PRINCETON MORTGAGE

Everydaywetrackwherevertheloanisin theprocesstowardclosing.Iftheloanis notwhereitissupposedtobebytheend ofanygivenday,thenoperationshaveto goto“HappyHour,”tofigureoutwhat wentwrong,addresstheissue,and communicatenextstepstoallteam membersinvolved. ThiswayourLOscanhaveconfidencethat PrincetonMortgageistakingcomplete accountabilitytogettheirloansclosed.

We are an approved seller to FNMA and FHLMC

We have 45+ aggregators to whom we sell loans as well, depending on who is offering best execution.

Conventional FNMA*

(Conforming, High Balance, HomeReady, Refi Now)

Conventional FHLMC*

(Conforming, Super Conforming, Home Possible, Home One)

FHA* (including High Balance and Streamlines)

VA* (including High Balance and IRRRLs)

USDA

*We offer 2/1 and 1/0 Temporary Buydowns on these products –further details can be provided upon request.

We have all the major players and are regularly adding niche players to offer competitive pricing.

Bank statement programs

Non-warrantable condos

Title Vesting in LLC

DU Approve/Ineligible Flex Program

DSCR Loans

Foreclosure/Bankruptcy

Seasoning of 1-Year

Asset utilization (depletion) Loans

ITIN Borrowers

Unique Property Loans

HELOCs

DSCR 2-8 unit mixed properties

DSCR 5-10 unit residential properties

Choice of several nationwide DPA Products (FHA/USDA 1st paired with a choice of 3 DPAs)

FHA Reverse Mortgages (HECMS)

Doctor Program

HUD 184 Product

FNMA/FHLMC VLIP (Very Low Income Program)

Nationwide CRA products with competitive pricing (must be in an investor-defined community)

Bridge Loans

FNMA Homestyle Renovation Loans

FHA 203(k) Renovation Loans

1X Close Construction Perm Loans

Currently offering TSAHC (TX), SC Bond (SC), NJHFA (NJ), RIH (RI), PHFA (PA), AFHFA (AL), Georgia Dream (GA) and CHFA (CO). Continuing to roll out other state bonds/DPA programs in 2024.

As of 8/15/24

Agencies for whom we are approved sellers (we sell loans directly to them):

Fannie Mae

Freddie Mac

Agencies with whom we are approved (we sell loans we originate, underwrite, and close under these programs through aggregators.):

FHA

VA USDA

Aggregators (To whom we sell conventional and government loans):

Amerihome

Bayview/Lakeview

Chase

Citi

Click N’ Close

Fifth Third

Flagstar

Freedom Credit Union

Maxwell Capital

Mr. Cooper

New Rez

PennyMac

PHH

Planet Home Lending

Rocket Mortgage

TMS

Towne Mortgage Company

U.S. Bank

Village Capital

Jumbo Investors

Chase

Flagstar

U.S. Bank

Servicers for FNMA/FHLMC:

Arvest

CMC Funding

JP Morgan Chase

Lakeview

Mr. Cooper

PHH

PNC

U.S. Bank

Broker Outlets/TPO:

AFR

Angel Oak

Change Wholesale

Clear Edge

Finance of America Reverse (FAR)

FNBA

Rocket Mortgage

State Bond Agencies

Alabama-AHFA

Colorado-CHFA

Georgia-GA Dream

New Jersey-NJHMFA

Pennsylvania-PHFA

Rhode Island-RIH

South Carolina-SC Housing

Texas-TSAHC

(We are continuing to roll out more!)

