Innovation Briefing

LIGHTING UP 5G ACROSS THE UK

It’s time to enjoy the thrill of connecting face-to-face and creating eureka moments together again. DTW 22 is the place the industry come together, where you can connect with your peers to co-create and do business.

If it can be done on zoom, we don’t want it in the room.

• Our most diverse speaker line-up ever is taking the stage, from the C-suite to DevOps team, this is where the industry meets.

• Hear from 200+ trailblazers across three summits, including speakers from Google, AWS, Rakuten Mobile, Sparkle, Colt, BT, Vodafone, and more.

And, it’s not all work and no play. Introducing the quad – our brand-new expo experience.

• Explore the latest tech innovations from 100+ exhibitors, hyperscaler partners, including Microsoft, AWS and Google, 27 proof-of-concept Catalysts and our startup pavilion showcasing the latest in disruptive tech.

With thanks to our event sponsors: Diamond Platinum CSP partners

BUILDING ON THE SUCCESS of the 5G Testbeds and Trials programme, the new Telecom Infrastructure Network is an important new approach for the UK. But it has come at a time of great change. When Testbeds and Trials was ramping up we were, even if we didn’t know it at the time, in a period of comparative stability. Today we face the opportunities and challenges of being post-Brexit and post pandemic, the uncertainty of rising costs of capital and resources, and the reality of conflict in Europe. Various parliamentary reports have concluded that the nation cannot be reliant on just Nokia and Ericsson. While the 5G Testbeds and Trials enjoyed the opportunities of this previous period, the Open Networks Research and Development Fund is born into a time of pragmatism.

To meet these challenges, we are in a second phase with a new management team, new stuff launched, 5G testbeds and trials put to bed, and the Future Networks programmes awake and getting going. Where we are going is laid out in the UK Open Networks R&D Fund Prospectus

“Accelerating the pace of telecoms innovation”, we have the Future open network Challenge, the Korea competition.

I’m delighted that the projects FRANC, SONIC and NeutroRAN are already collaborating. They have identified the need to be efficient, pragmatic and dedicated. Only if we can demonstrate real commercialism for what we are doing can we look back in three years and see the Open Networks Research and Development Fund as a success. We’ll need products, IP and revenue streams. We’ll need to demonstrate that what we’ve developed is important for the country. And we need to do it in the allotted timescale.

Part of the opportunity here, and a lesson learnt in Testbeds and Trials, is that we are no longer tied to 5G. That question of “why do you need 5G to do this” has gone away. We are now looking for the right technology to solve any given problem. This can be 4G, WiFi, LoRa, Satellite, Fixed, and of course 5G or whatever is suitable. Delivering an appropriate, resilient supply chain with secure technology is a matter of national security.

We are building a UK ecosystem, so the project’s first port of call with suppliers needs to be as close to home as possible. There is nowhere closer than the other projects in the FRANC programme. One of the things we learnt from Testbeds and

Trials was that the organisations that worked well both together and with each other became more than the sum of their parts.

Key to this was UK5G and for the future it will be UKTIN. This is the organisation that is taking over from UK5G. It comprises Cambridge Wireless, Digital Catapult, the University of Bristol and West Midlands 5G. All of which have been heavily involved in UK5G. So I expect the transition to be smooth. When looking for help your first port of call should be UKTIN.

Fortunately, we go into this period of extreme uncertainty with an army of people who’ve been through the 5G testbeds and trials. They are skilled and knowledgeable in the implementation of the technology. We are ready to build..

Keith Bullock Future Networks Programmes Programme Director DCMS

Keith Bullock Future Networks Programmes Programme Director DCMS

Head of UK5G Robert Driver

Head of Marketing Vicki DeBlasi

Content Creation and Curation

Crispin Moller

Lauren Kelly

UK5G Social Media

Kate Cartwright Administration

Emma Dexter

Contact: www.uk5g.org/about/contact/

c/o CW, Bradfield Centre, 184 Cambridge Science Park, Cambridge CB4 0GA

T: +44 (0)1223 967101 W: uk5g.org

Kate Bealing

Mija Valdez

CWJP

Chairman

Keith Young MBE

Editor

Simon Rockman simon@cwjp.co.uk

Creative Director

Matthew Inman

Business Development Director

Roger Hinkson roger@cwjp.co.uk

Finance Director

Delia Robinson

Photography

Stuart Berman

CWJP

14 Great College Street, London SW1P 3RX

T: +44 (0)20 8002 0000 CBP006075

No one likes waiting at traffic lights, least of all former Minister Matt Warman

Meet the people rising to the supply chain diversity challenge, as they really get motoring with their projects.

26

Space is big. really big, and it’s just becoming relevant to cellular mobile. Vodafone and AST, Elon Musk and T-Mobile are working on direct to space cellular networks, while British company Bullitt anounces a world first. 40

Liverpool 5G as built Europe’s largest 5G Standalone private network. It was designed to support the NHS with health, and particularly social care. But when the pandemic struck it was repurposed to support children learning from home. Jaine Pickering investigates.

The Testbeds and Trials have pioneered many aspects of 5G technology, often first of their kind use cases and working with new suppliers. DCMS and UK5G have worked to share the knowledge and build the ecosystem.

Smart Wireless Innovation Facility, or SWIFt is a 5G equipped incubator at the Nottingham Trent University Clifton campus. It has been designed as a living lab for researchers, businesses and policymakers demonstrate who the latest technology can be deployed and used.

UK5G INNOVATION BRIEFING IS PUBLISHED BY CW JP ON BEHALF OF UK5G, THE NATIONAL INNOVATION NETWORK FOR 5G . ALL RIGHTS RESERVED. ARTICLES MAY NOT BE REPRODUCED WITHOUT WRITTEN PERMISSION FROM CWJP. OPINIONS, COMMENTSAND VIEWS INCLUDED IN THE JOURNAL ARE NOT NECESSARILY THOSE OF UK5G

Protecting the nation against cyber attacks is the role of The National Cyber Security Centre, part of GCHQ. Technical Director Ian Levy explains the balancing of threats from a limited supply chain against the increased vulnerability of open architectures.

DIVERSITY MEANS DIFFERENT things to different people. In the mainstream it’s about having people of different races, backgrounds and cultures working together.

To radio engineers it’s a property of antennas placed less than a wavelength apart to interfere with one another and so increase their range.

For some Diversity is the Britain’s Got Talent dance troupe that pipped Susan Boyle in the 2009 final.

And to those concerned about the lack of choice when buying mobile equipment and services it’s aboutfinding alternatives to the main global players, namely, in the UK, Nokia and Ericsson.

It’s the third model of diversity – supply chain diversity – that has been exercising the British mobile industry.The problem is that there is not enough competition in the mobile industry. Thirty years ago there was plenty of choice: Siemens, Motorola, Alcatel, Marconi, and more. There were perhaps a dozen vendors who would sell you a 2G network.

The mobile industry has grown like crazy. In his book The 5G Myth, Professor William Webb gives a figure of $20 a month as the amount spent per person across the world. Given that there are more than six billion mobile phone accounts that’s $120 billion dollars a month coming into the industry.

So where did it all go wrong? Why did this fabulously wealthy industry find itself in a position where the people who made the equipment couldn’t make money? Strangely for such a big question there is a one-word answer: consolidation.

Mobile networks used to be something only large multinational corporations could build. Now the option is open to compaines, campuses and communites. Simon Fletcher and Caroline Gabriel look at the questions you should ask when buying a small cell and we list the companies who can supply the apparatus.

Over the past two decades, the major mobile networks have bought one another. Fewer bigger network customers was bad for supply chain diversity: as the significantly more powerful customers used their position to grind down margin.

Vendors found themselves looking at the prospect of either taking a job worth hundreds of millions of dollars and making next to nothing on it or seeing the work go to a rival.

This led to an industry death spiral. Only Nokia, Ericsson and Huawei survived. Many vendors looked at the huge investment necessary to move from 3G to 4G and decided it wasn’t worth spending the money on a loss-making business.

