Fuel Success

The value of marketing, and having a plan

Every business owner looks for ways to increase business. A great way to do this is through marketing. But, do you know what marketing is and what it isn’t? Having clear-cut definitions, and a basic understanding of marketing can help you develop a plan for your insurance agency that will lead to your agency’s growth.

What marketing is

According to the American Marketing Association, “Marketing is the activity, set of institutions, and processes for creating, communicating, delivering and exchanging offerings that have value for customers, clients, partners and society at large.”

What marketing does

Establishes and delivers value

Satisfies the needs of a target audience

Creates profitability for the business

What marketing isn’t

Marketing is not just …

• Direct mailings

• Telemarketing

• Print ads

• A website Marketing is not supposed to be …

• Entertaining … it should create a desire

• Funny … people may remember the joke, but they probably won’t remember your product

• Complicated … it should be user-friendly

• A miracle worker … it requires patience and planning

You can’t approach the marketing of your agency in a willy-nilly fashion. Placing an ad or posting something on social media and expecting fast results is not marketing. Marketing will only be successful if you create a plan and implement it.

Marketing plans from A to Z …

• Acquisition marketing. Convert leads into clients with targeted campaigns. Use lead generation and referral programs.

• Affiliate marketing. Partner with third-party affiliates to expand your reach, drive sales and build credibility.

• Brand marketing. Focus on your agency’s public perception to create trust, loyalty and recognition. Differentiate from your competitors and create connections with your clients.

• Content marketing. Focus on creating valuable content (e.g., blog articles, videos, white papers, webinars, infographics) that can attract and engage your target audience.

• Contextual marketing. Delivers personalized ads based on users’ browsing habits. Effective techniques include: behavioral targeting, dynamic ad placement, retargeting campaigns, content-based targeting, geotargeting.

• Conversational marketing. Engage in real time with your clients with one-on-one conversations. Use live chat, chatbots, in-person conversations and feedback.

• Email marketing. Nurture and build relationships. Keep your audience engaged, which will help them become loyal customers. Use: personalized campaigns, automated drip campaigns, newsletters, feedback surveys.

• Event marketing. Host or sponsor events. This will create direct interactions with potential clients and highlight your brand.

• Proximity marketing. Reach clients in a specific geographic area or location.

• Social media marketing. Enhance brand awareness, build customer loyalty and drive traffic to your website via social media platforms.

A timeline of factors that have influenced how we market

• 1450 Gutenberg’s printing press invented

• 1606 World’s first newspaper printed

• 1741 First magazine printed

• 1867 First (registered) billboard rental for advertising purposes

• 1922 First commercial broadcasted on the radio

• 1941 First TV commercial aired

• 1970 The term “telemarketing” is coined

• 1971 First email sent

• 1981 First personal computer sold

• 1994 First online sale is made (according to Shopify, it was Sting’s Ten Summoner’s Tales CD via the website NetMarket)

• 1998 Google’s search engine launched

• Video marketing. Use videos (e.g., coverage explanations, customer testimonials), to engage your audience and promote your brand.

• Word-of-mouth marketing. Keep your current clients happy so that they promote your brand through personal recommendations.

• 2004 Facebook launched

• 2005 Google Analytics and YouTube launched

• 2010 Instagram launched

• 2020 COVID-19 pandemic accelerates the digital transformation process — by 2022 e-commerce review is 785% higher than before the pandemic

Video marketing: Incorporate it into marketing plans

Matt McDonough, writer/editor & content curator, PIA Northeast

For insurance professionals working on marketing plans for their agencies, video marketing can be a powerful tool to use. While text can be effective on its own, video can take your marketing to the next level in terms of engagement and impact.

Why adopt video marketing

You may not think you need to adopt video marketing—or you may see the barriers to entry are too high—but the benefits are hard to ignore. Videos are a clear and appealing way to deliver information. They are a compelling way to present interesting information, and engaging visuals can get people more invested in the services your agency provides compared to text alone.

Additionally, there are material benefits to including video in your marketing plan. For instance, Google reviews your webpage and analyzes the featured content. If you have a diverse array of content (like featuring text, video and images on a single page), you can improve your ranking in the search engine.

Featuring video content also keeps visitors on your webpage for a longer time. One benefit is that this increases the chances of visitors further exploring your website. If you have a video that mentions multiple products or services, prospective clients may visit each product’s respective webpage. They also may leave the video playing in a different tab while they explore the website on their own.

This leads to yet another benefit when it comes to your webpage appearing in search engines: Google Analytics tracks the amount of time people spend on a given webpage. This means the more time people spend watching your videos, the higher the webpage ranks online.

Create and implement videos

While these are the benefits to video marketing, how do you start incorporating it into your marketing plan? Before you start putting people in front of a camera (or even purchasing a camera), you’re going to want to draft a plan to reach a certain audience with a specific product or service.

You also need to consider where you will be posting the video. Here are the questions that you must ask yourself for each video that you want to make:

• Is it for social media? Or is it for a specific webpage?

• Do you want to target a younger or older audience?

• When it comes to addressing an audience, do you prefer a casual tone? Or do you prefer something a bit more serious?

Once you have a clear idea of what kind of video you want to make, it is time to realize it. You can either outsource the production and post-production to an agency or create the video in-house. If you choose to outsource the video, you may need to screen different production companies to determine which one suits your needs the best.

If you choose to make the video in-house, there are a few more considerations, which include:

• writing and editing a script;

• planning your shoot (from shot composition to location); and

• shooting and editing the video.

A lot of work goes into video production, and while it may seem tempting to cut corners, viewers will notice dips in the quality of your work.

After you’ve posted your video to an appropriate platform (such as your webpage or on social media), keep a close eye on your metrics, so you can measure each video’s success. This information will help you make more effective videos in the future. Be sure to listen to feedback from your audience, too.

Takeaways

Video production is more accessible than ever, but it’s no walk in the park. A lot of work goes into producing and promoting videos.

However, if you determine that video marketing is the best course of action for your marketing plan, you can find it rewarding and beneficial for you and your agency.

This article is adapted from “Video marketing: How to incorporate it into marketing plans, create engagement,” which can be read in its entirety on PIA Northeast News & Media (blog.pia.org).

Bold solutions that fuel business growth

Your digital marketing plan must comply with the law

Danielle Caswell, Esq., Associate counsel, PIA Northeast

In an increasingly competitive marketplace, many insurance agencies are adopting comprehensive digital marketing plans to attract new customers, enhance visibility and engage prospects across multiple online channels. This includes leveraging social media and other digital marketing strategies to connect with clients and build brand awareness.

While utilizing the digital space presents significant opportunities, it also introduces complex regulatory and legal risks. From advertising compliance to intellectual property concerns, agents must create their digital marketing plans with a careful understanding of both marketing strategy and the law.

Your agency’s website

An agency’s website serves as the foundation of its digital marketing strategy—acting as both a virtual storefront and a central hub for client engagement. A well-designed, mobile-responsive site allows prospective clients to learn about services, request quotes and contact agents with ease. It also supports broader marketing efforts by hosting educational content, blog posts and client testimonials, which can improve search engine visibility and establish the agency as a trusted resource.