ORIGINATIONTECHNOLOGY

MAXWELL

POINTOFSALE

ENCOMPASS LOANORIGINATIONSOFTWARE

OPTIMALBLUE PRICINGENGINE ANDHEDGINGPLATFORM

SNAPDOCS HYBRIDCLOSING

ORIGINATIONTECHNOLOGYPARTNERS

LOANBEAM SELF-EMPLOYED TAXRETURNVALIDATION

FACTUALDATA CONSUMERCREDITAND VERIFICATIONSERVICES

PRISM(BLUEPRINT) SALARIEDINCOME ANALYSIS

AGENCYINVESTOR GUIDELINES CLOSINGCORP SETTLEMENTFEES

REGGORA APPRAISALORDERING

The purpose of this document is to provide potential or new Princeton Mortgage Loan Officers and Branch Managers with answers to the most frequently asked questions as it relates to Princeton Mortgage Operations.

General

What type of lender is Princeton Mortgage?

Princeton Mortgage is a retail correspondent lender approved to sell loans directly to Fannie Mae and Freddie Mac as well as being fully approved to originate FHA, VA, and USDA loans

Apart from direct selling to Fannie Mae and Freddie Mac, to whom does Princeton Mortgage sell loans?

Princeton Mortgage has an extensive list of aggregators to whom we sell our loans as well.

Does Princeton Mortgage have its GNMA Approval?

Not currently, as we sell all our loans on the secondary market servicing-released, which includes selling our government loans to aggregators. As we continue to scale and grow, we will monitor and evaluate when the time may be right for us to work towards establishing a servicing portfolio as a step towards GNMA qualification approval.

What is your tech stack?

We utilize:

Point of Sale (POS): Maxwell

Loan Operating System (LOS): Encompass

Customer Relationship Management (CRM): Total Expert

Pricing Engine: Optimal Blue (OB)

Hybrid Closings: SnapDocs

Mortgage Banking Account System: Accounting for Mortgage Bankers (AMB)

