ACKNOWLEDGED BY THE INDUSTRY AS THE LEADING MAGAZINE

ACKNOWLEDGED BY THE INDUSTRY AS THE LEADING MAGAZINE

How quality and service have helped in four decades of growth

Repairers vital to EV transition

The ADAS code explained

THINK GLOBALLY, ACT LOCALLY

Fix Auto and NOVUS Glass are proud members of the Fix Network family of brands and are expanding rapidly across Australia. With a growing footprint in both the collision and auto glass sectors, Fix Network is helping local repairers tap into the power of a global network.

When you join, you’re not just aligning with two industry-leading brands — you’re becoming part of a trusted, collaborative network powered by scale, defined by quality, and united by shared success.

At Fix Network, every workshop remains independently owned and operated — but you’re never on your own. Our global infrastructure is built to help local businesses succeed. Whether you’re looking to open new revenue streams, strengthen relationships with key insurance partners, or gain access to the same infrastructure your corporate competitors do — we’re here to support your growth without compromising your independence.

Franchisee partners benefit from:

• E stablished insurance and supplier relationships at both national and global levels

• G lobal infrastructure supporting over 2,000 businesses

• Industry-leading operational and training support

• A collaborative network of likeminded operators

• Strategic marketing campaigns that drive business locally and nationally

• Strong brand recognition and customer trust

• Innovative technology and tools

Thinking beyond panel? Glass could be your next move. In today’s rapidly evolving automotive industry, diversification isn’t just a smart strategy — it’s a necessity. If you’re a body shop owner focused

“Having our own glass and calibration technicians saves us time and brings more profit into the business. I would definitely recommend operating both franchises side by side.”

James Robertson, owner of Fix Auto and NOVUS Glass Gladstone

solely on collision repair, now is the time to consider expanding your services and future-proofing your business.

NOVUS Glass is a globally recognised leader in auto glass repair and replacement, offering independent panel shops a clear avenue for diversification.

Why add glass repair and replacement to your panel shop? As a shop owner, you already understand the importance of fast turnaround times, quality workmanship, and customer satisfaction. Now imagine extending those strengths into the auto glass space with a brand that understands both the business opportunity and what you need to succeed.

NOVUS Glass is not just another service provider — it’s a trusted brand built on the philosophy: “Repair first, replace when necessary.”

Adding NOVUS Glass to your panel shop allows you to tap into a growing market segment without starting from scratch. You’ll retain control as a locally owned business while gaining the competitive edge of a globally recognised brand with the infrastructure to support your growth.

Thinking about the next step for your business?

Whether you’re looking to grow your existing panel shop or explore new

revenue opportunities, becoming a franchisee partner with Fix Auto and/ or NOVUS Glass offers a proven path forward. With the strength of a global network behind you and the freedom to remain locally owned and operated, you’ll be well-positioned to diversify, grow, and future-proof your business in an evolving automotive industry.

Franchisee insight:

James Robertson, owner of Fix Auto and NOVUS Glass Gladstone, said:

“We were initially looking for a windscreen franchise to supplement our paint and panel shop. We were having difficulty getting glass technicians when we needed them. We contacted Novus Glass and inquired about whether they were looking for a franchisee in Gladstone and luckily, they were.

The Novus manager Jack Parkinson introduced us to the Fix Auto manager, and we immediately saw value in their support with negotiating with paint suppliers and obtaining contracts with insurers. Novus helped us purchase and train on ADAS equipment which also enabled us to bring calibration in house. Having our own glass and calibration technicians saves us time and brings more profit into the business. I would definitely recommend operating both franchises side by side.”

Future-proof your business with Fix Network’s family of brands. Let’s shape the future of repair — together.

The often-quoted statement that automotive technology is going through the biggest change in a century can seem daunting. But this transition from traditional ICE vehicles to alternative power sources is less intimidating when it is thought of as an evolution rather than a revolution. In Australia, this change is happening, albeit incrementally.

To see the change, you need to go back fifteen years to the early days of EVs, when only a handful of models existed and they still had the air of novelty if not fantasy about them.

But in the last three years this change has gathered momentum. Thanks partly to the NVES and an aggressive import market, there are now more than 100 models to choose from. In a few short years, partial or full electric powertrains are becoming increasingly mainstream and like most of the constant change in a century of motoring, it is driven by consumer demand.

The EV Motor Show held in Melbourne highlighted that while there are Lamborghinis and Ferraris that can show off their astonishing power and style, it is the middle of the road family market where the real industry push is happening. This is because for many people, shifting away from polluting ICE vehicles to cheaper and cleaner electric ones is a step they will take if the price and experience is right.

And while range and charging infrastructure remain some of the biggest impediments for Australians in their slow uptake of electric vehicles, technology seems to be doing some remarkable catching up.

In June, a Mercedes broke the milestone of a 1000 km trip on a single charge. While CATL have tested batteries

with longer range, this is one of the few times such distances could be achieved in a real world scenario. While these achievements take time to convert into accessible technology and models, it is worth recalling that one of the first trials done in Australia by the University of Western Australia and EV Works, completed in 2013, found its adapted Ford Focuses averaged only 131km per charge. Commercial models at the time could only manage 112km. So, in a little more than decade, range has practically increased five-fold and potentially as much as tenfold.

It is fascinating to contemplate what the next decade will hold, not only with EVs but in every other facet of technology that makes transport cleaner and safer.

For the moment however, battery EVs make up only two per cent of the total car parc. Hybrids are adding significantly to that number and with every day another barrier falls which was a significant impediment to new owners contemplating this alternative motoring experience.

Repairers are a vital part of this experience.

What all these vehicles have in common is high-voltage systems that require a degree of expertise and care to ensure they are repaired correctly but also worked on safely. In a world of change, in this regard, there is no change for leading repair businesses where quality and safety are constant standards.

Innovation and consumer demand has rarely allowed the repair industry to sit still. Adopting the necessary skills and equipment for EVs is taking place alongside a raft of changes which have occurred in automotive materials, techniques and other technology-driven upgrades. So, the latest 21st century challenges are really part of a continuum where an agile industry can and will meet the demand, as well as take up the business opportunities as they arise. That history should give the industry confidence it has the power of adaptation.

Eugene Duffy Editor

The National Collision Repairer

CHAIRMAN

John Murphy

john.murphy@primecreative.com.au

CEO

Christine Clancy christine.clancy@primecreative.com.au

HEAD OF SALES

Andrew Morrison andrew.morrison@primecreative.com.au

EDITOR

Eugene Duffy

eugene.duffy@primecreative.com.au 0412 821 706

BUSINESS DEVELOPMENT

MANAGER

Michael Ingram

michael.ingram@primecreative.com.au 0423 266 991

PUBLISHED BY

Prime Creative Media

379 Docklands Drive, Docklands, VIC 3008

03 9690 8766 www.primecreative.com.au

Automotive

Keep

DISCLAIMER

The National Collision Repairer magazine is owned by Prime Creative Media and published by John Murphy. All material in National Collision Repairer magazine is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical, including information and retrieval systems without written permission of the publisher. The editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions, or for any consequences arising from reliance on information published. The opinions expressed in National Collision Repairer magazine are not necessarily the opinions of, or endorsed by, the publisher unless otherwise stated. © Copyright Prime Creative Media, 2024

articles submitted for publication become the property of the publisher. The editor reserves the right to adjust any article to conform with the magazine format.

The

When

Australia’s love affair with big vehicles shows no sign of abating and workshops need to be equipped to cater for them to maximise their opportunities.

Australian new vehicle data shows large utes make up four of the top ten most popular models with light commercial vehicles making up almost a quarter of all sales, including 108,279 new vehicles hitting Australian roads in 2025 alone.

The upsurge in sales of new plug-in hybrid utes and hybrids indicate this trend will continue as the market adapts to lower emissions.

All this means collision repairers can expect to see more of the large vehicles in the years to come and part of this is ensuring a workshop is equipped with the bench systems to handle them efficiently and safely.

For more than fifty years Car-O-Liner has been internationally renowned as a leading alignment bench supplier to the industry and benches for large vehicles is one of their specialties.

Car-O-Liners BenchRack 6.3 Master System is designed to add to a workshop’s flexibility extending the usable length to a massive 6.3 metres.

The BenchRack 6.3 thus allows for a range of longer vehicles, such as

light trucks, vans and SUVs to use the equipment securely.

The BenchRack 6300 provides the high levels of drive-on convenience with its hydraulic lift and removable ramps. The tilt feature makes loading easier when approach space is limited, making this the most versatile repair bench on the market.

The equipment has strengthened its extra wide drive on ramps and clamping accessories to be used on vehicles.

The 10-tonne draw aligner pulls from almost any angle, 360º around the vehicle with the capacity to double the pulling power with an optional second draw aligner.

Adding to workshop efficiency is another of Car-O-Liner’s hallmarks and the BenchRack 6300 aims to increase the productivity of a workshop processes and its technicians.

The integrated lift allows technicians to work at the most comfortable height, while a generous amount of space between the vehicle and bench offers greater accessibility to underbody work.

It is also designed to avoid the unnecessary interruptions that arise when moving the car between different workstations for steps such as disassembly, alignment, welding, sanding and filling.

The BenchRack 6.3 metre Master Kit encompasses a range of vehicle applications within the EVO System and clamping accessories.

The BenchRack 6.3 Master System also adds flexibility with a range of features in a new, improved system.

• The flexible installation meets the needs of workshop sizes through either a pit or fixed mounting.

• The exclusive pillar jacks allow for a vehicles efficient and secure mounting with a threshold (rocker) support.

• The accurate real-time measuring is used best when integrated with CarO-Tronic Vision2 X3 and Car-O-Data vehicle measurement database.

