MAKING WOMEN COUNT

Making women count in the accountancy profession is not going to be an easy fix, according to Professor Nelarine Cornelius.

Opening the ‘Women in Accountancy’ event at Queen Mary University of London to celebrate International Women’s Day, she stressed it is

difficult to make progress when there are people determined to get in your way.

She is concerned some firms in the City of London are still able to bully and harass women with impunity, hiding behind non-disclosure agreements. This is not what nondisclosure agreements were

designed for and that has to change, too.

That is not to say there aren’t good things happening in the City, pointed out Professor Cornelius. But there are still too many organisations that don’t see the problem.

She felt there are now many women and men who know it is in everyone’s interest to see women in the top jobs too, and while some may resist women are on their way.

Speakers joining Professor Nelarine Cornelius (Associate Dean, People Culture & Inclusion at QMUL) were Arlyne Chinyanganya (CIMA qualified), founder of Roots to Fruits; Lorriane Twist (National director, Hays Accountancy & Finance); and Ashwini Poopalasingham (ACA PQ, QMUL Alumni at PKF Littlejohn).

NEW INQUIRY NOW

We need a formal inquiry into the role of accounting and auditing in the Post Office scandal, says Lord Sikka (pictured).

He has already called for an inquiry in the House of Lords, and he said he will now be pushing further on this.

In his keynote speech at PQ’s recent online conference – ‘The Accountant’s Odyssey: How do we shape the future?’ – he said the corporate governance of the Post Office has been brought into question, and that the board members, the non-executive directors, and both the internal and external auditors all need to be brought before an inquiry.

Lord Sikka explained the introduction in 1999 of new computer system, called Horizon, shows the huge scale to this kind of project. In all, 40,000 new computers needed to be connected to the system, and 67,000 people trained in how to use it to handle billions of transactions.

However, as we all know now, the Horizon system was prone to errors and crashes, and between 1999 and

2019 Jujitsu, who supply the system, changed the software code 19,842 times. You can see the huge scale of problem, stressed Lord Sikka

So, where were all the accountants he asked, when screens froze, or sub-postmasters encountered the ‘reversal bug’? And remember, he said, at the same time Jujitsu itself was able to change any transactions being submitted.

He explained that between 2000 and 2023 the Post Office had more

than 80 directors, and he feels all must have known that the system was flawed. Why did they keep quiet, he asked: was it so they maintained their bonuses?

Then there were the nonexecutive directors, the chairs of the audit, risk, compliance and remuneration committees. Lord Sikka stressed the key role of the NED is to challenge management, including the CEO, on financial and operational matters. He felt so far

there is little evidence to show any of these NEDs asked any questions.

The Post Office also has an internal audit department, reporting to the audit committee. Lord Sikka wondered: “What did the internal audit do? Did it never notice the money in the suspense account and any of the press clippings, did it never notice that the Horizon system was fundamentally flawed. Or maybe someone reported it all, but then someone else sat on it. Again, lots of questions to be asked.”

Then there are the external auditors, EY. Lord Sikka claims they knew there were problems, pointing to management letters to the Post Office Board (2011), and internal reports from the head of product (2010), and forensic accountant’s Second Sight’s sidelined report (2013-2015).

Lord Sikka stressed accountants can’t shape the future if they can’t learn from the past. He said there were huge consequences for thousands of individuals for the accounting failures, yet no accountants have been brought to account. That has to change.

You can check out all of what Lord Sikka has to say on the Post Office scandal at: https://youtu.be/ ibnC3Ts8k64. His talk starts at 3.56.

Incorporating NQ magazine www.pqmagazine.com/www.pqjobs.co.uk April 2024

Time to outsource your payroll A fully comprehensive professional payroll service offered for a very low monthly fee. My services will free valuable time to enable you to concentrate on other matters. Call Emma now for full details on 020 8803 6834/07889 885646 or email her at emmaarif@absaccounts-payroll.co.uk

WŝĐŬ�,d&d ĨŽƌ���d�

tĞ�ŚĂǀĞ�Ă�ƌĂŶŐĞ�ŽĨ�ůŝǀĞ�ĐŽƵƌƐĞƐ�ĨŽƌ���d�>ĞǀĞů�ϯ�ĂŶĚ >ĞǀĞů�ϰ�ƵŶĚĞƌ�YϮϬϮϮ, ƚŽ�ĐŽŵƉůĞŵĞŶƚ�ŽƵƌ ŽŶ�ĚĞŵĂŶĚ ŽƉƚŝŽŶƐ�Ăƚ�>Ϯ��>ϯ�ĂŶĚ�>ϰ��

,d&d ůŝǀĞ��ƉƌĞ�ƌĞĐŽƌĚĞĚ�ƐLJůůĂďƵƐ�ǀŝĚĞŽƐ�ƚŚĂƚ�ůĞĂĚ�ŝŶƚŽ�ƐĐŚĞĚƵůĞĚ�ůŝǀĞ�ŽŶůŝŶĞ�ŝŶƚĞƌĂĐƚŝǀĞ� DĂƐƚĞƌĐůĂƐƐĞƐ�;ǁŝƚŚ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ���Ăůů�ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ŵĂƐƚĞƌŝŶŐ�ŽĨ�ŬŶŽǁůĞĚŐĞ�–ĂĐĐŽŵƉĂŶŝĞĚ�ǁŝƚŚ�ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ� &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ�ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ�ĐŽ�ƵŬ�ĐŽƵƌƐĞƐ�ĂĂƚ� dŚŝŶŬ�������ƚŚŝŶŬ�,d&d tĞ�ŚĂǀĞ�Ă�ĨƵůů�ƐƵŝƚĞ�ŽĨ ������ƉƉůŝĞĚ�^ŬŝůůƐ�ĂŶĚ ^ƚƌĂƚĞŐŝĐ�WƌŽĨĞƐƐŝŽŶĂů�ĐŽƵƌƐĞƐ.

▪ DĞŵďĞƌƐŚŝƉ�ŽĨ�ŽƵƌ�ǀŝďƌĂŶƚ�KŶůŝŶĞ�>ĞĂƌŶŝŶŐ��ŽŵŵƵŶŝƚLJ�ĂŶĚ�ĂĐĐĞƐƐ�ƚŽ�Ă�ĚĞĚŝĐĂƚĞĚ�ƚƵƚŽƌ

▪ ,d&d�WĂƌƚŶĞƌƐŚŝƉ�ƐƚƵĚĞŶƚ�ŶŽƚĞƐ�ĂŶĚ������ĂƵƚŚŽƌŝƐĞĚ�ƐƚƵĚLJ�ƚĞdžƚ��ĞdžĂŵ�Ŭŝƚ�ĂŶĚ�ƉŽĐŬĞƚ�ŶŽƚĞƐ

▪ &Ƶůů�ƐLJůůĂďƵƐ��dŽƉŝĐ�ďLJ�dŽƉŝĐ�ƌĞĐŽƌĚŝŶŐƐ�ƐƵƉƉŽƌƚĞĚ�ďLJ�ƚŝŵĞƚĂďůĞĚ�‘live online’ dƵŝƚŝŽŶ�DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ�–ƌĞĐŽƌĚĞĚ��ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ

▪ Scheduled ‘live online’ ZĞǀŝƐŝŽŶ�DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ�–�ƌĞĐŽƌĚĞĚ��ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ

▪ ,d&d�ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ��ŵĂƌŬĞĚ��ǁŝƚŚ�ĂŶƐǁĞƌƐ�ĂŶĚ�ǀŝĚĞŽ�ĚĞďƌŝĞĨƐ &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ�ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ�ĐŽ�ƵŬ�ĐŽƵƌƐĞƐ�ĂĐĐĂ�

^ƚƵĚLJ��/D���ĐŚŽŽƐĞ�,d&d ^ƚƵĚLJŝŶŐ��/D���KƵƌ�,d&d ůŝǀĞ��,d&d ŽŶ�ĚĞŵĂŶĚ�ĂŶĚ�,d&d ƉůĂLJ�ƌĞƐŽƵƌĐĞƐ�ĂƌĞ�Ăůů�ŚĞƌĞ�ƚŽ�ŚĞůƉ�LJŽƵ�ƉƌĞƉĂƌĞ�ĨŽƌ��ĂŶĚ� ƉĂƐƐ��LJŽƵƌ�ĞdžĂŵ��

,d&d ůŝǀĞ��ũŽŝŶ�ŽƵƌ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ�ůŝǀĞ�ŽŶůŝŶĞ�ĨŽƌ�ŝŶƚĞƌĂĐƚŝǀĞ�DĂƐƚĞƌĐůĂƐƐĞƐ��ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ĂƉƉůŝĐĂƚŝŽŶ�ŽĨ� ƐLJůůĂďƵƐ�ŬŶŽǁůĞĚŐĞ��

