AUDIT AT THE CROSSROADS

No one it appears, neither current audit professionals nor prospective entrants, sees audit being a proper career choice unless they can achieve a work-life balance, are paid proper money and work in a supportive environment.

Audit professionals also want to see transparent career pathways and inclusive work environments.

Hardly surprising then that many young audit professionals plan to leave their current employer either within the next 12 months or within a few years.

A new extensive study by ACCA and the Chartered Accountants Australia and New Zealand found audit at a pivotal junction, with professionals expressing concerns about both a lack of career satisfaction and the prevailing practices currently found in audit firms.

It is achieving a work-life balance that mattered most. Survey respondents suggested that there

was also an urgent need to address at times unsupportive cultures within firms, which can impair wellbeing and work-life balance.

The study said firms may be taking steps to address these problems, but their initiatives may lack ‘visibility’.

Remuneration ranked as the

second-most important factor in the study, reducing the attraction and retention of talent in the audit profession in most regions.

Auditors felt that the intensive workload during busy seasons was not adequately compensated for. This was in turn demotivating, and if it remains unchecked could further

impact the attraction and retention of talent in the future.

And, as the authors of the report said, pay will always be considered inadequate if the impact of a poor work-life balance is not addressed.

There is also a perception of a lack of variety of work for auditors. The rise in regulatory requirements and standards has heightened the demands of the job, often causing audits to feel more like a compliance exercise rather than a value-adding service.

However, the authors of the study said the interest in sustainability reporting and assurance presents opportunities to attract, develop and retain staff.

Technology can also play a part in attracting people to the profession. Survey findings reveal a strong interest in advanced technologies among individuals considering entry into the audit profession.

Read the full report at https://tinyurl.com/57fsscm2

TOO ANXIOUS TO TAKE YOUR ANNUAL LEAVE?

Women working in the accountancy sector may not be getting enough time off work to recharge and relax, with new research from caba showing that over a third of female accountants (41%) say they’ve avoided taking annual leave on more than one occasion because they were anxious about handing over their to-do list.

The study of over 200 female chartered accountants in the UK found that almost nine in 10 (88%) women regularly sacrifice their own work-life balance to accommodate the needs of others.

A similar percentage (85%) said they struggle to set boundaries with colleagues and their manager regarding their time, workload or personal priorities. When asked why this is, two in five (40%) said that keeping people happy is more important. Over one in three (36%) said they worry they’re not deserving of their place at the company if they don’t push themselves.

Meanwhile, almost two in three (62%) respondents said they regularly experience

feelings of self-doubt regarding their abilities within their role. As a result, one in eight (80%) said they find themselves seeking validation from others for their work or decisions.

Two in five (40%) said they’re uncomfortable telling their manager about areas they feel less confident in, while four in five (80%) said they often feel like they need to work harder than their peers to prove their worth.

When respondents were asked about which strategies and resources they think would be helpful in combatting feelings of work-related self-doubt, the most common responses were flexible working arrangements (34%), regular feedback and recognition from their manager

Continued on page 5

Incorporating NQ magazine May 2024 w.pqjobs.co.uk FINALISTSAWARDS INSIDE

Advance your career with a Mindful Education course or apprenticeship Discover more at mindful-education.co.uk/learners

BOOK NOW at IFA.ORG.UK/AMLCONFERENCE24 PRICES IFAMember&affiliate£65 IFADirectstudent £40 Non-member £90 6.5 CPD HOURS TUESDAY 21 MAY | 9:30AM TO 4:00PM AML Conference Online 2024 @INSTITUTEFA INSTITUTE OF FINANCIAL ACCOUNTANTS INSTITUTEOFFINANCIALACCOUNTANTS INSTITUTEFA Gain valuable insights from experts about AML regulatory updates and how best practice can protect your business from being misused for the purposes of criminal activity. The role of the MLRO Richard Simms, Managing Director AMLCC What to expect in an AML review IFA AML Review team Bringing SARs to life Emma-Jayne Turner, Manager - Reporter Engagement, UKFIU, National Crime Agency “All too familiar” video and discussion Tim Pinkney, IFA Director of Professional Standards and Ian Hornsey, IFA Director and Regional Ambassador

IN THIS ISSUE

Our 21st PQ magazine awards night is here! The shortlist can be found on page 16, and there are lots of shining PQ trophies looking for a new home. Make sure you follow all the fun on 22 April. I can promise our finalists and guests are going to be wowed by this year’s venue – Lio London.

I don’t have a vote for our awards – independent judges do all that – so it was great to be a judge for the AAT Training Provider awards. After a four-year absence it was nice to see everyone in Nottingham enjoying themselves, and I even got to say hello to my old friend Paul Sizer from Gower College. A perfect night then.

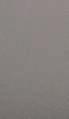

Our YouTube video of Lord Sikka talking about the Post Office Scandal has really taken off. Some 5,000 people have already watched it, and it makes for great viewing. Check it out at https://youtu.be/ jkCWvJt0l6A.

We will have a podcast of our ‘No accounting 4 the love of football’ ready for you next month. We got a great turnout at the Crypt on the Green, and big thank you goes to CASSL, ACCA, ICAEW and HMRC Enquires, Investigations & Powers magazine for supporting that one.

Keep reading, and we will keep trying to create content you want to read and things you want to listen to!

Graham Hambly, Editor and Publisher, PQ magazine

Features, etc

14 Have your say

Lord Sikka is right to question role of Post Office accountants – and your responses to his YouTube video. Plus our social media round-up

16 PQ Awards 2024

The red carpet is being rolled out for all the finalists for the PQ magazine awards night. Who made it onto our shortlist this year?

18 New ICAS syllabus

ICAS explains what the new syllabus will look like and how it is changing the way students learn

19 ACCA podcasts

Association launches podcast series designed to help its PQs deal with the common issues confronting them

21 AAT Training Provider conference special

Four pages of conference news and pix, kicking off with advice about improving your writing skills. Plus all the winners at the association’s awards; and we profile a special student with an inspiring story

26 IFA spotlight

5

6

12 Tech news Apple sued over ‘monopolisation’ of US

34 CIPFA spotlight

Local authorities struggle to balance the books as funding pressures increase and demand for services grows

35 Careers

Sorry may no longer be the hardest word; our Agony Aunt tackles your career queries; and our Book Club review

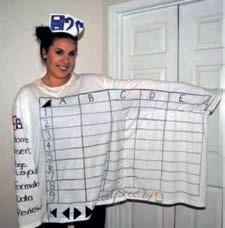

36 Fun

The lighter side of life – and accountancy

The columnists

Have you got fit-for-purpose anti money laundering safeguards in place?

27 AAT exams

Budgeting and variances explained

29 A question for Tom Tom Clendon explains the difference between a subsidiary and an associate – it’s all about control

30 CIMA pre-seen Saddle up for the latest OCS preseen exam

31 ACCA AFM exam

How to pick up the easy marks in the discussion part of the AFM exam

32 CIMA spotlight

How to gain understanding of the subjects that, initially cause you real a headache

Lisa Nelson How to lose that fixed mindset

Robert Bruce How diversity shapes UK auditing

Prem Sikka State getting new powers to spy on you

Anna Kate Phelan AppIe’s US case is one worth watching

Eddie Herbert Helping organisations achieve SBI targets

4

6

News

Equality, diversity and inclusion

EDI policies now becoming ‘tick box’ exercises?

4

Are

PQ Awards 2024 The short list is out now!

STEAM, perhaps?

Accountancy and STEM CIMA backs MPs’ call to make accounting a STEM subject.

Small businesses to benefit from increased apprentice funding

FRC updates standards Watchdog issues ‘comprehensive improvements’ to FRS 102

8 Apprenticeship reform

10

smartphone market

8

10

12

subscribe for FREE go to www.pqmagazine.com

To

May 2024

A note

contents p18 p22 PQ Time to outsource your payroll A fully comprehensive professional payroll service offered for a very low monthly fee. My services will free valuable time to enable you to concentrate on other matters. Call Emma now for full details on 020 8803 6834/07889 885646 or email her at emmaarif@absaccounts-payroll.co.uk

from the Editor

LISA NELSON

I

don't understand this – yet!

Carol Dweck’s concept of a ‘growth mindset’ has changed the way many people think about themselves and their abilities.

At the heart of her idea lies the belief that abilities and intelligence can be developed through dedication and hard work. Dweck contrasts this with a ‘fixed mindset’, where individuals believe their abilities are innate and unchangeable. This idea alone is hugely motivational.