• Effective anchoring and holding, combining with the EVO universal system means that no specific vehicle fixtures required.

• The clamping accessories provide a range of vehicles with strong, no-slip and safe holdings.

• The BenchRack 6.3m Master System meets OEM approved manufactures’ standards for equipment.

For more information on BenchRack 6300 go to: www.car-o-liner.com.au or call Car-O-Liner Australia on: (02) 4271 6287.

New to the U-Pol range: MicroFill

Pinhole Eliminator & Sealer

Micro pinholes are every spray painter’s nightmare: tiny voids that lurk, only to blossom into little holes when the primer goes on.

U-Pol’s new MicroFill Pinhole

Eliminator & Sealer is a singlecomponent, wipe-on paste designed to seal those micro pinholes—and sanding scratches—across virtually any substrate, cutting out costly callbacks and boosting paint shop productivity. Quite simply this is your best form of insurance!

Why MicroFill belongs in your paint shop

Rework is the hidden throttle on throughput. Every time you have to sand back primer, apply more filler and reprime, you lose time, materials and money. MicroFill prevents that cycle by:

• Sealing micro pinholes & scratches in one pass—no sink-back, no re-fills.

• Reducing primer soak-in by up to 30 %, so you use less product and spend less time topping up.

• Speeding cycle times: flash-off in just 15–20 minutes at 20 °C, then prime— no extra sanding required.

Armed with a single 200 ml bag, spray painters can lock down micro defects on steel, aluminium, composites and flexible plastics—bringing a new level of consistency and efficiency to every repair.

Real-world results

Industry veteran Scott Longmuir from Little Knocks Smash Repairs in Brendale, Brisbane can attest to the quality of the product and how it has helped his workshop.

“It’s a fantastic product – we’d been using a competitor’s before we got our hands on U-Pol MicroFill,” he says.

“Immediately we noticed the packaging is superior: the resealable bag means you use 100 % of the product, not half before it dries out.

“And the results are brilliant. We do about 25 cars per week and have used MicroFill on around 100 cars now—two or three bags—with outstanding results. It fills all micro pinholes and scratches with no sink-back. It works a treat. Once you get it out there, everybody will be using it.”

Scott’s experience mirrors the 30 per cent cycle-time savings reported in European trials, where shops consistently

cut key-to-key times by sealing micro pinholes early eliminating extra primer coats and repeat preparation passes.

Universal adhesion across substrates

Most pinhole sealers on the market stop at plastics or composites. MicroFill goes further, bonding reliably to:

• Polyester filler on steel & aluminium (including galvanised and E-coat)

• SMC and fibreglass panels and bumpers

• Thermoplastic bumpers (TPO, PP, PP+EPDM) without secondary adhesion promoters

That means you carry one sealer for all your most common repair substrates— no more juggling multiple primers or adhesion aids.

• Simple, Fast, Single-Component Application

• Sand the filler to P180–P240, opening up any tiny scratches.

• Clean with a degreaser (U-Pol System 20 or equivalent).

• W ipe-on MicroFill with a lint-free cloth or squeegee, filling every micro void.

• Flash-off for 15–20 minutes at 20 °C.

• Prime directly—no sanding, no waiting, no hassle.

Because it’s a 1K paste with built-in adhesion promoters, there’s no mixing, no pot life worries and no wasted material.

The resealable pouch keeps every gram fresh—even after weeks on the shelf.

Key Features & Benefits

• 200 ml resealable pouch: no wasted product, long shelf life.

• No additional sanding: prime over MicroFill after flash-off.

• Built-in adhesion promoters: ideal for composites and flexible plastics.

• Free from microplastics: meets modern environmental standards.

• One tool for multiple substrates: simplifies your consumables lineup. By preventing micro pinholes, MicroFill not only saves time and paint—it safeguards your reputation by virtually eliminating pinholerelated callbacks.

Integrating MicroFill into your workflow

1. Stock only MicroFill for micro pinhole sealing, ditching redundant specialty primers.

2. Train quickly: a five-minute demo shows new technicians how to wipe, flash and prime.

a small investment in MicroFill pays for itself in reduced primer consumption, lower labour costs and less rework, resulting in happier customers and increased productivity.

For Australian paint shops aiming to boost throughput and cut rework, MicroFill Pinhole Eliminator & Sealer is a strategic upgrade and a great insurance policy.

Its broad substrate compatibility—from steel, galvanised steel, aluminium to composites and flexible plastics—sets it apart, while its fast-dry, one-step paste application aligns perfectly with highvolume workflows.

As Scott from Little Knocks Smash Repairs confirms, it does exactly what it says: sealing micro pinholes with zero sink-back and zero waste.

To experience the productivity boost in your own spray shop, contact your nearest U-Pol distributor or visit: u-pol.com.au.

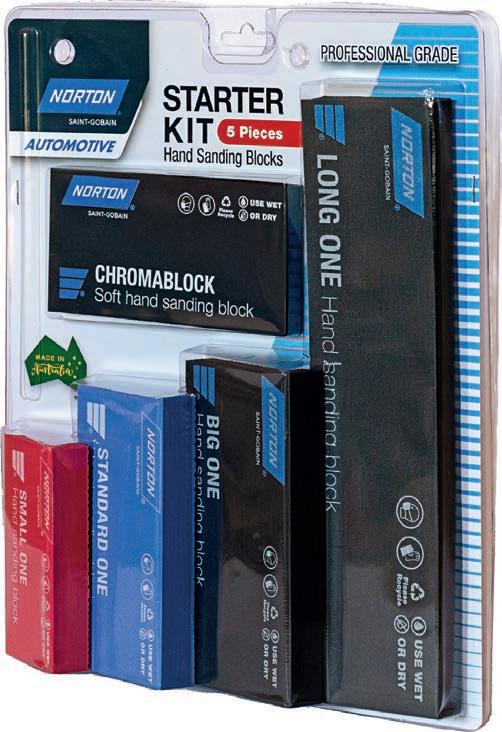

Norton has partnered with an Australian manufacturer to launch a hand sanding kit for the collision repair industry.

The five-piece Norton Starter Kit is designed to equip technicians with a versatile range of blocks for manual stages of the sanding process, from initial shaping to final surface finishing.

The core kit consists of four blocks crafted from Ethylene-vinyl acetate (EVA). This material choice ensures the blocks for small, standard, big, and long hand-sanding applications retain their softness and flexibility, allowing them to conform to panel contours with minimal effort.

The small, standard, and big blocks feature a speed grid to aid rapid material

removal, with each size suited to specific tasks—from accessing tight areas to efficiently sanding large panels. The EVA long block is included for smoothing and shaping across longer, curved surfaces.

The kit also includes the Chromablock which is made from a highly pliable Nitrile Butadiene Rubber (NBR), this block is engineered to handle complex convex and concave shapes. Its

of topcoats and clearcoats prior to buffing, assisting technicians in achieving a high-quality final finish.

Norton Block Starter Kit offers a practical hand-sanding solution for workshops. It provides flexible sanding for final touches and hardto-reach areas, promoting greater consistency and efficiency through the final paint rectification.

But it is available for a limited time only.

For more information go to: saintgobain.com.au

Four decades of satisfied customers have spread the word of his business and helped it grow to the dedicated team of today but in some ways, this success belies its humble beginnings.

“I had just got married, and my wife Lucia and I were as poor as church mice,” Tom recalls. “But I was really keen to doing something for myself.

“So, I moved out of the city and in those days, Mount Pleasant was like the outback, even though it was only 48 kms northeast of Adelaide. We found this little place out here. It was only a 25 X 45-foot shed, and away we went from there.

“We had two children at the time and my wife was pregnant with our third, and she would go into Adelaide picking up parts in the Holden station wagon. Heavily pregnant, no air conditioning, no power steering and there she was running around town picking up bits, because we had nobody up here to deliver any parts.

“I would stay behind and continue working. I worked 12-hour days, seven days a week trying to pay for this place,” he says.

“There was a house here, and slowly we did that up. But the beauty of living on site, Lucia would come down when the kids were asleep, and even when they were at school, she’d be down here helping me pull the cars apart and put them back together again.

“We did that for about the first two years together, and eventually we started employing.”

This difficult start enabled the couple to employ a quality panel beater, leaving Tom to focus on the spray painting. Then as more and more work came into the business, Tom could expand his team and focus on other aspects of development.

Apart from the commitment to quality and service, Tom has also had a progressive and proactive approach to automotive techniques and technology, ensuring his workshop was equipped with the best gear available.

“When customers used to first come down here to get a quote, it was just a tiny tin shed on a block and they would turn around and get out of there. I thought, ‘We can’t have this’. So, I had to change the area and the way it was seen. You see, back then in country South Australia there were no spray booths. No one had ever heard of two

forward for everybody else’s sake.”

While he understands people embrace change at different speeds, he believes you can recognise the passion in people and you need to both utilise and be inspired by it.

“Going forward, you need to keep embracing what is going on in your business, you’ve got to constantly monitor, look and tweak any issues that you may come across in the business.”

But Tom is also quick to point out that it is the value of his staff that have made the business a success, many of whom are long-standing loyal employees.

“The longest serving staff member we have here is a chap called Brett Stagg and he’s been here about 35 years,” Tom says. “I’ve had guys who have been in the team for 20-plus years as well, but they have since retired. It’s sad to see to somebody like that go, because it was a journey we were all on. These guys got me where I am today. Because it was a journey not just for me but for the whole team of us.”

This team approach extends to his apprentices, of whom the business currently employs three, and giving them the best support and opportunities possible.

