SPORTS BETTING OPERATOR

A Paddy’s Sportsbook is the first of its kind in the United Kingdom

A Paddy’s Sportsbook is the first of its kind in the United Kingdom

It’s been a very eventful quarter for sports betting operators – and not in an entirely good way. As Truist Securities analyst Barry Jonas put it, there are “daily headline risks” for the sector.

Still, it’s not like Jonas was hitting the panic button. He maintained “Buy” ratings (in an October 21 investor note) on both DraftKings and Flutter Entertainment, parent of FanDuel, “given their sports betting leadership and technological superiority.”

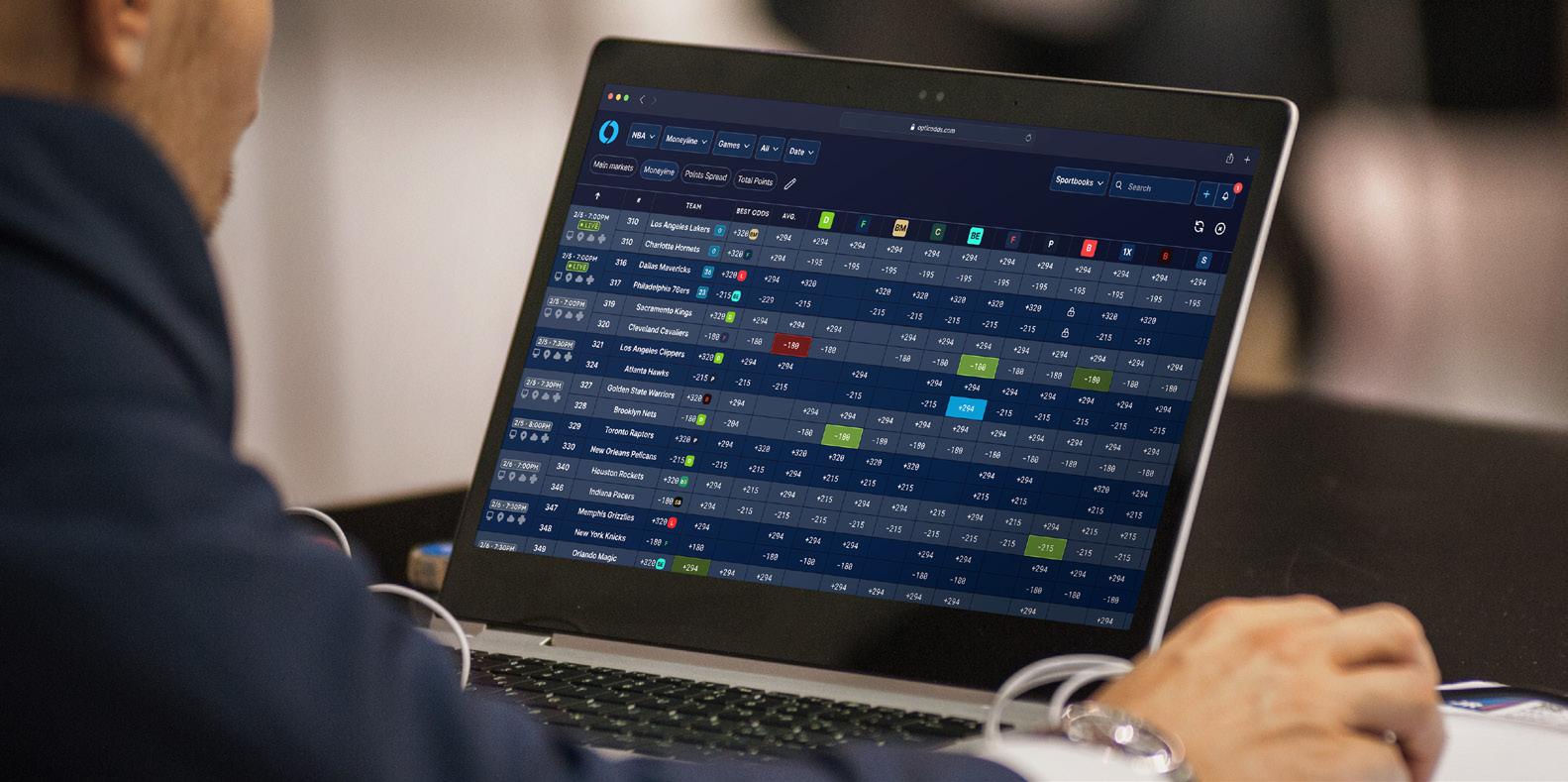

It’s been a dire quarter for OSB, as the incursion of prediction markets has caused digital stocks to sell off markedly. There’s stock-market disconnect, with investors panicking even as companies try to assure them that nothing meaningful has happened. From what we are hearing, most of the prediction-market gains are happening in states where OSB isn’t available.

The legacy operators find themselves between a rock and a hard place. If they remain passive, they risk losing market share or (more pressingly, perhaps) a leg up in the U.S. states where they’re not currently present. If they do move, they incur the wrath of state regulators, who don’t want to see OSB providers dabbling in unregulated, untaxed futures markets.

The prediction markets can’t even be trusted. Scarcely was the ink dry on a FanDuel to start trading swaps via CME Group than the latter knifed FanDuel in the back and made a different accord with a rival firm. It was an unkind blow, magnifying the (unrelated) hardship of an adverse NFL season, which has battered sports books already.

Meanwhile, states like Nevada and Ohio have fired missives across the bows of OSB operators, noting that getting

RIGHT: David McKee, Editor in Chief, Sports Betting Operator

into futures markets will land them in bad odor with the states … and imperil their licenses. Observed Jonas, “We think Flutter values their licenses and regulator relationships, and would not look to proceed unless their legal counsel gave them enough comfort.”

Some aren’t taking it that far. BetMGM has stood down from prediction-market dabbling, as has Caesars Sportsbook. Some would argue that they have less to lose than the two giants, BetMGM being a second-tier operator and Caesars Sportsbook arguably a third-tier one. Why risk those all-important licenses?

Even so, with FanDuel and DraftKings threatening to bolt to untaxed pastures, governments are looking to close the gate. Chicago, for instance, is airing the idea of its own, double-digit levy on OSB, the better to capture that money before it flees to “swaps.”

If all this is making you impatient, Jonas held out little comfort. “While multiple court cases look at sports prediction contracts, we think the issue may not be fully resolved until the Supreme Court weighs in – at best next year, if it’s expedited,” he wrote.

Grab a beer. We’re in for a long bout of uncertainty.

Publisher – Peter White peter@outsourcedigitalmedia.com

Editor in Chief – David McKee dmckee314@gmail.com

Editor EMEA – Damien Connelly damien@outsourcedigitalmedia.com

Las Vegas Correspondent – Ryan Slattery ryanslats@gmail.com

Associate Editor EMEA – Andrew Behan a.behan@librasgroup.com

Designer – Stewart Hyde www.de5ign.co.uk

Tel: 44 (0) 1892 740869 W: www.sportsbettingoperator.com

Editorial Policy: The views and opinions expressed in Sports Betting Operator remain principally the views of contributors and do not necessarily reflect those of the editor or publishers.

The publishers wish to avoid inaccuracies and, whilst every precaution has been taken to ensure that information contained in this publication is accurate, no liability is accepted by the editor or publishers for errors or omissions, however caused.

Unless otherwise stated, articles appearing in this publication remain the copyright of the publishers and may not be reproduced in any form without the publisher’s written consent.

Printed in the UK by Pensord Press.

Scylla

Paddy’s Sportsbook opens at the historic Hippodrome Casino. By Peter White

What’s driving U.S. operators East? By Katherine A. Baker, Joshua L. Kirschner & Samantha Ahearn

Why traditional betting faces its extinction event.

An

look at the current state of iGaming and

The role of local bookmakers in Eastern European

Powering

Sports Betting Operator speaks with SiGMA Group

Paddy’s Sportsbook opens at the historic Hippodrome Casino. By Peter White

When the doors opened on Paddy’s Sportsbook at the Hippodrome Casino on October 1, 2025, it marked a significant moment for British gaming and entertainment. This was the first, dedicated, in-casino sports book in the United Kingdom – the first physical expression of reforms made possible by the government’s Gambling Act Review.

For the Hippodrome, the UK’s largest and best-known casino, it was another landmark in a story defined by reinvention. The building has stood at the heart of the West End of London since 1900, first as a theater, then as

a cabaret and music venue, and since 2012 as a multi-level entertainment destination.

The launch night reflected that history of spectacle: Danny Dyer, Gemma Collins and Peter Crouch joined crowds of guests, media, and sports fans for a celebration that filled Leicester Square with light and noise. We caught up with Simon Thomas, executive chairman of the Hippodrome and chair of the casino operators group within the Betting & Gaming Council. We discussed how this partnership came about, what it means for the casino sector and why the Hippodrome continues to set the pace for the industry. Our conversation has been lightly edited for clarity.