One of the pivotal terms Dweck uses is ‘yet’. This small word holds immense power in shifting perspective towards a growth mindset and away from a fixed one. When faced with a learning challenge you might find yourself saying, “I don’t understand this”, which of course may be true. However, adding the word ‘yet’ acknowledges the difficulty but expresses optimism that you will figure it out.

The inclusion of ‘yet’ is a catalyst for resilience and perseverance. It can encourage you to embrace challenges rather than shying away from them, understanding that they are only temporary setbacks that can be overcome. ‘Yet’ reframes failure as a stepping stone to success and supports the view that mistakes are valuable learning experiences rather than indicators of incompetence.

It is sometimes difficult when talking about these sorts of theories to leave people with a clear practical application, but this is an easy one: give it a go, unless of course you don’t believe me ‘yet’.

Lisa Nelson is Director of Learning at Kaplan

In brief

Watch Lord Sikka in action on YouTube

We have turned Lord Sikka’s talk on the Post Office scandal into a 26-minute YouTube video. Where were the accountants, he asks, and he believes there should be an inquiry into their role in the whole debacle.

PQ columnist Lord Sikka emphasises that the scandal shows technology does not solve many of our problems , and in fact may actually create more.

He feels accountants need to be

Time to go beyond the buzzwords

While equality, diversity and inclusion (EDI) initiatives are increasingly commonplace, there is growing scepticism among professionals that these have now become mere ‘tick-box’ exercises, bringing few tangible improvements.

The worry is that, as a result, support for EDI efforts seems to be on the wane.

Research by the Young Foundation, which included ACCA, CIPFA and ICAS among the 12 professional bodies who took part, found that navigating professional life clearly comes with challenges for the vast majority of professionals from minority backgrounds. Almost three-quarters of those surveyed said they had experienced barriers to progression in their

careers, and felt they had experienced discriminatory or exclusionary behaviour in the workplace.

In the report ‘Beyond the

Destructive times await!

The world is falling dangerously short of the ambition that is needed to secure a safe future climate, says Emma Cox, PwC UK’s Global Climate Leader.

Commenting on the WMO ‘State of the Global Climate in 2023’ report, she added that the world’s collective failure to get to grips with climate change leaves us on

the cusp of an unpredictable and economically destructive time.

Cox said: “We must now bend

buzzwords’, author Alice Bell said the findings contradict claims that professional experiences are rooted in a meritocracy. Researchers found access and entry routes into many professions remain challenging for people from minority backgrounds.

The implications of this uncomfortable reality must be taken seriously, said Bell, as more than half (53%) of professionals surveyed say they have considered leaving their employer or profession because of issues related to EDI. Most commonly, this is because they feel overlooked or undervalued, with further concerns around progression, management, workload, pay and culture. They also feel excluded from informal networks.

the curve on emissions growth and urgently seize the opportunity to realign our global economy and net zero pathway with a 1.5°C future climate.”

PwC’s latest Net Zero Economy Index shows that a year-on-year decarbonisation rate of 17.2% is now required to limit global warming to 1.5°C above preindustrial levels – seven times greater than what was achieved over the past year (2.5%).

UK and Australia sign audit agreement

The UK’s Financial Reporting Council (FRC) and the Australian Securities and Investment Commission (ASIC) have announced a Memorandum of Understanding on Reciprocal Arrangements (MOURA) making it easier for auditors to work between both countries.

The agreement allows auditors

ready to deal with these challenges – and should remember IT is not flawless and can never be a substitute for human assessment and judgement.

Check out his talk at: https://youtu.be/jkCWvJt0l6A

Are you ready for Accountex?

Accountex London is returning this Spring, on 15-16 May 2024.

London’s Excel is expected to welcome over 10,000 accounting and finance professionals through

who have obtained professional audit qualifications as a statutory auditor in either the UK or Australia to more easily apply for recognition of their qualification and audit rights in the other nation.

FRC said this latest move will improve the quality of the UK audit market by increasing the number of skilled statutory aud-

its doors. The education programme offers up to 16 hours of free CPD, and will be held across 13 theatres and 250-plus sessions.

Among the speakers are former Chancellor of the Edxchequer Lord Hammond, who will be looking at what the future looks like for the UK economy and public finances. On his list is the part the tax system can play in delivering the solutions.

Mhari Aitken, ethics fellow at the Alan Turing Institute, will be

itors able to practise in the UK over time and make it easier for UK audit firms to export their services to Australia.

Similar audit arrangements have recently been signed with New Zealand and Switzerland, and the FRC is continuing to explore other agreements subject to rigorous qualification standards being met.

addressing the real risks of AI in her session.

PQ magazine is a partner of Accountex.

Great leap forward

ICAS believes its new syllabus and new way of learning represent the biggest shake-up in how it trains its students in its 170-year history.

ICAS CEO Bruce Cartwright explained that ICAS has constantly reinvented itself to remain relevant. See page 18 for more.

PQ the PQ Magazine May 2024 4

The finalist are…

Lio London, next to Leicester Square in the heart of the West End, is rolling out the red carpet for the 21st PQ magazine awards on 22 April.

But who are our finalists, we hear you cry. Well, they can all be found on page 16 of this issue.

As always the shortlist has some familiar and not-so-familiar faces on it. The town of Stockport will be well represented this year. Bee Motion (finalist in Best Use of Social Media) and Tim Mickleburgh (up for Graduate of

AAT scholarship still on offer

There is still time to grab an AAT scholarship, to help you get to the next level of your journey. PQ magazine and e-Careers have so far given away five sponsorships to AAT students. There is now one scholarship left to claim. To be in with a chance to win this last one you need to tell us why you should be awarded the free scholarship. Send your entry

to scholarships@e-careers.com, along with your full name and the level you want to study. You could be studying a whole level with nothing to pay!

Rebecca Guy, Jack Hancock, Khatra Ali and Hannah Walklett have already received their scholarship offers. And we have now notified our fifth recipient of their good news.

the Year) both hail from there. In a similar vein, Nottingham College and the Nottingham Chartered Accountant Students’ Society have also made the cut.

The awards will also have a real international flavour too, as one of the finalists for Lecturer of the Year, Ahmed Shafi, will be flying in from Pakistan.

It’s great too to see Bethany Duffy (pictured) on the NQ of the Year shortlist. She won PQ of the Year, but was unable to attend because she was in Australia. She promises she will be travelling down from Carlisle this year.

A special night is planned for all the winners and finalists.

Continued from page 1

(33%) and access to training and development programmes (30%).

Commenting on the findings, Ola Opoosun, Head of Support Services at caba, said: “The study findings show that there are still significant challenges for women working in the accountancy profession and that the industry still has some way to go if it’s to become a truly inclusive space for women. Many female chartered accountants are struggling with a lack of confidence in their role and this, in addition to other factors such as gender bias and a lack of representation at a senior level, is stopping them from reaching their full potential.

“We urge employers to reflect on the strategies and resources highlighted by many of the women who participated in our study and ensure that they’re doing everything they can to support and empower their female employees.”

As part of its ongoing commitment to the welfare of the ICAEW community, caba has launched its new Women in Accounting Hub, a dedicated online space where female ICAEW members can find support, development courses and other helpful resources.

PQ 5 PQ Magazine May 2024 PQ news

ROBERT BRUCE Profession must embrace all sorts

Many think accountants are the same the world over. But in fact they are not, far from it. Take the US accounting profession. Accountants in the US are very different from those in the UK, and it is down to the culture that shapes them.

In the UK people come into accounting from a range of disciplines. Imagine what it would be like if the only people who could become accountants were people with accounting degrees. It would, I suggest, tend to be a much duller world, and it wouldn’t necessarily attract the brightest and the best. They are not going to be people who always have brains that are bulging with ideas and the excitement of youth. But that is what happens in the US. You want to be an accountant? You have to have done a degree in accounting.

Raymond Chandler, writer and creator of the private eye Philip Marlowe some 70 or so years ago, started life as a bookkeeper. If such people cropped up in his books they were orderly folk amidst the gangster mayhem, wearing a row of different coloured pens in their breast pocket. Culture makes all the difference. And it is in the UK that accountants spread out all across the business disciplines. Small wonder that in a free-form world the UK profession is burgeoning and in the US it is dwindling.

Robert Bruce is an award-winning writer on accountancy for The Times

In brief

Time to swap planes for trains

BDO has told staff that they must swap planes for trains for shorthaul business trips so they can help the firm meet its net zero targets.

It is also telling workers to fly economy for journeys under seven hours and is also encouraging them to opt for premium economy class over business class on all longer flights.

BDO also wants everyone to travel less, and try to have fewer

STEM definition needs updating

AICPA and CIMA says MPs are right to call for accounting to be considered a STEM (science, technology, engineering, maths) subject in the UK.

