Economic Bulletin

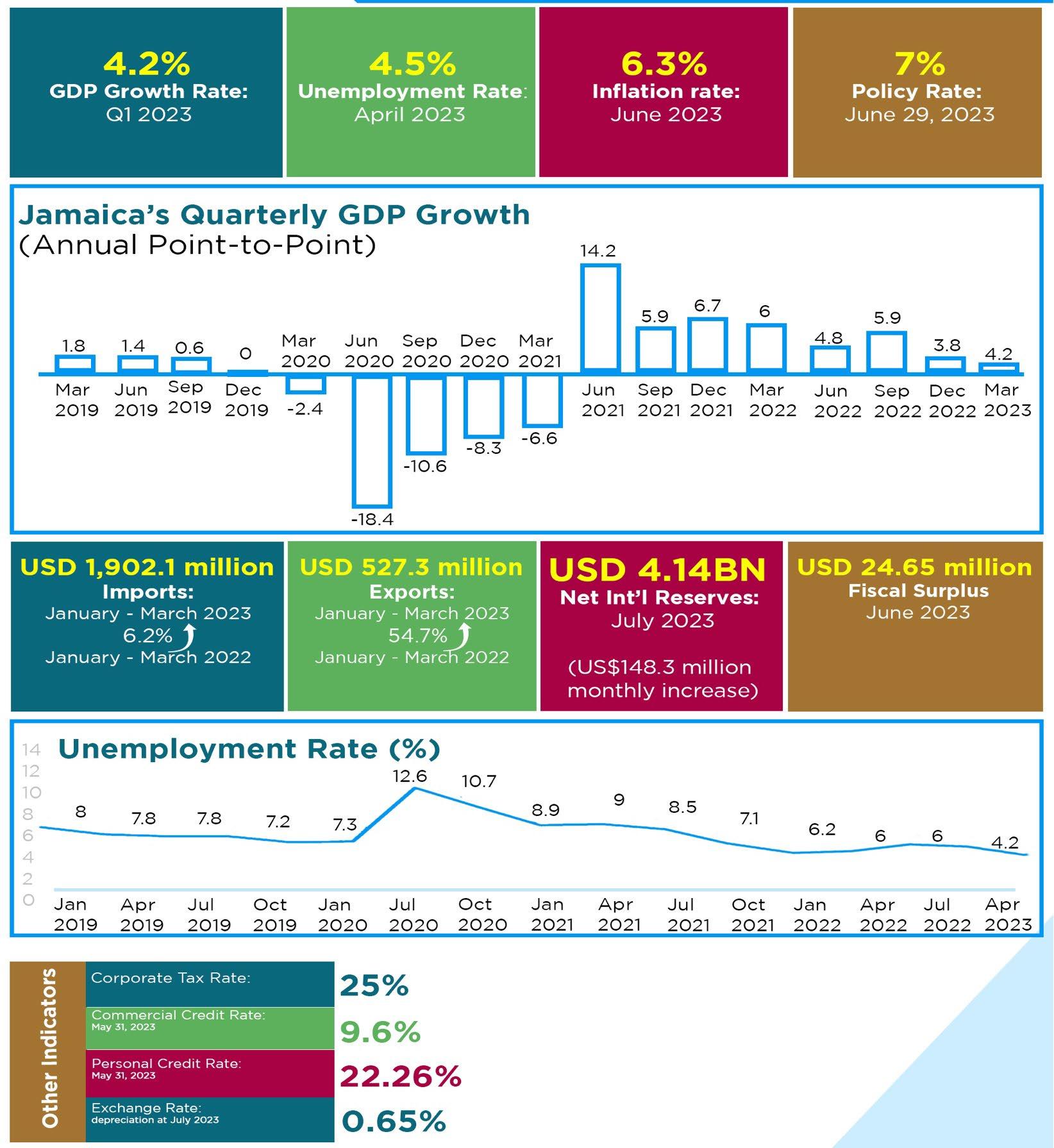

The 12-month point-to-point inflation rate has increased by 28 basis-points to 6.32%, above the Bank of Jamaica’s (BOJ) inflation target of 4%-6%. Despite the increase this is third lowest point-to-point inflation rate recorded since August 2021.The year-overyear movement was primarily driven by a 12 88% point to point increase in the ‘Restaurant and Accommodation Services’ division, along with 10 26% and 11.34% year over year increases in the ‘Food and NonAlcoholic Beverages’ and ‘Furnishings, Household Equipment and Routine Household Maintenance’ divisions. These increases were however tempered by the 2.21% and 1.59% point-to-point decreases in the ‘Communication’ and ‘Transport’ divisions respectively.