Simon, congratulations on another first for the Hippodrome. The UK’s first dedicated, in-casino sports book is quite a milestone. What does this launch mean to you personally and what does it represent for the Hippodrome’s evolution?

Thank you. It means a great deal because it’s the visible result of years of work to modernize casino regulation and show how the industry can contribute to the wider, nighttime economy. As chair of the casino operators group within the Betting

& Gaming Council, I helped lead the campaign that made this possible. So to stand there on opening night, with the screens lit and the room full, felt like the finish line after a long race. But we appreciate that this is just the starting line of optimizing the sports book itself.

For the Hippodrome, it’s part of the natural progression we’ve been making since we opened the doors in 2012 – continuing to evolve, to find new audiences, and to demonstrate that a casino can be a central part of London’s entertainment and broadmarket, night-time offer. The sports book is the next expression of that idea. It’s not just a betting space; it’s a social, high-energy venue that broadens what people expect from us.

You’ve said that “the Hippodrome has been reinventing entertainment in the West End for 125 years.” How does Paddy’s Sportsbook continue that tradition?

Reinvention is the Hippodrome’s heritage. The building has always been a place for whatever’s new – from water spectacles in 1900 to jazz, musical theatre, the world-famous Talk of the Town, Stringfellow’s Nightclub and now to modern, casino-based entertainment. We have always made a conscious decision to continue that spirit of innovation and boldness. Paddy’s Sportsbook continues that. It introduces a new form of entertainment to the West End: live sport as a shared experience in a quite unique setting. People come together for the energy of it, to watch, cheer and celebrate. It’s not just about placing a bet; it’s about atmosphere, fun and community. It gives London something genuinely unique: a completely new way to watch sport in one of the city’s most historic entertainment venues.

Let’s talk partnership. What made Paddy Power the perfect fit for the Hippodrome?

We were looking for a partner who shared our belief that betting is entertainment. Paddy Power is smart, playful, and deeply connected to sport and its audiences. Their brand brings humor and character, while ours brings heritage, hospitality, and West End credibility.

The partnership works because both sides bring strengths that complement the other. Paddy Power understands sports culture inside out. We understand how to create memorable experiences. Together we’ve produced something that isn’t a betting shop inside a casino. It’s a fully realized entertainment space with its own identity. It’s a Paddy’s venue but it’s much more than that. It’s a new concept for the West End and for the British casino market.

From your perspective, what did each side bring to the table? How did you make the collaboration feel like a genuine fusion of two entertainment brands?

Paddy Power brought the sports expertise, the creative energy and the public profile. And of course the betting know-how. The Hippodrome brought the venue, the understanding of customer flow, and the standards of delivery that come from running a major casino and hospitality operation.

We spent a lot of time getting the details right – the tone, the service, the design language. It had to feel fun and familiar to sports fans, but also live up to the quality and professionalism that define the Hippodrome. It’s that balance that makes the space work. You walk in and it feels like Paddy’s, but the scale, comfort, and style make it something entirely new.

ABOVE: Michelle Spillane, managing director, Paddy Power Online and Rupert Ellwood, managing director, Paddy Power Retail

Were there any creative or regulatory challenges in bringing a sports book into a casino environment for the first time in the UK?

Plenty. This had never been done in the UK, so we had to set the precedent, and satisfy both regulatory and operational requirements. The Gambling Commission quite rightly wanted to see how it would function in practice: how bets are taken, how we separate and monitor activity, and how we maintain responsible-gambling standards.

Creatively, the challenge was to design something that felt immediately engaging but not intimidating. We had to get the energy right – active, social and comfortable. The result is a space that welcomes sports fans, regulars, tourists and first-time visitors. It’s designed to be open, visible and accessible.

Walking into Paddy’s Sportsbook feels more Vegas chic than betting shop. What was the design brief behind the space?

The brief was simple: Create the best place in London to watch live sport.

We have 56 screens, including a 12-screen jumbotron, plus a full bar, food service and luxury seating. Every view is good, every detail has been thought through.

We wanted the design to encourage people to stay, talk and enjoy the spectacle. Casino design is about dwell time and turnover. You want energy, movement, and momentum and that’s what this achieves. The color palette, lighting and layout all contribute to a sense of excitement. The feedback has been fantastic: People walk in and immediately understand it’s something new.

The tech and layout are impressive. How important was it to make the space as much about comfort and atmosphere as betting? It’s crucial. Technology underpins the experience. The screens, sound zones and integrated systems make it all possible but what keeps people here is the atmosphere.

We’ve built a room that feels alive. You can watch several matches and events at once (as evidenced by showing every game during our NFL nights, as well as golf, football, rugby, tennis … this list is substantial) Have food from the in-venue burger and

chicken bar or get a Chop Chop (our award-winning Chinese restaurant) delivery without leaving your seat. The layout makes it easy to be part of the action. It’s designed for sociability and excitement.

That’s what differentiates it from anything else in the UK. It’s not just about betting; it’s about the shared enjoyment of sport in a premium, energetic setting.

The sports book feels social – people aren’t just betting; they’re eating, drinking and watching together. Was that the goal from the start?

Absolutely. The aim was to build a destination, not just a facility. Sport is inherently social and we wanted to capture that.

We’ve already seen the effect with the NFL audience. We were the number-one venue of choice for NFL watch parties before. But now the new sports book has taken that to another level. The room is packed, the atmosphere is extraordinary –genuinely the best we’ve ever seen. People come for the game but end up staying for the experience. It’s that sense of community that makes it work.

Many readers may not know that “Magic Mike Live” is also part of the Hippodrome. How does that sit alongside the sports book in the wider picture?

“Magic Mike Live” is a great example of how we’ve broadened what a casino can be. It’s a theatre production created and produced by Channing Tatum, and it’s been running in our theatre space since 2018. It brings in a completely different audience, people who may never have considered visiting a casino before.

It’s helped us demonstrate emphatically that the Hippodrome

is more than gaming. It’s a place for dining, theatre, nightlife, and now live sport, all in a casino-level safe and secure venue. Each element complements the others and together they create something distinctive in the West End: a genuine entertainment hub that appeals to everyone.

The launch night had a huge amount of buzz: Danny Dyer, Gemma Collins, Peter Crouch and a full house. How did that atmosphere reflect what you wanted to achieve?

It was exactly what we hoped for – fun, high energy and very British.

The guests, the media turnout, the excitement on the night all showed how much interest there is in this new type of venue. Danny, Gemma, and Peter gave it that extra bit of character and accessibility that both brands are known for.

The launch wasn’t just a PR moment. It created genuine awareness and momentum. People saw that the Hippodrome is still innovating, still driving the conversation about how casinos fit into the modern entertainment landscape.

Finally, what do these reforms – and this launch – mean for the future of British casinos?

The reforms help us continue competing on equal footing with other hospitality and leisure venues, but they build on a reputation we’ve been developing since we opened our doors in 2012. The Hippodrome has always shown what the casino of the future could look like: broad-market, entertainment-led, integrated into the life of the city.

My hope is that this encourages others to adopt the same mindset –to see casinos not as isolated venues but as part of the wider, night-time economy. If more operators take that

approach, offering experiences that combine entertainment and gaming, it will strengthen the whole sector. And it will make British casinos relevant to a much broader audience.

For us, Paddy’s Sportsbook is both a culmination and a beginning. It’s the product of years of work, but it’s also a signal of what’s to come. The Hippodrome will keep leading the way and we’re proud that this launch has once again set the standard.

By Katherine A. Baker, Joshua L. Kirschner & Samantha Ahearn

The legal landscape for sweepstakes casinos in the United States is rapidly shifting, with an increasing number of states applying regulatory scrutiny, legislative restrictions or prohibitions.

“Sweepstakes casino” is the colloquial term for gaming platforms where participants can obtain virtual currency to play casino-style or sports-prediction-style games for free, without having to make a purchase. Players can win real money or other prizes, under sweepstakes rather than gambling law.

Recently, several states have introduced laws banning or severely restricting them. Regulators are issuing cease-and-desist orders. State

attorneys general are initiating lawsuits. And private citizens are launching class actions and individual claims. As a result, operators are looking to alternate markets.

All the while, consumer demand persists. In fact, it’s surging. Interestingly, in the midst of growing legal scrutiny, online sweepstakes casinos have increased their player base at around three times the rate of real-money casinos. Consumers are drawn to the casual, low-barrier appeal of sweepstakes models, where play tokens can be earned for free and prizes redeemed. So U.S. sweepstakes operators are focusing on the majority of states where sweepstakes casinos remain permissible and looking farther afield to foreign markets – like Germany.

