PROTECTING THE UK FROM GLOBAL THREATS

BREAKING THE SUPPLY CHAIN IMPASSE

BREAKING THE SUPPLY CHAIN IMPASSE

collaboration, it’s Possible.

Ericsson is creating a world of limitless connectivity, where mobile technology opens new possibilities to pioneer a sustainable future. ericsson.com/imaginepossible

Head of UK5G Robert Driver

Head of Marketing Vicki DeBlasi

Content Creation and Curation

Crispin Moller

Lauren Kelly

UK5G Social Media

Kate Cartwright Administration

Emma Dexter

Contact : www.uk5g.org/about/contact/

c/o CW, Bradfield Centre, 184 Cambridge Science Park, Cambridge CB4 0GA

T: +44 (0)1223 967101 W: uk5g.org

Maeve Hickey

Mija Valdez

Kate Bealing

CWJP

Chairman Keith Young MBE

Editor Simon Rockman simon@cwjp.co.uk

Consulting Editor

Andrew Orlowski andrew@cwjp.co.uk

Creative Director Matthew Inman

Business Development Director

Roger Hinkson roger@cwjp.co.uk

Finance Director Delia Robinson

Photography Stuart Berman

Special Projects Alex Young

CWJP

14 Great College Street, London SW1P 3RX

T: +44 (0)20 8002 0000

Standalone is the tech of the future. Device security is a worry. Amazon starts CBRS biz and more Sonic funds.

DCMS is looking to stimulate British production of mobile network apparatus. A £36m fund has done that with the FRANC programme welcoming 15 consortia and 60 companies to kickstart an ecosystem that promises great innovations in equipment design.

Your easy reference guide to the 50 projects running in the Testbeds and Trials programme, FRANC, SONIC, WM5G, they include Urban testbeds, Rural projects, Industrial & manufacturing, Health & social Care. Creative media & sport. Ports & logistics, and Supply chain diversification. 4

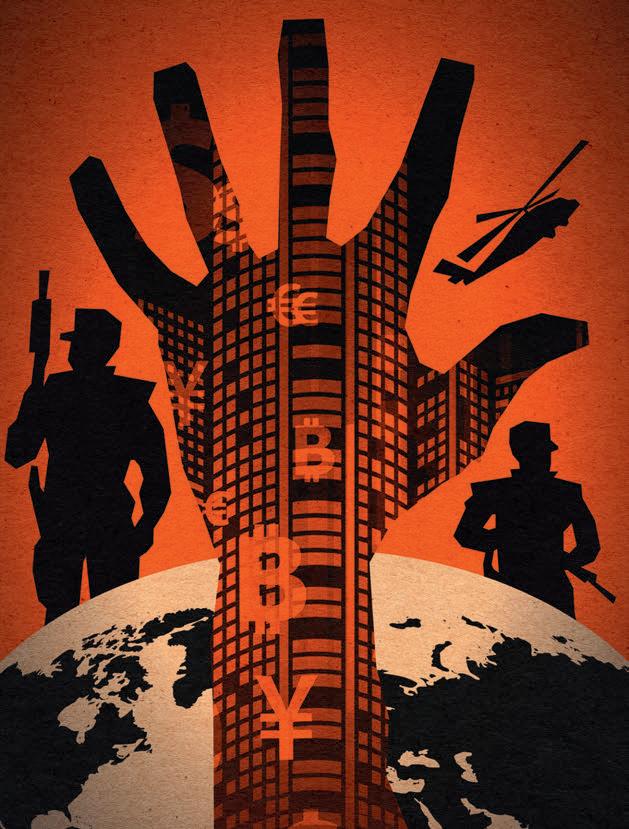

Huawei fears have been addressed but the chip shortage continues while, Russian, North Korean and state-supported hackers pose an ongoing problem.

Replacing visits with virtual pharmacists, Liverpool’s PANMAN has improved lives and reduced costs.

and reduced costs.

49

Once there were only four networks. Now there are thousands. What was true for Television foretells the future for mobile. Falling technology costs and liberalisation of spectrum has opened the way for a confederation of open private networks. These fill in unprofitable not spots and provide special services tailored to vertical markets. Catherine Gull tunes in.

UK5G INNOVATION BRIEFING IS PUBLISHED BY CW JP ON BEHALF OF UK5G, THE NATIONAL INNOVATION NETWORK FOR 5G . ALL RIGHTS RESERVED. ARTICLES MAY NOT BE REPRODUCED WITHOUT WRITTEN PERMISSION FROM CWJP. OPINIONS, COMMENTSAND VIEWS INCLUDED IN THE JOURNAL ARE NOT NECESSARILY THOSE OF UK5G

The first ever corporate wireless email system was at British Leyland in Coventry. This heritage is reflected in 5prinG, pronounounced “Spring” the West Midland 5G incubator programme is teaching dozens of companies about using communications to grow their businesses in construction, transport, manufacturing and health.

BEFORE I JOINED DCMS I WORKED FOR Ericsson, as a chartered engineer specialising in network design and optimisation. A proper, and rewarding, engineering job Solving engineering problems is what makes me tick, so when I was approached to run the 5G Testbeds and Trials Programme I jumped at the chance. The DCMS role was anopportunity to work in something different; funding incredibly bright people to experiment with 5G use cases. A £200m programme to build a 5G ecosystem.

Heading up the programme is a little like being a headmaster. I think of each of the projects as pupils. Individuals with skills and aspirations.

I’ve enjoyed watching them grow and mature, overcoming difficulties and turning ambitions into deployments. We’ve had many firsts within the projects and the achievements and awards they have made and received gives me a great sense of pride.

We are now coming to the end of term. The UK’s 5G showcase we are holding in Birmingham on March 22nd and 23rd will see the results of the projects demonstrated and, pandemic allowing of course, be a chance to meet and celebrate what we’ve achieved.

Like any good teacher we’ve learned a lot from the projects. They have influenced spectrum policy and we’ve seen lessons learned in the earlier ones benefit later ones. This has always been a research and development scheme so it’s no surprise that many have ended in a different place to where they started.

But the greatest thing we’ve learned is the need for more choice in infrastructure, particularly Open RAN apparatus. And that’s where this year’s new intake comes in. Wearing my proud headmaster mortarboard, I’m beaming at the calibre of the teams behind FRANC.

THE 6G FUTURE

Terahertz frequencies, Terabits speeds, free optical space transmission and new encoding technologies. Academics are always a step ahead. Some of the smartest people in mobile look at what the future has to offer. The standards are up for grabs and the battle lines are being drawn up. But what will we use it for?

We were bowled over by the number and quality of the applications. There are impressive names there: Three of the four UK mobile operators, ARM, Amazon, Toshiba, Thales, eight universities and significant overseas contributors adding to the funding from DCMS. That’s just the winners. The projects which have been funded represents fewer than half the applicants. I’d like to thank the team at DCMS, and our external advisors who marked the entrance exams. Next term is going to be very exciting. I am also keen to those who were unsuccessful to keep going and continue to contribute to the UK Telecoms agenda.

Now however it’s time for me to pick up the spanners again. I am moving on to become the CTO of a rapidly growing company rolling out fibre and 5G to underserved rural areas.

Vicki DeBlasi looks at the work UK5G is doing to promote the benefits of 5G to Transport, Health and Social Care

Working together is not always something that can be phoned in. Prepandemic there were weekly events. The UK’s 5G Trials International Showcase will be an opportunity to meet

WHILE EVERY CARE IS TAKEN IN COMPILING THE CONTENT, NEITHER UK5G N OR THE PUBLISHER ASSUMES RESPONSIBILITY FOR EFFECTS ARISING FROM THIS PUBLICATION.AVAILABLE ONLINE AT CWJPRESS.COM/UK5G

I’ll be sorry to leave the fantastic people I’ve worked with over the last four years, and extremely proud of our achievements. We have built a 5G ecosystem, and I look forward to taking my place within it

Ian Smith 5G Testbeds and Trials Programme Director, DCMS

Ian Smith 5G Testbeds and Trials Programme Director, DCMS

THE UK’S 2G AND 3G networks will be turned off by 2033 at the latest, 41 years after the first GSM phone call was made. The big four mobile networking operators have promised to abide by the timetable set DCMS, although the Government lacks the power to compel them to do so.

