Established in 2011, the Julis-Rabinowitz Center for Public Policy & Finance at the Princeton School of Public and International Affairs promotes teaching and research about the interactions between financial markets and the macroeconomy, with the aim of improving the design and implementation of public policies.

The Center offers opportunities for collaborations among students and faculty in the Princeton School of Public & International Affairs, other departments and the wider policy community. The Center encourages crossing boundaries both within economics and across disciplines such as economics, finance, law, politics, history and ethics.

Princeton University gratefully acknowledges the generosity of the following donors:

The Julis-Rabinowitz Family for the founding gift that made the Center possible.

Philip D. Bennett, *79

Joyce Chang, ’90 and Family

Mark R. Genender, ’87 and Family

Noah Gottdiener, ’78

Dean N. Menegas, ’83

For a more comprehensive view of the Center’s programs and activities, visit us at jrc.princeton.edu

It is my pleasure to present the Center’s annual report for the academic year 2023-2024. This year has been a period of remarkable growth, intellectual exploration, and impact as we continue our mission to advance rigorous research at the intersection of finance, macroeconomics, and public policy.

This report highlights new research by John Sturm Becko, Victor Degorce, and Ernest Liu, as well as my own work. Through events like our annual conference and collaborations with policymakers and industry leaders, our work informs policy debates, advances academic discourse, and provides insights into the forces shaping the global economy.

Beyond research, the center takes great pride in fostering a dynamic and enriching educational environment. Our co-curricular programs for undergraduate and graduate students include workshops, seminars, and experiential learning opportunities that bridge theory and practice. By engaging with leading academics as well as policymakers and practitioners, our students develop the analytical skills and policy acumen necessary to design future financial and macroeconomic policy.

Over the academic last year, the Center deepened its international initiatives in Pakistan and Africa. The collaboration with the Center for Economic Research in Pakistan continued with a second workshop in spring 2024 featuring several Princeton faculty speakers. Engagement through the Africa Policy Lab culminated in a student trip to Ghana to understand the country’s economic distress, and an alumni panel in Washington, D.C. on fostering sustainable and inclusive growth in Africa. We also partnered with the IMF’s Africa Department for a series of policy discussions, and I authored a piece on the global debt supercycle for the IMF’s F&D magazine.

We are deeply grateful for the support of our university community, partners, and benefactors who make our work possible. As we look ahead, we remain committed to building the evidence base for sound policy, fostering intellectual curiosity, and supporting the meaningful exchange of ideas.

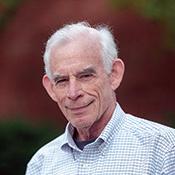

AtifMian

ATIF MIAN

Director, Julis-Rabinowitz Center for Public Policy & Finance

John H. Laporte, Jr. Class of 1967 Professor of Economics, Public Policy, and Finance Princeton School of Public and International Affairs

Mark A. Aguiar, Walker Professor of Economics and International Finance, and Director, International Finance

Yacine Ait-Sahalia, Otto A. Hack 1903 Professor of Finance and Economics

Roland J.M. Bénabou, Theodore A. Wells 1929 Professor of Economics and Public Affairs

Alan S. Blinder,* Gordon S. Rentschler Memorial Professor of Economics and Public Affairs

Markus K. Brunnermeier,* Edwards S. Sanford Professor of Economics, and Director, Bendheim Center for Finance

Miguel A. Centeno, Executive Vice Dean, Princeton School of Public and International Affairs, Musgrave Professor of Sociology, and Professor of Sociology and International Affairs

Amaney A. Jamal,* Dean, Princeton School of Public and International Affairs, Edwards S. Sanford Professor of Politics and Professor of Politics and International Affairs

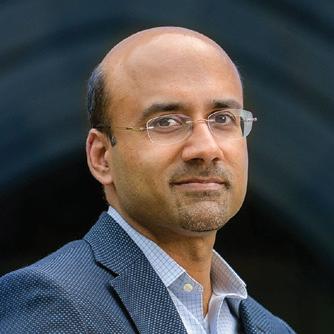

Harold James,* Claude and Lore Kelly Professor in European Studies, Professor of History and International Affairs, and Director, Program in Contemporary European Politics and Society

Jakub Kastl, Professor of Economics

Nobuhiro Kiyotaki, Harold H. Helm 1920 Professor of Economics and Banking

Henrik J. Kleven, Lynn Bendheim Thoman, Class of 1977, and Robert Bendheim, Class of 1937, Professor of Economics and Public Affairs

Moritz Lenel, Assistant Professor of Economics

Ernest Liu, Assistant Professor of Economics

Burton G. Malkiel, Chemical Bank Chairman’s Professor of Economics, Emeritus

Nolan McCarty,* Vice Dean, Academic Assessment, Princeton School of Public and International Affairs, Susan Dod Brown Professor of Politics and Public Affairs

Atif Mian,* Director, JulisRabinowitz Center for Public Policy & Finance, and John H. Laporte, Jr. Class of 1967 Professor of Economics, Public Policy and Finance

Ashoka Mody,* Charles and Marie Robertson Visiting Professor in International Economic Policy

Layna Mosley, Professor of Politics and International Affairs

Jonathan E. Payne, Assistant Professor of Economics

Stephen J. Redding,* Harold T. Shapiro 1964 Professor in Economics, Professor of Economics and International Affairs, and Co-Director, Griswold Center for Economic Policy Studies

Eldar Shafir, Class of 1987 Professor in Behavioral Science and Public Policy, and Professor of Psychology and Public Affairs

Christopher A. Sims, John J.F. Sherrerd 1952 Professor of Economics, Emeritus

Leonard Wantchekon, James Madison Professor of Political Economy and Professor of Politics and International Affairs

Wei Xiong,* John H. Scully 1966 Professor in Finance, and Professor of Economics

Motohiro Yogo, HughesRogers Professor of Economics

Owen Zidar, Associate Professor of Economics and Public Affairs

*Executive Committee Member

TCenter supports data-driven work that combines micro and macro-level data to address key policy questions related to economic growth, financial market behavior, monetary policy, and fiscal policy. This research intersects policy, finance, and macroeconomics. Over the past year, the Center has supported the work of four faculty and postdoctoral affiliates exploring diverse topics, including inequality, taxation, industrial policy, indebtedness, and financial development.

