The point-to-point inflation ratefor February 2024isnow26basispointsabovetheBank ofJamaica’s(BOJ)4%-6%inflationtargetto endat6.26%.Theprimarydriversofthis12month increase were the surges in the divisions of 'Food and Non-Alcoholic Beverages,' which saw a 7.70% increase, Transport by 9.60% and “Restaurants and Accommodation’ by 8.20%. Main risks to inflation continue to be the increase in taxi faresaswellaswageincreasesintheprivate sectorduetojobmarkettightening.

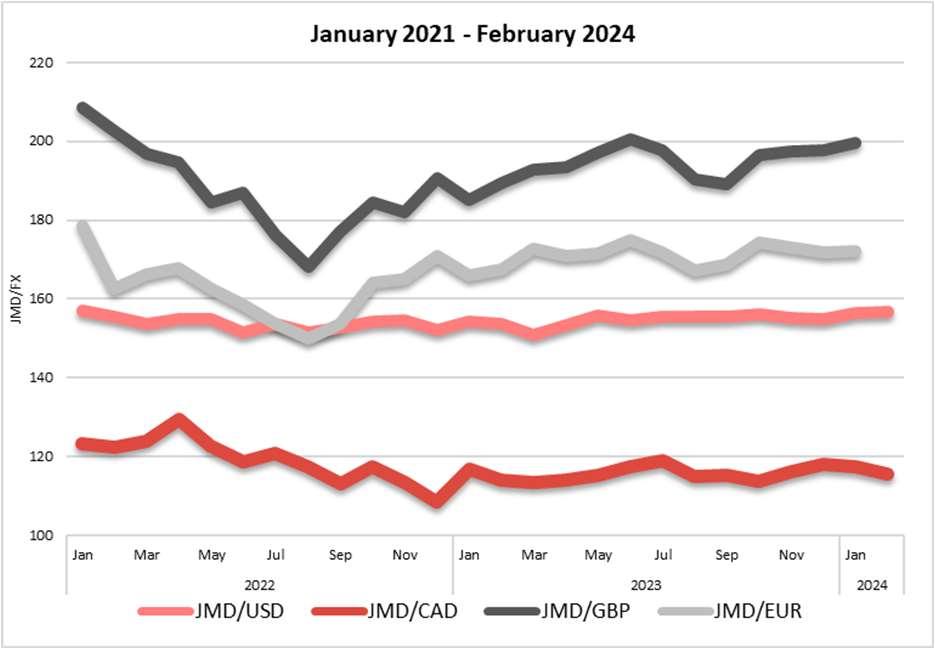

AttheendofFebruary2024,theJamaican dollar depreciated by 0.24% month-overmonth to the US dollar, with the weighted average selling rate (WASR) moving from $156.41 at the end of January to close February at $156.78. During the month,the central bank intervened in open market operations via the Bank of Jamaica (BOJ) Foreign Exchange Intervention Tool (BFXITT)flashsaleoperationsonfourtrading days, February 6, 7, 20 and 21, injecting a total of US$120million intothemarket.The BOJ is expected to maintain its influence overtheforeignexchangeratemarket,asits reserves continue to grow strongly. So far thismonth,theBOJhasnotintervenedinthe market.