The policy follows the recommendation made by the Telecoms Diversification Taskforce for stakeholders to agree on a sunset date. “The phasing out of these older services has been completed or in process in a number of other countries (eg, Australia, Canada, USA, Japan, South Korea),” the Taskforce noted. The US expects to complete to shut down 3G by 2023.

2033 is later than many would have predicted just a few years ago. For example, mobile industry expert and entrepreneur Nick Hunn told Parliament in 2016 that 2G “is scheduled to be turned off by 2026 at the latest, with others putting the date earlier”. 2020 was even touted, but a lot can happen in four years.

Switching off 2G and 3G will allow the spectrum to be “refarmed”, and put to use by more modern 4G and 5G networks.

Very few consumer mobile phones, aside from those with big buttons sold to older users, still use 2G or 3G, but issues arise with emergency services, and embedded and industrial equipment. Alarms systems and security cameras will need to be replaced, and while the eCall safety system for cars was optimised for 2G and 3G. New cars old sold in the EU since April 2018 must be fitted with eCall. A VoLTE (4G) version was only agreed three years ago. However, the biggest challenge of all in the UK will be with domestic smart meters. Second-generation (SMETS2) smart meters use 2G and 3G. While the communication component is a discrete module, these will still require an upgrade.

Earlier this year, Mike Hewitt, CTO of Capita-owned DCC, which operates the network used by smart meters to talk to energy companies, explained that, “4G has only reached a reasonable level of national coverage in 2020 and 5G will only have the required level of coverage towards 2030. It also has challenges with penetration into the parts of homes required for meter connectivity.”

The Taskforce noted that prolonging 2G was an obstacle to the policy goal of increasing supply chain diversity.

“The UK environment poses particular challenges to new vendors due to the ongoing requirement for and support of 2G, 3G, 4G and 5G networks,” the TaskForce concluded. “This imposes additional complexity on vendors considering entry to the UK marketplace and some neither have nor wish to develop solutions for technologies that are being phased out elsewhere.”

As a result, the switch off target is enmeshed in wider efforts to diversify the mobile telecoms equipment marketplace, and accelerate the adoption of OpenRAN standards.

“Joint activity will include investment in the research and development, deployment, and

adoption of open network technologies, creating the right market environment to foster and encourage innovation, and international partnerships that bring together learning from across the global supply chain,” DCMS explained in its announcement. £250 million has been committed to accelerate the adoption of the OpenRAN market in the UK. The R&D competition FRANC [see page 12] is an example.

The Government stated in the same announcement the target of 35 per cent of mobile traffic to be carried on OpenRAN equipment by 2030.

The Government rejected a Lord’s amendment to report on the progress of the diversification strategy to Parliament. “We have not yet committed to a specific way of reporting progress, as policy work is at an early stage and the criteria for how we measure its success is evolving in line with our policy,” Lord Parkinson of Whitley Bay, and the Parliament Under Secretary of State (Minister for Arts) told the House of Lords told in the Telecommunications (Security) Bill in November.

Ghz band to all.

AMAZON HAS MADE A dramatic entry into the fastgrowing private 5G network business Amazon Web Services announced its AWS Private 5G offering on November 30th, promising to reduce much of the time and complexity for a business looking to create a 5G network for its customers and partners.

“With just a few clicks in the AWS console, customers specify where they want to build a mobile network and the network capacity needed for their devices, and AWS delivers and maintains the small cell radio units, servers, 5G core and radio access network (RAN) software, and SIM cards required to set up a private 5G network and connect devices,” Amazon says.

Amazon argues that the complexity of integration, which often means outsourcing and co-ordinating multiple vendors, is a barrier that is deterring many enterprises from operating a private network.

AWS cites industrial and manufacturing use cases, sports venues and health care in its list of use cases, but the most interesting business innovation is in the pricing. Customers pay only for the bandwidth they use, rather than a perdevice fee. This means a business will be able to scale up or down rapidly between tiers.

AWS Private 5G is only available for trial so far in the US, where the network will use the shared spectrum service, Citizens Broadband Radio Service (CBRS), which opens the 3.55 Ghz to 3.7

Although Amazon is keen to use equivalents in other countries, no service outside the US has yet been announced. Ofcom made shared spectrum in four bands available in 2019, although one of these is for indoor use only. These aren’t suitable for macro (wide area) networks, but could be very useful for enterprises which know where they do business, such as their own factories and offices. By September 2021, 71 low power licensees had been issued to 23 licensees, and 192 medium power licenses to 13 licensees.

Growth is extremely rapid in this market. More than half of the organisations surveyed by NTT late last year (51 per cent) said they planned to deploy a private network within the next two years, while almost a quarter had already done so. Over 80 per cent surveyed agreed that the pandemic had made obtaining a budget for a private network easier, and Amazon’s flexible pricing model may make that an even easier sell. Over a third of organisations surveyed currently prefer to use a managed service provider (MSP) model for the private network.

At least three out of four new private networks in 2022 will be 5G, up from 31 per cent at the end of 2020, estimates Analysis Mason in its end of year predictions.

To find out more see https://aws.amazon. com/private5g/

ONLY ONE IN FIVE consumer devices embeds basic security into the product, and the Government is introducing new legislation to make sure they do. The Product Security and Telecommunications Infrastructure (PSTI) Bill was introduced on November 25th, and sets standards for ‘consumer connectable products’ It encompasses products such as smartphones, connected cameras, wearables and fitness trackers, smart home assistants like the Alexa speaker, and home automation and alarm systems.

The law follows an IoT security consultation by DCMS in 2019. The department worked closely with the National Cyber Security Centre, security experts and standards bodies such as ETSI to create the legislation.

ETSI, which had already created specifications for an IoT security standard, published a companion specification for securing smartphones on the same day.

ANALYSYS MASON IS EXPECTING A TWO YEAR SPIKE OF CAPITAL expenditure in standalone 5G networks, as operators upgrade to the latest and more capable equipment.

So far, 5G networks added so far are ‘non standalone’, an incremental upgrade to 4G adding NR (new radio) capabilities. 2022 will be the start of a period in which a cumulative $990 billion will be allocated to 5G investments, or around 65 per cent of total capital expenditure by mobile operators.

Labelling nonstandalone 5G networks as 5G has led to criticism, particularly in the United States, where independent consumer testing suggests that devices attach to a 5G network just 16.4 per cent of the time on AT&T, and 9.7 per cent of the time Verizon – both national networks. The official GSMA rules allow a handset to show a 5G icon if a network is available even if 4G is being used.

The analyst company made the prediction in its final quarterly bulletin of 2021. It also anticipates the supply chain squeeze to continue inhibiting demand into 2022. Analysys Mason calculates that 105 million fewer 5G handsets have been sold than might have been expected. It isn’t just components. Long delays in fulfilling Apple iPhone 13 orders were caused by outbreaks of coronavirus in Vietnam, where the devices are assembled. This has led to consumers sticking to their and spending their money on other purchases. Apple said it had cut its iPhone 13 production goal by 10 million units.

The ETSI specification TS 103 732 (see www.bit.ly/3FbojCy) addresses hardware, operating system software, and preinstalled system applications. Within those parameters, it covers a broad range of security features including cryptographic support, user data protection, identification and authentication, security management, privacy protection, resistance to physical attack, secure boot, and trusted communication channels. It identifies key assets of consumer mobile devices to be protected and identifies the threats associated to them and the functional capabilities that are required to mitigate those threats.

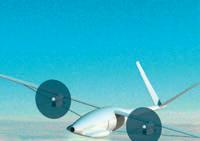

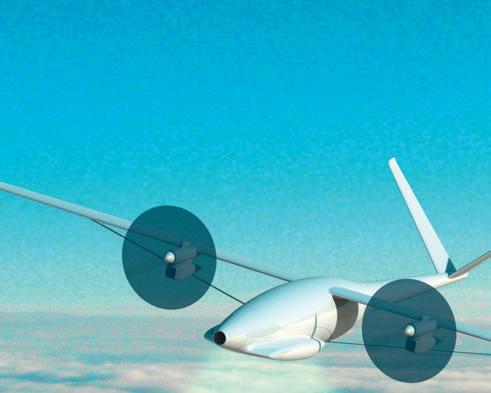

ABRITISH company has developed a unique radio solution to put 5G in the sky, using pilotless drones powered by ‘green hydrogen’ to wipe out rural notspots.