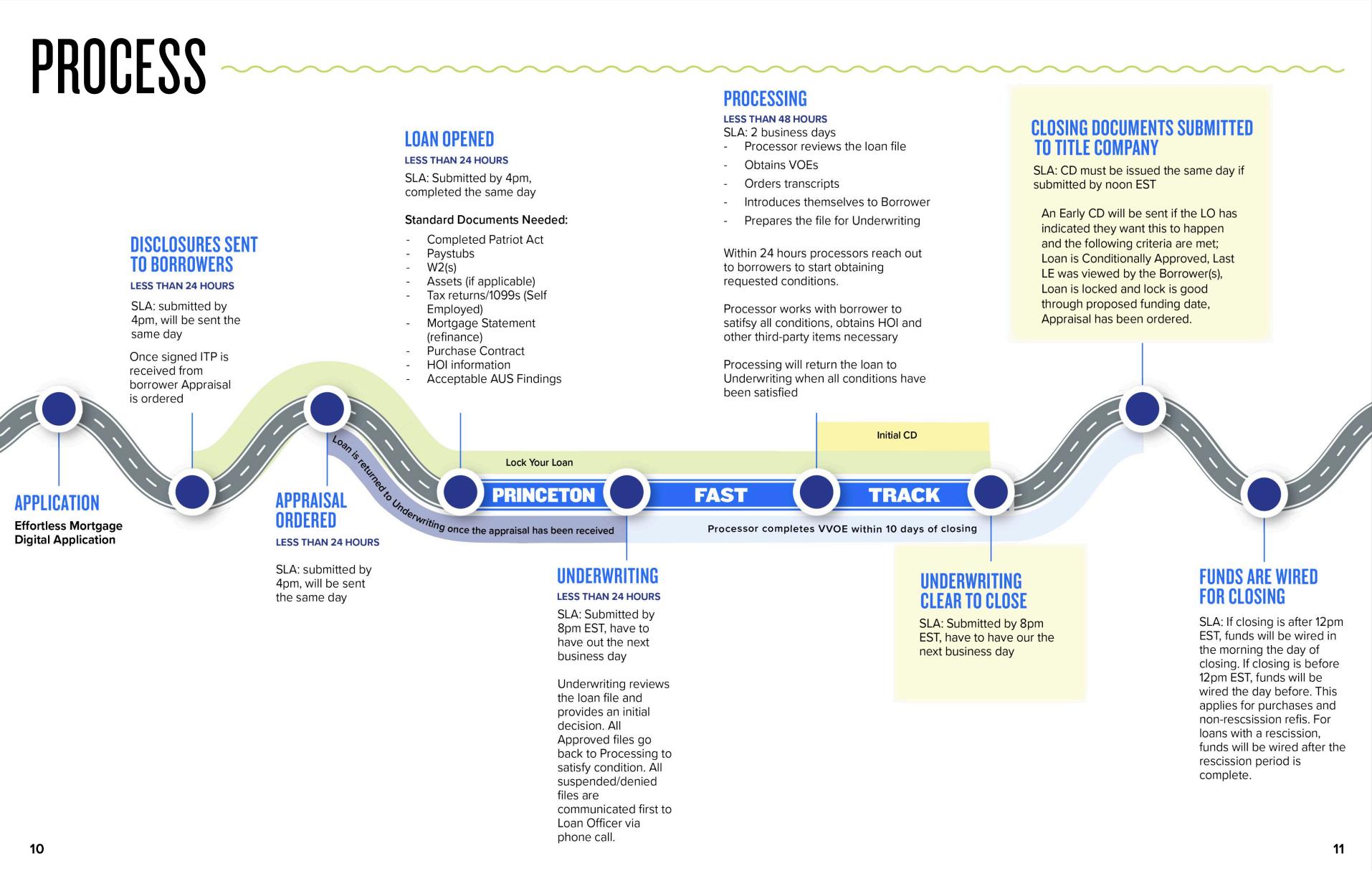

Describe the operational flow process.

Here are the operational flow steps:

Application: A Loan Officer meets with applicant and takes a complete and accurate loan application.

Disclosure: A Loan Officer submits the loan to the Princeton Disclosure team through the Encompass Loan Operating System (LOS) once he/she has the 6 pieces of information that constitute a valid loan application under the TRID rule: Name, Income, Social Security Number, Property Address, Estimated Value of the Subject Property, and Mortgage Loan Amount sought. Disclosures including a loan estimate--must be sent within 3 business days of the application date. The Disclosure Team issues disclosures within our Service Level Agreement (SLA) and in compliance with TRID.

Opening & File Review: Once disclosures are issued, the file flows to our Opening Team for ordering vendor services (such as title) and the loan is reviewed to determine if all the minimum required documents (see our Service Level Agreement for details) are in the file such that the file will be ready to move to underwriting once the executed intent to proceed is received. If the minimum required documents are not received, the Opening Team will suspend the loan in Opening per our SLA and notification will be sent to the Loan Officer of the documentation needed to move the loan forward.(See our SLA for details.)

Appraisal: Simultaneous with the above, the Appraisal Desk monitors the loan for the executed Intent to Proceed. Once satisfactorily received, if an appraisal is required for the transaction, the appraisal desk will order the appraisal and send out a payment link to the borrower. The appraisal order will be processed and assigned by our third-party vendor to an appraiser once payment is received.

File submitted to Underwriting: Once we have the executed Intent to Proceed and all minimum required documents per our SLA, the Opening Team will advance the file to Underwriting.

Initial Underwrite: The initial underwriting of the loan will be completed within 1 business day.

Approval Decision: If the loan decision is an approval, an automated approval notification will be sent from Encompass to internal loan associates.