When creating and maintaining a website, insurance agents must comply with key legal standards related to advertising, privacy and accessibility. Advertising content must be truthful, nondeceptive and compliant with state insurance marketing regulations. Privacy laws, such as the Health Insurance Portability and Accountability Act, the Gramm-Leach-Bliley Act, and other state-specific consumer data protections, require transparent data collection practices and secure handling of personal information. Additionally, agents must ensure their websites meet accessibility standards under the Americans with Disabilities Act, to provide equal access to users with disabilities through features like screen reader compatibility, captions and keyboard navigation among

Improper use of testimonials, even when well-intentioned, can trigger liability for false advertising or privacy violations …

many others.1 Consider creating and prominently posting on any site a Terms of Use and Privacy Policy to outline user responsibilities, data collection practices, and legal protections for both the agency and any site visitors.

Your agency website also can be used as a tool to promote brand awareness and cohesiveness. Consistent use of your agency’s logo, color palette and messaging reinforces the company identity and helps differentiate it in a crowded market. Protecting key brand assets through trademark registration are highly recommended, as registration provides businesses with an avenue for legal recourse against misuse or infringement. Agencies also can request that all team members, third-party vendors and independent contractors working with them use brand elements in accordance with established guidelines to preserve visual integrity and avoid confusion. To further safeguard an agency’s IP in connection with these relationships, clear provisions can be incorporated in third-party and independent contractor agreements that allow an agency to retain sole ownership and control over all proprietary materials, branding and client data. These types of clauses help ensure that an agency’s valuable IP remains protected, and that it cannot be used or transferred without explicit authorization.

The strategic value of social media

As consumer habits have shifted toward digital media consumption, insurance agencies are increasingly turning to platforms like Facebook, LinkedIn, Instagram, YouTube and even TikTok to replace or supplement traditional marketing efforts. These platforms offer a direct way to engage those clients who are in the younger, tech-savvy demographics who are less likely to respond to print ads or cold calls. This allows agents to foster client relationships where today’s consumers already spend their time.

Typically, social media posts by agents/ agencies are considered advertising under most state insurance laws. Therefore, like website requirements, all statements made on social media must be truthful and not misleading, compliant with state-specific regulations regarding policy descriptions, disclaimers and disclosures, and consistent with any marketing guidelines issued by the insurer(s) represented. Failure to do so can result in possible enforcement actions, license suspension and/or civil penalties.

Many social media (and website) posts contain client testimonials. The Federal Trade Commission considers a testimonial as a type of endorsement, and “an advertising message that consumers are likely to believe reflects the opinions, beliefs, or experiences of a consumer or celebrity who has purchased, used, or otherwise had experience with a product, service, or business.”2 Businesses are prohibited from creating or selling reviews and testimonials that misrepresent that they are by written by someone who does not exist (such as AI-generated fake reviews) or who did not have actual experience with the business or its products or services, and/

or misrepresents the experience of the person giving it. Businesses also can’t buy such reviews, procure them from company insiders or disseminate such testimonials when they knew or should have known that the reviews or testimonials were fake or false. Company insiders also are not allowed to create (and businesses cannot post) certain reviews and testimonials that fail to clearly and conspicuously disclose any material connection to the business.3

In addition to being subject to FTC guidelines, testimonials also are regulated by state insurance advertising laws, so accuracy and transparency aren’t just ethical—they’re required. In many cases agents and agencies must:

• obtain expressed written consent from clients before publishing any testimonial that uses their name, image or likeness,

• ensure that the testimonial is factually accurate and does not exaggerate or imply typical results without appropriate qualification, and

• avoid compensating clients for endorsements—unless such compensation is disclosed clearly.

Improper use of testimonials, even when well-intentioned, can trigger liability for false advertising or privacy violations, so it is important for agents to understand all the laws and rules that regulate their agencies.

Insurance agents also should exercise caution with any website or social media postings that could be interpreted as an inducement or rebate, as these practices may violate state insurance laws. Any offers, promotions, or gifts must comply with applicable regulations to avoid unintended legal and licensing consequences.4

IP considerations

Social media and other digital platforms and websites thrive on visual content, but it is important to understand how the creation of content to market your business can unintentionally lead to the infringement of others’ IP rights. When creating content and digital assets to post, unauthorized use of images, music and/or written material exposes agencies to IP infringement claims.

If an agency decides to use external content, all the proper licenses and permissions for commercial use must be secured prior to use and posting the content online, including the right to use any third-party IP such as software, music and/or artwork.5 It is best to avoid the temptation to borrow memes, infographics or videos from competitors or creators without permission. If an agency is utilizing influencer collaborations as part of its marketing strategy, all rights to any content created and shared should be clarified and documented, preferably prior to the beginning of the collaboration. And, if agents or agencies post sponsored content, they must adhere to all advertising regulations and disclosure requirements.

Creating original content helps to avoid potential IP infringement liabilities, as the content would be owned by the agency. Consider copyright protection and use watermarks or trademarks to prevent unauthorized reuse of such content. It may be tempting to use a carrier’s logo or other carrier IP in any such content, but you must remember that such use often is addressed directly in agency agreements between insurers and agents. Typically, these provisions govern the authority to use insurer logos, marketing materials, proprietary content and brand

assets. Usually, agents are granted a limited, revocable license to use such materials strictly in connection with authorized business activities and they must comply with branding guidelines prescribed by insurers, as well as any applicable advertising rules. Often, there are requirements that give the insurers final approval over any marketing materials created that include the insurer’s IP. Unauthorized use or modification of insurer-owned IP can constitute a breach of contract and expose the agent to legal liability or termination of the agreement.

Conclusion

As the industry continues to evolve, insurance agents who embrace digital marketing and social media, while staying mindful of legal and regulatory obligations, will be best positioned to connect with today’s consumers and sustain long-term growth.

Since the digital world is still relatively new to many businesses, considering ways to protect your agency from associated liabilities while navigating it is appropriate. Consulting legal counsel or a compliance officer before publishing any content can help mitigate some of the risks associated with social media and digital marketing, and insurance agents should consider carrying media liability insurance or errors-and-omissions coverage that can include protection for IP claims. These policies may help cover legal defense costs and potential damages arising from allegations, such as copyright infringement, defamation or unauthorized use of content online.

Some insurers also offer cyber liability policies with endorsements that address digital marketing risks, including issues related to data breaches or the inadvertent disclosure of confiden-

tial information via social platforms. Having the right coverage in place is an important part of a comprehensive risk management strategy in today’s digital landscape. If you are a member of PIA, you can obtain a free, no-obligation quote by visiting www.pia.org/quote/cyber.php.

Once an agency has carefully considered the legal risks and taken steps to protect itself from potential liabilities, it can confidently and creatively engage in digital marketing—because at its core, marketing should be both strategic and enjoyable.