A report by the All-Party Parliamentary Group (APPG) on Accounting for Growth, which CIMA provides the secretariat for, found that including accounting in STEM would give the grouping a more commercial focus, and guide young people towards developing highend skills relevant to the modern workplace.

The report stresses that the understanding of what STEM is supposed to achieve would benefit from clarification, and the grouping would benefit from a stronger focus on its commercial application. If accounting were considered a STEM subject, it would raise the status of the profession and recognise the

vital contribution it makes to the functioning of modern organisations.

Andrew Harding, FCMA, CGMA, Chief Executive – Management Accounting at AICPA & CIMA, said: “We welcome this report, and I hope it stimulates further debate on designating accounting as a STEM subject. In recent years, accounting has developed many high-level technical aspects, including the

It should be the same

Why, asked top tutor Chris Cain (pictured), are ACCA students in exam halls treated differently to those sitting their exam at home?

He said students sitting their exams in an official exam hall get pen and

paper to write and plan their answers. However, those sitting online get nothing and are subject to very strict rules about everything – they can barely move during the exam.

He said it was time

Time to tax capital gains fairly

Capital gains should be taxed at the same rate as income, says accountant and academic Richard Murphy in his Taxing Wealth Report. He said the arguments are straight-forward – capital gains are profits that people make from selling land and buildings, or pieces of art, or stock and shares, or anything else of that sort, that by

staff travelling together on trips. The firm is aiming to become a fully net zero business by 2050, and has an aim of reducing its emissions from business travel by 49% by 20230.

Outstanding balances

ACCA has reminded students that now is the time to pay any outstanding balance on their account.

ACCA said it is not too late for you to continue your journey – you

and large, wealthy people own.

Murphy stressed: “I can’t see any reason why they should pay a lower rate of tax on the money that they make from this activity than you and I do on working for a living.”

He added: “It is also very costly. We could raise at least £12 billion of extra tax revenue a year if the rates were equalised.”

just need to remember to pay your annual subscription. If any student is having financial difficulties or need further help, they should contact ACCA direct.

Siblings made up movies for £1m tax fraud

Brothers who tried to steal £1 million in a ‘staggering and audaciously dishonest’ film tax fraud have been jailed for a total of 14 years.

Craig Rees, 50, and his 52-year-

use of data analytics and advanced forecasting tools. It is right that this technical component is recognised through the STEM designation.

“Young people choosing their career paths should fully understand that if they train as accountants, they will be using cutting-edge technology to influence organisational decision-making at the highest level.”

for a level playing field and for the ACCA to relax the rules on those sitting online at home. Let them have paper, he said.

Cain, an approved trainer at PwC Academy, and PQ magazine are planning to work together to provide ACCA SBL students with a free, pre-seen mock, which can be marked for a small fee (£25). There will be more on this in the next issue.

You can read the Taxing Wealth Report 2024 at https://taxingwealth.uk/ Watch his video at https://tinyurl.com/mr2b2atc

old brother Carl, submitted fraudulent Film Tax Relief (FTR) and VAT claims to HMRC. The pair submitted inflated or made-up claims to HMRC for three separate films: Whispers, The Eight, and Violence.

HMRC proved the pair’s claims were fraudulently inflated for the first film, which was moved to the United States. The second film was entirely made up, and the third movie was produced in the US purely to submit further fraudulent claims.

6 PQ the PQ Magazine May 2024

Richard Murphy

WŝĐŬ�,d&d ĨŽƌ� ��d�

tĞ�ŚĂǀĞ�Ă�ƌĂŶŐĞ�ŽĨ�ůŝǀĞ�ĐŽƵƌƐĞƐ�ĨŽƌ���d�>ĞǀĞů�ϯ�ĂŶĚ >ĞǀĞů�ϰ�ƵŶĚĞƌ�YϮϬϮϮ, ƚŽ�ĐŽŵƉůĞŵĞŶƚ�ŽƵƌ ŽŶ ĚĞŵĂŶĚ ŽƉƚŝŽŶƐ�Ăƚ�>Ϯ �>ϯ�ĂŶĚ�>ϰ �

,d&d ůŝǀĞ �ƉƌĞ ƌĞĐŽƌĚĞĚ�ƐLJůůĂďƵƐ�ǀŝĚĞŽƐ�ƚŚĂƚ�ůĞĂĚ�ŝŶƚŽ�ƐĐŚĞĚƵůĞĚ�ůŝǀĞ�ŽŶůŝŶĞ�ŝŶƚĞƌĂĐƚŝǀĞ� DĂƐƚĞƌĐůĂƐƐĞƐ�;ǁŝƚŚ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ �Ăůů�ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ŵĂƐƚĞƌŝŶŐ�ŽĨ�ŬŶŽǁůĞĚŐĞ� ĂĐĐŽŵƉĂŶŝĞĚ�ǁŝƚŚ�ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ� &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ ĂĂƚ

dŚŝŶŬ����� �ƚŚŝŶŬ�,d&d

tĞ�ŚĂǀĞ�Ă�ĨƵůů�ƐƵŝƚĞ�ŽĨ ������ƉƉůŝĞĚ�^ŬŝůůƐ�ĂŶĚ ^ƚƌĂƚĞŐŝĐ�WƌŽĨĞƐƐŝŽŶĂů�ĐŽƵƌƐĞƐ.

▪ DĞŵďĞƌƐŚŝƉ�ŽĨ�ŽƵƌ�ǀŝďƌĂŶƚ�KŶůŝŶĞ�>ĞĂƌŶŝŶŐ��ŽŵŵƵŶŝƚLJ �ĂŶĚ�ĂĐĐĞƐƐ�ƚŽ�Ă�ĚĞĚŝĐĂƚĞĚ�ƚƵƚŽƌ

▪ ,d&d�WĂƌƚŶĞƌƐŚŝƉ�ƐƚƵĚĞŶƚ�ŶŽƚĞƐ�ĂŶĚ������ĂƵƚŚŽƌŝƐĞĚ�ƐƚƵĚLJ�ƚĞdžƚ �ĞdžĂŵ�Ŭŝƚ�ĂŶĚ�ƉŽĐŬĞƚ�ŶŽƚĞƐ

▪ &Ƶůů�ƐLJůůĂďƵƐ �dŽƉŝĐ�ďLJ�dŽƉŝĐ�ƌĞĐŽƌĚŝŶŐƐ�ƐƵƉƉŽƌƚĞĚ�ďLJ�ƚŝŵĞƚĂďůĞĚ� ůŝǀĞ�ŽŶůŝŶĞ �dƵŝƚŝŽŶ�DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ� ƌĞĐŽƌĚĞĚ �ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ ▪ ^ĐŚĞĚƵůĞĚ� ůŝǀĞ�ŽŶůŝŶĞ � ZĞǀŝƐŝŽŶ�DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ� �ƌĞĐŽƌĚĞĚ �ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ

▪ ,d&d�ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ �ŵĂƌŬĞĚ �ǁŝƚŚ�ĂŶƐǁĞƌƐ�ĂŶĚ�ǀŝĚĞŽ�ĚĞďƌŝĞĨƐ &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ ĂĐĐĂ

^ƚƵĚLJ��/D� �ĐŚŽŽƐĞ� ,d&d

^ƚƵĚLJŝŶŐ��/D� �KƵƌ�,d&d ůŝǀĞ �,d&d ŽŶ ĚĞŵĂŶĚ�ĂŶĚ�,d&d ƉůĂLJ�ƌĞƐŽƵƌĐĞƐ�ĂƌĞ�Ăůů�ŚĞƌĞ�ƚŽ�ŚĞůƉ�LJŽƵ�ƉƌĞƉĂƌĞ�ĨŽƌ �ĂŶĚ� ƉĂƐƐ �LJŽƵƌ�ĞdžĂŵ �

,d&d ůŝǀĞ �ũŽŝŶ�ŽƵƌ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ�ůŝǀĞ�ŽŶůŝŶĞ�ĨŽƌ�ŝŶƚĞƌĂĐƚŝǀĞ�DĂƐƚĞƌĐůĂƐƐĞƐ �ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ĂƉƉůŝĐĂƚŝŽŶ�ŽĨ� ƐLJůůĂďƵƐ�ŬŶŽǁůĞĚŐĞ �

,d&d ŽŶ ĚĞŵĂŶĚ �ĚƌŝǀĞ�LJŽƵƌ�ůĞĂƌŶŝŶŐ �ǁŝƚŚ�ĨƵůů�ĨůĞdžŝďůĞ�ƌĞƐŽƵƌĐĞƐ�ƚŚĂƚ�LJŽƵ�ĐŽŶƚƌŽů� ,d&d ƉůĂLJ ��ŽdžƐĞƚƐ�ŽĨ�ƚŽƉŝĐ�ƌĞĐŽƌĚŝŶŐ�ĂŶĚ�WƌŽĨŝĐŝĞŶĐLJ�ĞdžĂŵ ƐƚLJůĞ�ƉƌĂĐƚŝĐĞ�ĂƐƐĞƐƐŵĞŶƚƐ� &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ �ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ ĐŝŵĂ

KŶůŝŶĞ��ŽůůĞŐĞ�ŽĨ� ƚŚĞ�zĞĂƌ�ϮϬϭϳ

WĞƌƐŽŶĂůŝƚLJ�ŽĨ� ƚŚĞ�zĞĂƌϮϬϭ

WƌŝǀĂƚĞ�^ĞĐƚŽƌ��ŽůůĞŐĞ� ŽĨ�ƚŚĞ�zĞĂƌ�ϮϬϮϬ

^ƚƵĚLJ ǁŝƚŚ ,d&d WĂƌƚŶĞƌƐŚŝƉ ǁŚLJ ǁŽƵ ůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ tŚLJ ǁŽƵůĚ LJŽ Ƶ ŐŽ Ă ŶLJǁŚĞƌ Ğ ĞůƐ Ğ & Žƌ ŵŽƌĞ ŝŶĨŽƌŵĂ ƚŝŽŶ ĞŵĂ ŝů ŝ ŶĨŽ ΛŚ ƚĨƚƉĂƌƚŶĞƌƐ ŚŝƉ ĐŽ ƵŬ ǁ ǁǁ Ś ƚĨƚƉĂƌƚŶĞƌ

ĐŽ ƵŬ

ƐŚŝƉ

PREM SIKKA

New Bill targets the old, sick and poor

The Data Protection and Digital Information Bill going through parliament will change the relationship between state and citizen.

The Bill empowers the state to snoop 24/7 on the bank accounts of recipients of welfare benefits, including the state pension. The government claims that surveillance of the old, sick and poor will check benefit fraud, which in 2023 was estimated to be £6.4bn. No evidence of fraud by pensioners has been provided.

Currently, the government can request bank information on a case-bycase basis on suspicion of fraud only.

Under the Bill there is no such bar.

By snooping on bank accounts the government hopes to identify individuals who have more savings or income than permitted for meanstested benefits, and deny them payments. The government claims that mass surveillance would reduce fraud by £600 million over the next five years. For 2023-24, the government’s total expenditure is £1,200bn.

So, if you give a gift to a friend that pushes them over the savings or income limit, they may lose their benefits. If housing benefit is paid directly into a landlord’s bank account, then s/he also becomes subject to surveillance.

Despite the rhetoric of fraud prevention, no powers are being taken to snoop on the bank accounts of tax dodgers, money launderers or anyone overcharging the NHS.

Under the Bill, the right to financial privacy will only be available to the rich.

Prem Sikka is Emeritus Professor of Accounting at the University of Essex

Tax briefs

The childcare tax trap

Working couples with children face an “absolutely insane” financial penalty once their income goes above £100,000, says Stuart Adam, a senior economist at the Institute of Fiscal Studies.

Adam has criticised Chancellor Jeremy Hunt’s move to withdraw all free childcare entitlements and tax-free subsidies for working parents after their income crosses £100,000. He says this has created a childcare tax cliff-edge.

Reform package for apprenticeships

The UK government has said it will fully fund apprenticeships in small businesses from 1 April by paying the full cost of training for anyone up to the age of 21 – reducing costs and burdens for businesses and delivering more opportunities for young people to kick-start their careers.

This will remove the need for small employers to meet some of the cost of training and saves time and costs for providers like further education colleges who currently need to source funding separately from the government

and businesses.

From the start of April, the government also increased the amount of funding that employers who are paying the apprenticeship

AAT Training Provider Awards

The AAT Training Provider awards came back with a vengeance (in a good way), and there were lots of great stories on the night.

Peak Accountancy Training’s Stephanie Goodsell won AAT Apprentice of the Year, and she brought both her mum and grandma onto the stage to collect the award with her!

Training Link’s Katie Robinson walked off with the Student of the

Year award. She is also nominated for the PQ magazine awards later this month.

The coveted Tutor of the Year trophy went to e-Careers Karen Groves (pictured) and the Distance Learning Training Provider of the Year was Premier Training. Large Training Provider of the Year was awarded to New City College, and Apprenticeship Training Provider of the Year for

levy can pass onto other businesses. Large employers who pay the apprenticeship levy will be able to transfer up to 50% of their funds to support other businesses, including smaller firms, to take on apprentices.

Prime Minister Rishi Sunak (pictured) said: “Growing up in my mum’s pharmacy, I know first-hand how important small businesses are. Not just for the economy, but as a driver for innovation and aspiration, and as the key to building a society where hard work is always recognised and rewarded.”

2024 was Riverside Training.

Check out all the winners on page 22

ACCA signs exam deal with Uzbekistani body

ACCA and the Association of Certified Finance Professionals of Uzbekistan (ACFP) has agreed a joint examination scheme (JES) designed to enhance accountancy education and knowledge in the country.

Adam stressed that individuals also start to lose their personal tax-free allowance (£12,570) once their income crosses £100,000, pushing up their marginal tax rate to 60%.

The IFS has calculated that a parent who earns £134,000 with two children could be worse off than someone earning £99,000.

HMRC quick U-turn on closing telephone lines HMRC halted its proposed

The JES is focused on ACCA’s Advanced Diploma in Finance and Business in Russian (ADFBR). The ADFBR comprises seven exams and the Professional Ethics Module. As part of the JES individuals will have the

changes to its helpline services barely 24-hours after making the announcement on big, permanent cuts!

It said this is in direct response to immediate feedback, and now promises to engage with stakeholders about how to ensure all taxpayers’ needs – including small businesses – are met as HMRC shifts more people to online self-service in the longer term.

This means the phone lines for Self Assessement, VAT and PAYE will remain open between April and

opportunity to take examinations in taxation and law in compliance with Uzbekistan’s legislation.

In addition, after completing the ADFBR, students will be eligible to transfer to ACCA’s Strategic Professional level.

Mumin Ashurov, Director of ACFP, said: “We look forward to seeing students start to study the joint qualification. We are confident it will increase accountancy knowledge and expertise and will contribute to economic growth in the country.”

The JES is expected to run for an initial five-year period.

September, for this year anyway. HMRC’s CEO Jim Harra admitted that the pace of change in services needs to match the public appetite for managing their tax affairs online.

NI cuts are here

The National Insurance rates fell from 10% to 8% for 27 million workers across the UK, the second cut in a year.

It means anyone earnings a salary of £35,000 will have an extra £450 in their pockets.

8 PQ the PQ Magazine May 2024 news

Get your head around the new question types from AAT. Get Rogo.

Easily create accurate practice exams with Rogo’s question types, matching the new formats from AAT assessments.

to learn more

Visit getrogo.com

ANNA KATE PHELAN

Apple facing a sticky time in the US

There’s a big story developing in the US that may have a worldwide impact on the handheld device space.

The US Department of Justice (DOJ) is suing Apple for monopolising the smartphone market. They argue that Apple’s “exclusionary conduct” makes it difficult for people to switch phones, undermines industry innovation and imposes unnecessary costs on businesses, software developers and consumers alike.

Apple have been accused of blocking the growth of ‘super apps’, with functionality that would allow users to easily move between different smartphone platforms, diminishing the quality of cross-platform messaging apps so that consumers continue to buy iPhones. It is also accused of supporting limited functionality to drive purchases of both Apple Watch and iPhone, and limiting third-party digital wallets by preventing apps from developing their own cross-platform tap-to-pay.

The practice of enhancing a product’s ‘stickiness’ (the degree to which users have to return to the product time and time again) is well established in the tech industry. It appears that Apple may have hurtled towards increasing this metric without proper consideration of the potential legal ramifications.

It’ll be interesting to see how this case pans out. We have already seen a regulatory win for consumers, with the EU mandating that from the end of 2024 all portable electronics should use a USB-C charger, which will lessen the product ‘stickiness’ induced by Apple’s lightning charger cable. Watch this space!

FRC revises accounting standards

The FRC has issued what it says are “comprehensive improvements to financial reporting standards” for the UK and Ireland, which are used by 3.4 million businesses.

The changes follow extensive stakeholder engagement and consultation on the proposals with the FRC required to undertake a review of FRS 102 every five years.