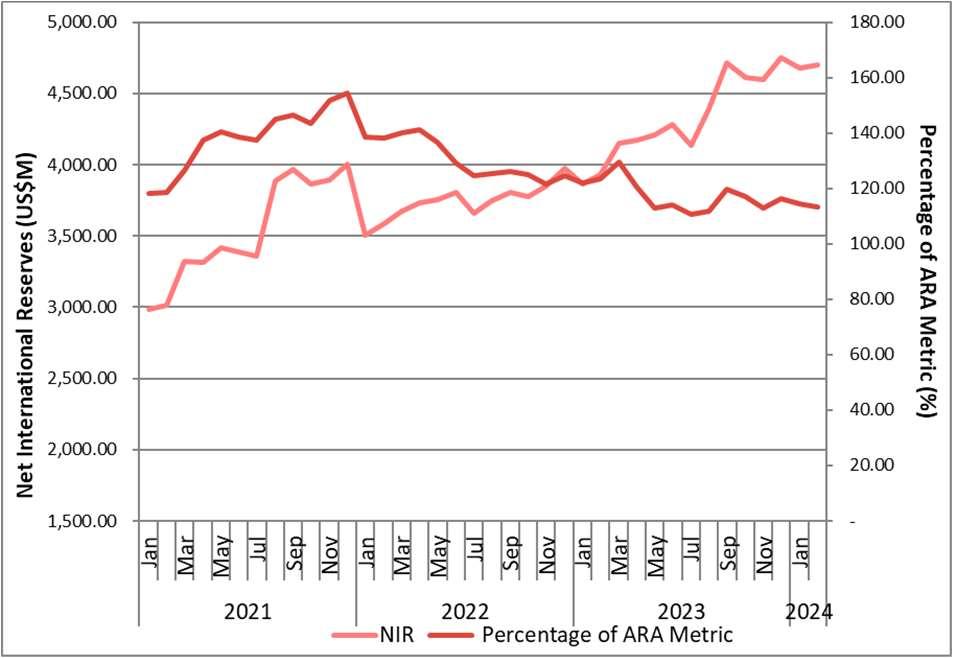

Thestockofnetinternationalreserves(NIR) as at end-February 2024 was US$4.70billion, a US$19.81million increase fromend-January.Foreignassetsincreased by US$19.62 million, mainly due to a US$35.25 million increase in currency and deposits. Meanwhile, foreign liabilities decreasedbyUS$0.19million,withliabilities to the International Monetary Fund (IMF) accounting for 100% of total foreign liabilities,ofUS$109.24million.

January –October 2023

International Merchandise Trade For the period

January to October 2023, Jamaica’s total spending on imports was valued at US$6,352.20million.Thiswasadecreaseof 0.60% when compared to the US$6392.90 million spent in the 2022 period. The increase was largely attributable to lower imports of “Raw Materials/Intermediate Goods”and“FuelsandLubricants.Earnings fromtotalexportsfortheperiodamountedto US$1,673.40million,anincreaseof16.90% abovetheUS$1,431.80millionearnedinthe corresponding2022 period. The increasein totalexportswasdueprimarilytoariseinthe value of exports of “Mining and Quarrying” and“Agriculture”.

From January to October 2023, the US, China,Brazil,JapanandColombiaemerged as Jamaica’s five main trading partners. Expenditureonimportsfromthesecountries

amounted to US$3,909.50 million, an increase of 0.50% when compared to the corresponding 2022 period. This increase was due largely to higher imports of machinery and transport equipments. The top five destinations for Jamaica’s exports were the US, Puerto Rico, Latvia, the RussianFederation,andIceland.Revenues fromexportstothesecountriesincreasedby 17.10%toUS$1,139.80million.

The ISM Manufacturing PMI registered 47.80% in February, down 1.30 percentage pointsfromthe49.10%recordedinJanuary 2024, representing a contraction in the Manufacturing sector for the 16th consecutivemonth.Economicactivityinthe ServicessectorexpandedinFebruaryforthe 14thconsecutivemonth,astheServicesPMI registeredat52.60%,0.80percentagepoints lowerthanthe53.40%recordedinJanuary, whiletheHospitalPMIregistered56.60%in February,a4.90percentagepointdecrease

from the January reading. Where-as the Services and Hospitality PMIs still represented an expansion in February, the decrease in both along with the steady contraction in the Manufacturing PMI were reflected in the unemployment rate in February2024,whichcameinat3.90%,0.20 percentage points higher than the 3.70% recordedinthepriormonthandwhichwasa slightuptickfromthepreviousyear’s.

Job growth occurred in healthcare, government, food services and drinking places, social assistance and in transportationandwarehousing.Despitethe higher unemployment in February, the job growth seen in the various sectors mentioned, and non-farm payroll increasing by 275,000, continues to support consumer spending. While the labour market slowly cools, the boost to consumer spending continues to have inflationary impacts, with inflation coming in at 3.20% in February, above expectations by 0.10 percentage point. Existing home sales rose by 3.10% month-over-month(MoM)inJanuary2024to 4.00 million but decreased by 1.70% yearover-year. The recent surge in home prices is boosted by lower mortgage interest rates inNovemberandDecember.

The US economy has continued to remain robustandtheprospectofa“softlanding”is seemingly becoming more imminent. The labour market continues to remain strong and the FED’s chair, Jerome Powell, has signaled that potential rate cuts are not far away. The markets have now shifted their expectation to a rate cut in July, underpinning their confidence that the FED will make monetary policy decisions based on data. And with inflation remaining sticky, thisshiftingexpectationoflessratecutsmay impactthefinancialmarkets.