Stratospheric Platforms Ltd is backed by Deutsche Telekom and led by the former CEO of the NATS air traffic control operation and a member of the UK government’s drone industry group, Richard Deakin.

The idea isn’t new - it’s one example instance of a high altitude platforms (HAP) which has

been tried before by companies including Facebook and Google parent Alphabet, but without success.

But the radio technology is new. The company has developed a unique 3m by 3m rotating antennas which once fitted to a drone could provide 5G connectivity for an area of 140 square kilometers (54 square miles). The antenna is composed of 2,000 parts providing beam forming, shaping and directing the signals to a specific area. “One aircraft could provide the M25 with coverage with a beam the shape of the M25,” Stratospheric Platforms

BUFFER ZONES are being established around some US airports after a stand off between the US air industry regulator, the Federal Aviation Authority, and the two leading US mobile networks.

The FAA has safety concerns over equipment in the 5G C-Band, at 3.7 GHz to 3.98 GHz interfering with radio altimeters on aircraft.

The C-Band was auctioned last year but has seen no deployments yet. The telecoms regulator the Federal Communications Commission has found no interference issues, and the networks have offered to lower the power of base stations near airports to allay concerns. But that didn’t stop the FAA issuing two mandatory advisories in December, which came into effect immediately. These order

Ltd’s CEO Richard Deakin told the BBC. Implementation will require changes to licencing which currently forbids flying base stations.

Deakin is the former CEO of the NATS air traffic control operation and a member of the UK government’s drone industry group. Deutsche Telekom has invested £70m in the company.

The drones fly at 60,000 feet, twice the height of commercial air traffic, and can stay airborne for nine days before returning to refuel. In an added twist, the drones can now be powered by ‘green hydrogen’, generated from surplus renewable energy. The hydrogen prototype will make its maiden flight later this year.

Unlike satellites, HAPs don’t require an intermediary technology such as a satellite base station to get connectivity. But the track record to date has been sketchy. Facebook abandoned its own solar powered drones project in 2018, and Alphabet liquidated its stratospheric balloon venture Project Loon after a decade of research in 2021. Loon absorbed $100 million of investment and was once named by Google founder and CEO Larry Page as his favourite Google ‘moonshot’. But the Loon engineers found it difficult to control the free floating balloons once they were in the stratosphere, however, where winds can reach speeds of 155 mph and change direction suddenly.

“Another great British invention, I fear, threatening to head off overseas,” wrote the Daily Telegraph’s Jeremy Warner in April.

For more information see www.stratosphericplatforms.com

the pilot of a landing aircraft who can’t see the ground because of poor conditions, not to use the aircraft’s altimeter, and require them to find another place to land.

“These limitations could prevent dispatch of flights to certain locations with low visibility, and could also result in flight diversions,” the FAA explains.

The C-Band and the altimeters don’t use the same portion of the

spectrum, but they are closely adjacent, separated by 220Mhz from the 5G radio traffic. The stand off requires one of the two warring agencies to give way. While the FCC has found no evidence of altimeter interference from 5G, the FAA says it has no proof 5G will not affect the altimeters.

In the UK, the Shared Access Spectrum N77 band runs from 3.8 GHz to 4.2GHz.

BUILDING A DIVERSE SUPPLY chain is a top priority for DCMS which has announced a cash injection of up to £15 million for SONIC Labs. This will help test equipment that might be used to meet an ambition for 35 per cent of the UK’s mobile network traffic to be carried over Open RAN by 2030. The labs at Ofcom and the Digital Catapult in London form a prototype testing facility for next-generation telecoms tech.

Run by Digital Catapult with support from Ofcom, the SONIC Labs programme enables telecoms suppliers to integrate early-stage products into working end-to-end systems tested in lab and real-world mobile network settings.

SONIC Labs opened in June 2021 with an investment of £1 million. The extra £15 million will be invested so the Lab can expand its programme of testing and international engagement.

Joe Butler, CTO, Digital Catapult said: “Diversification and interoperability are key

themes driving UK capabilities in advanced digital technology and we are pleased to expand Sonic Labs’ role in delivering fast, secure and reliable connectivity. We look forward to expanding access to our testbed network to companies looking to experiment with and test new products and services.”

The boost for the labs was announced alongside Digital Secretary Nadine Dorries, while meeting US Secretary for Commerce Gina Raimondo at the end of last year. Dorries§ said: “5G technology is already revolutionising people’s lives and businesses - connecting people across the UK with faster mobile data and making businesses more productive. We can only do this through stronger international collaboration”

The Secrtary of State also met with Director of the White House Office for Science and Tech Policy, Dr Eric Lander to discuss strengthening ambitions for the US-UK Technology Partnership which aims to foster collaboration on shared challenges across a range of issues including online safety, data and digital competition.

TECHNOLOGY INCUBATOR 5PRING IS WORKING TOGETHER WITH THE PINNACLE of motorsport, Formula 1® to explore the potential of 5G to revolutionise the events of the future. Formula 1 will work alongside Digital Catapult and a cohort of small and medium-sized enterprises to jointly explore 5G solutions to events industry challenges, as part of 5PRING: the UK’s first 5G commercial application accelerator. Formula 1 looking at ways to enhance event experiences for fans, making viewing experience more inclusive and interactive for audiences whether onsite and home - through the use of 5G and innovative technologies.

To find out more about 5prinG see page 20 of this issue

Vodafone has vowed to hire 7,000 new software engineers as it builds out its 5G services platform. They’ll be under the Vodafone Technology umbrella, across the UK and Europe. “Expanding software capabilities will allow Vodafone to build differentiated products and services at lower cost and own the intellectual property (IP) rather than sourcing them through suppliers,” the company said. Vodafone is also committed to cutting the time to create and launch new products and services by half, thanks to a new common API, and a single global services catalogue.

At least half of 5G’s chicken and egg problem may have been resolved. 60 per cent of new smartphones sold in the US are now capable of 5G, according to Simon Baker, co-ordinator of IDC global forecasting for the analyst company. In value rather than unit terms, 5G now represents two thirds of the market, and for Apple, some 85 per cent of new units shipped. All of Apple’s new models have been capable of 5G since the iPhone 12 in September 2020. Significantly, Chinese handset sales account for 46 per cent of the global 5G market, down from 87 per cent a year ago. Network rollout is lagging, however. OpenSignal found that consumers with both 5G smartphones and 5G plans are spending less than 10 per cent of their time connected to 5G, and it was only available in under a quarter of the locations they visited. T-Mobile gives the best average download speeds, availability and reach, according to OpenSignal. See www.opensignal.com/reports/2021/10/ usa/mobile-network-experience-5g

DCMS has launched a new resource aggregating helpful material for local and regional authorities who want to know more about 5G. The Place Hub is the fifth of its kind https://uk5g.org/discover/ places/ “We know from speaking to organisations that 5G can seem complex and intimidating; this work is looking to address that,” says UK5G’s Vicki DeBlasi. More on the vertical campaigns to promote 5G adoption on page 55.

I’m delighted to continue our work supporting companies testing and integrating Open Ran products.

JOE BUTLER

The global Covid-19 pandemic has brought into sharp focus the new ways in which we live and connect with each other. It is now clear that we are living through a time of profound global technological and sociological change, while also confronting another defining issue of our time: the climate emergency.

Although these issues are complex, there is reason for optimism. The solutions required to overcome some of these defining issues of our time present vast possibilities for our world too. But for this to work, both the public and private sector must show that they will drive forward, together, a shared purpose of limiting global warming to 1.5°C or less.