1 PIA Magazine, November 2021 (https://blog.pia. org/media-gallery) and ADA.gov (https://www.ada. gov/resources/web-guidance)

2 Federal Trade Commission (tinyurl.com/35mrhsjz)

3 FTC, 2024 (tinyurl.com/4auvcxr8)

4 PIA Magazine, September 2018 (www.pia.org/IRC/ qs/show.php?q=90980)

5 PIA Magazine, October 2024 (https://blog.pia.org/ media-gallery)

Our original specialty, Workers’ Comp has long served as the anchor line for our growing suite of commercial products. We distinguish our coverage by providing a host of value-added services before, during, and after a claim.

www.guard.com

Fall into Savings with PIA’s E&O Courses

This season, PIA is offering high-quality, in-depth seminars covering errors-and-omissions concerns that independent insurance agents face every day. Earn your E&O continuingeducation credits with some of the best instructors the industry has to offer.

Take full advantage of the E&O discount offered by Allianz and Utica National. This discount not only applies to the E&O courses, but for CIC AM | Agency Management Institute Webinar ^AZ^UN and 2024-2025 CISR AO: Agency Operations^AZ^UN , too.

Wednesday, Oct. 1, 2025—Emerging E&O Issues and Recent Court Cases^AZ^UN

Wednesday, Oct. 15, 2025—CIC AM | Agency Management Institute Webinar^AZ^UN

Tuesday, Oct. 28, 2025—2024-2025 CISR AO: Agency Operations^AZ^UN

Monday, Nov. 3, 2025—Loss Prevention & Ethics–There is a Connection!^AZ^UN

Wednesday, Dec. 3, 2025—Oops! I Did it Again … Errors & Omissions Claims^AZ^UN

*^AZ^UN—This course has been approved for E&O loss prevention credit by Allianz and Utica National.

Register online at: www.pia.org/category/education

AFCO Direct’s quoting and account management platform, ADEPT, is built to provide you more efficiency, more solutions

•System Integration

•Custom Branding

•Digital Return Premium

•Digital Down Payment

•Digital Signature

•Custom Reporting

•Agency User Management

•E-Z Endorsement Financing

Design+ Print

PIA Design & Print offers a one-of-a-kind relationship between you, your brand, and our diligent, creative and unique team of hardworking professionals whose top priority is building your business. With your input, we forge the path between you and your future clients, reliably growing your brand into a name people know and trust.

Contact Design & Print today to make the most of your business. You are important to us—let us show you!

Audit your agency—here’s why

Utica National Insurance Group E&O Risk Management

Why is it vital for you to audit your agency regularly? Auditing will help you identify errors in your files and help ensure your staff is adhering to agency policies and procedures while maintaining a high level of documentation quality.

An audit can help to reduce your agency’s exposure to errors-and-omissions claims while improving efficiency and customer satisfaction. You can identify areas where employees may lack understanding and provide them with additional training. Additionally, it demonstrates to the staff that they will be held accountable if they are not adhering to agency expectations. Employees not meeting the agency’s expectations increase the potential for an E&O issue. Who should conduct the audits? This will largely depend on the size of the agency and quantity of files to be reviewed. However, individuals should have sufficient experience with the material they will review and have been provided with training on the audit process.

How many files should be reviewed? This will vary depending on the work performed and the frequency of the audits. A benchmark of 10% is a place to start—but you must consider what makes the most sense for your agency. For newer or less experienced staff members, a higher number of files should be reviewed. This will help identify areas where additional training may be needed. However, even experienced staff members can make errors, so don’t forget to include them in the process, too.

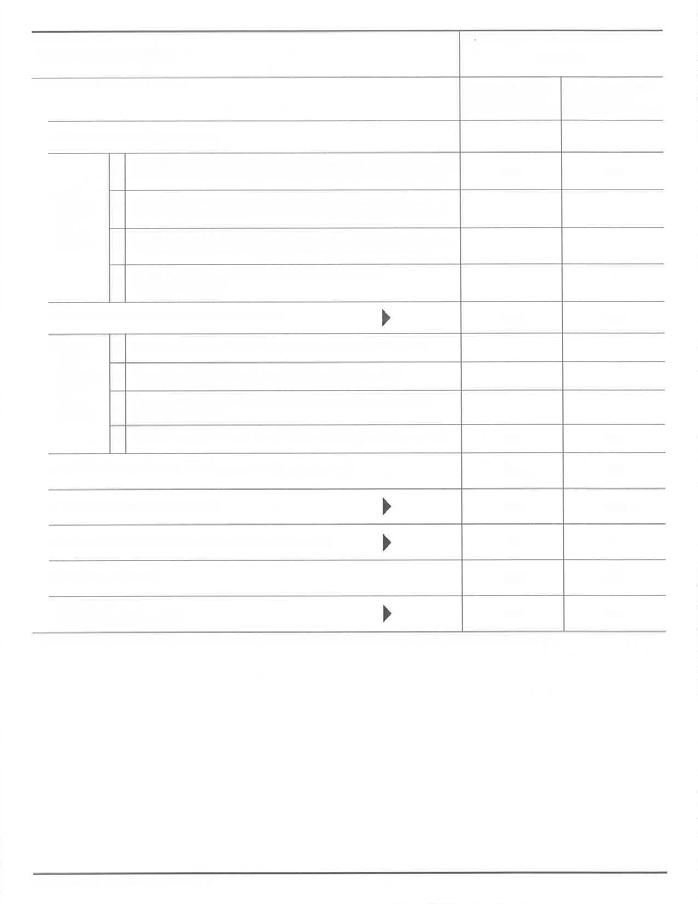

Your agency’s auditing process

How often should files be reviewed? Perform audits monthly, if possible, to identify any emerging issues or need for additional training quickly.

What areas of the agency should be audited? Because it’s likely that your agency consists of numerous disciplines— such as marketing, customer service, sales, accounting—ensure that all of these areas are reviewed. Each has procedures that, if disregarded or not performed properly, could cause problems for the agency.

What should you do with the data? Analyze the results for individual employees, and for the agency once the audits have been completed. Do specific areas/individuals stand out? Do your policies and procedures need modifications for clarity? Is additional training necessary? Advise employees who performed well and thank them for their efforts and commitment. For those who are not performing well, meet with them to better understand the reasons for the under-performing results, and help them improve.

When auditing your agency …

When you audit your agency, make sure to take specific actions regarding:

Workflow. Determine the workflow or process to be evaluated.

Determine intention. Identify the steps in the workflow or process as it is intended (make it fit your organization). Consider using the following markers:

• match to your policy; or

• match to information expected to be gathered on new accounts; or

• identify noncompliance with an established process. Review. Determine the review period. You may choose to begin by reviewing 30 files or 10% of total volume for an initial sampling. For best results, perform the workflow review regularly.

Reports. Identify if there are any reports that can be run within your agency management system that can assist with your auditing process.

Evaluation. Have a staff member who’s removed from the process evaluate the steps in the process. For a sample audit template, see: tinyurl.com/mr27e8fk.