The most significant changes apply to leases and revenue recognition to align with recent changes to international financial reporting standards. The changes

will provide better information to users of financial statements, including current and potential investors and lenders. In response to stakeholder feedback, the FRC said it has made improvements to the proposals for lease accounting and revised the recognition

Record year for Grant Thornton

It was another year of record performance for Grant Thornton, with net revenue up over 7% to £654m and operating profits up

18% to £146m, according to the 2023 annual report.

For the 12 months to 31 December 2023, the firm took on

exemption for leases of low-value assets to clarify that the focus is to ensure that the most significant leases are recognised on the balance sheet.

The FRC has also made a number of improvements and clarifications that are designed to make it easier for preparers to apply and understand the standards.

The FRC will also be hosting a webinar to discuss the new standards at 11am on 15 May 2024.

5% more employees, including over 1,200 new joiners and 25 new partners. Partner pay was up 11% to £644,000.

Grant Thornton’s CEO, Malcolm Gomersall, said: “2023 was another standout year for our firm and that’s down to the contributions of the more than 5,500 people who make up Grant Thornton. Whilst uncertainty, inflationary pressures and overall trading conditions continued to impact our markets, our firm’s resilience meant we are able to continue investing in our people and operations to remain a top choice for clients.”

Bahrain recognises AAT qualifications

Bahrain has recognised all seven of AAT’s qualifications, with the country’s education and training quality authority (BQA) aligning them with its domestic training framework.

Claire Bennison (pictured), AAT’s Executive Director of Customers, Partnerships, and Innovation, said Bahrainis completing an AAT qualification would rightly feel pride in their government’s affirmation of their new skills and knowledge.

More than 6,000 Bahrainis have studied the AAT qualifications since it began offering them to learners in the Middle East in the 1980s.

She said: “This recognition by Bahrain’s qualifications watchdog will be welcome news for the thousands of Bahrainis who already have AAT qualifications, but also for those who are aspiring to join our dynamic, global profession. Learners now have the clear assurance that with AAT they will gain a qualification of the highest standard.”

AAT is now hoping more countries across the Middle East will follow Bahrain’s move.

Female senior partner anyone?

Who wants to be PwC’s new UK boss? There are three candidates for the job: Marco Amitrano, head of clients & markets; Laura Hinton, head of tax; and Hemione Hudson, head of audit.

This is the first time women have appeared on the ballot, and there has never been a female boss of the PwC’s UK arm in its 175-year history.

The vote among partners takes place in April, and the winner will be unveiled at the end of the month.

Outgoing boss Kevin Ellis has spent eight years at the helm.

Deloitte expand office space in London

Deloitte has taken on more office space in central London less than two years after making drastic cutbacks, according to the Financial Times.

The Big 4 firm added 70,000sq ft of space in Shoe Lane, near its New Street Square HQ, and this means more staff will be returning to the office.

Deloitte told the FT: “In February we opened three floors in 66 Shoe Lane, with a fourth to follow later in the year – they are a mix of workspace and client space and increase our overall London campus space by 18% to support our growing business and ways of working.”

KPMG’s Jon Holt elected for second term

KPMG in the UK has confirmed that, following a partnership vote, Jon Holt has been re-elected with overwhelming support to serve a second term as the firm’s Chief Executive and Senior Partner.

Holt was appointed as CEO in April 2021, following KPMG in the UK’s move to a new governance model, which created separate roles for its Chair and Chief Executive.

Holt said: “2024 will see us make some big changes – combining our deals and consulting businesses into one practice called advisory –and exploring a potential merger with KPMG Switzerland to give us more collective power to invest and build new services for our clients.”

10 PQ the PQ Magazine May 2024 news

Anna Kate Phelan is Head of Product at Eintech

BOOK YOUR FREE TICKET WWW.ACCOUNTEX.CO.UK/LONDON PRIORITY CODE ACX132 TAKE YOUR PLACE AT THE FOREFRONT OF ACCOUNTANCY AND FINANCE THE No.1 ACCOUNTANCY & FINANCE EXPO NETWORKING EXHIBITION EDUCATION GET UP TO 16 CPD HOURS

EDDIE HERBERT

Crucial partners in setting SBTi targets

Accountants are emerging as vital partners for companies seeking to set ambitious emissions reduction targets through the Science Based Targets initiative (SBTi).

The SBTi enables organisations to align their climate strategies with the latest scientific consensus on limiting global warming to 1.5°C above pre-industrial levels, as outlined in the Paris Agreement.

By setting ambitious yet achievable emissions targets, companies can become climate leaders. This proactive approach enhances brand reputation in an increasingly eco-conscious marketplace and future-proofs businesses against potential regulatory risks.

Accountants’ expertise in stakeholder engagement can be invaluable in the SBTi journey. Their ability to understand current practices, future ambitions and feasible emissions reduction pathways helps ensure targets align with operational constraints and financial objectives.

Climate specialists such as Net Zero Now can turn these insights into actionable plans.

Net Zero Now’s end-to-end services equip companies to effectively set and meet ambitious emissions targets, from accurately measuring baseline emissions to conducting stakeholder consultations, reviewing reduction models and, ultimately, submitting targets for SBTi validation.

Ariel Edesess, ESG Senior Analyst at Hill Dickinson, said: “Working with the team at Net Zero Now to set acceptable sciencebased targets has been a powerful driver for us to make real, impactful changes.”

Using carbon accounting platforms, accountants can streamline the SBTi journey for their clients, fostering impactful sustainability efforts while contributing to the global fight against climate change.

Edward Herbert, Sales & Business Development Manager, Net Zero Now

Tech briefs

Google to charge

Google is believed to be looking at charging users for ‘premium’ internet search results powered by artificial intelligence (AI).

The tech giant’s main search engine would remain free to use, with additional content available to those who pay a fee, sources told the Financial Times.

Adverts would still appear alongside search results, even for subscribers, says the FT. However, charging would be the first time

US justice department sues Apple

A civil antitrust lawsuit has been filed against Apple over its “monopolisation or attempted monopolisation of smartphone markets in violation of section 2 of the Sherman Act”.

The US Justice Department and 16 other state and district attorneys are alleging Apple illegal maintains this monopoly over smartphones by selectively imposing contractual restrictions on developers. It is also claimed that Apple withholds critical access points into the market. That means Apple undermines apps, products and services that would otherwise make users less reliant on the iPhone, pushing

up costs for customers and developers.

The lawsuit emphasises it wants to restore competition to the markets “on behalf on the American people”.

Attorney General Merrick B. Garland said: “Consumers should not have to pay higher prices

because companies violate the antitrust laws.”

He continued: “We allege that Apple maintains monopoly power in the smartphone market, not simply staying ahead of the competition on its merits, but by violating federal antitrust law. If left unchallenged, Apple will only continue to strengthen its smartphone monopoly. The Justice Department will vigorously enforce antitrust laws that protect consumers from higher process and fewer costs.”

Meanwhile, Apple has rejected the allegations in the lawsuit and says it threatens the company’s core operations.

Intuit Quickbooks launches Bureau Payroll

Intuit Quickbooks has launched a standalone Bureau Payroll product for accountants, which is says will accelerate payroll for UK businesses.

Nick Williams, UK Product Director at Intuit QuickBooks, said: “QuickBooks Bureau Payroll was developed to alleviate the pain points that accountants face on a daily basis. Our research shows that payroll consumes up to one hour per client per pay cycle, which can

impact other critical tasks.

“The automation introduced by Bureau Payroll really makes

our solution unique. For instance, the automation of directoronly pay-runs has been met with a lot of enthusiasm from our accountant customers, who see the opportunity to reduce time spent on payroll accordingly. By boosting efficiency without sacrificing accuracy, accountants will have more time to focus on work that directly benefits their clients.”

Wolters Kluwer launches AML module

Wolters Kluwer has released an anti-money laundering module (AML) within its CCH iFirm platform.

A cloud-based solution, CCH iFirm AML provides accounting practices with the flexibility to manage AML compliance from anywhere at any time. In addition, it will offer biometric KYC – using

Google has made people pay for enhancements to its core search product.

Of course, Google already charges for some features such as storage space and for access to Gemini AI assistant in Gmail and Docs.

KPMG and Databrick

join forces

KPMG UK has formed a strategic alliance with Databricks, a leader in data and artificial intelligence. The alliance will help the firm’s clients

facial recognition to identify and authenticate individuals. This will remove the need to scan and email documents and check photos, helping to ensure secure and efficient identity verification, alongside a standard AML check.

Natasha Chryssafi, director of product management at Wolters Kluwer explained: “We realise that

get the most out of their data and AI and empower them to innovate at a faster pace.

Generative AI could add an additional £31bn to the UK economy per year, according to KPMG estimates.