,d&d ŽŶ�ĚĞŵĂŶĚ��ĚƌŝǀĞ�LJŽƵƌ�ůĞĂƌŶŝŶŐ��ǁŝƚŚ�ĨƵůů�ĨůĞdžŝďůĞ�ƌĞƐŽƵƌĐĞƐ�ƚŚĂƚ�LJŽƵ�ĐŽŶƚƌŽů� ,d&d ƉůĂLJ���ŽdžƐĞƚƐ�ŽĨ�ƚŽƉŝĐ�ƌĞĐŽƌĚŝŶŐ�ĂŶĚ�WƌŽĨŝĐŝĞŶĐLJ�ĞdžĂŵ�ƐƚLJůĞ�ƉƌĂĐƚŝĐĞ�ĂƐƐĞƐƐŵĞŶƚƐ� &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ��ǁǁǁ�ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ�ĐŽ�ƵŬ�ĐŽƵƌƐĞƐ�ĐŝŵĂ

^ ^ƚƚƵĚLJ ǁ ǁŝƚƚŚ , ,dd&d d WĂƌƚƚŶĞƌƐŚŝƉ� ǁŚLJ ǁŽŽƵůĚ LJŽŽƵ ŐŽ Ž ĂŶLJǁŚĞƌĞ ĞůƐĞ� tŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐƐĞ� &Žƌ ŵŽƌĞ ŝŶĨŽƌŵĂƚŝŽŶ ĞŵĂŝů ŝŶĨŽΛŚƚĨƚƉƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ KŶůŝŶĞ��ŽůůĞŐĞ�ŽĨ� ƚŚĞ�zĞĂƌ�ϮϬϭϳ

ƚŚĞ�zĞĂƌϮϬϭ� WƌŝǀĂƚĞ�^ĞĐƚŽƌ��ŽůůĞŐĞ� ŽĨ�ƚŚĞ�zĞĂƌ�ϮϬϮϬ

WĞƌƐŽŶĂůŝƚLJ�ŽĨ�

IN THIS ISSUE

A note from the Editor

In this month’s issue Lord Sikka calls for an inquiry into the accounting and auditing failures that contributed to the Post Office scandal, and Professor Nelarine Cornelius says too many firms are hiding behind non-disclosure agreements so they can bully and harass women with impunity. Proper news!

Add to that our stories on CIPFA moving in with the ICAEW and an ACCA PER scam, and you really are reading stories you won’t see anywhere else.

There is still time to sign up to our ‘No accounting 4 the love of football’ evening on Thursday 21 March. We have a great line up for you including Kieran Maguire, winner of a PQ magazine award for his podcast ‘The Price of Football’, Sofia Thomas from Juno Tax, Kunal Sajdeh, who works for the Deloitte Sports Business Group, and Patrick Way, KC a football tax expert.

You can sign up to this joint CASSL/PQ magazine event at https://shorturl.at/cikO0. I hope to see you there.

The deadline for the PQ magazine awards has come and gone. Well, you really did leave it to the last-minute.com – we had over 250 entries on deadline day! The entries are now with the judges, and the shortlist will appear in next month’s PQ magazine. The awards themselves take place on 22 April.

News

Graham Hambly, Editor and Publisher, PQ magazine

6 New ICAS syllabus

4 Accountancy body merger

Members of CPA Ireland and Chartered Accountants Ireland vote to merge the two institutes

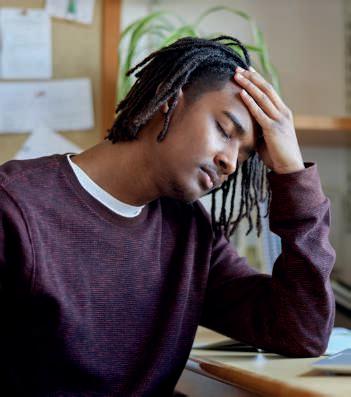

5 Wellbeing

Young professionals more likely to suffer mental health issues than older counterparts, a major study finds

Scottish institute revamps syllabus, with more emphasis on non-technical skills

8 Football crazy…

Sign up today for our great seminar on football’s finances with the great Kieran Maguire

9 New caba survey

Two in three female chartered

accountants ‘severely impacted by feelings of self-doubt’

10 ACCA PER scam Association finds 100 ACCA trainees falsified PER training records

12 Tech news

Xero previews GenAI-powered ‘business companion’

Features, etc

14 Have your say CCAB figures are fascinating – but a little old; and you voice concerns over deepfakes and AI. Plus our social media round-up

16 ACCA exam feedback

We run the rule over the March exam session – so what was the wheat and what was the chaff?

19 CIMA case study

Nasheen Wuisman offers a stepby-step guide on how to pass your case study exam

20 ACCA spotlight

Gen Z finance professionals demand diverse and inclusive workplaces

22 ACCA APM exam

Six top tips on improving your APM exam technique

23 CIMA spotlight

CIMA CEO Andrew Harding explains how management accountants can help lift the UK out of the economic doldrums

25 Company law

The changes made by Companies House that you need to know about

27 Accountex 2024

You need to book your ticket now for the world’s biggest accountancy expo

29 Study advice

How to bounce back from failing an exam by just one mark

30 AAT Level 2

Karen Groves explains how to approach a typical question on the overtime premium

31 Personal tax

Nick Craggs navigates you through the pensions minefield, especially pertinent for those

April 2024

sitting the personal tax exam

33 Digital currency

Dr Stefan Walters looks at what is sometimes perceived as the mysterious connection between cryptocurrency and gambling

34 CIPFA spotlight

What does CIPFA’s latest financial resilience index tell us about pressures on local authorities?

35 Careers

UK is falling down the PwC Women in Work Index league table; our Agony Aunt tackles your career issues; and our Book Club review

36 Fun

The lighter side of life – and accountancy

The columnists

Lisa Nelson Harness the power of meta cognition 4

Robert Bruce Where are the internal auditors when we need them? 6

Prem Sikka Ofwat needs to shape up – and fast 8

Anna Kate Phelan AI now going from hype to reality 10

Eddie Herbert Get help navigating the new carbon regs 12

To subscribe for FREE go to www.pqmagazine.com

contents

p22 PQ

p29

LISA NELSON

The magic of meta cognition

Meta cognition is not a term that rolls off the tongue, and the words themselves don’t help unless you’ve studied Latin or Greek. But if we look at its derivation, we find that ‘meta’ does in fact come from the Greek word meaning ‘beyond’ or ‘about’. So, ‘meta cognition’ refers to thinking about your own thinking, and it has the potential to significantly improve your ability to learn.

Imagine yourself staring at a computer screen or going over something in the textbook. Instead of passively absorbing information, meta cognition encourages you to take a far more active role in the learning process. It prompts you to ask questions such as ‘do I understand this concept?’ or ‘what strategies can I use to remember this information better?’

By engaging in meta cognitive practices you become more aware of your strengths and weaknesses as a learner and start to recognise patterns in your thinking and learning preferences.

Understanding what works best for you might take the form of using more visual aids, creating mnemonics, or practising selftesting.

You might want to consider assessment analysis, where after taking a test you ask questions about what went well and not so well, so identifying your strengths and weaknesses. Exercises such as these are called ‘exam wrappers' and encourage reflection – one of the most effective learning techniques there is.

Lisa

Nelson

is

Director

of Learning at Kaplan

Two become one in Ireland

Members of CPA Ireland and Chartered Accountants Ireland have voted to merge the two institutes.

The two Irish-based accountancy bodies will now work to implement the decision made by their members, which will see the creation of a single institute operating under the Chartered Accountants Ireland brand.

Over 10,000 CAI members voted, with 53.5% voting in favour of the merger. Members of CPA Ireland also approved the amalgamation proposal at an Extraordinary General Meeting.

In a joint statement, Sinead Donovan, President of the Chartered Accountants Ireland and Mark Gargan, President of CPA Ireland (pictured together), said they were pleased that members had seen the benefits of the proposal.

Donovan said: “This is a vote of confidence in the future. Thanks to every member who engaged with us along the way and who turned out to vote in such numbers. Our work continues now to secure the legal and regulatory consents needed to deliver on this mandate for a stronger profession.”

Gargan said: “As one single Institute, we will be more

strongly positioned to represent our members, to promote the profession and to be a positive voice representing the public interest. The move towards consolidation of professional membership organisations is gaining momentum globally, and Ireland will be a model for other professional bodies in this regard.”

CIPFA and ICAEW moving in together?

A little bird at ICAEW told us that they had seen a lot of CIPFA staff milling about ICAEW HQ in Moorgate Place recently. We wondered if a merger had happened without anyone telling us!

