CFE DRIVES ENERGY EFFICIENCY

CPM moving up the gears with conditioner technology.

CPM 24-LT-10 Conditioner

CPM 24-LT-10 Conditioner

To find out more about our products and services and to contact Lauren, visit trouwnutrition.co.uk

“Find out how our feed mill efficiency team can fine tune your process to save you money whilst reducing your carbon footprint.”

Lauren James Feed Additive Product Manager Trouw Nutrition GB

SUBSCRIPTION RATES:

One year: £80

Two years: £150

Three years: £200

ISSN 0950-771X

Views expressed by contributors are not necessarily those of the Publisher.

Feed Compounder September/OctOber 2023 page 1 Opinion: The Most Volatile Ever? 2 Ryan Mounsey: Feed Production Update 4 Robert Ashton: 10 Ways to Make a Difference 12 Colin Ley: View from Europe 14 Christine Pedersen: Milk Matters 16 Know what is in the Clamp and Supplement Precisely 17 Matthew Wedzerai: Scientifically Speaking … 18 Roger Dean: Company Reports & Accounts 20 Green Pages 22 Feed Trade Topics From the Island of Ireland Optimising Energy Usage in the Pelleting Process - Time for Change 26 With Con Lynch and Louis White Feeding People While Preserving the Planet 30 With Mark Lyons, Vaugn Holder and Nikki Putnam In Memory of Alf Croston 32 By Andrew Mounsey and Nevil and Roger Croston Futureproofing our Returns from Essential Oil Feed Additives 34 By Iain Campbell Extracting More Feed Value from Home Grown Forages 36 By Dr Philip Ingram ForFarmers 2023 First-Half Results 38 Precision Feeding of Poultry 40 By Ralph Bishop Optimum performance Under Oxidative Stress with Hydroxy-SelenoMethionine 42 By Florence Rudeaux New Products in the Feed Industry 47 In Brief 48 Why Levels of Mycotoxins May Be Increasing in Europe 53 By Sander Janssen Feed Production Machinery, Pelleting & Extruding 54 Feed Ingredients: Protein Products 56 Novel Ingredients for Feed / the Search for Soya Replacement 59 People 60 Buyers’ Guide 62 COMMENT COMPOUNDE R F EED Contents September/October 2023 Vol. 43 No. 5

Print

and On-Line

© Feed Compounder 2023 DEPUTY EDITOR: Ryan Mounsey ADVERTISEMENT/SALES MANAGER: Fiona Mounsey EDITOR: Andrew Mounsey PUBLISHED BY: Pentlands Publishing Ltd Plas Y Coed Velfrey Road Whitland SA34 0RA United Kingdom Tel: +44 (0) 1994 240002 Web site: www.feedcompounder.com E-mail: mail@feedcompounder.com

THE MOST VOLATILE EVER?

It’s a big statement to say something is the best, or worst, in living memory, but the UK grain trade is pretty close to justifying a ‘most volatile ever’ description as we approach the business end of the 2023 harvest.

Market volatility, driven by Russia’s invasion of Ukraine, and carried on by changing weather patterns globally, is creating a trading environment where cereal prices are moving up and down by anything between £3 and £6 a tonne on a daily basis. The daily rise and fall for oilseeds is even more pronounced at between £5 and £10 a tonne.

Add to this, severe on-farm anxieties over the quality of the current crop against the background of massive changes in input costs over the last two years and our volatility description could almost be termed something of an under-statement.

In addition, talking to growers and traders recently, there is also widespread concern over malting barley samples, some of which already look to be more suited to the feed sector than their preferred whisky production outlets. It’s all looking ‘very average’ at present, was how one UK grower summed up his harvest to date.

It’s much the same elsewhere in Europe with Copa and Cogeca, the EU farmer and farm co-op organisation, seeking urgent action from the European Commission in the face of a 2023 arable harvest which they say has deteriorated rapidly over the last two months.

The Brussels-based organisation has warned that the European cereals crop is in the throes of possibly its worst harvest since 2007, potentially leaving total output 10% below the sector’s most recent 5-year average.

How all this will play into the feed ingredients market is perplexing, especially with AHDB talking up the prospect of bigger crops being available in Ukraine and Russia (although such crops may never become available globally this year). There’s also the existence of larger than normal maize crops in the US to take into account.

Move too quickly on a feed ingredients purchase in such circumstances, therefore, and you could miss an emerging low price opportunity. Wait too long and you could be left with thoughts of what might have been as you pay the price of a delayed decision.

Many farmers, in an attempt to extract the best they can from the 2023 market, are sitting with more stored grain than usual, some of it from 2022. Their hope is that last year’s £250-£300 a tonne wheat prices will return, thoughts that are prompting them to reject the option of selling at today’s £180/190 a tonne trading range. The best advice for those in this situation is surely to average their returns over the last 24 months and accept this year’s reality. The other side of the coin,

after all, is that the £700-£800 tonne demanded for nitrogen in 2022 has been replaced by a £360 a tonne market this year with phosphate and potash back down at £400 to £450 a tonne. Best to accept that while input costs rise and fall so do crop values, hopefully balancing each other out in the process.

The same philosophy applies to buying feed ingredients, of course, although it’s always easier to recognise what others need to do to balance their books than to accept the same obvious logic in relation to our own industry.

Copa/Cogeca’s solution is for the European Commission to apply greater flexibility to its implementation of the CAP this year, avoiding placing farmer access to basic support under any kind of pressure. The organisation has also called for derogations to be applied in 2024, reflecting the extent to which current climatic conditions are already influencing plans for the next agricultural year.

A prolonging of the current suspension of import duties on ammonia and urea is also being sought, alongside their extension to other mineral fertilisers, as well as the suspension of antidumping measures relating to Urea Ammonium Nitrate. Copa/Cogeca’s argument is that such a combination of measures would help farmers cope with ‘a very difficult situation’ in which growers are being ‘squeezed from all sides’.

While the Commission’s ‘just back from holiday’ officials grapple with such demands, the rest of us have to cope with even more volatility while these options are considered. One of the rules of Brussels seems to be that if you think something is settled, or that a policy position is securely in place, then you will almost certainly be wrong.

The other side of this year’s volatile market concerns the way in which consumers are behaving in response to food price inflation and the all-round rise of the cost of living. While long-term global demand for meat remains secure, the short-term market is problematic. The latest retail figures, released by the UK’s Office for National Statistics (ONS), show food stores sales volumes falling by 2.6% in July 2023, continuing a steady decline in sales volume since January 2021.

Retailers report that the increased cost of living, including as applied to food, continues to affect sales. Consumer price inflation, as reported in July 2023, shows the cost of food and non-alcoholic drinks increasing by 14.9% during the previous 12 months, a rise which helps to explain why food store sales volumes are currently 5.1% below preCovid-19 levels (February 2020).

A volatile end to 2023 seems certain therefore, demanding extra close attention to be given to buying and selling activities within a definite ‘survival of the fittest’ marketplace.

page 2 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com opinion

Reduced nitrogen excretion Reduced carbon footprint Reduced soybean meal use Optigen®, the superior non-protein nitrogen source for ruminant nutrition. A cost-effective solution to help you overcome the protein challenge by managing fluctuating feed costs and improving the sustainability of your business. Optigen can be included in compound feeds and blends. Find out how Alltech can help you improve the sustainability of your business. sustainably Boosting the limits of your protein stock Alltech.com/uk Call: 01780 764512 ukenquiries@alltech.com

Feed Production Update

By Ryan Mounsey

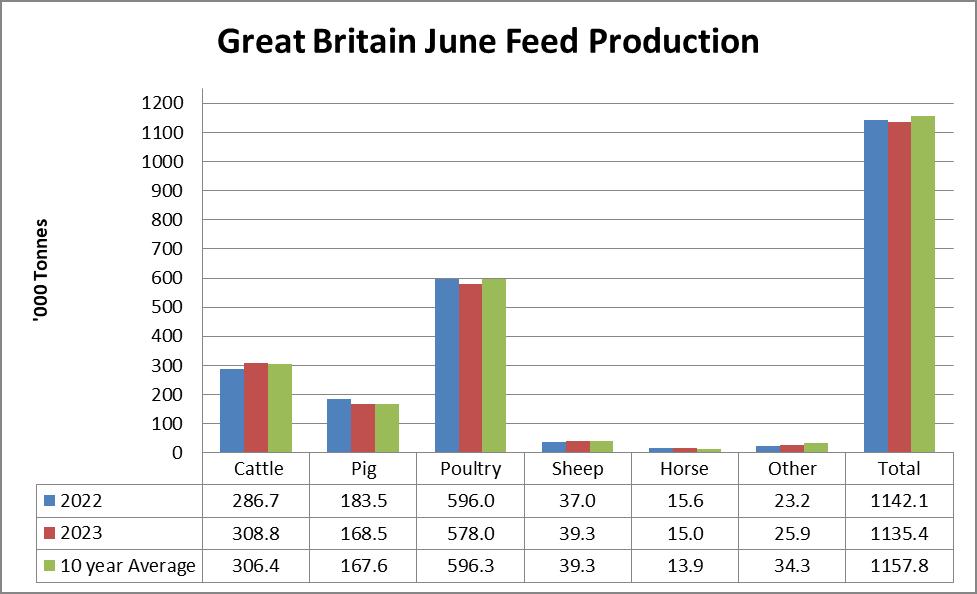

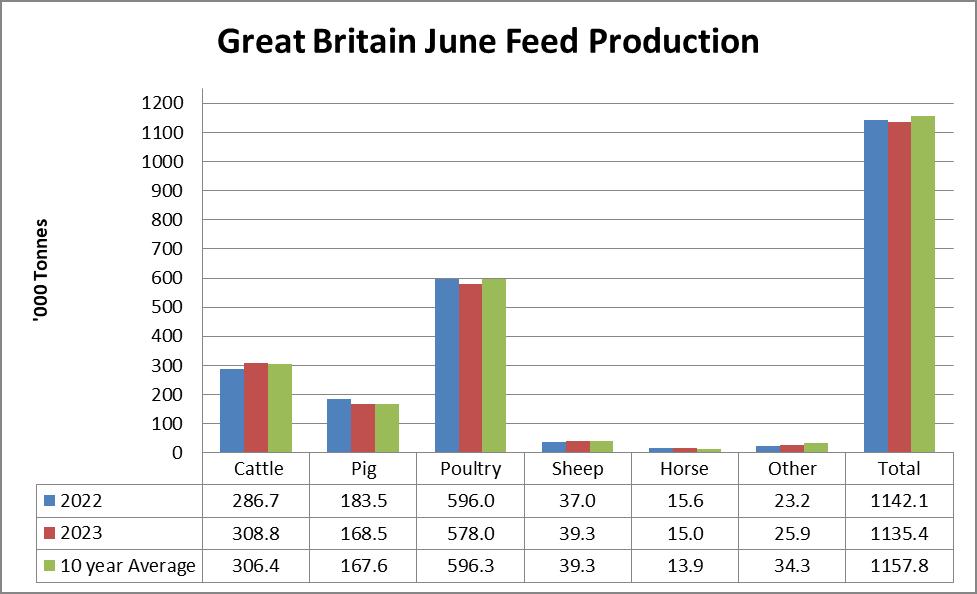

GREAT BRITAIN Monthly Production Update - June

Total production of compounds, blends and concentrates, including integrated poultry units, during the month of June 2023 declined by 6,700 tonnes or 0.6 per cent from its year previous return to 1,135,400 tonnes, the lowest output for the period since 2016. Moreover, the total under review was a marked 22,400 tonnes or 2.0 per cent below the 10 year average for June.