But Tom reserves his special praise for his manager Ross Papalia, who has

combination right, get those three guys in place and look after them, you’ll find that the rest falls into place, because they actually look after the back end perfectly and the front end even better. “

If there has been a hard part for Tom, it has been allowing Ross a free hand to manage Mount Pleasant more independently. But it’s a step that he has adapted to and reaped the rewards from.

“He and his foreman once bailed me up, about three years ago,” Tom recalls. “And they said to me; ‘Tom, Could you do

“But we reconvened and I said, ‘I’m going to give you three months, to see if you can do as good or better.’

“And they have. They just knocked it for six and it’s been fantastic.”

This step back has enabled Tom to address one of the few regrets of his career.

“I can do things that I should have done when I was younger, and embrace the family more,” he says.

“I can see my grandchildren more now. I do whatever I can to be at their

But this hasn’t meant he doesn’t keep a close eye on things, including a fascination with new equipment and tools and taking an active role in promoting the business with an idea of taking it to the next level.

On his long journey, Tom has known the difficult periods of a growing business.

“I think some of the low points are sometimes when work providers change the goal posts and you’ve had to adapt to their way of thinking and it goes against your grain. I find I have come to terms with that and we do.

“A lot of people know that I’ll tell you how it is, but sometimes you’ve got to hold back,” he says.

“But it’s a beautiful industry, it’s a

rewarding industry and there’s a lot of heartache that goes with it. Again, without my wife Lucia and Ross and my guys, my son Carmen that helps out the workshop as well, I don’t think I’d still be here. I would have moved on a long time ago.”

Among the many highlights of his long career in collision repair, he says he has a special place for the recognition of his peers and the wider industry.

“I was nominated as large repair shop for South Australia in 2021. And I went to the awards and then I was honoured with the National Repairer Award and that just blew me away.

“I wasn’t expecting that. I was up against some serious contenders, some serious, beautiful shops and great people and all of a sudden, this tiny little

shop in the Adelaide Hills cops this great accolade. That was a highpoint.”

But he also believes a business that is supported by the community should reciprocate with support and quietly help when it is needed.

“I think you genuinely need to show your enthusiasm to the community and district by working with them, whether it is Lions, or Rotary or Apex or some sort of fundraising club.

“We still support sports communities and Blaze Aid or men’s sheds. You work together with these people, for whatever they are trying to build or purchase. But you don’t need to have your name up in lights, you just help them out.”

If his familial approach to his team and the business has helped him build over these forty years, it is also guided by the same philosophy of service to his community and the customer.

“Somebody comes in here, even with something minor, you make sure it’s safe and it’s drivable until they can get their things together and get their policy through,” he says.

This includes wheel alignments, they have often not charged for to ensure the car is safe.

“Primarily, you make sure they’re okay. Make sure they’re not too inconvenienced and try and make the repair process as seamless as possible.

“That’s what I’ve always done from day one, and I’ve embossed that into everyone here. If the customer comes in and needs something done; check it out and make sure it’s 100 per cent.”

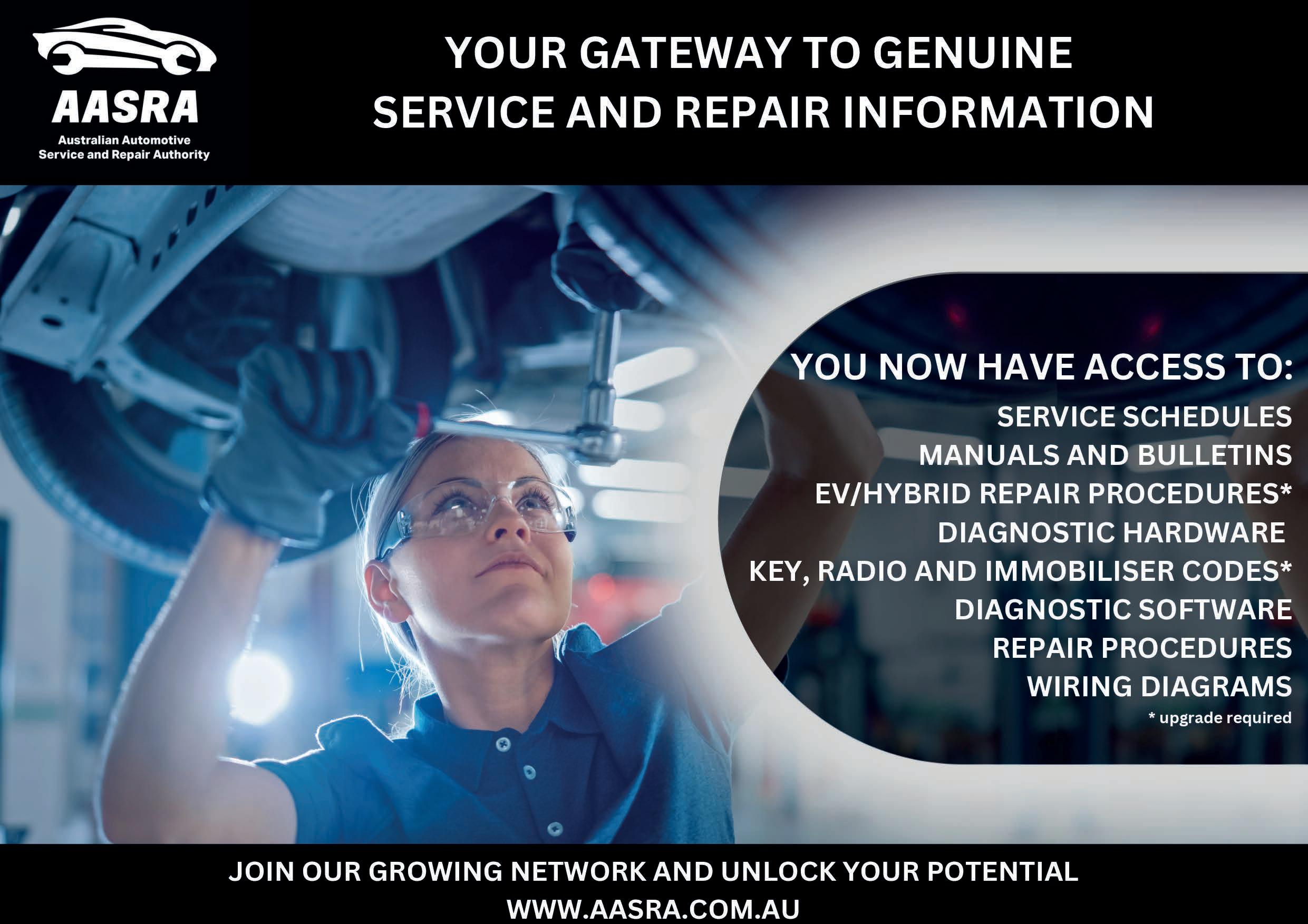

To calibrate or not to calibrate? It is the question collision repairers are being made to ask more often as vehicle technology advances. AASRA’s Joe McFadries takes a look at the new code aimed at helping workshops make more informed and safer decisions.

The Australian Automotive Aftermarket Association brought the industry together at the recent Autocare Convention in Brisbane, and the AASRA team was thrilled to be one of the many exhibitors at this pre-eminent biennial event. Thousands of technicians and workshop owners attended the world-class technical training and business education sessions, the highly interactive trade show, and the extensive opportunities to network.

Of particular interest to AASRA was the discussion about the all-makes repair model, and how best to leverage Australia’s Motor Vehicle Information Sharing scheme to enhance diagnostic and repair capabilities.

Dovetailing into this was the launch of the national ADAS - Industry Code of Conduct, (the Code) a practical, sectorspecific guide on how to manage one of the most critical safety issues in modern vehicle repair: calibration of Advanced Driver Assistance Systems.

AAAA Director of Government Relations and Advocacy Lesley Yates, has been a vocal advocate for the ADAS Code.

“The Code is a vital step in ensuring vehicle safety systems continue to

function as intended throughout a vehicle’s life,” she says.

“ADAS isn’t just a feature or an optional extra, it’s the foundation of future automotive technology. It’s the beginning of the next technological revolution.”

So, what does the new Code cover?

The ADAS Service and Repair Technical Working Group, consisted of specialists from collision and mechanical workshops, tyre and suspension specialists, and automotive glass and equipment suppliers. It developed the appropriate ADAS validation protocols, identified existing gaps in skills, tools and processes, ensured regulatory alignment, and now supports the implementation by providing guidelines training and resources.

With ever-increasing vehicle complexity and the need for calibration, ADAS equipped vehicles require more precision that ever before to ensure the vehicle is returned to the owner with all the inter-connected systems operating as they should.

By now we are all aware of the diverse array of sensor technologies

- such as cameras, radar, ultrasonic sensors, LiDAR and infrared sensors - that underpin ADAS, although understanding how they all “hang together” and the importance of getting it right is still a work in progress.

The Code identifies several scenarios when ADAS calibration should be conducted, and it highlights that ADAS functionality requires a combination of visual inspections, professional licenced diagnostic tools and equipment, and in some cases, road testing.

The Code defines 10 key areas of focus for successful ADAS calibration:

1. Workshop preparation

2. Testing and diagnosis of ADAS

3. Pre- and post-scanning

4. Repairing ADAS

5. Collision repairs

6. Best practice for windscreen replacement

7. M obile paint/touch-up/bumper repairs

8. M obile ADAS service providers

9. Tyre and wheel alignment service and repair

Craig Baills says the code was a timely collaboration bringing together experts to achieve some clarity for the industry:

“ADAS is not going away, in fact it’s becoming even more prevalent in newer vehicles with close to 50 percent of vehicles expected to have ADAS by 2030,” Baills says.

