FEBRUARY 2025 ECONOMIC BULLETIN

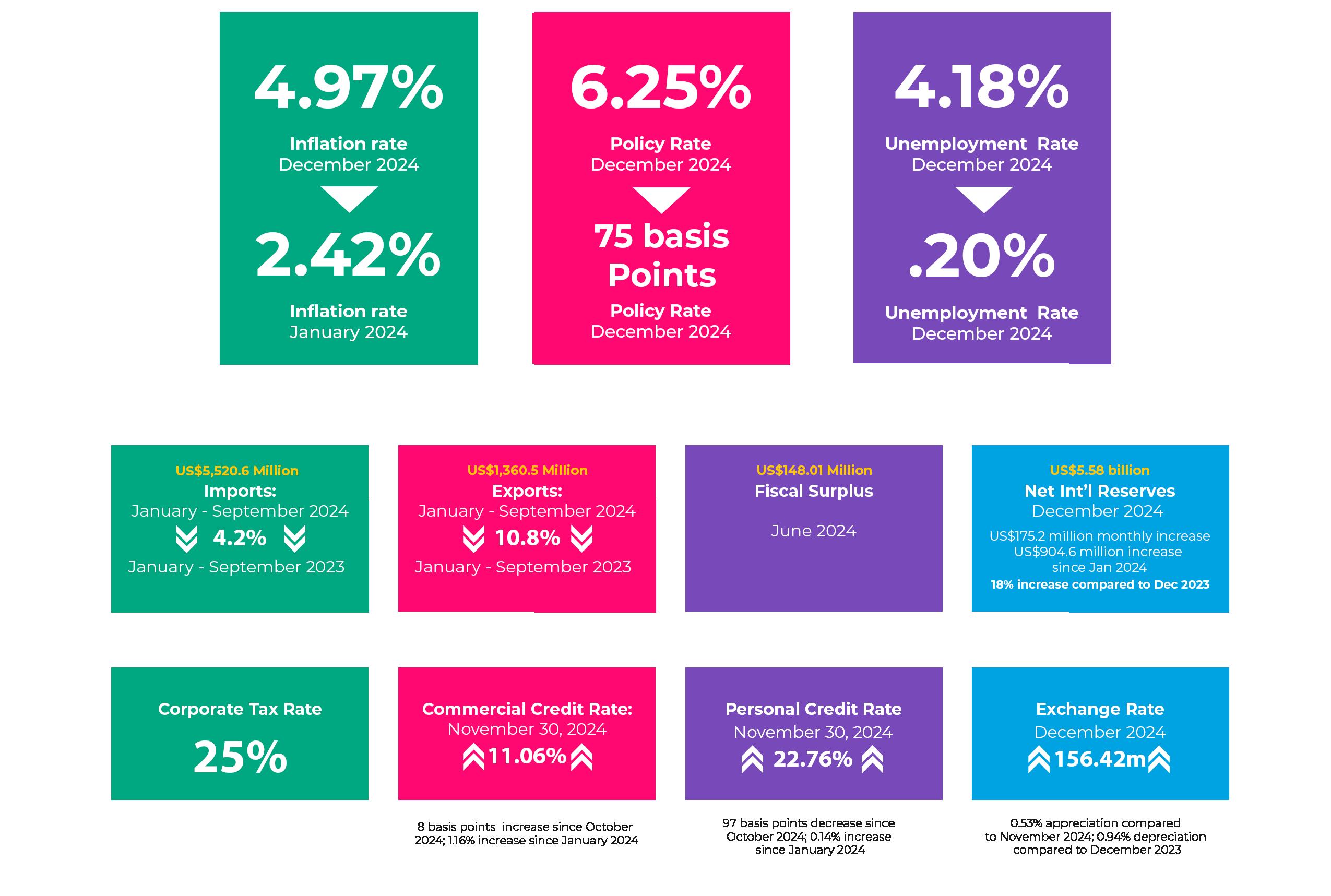

The inflation rate for December 2024, as measured by the Consumer Price Index (CPI), increased by 64 bps to 4.97%. This increase was accompanied by a 1.6-point rise in the CPI, reflecting increasing consumer prices. Despite this uptick, the inflation rate is still within the Bank of Jamaica’s (BOJ) target range of 4%-6% and signifies the fourth consecutive month that point-to-point inflation has fallen within this range. The primary driver of this was a 2,39% increase in the “Housing, Water, Electricity, Gas and Other Fuels” division. Over the past years, inflation has trended downwards from its peak in 2022. The recent trend of inflation consistently within the BOJ’s targeted band range is projected to continue, though persistent geopolitical risks pose potential challenges.