Analyze results. Identify gaps in which the actual practice did not meet the intended workflow.

Feedback. Provide real-time feedback to employees on their performance and single out any gaps in expected performance identified in the audit.

E&O

Action plan. Develop an action plan to improve any areas of noncompliance. There are two ways to find out if your staff isn’t meeting the job expectations: perform audits or wait for an E&O claim to develop. While performing audits takes commitment and time, it is more cost effective than the alternative.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and

subsidiaries. Home Office: New Hartford, NY 13413. This information and any attachments or links are provided solely as an insurance risk management tool. They are derived from information believed to be accurate. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have

been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues. © 2025 Utica Mutual Insurance Company

DOCUMENT CONVERSATIONS

Documentation is one of the best ways to help reduce your agency’s E&O exposure.

Best practices

• Document conversations immediately. If you wait to do it later, later may never arrive. Plus, the longer you wait, the easier it is to forget important points.

• Be detailed. Remember, notes need to be understood by everyone in your office. Include the name of the insured who was involved in the conversation, and the details of the conversation. Include any next steps that need to be taken, and avoid abbreviations as they may be misinterpreted by another staff member.

• Get a sign-off. Once the details have been documented. Send a note to the insured detailing what was said and agreed upon. Ask him or her to review the document and verify that there weren’t any miscommunications or lack of clarity. Ask if the insured has any additional questions or requests. Keep a copy of the signed document in your files.

This practice goes beyond client files. Don’t forget to memorialize discussions with wholesalers, managing general agents, carriers, and anyone else with whom you and your employees may speak with throughout the day. Remember, the person you may have had the original conversation with, may have left the business when you need to verify the information later.

MICHAEL STREIT PRESIDENT, EZLYNX

Fuel Success

Propel business growth with customer reviews

In a world in which everything from movies to meals gets rated online, it’s no surprise that insurance buyers are turning to customer reviews before choosing an insurance provider. With the insurance industry rapidly shifting toward a service-driven model–think insurance-as-a-service–what truly sets one agency apart from another isn’t policy coverage or cost. It’s the experience.

Clients want agents who are responsive, trustworthy, and genuinely invested in their well-being. That’s why online reviews have become one of the most powerful decision-making tools in the insurance world. While polished websites, catchy slogans and ad campaigns are helpful, it’s real customer feedback that often seals the deal for prospective clients. In an industry built on trust, actively fostering positive reviews, and ensuring those reviews are visible, can take your agency to the next level.

Why customer reviews matter for independent agents

Before diving into strategies for collecting better reviews and maximizing their value, it’s important to first understand just how impactful customer reviews can be for your agency.

Online reviews are the digital version of word-of-mouth. They allow your agency to speak for itself and can help establish trust even before a single face-to-face interaction with a client.

According to Review Trackers, about 61% of consumers consider online reviews and reputation influential when choosing an insurance agent.1 Even more striking—90% of consumers read three or more reviews to form opinions about local businesses.2

So, what is it that makes online reviews so effective? Unlike ad campaigns that come directly from your agency, reviews are seen as more trustworthy and unbiased. They come from real clients who should have no vested interest other than sharing their honest experience.

Generally, businesses with an average Google star rating of 4.5 or higher perform better than those with lower ratings. Not only does a high rating signal to clients that your agency is trustworthy and provides quality service, but Google’s algorithms also prioritize businesses with higher ratings, leading to better visibility in search results and increased organic traffic.

And, the best way to drive strong online reviews? Stay true to your agency’s values and consistently deliver exceptional service to your clients.

Amplify your agency with automated reviews

You know reviews are important, but asking for them can take a lot of time. Manually sending emails or calling clients to request feedback eats up the valuable hours that you could spend providing service to your customers or growing your business. Chasing down reviews can be frustrating and easy to forget amid your busy schedule.

What if you could automate the entire process and get more reviews—without lifting a finger?

Modern agency management systems have built-in features to automate your review process. They can send email prompts to customers automatically to ask them to leave a Google review after specific trigger events, which allows you to manage reviews effortlessly without having to leave your AMS.

These review requests can be sent directly to clients after key events, including:

• signing on a new customer;

• assisting a client in adding an additional policy; and

• completing a policy renewal.

Some systems also offer the option to send automated emails asking clients to refer your agency to a friend. This is another incredibly useful feature to take advantage of as it does the outreach for you, helping you connect not just with your clients, but with people in their inner circle. And, when it comes to trust, few things are more powerful than a recommendation from a friend.

Best practices for getting more—and better— reviews from clients

Now that you understand the importance of reviews and how the right agency management technology can streamline the process, here are a few key tips to help you increase your agency’s online review footprint.

No. 1: Ask for reviews the right way. While you want to maximize the number of positive reviews from your clients, it’s just as crucial to know when to ask—and when not to. Asking for a review before you’ve delivered real value or provided service can backfire. However, when you request feedback right after a positive interaction, you’re much more likely to receive favorable reviews. This not only boosts your Google rating but it ultimately strengthens your agency’s reputation and retention.

Here’s a simple way you can phrase automated emails when asking clients for reviews.

“We’re so glad we could help you with your insurance needs. If you had a good experience, would you mind sharing it in a quick Google review? It helps others know what to expect from working with us.”

No. 2: Make it easy and convenient for clients to leave reviews. Simplify the review process by providing direct links to your review profiles in follow-up emails, text messages or on your website. Modern agency management systems not only automate review requests, but they also include direct links to your agency’s Google review page, making it quick and effortless for clients to leave feedback. The easier and more convenient the process, the more likely clients are to take a moment to share their experience.

No. 3: Don’t fear negative reviews—respond to them. Yes, every agency wants glowing 5-star reviews. But don’t panic if you receive the occasional negative comment. In fact, a few mixed reviews can boost your credibility by showing that your feedback is genuine and unfiltered. When handling negative reviews what really matters is how you respond to them. A prompt, professional and empathetic reply demonstrates to potential clients that you take concerns seriously and are committed to resolving issues.

Example response to a negative review:

“Thank you for your feedback. We’re sorry to hear about your experience and appreciate you bringing this to our attention. Please reach out to us directly at [contact info] so we can better understand the issue and work toward a solution. Your satisfaction is very important to us.”

No. 4: Expand beyond Google (but start there). Google should be your top priority—especially when it comes to local search visibility. Agencies with strong Google reviews are more likely to appear in the Google 3-Pack—the prominent box at the top of local search results showcasing the top three businesses. Landing in the 3-Pack increases clicks and leads dramatically, meaning that over time you may be able to rely more on organic traffic and reduce your spending on paid ads.

But don’t stop at Google. Encourage clients to leave reviews on other platforms like Facebook, Yelp and the Better Business Bureau as well. Since clients use different platforms, maintaining a broad and positive presence will boost your agency’s credibility everywhere.