JOHN STURM BECKO, Postdoctoral Research Associate, JRCPPF. John Sturm Becko is an applied economic theorist interested in macroeconomics, public finance, and trade. His work explores optimal policy design under various macroeconomic conditions to provide valuable insights into topical policy areas, such as industrial policy, economic sanctions, and income taxation, and as a way to revisit classic questions in welfare economics. An overarching theme of this agenda is to explore the gap between benchmark policy models and key empirical facts. In several cases, this disconnect highlights interesting and unexplored theoretical issues in addition to critical policy recommendations.

VICTOR DEGORCE, Postdoctoral Research Associate, JRCPPF. Victor Degorce investigates current macrofinance and international economics issues from a long-run and historical perspective. His multidisciplinary research draws on macroeconomics, finance, and economic history. Patterns of financial liberalization, repression, and crises have been recurrent throughout history. Taking a long-run perspective can help us understand some of the main challenges facing developed and developing economies today

ERNEST LIU, Assistant Professor of Economics. Ernest Liu’s research is centered around the implications of weak financial institutions for economic growth, allocation of resources, and economic development. The primary strand of his research applies network models to answer general-equilibrium, policy-relevant questions, often from a long-run growth perspective, on a broad range of topics, including industrial policy, resource allocation, innovation, spatial economics, and global capital flows. His work on production network theory has cemented key insights on industrial policy, specifically the strong government support for upstream industries commonly seen in developing economies. His current

MARKUS BRUNNERMEIER, JRCPPF founding director, was awarded the Ludwig Erhard Prize for business journalism from the Ludwig Erhard Foundation for outstanding scientific work, a regulatory orientation and approach, and lucid explanations of economic and policy questions… ERNEST LIU received the 2023 Excellence Award and an Institute Fellowship from the Kiel Institute for the World Economy in recognition for his work on networks, trade, and industrial policy. Liu was also awarded an NSF CAREER Award to study how interconnected networks of companies, industries, technologies, and countries affect economic growth, capital flows, and industrial policy… LEONARD WANTCHEKON was awarded the 2023 Global Economy Prize from the Kiel Institute for the Global Economy. The annual prize recognizes pioneers of a cosmopolitan, economically liberal, and publicspirited society. Wantchekon was also selected to give the 2024 Sir W. Arthur Lewis Memorial Lecture in Development Economics, organized by the American Economic Association… JRCPPF faculty affiliates WEI XIONG and MOTOHIRO YOGO were elected as Fellows of the Econometric Society in recognition of their seminal contributions to the field. Founded in 1930, this international society advances economic theory in relation to statistics and mathematics.

projects use network models to study (1) global technological competition, (2) geopolitics, and (3) the transition to clean technologies. A secondary strand of his research explores macrofinance and financial development. In particular, he has looked at how long-term interest rates affect market concentration and productivity growth, how banks with market power respond to interest rate ceilings in small business lending, and how financial market imperfections not only distort economic allocations via underinvestment but may greatly amplify effects due to interactions across economic sectors or because the relationships between borrowers and lenders create under-development traps. He received his Ph.D. in Economics from MIT and joined Princeton’s faculty in 2019.

ATIF MIAN, Director, Julis-Rabinowitz Center for Public Policy and Finance.

Atif Mian’s work explores the connections between finance and the macroeconomy. His 2014 book, House of Debt, with Amir Sufi, describes how excessive household debt precipitated the Great Recession. Building on the themes in the book, his current research uses county-level data on household borrowing and employment to look at the impact of indebtedness on labor allocation across geographical areas and industries.

A new book by JRCPPF faculty affiliate and professor of history HAROLD JAMES, The IMF and the European Debt Crisis, surveys the International Monetary Fund’s attempts to support European economies in the aftermath of the global financial crisis.

In his new book, Seven Crashes: The Economic Crises That Shaped Globalization, HAROLD JAMES reviews seven economic crises over the past two centuries, exploring the causes and responses. Supply shocks, he finds, increase economic interconnectedness while demand shocks have the opposite effect.

Aimed at both policymakers and students, A Crash Course on Crises: Macroeconomic Concepts for Run-ups, Collapses, and Recoveries by MARKUS BRUNNERMEIER and Ricardo Reis provides an overview of how crises originate, how they are amplified, and how they can be contained.

Another strand of his work investigates the link between household debt and business cycles worldwide and the role of credit supply shocks. Mian’s research has appeared in top journals, including the American Economic Review, Econometrica, Quarterly Journal of Economics, Journal of Finance, Review of Financial Studies, and Journal of Financial Economics. Before joining Princeton in 2012, he taught at the University of California, Berkeley, and the University of Chicago’s Booth School of Business. He holds a Ph.D. in Economics from MIT.

How can a country design economic sanctions to maximize their economic cost to the sanctioned country at the lowest cost to the sanctioner? In a recent working paper, JOHN STURM BECKO considers this problem from the perspective of international trade. He highlights the parallels between trade restrictions as economic sanctions and the same restrictions as terms-of-trade manipulation. This connection has valuable implications for the design of trade taxes as sanctions. In another paper, Sturm and co-authors examine how fiscal policy propagates through complex and overlapping economic networks. Which forms of fiscal stimulus are the most effective, whom do they help, and how should they be targeted? The paper focuses on efficiently targeting fiscal policy in the presence of input-output linkages, regional trade, and heterogeneous households. A critical finding is that while policies’ distributional effects depend on network structures, maximally expansionary fiscal policy targets spending or transfers to households with the highest marginal propensity to consume.