Source: National Bureau of Statistics of China

In February 2024, theyear-on-year national ConsumerPriceIndex(CPI)experiencedan increase,withthecostoffooddecreasingby 0.90%,non-fooditemsincreasingby1.10%, the price of consumer goods decreasing by 0.10%,whilethecostofservicesrecordedan increaseof1.90%

China's manufacturing industry also experienced a minimal decrease in its Purchasing Manager Index (PMI) relativeto January. The synergy of the macro policies continued to take effect, production and demands maintained stable and saw an increase, employment and prices were generally steady, and the development qualitywasimproving.Thenationaleconomy

maintained the momentum of recovery and growthandgotofftoastablestartfor2024.

Indicator December 2023 JanuaryFebruary

Source: Eurostat; the Statistical office of the EU

EU overall inflation continues a downward trend, falling to its lowest level since July 2021, primarily due to falling energy prices. Notwithstanding, the lack of growth in GDP for two consecutive quarters, after modest gains in the first two quarters of 2023, indicatesthattheEUeconomyisonaweak footing. The EU’s economic sentiment also weakened slightly, disrupting the upward trendsustainedintheprecedingmonths.

At the sectoral level, industrial production wasmarkedbyongoingmonthlyfluctuations, with rates in January 2024 falling belowthe 2021level,indicatingasustaineddownward trend.Meanwhile,thereboundinretailtrade in January 2024 occurred during prolonged fluctuations hovering below its 2021 level, largely due to high inflation negatively impactingconsumerspending.

Trinidad&Tobago Indicator

2023

Source: Central Bank of Trinidad & Tobago

2024

TheIMFhasimprovedthegrowthoutlookfor TrinidadandTobagofor2024,increasingits real GDP expectations from 2.20% in January to 2.40% in March. The Central Bank also expects an improvement in economic activity bolstered by continued buoyancy in the non-energy sector due to continued strength in business activity, alongside robust consumer demand. However, forecasting activity in the energy sector to remain subdued due to the challenge of constrained gas supplies, coupledwiththenaturaldeclineinproduction rates at mature hydrocarbon-producing wells.

Notwithstanding, inflation is expected to remain low in 2024, barring fresh external shocks.Weatherconditions,possiblyhigher utility rates and the levy of property taxes could potentially prompt an uptick in domesticinflation.

DominicanRepublic

Indicator

Inflation (YoY)

GDP Growth (YoY)/IMAE

JanuaryFebruary

4.60% N/A

Source: Central Bank of the Dominican Republic

TheCentralBankoftheDominicanRepublic (BCRD) maintained its monetary policy rate at 7.00% for February 2024. This decision was taken, considering the dynamics of the international environment, the continued declineininflationandtheexpectationsthat externalinterestrateswouldremainhighfor longerthanforecasted.

Notably, the Dominican Republic continues to experience a decline in year-on-year inflation,leadingtotheratebeingwellwithin thecenterofthetargetrangeof4.0%±1.0%. Itisexpectedthatinflationwillremainwithin this range, under an active monetary policy scenario.Atthenationallevel,theDominican economy continues its recovery process, withanexpansionofthemonthlyindicatorof economic activity (IMAE) of 4.60% year-onyear in the month of January. This result reflected the dynamism of the hotels, bars and restaurants sector, as well as the improved performance of the construction, financialservicesandcommercesectors.

Source: Banco de Mexico

In2024,theMexicaneconomyispoisedfor strong growth, primarily fueled by domestic spending. This growth will be propelled by both consumption and investment, buoyed by the expansionary fiscal policy set for the year. The central bank, Banco de Mexico, anticipates economic growth ranging between2.3%and3.7%for2024.Thebank alsoforeseesasurgeineconomicactivityin thefirsthalfoftheyear,thusmaintainingits monetarypolicyrateat11.25%.Additionally, inflation is expected to continue its downwardtrajectorythroughout2024,witha projected alignment towards the 3% target bythesecondquarterof2025.