“ADAS is evolving at a significant rate which the industry must embrace, and the ADAS Code is designed to help workshops and repairers fully understand best practices when carrying out ADAS calibrations and repair work. It is a living Code that will most likely be adapted as the industry evolves and will continue to ensure that all repairers can correctly repair and calibrate ADAS systems to correct operation as the vehicle manufacturer intended.”

The ADAS protocol dedicates a separate section related to collision repair, highlighting the importance of the technology to this sector of the industry. Here is a summary:

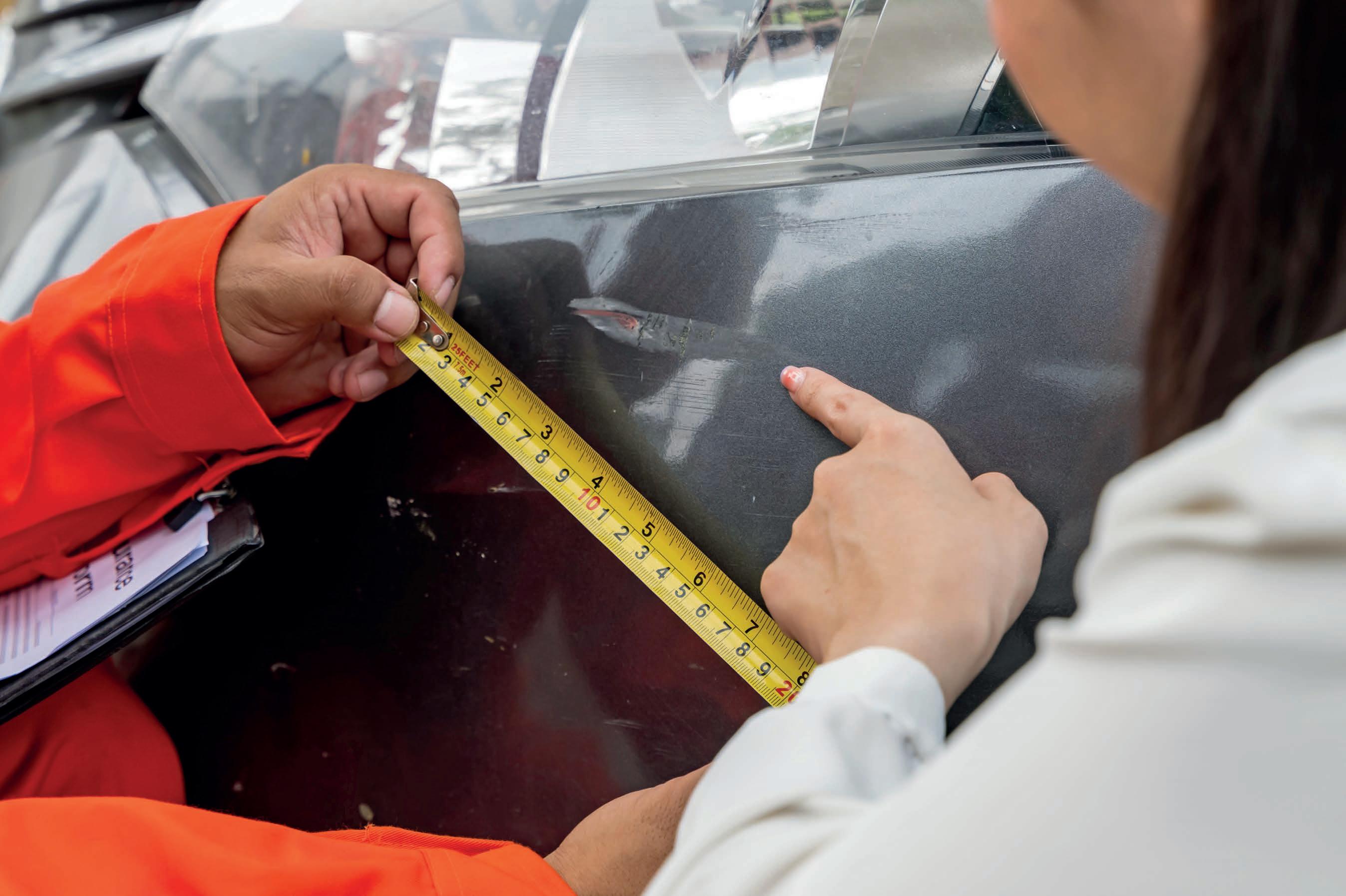

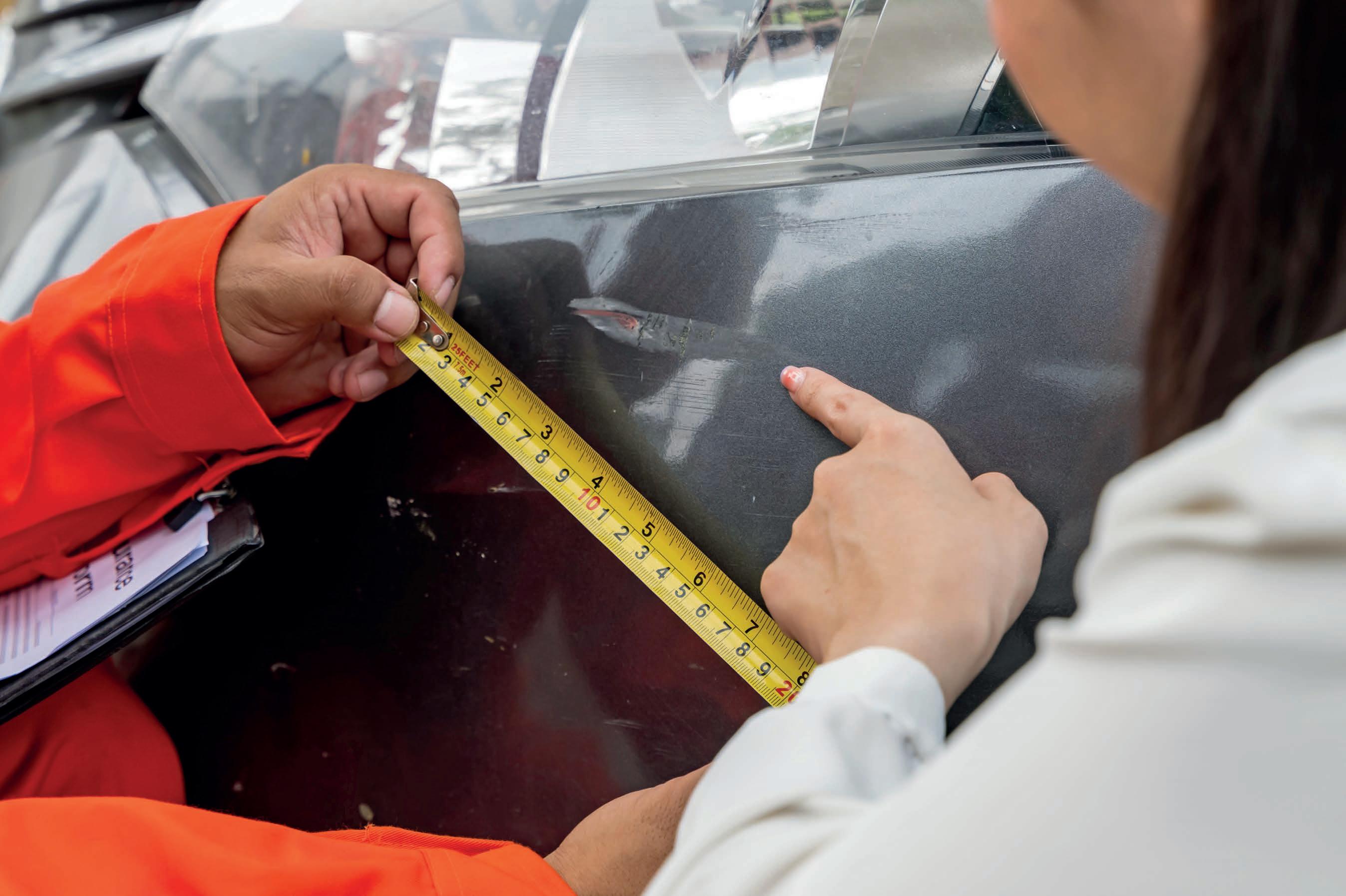

This is required whenever a sensor, radar or ADAS components’ alignment is disrupted due to vehicle collisions or damage, including cosmetic and minor collisions.

Modern collision repairs frequently involve sensor replacements and calibrations. To ensure accuracy, automotive manufacturers recommend that service providers conduct a prerepair diagnostic scan before any repairs begin and a post-repair scan after completing the job. This ensures that all system issues have been resolved, calibration has been successfully completed, and vehicle control systems are functioning correctly.

This is a precision process that is often complex and time-consuming. Some sensors require static calibration in a workshop, while others necessitate dynamic calibration during a road test. Many require a combination of both.

With many modern vehicles being equipped with 360-degree cameras

it is important to ensure the correct operation and calibration of these components post repair. This is necessary after replacing a camera, grille, door mirror, bumper cover, or other mounting components that impact the location and mounting of these cameras. Typically performed indoors using large, patterned mats positioned around the vehicle, noting that some systems require an additional dynamic road test after static calibration.

Required after airbag deployment, structural repairs, or wheel alignments. The calibration process involves centring the steering wheel and using diagnostic equipment to initiate and reset the steering angle sensor to zero degrees.

The renowned Sheen Community Fund is a model in how a major Victorian repair industry player can keep giving back to the community. In 2025 they have set themselves a new ambitious goal of $500,000. But big or small, the diverse range of projects are about making tangible differences to people’s lives.

Sheen Group founder and industry veteran Martin Stone has a special fondness for the children’s charity Variety, not only because of its long history with the repair group but because it is a charity he sees making a demonstrable difference to children’s lives.