Total feed production during the month of June 2023 was made up of: 50.9 per cent poultry feed, 27.2 per cent cattle and calf feed, 14.8 per cent pig feed, 3.5 per cent sheep feed, 1.3 per cent horse feed and 2.3 per cent other feed.

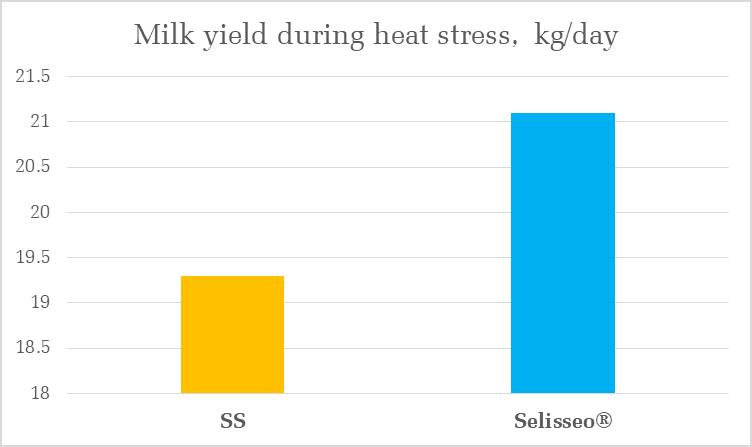

At 578,000 tonnes of output, total poultry feed was at its lowest June level since 2015 and was 18,000 tonnes or 3.0 per cent down on the return from the corresponding month a year previously. The current production was lower than all but two totals from the past decade and dropped 18,300 tonnes or 3.1 per cent below the decade long average for the month.

In contrast with the sector itself, both the poultry rearing and breeding compounds and turkey compounds subsectors bettered their respective year previous returns. The former did so by 1,000 tonnes or 3.6 per cent up to 28,900 tonnes and the latter by 800 tonnes or 16.0 per cent up to 5,800 tonnes, following two successive year-on-year declines. On the other hand, output of broiler feed compounds fell by 28,000 tonnes or 13.5 per cent to 180,100 tonnes, its lowest level for June since 2016. In addition, a 7,500 tonnes or 7.2 per cent decline in production of layer compounds brought output down to 96,600 tonnes, the lowest for the category since 2017. Finally, output of chick rearing compounds decreased by a more moderate 100 tonnes or 0.8 per cent to 11,900 tonnes.

Total cattle and calf feed production surpassed its year previous

counterpart by 22,100 tonnes or 7.7 per cent and rose to 308,800 tonnes, its second highest total of the past 5 years for the timeframe. In addition, 2023’s total was 3,330 tonnes or 1.1 per cent in excess of the 10 year average for June.

All cattle and calf feed elements outpaced their corresponding year previous returns. The standout figure from the sector was the 8,500 tonnes or 5.0 per cent rise in the output of compounds for dairy cows up to 177,900 tonnes, its highest return for June since 1995. Production of blends for dairy cows rose considerably from its 2022 return to 56,900 tonnes, an increase of 6,800 tonnes or 13.6 per cent. All other cattle compounds surpassed its year earlier counterpart by 1,800 tonnes or 5.5 per cent, however, the output of 34,500 tonnes was the second lowest for the month since 2002. Having fallen steeply for the past two Junes, production of all other cattle blends rose by a considerable 3,600 tonnes or 20.1 per cent to 21,500 tonnes; cattle protein concentrates followed the same pattern and bettered its year previous return by 500 tonnes or 9.3 per cent with an output of 5,900 tonnes. Total calf feed output for June in 2023 arrested a sequence of three consecutive year-on-year downturns as it grew by 900 tonnes or 8.0 per cent from a year earlier to 12,100 tonnes.

For the thirteenth calendar month in succession, total pig feed had decreased below its corresponding year earlier total, in this case, by 15,000 tonnes or 8.2 per cent to 168,500 tonnes. However, due to considerably lower outputs from the first half of the preceding decade, the current total was more or less in line with the 10 year average for the month, being just 100 tonnes or 0.1 per cent higher.

Not only were all pig feed subsectors down on their outputs from the corresponding month a year previous but three were at their lowest level for June since records were kept in their current form. Production of pig protein concentrates had halved from 2022 levels to 200 tonnes; pig starter and creep feed output had dropped by 500 tonnes or 10.6 per cent from a year earlier to 4,200 tonnes; and pig growing compounds production declined by 4,500 tonnes or 14.9 per cent to 25,700 tonnes. Additionally, pig finishing compounds fell by a notable 8,700 tonnes or 8.7 per cent from the record high for June from a year previous to 91,400 tonnes. Production of both link and early grower feed and pig breeding compounds fell by less substantial totals; the former did so by 500 tonnes or 4.8 per cent down to 9,800 tonnes and the latter by 500 tonnes or 1.3 per cent to 37,300 tonnes.

Following two year-on-year declines in output, total sheep feed production for June increased by 2,300 tonnes or 6.2 per cent from a year earlier to 39,300 tonnes. Moreover, the total under review outstripped the decade long average for the month by 300 tonnes or 0.8 per cent.

Blends for breeding sheep output remained at the same level as it was at in the period under review a year previously of 1,000 tonnes, whereas production of blends for growing and finishing sheep surpassed its 2022 return by 1,300 tonnes or 28.3 per cent and grew to 5,900 tonnes, a record for June. In contrast, compounds for breeding sheep were at their lowest total for June since 2002 of 2,800 tonnes, 900 tonnes or 24.3 per cent down on a year earlier. At 29,200 tonnes,

page 4 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

UK & IRELAND PREMIER SUPPLIER

- Feed Phosphates

- Feed Grade Urea

- Sodium Bicarbonate

- Oyster Shell Grits

- Magnesium Oxide

- Emulsifiers

- Caustic Soda Pearl

- Cubicle Liners

- Protected Fats

compounds for growing and finishing sheep had increased from the corresponding month a year previously by 2,000 tonnes or 7.4 per cent and sheep protein concentrates had bettered their 2022 output by 100 tonnes or 25.0 per cent, rising to 500 tonnes or output.

June total horse feed production had declined by 600 tonnes or 3.8 per cent from its level a year earlier to 15,000 tonnes. Despite this drop, the current output was 700 tonnes or 4.8 per cent greater than the decade long average for the month.

A rise of 2,700 tonnes or 11.6 per cent from a year previous brought June total other feed production up to 25,900 tonnes. However, the total under review was nevertheless a considerable 8,400 tonnes or 27.9 per cent below the 10 year average for June.

Second Quarter Overview

Total production of compounds, blends and concentrates, including integrated poultry units, during the second quarter of 2023 in Great Britain dropped below its year earlier counterpart for the second year in succession. The output under review, of 3,120,400 tonnes, was 134,300 tonnes or 4.1 per cent lower than in 2022. Furthermore, the current total was 147,600 tonnes or 4.6 per cent lower than the decade long average for the period.

Total feed production during the second quarter of 2023 was made up of: 47.1 per cent poultry feed, 29.5 per cent cattle and calf feed, 14.5 per cent pig feed, 5.1 per cent sheep feed, 1.5 per cent horse feed and 2.3 per cent other feed.

Total second quarter poultry feed was at its lowest level for the timeframe since 2012, a decrease from a year previous of 93,300 tonnes or 6.0 per cent brought output down to 1,471,000 tonnes for Q2. The current total was also a similar 96,600 tonnes or 6.4 per cent below the 10 year average for the quarter.

At 921,000 tonnes, total cattle and calf feed production surpassed its year earlier total by 20,300 tonnes or 2.1 per cent. However, despite this increase, the total under review was still 6,400 tonnes or 0.7 per cent lower than the decade long second quarter average.

A sizeable decline from the corresponding period a year previous of 54,400 tonnes or 11.0 per cent brought total second quarter pig feed production down to 452,000 tonnes, its lowest total for the period since 2018. Moreover, 2023’s total was 11,300 tonnes or 2.5 per cent down on the 10 year average for the timeframe.

For the second year in succession, total sheep feed output for Q2

failed to match its year previous level. At 158,300 tonnes, the production under review was 6,200 tonnes or 3.2 per cent down on that of 2022 and additionally, was 15,600 tonnes or 9.4 per cent lower than the second quarter average for the past decade.

Total Q2 horse feed production had dipped below the record high level amassed for the timeframe a year earlier, doing so by 2,700 tonnes or 5.7 per cent down to 45,800 tonnes. However, this was the fourth highest total for the period on record and as a result, the production under review was 3,200 tonnes or 7.2 per cent in excess of the 10 year average for the quarter.

At 72,500 tonnes, total other feed production was only the second sector to better its year previous output. It surpassed 2022’s total of 2,500 tonnes or 2.8 per cent. Despite this upturn, the current return was the second lowest for the timeframe since 2006 and was therefore a considerable 19,500 tonnes or 23.7 per cent down on the 10 year average for Q2.