It said that KPMG’s technical expertise, in combination with the Databricks Data Intelligence Lakehouse Platform, will help clients innovate using an open, scalable platform to meet all their data-driven requirements.

KPMG’s Audit practice is also

compliance with AML and knowyour-customer (KYC) requirements is vital for accounting firms, especially in light of continuing shifting regulations. CCH iFirm AML helps to transform the way companies manage their AML duties, helping them mitigate the risks associated with poor AML and KYC practices.”

embedding the Databricks Data Intelligence Platform with KPMG Clara, KPMG’s global audit technology platform.

Drones – a power for good!

One of the announcements in the Spring Budget that might have gone under the radar was the Government’s investment in drones for the emergency services.

However, PwC stressed an equal focus should be given to integrating drone data with existing systems.

12 PQ the PQ Magazine May 2024

tech news

Become a CGMA® designation holder with the CGMA® Finance Leadership Program.

Establish your expertise in the profession with the CGMA Finance Leadership Program (CGMA FLP). A digital-first learning and assessment platform, the CGMA FLP accelerates your route to the designation with flexible learning whenever and wherever you want.

Find out more at aicpa-cima.com/flp.

Founded by AICPA® and CIMA®, the Association of International Certified Professional Accountants® powers leaders in accounting and finance around the globe. © 2023 Association of International Certified Professional Accountants. All rights reserved. 2307-444079

BRAINIACS BRAINIACS BUSINESS WANTED

Lord Sikka is right

At first I thought that Lord Sikka’s call for an independent inquiry into the role of the accountants and auditors in the Post Office scandal was another way for him to ‘stick it to the establishment’. But after reading your frontpage article (PQ, April ’24) and listening to his recently uploaded video on YouTube, I have to say I have come over to his way of thinking.

We should know the name of the person at the Post Office who sacked the forensic accountants at Second Sight in 2013. I also see new evidence shows (in leaked recording) that officials knew of instruction for Fijitsu to remotely change sub-postmaster

accounts 10 year ago. All this was suppressed.

And the tapes reveal CEO Paula Vennells was also told about the serious issues in July 2013. It does all seems to

be unravelling for Post Office executives.

Finally, can I say that chartered accountant Rebecca Benneyworth (PQ, April ’24, page 36) just goes up and up in my estimation. It is interesting that her mum was a subpostmistress because she really understands how the scandal would have affected her. Her free website to help with the tax implications of compensation payments is a godsend for sub-postmasters and she should be made a dame!

Name and email address supplied

The Editor says: You can check out Lord Sikka’s arguments for an inquiry at https://youtu.be/ jkCWvJt0l6A. As our reader says, it is well worth a listen.

2XU�VWDU�OHWWHU�ZULWHU�ZLQV�D�IDQWDVWLF�o,�ORYH�34p�PXJ�

Lots of people have been watching Lord Sikka on YouTube talking about the Post Office Scandal. Here are some of your comments…

“A coherent and succinct overview. As Lord Sikka highlights, on the face of it this seem like an egregious failure by the internal and external auditors. Time after time with these major scandals we see that the external auditors prioritised their cosy financial relationship with the company over their broader legal obligations to the shareholders and the public interest. Arthur Andersen at Enron is the most salient example, but EY must surely bear some responsibility here. They have somehow managed to keep a low profile during these proceedings. As the good Lord says, time for an enquiry to examine their role! They should surely be contributing to the compensation of the SPMs, alongside Fujitsu and the POL?”

“Don’t go to market with a prototype with the expectation that bugs can be addressed on a live system. Classic failure of

project management no doubt caused by senior management demanding early results to get their bonuses. Bonuses drive short-term thinking and really ought not to be a feature of remuneration packages on taxpayer funded projects, ever.”

“What evidence besides a computer system did the PO have that the shortages were in fact real (none)? The computer should have been the first thread indicating as the PO saw it as theft. The next step should have been to discover where

the money went. They checked bank accounts, etc., but did not discover any missing money. In fact they discovered the opposite, that SPMs were taking out loans, borrowing money from friends & family to make up the shortfalls. Why would anyone who was stealing money arrange for loans (ending in bankruptcy, suicide, etc.) to pay back that same amount of money, doesn't sound logical.”

Watch the video at https:// www.youtube.com/ watch?v=jkCWvJt0l6A

@hmtreasury sent out a post on X (formerly Twitter) explaining: “Small businesses are the backbone of the UK economy. That’s why we’re cutting tax for small businesses, taking 28,000 out of paying VAT altogether. Another long-term decision to grow our economy.” Let’s just say it didn’t quite get the reaction it was expecting! Oh, and it put this out on 1 April.

David Pearce said: “Hmm. It’s not the business that pays it, but their customers. The business just passes it on.” Dean Maisey agreed, saying: “Small businesses don’t pay VAT – their customers do. If the business de-registers they can no longer reclaim the VAT they pay to suppliers for services/materials. So unless de-registering generates more business to cover the lost reclaimable VAT, the business will be worse off.”

Dan Richards said: “Surely a bad taste April Fools’ joke, as small businesses currently have the highest tax burden in years…” And Graham (not the editor) tweeted: “£5,000 is dwarfed by the increase in energy bills, interest rates, cost of living and commencement of bounce back loan repayments.”

Hud Pug wondered: “Is this another party election broadcast on behalf of the Tory Party?”

Interestingly (well, we were interested), the Electoral Commission answered this tweet. It said: “Communication from government departments providing information on a policy typically does not fall under electoral law. Electoral law covers such things as spending and donations by political parties and candidates, and the transparency of election material.”

All sorted then! Well, at least the tweet got 23.1K views. There are 456,200 people following @hmtreasury.

PQ Magazine PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker Contributors: Robert Bruce, Prem Sikka, Lisa Nelson, Anna Kate Phelan, Tony Kelly, Phil Gammon, Edward Netherton, Francesca Cullaney | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media If you have any problems with delivery, or if you want to change your delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2024

email graham@pqmagazine.com

OUR 2024 FINALISTS

The red carpet is being rolled out for all the finalists for the PQ magazine awards night. Who made it onto our shortlist this year? Well, here they are:

STUDENT BODY OF THE YEAR

Chartered Accountants’ Student Society of London

Northern Chartered Accountant Students’ Society

Nottingham Chartered Accountants Student Society

ACCOUNTANCY BODY OF THE YEAR

(announced on the night)

ACCOUNTANCY COLLEGE OF THE YEAR

PUBLIC SECTOR

Manchester Metropolitan University

Newcastle University Business School

University of Winchester

PRIVATE SECTOR

Accountancy Learning Limited

Future Connect Training & Recruitment

Kaplan

ONLINE COLLEGE OF THE YEAR

First Intuition

FME Learn Online Training Link

ACCOUNTANCY LECTURER OF THE YEAR

PUBLIC SECTOR

Dr Samar Gad, Kingston University, London

Dr Faisal Sheikh, Nottingham Trent University

Lim Keong Teoh, University of Winchester

PRIVATE SECTOR

Karen Groves, e-Careers

Ahmed Shafi, Mirchawala Hub of Accountancy

Maria Yearsley, Kaplan

STUDY RESOURCE OF THE YEAR

Accountext+

Corporate Reporting Revision

Preparation Session, First Intuition

Premier Training’s ‘Every1Welcome’ series

The Little Book of Secrets from AICPA & CIMA

INNOVATION IN ACCOUNTANCY

Creative Accounting, a collaboration between academics from QMUL, Coventry University and Monash University, Australia

First Intuition Accountancy Academy

Icarus accounting simulation App, UCL & Lynsie Chew

Nottingham College’s AAT delivery

BEST USE OF SOCIAL MEDIA

Bee Motion

Career Goals by Kaplan

Will Boardman (YouTube @willboardman) PODCAST

OF THE YEAR

Exam World Meets Business World, Paul Merison, LSBF

Kaplan’s Learn Better Podcast

Marty Windle SBL Guru Podcast

The First Intuition Podcast TRAINING MANAGER/ MENTOR OF THE YEAR

Zeeshan Ahmed, Future Connect Training & Recruitment

Dr Ishani Chandrasekara, Queen

Mary University of London

Libby Walklett, the Ethical Bookkeeper

ACCOUNTANCY TEAM OF THE YEAR

Newcastle University Business School

St Mary’s Accounting Services

The Financial Systems Team at Christie NHS Foundation Trust

GRADUATE/ APPRENTICESHIP TRAINING PROGRAMME OF THE YEAR

Buzzacott LLP

First Intuition Apprenticeship Training Programme

KPMG

ACCOUNTANCY PERSONALITY OF THE YEAR

Sarah Ghosh

Grace Hardy

Gareth John

EDITOR SPECIAL AWARDS

(announced on the night)