However, a spokesperson for CIPFA told PQ magazine: “As we announced last year as part of our joint statement on closer working, CIPFA and ICAEW are

looking at many options to improve and strengthen our offer to members. CIPFA member and staff already have access to the facilities at Chartered Accountants’ Hall (CAH) as part of this arrangement,

including the business centre, library and club. We are currently exploring the option of using office space in CAH for CIPFA staff while maintaining a presence in Mansell Street for training and CIPFA meetings.”

Celebrating becoming a member

Aisha Parpia recently attended The Underglobe in London for the ACCA Celebrating Membership event. She said being part of the

ACCA family “feels like we are plugged into a global community of likeminded professionals uniting us as influential figures in the realms of

accountancy and finance”.

Aisha transitioned from a biomedical scientist to an accountant and she said the skills she has acquired on her journey have provided her with a distinct advantage in some ways.

PQ the PQ Magazine April 2024 4 Award nominations with the judges The deadline has come and gone, and now the nominations for the 21st PQ magazine awards are with our independent judges. The shortlists will be published in next month’s issue, and invites will be sent to all those on the list. The awards night itself will be taking place on 22 April, at the highly fashionable Lio London. The trophies have been made, and the red carpet is being cleaned as we speak. Hopefully we will see you there. ICAEW climate essay competition 2024 ICAEW is inviting its current students, recently qualified members and university students to submit a 5,000-word essay, video or podcast answering the essay question: Accountants as Climate Champions – why and how should the profession lead on climate change? The closing date for entries is 11 April, and the winner, who will receive £5,000 in cash, will be unveiled in June 2024. In order to apply, and in case of further questions, please email your submission to Sarah.Reay@icaew. com If you are submitting a video or a podcast, please keep the length to 20 minutes. All entries will also require references to be submitted. To see previous winners go to ICAEW Climate Essay Competition | ICAEW FRC sanctions KPMG KPMG has been sanctioned by the Financial Reporting Council to the tune of just under £1.5 million over failures of its audit of M&C Saatchi plc (for the financial year ended 31 December 2018). FRC has also issued KPMG with a severe reprimand. Adrian Wilcox (the audit engagement partner) was fined £48,750 and was severely reprimanded. KPMG also paid the costs of the investigation. The FRC investigation was launched following M&C Saatchi’s discovery of accounting errors, announced in 2019. In brief

Poor mental health epidemic

Young people are more likely to experience mental health disorders than those in their thirties and forties as fears rise that a youth mental health epidemic is helping to drive a UK skills shortages.

The Resolution Foundations’ three-year study found that in 2021-2022 more than one in three (34%) young people aged 18-24 reported symptoms of conditions like depression, anxiety or bipolar disorder – up from one in four (24%) in 2000. As a result, more than half-amillion 18-24-year-olds were

prescribed anti-depressants in 2021-22.

The rise in mental health

CIPFA unveils new CEO

CIPFA has appointed Owen Mapley (pictured) to be its new CEO. The current CEO of Hertfordshire County Council will take up the leadership of CIPFA in the coming months, following the retirement of current CEO Rob Whiteman.

Mapley started life as an accountant at PwC where he qualified as a chartered accountant.

Mapley said: “CIPFA plays a unique and vital role at the heart of public

problems among young people is not just a health crisis, it is limiting their economic options, too. The report finds that between 2018 and 2022, one in five (21%) 18-24-year-olds with mental health problems were workless, compared with 13% of those without mental health problems. The number of young people workless due to ill-health has more than doubled over the past decade, from 93,000 to 190,000. People in their early 20s are now more likely to be economically inactive due to ill health than those in their 40s.

service financial management both in this country and globally. I feel both personally and professionally thrilled and honoured to be succeeding Rob, who has done so much both for CIPFA and wider public service. I look forward to joining CIPFA to lead its work to pursue sustainable, confident and resilient public services, ensuring public money is well managed for the benefit of us all.”

AAT scholarships are still available

PQ magazine and E-careers have joined forces to offer a free scholarship each month to an AAT student. There are two scholarships still up for grabs for students who want to get qualified.

To be in with a chance all you need to do is tell us why you should be awarded the free scholarship. Send your entry to scholarships@ecareers.com, along with your full name and the level you want to study. And, yes, you could be studying a whole level with nothing to pay.

Jack Hancock, Khatra Ali and Hannah Walklett have already received their scholarship offers. And we have now notified our fourth recipient of their good news.

Remember, once you have entered you will be kept in the draw for all the available scholarships left, so if you don’t win it the first time there are still other chances to win.

PQ 5 PQ Magazine April 2024 PQ news

ROBERT BRUCE

Where’s the common sense?

I had no idea. I have always extolled and encouraged the idea of companies and other organisations having an internal audit function. It seems so obvious. Yes, the external auditors come in every year and either blunder about or incisively spot a systems failure depending on your opinion from in-house, but the internal audit function does something much more important. It sets up a system from within the company, embedded within the company, that brings it own rigour to bear.

People talk much about the importance of tone from the top.

Internal audit can be a generator of tone from within, spreading out through the organisation. Blithely, I have worked on the assumption that all companies of any reputation and size would, of course, have an internal audit function. But it seems several UK water companies simply don’t. In a letter from internal auditing body the Chartered Institute of Internal Auditors to water regulator Ofwat, it pointed out that three of the main UK water companies have no formal internal audit functions. This, it said, is “concerning given the complex operational and financial landscape these companies navigate”.

These are turbulent times for water companies and there are worries about the three companies – South East Water, Sutton and East Surrey Water, and Portsmouth Water – involved. It is baffling. Not only do they lack internal auditors. They lack ordinary common sense.

Robert Bruce is an award-winning writer on accountancy for The Times

Here comes CA24

ICAS is planning to launch its new CA24 syllabus in April. The plan is to embed technology into the qualification and put more emphasis on non-technical skills, such as complex problem solving

and professional scepticism. There will be core modules in which students will have to build on their understanding of double entry bookkeeping skills by preparing accounts using Xero accounting

ACCA March exam feedback

The AAA and APM exams stood out again as the ‘difficult ones’ for March sitters. Both papers had 34% pass rates in December and students are not expecting anything better this time around.

The AAA exam was described as ‘meaty and hard’, with many students admitting they panicked when they read Q1. Some PQs said that is why they answered Q3 and Q4 first, hoping to give themselves more of a chance of passing.

Some 29% of sitters in the Open

Tuition Instant Poll said the AAA exam was a disaster for them, with another 44% saying the exam was hard. That’s almost a record, but not in a good way!

APM sitters described their exam as ‘horrible’ and ‘really hard’.

But it wasn’t all doom and gloom. Over 60% of those sitting the March SBL exam thought it was OK, in the Open Tuition exit poll, and 54% of sitters were OK with the AA exam.

Check out all the feedback from the March exams on page 16

Speed dating the bodies

Well, it really happened! We got all the accountancy bodies to take part in ‘speed dating’ event as part of the Careers in

Accountancy half-day conference at Queen Mary University of London. Each body had five minutes to explain

software.

Data risk and technology and the use of dashboards to communicate meaningfully with clients will also be there in the Data Analytics and Insights module. Ethics and the use of AI is being built into the final level Professional Ethics course.

In the new ICAS qualification all students will ‘enjoy’ sustainability integrated throughout the mandatory curriculum modules, so they can “glean a true understanding of the cross-cutting nature of sustainability”.

In addition, at Skills – Elective level, students must choose to do one of four electives, including a Sustainability for Accountants option.

ICAS also offers a three-tiered general sustainability CPD courses, as well as shorter, topic-specific training.

what made them different.

Representatives from AAT, ACCA, CIMA, CIPFA (in the form of PQ editor Graham Hambly), ICAEW and IFA all stepped forward to make their pitch. We are not sure who won, but the audience of sixthformers, graduates and PQs must have wondered just why there are so many accountancy bodies in the UK.

6 PQ the PQ Magazine April 2024 Failing by one mark How do you pick yourself up after you fail an exam by 1%? Well, accountancy revision coach Helen Pretty says you need to rebook your exam immediately. For CIMA students she recommends looking for an exam in two to three weeks’ time, because you still have such a strong knowledge base in your head. But whatever body you are with you must book your re-sit for the next available exam sitting. However, something needs to change, and Perry suggests that it might mean you need to read less and practise more. You need your exam techniques as sharp as they can be. Check out more great advice on page 29 Don’t take your notes to the exam ACCA student Yiwen Liu of Yantai, from China has been removed from the student register. During her TX exam she was found to be in possession of a sheet of A4 paper with notes written on it while at her exam desk, contrary to exam regulations. Liu was deemed to have acted dishonestly as she “intended to use the unauthorised material in her possession to gain an unfair advantage in the exam”. The Disciplinary Committee ordered Liu to be removed from the student register and pay £4,800 costs to ACCA. New powers for Companies House Companies House has new and enhanced powers to improve the quality and reliability of its data and tackle misuse of the companies register. The first measures under the Economic Crime and Corporate Transparency Act 2023 (ECCT Act) came into force on Monday 4 March, 2024. Companies House said its priority now is cleansing the register to remove details of those appointed without consent. Check out our feature on the key changes on page 25 In brief

Developed with accountants in mind. Visit getrogo.com for your free trial Accurate replications of questions from ACCA, AAT, CIMA, ICAEW & ICB. Discover fully-functioning spreadsheet features for your accountancy training. Discover Rogo.