Variety is dedicated to helping sick and disadvantaged children through grants to families, schools, and communities, helping them gain mobility, communicate, participate in education, and build self-esteem.

The Sheen Community Fund, which has notched up more than $4 million for the charity, engages in numerous activities throughout the year to keep this vital work going, including the large-scale Grand Final Lunch, the Kids Christmas Party, the Bikes for Kids program and the Variety Bash.

2025 will mark the 50th anniversary of Variety’s Bash, a well-known charity drive across remote Australia and this August it will take place as a National Bash with 650 cars and more than 1600 participants. The example Martin Stone sets for the 27 shops in the Sheen Panel Service is that giving is as much about involvement as cash donations. Since 1997 he has participated in 21 Victoria Bashes, raising millions for Variety.

While the spectacular event is fun, its high profile is also about delivering a maximum return to those in need.

Manager of the Sheen Community Fund David Whitehead says this is another of Martin’s driving principles with the fund, to ensure every dollar makes a difference and maximises the impact of the generosity of their network of suppliers and supporters.

“Of all the charities in the marketplace Variety has a high percentage of cut-through. They manage their cost base well,” David says.

“For Martin that has been a key driver. He knows where his money is going. That’s because as I’ve said before, Martin would rather give a kid the whole iPad than 90 per cent of it.”

Final fun

Contributing to Variety and the community fund target in 2025, the Sheen Group will again be the naming right sponsor of the massive Grand Final Lunch, where Sheen has built exceptional momentum.

“It’s a powerful event that then tells the story for the next 12 months,” David says. “People remember it. They have a great day and we leverage that and that’s why it sells out.”

The lunch is also an opportunity to spread the spirit of generosity and the great cause among the wider repair community.

“We’re trying to engage our suppliers in what we’re doing as well,” David says.

“Rather than it just being Sheen, it’s got to be collective fundraising. We’re slowly trying to get them involved, to see the value in what they’re doing.

And the next year, they want to keep contributing. So, they bring their customers, their friends or suppliers, and they get to share in it. And I see that organic tribe growing.”

This momentum means those who were once Sheen’s invitees now return with their own booked tables to join in on the fun and giving to Variety. They now add up to more than 30 tables of the 100 in the expansive banquet hall at Crown.

One of the most tangible of the Varietyled charity programs is Bikes for Kids where Sheen Panel Service can hold workshops for their workshop staff to assemble the bikes for needy kids. This brings individual workshops and their staff into the giving circle through participation, right down to seeing the smiles on the faces of the young recipients when they receive the gifted bikes.

One of the new charities the Sheen Community Fund has partnered with is Our Village, that incorporates St Kilda, Geelong and Eureka Mums, helping collect and rehome essential items for

maximum benefit for each dollar given.

“It’s a small charity that’s not getting

“While with our direct financial resources, we can buy some product and

The Sheen Community Fund has continued its standout support for the Good Friday Appeal for the Royal Children’s Hospital in Melbourne – to which it has pledged $25,000 in 2025. Again, the giving is specifically targeted to make a difference, with the money going directly towards a Terumo Spectra Optia Apheresis System. The system performs a wide range of procedures, including stem cell collection, red cell exchange and plasma exchange that can be used in the treatment of sickle cell disease, leukaemia, cancers and brain tumours, kidney and neurological diseases for children.

Another success for the Sheen Community Fund has been its 2025 Golf Day, that followed an inaugural event in 2024. It combined the fun of a social day for staff and supporters but critically helped raise funds for a Specialised Assistance Dog for a 9-yearold boy. This companion will significantly

enhance the boy’s quality of life, allowing him the opportunity to engage more intentionally with the world beyond his bedroom.

The range of causes is diverse for the Sheen Community Fund and the giving goals are high but, in these ways,

it illustrates how the collision repair industry can go beyond and above to help change lives.

For information on how to donate go to: www.lmcf.org.au/ways-to-give/sheencommunity-fund

IAA makes it easy to access quality salvage and low-value vehicles through a powerful, tech-driven platform - now live in Australia.

From car enthusiasts and first-time buyers to established businesses, we’ve got the vehicles you need.

Another significant report has highlighted the importance of the ‘whole of life’ experience for potential EV owners, including service and repair. The NRMA insight shows the importance of consumer confidence and the urgent need for upskilling in the repair sector.

The shortage of skilled repairers, parts and the safety of EVs remain major barriers to their uptake in Australia according to a new insurance report Changing Gear from the NRMA.

The report shows almost two thirds (62 per cent) of EV owners are concerned about the lack of qualified repairers. 90 per cent of those who currently own or intend to buy an EV say the insurer being able to access qualified EV repairers was important.

It is the second in a series of reports and highlights obstacles in perception that have inhibited the growth of alternative powertrains since the adoption of the New Vehicle Efficiency Scheme aimed at raising the proportion of low emissions vehicles.

The learnings from the report also reflect a repeated call by aftermarket groups including the MTAs and the AAAA, for governments to step up support for the transition by ensuring adequate skills in the repair sector. This will ensure a good EV experience is not only about purchasing but about repair and maintenance, they say.

The NRMA report has also highlighted

68 per cent of Australians were worried about EV battery recycling and disposal, with only 30 per cent expressing confidence in the feasibility of battery reuse and recycling.

This lack of trust is reflected in attitudes toward second-hand components, with fewer than a third (31 per cent) willing to use a recycled battery.

Fears that there is an insufficiently trained workforce are also acting as a barrier to uptake as people consider the longer-term implications of EV ownership.

“These concerns are well-founded: while EVs typically need less servicing over their lifetime, their maintenance and repair require specific skills that traditional mechanics often lack,” the report noted. “According to 2023 data, roughly one in ten repairers in Australia were certified to handle EV repairs, leaving a significant portion of the market under-served. This can lead to increased wait times for repairs, vehicles needing to be transported long distances to appropriate repair

facilities, and vehicles being written off more readily.”

Unlike service and maintenance, which are often handled by dealers under warranty, collision repair could make these impacts more acute, as collisions can occur in any part of the vehicle’s life and independent repairers may be the ones called on for the work.

“To address these concerns and help bridge the skills gap, it will be important to see investment in training programs that provide technicians with the necessary skills and equipment to safely service and repair EVs,” the report recommends.

“There are high levels of support among consumers for a national training package to upskill mechanics in service and repair of EV repair (66 per cent).”

“Industry collaboration and partnerships with educational institutions can play a key role in ensuring a pipeline of skilled technicians are ready to meet the demands of the evolving market.”

While the push has been strong for more government support to assist

small workshops become EV-safety compliant, the report also highlighted one solution to upskilling of the industry lies in specialised service providers and trainers.

Bosch Automotive Service Solutions

General Manager John Bright says the gaps in EV skills uptake is exacerbating the existing recruitment issues in automotive.

“The shift to electric vehicles is driving a significant transformation in the skills needed across the automotive service industry,” Bright says in the report.

“The sector is already facing a shortage, with over 38,000 unfilled automotive positions, and the transition to EVs is presenting new challenges. EVs are software-driven machines, and while hybrid technology has provided some exposure to highvoltage systems, there is an urgent need for more training to keep up with evolving technology.

“As an industry, we must collaborate to attract more talent. We need to highlight the sector’s focus on new technologies and demonstrate how

repair work now revolves around diagnostics, software updates, and battery management. Without a commitment to modernisation, we risk falling behind in the EV era.”

willing to pay

Like the 2024 report to consumer attitudes, the new report also identified

cost as one of the barriers to a more rapid uptake.

It established that while consumers care about lowering their greenhouse footprint, they may be hesitant to pay extra for it. This is exacerbated by the relative ignorance about how EVs can offer lower running costs.

Australians are increasingly ecoconscious, with 60 per cent valuing sustainability personally.

But many consumers remain hesitant to pay a premium for environmentally friendly options with less than half (47 per cent) expecting to pay more for sustainable products and services, and only 38 per cent willing to do so.