The Jamaican dollar (JMD) appreciated by 0.53%, month-over-month, to the US dollar, with the weighted average selling rate (WASR) moving from $157.25 at the end of November to close December at $156.73.

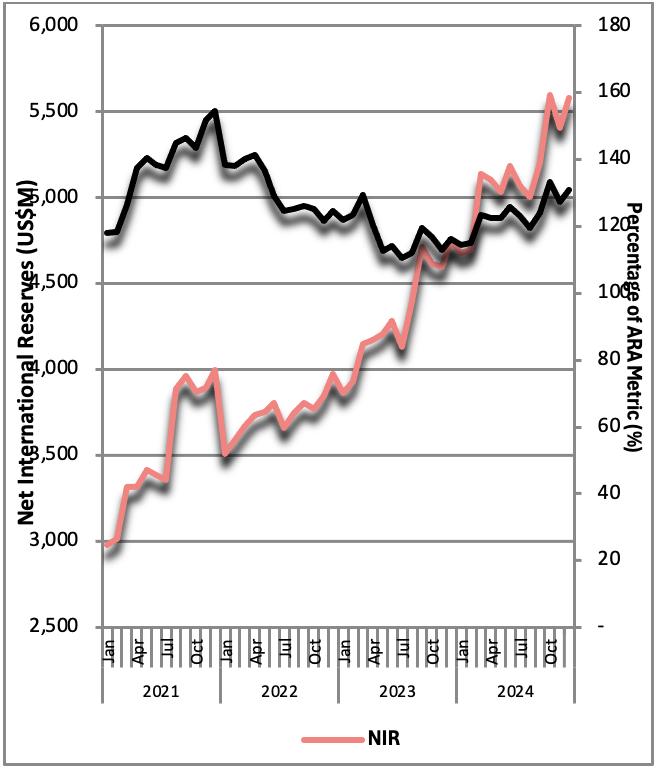

During the month, the central bank intervened in open market operations via the Bank of Jamaica (BOJ) Foreign Exchavnge Intervention Tool (B-FXITT) flash sale operations on three trading days, November 20, 21 and 22, injecting a total of US$130 million into the market. During December, the central bank did not intervene in open market operations via the Bank of Jamaica (BOJ) Foreign Exchange Intervention Tool (B-FIXITT) flash sale operations. December joins June and March as the only other months in 2024 where the BOJ did not intervene. The BOJ is expected to maintain its influence over the foreign exchange market, as its reserves continue to grow steadily.

The stock of NIR as at the end of December 2024 was US$5.58 billion, a US$175.16 million decrease from the end of November. Foreign assets increased by US$157.4 million, mainly due to a US$247.8 million increase in special drawing rights. Meanwhile, foreign liabilities decreased by US$17.8 million, with liabilities to the International Monetary Fund (IMF) accounting for 100% of total foreign liabilities, of US$49.2 million.

For the period January-September 2024, Jamaica’s total import expenditure amounted to US$5,520.6 million, reflecting a 4.2% contraction compared to US$5,764.1 million during the same period in 2023. This decline was primarily driven by reductions in the importation of “Raw Materials/Intermediate Goods” (12.4%) and “Fuels & Lubricants” (6.3%). The United States, China, Brazil, Japan, and Colombia emerged as Jamaica’s top five trading partners, with total import expenditures from these nations declining by 5.4%, totaling US$3,353.3 million when compared to the previous year’s corresponding period.

On the export side, Jamaica recorded earnings of US$1,360.5 million, marking a decrease of 10.8% from the US$1,524.5 million earned in the same period in 2023. The decline in export revenues was largely attributed to a significant 57.8% drop in re-exports. Notably, Jamaica’s top five export destinations—comprising the United States, Russian Federation, Iceland, the Netherlands, and Canada—accounted for an increase of 15.4% in export earnings, totaling US$967.1 million. This growth was primarily driven by higher exports of “Crude Materials.”