PREM SIKKA

OFWAT needs to shape up –and fast

Thames Water is teetering on the edge and is looking for a possible £5bn bailout. Perhaps, the same fate awaits other companies.

Attention must focus on OFWAT and the Environment Agency for permitting predatory practices. Nearly a trillion litres of water is lost each year and companies routinely dump sewage in rivers. This boosts profits and has enabled water companies to pay £75bn in dividends since privatisation, funded by debt and underinvestment and all approved by regulators. Water bills have risen by 40% in real terms and 28% of customer charges cover the interest paid on debt.

Puny penalties have failed to curb abuses. For example, since 2010, Anglian Water has been sanctioned 74 times and fined £6.2m; Thames Water 98 times and fined £175m; and Yorkshire Water 94 times and fined £109m. Fines have become just another cost of doing business.

Despite the sanctions directors receive mega pay packets. For the years 2021, 2022 and 2023 executives of water companies in England collected remuneration of £70m, including nearly £41m in bonuses.

Regulators soothe public concerns with claims that companies have invested £215bn in infrastructure. This is misleading as water companies have been capitalising interest payments and part of their repair and maintenance costs which they consider to be an enhancement. Such policies are imprudent.

Elimination of the profit motive and effective regulation of water is long overdue.

No accounting 4 the love of football

The Premier League, Football League and UEFA each has its own regulations governing club finances. The Premier League has a number of financial rules in place, including requirements for clubs to pay transfer fees, salaries and tax bills on time. They must also submit accounts annually, and disclose payments made to agents.

The rules also state that Premier League clubs are not allowed to make a loss of more £105m in a rolling three-year period.

We will be kicking around the whole subject of football finance on Thursday 21 March, and there is still time for you to come and join the fun!

The line-up for this free evening is also complete, and alongside University of Liverpool’s Kieran Maguire (pictured) we have Sofia

Thomas from Juno Tax, Kunal Sajdeh, a manager in Deloitte Sports Business Group, and Patrick Way KC, a football tax expert.

You can sign up to this joint

Paying the motherhood penalty

For every £1 earned by a man in the UK a woman, on average, earns 90p, despite having a similar personal and professional background, according to PwC research.

The latest Women in Work Index found women are still paying a motherhood penalty and for health-related challenges at older ages (menopause).

And, at the current rate of progress, it will take 43 years to close the gender pay gap in the UK.

Ethnicity and gender also play intersecting and often compounding roles in driving inequalities in the workplace, said PwC. It found that Bangladeshi women face the largest pay penalty relative to white men. For every £1 earned by a white man a Bangladeshi women with similar personal and workrelated characteristics earns 75p on average.

The authors estimate that if women in the UK no longer faced a gender pay penalty, the potential increase in women’s earnings could be up to £55 billion a year.

See more on this on our careers page.

CASSL/PQ magazine event at: https://shorturl.at/cikO0

A big thank-you goes out to our sponsors for the evening: ACCA, ICAEW and HMRC Enquiries, Investigations & Powers magazine.

BPP wins top apprentice prize: BPP picked up not one but two awards at the Apprentice Awards 2024 in Birmingham recently. It picked up the Legal, Finance and Accountancy Apprentice Provider of the Year. It then won the big one – Apprentice Provider of the Year.

8 PQ the PQ Magazine April 2024 news

Sikka is Emeritus Professor of Accounting at the University of Essex Dealing with the tax agent problem ACCA has welcomed HMRC’s proposal to only work with tax agents who are members of recognised professional bodies. It is all part of HMRC’s aims to raise standards in the tax advice market. Although ACCA is clear that the proposal would need to be carefully implemented to ensure that taxpayers, agents and the Exchequer benefit, it said it did not see why the move would lead to a spiral of

cost and nonproportionate regulation. ACCA’s Glenn Collins, said: “It has long been recognised that HMRC has issues with some agents it deals with who act in an unprofessional manner. This step is designed to deal with this problem.” Beware the scammers With the Self Assessment tax deadline behind us, HMRC is now warning people to be wary of bogus tax refund offers. The concern is taxpayers who completed their tax return might now be taken in by an email, phone call or text message offering a tax rebate. These phishing scams are designed to harvest personal details for selling on to criminals, or to access people’s bank accounts. HMRC responded to 207,800 referrals from the public of suspicious contact in the past year to January – up 14% from the 181,873 reported for the previous 12 months. More than 79,000 of those referrals offered bogus tax rebates. HMRC exposes tax avoidance scheme A complex tax avoidance scheme that moves income offshore has been exposed by HMRC. The scheme – linked to businessman Darren Patrick-Green – involves contractors joining Singapore registered Procorre LLP to avoid paying income tax and National Insurance. Tax briefs

Prem

increased

The need to be perfect

Almost two in three (62%) female chartered accountants say they’ve been severely impacted by feelings of self-doubt regarding their ability to perform in their job role, according to a new study published by caba, the occupational charity for ICAEW students and members.

Of these, 29% cited an overwhelming need to always be ‘perfect’, 27% said they have a heightened sense of stress or anxiety, and 26% reported a heightened fear of failure.

Accountant Rachel Harris

MAAT MBA MCMI and founder of @accountant_she, said: “When

I first started my career as an accountant I remember being told that I had ‘too much personality’. I struggled to fit into the mould of how an accountant was supposed to look and behave, and this led to feeling that I didn’t belong. I witnessed women around me trying to blend into the status quo, even taking off their wedding rings during interviews.

“Since starting my own accountancy firm I’ve had the opportunity to break down these stereotypes and create a safe space where everyone can be themselves, regardless of their gender. As a result, I’m now

Are you Accountex bound?

PQ magazine has again partnered up with Accountex London, which brings together over 10,000 accountants on 15-16 May at Excel.

Accountex London is now the world’s largest accountancy and finance expo. You can register for free at https://www.accountex. co.uk/london/

Some 295 software and service suppliers will be exhibiting, alongside an extensive CPD accredited education programme,

surrounded by role models who I look up to – whether that’s a working mum or someone who feels they can stand up and ask for help or training without fear of looking weak.”

to help visitors stay up-to-date with the evolving landscape of the profession.

Among the confirmed speakers are Lord Philip Hammond and Lucy Cohen (a PQ magazine award winner).

And Accountex is a great opportunity of networking and a place you will get a real sense of community.

Find out more on page 27

Oxford Brookes BSc deadlines loom large

ACCA has reminded students and members that if they want to complete the BSc (Hons) in Applied Accounting from Oxford Brookes University there is now a limited time available.

All students and members must submit all the requirements for the BSc programme by May 2026.

May is the final opportunity to register and submit the Research and Analysis Project (RAP), and also the final opportunity for RAP resubmissions.

Any individuals who fail the RAP in May 2026 will then have just one opportunity for resubmission in November 2026.

December 2026 will see the closure of the BSc programme. Anyone registered on the programme who has yet to meet the assessment criteria will no longer be able to achieve the BSc.

Prior to the completion deadline students will still need to have passed all Applied Knowledge and Applied Skills exams, including FR, AA and FM. They would also need to have completed the ACCA Ethics and Skills module.

PQ 9 PQ Magazine April 2024 PQ news

Become an Intermediate Financial Accountant Unlock you career potential with the IFA Graduates, recently qualified and part qualified accountants get the support, guidance and recognition you need to set yourself apart in a competitive SME job market with: • Designatory letters IFA AIPA • Access to a variety of technical resources • Relevant CPD webinars and networking meetings • Financial Accountant, our member magazine • MyCommunity, our online member space • A weekly enewsletter covering accounting, finance and business FIND OUT MORE at IFA.ORG.UK/ROUTESIFA

Rachel Harris (left) picking up her PQ magazine Accountancy Personality of the Year award last year

ANNA KATE PHELAN

AI going from hype to reality

ACCA PER scam comes to light

ACCA investigators have uncovered a scam for would-be members to get their practical experience training records signed off by a bogus supervisor.