Month-over-month inflation increased by 1.01% in June 2023. This was driven mainly by the 4.23%, 1.28% and 6.37% monthly increases in ‘Restaurants and Accommodation Services’, ‘Food and NonAlcoholic Beverages’ and ‘Furnishings, Household Equipment and Routine Household Maintenance divisions, respectively. The increase was however tempered by the 0.76% decline in the ‘Housing, Water, Electricity, Gas and Other Fuels’ division due to lower electricity, water and sewage rates. The monthly increase in ‘Food and Non-Alcoholic Beverages’ was a result of increases in the price of carrot, tomato, lettuce, yam, and onions. While the increase in the Restaurants and Accommodation Services reflected higher prices for meals and drinks. The economy continues to realize the pass-through effects of the 44.40% increase in the National Minimum Wage as well as the compensation increase of government workers

The BOJ’s overnight policy rate was held at 7.00%, following the Monetary Policy Committee (MPC) meeting on June 29, 2023. The decision to maintain the policy rate was supported by the positive inflation results recorded for June 2023, which saw inflation rate on the outer bounds of the central bank’s upper limit of 4%-6%. The rate is likely to be maintained until Q4 of 2023, as the interest rates offered on deposits and loans have continued to see small increases in line with the policy. The next MPC meeting is scheduled for August 18,2023.

At the end of July 2023, the JMD weakened month-over-month, with a depreciation of 0.65% against the US Greenback. According to the BOJ’s Weighted Average Selling Rate (WASR), the local dollar lost $1.00 to end the month at $155.6297. To satisfy increased demand for foreign exchange and avoid depreciation of the exchange rate, BOJ issued two flash sales through its Foreign Exchange Intervention Tool (B-FXITT) on July 7 and July 10. Both sales were oversubscribed with US$71.60M and US$49.4M chasing US$30M and US$20M respectively. The highest allocated bid price of each sale was $155.09 and $154.92 respectively.

The stock of net international reserves (NIR) experienced a US$148 26 million decrease month-over-month in July to close at US$4.14 billion. Foreign assets decreased by US$143.39 million, mainly due to a US$135.13 million decrease in currency and deposits. Foreign liabilities increased by US$4.87 million, with liabilities to the IMF accounting for 100% of total foreign liabilities, which amounted to US$508 12 million.

Expenditure on imports grew 6.20% during Q1 of 2023 when compared to the corresponding period in 2022.The increase was mainly due to increased imports of ‘Raw Materials/Intermediate Goods’, 'Consumer Goods' and 'Capital Goods’ which climbed by 6.20%, 10 90% and 14.90%, respectively.

Earnings from exports saw a 54.70% increase over the same period in 2022, mainly owed to a 63.90% increase in the value of exports of ‘Mineral Fuels’. The improvement in total exports is also directly a result of US$91.7 million and US$385.5 million increases in re-exports and domestic exports respectively. This has resulted in the trade deficit being lessened by 5.10%

The five main trading partners for the period were the US, China, Brazil, Japan and Trinidad and Tobago. Expenditure on imports from these countries increased by 5.80% when compared to the corresponding period in 2022, chiefly due to higher imports of fuels from the USA. Meanwhile, the US,

Puerto Rico, Latvia, the Russian Federation, and the United Kingdom were the top five destinations for Jamaica’s exports. Exports to these countries increased by 70.00%.

The Institute of Supply Management (ISM) Purchasing Manufacturing Index (PMI) ended July at 46.40%, 40 basis points higher than the 46 00% recorded in June. This was the eighth month of contraction after 30 months of expansion. The marginal month over month increase shows that companies are still aiming to manage output as demand continues to soften. The increase in the PMI was mainly supported by a 170 basis points increase in the New Orders Index as well as a 160-basis point increase in the Production Index which have both increased at a slower pace. Contrastingly, the ISM Services Index registered a 120 basis points decrease from 53.90% in June to 52.70% in July

The release from the US National Association of Realtors (NAR) on pending home sales showed that the index increased by 0.30% to 76.80 in June 2023. Year-overyear pending sales fell by 15.60% when compared to June 2022. Chief economist at the NAR, Lawrence Yun, stated that the housing recession is over, and a shortage currently exists in the market due to lack of supply. Homebuilders have increased

production and staff in an attempt to meet the increased demand as seen by multiple offers being given on home sales.

The Consumer Price Index for all Urban Consumers (CPI-U) increased by 3.00% in June on a point-to-point seasonally unadjusted basis and 0.20% on a monthover-month seasonally adjusted basis. On a point-to-point basis, the increase was due to a 4.80% increase in the All items Less Food and Energy Index and a 5.70% increase in the Food Index. This was tempered by a 16.70% decrease in the energy index on a point-to-point basis. The 3.00% seasonally unadjusted increase is the lowest 12-month increase since March 2021, proof that the pass-through effects of the Fed’s monetary tightening policy are being realized though lagged in responsiveness The Producer Price Index (PPI) for final demand increased by 0.10% month-over-month on a seasonally adjusted basis in June 2023 and increased by same on a point-to-point unadjusted basis. The 0.20% increase in the final demand index was led by the prices for final demand goods, which remained unchanged.