Why Germany? It is a particularly appealing destination for sweepstakes operators for a few reasons. First, there is a massive market potential. Germany is Europe’s largest economy, the host of cutting-edge gaming technology and has a significant appetite for online gaming. Revenue projections estimate that Germany’s gaming market will reach $226.9 billion at the end of 2025. Germany is also a leading innovator for technology in online gaming, providing consumers with cutting-edge online-gaming products.

Perhaps the most compelling factor is Germany’s relatively structured and predictable regulatory environment, especially when contrasted with the fragmented and inconsistent approach in the U.S. In 2021, Germany passed the Interstate Treaty on Gambling (the “Treaty”), which significantly changed the legal framework for online gambling in Germany. While still conservative, the Treaty liberalized previously restrictive laws. It replaced a near-total ban on online gambling

RIGHT: Katherine Baker, a Boston-based partner at Nelson Mullins Riley & Scarborough LLP and chair of the firm’s Gaming Industry Group, assists casino gaming, iGaming, sports betting, and fantasy sports operators, vendors, and entrepreneurs in navigating the state and federal commercial, and tribalgaming landscape, including leveraging fintech solutions.

LEFT: Joshua Kirschner,an Atlanta-based attorney at Nelson Mullins Riley & Scarborough LLP, focuses his practice on the gaming and gambling sectors, and represents businesses and individuals in a wide variety of regulatory and white-collar litigation matters. A primary focus of his practice is assisting casino, iGaming, sports betting, and daily fantasy sports operators, vendors, and entrepreneurs to navigate the state, federal and tribal gaming landscapes.

with a framework designed to balance regulation, consumer protection and market access.

Sweepstakes do not fall neatly into the gambling definitions of the Treaty. It defines gambling similar to how most states in the U.S. define gambling, requiring three key elements: (1) a stake or monetary consideration; (2) an element of chance; (3) and a prize of monetary value. Sweepstakes casinos using a free or dual-currency model (e.g., “Gold Coins” for fun play and “Sweep Coins” for redeemable prizes), avoid the “stake” requirement by allowing users to play for free or obtain in-game currency without direct purchase. This creates the same unregulated, gray area that persists in the U.S.

But, unlike the U.S., Germany appears not to have signaled any desire to define the dual-currency model as a gambling stake or otherwise target online sweepstakes casinos. It is worth pointing out, however, that – either way –

sweepstakes operators would still need to comply with other laws applicable to promotions, such as Germany’s Act Against Unfair Competition (UWG), General Data Protection Regulation (GDPR), and consumer protection and contract provisions of the German Civil Code (BGB).

Even if Germany were to classify sweepstakes as gambling, it would likely only result in making those operations subject to the framework of the Treaty, which is relatively friendly, structured and commercially workable.

RIGHT: Samantha Ahearn, a Boston-based attorney at Nelson Mullins Riley & Scarborough LLP, is a litigator who focuses her practice on complex commerciallitigation and business disputes, insurance disputes, labor and employment matters, internal investigations, and gaming regulation.

This would not drive operators out of Germany, as in the U.S., but would instead offer them licensing and oversight, i.e., legitimacy, within a more predictable regulatory environment. If history is any guide (see DFS 2.0), we expect this is ultimately where the U.S. will land with sweepstakes casinos when the upheaval inevitably subsides.

Sources: https://www.lexology.com/library/detail.aspx?g=32eb712a-6346-4445-833b-ce5ecd14f5ee

https://www.cliffordchance.com/content/dam/cliffordchance/briefings/2021/07/new-german-interstate-treaty-ongambling-entered-into-effect.pdf

https://www.swlaw.com/publication/banned-fined-and-redefined-the-2025-state-crackdown-on-online-sweepstakes/ https://sbcamericas.com/2025/05/30/sweepstakes-player-acquisition-report/ https://iclg.com/practice-areas/gambling-laws-and-regulations/germany

https://intel.sccgmanagement.com/sccg-news/2025/10/8/germany-leads-europes-expanding-casino-market/?utm_ source=chatgpt.com

https://www.sweepsy.com/us/

https://esportsinsider.com/de/gluecksspiel/sweepstakes-casinos

https://sweepstakesplayde.com/#:~:text=Sweepstakes%20casinos%20in%20Germany%20provide%20a%20 unique%20way,a%20model%20with%20%E2%80%9Csweeps%20coins%E2%80%9D%20%28or%20similar%20 tokens%29.

https://www.forbes.com/sites/danielwallach/2025/02/24/legality-in-doubt-sweepstakes-casinos-could-be-targeted-bystate-attorneys-general/

https://globig.co/navigating-sweepstakes-and-contests-regulations-in-germany-a-practical-guide-for-marketers/

Why traditional betting faces its extinction event. By Mark McGuinness

Icome from a third-generation family steeped in sports betting. Yet for today’s socially integrated player, traditional sports books feel passive and transactional, the antithesis of Gen Z’s experience-led mindset. Prediction platforms are the natural product of an attentiondriven economy and they’re reshaping everything we once knew about engagement.

From my earliest memories, gambling in my family in Scotland meant odds and margins, not marketing campaigns. That heritage taught me that liquidity and risk management were sacred disciplines. Later, as I built affiliate programs and digital growth strategies in iGaming, I carried that same rigor into modern marketing. But today, I find myself in conflict with my roots. For players raised on interactivity, narrative and community, traditional sports books increasingly

look like relics. Online betting is passive: You choose a market, place a wager and wait. There’s no immersion, no feedback loop, no sense of participation. For Gen Z, an audience shaped by social validation and live content, that experience feels sterile.

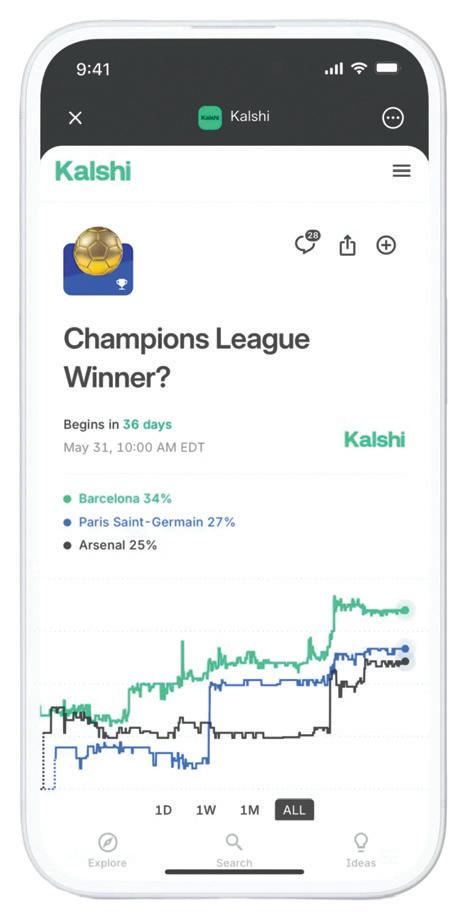

Polymarket took center stage when Intercontinental Exchange announced up to $2 billion in investment, valuing it at about $8 billion. That was a bold statement of institutional faith. Founder Shayne Coplan has said the platform serves “a different type of user behavior – people who want to bet on real-world events beyond sports.” That framing matters. It positions prediction not as gambling but as participation in the broader cultural conversation.

Polymarket isn’t alone. Kalshi’s valuation climbed to $5 billion after a $300 million round, more than doubling within months. Meanwhile,

analysts note that DraftKings’ share price volatility now mirrors investor uncertainty about whether the sports book model can compete with agile prediction platforms. Even DraftKings’ CEO Jason Robins recently acknowledged that prediction markets could flourish “in states where online sports betting is not yet legal” – a subtle admission that the next battle for attention is already underway.

We are living firmly in the experience era, where attention and excitement are the currency of value. Behavioral neuroscience shows that anticipation and uncertainty activate the brain’s dopamine pathways – the same neural circuits that govern curiosity, play, and learning.

Our brains crave excitement and agency; they are wired to seek experiences that feel participatory, not passive. Traditional sports books offer closure; prediction platforms offer continuity. They turn every market into

a story that evolves in real time.

In practice, prediction markets aren’t competing with sports books, they’re competing with Netflix, TikTok and the live-stream economy for dopamine. That’s why they’re winning.

Think about how Gen Z experiences entertainment: co-creation, conversation, community. Passive betting feels like the antithesis of that world. When I audit sports book marketing funnels, I often find no emotional hook beyond the odds. Registration, deposit, bet, outcome and that’s it. No suspense curve. No shared moment.

Prediction platforms, on the other hand, embed narrative in every trade. A user can wager on an election, watch the odds shift as news breaks, debate outcomes with others and revise positions in real time. It’s emotional theatre, the perfect fusion of speculation and story.

For Gen Z, that’s irresistible. For sports books, it’s existential.

The industry’s survival depends on how it frames the prediction revolution. If prediction is dismissed as fringe speculation, sports books will lose by inertia. But if they reframe it as participatory entertainment – the natural evolution of betting – they can adapt.