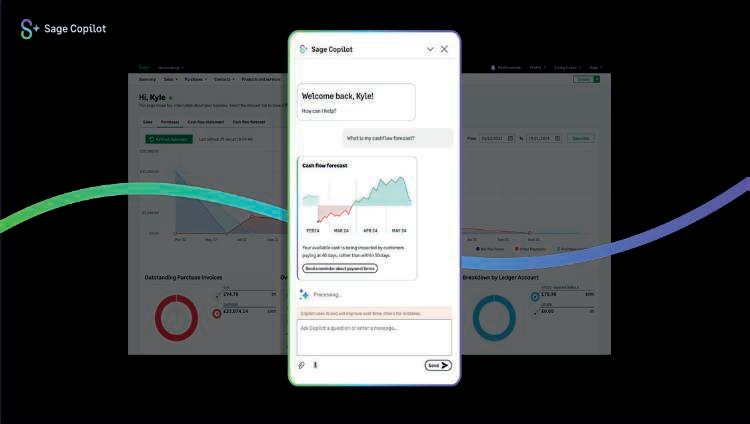

AI has been such a hot button topic for the last year. The public finally saw a powerful tangible tool in ChatGPT and businesses are racing to get ahead of the game and utilise AI ahead of their competitors.

Tom Herbert, AccountingWeb’s technical editor, has decreed “2024 is the year when AI in accounting transitions from hype to reality”, and we are already seeing announcements from the main players in accounting software.

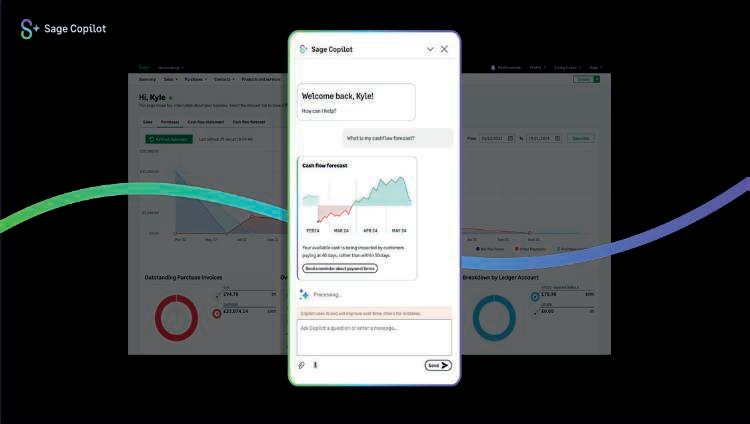

Sage has launched ‘Sage Copilot’, a generative AI fuelled productivity assistant. Sage believes the feature will act as a member of your team, entrusted with administrative and repetitive tasks. It will be made available to us in the UK later in 2024 in the Sage for Accountants and Sage for Small Businesses suites.

Xero are also launching a generative AI powered business assistant, called ‘Just Ask Xero’ (JAX). Similarly, Jax is a business companion that can automate routine tasks and provide intelligence to inform business decisions. A beta version of Jax is due to go live later this year.

Both offerings are yet to launch but promise to revolutionise the way in which accountancy professionals approach day-to-day tasks.

This is very exciting stuff with huge ramifications for the industry at large if successful. As accountancy professionals it’s becoming increasingly important to watch this space, and I’d advise brushing up on your AI prompts pronto!

Anna Kate Phelan is Head of Product at Eintech

PQ magazine has discovered that in 2021 the professional development team became aware that 100 ACCA trainees had claimed in their completed PER training records that their Performance Objectives (PO) had been approved by the same supervisor.

During the course of the investigation a review of the available records was conducted. The review indicated that the

PO Statements had been copied among a large number of the 100 trainees.

Feier Guo of Ningbo, China, was one of those 100 and his case recently came before the Disciplinary Committee.

Where are AATs paid most?

AATs looking for top-paid jobs need to head for the private sector not practice, according to the AAT salary guide.

In a change from previous years the private, non-practice sector

now comes out on top in terms of the highest average full-time salary by industry sector.

AAT members and fellows are earning on average £37,850 in the private sector (non-practice), and

Talking about failure

Failing your accounting exams can affect your mental health and make it difficult to talk to the people around you. However, normalising conversations around failure is important because not speaking about it can take its toll on your wellbeing, says ICAEW charity caba.

It pointed out that the March 2023 statistics show that 25.7% of ICAEW students who sat one exam failed. When they sat two exams that number dropped to 9.6%, and when they sat three it decreased further to 3.5%. Realising that you’re not alone if you’ve failed

Guo had applied for membership on 25 January 2021. After initially accepting his application by email, ACCA shortly afterwards sent another email advising him that the membership acceptance email had been sent in error. This email explained that his application had been selected for a practical experience audit, and that he remained an affiliate.

The ACCA disciplinary hearing found Guo had in fact not achieved all or any of the performance objectives he claimed. It ordered him to be removed from the affiliate register and pay costs to ACCA in the sum of £7,500.

students are earning £26,009. In both cases, these members and students are earning £4,000 a year more than those working in practice.

The average pay for MAATs and FMAATs in the public sector is £37,000, while students are earning £25,000.

This trend continues with the private sector (non-accountancy practices) remaining the top bonus payer. Those in private sector are also much more likely to receive a bonus and be on a bonus scheme compared with other sectors.

To find out more and to use the salary calculator go to http://tinyurl.com/4y93e8ur

an accounting exam will help you come to terms with the situation and take some of the pressure off.

caba said instead of focusing on the fact that you’ve failed, shift your focus to consider what the next best step is; see it as an opportunity to grow and bounce back stronger.

For more help go to https:// tinyurl.com/4h5t6kcz. The advice works for all accountancy students.

KPMG tax tools get AI help

KPMG UK and Blue J have announced that they will launch a new generative AI powered product to answer challenging tax research questions in seconds. KPMG will have exclusive access to the tool, Ask Blue J, among the Big 4 firms in the UK for the first three years.

This expansion builds upon KPMG’s existing alliance, which sees the firm use Blue J’s AI technology to predict tax scenario outcomes with 90%-plus accuracy for employees to then review. For example, working out whether a worker is employed or self-employed for tax purposes. This dramatically reduces the time spent searching

for and analysing tax legislation and case law.

EY relocates in Leeds

w office in Leeds city centre, continuing the firm’s investment in its growing Yorkshire business. The new office, based in Wellington Place, is only a short walk from Leeds train station and combines a well-connected location with enhanced technology and facilities.

EY is expected to relocate to its new premises in Summer 2024. The move follows the end of the firm’s current lease at Bridgewater Place. EY’s Leeds’ business has seen consistent strong growth in recent years and now employs over 480 people, including 39 partners. EY also welcomed 34 graduates and apprentices to the Leeds office in September 2023.

City centre living on the rise

Residential and purpose-built student housing developments led construction activity across four of the UK’s regional cities with over 29,000 city centre homes under construction or completed in 2023, according to the Deloitte Regional Crane Surveys.

The latest Crane Survey series monitors construction activity in the central areas of Belfast, Birmingham, Leeds and Manchester. Development activity remained strong in 2023 with the four cities collectively recording 63 new construction starts across a range of sectors including offices, residential, hotels, retail, education and student housing. In total, 151 schemes are currently under construction.

10 PQ the PQ Magazine April 2024 news

Navigating the new carbon regs

New carbon regulations will have major implications for businesses and require proactive preparation from accountants. The most significant is the UK's Sustainability Disclosure Standard (SDS), mandating expanded disclosures and detailed transition planning for companies by 2025. Additionally, from April, the NHS will require Net Zero commitments from firms bidding on contracts over £10,000.

To help clients prepare, accountants should complete a maturity assessment of current climate strategies against the regulatory requirements and advise optimal steps. This includes reviewing current practices against likely SDS requirements and identifying any needed governance and data changes to enable robust reporting.

Accountants with clients affected by SDS should take some key steps to help with the transition. First, they should educate themselves on forthcoming regulations as details emerge following the current consultation ending in Summer 2024. Second, they should review current client data collection practices against expected requirements and recommend required changes. Third, position compliance as an opportunity to add value through sustainability strategy, rather than only a burden.

When NHS bidding requires detailed emissions data, platforms like Net Zero Now are purpose-built to provide the reporting capabilities clients need for PPN 06/21. Please get in touch to learn more.

The regulatory landscape is shifting –taking action today will keep businesses ahead of the curve.

Edward Herbert, Sales & Business Development Manager, Net Zero Now

Just ask Xero!

Xero has previewed its new GenAI-powered smart business companion for small businesses and their advisors – Just ask Xero (JAX).

When available, Xero’s customers will be able to use JAX to complete tasks like generating an invoice, editing a quote or paying a bill, either in Xero or other commonly used apps and surfaces such as mobile, WhatsApp and email.

JAX will not only complete the task, but it will also anticipate

other tasks that may follow, such as sending an email to follow up an overdue payment. It will also provide rapid, personalised insights on demand, such as cash flow projections, to give customers the confidence they need to make business decisions.