For the 140 years of its existence and its 120 years in the UK, Ericsson has always had a purpose: to connect people. But with immediate action required now to safeguard the planet for future generations, it is committed to ensuring that this global connectivity is a force for good. Ericsson believes that a more connected future is a more sustainable and resilient future.

COP26 was a pivotal moment for businesses and governments across the globe to confront their responsibilities to safeguard the planet from excessive temperature rises. It is now clear that to limit temperature rises to 1.5°C by the end of the century, the ambitions set out at the conference will need to be followed by action in quick step.

1 in 7

As a global technology leader, Ericsson understands the role that innovation must play to transform the economies which support the aspirations of a growing population of almost 8 billion people. There is an urgent need to find a more sustainable equilibrium for the planet. But given the pressing nature of the climate emergency, breakthrough innovations that will take time to materialise cannot be the only route forward. Instead, the focus must be on the tools and solutions that can be deployed at scale today to make a measurable impact.

When it comes to 5G there is no need to imagine what is possible. The digitisation of economies, and the transformation of traditional industries through the application of 5G already promises enormous energy efficiency gains and carbon savings. Put simply, more 5G connectivity is fundamental to the UK and Europe achieving their climate targets.

Ericsson’s recent Connectivity and Climate Change report found that this technology can play a crucial role in enabling the societal and environmental transformations necessary to deliver immediate carbon savings and keep the 1.5°C target alive. It specifically found that for Europe, 5G connectivity enabled solutions could reduce the continent’s CO2 emissions by 15 per cent by 2030 That’s the equivalent of taking one in seven of the EU’s cars off the road.

5G enables businesses to make considerable sustainability gains by increasing the energy efficiency of operations. For example, this can be achieved through better monitoring of usage, or by reducing waste and material costs through optimising management practices. The same report found that using 5G technology across the four high-emitting sectors of power, transport, manufacturing and building could raise the total emissions reduction up to 20 per cent. This is equivalent of the total annual emissions of Spain and Italy combined.

Despite these clear benefits, 5G’s roll-out across the UK isn’t where it needs to be. It is lagging behind both North America and North East Asia, with 5G population coverage currently around just 36%. As a result, in the UK, 5G market penetration has been low: with just 6% uptake, while Western Europe trails closely behind. While progress has been made in 2021 with the conclusion of a long-awaited spectrum auction in the UK, it is in danger of strolling towards a more connected, low-carbon future, while

others are sprinting in the same direction.

Ericsson examines the crucial role of 5G and connectivity in the UK and Europe’s net zero journey5G connectivity could help reduce Europe’s CO2 emissions by 15 per cent by 2030. That’s the equivalent of taking one in seven of the EU’s cars of the road.

With 5G roll-out, Europe is strolling towards a more digital, low-carbon future, while other regions are sprinting in the same direction. Policymakers and regulators have a major role to play here by realizing the competitive economic, social and sustainable potential of 5G.”

Borje Ekholm, CEO Ericsson. Ericsson Climate and Connectivity report 2021

A continued slow roll out of 5G and adoption here in the UK will delay the ability to take advantage of the opportunities that connectivity enables for people, business and the planet. To change this status quo, policymakers around Whitehall and regulators across the board have a major role to play by working together at pace to overcome practical, regulatory and financia l obstacles. Once 5G is understood as the backbone of the digital economy with the benefits that it offers, it will be able to reach its full potential in helping the UK to reach the sustainable recovery that it requires. For example, support from Government so that Mobile Network Operators can obtain access to deployment sites will be key. Three UK recently revealed that 50 per cent of planning applications are turned down across the country, and near enough 100 per cent are rejected in London alone.

We will also need 5G technology to enable immersive online collaboration and communication tools – helping to shrink distance, simulate physical presence and

reduce travel. Healthcare, education, road and rail can all benefit from the positive effects of a modern digital infrastructure and combine to further reduce the human impacts on the planet. Next generation connectivity can also pave the way to cleaner and smarter energy, introducing real time data and infrastructure monitoring to create “intelligent” energy networks, making today’s suppliers more efficient and flexible in response to the country’s future energy demands. Once these benefits become obvious and tangible, demand for this type of technology across both consumer and enterprise areas will be catalysed.

The Government and telecommunications industry in the UK need to play their part in developing solutions, helping to create an environment that will foster the deployment of these technologies. This will in turn will open up new revenue streams, grow the economy but also help the planet to drive down emissions.

Recent analysis commissioned by Ericsson and conducted by Analysys Mason found that the full roll out of 5G could be worth £15bn to the UK in net economic benefits, in addition to the already expected benefits of enhanced mobile broadband. We can already see that the seismic changes that 5G can deliver are not just theoretical, they’re market ready, and are delivering carbon savings today in the UK and beyond:

• Ericsson’s 5G Smart Factory in Lewisville, Texas uses 24% less energy and 75% less indoor water, avoiding 97% of operational carbon emissions than comparable buildings.

• In Dorset, Ericsson and Vodafone are pioneering a number of 5G innovations to revolutionise rural connections, improve conservation and farming methods and enhance the wellbeing of local communities. For example, it is home to the world’s first connected buoy and agri-trials with 5G connected robots, sensors and drones all of which can drive down carbon emissions.

• In Nottinghamshire, drones powered by 5G have been used to safeguard forest ecosystems, providing the local council with huge volumes of real time data from difficult to reach areas. This information helps teams to understand, measure and take effective action to preserve these vital resources for future generations.

• The Port of Livorno in Italy has been transformed by 5G deployed by Ericsson, using IoT sensors to track activity and provide invaluable mass data collection for decision-making and better coordination between humans and devices which can be replicated across the world. Annual cost savings of €2.5m have been estimated, with a 25% improvement in productivity and a reduction in CO2 by 8.2% per port terminal.

So that the meaningful and urgent action that is required to combat the issue of climate change can be taken, the public and private sectors need to apply the same urgency to this immediate digitisation as they have to other necessary emergency measures, as done very recently during the pandemic. Except this time, it is not a race to digitise to support remote working. It is the race for our futures.

To find out more about how Ericsson is pioneering a sustainable future through limitless connectivity see www.ericsson.com/sustainable-future

FIFTEEN CONSORTIA HAVE won funding from DCMS to develop new technologies which will expand the choice that both the big mobile operators, and the growing number of companies installing private networks have when specifying equipment. The Future RAN Competition, known as FRANC, is the first of a new breed of 5G projects. In a departure from previous initiatives such as the 5G Testbeds and Trials, FRANC is intended to stimulate research and development of new infrastructure products.

The need for this comes from the dearth of suppliers of telecommunications equipment. Once there were dozens of

companies developing mobile infrastructure, from Marconi to Motorola, today there are only a few major players that are deemed secure, and in the UK that means a choice between Ericsson and Nokia. With all networks wanting to buy from at least two companies, the government wants to stimulate the market, grow british technology and generate Intellectual property FRANC reflects a wide mix of participants, from universities to startups, small innovative companies and major multinationals. Three of the four major mobile network operators are among the companies involved, along with one overseas operator. For example the Flex5G project has attracted international partners, leading operators and

technologists to deliver the most flexible, advanced 5G-SA network solution that Europe has to offer.

There is an emphasis on supporting Open RAN, pioneering new technologies, and developing the components that go into mobile phone cells.

When the FRANC competition was announced, DCMS said it was looking to take a portfolio approach. It would not just fund bids designed to provide the Mobile Network Operators with complete alternatives but seek to build a British ecosystem with complementing and cooperating projects.

Here we look at the projects and how they will revolutionise the market for mobile network apparatus.

WE KNOW THAT THE UK has brilliant scientists and technologists. Only the US has more Nobel prize winners. But too often inventions originating thanks to UK innovation have gone on to be commercialised overseas.

The Future RAN Competition - or FRANC for short - is different. This £36 million scheme will support R&D right across the UK to develop a new breed of more open and interoperable mobile networks made of equipment from a range of suppliers.

The aim of this is not just to produce new products that are globally competitive, but to speed up the construction of the more secure, resilient and innovative telecoms supply chain we need for the future.

With more than sixty companies and organisations taking part in fifteen projects, collaboration is one of the most important aspects of the FRANC.