No. 5: Leverage positive reviews across marketing. Your best reviews shouldn’t live on the web alone. With the right permissions, you can really take advantage of key client quotes and testimonials by repurposing them across your marketing content, adding them to your website, using

them in emails, or creating quote graphics for social media. A great review is more than praise; it’s proof that your agency delivers.

No. 6: Keep it authentic and compliant. When it comes to reviews, integrity matters. Following legal and ethical best practices isn’t just about avoiding penalties, it’s also about protecting your agency’s long-term reputation. Never offer incentives like discounts, gift cards or cash in exchange for a review. While it might seem like a harmless way to encourage feedback, doing so violates platforms like Google’s guidelines and can seriously harm your credibility.

It’s also important to resist the temptation to generate fake reviews, or have employees, friends or family post under false identities. These shortcuts might offer a temporary boost, but they can lead to long-term consequences—such as being flagged or removed from local search listings entirely.

The bottom line? Encourage honest feedback from real clients based on real experiences and your reviews will reflect the quality and values of your agency naturally.

Let your reputation do the talking

In today’s competitive insurance landscape, service is your strongest differentiator, and online reviews are how the world finds out about it. But building a strong review presence doesn’t mean adding more to your already full plate. The right agency management solution and automation tools can seamlessly prompt clients for reviews at just the right moment—without having to manually follow up after every interaction.

Instead of chasing testimonials, let your technology do the heavy lifting and free you up to focus on what really matters: delivering the kind of review-worthy service that clients rave about. When you pair exceptional client experiences with smart automation, reviews become a natural, continuous part of your growth strategy. You’ll build more than a great rating—you’ll build a lasting reputation that drives referrals and long-term success.

Streit is the president of EZLynx. With nearly a decade of experience in private equity operations and an MBA from Harvard Business School, Streit has become well-versed in the mechanics of deals and integrations, offering invaluable insights and contributions to the insurance industry.

1 Reviewtracker, 2021 (tinyurl.com/3943xk79)

2 GatherUP, 2024 (tinyurl.com/p53txfw7)

Nearly

PIA offers a searchable database of previously asked member questions answered by our highly qualified specialists.

questions answered last year alone

“I appreciate how PIA Northeast gets information out to its members that is timely and informative on what is going on and changing in the industry. I also am very pleased with the smooth process of renewing my E&O policy through PIA.”

—Michael Cavalieri

Vehicle Insurance Brokerage Services Inc.

“You have been extremely helpful over the past several months when we have had issues with carrier contracts, cyber filings, and now a licensing concern. I say over and over that one or two calls to PIA’s Industry Resource Center to access PIA’s in-house attorneys more than pays for the membership dues.”

—Fred Holender, CLU, CPCU, ChFC, MSFS

Lawley LLC

“PIA Northeast’s membership resources page has been extremely helpful to me and my staff as we navigate the ever-changing world of insurance. The page has terrific information on crisis planning and preparation, marketing, staffing, agency development, and provides access to experts. I particularly like the technical hotline where you can submit a request online and receive an answer back from an expert on the topic. The technical hotline is worth the cost of membership alone!”

—Timothy G. Russell, CPCU

The Russell Agency Inc.

Data-driven insights. Better agency outcomes.

Business intelligence results in informed decisions. That’s why SIAA provides its independent agency members access to industry leading information systems. Having actionable data means more sales and revenue, operational efficiencies, and meaningful processes. It’s another way we provide our member agencies with the tools they need to enhance their success.

Wherever you are on your journey as an independent insurance agent, or your journey to become one, you owe it to yourself to check out the benefits of becoming a SIAA member. There’s a reason over 5,000 independent agents are availing themselves of the tools, knowledge, and support provided by The Agent Alliance.

Learn how joining our community can make the difference in your long-term success.

siaa.com info@siaa.com

M&A: Follow the trends

Sean Kenny Senior vice president of corporate

Position your agency for strategic, sustainable growth

There’s a quote from the late Charlie Munger—Warren Buffett’s longtime business partner—that I’ll never forget. He said, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

It’s timeless advice for independent agency owners—especially in today’s merger and acquisition landscape. We remain in a strong sellers’ market, yet stubbornly high interest rates and the recent passing of the One Big Beautiful Bill Act are creating uncertainty. Whether agency principals are looking to grow through acquisition or preparing for a sale, it’s critical to follow Munger’s advice and know the numbers better than the person on the other side of the table.

Let’s take a closer look at recent M&A activity, uncover key trends, and find opportunities for both buyers and sellers.

Demand continues to outpace supply

The number of M&A deals is down about 20% compared to pre-COVID levels,1 which is arguably the most relevant data point. Yet, a massive imbalance between supply and

demand still exists. And, according to our research, only a small fraction of the estimated 35,000 to 40,000 independent agencies nationwide are listed for sale at any given time, and each one can attract a handful of the 40 to 50 serious, capitalized buyers, allowing sellers to shop around for the most attractive offer.

Typically, sellers’ markets like this one create higher valuations, but we’re seeing a distinct divide based on the size and type of agency being acquired. Larger niche agencies continue to attract the same top-tier multiples we saw pre-pandemic. However, we also find that smaller, generalist agencies (those with revenue under $500,000) have seen a roughly 20% decline in valuations since their pre-COVID pandemic peak.

Why the difference? Higher interest rates are prompting buyers to be more strategic in their acquisitions. They’re seeking targets that no longer just provide scale, but which also bring them scope—be it through agencies with specialty lines, located in a desirable and growing metropolitan areas, or agencies having talented producers and leaders on staff.

Top trends: consolidation and integration

The consolidation wave we’ve seen over the past 15 years on the distribution side is continuing. That wave has washed out many of the larger agencies, resulting in estimates that 85% of remaining independent agencies have less than $5 million in revenue. Enter mega-mergers. In April, Aon acquired NFP, 2 and before year’s end, Gallagher and Brown & Brown are expected to close on their purchases of AssuredPartners3 and Accession Risk Management,4 respectively. These three transactions represent nearly $40 billion in combined deal value. Such behemoths have realized that, given the current landscape, it’s extremely difficult to move the needle on inorganic growth. As a result, they have resorted to targeting $1 billion brokers to help them grow, some of which have been incredibly opportunistic.

While the numbers are important, so are the nature of these transactions. We’re seeing a greater push toward post-sale integration on both the carrier and agency side. In the past, it wasn’t uncommon for acquirers to buy an agency and leave its existing operations largely intact, allowing the agency owners to maintain their existing systems, staff and local identity into perpetuity post-sale. Today, many buyers have accelerated the integration of newly acquired agencies into

their systems, culture, ledgers and trade names, typically starting with a hybrid approach, then moving quickly toward full assimilation. For buyers and sellers, this development means that cultural fit is as critical to a successful deal as valuation and cash flow.

What’s ahead: OBBB and interest rates

While the OBBB created significant debate, it helped provide some clarity for agents who are looking to buy or sell an agency. The bill maintains the 21% corporate tax rate 5 while increasing tax benefits6 for qualified small-business stock, which could benefit agencies structured as C-corps from a capital gains perspective.