Production was markedly down across the majority of species in the second quarter and even in both cases where production was greater than a year previous, outputs were lower than the long term average for the period. With the release of the Q2 figures, production from the first half of the year is available to analyse and this is done below.

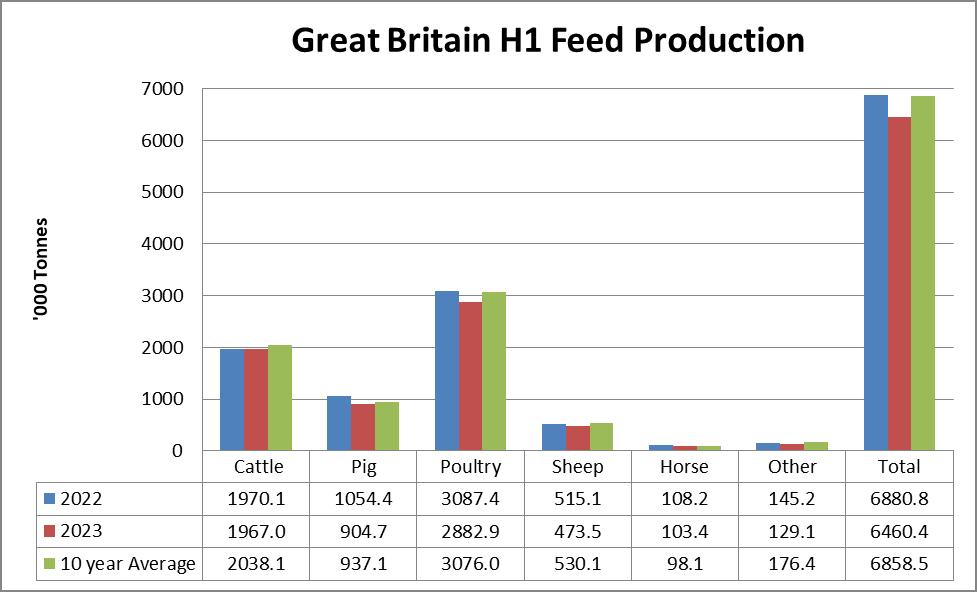

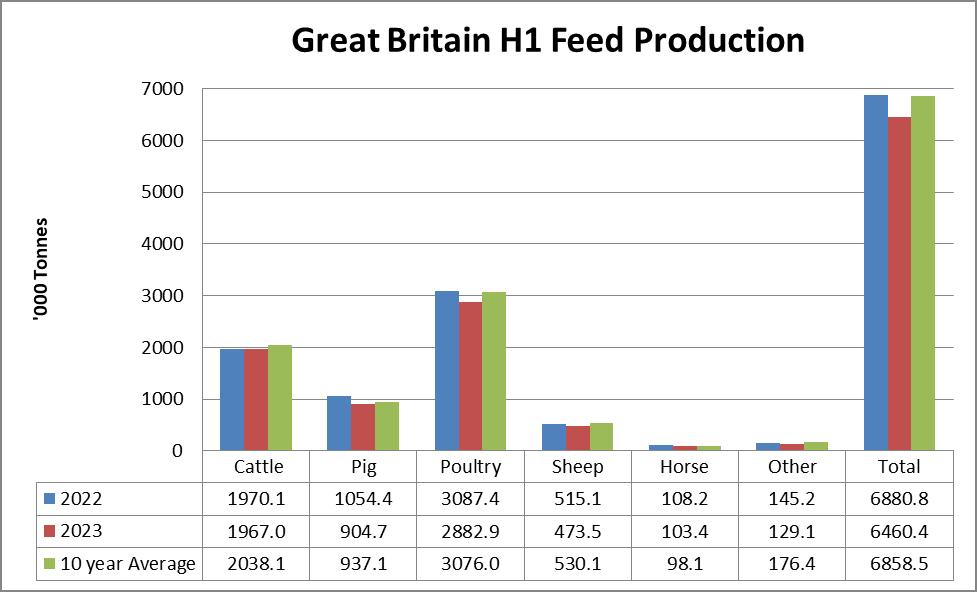

Half-Year Production

Total production of compounds, blends and concentrates, including integrated poultry units, during the first half of 2023 had decreased by 420,400 tonnes or 6.1 per cent from the corresponding period a year earlier to 6,460,400 tonnes. Production from the period was at its lowest level since 2012 and in addition, was 3981,100 tonnes or 6.0 per cent lower than the average for the timeframe over the past decade.

Total feed production during the first of 2023 was made up of: 44.6 per cent poultry feed, 30.4 per cent cattle and calf feed, 14.0 per cent pig feed, 7.3 per cent sheep feed, 1.6 per cent horse feed and 2.0 per cent other feed.

For the first time in seven years, total poultry feed production for the first half of a year had dropped below three million tonnes of output. The current output, of 2,882,900, was 204,500 tonnes or 6.6 per cent down on its year previous total. Furthermore, 2023’s H1 return was 193,100 tonnes or 6.5 per cent down on the 10 year average for the period under review.

Production from all poultry feed subsectors was below that of the corresponding timeframe a year previously. Integrated poultry unit output was at its second lowest first-half level since records were kept in their current form of 1,029,700 tonnes, 41,300 tonnes 3.9 per cent less than a year previous. Similarly, turkey feed output for the first half of 2023 was at its lowest level on record of 28,900 tonnes, down 4,000 tonnes or 10.3 per cent from a year earlier. Layer feed production in the timeframe had declined for the third year in succession, in this case by 55,800 tonnes or 9.5 per cent to 516,900 tonnes; the output of poultry breeding and rearing feed decreased by 9,200 tonnes or 5.1 per cent to 150,900 tonnes. Finally, broiler chicken feed and chick rearing feed

page 6 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

production both fell by 8.8 per cent from the first half levels from a year previous, the former decreased by 103,300 tonnes down to 979,100 tonnes, its lowest total in seven years, and the latter by 7,100 tonnes to 61,000 tonnes.

Total cattle and calf feed production during the first half of 2023 was closely aligned with that of its 2022 counterpart. The output under review of 1,967,000 tonnes was 3,100 tonnes or 0.1 per cent lower than a year earlier. The current total was a more significant 71,100 tonnes or 3.6 per cent below the decade long average for the period.

Despite the overall downturn in production, output from the largest cattle and calf feed category, dairy cow compounds, was up 18,900 tonnes or 1.8 per cent to 1,047,100 tonnes. Following a sharp decline in first-half output a year previously, blends for dairy cow production also surpassed its 2022 return by 29,000 tonnes or 6.8 per cent, up to 396,900 tonnes. In contrast, all other cattle feed declined from a year earlier by 26,300 tonnes or 9.1 per cent to its lowest level on record for the timeframe of 256,900 tonnes. All other cattle blends output for H1 also fell sharply from a year previous, down 16,900 tonnes or 10.0 per cent to 137,700 tonnes. Production of all calf feed was at its lowest level for the first half of a calendar year since 2011; the 83,100 tonnes or output was 6,500 tonnes or 6.5 per cent below that of a year earlier. Lastly, protein concentrates for cattle and calves production fell by 1,300 tonnes or 2.7 per cent to 45,400 tonnes.

Having risen year on year for the five years, total first half pig feed production was 149,700 tonnes or 14.9 per cent down on a year earlier at 904,700 tonnes. Furthermore, the total under review was 32,400 tonnes or 3.5 per cent under the decade long average for H1.

All pig feed subsectors dropped significantly from their respective returns of a year previous. Most notably, first-half pig growing feed production decreased 38,100 tonnes or 20.4 per cent to its lowest level for the period on record of 132,900 tonnes. Production of pig starters and creep feed and pig protein concentrates were both also at their lowest H1 outputs since records were kept in their current form, dropping below their year previous counterparts by 3,800 tonnes or 14.3 per cent to 20,800 tonnes and 900 tonnes or 32.1 per cent to 1,400 tonnes respectively. Pig finishing feed output fell a marked 86,300 tonnes or 17.0 per cent from the unmatched total for the period in 2022 to 498,100 tonnes; this was, however, the third highest first-half output for the subsector on record. At 202,400 tonnes, pig breeding feed was at its lowest H1 output since 2018, down 15,800 tonnes or 7.0 per cent

from a year previous and lastly, pig link and early grower feed had fallen by 4,900 tonnes or 9.3 per cent to 49,200 tonnes.

A decline in first-half output of 41,600 tonnes or 7.3 per cent brought total sheep feed production to 473,500 tonnes, its lowest total for the timeframe since 2005. The current output was an even greater 56,600 tonnes or 11.3 per cent lower than the 10 year average for the first half of the year.

Despite this downturn, blends for growing and finishing sheep, at 32,200 tonnes and protein concentrates for sheep and lambs, at 3,200 tonnes had both surpassed their year previous counterparts, doing so by 2,200 tonnes or 6.6 per cent and 300 tonnes or 7.7 per cent respectively. In contrast, first-half production of blends for breeding sheep had decreased by over a quarter to 14,400 tonnes, the lowest total for the period on record and 6,800 tonnes or 29.8 per cent down on 2022. Compounds for breeding sheep production were also at its lowest level for the timeframe under review; it had fallen 25,600 tonnes or 9.9 per cent to 192,800 tonnes of output. The sector’s largest element, compounds for growing and finishing sheep, at 230,900 tonnes of production in the first half of 2023, was 11,700 tonnes or 4.7 per cent down on a year previous.

Total H1 horse feed production, at 103,400 tonnes, had decreased from a year earlier by 4,800 tonnes or 4.4 per cent. Nevertheless, this was the fifth highest total for the month on record and as such, outpaced the decade long first-half average by 5,300 tonnes or 5.3 per cent.

A fifth successive, year-on-year decline in total other feed output from the first 6 months of a calendar year dropped production to its lowest level since 1995 of 129,100 tonnes. This was 16,100 tonnes or 9.5 per cent down on a year previous and an even more notable 47,300 tonnes or 31.0 per cent lower than the 10 year H1 average.