What happened to savings during the Great Depression? A new publication by VICTOR DEGORCE and co-author Eric Monnet uses new data covering 23 countries to show that the banking crises of the Great Depression coincided with a sharp international increase in deposits at savings institutions and life insurance. These findings explain the fall in credit and aggregate demand in the 1930s, as deposits fled from commercial banks to alternative savings forms. This fueled a credit crunch since other institutions did not replace bank lending. While asset prices fell, savings held in savings institutions and life insurance companies increased as a share of GDP and in real terms, highlighting the need to consider nonbank financial institutions when studying banking crises. In another project, Degorce and co-authors assembled a new daily database of spot and forward exchange rates and interest rates from 1920 to 2020 to study long-run deviations from the Covered Interest Parity (CIP). CIP is a crucial relation in international finance, which states that the return from investing in a foreign currency should equal the return from investing in a domestic currency when hedging the exchange rate risk. The main finding is that substantial CIP deviations have been the norm over the last century except for G10 currencies during the years immediately preceding the Global Financial Crisis (2000–2006). This result suggests that limits to arbitrage have been a common feature of the foreign exchange market since 1920.

Countries are exploring various “green” industrial policies to reduce reliance on fossil fuels. In a new paper, ERNEST LIU et al. analyze a model of green technological transition along a supply chain. The analysis shows that (1) small, targeted, industrial policies may bring significant welfare gains; (2) if subsidies are limited to electrification in a single sector, they should target a downstream sector; (3) overinvesting in the wrong branch upstream can derail the overall green transition downstream; and (4) with a carbon tax and absent industrial policy, the economy can get stuck in a “wrong” steady-state. Another recent paper studies the optimal cross-sector allocation of research and development resources in an innovation network to take advantage of cross-sector knowledge spillovers and achieve long-term growth. Using a network model of R&D allocation and data on more than 30 million global patents from all major economies to evaluate R&D allocative efficiency across countries, Liu et al. find that in the US, improving R&D allocation could generate an 8% gain in welfare.

In recent decades, the US economy has seen low interest rates concurrent with a rise in measures of firm market power. Why have these two patterns emerged? Recent work by ATIF MIAN, ERNEST LIU, Thomas Kroen *22, and Amir Sufi uses high-frequency interest rate shocks to show that falling rates in a low-interest rate environment benefit industry leaders. This benefit for industry leaders diminishes in a higher-rate environment. The paper estimates a “competition-neutral” nominal federal funds rate of about five percentage points, at which industry leaders and followers are impacted equally by an interest rate change. In a new working paper, Atif Mian, former JRCPPF research specialist VERÓNICA BÄCKER-PERAL, and JONATHON HAZELL (LSE) estimate the natural rate of return on capital over the last 20 years. Using data on UK property leases, a fraction of which are renewed every month for durations of 90 years or more, they estimate the expected long-term housing yield over the period 2000–2023. From an average of 5.3% between 2000 and 2006, the housing yield dropped sharply during the Great Recession and continued to decline to 2.8% in 2023, despite rising shorter-term yields in the last decade. Cross-sectional estimates show that long-term housing yield is higher in areas with more housing risk and declined more in areas with more inelastic housing supply

VERONICA BACKER PERAL is a senior research specialist at the Center. She graduated from Loyola Marymount University with a triple major in applied mathematics, computer science, and history. Previously, she worked as a research intern at the Philadelphia Federal Reserve Bank. Her research interests include finance, public policy, and historical economics.

SAM NAK-KYU BARNETT is a senior research specialist at the Center. He recently earned a B.A. in mathematical economics from Columbia University, where he wrote a senior thesis titled “Complexity and Income-Driven Student Loans.” Previously, he worked at Harvard Business School and the Puget Sound Business Journal. Originally from Seattle, he enjoys running and plays jazz saxophone and piano.

JOHN STURM BECKO is a postdoctoral research associate at the Center. He researches optimal policy design in macroeconomic settings. His work provides policy guidance about topical issues like international trade sanctions and targeted fiscal policy. At the same time, it also seeks to address fundamental questions in welfare economics, such as when markets are prone to coordination failures and whether Pareto efficiency tests provide robust policy guidance. John holds a Ph.D. in economics from MIT, an M.Phil. in economics from Cambridge, and a B.A. in physics and math from Harvard.

DONAL BYARD is a lecturer in the economics department at Princeton University and professor of accounting at the Zicklin School of Business, Baruch College-CUNY. Since 2017, he has taught Financial Accounting at Princeton. He is an expert on financial reporting standards, Securities and Exchange Commission regulation, European securities markets, and international securities regulation and has published in numerous scholarly journals. His current research focuses on financial analysts’ use of voluntary disclosures and externalities (or spillover effects) arising

from the adoption of the International Financial Reporting Standards in Europe. A graduate of the University of Limerick and University College Dublin, he holds a Ph.D. in accounting from the University of Maryland.

JEAN-CHRISTOPHE DE SWAAN is a lecturer in the economics department, where he teaches courses on ethics in finance and Asian capital markets. De Swaan is a partner at Cornwall Capital, a global investment fund. He is the author Seeking Virtue in Finance, which calls on finance practitioners to restore the discipline’s focus on serving society. He also regularly contributes to key business publications, including Financial Times and Nikkei Asia. JC de Swaan received his B.A. from Yale, M.Phil. from Cambridge, and a MPP from Harvard’s Kennedy School.

VICTOR DEGORCE is a postdoctoral research associate at the Center. His research investigates current topics in empirical macrofinance, such as the international transmission of monetary policies and exchange rate determination from a long-run perspective. His work is multidisciplinary, drawing on macroeconomics, finance, and economic history. He holds a master’s degree in social sciences from Sciences Po and a Ph.D from the Ecole des Hautes Etudes en Sciences Sociales in Paris.

ALAN XIAOCHEN FENG *15 is an economist at the International Monetary Fund (IMF). His responsibilities at the IMF include leading capacity development projects across IMF membership countries, covering financial sector issues in IMF’s bilateral consultations for Italy, Singapore, and Lao PDR, among other membership countries, and leading analytical chapters for the flagship Global Financial Stability Report. His research interests include macrofinancial issues, climate and ESG finance, and the use of technology in financial services. He received his bachelor’s degree in computer science and mathematics (double major) from the Hong Kong University of Science and Technology and a Ph.D. in Economics from Princeton University.