That’s where we are today, but not where we will be tomorrow. Two things are changing. The first is the government-led programmes to build a supply chain, but just as important is the future of those providing the coverage. In a model of a network of networks, where there is a diversity of customers there is more opportunity for the new generation of suppliers to find customers looking to fill the gaps left by the major mobile networks.

All good things come to an end and UK5G was a very good thing. It showed that even with the best possible communications there is a value in meeting face to face and then while we couldn’t do that it found ways to create as much of the value possible through virtual meetings. The result was a community which worked together to learn about 5G. As UK5G concludes we look forward to UKTIN.

Just as diversity of race, gender and culture is important, just as the radio propagation of antennas using diversity is a tool in deployment and just as a diverse choice of suppliers is key, a diverse number of customers is important too.

GOOGLE IS TRYING TO shame Apple into opening its proprietary iMessage service and adopting RCS, the messaging stack originally devised by the mobile telco industry. “It’s time for Apple to fix texting,” is the banner of the Google-funded site, Get The Message (https://www.android. com/get-the-message/)

While iMessage users can exchange messages from a variety of Apple devices, the vast majority of mobile users in the world are on Android. But they are represented to iMessage users as a “green bubble”, meaning they cannot receive rich media or participate in group chats without risking mobile network charges.

Apple internally acknowledged that interoperability would “remove [an] obstacle to iPhone families giving their kids Android phones,” according to one executive. Moves to impose messaging interoperability were added to the EU’s Digital Markets Act earlier this year.

RCS was originally announced in February 2008, before Apple had even opened the Apple iPhone app store. Conscious of the poor take-up of MMS, which operators saw as a profit centre, and fearful of over-the-top messaging services, the operator industry

developed the RCS suite, enhancing basic SMS messaging with group chats and rich media.

The result was a complex, multi-layered specification exceeding 2,000 pages of documentation, which nevertheless did not include international interoperability – a default feature of IP-based messengers such as WhatsApp and which only came a decade later in 2018.

As a result of the flop, free-to-use IP-based messaging services such as BBM, then

WeChat, WhatsApp, and Facebook Messenger proliferated, guaranteeing users interoperability and no hidden billing costs.

Google isn’t as altruistic as the marketing campaign suggests. It effectively took control of the RCS specifications three years ago, and RCS messages now run through Google’s servers. It also follows years of failure as Google launched successive over-the-top messaging clients: GTalk, Google Voice (with its own messaging client), Hangouts, Allo, and Duo all failed to impact the market.

RCS was incorporated into its Android messaging client in 2019 (as optional “chat features”) and gained end-to-end encryption (E2EE) for 1:1 conversations last year. But beware: RCS is now a proprietary Google service, Ron Amadeo at technology publication Ars Technica pointed out: the only third party allowed to integrate with it is Samsung, thanks to a private agreement.

“Other than Google being desperate for one of the few messaging solutions it hasn’t exhausted with mismanagement, there’s no clear argument for why RCS is worth this effort,” he wrote. Amadeo joined calls for Apple and Google to work together on an entirely new standard.

www.android.com/get-the-message

An uptake in the niche practice of using mobile networks to replace cable or DSL has prompted Barclays to downgrade expectations of the share prices of US cable operators. Such offerings are called FWA, or fixed wireless access, and Three first launched 5G in the UK as a domestic FWA broadband package, rather than an upgrade for mobile phone users.

US mobile operator T-Mobile added more FWA customers in the most recent quarter than Comcast or Cable expect to add in the entire year. Additions in the fixed line market are largely fuelled by house moves. The additions are lower than expected, and the FW additions higher than expected. Barclays Group media analyst Kannan Venkateshwar was one analyst to adjust his equity ratings.

T-Mobile USA added 560,000 fixed wireless subscribers in Q2, far exceeding consensus expectations. Shipments of FWA modems are expected to double in 2022 to 3.6 million, according to the GMSA, although today most remain 4G only.

The prediction is based on a survey of vendors. Almost one in ten US households may be using FWA as their main broadband connection by 2026, according to analysts Global Data.

TWO OF THE UK’S FOUR mobile network operators now claim to have reached half the population of the UK with 5G.

Hutchison-owned Three says it now reaches 56 per cent of the population, one percentage point higher than the 55 per cent that EE claims to cover. O2 and Vodafone can claim to cover around 35 per cent of the population, according to a RootMetrics, which has been acquired by speed test company Ookla, in a survey conducted over the first half of 2022.

RootMetrics data also confirmed that Three has the highest peak speeds for 5G, with a median download speed of almost 200 Mbit/s. O2 came bottom with 110 Mbit/s. Ookla confirmed that Three delivered the fastest download speeds, although it placed Vodafone in first place for upload speeds.

URSULA VON DER LEYEN , president of the EU, is on a charge to save energy and the planet. And in her sights are the way we use and repair mobile phones.

As part of the EU Ecodesign Regulations, the European Commission is looking for a 25 percent reduction in the power used by mobile phones, tablets and cordless phones by 2030. Using 2020 as a baseline this would see consumption drop from 39.5 TWh to 25.4 TWh.

But it is the repair of mobile phones, a recognition that consumers want to have the same device for longer, that has the biggest impact on the industry.

The proposals look to equip registered, professional repairers with the skills, tools and

parts to maintain a phone for at least five years after a device is removed from sale, with comprehensive details on how to take apart, repair and re assemble phones and tablets.

Replacement of batteries will have strict rules with the devices where batteries are more prone to needing replacement will have to be simple for the layman to swap. Allowance is made for ruggedised phones. Consumers are looking to use their phone for longer and upgrade less often, in part because model to model improvements are less significant than in 2G and 3G devices. : https://op.europa.eu/en/publicationdetail/-/publication/955d36e7-2906-11ed8fa0-01aa75ed71a1/

Despite inflation-busting price increases, the UK mobile consumer has seen the cost of data fall, according to a report from Cable.

“Contrary to what one might expect as the cost of living continues to rise, the average package cost has fallen, from $23.28 to $17.58,” said analyst Dan Howdle.

Cable surveyed 58 UK SIM-only consumer plans, and compared them with plans from providers in more than 100 other countries. These were then converted to US dollars as a reference currency. The numbers exclude roaming costs.

The analysis priced mobile data in the UK at $0.79 per GB, a significant fall from 2021, when it was calculated to be $1.48/GB. The average package had fallen in price from $21.28 to $17.58.

But this places the UK behind France ($0.12/GB) and Italy ($0.23/GB).

The high costs of mobile data in Sweden ($1.88), Germany ($2.67), Belgium ($3.00) and Switzerland ($7.25) may reflect local purchasing power, as well as a less competitive market. Israeli mobile pay consumers pay just 4c for a gigabyte of mobile data a month.

None performed well with latencies of 40 milliseconds, however. That’s a far cry from the promises made at launch.

“With 5G’s sub-5 or sub-2 ms latency, you can get live 3D video to your fully wireless headset and experience events in real-time –kissing goodbye to motion sickness,” one mobile network promised as it turned on 5G in July 2019. The benefits are real, but theoretical unless the network moves to the newer 5G Standalone technologies. Ookla found median latencies of 29ms for Vodafone and EE, 32ms on O2, and 35ms for Three.

SOME PARTS OF THE population have concerns about the potential health effects of the RF exposure, in particular that of mmWaves, related to 5G.

The European Union recognised these concerns and provided funding in its Horizon Europe research programme for research in this area.

GOLIAT (5G exposure, causal effects, and rIsk perception through citizen engagement) is a five-year project aimed at providing responses to some of the questions raised by the new wireless technologies, with a special focus on 5G.

The aims of GOLIAT are to monitor radiofrequency electromagnetic fields (RF-EMF) exposure, particularly from 5G, to provide novel insights into its potential to affect health and wellbeing, and to understand how exposures and risks are perceived and best communicated using citizen engagement.

Part of the GOLIAT project focuses on two particular societal groups: (i) young people who could be more susceptible to the effects of RF-EMF, and (2) workers and industry, for which

particular industries, occupational settings or scenarios could result in high exposure levels or abnormal exposure patterns.