Total production from every month comprising the first half of 2023 was below that of its year earlier counterpart demonstrating a consistent drop-off in feed production in the year to date. Outputs from all sectors were also lower than their year previous returns and only in the horse feed sector was production greater than the long term average. Its appears that Great British animal feed production is on course for its lowest return for a decade if there is no change in trend during the second half of 2023.

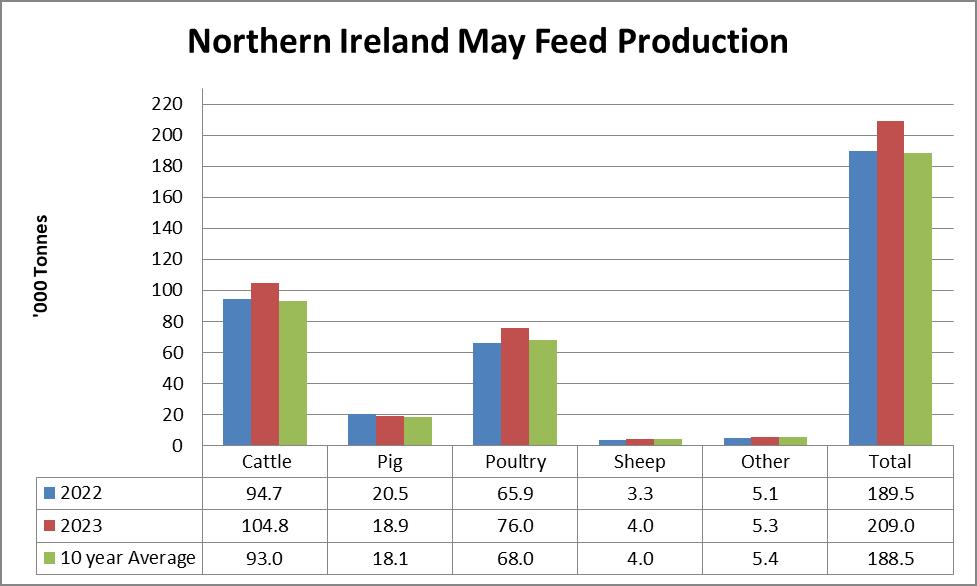

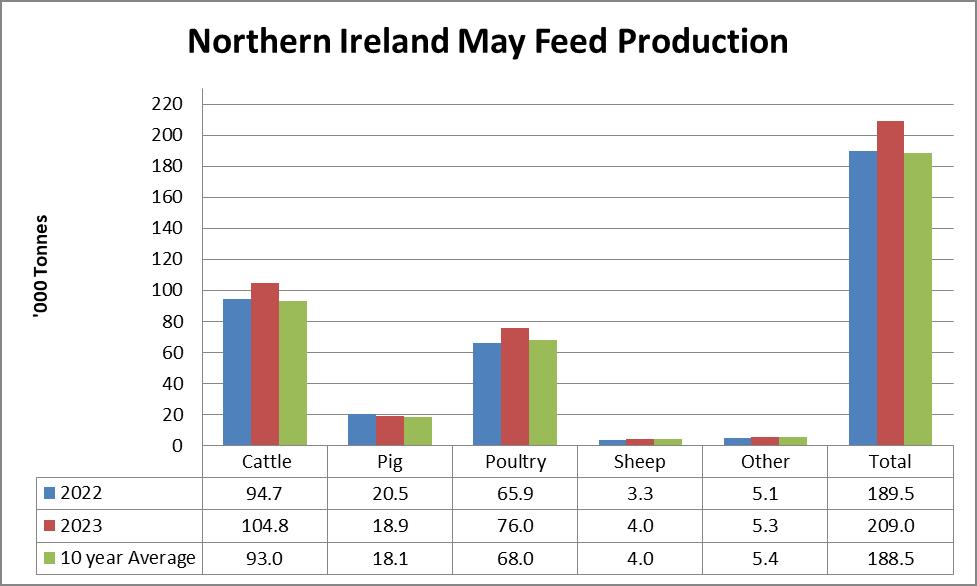

NORTHERN IRELAND Monthly Production Update – May

Total production of compounds, blends and concentrates during May 2023 in Northern Ireland surpassed its year earlier return by a considerable 19,500 tonnes or 10.3 per cent to 209,000 tonnes. This was the second highest May total on record, only below the output of 2018, and as such, was 20,500 tonnes or 10.9 per cent in excess of the decade long average for the month.

Total feed production during May 2023 was made up of: 50.1 per cent cattle and calf feed, 36.4 per cent poultry feed, 9.0 per cent pig feed, 1.9 per cent sheep feed and 2.5 per cent other feed.

An increase of 10,100 tonnes or 10.7 per cent from a year previous brought May cattle and calf feed production up to 104,800 tonnes, its

page 8 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

BEYOND NUTRITION, THINK FUNCTION!

Inneus® is the first solution highlighting the functionality of amino acids for animal nutrition in European Union.

Inneus® is part of the new Metex Animal Nutrition solutions, dedicated to intestinal health and welfare.

Several scientific trials have shown the ability of Inneus® solutions to enhance piglets or birds’ resilience against various physiological and sanitary challenges.

metexanimalnutrition.com Tailored for animal, inspired by nature

Inneus_multispecies_ADhp_Eng_202302

highest level since 2018 and the third highest since records were kept in their current form. Additionally, the output under review outpaced the 10 year average for May by 11,800 tonnes or 12.7 per cent.

In contrast with the sector as a whole, production of beef coarse mixes or blends fell 700 tonnes or 4.4 per cent below its year previous counterpart. All other cattle compounds and protein concentrates for cattle and calf were both at the same outputs as a year previous at 300 tonnes and 100 tonnes of production respectively. The remaining subsectors all bettered their respective returns. The sector’s largest element, dairy cow compounds had increased to record high output for the month of 55,300 tonnes, surpassing its year earlier total by 5,100 tonnes or 10.2 per cent. Other calf compounds, at 6,200 tonnes of output, was also at an unrivalled production total for the month of May, bettering its year previous return by 1,200 tonnes or 23.2 per cent. Production of dairy coarse mixes or blends had risen by 3,900 tonnes or 26.0 per cent from its 2022 return for May to 18,800 tonnes, the second highest total for the month on record. Lastly, beef cattle compounds output grew by 700 tonnes or 8.1 per cent to 9,200 tonnes.

At 76,000 tonnes, total May poultry feed had surpassed its year previous return by 10,100 tonnes or 15.4 per cent, rising to its second highest total on record. 2023’s output was also in excess of the decade long average for May which it bettered by 8,000 tonnes or 11.8 per cent

Turkey and other poultry feed production during the May of 2023 rose considerably from the corresponding period a year previously. The 2,500 tonnes of output from the period was 1,600 tonnes or 195.0 per

cent greater than the all-time low posted in the corresponding month of 2022. Broiler feed and chick rearing feed both also markedly surpassed their year previous counterparts: the former did so by 8,500 tonnes or 24.8 per cent up to 42,800 tonnes and the latter by 500 tonnes or 24.8 per cent to 2,600 tonnes. Finally, layer and breeder feed production declined by 500 tonnes or 1.8 per cent from a year earlier to 28,100 tonnes.

Total pig feed was the only sector in May where production fell below that of a year earlier, doing so by 1,700 tonnes or 8.2 per cent to 18,900 tonnes. This was the lowest total for the month since 2018 and yet, due to the considerably lower output from the first half of the past decade, the current total surpassed the 10 year average by 800 tonnes or 4.2 per cent.

Production from all pig feed sectors fell below their year earlier counterparts. A decrease in output of 800 tonnes or 9.1 per cent from the record high of a year previous brought pig finishing feed production down to 7,900 tonnes; pig starter and creep feed production fell from a year earlier by the same proportion, 9.1 per or 200 tonnes to 2,100 tonnes. Pig link and early grower feed and pig growing feed both declined from their respective 2022 returns by 300 tonnes, the former to 2,800 tonnes, down by 10.5 per cent and the latter to 3,500 tonnes, down by 7.0 per cent. Lastly, pig breeding feed output for May fell for the second year in succession, in this case, by 100 tonnes or 3.3 per cent to 2,600 tonnes.

After a significant fall in output a year previously, May total sheep feed production rose 700 tonnes or 20.9 per cent to 4,000 tonnes. This increase brought the total under review to the same level as the decade long average for the month. Production of breeding sheep compounds for sheep, having halved a year previously, had grown by 200 tonnes or 31.3 per cent to 600 tonnes of output.

Production of coarse mixes or blends for sheep remained at the same level as it has been at for the past four Mays at 800 tonnes, whereas growing and finishing compounds for sheep rose by 500 tonnes from a year previous to its second highest total for the month on record of 2,600 tonnes, a sizeable increase of 24.6 per cent.

At 5,300 tonnes of output, total other feed production had surpassed its corresponding year earlier return by 200 tonnes or 4.8 per cent. However, the current output was still 100 tonnes or 1.5 per cent lower than the 10 year average for May, thanks, in large part, to the anomalously high return of 2019.

page 10 September/OctOber 2023 Feed Compounder Comment

Compound

Engineering Ltd www.cfegroup.com

section is sponsored by

Feed

NAME OF THE VETERINARY MEDICINAL PRODUCT: FLUBENMIX 5%, 50 mg/g Premix for Medicated Feeding Stuff. ACTIVE INGREDIENT: Flubendazole 50mg. Legal Category: POM-VPS , Vm 43877/4013. Drug premixes for animal feed. For animal treatment only. To be supplied only on veterinary prescription. Administration by a veterinary surgeon or under their supervision. Target species: Pigs, chickens, turkeys, geese, partridges and pheasants. CONTRAINDICATIONS: Do not use in cases of hypersensitivity to the active substance or to any of the excipients. WITHDRAWAL PERIOD(S): Meat and offal: pigs: 3 days, chickens: 5 days, turkeys, geese, pheasants and partridges: 7 days. Chicken eggs: 0 days. Not for use in other poultry laying eggs for human consumption.

AUTHORISATION HOLDER:

3621 ZB Breukelen, The Netherlands. Use Medicines Responsibly. Advice should be sought from prescriber. Further information is available from the SPC or contact Kernfarm B.V. info@kernfarm.com, www.kernfarm.com. Date advert designed: feb 2023.

your local wholesaler!