Public framing is already shifting.

Polymarket’s investment gives it legitimacy; Kalshi’s valuation gives it momentum. The narrative has moved from “Will prediction markets compete?” to “How fast will they dominate?”

Traditional operators still cling to arguments about liquidity and margin control. But audiences don’t crave liquidity. They crave relevance. They want to be part of something

happening. That’s where sports books fail: They manage the event but they don’t animate it. To survive, sports books must stop defending old margins and start designing new emotions.

If I were advising a sports book CEO today, my directive would be simple: Reconceive the product around participation. Start by building prediction layers inside your existing ecosystem and let users speculate on cultural and political events, not just fixtures. Bring prediction markets into the UX of everyday engagement.

Next, embed community mechanics. Add live commentary, chat functions and sentiment indicators. Let odds fluctuate visibly with social energy – turn data into drama.

Then measure emotional engagement as carefully as financial turnover. Track how often users return to view odds shifts, interact with others or revise bets. Those metrics will become your new retention indicators.

watched and not for those who interact. The new generation doesn’t want to wait for results; they want to shape them.

Prediction markets turn speculation into participation. They connect culture, economics and emotion into a single dopamine-driven loop. Capital markets see it. Consumers feel it.

Regulators are trying to catch up.

And maybe that’s why betting shops still survive in today’s multi-channel gambling ecosystem. They offer something online sports books no longer do: socialization, conversation and community. People go not just to place a bet but to be part of something. That sense of belonging –the shared thrill, the human contact – still matters. It’s the one emotional dimension that prediction markets have learned to replicate and that digital sports books have largely forgotten.

Finally, recruit differently. Bring in behavioral scientists, social-content strategists and product designers who understand what triggers engagement. You can’t spreadsheet your way into relevance; you have to design for it.

A decade from now, traditional sports books may survive only as subsegments of broader prediction ecosystems. Like the dodo, they aren’t doomed by malice – just by evolution.

I come from a lineage that built sports books on trust, odds and margins. But that world was built for players who

Traditional sports books can still adapt, but only if they stop thinking in transactions and start designing for experiences. In this new era, attention is yield and excitement is margin.

The forecast, fittingly, is clear: The experience economy has arrived. The only question left for sports books is whether they evolve … or go extinct.

Mark McGuinness is a global marketing leader with 20-plus years of experience across Web3, iGaming, and crypto. He specializes in building community-first brands, scaling growth strategies, and integrating NFTs, tokens and decentralized ecosystems into engaging digital experiences. As CMO of Devilfish.com, he is redefining social poker for a new generation of free-toplay players via monetization of digital avatars and micro-transactions within the co-creator ecosystem.

Since the overturning of the Professional & Amateur Sports Protection Act (PASPA) in 2018, online operators such as DraftKings, FanDuel, BetMGM, Caesars, etc., have invested heavily in marketing and promotions to capture market share, and grow as quickly as possible within a competitive landscape. Moreover, the initial land grab occurred during a time of cheap capital, which enabled the greenlighting of investments with longer payback periods, resulting in an extended period of initial losses for operators.

In fact, even by 2023 most operators remained unprofitable despite online revenues reaching $15 billion to $17 billion (sports betting and iGaming combined). Today, the industry has shifted more toward sustainable growth, with strategies focused on optimizing customer acquisition costs (CAC), enhancing lifetime value (LTV), reducing promotional intensity and prioritizing customer retention over customer acquisition. All of these drive greater profitability. With that said, the old managerial dilemma of balancing growth vs. investment remains at the core of all operator strategies today.

The United States sports betting market has seen rapid expansion, growing to a market gross gaming ratio (GGR) size of $3 billion in 2020 to $30 billion in 2025, with roughly 60 percent of the U.S. population having access to online sports betting (OSB). Key growth drivers include state-by-

state legalization, increased consumer adoption and engagement, and higher operator-take rates (higher hold rates on handle) from improved products and offerings (e.g., single-game parlay/ prop bets, live betting etc.).

A major driver for accelerating this growth has been the amount of dollars put into marketing and promotions by companies in order to acquire customers faster, and to grow the market. Sports book operators deploy bonuses, free bets and advertising across TV, digital, and partnerships to attract users. But this comes at a cost, often eroding margins in early statelaunch periods. Sports book operators allocate substantial budgets to marketing, with top players spending $1 billion annually as of 2025. This is in addition to promotional offers of hundreds of millions which don’t show up as a cost on the income statement. Rather, they reduce net revenue. Generally, profitability typically emerges after two to three years of investment, as markets mature

and fixed costs are spread over larger user bases. However, this timeline is becoming increasingly short, as operators have been acquiring customers more efficiently while the value of players is also increasing.

With profitability becoming more important for investors in recent years, sports book customer-acquisition strategies have evolved towards quality over quantity, while using data-driven approaches targeting a LTV/CAC (life-time value / customer acquisition cost) ratio of 3:1 or higher.

Other key KPIs monitored by operators include: GGR, NGR (net gaming revenue), ARPU (average revenue per user), and ROI (marketing return on investment) to adjust spend.

In fact, compared to the early days in the U.S., operators have reduced overall promotional intensity, shifting from high-cost, “risk-free” bets to more-targeted, value-driven promos such as personalized bonuses based on user interests. This not only encourages sustained play, which drives higher retention, but enables sports books to avoid “bonus chasers.”

Given that retaining a customer is generally cheaper than acquiring a customer, operators have seen better profitability. As a result, investors and operators have started placing more emphasis on NGR hold rates over GGR hold rates, which is a better measure for not only hold but also promotional efficiency.

In sum, while sports betting acronyms are getting longer, the payback periods are getting shorter. This move towards sustainable growth focused on profitability by optimizing customer acquisition and retention strategies, in our view, will continue to drive higher market values for the industry for years to come.

ABOVE: Chad Beynon, Macquarie Capital’s U.S. head of research and senior Gaming, Lodging & Theatre analyst

Chad Beynon is Macquarie Capital’s U.S. head of research and senior Gaming, Lodging & Theatre analyst. He has followed the sector for over 20 years and collaborates with his global team of gaming analysts. He previously conducted Consumer Research at Prudential Equity Group and is a proud graduate of the University of Maryland.

Disclosures: Macquarie provided the following company disclosures as of October 24, 2025.

Caesars Entertainment (CZR US): Macquarie has provided noninvestment banking, non-securities services to Caesars Entertainment in the past 12 months, for which it received compensation.

DraftKings (DKNG US): Macquarie Group Ltd., together with its affiliates, owns a net long of 0.5 percent or more of the equity securities of DraftKings.

Mark “Mugen” Striegl boasts an impressive MMA career. He has 18 wins and five losses. He won his first 12 professional fights in dominant style, with 10 wins by submission and only two by judges’ decision.

Currently, Striegl keeps training but focuses more on teaching young athletes, spending time with family, and taking part in entertainment projects. How did the career of this top fighter start? Which fight was the most memorable and what does he plan to do in the near future?

Striegl was born and raised in Tokyo, where his parents taught at international schools. From childhood, he was interested in sports and tried many

types, from cross-country running to baseball.

However, the influence of Japanese martial arts proved stronger than his love for more-traditional sports. Following his older brother, Striegl joined a school wrestling club at age 10. The young fighter quickly realized that martial arts were exactly what he was looking for. Hard work in training and natural talent soon paid off, bringing his first victories.

At 18, Striegl had his first, amateur, mixed-martial-arts fight. The match took place at Pancrase MMA Stadium in Tokyo, with a large group of friends cheering from the stands. Despite the pressure from the crowd, he stayed calm and won his debut fight, kicking off his MMA career with a victory.

Striegl began his career as a wrestler and gradually developed his style around grappling. Most of his MMA wins came from chokes and joint locks, including his signature Scarf Hold Armlock and Rear-Naked Choke. In combat sambo, Striegl also honed his striking skills, allowing him to catch MMA opponents off guard with a powerful knockout.

According to Striegl, the most memorable fight of his career was against Korean champion Do Gyeom Lee for the URCC title, at Araneta Coliseum in Manila. Tensions ran high before the fight, as his opponent acted overly confident and rude, insulting Striegl and his team. But once they faced off in the octagon, everything fell into place: In the first round, Striegl choked out his arrogant opponent with a Standing Guillotine Choke, leaving him completely unconscious.

Over his career, Striegl has trained with top coaches and fighters, including Dominick Cruz, Benson Henderson, Norifumi Yamamoto, Brandon Vera, Bryce Meredith, George Castro and many more. That’s why he plans to move into coaching himself over the next five years. Already, Mark actively shares his knowledge with young athletes during training with the Philippine national sambo team.

Despite being semi-retired from active MMA competition, Striegl still maintains amazing physical condition. Years of daily training and a proper diet have become his way of life. Mark sees himself not just as an athlete but as a martial arts master, like the legendary fighters of the past. Regular training, he says, also brings him peace of mind and balance.