The ISM Manufacturing Purchasing Managers’ Index (PMI) for December 2024 registered 49.3%, marking a 50-basis point improvement from November’s 48.8%. While still indicating contraction for the ninth consecutive month, the December reading suggests a moderation in the rate of decline, offering a potential sign of stabilization in the sector. A PMI below 50% signals contraction, but the uptick in December points to the possibility of a recovery as conditions stabilize. The ISM Services PMI rose to 54.1% in December, up from 52.1% in November, reflecting continued expansion in the services sector for the sixth consecutive month, further underscoring the resilience of the broader economy. The Hospital PMI stood at 56.3% in December, marking the 16th consecutive month of growth in the healthcare sector, although this represented a 220-basis point decline from the prior month’s 58.5%. Despite this pullback, the sector continues to show expansion, albeit at a decelerated pace.

The three major US stock indices experienced a downturn at the end of December despite enhanced positive market sentiment, lower inflation, and an aggressive rate cut decision by the Fed. The Dow Jones Industrial, S&P 500, and Nasdaq all rose by 1.90%, 2.00%, and 2.70%, respectively. However, the indices showed a decline compared to the previous month. The Dow Jones closed at 42,544.22 in December, down from 44,910.65 in November. The S&P 500 finished December at 5,881.63, lower than the 6,032.38 recorded in November. Meanwhile, the Nasdaq Composite ended December at 19,310.79, a slight increase from its November closing of 19,218.17.

In December 2024, the US economy showed strong job growth, adding 256,000 jobs compared to 212,000 in November. This uptick in employment signals continued resilience in the labor market despite rising inflation. While inflation stood at 2.7% in November, it edged up to 2.9% in December, highlighting persistent price pressures. This shift in inflation, alongside strong job numbers, could influence the Federal Reserve’s monetary policy decisions in the coming months.

Since October 2024, the US 10-year Treasury yields have steadily risen back to 4%, maintaining this momentum to reach a high of 4.58% by December 2024. This increase was primarily driven by the stronger-than-expected job market in early October, which signaled ongoing economic strength. The rise in yields reflects investor expectations of sustained growth, but also higher inflation pressures. tions, adding a layer of uncertainty to the outlook.

In the housing market, existing home sales rose by 2.2% month-over-month in December, reaching a seasonally adjusted annual rate of 4.24 million units. This marks the third consecutive month of year-over-year gains, with a notable 9.3% increase compared to December 2023. This positive momentum in home sales is seen as a favorable signal for the housing market, particularly amid the ongoing challenges posed by elevated mortgage rates and affordability concerns throughout 2024.

The China General Manufacturing PMI edged down to 50.5 in December 2024 from November’s 5-month high of 51.5, missing market estimates of 51.7 while marking the third straight month of growth in factory activity. Several factors likely contributed to this moderation in factory activity such as weak external demand with global economic conditions remain uncertain, with sluggish demand in major export markets like the U.S. and Europe, as well as geopolitical tensions and trade restrictions could have also impacted export orders. Slower domestic consumption despite government stimulus, domestic demand growth may not be strong enough to sustain the pace of expansion. Consumer confidence in China remains fragile, partly due to concerns about the property sector and job security.

Supply Chain and Production Costs such as raw material costs, including oil and metals, have been volatile, affecting profit margins for manufacturers. Disruptions in global shipping (such as those caused by the Red Sea crisis) could have impacted supply chains. A major contributing fact is also softening policy effects with the positive effects of stimulus measures (such as interest rate cuts and infrastructure spending) may have started to fade.

Potential Implications include slower growth momentum with the drop suggesting that while China’s manufacturing sector is still expanding, the recovery may be fragile. Potential Policy Response may see the Chinese government and central bank considering additional measures, such as monetary easing or targeted fiscal support, to boost demand. Since China is a major exporter, any slowdown in its manufacturing sector could affect global supply chains and commodity markets. Overall, while the PMI remains in expansion territory, the decline indicates that China’s economic recovery is not yet stable and may require further policy support.

The steady increase in inflation suggests growing price pressures, which could be caused by higher energy costs, rising wages, or supply chain issues. If inflation continues to rise, the European Central Bank might delay interest rate cuts or even consider tightening policy further to prevent overheating. However, inflation around 2% aligns with the ECB’s target, meaning that policymakers may not see this as alarming yet. The slight drop in November suggests a brief improvement in labor market conditions, possibly due to seasonal hiring before the holidays. The return to 5.9% in December indicates limited job market momentum, meaning employment growth may be slowing. A stable unemployment rate suggests the EU labor market remains resilient despite economic uncertainties.