5%, 50mg/g

YOUR TRUSTED

formula

PRODUCT

MARKETING

Kernfarm B.V. De Corridor 14D,

IT’S ALL IN Check

KERNFARM FLUBENMIX

THE MIX

Flubendazole

ONE

PRICED

For pigs, poultry and game birds WELL

Need a dewormer? Refresh yourself. Your ubendazole premix alternative is already here. MORE INFO? SEE KERNFARM.COM OR SCAN QR CODE

Always available

Ten Ways … to make a difference

By Robert Ashton

By Robert Ashton

We all want to do good and many aspire to leave the world a better place, but where do you draw the line between out and out altruism and self-interest? Making sure we have enough money to live comfortably and realise personal ambitions has to be our priority, and some seek public office only because it creates opportunities to influence decisions that can impact on their personal prosperity. Can one really justify acting in ways that improve your lot, because you are also improving the lot of others?

Others are motivated by religious fervour to make seemingly huge personal sacrifices for the benefit of others. While their behaviour is commendable, it can make them impossibly smug and immune to constructive feedback, because they believe that their actions are divinely inspired. It can somehow seem that the more they sacrifice the better they feel. How can that be sensible?

I’ve been reflecting on the motivation for doing good, because in the last few months, since moving to the Suffolk coast, I have found myself taking on three trustee roles: one with a steam museum and two with Quaker charities. I know that I have experience, expertise and contacts able to help all three over the hurdles they face, and now I am wholly focused on being a writer, they give me useful opportunities to use hard learned skills from my former life. Here then are ten ways I think you might choose make a difference to the lives of others:

1. Plant golden seeds – The management writer Charles Handy once told me that when someone who has no personal interest in you says you’re doing a great job, it has far more impact than if it comes from your mum, partner or boss. Taking the time to tell someone they’re doing well takes little effort, but can make all the difference to their motivation.

2. Become a trustee – I’ve had many trustee roles over the years, and have found them really useful when running my own business as they taught me a lot about HR and financial management. Don’t wait until you’re old to consider becoming a trustee, but recognise that you are trading your expertise and network for useful business experience you might not otherwise gain.

3. Pick up litter – There is evidence that suggests that keeping the place neat and tidy reduces littering, graffiti and vandalism. Don’t do what I once did and pick up what someone’s just discarded and hand it back to them. That’s unnecessarily provocative and might earn you a black eye. But picking up litter is a behaviour others will often copy, so why not start a trend in your neighbourhood?

4. Sponsor someone – I’m sure that like me, every week brings you invitations to sponsor someone’s run, or help fund medical

treatment for a seriously ill child. Unless it’s someone close to me, I tend to pass on these and instead support community share issues where I know the result will be a community owned business that can deliver lasting impact. But that’s my preference and yours might be different. Sponsoring encourages innovation, can be tax efficient and is catching too!

5. Think and act ‘green’ – One of the problems with our quest to achieve ‘net-zero’ is that those best able to change policy and practice will be dead long before the impact of doing nothing is felt. However, if everyone takes a few steps in the right direction, the world will move a lot closer to becoming environmentally sustainable. Do your bit.

6. Mentor a vulnerable adult – I can tell you from experience that there’s nothing that makes you feel more grateful for what you have, than to mentor a recently released offender as he rebuilds his life after a long prison sentence. It’s also gratifying to be able to help them practically as they prepare for job interviews and fill in forms to claim benefits or find a place to live. Who could you mentor?

7. Challenge a bully – It takes courage to challenge someone who’s being anti-social and often they’re under the influence of drink or drugs, so there’s a real chance of being physically attacked. Rather than tackle someone on your own, invite other by-standers to join you in stepping in. Be prepared to offer support if their aggression turns into tears, or to back off if you no longer feel safe.

8. Speak to that person looking depressed on the platform edge – Asking if someone is OK costs nothing, and might just save a life. 99 people in 100 who look sad are just that: sad. But one in a hundred might be feeling desperate enough to act irrationally. I’m always mindful of the phrase that ‘suicide is a permanent solution to a temporary problem.’ On a lighter note, I’ve long been a fan of conversations with strangers, for example when you find yourselves sitting together on a train on in a waiting room.

9. Volunteer – There are a million ways to volunteer, and only you will know if the way you choose makes a difference. My experience has often been to challenge the assumptions about what volunteers are being asked to do, which isn’t always what’s needed! Volunteering can be good whatever your age, background of job. Play the field and don’t say yes to the first opportunity, unless sure it’s right for you, and the organisation.

10. Doing something usually beats doing nothing – Activity always wins over inertia and doing something, even if not quite the right thing gets you closer to making the difference you want in the world. Doing something is a good place to start!

When you become receptive to the idea of getting involved with things and trying to make life better for others, it’s really important to not overcommit and to say no to things that don’t feel right, or don’t fit with your work or home life. You cannot help others if in doing so, you harm yourself.

page 12 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

COREmill has been built on 40 years of experience in the Milling Industry; we have designed our software around the specific challenges of the milling & grain industry.

Providing agritech solutions for over 40 years, helping clients to innovate, grow and adapt to change.

COREmill manages 50% of all Irish grain intake

T : +353 25 41400

E : info@coretechnology.ie

W : coretechnology.ie

COREmill is trusted by 40% of feed compounders in Ireland

View From Europe

By Colin Ley

Europe goes big on sustainability

Meat production is no longer a simple process of feeding livestock, slaughtering, and processing at the right stage of growth, and putting a quality product on the consumer’s plate.

Today’s farm-to-plate chain must also be transparently sustainable, in every sense of the word. Views will differ on the validity of this requirement but it’s probably more beneficial to focus on how our industry can best contribute to the demands surrounding modern meat production than debating how we reached this point in the first place. For better or worse, the sustainability argument has moved on, so let’s concentrate of what lies ahead.

In this context, I really enjoyed the comment made recently by Hsin Haung, Chair of the Food and Agriculture Organization (FAO) Livestock Environmental Assessment and Performance (LEAP) Steering Committee.

Seeking to encourage farmers and support industries to inform politicians (Ministry of Agriculture, Ministry of the Environment, Ministry of Health, etc.) of the many contributions that livestock production makes toward a sustainable food system, he said: “A food system cannot be sustainable without livestock.”

With so many arguing that meat production is bad for the environment, even bad for our health, it is reassuring to have someone who actually knows what he’s talking about and speaking in such positive terms about the role of livestock in today’s sustainable food chain.

“On current trends, it is clear is that we need to produce more food,” said Mr Haung, speaking primarily in his other role as secretary general of the International Meat Secretariat (IMS). “As the global population continues to grow, more livestock products are needed, particularly in countries where people currently don’t even have enough to meet basic nutritional requirements.

“Nearly 1 billion people are still under nourished. Livestock production, however, is a pillar of livelihood, rural development, and culture in numerous countries. Providing nutritious food in a sustainable and equitable manner will be a significant challenge, to which our livestock industries are well positioned to respond. Livestock can significantly contribute to the delivery of the UN’s Sustainable Development Goals.”

While acknowledging that it has become very difficult to have a balanced discussion on livestock in 2023, he urged all involved in the meat-based food chain to engage the public in a two-way discussion to better explain our industry’s current complexities. Maybe then we could reach a position of shared understanding.

Livestock production systems, he added, have been on a continuous journey of improvement, including embracing a culture of improving sustainability.

IMS, which is a Paris-based nonprofit organisation representing the

meat industry, is currently participating in a three-year cycle (2022-2024) of international cooperation which includes the upcycling of agricultural products that cannot be consumed by humans. This features the conversion of such items into ‘valuable and nutritive’ food, alongside the reusing and recycling of waste and residues which also contribute to agrifood systems that are both sustainable and efficient.

Positive input from Mr Haung, who will be expanding on his ideas during an IMS-backed Livestock Supply Chain Connect event in London on September 20-21.

International Year of Millets 2023

Providing livestock producers with ready and reliable supplies of compound feed is a crucial part of the sustainability story. Having access to ready and reliable sources of raw materials is essential, of course, in getting us all to the starting line of feed production, especially in a world where the growing of traditional grains is subject to an increasing climatic challenge.

In this context, it would be remiss to allow the International Year of Millets 2023, as designated by the Food and Agricultural Organization (FAO), to pass without appropriate mention. Millets, after all, have shown themselves to be equipped to grow on arid lands with minimal inputs and to be resilient to changes in climate. They are therefore an ideal solution for countries to increase self-sufficiency and reduce reliance on imported cereals.

These are not my words but those used by FAO to express the hope that millets will be given a wider production platform in the future, rather than being consigned solely to their Africa/Asia history, valuable as that is. With the conventional production of cereals across Europe often coming under severe temperature and water pressures, all possible alternatives need to be explored. That definitely includes millets which are viewed (by some anyway) as being able to grow twice as fast as wheat, while consuming 70% less water than rice.

Facts like these always need investigation, so we should treat such headline figures with a degree of caution. The core message, however, is that millets represent a potential solution to future production demands and clearly warrant our attention.

It’s also worth remembering that FAO previously declared 2013 as the International Year of Quinoa, a focus which has certainly raised the prominence of that crop during the last decade. Hopefully, the Organization’s current attention will do the same for millets, potentially increasing the impact of the crop in its traditional African and Asian heartlands while also making it a more commercial human and animal feed alternative across Europe and the rest of the world.

Research and development response

Responding to FAO’s 2023 focus on millets, the Italy-based gluten-free diet and nutritional needs business, Dr Schär, recently stated that 40% of the world’s plant species are at risk of extinction. This, they added, is due to rapid climate change, drought, deforestation, urbanisation, pollution, and intensive monoculture.

“Europe is currently suffering from increasingly critical climatic conditions,” said Ombretta Polenghi, Director of Global Research & Innovation at Dr Schär, speaking as an introduction to promoting a company project called VItaMì (Varietà Italiane di Miglio) which is centred

page 14 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

on the development of new millet varieties with improved (it is claimed) agronomic, technological and nutritional characteristics.

Since launching in 2020 with the first implementation of crosses between selected millet varieties, VItaMì has embraced greenhouse cultivations of around 6,000 millet lines. These were drawn from four different crosses and have led to the selection of 1,000 plants for further field-based development.