Striegl is a fierce fighter in the ring. But at home he becomes a loving father of two who enjoys spending time with his family. He believes it’s important for his children to stay active, and to develop both body and mind. His six-year-old son is already training in jiujitsu.

The young man’s hobbies also include fishing, cooking and entertainment projects. He has a personal YouTube channel with 500,000 subscribers. There he posts funny videos about martial arts and fitness. Recently, he appeared in the film Keys to the Heart as a villainous fighter. Striegl is open to taking part in other entertainment projects, including TV series, movies and reality shows.

Recently, Striegl signed a partnership deal with the well-known, international brand 1xBet. The fighter takes his role as a 1xBet ambassador seriously, as the company’s values align with his own beliefs.

“1xBet is a global brand with huge potential that focuses heavily on sports. I believe my values –determination, drive and hard work – align with 1xBet’s values. Together, we’ve created initiatives that celebrate athletic excellence and bring fans closer to the best sporting events. After all, I’m a martial artist and an athlete, and I’m proud that companies like 1xBet appreciate and support sports,” says Striegl.

The 1xBet brand is widely recognized by sports fans worldwide. It is a leader in the betting and gaming industry, partnering with many famous clubs and sports organizations, including Paris Saint-Germain, FC Barcelona, Italy’s Serie A, FIBA, and Volleyball

World. The 1xPartners affiliate program, however, is best known to those interested in making money online. Over nine years of successful operation, 1xPartners has brought together more than 500,000 participants from 150 countries. The program adapts to the needs of each region, providing partners with over 250 withdrawal options, including major international platforms and widely used local services. Members especially value lifetime commissions of up to 50 percent for referred players, a registration-to-deposit conversion rate of 70 percent and exclusive VIP offers for the most active participants. Join the affiliate program now and gain access to unique opportunities for maximum earnings in sports and esports.

1xBet is a world-famous company with 18 years of experience in the betting and gambling industry. The brand’s customers place bets on thousands of sporting events and play popular games from the best providers in online casinos. The

company’s website and application are available in 70 languages. The list of 1xBet’s official partners includes Paris Saint-Germain, FC Barcelona, the Italian Serie A, FIBA, Volleyball World, CAF and other popular sports brands and organizations. The company has repeatedly become a nominee and winner of prestigious professional awards, and its platform is visited by more than three million players from all over the world monthly.

1xPartners is an affiliate program that enables media partners to earn a substantial income from iGaming advertising. The project was launched in 2016 and has since attracted over a half-million participants from around the world. Clients trust 1xPartners for its easy registration process, high conversion rates, prompt customer support with experienced personal managers, high-quality promo materials, referral promo codes and automated weekly payouts. The 1xPartners program is regarded as one of the best in the industry, as confirmed by prestigious honors from IGA, SiGMA Awards, and SBC Awards.

By Marko Mitevski

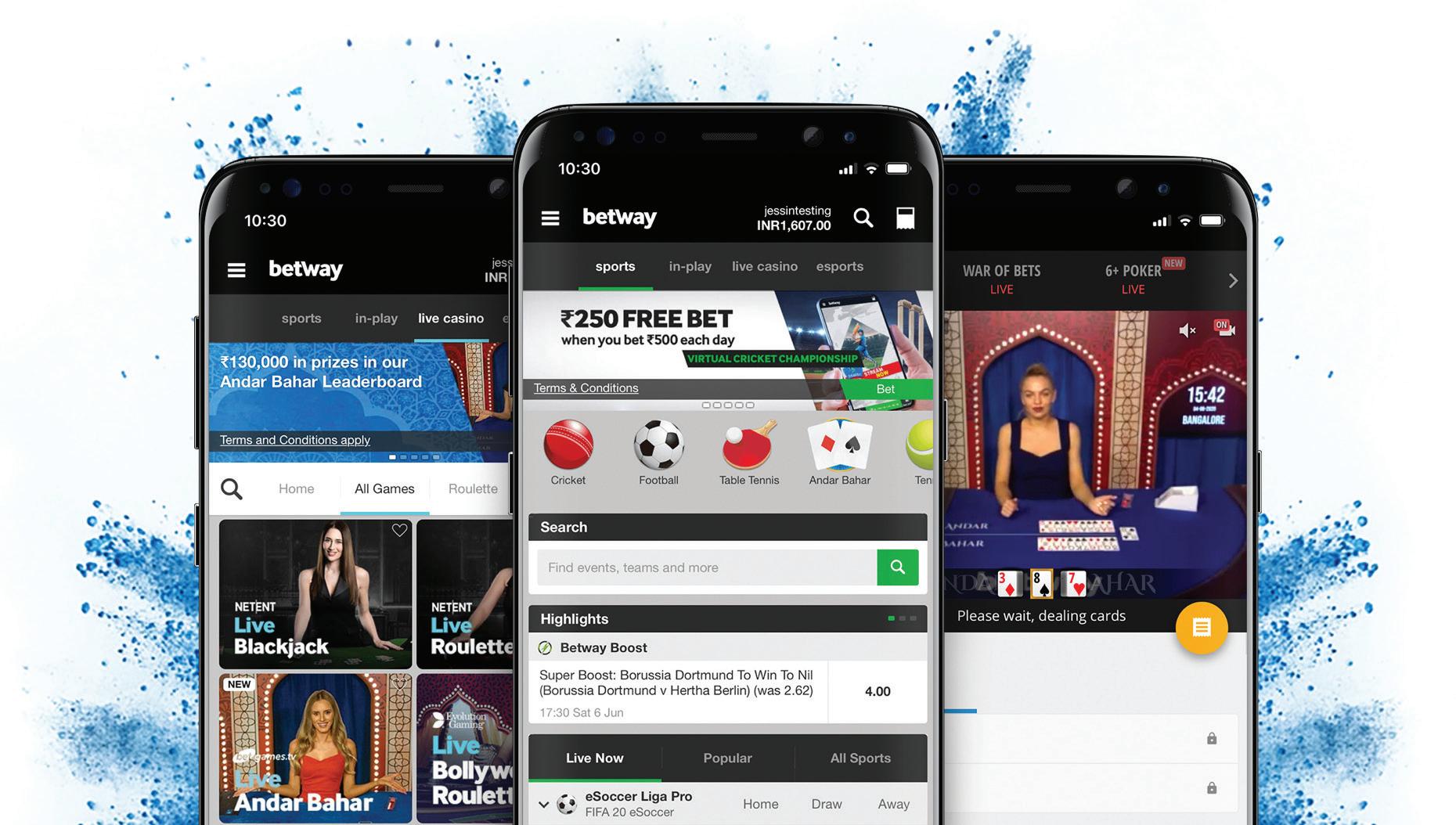

In past years, Eastern European markets have become some of the fastest-growing sports betting markets across the globe. Nations like Poland, Romania, Bulgaria, Serbia, Croatia, and others have rapidly expanded their online and offline forms of wagering. This is due to the development of better Internet infrastructure and more disposable income, combined with a cultural obsession with sport. Thus, a new competition has arisen between local/ regional operators that have a certain level of intimate understanding of their respective markets. Their international rivals are global operators such as Bet365, Betway, 1xBet and others that are emerging with their own level of expertise, larger budgets, and better technologies.

The competition between local and global operators is evolving the betting environment in Eastern Europe. Each type of operator has its own pros and cons, and caters to a unique customer base. To understand the competition and how the sports betting environment looks generally, we should think about the cultural, regulatory, and technological drivers that differentiate this competition.

Eastern European bookmakers have been around for more than 30 years, before there was ever online gambling. Many are small family businesses or part of a national chain selling only bets on traditional sports – football, basketball or horse racing. They are still in business and able to adapt to

ever-changing national political or economic conditions (especially arising increasingly in the post-Communist transition), in large part because they have built longstanding relationships with their customers.

These bookmakers depend on community trust and personal relationships to survive in a non-digital world. Customers, the majority of whom live in small towns or regional cities, value familiarity. They know the person behind the betting counter, are confident in the odds format and have a social interaction when entering a local shop. That trust translates to the online arena, in that local brands are creating their people-centric online experience through mobile apps, localized websites and social accounts.

Another advantage is how they adapt to culture. Local betting shops provide promotions, betting markets and customer service tailored to Eastern European betting preferences. Often they will have markets on their local sport, such as Polish Ekstraklasa

football, Serbian basketball or Romanian Liga I matches. The localized marketing strategies they implement, almost always centered around local sporting heroes or sponsorships at the local level, provide a meaningful way for them to interact with the community.

Local bookmakers possess a strong history and credibility, while global betting brands have scale, a grip on technology, and access to massive market budgets. Companies such as Bet365, Unibet, and Betway have begun to expand aggressively into Eastern Europe, to reach the massive and growing online audiences. They offer top-to-bottom technology platforms, sophisticated data analytics and limitless betting markets, all the way from the Premier League to niche esports events.