EKATERINA (KATYA) GRATCHEVA is a Senior Advisor on Climate and Sustainable Finance at the International Monetary Fund (IMF). Over her 20-year career in the financial industry, she has led policy dialogue with ministries of finance, central banks, public pension funds, and international financial institutions on issues related to sovereign assets, liabilities, and developing access to capital markets. Before joining the IMF, she led the finance function of the $10 billion World Bank’s Climate Investment Funds. Katya’s work applies evidence-based approaches to assess sovereign ESG and sustainable finance. Her widely cited sovereign ESG publications raise fundamental issues about current sovereign ESG approaches and proposed solutions. She also focuses on developing alternative approaches and data sources, such as satellite data, and advises the Human Rights Measurement Initiative. Her earlier experience included investment management of the World Bank Group’s assets, risk and performance management, and banking. She holds an MPA from Harvard Kennedy School, an M.Sc. in applied math from Moscow State University, and a Ph.D. in operations research from George Washington University.

AMIL MUMSSEN is a senior research specialist at the Center. He holds a B.S. in applied mathematics and economics from Brown University. Born and raised in Washington, DC, he has always been passionate about understanding the world through the lens of politics. Outside of academics, he enjoys playing soccer, mastering the piano, and spending time in nature.

SÉRGIO ANDRÉ CRISTOVÃO NASCIMENTO is a senior research specialist at the Center. He received his B.A. in Economics from UC Berkeley and worked as a research assistant. His research interests lie in the intersection between finance, macroeconomics, and econometrics.

BUNMI OTEGBADE *19 is a global social impact leader and currently Senior Director at Ashoka, leading knowledge production for peer-driven networks and strategic institutional partnerships in North America. He is also a venture investor, debt and equity, in fast-growing technology firms in life sciences, deep tech, clean energy, and inclusive financial technologies in emerging markets with a focus on Africa. His interests range from innovation policy and technology transfer to the financial market institutions that drive inclusive economic development in emerging markets. He holds a B.Eng. from Baylor University and an MPP from Princeton’s School of Public and International Affairs.

MAROOF A. SYED is a non-resident fellow of the Julis-Rabinowitz Center for Public Policy & Finance and the president and CEO of the Centre for Economic Research in Pakistan (CERP). He has over 25 years of entrepreneurship, investment, and leadership experience in multiple sectors. He combines academic work in public policy, economics, and engineering with extensive experience in leading organizations and building institutions. His public policy interests include innovation for economic development, data analytics and decision sciences, and evidence-based governance. Before leading CERP, Syed held several senior management positions at big and startup technology companies, including Broadcom Corporation (formerly Silicon Spice), Texas Instruments, and Intel Corporation (formerly Dialogic). He co-founded Karnybo Group, which invests in late-stage preIPO technology companies, including Tesla, Twitter, Facebook, Jawbone, Square, and Palantir. He is the 2017 recipient of the Lucius N. Littauer Award from the Harvard Kennedy School. He is also on the Pakistan Innovation Foundation (PIF) Board of Directors, the African Development University, and the Public Interest Law Association of Pakistan. He is a Charter Member of the Organization of Pakistani Entrepreneurs of North America. Syed has a B.S. in computer systems engineering from Rensselaer Polytechnic Institute and a master’s in public administration from Harvard’s JFK School of Government.

Funke Aderonmu, MPA, International Development

Lilian Best, MPP

Nicholas Brown, MPA

Tom Carter, MPA, Economic Policy

Adhitya Dhanapal, Ph.D., History Department

Charlie Fraser, MPA, International Development

Zach Gross, MPA, International Relations

Thomas Horn, MPP, Economics and Public Policy

John Kearns, MPA, Economic Policy

Kimberly Kreiss, MPA, Economic Policy

Caroline Kuritzkes, MPA, International Development

Nong Li, MPA, International Development

Rachel Morrow, MPA, Domestic Policy

Elmir Mukhtarov, MPA, International Development

Graciela Muniz Cahuana, MPP

Fernando Pernas, MPA, Economic Policy

Achinthya Sivalingam, MPA, International Development

Nicholas Brown, Distinction on the QE1, International Development

Tom Carter, Distinction on the QE2, Economic Policy

Charlie Fraser, Distinction on the QE2, International Development; recipient of the David Bradford Prize, awarded to the student with a distinguished academic record and a record of service in the Science, Technology, and Environmental Policy program

Caroline Kuritzkes, Distinction on the QE2, International Development

The Center’s Student Associates Program fosters collaboration between students and faculty in order to enhance learning and research about financial markets. By becoming a JRCPPF associate, both undergraduate and graduate students enjoy unparalleled opportunities to interact with Center-affiliated faculty, contribute to research, and interact with government and industry leaders.

DICKSON BOWMAN, Walter C. Sauer ’28 Prize: Joint eligibility with Politics, SPIA. Prize awarded annually to the student whose thesis or research project on any aspect of US foreign trade is judged to be the most creative.

JAMPEL DORJEE, Griswold Center for Economic Policy Studies Prize: Awarded annually to the five seniors with the best policy-relevant theses.

KATIE KOLODNER, The Proctor and Gamble Prize: Awarded to a graduating senior(s) who has written the best thesis in operations research or finance.

SHIRLEY REN, Wolf Balleisen Memorial Prize: The best thesis on an economics subject, written by an economics major.

MAYA SATCHELL, Elizabeth Bogan Prize in Economics: Awarded annually for the best thesis in health, education or welfare.