We’ve got the support of all of the main UK networks, as well as Microsoft, Cisco and many other major businesses. While the projects are part-funded by DCMS, several of these partners are contributing to the overall project cost.

Many of the projects look at more flexible, efficient and intelligent ways to build a cell, construct a network and put it all together. It’s about understanding what makes a mobile network tick and what can be done differently, including developing new components for making cells and new testing equipment to ensure the kit is working correctly.

FUNDING TABLE

Communication and cooperation between the participants will lead to them being far more than the sum of their parts, and will supercharge the government’s £250 million strategy to end our reliance on a small handful of firms to build and maintain our telecoms networks.

We all know the benefits to the economy of better digital connectivity. The government is committed to delivering the next-generation of broadband to even the most hard-to-reach parts of the UK through Project Gigabit - the biggest government-backed roll out ever seen in this country. Much of that will be fibre, but having our own 5G technology will be essential for many of the harder to reach locations.

But FRANC is not just about delivering better and smarter 5G products. The scheme is looking to stimulate the British telecommunications industry in a new and open way. It’s about building an ecosystem and commercial models that can be used to sell British telecoms brilliance around the world.

Some of this brilliance has come from the experience gathered in our 5G Testbed and Trials programme, which thanks to our £200 million investment since 2017 has developed a whole host of new uses for 5G to propel our economy and enhance people’s lives.

For example, Bristol-based Blu Wireless is working with the Airspan team in Reading to explore how to enable seamless connectivity between base stations in roadside and other mobile infrastructure, for when we and our phones are on the move.

The Best of British project, or BoB, grew out

The huge interest in the competition, with significantly more applicants than anticipated has seen a large number of projects funded.

Projects range from radio test equipment with a DCMS contribution of less than £370,000 to a British designed, built and manufactured mobile network at nearly £5m. All programmes are fund matched with the consortia providing a minimum of 40 per cent of the development cost. Figures given here are just for the DCMS element of the funding.

of a Rural Connected Communities project just south of Stonehenge which found that there was a lack of suppliers of small cells suitable for the new breed of small network.

I consider myself very lucky to have become the minister responsible for telecoms just as FRANC is starting out. As I write this, we are finalising the contracts with a view to projects kicking off in early 2022. I’m looking forward to getting out and about to meet the teams and learn more about each one.Once the projects have developed their early-stage products, they will be able to put them to test in Sonic Labs - a state-of-the-art facility backed by a £16 million government investment that enables telecoms companies to gather granular levels of data on how their equipment behaves in a fully interoperable, technology-neutral mobile network.

The article here explains what each of the projects is working on. Use it as a guide to aid communication, cooperation and collaboration.

Lopez

FRANC is looking to stimulate the British telecommunications industry in a new and open way. Building an ecosystem and commercial models that will sell British telecoms brilliance around the world.Julia

Amajor challenge for every mobile operator is the integration of the private networks in a secure and cost-effective manner.

This project sets out to solve that problem for the industry.

The project sees one of the largest operators in the UK working with one of the smallest. Led by Virgin Mobile O2, The 5G Drive consortium brings together Wavemobile, Cisco, Ori Industries, and the University of Warwick. Wavemobile brings its expertise in depolying small, specialist networks targetted at notspots. Ori Industries is expert at deploying cloud-based edge processing technologies.

Rapid growth and interest in private networks means a more streamlined approach needs to be taken to get private and public networks working side by side. In the past it has been possible to treat each instance as a special case but the volume of new deployments makes this impractical.

The 5G Drive project is developing an 5G Open and Diversified RAN Integration solution for private mobile networks, that is low cost, secure, and capable of integrating with public networks. The consortium will also include a ‘Vendor Evaluation phase’ for private 5G RAN vendors to test their networks against the solution concepts.

The objective is to make it easier for the customers of the mobile network operators to install their own private enterprise networks in a manner which is as uncomplicated for both parties as possible.

The business opportunity for the project is to find a low cost and secure solution that will allow Diversified/open private 5G network RAN vendors to be easily Integrated into public networks, as well as carrying out Vendor Evaluation of the developed Future RAN Competition solutions too.

The Telecom Infra Project-led Accelerating RAN Intelligence in 5G project (ARI-5G) will drive progress on network management and optimisation for Open RAN.

Specifically, ARI-5G examines how the RAN is operated in a multi-vendor environment, focusing on the RAN Intelligent Controller (RIC) and its role in network automation, providing fine grained, use case driven control and management of RAN resources.

An interoperable ecosystem will benefit the entire telecommunications industry, and the demonstration of multi-vendor network management models will be a key enabler to adoption.

This project will look to validate interoperable architectures while seeding technical capabilities in the industry.

Although elements of Open RAN-based architectures are increasingly being deployed worldwide, several of the specific technologies are still in developmental stages.

The aim of FRANC is that development activity and the subsequent creation of new standards can occur in the UK. The programme ensures that devlopment activity and creating new standards occurs in the UK, and incorporates many UK partners.

Most network operators are enthusiastic but also cautious about Open RAN, and technology vendors still need to prove various concepts before purchase orders will be made by operators in larger numbers.

The caution means that some vendors have been reluctant to invest because the marketplace is still developing. This project can provide validated solutions that can unlock demand and encourage further investment

Led by TIP, the Telecom Infra project, the consortium includes Accelleran, Amdocs, AttoCore, BT, VIAVI and West Midlands 5G.

Beacon-5G will develop a high performance Open RAN 5G system aligned with Open RAN framework and principles, focusing on reconfigurability, security, trustworthiness, and service architecture agility.

Led by Toshiba Europe, the project consortium brings together recognised global technology leaders, Toshiba and Thales, along with four Tier 1 International O-RAN equipment suppliers - Accelleran, Benetel, Effnet, Phluidoand a prominent UK 5G core network solutions provider, Attocore.

Also involved is NDEC, a UK centre of excellence in cyber resilience, the Institute for Future Transportation and Cities at Coventry University, and two public sector organizations - South Gloucestershire Council UK , University Hospital Coventry and Warwickshire NHS UK. with ambitious digital transformation agendas.

The broader vision is to realise a highperformance 5G system that can be rapidly reconfigured and optimised for diverse industrial and consumer applications. These may be in private local networks, or public carrier networks. Deployments, from mobile network operators (MNOs) or non-MNOs, can be extended to both industrial and consumer sectors in indoor as well as outdoor environments

The goal of building a high-performance, robust, versatile, and resilient 5G system based on general-purpose hardware, thirdparty RAN and core components, and openinterface solutions is not possible without solving a significant number of challenges. The project provides various technological innovations toward some of the main functional priority areas identified by DCMS, thereby playing a key role in achieving the goals of the UK Government’s 5G supply chain diversification strategy.

Best of British, or BoB will build high performance small cells 100 per cent designed and manufactured in the UK. The apparatus it produces will significantly reduce the cost of deploying a small network through advanced radio design, while expertise in engineering low power consumption cells will reduce the environmental impact and running costs.

The Project is led by Telet Research, which as a full operator member of the GSMA bills itself as the fifth UK mobile network. It will be working alongside specialist cell manufacturer cellXica and Southampton University spin-out AccelerComm.

E xisting equipment uses generalised algorithms for some aspects of cell design. AccelerComm optimises these for 5G to deliver substantial performance gains. A network built using hardware designed with this technology will need 20 percent fewer cells than a network built with existing technology to provide the same level of coverage . Working closely with the engineering team at cellXica means that the technology can be delivered in a short timescale.

The relationship between the partners was as a direct result of UK5G organised events for FRANC. The cell the project will design will be built in a short production run aimed at serving private, local government and industrial owned networks which operate within UK Shared and Local Access Spectrum.

The project will offer a complete Neutral Network solution which includes spectrum acquisition, numbering, core and operator interconnect. This is a much more comprehensive offering than most end to end offerings. E xisting test and trial locations in Liverpool, the Chalke Valley in Wiltshire and other urban, suburban and rural test beds that were established in earlier 5G RCC and Create projects will validate the technology.