Following the project’s first field trials in 2022, and the initial selection of the best lines that emerged, the innovation team at Dr Schär has committed itself to delivering ‘top varieties to trusted partners by 2025’, with the aim of commercial seed supplies being ready for release by 2026.

I’m sure there are other developers out there doing equally valuable breeding and development work, of course, so excuse me for not mentioning you by name. Instead of complaining at being overlooked, however, just make sure you get your message out there.

EU returns to action

Having focused attention in my previous column on the extended holiday enjoyed by the European Commission (EC) in August, it seems only fair to give a mention to the hosting of an agriculture-based ministerial meeting by the Spanish Presidency (of the EC) at the beginning of September.

Due to be held at the Palacio de Congresos of Córdoba (shortly after Feed Compounder went to press) the agenda focus was set to be placed on the search for innovative solutions and the use of new technologies to make agriculture more sustainable and competitive in the face of climate change and its consequences.

Working sessions were planned to discuss how to address growing global food insecurity caused by climate change, economic crises and conflicts, challenges which are seen as ‘seriously jeopardising the goal of eradicating hunger and malnutrition, as comprised in the 2030 Sustainable Development Strategy’.

Also on the table for discussion was a legislative proposal concerning plant varieties produced using new genomic techniques (NGTs). This is one of key measures being pursued by the Spanish Presidency before its term of office concludes at the end of December.

According to the Spanish plan, NGTs will make it possible to develop plant varieties which are better adapted to the new conditions derived from climate change, especially those related to drought. The aim is to develop seeds and plants resistant to pests and diseases and to use fewer natural resources, less fertiliser and fewer plant protection products. The result being sought is more sustainable and profitable production for farmers.

If this plan works as envisaged, the proposed new legal framework will allow NGTs to be used in breeding ‘more resilient varieties in a shorter period of time and at lower cost than current methods’. It is also seen as helping transition the EC towards a ‘more sustainable, productive and climate change-adapted model, which will also reduce the EU’s dependency on imports in the face of unstable political scenarios’.

This sounds like Spain’s Presidency team is fully refreshed after its holiday and has returned to work with a determination to make the most of its remaining four months in charge.

Bug splats

One of the more interesting press notes to reach me in recent days

was centred on the exploits of pilots as Essex and Suffolk Gliding Club who had noticed an increasing number of bug splats on glider wings. Not immediately relevant to feed compounding you may say, but stay with me.

For effective gliding, apparently, you need clean wings, not ones covered in bug splats. Faced with the task of extra cleaning this summer, therefore, the Essex and Suffolk pilots decided to ask their local wildlife trust what was happening. This led to the launch of a new bug splat counting project which could ultimately impact crop production efficiency across the UK.

Gathering details of what bugs are out there, both at ground level and in the air, is helping wildlife specialists track changing pollinating insect numbers, whose survival and choice of location can have a significant influence on plant and crop production.

The risk is that as insect populations change, due to new weather patterns or land use developments, some species may disappear, resulting in gaps being created in beneficial insect communities. This could be detrimental to the control of aphids on growing crops.

When everything is in balance, our current insect populations complement each other in the jobs they do, working together to both pollinate plants and protect crops. In dealing with aphids, for example, ladybirds feed on the top of a crop, where aphids typically settle. As protective measure, however, aphids quite often drop to ground level to avoid ladybirds, at which point ground beetles take over and eat the aphids off the ground.

According to Dr Lorna Cole, an agricultural ecologist with SAC Consulting in Scotland, changes are taking place and it’s vital to keep track of what these are, and which insects are being affected. She’s running a study in Ayrshire with the Scottish Wildlife Trust which includes farmers in the development of a so-called ’superhighway’ of nectar and pollen-rich sites for wild pollinators.

“We are certainly seeing changes in insect populations due to climate change with some species moving up the country in recent times,” she told me. “Regular monitoring of such changes is important, especially to raise awareness of any new pests that may emerge or other adjustments in the current spread of species.”

She’s also encouraging farmers to take a little extra time to improve wildlife habitats on their land to give surviving insects the best possible chance to help with crop production and aphid consumption.

Invasive species

Still with insects, a major report on the rapidly growing threat that invasive alien species pose to biodiversity, ecosystem services, sustainable development and human well-being was due to be published in early September. Not available when Feed Compounder went to press, the report will definitely be worth finding.

Produced by the Intergovernmental Platform on Biodiversity and Ecosystem Services (IPBES), the report is called ‘Assessment Report on Invasive Alien Species and their Control’. Resulting from more than four years research, compiled at a total cost of US$1.5 million, the report has been prepared by 86 international experts from 49 countries.

Pre-release publicity declared that invasive alien species are one of the five major direct drivers of biodiversity loss, a fact which, in itself, makes this a must-read document.

Feed Compounder September/OctOber 2023 page 15

Milk Matters

By Christine Pedersen Senior Dairy Business Consultant The Dairy Group christine.pedersen@thedairygroup.co.uk www.thedairygroup.co.uk

With lower milk prices and high input costs putting pressure on cashflows and profits, producers are asking where they can cut costs. Feed costs are typically around one third of the total cost of production so are a logical place to start. There are several ways dairy farmers can reduce their feed costs; maximising the use of home-grown forage and reducing feed costs continues to be a large driver for increasing farm profitability.

AHDB reports latest grass growth and quality figures and there is no surprise to see that average grass growth rates through the summer have been significantly higher than previous years:

high levels of forage dry matter intake (up to 16 kg/head/day for milking cows) thus displacing more expensive concentrates. In contrast to previous years, grass silage stocks are plentiful, but initial reports of average 1st and 2nd cut quality indicate low protein, high fibre silages. Averages hide variable results and regular forage analysis will allow rations to be updated and adjusted as necessary.

Average dairy concentrate prices have started to reduce over the summer months as prices for both cereals and proteins have fallen. Rations formulated with cereals and rapeseed meal currently offer the best value for money on the basis of the energy and protein that they supply and give tried and tested results when starch and fibre levels are balanced. Rapeseed meal and feed grade urea frequently represent better value than soya and many of our clients feed little or no soya with no adverse effects on performance. It goes without saying that eliminating any feed additives not deemed cost-effective will save costs.

CALF HOUSING FOR HEALTH AND WELFARE

Farmers in England have recently learned that they will be able to apply for a Calf Housing for Health and Welfare grant to build new, upgrade, or replace existing calf housing buildings to deliver health and welfare benefits for calves up to 6 months of age. My colleague, Jamie Radford, says: “The grant provides farmers with a great opportunity to increase calf growth rates through improved calf health and welfare and ultimately improve cow performance. It is well documented that increasing daily liveweight gain of heifer calves has a positive impact on their milk yield. Studies have shown that for every 0.1kg daily liveweight gain increases, milk yield in the first lactation can increase by up to 200kg.

Producers may be inclined to reduce concentrate inputs to utilise the available grazing but the success of this strategy will depend on the quality of the grazing available, stage of lactation and cow grouping options.

Starting from the basic principle that all classes of livestock should be fed to meet recommended nutrient levels, where milking cows are fed a single ration there is always a compromise in meeting the requirements of cows at different stages of lactation. Fresh cows have high nutrient requirements to produce milk – if nutrients are undersupplied in early lactation, peak milk can drop and the income potential for the whole lactation will be reduced. Fertility is likely to be affected too with excessive loss of body condition impacting on conception rates and fewer peak milk yields in the following 12-month period, again reducing the income potential. Where infrastructure and labour allow the herd to be split, target higher intakes of grazing for pregnant, late lactation cows whilst buffer feeding fresh calvers to ensure that their nutritional requirements are met for peak production. Producers should be reminded to monitor body condition score regularly and adjust diets and/or groups to ensure cows are in the correct body condition for their stage of lactation.

Where there is sufficient forage of appropriate quality to ensure that nutrient requirements can be met, rations can be formulated with

Calf housing conditions may be compromised due to poor ventilation and a layout that is labour intensive. At a time when labour is difficult to find, this grant will allow farmers to design their calf facilities to maximise efficiency and implement new technologies that in turn will provide data to assist in making management decisions.”

The grant which will open for applications this autumn is competitive, and applications will be scored against the funding priorities. There will be a 3-stage application process:

Stage One: Online checker to check eligibility and how well the project fits the funding priorities.

Stage Two: Ambient Environment Assessment - details of the design and specification of the proposed calf housing project.

Stage Three: Full Application including accounts, quotes and vet support.

Grants can cover up to a maximum rate of 40% of the eligible costs of a project. The minimum grant is £15,000 (40% of £37,500). The maximum grant is £500,000 per applicant business. The minimum grant amount does not include costs associated with rooftop solar photovoltaic (PV) panels. If rooftop solar PV panels are included, 25% of the eligible costs of purchase and installation will be grant funded. Buildings must have a roof that is designed to support solar PV panels, for use as part of the project or potential use in the future with certain exceptions.

The Calf Housing for Health and Welfare grant will gather information on projects receiving public investment including calf mortality, medicine use, temperature and humidity data. Supplying

page 16 September/OctOber 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

this information will be part of the agreement obligations, and failure to provide this information may delay the claim payment.

All projects must meet the legal requirements for calf housing. This grant offers funding to help farmers deliver higher standards for health and welfare and is not intended to help meet the minimum standards. There are no similar grants on offer in Wales, Scotland or Northern Ireland at present.

SFI 2023

The Government has also announced that farmers in England can sign up for the Sustainable Farming Incentive (SFI) 2023 from 18 September. For intensive grassland farmers, the action “Legumes on improved grassland” which requires establishment of legumes (red

clover, white clover, alsike clover, sainfoin, lucerne, bird’s foot trefoil) into new or existing swards with a payment rate of £102/ha could be part of a whole farm application. For those keen to establish herbal leys or maintain existing herbal leys, the “Herbal Leys” action with a payment rate of £382 per hectare per year could be attractive. These are 2 of 23 actions on offer including soil health, moorland, hedgerows, integrated pest management, farmland wildlife, buffer strips, and low input grassland. Farmers can choose their own combination of actions in a new ‘pick and mix’ structure and SFI actions and Countryside Stewardship (CS) options can be combined in the same parcels, and on the same areas of land within parcels, if the land is eligible for both schemes and the actions are compatible. Payments under SFI 2023 will be made quarterly in arrears.