ACCOUNTANCY APPRENTICE OF THE YEAR

Diana Hume, Department of Business and Trade

Armanda Nazuiri, London Borough of Newham Council

Tomos Rees, Clay Shaw Butler

DISTANCE LEARNING STUDENT OF THE YEAR

Marina Frost

Katie Robinson

Gayane Voskanyan

ACCOUNTANCY GRADUATE OF THE YEAR

Corina Birca, London South Bank University

Tim Mickleburgh, University of Manchester

Alhaam Noer, University of Leicester

NQ OF THE YEAR

Bethany Duffy

Lyndsay Falconer

Arthur Kaliisa

Aishani Sinha

PQ OF THE YEAR

Luke Carter

Grazia Maria Pia Salcuni

Morgan McIntosh

Declan Stoppard

PQ Magazine May 2024 PQ Awards 2024 16 PQ

For more information and to receive 15% off your ICB Exemption application, call ICB HQ on 0203 405 4000 and quote ICBPQ Email us at exemptions@bookkeepers.org.uk www.bookkeepers.org.uk/PQ PQ with AAT, ACCA, ICAEW or CIMA? Why wait? Join ICB today! Fast track your career by using your existing qualifications to join the world’s largest bookkeeping organisation. As a Certified ICB Bookkeeper you’ll benefit from: Professional status and recognition Free legal and technical advice-line Local and national events Resources, webinars, templates and help sheets Accounting news, emails and updates Discounts with 100s of retailers including Sainsbury’s, Tesco, ASOS, and Curry’s And being part of a community that really cares The Institute of Certified Bookkeepers

Redefining accountancy training

ICAS explains what the new syllabus will look like and how it is changing the way students learn

The Institute of Chartered Accountants of Scotland (ICAS) has unveiled the biggest shake up in how it trains accountancy students in its 170-year history.

ICAS has launched both a new syllabus and a new way of learning for students. The new syllabus will make sure that the qualification remains relevant in an evolving global business landscape and ICAS students will learn through a UK first training model.

The new syllabus includes future-focused themes of sustainability, technology, and business ethics, alongside the core technical accountancy skills that the CA qualification is globally renowned for.

Great leap forward

Gail Boag, Executive Director of Learning at ICAS, said: “The introduction of the new syllabus and learning delivery model is the biggest leap forward yet in the way we train CAs. It allows us to keep pace with the influence of global socioeconomics and technology on business today. Firms were calling for greater flexibility in how we train students, and now thanks to our new model this is possible.

“While we have always updated our syllabus to reflect global developments to make sure that each generation of CAs remains relevant, this change is more significant, reflecting technological and other geopolitical factors that both enable and disrupt the profession.

“The qualification focuses on so much more than finance and equips students with the skills that they need to be business leaders of the future, incorporating ethics, sustainability, and use of technology as part of the syllabus.

“The method in which we deliver the CA training has evolved dramatically, creating the best possible learning environment which combines remote digital learning with in-person classroom and community events. But we also know that the true barometer of our success is the impact that our students will go on to make throughout their careers with the skills that we equip them with now. The CA designation remains a badge of quality and trust, something that can be seen in the fact that CAs hold senior positions in 83% of FTSE companies.”

The new syllabus was created in response to demands from the accountancy profession for a qualification that meets their challenges and helps them attract the best talent.

Sustainability and the impacts of technologies like AI are rapidly driving changes in the business environment and shaping the next generation’s career expectations.

The new ICAS syllabus empowers CAs by providing them with practical skills and knowledge to collaborate, communicate and provide leadership on sustainability issues. Helping boards and management understand the link between those issues and financial performance.

Reshaping the role

New courses cover topics such as data analytics and business intelligence, and students learn directly on the digital platforms, such as Xero and Power BI that are currently reshaping the role of the accountant, something that has not been done before.

Bruce Cartwright CA, CEO at ICAS, said: “Throughout our 170-year history, ICAS has constantly reinvented itself to remain relevant in an ever-changing world. The introduction of this new syllabus represents one of the biggest changes we’ve ever made. We believe it goes beyond the numbers, to foster the ethical mindset, technical skills, professional knowledge and practical experience that will establish CAs as the business leaders of the future.”

Scheduled across four terms each year, there are now more enrolment options and greater control over the paths students can follow.

Save time on your career progression with the CGMA® Finance Leadership Program.

Employers can also choose how quickly their students’ progress and how often and when they’re in the office focused on work and clients.

Three years’ time

Unique to ICAS, employers and students can see their course schedules three years in advance, and new electives provide opportunities for specialisation and role-relevant learning. All this is delivered while still maintaining the high levels of challenge and integrity for which the CA qualification has long been known.

The syllabus also features additional touchpoints that maximise students’ engagement with tutors and peers. These include in-person workshops, pre-assessment drop-in sessions and ICAS’ first-ever UK-national induction event, which will be held at the Edinburgh International Conference Centre on 9 September.

For the first time in the UK, accountant trainees and their employers can see what they’ll study for the entire three-year period at the start their studies. They will also be able to choose when they study certain subjects and specialties meaning that both the student and the employer can plan when they will study and when they’ll learn on the job, servicing clients and working in the business. Training with ICAS will also mean that students can study online, but also access in person workshops and tutor time.

18 PQ PQ Magazine May 2024 new ICAS syllabus

WANTED BRAINIACS BUSINESS

On Your Marks…

ACCA launches podcast series designed to help to PQs deal with the common issues confronting them as they look to get qualified

Are you putting off booking your first exam, or struggling to get back into studying after a failure?

A new podcast series launched by the ACCA, called ‘On Your Marks’,explores techniques to help students tackle any potential challenges head on, wherever they are at in their journey to qualification.

Hosted by ACCA’s Krutika Adatia (pictured), podcast guests include experts ranging from a life coach to a neuroscientist, to help students understand what can hold them back when setting out to achieve their goals – whether that’s preparing for an exam or training for a marathon.

From the importance of hanging out with your mates to the neuroscience of procrastination, the series explores how to get going when the going

gets tough – including techniques for building resilience for when life doesn’t go our way.

The episodes

Episode one – Preparing to start: Why can it be so hard to start something new, even if we want to? What might help us take the first step? We sit down with Michelle Elman, a five-board accredited life coach, author, broadcaster and public speaker, and all-round expert in helping people face their demons and rise to personal challenges. From coping with pre-exam nerves to dealing with envy when people post their wins on social media, we look at how we can clear the path ahead and get working on our goals.

Episode two – Setting great goals: In this episode we’re talking goal setting. We sit down

with cognitive behavioural therapist Sarah D Rees to understand why some of us struggle with setting, and achieving, our goals. From breaking down big plans to calming your inner critic, and rewarding yourself along the journey, we look at strategies to help keep us all on track –both practically and emotionally, while working towards our objectives.

Episode three – Building resilience: Pushing on towards our goals is great, but as we all know life can have a way of messing with even the best laid plans. In episode three it’s all about becoming more resilient. We sit down with Josh Wintersgill, Great Britain’s Young Entrepreneur of the Year in 2019 and founder of AbleMove, to dig into the topic of resilience. From tips on facing up to failure to an honest look at coping when we’re feeling low, we talk about strategies to keep us all going when the going gets tough.

Episode four – Nourishing relationships: When we’re pushing towards a goal, or just generally having a tough time, many of us will instinctively turn to our friends, family, colleagues or even pets for support. Why? In this episode we’re talking relationships. We sit down with Dr Anna Machin, an evolutionary anthropologist who has spent her career studying the science of close human relationships. From the neurochemicals underlying your tightest friendships to tips for the best social activities for your brain when you’re facing down deadlines, we dig deep into how our connection with others helps us get where we want to be.

Episode five – Beating procrastination: Procrastinating over tasks, even ones we care about, is a normal if painful part of life for most of us. We sit down with Dr Julia Ravey, a neuroscientist, author and self-confessed procrastinator. She’s an expert in understanding what’s happening in our brains when we put off tasks – from conflicts between the logical and emotional centres of our brains, to tricks for creating sustainable revision habits.

Episode six – Exploring ACCA resources: In this final episode we sit down with Paul Kirkwood, ACCA’s Regional Head of Education and Learning for ACCA in the UK. Paul is joined by new ACCA member Shaun Fenwick, who works in the accounting team at Brixton Brewery and recently completed all his exams. We talk about starting the qualification and the decisions you need to make, the common fears and struggles, resources available through your ACCA journey and how to push yourself to take that first step.