JanuaryFebruary

Source: Banco de la República Colombia

In February 2024, the Central Bank of Colombiaoptedtokeepthemonetarypolicy rate unchanged. This action was driven by severalfactors,includingtheongoingdecline in annual inflation, favorable external circumstances, and the bolstering of the Colombianeconomyattributedtoareduction in external imbalances. For the eleventh

consecutive month, annual inflation has recorded a decline which is attributed to similar downward trend in core inflation rates. Additionally, the inflation forecast for theendof2024hasbeenreducedfrom5.9% to5.4%,withtheexpectationofconvergence to the target range of 3% by mid-2025. Consequently, the growth forecast for 2024 has increased to 1.1% from January’s projectionsof0.8%.

Headline Inflation

JanuaryFebruary

3.02% 3.29%

Monetary Policy rate 6.50% 6.25%

Source: Central Reserve Bank of Peru

The Central Reserve Bank of Peru (BCRP) reduceditsmonetarypolicyrateby25basispointsforFebruary2024.

Thedownwardtrendinyear-on-yearinflation was disrupted by a 0.27% increase, due to increases in the price of certain foods and beverages, as well as in water rates. Notwithstanding, year-on-year inflation is projected to continue its downward trend in the forecast horizon and will be within the targetrangeinthecomingmonths.

Notably, a recovery was recorded in most leading indicators of economic activity and expectations. However, most indicators remain in pessimistic territory. The outlook for global economic activity points towards moderate growth in the context of lower inflationary pressures. However, risks associated with international conflicts remain, with expected adverse effects on fuel and freight prices. On a positive note,

climate risks mainly associated with the El Niño phenomenon have decreased comparedtothebeginningoftheyear.

Source: Banco Central de Chile

TheCentralBankofChilehasoptedtokeep its monetary policy rate steady at 7.25%. Thisdeliberatechoiceisaimedatreinforcing the continued decrease in inflation, as indicated by the annual Consumer Price Index (CPI), with the anticipation that inflation will convergewith thebank'starget range of 3.0% by the latter half of 2024. Concurrently, the monetary policy rate is expectedtostabilizeatitsneutrallevelwithin thesameperiod.

Jamaica's recent elevation in economic ratings marks a significant milestone in its journey towards sustainable growth and financial stability. Fitch Ratings Agency's decision to upgrade thenation's Long-Term Foreign-Currency Issuer Default Rating (IDR)inMarch2024toBB-,underscoresthe enduring nature of Jamaica's macroeconomic stability. This trajectory of improvement, spanning over consecutive years, highlights that Jamaica's economic resurgence is not merely a fleeting occurrence but a reflection of its steadfast commitment to sustainable progress. The

reaffirmation of Jamaica's economic standing by Fitch, following last year's improvements,dispelsanydoubtsregarding the sustainability of its economic growth. This consistent upward trend in ratings not only enhances investor confidence but also facilitates greater access to capital for domestic enterprises, enabling them to invest in growth opportunities at more favorablerates.

The successive upgrades by leading rating agencies, including S&P and Moody's, further solidify Jamaica's position as an attractive investment destination. The elevation of Jamaica's ratings, from 'B+' to 'BB-' by S&P, and the adjustment of the economicoutlookfromStabletoPositiveby Moody's,demonstratethenation'sresilience in the face of external challenges. These commendations in addition to Fitch’s most recent rating underscore Jamaica's enhancedeconomicautonomyanditsability to navigate through adversities while maintainingapositivegrowthtrajectory.

These achievements position Jamaica as a beacon of resilience and promise in the global economic landscape. The nation's commitment to fostering a conducive environment for investors, coupled with its unwaveringdedicationtofinancialprudence, lays the foundation for sustained prosperity and progress. With renewed investor confidence and a positive trajectory forecasted by leading ratings agencies, Jamaicastandspoisedtoembarkonapath of sustained prosperity, shaping a brighter futureforitscitizensandinvestorsalike.

Sources: Statistical Institute of Jamaica (STATIN),BankofJamaica(BOJ),Planning Institute of Jamaica (PIOJ), Bloomberg, International Monetary Fund (IMF), Observer, Gleaner, US Bureau of Labour Statistics, US Census Bureau, Institute for SupplyManagement,NationalAssociationof Realtors,CentralBankofBarbados,National Bureau of Statistics of China, Central Bank of the Dominican Republic (BCRD), Banco deMexico,BancodelaRepúblicaColombia, Central Reserve Bank of Peru, Banco CentraldeChile,Eurostat,

*Projections/Budget ^Actual ~Actual as at March 13, 2024

* Projections are taken from Bloomberg survey of economists as of March 11, 2024