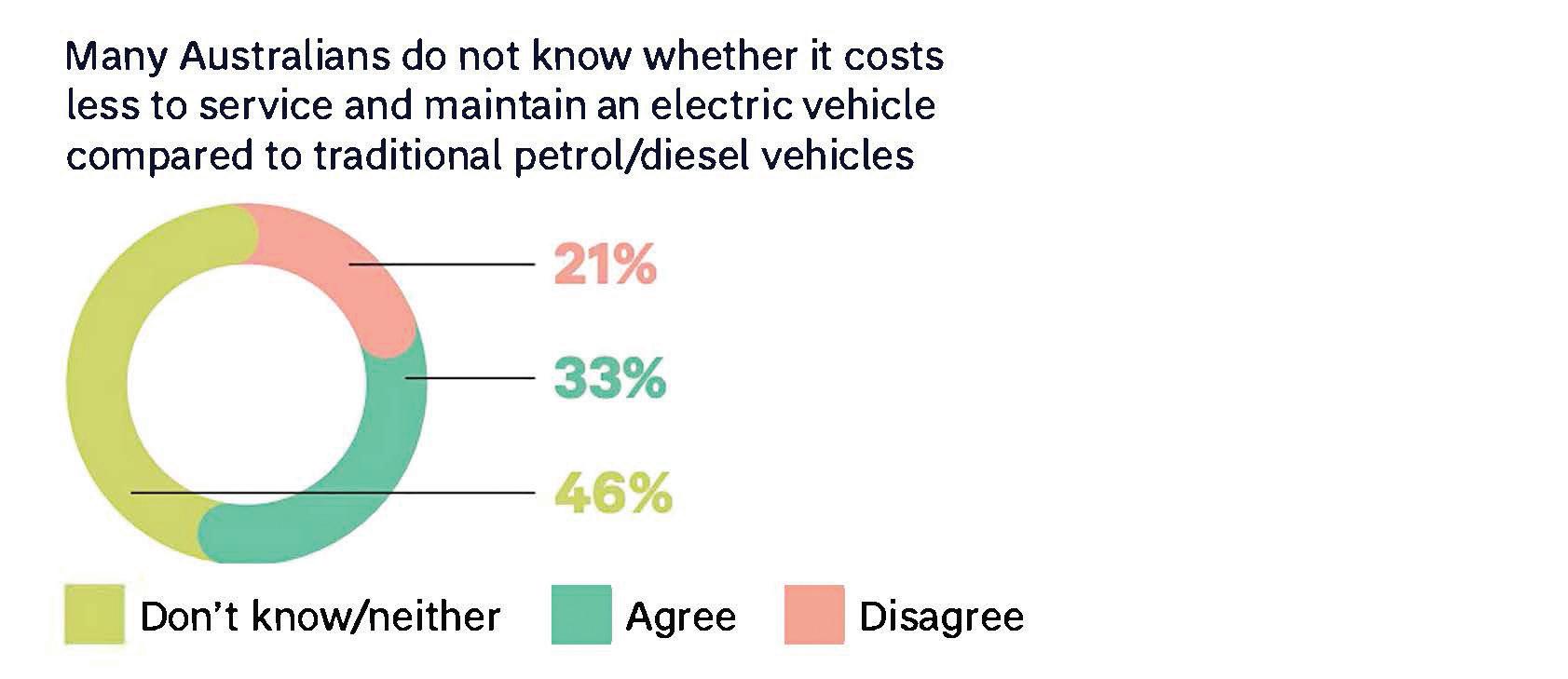

Where uncertainty of consumers around the cost of running and repairing EVs presents a hurdle with less than a third (30 per cent) believe EVs offer the cheapest running costs, while 42 per cent of those not considering an EV cite higher overall ownership costs as a deterrent. This perception persists despite almost half of the recipients being simply unaware of the comparative servicing and maintenance costs of EVs versus petrol/diesel vehicles. 46 per cent say they don’t know.

The solution the report says is better education about these benefits beyond sustainability. NSW department of transport research showing EVs are 40 per cent cheaper to maintain and run.

Misinformation a major barrier

This report comes at the same time as research from the University of Queensland showing more than a third of Australians wrongly believed EVs were more likely to catch fire than ICE vehicles.

The UQ survey deliberately posed

untrue questions to gauge public responses and opinions and the impact of misinformation.

It investigated the prevalence of misinformation in four countries –Australia, the United States, Germany and Austria and found substantial agreement with misinformation across all countries.

The most widely believed myth was that electric vehicles were more likely to catch fire than petrol cars, 43–56 per cent depending on the country, with Germany the highest.

The NRMA report noted that EV battery fires are extremely rare, with only 712 fires reported worldwide since 2010, even though there are more than 58 million EVs on the road.

But despite this, over two-thirds of Australians (69 per cent) remain concerned about EVs catching fire, or their safety when charging.

NRMA Insurance CEO Julie Batch

says it showed the work that needed to be done to overcome confusion and misinformation and build confidence in an electric future.

“Reports of battery fires often don’t distinguish between the high-quality batteries used in road-registered EVs and the lower-grade batteries found in some e-bikes and e-scooters,” she says. “Unfortunately, it’s the latter that have caused most of the recent fires and property damage.”

“In the future, auto repairs will increasingly be about diagnostics, software updates, and battery management. We need to rethink how we attract and train talent, so there’s a steady pipeline of skilled professionals ready to keep EVs on the road.”

The NRMA report recommends introducing regular battery health checks to build trust and strengthen

the second-hand market, developing a battery supply chain that supports recycling and repurposing, and providing specialised training for technicians and first responders.

The report uses Norway as the model where EVs now make up 89 per cent of new car sales – and is driven by strong government support, tax breaks, and a reliable charging network whereas in Germany EV sales dropped after subsidies were removed.

The NRMA report shows potential EV owners could be persuaded with support, lower electricity costs (45 per cent) and more affordable EVs (40 per cent).

Most current EV owners (81 per cent) support government incentives, and over half (53 per cent) want more local charging stations.

Most Australians turn to motoring groups (58 per cent) and mechanics (56 per cent) for reliable EV advice.

training

The life of an automotive technician today is worlds apart from what it was just a few years ago.

Diagnosing faults via computer, reprogramming ECUs, and updating vehicle software are now everyday tasks in the workshop. The days of purely mechanical repairs are giving way to highly technical, digital processes, and the pace of change isn’t slowing down.

Australia’s automotive landscape is uniquely complex. Our geographic vastness and diverse regional needs mean that internal combustion, hybrid, and electric powertrains will likely coexist in workshops for many years to come. While ambitions to make Australia ‘the next Norway’ in EV adoption have quietened, the transition is well underway, albeit in a form that’s uniquely our own.

This variety makes training particularly challenging. But despite ongoing skills shortages across the sector, MTA NSW is doubling down on its mission to support members, apprentices, and auto businesses in keeping pace with technology, while reshaping public perception of the industry along the way.

“The perception is still that of a dirty environment for the duration of an apprentice’s working life. That’s simply not the case,” says Jason Steporowski, General Manager – Memberships, MTA NSW. “We’ve seen members start out as a car washer, technician or parts interpreter and go on to become a

business owner or dealer principal.”

“It’s a large industry, and it’s evolving rapidly. You’re not stagnant, there are opportunities everywhere.”

One of the most surprising developments in recent years is the uptake of EVs in regions where it was once assumed they’d never gain traction.

In Moree, regional NSW, MTA trainers were struck by the number of EVs parked on the main street, alongside the usual lineup of farm trucks. This isn’t an anomaly. Farmers, often early adopters of solar energy, are seeing clear financial and environmental benefits from electrification. With diesel among the highest operating costs on a farm, pairing renewable energy with electric vehicles and machinery just makes sense.

MTA NSW’s specialist trainers, some of whom have studied in US automotive classrooms, have also observed growing alignment between the auto and tech industries. In the US, education providers are integrating automotive and IT training, recognising how closely the two are now linked.

“The automotive department and IT department are now often the same thing,” Steporowski explains. “Gone are the days when workshop systems ran on clunky, outdated software. These days, they’re cloud-based, modern platforms with increasing complexity and capability.”

The shift seen in US training environments could provide a valuable

roadmap for Australian institutions. As emerging technologies reshape what it means to work in the industry, training must evolve too, and with it, the appeal of automotive careers is broadening to attract a new generation of talent.

As Stavros Yallouridis, CEO at MTA NSW, recently noted in a release discussing some of the reforms that are currently underway in preparedness:

“As the largest private automotive Registered Training Organisation (RTO) in NSW, with over 2,200 apprentices in training, we’ve already helped more than 800 individuals complete EV training. This demonstrates not only the industry’s readiness to adapt but also the strong demand for these skills as the market evolves.”

“This modest but growing segment underscores why the timing of these regulatory reforms is appropriate. It’s important to undergo due diligence and preparation without undue urgency, as the market naturally evolves.”

As we move through the second half of 2025, there’s much to look forward to, particularly in how we train and prepare the next wave of automotive professionals. Whether you’re entering the trade or already deep into your career, opportunity abounds.

“This is the biggest advancement in our industry in over a hundred years,” says Steporowski.

Living in the Philippines and loving her career working with the Bodyshop Recruit team, Alecks Genota is the behind-the-scenes guru for all things recruitment.

More than just a job, Alecks has discovered her niche, and many lessons along the way.

As the administrative assistant, Alecks helps to manage the day-today operations of the recruitment and outsourcing sides of the business.

Her role is a mix between team coordination, client relations, process improvement, and making sure everything runs according to the plan. Working remotely, Aleck’s often

travels to Manila to meet Bodyshop Recruit director, Ash Jardine, and other team members to trade test panel beaters and spray painters.

Alecks is originally from Santa Rosa in Laguna, south of Manila. Now she lives eight hours north of Manila.

“I love being away from the metro and all the traffic,” Alecks says.

“Working remotely in the Philippines has been great; I get to enjoy the best of both worlds, living in my home country while collaborating with amazing people in Australia.”

With a diverse career background, Alecks has found all her skills to be transferrable into the repair industry.

“I studied dentistry and loved it,” Alecks says.

“I was doing well in dental school, but then I took an 18-month break to serve full-time in our church. When I returned, I realized that I no longer saw myself working in a dental clinic.”

Wanting more freedom in her work, Aleck’s looked around for other opportunities.

“I wanted more flexibility in my schedule, the freedom to work remotely, and the ability to travel when I wanted,” Alecks says.

“The pandemic became a turning point, pushing me to explore remote work, which

eventually led me to where I am today.”

With no prior experience or relation to the industry, Aleck’s found herself in the middle of fresh business that was only just getting started.

“I didn’t exactly plan to work in the automotive industry—it kind of found me,” Alecks says.

“My background was in the medical field, but during the pandemic, I discovered a passion for operations and recruitment.”

“I spent a couple of years freelancing for clients in the US, Canada, and Singapore, helping them streamline processes and hire the right people.”

A cousin of Aleck’s knew her passion for operations and recruitment and forwarded her a job post she had found online.

“The post mentioned occasional travel, and I thought, working from home with the chance to travel? Sounds like a win,” Alecks says.

“At the time, Bodyshop Recruit was just a startup—just me and Ash. We built the business from the ground up, and now, we’ve expanded into virtual teams that support the repair industry.”

Alecks finds her job fulfilling and inspiring, as her job is more than finding

the right workers for repair shops.