Suspense Decision: If the loan decision is suspense, the Underwriter will attempt to call the Loan Officer first to discuss the loan and subsequently send out follow up written communication to all internal loan parties, so everyone is on the same page If the Underwriter is unable to reach the Loan Officer by end of business, the Underwriter will send out written communication to the Loan Officer, Loan Processor, and Loan Officer Assistant on it and will follow up the next morning with the Loan Officer to see if there are any questions

Denial Decision: If the loan decision is a recommendation for denial, the Underwriter will call the Loan Officer to discuss the risks, offsets, and the “why” behind the recommendation for denial. The Underwriter will then submit the file to Underwriting Management for Second Level Review. A Second Level Review is performed to ensure the decision is accurate and there is no opportunity for a counteroffer. If the Second Level Review results in a concurrence with the denial recommendation, the Second Level Reviewer will call the Loan Officer to go over the final credit decision and then send out a written communication to the Loan Officer, Loan Processor, and Loan Officer Assistant on it. The Second Level Reviewer will complete the Adverse Action and notify the Disclosure Team of the denial. The Disclosure Team will issue the denial and move the loan in the Encompass LOS out of the active pipeline.

Conditions: Whether a loan is approved or suspended, after the underwriting decision is rendered, the Loan Processor then works to gather any necessary stipulations from the borrower (and third parties, as applicable). The Loan Processor does not hold up the file by only submitting conditions once everything is received; rather, the Processor strives to submit conditions in batches such that when key documentation is received which includes things that could impact the loan--such as an appraisal or income documents…that the information is reviewed by the file Underwriter as soon as possible, so there are no last minute surprises in case additional information or clarification is needed as it relates to condition documentation submitted.

Locking the Loan: The Loan Officer locks the loan with Secondary Marketing via the Optimal Blue system. Please see the SLA Matrix for more information on Lock Desk policies and hours.

Closing Disclosure (CD): The Loan Processor has control over the Closing Disclosure in terms of the timing of its issuance. The Loan Processor can request an Early CD, which is unbalanced, after the loan is conditionally approved and locked The Loan Processor can request an Initial CD (ICD), which is balanced, once the loan is conditionally approved, locked, and we have the title commitment, tax certification, and Homeowner’s Insurance (HOI) Additionally, for an ICD we need the invoices in the file for credit, appraisal, and other borrower charges The Loan Processor requests either the Early CD or the ICD in Encompass based on completion of a screen that contains boxes for the Loan Processor to check off confirming required information is in the file Then the loan automatically flows to the Closing Department for the issuance of the Early CD or ICD.

Clear-to-Close (CTC): When the Loan Processor is submitting the last batch of conditions to Underwriting for review, he/she indicates in Encompass that it is a CTC submission (thereby making everyone aware that it is anticipated that the most recent condition documentation should clear all remaining stipulations such that the Underwriter can move the file to a Final Approval (Clear-to-Close) milestone in Encompass. Once the Underwriter satisfactorily clears the file to close, the loan advances to the Closing Department for issuance of the Final CD and Closing Package. If the last submission of conditions does not result in the file being clearedto-close, the Underwriter will update the remaining conditions to clarify what is needed and the file will be returned to the Loan Processor.

Closing Docs Drawn: Once the loan is cleared-to-close, the Loan Closer balances the Final CD with the Settlement Agent and all parties (more information is in the Closing FAQ Section within this document) and then issues the loan closing package.

Funding: Funding is issued to the settlement agent by wire from our warehouse bank either on the date of disbursement of the loan or the prior afternoon if the loan is closing first thing in the morning.We do not require funding authorization before disbursement.

Post-Closing: When the closed loan package is returned to Princeton Mortgage, the Post-Closing Team reviews the closing docs, scans them into Encompass, and then ships the original promissory note to the applicable warehouse bank. Once Secondary Marketing commits the loan to an investor, the Post-Closing Team delivers the loan (credit and closing package). If there are any purchase clearing stipulations from the investor, Post-Closing addresses. Once the loan is purchased, the purchase advice information is entered into Encompass and uploaded to the warehouse bank and Accounting is notified The Post-Closing team also handles government insuring and follow up on the receipt of final docs (recorded security instrument and final title policy) and delivery of those docs to the investor or document custodian, as applicable

First Payment: Depending on the timing of the loan being purchased by an investor, if the first payment is due to Princeton, then the Post-Closing team will follow up with the borrower to collect same. The borrower receives a First Payment Letter and breakdown with the closing package.The Post-Closing team also sends out a separate notification to the borrower by both email and by U.S. mail.