However, the future remains murky. We don’t yet know to what degree the international tariffs will impact short-term inflation. Interest rate uncertainty is equally as concerning. Should the Federal Reserve cut rates later this year, it will lower the cost of capital, potentially spurring economic activity and investment, in much the same way as the OBBB is designed to do. Markets anticipate two cuts before year’s end, but those predictions don’t always become reality. Last year, markets priced in six rate cuts, but the Fed made only three.

TRAVEL AGENTS AND TOUR OPERATORS

PROFESSIONAL LIABILITY PROGRAM Partner with Aon Today!

• Brokers - No minimum premium volume requirements to place business in this program

45+ years serving the travel industry

• Recognized industry partner with top national travel associations

•Custom policy specifically designed for the travel industry

Professional Liability Insurance for:

• Travel Agents and Travel Agencies

•Standard Tour Operators

•Student Tour Operators

•Adventure Tour Operators

•Receptive Tour Operators

•Destination Management Companies

•Meeting Planners (Corporate)

Policy Includes:

•Worldwide Territory

•General Liability

•Errors & Omissions

•Non-owned & Hired Auto

•Personal Injury

• Industry specific endorsements Learn more

Taking the first steps

Regardless of the external pressures on the M&A environment, a successful deal begins with a solid understanding of the financials. It may sound like common-sense advice, but this is when we see many transactions come up short. Agency principals must understand their earnings, cash flow and operating margins thoroughly. Owners who run their agency like a lifestyle business—taking money out as needed without focusing on tracking their recurring profit—will be at a severe disadvantage at the bargaining table. Additional M&A best practices for both buyers and sellers:

Hire a specialized M&A attorney. Choosing the right M&A attorney is like selecting a surgeon; the best ones are both specialized and highly experienced. It’s not recommended to trust the complex deal process to the same family attorney who draws up your corporate documents and employment agreements. It also is not recommended to try to save money by using ChatGPT to build an M&A contract. Dedicated M&A attorneys will charge a significant fee, but think of it as a watertight insurance policy, one that you’ll seriously thank yourself for purchasing if something goes wrong during or after the transaction process.

Seek guidance from others. Buyers and sellers should tap into resources from peer networks and agency alliances— especially if it’s their first M&A deal. Some alliances offer lender relationships that can provide capital to buyers at reduced rates. Others offer specialized perpetuation planning support, helping agency principals achieve their goals and develop a future-focused succession plan that will lead to a lucrative exit.

Action steps for buyers

Higher capital costs make traditional arbitrage plays (i.e., buying low, scaling up and selling high) more difficult to achieve. That’s why buyers should focus on acquiring agencies that will help them achieve specific goals, such as adding a profitable new product line or breaking into a new geographic market.

Buyers also should seek agencies that can level up their technological capabilities. A small but scrappy agency that has cut costs and moved faster with proven AI or optimal customer relationship management system use cases, for example, may be an attractive target for a larger agency struggling to increase efficiency and implement modern technology.

Action steps for sellers

Differentiation is the secret sauce to gaining interest from buyers. General agency principles should look for ways to stand out from the crowd. Wow-factors include having a mix of personal and specialty lines, and building a sales culture with producers who have their own individual specialties. Agencies with higher levels of specialization and resources dedicated to growth will tap into higher-margin markets and demonstrate deeper value to potential suitors.

The best position for an agency in the M&A landscape is one that is strategic and fosters sustainable growth. Whether preparing for an acquisition or a future sale, or planning for long-term perpetuation, understanding the fundamentals shaping today’s M&A activity offers a significant competitive advantage. Clean financial reporting, diversified offerings and operational efficiency are more than M&A best practices, they are crucial elements of strong agency management and business acumen. Agents who keep a finger on the pulse of elements impacting M&A opportunity, while viewing their agency through a long-term lens, will not only navigate the current market more effectively, but build stronger, more resilient and valuable independent insurance agencies.

A successful merger or acquisition doesn’t happen on the day of closing. It requires months of preparation. Agency owners who heed Charlie Munger’s advice and who understand not only their own business, but also the current M&A marketplace, will navigate the transaction process with ease and secure the best deal for their business.

Kenny is the senior vice president of corporate development for SIAA–The Agent Alliance, with more than 5,000 member agencies and more than $17 billion in written premium. He is responsible for helping design and execute SIAA’s inorganic growth strategy through new investment opportunities, partnerships, joint ventures and acquisitions. This includes managing external relationships, sourcing, negotiating, valuing and structuring strategic acquisitions for the company. Prior to joining SIAA, Kenny served in manager and executive roles at Gallagher, Ryan Specialty Group and KPMG.

1 The Hales Report, 2019 (tinyurl.com/jud8xv3n)

2 AON, 2024 (tinyurl.com/2r2vvr7s)

3 Reinsurance News, 2025 (tinyurl.com/yc6etxkk)

4 Brown & Brown, 2025 (tinyurl.com/2r9dp8zb)

5 Michigan Chamber of Commerce, 2025 (tinyurl.com/pneyhu5d)

6 Holland & Knight, 2025 (tinyurl.com/3d25ekt7)

A cure-all that can increase your agency’s sales significantly

John Chapin, President, Complete Selling

Lately, I heard two sales gurus talk about the importance of tone, and how to use it when selling. While these gurus really know their stuff—and they have proven themselves when it comes to sales—it is not the cure-all I’m talking about in this article.

The cure-all I’m referring to not only guarantees that your tone is correct (which is important), but it also ensures that several other key sales elements are in place.

What are the other sales elements? They are:

• building rapport with the prospect;

• doing what’s right for the prospect;

• fighting off buyer’s remorse;

• building a foundation for a strong relationship; and

• paving the way to more sales—either to prospects or to people they refer to you.

So, what is this cure-all? It’s caring.

The power of caring

If there’s one thing that seems to be missing in most sales these days, it’s truly caring for the prospect. If you truly care, then tone, and the other sales elements mentioned previously, naturally follow.

Think about some examples in your personal life: if you’re proposing to the love of your life, or yelling to stop your kid from running into the street into oncoming traffic, does someone have to tell you to use the right tone? If you’re giving a eulogy for your closest friend or family member, is anyone talking to you about what tone to use? No. You know intuitively, and it flows because you care deeply for each of the people in these scenarios.

It’s the same when you truly care about doing what’s best for your prospective clients. For example, if you sell life insurance, and you’re truly concerned for the 28-year-old prospect who’s married and who has two young children and no life insurance, no one must tell you to have a tone of

Preparation includes researching and getting ready for your meeting with the prospect. Both actions will vary based on the size of the sale, the length of the buying cycle, and the number of decision-makers involved.

concern when you respond to those facts. The proper tone comes out of your mouth naturally.

In addition to getting the tone correct, truly caring also will give you the additional benefits mentioned earlier: in short, skyrocketing your closing rate, building strong relationships, and leading to more sales down the road.