ADWOA AFRIFA, Economics

EBUN AJAYI, SPIA, Honors

WILLIAM AO, Computer Science, Honors

SRUTHI BHARADWAJ, SPIA, High Honors

DICKSON BOWMAN, Economics, Highest Honors

MELISSA CHUN, ORFE

JAMPEL DORJEE, Economics

STEVEN FREIDENRICH, Economics

TEDDY GUTMAN, French & Italian, Honors

NOAH HARRIGAN, Economics, Honors

DANIEL HU, Computer Science

MICHELLE HUANG, ORFE

CALVIN HUNT, SPIA, Honors

SABINA JAFRI, Economics

VIVEK KOLLI, ORFE

KATIE KOLODNER, ORFE

ALAN LIN, ORFE

ANANYA PARASHAR, ORFE

SYDNEY PARGMAN, Economics

MARKO PETROVIC, SPIA

SHIRLEY REN, Economics, Highest Honors

MARK ROSARIO, SPIA

MAYA SATCHELL, Economics, High Honors

MOHAN SETTY-CHARITY, Economics, Honors

KELLSIE SHAN, Economics, High Honors

ZOE SIMON, Economics, High Honors

ADITHYA SRIRAM, ORFE

RAJIV SWAMY, Computer Science, Honors

CHRISTOPHER THOMAS, Economics

DYLAN TIE-SHUE , ORFE

LANA UTLEY, Economics, Honors

BRYAN WANG, Computer Science, Highest Honors

GLORIA WANG, Economics, Highest Honors

LAWRENCE WANG, Economics

STONE YANG, Economics, Honors

ASTER ZHANG, Economics, High Honors

This past summer, five Princeton undergraduates participated in internships supported by the Julis Rabinowitz Center for Public Policy & Finance and the Dean Menegas ’83 Fund. These internships offered students passionate about economics, policy, and finance the chance to apply classroom knowledge to real-world policy design and implementation. The diverse projects included economic research, policy proposals, and financial modeling, enhancing their analytical skills and multi-disciplinary understanding of public policy.

NOAH SILBERMAN ESHAGPOUR ’26 worked with the Barcelona Metropolitan Strategic Planning Authority on airport capacity and tourism challenges, crafting policy recommendations for traffic shifts and environmental restoration.

MARIA ELENI ZIGKA ’24 interned with Congressman John Sarbanes, focusing on environment, energy, health, voting reform, and Eastern Mediterranean foreign policy, while researching national electricity grid reforms.

BRYSON JANDWA ’26 studied the potential for Shariacompliant financial products in Tanzania with the Capital Market and Securities Authority, analyzing market data and regulatory changes.

ABRAHAM JACOBS ’26 interned with House Speaker Kevin McCarthy, gaining insights into the workings of Congress and public service through legislative research and constituent relations. “My internship on Capitol Hill was a transformative experience that deepened my understanding of American politics, government, and public service,” said Jacobs.

SYDNEY PARGMAN ’24 nterned at the United Nations Department of Economic and Social Affairs, analyzing policies on education, immigration, and the environment, and helped design a digital knowledge platform for policy discussions.

“My internship on Capitol Hill was a transformative experience that deepened my understanding of American politics, government, and public service.”

— ABRAHAM JACOBS ’26

ECO 301 Macroeconomics, Mark A. Aguiar, Iqbal Zaidi l ECO 315 Topics in Macroeconomics, Nobuhiro Kiyotaki l ECO 361 Financial Accounting, Donal Byard l ECO 325 Organization and Design of Markets, Jakub Kastl l ECO 342 Money and Banking, Markus Brunnermeier l ECO 362 Financial Investments, Motohiro Yogo l ECO 466 / FIN 521 Fixed Income, Options, and Derivatives, Yacine Aït-Sahalia and Caio Ibsen Rodrigues de Almeida l ECO 492/FIN 592 Asian Capital Markets, JC de Swaan l ECO 494 / FIN 594 Chinese Financial and Monetary Systems, Wei Xiong l ECO 504 Macroeconomic Theory II, Nobuhiro Kiyotaki and Giovanni L. Violante l ECO 523 Public Finance, Henrik J. Kleven l ECO 527/FIN 527 Financial Modelling, Moritz F. Lenel and Wei Xiong l FRS 149 Ethics in Finance, JC de Swaan l POL 335 The Political Economy of the United States, Nolan M. McCarty l POL 385 International Political Economy, Layna Mosley l POL 492 / SPI 422 Political Economy and Development, Leonard Wantchekon l SPI 524 The Political Economy of Central Banking, Alan Blinder l SPI 525 Public Economics and Public Policy, Henrik Kleven l SPI 543 International Trade Policy, Stephen J. Redding l SPI 571C Political Risk Analysis, Layna Mosley l SPI 582F Understanding Macro & Financial Policy, Atif Mian l SPI 593B Evolution and Global Diffusion of Macroeconomic Ideas, Ashoka Mody l SPI 594A Behavioral Economics, Roland Bénabou

Sixty-two MPA, MPP, and Ph.D. students came together on January 22–24 for the annual short course, Financial Markets for Public Policy Professionals (FMPP). Created in response to the 2008 global financial crisis, this intensive threeday class is an important complement to the curriculum at Princeton’s School of Public and International Affairs. Now in its 14th year, this unique mini-course has educated nearly 700 policy graduate students. The material covers aspects of financial markets that should be part of the vocabularies of all public policy practitioners. Students start with the fundamentals of financial markets, including the role of banks and financial intermediaries, and then examine how the Federal Reserve and Treasury operate and how these institutions interact with markets. The core curriculum is complemented with lectures and panel discussions about financial regulation, the Great Financial Crisis, state and local financing in the US, Asian financial markets, and distributed finance. Since 2015, the course has been funded through the generosity of Noah Gottdiener ’85.

y Framework for Understanding Financial Markets, Lance Eckel & Matt Porio, Managing Partner, Finance IQ

y Accounting for Policy Makers, Donal Byard, Zicklin School of Business, Baruch College

y Mortgages, Derivatives, and the Great Financial Crisis, Pallavi Nuka, Associate Director, JRCPPF, Princeton University

Date: Winter session January 22–24

Audience: 62 MPA, MPP, and Ph.D. students

Topics: Accounting principles, financial markets, regulations & policy

Financial support: Noah Gottdiener ’78

More info: https://jrc.princeton.edu/teaching/fmpp

y Asian Capital Markets, JC de Swaan, Princeton University and Corning Capital

y Fintech and Public Policy, Charles Schorin, Taconic Advisory Partners

y Asset Management, Kristin Burke, ’03, Harding Loevner

y Municipal Bond Markets, RJ Gallo, Federated Investors

y National and International Financial Regulation, Norm Champ ’85, Kirkland Ellis, LLP; Dianne Dobbeck, Federal Reserve Bank of New York; Carolyn Wilkins, Princeton University and Bank of England; Charles Yi, Federal Housing Finance Agency