Transfer of Servicing: Once the loan is sold on the secondary market, there will be at least 15 calendar days between the sale of the loan and the transfer of servicing to the investor. Princeton will send a Transfer of Servicing notice to the borrower by both email and by U.S. mail notifying him/her of the new servicer and providing the new servicer’s contact information, address for payments, and date the borrower should commence paying the monthly mortgage payments to the new servicer.

Do you have a defined Service Level Agreement (SLA)?

We do have a Service Level Agreement Document within our Policies and Procedures Handbook on our HUB (intranet) that clearly defines the turn-times for each department.

How do you hold the operations team accountable for adhering to the defined SLAs?

Happy Hour: We have Happy Hour scheduled at 5 p m Eastern every business day!Now, we know you are thinking that a Happy Hour involves a tropical drink with a little umbrella or perhaps a tall lager it is not that kind of Happy Hour! Instead, it is a meeting for all the front-end department managers Our department managers monitor pipelines throughout the day to facilitate keeping everything on track such that all work that requires an action that day whether issuing disclosures, performing a new underwrite, issuing a closing disclosure, and so forth is completed prior to 5 p m If everything is completed before 5 p m , then we “cancel” our Happy Hour meeting.As an organization, we set metrics around canceling Happy Hour a certain number of times within each quarter (such as 45 times within the 60+ business days of the quarter). It is important that we measure our results each business day.

What happens if Happy Hour is held? If all the operational work that is due out that same day is not complete, then Happy Hour is held. It is not actually an hour….it may span from 5-15 minutes, typically. We discuss the files that are not complete, why they are not complete, and the game plan for getting them complete while maintaining the customer’s scheduled closing date. For example, if underwriting has a file outstanding, the update might be that we are awaiting an updated mortgage insurance certificate and should have that in 20 minutes; or if closing had a file outstanding, it may be that they agreed to accommodate a rush closing disclosure and are working on it now.

What is the communication surrounding Happy Hour? An email is sent to the whole organization stating either 1) Happy Hour was canceled (go team!) and progress towards our quarterly metric (i.e., we have cancelled 39 Happy Hours so far towards the quarterly goal of 45); or 2) Happy Hour was held, the loans involved, and the action plan for getting them across the finish line on time.

Why is Happy Hour important: It provides assurance and clear communication to our customers (we consider the loan officer to be our customer) that we are keeping the borrower on track for closing the loan on time. Moreover, we do a high volume of purchase business, and in purchase transactions, there are many parties involved (buyer, seller, buyer’s agent, seller’s agent, settlement agent, etc ) and there can be multiple transactions that hinge on one another (such as a seller selling a home so he/she can purchase another home) The importance of closing on time therefore is exponential in terms of impact, as the loan officer has a relationship with the buyer’s agent and the buyer, and the potential for developing a relationship with the seller’s agent not to mention the possibility of repeat business with the borrower(s) and referrals This transparent communication keeps loan officers apprised of the matter which avoids them having to make calls to operations to ascertain status on why an expected action on a file due out that day has not taken place. Communication is a beautiful thing!

How does Princeton Mortgage demonstrate that it stands behind its “Effortless” Process?

We do so through the Princeton Promise, which states that if a borrower is unhappy for any reason during the loan process, we will pay $1000.00 towards his/her closing costs.We are putting our money where our mouth is, so to speak, with this guarantee. How many mortgage companies do you know that do that? We have confidence in our operations team, and so should you! Do you have to micro-manage your files at your current place of employment? Should you decide to come to Princeton Mortgage, you will see that once we accept a file into operations (i.e., it passes Opening/File Review and goes to Underwriting), then we believe it is the responsibility of operations to see that file through to closing (while keeping a Loan Officer informed of pertinent matters). A Loan Officer should be able to focus on bringing in more loans and building meaningful relationships with realtors and builders not being mired down with following up on files. This means that all the departments within operations are focused on the borrower and working in tandem to get the borrower to close on time and creating a seemingly “Effortless” experience for both you, the Loan Officer, and the borrower!