GOLIAT is led by the ISGlobal institute in Barcelona and involves 22 institutions. The University of Bristol leads the work on the use of 5G in industry and for workers and will focus on developing and conducting exposure measurements and neuropsychological and wellbeing effect studies in worker populations exposed to 5G.

Professor Frank de Vocht of the University of Bristol told us: “To obtain as comprehensive as possible a picture of 5G implementation and developments in industrial settings, we are keen to discuss the application of 5G with representatives of industries and companies that have implemented 5G or are planning to.”

If you are interested in discussing EMF effects or would like to know more about the GOLIAT project, email Professor Frank de Vocht at frank.devocht@bristol.ac.uk. The project brief is available at www.isglobal. org/en/-/5g-exposure-causal-effects-andrisk-perception-through-citizen-engagement

A consortium of industry and German academic research institutes has identified six key areas for R&D work for 6G. The 6G Lighthouse Project brings together vendors Nokia and Ericsson, and 15 universities and research institutes, with Nokia chairing. Codenamed Anna, the initiative wants to “drive global pre-standardisation activities from a German and European perspective”, mirroring national efforts in France and Spain. Standardisation work for 6G only commences in three years’ time; there’s lots of 5G to do first, before it can deliver on even a fraction of the promise. The most significant milestone will be v5G Advanced in 2024.

www.nokia.com/about-us/news/releases/2022/07/11/nokia-to-lead-german-6g-lighthouse-project/

Market challeneger Xiaomi has demonstrated 210W charging. Using its 11 Ultra mobile phone, the company reports charging the 4,000 mAh battery from 0 per cent to 100 per cent in 8 minutes. The rapid charge showed 210W of power and received a certification as well. This makes it the fastest charging that has yet been demonstrated.

BT has claimed a breakthrough in aggregating four different spectrum bands on a 5G standalone network for the first time.

Pooling the bands allows for greater throughput and efficiency. The successful trial, using Nokia radio equipment and a MediaTek 5G modem, took place at BT’s Adastral Park centre in Suffolk. It aggregated 2.1 GHz, 2.6 GHz, 3.4 GHz, 3.6 GHz bands on EE’s network.

MediaTek’s M80 chip provided the “handset”. A lab test in March demonstrated transmission speeds of almost 3 Gbit/s on the downlink. Lower bands penetrate walls better, while the higher bands provide additional capacity.

Amazon has finally launched its widely anticipated “5G in a box” service, AWS 5G Private, in its first market, the United States.

The US is well suited to this approach as CBRS spectrum licensing allows free access to unused frequencies.

The service is intended to allow organisations to design and deploy a 5G private network with little or no expertise, with the deployment and management handled remotely by Amazon’s AWS service.

A blog post by AWS’s Jeff Barr demonstrates how a new network can be specified and ordered with just four basic web forms. Amazon bills $10 per hour for each radio unit.

While it supports only 4G for now – 5G is coming – it is a landmark in taking cellular industry technology and making it widely available for private commercial use Amazon claims a watching brief for the UK.

and expense of starting from scratch each time. Critically, however, they should only ever be treated as a framework to start conversations. Eynon offered this guidance: “Know your context, know who you’re dealing with, know the challenges on them and what’s going to be possible.”

Dunn highlighted that although Eynon’s work is in very different regions, there are some common learnings that others can build from, such as a recognition that standardised templates can only ever be templates: they start off conversations but there will always be unique factors that come into play for specific sites, and authorities need to be empowered and capable to adjust the templates to work for them.

PROGRESS IS BEING MADE in the project to help local authorities manage sites that can be used to expand the mobile networks. The goal of the programme is to provide organisations with the tools and skills to digitally manage public sector assets through testing of different approaches.

At a face-to-face event in Bristol in June, more than 100 people from regional and local authorities, the telecoms industry, government and other stakeholders caught up on developments.

A panel that included four mobile network operators was chaired by Gareth Elliott from Mobile UK. It was followed by a crossgovernment panel that included Building Digital UK, the DfT, the Barrier Busting Task Force and the National Underground Asset Register, chaired by Nick Wiggin from DCMS.

“It was a fantastic occasion,” said Wiggin, “a genuine sense of the industry and government coming together to drive forward digital connectivity. The face-to-face networking elements were incredibly well-received and the main piece of feedback was to do more in-person events like this, to drive collaboration.”

That collaboration was demonstrated by the presentations. Gary Littledyke from Wessex and Lynne Wilson from West Berkshire explained that the key to success in asset data collection is thinking strategically about what

data will provide the greatest value, rather than just collating everything available. They explained how contextualising data can improve the process for infrastructure providers, and there was a real sense that now is the time to develop these asset management platforms.

Nicola Scullard from West Sussex talked through her consortium’s approach to mapping process workflows and measuring the improvements. She observed that the team who looks after an asset is not likely to be the one that makes a decision on using it. West Sussex has therefore decided to develop a bespoke product to deliver the requirements of all the councils who would eventually use it, and is working to ensure processes are built into the product from the start. Scullard said the benefits of the pilot will be measured in terms of making things quicker: “how we can remove steps, streamline and make deployments more quickly”.

A key to working together and reducing the process overhead is having standardised commercial models for access to assets, and this subject was co-presented by Sarah Eynon of Scottish Futures Trust Infralink and Lucy Dunn from the West London Alliance.

It was clear from their presentation that standardisation of contract templates can help to streamline processes and avoid the time

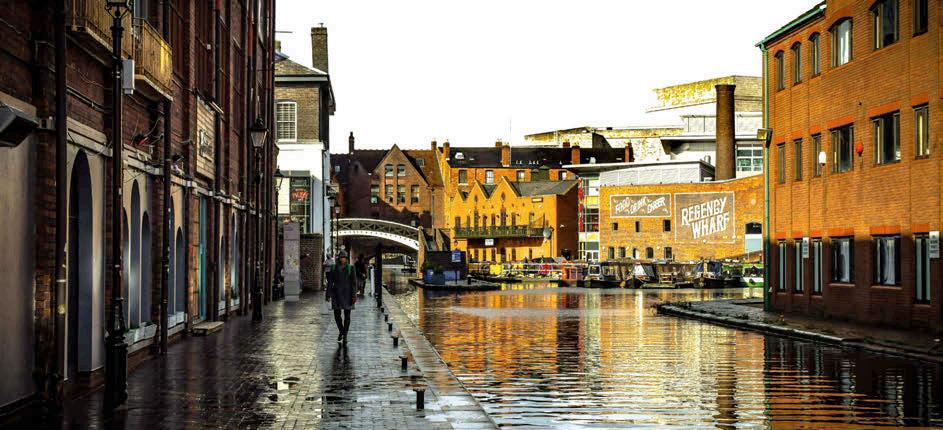

There is an irony in the term “digital asset management”. Traditionally this means the management of assets that are in themselves digital – artwork, logos, intellectual property and the like. When Antony Corfield from the West of England Combined Authority and Vasilis Papakonstantinou, from West Midlands 5G talked about enabling local authorities to support digital asset management they were discussing the digital management of physical assets, typically bus stops and street lights. Corfield reflected on how the industry could help local authorities. “There needs to be recognition that there are constraints in the public sector,” he observed, adding that an openness to dialogue means all sides can achieve what they need more quickly.

Both presenters agreed that it would be valuable for industry to consider how to create more win-win situations for local authorities, especially in supporting those who may not have the connectivity know-how.

Turning to central government, Papakonstantinou highlighted the value of events such as this to disseminate information to leaders, to ensure they are equipped with relevant insights and empowered to build their own digital strategies. He added: “It would be great to see digital champions everywhere. If central government had a way of monitoring this, it could identify gaps and intervene to try to direct places to take the successful actions we’ve seen elsewhere.”

A more in-depth write-up of the DCIA Dissemination Event can be found on the uk5g.org website.

If you would like to get involved in the DCIA programme, please email dcia-info@dcms.gov.uk

MATT WARMAN TALKED about a number of significant announcements when he attended the Testbeds and Trials at the Smart Junction 5G conference. These include the £250million Open Network R&D funds supporting the supply chain diversification strategy.