While inflation is rising, economic growth in the EU may be cooling down, limiting job creation. The dip in November could be due to pre-holiday employment, which then stabilized in December.

Some industries, like tech and finance, are experiencing layoffs, while others, like healthcare and construction, remain strong.

If inflation continues rising, the ECB may delay rate cuts, keeping borrowing costs higher for longer. Higher inflation could reduce real wages, affecting household consumption. Despite economic headwinds, the labor market appears resilient, preventing a major slowdown.

The EU economy is facing moderate inflationary pressures but stable employment, suggesting a soft-landing scenario rather than a major downturn. However, future ECB policy moves will depend on whether inflation continues rising in early 2025

The European Union, the Consumer Economic Sentiment Indicator, measures the level of optimism that consumers have about the economy. The Consumer ESI measures consumer confidence on a scale of -100 to 100, where -100 indicate extreme lack of confidence, 0 neutrality and 100 extreme confidence.

Inflation in Trinidad & Tobago increased slightly from 0.2% in October to 0.5% in November and December 2024, indicating mild price pressures.

A 0.5% inflation rate is still very low, suggesting that overall price stability remains intact.

Inflation in Trinidad & Tobago increased slightly from 0.2% in October to 0.5% in November and December 2024, indicating mild price pressures. A 0.5% inflation rate is still very low, suggesting that overall price stability remains intact. The economy is likely not experiencing strong demand-driven inflation, meaning consumers are not significantly increasing their spending. Food inflation is a common driver in Trinidad & Tobago, especially if there were supply disruptions or import cost fluctuations. Any increase in global oil prices or adjustments to local subsidies could have pushed transportation costs higher. The country relies heavily on imports, so exchange rate fluctuations or global price increases could have contributed. Any tax adjustments or public sector wage increases may have had a minor inflationary impact. The Central Bank of Trinidad & Tobago maintained the interest rate at 3.5%, meaning it did not see inflation as a significant threat. Keeping rates stable suggests that the economy is not overheating, and that growth remains moderate. If inflation were rising sharply, the CBTT would have increased rates to slow down borrowing and spending. Trinidad & Tobago’s low inflation and stable interest rates signal a stable economic environment, but growth may still be weak, requiring careful monitoring of global energy markets and domestic spending trends.

Inflation in the Dominican Republic increased from 3.16% in October to 3.35% in December 2024. While the increase is modest, it suggests a gradual rise in price pressures. Inflation remains within or slightly above the central bank’s target range, meaning there is no immediate concern about runaway inflation. The hurricane season and potential weather-related disruptions could have affected local food production and imports. Any shortage in staple goods (rice, plantains, poultry) may have caused price increases. Global oil price fluctuations could have driven higher fuel and transportation costs, feeding into inflation. Import costs for goods may have increased due to rising freight rates and supply chain disruptions. The Dominican peso depreciated against the U.S. dollar, pushing import prices. The Central Bank of the Dominican Republic (BCRD) raised the interest rate from 5.25% in October to 6% in November, then reduced it to 5.57% in December. This pattern suggests the BCRD acted to control inflation but adjusted when inflationary pressures appeared to stabilize. The slight increase in inflation in November may have prompted the BCRD to raise rates to 6% to slow down credit expansion and prevent overheating. A 6% interest rate is relatively high, and keeping it elevated for too long could slow down economic growth.

The December cut to 5.57% suggests the BCRD was balancing inflation control with supporting growth. If the U.S. Federal Reserve signaled a shift in monetary policy, the Dominican Republic may have adjusted its own rates to maintain capital inflows and financial stability. The BCRD used interest rate adjustments to balance inflation control and economic growth. The mild inflation increase reflects higher food, fuel, and tourism-related costs, but monetary policy remains flexible to ensure price stability without stalling economic activity.

Inflation in Mexico steadily declined from 4.76% in October to 4.21% in December 2024, indicating a cooling of price pressures. This suggests that inflation is moving closer to Banxico’s (Mexico’s central bank) target of 3% ±1%, improving economic stability. Slower inflation means consumer purchasing power is improving, making goods and services more affordable. Banxico maintained high interest rates throughout 2024, which helped reduce demand-driven inflation by making borrowing more expensive. A global decline in government-controlled fuel subsidies may have contributed to lower transportation costs. The peso may have appreciated against the U.S. dollar, reducing the cost of imported goods and helping control inflation.