View now or listen through wherever you get your podcasts. And don’t forget to subscribe!

• Thanks to ACCA for this article

PQ 19 PQ Magazine May 2024 ACCA podcasts

Registered Tuition Provider

We are the AAT Distance Learning Training Provider of the Year!

To celebrate, we are offering £200 off AAT Accounting courses and £50 off AAT Bookkeeping courses throughout April.

This could be the perfect time to gain a practical, internationally recognised accountancy qualication that can open doors in any industry.

We offer interest-free instalment plans for all courses, as well as FREE Xero accounting software training and certication.

Please contact us on 01469 515444 or info@premiertraining.co.uk with any questions you may have.

You can also enrol online at www.premiertraining.co.uk

Get Started Today

Start your studies the same day24 hour online access with instant access to tutor support.

Learning Resources

Award winning learning resources including printed books, eBooks & e-learning, videos and quizzes.

Assignments

Prompt marking turnaround –marked by a tutor (not a computer).

Xero Advisor Certication

Training has teamed up with Xero and is pleased to offer the Xero Advisor Certication Equivalency Course FREE OF CHARGE to anyone who enrols.

Premier

515444 AAT Distance Learning AAT Distance Learning

www.premiertraining.co.uk 01469

How are your writing skills?

It’s time to write your way to your success, says

Cath Littler

Ihad the pleasure delivering a workshop to tutors and managers at AAT’s face-to-face training provider conference, something that I have done so often that none of us can remember a TP conference when I wasn’t running a workshop!

While the topics over the years have changed, the single thread of teaching accountants writing skills has remained constant and, whether English is a first or second language, there are three main points you should remember:

• Confidence and skill are built through repeated practice.

• You can learn how to structure an email to a client or an exam answer by learning the right phrases and including the right information.

• It is important to understand what you are being asked.

The yin and yang of practising writing

The really great thing about practising writing is that it helps you to understand what you are writing about. This is because if you write about something you must understand it enough to get your point across. You probably find writing to a friend about something that you are passionate about easy – because you know what you want to say and have probably said it repeatedly.

However, the first time you write about something your brain is not ready, so it is hard to find the right words. The more you write, the more you understand, and everything gets easier. This is because you have arranged the information in your brain ready to be shared.

So if you go into an exam and have to write about something that you have never written about before, you will struggle to do it well. If you have had a lot of practice, you will find it easier and quicker to answer questions and to get a good mark.

The right words and phrases

One of my roles is to end-point assess AAT apprentices who often discuss how difficult they found answering the phone or writing emails to clients when they started. Once they understand what words and phrases to use it becomes easier. After all, accountants must repeatedly email clients for information and the information required is usually similar, so the main section of the email will also be similar. The first email

to a client will take a long time to put together and will be checked by a manager, but over time trainee accountants learn the right phrases to use and the right information to ask for.

The same principle can be applied to answering exam questions. When you start practising it is hard, but over time and with regular practice you will learn the right words and phrases to use, and it becomes easier.

At the conference workshop I also encouraged tutors to use a range of different scenarios for learners to practice on. That is because it widens the learning experience; the more you must apply your knowledge to different situations, the better you understand it and can apply it at work and in an exam.

The right information

It is also always important to include a good amount of detail when communicating with clients or answering an exam question. For example, if you are emailing about an overdue invoice, you will include the invoice number, date, amount and when payment was due. If you are writing about changes to profit margins you should not just say that the margin has improved – that is not going to help the client or

get marks in an assessment. Instead, you should say something like ‘Profit margin has increased from 10.2% to 11.4%, showing that for every £1 of income, the organisation is now earning an extra £0.012 profit.’ That helps the client, and the examiner knows that you understand the principle.

So include details and explanations, even if it seems too obvious to you. The client and examiner need to see the information.

Understand what you are being asked

This is where answering client questions can be different from answering exam questions. Clients are often not sure what they are asking so some backwards and forwards is usually required before understanding is reached.

In exams you only get one shot at answering, so examiners use command verbs such as ‘state’, ‘explain’, or ‘describe’. You need to understand the differences between the verbs and what they are asking. AAT has lots of e-learning on command verbs – much of which I have written, so go and have a look so that you understand what examiners are asking.

• Cath Littler, head of learning and development at Mindful Education

PQ AAT Training Provider Conference

Awards

And the award winners are…

The AAT recently unveiled the winners of its Training Provider Awards 2024 – back after being away for four years. So who walked off with the coveted trophies?

Opening the 2024 awards in Nottingham, AAT CEO Sarah Beale, said: “Our Training Provider Awards recognise the life-changing excellence evident in the work of so many of our training partners. And this year’s calibre of nominations was exceptionally strong.”

AAT first held these awards in 2016, but this year was the first opportunity providers had to come together since the onset of the pandemic.

Addressing the room of 150 finalists, Beale stressed: “I want to congratulate each and every training provider, student and tutor who has been shortlisted for these prestigious awards. Each one of you has shown outstanding performance in the classroom, online or in the workplace.”

She went on: “Whilst being a finalist for an AAT Training Provider Award is an achievement in itself, the small number who clinched the top prizes can now rightly claim to be industry leaders.”

Beale thanked the judges for volunteering their time to shortlist the dozens of stand-out nominations, and who made the final call on the night’s winners – among them was PQ magazine’s very own Graham Hambly.

In all, 10 AAT awards were up for grabs. Prize categories for training centres included best

THE 2024 WINNERS IN

Small, Medium, and Large Training Provider Of The Year, New Provider, Distance Learning Provider, and Training Provider of AAT’s highly regarded apprenticeship programme.

Exceptional educators were also acknowledged on the night. The award for AAT Tutor of the Year went to Karen Groves of e-Careers. Meanwhile, learners Stephanie Goodsell and Katie Robinson received AAT’s top awards for best apprentice and best student, respectively.

The night’s first heart-stealing moment went to AAT Apprentice of the Year Stephanie Goodsell, who collected her award on stage supported by her positively beaming mum and nan, supremely proud of their Steph’s achievement.

Guests were told that Steph, who studies with Peak Accountancy Training, excelled in everything she does. She displayed serious commitment to both her academic studies and workplace responsibilities, having achieved first-time passes on all her AAT assessments and excellent grades in the process. Steph also received outstanding feedback from her placement employer, with the firm’s leadership noting the winning apprentice excelled in a variety of workplace challenges, including

dealing with VAT returns in foreign currencies and even playing a teaching role in helping senior managers navigate new accounting software.

The evening’s host, television personality Scarlette Douglas, said for many students taking the apprenticeship route balancing work and study is not always straightforward. She explained: “The world of work can be a challenging environment to adjust to, especially for those fresh out of school, but some apprentices excel and thrive. Steph, our AAT apprentice of the year, is clearly one of them.”

Douglas also announced AAT’s Student of the Year as Training Link’s Katie Robinson, the second ‘heart steal’ of the evening. “A remarkable student in every single aspect,” Douglas told the audience, “Katie overcame adversity when her dad became seriously ill early into her studies, requiring a three-hour round trip to visit him in hospital. She did this every day, on top of her study and work commitments. Despite the challenges, Katie achieved impeccable academic results in her AAT studies – even sharing her journey to motivate and inspire others.”

You can read more about Katie on page 26

Best

PQ 22 PQ Magazine May 2024 AAT Training Provider

FULL

Training Provider of the Year: University of Gibraltar

Training Provider of the Year: Future Connect Training and Recruitment Ltd

Training Provider of the Year: New City College

Small

Medium

Large

New Training Provider of the

Training

Ltd

Year: 3 Counties Accounts

Service

MAS

International Training Provider of the Year:

Education: Management & Accountancy School (Myanmar)

Apprenticeship Training Provider of the Year: Riverside Training

Distance Learning Training Provider of the Year: Premier Training

AAT Tutor of the Year: Karen Groves (e-Careers) AAT Apprentice of the Year: Stephanie Goodsell (Peak Accountancy Training)

AAT Student of the Year: Katie Robinson (Training Link)

Recognition Award Winner:

Intuition – AAT special recognition award

AAT Special

First Intuition First

Stephanie Goodsell (Peak Accountancy Training) – AAT apprentice of the year

PQ 23 PQ Magazine May 2024 AAT Training Provider awards

3 Counties Accounts Training Services – best new training provider of the year

Time to wave your napkin in the air, like you just don't care

Future Connect Training & Recruitment – the medium training provider of the year

MAS Education: Management & Accountancy School (Myanmar) – international training provider of the year

New City College – the large training provider of the year

University of Gibraltar – the small training provider of the year

Riverside Training – apprenticeship training provider of the year