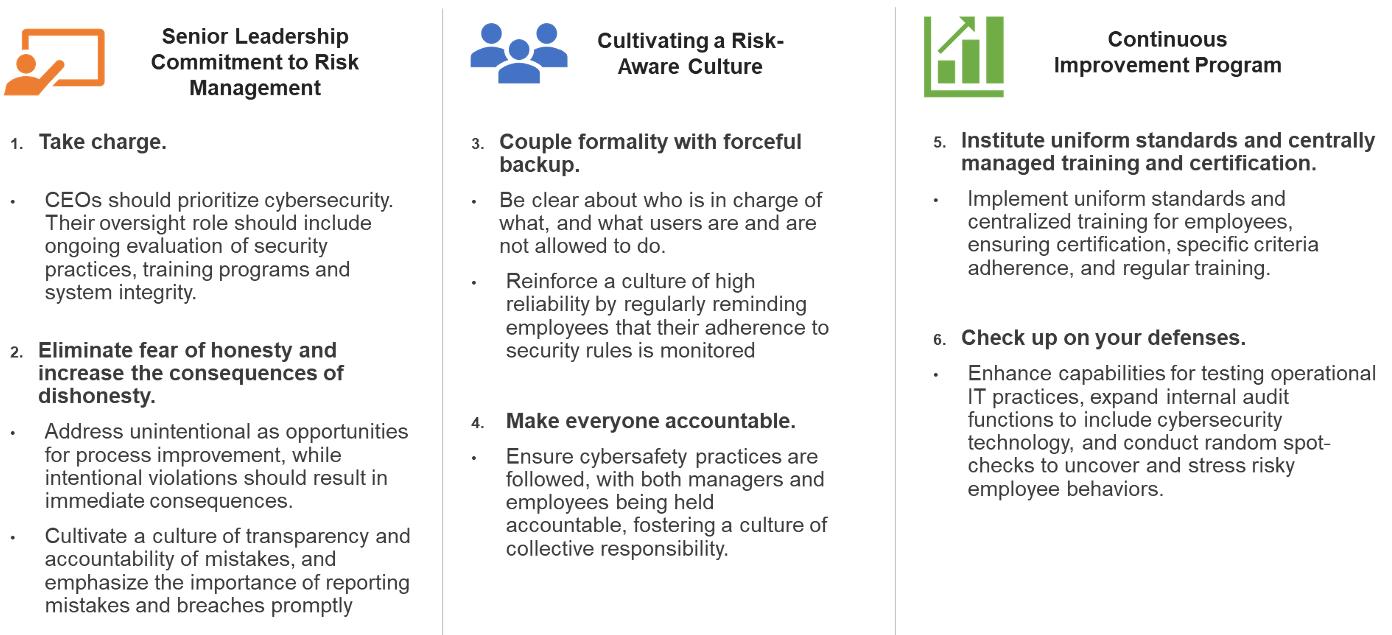

applying HRO transformation in IT services

Today’s technology-driven businesses such as cloud computing and data center services are progressively operating in settings similar to those of HROs. Those organizations cope with cyber-attacks on a daily basis and need to avoid disruptions of services. Leaders of those organizations can draw inspiration from the US military and create high reliability IT organizations that systematically protect themselves against cybercrime. The approach adopted by the US military, divided into 6 principles, is based on the three cornerstone pillars of HRO transformation. It requires the personal attention of the senior leadership, as well as substantial investments in training to improve the technical capability, to build and nurture a culture of high reliability. This approach, highlighted in Figure 1, could be deployed in any organization that is exposed to elevated cybersecurity risk and seeks to build a high reliability business.

conclusion

In conclusion, High Reliability Organizations (HROs) offer a compelling model for organizations navigating the treacherous waters of unpredictability. HROs maintain constant vigilance, avoid oversimplification, stay attuned to their operational environment, prioritize resilience, and empower expertise. However, the journey towards becoming an HRO is not a one-size-fits-all endeavor. It requires a tailored approach rooted in three fundamental pillars: senior leadership commitment to risk management, cultivation of a risk-aware culture, and the implementation of a continuous improvement program. In our fast-paced world, marked by continuous and rapid change, the path toward becoming a High Reliability Organization is an investment in long-term sustainability and success.

Figure 1: US Army’s Principles for High-Reliability IT organizations

35 Intelligent Risk - February 2024

references

• Schinagl, S., Shahim, A., Khapova, S., & van den Hooff, B. (2023). Digital security governance: What can we learn from high reliability organizations? In T. X. Bui (Ed.), Proceedings of the 56th Annual Hawaii International Conference on System Sciences (HICSS 2023) (pp. 5938-5948). (Proceedings of the Annual Hawaii International Conference on System Sciences; Vol. 2023-January).