The Coordinated Multipoint Open Radio Access Network (CoMP-ORAN) will deploy densified outdoor small cell clusters using 5G New Radios (NR) to complement existing mobile networks, reduce the cost-per-bit and deliver enhanced 5G network performance.

The project is led by 5G Neutral Host Operator Dense Air, working with Airspan Communications, Blu Wireless, Radisys and the University of Glasgow.

Building radio backhaul into a cell significantly reduces the need for expensive fibre installations. At the same time, CoMPO-RAN will provide enhanced performance in the form of better coverage and higher capacity. This will enable mobile network operators to deliver excellent 5G at a significantly lower cost-per-bit and enabling faster deployment timelines by removing the need for the installation of fibre backhaul at each cell in a cluster.

This project will develop a novel 5G New Radio CoMP algorithm and software implementation, plus a new 5G RAN product with an integrated mmWave fronthaul capability developed by Blu Wireless. The project encompasses the full lifecycle, from concept design through to prototyping and proof-of-concept deployments, which will be used for validation in preparation for mass commercial deployment.

It is anticipated that the product, developed and prototyped in the UK will be widely exported, initially targeting markets where Dense Air operates.

The solution will be validated at the AutoAir testbed at the Millbrook automotive proving ground, an existing DCMS 5G funded project, providing a secure environment to evaluate and document the solutions impact in real-world scenarios ahead of scaled commercial deployments.

One of the most challenging components in a mobile network site is the ‘Distributed Unit’ or DU. This performs signal processing, converting radio signals to data traffic that can then be transported by the microwave, optical and wireline networks to the core network infrastructure.

The project will develop Distributed Unit devices to meet industry requirements including reduced power, smaller form factors, improved spectrum efficiency and reduced latency.

Working principally with UK based vendors, it will integrate products into an operational Distributed Unit component that is ready for deployment in 5G networks.

Through this integration, the collaborators will accelerate the understanding of component integration, knowledge which can then be embedded into emerging Open RAN standards.

Open and stable interfaces are at the root of Open RAN, enabling innovation through the selection of component vendors to meet specific market requirements.

Led by ADVA Optical Networking, the consortium comprises AccelerComm and CommAgility, both of whom are experts in the deepest level of cell architecture, along with BT and the University of York. The fifth member, the Scotland 5G Centre, provides project co-ordination and leading collaboration with other projects and organisations. Testing of the DU will initially be conducted at labs in the North of England supported by ADVA UK, with later testing taking place at BT’s Adastral Park facility.

Development of the Distributed Unit through the project will reflect market requirements, for example neutral host deployments, where the innovation of Open RAN delivers benefits over traditional architectures.

The Energy-efficient Cloudlets for ORAN, or ECORAN project will reduce the power consumption of the commodity hardware used by Open RAN.

A cloudlet is a small-scale server cluster which provides low latency data processing close to the smartphones, tablets and wearable devices it is designed to serve. It is a form of Edge processing. While Fog Computing needs connection to the cloud and Mobile Edge Computing is always standalone, Cloudlets can operate in either mode.

ECORAN looks to reduce the energy consumption of cloudlets by introducing novel ways of interconnecting and managing the cloudlet servers, accelerators, storage and interfaces.

The project is led by the University of Leeds in partnership with Ultracell Networks.

ECORAN takes an intelligent approach to scaling capacity as it is needed. For example, demand peaks may be witnessed in stadiums, in shopping centres and in city centres for short durations during a match, during the lunch hours or during an event.

The servers currently consume around 20 per cent of the total power consumption of the Cloudlet. This is expected to rise to over 80 per cent of the total power consumption. The processing capability per server has increased slowly, but the network interconnecting servers has evolved from 1 Gb/s to 10Gb/s server interfaces, to its current standard 100Gb/s rate. Speeds of 400Gb/s per server connection are expected soon. Initial results show that the power consumption of the network interconnecting the servers can be reduced by around 82 per cent and a similar reduction in latency, of around 85 per cent, is observed by eliminating the hierarchies of the switches that connect the servers.

IImplementing fundamental changes to its complete 5G SA network, Flex-5G has a tagline ofFlexible, Efficient and HighPerformance 5G Open RAN. The project’s network or sub-parts thereof that can take many forms, even combining the whole 5G SA network into one box similar in physical appearance to a desktop computer, server or workstation, as might be installed in a factory or office.

Led by systems integrators AWTG, the consortium is impressive for having three mobile operators working together: Vodafone and Virgin Mobile O2, along with Zain from Saudi Arabia. The roll-call adds Lime Microsystems, University of Surrey 5G..6GIC, CommScope, Viavi, Emirates ICT Innovation Center (EBTIC), Amazon Web Services and Cambridgeshire County Council. Five of the members of the consortium are unfunded in that they will contribute to the project without receiving support from the DCMS grant.

Flex-5G is fully Open RAN compliant so can be broken down into constituent distributed modules that can interoperate with modules created by others. This presents vast flexibility and diversification benefits. The solution is at the cutting-edge of “software radio”, doing as much as possible in software using general purpose processors in conjunction with other programmable elements. Flex-5G leverages the flexibility of its software-basis applied to this commodity hardware to increase the performance and efficiency of the 5G network, and to improve upgradability, customization to use cases, robustness and security through software patches and configuration options. OOther cutting-edge 5G innovations are introduced in Flex-5G, most notably key advances on Massive MIMO technology—improving the performance and practicality of high-end 5G networks.

Although the smallest project in FRANC in terms of funding, the FRAT project packs a punch and will produce equipment to be used in the development of mobile base station infrastructure.

Radio test systems have historically required customized, home-brewed setups. As much time and cost can be spent debugging the test setup as is spent designing the radio. This creates a significant barrier to entry for radio developers, as the development team not only requires radio expertise but also requires digital skills to develop baseband emulators. AceAxis, in partnership with MAC Limited will build a Future RAN Advanced Test system, for use by radio network equipment vendors who are designing, building and testing 5G Future RAN radios. A standardised solution will encourage new entrants to focus on innovation of the radio and the antenna.

Swindon based AceAxis has a history of building equipment which optimises the use of radio spectrum on cell sites so that different frequencies don’t interfere with one another. MAC, which is based in Southampton, has been experience of the specification, design and implementation of wireless systems going back to 2G.

Future RAN interfaces are clearly defined. Using these interfaces, along with 3GPP definitions, provides the opportunity for the Future RAN Advanced Test system to become a trusted industry standard for developing 5G radios. By allowing radio developers to focus on their areas of expertise, FRAT will reduce barriers to entry and encourage 5G radio supply chain diversification.

Building on AceAxis existing products this project will create a standardised, costeffective, off-the-shelf solution that covers the key RF measurements with the Future RAN optical interface, in a single unit.

Almost every piece of 5G hardware requires multiple semiconductor switching devices to generate the signals being transmitted. Gallium nitride (GaN) switching devices are used in a wide range of applications from consumer electronics to defence radar systems. UK developed GaN technology is used in NASA’s Mars Perseverance rover.

GaN is set to become the technology of choice for 5G communications hardware due to its high frequency operation and high-power density.

The ORanGaN project will develop a sovereign UK supply chain, including manufacturing processes, and packaging solutions for radio frequency gallium nitride (RF-GaN) devices.

Manufacturing will take place at the chip Fab near Newcastle.

The project is led by INEX Microtechnology, working with Custom Interconnect, Viper RF and the Compound Semiconductor Applications Catapult.

High demand has led to a worldwide shortage of manufacturing and design capacity for semiconductors including GaN devices. Currently, there are no UK manufactured GaN devices suitable for 5G applications. All current 5G hardware uses semiconductor devices made offshore instead.

Inex manufactures RF-Gan devices used in radar systems, however working at the higher levels of precision required to work at 5G frequencies poses new challenges: it requires smaller feature sizes, and a higher degree of control than for lower frequency radar applications. This project will deliver a new UK based manufacturing processes, facilities and device designs required by 5G.

The project will enhance the UK’s manufacturing capacity for GaN devices in the mobile supply chain.

O-RANOS main motivation is to address key architectural and technological challenges for deploying end-to-end O-RAN multi-domain (private-public) interoperable networks.