Do we collect any fees from the borrower upfront?

Yes, the appraisal fee (if applicable and not a VA loan) and a condo questionnaire fee (if subject property is a condo). All other fees are collected at closing. Once the Intent to Proceed is received and fully executed, if an appraisal is required for the transaction, a link will be emailed to the borrower through which payment can be made for the appraisal. (VA loans are currently excluded from payment being required up front; the fee is collected at closing.) If the subject property is a condo, a payment link will be sent to the borrower from our vendor through which we order condo questionnaires.

May a branch handle its own disclosures?

Not currently, but we are exploring avenues to be able to offer this option such that disclosures are safe, compliant, and do not require any cures.

Is there a Rush process?

Yes, if you have a loan that needs to close in a shorter time frame than our SLA, or you have a new realtor relationship and are wanting to make a stellar impression, or if there is a customer service issue or the loan needs to be restarted for some reason, you can request consideration of a Rush for the loan through Encompass The reason for the rush must be selected in the system The rush can be requested by the Loan Officer, Loan Officer Assistant, or Processor When the request is triggered in Encompass, it sends notification to several Princeton managers on the distribution The rush will either be approved or denied within the SLA (see SLA document) and upon the rush decision being made and entered into Encompass by the responding manager, the system will send a notification to the requestor. For full details, please see our Operations Rush Request Standard Operating Procedure in the Policy & Procedure Handbook on the HUB (intranet).

What is the appraisal ordering process?

Once the Intent to Proceed is signed by all parties, the appraisal is ordered in the Reggora system through Encompass, our loan operating system. A payment link is sent to the primary borrower’s email address and once paid, the order is sent to an appraiser through the AMC. All communication regarding the appraisals is managed by the Appraisal Desk. When the report is delivered, it is quickly reviewed by the Appraisal Desk Team and submitted to underwriting. Any revision requests or reconsideration of value requests are submitted through the Appraisal Desk.

What is the average appraisal turn-time?

Standard turn times in most geographic areas are 5 business days from the date payment is received.

What if an appraisal rush is needed—what is the turn-time?

Typically, 3 business days from the date payment is received

Can I recommend an appraiser from my area? Can I have an appraisal panel?

We utilize a third-party appraisal vendor to complete our appraisals and manage the appraisal assignments. We can work with the vendor to ensure proper coverage in your area.

Are the appraisal fees competitive?

Yes.

For the third-party appraisal vendor, is there any sort of guarantee on the delivery of the appraisal?

Yes there is a guarantee through our primary Appraisal Management Company (AMC). Princeton Mortgage is partnering with a nationwide AMC who not only has competitive appraisal fees and turn-times, but they also stand behind the commitment for delivery of the appraisal on time. Once the appraiser accepts the appraisal order and indicates a delivery date, if the appraisal is not delivered on time, then the AMC pays for the appraisal (and the borrower will be refunded the previously paid appraisal fee).

What is the process for a reconsideration of value?

Email the Appraisal Desk with additional comp addresses (3-4) and a brief description of why those are better than the comps that were used The Appraisal Desk will get that information to the AMC for appraiser review Typical response time from the appraiser is 24-48 hours after the Appraisal Desk provides the information to the AMC

Do you have your own underwriting guidelines or underwriting overlays?

We underwrite to the applicable agency (FNMA, FHLMC, FHA, VA, USDA) and therefore there is no need for our own underwriting guidelines. We do have a few minimal underwriting overlays, which are in our Policy & Procedure Handbook on our HUB (intranet).

Are there exceptions available for the underwriting overlays?