Diya Jolly, Chief Product Officer at Xero, said: “Technology has changed the lives of small businesses dramatically – first with cloud accounting, then automation, and now through GenAI. We’re

embracing this new wave of tech innovation responsibly, with our customers at the heart of what we do, as we deliver on our vision to be the most trusted and insightful small business platform.”

Sage launches generative AI Copilot

Sage has unveiled a new generative AI-powered productivity assistant, which it says will revolutionise the whole accounting, finance and management process (there seems to be a theme here).

Sage believes its new product, called Sage Copilot, will act as “a trusted member of your team”, handling administrative and repetitive tasks in real time. It will also recommend ways to make savings and drive business improvements.

CEO Steve Hare said Sage Copilot will bring trusted AI into the heart of what accountants do, automating tasks and providing insights to fuel growth and efficiency. He explained: “It

is not just an AI feature, it is a commitment to build a future where businesses can focus on their goals, supported by AI they can trust from Sage.”

But don’t get too excited – Sage Copilot will be available in the UK later in 2024, as part of Sage for Small Business and Sage for Accountants suites.

Wolters Kluwer launches CCH iFirm

Wolters Kluwer Tax & Accounting (TAA) has launched CCH iFirm, its award-winning cloud-based practice management and compliance software platform, in the UK.

Designed to help make tax and accountancy practices more efficient and productive, the new platform offers efficient and

automated workflows and full integration and visibility across a range of accounting tools. It enables access to real-time data, while adhering to the top industry security standards. CCH iFirm also allows users to access new opportunities “driven by data analysis, visualisation and reporting”.

A leading cloud platform in the North America and Asia Pacific markets, the UK launch of CCH iFirm is the first in Europe. Existing users of Wolters Kluwer CCH Central, the on-premise accounting system in the UK, can choose to make a one-off switch or a phased transition to the new platform.

12 PQ the PQ Magazine April 2024 Apple fined £1.6 billion Apple has been fined the ‘small sum’ of £1.57bn by the European Commission for favouring its own music streaming app over rivals. The EC said the tech giant broke EU antitrust rules because it prevented app developers from telling iOS users about the cheaper music subscription options outside of the App Store.

EC’s Margrethe Vestager said: “For a decade, Apple abused its dominant position in the market for the distribution of music streaming apps through the App Store. Apple illegally restricted app developers’ ability to inform users about cheaper options to buy outside the ecosystem.” Apple said that it plans to appeal the decision. Nigeria claims £8bn compensation The Nigerian government is demanding £8 billion in compensation from cryptocurrency firm Binance. Two Binance executives were arrested in Nigeria in early March and the government is claiming Binance manipulated the foreign exchange rates via currency speculation and rate-fixing. The Nigerian currency (naira) has lost some 70% of its value in recent months. Now Binance has announced that it will discontinue all Nigeria naira services. It went on to say any remaining naira balances in user accounts will be automatically converted to Tether, a cryptocurrency pegged to the US dollar. Apple sales dip in China Apple iPhone sales in China fell 24% year-on-year in the first six weeks of 2024, according to Counterpoint. And while the US tech giants sales dropped its chief competitor there, Huawei, saw sales jump 64% in the same period. Overall, the smartphone market in China shrank 7%, the report said. Tech briefs tech news

The

EDDIE HERBERT

Founded by AICPA® and CIMA®, the Association of International Certified Professional Accountants® powers leaders in accounting and finance around the globe. © 2023 Association of International Certified Professional Accountants. All rights reserved. 2307-444079 The CGMA Finance Leadership Program (CGMA FLP) is your fast-track path to the internationally recognised CGMA designation. A flexible digital-first learning and assessment platform, the CGMA FLP is designed to fit busy schedules and helps you progress faster. Become a CGMA® designation holder with the CGMA® Finance Leadership Program. TRAILBLAZERS TRAILBLAZERS FINANCE WANTED Find out more at aicpa-cima.com/flp.

The profession by numbers works

Loved your front cover (PQ, March ’24)! It is good to see the real worth of the profession in print. My only criticism of you (or maybe I should blame the CCAB) is why you used 2022 figures – is there not more up-to-date stats that could have been used?

I would expect the profession to now be employing a million people in the UK and Ireland!

That is such a massive figure, and our contribution of £97.7 billion to the GDP is staggering. I am surprised that Brexit has not had more of an effect – £4 billion worth of accounting services being exported is impressive.

The sheer number of students

under the CCAB umbrella always staggers me – 585,000. OK, membership rose 14% in the UK and Ireland in the past five years, but what we aren’t told is the percentage of those half-amillion students who make it to qualification. As a student that is an important omission, but I

suppose this report was more about the economic impact of accountancy.

Name and address supplied

The Editor says: This was the third CCAB report seeking to demonstrate the value of accountants to the UK and Irish economies in terms of commerce, number of member and accountancy firms, GDP contribution, employment, tax revenue, and export of accountancy service. There is lots more in that January report we didn’t cover, including how the profession is championing diversity and inclusion, and its contributions to environmental sustainability. Check out the report at https://tinyurl.com/ymmuwxns

Our star letter writer wins a fantastic ‘I love PQ’ mug!

Deepfake CFO

I was shocked to read about the deepfake CFO in Hong Kong (PQ, March ’24, page 12). It appears we are now in a position where we can’t even trust the people we see in our Teams meetings! The fact that someone can now fake your CFO and fellow team members is just scary. But how was such a junior member of staff able to pay out £20 million without the necessary checks? If my CFO contacted me I would want to see the proper paper work and a PO number, at the very least. I think the story maybe also said something about the power structure in that firm.

My personal worry is it will mean more companies will seek to get us all back in the office again. However, there is now a problem, as my firm has downsized its office space so can’t have us all come back in at once, there simply aren’t the desks anymore.

Name and email address supplied

AI for everyone

I have to agree (PQ, March ’24, page 3) that universities need to do something about the prevalence of AI on campus. Your story said the survey found

more than half (53%) have used generative AI to help them prepare assessments, but it my opinion it is more than that. I think it is more like 75%–80%.

It was interesting that male students, students from more privileged backgrounds and students of Asian ethnicity, are much more likely to have used

generative AI than other students. Now that is true!

But how are they going to provide AI to those who cannot afford it? Something needs to happen quickly before the gap is too great. Maybe the Big 4 firms could create an initiative to provide the kit and funding.

Name and address supplied

Our ‘avoid hitting the wall’ feature from last month’s issue got lots of hits on social media. In it CIMA’s Nasheen Wuisman told studiers they need a plan to pass the exams, and that a study plan can save you from being overwhelmed by the size of the task ahead.

As VIVA Financial Tuition’s Thomas Newman said: “Even a very simple plan makes the world of difference. In fact, the simpler the better, because it increases the chance of sticking to it.” Mark Ingram of FME fame added: “Everyone needs a plan – but as your pic shows, starting with the wrong base can lead to some ‘interesting results’ –so show your plan to someone who’s already been down the road you are about to tread.”

Everyone had a fantastic time at the recent CASSL Ball, which was hosted at the wonderful Chartered Accountants Hall. It was great meeting up with friends old and new. And, of course, it was great to be a sponsor, too. A special thanks has to go to Sunny Yang (and his dad) for showing us all such a great time.

PQ Magazine PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker Contributors: Robert Bruce, Prem Sikka, Lisa Nelson, Anna Kate Phelan, Tony Kelly, Phil Gammon, Edward Netherton, Francesca Cullaney | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media If you have any problems with delivery, or if you want to change your delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2024

email graham@pqmagazine.com

BOOK YOUR FREE TICKET WWW.ACCOUNTEX.CO.UK/LONDON PRIORITY CODE ACX132 TAKE YOUR PLACE AT THE FOREFRONT OF ACCOUNTANCY AND FINANCE THE No.1 ACCOUNTANCY & FINANCE EXPO NETWORKING EXHIBITION EDUCATION GET UP TO 16 CPD HOURS

ACCA March exam feedback

Were FR and SBL that easy, and APM and the tax papers that much harder? Only the results will tell on 15 April, then it’s cake all round!

PM

March sitters said the exam ranged from ‘OK’ to ‘tricky’ to a ‘disaster’.

One sitter did wondered why there was nothing on divisional performance or transfer pricing. However, a student who did get the transfer pricing question (remember there are different papers) said they “screwed it up”. Another PQ agreed that section C with transfer pricing and the optional production plan was just “too hard”.

Time pressures were also ever-present, and the longish calculations made it all a bit tight.

There was also criticism of the length of section B questions – for some they felt like section C questions.

In the Open Tuition Instant Poll some 17% of sitters said the exam was a disaster and another 29% found it hard.

TX

“It was tough,” according to one sitter, and another agreed it was all “pretty tough”.

Some sitters questioned whether it was even possible to complete the exam in the allotted three hours: “It was a race against time,” explained one.

In the Open Tuition Instant Poll 41% ticked the hard box after sitting the March exam, and another 15% felt it was a disaster.