This will allow the creation of new business models that can be used for both Enterprise and public sector customers as well developing new use cases.

Led by the Cellnex Connectivity Solutions and working with University of Bristol, Attocore, Weaver Labs, Satellite Applications Catapult and Parallel Wireless the project will add value to the O-RAN Alliance specifications by particularly focusing on the emerging public and private 5G network multi-vendor Open RAN environment and their interworking challenges. To achieve this, O-RANOS will leverage the rApps and xApps development framework supported by the Open RAN architecture. The project will develop x and r application templates that will enable APIs to interact with the A1 and E2 interfaces as well as Machine Learning production models (CNFs predictors). For example, a key focus for xApps development will be RIC based handover between public and private networks.

To extend further the opportunity of privatepublic interoperation, the project will implement novel backhauling and neutral hosting services with a particular focus on satellite backhaul (mainly GEO and LEO constellations) for connecting to different core vendors.

In order to aid the development of further features, validate outcomes and accelerate deployment, O-RANOS will build an AppStore that will deploy and manage applications. An example will be implementing a Zero Trust approach for security. ML training phase and production models will be leveraged as part of the AppStore offering.

Proteus is breaking open the proprietary nature of mobile base stations by creating a flexible layer of software which interfaces directly to the radio hardware. This will allow companies, large and small, outside the handful of big vendors to develop competitive products which are quicker to market, lower cost and have lower -power consumption.

E xisting equipment uses designs dictated by the choice of the baseband processor. The Proteus Open RAN architecture will separate, or abstract, the underlying hardware from the baseband processor.

Slotting in a new processor will no longer require a redesign of the whole cell, giving the manufacturer a wider choice of suppliers and the ability to upgrade as new processors become available. The improved choice extends to the ability to use CPUs designed for general computing applications such as PCs and servers, not just dedicated mobile phone baseband processors. This reduces the costs and improves supply chain resilience.

The consortium is led by Parallel Wireless with ARM, BT, the University of Bristol, Wireless Excellence and Real Wireless.

They bring with them a deep understanding of 5G Open RAN, chip design expertise, the largest mobile network in the UK, detailed knowledge and patents on new radio innovations, an existing portfolio of 5G hardware and expertise on the mobile industry.

By abstracting the physical layer from the compute, the new design introduces a freedom to innovate. It means better, cheaper, and more capable equipment can be brought to market sooner. Equipment manufacturers can have a more comprehensive portfolio of products with reduced cost of software maintenance.

Radio antennas are connected to base stations using fibre optic cables. This eliminates the losses which are inherent in an electrical connection. The link between the antenna and base station is known as fronthaul. The project will develop ground-breaking, UK-made, scalable, costeffective optical interface technology, to enable the dense roll out of optical fibre 5G radio access networks with open digital interfaces for interoperability and low latency.

It is led by Rushmere Technology, working with Teropta, BT, Compound Semiconductor Centre and Aston University. Rushmere is based in Ipswich, and an expert in passive optical networks, using high power lasers to eliminate the need for amplifiers and significantly reducing the cost of deployment.

Nottingham based TerOpta specialises in remote sensing and cloud-based analysis of environmental and pollution data. Its IoT expertise comes from a senior team with experience of R&D at major telecommunications companies such as Marconi and Ericsson, giving TerOpta a great deal of experience in communications, monitoring and control technology.

Compound semiconductors are chips that amplify power and light, and use materials other than silicon. An established technology, semiconductors have been typically used for high power applications, but the fast-switching properties of compound semiconductors make them useful a number of different aspects of 5G network and handset design. The Compound Semiconductor Centre is part of the Cardiff cluster of companies and institutions which are pioneering the development and implementation of this technology. It is as a joint venture between IQE plc, the leading supplier of advanced compound semiconductor wafer products, and Cardiff University.

The Power Amplifier, or PA, is the chip which puts the energy into a radio signal. It’s an essential part of all mobile phone base stations.

This project uses world leading British expertise to develop a more efficient PA, for base stations with a power output of up to 10W, along with the hardware and software needed to drive it in a flexible and secure manner. This will work alongside a radio architecture devloped by the project.

Led by The Compound Semiconductor Applications Catapult, the consortium also comprises Lime Microsystems, Slipstream Engineering Design, and quantum cryptography experts Arqit.

The consortium will develop a 5G Open RAN platform that uses Software Defined Radio to produce a signal across a wider range of frequencies, up to 10 GHz, than is typically available. This will allow infrastructure manufacturers to build more efficient mobile base stations which work across more frequency bands. It’s a solution which is particularly necessary in dense urban environments.

Compound Semiconductors are particularly well-suited to Power Amplifiers, providing the fast switching needed for 5G, and high efficiency between the amount of power put into the circuit and that radiated by the antenna. Bradford based Slipstream Engineering Design is an RF design company, while Lime Microsystems has a portfolio of Software Defined Radio products.

As well as developing a more flexible and scalable radio the team will also integrate a new security layer based on Arqit’s QuantumCloud platform that will provide security by default in the operation of the system by using stronger, simpler encryption that is unbreakable even with a quantum computer.

Mobile networks are now too complex for operators to be sure that manual control of the network provides the best experience for the customer. Open RAN adds modular components, often from multiple vendors, so the difficulty of managing the network increases further.

This project uses artificial intelligence and machine learning, along with the latest advances in cloud technology to optimise the network more efficiently.

The ‘Towards AI Powered and Secure CarrierGrade Open RAN Platform’ (TAPSCORP) consortium brings together Metaswitch, which was acquired by Microsoft in July 2020, Intel R&D, Capgemini and the University of Edinburgh.

Machine learning algorithms can dynamically configure next-generation telecoms networks in a way that will not only improve connectivity but also create significant economic opportunities, enabling new UK innovations.

The AI compute capabilities acessable in the cloud are capable of optimising performance, improved management, and detecting anomalies across various disaggregated RAN components.

The virtualisation of cloud technologies provides higher levels of security and the ability to scale required for the large disaggregated networks deployed by national carriers.

The combination of Open RAN and edge computing brings an opportunity to create customised interactions between the RAN and applications through slicing and beyond, enabling new 5G applications and services, such as augmented and virtual reality , manufacturing, and gaming. The extensive developer ecosystem can also leverage cloud APIs to reap the benefits of programmable networks promised by the Open RAN architecture.

Regional champions in the West Midlands didn’t have to look far for ideas on how to capitalise on 5G. The heartland of England has a rich industrial heritage as the birthplace of the industrial revolution and modern manufacturing, described by the UK’s International Trade Minister Graham Stuart MP as the historic “workshop of the world”.

MANUFACTURING IN THE West Midlands today is worth £32 billion to the UK economy annually, employs more than 300,000 manufacturing people, and the region boasts household names including including JLR (Jaguar LandRover), Rolls Royce and Boeing.

But making sure that West Midlands industry maintains its leadership – and those jobs – was just one of the challenges being tackled by the umbrella organisation promoting 5G in the West Midlands 5G (WM5G).

A dynamic and energetic Mayor, Andy Street, bought into the idea of using 5G to promote West Midlands industry and services very early on, soon after he was elected Mayor in 2017.

“Andy threw his weight into it – he was determined make the West Midlands the centre for 5G. The Mayor was being super-supportive and his buy-in and enthusiasm galvanised the team,” says Lesley Holt, Accelerator & Communications Director for WM5G, Holt. WM5G kicked off in March 2018.

Now, three years in, says WM5G MD, Robert Franks, “We have delivered our initial objectives The planning environment for putting cell sites on top of buildings changed radically with the introduction of the new ECC Electronics Communications Code , in 2017”

“It was very well intended, but it has effectively changed the business model for putting masts on the top of buildings, created a lot of confusion, and has slowed the roll out. It can take three years to get planning permission.”

So the organisation found itself working to smooth the path for the operators when they hit planning obstacles at the local level.

“We’ve got a good relationship with all the seven local authorities at different levels. So we created a 5G Digital Forum, which nominates champions for each local authority. Part of our activity has been building those relationships and getting those champions on board,” says Holt.

The champions are there to navigate the local authority’s processes.