Know what is in the Clamp and Supplement Precisely

Attention to detail when rationing will be needed to get the best from this year’s grass silages to help maintain margins in the face of the current milk price: feed price challenges.

Discussing the results of over 1800 first cuts and 500 second cuts analysed at the company’s laboratory in Ashbourne, Trouw Nutrition GB Ruminant Technical Development Manager Dr Liz Homer advised that while quantity does not seem to be an issue this year, quality may hinder dry matter intakes, requiring precise supplementation.

“Grass growth in the first half of the season was above average although cutting dates were disrupted by the weather. Mid-season growth has remained high due to the wet July which should reflect in larger third and subsequent cuts helping to increase total stocks.

“The weather is also affecting maize crops. While crops in the field look strong, the lack of sunshine could have implications for cob development and starch content. So understanding forage quality is going to be key.”

The results show dry matters are good for both first and second cuts. Metabolisable energy is averaging over 11MJ/kgDM with crude protein over 14%DM. However, NDF and lignin contents are high which will affect digestibility and intakes.

“Although the headline figures are good, overall we are looking at

2023 Grass Silage Average Analyses to 1 August (Source: TNGB)

more fibrous and less digestible forages with lower rumen fermentable carbohydrate and protein. This means silages will need careful balancing to keep the rumen fired up to digest the higher fibre, increase forage intakes and make the most of silage stocks.

“Nutritionists will need to concentrate on ensuring diets balance rumen fermentable carbohydrate and protein, to optimise microbial protein and rumen energy supply. It will be a case of providing the supplements that will do the job and perform optimally in the rumen, rather than buying on headline analysis and price.”

Dr Homer stresses that averages are only a guide and says it is vital that farmers get all clamps analysed regularly through the season so diets can be fine tuned as required. She points out that most clamps will be very variable comprising different cuts and different swards harvested at different times in varying conditions.

“The only way to account for variability is to analyse clamps on a regular basis, certainly at least monthly. This will allow better informed decisions to be made about supplementation to optimise the contribution from forage and income over feed costs.

“Hopefully farmers will have good forage stocks and with regular analysis will be able to make the most of their investment in forage,” Dr Homer concludes.

Feed Compounder September/OctOber 2023 page 17

Early first cuts First cut Second cut Number of samples 500 1828 494 Dry matter (%) 31.0 31.2 35.4 D value (%) 69.6 70.2 69.1 Crude protein (%DM) 14.3 14.3 14.2 Metabolisable energy (MJ/kgDM) 11.1 11.2 11.1 NDF (%DM) 44.5 44.7 44.3 Lignin (g/kgDM) 40.2 40.7 40.2 Rapidly Fermentable carbohydrates (g/ kgDM) 192.7 195.4 195.9 Total fermentable carbohydrates (g/kgDM) 417.1 421.5 425.2 Rapidly Fermentable Protein (g/kgDM) 92.5 91.9 89.5 Total Fermentable Carbohydrates (g/kgDM) 104.2 103.8 102.8 DyNE (MJ/kgDM) 5.80 5.79 5.85

Scientifically Speaking …

By Matthew Wedzerai

Health-impacting properties of insects

Besides being valuable protein sources, insects are rich sources of antimicrobial compounds that could be explored as potential antibiotic alternatives. In this study, researchers from the University of Parma shed light on the different antimicrobial properties that could be harnessed to improve the health and welfare of animals.

Sustainable nutrition and food security are the focus of the global agenda supported by the United Nations Sustainable Development Goals ( United Nations, 2015 ). One of the aims is to feed safe, sufficient, and nutritious food to the ever-increasing world population. The irresistible feed-food competition draws attention towards the unveiling of new protein sources that could serve both human and animal needs. Insects are a promising feed protein source due to their high nutritional value and positive effects on animal health. But what exactly can they offer to support animal health? Evidence: the resilience of insects to infections by different parasites indicates they are an excellent type of biomass for the extraction of various

antimicrobial compounds.

In this review, recently published in the journal Trends in Food Science & Technology, researchers differentiate intrinsic and extrinsic antimicrobials derived from insects in terms of their constituent components and metabolite production. Their findings are to stimulate the utilization of insect antimicrobials to extend the market size of the sector, support the circular economy, contribute to environmental sustainability, and reduce antibiotic usage.

Antimicrobial activity of insects

Interaction between bacteria and insects has recently attracted interest in the scientific community. On the one hand, some bacteria that colonize the insect body produce metabolites that are selectively toxic to invertebrates such as DNA-intercalating compounds. On the other hand, the insect gut microbiota produces a wide range of metabolites in defence against pathogenic bacteria. Two lines of defence against pathogens exist:

• The cuticle; a complex barrier mainly comprised of lipid and chitin with antimicrobial properties designed to prevent or retard the entry of pathogens,

• The hemolymph; analogous to mammalian blood, is involved in transporting nutrients, waste products, and signal molecules, and contains cellular and humoral defence mechanisms responding to a variety of microorganisms.

The two lines of defence are defined as intrinsic and extrinsic according to the constitutive or inducible nature of the antimicrobial compounds (Figure 1). Intrinsic defence is represented by constitutive molecules of the body that possess antibacterial activity, while extrinsic

Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

page 18 September/OctOber 2023 Feed Compounder

Figure 1: Schematic representation of the insect immune system. The two lines of defence containing intrinsic and extrinsic antimicrobial activity are represented by body components and humoral response, respectively

defence (Figure 2) is related to inducible metabolites synthesized in the body to counteract infections.

Intrinsic antimicrobial activity (body composition)

Insects are valuable sources of proteins, lipids, vitamins, and minerals. Their body composition differs according to the species, developmental stage, and growth substrate. For example, studies show that H. illucens larva are rich in protein, while the prepupa is high in lipid content, and the pupa has elevated chitin levels. H. illucens metabolizes a large proportion of fatty acids into lauric acid, which has antimicrobial activity against gram-positive bacteria such as Clostridium perfringens

Chitin, a naturally abundant linear polymer composed of N-acetylglucosamine is the main exoskeleton component in insects. Chitin may be converted into chitosan chemically or enzymatically by deacetylation which increases its antimicrobial activity. Chitosan is the more potent antimicrobial version for two reasons: it possesses positively charged amine groups which interact with components of the bacterial cell surface (lipids, proteins, carbohydrates) and has high solubility — RNA and protein inhibition due to effective diffusion in microbial cells. Although fatty acids (particularly lauric acid) and chitin/ chitosan are the most researched intrinsic insect anti-microbial molecules, other compounds have been identified. For example, 1-lysophosphatidylethanolamine is a constitutive antimicrobial compound in the Musca domestica (housefly) membrane that is effective against gram-positive bacteria.

Extrinsic antimicrobial activity (AMP production)

The humoral response of insects involves the synthesis of a wide range of antimicrobial peptides (AMPs) in the fat body, haemocytes, digestive tract, salivary glands, and reproductive tract. Pathogen recognition by pattern recognition receptors leads to AMP release into the haemolymph. Studies show that these peptides have strong antibacterial and antifungal activities comparable to similar compounds present in vertebrates and plants. The common feature of AMPs is their small size and positive

charge. Their mechanism of action depends on the type of AMP and the target pathogen. AMPs may interact with the microbial membrane surface, alter the permeability, and induce cell lysis, or enter the cell and damage bacterial components such as DNA and RNA.

The researchers suggested the use of insect AMPs in livestock production as feed supplements beneficial to animal health. They highlighted that insect AMPs may be classified into four families based on their amino acid composition and secondary structures:

• α-helical peptides (cecropin and moricin),

• cysteine-rich peptides (defensin and drosomycin),

• proline-rich peptides (apidaecin, drosocin, and lebocin), and

• glycine rich proteins (attacin and gloverin).

It was further mentioned that cecropins, defensins, proline-rich peptides, and attacins are the common insect AMPs. Cecropins represent the most abundant linear α-helical AMPs in insects with antimicrobial activity against gram-positive and gram-negative bacteria, antifungal activity, and anti-inflammatory activity with their mode of action involving bacterial cell membrane lysis and inhibition of proline uptake.

Potential as antimicrobial sources in feed

The high nutrient value of insects as an alternative source of protein, fat, and several other compounds including micronutrients and chitin presents them as a sustainable feed resource.

The EU feed legislation has allowed the use of insects in feed for pets and aquaculture since July 2017, while live insects are permitted under national legislation in certain EU Member States for fish, poultry, and pig. More recently, as reported in an IPIFF report, the EU Member States voted positively on a draft regulation aimed at enabling the use of processed insect proteins in poultry and pig nutrition. The positive effects of using insect AMPs as feed supplements are expected to bring improvements in growth performance, and gut health. The researchers strongly believe the antimicrobial compounds of insects described in this review may drive research into further exploration of their potential as animal-health-impacting feed additives.

Feed Compounder September/OctOber 2023 page 19

Figure 2: The humoral response following a pathogen attack involves the synthesis of various antimicrobial peptides (AMPs)

SMALL INPUT – GREAT EFFECT

Company Reports & Accounts

By Roger Dean

GLW Feeds Ltd

The company registered its Annual Report and Accounts for the year ending 30 September 2022 with Companies House on 22 June 2023.

The principal activity during the year under review was that of ‘agricultural feeds and crop merchants with ancillary services of consultancy and transport’.

The company’s directors state that they are ‘very satisfied’ with the performance of the company during the financial year under review. The company reported ‘a significant increase’ in its turnover, driven primarily by the increase in the price of raw materials.

In the year to 30 September 2022, the company reported turnover of £139,430,893, compared with turnover in the previous financial year £107,708,246, equivalent to an increase of 29.4 per cent. After deducting the cost of sales, Gross Profits amounted to £15,941,955, compared to the previous year Gross Profit of £10,723,175, equivalent to an increase of 48.7 per cent. This suggests that the company was particularly successful in dealing with the increase in raw material costs. The company recorded a pre-tax profit of £6,253,096, compared with £2,547,784.

The company has a significant interest in poultry feed. During the year under review, the number of Avian Influenza cases ‘rose dramatically’ with flocks affected by the outbreak leading ‘to a reduction in demand for poultry feed’. Given that the situation has continued into the new financial year this continues to be a risk to the business. In the year under review, the company’s poultry feed sales declined by 20 per cent.