FR

Well, here’s an exam that students didn’t hate! In the Open Tuition Instant Poll some 53% of sitters said the exam was OK, 6% said it was easy and just 12% felt it was a disaster. This is a bit of a result, when compared to the polls for the other exams.

That meant one sitter called it ‘normal’ and another said: “I’m not gonna lie, don’t know how this is possible but I found the actual exam itself a bit easier than the two practice versions and easier than the specimen?”

Others left their exam desks thinking it was all suspiciously easy. People were so chilled some said they actually ‘loved’ the interpretation question!

AA

Students found section A harder than expected, and many also struggled with the audit risk question in the AA exam, this March.

Sitters admit they find it so difficult to even guess how they did: “I wrote loads but no idea if what I wrote way right,” explained one PQ.

Many felt it was a paper of two halves! Section A was the more difficult half and section B was much more what students were expecting.

But generally, students got the exam they were ‘expecting’. The Open Tuition Instant Poll

backs this up, with 54% of sitters saying the March sitting was OK. A further 33% said it was hard, but just 6% felt it was a disaster.

FM

“Such a hard exam, even section A and B were tricky,” said one March sitter. Another thought is was such a hard exam – “difficult ratios with different investments, sharia law financing theory, the divisible project, part B had some tricky questions as well!” One more just called it ‘painful’. For some the problem was the lack of WACC and NPV calculations and no working capital – especially as their tutors had spent so much time on these topics

In the Open Tuition Instant Poll just one in three sitters (33.92%) said the exam was OK. For 43% the March exam was hard and for another 19% it was a disaster.

SBR

One sitter felt the only normal question was Q1, the rest were a disaster: “How can they give literally three sentences about financial asset and financial liability and require an answer for 10 marks?” The crowd funding and disclosure questions were also given a thumbs down! One sitter agreed: “I didn’t really understand the disclosure question.”

There were a lot of votes in the Open Tuition Instant Poll. Some 37% of sitters felt the March paper was hard, and another 17% felt the exam was a disaster for them.

SBL

PQ magazine can’t remember when over 60% of sitters thought an ACCA exam was OK, but that is what SBL sitters told the Open Tuition Instant Poll this time around! Just 9% said the exam was a disaster and 24% said it was hard.

As one sitter explained the questions themselves were not too challenging. For them the problem was time management.

Another sitter said it was a fair paper, and probably the best P-level paper. Yet another predicted they would get 56 marks (seems very precise) and said the exam was ‘alright’.

Check out Sean Purcell’s feedback of the March exam: https://www.linkedin.com/feed/ update/urn

APM

It was hard to find anyone who liked the variance question this time around. It was described as ‘horrible’ and ‘really hard’.

One sitter had the questions on e-commerce, benchmarking and cloud computing for Q1, performance pyramid and reward schemes for Q2 and big data and ethics for Q3 and thought it was all pretty easy. Those who got this set of questions though it was more like an SBL exam –no calculations required in any of the questions.

In the Open Tuition Instant Poll 36% of sitters said the March exam was hard and for 19% it was a disaster

16 PQ PQ Magazine April 2024 ACCA exam feedback

ATX

Sitters wondered why such a small amount of the syllabus was tested this time around. It meant many felt that all the bits they had revised just weren’t tested.

Some sitters got the question of calculating salary after expenses, found the car element threw them off. “It was a hard question,” said one sitter.

In The Open Tuition Instant Poll 19% called this exam a disaster, and another 34% just found it hard.

AAA

The March AAA sitting was described as “meaty and hard” by one sitter. Many PQs found this a very challenging paper. One called it ‘horrendous’.

Students panicked when they saw how much they had to read in Q1. Some PQs said that is why they answered Q3 and Q4 first. As one sitter explained: “Not a nice paper, ended up talking absolute rubbish in Q1 and Q2. ”

The Open Tuition Instant Poll shows this paper was a disaster for 29% of sitters, with another 44% finding it hard. Making it by far the most hated exam to date! Just one percent of sitters said they found the exam easy.

AFM

Not many sitters like the AFM exam this time around, and it was a ‘disastrous’ and

‘horrendous’ sitting for quite a few out there. Several PQs said they were seriously thinking of giving up on ACCA!

Some sitters admitted they simply ran out of time, so didn’t get to attempt the calculations in part C. Others resitting the exam felt it was

nothing they hadn’t seen before, but that didn’t make it any easier!

The Open Tuition Instant Poll saw 28% saying the exam was a disaster and a further 42% thought it was hard. Only 28% said it was OK.

THE ACCA PM AND APM MARRIAGE

Marriage might be a strong word, but there’s no doubt that the ACCA PM and APM papers have a strong link, which needs to be well understood by students before embarking on their final level optional papers.

The APM pass rates are generally worse than the PM ones, and when you explore the reasons why, it comes as no surprise. Generally, most PM students are not well prepared for the written parts of the PM paper – the dreaded Constructed Response parts in Section C. Most accounting students do not like the written parts of papers, instead favouring the numerical parts. This is often their focus from the beginning of their PM studies.

they don’t like the writing parts of the paper, they quite often wait until the revision period for APM to begin revisiting the PM technical content, as well as learning how to APPLY the theory to the questions. By then it is very far down the road, which makes passing the paper very challenging. The best thing to do when you’re studying PM for ACCA, is to learn the technical theories as well as possible, especially if you plan to sit APM afterwards. Try to keep refreshing the technical knowledge if possible. Finally, practice section C writing during PM as much as possible, as these will be transferrable skills should you come to sit APM later on.

Once they pass PM exam, they mostly forget the tougher technical parts of the paper, and as

• Jean-Paul Noel-Cephise is a tutor on MAQ Learn Online. See: https://maqlearnonline.com/tutors/jean-paul/

PQ 17 PQ Magazine April 2024 ACCA exam feedback

AAT: What level should I start at?

Identify the right AAT qualication for you with Premier Training’s Skills Checks.

Your free online Skills Check is automatically sent to a Premier Training tutor who will advise you on which AAT level to study rst. Head to our website at www.premiertraining.co.uk for more details.

You can start AAT distance learning courses on any day and t your studies around your job and other commitments.

Interest-free instalment plans are available for all courses as well as FREE Xero training and certication.

Get Started Today

Start your studies the same day24 hour online access with instant access to tutor support.

Learning Resources

Award winning learning resources including printed books, eBooks & e-learning, videos and quizzes.

Assignments

Prompt marking turnaround –marked by a tutor (not a computer).

Advisor Certication

Xero

Premier Training has teamed up with Xero and is pleased to offer the Xero Advisor Certication Equivalency Course FREE OF CHARGE to anyone who enrols.

info@premiertraining.co.uk 01469 515444 AAT Distance Learning AAT Distance Learning

Been there, done that –passed the case study!

CIMA’s Nasheen Wuisman offers a step-by-step guide on how to pass your case study exam

There is no better way of finding out what it’s really like to sit the case study exam than from those who have lived it.

The pressure of mastering all the necessary skills, learning technical content in the relevant level of the CGMA Professional Qualification, focusing on exam technique, time management, understanding the grading, what the examiner wants and then finding the time to practise questions to bring it all together –all in all is overwhelming!

But it is reassuring to say the least, to know that every candidate feels this way, especially those who have faced these challenges and passed their case study exams.

So, let’s see what these successful candidates can tell us of their experiences and what they found got them through their revision and exam preparation.

Revision tips

Flash cards can be a great way of breaking down the large CGMA syllabus into manageable chunks to learn from. By going through your notes from the component parts of the level you are studying and pulling out the key points, you will have a set of flash cards to use in your question practice. This is a two-way process. As you do your question practice, make sure that if something comes up in a question, that you need to know and isn’t in your flash cards,

then add it in. That way you can increase your confidence in knowing you are covering as many of the key topics as you go.

Study from the flash cards – some people like to make posters – rather than in-depth notes. You can still refer to detailed notes if you need to, but becoming familiar with the flash cards is a good way to remember and memorise the overall syllabus. They are also easy to carry around with you to look over at any given opportunity.

Use the CIMA exam blueprints! These are available on our site, and they set out in detail everything a candidate is supposed to be confident in for each level. Look at the “I can…” statements outlining the skills and knowledge you need to demonstrate to pass your case study exam. Remember, all CIMA exam questions come from the competencies outlined in these documents. These statements can really help you assess your progress.

Use multiple past papers for question practice. Compare your answer with the model answers to see what the examiners are asking for and whether your answer would gain marks. The key is to appreciate the things you did well and review the areas which need improvement. Getting it wrong during revision and practice is not only common, but also the best way to learn – as you now know what not to do next time and why.