Reflecting on a comment from EE’s Andy Sutton that Open RAN is not ready for prime time right now, Warman said: “It is that money that the UK is genuinely trying to lead the world with, to get some of that work done faster than it could be done elsewhere. The Future Open Networks Challenge, £25 million for research, will take these things further and faster to embed greater openness and interoperability into networks from the start. It is a really important part of working with academics, with researchers, and with telecoms companies to make that open by default.”

The aspiration is to enable the UK government and industry to draw on a more diverse range of vendors, and built into this is compatibility testing.

Warman also looked to the benefits of working internationally. “It’s critical that countries work together, the private sector as well as the public sector,” he said. “We have a project with the Republic of Korea on the cutting edge of R&D that is hugely important.

Samsung is obviously an enormous player in this area. It’s brilliant that we were able to work alongside the Koreans to make that a reality.”

He also talked about TIN, the £10million Telecommunications Innovation Network competition with Digital Catapult, Cambridge Wireless, the University of Bristol and West Midlands 5G working together to establish and oversee that network which was recommended by the diversification task force.

Ministers are not supposed to have favourite projects, but it was clear at the 5G Realised conference last year that Warman, then Minister for Digital Infrastructure, had a soft spot for Smart Junctions 5G. In the topsy-turvy situation with ministers of the midsummer we saw his replacement resign, Julia Lopez and Warman slot back in, he’s now reliquished the position once more to Julia Lopez

The Smart Junctions project demonstrated a use case and addressed both the challenges and benefits of open networks. Led by sensor and software AI technology company VivaCity, the project showed the benefits of real-time traffic control and the cost savings from rolling out smart junctions. The use case proved the business model and it is hoped that the project will be expanded. The key metric is that the technology cut journey times by up to 23 per cent. The implementation of the 5G private Open RAN network took a multi-vendor

approach, looking at cutting the cost and making that scalable, and to address security VivaCity worked with its suppliers to prioritise cyber security - Weaver Labs led the security work package

The project, much like Liverpool 5G, has also demonstrated to the local authority the benefit of owning and managing the network to be able to use it for their own use cases, cut their costs, benefit from enhanced connectivity, and also to be able to rent out the capacity.

The VivaCity vision-based sensors have core capabilities to count, track and classify various modes of transport. They are adaptable in their approach: things such as air quality, sustainable modes of transport such as bikes, pedestrians and e-scooters, or even haulage prioritisation. There are more vehicles on the roads these days and the technology used to manage them has been around since the 1990s. The step-change deployed by VivaCity is a reinforcement learning approach to traffic signal control. If we look back at coordinated traffic control in the 1990s, it was very much congestion-focused. The automation for the time was unusual and meant the high costs were favourable. They were accepted. Roll forward to today and it’s a very different world we’re experiencing.

The VivaCity traffic optimisation model builds from a single set of traffic lights through local to citywide and regional. Each smart junction has a virtual occupancy zone to see how the movement of traffic and queues change throughout the day. This isn’t just traffic, it includes pedestrian and cyclist zones. The modes of transport are identified at the edge and the data sent to the cloud where the VivaCity reinforcement learning agent sits. It takes that raw data and decides on an action based on the training that’s been in simulation. Simulations are run before deploying anything on the street so as not to cause major accidents while training and validating the system for real world control. The agent makes a decision and sends it down to the traffic controller cabinet to control the traffic lights.

As part of this project, VivaCity has been developing the user interface that Transport for Greater Manchester can use daily to analyse what’s happening in its network. It feeds through live occupancy data on different arms of the junction and can be used to validate what sort of decisions the agent is taking to see that it’s making sensible actions based on

the occupancy. Traffic is controlled in stage movements and phase movements. Latency graphs show real-time analytics of what is happening with the network.

The first deployment, for Testbeds and Trials, has been on a busy stretch of the A6 in Salford, Greater Manchester. It’s a main corridor to the city centre which gets very congested and there are many network issues because of the geography, Salford University and multiple train stations along the route. There are nine smart junctions, with 57 sensors to cover every single one of those junctions, including their upstream to collect journey time data.

VivaCity developed and repackaged the Benetel 5G equipment and is looking to further development to integrate 5G technologies into production hardware. It has to be 5G to give the low latency for a real-time connection, and because the available N77 spectrum uses 5G equipment. In Cambridge and Peterborough VivaCity has used a wired ethernet connection but has found this prohibitively expensive to scale, with lots of unknowns in terms of ducting and infrastructure which derail timelines and also costs. Although much more scalable, a public network offers its downsides, as experienced in instances within other smart junctions trials due to it being susceptible to congestion at peak times – precisely when the real time data is most needed. It has proved its worth with significant reductions in journey times and reduced pollution from vehicles idling at lights. VivaCity expects that as more coordinated junctions are added there will initially be a multiplier effect on improvements in traffic flow until an optimal level is reached.

Weaver Labs’ core expertise is networks and software. Its skillset was the right one not only to deliver a network that could deliver the objective of VivaCity’s use case but to work

alongside TfGM on the strategy setting for the whole region and a new outlook for innovative business models in telecoms. Weaver Labs brought its technical and commercial proved to be a necessary combination to make this project a long-term success for private networks in public sector. On the technical side, Weaver Labs delivered a pioneering setup, highly innovative, scalable, replicable and affordable using edge-cloud for OpenRAN. This was surrounded by challenges which were presented in the lessons learned panel at the event. All project partners as well as DCMS agreed that OpenRAN technology is in its infancy, and the partners showed resiliency and adapted the project’s objectives and ambitions to deliver despite this. Hannah Tune, from TfGM underlined the lack of skills within the public sector to deploy and manage telecoms infrastructure and how up-skilling has been central to this project

On the commercial side, Weaver Labs and TfGM proved the business case for publicly owned networks. This has been a topic of interest not only for Manchester but also widely discussed in the UK. It was demonstrated that a 5G network built using

publicly owned assets, and operated using CellStack (Weaver Labs’ cloud-based management tool) can provide all the value added to the city, while showing significantly improved costing model. The 5G Smart Junctions solution scales, because is based on infrastructure sharing and a collaborative economy.

MOHAMMAD LARI, former Head of CrossGovernment and International Coordination for the 5G Testbeds and Trials Programme, looked at the bigger picture into which Smart Junctions 5G fits “DCMS and the investments that we’ve made over the years, the policies and the strategies that we’ve developed in coordination with the investments and policy thinking that the industry has done, the local authorities have done and reverted back to us with.

“All of that accumulates into strategic aims and those aims are threefold,” he explained, and he laid out his three elements for sustainability. The first being a catalyst for change. “That catalyst is based on real challenges, whether it is the challenge for an individual or a community. It’s the only way we can achieve greater sustainability of the environment that we live in, or the technologies that we utilise. There needs to be a challenge.”

The second element for sustainability Lari highlighted was the people: “It’s the creative spirit. It’s the individuals behind the change, who recognise that there’s a change and they want to do something about it. And they want to do it in a way that perhaps has been tried and tested, but they want to tweak it, or something that they’ve come up with on their own, or something that’s just an effort, perhaps not getting to the right solution on day one, but getting to it eventually.”

His third element is perhaps the one most identified with the Testbeds and Trials Programme. “The third part of a sustainable solution is innovation, to drive growth. Innovation to drive the economic recovery for the country, and also the economic recovery of the local communities that we reside in.”

The Smart Junction 5G conference formed something of a bookend, with Lari looking back at the legacy of the 5G Testbeds and Trials and Warman looking forward to the new Future Networks programmes. But whatever part of the programme it forms, there was universal agreement that less time spent waiting for traffic lights to change is a very good thing.

Technology is at the heart of what citizens want to see in almost every aspect of public services. This program has had a practical impact scalable across the country.