The user experience is one of the key attractions of global brands. Their sites are fast, sleek, and underpinned by cutting-edge algorithms used to offer bespoke recommendations and change odds dynamically. To young, tech-savvy, English-speaking bettors in Eastern Europe, these sites are luxurious and trustworthy.

Furthermore, international companies possess the capital to provide substantial sign-up bonuses, free bets and loyalty options that local bookmakers may struggle to provide. They may advertise featuring global sporting stars or major sponsorship contracts, creating a visibility and respect that crosses all borders.

Nevertheless, international companies are experiencing challenges when it comes to Eastern Europe. Language, currency and regulatory differences between each nation make their operations complex. In some cases, foreign-based betting firms are limited or taxed heavily by countries,

forcing them to operate outside the country or partner with domestic firms. While there are difficulties, their growth will continue – based solely on this insatiable market for betting on digital platforms.

Regulation is a primary factor establishing a local or global operator in the betting space. The situation in Eastern Europe can seem a bit disorienting, due to the fragmented state of law. For example, Poland and Romania have moved to a system of regulation for online betting that is more centralized, and generally covers more aspects of the market. It requires operators to apply for local licensing, as well as meeting local taxation and regulatory requirements. This is a positive development for domestic operators who could comply with the local bureaucracy of licensing.

On the other hand, countries such as Bulgaria and the Czech Republic have had a more-open market, allowing international operators to apply for and/or offer these services as they navigate any licensing required. Other operators are still operating in smaller markets legally in a gray area, with international sites providing

services to local players without laws legalizing these services and without enforcement against the international sites.

Local betting houses generally have an advantage in forging stronger ties to government officials. Many people think of them as legitimate and local businesses, contributing to the national economy while also encouraging local industry. Global brands are sometimes seen as taking money out of the country and destroying local jobs. However, many of these global businesses have lobbied local governments to establish themselves as legitimate businesses concerned for responsible gaming and adding to their local economy.

The tension between restriction and competition affects how the market develops. As more and more municipalities grasp the potential tax revenues from regulating a legalized betting environment, they might even be the ones to define whether local businesses will outperform global brands.

Originally, technology was a definite strength for global brands but that gap is quickly closing. Local bookmakers

have made inroads with their digital transition, which includes mobile apps, live betting, payment integrations and even technology partnerships with European companies to modernize their platforms, all to the same formal technology benchmarks as international brands.

However, global brands remain at the forefront in data analytics and AI-driven personalization. They can leverage real-time data to offer cash-out, live odds and personalized promotion. This level of interactivity is in line with the preferences of a younger bettor cohort who, having grown up with real-time, less-fractioned digital experiences, have a higher expectation of it.

Nevertheless, local operators are not falling far behind. Multiple local operators are starting to innovate out of localization, including collaborating with various national local payment systems. They are offering customer engagement and service on locally based platforms, and leveraging local engagement with cultural touch points like national holidays or local sport events. This combined approach, which modernizes technology but also is respectful of the culture it resides in, is working.

The distinction between local bookmakers and global ones in their marketing approaches is stark. Global operators tend to rely on mass-market ad campaigns (think TV commercials, football sponsorships, influencer marketing and digital marketing). The tone of global-brand marketing is often sleek, professional and aspirational, with a focus on the modern bettor who wants to bet conveniently – and with class.

But sponsorship of local football clubs or other community programs gives local bookmakers concrete authenticity that most global bookmaker sponsorships cannot bring. This emotional connection can be just as valuable as a large advertising budget in some Eastern European markets. Another growing area is social-media engagement. Both local and global operators are now allocating money towards platforms like Instagram, TikTok and YouTube to reach a younger audience. In those instances, local brands have an even stronger advantage over the global ones because their content is culturally relevant or applies local memes. They can foster a community around their own brand.

Trust continues to be an instrumental facet. Although global brands add a layer of international credibility and professionalism, a majority of Eastern European bettors prefer to remain on familiar platforms regulated or controlled by the government of their jurisdiction. Bettors have always thought their money and data were safer with a business that they can access or to which they can go in person, rather than taking the risk of simply registering for an unknown or unregulated platform.

Consumer behavior in the region is also changing. Younger generations are growing up in a completely digital world, and are more willing to use global platforms, cryptocurrency and alternative payment methods. Older bettors continue to prefer to bet in cash with their local bookmaker. There, they can also stand around and talk to someone they know about sports.

The generational divide clearly demonstrates that the challenge

facing local and global bookmakers is not simply a battle for market share. It is about an identity that the consumer trusts and the evolution of consumer behaviors.

The outlook for Eastern European gambling is probably not going to be a single-market landscape but more in line with coexistence and collaboration. As the regulation is becoming more harmonized and technology becomes more accessible, we will see partnerships develop in which a global brand will partner with or buy a local operator for market placement plus a level of local identity.

Such partnerships will create a win-win situation: The global brand will offer expertise around digital, innovation, regulatory compliance and product development, while the local operator will have good knowledge of the cultural, language and customerbehavior domains. Ultimately, this may put in play a sophisticated, competitive and transparent betting ecosystem across Eastern Europe.

Naomi Barton, portfolio director for iGB Affiliate provided a behindthe-scenes preview of January’s event. She explains what it is that makes the show such a standout in the affiliate diary, and how it powers the partnerships and strategies driving the next wave of iGaming growth.

iGB Affiliate 2026 marks the largestever edition of the event, with a 19 percent increase in floor space. What were the key drivers behind this expansion and how do you interpret the surge in exhibitor demand? This is the industry’s only dedicated iGaming affiliate showcase. This means that we are totally in tune with the needs of the market. We work with the community to deliver exactly what it

needs and wants. The growth means that iGB Affiliate 2026 will span 17,815 square meters, which is not only a 19 percent increase on 2025 but nearly double the footprint of the 2022 event (9,153 square meters).

The expansion, which is taking the show into Halls 8 and 8.1 at Fira Gran Via Barcelona, reflects unprecedented demand from new exhibitors. They are drawn by the event’s unrivaled business opportunities. Interest also comes from established partners, scaling up their presence at what is now regarded as the industry’s single-most-important growth platform.

Nearly doubling in size since 2022 is an impressive trajectory. How do you and your team manage scaling at this pace while maintaining the show’s trademark quality and community feel?

That level of sustained growth is unprecedented for a B2B event of substance. That’s down to the fact that my team works extremely closely with our community of stakeholders and that the event brand stands shoulderto-shoulder with the industry. Being immersed in the industry and being absolutely in tune with the needs of the industry means that the event will inevitably reflect market needs. Every big decision that we make is taken in partnership with and having consulted with the industry. In this way iGB Affiliate is a product of the community and reflects the personality of the industry.

The move to Fira Gran Via Barcelona clearly paid off. What specific aspects of the venue and the city have helped supercharge the show’s success?

The decision to relocate to Barcelona wasn’t taken lightly. In fact, every aspect of the move was interrogated, challenged and subsequently validated. The winning city bid had to meet exacting standards covering areas such as the hospitality infrastructure, global transport links and the availability of large stocks of hotel accommodation. However, the main issue was the quality of the venue and the ability it offered to scale. Fira Gran Via Barcelona allows us to grow and meet the ambitions of the markets that we serve.

With a dedicated registration area and improved transport links, how important is the attendee experience to the continued growth and global reputation of iGB Affiliate?

It’s fundamental. I’m firmly of the belief that everyone who attends the show is a highly valued customer. iGB Affiliate 2026 will attract visitors from 100-plus nations many of whom will have traveled huge distances to be

ABOVE:

Naomi Barton, portfolio director, iGB Affiliate

with us. Our visitors have a choice and we recognize that we need to earn their custom. That means delivering an exceptional at-show experience.

How has the profile of affiliates attending iGB Affiliate evolved in recent years?

We operate in a highly dynamic sector, which is powered by technology and where the only constant is change. As the industry’s leading live event, iGB Affiliate reflects the profile of the audience, as well as the changes that have and continue to take place. Our job as custodians of the iGB Affiliate brand is to be sensitive to changing needs, sufficiently agile to be able to respond swiftly, progressive in our outlook and in tune with the business.

Given the event’s increasingly international profile – delegates from 119 countries last year – how do you ensure the show delivers value to both established European markets and fast-growing regions like LatAm, Africa, and Asia?

iGB Affiliate is an undeniably international show. In order to continue to attract so many industry professionals from 119 nations, we need to ensure that the offer is current, appropriate and attractive. The core

reason for attending an event is the quality of the exhibitor lineup. We have succeeded in winning the support of all of the leading brands active in the space. We also ensure that our content reflects the needs of a global audience. All of this entails working with the market, listening to the market and acting on the feedback we receive from the it.