Using the pre-seen Think of the pre-seen material as much

more than an exam text. If you want to do well, you need to completely immerse yourself in it, really believe that you work in this company. Always write and think in the first person. Jump into the pre-seen and say “we should” not “they should” when you review and practise your answers. Some people find it helpful to read up a little about the industry in question, so you get a real feel as to what it could be like to work in that industry.

The time you spend doing this is going to be well-spent. Examiners ALWAYS feed back on the need to be familiar with the preseen and how they can see when an answer reflects these efforts put in before the exam. Remember to link ideas you write in the exam back to the pre-seen. To give one example of how this works consider the company’s cash position presented in the pre-seen – if the unseen proposes investment, question whether the entity is in a position to invest or whether it’s struggling with working capital, before presenting a proposal in your answer. Demonstrate you have considered this to show your awareness of its importance within this decision.

The exam itself

Write bullet points to plan your answer then use them as headings to structure it. Always look back to the task repeatedly when writing your answers. You might have missed something or easily go off track and waste time writing content which is not relevant.

A good night’s sleep

Plan a day of rest before the exam. You don’t want to be covering new ground the night before. By then you should have learnt as much as you are going to learn, so give your brain a chance to breathe – you will be more confident during the exam that way.

All these fantastic tips were from successful candidates after they passed their case study exams. You can find these and many more in our ‘Little book of secrets’ resource. This is just what you need to help focus in the days before the exam.

When you are in the midst of your revision journey it’s hard to see what success looks and feels like. Always remember that there were thousands of candidates before you who have felt how real the challenge is. For the thousands of candidates after you, you will be the success story they follow!

• Nasheen Wuisman, Senior Manager of Global Academic Progression at AICPA & CIMA, together as the Association of International Certified Professional Accountants

PQ 19 PQ Magazine April 2024 CIMA case

Fit for the future

Gen Z finance professionals want diverse and inclusive work environments where they can develop new skills, says ACCA’s Jamie Lyon

As an accountancy student, what are you looking for in an employer? The largest global talent survey across the accountancy profession from ACCA suggests that a diverse and inclusive working environment is likely to top your wish list.

ACCA’s Global Talent Trends 2024 report, with almost 10,000 professional accountants participating across 157 countries, found that almost two-thirds (64%) of UK finance professionals rate diversity, equity and inclusion (DE&I) as a key factor when choosing an organisation to work for. That figure shoots up even higher – to 76% – for Gen Z professionals (those under the age of 26). However, many Gen Z feel organisations are selective about just focusing on certain aspects of EDI, like gender, and feel that broader approaches to diversity are needed.

These findings suggest that finance professionals of all ages, but especially younger finance professionals, believe strongly in the principle of a diverse and inclusive working environment. This belief is probably grounded in a fundamental sense of fairness, as well as a conviction that they themselves are more likely to thrive and advance in a workplace that prioritises DE&I.

Workplace concerns

Given the challenging economic climate and inflationary issues in many markets, it is no surprise that salary and reward is a major issue for Gen Z.

Over half (55%) of Gen Z finance professionals globally are dissatisfied with their pay packet. This helps to explain why 52% are planning to move to their next role within the next 12 months, with that move far more likely to be external than internal.

Another major concern for Gen Z – which reflects today’s fast-moving business landscape – is development. In fact, improved career opportunities are the biggest reason why Gen Z finance professionals are intending to move to an external organisation (33%), closely followed by pay (32%).

Globally, less than half (49%) of Gen Z finance professionals are satisfied with the career opportunities on offer with their current employer. Three of their biggest workrelated fears for the future are poor career development opportunities (cited by 37%), not having the relevant skills for the future (28%), and jobs being replaced by technology (27%).

Excited by AI

The International Monetary Fund has predicted that artificial intelligence (AI) will affect almost 40% of jobs around the world, replacing some and complementing others. In the UK, finance professionals are generally optimistic about the technology’s potential, with around two-thirds

(66%) believing that AI will enable finance professionals to add more value in their work. Nevertheless, 42% are concerned about the impact of AI on their own role and 22% feel overwhelmed by the rapid rate of technological change.

Significantly, nearly three-quarters (71%) of UK finance professionals would like their employers to provide more training on technology. Accountancy students will therefore want to bear this finding in mind when they apply for roles. For example, when meeting prospective employers, they might want to ask what training the employer provides on using new and disruptive technologies such as AI.

Under pressure

The research underlines that mental health is a major issue for finance professionals, both in the UK and overseas. Globally, three in five Gen Z finance professionals (61%) believe that their mental health is suffering due to workplace pressures while 55% of UK professionals – across all age groups – say the same.

Globally, Gen Z finance professionals appear to be highly mobile, with 60% having plans to move to a different country or location, either

in their next career move or later in the future. They are motivated to work overseas by the possibility of a bigger pay packet, getting to seize new opportunities, and boosting their CV with international work experience.

The research suggests that UK-based financial professionals are less likely to work overseas than their peers in other countries, however. Just 15% of UK respondents to the research said they wanted to move internationally in their career at some point, the lowest score across any region. This may reflect the impact of Brexit on finance professionals’ mobility within the EU, as well as the psychological aftermath of the Covid19 pandemic, which separated people from friends and family members abroad.

Overall, the research highlights that Gen Z finance professionals are looking to work in a diverse and inclusive environment, where they are well paid and have opportunities to collaborate and develop. They also want that environment to be good for their mental health. These findings should serve as a wake-up call for all employers looking to attract and retain the newest generation of accountancy talent. • Jamie Lyon is head of skills, sectors and technologies at ACCA

20 PQ PQ Magazine April 2024 ACCA spotlight

No accounting 4 the love of football

Brought to you by

An evening with University of Liverpool’s Kieran Maguire, of The Price of Football podcast fame, and friends…

Those friends are:

Sofia Thomas, partner at Juno Tax and chair at International Sports Tax Association

Kunal Sajdeh, manager in the Deloitte Sports Business Group and sub-editor of the 2024 Deloitte Football Money League

Patrick Way, KC, football tax expert

Our love of the game always comes at a price, the problem is understanding how finance and football can keep the beautiful game, well, beautiful!

With Kieran & co help we will follow the money and find out what is really going on! We may be starting with Everton, but who knows where the evening will take us!

No accounting 4 the love of football – does football finance work?

Date: Thursday 21 March

Venue: The Crypt on the Green, St James’s Church, Clerkenwell Close, London EC1R 0EA

Time: 6pm to 8.30pm. Kick off at 6.30pm

Sign up at: https://shorturl.at/cikO0.

No VAR will be in operation on the night!

This event is supported by

HM RC Enquiries & Powers

Six tips to improve your APM technique

There are many critical success factors for passing APM, so here are a few suggestions from Brigita

Time management

Ensure you always practise questions under the limited time you will have in the exam. Set aside 50 minutes for a 25-mark question and 95 minutes for a 50 marker. Next, when doing the question, don’t split your time per requirement, using the average minutes per mark technique. Given the nature of the subject and the professional marks in the exam, you’ll benefit more from having a holistic approach thinking about all the requirements and how it all links together, in the big picture for the organisation in the scenario.

So stick to the time per question and for the 50 minutes you have for a 25 marker, aim to do as much as you can on any of the requirements within it, writing the easiest points within the whole question first.

Be balanced

It will be far better if you have points written under each question requirement, even if not as many to give you the maximum marks. Your job is to respond to the CEO’s request for work and they’ve given you a few tasks. Imagine how disappointed they’d be if you overloaded them with information on some of those and ignored the rest!

Plan

Invest quite a bit of your time allowance at the start in brainstorming the question and planning your answer. Use the requirements and the tasks from the embedded requirements to give you some structure. If at this stage you ensure you drop some good ideas under each requirement, when you start writing your answer, you can easily achieve the spread, mentioned in my previous point.

Petrova

I know many of you feel reluctant to spend much time on planning but this could pay off massively. Thinking properly about the matters in advance helps you get relevant points, better structure and improve your professional marks output, too.

Apply

Just knowledge and general points about topics would score you some marks but unlikely to give you enough to pass. Indeed, these could be very useful at the initial brainstorming stage, to get you started and give you some initial structure. Then, while still brainstorming and going through the scenario, look for case clues that you can use. There will be some to support

the general points you have made and there will be others you couldn’t have thought of in advance, as they will be scenario specific. If you want to do well, make sure you marry the general ideas you had with the case points you found!

Justify

Remember, if you simply state things, even if they are correct, you could still be scoring nothing, due to lack of justification. You can’t just tell the CEO that some things are good and some are bad: they’d need to know why. So, for example, you might think that writing something like “The performance report is good, because it contains KPIs regarding the company’s objective of achieving XXXX”. That’s a good start, but why does the report need such KPIs? Maybe adding something along the lines of “…and thus can show the company’s progress towards it” or “it can indicate if some corrective action is needed” – could help you round up that mark.

Mind the numbers