Getting projects together to foster collaboration has been part of the success of UK5G and will form a major part of the new UKTIN organisation. The first event under the Future Networks Programmes saw the first opportunity for projects to meet each other and key people from DCMS. If you couldn’t make it to the event, or even if you did, here are the people you need to speak to, to build the ecosystem

David Owens, of Virgin Media O2, explained the challenges of integrating national mobile networks with small private ones. His project is working with Wavemobile, Cisco and the University of Warwick, with a particular focus on security. He told the event: “5DRIVE will provide a great way for new and old vendors to enter the market with a cost-effective, scalable, secure solution. This will be the first time a private network will be connected using a new architecture.”

>> David OwensA collaboration between Telet, AccelerComm and cellXica, this is a project to build the M5Q, a small British-developed, designed and produced cell aimed at the new generation of small networks.

It will use leading-edge firmware to maximise energy efficiency and lower running costs. One of the experimental aspects will be the ability to manage frequencies in a collaborative process with other cells in the area to provide maximum spectral efficiency, opening the way to new licensing models.

>> Andrew Miles, Julia Cordall, Peter Gradwell

ARI-5G, or Accelerating RAN intelligence in 5G, has a goal to test and measure performance of 5G RAN in lab. It will concentrate energy efficiency, spectral efficiency and interference management. The project is looking to engage mobile operators to help them lower running costs. It is also looking to work with developers to try to reduce their physical dependency of networks and come up with great xApps and RF use cases. Led by the Telecom Infra Project, there is an emphasis on open networks: “We want to establish multivendor open RAN That is about being interoperable, interchangeable and integrable.”

>> Osman TaherGraham Currier, Chief Operating Officer of Dense Air, explained that the CoMP-O-RAN project is built around small cells that co-operate, working together to extend the range of individual components. Glasgow University is writing the algorithms with partners Blu Wireless on mmWave, Airspan on 5G NR, and Radisys on the software stack. Currier recognised that the result has to work economically as well as technically. He explained: “We have labs already constructed, lab work starting, and field trials will be held at Millbrook Proving Ground.”

>>

Graham Currier

The “Distributed Unit” or DU performs signal processing, converting radio signals to data traffic that can then be transported by to the core network infrastructure.

Working principally with UK-based vendors, it will integrate products into an operational Distributed Unit component that is ready for deployment in 5G networks.

Led by ADVA Optical Networking, the consortium comprises AccelerComm and CommAgility, both of whom are experts in the deepest level of cell architecture, along with BT and the University of York.

Scotland 5G Centre provides a project management function of co-ordination and leading collaboration with other projects and organisations.

Testing of the DU will initially be conducted at labs in the North of England supported by ADVA UK, with later testing taking place at BT’s Adastral Park facility.

>> Abigail Elcock, Eric DowekFlex 5G

Ecoran, or energy-efficient cloudlets for open radio access network, is building energyefficient processing that connects servers in cellular passive optical network which it refers to as CPON.

By applying machine learning the architecture reduces the energy by 82 per cent. The infrastructure provides 100 times faster interconnection between servers, and 60 times faster intensive computations by eliminating the hierarchy of switches used in the centre architectures. If deployed worldwide the reduction in emissions would be equivalent to those of a country the size of Greece.

Key to this is reducing the underutilisation of resources within data centre. The project is talking to Rolls-Royce, Jaguar and Ford and Nissan, and working closely with the High Value Manufacturing Catapult.

>> Abdelrahman Elgamal, Azza Eltraify, Sanaa Mohamed

The biggest project in terms of partners, Flex 5G brings together systems integrators AWTG, Vodafone and Virgin Mobile O2, along with Zain from Saudi Arabia.

The roll call adds Lime Microsystems, University of Surrey 5G..6GIC, CommScope, Viavi, Emirates ICT Innovation Center (EBTIC), Amazon Web Services and Cambridgeshire County Council. As one might expect it’s an ambitious project building and combining the components for a full 5G Standalone network. With a mix of partners ranging from a silicon supplier to hardware providers, as well as those who provide the novel algorithms and the software solutions that sits on top along with the eventual customers for depolyement: the organisations that could test those and verify the applicability of these types of solutions out in the field it’s an end-to-end programme for building, testing and using a full 5G network.

>> Colin Bryce, Karolis Kiela, Marcin Filo

Swindon-based AceAxis, in partnership with MAC Limited, will build a Future RAN Advanced Test system, for use by radio network equipment vendors who are designing, building and testing 5G Future RAN radios.

AceAxis has a long history in designing and building cells, often licensing those designs to major vendors. Through its work, building both radio heads and distributed units, the company has learnt a lot about working to EU and Open RAN standards.

The consortium is using this expertise to build test equipment for the wider industry. It hopes that this will lower the barriers to entry for smaller vendors and help grow the open RAN community.

Future RAN interfaces are clearly defined. Using these interfaces, along with 3GPP definitions, provides the opportunity for the Open RAN Advanced Test System to become a trusted industry standard for developing 5G radios.

>> Choong Wong, Steve Cooper

The GaN in the name is Gallium Arsenide, a compound semiconductor that has some advantages over silicon for making chips. It provides faster switching and handles power better, but cannot be used for making central processing units.

In mobile device design, GaN is an important technology. And there is a facility for making the chips near Newcastle. The project is working to repurpose designs for radar. The project is led by INEX Microtechnology, working with Custom Interconnect, Viper RF and the Compound Semiconductor Applications Catapult.

The current chip shortage is forecast to last at least 10 years and to worsen. Having UK-supplied chips is essential for national security. The project will develop Monolithic Microwave Integrated Circuits, or MMICs, to remove the threat of supply shortages.

The consortium is particularly looking to supply its components to other projects developing products as part of FRANC.

>> Andrew Stokes, Andrew Whitworth, John Boston, Roger Carline, Andrew Thomas

This project is creating an architectural blueprint for multi-domain public and private 5G networks with multi-vendor integration, interoperability and satellite backhaul.

The partners are Cellnex Connectivity Solutions and working with the University of Bristol, Attocore, Weaver Labs, Satellite Applications Catapult and Parallel Wireless.

Cellnex has extensive experience of working with the major mobile network operators to install private networks, including at the Etihad stadium, on the Brighton mainline and at Bristol port.

Andrew Thomas from Cellnex explained: “Our impact in the market is to create use cases to demonstrate that network resources can be shared between a public MNO and private network.”

The project will use novel backhauling and neutral hosting services with a particular focus on satellite backhaul (mainly GEO and LEO constellations) for connecting to different core vendors. The team is looking to work with developers to exploit its framework for secure xApps running on the platform.

>> Andrew Thomas, Ashweeni Beeharee, Jeff Land

This project uses artificial intelligence and machine learning, along with the latest advances in cloud technology to optimise the network more efficiently.

The ability to swap components in and out of the design of a mobile phone base station adds flexibility, reduces the build cost and, most importantly, adds to the security of the supply chain. But it’s not usually possible. Cells are designed around a particular chip and changing that would require a ground-up redesign.

Justin Sims, a systems engineer from Parallel Wireless, explained that Proteus is a project to abstract the specifics of chip-level components from the overall design. He explained that initially this was for x86-type chips but that an ARM based PCI accelerator card was the next step. The programme is looking to demonstrate that performance is not impacted by the abstraction layer.

The consortium is led by Parallel Wireless with ARM, BT, the University of Bristol, Wireless Excellence and Real Wireless.

>> Hamid FalakiThe consortium will develop a full 5G Open RAN platform that uses Software -Defined Radio to produce a signal across a wider range of frequencies, up to 10 GHz, than is typically available.

The project will deliver an innovative solution for Open RAN, which will reduce costs for owners, break single dependencies, and disaggregate hardware and software.

This will allow infrastructure manufacturers to build more efficient mobile base stations which work across more frequency bands.

Led by the Compound Semiconductor Applications Catapult, the consortium also comprises Lime Microsystems, Slipstream Engineering Design and quantum cryptography experts Arqit. CSA Catapult is a test and support facility that pulls in many industry experts to provide feedback and advice on direction and progress. Slipstream Design is providing a software-driven and frequency-agnostic power amplifier

Lime Microsystems is offering a highly integrated developed power radio chipset and modules for fully programmable solutions.