Do your homework

So, where is the disconnect with caring and how can we remedy it? Salespeople are busy and they are under pressure to make sales. Despite these challenges, I believe most salespeople do care. The problem is that their actions don’t necessarily convey this. Why?

To convey to the client or prospect that you truly care, the needed actions require time and work—more time than most salespeople think they have and more work than most are

willing to do. That work is primarily preparation and practice. Preparation includes researching and getting ready for your meeting with the prospect. Both actions will vary based on the size of the sale, the length of the buying cycle, and the number of decision-makers involved. Practice means roleplaying the different sales scenarios and knowing what you’ll do in all sales situations.

The truth is the average salespeople do not do the necessary work, so they find themselves in a situation in which they simply show up and pitch their product hoping it’s what the prospect needs and wants. That’s why the average salespeople’s closing ratio across industries is 33%. They have a square peg that they try to force into a round hole. Even in cases when they do run

Our email marketing campaigns are highly visible: put your brand in front of PIA Northeast members and prospects across the association’s footprint Contact us today: we only run 6 campaigns a year.

into a square hole, they may address it incorrectly by pitching instead of problem solving.

Show you care

How do we show we care and how does that make the sale so much easier? One way is to do the necessary research and to prepare well-thought-out questions that both set you apart from the competition and show the prospect you’ve done your homework.

The next is to follow that up by focusing on problem solving versus pitching. When you approach each conversation from the mindset of being the prospect’s or client’s problem solver, not your product promoter, everything shifts. You start engaging with meaningful questions, listening more than talking and responding in ways that naturally build trust and rapport.

You need to see each meeting as a chance to step into the client’s world, ask meaningful questions, and bring solutions that are customized to each person. The most effective way to do this is to approach each meeting with curiosity and a desire to understand what your prospect or client wants and needs, and to make sure the person gets the right solution.

When you go into each meeting truly caring about the prospect—and taking the actions that convey that—you’ll no longer have to worry about your tone, building rapport and making the sale. All those elements will flow naturally as a biproduct of your caring and concern. Chapin is a motivational sales speaker, coach and trainer. To have him speak at your next event, go to www.completeselling.com. He has over 37 years of sales experience as a No. 1 sales rep and he is the author of the 2010 sales book of the year: Sales Encyclopedia (Axiom Book Awards). Reach him at johnchapin@completeselling.com.

Advertising laws, marketing text messages, DOL overtime and more

PIA technical staff

Have a question? Ask PIA at resourcecenter@pia.org

Advertising ‘free rate quotes’

Q. Are insurance producers or insurers allowed to advertise that they provide “free rate quotes” for automobile insurance?

A. Yes. The Insurance Law and regulations do not prevent this type of advertising, if fees (e.g., motor vehicle abstract fees) are not charged.—Bradford J. Lachut, Esq.

Advertising ‘no phone quotes’

Q. Can insurance producers advertise that they provide “no phone quotes”?

A. According to the Department of Banking and Insurance, a producer cannot advertise “no phone quotes.” However, in response to an oral request for a quotation, agents can provide the minimum information set forth in the regulation concerning rate levels in the applicable territory.

While providing a detailed quote is not required by the regulation, agents cannot advertise “no phone quotes,” as such an advertisement would indicate an unwillingness to provide the minimum-required information. —Bradford J. Lachut, Esq.

School bus passengers

Q. If a child is injured on a school bus, what policy pays the child’s medical expenses? It is my understanding that the school bus is not required to maintain personal injury protection coverage. I have been told that the injured child would present a PIP claim against the parent’s personal automobile policy; however, wouldn’t we run into a problem meeting the definition of a private-passenger-type vehicle under the PAP?

A. The New Jersey Automobile Reparations Reform Act (also known as the no-fault law) provides a generous package of PIP benefits to persons injured in an accident involving an “automobile,” which is defined in the law to exclude a school bus.

Consequently, there are no PIP benefits to pay for a child’s injury while riding in a school bus. A school bus also does

not qualify as an “insured motor bus” for coverage provided by the New Jersey Medical Expense Benefits Coverage–Motor Bus Passengers (CA 22 59) endorsement, which has a limit of $250,000 per person for reasonable medical expenses.

However, a personal auto policy does have Extended Medical Expense Benefits Coverage that will respond with a limit of $1,000 or $10,000—depending on the choice made when the policy was purchased.

If the school’s bus insurance policy includes the optional ISO Auto Medical Payments Coverage (CA 99 03) endorsement, then the school’s insurance company will pay medical expenses until that limit is exhausted. This coverage, if applicable, pays its benefit before the Extended Medical Expense Benefits Coverage on the parent’s personal auto policy begins to pay its benefit.

When the Extended Medical Expense Benefits Coverage and Medical Expense Coverage are exhausted, the parents may be able to obtain coverage for excess medical expenses from their health insurance policy. Be advised that health insurance may have deductibles, co-payments and various limitations.

Under the provisions of the no-fault law, covered persons injured in an automobile accident can give up some of their rights to sue for noneconomic (e.g., pain and suffering) damages in exchange for a reduction in premium. This is called the “verbal threshold” option, applicable to injuries involving an “automobile.” Since a school bus is not an “automobile,” choosing the verbal-threshold option will have no impact on the right to sue persons or entities responsible for a child’s injury.

So, while no PIP benefits are available for a school bus accident, the right to recover damages from the person or entity at fault is not impaired. However, under New Jersey law, Title 59–Claims Against Public Entities, lawsuits against a municipal owner of a bus would be subject to Title 59’s own verbal threshold regarding noneconomic damages. —Joseph Patterson

Marketing text messages

Q. Do I need permission to send marketing text messages?

A. According to the Federal Communications Commission Telephone Consumer Protection Act, to send marketing text messages to nonclients, you must get prior, written consent. That could be an option to text a number to receive the text messages, or the ability to input information into a form on a website to indicate that a person wishes to receive marketing text messages from you. You also must offer an optout option so people can stop receiving your messages if they so choose.

Postal Ownership Statement

Marketing messages to clients can be sent without prior written consent because a business relationship exists. However, you must offer clients the ability to opt out of receiving the messages if they so choose.

For a sample electronic consent form access Sample electronic delivery consent form (QS90802) in the PIA QuickSource library.

You can learn more information about the FCC Telephone Consumer Protection Act rules here: tinyurl. com/bdct5j78.—Bradford J. Lachut, Esq.

Q. Will my producers qualify for the outside-sales exemption, even if many of them maintain office space at the agency?

A. It depends. To qualify for the outside-sales exemption, an employee’s primary duty must be making sales, obtaining orders or contracts for services or for the use of facilities for which a consideration will be paid by the client or customer. In addition, the employee must be customarily and regularly engaged away from the employer’s place or places of business.

Whether producers are “customarily and regularly engaged away from the employer’s place of business” depends on the extent to which they engage in sales or solicitations, or related activities, outside of the agency’s place or places of business. By meeting clients face-to-face outside of the agency’s place of business to initiate sales (e.g., at the client’s home or business, at a restaurant or a club), producers would fulfill the outside requirement of the outside-sales exemption.