• Chassin, M. R., & Loeb, J. M. (2013). High-reliability health care: getting there from here. The Milbank quarterly, 91(3), 459–490. https://doi.org/10.1111/1468-0009.12023

• Bogue, B. (2009). How Principles of High Reliability Organizations Relate to Corrections. Justice System Assessment and Training (J-SAT), Volume 73 Number 3

• Sutcliffe, K.M. & Vogus, T.J. (2003). Organizing for Resilience. In Cameron, K., Dutton, J.E., & Quinn, R.E. (Eds.), Positive Organizational Scholarship. San Francisco: Berrett-Koehler. Chapter 7 pp: 94-110

• Winnefeld Jr., J.A., Kirchhoff, C., and Upton, D.M. (September 2015). Cybersecurity’s Human Factor: Lessons from the Pentagon. Harvard Business Review. https://hbr.org/2015/09/cybersecuritys-human-factor-lessons-from-the-pentagon

• Coutu, D. (April 2003). Sense and Reliability. Harvard Business Review. https://hbr.org/2003/04/sense-and-reliability

• Weick, K. E., & Sutcliffe, K. M. (2001). Managing the unexpected: Assuring high performance in an age of complexity. Jossey-Bass. https://psycnet.apa.org/record/2001-18334-000

peer-reviewed by

Carl Densem

author

Famien Konan

Famien works in the Treasury Clients Solutions Division at the African Development Bank. With over fifteen years of experience in the financial services sector, he also specializes in treasury risk management, and the implementation of quantitative analysis tools and methods for investment management. Mr. Konan began his career as a financial software consultant in the credit derivatives markets. He holds a master’s degree in telecommunications engineering from IMT Atlantique (Telecom Bretagne), as well as a mathematical degree from Université de Bretagne-Occidentale. He is a PRM holder since 2010.

36 Intelligent Risk - February 2024

This article demonstrates how evolving societal expectations and the well-being of future generations determine that ESG is both a key and a challenge to organizations pursuing long-term value creation and financial sustainability.

ESG and world change: the competing perspectives

by Ina Dimitrieva & Elisabeth A. Wilson

preparing for the future

Given their inherent sustainable nature, Environmental, Social, and Governance (ESG) issues appear to be here to stay. Increasing numbers of organizations are recognizing the benefits of leveraging ESG to optimize performance. Capital raised for private market ESG funds tripled between 2020 and 2022, while perceived ESG-related concerns are a growing consideration for whether investors pursue or reject deals1. The link between ESG and long-term value creation is becoming more and more evident.

Still, the stakes for business as usual are rising in the face of evolving regulatory expectations, political opposition, and legal challenges, and it is becoming difficult for organizations to balance pursuit of ESG against positive or negative public sentiment. This is where organizations must identify that there is no winner-take-all scenario in the face of competing perspectives. Regulators are pushing for comprehensive climate change-related disclosures to increase transparency and awareness for investors and other stakeholders. But many corporations are challenging these attempts as overly prescriptive, inconsistent, and premature in the face of ESG data scarcity and complexity of decisionmaking. Non-government organizations (NGOs) are moving the needle in the direction of ESG, but they cannot drive markets without corresponding product availability. On the other hand, consumers, especially younger generations, are interested in environmental and societal advancement— and are willing to funnel their money in this direction 2. This is where organizations are quickly realizing they must not only align with regulatory expectations but need to adapt to consumer preferences, industry competition, and technological advancement in order to radically transform their business models and pursue long-term value creation.

Synopsis

Intelligent Risk - February 2024 37

the rise of ESG

ESG is not a new concept, but it has been slow to gain market traction. However, it came to prominence in 2021 due to myriad factors. The COVID-19 Pandemic and simultaneous, increasingly catastrophic weather events highlighted the mortal, economic, and supply chain repercussions that could result in the face of future extreme climate-related scenarios. Unprecedented social change as a result of the Black Lives Matter Movement in the United States and increased migration of refugees towards Europe in response to war and political instability have shaken perspectives on global and domestic unity. And consumer wariness over governance and ethics remains a key concern since the 2008 Great Recession.

COVID-19 also ushered in an existential crisis for many, prompting The Great Resignation (and the subsequent War on Talent) as people reconsidered their work and family-oriented goals. Increasingly, people want to align themselves with companies that uphold and exhibit their values, which is now one of the motivating factors in the flow of talent.