The project’s goal is a full platform without the limitations of a traditional vendor.

>> Andy Sellars, Ayan Ghosh, Fatemeh Hoveizavi, Graham Peters, Sally Roberts, Scott Alexander, Simon Maggs

The “Towards AI Powered and Secure Carrier-Grade Open RAN Platform” consortium brings together Metaswitch, which was acquired by Microsoft in July 2020, Intel R&D, Capgemini and the University of Edinburgh.

The programme is looking at pulling together open components from a large number of sources and managing them centrally with a single dashboard.

The integration makes sure there is security running through the whole system. It pulls together core network functions, billing and edge into a single system and uses artificial intelligence to co-ordinate the monitoring.

Adding new functionality should be easy. Bozidar Radunovic, principal researcher at Microsoft Cambridge, told the event that the with the platform “anyone can deploy a grand virtual function on top of the platform without having to do any special configuration”.

He added: “The second goal, also paramount for an open architecture platform, is security. We want to make sure the open platforms and components running on them are secure: the billing process, in terms of attack protection, in terms of the usual security and trust, we have all certain contexts with other platforms in the cloud.”

Innovate UK KTN exists to connect innovators with new partners and new opportunities beyond their existing thinking – accelerating ambitious ideas into real-world solutions. KTN is part of the Innovate UK Group – the UK’s innovation agency.

Connect with us to access horizon-expanding events, potential partners, bespoke support and innovation insights.

@KTNUK ktn-uk.org

We create diverse connections to drive positive change.

OTHING CONCENTRATES the mind more on security than a war in Europe. The Russian invasion of Ukraine has seen heightened awareness of all kinds of threats. These include cyber-attacks and the implications of not being able to get deliveries of equipment the UK needs to maintain its telecommunications networks.

The National Cyber Security Centre is charged with protecting the UK from such dangers. Dr Ian levy, Technical Director, explains: “We are here to make the UK the safest place to live and work online. That’s our tagline. And we do that through all sorts of different things. We’ve got programs to try to upskill children, so the next generation is more digital-literate and

“We’ve got programs to assure people and services so that if you want to buy a consultant in cyber there’s somebody with a solid recommendation and so on, and so on. We’re the national incident management authority. We do 770 incidents a year on average. So about two a day.”

The organisation works closely with Critical National Infrastructure sectors to make sure they are as secure as they need to be for our future reliance. The National Cyber Security Centre is the public face of its parent GCHQ in Cheltenham, and it’s been building relationships with British businesses to help to protect them since it was founded in 2016. A relative newcomer given that GCHQ celebrated its

Levy is affable, open and chatty. Not the “I can’t answer that question” kind of person you might expect from a spook department, but then he started at GCHQ as a mathematician. “I spend a lot of time in GCHQ doing some very interesting things with this job, Technical Director at the NCSC. It’s absolutely the best job in the world,” he says. “I kind of worked my way up through GCHQ, trying to bring a bit of realism to some of the things we’ve done.

“When I started, GCHQ’s security mission was very academic and I think we’ve moved it quite a long way over the past few years to being something that is pragmatic, based in evidence and reality, and actually implementable, which was not always the case with government security. It wasn’t really cognizant of the real-world constraints.”

Protecting telecommunications networks is a responsibility that has grown in importance the more we digitalise our lives and as telecoms has become critical to the functioning of society. Levy explains: “We want to make sure that those networks, whether they be fixed or mobile, are as secure as they need to be: commercially sensible, resilient and robust so that the country can rely on them properly.”

That’s not just protection from hackers. “With DCMS we are trying to diversify some of the product supply, because at the moment we’re overly reliant on a very small number of suppliers, to the point that we are nationally dependent on them. And from a national security point of view, that’s a terrible place to be. We need to better understand how we can shape the markets so there’s more supply. That helps both private networks and public networks, big and small, increased diversity, increased robustness. That’s a key part of our mobile work with DCMS.”

Levy has a proper understanding of the scale of the problem. “I think the chance of us rebuilding Marconi is basically zero, but it’s still about making sure we have the right kind of equipment, the right kind of security wrap around those networks so that they can provide the service we all expect,” he says.

The approach NCSC has taken to supply chain diversity is akin to the one Ofcom has taken to spectrum: not by following established practices and standards but by understanding market needs and pioneering approaches to build a critical mass to ensure equipment is available and secure. “The global market is so big and we are a very, very small part of it,” Levy says. “We have to try to make sure that others demand the same sorts of things as we do, so that we’re not asking for something the rest of the market doesn’t want, but we’re leading the rest of the market to asking for what we want.

“Governments around the world, specifically the UK government, need to engage much better and more deeply with all the vendors and the whole ecosystem for telecoms, because the incentive model has been broken for the past few years. The Telecoms Security Act goes some way to fixing that but the first point of call is for new market vendors to speak to DCMS and Ofcom because they’re going to be the ones who actually enforce the code. When it gets into deep technical stuff, obviously you could come and talk to us and that’s fine. But DCMS and Ofcom to start with.”

LEVY RECOGNISES THAT there is no point in remedying the issue of supply chain security by replacing the equipment with apparatus that increases the vulnerability of the networks to attacks. This is a distinct possibility when you introduce open systems. It’s the role of the

NCSC to oversee the security aspects but by monitoring the situation from the outset there is a path to networks which are both diverse and secure.

“We need more of a group of like-minded companies, entities, countries to help make sure things like the O-RAN alliance are putting out the right sorts of standards,” Levy says. “Because some of the stuff that’s in there at the moment needs some work from the security point of view. We need a plan of making sure that implementing open networking, whether it’s O-RAN or something else, doesn’t reduce the security of the networks we’ve worked so hard to fix.”

It’s a big job, and but Levy sees progress.

“We spent six years getting the new regulation in place and another six years to get a code of practice done. Our open networking starts to develop here. We’re still in trials. It doesn’t do high capacity. It doesn’t do high contention. Doesn’t do low power. It doesn’t do a whole bunch of other things. We’ve got to fix all of those. While that’s happening, we can fix security as well. So, by the time it’s ready for prime time, we’ve got the right stuff in place.”

And the National Cyber Security Centre has experience in implementing industry-wide security schemes. “We did one in the financial services sector with the Bank of England called CBEST, that was about understanding systemic risk across the financial sector.”

CBEST is a framework rather than a recipe. The Bank of England provides an implementation guide, but it’s really about ensuring that firms are tested against realistic threat scenarios generated by qualified threat intelligence providers. Testers engage in scenarios mimicking the most credible attackers, using relevant and up-to-date tactics, techniques and procedures.

It’s something Levy says works well: “Over the past decade it has raised the bar in the financial services sector in an evidence-based way. We have GBEST, which is the government version. TBEST will be the telecoms version. We’ve done some experimental testing and it’s really interesting. That’ll become part of the

regulatory regime that Ofcom then enforces.”

The framework, if followed, will ensure that the design of private networks protects the organisations interested and, within a network of networks, the nation. It’s a real threat, and not a new one, as Levy reminds us: “When a foreign power has some sort of control over parts of your telecoms infrastructure, that’s a scary thought. Back in 2018, the Russian state had been attacking telecoms networks in the UK. We explained how people could spot that and how people would kick them out. The Telecoms Code of Practice is all about trying to make that much, much harder for them to succeed, but much easier for people to notice when they do get in and easier to kick them out and limit the blast radius of where they can have an effect.”

MORE SIGNIFICANT IS the banning of Huawei, in which the NCSC took a leading role. Initially the recommendation was that it was safe for 35 per cent of the Radio Access Network to use Huawei radios but that changed when America imposed an embargo on American companies selling chips, and in particular field-programmable gate arrays, or FPGAs.

When a traditional chip is made its function is fixed, but chips have to be made in huge numbers to be economic. Products like mobile phone base stations are not made in large enough quantities to justify dedicated chips. A way around this is the field-programmable gate array. A chip of building blocks where there are fuses between each one. By blowing fuses in the chip it can be designed to perform the necessary function. When the chips in Huawei went from designs in which the fuses had been blown by an American company to a fully flexible raw design NCSC changed its recommendation.