Improvements in domestic food production or reduced supply chain disruptions may have helped lower prices for staple goods. High interest rates discouraged borrowing and spending, leading to lower demand for goods and services, which helped ease inflation.

Banxico gradually lowered its benchmark interest rate from 10.5% in October to 10% in December 2024, signaling confidence that inflation was coming under control. Mexico’s interest rates remain high, meaning the central bank is still cautious about inflation risks but is beginning to ease monetary policy. Lower rates reduce borrowing costs, which can stimulate business investment and consumer spending in early 2025. As inflation declined steadily, Banxico saw room to ease monetary policy without risking a resurgence in price pressures.

Colombia’s inflation decreased from 5.41% in October to 5.2% in November and remained stable in December 2024. The slow decline suggests that price pressures are easing but not fully under control. While inflation remains above the central bank’s 3% target, the downward trend indicates progress in stabilizing prices.

High interest rates throughout 2024 (9.75%) reduced borrowing and slowed down consumer spending, helping to cool inflation. Improved agricultural output or reduced supply chain disruptions could have contributed to more stable food prices. Colombia’s central bank (Banco de la República) kept rates at 9.75% in October and November, then lowered them to 9.5% in December 2024. The December rate cut signals that the central bank is gaining confidence that inflation is stabilizing. However, 9.5% is still a high interest rate, meaning the central bank is proceeding cautiously with monetary easing. With inflation stabilizing at 5.2%, the central bank saw room to begin easing monetary policy without risking a resurgence in price pressures. The Colombian peso remained stable, allowing the central bank to reduce rates without triggering capital outflows. Colombia’s inflation is stabilizing, and the central bank is cautiously lowering rates to support growth while keeping price pressures under control. If inflation continues falling in 2025, more rate cuts could follow.

Peru’s inflation increased slightly in November (2.27%) before declining to 1.97% in December 2024. Inflation remains very low and within the Central Bank of Peru’s (BCRP) target range of 1%–3%, indicating a stable price environment.

The dip in December suggests that price pressures eased, likely due to lower demand or improved supply conditions. Possible seasonal factors (higher consumer spending before the holidays). Temporary food or fuel price fluctuations due to weather conditions or import costs. Weaker domestic demand, possibly due to high borrowing costs and lower consumer spending. Stable or declining fuel and transportation costs and A strong Peruvian sol (PEN) reducing imported inflation are also some of the main contributing factors. The Central Bank of Peru (BCRP) lowered its benchmark interest rate from 5.25% in October to 5.0% in November and kept it there in December. This indicates that the BCRP is prioritizing economic growth while ensuring inflation stays within target. A rate of 5% remains relatively high, suggesting the central bank is still cautious about inflation risks. With inflation well within the target range (1%–3%), the BCRP had room to cut rates to support growth. Peru’s inflation remains stable, and the central bank is cautiously cutting rates to support growth. If inflation stays low in

Multiple shocks, including Hurricane Beryl shaped Jamaica’s economic performance in 2024, weakened global economic conditions, and shifted monetary policies. While natural disasters disrupted key industries, inflation stabilized, and monetary easing by the Bank of Jamaica helped mitigate further declines. The Planning Institute of Jamaica reported that Real Value Added declined by 2.8% in the July–September quarter of 2024, compared to the same period in 2023. The downturn was primarily caused by Hurricane Beryl, which inflicted JMD 32.2 billion in damage (1.1% of GDP) and disrupted multiple sectors.

The most affected industries included:

• Agriculture (-13.5%): The hurricane devastated domestic crops, with 13 out of 14 parishes reporting lower harvests. Traditional export crops suffered, with banana production down 18.7%, coffee down 70.4%, and cocoa down 74.2%.

• Mining & Quarrying (-15.2%): Alumina production fell 12.6%, while crude bauxite output declined 33.1% due to hurricanerelated port damage.

• Manufacturing (-2.0%): Declines were recorded in beer & stout production (-21.6%), edible oils (-7.9%), and flour (-3.1%).

• Construction (-2.8%): The sector was hit by a 10% decline in construction-related inputs and a 3.5% drop in housing starts.

• Tourism (-2.1%): The Level 3 U.S. travel advisory, issued in January and July 2024, coupled with hurricane-related flight cancellations, reduced visitor arrivals by 3.1%.

Overall, for the first nine months of 2024, Jamaica’s GDP shrank by 0.4%, with business confidence falling by 8.6%. Despite economic challenges, Jamaica’s inflation remained stable, allowing the BOJ to cut interest rates four times in 2024.