On Monday, Apr 29, 2024, 25 JRCPPF undergraduate students traveled to Washington, DC, to meet with a host of Princeton alumni and learn about a range of economic and finance policy careers in the Federal government and the public sector. This day included insightful conversations with policymakers, both career civil servants and political appointees, from the Congressional Budget

The first meeting with staff at the Congressional Budget Office (CBO) offered an overview of the office’s work and its role in developing independent, nonpartisan cost analyses to support the legislative process for both houses of Congress. The distinguished Princeton alumni described their career journeys from Princeton to the public sector, as well as the multi-faceted activities of the Com-

ing national economic and

Under the guidance of Atif Mian and Ernest Liu, the Macrofinance Lab supports research at the intersection of finance and the macroeconomy. Since the lab started in 2018, it has supported 7 dissertation fellows and 16 summer research fellows. The lab is developing an open-source textbook based on the doctoral-level course taught by Mian and Liu, to promote teaching and research about the linkages between finance, debt, and macro-level outcomes. The lab has also published three new historical macrofinancial datasets, which are freely available. Visit macrofinance.princeton.edu for more information.

Affiliated Faculty and Researchers:

y John Sturm Becko, Postdoctoral Research Associate, JRCPPF

y Victor Degorce, Postdoctoral Research Associate, JRCPPF

y Moritz Lenel, Assistant Professor of Economics

y Ernest Liu, Assistant Professor of Economics

y Atif Mian, Director, JRCPPF

y Jonathan E. Payne, Assistant Professor of Economics

A joint initiative of the Center for Collaborative History and the JRCPPF, the Economic History Workshop is a monthly seminar series (ehw.princeton.edu) that provides a forum for faculty, scholars, and students to discuss research, ideas, and historiographical methodologies within the broadly construed field of economic history.

Affiliated Faculty:

y Michael Bordo, Visiting Research Scholar; Board of Governors Professor of Economics and Distinguished Professor of Economics, Rutgers University

y Leah Boustan, Professor of Economics and Director of the Industrial Relations Section

y Harold James, Claude and Lore Kelly Professor in European Studies; Professor of History and International Affairs

y Ekaterina Pravilova, Rosengarten Chair of Modern and Contemporary History; Professor of History; Acting Director, Program in Russian, East European, and Eurasian Studies

y Stephen J. Redding, Harold T. Shapiro 1964 Professor in Economics; Professor of Economics and International Affairs

Samya Aboutajdine

Narek Alexanian

Max Alston

Veronica Backer

Peral

Christine Blandhol

Francisco Cabezon

Anshu Chen

Zheyuan (Kevin) Cui

Jan Ertl

Rafael Goncalves

Sebastian Guarda

Nicolas Hommel

Michael Jenuwine

Zhuowen (Jason)

Jiang

Jiwon Lee

Chun Beng Leow

Dexin Li

Shiqi Li

Ziang Li

Jialiang Lin

Lukas Mann

Jessica Min

Vivikth Narayanan

Sérgio Nascimento

Georgios

Nikolakoudis

Manuel Perez

Arhcila

Eric Qian

Yinan Qui

Junyi Que

Sebastian Roelsgaard

Niklas Rafael Schwalb

Vartan Shadarevian

Yinshan Shang

Ruairidh South

Robert Wagner

Sifan Xue

Chansik Yoon

So Hye Yoon

Yinjie Yu

Alicia Zhang

Xiang Zhang

Ziqiao Zhang

William Zhao

Ziqi (Jack) Zhao

Haonan Zhou

Yuci Zhou

Lukas Althoff

Friedrich Asschenfeldt, Coordinator

Bianca Centrone

Adhitya Dhanapal

Rebecca Giblon

Brendan Greeley, Coordinator

Jack Guenther

Peilun Hao

Liane Hewitt

Tristan Hughes

Griffin Jones

Meredith McDonough

Pablo Pryluka

Jonathan Raspe

Brian Rogers

Neel Thakkar

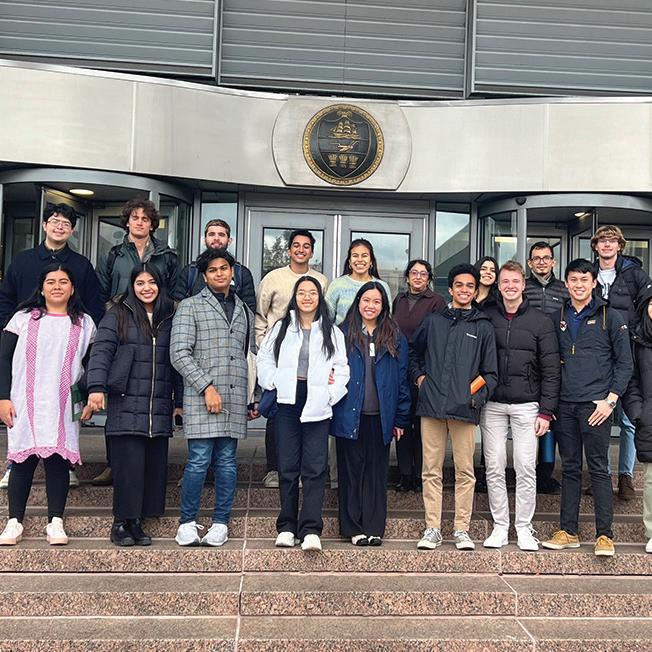

Bridging the academic and policy spheres and building on the JRCPPF’s 2023 annual conference, the lab facilitates a multi-disciplinary approach to investigating and teaching about macroeconomics and development. Over the January 2024 winter break, 12 graduate students from the Princeton School of Public & International Affairs (SPIA) spent a week in Accra, interviewing Ghanaian policymakers and leaders about the country’s debt crisis and policy responses. The policy trip was the culmination of the fall 2023 reading group.