With iGB Affiliate 2026 already setting new records, what’s next on the horizon for the brand? How do you envision the show evolving over the next few years?

2025 was a record-breaking edition which underscored its international credentials with so many nations represented on the show floor. It’s important that the show continues to grow and we will be extending our

global footprint even further. For the 2026 edition of iGB Affiliate Barcelona, we are implementing a major strategic drive targeting dynamic emerging markets, including those in CEE and Latin America. Working in partnership with the industry, we’re leveraging the unparalleled reach of the iGB Affiliate Barcelona brand to unlock the business opportunities that exist in the world’s newest and fastest-growing territories.

iGB Affiliate has always been known for its mix of business and networking. What new initiatives can attendees look forward to?

iGB Affiliate is a fully rounded experience both on and off the show floor. The iGB Affiliate dinner series provides additional networking opportunities for specific cohorts such as operators and senior-level affiliates. We will be staging the C-Leaders iGaming Affiliate Summit which is being sponsored by iGB Executive. We have responded to specific feedback from customers, and introduced new social networking areas both inside the hall and outside, utilizing the Sky Garden. Attendees will be able to participate in the World Gaming Wellness Run on the opening day of iGB Affiliate. The World Gaming Unwind Session on January 22 will end World Gaming Week on a collective high

The iGaming affiliate industry continues to evolve rapidly amid shifting regulations, data challenges and AI-driven marketing. How is iGB Affiliate reflecting or supporting these industry changes?

With AI reshaping marketing, tighter regulations rolling out and data challenges growing, what we provide via iGB Affiliate Barcelona is the opportunity to give affiliates, operators, tech innovators, and

media buyers a physical space to connect, collaborate, and get ahead. This will include: targeted content sessions comprising show floor talks, case studies and presentations from relevant speakers who are leading the charge in this area.

In terms of curated networking we will have iGB Introducing, where attendees can meet people they don’t already know via pre-arranged meetings onsite. We will also have the brand-new iGB Oasis for meeting and networking.

Everything that we do drives the connections – curated, social and business-led – that iGB Affiliate is famous for.

We are bringing together clever, innovative and respected voices from tech, affiliate marketing, and gaming sectors to share where they think the market is going, what to focus on, and how to prepare. In essence iGB Affiliate fuels the partnerships and strategies driving the next wave of iGaming growth.

Finally, what’s your message to affiliates and partners who haven’t yet attended iGB Affiliate? Why should they make Barcelona their destination this January?

The proposition driving our international comms in support of iGB Affiliate Barcelona is ‘Are you ready to claim your EDGE?,’ which I think summarizes the business credentials of the show.

iGB Affiliate is the only dedicated iGaming event for affiliates in the world and will be a hotbed of innovation, featuring over 200 exhibitors showcasing the single-largest concentration of solutions, designed to give operators first-mover advantage in what is an ultra-competitive, global marketplace. No other event brings the entire iGaming ecosystem together

comprising operators, game providers, tech vendors and affiliate – all under one roof.

The opportunities to build new business, strengthen key partnerships and form new, trustbased relationships are unique to iGB Affiliate. That is why we are expecting to welcome 11,000-plus affiliate professionals to Barcelona in January, all with a shared ambition to immerse themselves in the future of iGaming and start the year with a robust competitive edge.

Affiliates looking to secure their place at iGaming Affiliate Barcelona can unlock their complimentary entry at: https://igb-affiliate.reg.buzz/?utm_ campaign=bigba26-partners&utm_ medium=display&utm_source=pr

By Peter White

SiGMA has grown from a Malta-born event into a truly global brand. Looking back, what key decisions or turning points allowed SiGMA to scale beyond its home base and achieve international recognition? You’ve described Covid-19 as both a crisis and an opportunity for SiGMA’s expansion. How did that period reshape your long-term strategy for global growth?

It was a do-or-die moment. The difficulties seemed almost insurmountable. We had just opened an office in the Philippines and announced our first international event in Manila when the pandemic hit. As the events industry ground to a halt, we chose to rethink our strategy –going all-in with a bold decision to hold a summit in Dubai.

Against all odds, it was a resounding success and the start of our global journey. We also launched a VC fund, SiGMA Play, an affiliate program that marked our expansion into media and the SiGMA Foundation – our charitable arm – that same year. While undoubtedly a challenging time, it was also a wake-up call, a reminder that complacency can lead to failure. Adaptability and resilience are key.

One of the most significant milestones for SiGMA has been taking our events global while maintaining a high level of quality for exhibitors and attendees. With over 340 experienced,

ABOVE: Emily

Micallef, CEO, SiGMA Group

skilled employees and offices in six locations, we’re confident we’re equipped to deliver excellence, no matter where we are. We’re excited to launch our World Tour next year, which includes events in eight strategic cities, as well as a number of exciting side events, such as the SiGMA Poker Tour, which includes stops in Malta, Sao Paulo, Manila, Cape Town and Mexico.

What makes SiGMA different from other iGaming and tech summits around the world, and how do you plan to strengthen that positioning over the next few years?

Unlike other industry events that focus heavily on single areas of

interest, SiGMA serves as a stage for multiple sectors – a trusted source that connects the B2B, B2C and now B2G industries. Our summits platform diverse verticals that generate plenty of cross-over opportunities, with space for both land-based and online operators on our expo floor. Our content is also localized for the markets we’re active in, with many of our conferences and media products produced in multiple languages. We also bring tech closer to the gaming industry through the AIBC brand, which specializes in frontier technologies such as AI, blockchain and Big Data.

Additionally, our events are also based on a unique formula that bridges high-level networking with business opportunities. Curated guest lists mean that each event feels personalized, bringing the right people together at the right place and time. From affiliate retreats to private dinners, the transition between entertainment and business is seamless.

This year’s SiGMA Central Europe takes place in Rome. Why was Rome chosen as the host city, and what unique opportunities does this location bring to the event and its delegates?

Italy represents Europe’s largest untapped online-gambling market, with only 25 percent of its €16 billion gambling revenue currently generated online. This leaves a €12 billion offline segment ripe for digital transformation. The country’s online-gambling industry is rapidly expanding, projected to grow to around €3.8 billion by 2029. By hosting SiGMA in Rome, the event positions itself at the centre of Italy’s online-gambling revolution, offering delegates the chance to engage directly with one of Europe’s

most promising and fastest-growing markets.

Beyond gaming, Rome is thriving when it comes to digital entrepreneurship and startup innovation. Italy leads Europe in venture-capital growth, supported by initiatives like the Houses of Emerging Technologies, which foster groundbreaking ideas in fintech and tech-driven industries.

Rome is a city that has a long-held legacy of shaping the next generation of ideas, making it a fitting backdrop for the discussions and collaborations that will influence the future of gaming. Additionally, its connectivity and accessibility – boosted by an efficient metro network, and two major airports, as well as its rich culture – create an ideal and beautiful meeting point for global delegates. The conference is expected to draw 30,000 delegates, 550 speakers and over 1,000 exhibitors and sponsors to the Fiera Roma, a state-of-the-art expo center.

What themes or topics will dominate the agenda in Rome, particularly around sports betting, gaming regulation and emerging technologies?

This year’s SiGMA agenda offers a powerful, three-day journey through

the main forces shaping the global gaming landscape: regulation and emerging technology.

Day One opens with the Regulatory Briefing Stage, featuring panels such as “License to Launch: Winning Strategies for Entering Regulated Markets,” “Italy’s Grand Gaming Reform – Where Do We Stand?” and “Voices of Authority: Inside Europe’s Regulatory Roundtable.” These sessions set the tone for a program that places compliance, responsible growth and cross-border cooperation at the heart of industry dialogue.

Day Two deepens the focus with “Navigating Europe’s Betting Regulations: Compliance in the Age of AI” and “Betting on Tomorrow: The Power of Prediction Markets.”

Discussions around the cashless revolution, the illegal gambling epidemic, and the future of slot machines highlight innovation within structured regulation, while sessions like “AI and the Future of Sports & Tech” showcase how data, automation, and fan insights are transforming engagement.

By Day Three, attention turns to sports betting integrity and AI-driven transformation, with panels such as “Tipster Economy: How Italy Turned

Sports Betting into a Community” and “Growing Sport-Integrity Challenges.”

Meanwhile, Frontier Tech sessions like “AI Solutions for iGaming,” and “Building with AI” confirm that technology and regulation now move hand-in-hand, ensuring that innovation evolves responsibly across the gaming ecosystem.

You’ve said that within SiGMA, “no one is more than anyone else.” How do you instill that culture across a growing, international team?

At SiGMA, we’ve built a culture where hierarchy doesn’t outshine value. As our founder, Eman Pulis, always says, “Leave your ego at the door,” and that’s something we truly live by. SiGMA has a long history of empowering its staff. We maintain an open-door policy at every level. Whether you’re a brand-new intern fresh out of college or a part of the leadership team, there’s always room for your ideas to be heard and respected, and for talented, hardworking people to thrive.