Inflation dropped from 7.4% in January 2024 to 5.0% in December 2024.

• Core inflation (which excludes food and fuel) remained at 4.2%, marking the 17th consecutive month below 6%.

• Foreign exchange markets stabilized, with moderated wage pressures helping to contain inflation expectations.

• BOJ lowered its policy rate to 6.00% in December 2024, marking the fourth consecutive rate cut to support economic recovery.

Looking ahead to 2025, the economy faces both risks and opportunities. The emergence of DeepSeek AI, a low-cost Chinese artificial intelligence model, could disrupt the AI sector globally, while new U.S. tariffs under President Donald Trump on Mexico, Canada, and China could have significant trade implications for Jamaica and the wider Caribbean.

The rise of DeepSeek AI, a low-cost, open-source AI model from China, has disrupted the global AI market, causing tech stocks to fall by 20-30% before recovering.

The key implications for Jamaica include:

• Lower AI adoption costs: Businesses in Jamaica could leverage cheaper AI models for customer service, financial services, and logistics.

• Challenges for U.S. AI dominance: DeepSeek’s emergence could weaken U.S. tech firms, which Jamaica depends on for AI development.

• Potential supply chain shifts: If AI hardware investments increase, Jamaica could

However, with the U.S. restricting AI chip exports to China, there is a risk of supply chain disruptions, which may affect AI accessibility in Jamaica. attract foreign direct investment in AI-related sectors.

U.S. President Donald Trump has announced new tariffs on imports from Canada, Mexico, and China which will have both direct and indirect impact on Jamaica.

The tariffs are as follows:

25% tariff on Canadian and Mexican imports.

10% tariff on Chinese imports.

10% tariff on Canadian energy exports.

• Higher import costs: Jamaica imports consumer goods from China and Mexico will experience higher tariffs and increased costs, leading to inflationary pressures.

• Trade diversion opportunities: Jamaican exporters may benefit from U.S. importers seeking tariff-free alternatives, creating new trade opportunities for rum, coffee, and bauxite.

• Supply chain disruptions: If Chinese manufacturers offshore production to bypass U.S. tariffs, Jamaica could position itself as a nearshore manufacturing hub.

• China: The 10% tariff on Chinese goods is intended to curb China’s dominance in U.S. trade. This could slow China’s export growth and force Chinese firms to relocate production to avoid tariffs.

• Mexico: The 25% tariff will hurt Mexico’s exports, particularly in automobiles, electronics, and agriculture. Since 73% of Mexico’s GDP relies on trade, the country could face economic slowdowns, affecting remittance flows to Caribbean nations, including Jamaica.

• Canada: The 10% tariff on Canadian energy exports could lower demand for Canadian oil and gas, weakening the Canadian dollar. This could impact Canadian investments in Jamaica and reduce Canadian tourist arrivals

While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP. However, in 2023 the U.S. trade deficit in goods was the world’s largest at over $1 trillion.

Along with the implementations of the tariffs the Trump administration has put the U.S. Agency for International Development is at the center of a political firestorm, indicating it will shut it down as an independent agency and possibly move it under the State Department in a larger effort to crack down on federal bureaucracy. The potential shutdown could negatively impact Jamaican businesses and the overall economy by disrupting funding for key development programs. SMEs, which benefit from USAID backed initiatives such as microfinance, trade facilitation, and entrepreneurship support, may struggle to access capital and technical assistance, slowing their growth. Sectors like agriculture, tourism, and manufacturing, which receive USAID support for infrastructure, training, and market access, could face setbacks, leading to lower productivity and reduced exports. The loss of disaster preparedness and climate resilience funding may also make Jamaica more vulnerable to hurricanes and economic shocks, raising operational risks for businesses.

Sources: Statistical Institute of Jamaica (STATIN), Bank of Jamaica (BOJ), Planning Institute of Jamaica (PIOJ), Bloomberg, International Monetary Fund (IMF), Observer, Gleaner, US Bureau of Labour Statistics, US Census Bureau, Institute for Supply Management, National Association of Realtors, Central Bank of Barbados, National Bureau of Statistics of China, Central Bank of the Dominican Republic (BCRD), Banco de Mexico, Banco de la República Colombia, Central Reserve Bank of Peru, Banco Central de Chile, Eurostat.