In April 2024, Funke Aderonmu, MPA ’24, and Nick Brown, MPA ’25 organized a policy symposium in Washington, DC, on “Financing Sustainable, Inclusive, and Rapid Growth in Africa.” The event featured distinguished speakers and Princeton alumni: Professor Shantayanan Devarajan ’75 from Georgetown University, James Ladi Williams ’18; associate consultant at McKinsey & Company; Jane Rhee ’06, chief of staff at the U.S. Development Finance Corporation; and Darius Nassiry ’96, vice-president for climate, resilience, and sustainability at WSP.

Affiliated Faculty & Researchers:

y Victor Degorce, Postdoctoral Research Associate, JRCPPF

y Atif Mian, Director, JRCPPF

y Pallavi Nuka, Associate Director, JRCPPF

Baneen Abbas

Funke Aderonmu

Nana Agyeman

Ben Anderson

Lilian Best

Nicholas Brown

Tom Carter

Katie Deal

Tom de Fonblanque

Maria Dooling

Charles Fraser

Dylan Gates

Madeleine Granda

Zachary Gross

John Kearns

Caroline Kuritzkes

Nong Li

Tendekai

Mawokomatanda

Elmir Mukhtarov

Rosemary Newsome

Fernando Pernas

Shannon Presha

Achinthya Sivalingam

Frances Steel

Robert Szirmai

Ayushi Vig

Jing Xie

Pakistan's energy sector faces significant challenges, including inefficiencies, financial losses, and a heavy reliance on imported fossil fuels, contributing to a cumulative debt of roughly $9.5 billion as of early 2024. The outdated grid infrastructure, low efficiency of state-run distribution compa nies, and high capacity pay ments for unused thermal power exacerbate the situation.

The "Navigating the Energy Transition for a Sustainable Future" workshop, conducted jointly by CERP and Princeton University, was held in Islamabad, Pakistan from May 26-28, 2024.

experts including Princeton faculty Chris Greig, Elke Weber, Amy Craft, and Maroof Syed. These experts discussed strategies for enhancing energy security, fostering economic growth, and meeting global climate commitments.

Key recommendations included improving demand forecasting, integrating renewable energy, and addressing governance issues. A successful energy transition is essential for Pakistan's economic stability and environmental health. To read more on this workshop, go to jrc. princeton.edu/news.

The Center’s 13th annual conference explored significant questions for long-run macrofinance, looking at the impact of supply-side macroeconomic policy, the intricate relationship between inflation and asset prices, and how the global economy responded to the tightening cycle initiated in 2022.

INMACROFINANCE THELONGRUNNEWINSIGHTS GLOBALECONOMY ON THE FEBRUARY 22-23, 2024

THIRTEENTH ANNUAL JRCPPF CONFERENCE

The session speakers included JOHN STURM BECKO (Princeton University), XAVIER GABAIX (Harvard University), JONATHAN HAZELL (London School of Economics), Kilian Huber (University of Chicago), RÉKA JUHÁSZ (University of British Columbia), HANNO LUSTIG (Stanford University), Ernest Liu (Princeton University), ATIF MIAN (Princeton University), CAROLIN PFLUEGER (University of Chicago), (New York University), MORITZ SCHULARICK (Kiel Institute for the World Economy & Sciences Po), GIOVANNI VIOLANTE (Princeton University), ANNETTE VISSING-JORGENSEN (Federal Reserve Board), WEI XIONG (Princeton University), and MOTOHIRO YOGO (Princeton University).

“It's very hard for the government to say in a big financial crisis, we're not going to do anything… So, the best way to deal with it is before the fact. And, that means tough regulation and oversight, making sure that your banks are stable, and the shadow banks are stable.”

BEN S. BERNANKE, Nobel Laureate, co-recipient of the 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel; Senior Fellow, Brookings Institution

“History shows that the journey from invention of general-purpose technologies to innovation to productivity can be long and uneven. Although adoption of generative AI is happening rapidly, the full benefit of technology requires complementary investments and changes in corporate structure, management practices, and worker training.”

LISA D. COOK , Member of the Board of Governors, US Federal Reserve System

India Is Broken: A People Betrayed, Independence to Today (book talk), Ashoka Mody, Princeton University

Scaling Up Climate Technologies in India and the Global South: Innovations in Venture Capital (panel discussion), Anajali Bansal, Avaana Capital, Swapna Gupta, Avaana Capital, Chris Creig, Princeton University, Elie Bou-Zeid,Princeton University, Moderator: Anu Ramaswami, Princeton University

A Quiet Corporate Sector Revolution in Japan, JC de Swaan, Princeton University

Power and Progress: Our ThousandYear Struggle Over Technology and Prosperity (public lecture) Daron Acemoglu, MIT, Atif Mian, Princeton University

Undergraduate Associates Faculty Dinner with Cecilia Rouse, Princeton University

The Ruble: A Political History (book talk), Ekaterina Pravilova, Princeton University

Expectations from the 28th Conference of the UNFCCC Parties (COP28) and Likely Outcomes (Bradford Seminar Series), Farrukh Kahn

Undergraduate Associates Faculty Dinner with Atif Mian, Princeton University

Banking on Slavery: Financing Southern Expansion in the Antebellum United States (book talk), Sharon Murphy, Providence College

Undergraduate Associates Faculty Dinner with JC de Swaan, Princeton University

Seven Crashes: The Economic Crises That Shaped Globalization (book talk), Harold James, Princeton University

The Past and Future of Planning (panel discussion), Bill Janeway, University of Cambridge, Liz Chatterjee, University of Chicago, Harold James, Princeton University, Yakov Feygin, Berggruen Institute

State Planning and Private Entrepreneurship in the 20th Century (Conference)

The First Standby Arrangements of the International Monetary Fund in Argentina and Brazil, 1958-64 (EHW), Fernanda Conforto de Oliveira, Geneva Graduate Institute

The Banking Regulatory Outlook: What’s the Right Way Forward? (panel discussion) William Dudley, Princeton University, Aaron Klein, Brookings Institution, Carolyn Wilkins, Princeton University