As we grow internationally, we encourage cross-team projects, open feedback, and regular touch points between global offices, cultivating a tight-knit, family feeling. All our employees also benefit from opportunities to travel and work from any of our offices, which allows our teams to feel more connected, to learn more about the different cultures of the places we’re active in, and to broaden their perspectives. We recognize the great responsibility that comes with being an international organization.

SiGMA brings together C-suite executives, startups, regulators and innovators under one roof. How do you balance the voices of these diverse stakeholders?

Balancing the voices of such a diverse audience is all about creating the space for meaningful dialogue. This year, we’ve gone all out to ensure everyone has a platform by building four dedicated stages at the Fiera Roma, each one focused on its own specific niche: Regulatory Briefing, Affiliate Leaders, People Partners & Performance, and Frontier Tech & Payment Experts.

We’ve designed the program around the industry’s real priorities: regulation, investment, AI, ESG and market expansion. With over 550 speakers leading the conversation across these stages, we’re making sure every perspective – from startups to regulators and C-level leaders – is heard.

Beyond the exhibition floor, SiGMA has built a reputation for side events: training, charity initiatives, networking retreats. How do these elements support your mission of promoting regulated and responsible gaming globally?

Industry events like SiGMA play a pivotal role in addressing concerns about responsible gaming by fostering transparent dialogue and promoting safe gaming practices. SiGMA’s events serve as important platforms where stakeholders – including operators, regulators, and technology providers – can collaborate, share insights, and develop strategies to enhance player protection and ethical conduct within the gaming sector.

On the business-to-government side, we host a number of dedicated events that bring together regulators, policymakers and industry leaders to ensure regulation remains at the forefront of every discussion. These sessions create a space where stakeholders can exchange ideas and knowledge, align on best practices and

strengthen frameworks for safer, more transparent markets.

Our training workshops, charity initiatives and networking retreats all support the same goal: building a community that values responsibility as much as innovation. By connecting the right people in the right environments, we’re helping shape a global gaming industry that grows sustainably and ethically.

The SiGMA Awards have become a key highlight of the summits. Could you share more about the new Hall of Game category and why now was the right moment to introduce it?

Hall of Game was created to honor individuals who have driven meaningful change, visionary leaders whose influence has shaped the gaming and tech landscape in profound ways, guiding it through its formative years, setting global standards and building regulatory frameworks that continue to define it today. The industry has reached a level of maturity where reflection and recognition are as vital as innovation. As gaming and technology continue to evolve at an unprecedented pace, Hall of Game serves to inspire the next generation of leaders to carry that legacy forward.

Shaping the future of sports betting integrity. By Khalid Ali, CEO of the International Betting Integrity Association (IBIA)

With over 90 regulated betting operators and 200 brands generating and monitoring over $300 billion in sports betting turnover per year, the International Betting Integrity Association (IBIA) has become a key player in the detection and reporting of suspicious betting activity.

The global sports betting landscape is however evolving at an unprecedented pace. Internationalization, digitalization, and technological developments such as cryptocurrency and artificial intelligence are reshaping the way sports betting markets operate.

At the same time, the sporting world itself is being transformed: Esports is growing rapidly, women’s sports are gaining prominence and new sporting powers are emerging worldwide. In this context of rapid change, safeguarding integrity in sports betting has never been more important — or more complex.

As IBIA celebrates its 20th anniversary, it is a moment not only to reflect on past achievements but also to look ahead to the future. Over the past year, we have asked ourselves a fundamental question: How can we more successfully confront the challenges and capitalize on the opportunities created by this dynamic new environment?

ABOVE: Khalid Ali, CEO of the International Betting Integrity Association (IBIA)

The answer to this question is Mission 2030, our new strategic roadmap. It is designed to guide us over the next five years and provides a clear vision for how the organization will evolve, and how it will continue shaping the future of sports betting integrity.

It sets a clear ambition: to strengthen IBIA’s role as the global standard for sports betting integrity, whilst also defining our core mission. That is to safeguard sports, athletes, betting operators and consumers from match-fixing. Our vision is to create an environment in which the highest integrity standards are applied across all regulated sports betting markets worldwide.

Operator intelligence is at the heart of our integrity model. Our Global Monitoring & Alert Platform (Global MAP) already allows us to monitor and analyze over $300 billion of regulated global betting transactions annually. It was recently upgraded to increase its ability to detect and report suspicious betting activity. Looking ahead, we will continue to strengthen our Global MAP to increase our ability to support investigations and the successful prosecutions of match-fixers.

No single stakeholder can tackle integrity risks alone; meaningful progress requires collective action. It is only by working closely with regulators, sports bodies, operators, athletes, and law enforcement that we can build stronger, more resilient systems to protect both sports and the betting industry. Therefore, an additional key objective is to expand and deepen our collaboration across the global sportsintegrity ecosystem.

Finally, prevention is at the heart of Mission 2030. With our unparalleled access to industry data, IBIA is already uniquely positioned to provide policymakers and regulators with insights into global betting-integrity developments and trends. This will become even more important as they seek to understand the complex and rapidly evolving nature of sports betting.

The unfortunate truth is that corrupting sporting competitions requires the active involvement of vulnerable players or officials, and this remains a challenge. Athlete-education

programs are therefore an essential element of protecting sports and athletes from the threat of betting related matchfixing, and will remain central to our work.

We need a more proactive approach to ensure that any developments – from new market openings, to emerging sporting markets and technological innovations – can be managed effectively before any problems arise. Mission 2030 is intentionally designed as a roadmap rather than a static plan. It sets a clear direction whilst allowing us to be dynamic and responsive to change. It also ensures that collaboration is central to its implementation, with detailed actions and tactical initiatives being developed in close partnership with stakeholders.

To mark this new phase in IBIA’s development, we are unveiling a refreshed brand identity and a new strapline: Safeguarding Sports Betting. This update is more than visual; it reflects our expanding global presence, our renewed focus on the future and our commitment to collaboration as the foundation for integrity.

The new logo – six interwoven segments – symbolizes the interconnected pillars of the global sports betting ecosystem: operators, governing bodies, athletes, regulators, law enforcement and institutions. Together, these relationships are the foundation of the sports-integrity ecosystem.

Ultimately, Mission 2030 represents both ambition and preparedness. It is

about more than responding to current challenges. It is about building the resilience and adaptability needed to navigate a rapidly changing global environment. By combining enhanced operator intelligence, stronger collaboration, proactive prevention and a modernized brand identity, IBIA will be ready to respond effectively to emerging trends.

As the sports betting landscape continues to evolve, one thing is clear: The future of sports integrity will be shaped by those who anticipate change, who innovate and work together. While the challenges are complex, collaboration is key to shaping the future of sports betting integrity.

In September, the International Betting Integrity Association (IBIA) held its fourth Payment Provider Forum meeting at Lisbon’s iconic Estádio da Luz, alongside its annual Working Group meeting. The Forum, which brings together payment-service providers committed to safeguarding the regulated-betting ecosystem, continues to gain momentum, welcoming iugu, one of Brazil’s leading financial-technology companies, as its newest member.

The IBIA Payment Provider Forum was established to protect the betting market from financial fraud linked to competition manipulation. Its members sign a Declaration of Commitment & Participation, pledging to uphold best practices in integrity, transparency and monitoring. Through collaboration between payment providers and betting operators, the Forum aims to close integrity gaps and strengthen governance across the global-betting supply chain.

“We are pleased to welcome iugu as a new member of the Payment Provider Forum,” said Khalid Ali, CEO of IBIA. “The involvement of responsible and committed payment providers is essential to support the integrity and sustainable development of the regulated sportsbetting market, especially in emerging regions like Brazil.”

For iugu, the partnership marks a major milestone. “Our membership in the IBIA Payment Provider Forum underscores our commitment to the highest global standards. We are eager to actively contribute to the sector’s growth in Brazil and internationally,” stated Ricardo Dostaole, head of bets at iugu.

The timing is critical for Brazil’s expanding regulated betting sector. According to the Secretariat for Prizes

& Betting (SPA) of the Ministry of Finance, 17.7 million Brazilians placed online bets in the first half of 2025. It is a number that underscores both the opportunity and the responsibility of payment providers within this ecosystem.

To further inform discussions, Ed Birkin, managing director at H2 Gambling Capital, presented key data and insights on Brazil’s current betting landscape during the Lisbon meeting. With members collaborating in person to approve new projects and chart their next steps, the Forum reaffirmed its role as a unique global platform for cross-sector engagement on betting integrity and financial transparency.

As 2025 draws to a close, IBIA’s Payment Provider Forum is preparing for its fifth and final meeting of the year, where it will discuss its strategic direction and activities for 2026. The Forum is determined to continue its mission of fostering trust, transparency and innovation in sports betting worldwide.