“When we come across a planning problem, we get the details. We’ve broken down some

One of the 5prinG smart cities projects from Aralia can help with the menace of flytipping. Aralia has developed an AI-enabled camera which can operate in low light at remote locations. Onboard algorithms can detect the illegal dumping of waste, and help authorities to identify the flytippers. The system runs continuously, with autonomous monitoring of specified regions of interest within the system’s field of view. Alerts are sent in real-time giving the location of the fly-tipping incident, plus additional information such as the colour of the car. The system is also being tested to help detect trespassing on UK railways, with installations at two railway stations.

problems, and had planning instances dismissed after we’ve intervened and resurrected the application.”

Part of the job is changing the mindset, from seeing planning as a short-term profit centre to a long-term economic advantage.

“It helps when local authorities understanding the opportunities. Previously a lot was a revenue generator. They needed to help educate their organisations about what the opportunities were.”

That hard work is paying off.

The West Midlands came top of all the English combined authorities for 5G coverage Admittedly, 22 per cent extent of coverage sounds like a low base, but it’s nevertheless a base that others envy, and other regions can learn a lot from the comprehensive efforts that WM5G has made to ease the path of network deployment.

The 5prinG accelerator is another example of an innovative, proactive approach to stimulating the region economically, fulfilling Franks’ second objective. It’s an accelerator that acts like a platform, or matchmaker – an intermediary that matches demand for new applications and 5G use cases from local

industry to suppliers who have something to help. The former include big corporates and local businesses for example, while on the supply side, are industry parties who can help.

“Birmingham has largest number of startups outside of London - it has an amazing base. However, when you look at the data from the scale up industry - although there are some great success stories like GymShark, there aren’t enough of them,” Franks explains. “The number of ‘scale ups’ has gone backwards –and we need to do more to support these organisations to grow.”

One reason for this, he suggests, is that the supporting infrastructure outside London is not as mature: the region receives three per cent of the venture capital investment that London receives. Hence the need for a startup incubator.

“We’ve got amazing startups, just above the network layer, who are developing applications, services and platforms, and who have brilliant ideas for how we can use 5G combined with other things like IoT and AI to improve industry.”

The 5prinG consortium by O2, Deloitte, Telefonica’s innovation hub Wayra, and the Digital Catapult. 5prinG opened the first

accelerator in Birmingham in March 2020, with facilities in Coventry and Wolverhampton to follow. Each has a private 5G network.The accelerator helps those late stage startups reach develop prototypes, but also provides an education function for a broader range of businesses.

“It’s an environment where organisations of any size can experience 5G,” Franks explains. Over 500 organisations have already taken advantage of it.

“We throw out challenges then work with startups, usually over a three month period to meet that challenge and move that business on.” 5prinG eschewed the equity model, where it makes capital investments in the startup and sees advantages indirectly. Instead it wants them to grow, or even move to the region.

“5pringG delivers a range of programmes; if an organisation wants to find out more about 5G, we can help them - they can join a shorter one to two day event,” says Holt.

“The longer 12-week programmes are themed - we’ll identify a sector and some

demand side owners, and invite them to come on board.” 5prinG typically takes in around 12 to 15 organisations at a time, and a winning project has multiple sponsors.

For examples, seven local authorities signed up to the Smart Cities challenge.

“That identified four or five key areas that they wanted addressing. We then did an innovation call - whatever the challenge for supply side organisations, they can then show them a product or idea.”

The selection process has winnowed around 90 applicants down to 16. WM5G hopes to reach some 2,000 businesses via 5prinG. Those key vertical sectors, include transport, manufacturing and live events. It functions as a kind of platform, or match-maker, peering demand for 5G with possible suppliers.

WM5G’s earlier programmes provide a taste of what enterprise can do with advanced network, at times, influencing the business at a profound level

The idea of 5G-gleaned data allowing new business cases has been recognised more broadly at the 5G private network

at the Manufacturing Technology Centre in Coventry. This will allow manufacturers to share lessons learned from applying robotics to the modern factory.

Here the High Value Manufacturing Catapult encourages SMEs to adopt new technology “Six hundred SMEs a year go through it,” says Frank.

NexGWorkx, owned by Malvern Hills Science Park, offers something similar: ‘Testbed as a Service’. NexGWorkx has been involved in a private 5G network that seek improves safety on construction sites, in partnership with PLINX. See www.bit. ly/3Gtjp58.

WM5G has over a dozen transport products and services under development.

“These are based around exploring operational efficiencies, supporting expansion betting more people to use services and connecting them better, and improving the customer experience,” explains Chris Holmes, a director at WM5G.

The first generation trials included Appyway, which improves parking by deploying

sensors sensors that report back the availability of parking spaces real-time. Another, Vivacity, took advantage of the CCTV cameras fixed at road junction sensors, only instead of fining motorists, it gauges the density of traffic.

GoMedia did something similar, only counting passenger volumes on trams. It also reports back in real-time – something not possible with manual sampling. And Ericsson has demonstrated a proof-ofconcept that uses the infastructure itself to monitor user density, anonymously.

Ericsson’s innovation used the signal from the handset to look at the scattering of the data and determine how many road users were

active. Ericsson’s mast-as-a-sensor initiative uses machine learning to turn the radio wave characteristics into vehicle counts. Data already comes from analog sensors – but these could be removed, as a 5G mast covers wider area.

Several experiments have endured. The region has a 5G road sensor network, with weather sensing as well, in partnership with Transport for West Midlands.

One discovery that WM5G has absorbed is that real-world business cases of 5G really need a solid uplink, which is rarely hyped.

“Three of those projects used upload, rather than the much talked about download”, observes Holmes.

The combination of 5G and artificial intelligence is being developed to look for unusual patterns in traffic to combat car theft. For example, thieves will use a car for transporting the gang to steal cars, and then drive in a convoy to their destination. Such a pattern can be recognised, so that the police can react before a report of theft has been made by the owner. Video surveillance operator Bikal is working with the University of Kent to develop the system. Bikal and Kent are also examining new ways that police might to react to the detection, by deploying mobile police cars and drones. The project takes advantage of the edge technologies within the Wayra accelerator

Worcester 5G, Ericsson, BT and DCMS have paid for us to get through this project

The rail network is also getting some 5G attention in three trials. The West Midlands was the first tram system in the UK to use 5G. These projects provide something similar for network planners – determining the real-world usage.

Two of the projects are vital for safety: monitoring in real-time the state of a train’s pantograph – the apparatus that connects the carriage to the overhead lines, and the state of the track itself. Transmisson Dynamics’ Jenny Hudson explains that kinks and cracks in the overhead wire are harbingers of trouble to come.

“Breakages can cause potential disruption to service and in extreme cases, risk to life as well.” The longer those go unresolved, the greater the danger to the public.

The hoIistic pantograph damage assessment system uses Streams high definition image processing which provides measurements of the wire stagger and carbon wear. JR Dynamics, Newcastle University, Angel Trains, West Midlands Trains and AQ Ltd

have teamed up to produce it. Angel trains is a rolling stock leasing company, West Midlands Trains an operating company

The project sends alerts to the train operating companies (TOCs) as quickly as possible.

High resolution is footage is required, and this needs high bandwidth network capacity. Thisis also an example where the higher capacity uplink path of 5G is vital, allowing use cases not possible before.

Connectivity can make a difference in terms of improving the region’s health WM5G has examined a range of areas where 5G can be applied, ranging from prevention, to managing long-term conditions, to emergency response.

One headline-grabbing initiative saw the region host the UK’s first ultra-sound scan over a 5G network. The demonstration, in 2019, was the first showcase of how 5G and virtual augmented reality over the new network.

The greater bandwidth offered by 5G allowed the scan to be performed on the go, and the information relayed to a consultant to make an instant diagnosis. Long-term, the technology could result in fewer patients being required to book in as out patients at the hospital.

While that was a demo, WM5G also allowed five care homes in the region to be connected, allowing residents to receive full GP consultations. GPs could perform ‘ward rounds’ remotely using IoT capabilities. That’s turned into a mature operational system planned for use in thirty care homes.