Designing Effective Environmental and Conservation Policies: The Role of Collective Approaches (Bradford Seminar Series), Kathleen Segerson, University of Connecticut

The New China Playbook: Beyond Socialism and Capitalism (book talk), Keyu Jin, London School of Economics

Philadelphia Fed Field Trip

Financial Markets Regulation (panel discussion), Norm Champ, Kirkland and Ellis, LLP, Dianne Dobbeck, Federal Reserve Bank of New York, Carolin Wilkins, Princeton University, Charles Yi, Federal Housing Finance Agency

As Gods Among Men: A History of the Rich in the West (book talk), Guido Alfani, Bocconi University

Scholars of Finance: Tri State Summit

From Fields to Homes: Rural Midwestern Farm Companies’ Offseason Gas-Powered Washing Machine Production, 1907–1929, Rebecca Gilbon, Princeton University

Ours Was the Shining Future: The Story of the American Dream (book talk), David Leonhardt

Can Trade Policy Mitigate Climate Change? (Bradford Seminar Series), Farid Farrokhi, Purdue University

13th Annual Conference: Macrofinance in the Long Run: New Insights on the Global Economy, Lisa D. Cook, Federal Reserve Board, and Ben S. Bernanke, Brookings Institution

The Clash of Competition Policy with Industrial Policy and “Strategic Autonomy”: Challenges for Europe and the US (European Union Program), Fiona Scott Morton, Yale University

The Banker’s New Clothes: What’s Wrong with Banking and What to Do About It (book talk), Anat Admati, Stanford University

A Conversation on Monetary Multiplicity, Rebecca L. Spang, Indiana University Bloomington, Viviana Zelizer, Princeton University

Roundtable Discussion with Amitabh Kant, India’s G20 Sherpa

Undergraduate Associates Faculty Dinner with Alan Blinder, Princeton University

Sanctions on Russia: Lessons Learned, Ellina Ribakova, Peterson Institute for International Economics

Industrialization, Urbanization, and the Problem of Separation Between Work and Home in Tokyo’s Early 20th Century Textile Industry, Brian Rogers, Princeton University

Designing Effective Environmental and Conservation Policies: The Role of Collective Approaches (Bradford Seminar Series), Kathleen Segerson, University of Connecticut

Roundtable Discussion with US Congressman Patrick McHenry

Ideas to Articles: Undergraduate Research in Economics, Finance & Policy, Shirley (Yilin) Ren, Aaron Ventresca, Cate Brock, Emily Merola, Clement Herman, Luther Yap

Economics in America: An Immigrant Economist Explores the Land of Inequality (book talk), Sir Angus Deaton, Princeton University, Julian Zelizer, Princeton University

Undergraduate Associates Faculty Dinner with Swati Bhatt, Princeton University

The Chains That Bind: How Global Value Chain Integration in the EMU Buffers Global Shocks, Ryan Weldzius, Villanova University

Unpacking and Understanding India’s Economic Data, Arvind Subramanian, Peterson Institute for International Economics

Financing Sustainable, Inclusive & Rapid Growth in Africa, (SPIA-DC Symposium), Shantayanan Devarajan, Georgetown University, Darius Nassiry, WSP Consultants, Jane Rhee, US Development Finance Corporation, James Ladi Williams, McKinsey & Co.

Roundtable Discussion with Hal Varien, Emeritus, University of California, Berkeley

Alumni Career Panel, David Mitchell, Washington Center for Equitable Growth, Bunmi Otegbade, Ashoka, Mayu Takeuchi, Brookings Institution (SPIA-DC)

Keeping the Lights On: A Discussion on Global Energy and Macroeconomic Policy, Amy Myers Jaffe, NYU School of Professional Studies, Helima Croft, RBC Capital Markets, Edward Morse, Hartree Partners, Abhiram Karuppur, Harvard Business School

Atif Mian, Director, and John H. Laporte, Jr. Class of 1967 Professor of Economics, Public Policy and Finance

Pallavi Nuka *04, Associate Director

Nancy Turco, Program Coordinator

Alan S. Blinder ‘67, Gordon S. Rentschler Memorial Professor of Economics and Public Affairs

Markus K. Brunnermeier, Edwards S. Sanford Professor of Economics, and Director, Bendheim Center for Finance

Amaney A. Jamal, Dean, Princeton School of Public and International Affairs, Edwards S. Sanford Professor of Politics and Professor of Politics and International Affairs

Harold James, Claude and Lore Kelly Professor in European Studies, Professor of History and International Affairs, and Director, Program in Contemporary European Politics and Society

Wei Xiong, John H. Scully 1966 Professor in Finance, and Professor of Economics

Philip Bennett *79, Board Director, Standard & Poor’s Global Ratings

Michael Bordo, Board of Governor’s Professor of Economics and Director of the Center for Monetary and Financial History, Rutgers University

Joyce Chang *90, Chair of Global Research, JP Morgan Chase & Co.

Mark Genender ’87, Managing Partner, Bristol Growth Capital, LLC

Pierre M. Gentin ’89, Chief Legal Counsel, McKinsey & Company, Inc.

Linda S. Goldberg *88, Financial Research Advisor on Financial Intermediation Policy Research, Federal Reserve Bank of New York

Robert A. Johnson *86, President, Institute for New Economic Thinking

Mitchell R. Julis ’77, Co-founder and Co-CEO, Canyon Partners, LLC

Christopher Marks *96, Managing Director and Head of Emerging Markets, Mitsubishi UFJ Financial Group

Dean Menegas ’83, General Counsel, Spinnaker Capital Group

Bing Shen ’71, Board Director, CTCI Corporation and Far Eastern International Bank

Ajay G. Shroff ’98, Chief Investment Officer, Ridgeleigh Capital

Charles Yi *03, Senior Legal Advisory, Federal Housing Finance Agency

Editor: Pallavi Nuka

Design: Nita Congress

Photo credits: Sameer Khan, Nancy Turco, Pallavi Nuka, Denise Applewhite, Princeton Communications Office, Adobe Stock

Copyright © 2025 by the Trustees of Princeton University

In the Nation’s Service and the Service of Humanity