Levy explains that the NCSC did another analysis and went “Huh! That means that all the assurance work we’ve done around having a safe place to stand and understanding certain things no longer applies. Because if the FPGA is Chinese, instead of US, I don’t trust it anymore. And so the things I can say about the boundary go away.”

He sees the US embargo as having a significant effect on Chinese infrastructure vendors, not just Huawei. “They can’t buy Electronic Design Automation tools, they can’t buy particular IP macroblocks for embedding

into their own chips. They can’t even buy things like Broadcom ADSL chips, even though they’re kind of commodity. So that Foreign Direct Product Rule is absolutely swingeing in terms of what it stops them doing.”

The Huawei decision came at the end of decades of back and forth. It wasn’t a matter of looking to block the vendor but if the risk of leaving it in outweighed the management of doing so.

The new, pragmatic NCSC understands that the UK won’t be able to build all the equipment it needs and that you can’t lock down everything. “If the security of your critical infrastructure relies on somebody not shimmying up a lamp post, you’ve probably built it wrong,” says Levy. The risk needs to be managed centrally. “You can design most telecoms networks to be resilient to exploitation. So you control the blast radius.”

That pragmatism extends to looking at the other consequences of requiring more powerful equipment to encrypt signals. Levy explains: “So what does that mean for power consumption? What does it mean for reliability? What does it mean for the operational management of all the keys that have to be done? It’s not just the capital costs, it’s the operating expenditure. If you’ve got 10,000 base stations, you have about 25,000 certificates to manage. How are you going to do that? How many people do you need? And so on and so on and so on. So there’s a real balance that has to be done.”

Thinking about how to solve these problems before there is an urgent need, like a direct foreign attack, means that there is a solution to hand. It’s also about judging what is likely to happen. The European Union put out a research paper on Russian Cyber Attacks on Ukraine and postulated on the reasons why there had been fewer than expected. The Russians released a virus known as NotPetya, which went everywhere, and it fell to the NCSC to deal with it.

But Levy doesn’t hold with the EU view that it was less than expected: “We think they’ve done broadly what we said they’d do. I think it depends what optic you’re looking at, as to how much cyberattack Russia has done. If you’re sat in the Ukraine, it doesn’t feel like little. I’ll tell you that for nothing.”

The ongoing war will make National Cyber Security Centre a very busy place, but, perhaps, if it concentrates people’s minds on security, it will also make some of its education work that little bit easier.

I think the chance of us rebuilding Marconi is basically zero

• Relevance and incentives: Accelerate adoption of services relevant to the user. Services for the elderly would include telecare, wellness programmes, home visits, wearable devices, deployment of AI to detect and trigger alarms and dispatches for events such as falls.

• Scalability: Initiatives often start as pilot projects, so give careful consideration to enabling large-scale adoption. Factors may include policy and regulation including new procurement models such as public-private-partnerships and long-term access to spectrum.

• Empowerment: Fully empower users by creating communities of interest with a voice when policy decisions are made. Co-design services in collaborative service delivery models.

Access to the digital world has long been di cult for rural and disadvantaged urban communities who are distanced, economically, socially and educationally due to their inability to access adequate broadband services. The COVID19 pandemic further broadened the “digital divide.” Almost overnight, vulnerable populations were cut o from access to government services, healthcare, education and retail resources, disproportionately a ecting people living in rural or deprived suburbs.

The latest figures from Thinkbroadband (July 2022) show that gigabit-capable broadband connectivity is now available to close to 70% of UK premises – so the national programmes from telcos supported by government funding (Superfast, LFFN, Gigabit Programmes) are driving much better coverage, but getting fibre in the ground is only part of the process – making sure all citizens can access education, health, employment and other vital services digitally is a much bigger challenge.

As governments start to allocate funds from their recovery plans to level-up and to bridge the digital divide, it’s increasingly clear that we must go even further to ensure digital inclusion. Beyond giving citizens access to high-speed broadband internet services and devices, we must be sure they understand the benefits, have the skills to use the internet and have access to local content, along with the knowledge of how to stay secure and protect online data.

Achieving digital inclusion is a fundamental enabler for society, making it a strategic public policy priority. AWTG has been using a wide range of wireless technologies in support of local government, and helping them through the digital inclusion framework, a comprehensive approach comprising five key elements:

• A ordable access: First and foremost, provide equal and a ordable access to quality broadband – not just to business centres or other areas with deep pockets, but throughout the community, including lower-income and rural areas. Enhance results with adapted regulation, as well as public-private partnerships with nontraditional players such as municipal networks and telcos, along with shared and neutral host networks.

• To achieve this consider not only fibre but also Fixed Wireless Access (FWA), which can also provide near gigabit speed using 5G technology. Such solutions provide fast, reliable, internet access with a lower cost of deployment than fibre for some semi-rural or rural areas and can be deployed much faster.

• Tools and training: Provide the necessary tools and training to make services highly usable. This means being suitable for the digital education levels of the average user, and able to generate actionable design feedback through analytics, demographics, citizen segmentation and needs analysis.

AWTG has been helping government for over a decade building the country’s first unlimited free-of-charge public access Wi-Fi mesh network in Barnsley in 2011. Since then it has built similar networks in Kingston Upon Thames, seven areas in central London and Dundee.

With new insights and funding triggered by the pandemic, now more than ever is the time to enhance digital access to ensure no one is left behind.

AWTG is a technology innovator and network systems integrator with a strong track record in delivering operationally transformative solutions that connect communities, transform organisations, and build economic and social value. Our team operates across the UK, Europe and the Middle East. www.awtg.co.uk

Nokia creates technology that helps the world act as one. A trusted critical networks partner, we are committed to innovation and technology leadership across mobile, fixed and cloud. We create value with IP and long-term research. Led by award-winning Nokia Bell Labs. We build capabilities for a sustainable and inclusive world.

www.nokia.com/networks/ industry-4-0/

A quarter of a century ago, Motorola launched Iridium, the first satellite-based mobile network. It flopped. Killed by cellular. Now space is back. Andrew Orlowski looks at how low earth orbit satellites can reach the parts towers cannot.

REGULATORS LIKE TO put a cap on how tall mobile phone towers can be around the world, but an audacious space venture is about to smash such limits. A rocket will roar into the sky above Cape Canaveral later this month. After reaching an altitude of around 500km above Earth, it releases its payload: the satellite BlueWalker 3, which then turns into a mobile phone base station.

In many ways, this is the most ambitious satellite venture yet attempted, one that many experts thought impossible: an orbiting cellular mobile network. It’s the first and only such network in space that unmodified, everyday mobile phones and modems can

use. This is a collaboration between AST Space Mobile and Vodafone, and the motivation for Vodafone is bringing what’s called direct-to-mobile coverage next year for regions not covered by a signal. Vodafone has a significant presence in Africa and India, and in many regions users with cheap commodity smartphones attach to these new Vodafone “masts”, joining the network automatically, initially with 4G, but later with 5G.

To achieve this feat requires satellites several times bigger and many times more complex than NASA’s $10billion James Webb Telescope. And there will be 20 of them to start with. The mind-boggling ambition of the venture is an example of the explosion of investment in space communications, says Paul Febvre, Chief Technology Officer at the

UK’s Satellite Applications Catapult.

Sixty years ago, the space market opened up to the private sector with Telstar – the first private satellite network – an event that captured the imagination so much at the time that it inspired a rare No 1 pop smash on both sides of the Atlantic.

“This is a renaissance, but satellite communication has always had to stand on its own two feet,” says Febvre. “The first consumer market was broadcast media, however increasingly enterprise and consumer demand for broadband communications is driving investment at scale.”

Two economic trends have formed a confluence – and just as when two rivers merge, things can get quite turbulent. One trend is the diminishing cost of throwing

Bluewalker 3 will provide mobile connectivity to standard, unmodified, mobile phones

communications gear into space, thanks to reusable and cheaper private sector rocketry. The best known is Elon Musk’s SpaceX and its internet satellite subsidiary, Starlink.