It is important to note that producers may qualify for the outside-sales exemption, even though they perform some activities at the agency’s place of business, so long as the inside-sales activity is incidental to, and in conjunction with, qualifying outside-sales activity.—Bradford J. Lachut, Esq.

PIANJ 2025–2026 Board of Directors

OFFICERS

President Roger C. Butler, CIC

Barclay Group

202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594

rbutler@barclayinsurance.com

President-elect

Aaron Levine, CIC

LG Insurance Agency PO Box 3202

Long Branch, NJ 07740-3202 (877) 288-7169 aaron@lginsuranceinc.com

Vice President

Lisa Hamm, CIC

Clyde Paul Agency 47 Maple St., Ste. 301 Summit, NJ 07901-2571 (201) 991-7598

lhamm@clydepaul.com

Vice President

Michael Beckerman, CPCU Acrisure of New Jersey 111 Wood Ave. South, Ste. 400 Iselin, NJ 08832-2727 (732) 815-1400

mbeckerman@acrisure.com

Secretary/Treasurer Christopher J. Powell Hardenbergh Insurance Group 8000 Sagemore Dr., Ste. 8101 PO Box 8000 Marlton, NJ 08053-8099 (856) 890-7106 cpowell@hig.net

Immediate Past President

Andrew Harris Jr., CIC, AAI, CISR Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 andrewharris@lianet.com

PIA NATIONAL DIRECTOR

Paul Monacelli, CIC, CPIA Veterans Insurance Agency Inc. 18 Knights Bridge Dr. Randolph, NJ 07869-4633 (973) 805-3555 paul@adpmanagementsvc.com

DIRECTORS

Lydia Bashwiner, Esq. Otterstedt Insurance Agency Inc. 540 Sylvan Ave. Englewood Cliffs, NJ 07632-3022 (201) 227-1800 lbashwiner@otterstedt.com

Yossi Bolanos

Yossi United Insurance Agency LLC 1010 Clifton Ave., Ste. 208 Clifton, NJ 07013-3528 (973) 773-9200 ybolanos@yossiunitedinsurance.com

Kenneth Bull, CIC, AU Ironpeak PO Box 806 Olean, NY 14760-0806 (716) 373-5511 kbull@ironpeak.com

Walter Conroy

Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 wconroy@lianet.com

Alyssa Delaney

KRH Consulting 155 Munro Ave. Hazlet, NJ 07734-3027

Maria N. Escalona, CPIA

Jimcor Agencies Inc. 60 Craig Road Montvale, NJ 07645-1709 (201) 573-8200 mescalona@jimcor.com

Becky Mateus, CIC, CPIA, ANFI, CFM

World Insurance Associates LLC 100 Wood Ave. S., Floor 4 Iselin, NJ 08830-2716 (732) 380-0900 beckymateus@worldinsurance.com

Josh McManigal

LG Insurance Agency PO Box 3202

Long Branch, NJ 07740-3202 (877) 288-7169 josh@lginsuranceinc.com

William J. McMahon III, CIC, CWCA

McMahon Agency Inc. PO Box 239 Ocean City, NJ 08226-0239 (609) 399-0060 billm@mcmahonagency.com

Shanna Muscavage Ironpeak 610 N. Pine St. Lancaster, PA 17603-2824 (717) 471-2339 smuscavage@ironpeak.com

Logan True, CRIS

The True Agency LLC 4 Valley View Dr. Mendham, NJ 07945-3109 (908) 295-3277 logan@trueagencyllc.com

Casey Yarger, CIC, CRM

Robert Petri & Daughter

258 Ryders Lane PO Box 820 Milltown, NJ 08850-0820 (732) 545-4540 cyarger@petriinsurance.com

DIRECTOR/YIP LIAISON

Tim Latimer JS Braddock Agency 22 N. Main St. Medford, NJ 08055-2412 (609) 654-5800 tlatimer@braddockinsurance.com

ACTIVE

PAST PRESIDENTS

Anthony F. Bavaro, CIC, CRM Liberty Insurance Assocs. Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 abavaro@lianet.com

Louis Beckerman, CIC, CPCU Acrisure of New Jersey 111 Wood Ave. South, Ste. 400 Iselin, NJ 08832-2727 (732) 815-1400 lbeckerman@acrisure.com

Bruce Blum, CPIA, TRA Blum & Walsh Group Inc. c/o TE Freuler Agency Inc. 270 Davidson Ave., Ste. 101 Somerset, NJ 08873-4158 (732) 246-1330 bblum@tefreuler.com

Rip Bush, CPIA Keer & Heyer Inc. 1001 Richmond Ave. Point Pleasant Beach, NJ 08742-3047 (732) 892-7700 rip@keerandheyer.com

Charles J. Caruso, CIC, CPIA AssuredPartners Jamison 20 Commerce Dr., Bsmt. 2 Cranford, NJ 07016-3617 (973) 669-2311 charles.caruso@assuredpartners.com

Donna M. Cunningham, CPIA ADP Partners Insurance Agency Inc. 4 Sutton Place Florham Park, NJ 07932-2143 (973) 845-8700 donna@adppartnersinsurance.com

Michael DeStasio Jr., TRIP AssuredPartners of NJ 20 Commerce Dr., Ste. 303 Cranford, NJ 07016-5868 (732) 574-8000 mike.destasio@assuredpartners.com

Donald F. LaPenna Jr. DFL Consulting Group 9728 Everglades Drive Naples, FL 34120-1998 (908) 337-9344 dflajr@gmail.com

John A. Latimer, Esq. Barclay Group 202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594 jalatimer@barclayinsurance.com

Connie Mahoney

Mark Anthony Associates 615 Sherwood Parkway PO Box 1068 Mountainside, NJ 07092-0068 (908) 654-9500 cmahoney@maainsurance.com

Steven C. Radespiel Insurance Center of No. Jersey Risk Strategies Company 33 Crestwood Pl. PO Box 399 Hillsdale, NJ 07642-0399 (201) 525-1100 sradespiel@icnj.com

Keith A. Savino, CPIA Broadfield Group Trucordia 68 Main St. Warwick, NY 10990-1329 (201) 512-4242 keiths@broadfieldinsurance.com

William R. Vowteras Fraser Brothers Group LLC 811 Amboy Ave. PO Box 2128 Edison, NJ 08818-2128 (732) 738-7400 bill@fraserbrothers.com

13 AFCO Direct

16 Agricultural Insurance Management Services

26 AON Affinity Travel Practice

BC Applied Underwriters

11 Berkshire Hathaway GUARD Insurance

17 JENCAP

7 Omaha National

14 PIA Design + Print

28 PIA E&O Insurance

12 PIA Education

22 PIA IRC

33 PIA Members’ Choice

24 PIA NumberONE Comp Program

30 PIA Partner Email

2 The Premins Company

23 SIAA

8 Venbrook Group

For more information about an advertiser, email ads@pia.org, or call (800) 424-4244