“What makes this job truly fulfilling is seeing how we’re changing lives,” Alecks says.

“Whether it’s helping Filipino workers land opportunities in Australia or giving virtual estimators the chance to earn five

times more than the average salary here. It’s rewarding in ways I never expected.”

Managing people

Managing a team of 30 staff members, Alecks has learned a lot of skills to navigate

the challenging and positive times.

“It’s definitely a challenge, but one I genuinely enjoy,” Alecks says.

“No two days are ever the same, and if there’s one thing I’ve learned, it’s that people management isn’t a one-size-fitsall job.”

“On some days, it’s about structure and efficiency, making sure processes run smoothly. Other days, it’s about adapting on the fly, handling unexpected issues, and keeping everyone engaged.”

Alecks highlighted how her approach to managing a team is a balancing act.

“I’ve had to master the art of balance, knowing when to be firm, and when to be flexible,” Alecks says.

Her role has helped to develop her skills in leadership, conflict resolution and process improvement.

“If I’m being honest, the biggest skill I’ve gained is patience,” Alecks says.

When you’re managing different personalities and work styles, you quickly learn that patience and a good sense of humour is just as important as strategy.”

Alecks credits her boss, Ash on teaching her how to manage people.

“I’ve learned a lot of my skills through working closely with Ash,” Alecks says.

“He’s been a great example of leading with both confidence and understanding, knowing when to push people to be

better and when to step back and give them space to grow.”

“Watching how he handles different situations has definitely shaped the way I approach leadership.”

Earning respect

Not one to dwell on being among a male dominated industry, Alecks believes in earning trust and respect, regardless of gender.

“Honestly, I don’t think much about the fact that there aren’t many females in the repair industry,” Alecks says.

“Mainly because at Bodyshop Recruit, I have a voice. My thoughts and opinions are valued, and I’ve always been encouraged to speak up and contribute. That kind of environment makes all the difference.”

Alecks outlined that she approaches challenging clients with a strong work ethic.

“Of course, there have been moments where I felt I had to prove myself more, especially with clients,” Alecks says.

“I’ve learned that respect is earned by the work you do. I let my results speak for themselves, and over time, that’s what matters most.”

Working at Bodyshop Recruit, Alecks has leaned into their values and has embodied them into her work style and attitude.

“Within Bodyshop Recruit, I’ve been lucky to work with a team that values performance over anything else,” Aleck says.

“It’s never about gender. It’s about getting the job done and doing it well.”

Overcoming personal challenges that coincide with work is something that Alecks had to navigate early on in her career in repair.

“Having my first baby while balancing a demanding role was definitely a challenge,” Alecks says.

“During my third trimester, I struggled with pregnancy brain, which made it frustrating to not be as sharp as I used to be.”

“Simple tasks that once felt effortless suddenly required extra focus, and I found myself second-guessing things I normally handled with ease.”

After having her daughter, Alecks found a new challenge in balancing motherhood and her career.

“When I returned to work, the real challenge began,” Alecks says.

“Juggling motherhood, work responsibilities, and my own well-being. There were days I felt like I wasn’t doing enough in either role and finding that balance took time.”

“To get through it, I had to completely

rethink the way I worked—prioritizing better, leaning on my team more, and setting clear boundaries.

“I also had to cut myself some slack and realize that I didn’t have to do everything perfectly—I just had to keep showing up and giving my best.”

Alecks leaned on her colleagues for support in the early days of becoming a mother, but has now found her new groove.

“Honestly, I don’t think I would’ve managed without Ash and Jim being incredibly supportive,” Alecks says.

“They never made me feel like I had to choose between being a good mum and being great at my job. Their flexibility and trust allowed me to find my rhythm.”

Alecks is focussing on her strengths and the passion she has for problem solving and developing and implementing efficiencies.

“Nothing is more satisfying than fixing

a broken process, seeing the impact, and knowing you’ve made someone’s job easier,” Alecks says.

“As for the industry, I love that there’s so much room for innovation. Virtual estimating has already revolutionized the way shops operate, and with the rise of AI and technology, I can’t wait to see what’s next.”

Alecks is looking forward to where the industry will go with the rapidly evolving technological advancements that allow people to work and complete jobs virtually.

“Virtual teams are widely used in many industries, but the automotive repair sector has been slower to adopt them,” Alecks says.

“When we introduced virtual estimators to the industry, it came with challenges.

“But once repairers saw the benefits firsthand—faster turnaround times, improved accuracy, and cost savings, they realized it was a game-changer.”

“Our pilot shops who took a chance on us in 2023. Their willingness to innovate paved the way for broader industry adoption.”

Finding the joy in little things, Alecks enjoys spending time with her daughter and with her family.

“Aside from family time, it’s me and my Kindle against the world,” Alecks says.

“I love reading, especially about business, self-help, psychological thrillers. You name it.”

“I’m also a sucker for spontaneous road trips. If there’s a chance to get in the car and go somewhere new, I’m in.”

For years to come, Alecks is looking forward to continuing growing in her career.

“I want to help BSR expand as much as I can,” Alecks says.

“We’re building something amazing, and I want to see just how far we can take it.”

Estimators play a vital part in the workflow of every collision repair workshop, so keeping their skills up to date is as vital as other technicians in ensuring safe, complete and quality repairs. I-CAR Australia unveils a new focus in its ProLevel training program.

As the collision repair industry navigates rapid changes in vehicle design, safety technology, and repair expectations, the need for accurate, timely, and rolespecific training has never been greater.

I-CAR Australia continues to play a critical role as the connector—linking industry stakeholders with training solutions that are relevant, responsive, and ready for the future. Its success for many businesses is its agility in staying up to date and aligning skills, technology and repair capability across the sector.

Whether it’s responding to the rise of electric vehicles, ADAS calibration, advanced materials, or insurer-led repair standards, I-CAR ensures the right training reaches the right people, at the right time.

Introducing the updated ProLevel Training Program

To further strengthen its support of a skilled, modern workforce, I-CAR Australia has commenced a full refresh of its ProLevel training program, beginning with the Estimator role.

This updated training framework is designed to reflect the complexity of today’s vehicle repair environment and the increasing importance of each team member’s role in delivering complete, safe and quality repairs.

The estimator: cornerstone of a successful collision repair process

I-CAR Australia COO Jason Trewin explains that in today’s fast-evolving automotive repair industry, the estimator plays a mission-critical role—one that directly impacts repair accuracy, customer satisfaction, profitability, and compliance.

“In many ways, the Estimator is the heartbeat of a collision repair facility. Their skill and knowledge determine how the repair begins—and often how it ends,” Trewin says.

Gone are the days when estimating simply meant writing up damage.

Today’s Estimator must be part technician, part customer service professional, part compliance officer, and part production planner.

Why the estimator role is so vital:

1. First point of technical accuracy

The Estimator is the first line of defence in ensuring repairs follow OEM procedures. Their ability to assess damage accurately—including hidden or structural impact—can determine whether a vehicle is repaired safely or falls short of manufacturer expectations.

2. Blueprint for the entire job

Every successful repair starts with a precise and complete estimate. This

document becomes the roadmap for the technician, refinisher, and parts team—guiding decisions that affect cycle time, material usage, and quality outcomes.

3. Compliance and liability control

Insurers, OEMs, and regulatory bodies are placing greater pressure on repair accuracy and documentation. Estimators must understand how to integrate repair standards, ADAS considerations, EV safety, and OEM positions into every assessment.

4. Communication hub

Estimators are the critical link between the workshop and the customer, insurer, and supply chain. Their ability to clearly explain repair timelines, manage expectations, and document progress affects the overall customer experience and brand trust.

5. Business performance driver

A well-trained Estimator can minimise supplements, reduce rework, streamline production, and protect margins. They are integral to the financial and operational success of every modern repair business.

Industry connection

Industry connection has been at the heart of I-CARS drive to develop and deliver smarter, more relevant training.

“Our goal is to stay connected to every

corner of the industry—so we can ensure the workforce is equipped for what’s on the road now, and what’s coming next.”

Trewin says.

It achieves this with by maintaining active relationships with key industry groups, including:

• OEMs: aligning training with current repair procedures and structural technologies

• Insurers: to meet compliance, liability, and repair quality requirements

• Individual Workshops and Collision Groups: to deliver training that fits real-world needs

• Refinish companies and equipment suppliers: Ensuring that the entire industry has a voice

• RTOs and Trainers: to support national access and delivery

• Government Skills Councils: including AUSMASA (Mining and Automotive skills Alliance) and as a representative on its SWAP (Strategic Workforce Advisory Panel) to influence future workforce policy

With this evolving training framework, I-CAR Australia continues to serve as the link between:

• Vehicle innovation and technician knowledge

• Industry expectations and training delivery

• Policy development and workshop capability

By keeping one hand on the pulse of the repair floor and the other in national planning discussions, I-CAR training is fit-for-purpose, future-proofed, and aligned to real-world needs.

Following the Estimator update, I-CAR will continue to modernise the ProLevel training pathways for:

Stage One: New estimator pathway released

The first phase of the ProLevel update focuses on the estimator, a role that has evolved into a technical and strategic linchpin within repair facilities. I-CAR Australia’s updated Estimator training pathway includes 19 new or refreshed courses tailored to today’s repair realities— supporting accuracy, compliance, and professionalism from start to finish. Deep focus on:

• Structural Technicians

• Non-Structural Technicians

• Refinish Technicians

• Production Managers

Each pathway will reflect modern role expectations, new vehicle technologies, and real-world repair practices. These updates will be finalised over the next coming months.