Following the US Federal Reserve Federal Open Market Committee (FOMC) meeting on July 26, 2023, the Fed Funds Rate registered a 25-basis point hike making this the 11th rate hike. This leaves the Fed Funds Rate at the target range of 5.25% - 5.50%. The increase coincides with the Fed’s commitment to its monetary policy as the labour market remains strong and inflation above its 2.00% target range. This range is

susceptible to further hikes as the FOMC sees fit based on labour market data and other international economic developments.

For the month of July 2023, the unemployment rate changed marginally to 3.50% from the 3.60% recorded in June. Total non-farm payroll employment rose by 187,000. Health care, social assistance, financial activities, and wholesale trade contributed the most to the increase in employed persons. The labour force participation rate remained at 62.60% for the fifth consecutive month while the employment-to-population ratio remained at changed marginally to 60.40% respectively.

In the first half of the year, January to June 2023, despite challenging global conditions and the need to pursue reform and stability, China effectively implemented decisions, focusing on steady progress. They adhered to the new development philosophy, advanced a new development pattern, and emphasized high-quality development, while addressing COVID-19 alongside economic concerns. This led to recovering market demand, increased production, stable employment and prices, and steady income growth. Overall, the national economy demonstrated strong recovery momentum.

Preliminary estimates indicate that China's GDP in the first half of the year reached 59,303.4 billion yuan, marking a 5.5 percent year-on-year increase at constant prices.

This growth rate was 1.0 percentage point higher than the first quarter of 2023. The primary industry's value added grew by 3.7 percent, the secondary industry's by 4.3 percent, and the tertiary industry's by 6.4 percent. The GDP saw a 4.5 percent yearon-year growth in Q1 and a 6.3 percent growth in Q2. Moreover, the GDP increased by 0.8 percent compared to the previous quarter.

The 6-month assessment of Barbados' Economic Performance for January to June 2023 was released by the Central Bank of Barbados. During this period, the nation's actual Gross Domestic Product (GDP) growth reached 3.90%, marking the ninth consecutive quarter of economic expansion. This growth was propelled by a robust winter tourist season and enhancements in nontradable economic sectors.

As a consequence of this economic upturn, a fiscal surplus of $13.9 million was achieved. However, the increased expenses related to government interest and labor within the public sector partially offset revenue collections. Despite this, the debt to GDP ratio returned to its pre-pandemic level of 117.50%. It's important to note that although the debt stock was higher at the close of June 2023 compared to December 2022 due to loans from international financial institutions, this did not hinder the recovery.

Barbados' economic resurgence also led to favorable conditions in the labor market, with an 8.90% employment rate. This translated to a rise of about 1,700 individuals employed in Q1 of 2023 when contrasted with the same period in 2022. The country's gross international reserves were also augmented by the rebound in tourism and a reduction in import values, resulting in international reserves amounting to $3.1 billion. Nonetheless, these encouraging economic indicators were tempered by a notable inflation rate of 5.90% at the conclusion of the review period. The higher inflation was attributed to increased demand for dining and recreational services. This heightened demand, combined with adverse weather conditions like heavy rainfall and drought, negatively impacted agricultural output and consequently led to elevated food prices

During its monetary policy meeting in June 2023, the Central Bank of the Dominican Republic (BCRD) made the decision to decrease its monetary policy interest rate (TPM) by 25 basis points, bringing it down from 8.00% to 7.75% per year. Additionally, the rate for the permanent liquidity expansion facility (1-day Repos) was reduced from 8.50% to 8.25% per year. Furthermore, the rate for remunerated deposits (Overnight) underwent a decrease from 7.50% to 6.75% per year, widening the lower range of the Central Bank's interest rate corridor.

The stable performance of foreign exchangegenerating activities has played a role in maintaining the stability of the Dominican peso, which has witnessed an overall appreciation of around 1.7% by the end of June 2023. This positive trend in the external sector has also supported the bolstering of international reserves, which currently stand at approximately US$16.2 billion. These reserves are equivalent to 13.2% of GDP and provide coverage for six months of imports.

Sources: Statistical Institute of Jamaica (STATIN), Bank of Jamaica (BOJ), Planning Institute of Jamaica (PIOJ), Bloomberg, International Monetary Fund (IMF), Observer, Gleaner, US Bureau of Labour Statistics, US Census Bureau, Institute for Supply Management, National Association of Realtors, Central Bank of Barbados, National Bureau of Statistics of China, Central Bank of the Dominican Republic (BCRD), Banco de Mexico.

*Projections/Budget ^Actual

~Actual as at June 20, 2023

* Projections are taken from Bloomberg survey of economists as of June 20, 2023