There is an exception process available for government loans with credit scores below the PMC minimum threshold for purchase transactions with an AUS approve/eligible (no manual downgrades), as warranted. This is defined towards the end of the Underwriting Overlays document.There is no guarantee of exception approval—the overall risk must be evaluated. We want to make sure we are setting the borrower up for success and the borrower has not only the ability, but also the willingness to pay the new mortgage obligation timely.

If my credit score exception is not approved, what are my options?

Good news! We have broker outlets available! If we cannot do the loan through our retail channel due to the loan risk, we are able to broker the loans out (we would not want to broker out loans that we CAN do through our retail channel, of course) You do not have to lose the loan to another lender; instead, review our broker outlets (see the Product Matrix/Broker tab for available outlets and Account Executive contact information)

Average underwriting turn-times?

Our average underwriting turn-times are 24 hours (1 business day) for new underwrites, conditions, and TBD loans.

Do you have an Underwriting Scenario Desk?

Yes! Email any scenarios or guideline questions to scenarios@princetonmortgage.com . Someone from the Underwriting team will review and respond to it within the defined SLA (see SLA document). If it appears to be a more complex situation or question, the responder will call you to discuss, to drive clarity so we can provide the best guidance.

Do you offer a TBD process whereby a loan can be preliminarily evaluated by Underwriting and a pre-commitment issued?

Absolutely! If you would prefer an underwriter to look at a file and to issue a pre-commitment, if approved for same, the file can be submitted through Encompass. It will bypass disclosures, as these files should not have the defined TRID 6 pieces of information that constitute a loan application. Note that if a pre-commitment is issued, and the loan later flips to a “real deal”, when the file goes to Underwriting, it will generally be assigned to the same Underwriter who reviewed the TBD file, for consistency (unless the Underwriter is out of the office sick, on vacation, or there are load-balancing needs).

What if I disagree with an Underwriter on a loan condition—how do I escalate?

If you disagree with an underwriting stipulation, we ask first that you or your Loan Processor please call the Underwriter to have a conversation about it Yes we encourage you interacting with the Underwriter! We want you to build your relationship with the Underwriting team, so we ask that any time there are questions, that you start with a conversation with the Underwriter.

If you cannot come to a meeting of the minds with the Underwriter on the matter, and you want to escalate it further there is no drama there are no 10 levels of red tape to go through we have a very simple and direct process: You have the Loan Processor submit an escalation request through Encompass. That notifies Underwriting Management and the Sales Support Manager of the request by distribution email. Underwriting Management will review and respond to the request within the defined SLA (see SLA Document). Underwriting Management will reach out to the Loan Officer or Loan Processor to discuss it before finalizing the response in Encompass.Once the response is captured into Encompass (approved; incomplete request; denied), an automated email notification to the escalation requestor and all loan parties generates, so everyone is kept informed.

May I have a dedicated Underwriter?

Yes, it is possible if you are a top producer! Please contact our EVP National Sales Director to discuss this further.

How do pricing concessions work?

If a pricing concession is needed, a Loan Officer should reach out jointly to the Sales Support Manager and Branch Manager. They will need the following information for consideration:Borrower’s name, loan number, loan amount, loan type, interest rate, total concession in basis points (bps), points being charged, reason for concession. Concessions are not guaranteed and are made on an “as needed” basis. The Sales Support Manager and Branch Manager will review and render a decision to either approve, counter, or deny the request.They will communicate with the Loan Officer directly on it.

What sort of sales support does Princeton Mortgage have?

We have the Genius Bar!What is that? It is a dedicated sales support team to be your primary “help desk” for anything ranging from such things as problems running an AUS, or your computer is not functioning properly, or you need assistance with finding some product information. How great is that?! A one-stop shop! The Genius Bar can be reached at helpme@princetonmortgage.com .

What if I need help restructuring a loan—to whom to I turn?

If you have a Branch Manager, please contact him/her In the event the Branch Manager is unavailable, then please reach out to the Genius Bar at helpme@princetonmortgage com

How do closing docs go out?