Mason’s Animal Feeds

The company submitted its annual Report and Accounts electronically for the year ending 31 October 2022. The principal activity of the company during the year under review was that of the manufacture of prepared feeds for farm animals.

Given the conditions prevailing in the agriculture sector and, in particular, the volatility in the cost of raw materials, the Director, Mr C.W. Purdy, considered the results during the year to be ‘satisfactory’. The company reported turnover amounting to £49.2 million, £13.4 million or 37.4 per cent more than in the previous accounting period. The company’s direct costs amounted to £43.5 million (£30.5 million in the previous year), resulting in a Gross Profit of £5.71 million (£5.3 million). After deducting administrative expenses and adding other operating income, the company’s operating income during the year under review amounted to £1.27 million, up on the previous year’s operating income by 39 per cent. After accounting for interest received and paid, the company’s profit before taxation amounted to £1,192,676, an advance of £344,547 or 40.6 per cent over the previous accounting period.

The ultimate controlling party is Mr C.W. Purdey, by virtue of his shareholding in the parent company.

page 20 September/OctOber 2023 Feed Compounder

MULTI SPECIES www.biochem.net

Feed Safety for Food Safety® Bioavailable combination of metal and glycine Successfully tested in various animal species Safe trace mineral supply for high performance Contact: Oliver

Caiger-Smith@biochem.net Mobile: +447722 019727 E.C.O.TRACE® 19-04-15 HW Anzeige - E.C.O.Trace - 86x254 mm.indd 1 23.04.2019 14:49:24

Caiger-Smith Technical Sales Manager

www.cfegroup.com

Comment section is sponsored by Compound Feed Engineering Ltd

W.J. Watkins and Son Ltd

The company published its report and accounts for the financial year ending 31 October 2022 on 13 July 2023.

The principal activities of the group, as defined by its Standard Industrial Classification code (SIC) are ‘01460 the raising of swine/pigs’. This implies a significant requirement for feed.

In the financial year under review, the company reported turnover of £13,259,339, an advance of £1,469,824 or 12.5 per cent compared to the previous accounting period. However, the company’s overall financial position was significantly affected by ‘impairment of property work in progress’ and reflected in the negative gross profit of £599,977. This resulted in a negative Gross Profit margin of 0.3 per cent compared to the previous accounting period of 6.9 per cent.

The company’s results also reflected what the Directors described as ‘the unprecedented challenges’ faced by the pig industry in the preceding two years. Data released by the Agriculture and Horticulture Development Board (AHDB) suggested that ‘average pig producer net margins during the four quarters ending 30 September 2022 were down 29 per cent, compared to a fall of 13 per cent in the corresponding period a year earlier and an increase of 8 per cent in the four quarters ending 30 September 2020’. AHDB estimates that, while finished pig prices increased by approximately 15 per cent in the year ending 30 September 2022, feed costs increased by approximately 33 per cent. The company noted that the Russian invasion of Ukraine had contributed significantly to the increase in costs and further cost inflation had emerged as a result of labour shortages at abattoirs, thus delaying the processing of pigs and resulting in increased feed consumption and other costs.

The ultimate controlling party is Mr David J Watkins, by virtue of his shareholding.

Burns Pet Nutrition Limited

This company’s statutory Report and Accounts for the year ending 31 July 2022 was delivered using electronic communications in accordance with the Registrar’s rules under Section 1072 of the Companies Act 2006.

The principal activities of the company are the manufacture, distribution and sale of petfood throughout the UK, the Republic of Ireland and the rest of the world. The company also manufactures and distributes food for working dogs, including assistance dogs. The company states that its core value is responsible pet ownership.

The pet foods by the company were developed by its founder when practising as a veterinary surgeon and the connection with the veterinary sector remains important to the company.

In the year ending 31 July 2022, the company reported turnover of £22.72 million and Gross Profit of £7.83 million. After accounting for administrative expenses and some minor operating income items, the company reported an operating loss of £225,814. After taking into account a provision for a loan balance of £6,090,484 for the year under review, the company recorded a pre-tax loss of £6,663,559.

Burns Pet Nutrition Holdings Limited is regarded by the Director as being the company’s ultimate parent company. As of 31 July 2022, 100 per cent of the issued share capital was transferred from J. Burns to Burns Pet Nutrition Holdings Limited. J. Burns remains the ultimate controlling party by virtue of his 100 per cent shareholding in the parent company.

Feed Compounder September/OctOber 2023 page 21

01829 741119 admin@croston-engineering co uk Supporting manufacturers since 1976 with solutions in b bulk handling, storage, and pneumatic and mechanical conveying, we have a wealth of experience for you to rely upon. croston-engineering.co.uk Design and Implementation New system solutions Modifications to systems Software improvements Minor ingredient additions Water dosing solutions Ongoing Support Critical Spares and Parts Emergency repairs DSEAR Reports Site surveys Fault finding Servicing and Maintainance Equipment Servicing Silo and pipeline cleaning Infestation works Calibration and certification Continuity and Earth testing

Green Pages

Feed Trade Topics from the Island of Ireland

IRISH TILLAGE FARMERS FACING HUGE LOSSES

Irish Farmers’ Association (IFA) National Grain Chairman Kieran McEvoy is indicating that many tillage farmers in Ireland are facing into a serious loss-making situation.

Spring barley and winter wheat enterprises are incurring significant losses per acre, particularly on rented land.

Analysis completed by IFA shows that a 2.6t/ac spring feed barley crop grown on rented land is losing approximately €125/acre, even after all direct payments.

High land rents – inflated by new nitrates rules – and declining CAP payments are hammering tillage farmers this year.

“The combination of declining CAP payments; very high input costs; moderate to poor yields from a difficult growing season; high land rental costs; and atrocious weather in July and early August are all coming home to roost now,” Kieran McEvoy outlined.

“While the weather has improved over the past 10 days with better ground conditions, many farmers still have winter barley straw unbaled and a significant portion of spring barley crops yet to harvest,” he continued.

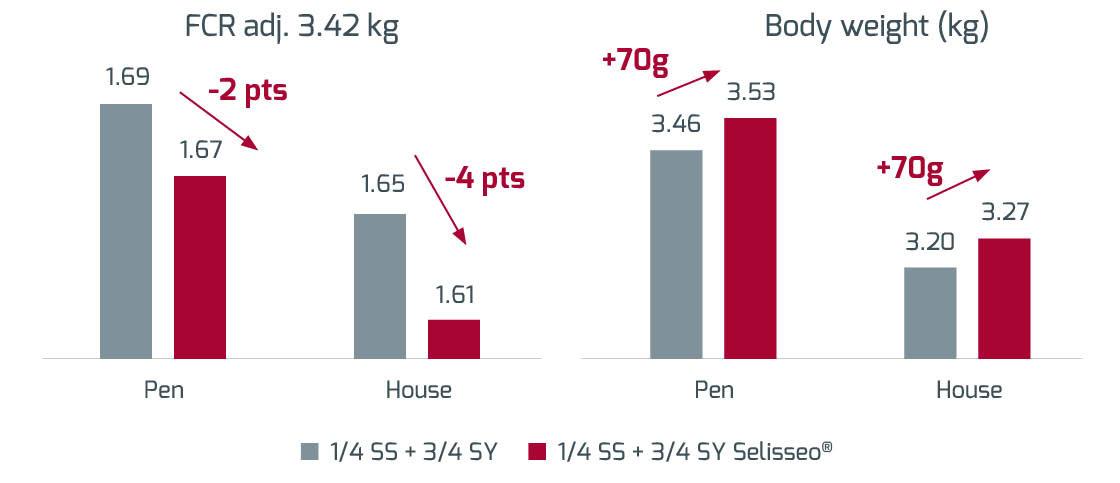

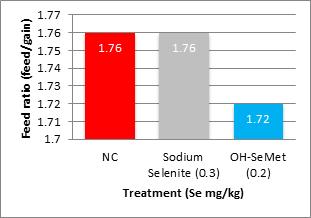

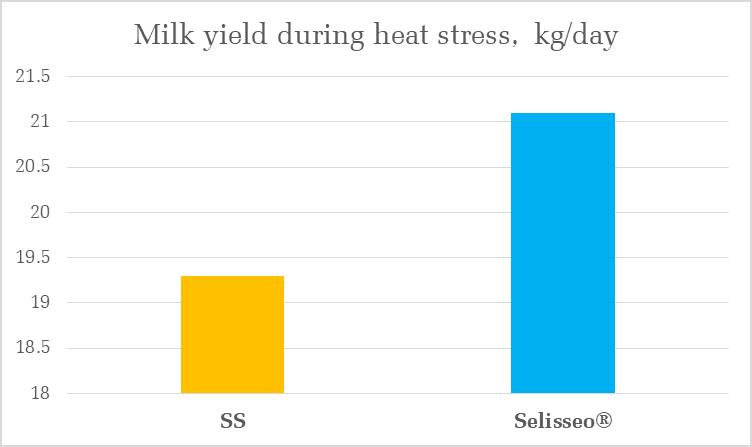

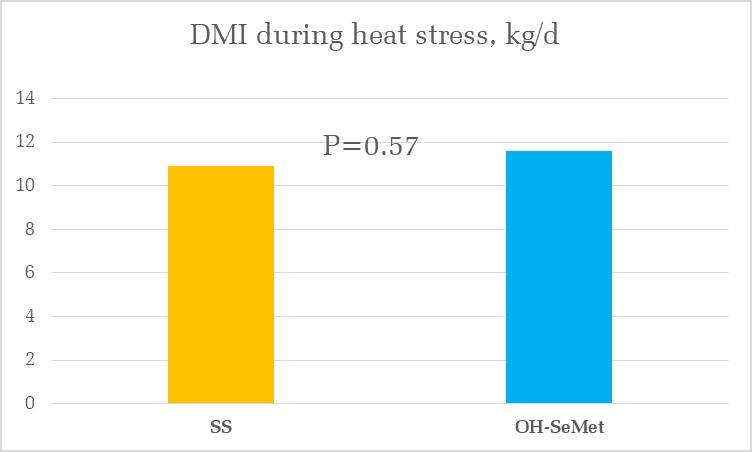

Many of the later sown malting barley crops are now facing very high rejection levels.