For more on I-CAR Australia’s updated ProLevel training and industry partnerships, follow us on LinkedIn or visit: i-car.com.au

• Repair planning & documentation

• Damage analysis

• A DAS & EV considerations

• OEM procedure sourcing & usage

• Blueprinting best practices

• Training aligned to industry, insurer and OEM expectations

• Available through online, virtual, and face to face platforms.

• Counts toward Gold Class™ and Platinum Individual credentials

• This refresh ensures estimators are fully equipped to support repair outcomes, reduce cycle times, improve customer experience, and protect business liability

Sometimes it is a bit of luck that lands an apprentice with the right opening into a business. But once there, it is an attitude to learning and an atmosphere of encouragement that can make all the difference and turn an opportunity into a career.

For McClure Refinishing apprentice Shané Meyer, the unfolding differences between idea and reality can make for surprising results. When Shané was at school she had the idea that her pathway would lead into a university degree in forensic science. Now several years later, as a spray painter and loving it, it’s her passion for detail that is perhaps one of the few carryovers of that early plan.

ended up at a truck shop, and now I work

about his journey with spray painting and how much he enjoyed it compared to the One of the standouts of her journey so

“I feel like I was very, very lucky that Anne and Ben had the space to take me on at the time that they did, “ she says. “I don’t feel that any other big shop that pushes jobs through would have given me the time to learn the stuff that I have learned and in such a short time.”

Shané says key to her development has been a supportive atmosphere that was evident from the beginning at McClure Refinishing.

“It was really easy to start at McClure’s,” she says. “They were all really welcoming. I didn’t feel scared or anything and just got straight into it. They give me a lot of allowance to do things that I haven’t tried before, such as

good atmosphere for that.”

Learning incrementally with the right support has added up to a point in her career where, as a third year, she can look back with a sense of achievement.

“I could not have imagined it, “ she says. “All the stuff that I didn’t know back then (at Autobarn) to everything I’ve learned now. it feels like a big accomplishment for me.”

Custom paint and linework remain among her favourites. Developing the skills has enabled her to do some work on motorbike tanks, where she loves the finer detail. The work in general gives her the satisfaction of a job well done.

“Just looking at the finished product!,” she says. “Especially when we’ve got resprays and they come in and you see what it started out as. Compared to the finished product that you have helped produce, that is pretty rewarding.”

Shané says she has found working with new technology like a UV prime light and new sprayguns exciting and even some of the difficult technical elements of the job like colour matching.

“I’m starting to get the hang of it. It is pretty hard, especially looking at the whites in the sun when you can barely see the panel but I’m getting there. And

I’ve always got my tradesmen there to help me and decipher what to do.” and hopefully learn even more by just doing the job from start to finish. I’ve

Loyalty Shané has her ambitions firmly set

When it comes to a repeatable, consistent paint application process, a precise spray gun setup is key. Unfortunately, some painters haven’t got the message. Using the correct product mix, combined with the same spray gun setup, the same application environment and the same technique for each job, should make it straightforward to produce a consistent end result which is the mark of a skilled painter.

I still meet the odd painter who reckons they can judge the correct spray gun inlet air pressure by simply pulling the trigger and listening. How can that possibly be accurate when there are so many variables? For example, every gun makes a different sound, the fan adjustment changes the sound, the spray booth and workshop are often noisy and you might even suffer from a touch of industrial deafness. I have had people set their pressure using that method and when I have checked it with a gauge it was found to be way out. Getting the pressure right is important because it affects so many things. For example, higher pressure makes basecoat metallic particles stand up, leaving a darker appearance on the angle which creates a halo around

the blend edge. It can also cause mottle issues and ‘basecoat profiling’ where the paint dries before it hits the panel and leaves a sandytype finish. Low pressure is also an issue – particularly with clearcoats. The result is solvent boil, a soft film and poor bake cycles, as well as a final appearance that is not up to scratch. Pressure also impacts product coverage. The higher the pressure the more you lose in poor transfer efficiency so more product is used and more coats are required to get coverage, resulting in cycletime and job cost blow outs.

Tips & recommendations

Pressure gauge: priority is a method of accurately measuring inlet air pressure. The most convenient is to buy a SATA DIGITAL model which has a built-in digital gauge. The latest SATA jet X gives you two options – the jet X DIGITAL or the jet X DIGITAL Pro – and both come with a number of handy features. If you don’t have a SATA gun, at least

adjust air pressure and material, give it a test and you are ready to go! Check gun performance regularly:

a spray gun setup wall chart which is packed with handy data, check the PPG Product Data Sheet or speak to your PPG Territory Manager.

Tech tip is brought to you by Trevor Duke, PPG National Training Manager ANZ.

with Steven Theron

As windscreen technology advances it is vital repair training keeps pace. Sika has revolutionized automotive aftermarket training for vehicle glass replacement with

chemicals, has launched its groundbreaking Automotive Aftermarket Academy, a digital training platform set to transform how automotive technicians master vehicle glass replacement.

Following its successful regional debut in Australia in late June, this strategic initiative marks a new era in Sika’s engagement, training, and support for its partners and customers worldwide.

The academy represents a significant strategic investment and the culmination of a two-year, cross-functional effort led by Sika Corporate and the US Team, with support from regional stakeholders. This comprehensive online platform is designed to provide professional, safetyfirst education, acting as a key market differentiator for Sika in the aftermarket.

The “Master the Art of Auto Glass Replacement!” Academy is built on an interactive e-learning experience, providing access to 43 in-depth instruction videos and a comprehensive training library covering the complete vehicle glass replacement process. Unlike traditional methods, the program features interactive videos in realistic settings, allowing participants to observe actual auto glass replacement scenarios rather than just theoretical concepts. This immersive approach ensures that learners gain a true understanding of the techniques, materials, and precision required for a high-quality, leak-free installation every time. It effectively removes the guesswork from the crucial process of vehicle glass replacement.

The online curriculum delves into a wide range of essential topics, ensuring a thorough understanding of the entire vehicle glass replacement process. Key areas of study include:

• Step-by-Step Installation Overview: From initial vehicle inspection and glass preparation to adhesive application and final cleaning, the course provides a detailed, methodical approach.

• Material Science and Application: Participants will gain expertise in selecting and applying the correct Sika materials, including various surface preparation options like Clear Aktivator, All Black, and Primerless to Glass processes, as well as understanding different adhesive

types (e.g., polyurethane) and their characteristics.

• Pinchweld Preparation: The academy emphasizes the critical importance of proper pinchweld preparation, including full-cut methods, corrosion removal, and bare metal treatment, to ensure optimal adhesion.

• Advanced Considerations: course covers specialized scenarios such as bonding to aluminium and FRP bonding flanges, dealing with freshly painted vehicles, and specific procedures for special weather conditions.

real-world challenges. The content is aligned with OEM-compliant methods and reinforces best practices and safety standards, with safety truly at its core.

• ADAS and Recalibration: Given the prevalence of ADAS, the program includes crucial training on recalibration processes, highlighting the impact of windshield replacement on these vital safety systems.

• Safety and Standards: A strong emphasis is placed on health and safety protocols, minimum drive-away times (MDAT) for various vehicle types, and adhering to industry standards. Sika’s commitment to safety is evident in their rigorous testing, which often exceeds federal safety standards like FMVSS 212.

• Problem Solving: The academy also addresses common challenges and offers solutions for issues like poor adhesion, sealing leaks, and dealing with different types of glass (thermal coated, organic glass, gasket sets, used glass).

• Certification: Upon successful completion of the course, participants will receive an official certification, a testament to their expertise in professional vehicle glass replacement. This certification serves as valuable proof of their enhanced skills and commitment to industry best practices. A key emphasis within the academy is the importance of using OEM approved polyurethane adhesives to return the vehicle to its original equipment manufacturer (OEM) standard for safety. Adhering to the correct procedures is paramount for customer safety, as a properly bonded windshield is essential for the structural integrity of the vehicle, acting as a crucial component in maintaining roof crush resistance and serving as a backboard for airbag deployment. This crucial aspect ensures that the vehicle’s structural integrity and occupant safety features are fully restored after glass replacement, aligning with Sika’s commitment to safety.

The online academy offers a flexible learning schedule, accessible anytime, anywhere, accommodating the demands of busy work schedules. End-users can train at no cost and receive certification to enhance their professional qualifications. This includes a downloadable certificate and a LinkedIn-ready badge to showcase newly acquired skills.

Enrolling in the Sika Automotive Aftermarket Academy is straightforward. Users can access the course by scanning the provided QR code or by visiting the Sika Knowledge Centre Online Training Platform directly at: aus.knowledge.sika.com/

An opportunity for wider reach Sika’s long-standing reputation as a trusted supplier and manufacturing partner to the automotive industry,

resource for auto glass professionals. By mastering the techniques, materials, and precision taught in this program, technicians can confidently deliver highquality, safe, and durable vehicle glass installations, ultimately benefiting both their businesses and customer safety on the road. Sika’s integration of this digital training will enable a wider customer reach through nationwide access to online education, increase efficiency by freeing up resources for targeted business development activities. Furthermore, it will foster stronger customer engagement and loyalty development through ongoing training. This is a first-of-its-kind training concept, simplifying the onboarding and training of new customers.

The platform and content were developed through a region-wide team effort with input from across regions and support from corporate departments. Special acknowledgment goes to the Swiss Aftermarket team and partner Glass Troesch, who generously supported the filming location and onsite collaboration.

With digital platforms available in English, German, Spanish, French, and Italian, Sika is setting a new benchmark in training excellence and commercial impact, shaping the future of Automotive Aftermarket education.

For more details on Sika solutions for the automotive aftermarket, contact Sika or visit the sika website: www.sika.com/aftermarket

Three years on since the landmark Right to Repair laws came into place, the federal government has ordered a formal review into the information sharing scheme and how it affects repairers and consumers.