Current state: Once the loan is CTC, the loan goes into a queue for the closer to issue docs. The closer will do a balance with settlement agent of the final CD via email.Once we have a balanced CD, then the closing docs are sent to the settlement agent via SnapDocs in tangent with our Encompass system. The settlement agent receives it by a secure email. A separate email is sent to all parties (processors, loan officers, LOAs, and settlement agents) with the final CD and it lets them know that the closing docs have been sent to the settlement agent. Note that SnapDocs is our 3rd party vendor we utilize for hybrid closings.We also utilize their services for wetsigned (all docs manually executed) closings as well. The Loan Officer is able to indicate at the time of loan submission if a hybrid or wet closing is desired. If no option is selected, the system will default to hybrid except in the event of state bond loans or niche products. The benefit to the borrower with hybrid closings is that he/she can preview the documents ahead of the closing date—which gives the opportunity for any questions or adjustments needed—and then on the day of the closing, the borrower can electronically execute most of the closing docs. When the borrower goes to the settlement agent’s office, instead of an hour closing, the timeframe is cut down two-thirds since only the promissory note, security instrument, and a few key other documents must be wet-signed. This makes a better experience for the borrower (and fewer hand cramps from signing so many documents), not to mention other parties involved

Future state: We recently rolled out hybrid closings for the whole company The next stage will be rolling out full e-closings with e-Notes This will improve the borrower’s experience even further and expedite loan sale

Is your closing team experienced in “dry” state (escrow states) closings?

Yes. We routinely perform closings in states where dry funding is permitted, such as California. We are familiar with coordinating between settlement agents and escrow agents. We are aware that funding may be on a different date than closing, and interim interest should only be charged from the date of disbursement of funds.

Is funding authorization needed while the borrower is at the closing table before the settlement agent can disburse?

No funding authorization is needed. After we send the balanced CD, we let the settlement agent know the wire amount and send them a wire breakdown before the wire is sent. Wires are sent same day unless closing early morning. 4:30 p.m. Eastern is the cut-off time for wiring funds.

What is the difference between Princeton’s Early CD Process and Initial Closing Disclosure Process? Early CD Process

Once the loan is locked and conditionally approved, then the LO can determine if an early CD is desired. Need settlement agent info to order early CD. This is not a balanced CD.

Initial CD (ICD) Process

Loan needs to be locked, conditionally approved, have all the invoices for HOI, title work, tax cert The Closer drafts the initial CD and sends it to the settlement agent with a request for it to be reviewed within 1 business day Once finalized, the Closer issues the ICD

Does a CD need to be acknowledged by all borrowers?

Purchase At least one borrower must acknowledge the CD.

Refinance All borrowers should acknowledge the CD.

Who coordinates with the attorney, escrow agent, or title companies?

The Closer handles the communication and logistics between these parties.

Do Loan Officers have to get involved in post-closing conditions for loan sale?

Generally, no—the Post-Closers strive to handle most items and involve front-end operations sparingly, when needed, such as when a customer is unresponsive.

Do Loan Officers have to get involved with first payments?

No. Although there is a first payment letter included in the closing package and the Post-Closing Department sends out subsequent first payment letters by email and mail to borrowers, sometimes a borrower has questions Please direct those questions to postclosing@princetonmortgage com

How often do you evaluate your product offerings?

We are constantly working on new product offerings, and the product group has regular meetings at least 3 times per month. As a Loan Officer, you have “boots on the ground” and may be able to provide valuable market intel on new products or programs we need to consider. If you have suggestions or recommendations, please notify the Sales Support Manager so it can be added to the agenda for the next product meeting for consideration.

Does Princeton Mortgage have broker outlets available for Non-QM Loans?

Yes—We have multiple outlets available.

Additional questions?

Please do not hesitate to reach out to compliance@princetonmortgage.com .