Musk has launched thousands of small satellites into Low Earth Orbit: LEO satellites. But at the same time, the costs of running terrestrial mobile networks have stayed stubbornly high. There’s no respite for landlocked mobile operators who must churn their equipment every few years, making constant capital expenditure (capex) top-ups, and the operating costs (opex) are increasing.

“The investment requirements of terrestrial mobile networks are sky wateringly high,” says Febvre. “That’s what’s causing this re-visiting of how we deliver communications.” While the vast outlays of the 3G auction haven’t been repeated, licence costs remain a significant outlay for mobile operators. Every five years or so the network must be refreshed. And the power requirements of the equipment have rocketed with 5G. In 2019, China Mobile shed some light on this. 5G needs three times as many base stations as 4G, each base station requires three times the energy – and is four times the price. And that’s before expensive and power-guzzling “edge compute” functions have been added. Even as they consolidate and re-design their networks to gain efficiency, mobile operators are running to keep still.

The mobile satellites in space have several advantages. They use virgin infrastructure, without the slow backhaul links that make the 5G experience so miserable for consumers. Despite being very far away, which increases round trip delays or latencies, what the engineers call the “link budget” is low. These electrons don’t need to trundle across ancient copper and through old switching equipment. While Starlink or AST won’t be quite as zippy as a pure virgin 5G network served only by fibre, they offer a reasonable consumer experience. And they’ve proved unexpectedly resilient too, particularly in Ukraine. SpaceX sent 15,000 Starlink kits to the country in March, and it has evaded Russia’s attempts to block and jam the signals.

“It helped us a lot, in many moments related to the blockade of our cities, towns, and related to the occupied territory,” Ukraine President Volodymyr Zelensky acknowledged in June. “Sometimes we completely lost communication with those places.” Starlink satellites have been used operationally to

drone strikes, and to inform populations under siege. However, it’s primarily in data and voice communications where the race to populate space will see the greatest market impact.

Back in Newbury, Vodafone executives have been monitoring the pre-flight checks to BlueWalker 3 with AST Space Mobile, which is a scaled-down version of the operational satellites. “It’s fair to call it an audacious engineering feat,” says Luke Ibbetson, head of Vodafone’s R&D organisation. He’s also a director at AST Space Mobile.

While the thousands of new low Earth orbit satellites are the size of an old Mini, the Vodafone network stations will be much larger. BlueWalker 3 is the size of a tennis court, which means it already dwarves the $10billion James Webb Telescope. The operational satellites will be four times as

large again, at 900 square metres. “They’re approaching the largest thing mankind has put in orbit,” says Ibbetson.

The two partners began collaborating in 2018, with Vodafone investing in the Midland, Texas-based company and helping redefine the design. Unfurling the vast solar-powered base station is both complex and risky. But it’s remarkable that it’s even got this far. Radio boffins declared that terrestrial cellular equipment would never be practical in orbit –for reasons AST says it has overcome.

The reason for the scepticism is a phenomenon known as the Doppler effect, which is the variation in wave frequency created by a moving object. In 1845, the Austrian physicist after whom the phenomenon is named, CJ Doppler, placed trumpeters in a railway carriage, while musically trained listeners lined the track, and noted the sound as it passed. A mobile phone experiences the same effect when the base station is moving – in this case, at thousands of miles an hour. On its own, this would indeed defeat the terrestrial equipment we use today. AST’s research emerged from science that investigates how to mitigate for the Doppler effect of a fast-moving base transmitter and receiver. AST has more than 2,000 patents, and many deal with just this.

“The special sauce that AST has introduced is a way of compensating for the increased Doppler,” Ibbetson explains. “We’ve been able to test that and we’ve tested them in the lab using real equipment.

We’ve got a large amount of confidence. In addition, the scaled-down version has been laid out in reverse, too: we’ve tested the array that’s going into space on the ground, and put a mobile phone in space to talk to it.”

What is surprising is the performance of the new low Earth orbit systems. Since the 1990s internet has used geostationary satellites, at altitudes far higher than the new arrivals, that made for long delays.

“It doesn’t suffer as much latency as you get from a geostationary satellite,” Ibbetson explains. “It means end-to-end we can reduce it to something very favourable, and we don’t have several levels of aggregation, as we do on a terrestrial network.”

“Each satellite is a large beam-forming array. So all of the stuff that compensates for the larger link budget is done through space by having a physically larger antenna array.”

The AST satellites will provide coverage to plus or minus 8 degrees on either side of the equator, a territory covering the tip of India, Indonesia and of course, Venezuela and Columbia, and vast swathes of equatorial Africa. It will become operational in 2023.

For now, though, the great space race is a contest between Starlink, OneWeb and Amazon-owned Kuiper Systems to provide ubiquitous reliable connectivity. Unlike AST, these require a ground station dish.

Reading-based handset maker Bullitt is developing a phone with direct to satellite two-way messaging.

The device, which has been on the drawing board for the past two years, brings together one of the world’s leading chipset manufacturers as well as a satellite network infrastructure partner to create a messaging service that will switch seamlessly between wi-fi, cellular and satellite. This uses a combination of a customised chipset,

a proprietary app and a sophisticated core network with infrastructure installed in satellite ground stations around the world. Bullitt’s rugged phones (sold under the Cat and Motorola brands) have always been designed for use in challenging environments and remote locations. But where the phones themselves may not let people down, sometimes a lack of cell coverage does. So, Bullitt decided to take the matter into their own hands.

In August Starlink and T-Mobile announced that it will create a new network, broadcast from Starlink’s satellites using T-Mobile’s midband spectrum nationwide. This true satelliteto-cellular service will provide nearly complete coverage almost anywhere a customer can see the sky using an unmodified mobile phone. With this technology, T-Mobile is planning to give customers text coverage practically everywhere in the continental US, Hawaii, parts of Alaska, Puerto Rico and territorial waters, even outside the signal of T-Mobile’s network starting with a beta in select areas by the end of next year after SpaceX’s planned satellite launches. It will start with text messaging, including SMS, MMS and participating messaging apps, afterwards, the companies plan to pursue the addition of voice and data coverage.

With its own launchers, SpaceX has an advantage – it doesn’t need to book rocket launches with anyone else. And the rollout continues to accelerate. One SpaceX launch alone in late July, its 33rd, added another 53 satellites in one shot. The reusable launch vehicle returns to Earth to land on a small drone ship, another cost saving. Today there are almost 3,000 Starlink satellites now in operation. OneWeb, a consortium in which the UK has a stake and which intends to merge with Eutelsat, has launched 428 satellites, with 1,280 more planned in medium Earth orbit –higher than LEO constellations, but capable of providing navigation and positioning. (OneWeb declined to be interviewed for this article.)

The largest order for launches placed so far has been by Amazon’s Kuiper, which has bought 83 launches to place more than 3,000 satellites into low Earth orbit. Starlink and OneWeb provide consumers and businesses

with connectivity across the UK. With speeds of between 50Mbps and 150Mbps – although some achieve twice that – and latency between 20m and 40m, it compares well against fixed-line broadband in remote areas. For enterprises, both Starlink and OneWeb are focusing on transportation – inking trucking and maritime deals as fast as they can.

Mobile operators are also using the new space infrastructure to make their 5G network more resilient. Although they always prefer to

use fibre for backhaul, satellite is a godsend when something goes wrong. “Satellite communication creates resilience in the networks, and that’s what we’re seeing,” Febvre explains. “Satellites are helping reduce the investment required to produce a resilient network. For rapid deployment in an emergency, or for quick fix in case of failure.”

That means “native 5G” that’s beamed from space to a “native” satellite 5G phone –one you might buy on the high street. Yes, that’s coming, but not yet.

“What becomes much more interesting is where you can remove the requirement for any special infrastructure on the ground – and use the infrastructure in space,” says Febvre. AST remains unique in being the only cellular mobile network in space, but building native satellite reception into phones may not be far behind, as the basic 5G air link protocols are being adapted for space.