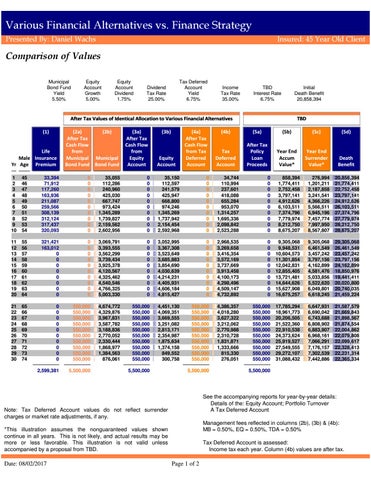

Various Financial Alternatives vs. Finance Strategy Presented By: Daniel Wachs

Insured: 45 Year Old Client

Comparison of Values Municipal Bond Fund Yield 5.50%

Equity Account Growth 5.00%

Equity Account Dividend 1.75%

Tax Deferred Account Yield 6.75%

Dividend Tax Rate 25.00%

Income Tax Rate 35.00%

TBD Interest Rate 6.75%

Initial Death Benefit 20,858,394

After Tax Values of Identical Allocation to Various Financial Alternatives (1)

Life Male Insurance Yr Age Premium

(2a) (2b) After Tax Cash Flow from Municipal Municipal Bond Fund Bond Fund

(3a) After Tax Cash Flow from Equity Account

(3b)

Equity Account

(4a) After Tax Cash Flow from Tax Deferred Account

TBD

(4b)

(5a)

(5b)

(5c)

(5d)

Tax Deferred Account

After Tax Policy Loan Proceeds

Year End Accum Value*

Year End Surrender Value*

Death Benefit

1 2 3 4 5 6 7 8 9 10

45 46 47 48 49 50 51 52 53 54

33,394 71,912 117,260 163,936 211,087 259,566 308,139 312,124 317,437 320,093

0 0 0 0 0 0 0 0 0 0

35,055 112,286 240,960 425,030 667,747 973,424 1,345,289 1,739,827 2,159,562 2,602,956

0 0 0 0 0 0 0 0 0 0

35,150 112,597 241,579 425,947 668,800 974,246 1,345,269 1,737,942 2,154,454 2,592,968

0 0 0 0 0 0 0 0 0 0

34,744 110,994 237,601 418,088 655,284 953,070 1,314,257 1,695,336 2,098,842 2,523,288

0 0 0 0 0 0 0 0 0 0

858,394 1,774,411 2,752,458 3,797,141 4,912,626 6,103,511 7,374,796 7,779,974 8,212,750 8,675,207

276,994 1,201,211 2,187,858 3,241,541 4,366,226 5,566,511 6,945,196 7,457,774 7,997,950 8,567,807

20,858,394 21,774,411 22,752,458 23,797,141 24,912,626 26,103,511 27,374,796 27,779,974 28,212,750 28,675,207

11 12 13 14 15 16 17 18 19 20

55 56 57 58 59 60 61 62 63 64

321,421 163,012 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0

3,069,791 3,393,555 3,562,299 3,739,434 3,925,378 4,120,567 4,325,462 4,540,546 4,766,325 5,003,330

0 0 0 0 0 0 0 0 0 0

3,052,995 3,367,308 3,523,649 3,685,883 3,854,690 4,030,639 4,214,231 4,405,931 4,606,184 4,815,427

0 0 0 0 0 0 0 0 0 0

2,968,535 3,269,658 3,416,354 3,572,169 3,737,669 3,913,458 4,100,173 4,298,496 4,509,147 4,732,892

0 0 0 0 0 0 0 0 0 0

9,305,068 9,948,531 10,604,573 11,301,854 12,042,831 12,855,405 13,721,481 14,644,626 15,627,908 16,675,257

9,305,068 6,461,549 3,457,242 3,797,156 4,162,899 4,581,476 5,033,856 5,522,620 6,049,801 6,618,245

29,305,068 26,461,549 23,457,242 23,797,156 24,162,899 18,850,976 19,441,411 20,020,800 20,740,035 21,459,224

21 22 23 24 25 26 27 28 29 30

65 66 67 68 69 70 71 72 73 74

0 0 0 0 0 0 0 0 0 0

550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000

4,674,772 4,329,876 3,967,831 3,587,782 3,188,836 2,770,052 2,330,444 1,868,977 1,384,563 876,061

550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000

4,451,130 4,069,351 3,669,555 3,251,082 2,813,171 2,354,987 1,875,634 1,374,158 849,552 300,758

550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000

4,386,357 4,018,280 3,627,322 3,212,062 2,770,988 2,310,728 1,831,871 1,333,666 815,330 276,051

550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000 550,000

17,785,294 18,961,773 20,206,505 21,522,360 22,910,538 24,373,624 25,919,527 27,549,555 29,272,107 31,088,432

6,647,931 6,690,042 6,743,688 6,808,902 6,883,907 6,968,161 7,066,291 7,176,157 7,302,539 7,442,886

21,587,579 21,669,843 21,898,567 21,874,554 22,004,862 22,079,808 22,099,617 22,328,413 22,231,314 22,365,334

2,599,381

5,500,000

5,500,000

5,500,000

See the accompanying reports for year-by-year details: Details of the: Equity Account; Portfolio Turnover A Tax Deferred Account

Note: Tax Deferred Account values do not reflect surrender charges or market rate adjustments, if any.

Management fees reflected in columns (2b), (3b) & (4b): MB = 0.50%, EQ = 0.50%, TDA = 0.50%

*This illustration assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. This illustration is not valid unless accompanied by a proposal from TBD.

Date: 08/02/2017

5,500,000

Tax Deferred Account is assessed: Income tax each year. Column (4b) values are after tax.

Page 1 of 2